Can the young save the California housing market? 5 demographic trends impacting the California housing market from 2010 to 2020.

California has been fortunate to have favorable demographics for many decades. The country in general has been supported from the baby boomer generation and their spending and willingness to go into debt for consumption prowess. Yet demographic changes may create an environment that will make it harder for the California housing market to recover. “Recover†is such a vague term. Housing affordability in many parts of the country is actually helping households with lower incomes purchase homes without over burdening their balance sheet with debt. The property ladder mentality worked well in California as the massive affluent baby boomer cohort bought and sold their way to their ideal home as long as home prices moved up by 7 to 10 percent each year. Yet with a younger and less affluent generation coming up behind them, can the young save the California housing market?

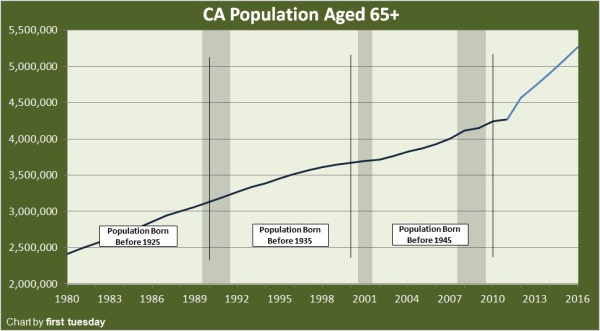

Fastest growing segment of population those 65 and older

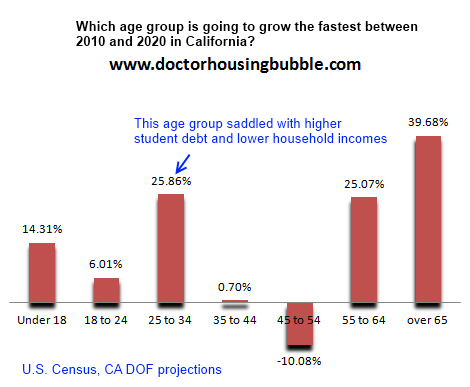

The fastest growing age segment in California is the 65 and older crowd. It is important to understand these demographic changes moving forward:

Why is this important? If we look at the above chart we see the compression in the middle between the 35 and 54 crowd. The 55 and older population is going to boom in California, in particular the 65 and over segment:

Source:Â First Tuesday

The charts above are critical in understanding the future of the California housing market because a big amount of pressure will sit on the 25 to 34 year old crowd this decade. This age group as we have noted, is saddled with enormous levels of student debt and many are finding employment opportunities with less pay. Now this might be one of the explanations as to why even after home prices have collapsed and interest rates are at record low levels that home sales are still weak in the state. The 65 and older crowd is also more likely to sell based on lifestyle pressures. Contrast this to many in recent years that have opted out of the market as distressed sales dominate and they nostalgically look at 2005 and 2006 as their optimal sales point.

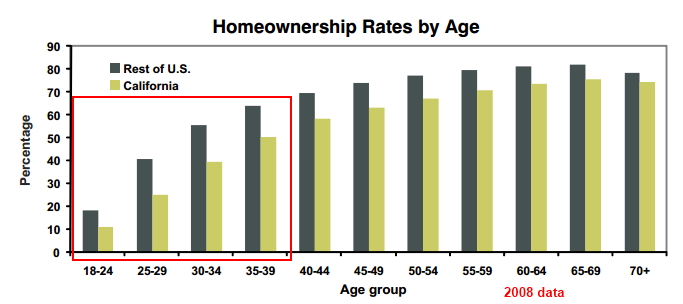

Low home ownership rates with younger Californians and potential growth rests heavily with this group

The majority of those 40 and younger are renters and the rate of home ownership in California is well below that of the nation:

A big part of the issue is affordability. Low interest rates and lower home prices mean little if household income cannot catch up. This is why California has continued to make post-bubble lows in home prices. In areas like the Inland Empire or the Central Valley rental parity is largely achievable. However in many mid-tier markets home prices still remain inflated. Take for example the short sale condo market in Orange County. On the surface rental parity seems feasible but those who actually spend the time to examine the true costs including insurance, taxes, Mello-Roos, HOAs, and mortgage insurance suddenly realize a payment can jump by 50 to 60 percent.

The fact that distressed sales still dominate the California housing market should tell you something. Or look at the rate of home sales.

