The Insanity that is San Francisco Real Estate: Median home price is 34% higher than previous peak bubble price and stands at $1,360,000.

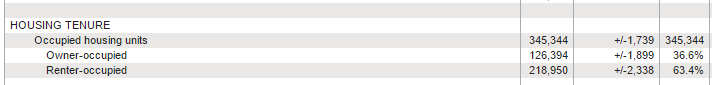

San Francisco real estate is operating in a bubble only understood by venture capitalist running start-ups with no net operating income yet generating millions in funding phases. Sell the sizzle and not the steak. The gold tech rush is in full swing. San Francisco real estate makes Southern California housing look like a timid and shy teenager in comparison. San Francisco County has about 850,000 residents (compared to Los Angeles and our 10,000,000 residents spread out across a massive amount of land). We do share one thing in common and that is both counties are heavily dominated by renting households. But in San Francisco renting is by far and away the most common form of living (63% of households rent). One thing that is standing out is how out of control real estate prices are in San Francisco. The latest report shows that the median home price is now selling for more than 34% from the previous bubble peak! You have to see the actual nominal numbers to see what is unfolding.

The San Francisco real estate gold rush

San Francisco real estate is reflecting the money rushing into the tech sector. The tech sector has benefitted greatly from the mega stock market bull run we are witnessing. It should come as no surprise that real estate follows on the coattails of economic expansion. Yet it should come as a surprise as to how insanely high real estate prices are in the Bay Area.

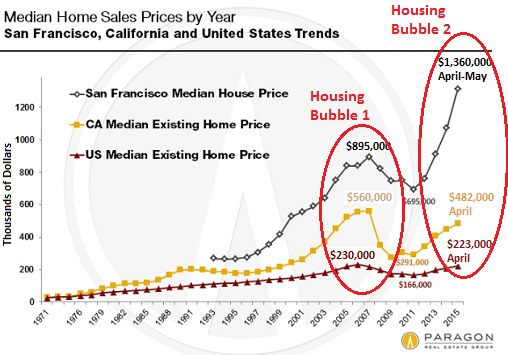

Take a look at the latest data on home sales prices in San Francisco:

In the last peak, the median price of a San Francisco home hit $895,000 in 2007 (California overall was at $560,000). Today, the San Francisco median home price is $1,360,000 while California’s median home price is $482,000. That is simply crazy.

What I found interesting is that 27% of households have mortgages that are less than 20% of household income (these are likely paid off homes or the all cash buyer crew). But you have nearly 40% of households spending more than 35% of their income on housing payments (the Census stops counting above 35% for some reason assuming you wouldn’t be nuts spending 50 or 60 percent of your income on your monthly mortgage which is common in California).

And this is for people that own. The vast majority in San Francisco do not own:

Source: Â Census

San Francisco County has the highest percentage of non-homeowner occupied units of any California county. San Francisco is home to the tech worker sardine living trend. Rents in San Francisco are also out of control. But what if you wanted to buy today?

Just take a look at what you can buy for $1 million in the Bay Area.

953 Teresita Blvd, San Francisco, CA 94127

2 beds 1 bath 1,323 square feet

Here is the ad:

“Terrific mid-century fixer in great location on the border of sought-after Sunnyside and Miraloma neighborhoods. Two beds, one bath, eat-in-kitchen, living room with wood-burning fireplace and formal dining room all on main level. Deck and wooded garden. Bonus room downstairs (not warranted by seller or agents). Attached garage with 2-car tandem parking, washer/dryer and storage. Overlooks Sunnyside Park and beyond. Nearby Monterey Blvd, Glen Park, Twin Peaks, and Ocean Avenue shopping, restaurants and amenities. Conveniently located a short distance from BART as well as 280 and 101. Walk to Glen Park Canyon, Mt. Davidson, and parks galore! Call about this fantastic opportunity with terrific upside potential. DO NOT DISTURB TENANTS.â€

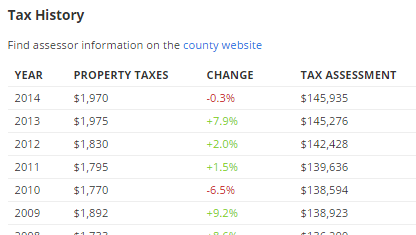

Does this look like a million dollar home to you? What I find interesting is not that a 2 bedroom and 1 bath home built in 1946 is going for this price but that the place is still being assessed taxes at this level:

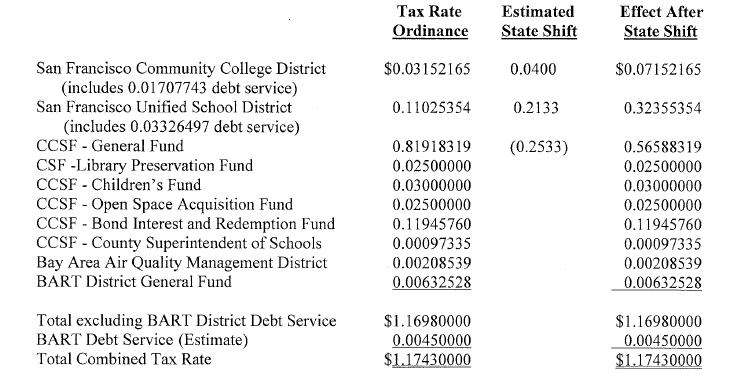

Taxes are being assessed on this place as if it were valued at $145,000! The current annual taxes are $1,970. If a buyer is going to pay the asking price of $1,000,000, their tax bill will go up to $11,700+ (basically a tenfold increase for the same public services and benefits)! Sure makes sense:

It is also funny that the ad says “DO NOT DISTURB TENANTS†because at this level, they are probably getting a nice chunk of change renting this place out. But someone realizes when they are holding onto a million dollar ticket.  Here is a Street View of the place:

Happy house hunting in San Francisco!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

105 Responses to “The Insanity that is San Francisco Real Estate: Median home price is 34% higher than previous peak bubble price and stands at $1,360,000.”

This is all good. There is a lot of “Google “money out there to invest in the Emerald Triangle where I do the Lord’s work of being a farm advisor for the hard working farmers. Prices of good land in the Emerald Triangle are going up, the farmers are beginning to feel the increase and some use their own crop, which I strongly advise against for a number of reasons. Santa Cruz mountains prices are high too. On paper I am now a multi millionaire, but it has not changed me and Forest Lady’s lifestyle in the least. Got to go, I hear Forest Lady calling me.

