Why the American dream is only a dream for most – Rent versus buying a home analysis in Culver City. Why it makes sense to rent in bubble cities and why the mainstream press fails to mention household incomes.

Simply because people continue believing in something does not make it true. Last week a few readers sent over an article from the New York Times discussing that nearly 9 in 10 Americans still say that homeownership is an “important†part of the American dream. I always find these surveys to be fascinating since they target emotion rather than data. Of course, nowhere in the survey was income discussed but then again we are in the debt bubble delusion machine here. Interestingly enough lower in the survey 58 percent believed that lenders should require the standard 20 percent down. Do these people have any clue what is going on with FHA insured loans and their near nothing down 3.5 percent down payments? First, the question about homeownership does not reflect the ability to own a home at current income levels. I bet if you asked people “do you think education is important†you’d probably get a similar result but does that justify $50,000 a year for college? Yet this kind of psychological reasoning is what brings in the buyers into inflated areas like Culver City where yes, prices have fallen but are still solidly in a bubble. Today we’ll carefully examine why it makes sense to rent in many of these bubble cities.

Culver City bubble going strong

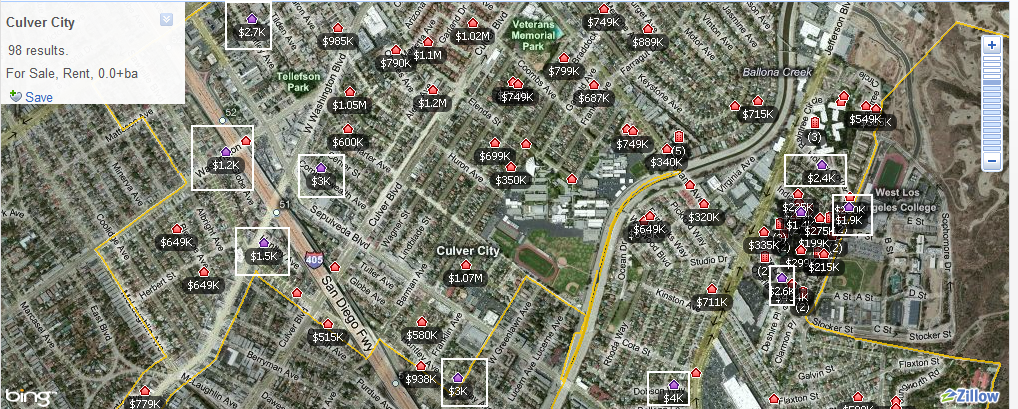

The first thing we should do is get an over arching view of the city:

The purple colored properties are those available for rent while the red colored homes are those for sale. Culver City has seen prices decline but still remains in a bubble. To remind people about what a bubble is, prices are disconnected from underlying fundamentals (i.e., household incomes, etc). Sure, based on the survey regarding the American dream you have enough people silly enough to dive into hundreds of thousands of debt for cookie cutter homes but this isn’t news. In fact, this is the exact reason why the housing bubble gained so much steam in the United States. The emotional desire to buy did not coincide with a decade of lost incomes. Remember this ad?

Of course there is no mention of incomes. Back to the above map you’ll notice that rental prices are rather reasonable in a good city. Let us pull up an example and run the numbers.

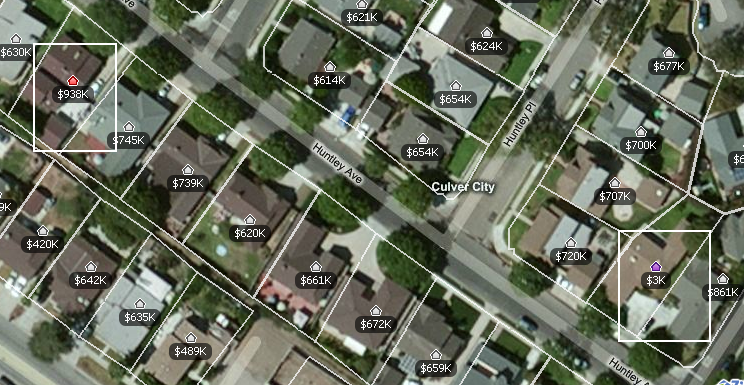

Above we have two similar properties. The home for sale is this place:

4473 HUNTLEY AVE, Culver City, CA 90230

Listed   05/05/11

Beds     4

Full Baths            3

Partial Baths      0

Property Type  SFR

Sq. Ft.  2,488

$/Sq. Ft.              $377

Lot Size 5,869 Sq. Ft.

Year Built            1952

The current list price is $938,000.

4 bedrooms and 3 bathrooms home listed at 2,488 square feet. Okay, let us take a look at the rental:

This place also has 4 bedrooms and 3 bathrooms and is listed at 1,800 square feet. The current monthly rental rate for this home is $3,000. So you have a home that is a solid substitute for the home that is currently selling for close to one million dollars but is renting for $3,000 per month. This is a perfect example of a city in a major bubble. Take a look at the sales history for the home that is selling:

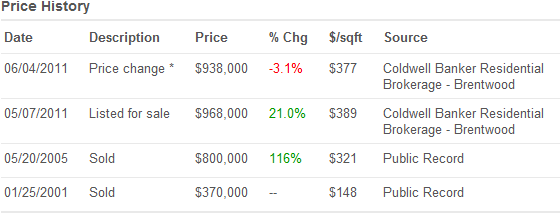

The place sold for $370,000 back in 2001. Keep in mind that over this decade household incomes have gone stagnant. So what justification is there for this home appreciating nearly $600,000 in 10 years? When you run the numbers you see why renting the home in this area makes so much more sense than buying:

Purchase price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $938,000

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 10%

Total monthly payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6,500 (principal, interest, taxes, insurance @ 6.5%)

Case needed to close:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $121,112

Buying this home will eat away $6,500 per month while the rental will take $3,000. $3,500 a month in extra cash is a big deal. Whenever we present an argument like this you will always get the argument that you also get the interest deduction for buying a home so the cost is lowered. But this is like spending one dollar to save thirty cents. With that additional disposable income you have, you can find creative ways to lower your income like funding an IRA, putting more into your 401k, or how about using that extra cash for a business where you will find similar deductions? The bottom line is that if you buy this home in Culver City you will be paying out of your monthly budget $6,500 in housing payments.

Any way you slice it buying in this area makes no sense at current price levels. To comfortably afford this mortgage a household would need to be grossing $280,000 or more per year. For the 90230 zip code in Culver City the average adjusted gross income is $62,972. Let us be generous and say that homeowners have an adjusted gross income of $120,000 or twice the average. There is no way that it comes even close to $280,000. In fact, in California only 6 percent of households make more than $200,000 and I assure you they are looking at more prime properties.