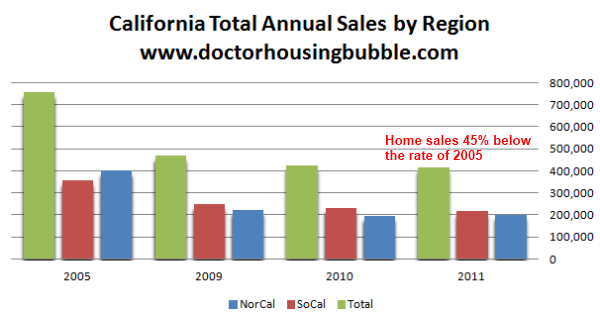

California home sales nearly half the rate of 2005 despite low mortgage rates and lower prices

Home sales are still rather low even with incredibly low mortgage rates and lower prices:

California home sales are down roughly 45 percent from the 2005 booming pace. You would think with home prices in many areas down by 40 to 50 percent from the peak that sales would be picking up. That might be the case if your vision was simply narrowly focused on home prices and not household incomes. The argument that incomes do not matter was an argument used during the peak days of the housing bubble as well. Income absolutely matters. The reason baby boomers had a stable housing market is that home prices went up in tandem with actual incomes (let us set aside for the moment the nonsense of the no-doc-no-income-no-job-no-verification loans fostered in California). The income growth has not happened in the last decade as real household incomes have gone stagnant for well over a decade. Focusing even more closely at younger Californians things have gotten much tighter.

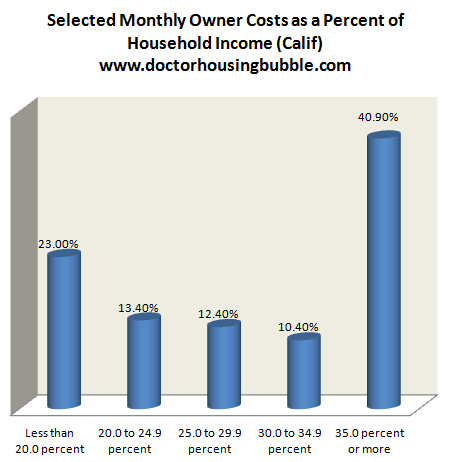

Californians spend a large amount of income on housing

Even those that currently own in California, many are stretching their budgets to own that home. Contrary to the myth that every California home owners is flush with cash and transforms into Donald Trump once a mortgage is in their name, the vast majority of Californians spend over 35% of their household income on housing costs:

Source:Â Census

Even most government figures consider this excessive:

“(Census) In Census 2000 the selected monthly owner costs are calculated from the sum of payment for mortgages, real estate taxes, various insurances, utilities, fuels, mobile home costs, and condominium fees. Listing the items separately improves accuracy and provides additional detail. When combined with income, a new item is created – Selected Monthly Owner Costs as a Percentage of Household Income. This item is used to measure housing affordability and excessive shelter costs. For example, many government agencies define excessive as costs that exceed 30 percent of household income.â€

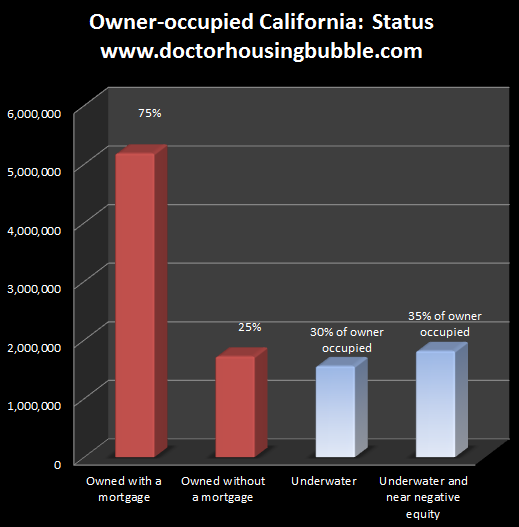

According to the above definition, over 50 percent of Californians that own their home with a mortgage (roughly 75% of home owners) are in the excessive category. Since many in this category by definition are older, it becomes more understandable why the non-distressed market in California is virtually non-existent. Distressed properties are still making up nearly 50 percent of all sales and it is starting to become more apparent why. Many simply cannot sell because they are deeply underwater.

30 percent of California homeowners with a mortgage are underwater

This probably shows the biggest issue at hand. Of those that own a home in California with a mortgage, largely older Californians, over 30 percent are underwater on their mortgage:

Throw in those that are near negative equity (those with 5% of equity or less) and the number balloons to 35 percent. You begin to understand why there are so few current non-distressed sellers on the market selling their homes for reasonable prices. 35 percent cannot by definition without becoming a short sale (and obviously with markets in SoCal the vast majority of current MLS sales are now listed as short sales as people realize the bubble is now long gone in the rear view mirror).