Can you say “Dot.Com/Real Estate Bubble 2”?? Let see, Dot.com bubble 1 was in 1999, then crashed. Eight years later, Real Estate Bubble 1 was in 2007, than crashed. Now here we are again 8 years later in 2015, with bubbles in both juicing the Bay Area to an all-time bubble history. But THIS TIME is different, of course. Rich foreign investors paying all cash for everything. Sounds kind of familiar. I’m sure this is sustainable, and it must be a paradigm shift! If you take on this risk, you don’t have anyone to blame but yourself.

History repeats………. Few big time winners and lots of small time losers, I’m afraid. Privatize profits and socialize losses. The Great American Dream.

http://www.westsideremeltdown.blogspot.com

On my last foray to the Emerald Triangle I talked to one of the “farmers” who had stopped growing and said ” prices are down close to 70 percent at the wholesale level, I won’t put a spade in the ground for these prices and a lot of the new ‘farmers’ paid way to much for there land having bought when the prices were way up, they are going to lose their hemp shirts!”

Wow! Insane in the Membrane!

Jim, hopefully you don’t live within 10 mile radius (and W of 405) of “Silicon Beach”. With Google/Yahoo/Microsoft having a hard presence, prices are still considered cheap in their terms. But any bubble that bursts will start with the subprime areas then the prime over a span of 2-4 years. Over the past 8 years, I’ve seen my office building parking lot (a pretty big lot shared w other companies) go from half empty to now, when I arrive at 8:30am, all levels are filled to the roof. The blogs are filled with indicators that the economy is doomed, but my office building parking lot occupancy doesn’t reflect those signs.

Its all credit. Mirage of good times, but once the credit turns off look out.

Jim-Credit won’t shut off for good borrowers..

The bubble will burst, in fact I hear/see more signs of people saying we are not in a bubble, that is telling.. little rate bump in September, market decline, election year keeps oil low, maybe 2016 is when you see decline…

We just sold for 400 million, in SAAS vertical. The company overpaid for us. This is a similar scene to 99-2000 here. Let’s see how this game plays out. Remember, this experiment is failing to create wage inflation…

thus bubbles it is..

Also anecdotal but I too know of a “Silicon Beach” office complex lot which has been filling up over the past couple of years. Upon closer inspection it appears that channel stuffed autos is a major contributor. cd, the credit may be there for better rated borrowers but the question is going to be with their balance sheets when things turn lean.

By the way, what the hell is a “hard” presence? As far as I can tell, the Goog, Microsoft and the likes of them are currently chasing momentum on the west side, not sure how that could be considered “hard”, I bet it’s fleeting.

This South Pasadena house has gone Pending. Don’t know the sales price, but it was listed at $699,000 — https://www.redfin.com/CA/South-Pasadena/831-Orange-Grove-Pl-91030/home/7005589

The backyard faces train tracks. Don’t those trains — the Gold Line? — run constantly? Wouldn’t it be loud to have a house next to train tracks?

The rest of the neighborhood looks pretty busy too, with that huge commercial parking lot nearby.

That really isn’t that nice of an area…to be honest. Lots of Filipino gangsters within a few blocks. City Collgege and MUNI close by are crime magnets.

You know not of what you speak. Google a crime map for Miraloma Park, virtually NO crime. Call SFPD and they will tell you this neighborhood has the lowest crime rate in SF and SF has a very low crime rate for a major city. Oh wait, there was a theft of hydrangeas from a bush in front of someone’s house in Miraloma. http://www.sfgate.com/bayarea/article/my-neighborhood-MIRALOMA-PARK-2902859.php

Daly City has a large Filipino population, no neighborhood in SF does (check census records) there is some property crime but it can hardly be characterized as “gang” activity. Obviously you are yet another suburban weenie who moved to SF and fears crime everywhere – their skin isn’t the same color as mine, they must be criminals!

My friend just sold his 1100 Sq/Ft. rental house in Cupertino for 1.2 mil.

He bought in in 1980 for 140K

He said the realtor told him,

“If he had the old house demolished and the property cleared off,

He could have gotten more”.

The value is in the land.

State income tax and capital gains will get a big chunk of those profits.

That’s why the govt. loves bubbles. Higher property taxes too, as Dr. HB. mentions.

Taxes on the capital gains is the only way the state can recoup decades of lost revenue due to Prop 13. They’ll always get you either way or another.

I had no idea there is a ‘government’ tax component is selling a house. With stock options, if you purchase them a year before your company sells, the money get’s added to your income, which is then taxed at your usual income tax rate. But if you exercise your options before the year your company sells, then all you pay is capital gains which is only much lower.

Can someone please explain how this works when you sell a home? The point being, why flip a house in a few years if the government(s) end up taking a large chunk of the profits?

You already answered your own question – it’s called profits or capital gain. You pay 15% and keep 85%. Isn’t that sweet? If you lived in the house for at least 2 years, you don’t pay any taxes up to $500,000 (if married or $250,000 if single).

No discussion of SF housing is complete without mention of foreign buyers. They make up a large majority of buyers in most neighborhoods south of Cesar Chavez and also the Sunset District. Many of them view SF real estate as safe haven for their cash (some it acquired by questionable means). So, they have no concern for the principle of substitution, and will offer far above asking price to ensure that their offer is accepted in a bidding war. They pay all cash, or put a lot more than 20% down. I’d say they are just as big a factor as tech money, especially in driving up the entry level for single family homes. The City should consider an extra tax on purchases by non-US residents, but of course that would be political suicide.

Any article that doesn’t mention this completely misses the boat. Even a two-income Google software engineer pair can’t afford the typical SF house. By some estimates 75% of buyers are all-cash foreign buyers, mostly from China. A large percentage of realty offices now work exclusively with China and are bilingual Chinese. The tech industry is the easy us against them target, but that’s not the cause of the bubble. I foresee a massive drop in prices if China’s economy implodes more.

Couldn’t agree more! So sick of people parking their hot money here and taking up the scarce housing.

Anyone living in the bay area understands that tech is the principal driver of housing in the area. The crazy sums paid in stock and bonuses fuel the house inflation and if/when that ends, so will the bubble.

In the mean time, we got the call that our landlord is raising our rent by 30% ($700 per month). Not sure where she came up with that figure. Fortunately for us, we just bought a home out of state and have an escape hatch. The Bay Area is a soulless wasteland of techies who primarily focus on “the next greatest app” and making sure everyone sees them in their Tesla. Boring! Some of the most unfriendly, fake people on the planet. Just like LA, everyone is somehow “in the industry”. Only difference is in SoCal it is entertainment. Happy to soon be moving on to a great new city with super creative, friendly, soulful people.