Again the mainstream press fails to examine household incomes because it counters any of their fluff pieces. The most important factor in having a healthy housing market is the underlying economic situation for households. Stagnant incomes and 16 percent underemployment (23 percent in California) do not bode well for home prices. Why is this fact under-reported? When the bubble was raging there was no focus on stagnant income growth yet we found every absurd article on why home prices would keep rising. Now, we see articles trying to justify a bottom. Where is the detailed analysis showing that many cities are flat out in bubbles still? No wonder why alternative media is finding a home because very few bother to do the mathematical work to show that psychology can only keep dreams alive so long until math has to bring it back down to reality.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “Why the American dream is only a dream for most – Rent versus buying a home analysis in Culver City. Why it makes sense to rent in bubble cities and why the mainstream press fails to mention household incomes.”

Dear Mr. HousingBubble,

As usual your analysis of RE in our state is on the ball. Anyone who reads your blog won’t be buying any time soon.

Why income, the bottom line, is not included in the equation by the so-called RE experts is beyond me. Of course, they certainly have no hidden agenda do they???

Have a great July 4th,

Peter

Some parts of the country are very different. Where I live (Charlotte, NC) it is cheaper to own than rent. I just bought a 4 br. 2.5 bath house on .4 acre for $184k. 25 minute commute to center city. Taxes, insurance, mortgage will be $1130 w/ 8% down. To rent something similar would be $1300+ month. Median income in Charlotte is $48k. Market seems to be pretty close to balanced. I expect prices will overshoot to the downside but I think the bottom is within a two or three years. The situation above seems unfathomable based on what I see here.

Oh, but the humidity there!

The one for sale is in reality worth…..$370K at best and that is reflected in what it might rent for…$3K/month

The economy was maybe down from the dot.com bubble when the house sold in ’01, which maybe bumped the price down slightly (if any),but it wasn’t off a cliff with a knife in its back holding a hand grenade like it has been this time around, and the house then sold for $370k. Now they want $968k for it?!? Looking at the miserable state we’re in, that place should realistically take an instant $600k haircut (unless heavily upgraded with a 24k gold counter top). And then we can start pricing it according to: shadow inventory, income levels, unemployment, bad state of the economy etc.

Realistically, prices should be in the toilet, and anyone who is still employed and have a couple of cents left should be able to put down their 20%, get a loan, and move in.

I’m sick and tired of the disconnect, and people who don’t comprehend facts. It’s like we’re in this thick fog, and a non-factual logic is being applied. You would have thought that we would have learned something by now, after ten years of bad deals?

You could see the storm coming in ’08, and you just had to hunker down and wait for it to pass. We’ll, I see another storm coming, I don’t think we have taken our medicine from the first round.

Thank you Dr. H.B. for another excellent article.

I hear people parrotting the “Make It 20% Down” line.

I seriously doubt they have thought it through.

Surveys have shown that 53% of current homeowners could not have bought if they had to put down 20%

Other studies have clearly shown that it would take the median household (that $50ishK income) close to 15 years to save up 20% down for a house where the mortgage, insurance and taxes was not more 28% of their income.

FIFTEEN YEARS – and that assumes that the household is NOT carrying student loan debt which is, on average $29,000 per person.

If a young couple wants to buy a house in 5 years, here is a typical scenario. They each has the average student loan debt (total $58K), have 1 child (something that can not wait until they are in their late 30s & able to buy a house after saving 15+ years) & have 1 car payment for a $15,000 car, then the income they need is staggering. After factoring in retirement savings of $7200 a year, childcare so they can both work, rent (at the amount my old 2 bdrm apartment in a grad student/young professional area now rents for), student loans, their share of employer health insurance and a Food Stamp level food budget…..and saving enough to have a 20% downpayment in 5 years ….. they need $98000 a year. Ninety Eight Thousand. And they can afford MAX – after saving $9000 a year for a downpayment of $45,000 – a $224,000 house which would be 2.28 times their income.

That kind of household income – $98K – is the top 13% of all households and the top 6% of all workers. That means they would each need to earn about $50,000 – the top 25% of all workers.

It is virtually impossible for the bottom 80 -85% in the US to save up a 20% downpayment in less than 15 -20 years. The cost of living in the US is simply too high as compared to 30 years ago & incomes are too low & have not kept up with the costs.

ANd when you force that many potential buyers out of the market 2 things happen:

(1) House prices fall through the basement;

(2) Land ownership becomes concentrated in the hands of the top 10% & the other 90% become tenant/peasants

BTW, the FHA has been a 3 1/2% downpayment for decades. It is NOT the amoun t of the downpayment that is causing the default on FHA loans – it is the loss of INCOME for 90% of those in trouble. FHA was always geared more to the middle and working class households – not the upper 2% with their $250,000+ incomes who want to buy a $750,000 house! It should be focused back on its primary mission and loans capped at the median priced house in a county.

Amen Ann!

Govt should have no role in helping upper middle class/wealthy people buy homes, and mortgage interest deduction should disappear too

Ann, I am one of those people who are screaming for a minimum 20% downpayment. If that number was kept in check the last decade, we wouldn’t be in the mess we are in now. Back in the “good old days”, people saved many many years for that downpayment and banks were very picky about who they would give loans to.

Your argument in a nutshell is that it would take your average person too long to save a 20% down; therefore, we need smaller downpayments. How about this, why can’t home prices fall to realistic levels where a king’s ransom won’t be needed for a downpayment. Home prices are still completely and totally inflated in any decent part of southern California. It doesn’t take an advanced degree to see that prices need to come down in order to have a healthy future housing market.

From today’s Culver City post, this seller wants more today for the house than it sold for during the peak of the bubble in 2005. WTF? Remember what I was saying about home prices need to come down.

BINGO!

Anns fails to think about what she is saying.. If far less people were able to buy with 20% down, prices would come down to levels where far more people could buy with 20% down)!

She screams how unfair it is to the average person to have to save 20% of bubble prices while proposing ideas that will keep those bubble prices.

What is better Anns, 20% down of 900K or 20% of 350K? You are rooting for the 20% of 900K while failing to realize the people you are so worried about would be far far better off with 20% of 350K.

There is only one reason you would be rooting for 20% down on 900k, you somehow benefit from the current bubble prices. Perhaps I was wrong when I said,, “Anns fails to think about what she is saying”. It seems more probable that you are thinking very much about what you are saying, and your own self interests.

You hit the nail on the head.

“Back in the “good old daysâ€,……

The average priced car only cost 27.3% of the median household income – not 60% as it does today.

My very highly ranked private undergrad college (among top 2% in selectivity) had a sticker priced that was 33% of the median household income – not 100% as it is today.

One worker could support a household on a median wage – now it takes 2.

And then there are halthcare costs which have exploded expotentially…… my neighbors were thrilled they finally qualified for Medicare. As small business owners they had been payig for their own coverage — with PREMIUMS alone of $16,000 a year for 2 people. “Back in the good old days” it was only $1800 a year for a FAMILY and $800 for an individual — and yes, I know what it cost 30 -40 years ago as my family owned a business since 1930 that provided coverage to its employees with first dollar coverage, medical, dental and vision and prescriptions.