A big wildcard will be the retiring home owners of California. Will many sell to leave the state? Hard to say but California has a solid climate but the cost of living is high. Now with home prices in places like Arizona and Florida dirt cheap and the cost of living much lower, some might opt to sell a place, buy a home, and sock away $100,000 to $200,000 in the bank. Some may pass their home to their heirs but that does little to create a liquid market. Ultimately we are left with forced sales from the distressed pipeline being the bulk of California home sales because younger buyers simply do not have the income to purchase more expensive homes. That is why FHA insured loans now make up over 30 percent of all home purchases (with an average 4% down payment).

Can the young save the California housing market? Take a look at the above data and arrive at your own conclusion.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

65 Responses to “Can the young save the California housing market? 5 demographic trends impacting the California housing market from 2010 to 2020.”

The Boomers are woefully underfunded for retirement and the youngsters are saddled with large school debt and poor employment prospects. Both groups will not be the engines of growth that will raise real estate prices. Where is the new money to buy starter homes and move up the housing market going to come from?? I just don’t see it.

This leads me to think that the Boomers who can afford it will be letting their kids live at home for as long as it takes for them to get a job that pays enough. Which may never happen. The rest of the Boomers will be migrating to a place where a Social Security check buys them a better living.

Excellent assumption…

Belize? Costa Rica? Argentina? Any suggestions?

look into Panama

Philippines

The only hope is that they start building very small, inexpensive starter homes. And when I say ‘small’, I mean 1200 sq. ft. Once we get a bottom in prices, and they build affordable homes, we can get reestablish the ‘move up’ buyer regime.

Currently, they are compounding the problem, with low down payments and attempting to put a floor under housing prices. The are not creating next decades ‘move up’ buyers with these practices. If they would just let the whole thing drop to sustainable bottom, we could start to create next decade’s move up buyers. This is the key. First time buyers will never get this market going, on its own, especially with the student debt problem.

So to answer the question, yes, the young can save the CA housing market, but only starting from a lower level, with smaller houses.

Another very good thought…

I don’t think new built small homes is the answer. Why would I buy a new built small box when I can buy a less than 10 year old 2,000 sq foot box for the same price it would cost to build the new smaller box? I would not buy the 1,200 sq foot box… the system has to clear, pig through the python.

Actually, I’ve heard that there’s a few builders that are now building 1000-1200 sq ft homes that are selling well. Low price is the key and the existing prices are not being allowed to get there….fast enough. Plus maintenance, heating, cooling, etc.. are all cheaper. And let’s not forget the sweet govt loans that make it all possible.

Nice point, however, the average home in the United States was 1200 sq ft until about 1980. So what 1200 sq ft really implies is a reversion to the mean.

During the recession that happened after World War II ended, the average new home was around 800 sq ft. There were hundreds of thousands of these post-WW2 800 sq ft houses built in the Los Angeles region. Many have since been torn down and replaced with McMansions.

Perhaps the majority of buyers should disregard move up system altogether. That is what my wife and I have chosen to do. We are renting cheap, saving and investing. Instead of attempting to build equity through the so-called “property ladder” we are distancing ourselves from RE for the time being and building equity elsewhere. When we are ready we intend to buy a home we can be happy with for the rest of our lives.

If you expect real estate to be down in the near term and then mostly flat for at least the next 10 years, expecting to buy a starter home and trade up seems like an awful idea. And 1200 sq ft for the rest of our life? No thanks, I’ll stay uncommitted to our 900 sq ft apartment until we’re ready to buy bigger or move back east.

sounds like a good strategy to me……the old not all eggs in one basket theory worked for us – thank heaven we had the sense to not overspend in real estate like most of our acquaintances did

That’s exactly what I bought new in 1999 for $100k. Got it down to 77 payments to go and am barely able to sell it for what I paid for it. Oh well. But at least I’ll own it outright soon and will be part of the 25%.

The problem is that the small “inexpensive” starter homes builders are building right now cost more than a 3000+ sq foot home that is selling as an REO or short. I’m sure this will work itself out over time, but right now if you buy a new home you essentially lose $100,000 the day you open the door for the first time. Buying a new home is now akin to buying a new car. I’m honestly amazed builders are selling any new homes in CA given the prices they are asking. $150 /sq ft in inland areas when you can buy places easily in the $60-$70 /sq foot range.

Well we were just looking at new houses in Irvine and builders are not ready to negotiate also because whatever they are building is getting sold at asking price….Asian buyers want new homes….just have a look at the village of irvine website and u will know how ridiculous their prices are….prices are still insane in Irvine….

The young, particularly in Southern California, are not getting married or having children at nearly the rate of even five years ago. Many present younger couples and the new couples forming, have one unemployed or not earning very much and thus many couples in this demographic have less total household income than their predecessors. Remember that once one falls off that career income ladder, one doesn’t recover for ten years or even more. The student lending going on is perhaps not what one might think: something like 40% is borrowed as new loans by those over thirty and a huge percent still by those over 40 and even age 50! Thus it is clear lots of those going back to school have no money. The students now enrolling will incur debt much higher even than those who first enrolled five years ago. One estimate of these fuzzy student loan figures and their methodology put the present default rate for those graduated, at about 30-40% missing at least one or more payments.