Thanks for summing it up so well. “Making sure everyone sees them in their Tesla…” Indeed.

Agreed. Where are you moving to?

We’re trying to figure out the next place before our landlord does the same.

I’ve lived in the Bay Area off and on over the course of my life. Unfriendly is what that place is. Hard place to make friends and meet people – unless you are part of the same tribe as someone else, you are seen as suspicious. If you don’t like running marathons, people won’t talk to you. Being there is like being in high school all over again but this time with awkward adults instead of teenagers.

Amen!!!!!!!

If you’re a grown adult, you make own life. You aren’t bothered by someone asking you about “marathons”. I haven’t heard of anyone running marathons, in South Bay, yet. May be Crossfit…but not the marathons, sorry. You make own life, own interests and entertainment. You said “we”–means you have SO–what friends do you need, you have a family? Bay area is just like any other place–there’re different people, with different interests. Be own start and you can attract people with similar interests to yourself. Or learn to be a lone wolf. People all over US are quite boring an impersonable, it’s all the same, in every area–I had lived all over continental US, same boring thing everywhere.

you paint with a broad brush and good riddance….if you can’t make it in San Francisco with all the hot money flowing, move. Maybe your app didn’t make it 🙁

There are lots of great people in the bay area, in fact there more outdoor orientated and conscious, generally thinner, not water wasters of and more cultured. Great surfing, hiking, north coast nearby..

you pay a premium…but premiums do drop…

You may think techies are “soulless” but I assure you aren’t shining any soulfulness or interesting personality either. People are in the SV because they need to survive, soulless wasteland or not. Perhaps they don’t want to be a minimum wage slave forever or someone who’s discrimnated against because of their accent by “native born ‘Muricans” (those who killed off all Native Indians….I guess now it’s a pay back time, huh?). I assure you a lot of “techies” had other carereers and interests, having been artists, journalists, etc, but unltimately, you do what pays the bills, unless you’re a trust fund baby (or typical deluded American brat–excuse me—who still doesn’t realize that the train of “American dream” had passed them by and is speeding away and their ultimate future is slams and poverty, as they and their Lit or History degrees are not competitive)

“In San Francisco, you definitely have this tale of two cities. You have a lot of very rich people. The top 5% have a median income of $350,000. And then you have 23% of the population at poverty levels,†Adachi told the L.A. Times. “When you have income disparities like that, you’re going to see crime rates that may reflect that. “

“Police also point to a new voter-approved change in state law that makes possession of stolen goods under $950 a misdemeanor.”

http://sanfrancisco.cbslocal.com/2015/06/10/car-break-ins-robberies-on-the-rise-in-san-francisco/

“Yet from January to May, serious violent crime jumped 16 percent, and serious property crimes rose by 20 percent.”

http://www.sfexaminer.com/sf-crime-rate-jumps-despite-fewer-arrests/

Meanwhile, in DTLA –

“The trend in Central Division was not limited to violent crime. Property crime, which includes car theft, personal theft and burglary, surged 25% higher. Burglaries jumped from 114 last year to 182 this year, an increase of 60%.”

http://www.ladowntownnews.com/news/as-crime-surges-downtowners-worry/article_57e4f716-3247-11e5-aa62-079b56f2b0c8.html

No worries, if gentrification doesn’t save you, a “prime” location will.

The gold strip from Malibu down to Manhattan Beach is more expensive than the bay area. Have you tried to find something under 2 million in that strip? That is a lot of houses. And if you try to find something affordable east of that gold strip, you find yourself mirrored in an area plagued with crime. That is what LA has turned into .. either 2 million for a tear down, or 900K for a crime ridden area. What happened to the safe middle class areas? Where are they? People are better off relocating. I know of a home that sold for 330K in Manhattan beach back in 1993. Now, it is in the mid 3M range. That is 10x in 22 years. This is a crisis. A true crisis.

Chasing down the market:

https://www.redfin.com/CA/Culver-City/9026-Hubbard-St-90232/home/6721611

A drop in asking price from $2mill to $1.2miilion

I’ve observed a trend of that very sort of hard and fast ask reduction velocity in a number of owner-occupied (non-flipper) properties in L.A. city and county over the past several weeks. It seems like something has suddenly turned but maybe it’s an anomaly.

There seems to be huge variation by region.

Here in West Woodland Hills/Calabasas, where I am looking, the desirable homes (i.e., mid-century modern ranches, 700-900k range) are going INSANELY fast with multiple offers and prices rising quickly. Looking at the selling price per SF in WH for the past 6 months, the average sold price per SF has exceeded the average asking price per SF for the first time in a long while. In other words, the AVERAGE sale here is for more than asking price.

One mid-century modern we made an offer on had 16 competing bids! Agent used the old trick of under-listing it at 689k, we bid 50k over asking price and were beat by someone paying over 780k.

We just got a house we’d really been wanting into escrow, also mid century modern, but had to pay what is probably $35k over what it would have sold for in Jan/Feb. For good houses, the market is just crazy, and I mean as a buyer, shi&%y. Seems like everybody is trying to get in before rates go up or the kids are back in school.

Or, maybe compared to many areas on the westside (and may parts of Sherman Oaks, and Encino, esp. south of Ventura), this inflated price level for a 2200SF mid-century modern still looks like an absolute bargain.

That said, there is another side of the market here where many homes are sitting on the market for 45-90 days. Also, I have detected a noticeable increase in pre-foreclosure and foreclosure listings in this area…. foretelling the near future maybe?

Not familiar with where you’re looking, perhaps people are more desperate to buy at the top over there.

It does seem that foreclosures are rolling out a little bit more, I figure it’s simply banks trying to unload at the top.

Haha, and it’s still over $600 a square foot. Those are really odd price drops too…don’t usually see drops that big and quickly.

@ john That is not ‘chasing down the market’ that is a revision to a ridiculously price to begin with.

as Jim Taylor would say: ‘hosing to tank hard 2017’ 🙂

How many more properties with huge price reductions like that are needed to declare “RE IS TANKING”?

Reductions in LIST PRICE are meaningless.

Have there been any widespread reductions in SALES PRICE?

Are MANY houses SELLING for LESS than they sold for only a few years ago? If so, then I’ll call it a tank.