__

And the housing cash was NOT caused by how much a buyer did or did not put down. It was caused by LOUSY underwriting! No proof of income. Loans where the payment was more than 28% of gross income. Loans that didn’t include taxes and insurance in figuring the ratio or DTI. Mortgages given when the mortgage and other fixed debts went up and over 35 – 37% of gross income….

The downpayment is NOT an issue. My little local commuinity bank does most of the State Housing Authority home loans in the 2 county area – loans with limits on income and limits on price of house. These are anywhere from 0 down to 3% down loans. They have been doing these loans for 15 years. They have NEVER had a default on those loans – the buyers had to document every penny, have held the same job for 3 years, couldn’t spend more than 28% of gross on front end DTI and couldn’t have fixed debts that came to more than 36% of gross for the back end DTI.

And if the downpayment mattered then a borrower here wouldn’t have walked away from their beach house where they put down 25% and borrowed another $2,100,000. They blew it off when after 4 years it wouldn’t sell for even 1/2 of what they owed (and the bank – BOA – was the one cutting the price.) They walked and let over a $500,000 be gone in the wind. That dionwpayment – an enormous downpayment D-I-D N-O-T matter. (And no they were not flippers – had it for 4 years and then were getting divorced.)

Exactly. Ann WANTS ARTIFICIALLY INFLATED PRICES. That’s what the 3% downpayment is for – not making homes affordable, but making them UNaffordable without government subsidized credit, turning even more of the population into debt slaves than already are. No thanks. 20% down and a private housing loan market will return sanity to home pricing and banking practices, for the benefit of everyone but the banks, the realtors, and the folks who profited from the bubble or were stupid enough to speculate in bubble priced housing.

Exactly. It wouldn’t take 15 years to save up for a down payment if prices weren’t artificially inflated by foolish financial ideas like 3% down payments, tax write-offs on interest, govt backed mortgage companies, 30 year mortgages, govt bail outs of insolvent banks, and all of the other perverse schemes concocted to keep people in debt slavery so they can have a shiny new toy and be just like the Jones’.

Don’t forget proposition 13 which keeps supply from coming on the market.

Ann,

I see where you are coming from. I believe that all the shenanigans you describe were a cause of the housing bubble. Were they more or less important than 20% down, I can’t say. But each factor played a role. Add the credit default swaps, wildly inaccurate rating agencies, and the circumvention of reserve ratios with securitization, and runaway government borrowing. It was like the operators at Chernobyl pulling the control rods one by one until disaster occurred.

Keep posting. I love the clash of ideas.

Anns, can you please answer one question for me. Did you buy an overpriced house in California and now you don’t want to see prices go down? I suspect you did with your reasoning.

Here is your reasoning in a nutshell again: prices for cars, tuition and healthcare all have went up from the past, so houses should too. That is complete BS.

You are completely off your rocker when you say no or low downs had nothing to do with the housing collapse. When people but nothing down, there is little to lose other than some fictious credit score. First of all, if you haven’t saved a penny why should you be given the opportunity to make the biggest purchase of your life? Additionally, when you have no skin in the game…turning in the keys makes the most financial sense if a big drop in prices occur. Multiply this by several million and you have major trouble on your hands. I don’t have the data in front of me, but I would be willing to bet that the majority of people who defaulted in the last 5 years put very little down of their own money.

Face it, prices need to come down. I know Washington, Wall St., banks, realtors, housing industry will kick and scream the whole way down, but there is no stopping the inevitable.

Ha ha yea right! You just GOTTA lv the logic on these posts. Hell, why not make homes 100% down or a straight out buy!!! Man, the prices would be so low if people had to put 100% down, and you know what? No one would “walk-away” from their homes.

Enough of these “poor” people cluttering up the financial world, it’s time to let the “elite” own the majority of the homes. 100% down, stop helping poor people get a leg up, they don’t deserve it.

Wheresthebeef is spot on.

Back in the day, it was 20% down or hit the road. No lender would look at you.

That kept prices honest. Nobody would try to sell a house that nobody could affort on those terms.

Bring the prices back in line with incomes, and raising 20% by people who can service debt wont be a problem again. But people who cant raise 20% have no business owning real estate. They are called tenants.

If they cant afford Porsches or yachts either, guess what. They shouldnt have them.

Weep not for those who cant buy overpriced real estate. But dont tell me that we should lend them the money to do it. Thats how we got in this mess in the first place. Just ask barney frank.

Swiller, you need to redefine your definition of “help”. We didn’t help the millions of “poor” homeowners by getting them into loans they could not afford, or they had to stretch their budget until there was no wiggle room. The way to “help” the poor is not through enslaving them to debt, and the extension of credit, it is through real housing affordability. Larger down payments are just one of the factors which would bring affordability back to housing.

In the end I think the market should set its own rules without government mandates and the government should just exit the market altogether so I fundamentally disagree with a 20% mandate, but we live in a market where the government still backs loans at 3.5% up to 729k, and the fed meanwhile is keeping interest rates artificially low extending easy money to the banks. In a truly free market I don’t think the banks would even consider less than 20%, or if they did as during the housing boom, they would be allowed to fail. But we don’t live in that world.

What was to be elastic is the price, not the draw string in the sellers underwear. The market needs to get over bubble land. Lawerence Welk turned off the bubble machine years ago. GET REAL.

Who is Lawrence Welk?;-)

Seriously Anns, I don’t want to gang up on you but you truly are failing to see the bigger picture.

There’s a difference between individuals vastly overpaying with even a 25% down payment and losing the house (ahem, because it wasn’t worth $2mm) and everyone, in the aggregate, having been required to put 20% down. Like in Texas where 20% was required by law bubbles are popped before they even start to inflate, because that 20% is always a floor. You mentioned lousy underwriting, but the lousy underwriting was enabled by the fact that it’s easy to lie about your job, your income, etc, but it is exceptionally difficult (if not impossible) to get around showing up at the closing with 20% of the purchase price. (I take that back – Countrywide took care of that, too – the 80/20 piggyback. They can fund 100%+ of a mortgage and claim that the buyer put in 20%. Brilliant!)

We are in a deflationary period in housing. This deflationary period is following an inflationary period, i.e. the 2000’s. Keeping underwriting standards low (no 20% requirement) tries to keep the good old [unsustainable] days alive. Since few people could show up at closing with 20% of inflated values, property prices will fall.

I think your 5 year plan is reasonable. Saving 9k/year with combined 98k income for a young couple then buying a home at 224K (which is how much 3/2 homes should cost in Burbank) sounds completely reasonable to me.

Handing out no down loans seems like a fail-trap for people who don’t know how to save properly.