On topic to those first time and low-down younger buyers: FHA is producing a monthly summary report and it is a must-read for anyone wanting to buy a home in many markets, especially the default rate progressions (which are a warning of future large volume foreclosures).

Things are uncertain but we are still having kids. I’m not going to let a temporary period of bad times stop something that will last forever, and I’m confident enough in my skill set and networking that I will always have some type of employment.

Unfortunately its the banks versus homeowners. And we all know who usually wins that one. Presently the govt has chosen theJapanese model of stagflation and will drag this out out as long as possible. Another 5 – 10 years of destroying homeowners is in the works unless they stop propping up housing.

http://www.westsideremeltdown.blogspot.com

Thank you DHB for another great article! Jason, you are on the money! What is amazing to me is that in spite of trying to “put a floor” under housing prices for years now, they continue to drop anyway. This market is going to correct no matter what they do. The math is the math. I read an article yesterday about the South OC condo market. Apparently, it has imploded. You can pick up condos for 69k, (look out for high HOA’s). I think that is going to be a trend moving forward, niche markets imploding. Delusional sellers still abound though…..sigh. As a result, the only thing that seems to be at question is, “How long is it going to take us to hit the REAL bottom?”.

When I was still living in Phoenix, in late 2009, I came across a pretty decent downtown area condo. THe building was from the 70’s, good condition, as was the condo, real solid, slab walls and floors and had about 20 floors. The condo was going for 29K! Yes, 29k! It turns out the HOA was something like 600 a month.

Here in San Diego it seems like sellers don’t consider HOAs fees a burden to the buyer but simply a “member ship fee” that is the buyers problem.

Other parts of the country are good reminders that eventually it IS all about the math in the end.

In one the charts above –excellent charts above as usual and excellent analysis–, home sales are 45% below the 2005 rate.

However, not having all the historical data, it appears that the current rate of sales in California may be in line –Plus or minus 5%– with those prior to 1997 or 1998 (when the latest housing bubble originally started in my opinion.)

We have had the housing bubble something close to approximately 10/11 years (1997-2007), and it will take time. It has only been five years so far for the bubble to deflate. If one wishes to deflate a tire or a balloon or a bubble, it seems like the logic may require to deflate it slowly and not all of a sudden.

I freelance in the film industry and thought I would start looking for a fixer-upper home in the 320K range. At the moment I am in between projects and have time to look and research in case something happened to come up and the low interest rates are appealing. I have a credit score of over 740 and was getting pre-qualified with my Credit Union (First Entertainment) for putting down 20% ($60,000) which I could do comfortably and not deplete my reserves. My credit union denied me pre-approval because of my status of being “currently unemployed.” I showed my tax returns since 2008 and every year except 2009 I cleared six figures not working the whole year so they understand annually what I am expected to earn. The lender was sure when I first went it that it wouldn’t be a problem to get pre-approved, but I would have to be working at the time of purchase which I was fine with. The pre-approval would be good for 90 days and I’m sure I would have a job within that time. Anyway the underwriters thought I was a risk and denied it. I don’t think I can be a bigger risk than someone with an FHA loan putting down the average 4% with the median income. Also I’m sure that my mortgage with taxes would not be over $1500 a month, which is what most people pay for a 2bd/2bth in Valley Village, where I live. The lender was apologetic and I told him that once I got a job I wouldn’t have the time to look. He said he’d keep my paperwork on file and that I should get pre-approved towards the end of the next job so I can then have 90 days to look at that point. It’s not a big deal and I’ll take it as a sign that the now is not the time, but it is frustrating to me since I was in a situation where my numbers were responsible and conservative in my opinion.

Paul, you are a bigger risk to the bank than someone with the FHA loan because FHA loans are insured against default.

In my experience, credit unions usually don’t have the most flexible mortgage product offerings. I bet a good broker could find you a loan.

Jason, price has little to do with the size of a home here in Southern California. It’s all about location. We already have large numbers of homes in the 900 to 1300 square foot range. In the better neighborhoods, many are priced above $650,000. And at that price you’re probably going to be doing a lot of fixing up.

I am currently standing in Manhattan Beach. Would someone please bring over a time machine set at 1965. When I arrive at that time (1965) M.B will be filled airline employees, surfers and Blue Collar workers. I can then live near the beach, with a very low payment. My surrounding communities of Lawndale and Hawthorne have low crime and still decent schools. Hopefully when I take my time journey back my memory of L.A area will disappear of what life will be like in 2012!