Son of Landlord excellent take. If you check closed public records and see if a seller took a bath that is “the tale of the tape.” Case in point, helped my buddy buy a home in N. Scottsdale AZ about 4 years ago. The property was bought original owner for 919k, I had him buy it when the owner hit on hard times for $663k the mortgage pay off. N Scottsdale is in a very soft market for the past 1.5 years. The value of the home in good times easy $995k. He listed it 1 year ago for 849k no takers after 90 days. He lowered it to 810k, 30 days later no takers, then he went into the 700’s bingo 787k took it. Of course it looked like he lost his shirt, but he made a okay profit not great like we thought because the market tanked. The buyer now has a $787 home worth at least $ 919k when the markets comes back so it look bad for everybody not really, you must see the whole picture of a transaction. Lower of a list price means next to nothing only data shows you lowered the price and nothing else about the properties history ?

Son of Landlord…I posted on this but looks like it went away, any how very good take, lowering a list price means nothing, it is just a lower price and nothing should be read into that price without knowing the properties history.

Reductions in list price absolutely matter in a number of ways. Claiming it doesn’t is as stupid as claiming it’s a tank.

Son,

Big ASKING PRICE reductions absolutely do matter. It’s a sign. True- the selling price is the ultimate barometer, but if enough sellers start slashing their prices and selling prices begin to fallr, you have the beginning of a tanking in progress. Sure, you’ll have a bunch with crack-pipe asking prices, but they’ll eventually have to come down to reality. Asking prices gives you an IDEA how warm the pool is before diving in.

You forget that for how long, people bid UP from the asking price. SoCal market is cooling, prices are too high and properties aren’t moving. If prices went UP 40% in three years and they drop 20% in 6 months, that’s TANKING. You just lost 50% of the gain.

Bubble, we need more time and data to better know where it’s heading. It could be a leading indicator of a tank, or not. But indeed, it impacts people who are buying and selling.

This would not be the first time that I’ve read in comment threads that somehow ask doesn’t matter. At best these people are being ignorant.

I’m too lazy to hash it out here as there is a ton of research available which refutes the idea that ask is meaningless. It’s complicated. If they want to remain ignorant about the matter, that’s fine, but truth seeking readers stumbling upon this discussion would do best to be aware that there’s plenty of supporting evidence published and easy to find by Googling the subject.

Robert, you are absolutely right. There are so many transactions where the seller lists at an astronomical price, then has to lower it and still makes out huge. I see it all the time.

Hotel,

To look at asking prices as the main market temp gauge, you are correct. To ignore asking prices when aggregated, then compared against selling prices to see if they are either higher or lower gives an idea as to if it’s a buyer’s or seller’s market. Ignoring the asking prices completely is an incredibly ignorant view of economics. Please post some of your Googled sources for reference. We’ve gone over asking prices versus inventory versus selling prices many times here. Might want to go re-read the last decade of posts.

Not as dramatic as the above, but saw this one today. Someone thought/thinks their place is worth a lot more than everyone else does…and they’re slashing quickly.

https://www.redfin.com/CA/Los-Alamitos/12112-Chianti-Dr-90720/home/3373441

The Bay area is the epitome of the new world order … you are either one of those young software designers or engineers making six figures with bonuses/stock options, or are the declining middle America who no longer has the coattail economics to hold onto. It used to be that all that innovation led to lots of middle class jobs in manufacturing, having a beneficial impact down the ladder, which in turn fueled the initial housing booms in California. Now, since all that manufacturing occurs in China or elsewhere, we have a huge gap. Much more so than a L.A./O.C., the bay areas real estate is the direct result of this elitism.

This is so true! In the last tech bubble I was easily able to attract interest for Bay area tech jobs as your typical tech support person. Now, I need to be proficient in 10 different programming languages and looked down on if I have “just ” a bachelors degree. So if you are an experienced person in IT, you are left out in the cold while people who can afford college (which a percentage are already rich by family) are getting richer. People who worked in the factories are screwed even more leaving the biggest job boom, minimum wage jobs serving food or providing a service.

I’ve a friend who worked in IT.

In 1984, he graduated with a B.S. in Economics. He couldn’t find a job where he lived — New York City. So he got a Certificate in Computer Programming. A one-year certificate program from some no-name trade school.

He soon got a job in the IT dept of a Fortune 500 company in NYC.

I guess in the 1980s, you could get an IT job with just a certificate. Now, no longer?

I’m in IT and it’s really an interesting industry to be in. If you have the right skills and leadership ability you can do really well. I’m in essence making a Norcal salary and living in Riverside County. I always observe the people I work with too and the majority don’t have fancy degrees or anything, they are just alot of people grinding it out for the right opportunity and doing what they have to do.

If you have the experience, there is a place for you in IT…regardless of where your diploma is from.

I’m finding this too in the Bay – all this chasing after credentials as if they mean anything. The first tech boom created a lot of jobs in finance, marketing, sales as well as programmers. This one is just about programmers, and not any programmers but only ones from Stanford. There’s this bizarre authoritarian bent to that whole scene – obsessed with rankings in everything – where you went to school, where you live, etc.

Factory work doesn’t pay what it use to,since most of it is done in the US South. There are a lot of factory jobs that only pay 9 to 14 an hour, read Craig list for factory jobs and find out. There is a lot less unionization hence factory work now pays like clerical work unless you are a well skilled machinists. In fact the US has gain back factory work since it has the lowest paying factory jobs in the non-third world. Western Europe and Japan wages are higher. In fact China has less a lot of factory work to Vietnam in Textiles and to Mexico in Cars. Mexico is a hub for Car factory work it has Ford, Toyota, Audi and so forth. Engineering jobs are different since that requires at least a 4-year degree and I would not consider them blue factory jobs In fact in many factories the highest paying jobs are management or sales which doesn’t require a blue collar background.

You don’t have any realistic idea of life of “software designers”. I’m one of them, with a “3-figure pay”. After taxes robbery (used to pay for illegals and leeches welfare), which takes away big part of my pay, I’m left just surviving and hoping to soon escape this armageddon without looking back. I can retire early into my original (cheaper cost of living) home country (though I’m a US citizen and been here for almost 20 years), and escape this US suicide train. It is nothing but a suicide train driven by madmen.

I lived in Palo Alto the last 15 years. In ’98 you could buy an Eichler single-family home for $400K, which now sells for $2M, in nondescript, working-family, mid-town PA. Rents went from $1400/mo for a 1BR, to now $3200/mo. Modest 3/2 townhouses jumped from $750K in ’10 to $1.3M now. And this summer, tech interns are renting backyard tents with the right of one shower a day for $900/mo in Mountain View.