Bring on 20%.

The numbers are the same downunder. I just signed a lease on a dual residence property in a very nice beach community with an incredible view of sea and offshore islands. Essentially I am renting a 4/3, although it is divided into a 3/2 upstairs and a self contained 1/1 apartment below. There is a 2 car attached garage for my use (The owner is using the other garage) and additional outside parking for my boat. We pay rent weekly here, but it works out to NZ$ 2167 a month.

It is hard to determine what constitutes a sale price for a house in this community, as very few have changed hands in recent years as the market is frozen. Wishing prices for houses of similar size and location (some have been on the market for 2 years) range from circa NZ$ 650,000 to 850,000. In short, the houses are valued at around 30 years rent, same as Culver City.

Australia is worse, where houses in Melbourne and Sydney are priced at 40 years rent. Even better, there are no fixed mortgages here, they are all ARMs! Only a fool would buy a house in this market.

Ok, off-topic…but are you in “Paraparam” by any chance? I lived in Wellington [Churton Park] in 1998-99 and want to retire in NZ. I am wondering what property prices have done since the late nineties. Thx for the info.

NZ housing prices are currently ridiculous… i think i remember reading last year that they were coming out with a 40+ year interest only mortgage! My parents bought some properties in the 90s and i remember thinking they overpaid. Prices went down for a couple of years in the 90s but all theyve done since then is skyrocket. In a market as small as new zealand it’s just a matter of time until it crashes… just dont know when that will happen. Of course the NZD has also doubled against the USD in the last 10 years so if youre using US$s to buy then it’s a gamble as to what the fiat currency will be worth in a few years time.

Homes in the U.S. are the most affordable they’ve been in decades and prices may start to climb as soon as the third quarter, Housing and Urban Development Secretary Shaun Donovan said today.

Homes in the U.S. are the most affordable they’ve been in decades and prices may start to climb as soon as the third quarter, OBAMA’s Housing and Urban Development Secretary Shaun Donovan said today.

“It’s very unlikely that we will see a significant further decline,†Donovan said today on CNN. “The real question is when will we start to see sustainable increases. Some think it will be as early as the end of this summer or this fall.â€

Oh my, break out the beer barrel tomorrow. Good times are coming, according to our “Great Leader’s” mouth piece. Do you think that the Administration would lie to us?

He might be right on the 3rd quarter (1 chance in 4). Fortunately, he had the good sense to not specify what year, or decade.

Actually, there are many parts of the country where he is right. Can’t go wrong in Phoenix or Vegas and many other places. West Coast will decline, at best stagnate til inflation catches up in 10 years or so.

That is what my freind said to me when he bought a condo in Phoenix a year ago.

For sure Martin….I’ve got cousins my age (early 30’s) in Kansas City that are now buying nice places (3/2 or better) in the range of 40-60K…..places in the mid-west and the rustbelt of Ohio, Indiana, Penn, upstate NY have hit bottom or are very close to the bottom.

Can’t go wrong in Phoenix or Vegas and many other places.

You couldn’t be more wrong. Vegas is a sh*thole. People are getting destroyed that purchased a year or two ago, thinking “they couldn’t go wrong”. But whatever.

To those who responded to my initial post.

First, I didn’t say anything about buying in Phoenix last year nor did I say buy a Condo last year, I would NEVER buy a condo.

I am old enough to know that a sure fire way to lose in life financially speaking is believing you KNOW what is going to happen.

The facts are you can rent a 150K house in a good neighborhood of north Phoenix for 1500 or so a month or you can buy it for 650 a month. The fact is you can buy it below build cost.

If you are planning on staying put for years to come it is best to go with the facts because you are already ahead.

A bird in the hand is worth two in the bush.

.

On the other hand things in Phoenix above 250, certainly 350K probably have a ways to fall and I would not buy.

Or, you could bet that prices will fall more than you would spend in rent but again, why not go for the sure thing IF THE CIRCUMSTANCES FOR YOU are right?

Martin,

And what if things get worse in Arizona? What if that $150k property drops to $75k in 3 years? Sure you are paying less than the renter in those three years, but you are stuck for another 12 or 27 as an owner. The renter can pack up and LEAVE. You can’t. Enjoy the $600 a month mortgage when you are living in a ghost town.

Spartan.

Haven’t you been paying attention?

You pocket that savings every month and if things go the way you suggest, which I doubt, you simply WALK THE F AWAY!

You have nothing to lose if your worse case scenario takes place.

Your irrational fears won’t stop me from taking the sure bet.

You would pay an extra 1000 a month so that you don’t have to worry about walking away and screwing a bank?

Just remember money is literally dropped from helicopters these days so to have morals about not screwing a bank is just plain silly.

Both those houses are one street away (Sawtelle Bl) from the 405 freeway. Even with the soundwalls you can hear the freeway traffic 24/7. Don’t forget the pollution as well if you’ve got young kids playing in the patch known as the backyard.

freeway proximity is a potential health issue on top of the constant drone of the freeway. I have noticed a lot of the ‘good deals’ these days are too close to a freeway or on a street that is more like a highway from 5am to 2am (Highland, Bundy, Olympic, etc).

Excellent point about health impacts with respect to freeway proximity; Environmental Engineers actually model limited-access highways as long narrow SMOKESTACKS, in terms of both emitted pollution and thermal effects on local climate. ;’)

Man, Greater LA really screwed the pooch in terms of urban/transportation planning, despite all the advantages of 20th Century knowledge and hindsight. It is their everlasting shame that other cities, laid out a full century OR THREE before LA still continue to function and flow better than la-LA. But I guess that doesn’t mean a tract-shack next to the freeway isn’t worth 8.5x local incomes… 🙄

California’s nicer areas may be an exception, because of high demand for rentals, but I don’t see any reason why RENTS should remain as high as they are in most cities in the U.S. Lots of people prefer to rent these days, but there are supposedly 13 million vacant houses at this point, or something like that. No doubt many of them are in bad neighborhoods, or in the rust belt, etc., but I wouldn’t be surprised if rents plateaued and then began to fall at some point in most areas. If immigration slows down and more kids stay with their parents until they marry, the demand for apartments may decline over the next five to ten years.

As a (admittedly small-scale) landlord, I can tell you with high certainty that:

a) There is no “conspiracy” or even cartel to “prop up” rents. If there were, it would be, as all RE condtions are, LOCAL… and *I* would be joining up, lol.

b) While all “statistics” are suspect, the ones on vacant housing units are especially so. But even taking the higher numbers, as someone who tours (or at least peaks into) several vacant props per month, I can tell you that in a Bubble Zone like mine (So-Fla), only about 15% are in RENTABLE condition, and of those, over half are embroiled in some stage of legal limbo.

i.e. the “excess” supply is not nearly what your stats would suggest, and you’d be shocked at the $$ required to get even a gently abandoned property into tenable shape here in Mildew-Land… let alone a foreclosure that’s actually been pillaged and stripped.