I’ve lived in Torrance for around 10 years and have gotten to know a lot of original owners in different parts of town (Prop 13 lottery winners). They claim that Torrance was more expensive than MB when they bought their Torrance 3/2 home in the 60’s because there were mostly just small 2/1 cottages at the beach and there was very little infrastructure (retail stores, gas stations, restaurants, etc.).

Anybody who bought prior to 2000 in a halfway decent area is a Prop 13 lottery winner, not just Grandpa and Grandma who are in their original 1960s era house.

Today’s first time buyers literally have the deck stacked against them in evey conceivable way. As long as Granny won’t be taxed out of her house, all is well!

Smoke another one!! My parents, (my kids grandparents) pay nearly the same annual property tax that I do, in the same zipcode. You fools have a huge misconception of prop13. Propety gets re-assesd every year, and goes UP. Prop 13 just caps the annual increase allowed to what, 2%? Add it up silly, year after year, eventually grandpas share catches-up!! In the menatime, mine goes up too!!! Jealousy and ignorace doesn’t change the facts.

Surfaddict, I don’t know what neighborhood you live in, but you are a fool to say something like that. It’s simple math man. In any decent area, houses that sold for 200K back in 1996 sell for 600K today (go to Redfin and look around for a few minutes if you don’t believe me), houses that sold for 300K in 2000 sell for 600K today, etc. etc, etc. Assuming your prop 13 basis increased 2% per year…the new buyer is paying MUCH more. And if you are a buyer from way back in the day (1970s), it is almost laughable what you are paying for property taxes.

Here in the beach cities, I am seeing original owners selling. Some of these lucky bastards are paying around $1500/year due to Prop 13. The new buyers will be paying over 10K/year. If you are living in the IE, it’s definitely not that extreme; however, anywhere decent in LA or OC and you see this all day long. I wouldn’t expect anything else when you threaten to take people’s welfare away…they generally throw a fit!

I sold a house in NorCal for $1.25M that had been owned by the same people since 1965. Their yearly tax bill was around $1200. Prop 13 lotto winner is right.

My brother has 3/1 in M.B. an original. When he told me what a comparable down the street sold for I almost fainted!

As far as beach prices in the sixties, you are right. Hermosa was known as a Drug Dealer town that no self respecting Yuppie would be caught dead in. Oh wait, the term Yuppie had not been invented yet! Manhattan was known as the Low rent types, but very good looking young airline Flight Attendants. Of course, back then they were all female.

I am afraid we are a victim of paradise lost!

Surfaddict, I hate making examples out of people but you definitely deserve this one. As I know, most people in this world at bad at math (and I think you are one of them).

Let’s take Grandpa for example. Let’s assume he bought a house for 100K in California in 1978 when Prop 13 was passed. Knowing that Prop 13 can only increase your taxable value by a max of 2% per year, the taxable value of Grandpa’s house would be 196K in 2012.

Are you really going to tell me that a house that sold for 100K back in 1978 will only fetch 196K today. Cmon man! That same house will probably sell for 500K plus and that is why Prop 13 is unfair!

And no, Grandpa’s taxable value will never catch up to current values in his lifetime. And this is how Prop 13 works, and it seems as if I understand it much better than you do.

OK all retarded experts, please lay-out the consequence of fully repealing prop 13. Will utopia take place at that moment? Will it all be fair for jealous fools that overpaid?? Will my bill go UP or DOWN? Enlighten me. I’ll come clean, and note that my Dad bought his current place summer 86, and I bought mine in summer 95…and if you look at the case-shiller index these are two most recent dips below the mean…so we paid about the SAME AMOUNT in price, hence our property taxes are very similar. It is completely immoral to envy others. Go- ahead repeal prop 13, and “fix” / teach grandpa / old land owner a lesson, what do you or them gain? Are you happy you “stuck” it to the “rich guy? What should property tax be based upon? A willy nilly guess? Property taxes actually are anti liberty, property rights are at core of a free society. Be careful the road you are going down, it destroys opertunity, and only strengthens tyrany & contol over US.

I’m there everyday. Beaches are over rated.

I was a young buyer, back in 2005. I put 20% down, and since then have additionally prepaid an equal amount to that original down payment. In other words, I’ve paid, out of my pocket, 40% of the original price. If the bubble had never happened, I would probably be about 2 or 3 years from owning my place, free and clear (or at least mortgage free). But the bubble did happen, and I paid more than was sensible to have a nice, ghetto-free place, thinking I could cash out, and move somewhere cheaper (out of state) if need be.