Traffic and housing planning is an absolute failure. Traffic has come to an absolute standstill at rush hour on 101. I never thought I would see it as bad as the tech boom in ’01, but now it’s much worse. The antiquated, diesel-belching Caltrain still chugs slowly up and down the peninsula, and the PA HUC just turned down a permit for 230 housing units to be built in place of an old Frys store. And the finally nail in the coffin is Levi Stadium which chokes 101 at Great America every time there is a concert or ballgame. It is an absolute traffic Armageddon, and will not recover for a couple decades if ever.

What is driving this insanity is option money from FB/APPL/GOOG (FAGs) employees, Chinese investors, and Prop 13. Routinely, option-rich FAGs are bidding $300-500K over asking price on mid-Peninsula starter homes in the $1.5-2.0M range, coming in with CASH! Chinese investors are buying $10M homes in Old-PA and leaving them empty (shadow homes)! Only a gardner comes by occasionally and waters the plants. And of course, Prop 13 has limited supply because who in their right mind would sell and move somewhere else in CA only to pay 10x the property tax?

The last run-up from the ’05 peak pushed my wife and I out of the area. We have relocated to San Diego, where she found a better job, and the RE here is much more realistic. At least one can get a view of the ocean here instead of a parking lot for the same or less money! And much better weather!

How can I convince my husband that this isn’t the only job market where he can make a good salary? Yes, he is at a software company. But I cannot believe that SV will monopolize the software job market forever. I wanna GTFO soon.

Laura…Take this from a person who has been in the game of housing and property investment for a long time and has seen first hand marriages disappear because of one partner gamble that a life can be sought out side their comfort zone.

True your spouse looks like he makes a excellent salary and the grass can look greener if you just “buy a home in a cheaper market and cut down expenses and he finds a job with less pay but it will work out???” BE CAREFUL, I was in the Denver market when CA. transfers thought they would buy a nice two story house in metro Denver and finds a nice paying job and life would be good. Many men and women got caught and what they found, fair paying jobs for men and a rather sparse outlook for a women to succeed their. A narrow approach in that part of the country. I saw marriages go south after two years with either spouse unable to get a decent job and the cost of living in the Rocky Mountains that not as great or cheap as one thinks.

The same situation played out in Phoenix, a couple I know did extremely well in San Diego then went to Phoenix found a beautiful desert mountain home and took the leap, today they are broke and divorce. Not to say their are stories of a better life out of state my wife and I live that life but we left with a small fortune and big monthly income if that is not the case for you, be happy your spouse at the present he doing well and don’t risk a so called better life I unless you really line up the stars and have a very large comfort zone which maybe you can with a large cash out otherwise stay put for now?

Seattle, Denver and Portland in that order.

I’m done also…I’d love to stay as a DINK in Oakland but’s it’s becoming less and less livable for us in our early 30’s making a combined 170K-ish…which is totally insane to think about.

Hopefully I can work from home a few days (go to job sites the other days) and my SO can get another job…but we are looking to move to Sacramento by next summer.

You can work in software pretty much anywhere anymore. IT is really becoming much a work at home industry any more. Alot of people pretty much play mercenary to go find the highest salary. I’m sure your husband could find something somewhere else without too much of a problem. I’m getting numerous requests a week for my skills.

To Robert who replied to me :

You’re making the wrong assumptions about the set of reasons compelling me to move. One big on is the absolute brokenness of the CA political system, including Prop 13. I cannot abide by paying an out-sized property tax bill while long-term residents and heirs of long-term residents pay a fraction.

As Kim-Mai Cutler so aptly put it in her long-form article from Techcrunch about SF’s entrenched development problems and NIMBYism(http://techcrunch.com/2014/04/14/sf-housing/):

“Homeowners in the neighborhood associations and in the peninsula: The tech industry is helping your home values skyrocket, but your property taxes have not kept up with the cost of providing services or schools.

Stop sitting in the background while the city’s workers, the poor, the elderly and its young duke out in this ugly charade.

While there are some tech workers who do strike it rich, most just have salaries and would love to raise families in the Bay Area just as you did when you came here years ago.

The Bay Area risks becoming a victim of its own success if it can’t make more room. At this point, blocking individual housing developments to protect your views is tantamount to generational theft.”

Laura, why don’t you start making your own “salary” instead of taking it from your “husband”? It’s really disgusting to read adults posting such things.

To say the real estate bubble in the bay area is solely on the backs of Facebook, Apple and Google employees is way too simplistic. These people make good money, but by and large, they make market rate and there is a heavy contractor component in these companies. And for each southbay tech star there is one that is imploding, Cisco and HP come to mind. Also, growth in the ‘FAG’s is slowing and with that, hiring and salary increases will slow according.

As the Dr. mentioned, the real growth in bay area tech is in the startup. A growth fueled entirely by speculative money. How many billion dollar unicorns are there now? A valuation based on what?

Not really. If you look at newly minted millionaires with freshly minted stock-options that can be used as a down-payment for a home, FB alone has probably created 2,000-3,000 in the last five years. I know a lowly FB HR lady who cashed in $2M three years ago and bought a Belmont starter home for $1.8M. Startups that are sold (not IPO), may have a few success stories like this, but often two-thirds or more of the option money goes to VC funds and the preferred stock investors (who are already in their multi-mil homes), so net, you may have 5-50 employees above that $1M line that are on the market for SV starter homes in the $1.5M range. So it’s doubtful that all the startups sold in the Bay area in the last five years have made more millionaires (clearing > $1M) than the FAG group. I would guess the FAG group overall has minted 5-6,000 new millionaires in the last five years, and startups maybe a third or less that number. I would guess the only super-successful startups that may have created more than 100 millionaires are GoPro and Nest.

Looks like the usual I can’t take CA. anymore. Certainly can’t blame you but again read my post to Laura, Was in Denver for the 4th visiting friends, traffic was bad very bad, housing $925k for a house on a 7000ft envelope and shaking hands with the neighbor.

Local news full of the usual one shot dead, couple robbed at gunpoint, folks sick of bad pot hole streets. The weather typical Co., rain 55 deg. sunny 87 deg., rain three days 59 deg. sunny 91 deg. Pollution from a fire in Calgary Canada blew in stay home that day?

Don’t know folks, but this country in general, no place to hide, some areas are still good as I have posted before but please you better be well set in life or you will face the same challenges some place else and maybe worse?