PS: also a big element of “the stats” in So-Fla are built-but-never-occupied condos that have little to none of the interior work completed. They’re getting finished and dribbled out one by one as rentals, not due to any “conspiracy”, but simply due to current banking conditions–no one can/will take the huge financial bites anymore… it’s more of a slow “boot-strapping” your way back, pay-as-you-go environment, for players both large and small. Who can find blame there?

Ok, I’m confushed. A little fuzzy on my math.

the rental house math is: $3,000 / 1800 sq. ft. = $1.67 / sq. ft.

The selling house is: 2,488 sq. ft. or 38% larger then the rental house.

This would seem to imply a rental price, if one were to rent, of $4155 / month.

Thus if I were a cash investor looking to buy the 2,488 sq. ft house…

$4,155 * 12months = $49,860.

My investment return would be $49,860 / $938,000 = 5.32%.

As I understand the rough rule of thumb: investors to rent out property want minimum of 10%. Buyer / owner /occupants want minimum of 5% “return”.

Thus it would appear that this $938,000 house is starting to become an interesting value, strictly based on these numbers. Not including fixing house up, modifying, and all the other variables.

Am I missing something in these numbers….

Working backwards….if this 2,488 sq. ft. house rented for $3,000 / month => $1.21 /sq. ft.

At a 5% return….a rental of $3,000 /month should sell for $720,000. ($36,000 / .05)

In order to get to a 2001 price of $370,000….. would have to rent for $1542 /month. Or $.62 / sq. ft. A seemingly large rental price drop??

Am I missing something here??

Thank you.

I don’t mean to sound a little “loud” but you are DEFINITELY missing a number of key factors. For example, you should probably assume that taxes, insurance, repairs, maintenance, vacancy account for an EXPENSE factor of about 40-50% (let’s use 45%) conservatively, as it costs a lot of money to “run the house as a business”. So you’ll want to start by reducing your total income by 45%, which brings the return down below 3%.

The second challenge is that most cash investors aren’t looking for below 3% (I am one of them). We’re looking for 10% knowing that true inflation is running at about 8% today. The other issue, of course, is that we’re demanding deep discounts to reflect future price DEFLATION. Yes, we all expect prices to CONTINUE to decline and, just like the loan appraisals that are coming in suspiciously low (this is literally because banks are factoring in future price declines), we’re trying to protect ourselves by buying at a steep discount, which in theory will bring up our yields.

There’s one very simple and quick calculation that investors do, at a glance, to decide if it’s even worth taking any time on a specific property: If the MONTHLY rent is 1% or more of the purchase price then it’s worth looking into further. In this case the monthly rent you mention is about $4,000, the property price is about $9,000, and the rent:price ratio is less than 0.5% or less than 50% of target, which explains why the yield is so low (below 3%). This ratio wasn’t necessarily accurate when people we factoring in price appreciation in CA but now, as everyone is looking at cash flow, it’s spot on. I hope this helps.

Good luck to everyone and be VERY careful. Whether you’re investing or buying as an owner-occupant, be sure that you’re comfortable with price DEFLATION eroding your equity in the coming years if you’re considering buying a house.

Good luck to everyone,

Investor J

http://www.meetup.com/investing-363/

http://www.meetup.com/FIBICashFlowInvestors/

Let me guess, you’re not really an investor yourself, are you? Simplifications like yours are the perfect recipe for a failed investment…

I don’t usually reply to posts like these but I would like to point out to everyone else that whoever replied to my “simple” formula is probably just afraid of the unknown when it comes to investing, which is not uncommon. Unfortunately fear is one of the great inhibitors of success.

Feel free to check out the links below and you’ll quickly see that you’re wrong about me being an investor. In fact, I am a full-time cash flow investor who has been at it long enough now (a decade) that I am lucky enough to be living off my cash flow. I also co-founded a public networking group for investors that now has 11 chapters with monthly meetings throughout SoCal and over 2,000 members.

Good Luck To Everyone,

Investor J

http://www.meetup.com/investing-363/

http://www.meetup.com/FIBICashFlowInvestors/

Hahahaha, and just to think: had the TARP/TALF/QE’s 1&2 et al gone directly to homeowners to pay off the mortgages and then they had became the mortgage holder (US Treasury), there would now be the semblance of an economic “recovery.” A semblance, because for all the squawking by Libertarians about the “failed Keynesian” tactics by Obama (started by Bush) of all the new debt created….this is not “Keynesian” policy.

Keynesian policy stated the debt was to be used to create JOBS, not BILLION DOLLAR BONUSES for WALL STREET BANKERS. Capice, America? All you are getting is the BILL. And the shaft.

Foreclosures and dislocations from job losses would and could be ended had the “bail outs” come to those paying for it…… payments easily extended when necessary, home prices adjusted to new reality, increasing homelessness ended…but again, that is not what the policy makers desire…they want to be made whole on diminished value assets. They want to “win” on losing bets placed…and you & I pay for it.

And this is the result desired from those making policy…what is desired is exactly what is occurring….the heck the little people.

The short-sighted greedmeisters turned America to a place where we shipped our jobs off-shores, called making paper asset WMD’s out of thin air an “Industry”, and thought making houses constituted manufacturing, while real manufacturing jobs were sent to lowest labor areas possible, in US and world-wide….where the workers can’t afford the goods they make either: a “lose-lose” situation these geniuses are now figuring out. They’d never heard of Henry Ford: “was he a banking lobbyist?”

Maybe they’re figuring it out, they do have those “University” diplomas holding them back….more worthless paper….if by the results they are judged.

$50,000/year college educations? I recall a PBS documentary I watched maybe 20 years ago now….highly educated idiot, talking about how we were changing into a “Service Economy” from an “Industrialized” economy…. expounding on the wonderfulness of Free Trade, High Tech, and low labor costs abroad…then had the most puzzled look when asked: “how about those Americans losing jobs in highly-paid manufacturing jobs…where will they find jobs to sustain their standard of living” and what did this highly educated idiot have to say?

“I am not a Social Scientist, my field is Trade & Economics”…as if it takes brains to figure out the consequences….wish we could find this genius now….and a rope and a tall tree….

Incomes have stagnated for the bottom 80-90% since 1972. My folks bought a house in Los Altos in 1972, 1400 sq ft, 1/4 acre, two bedrooms: $38,000…and bargained with the widow for a week before agreeing on sale.

My youngest brother still lives in that house, both folks gone now…it hit $1.4 million in 2006. $980,000 last I checked Zillow. Look out below…..

Think my dad, a United Airlines mechanic, and mom, a high school grad that worked for the federal government her whole life from age 21, could have ever afforded to live in Los Altos now? Just because they worked hard every day of their life to provide a better life for their kids than they had had growing up in the Depression? No way.