Now I’m getting older, and my retirement fund is underfunded, I cannot presently continue to chase the value of my property down the ladder with prepayments; I have to fund my retirement account, over the next 5 years, to enjoy 30 years of compounding. In my early twenties, around 2001, instead of funding my retirement account, I ‘invested’ in a 1/5 ownership of a beach condo on the east coast, which after short term rentals, and HOA, puts me at about a 1.5k net loss per year (which is about what I would pay to go there for a week anyway, so i’m not complaining). Incidentally, since 2001, that 55k I originally put in, is now only worth about 30k. It probably won’t be worth that in 20 or 30 years, when people wake up to the fact that sea level is rising (the property is only about 9 feet above sea level, and the island it is on constantly is having to combat beach erosion, by expensively pumping sand and muck from the surrounding sea floor back up onto the beach).

My point being: in a non-bubble world, i would have had enough money to purchase a starter place, then a few years later, work my way up the ladder, with a more expensive place. As it is, my starter place will be my FINAL CA RE purchase, and will most likely turn into a rental when i want to move somewhere cheaper. I definitely cannot afford kids, ever, and my place isn’t big enough to raise a family, which makes me almost un-marry-able here in the land of fruit and nuts. I’m presently 36. So there’s my demographic story (or case study).

You have a job, you are one of the lucky ones. Plus, not all women want kids!

Al Gore recently bought an oceanfront estate in Summerland, CA for $17M, he isn’t worried about the sea rising, why should you??

1) Al Gore is 64 years old. Buy the time coastal property values start to drop do to sea level rises (or special local assessments to combat the rise through engineering) he will be either too old to care or dead. I on the other hand, being much younger than Gore, will be quite alive when either oceanfront owners start to scratch their heads at the storm surge water coming uncomfortably close to their backyards, or fellow islanders start to get their pocket books gouged to buy and maintain sea wall barriers.

Like I said before, currently the town my place is in, pays a crew to restore beaches via pumping seafloor onto the beach, every 3 to 5 years, whilst I take a net yearly loss of 1.5k after rental income and taxes/HOA; were those expenses to grow proportionally, because of increased expense of keeping the sea out of peoples’ backyards, I would be in trouble. Also, the ‘wind’ and ‘flood’ premium everyone pays via insurance will probably be proportionally going up as more damage happens do to the rise/storm surge rise/hurricane intensity/destruction increase.

2) Al Gore is infinitely richer than I am. He probably doesn’t think of his vacation home as a critical investment for retirement. He can probably sell at a loss and not be too worried about that such will put him in a position where he can’t afford to eat, pay for blood pressure pills, or gall bladder surgery.

3) I don’t know about the local topography where Gore’s place is located, but there lies the possibility his place sits a few feet higher above sea level than mine. Lots of places on PCH are sitting atop rocky foundations looking over the sea. The IPCC projection is 2 meters of rise by 2100. If the trajectory is linear, then by the time I would like to cash out, there will have been about 2 or 3 feet of rise, and the IPCC’s projection will be more credible in the mind of the everyday-joe-homebuyer. I’m currently only 9 feet over sea level. If Gore is sitting on a 20 foot rock wall, I’m sure he’s not too worried. But that is speculation since I don’t know where his place is.

You haven’t been to Summerland , CA have you? It is all hills and you have to climb down to the beach.

fyi i surf there several times a year.

“Now I’m getting older, and my retirement fund is underfunded, I cannot presently continue to chase the value of my property down the ladder with prepayments; I have to fund my retirement account, over the next 5 years, to enjoy 30 years of compounding.”

You still believe in that eh? The stock market has been flat over a decade.

Yes, I believe over a 30 year period, the equity markets will grow credibly. Those Chinese and Indian middle classes, which are expanding, are all going to want breakfast cereals, band-aids, blood pressure meds, batteries, McDonalds, Pepsi, clean drinking water, etc… Even in the Great Depression, if one just reinvested their dividends, they would have had, on average, a 6% rate of growth on their money. 6% isn’t great, but over 30 years 150K will turn into 850K. Still not that great, but then again is it probable the world is going to be in a great depression the next 30 years? Bump that 6% average rate up to 8% and 150k yields 1.5M. Dump that in blue chip dividend growth stocks, and closed ended, dividend centered stocks, add a little social security, and a small pension, and things won’t be too horribly bad; especially if you move somewhere cheap.

I am in the same boat. Bought in 2005, now mid thirties, freaking out what to do even when I haven’t been late with a payment once. The prospect of staying in this concrete box of a house without ever gaining equity for the next 40 years is depressing me. What kind of investing in retirement are you talking about, it seems the stck market and mutual funds just tank every few years erasing any gains and the bank offers less than one percent interest?

The boomers are not leaving their jobs. They plan on working until they die. Employers can’t fire them due to lawsuits(boomers are real troublesome). It is the young people without work who will leave the state.