Have you ever read the Fantasy/Sci Fi novel “The Carnelian Cube” written by L. Sprague de Camp and Fletcher Pratt? A man finds a magic cubical stone that can take him to a world that conforms with his specific wish. Unfortunately, the Devil is in the details, and each world he thinks up gets progressively worse despite his best intentions.

So glad this San Francisco native left the bay area 14 years ago and bought a little cottage on 1 1/3 acre in beautiful Carmel Valley (the REAL one, in Monterey County). Best thing I ever did

You really can’t compare traffic, home cost, anything, to Southern California. My best friend lives in Denver, and I just moved to Portland from LA last year, and, while, things aren’t cheap and easy, it’s still worlds better than LA. Plus, if you want cheap and easy, there are zillions of Midwestern towns were one can comparatively live like a king.

Unless one is making $500K+ per year, or is trying to “make it” in the entertainment industry, I can’t imagine choosing to live in LA. I wish I left earlier, and so does my wife, who grew up there.

That being said, Portland is awful, please don’t move here. 😉

We moved from LA to Portland. What a mistake that was! Portland really is an awful place live in. It rains too much, traffic is horrible, housing is expensive, taxes are high, and the city is filled with hardcore radical leftists and environmentalists. We recently left Portland for western Washington near the Canadian border. We like it so much better here!

Bay Area is no place for young families or the middle class. Want to buy in an area with goods schools, all homes are $1M plus. You need a combined income of $200k/yr minimum to have a “middle-class” lifestyle in the Bay Area and send your kids to a decent school, save for retirement, etc.

***

Bay Area has lost it’s allure for me, I’ve lived here my entire life and am moving next year. Nice weather (except for drought) and high incomes is all the BA has now. Horrible COL, Horrible Traffic, Poor schools (except for $1M+ neighborhoods), Foreigners everywhere who have no intention of Americanizing, High Stress & Long Hours Jobs…too many negatives.

Joe – well said. I left 1 1/2 years ago and haven’t looked back. Californians aren’t necessarily welcomed in Montana so I grew a beard to fit in 🙂 Of course the big trick is to keep the California salary and live elsewhere.

Yep, left for Portland last year, and figure out a way to run my company from home, so I’m making the same money. Plus, if my business ever goes south, I can always move outside of town into other parts of Oregon, where it is really affordable.

These prices are insane, and they have postage-stamp size lots. I know we have had inflation, but coastal California prices make the dollars value look like it’s next to nothing.

I bailed on the Grey Area 25 years ago after getting my snobby degree from one of the snobby schools. The whole “We’re better and smarter than everyone else” vibe has only grown more insufferable over the years, with property values providing a justification for the worst of the self-satisfaction.

Every visit to the Bay Area is now a traffic ridden nightmare. You couldn’t pay me enough to move back there.

“We’re better and smarter than everyone else” – that’s what I encountered on a daily basis living there over the years. It gets so tedious. It’s not just tech people, it’s also racial religious, ethnic, career and geographic groups that do this there. People from SF talk so much trash about the rest of the country even places like Berkeley. Every racial/religious group there feels persecuted and superior to every other group too. I got so sick of walking on eggshells about people’s complexes there that in the end, I spoke to no one except my dog. I have no idea at all why people are so crazy to be there.

Never forget for a second that the Chinese are sheep. They only follow the current trend. If a few start to dump real estate and the great unwashed who have sunk their life savings into whatever was flavor of the investment month (like the hapless alpaca guy) they will all dump their “investments” faster than you can say fortune cookie.

Like a ripple in a pond

Dire straights…I have posted, dealt with, and followed Chinese purchasing and trend habits for some time now. No question, the Chinese for the most part are well known to jump ship if they think anything is going out of favor even if it isn’t.

They will buy at a whims pace and sell at a furious pace if rumor has it their investment is not what they thought. They will easily dump SF real Estate in a NY minute.

When I was in the auto business we knew if Chinese folks bought a high end vehicle and read consumer reports, Motor Trend (for example) thought the car they bought was running out of steam they would trade in or have us buy back at a very large loss not to be seen in something that was maybe not a trend setter anymore.

They gamble the same way, losing larger sums of money to win back a small portion but profess to relatives and friends they hit it big in Vegas. Good take Dire

Excellent analysis, I had no idea that ‘keeping up with the Jone’s’ was so prevalent in Chinese culture. Perhaps we should have a followup blog post on the impact of immigrant money into the CA housing market.

My one data point regarding Chinese. I bought a very nice used late model car off a Chinese woman from NY via craigslist. She took a job out in the boonies (my locale) but found she missed her family (and young kids!) and she didn’t want to foot the bill to ship the car back (employer would pay but she broke the contract early). Anyway, we get to talking and it turns out she owned a condo near where I used to live in SoCal. I ask “I thought you lived in NYC, did you used to live in SoCal?”. Nope, she visited and liked the area so she bought a condo there! Said she wasn’t making any money, just covering expenses. She struck me as very impulsive, a nice person but not able to control her whims well.

Dumping assets is an inverse function of liquidity. For China it is first, the domestic stocks (oh, that is not future tense anymore, my mistake) that go out the window, then it is a cat and mouse game with central planning to see what falls next. The Chinese will liquidate foreign real estate holdings up to the last possible moment. They are more likely to dump domestic real estate before that is illegal, then commodities, then the kitchen sink and then finally that SFR in Sierra Madre. Chinese nationals better hope that the Chinese government doesn’t demand or impose liquidation of foreign assets to bolster the internal domestic ponzi.

So true, they love to gamble but tend to have little fortitude for hanging in. The real questions are around the exposure the overall marketplace has to it.

Ah, of course, I guess only the Chinese are subject to herd mentality, good thing we live in America where everyone is a contrarian!

That’s already well known and beside the point. It’s often insinuated that Chinese investors are providing fundamental support to certain markets, as if somehow their circumstances make them immune to speculative fever breaking, and by extension giving those markets a sense of safety. That collectively the Chinese tend to exhibit attributes of piss poor gambling behavior is appropriate and on-topic.

LOL, very astute. This is why I love DHB!

From Bloomberg:

Luke Iseman has figured out how to afford the San Francisco Bay area. He lives in a shipping container.

The Wharton School graduate’s 160-square-foot box has a camp stove and a shower made of old boat hulls. It’s one of 11 miniature residences inside a warehouse he leases across the Bay Bridge from the city, where his tenants share communal toilets and a sense of adventure. Legal? No, but he’s eluded code enforcers who rousted what he calls cargotopia from two other sites. If all goes according to plan, he’ll get a startup out of his response to the most expensive U.S. housing market.