Where will the price for this house eventually end up? I am guessing @ $275,000-$350,000 if the FRN’s don’t collapse completely in value through Fed-induced hyper-inflation…

Meanwhile the banksters frontrun their way to billions in unearned loot, and leave taxpayers the bills for their losing bets. While accepting “bail-out” funds and refusing to adjust mortgage prices to reality…because, in reality, they are all insolvent.

America…wake the heck up…time to clean house…… in D.C. Out with the old, in with ALL new.

my sentiments to the letter.

Totally agree but it’s gonna take a really hard and long fall to snap Americans out of complacency. That’s by far our greatest weakness as a populace.

Yeah, farang, that’s the crazy thing. If they had just handed the trllions to mortgage payers, the money would have ended up with the banks anyway, and the economy would be booming.

Obviously, there is no free lunch, and in that scenario we would get hyperinflation sooner, rather than in the present (actual) case, later. But the present case is far more destructive because of the way it is destroying so many families with high unemployment. We’re going to get high inflation anyway, so there is no use fighting that. Shoulda fought unemployment, but it is a bit late now.

I completely agree farang. The American middle class has been raped and pillaged by the banksters in Wall Street. In fact, they did before just when the tech bubble hit. Politicians and banksters have agreed that keeping Americans enslaved (in debt) all of their adult life is a good way to rack up interest payments. With the expansion of credit, increase of housing and education, the middle class has very little disposable income. Even worse, the smart growth development and housing policies in California have increased prices even more. In the 1970s, Houston and San Francisco had the same home price/income ratio (about 2.2-2.5). In 2006, San Francisco went to 10, while Houston’s has at its historical norms. Talk about a bubble. That is some crazy ish man. Remember folks, debt=slavery.

At 1800 sf and 4 bedrooms, 3 bathrooms, that rental property must have very small rooms.

The house currently listed for $938,000 clearly has an addition in the back. Perhaps when it sold in 2001 for $370,000 it was much smaller (perhaps just 1200 square feet or so). Then maybe those 2001 buyers added on; this could explain its high sales price in 2005 and its low price in 2001. Just guessing, but $370,000 seems too low for this house in 2001.

Also, to mathchallenged and confused, you have to subtract for expenses before you can calculate your cash on cash return, which would be under 5%.

Those numbers sound about right, from 2001 to 2005 it wasn’t uncommon for houses in many Socal cities to double in value. In my neighborhood in Huntington Beach, the little 3/2 ranchers were selling for around 300-350K in 2001. These same house were going for 650-800K during the peak of the bubble (2005/6 timeframe). No bubble there folks, Suzanne told me so. 🙂

I suspect an addition was made after the 2005 sale. That is the only reason this seller could possibly justify asking almost 150K than a 2005 peak bubble price sale. Either that or people are crapping gold turds in Culver City.

Where do you get 6.5%? People are getting 4.x% on a 30 year fixed, and 3.x% on 5/1 ARM.

All I’m going to say is that with only 10% down, this would be considered a Jumbo loan. Do some internet searching.

Mathematics is the great equalizer when it comes to real estate. It’s too bad most people don’t take the time to analyze the most important financial decision of their lives. Lazy, dumb, no time, family or social pressure are but a few “reasons” they don’t do the math. Over this last decade, when others were figuring out complex mathematical ways to keep the housing scheme alive, people were either too tired, greedy or pressured into buying homes they couldn’t afford. This includes the entire spectrum of buyers from “sub-prime” to “prime”. Not to mention, the lax government oversight that allowed this crime to go on. Until the faces change in the financial arena of government, we will have the same result, only this time much worse.

Sub-prime markets have already corrected 50% or more, whereas everthing else is around 25% off. Anyone buying in mid-level or high-end tiers will get whacked another 25%, as loss of incomes eventually affects the top of the real estate chain.

Every government trick in the book has not and will not keep the market from going where it ultimately must go. Down to real affordability. Back to the point where incomes support mortgages, so people can “Live” in a house again.

Anyone buying into the MSM and Industry spin hasn’t learned from before and probably never will. Keep saving your money and you will be in the catbird seat, once everyone else has given up hope.

http://www.westsideremeltdown.blogspot.com

Sometimes I could strangle my friends who bought a $700K home that has no a/c and a leaky roof. They went the FHA route with only 3.5% down. They bought a year ago and it’s probably underwater, I would guess. They have no money to repair the roof and are roasting in the heat. Way to go.

Unfortunately, politics will interfere with the bottoming out of the RE market. It’s only mid-2011 but it feels like we’re in election-year mode already. The gov’t, banks and RE lobby will do all they can to prop up the bubble mentality thru the 2012 election cycle. After that, when the economy craters again in 13′, Socal bubble areas will finally fall to pre-bubble levels. Don’t buy nuthin’ until the smoke clears away and all the phony gim micks have been used up. Buy a place to live, period. And keep following the good Dr. His posts are dead-on accurate.

I don’t know about that, Mikem. At the federal level I think they will get a debt ceiling deal done, within a few days of the drop dead date, Aug. 2. But they are going to cut a lot of federal spending, I presume, and that means a lot of good paying jobs.

They aren’t going to cut social security or the military.

But the likely targets, HUD, Energy, Transportation, EPA, Education, all of those employ relatively high paid workers, most of them home owners or likely buyers. Look out below. Housing will take another big leg down, and I’m not even factoring in employment cuts by state and local governments.

Take MN. 20,000 state workers are laid off until they patch their budget up.

I don’t believe either social security or the military are untouchable anymore. Defense cutbacks are already on the table and both sides seem willing to entertain them. Likewise, if you take a look at where the debt comes from:

http://en.wikipedia.org/wiki/United_States_public_debt

..specifically the public vs. gross debt plots, it seems clear that perhaps 40% of the gross debt is just the government owing itself money. Now, if you believe (like I do) that this is total nonsense — you can’t owe yourself money — then you will quickly agree that there is no social security trust fund! You will be left with the conclusion that social security is actually a paygo program that runs a surplus every year that the government uses for other things. That is, it is a socialized immediate transfer of wealth from young to old, not an investment vehicle. (Here I am using the term socialized without the usual contempt you will read most other places on the web. It just is what it is.)

When the surplus runs out and the money has to flow the other direction, then the poop hits the fan and you can bet your bottom dollar that social security benefits will be cut back or the payroll tax will be increased or some mixture thereof to balance payments again to make the program at minimum budget neutral. This will happen due to demographics and there is not a lot that anyone can do about it. We will only have two workers per pensioner instead of 16 in 1950. It should be obvious that we can’t afford to deliver the same level of financial assistance to Boomers that we did to their parents and grandparents. The Boomers just didn’t have enough children. Social security payments will be revised downward and pensioners will have to live more frugally.