The distressed properties are usually in poor shape and you get what you pay for.

I have noticed this trend as well (im in my thirties)and it will cause a permanent crisis in the job market. Currently work with 3 ladies from 63 to 73 years of age, all own homes outright, have social security , savings and husbands with pensions . They all make from 60 to 100000 plus and all say they will work til they die. How on earth are the younger generations going to find jobs, pay off student debt, support families, buy homes etc. when the older folks occupy good paying positions, refuse to retire and still take ss income and use public resources for 10 or 20 years longer than previous generations who retired at 60 to 65?

California is overpopulated. Public policy should be directed to reducing population to 1950 levels.

The entire country is overpopulated and in severe resource overshoot, as is increasingly evident by the severe droughts being experienced by both the Southwest and the Southeast, the oil squeeze, and the inflating prices of farmland as more land is devoted to the uneconomic production of corn for fuel.

Unfortunately, public policy is biased towards increasing the population, with the result that we are the only developed country whose population is still increasing. I hear that the population is still growing at the rate of 5% a year here in the U.S., which puts the country on track for a doubling of the population in about 35 years. Where the fossil fuels, water, phosphorus, and even uranium will come from to feed and power this country is a mystery to me.

Policy makers in all the developed countries are unfortunately narrow, linear thinkers and thus more concerned with the continued funding of our pyramid-style retirement plans, not considering how an expanding base of ever-poorer people will support and feed even themselves, let alone their elders. It’s a damned-if-you-do and damned-if-you-dont situation: a shrinking population of young means fewer people supporting more elders, but an expanding population means ever more and poorer youth who are unable to support even themselves in a world of rapidly depleting resources on which all wealth is founded.

Time to take the hard but necessary step of reducing retirement entitlements for the current generation of retirees, and rewarding people for saving rather than spending. This will be a very, very difficult shift to engineer and will probably mean a lot more near-term hardship for nearly everyone. But we have to do it if we want to seriously reduce the size of future generations to numbers that can be supported in comfort with remaining resources while not overburdening our young with the care of elders

Wow, 5%? What reference are you using? I ran a calculation months ago, based on data I found on google which said the US population was currently rising at 0.9%, but in the past, had and average rate of something a bit over 1%. I can’t remember the details of my calculation, but i estimated that if the population grew at 0.9%, then in about 750 years every square inch of the US (and Alaska and Hawaii) would have to be covered in 1,500 square foot, SFR homes, holding 4 people each, wall to wall, if everyone wanted to live in such a fashion. No room for streets, forests, gas stations, drug or grocery stores, sewage treatment plants, etc..; cut down all the trees, and cover all the deserts, mountains, etc. with single family, ranch style, one level homes.

What is scary is that some 3rd world and developing nations do have 3% annual growth.

Anyway, if it’s really 5%, then the population will double every 14 years {1.05^14} or {70/5}. The first law of sustainability is that exponential growth is not sustainable. The definition of modern agriculture is the conversion of petroleum into food (via all the equipment it takes to run a mega-farm and ship out its product (and perhaps the fertilizers are oil derivatives too?)), thus peak oil = peak agriculture, peak air travel, etc. unless technology can keep up.

a fez, I stand corrected… it is .9%. Do not know where I heard the original figure.

Still a scary figure, and the world’s population is growing at 1.9, which is enough to completely pave the planet with people in another couple hundred years.

We won’t be able to consume 25% of the world’s dwindling resources forever. Unless we can both curtail population growth and develop an energy source richer and denser than fossil fuels, I don’t see how we will retain anything like our current standard of living. Even given full-bore development of nuclear, including the thorium fuel cycle, we will still be short of water and good farmland.

The relaities of India and China completely de-bunk your theory. I’m as anti-people/human as the next abortionist, but i had to call b.S. sorry.

Overpopulation is the root cause of most of California’s ills.

not just California, but the whole planet – technology has created the need for fewer workers, but there seems to be no slowing the people who want kids

Religion encourages breeding.

And there’s actual debates happening about birth control being covered by insurance and the increased costs involved with that. Once again the big picture is not in consideration.

I think it actually is. Leaving out the big picture of global overpopulation for now, even though it’s a major issue. Let’s just look at Los Angeles. We don’t have the money to fund adequate transportation in Los Angeles. Public tranportation options like light rails take decades to be built at current rates of funding. We have no real means to fund new freeways (and even we did can you imagine the polllution?). Can anyone really argue that Los Angeles is not overpopulated for what the infrastructure supports? Never mind all the other infrastructure, like schools, paving the existing strees (!), etc., it’s piss poor in L.A.. And never even mind the water issues. Even for a city not built in a dessert, at a certain point the costs of increasing infrastructure to support cities I think grows exponentially compared to linear increases in population and thus linear increases in tax revenues (if even that depending on demographics).