“It’s not making us much money yet, but it allows us to live in the Bay Area, which is a feat,†said Iseman, 31, who’s developing a container-house business. “We have an opportunity here to create a new model for urban development that’s more sustainable, more affordable and more enjoyable.â€

As many as 60,000 San Franciscans live in illegal housing, according to the Department of Building Inspection.

Iseman collects $1,000 a month for each of the 11 structures parked in the 17,000-square-foot warehouse he rents for $9,100. Tenants include a Facebook Inc. engineer, a SolarCity Corp. programmer and a bicycle messenger.

Granted it is Oaktown, but an SF expansion is not far behind at these prices.

I live near there…there bridges under 80/880 are filled with “homeless” tents (all the nicer REI brand)…I assume they actually have jobs…when you walk from downtown Oakland under the highway to get to Jack London Square…or drive to Alamada in the tube…it’s actual village. They have BBQ’s at night and sit around smoking weed and drinking wine (LOL…for real).. “house” rules posted on the walls…people panhandling in shifts…people watching tents while others are at work.

I actually commented to the EastBayExpress to push for the city charge them a camping fee and get port-a-potties put under there.

/rant over.

Living in tents, living in shipping containers, camp stoves…WTF. There better be some massive payoff down the road to put up with shit like this. These people have no reason to complain, they can leave for greener pastures anytime they like. LA real estate looks like a resolute bargain compared to that madness.

#prime #desirable #rich foreigners #perfect weather #rental parity #supply and demand #Prop 13 lottery winners #housing to tank hard soon

Funny. According to CashShiller, the Los Angeles area has appreciated more since 2000 than the Bay area. From what I see a decent safe area in Los Angeles costs more than an equivalent area in the Bay area. Los Angeles has a larger percentage of ghettos, which drag the average down. However, when the money being thrown away in tech startups slows, the Bay area will take a bigger drop than Los Angeles since Los Angeles has a more diversified economy. The tech startups are being funded with printed money from the central banks. That will end shortly, and the Bay area will take a pounding. Los Angeles will also take a hit, but not as hard.

LA diversified economy? Maybe, but it’s a pretty low wage economy with more and more high-paying jobs leaving every day.

LOL The start of a Kowloon city in San Fran.

http://www.dailymail.co.uk/news/article-2139914/A-rare-insight-Kowloon-Walled-City.html

I know someone in the Bay area who first bought a 2 BR in Santa Cruz while working in tech in SV, and then got a tech job near SF during the big crash and bought another 2 BR in Redwood City, renting out the Santa Cruz digs. This person isn’t terribly materialistic, but fate has dealt them a pretty good hand, don’t you think?

1.3 million? Whoah! That makes LA look cheap. Just look at the glorious 865sq ft. 2/1 crapshack located in one of the most distinguished ghettos of LA which can be yours for the low low price of 500K.

https://www.redfin.com/CA/Los-Angeles/4576-W-23rd-St-90016/home/6899678#main

Make sure and check out the street view so you can see the boarded up crackhouse two houses down from your future home. I’m sure your kids will enjoy growing up in this colorful neighborhood while getting a education at some worst schools in LAUSD. How glorious it is to live in LALA Land.

It’s not the most ghetto part of the city but corner lots in the ghetto are a little more special. Why? Because in the ghetto you tend to have more people congregating on sidewalks in undesirable ways and there’s nowhere better to do so than on the corner – right in front of your corner house. Another great feature of living in the ghetto is the higher occurrence of loud vehicle traffic infiltrating the privacy of your home. Corners provide a better opportunity for peeling out, squealing around a turn, engine revving, and more time to enjoy the bass from cars coming to a stop. It’s offset at an appropriate discount, but at a price premium, no thanks.

This area will probably turn into something nice over time, the problem is how long does one have to endure waiting out the BS and at what cost does that come.

Hey look, it’s one of the neighbors: https://goo.gl/maps/OiUs1

Lol, nice commentary @Hotel California.

That neighbor looks like a nice upstanding gentleman. What could possibly go wrong with neighbors like him? I’m confident that my kid would be perfectly safe in that neighborhood.

Although I have to question your assertion that “This area will probably turn into something nice over time…†With the increasing number of immigrants entering from the south, and the shrinking number of middle/upper-middle class people in all areas of the country, I wouldn’t count on that neighborhood getting much better. It’s not like Venice or Santa Monica where there is some inherent value of the area (like the beach). I’ve been wrong before, though.

HC, that post had me in tears laughing so hard. Thank you for that, I needed it after the past couple months of house hunting.

Location, Location, Location! 1lock North of the 10 freeway and sandwiched in between La Brea and Crenshaw for 1/2 a million dollars.THey forgot to say “easy freeway access”. 2+1 865 Sq Ft 80 yr old bungalow with all the bells and whistles. Gonna need a bigger lipstick for this pig.

Good luck sleeping safe and sound at night here.

http://www.westsideremeltdown.blogspot.com

“Does this look like a million dollar home to you?”

downtown san fran, two (!) car parking, wooded garden (see those trees in the back?), walking distance to everything? yeah, actually, it does.

Weird how the container dwellers find it worth it to sink to such squalor, or anyone at a tech startup finds it worth the ridiculous prices for better pay (even though the better pay does not make up for the cost of housing) – all for employment at a hip company or just to be able to say they live in the bay area. Narcissism? Meanwhile, I lounge on my Costco patio couch every weekend, sipping a microbrew or three while the kids play, listen to the birds sing and stare at the trees in the private park behind our house. My wife and I combined probably don’t make much more than Facebook Guy in his shipping container, but we live in suburban paradise, and still have several thousand left over every month.

Those are some spectacularly messed up priorities, man. Unless you genuinely enjoy sleeping in an oven. Still, I get the feeling he would look down on me for being a lemming or something.

Pocket listings which don’t appear in MLS, sell of a home the seller request withheld as a sale which then doesn’t comp out in the neighborhood for sometime. The deal where a buyer doesn’t want to pay high property tax and the seller wants to pay a lower commision in cash deals. The buyer writes back a check to seller like purchasing of furnture on a separate bill of sale. To say research of a property is to drawn out is like saying one opinion from one doctor is enough in your course of treatment.

I saw homes that I couldn’t believe there was no comp in the neighborhood because of the above scenarios. After much digging I got the real story and than was armed with facts of why the house I was interested in was either a good investment or a loss waiting to happen. This is like when I was in the auto business the know it all comes in and thinks he didn’t leave money on the table, of course he did ( we always have back end incentives from the MFG) otherwise we dismiss him from the dealer ship politely, we didn’t sell cars at a lost to anybody.