That can is currently being kicked down the road, not from irresponsibility, but I think just because almost all in Congress know social security as a handy pay go vehicle that gets them extra $$$ for pork, and that it can and will be fixed on the day it needs to be. There are large political costs for doing it any sooner. It is just a matter of time. Since we are now in endgame, the various parties are playing chess at the moment trying to figure out how to stick the political tab on the other party. This silly nonsense over the debt limit is just a warmup. I thought the payroll tax holiday was a cynical attempt by the Republicans to make the day of reckoning come sooner, which should be to their liking, but after listening to Obama defend it too, I think he actually believes it is a way to put extra money in the hands of folks who will spend it. So, I suppose there is some justification for it in the short term, not that I like it.

In the mean time, there will likely be some crafty patches to the social programs like the ability to retire at much reduced pension at 62, which save the government money over the long term. How many people will say no to free money now, even if they are mostly assured of more money later if they do?

I heard a speaker a couple weeks ago talk about an alternative approach to improving the housing market that sounded interesting to contemplate.

His research showed that examining the historical delinquency records for mortgages by down payment made revealed that prior to the introduction of subprime mortgage loans when unqualified borrowers got loans, delinquency rates were independent of the % downpayment made.

Assuming that is correct (I have not attempted yet to verify this proposition), his suggestion is to allow 0% down loans on current housing stock. The caveat is that only buyers whose income truly qualified them would get the loans.

This would appear to do a number of things:

1. Eliminate the multi-decade delay in young buyers accumulating enough for a 20% down payment.

2. Recognize that many college grads now have student loans that approximate a mortgage, but can afford to make the payments on those loans as well as make rent or a mortgage payment.

3. It would cause housing prices to soften but not collapse

4. Current and shadow inventory would be absorbed faster than under the current rules and requirements.

Thoughts?

I believe I might have seen the same person (Bruce Norris? – very smart guy) a couple of weeks ago as well. I was actually sitting next to him at a dinner prior to one of the events at which he spoke. I asked him quite a few questions and the one clarifying item that he mentioned with regards to your comments above is that the 0% down loan MUST be allowed to transfer (ie. Assumable) to a new buyer in the future. He specified this because his thought is that an assumable mortgage can be beneficial for future buyers and if new buyers can’t afford the current mortgage then it can simply be assumed by someone else who also strictly qualified via their income.

I think it’s a good idea, in theory, assuming VERY strict standards, but it will never fly in practice. I’m guessing there will be several comments here mentioning that 0% down is crazy. But the data does show that deliquency rates are not correlated to down payments, as crazy as that sounds…

Good Luck To Everyone,

Investor J

http://www.meetup.com/investing-363/

http://www.meetup.com/FIBICashFlowInvestors/

If you cannot save enough for a down payment then you are de facto not a reliable risk for buying a house with zero down. It clearly means you are living on the edge, paycheck to paycheck. It is what is called “catch-22”.

Jake, I understand what you say. I think the kicker is the strict qualification on income and debt disclosure. If a candidate makes enough money and is not burdened by prior debt, then that person probably can see the deal through. If the income is not in place, or the debt load is high, then you are correct. That mortgage is doomed.

I’m kinda curious on what the data distribution looks like. How many 0% and low down-payment loans were taken into account in the study? Did they deviate as equally as those with 10%, 20% down? Did they include the relationships between low down payments for jumbo-level loans vs minor loans ( < 50K), etc? Must be some pretty fascinating stuff!!

I love this site-I see clearly that buying now is not a good deal and renting is the way to go. Any thoughts on what to do if you own a home now but want to sell in the next five years? What the word on the street? Sell now and lock in some equity/profit or let it ride and hope things don’t get significantly worse?

It really depends on how your market did so far, has it corrected by 50%? Then I would probably wait till I’d want to move, but if you’re in one of the areas that corrected by only 25% or so, I would definitely sell asap!

Sometimes it think that bay area housing prices don’t reflect what the average person can afford at all. Proposition 13 keeps supply relatively low (before the down turn). So it should actually just reflect the relatively small top X% of buyers, which is all you need to make sure the limited number of houses get sold. I don’t have any idea what X is, but I have a feeling that it is well populated by people supported by wealthy offshore family, IPO windfalls, etc. there are plenty of ordinary people who own homes here, but they all seem to have bought them some time ago.

Prop 13 helps keeps old people from being homeless. It doesn’t affect inventory much> Where do folks come up with these misconceptions? I think it based on envy. There are plenty of tract homes, and what about shadow inventory? That is HUGE right now, it dwarfs MLS listings. We aren’t running out of houses or land. All you need is a patch of dirt, some 2 by 4’s, and some labor, and you got a house. I guess a generation of pencil-pushers have no clue, that is why so much construction labor has waded across the rio grande.

Maybe Pencil-Pushers is out dated & inaccurate, I should have called us “Keyboard-Tappers”

Surfaddict, I agree that nobody should be forced out of their home due to the inability to pay property taxes. But this is where it should end.

While some of prop 13 truly helps old people stay in their homes, prop 13 benefits rich people and corporations a lot more. I see hundreds of multi-million dollar homes out in the coastal cities of SoCal where the owners pay less property taxes than most people that own homes in Inglewood. Somehow I doubt that many of the ocean front owners are struggling old people on food stamps.

Prop 13 should simply not apply to corporations, second homes, or rich people (not sure about the threshold, maybe $5MM net worth and up?)

End Prop 13 now and at the same time change the tax code to help people stay in their primary residence by reducing their property tax burden if necessary.

Well of course inventory is way up NOW due to defaults! I was talking about pre-crash, the actual time of financial insanity. Current markets are moving toward sanity.

The problem with prop 13 is that it pushed through dome extremely unfair and expensive tax cuts for *everyone* in the name of pensioners. If you really want to save pensioners then freeze taxes (no increases even!) at the time of retirement, not at the time the house was bought. That is far, far less expensive and distorting. Pensioners are just a distraction here.

When Greece defaults, (not if, when), any ideas on what effect that will have on the U.S. , or the housing market?

Panic buying of US treasuries should force down interest rates further. Especially if Congress can pass a reasonable budget before Greece (or any number of other countries) defaults.

I think the lower rates plus the general economic insecurity surrounding a sovereign default net to zero effect on US housing.

I agree that there will be a flight to safety, via both Treasuries and the dollar. However, to be honest, no one can really tell. The first problem is that the exposure is wide spread, including US Banks. The second problem is that no one knows what derivative products will be impacted, either directly or indirectly. It could have a cascading effect, and probably will have. The real question is what is the size of that avalanche? It may well be manageable. Or not. I think the odds are that it is manageable, but I could very well be wrong.

You are right, this borderline slum has about 50% more to go and an area I know well. What is going to kill this area is out of state, in CO the dump shown would be about $150K and a better neighborhood/location. So basically you leave this hell hole, work at Home Depot and have a better house and quality of life. No brainer

“No wonder why alternative media is finding a home because very few bother to do the mathematical work to show that psychology can only keep dreams alive so long until math has to bring it back down to reality.”