For the risk of sounding politically incorrect, our Govt has done everything they can to INCREASE the pop of California. And they continue to do so!

The shadow inventory needs to be sold – at whatever cost! It’s like a foreign object in the body, allowed to infect and fester for years. It requires surgical removal, maybe even the amputation of a limb.

With older homes costing so much less, I don’t think there will be much building activity in the next decade. Which will be bad for employment but good for the general market, as prices should stabilize at some point (which will be way lower than today’s price level).

Access to financing will be key, not just low rates for folks who easily qualify. Americans are great at adapting. They are resourceful and clever and it’s too harsh to say they got to pay off a mortgage in less than 8 or 10 years. But if they make extra sacrifices the first few years, these extra payments will have an impact later on. Just buy a programmed HP business calculator and see this effect.

Access to financing is key IMHO. And a huge percentage of the working population won’t have the required access.

Does converting Mansions into condos make any sense – be difficult for the neighborhood to swallow but it may be possible for the McMansion owners to receive a 2006 price?

The comparision between median home prices in California versus the nation at large might show some predictive value. I went back to 1968 and looked through 2011.

You notice a divergence in 1975 that never let up. However, normal seems to be around +71 (1968 to 2008). Now, we’re at +89.

Maybe we’re headed back to the 90’s when the differential was around +76 (average) but hit its nadir at +53 (1996). If that’s the case, we’ve got a lot more room to fall here in Cal versus the Nation as we’re currently at ~ +89, with bad demongraphics, politics and economics staring at us in the face for some time to come.

1968 California median + 15% versus National median sales price

1969 +11

1970 +7

1971 +8

1972 +8

1973 +9

1974 +8

1975 +18

1976 +28

1977 +45

1978 +46

1979 +51

1980 +60

1981 +62

1982 +65

1983 +63

1984 +58

1985 +59

1986 +66

1987 +66

1988 +88

1989 +119

1990 +111

1991 +107

1992 +98

1993 +83

1994 +73

1995 +61

1996 +53

1997 +53

1998 +56

1999 +63

2000 +74

2001 +78

2002 +100

2003 +119

2004 +145

2005 +154

2006 +151

2007 +156

2008 +75

2011 ~ +89

Nice post!

The average 1st time homebuyer in CA is 35 years old. The young in CA are either under educated, and lower on the pay scale…or educated and deep in student loan debt. To further complicate things, the best jobs tend to be in the priciest areas, making most young people renters. Commuting to the IE is rare for a transplant as life does not exist east of Pasadena until you have lived here 5 to 10 years and start to learn the real CA lifestyle.

Like I said before, the days of the plumber and welder and aerospace worker supporting the state in a major way are done. You can make six figures out of school down in the OC being a smartphone app developer, or be one of the lucky ones that make it in entertainment or high levels of engineering…but for most Joe Sixpacks, opportunity exists in Vegas and Phoenix, not L.A.

I find a silver lining in the census data as an employed 34yrld professional in Los Angeles. Looks like I am going to have lower competition over the next 15 years, as the generation ahead of me leaves the state and /or starts slowing down(presumably), and the generation behind is saddled with high debt and low levels of professional experience. I’m just trying to keep my head in the game at this point, as my family is assailed by 40% effective tax rates, stagnant to slightly lower income, and inflation of the cost of everything we buy except the services of the help.

Don’t dismiss the high rental costs, too. Many young people that are living in their own households are renting at prices that take a much higher percentage of their income than experiences by previous generations. This makes it even harder to save for a down payment, in addition to problems with career interruption, lower salaries, unemployment, etc.

Man you are telling my story exactly! Rent is currently around 40% of our take home. We have bills, student loans and general living expense. Under no circumstance will we be able to afford to buy a home. We’re lucky if we have $5 left at the end of the month. We don’t eat out, don’t buy expensive toys, have 1 car, and wear our clothes until they fall apart. Our last 5 years of employment has been spotty due to layoffs, moves, etc. We’re getting into our mid-30’s, and children and home may never happen for us since we can’t afford it. The only people I know with kids are those who are a little older who rode the dot-com boom and have solid careers or people who had unplanned babies.

Trust me from experience, there is never a perfect time to “plan” having kids. You just have to do it, especially being in your mid 30’s. You will be mid 50’s by the time they move out! I’d be getting busy if I was you. There is always a way to afford it, I’ve never asked for help and our kids are fine. What happens is you get more resourceful in life, maximizing space and getting everything on sale and in bulk. Plus you pay less taxes and get $1000 credit every year.

Just do it.

Leave a Reply to Jay