Average home price in Venice increases 17% YOY. From todays LA Times article; 846 Warren Ave., Venice, 90291

http://www.latimes.com/business/realestate/hot-property/la-fi-hotprop-venice-bungalow-20150803-story.html

“The median sale price for single-family homes in the 90291 ZIP Code in June was $1.81 million based on 26 sales, according to CoreLogic. That was a 17.3% increase in median price compared to the previous year”.

http://www.zillow.com/homedetails/846-Warren-Ave-Venice-CA-90291/20453516_zpid/

Doc: Taxes are being assessed on this place as if it were valued at $145,000! The current annual taxes are $1,970. If a buyer is going to pay the asking price of $1,000,000, their tax bill will go up to $11,700+ (basically a tenfold increase for the same public services and benefits)! Sure makes sense:

_____

We’re getting close to topping-out. What’s rattled this landlord into looking to sell at lottery-winning asking price? We’ll soon have the landlord/investor side under siege – with fewer willing or procedable buyers at these prices..

In the UK the newly elected Conservative party has recently pulled a master-stroke against the army of private property-investors, via taxation relief changes. It comes over 4 years, tightening each year. One moment property-investors were smug as anything, but many of the smart ones are realising this tax change basically leaves them technically insolvent, because so many have acquired so many properties via leveraged and taking equity out of previous properties.. 10-100+ properties. It’s brilliant. Tax-man just declared war on property-investors in UK – and we’re some of the smarter ones (very dumb still) panic. I just hope it’s repeated US side. It shows that Governments do look at the investors as a source of revenue. They’ll want increased turnover. And what better than a crash, and more homeowners who vote. Landlords with lots of properties only have 1 vote each.

Galaxy Brain, this is all very, very bad news for tenants in Britain. They will be the real victims as rents are hiked to cover the taxes. The landlords can’t afford to own the properties if they can’t generate the cash flow to cover their bills.

I paid more property taxes in Chicago through my rent, than I do now as the owner of a larger and better condominium. I was horrified when I looked up my landlord’s taxes online- my unit’s share of the taxes, for that 4- room 1 bed, was 60% higher than the taxes I pay for a 5-room condo in much better condition. In Chicago, a large building (more than 6 units) is taxed as a “commercial” property. The 3-tiered structure in this city has triggered a lot of condo conversions. That’s unfortunate for renters and the neighborhoods alike, as many large, older buildings that were comfortable, well-run, professionally managed rentals are either lost to the rental market altogether, or, worse, become failed condos and unregulated rentals run by small investors who have no idea how to manage their properties.

Here is some wisdom to challenge that.

_______

Landlords already charge the max they can, ‘market’ rents. If council tax was increased and the tenant had to pay more, rents would have to reduce by a commensurate amount to maintain that max value. i.e. net cashflows are the same, but either rents or prices would fall. It’s the same as with SDLT – technically paid by the buyer, economically worn by the seller.

A landlord can try and a tenant can just say no thanks. Housing supply is inelastic, housing demand isn’t. The price of housing services (rents) are therefore almost entirely a function of demand (affordability). Land or house prices amount to the NPV of equivalent future rents accruing to them, so a higher tax impacts future cashflows determining today’s value, lowering it. All else being equal they cannot be passed on as additional costs to tenants because the tax is worn by inelastic immovable supply and not more price sensitive (net wages) demand. Whether it impacts the landlord is not relevant while rent > costs and if it becomes relevant that’s a Government taxes and not a tenant issue.

If you think that’s wrong then why do landords or sellers rent or sell at the prices they do today, and not higher? Or alternatively who bears the liability if tenants just move or opt to buy in the event that a new net tax + rent is more expensive?

_______

Digsby

I’ve just been musing on what it is that winds me up so much about the bleatings of these overleveraged landlords to the taxation change, and I think it is this:

They proclaim that the government have let their tenants down by forcing rents up, but it is they who have done so by putting themselves in a position where they cannot provide the services they charge for, which is fundamentally a security of tenure free from the risks from the ravages of house prices, interest rates, mortgage regulation and so on.

So an element of rental fees is insurance, and they have failed to provide that insurance by indirectly exposing their tenants to that which they should be sheilding them from.

They take these risks on behalf of the tenants, and a good landlord should themselves either be unexposed to these risks, or be willing to absorb them, and yet I have seen posts proclaiming that their tenants accepted the risks through tenancy, which is rubbish.

Landlords go bankrupt, but the houses aren’t knocked down. The tenants stay where they are and continue to pay rent to the receiver. The receiver sells the houses on to new owners at a lower price. Or a new owner may rent them and make an acceptable return on the investment (maybe the lower purchase price even allows lower rents for the new tenants!)

Laura, the assertion that “rents are hiked to cover the taxes” is mostly incorrect as rental properties do not exist in a vacuum free of market forces. Taxes are a business expense and expenses do not inform product pricing in the same manner or degree that consumer (renter) ability to pay and marketplace competition does. Outside of a cartel arrangement with a captive market, this is reality.

It is true that “landlords can’t afford to own the properties if they can’t generate the cash flow to cover their bills” but many will still carry the losses holding out for eventual cash flow later on.

The example of a former landlord’s property taxes vs yours is misguided. Tax structure and planning for rental property businesses as compared to personal primary residences is quite different enough that unless you know the landlord’s books and tax filings, you don’t know enough to make a real comparison.

Look at the fun(!!!!!!) the renters in the UK are having after the UK taxation changes that have really put so many property-investors in really difficult positions.

Song (HMRC = equivalent of, Internal Revenue Service )

https://www.youtube.com/watch?v=YDVTfkb7VUs

Landlord with loads of properties.. he was once just a butcher’s apprentice and wanted to become a pro-breakdancer, but found success in property investment, loads of properties, via MEW (mortgage equity withdrawal). It’s got to come to the US.. the move on investors!

Downfall video (2015). https://www.youtube.com/watch?v=zZLjtMoB2F4

The start up bubble as well as tech bubble is/would gradually burst.

Apple last 15% in last few weeks, YELP lost 30% as well as tweeter.

The show has just started…. tighten your belt.

Before embarking on stocks analysis…I recomment learning to spell things like “Twitter” (no, it’s not “tweeter”)

An spot on short read.

http://www.nationalreview.com/article/371271/golden-gated-communities-kevin-d-williamson

Interesting outcomes vs what was predicted here…. huh.

Leave a Reply