Mainstream media is owned by wealthy people who would rather not destroy their wealth by slowing down the money machine built on the backs of the average American. We are a consumer nation, trained to spend until we cannot spend anymore. Peak credit anyone?

Hear here!

This home for sale is just one example of how sickening the housing market still is in some places. I live in a California coastal town and the homes are WAY overpriced. The economy in California is not good, to say the least.

This crap is going to come crashing down. IT HAS TO. And the chump selling this house is delusional.

Hey do any of you anti-Prop 13 people really know how it works? Reading on this blog, Prop 13 is blamed for everything, including the bubonic plague! Show me where the State of California has seen its revenues drop due to Prop 13. Prior to this real estate downturn, houses where turning over, on average every 5 years. Therefore, between 1978 – 2006 the housing stock has turned over quite a lot. When a house is sold it gets re-appraised and generates new income taxes for the state. Therefore, if you don’t sell you are not jacked for more taxes, other than for the increase in inflation – which if you all remember was fairly brutal back in the late ’70’s and early ’80’s. I still have not seen any statistics which show California suffering due to Prop 13. The only statistics I’ve seen are the 1,000s of lousy politicians always blaming Prop 13.

Research, my friend!

http://en.wikipedia.org/wiki/California_Proposition_13_(1978)

Not only does prop 13 redistribute wealth from new homeowners to long time ones, but more importantly, it caps property tax rates. It also contains the provision that requires a 2/3 majority of the legislature to pass a tax increase. It is far easier to pass a constitutional amendment to deprive a minority of a basic right (like the right to marry) at 50% + 1 votes than it is to raise taxes to address temporary budget shortfall at 2/3.

Most notably, when Prop 13 was passed, it forced an immediate rollback of property taxes such that local municipalities lost a very large chunk of their funding and became dependent on the state to make up the difference, to the tune of about half. While property taxes are a dependable source of income, the state now relies more on income tax, which booms and craters along with the business cycle. This set the state up for wild swings income to pay for a fairly inflexible set of ongoing costs, without the legislative tools to temporarily adjust tax rates to even things out. Thus, Proposition 13 is directly and nearly fully responsible for the basket case that is California public finance today.

If you are having trouble finding it, specific evidence of distortions to the housing market can be found in citations 28 and 29 on that wikipedia.

Sorry was out of town for a week! But you are just mouthing the same old tired Prop-13 garbage. You are part of the crowd who wants more taxes but don’t understand what that does to our economy. You did not address my point that the housing stock in California has turned over many times since 1978. Therefore, Prop -13 over this time frame had no major impact to tax revenues. Those few people that are still in the homes since 1978 would make no difference if they paid their updated taxes. People, like you, who complain about taxes live in a cloud. California has seen its taxes grow exponentially. That’s not the problem! Spending is the only problem. Show me where revenues have declined since 1978?

Mr. Ollman, please don’t cite Wikipedia – a discredited source! Try doing your own homework. Remember, Prop. 13 is not a hard cap of property taxes. Levies are adjusted to current market value when property changes hands. And that happens all the time – which was the point of my comment.

According to the Board of Equalization, a more credible source, total property taxes collected in 2006-07 were $43.16 billion. (Wasn’t able to get update numbers, but am sure that several years will make no difference!

The oldest property tax stats I could find were for 1980-81, from caltax.org. That year, property tax revenue was $6.36 billion.

So since shortly after Prop. 13’s adoption, property tax revenue increased by 579 percent. That is not a typo. It went up 579 percent.

During the same span, population went from 24 million to 38 milion — an increase of 58 percent.

As for inflation, as of January 1981, the rough midpoint of the 1980-81 fiscal year, the Consumer Price Index — which gauges inflation — was 88. As of January 2007, it was 202.4. That is a 133 percent increase.

So property tax revenue has increased by more than triple the combined rate of inflation and population growth — 579 percent versus 191 percent! Wow, Mr. Ollmann Prop -13 really hurt CA – “sarc – on”…..

In 1980-1981, the total of all general and special fund revenue for the state of California was $22.1 billion. For 2006-07, it was $120.7 billion. That is an increase of 555 percent.

You follow? PROPERTY TAX REVENUE WENT UP FASTER THAN OTHER SOURCES OF REVENUE!

So now, Mr. Ollmann, do you think the Prop -13 hurt CA? Better yet, do you think we need more taxes? Tax revenues are not the problem, spending by drunk politicians and followers like you Mr. Ollmann is the nexus of our current/future demise!

Interesting point. Any ideas on where one might find the CA property tax revenues over time?

I think property taxes should be eliminated altogether. We get taxed on our income, we get taxed on property that is paid off, we get taxed on income that we spend. Time for a single flat tax on income or a consumption tax. Eliminate all other taxes, period.

This makes sense as Prop13 effectively forces you to act by selling within 5 years. If you hang on any longer you start to reconsider losing that lower property tax you are currently enjoying. Effectively, Prop13 creates an incentive to sell within those 5 years. My old neighbor pays $600 a year, I pay $1,200/yr and the new guy on the corner pays $3,300/year. All for essentially the same home (1950s 3/2 or 2/1 homes). No, there is no reason why you can’t simply freeze an owner’s property taxes if they meet some senior age requirement and then have the home be required to pay up on any difference in taxes owing upon their death or transfer to their heirs. Balancing LOCAL funding requirements (like school, fire, police) on the backs of the STATE budget is insane unless you want to go to a “nationalized” system like Canada with the RCMP, etc. (which has their own set of problems too).

Want to know what interest rates are going to do? Here’s a critical read:

http://news.goldseek.com/GoldSeek/1309532700.php

Note that according to the OCC “derivative contracts remain concentrated in interest rate products, which comprise 82% of total derivative notional values. Credit derivatives, which represent 6.1% of total derivatives notionals, increased 5.3% to $14.9 trillion. It is the settlement of these interest rate derivatives – specifically int. rate swaps of duration between 3 and 10 years – that creates artificial scarcity of physical U.S. government bonds.”

Or, in short, this is how the Feds are keeping rates down. Much to Bill Gross’ very, very big surprise and very bad bet. And it’s taking about $300 Trillion to do so.

If (or when) interest rates do rise, not only do the big banks have a serious problem on their hands, but so does the Federal Reserve and the U.S. Treasury.

The article is really a “must read”.

I LOVE IT. Realtors would LOVE NOTHING MORE THAN:

0% DOWN! No payment for 1 year! 95 Year Term! Only 1% financing! No Credit Check!

Every house in the country would immediately be worth $1.5 Million!!

How can someone with a modest income get approval for an $800-900k loan? Is money still being given out like candy in CA? That would explain why it’s still a bubble.

Leave a Reply to in_awe