Cramming into small homes in Southern California: Take a look at this 480 square foot property in Highland Park.

The latest sales figures for California show a market that is hitting a stalemate. Sales are dropping and many sellers have pulled properties off the market hoping that spring will bring better days. People run 30 year projections of perfect stability but think of what has happened in California only in the last 15 years. We had the boom, bust, and boom of the tech sector. We had the boom, bust, and boom of housing again. Do people think that the 1,000,000 completed foreclosures occurred to people that wanted to lose their homes? Don’t you think they wanted to believe in the buy and hold forever mantra? What is rarely mentioned is that most lost their homes with standard mortgages, not your toxic junk. Why? Because the economy hit a recession (and a rather significant one). The issue of course is that you need to maintain cash flow for a long duration. Given the current mindset in the market, it is interesting to see what people perceive as a good deal. We’ve seen homes the size of closets hitting the market as some sort of starter home for those on cash strapped budgets. Today we highlight one of the smallest homes we have seen out in Highland Park.

Pre-Great Depression built, Great Depression size

People don’t really dig into the building quality of homes in California. They just assume that if a place has a door and a roof, then it is worth $700,000. Whenever we get storms, many people get a rude awakening to shoddy roof work or problems with foundations. Then the construction bills pile up.

Don’t fret ye house searcher, there is an excellent deal for you out in Highland Park.

Take a look at this mega mansion:

411 S Ave 56, Highland Park, CA 90042

1 bed, 1 bath, 480 square feet

480 square feet! Now that is a tiny home. At least you will save on heating and cooling this place. Take a look at the ad:

“Cute as a button! 1+1, copper plumbing, good condition, patio, raised foundation, good floor plan, nice street. This is your chance for home ownership at a really low price or your first income property, guaranteed not to last!â€

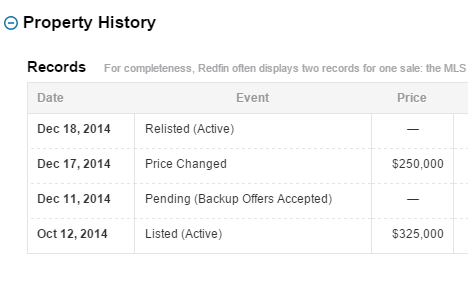

And nearly the size of a button. Smart audience targeting. Either live in this home or turn this into a rental property (targeting the dwindling investor herd in California).  To show you how absurd pricing can get just look at the property history here:

So wait, in two months this property dropped by $75,000? In other words, this home was de-valued by more than the annual household income for a typical California family. People have lost all perspective on value and are enamored by the low interest rate cult. You still have a 30 year mortgage linked to this place. What is your opportunity cost here? Are you missing out in investing in stocks? I always find it interesting how some people view real estate as fully safe yet the stock market as risky. Say you bought this place. 30 years go by and it is paid off. You still have taxes. You still have insurance. You still have maintenance. Where is your income going to come from? Many in California locked a large portion of their wealth into housing and many are trapped in their hardwood floor granite countertop stucco sarcophagus.

Going back to this home, take a look at the bathroom:

You can shower, use the toilet, and wash your hands all without moving. Now that is what I call efficiency. And this dream life can be had for only $250,000. Ignore the $325,000 price tag since that was simply a starting point. For this price you get to lock in the full usage of California sun, weather, and access to all the awesomeness that is SoCal.

Here is the Google Street View of the house:

480 square feet is waiting for you to call it home!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

100 Responses to “Cramming into small homes in Southern California: Take a look at this 480 square foot property in Highland Park.”

Also freeway close. Very, very freeway close. “Free alarm clock because the rush hour traffic will wake you up” close.

Apropos of nothing, when I was in Rome on vacation (years ago), I rented an inexpensive hotel room, and the bathroom WAS the shower. No need for a shower curtain — the shower head was just pointed away from the sink and toilet, and the entire room had a drain in the center.

I lived in Highland Park in 2008, when all the hub-bub was just starting. The York was getting popular, the old pet store was still there, and taco men were on the street with nothing but their egg crates to sit on, and a pan with a propane tank to cook with. I was one of the only white people at the park on any given day, with my daughter. The change was slowly beginning.

Now it’s one of the hottest spots to live in L.A., and York and Figueroa are CRAZY SICK! Restaurants, record shops, hip bars, are the norm.

Go on CL and look at rental prices for a house. The floor is about $2600/mo right now and buying will run you over $500k. Eagle Rock, Silverlake, and Echo Park are full so the spillover is going into Highland Park. Glassel Park and Cypress Park will be next, all the trash and cholos are moving to Hemet and Hesperia.

L.A. is a town where the big dogs with big degrees and big jobs play. Everyone else has a place called Lancaster or San Jacinto they can lay their head down at. Or move to Phoenix, Dallas, Atlanta, or Florida and wish that you could cut it in L.A.

It’s true, the area is changing. But I think it may take another 10 years until they get the gang problem under control. Highland park me up here safe and hip, however it’s far from that if you look at the crime statistics. It’s actually a very dangerous area. Anyone wanting to raise a family would be better off spending the money in another area.

Although I think this house is priced very high, I constantly see them selling. I don’t know if it’s the next bigger sucker syndrome or it’s priced right. Only time will tell. But one thing I know for sure is that am not in this market and I am not profiting from the upswing in prices over the past 5 years.

Yes it all makes perfect sense. People are sick of commuting, that is sooo 90’s.

The bridging of Highland Park, Cypress Park, Glassell Park, and El Sereno will tie the eastern Hollywood area into the wealthy Alhambra and South Pass.

Tujunga and Sun Valley are long term candidates for gentrification, sort of a “Fast Times at Ridgemont High” revival for the Valley. I’m very happy for all of them.

What will the cap and trade gas tax do to the Inland Empire commute? I can see Rancho surviving the Pasadena commuters but other than that, who knows.

Yup. I live (with my mother-in-law! LOL!) across the freeway not to far from this real home of genius. The street I’m on has already had a few flips done and prices are escalating rapidly, though nowhere near Highland Park levels yet. But we’re “South Pasadena adjacent” so I’m sure it’s coming soon, and it’ll be a boon for my MIL’s paper net-worth…

No kidding. Until the gang problem is under control, and the public schools are rated a “7” or higher, I can’t imagine wanting to move to Highland Park with my family. My best friend lives in Highland Park, so I spend time there, and it’s still a mostly bad area. It takes more than one street of nice bars/restaurants to get me interested, and I wouldn’t want to live there for $250K, let alone $500K +.

My business partner lives in Highland Park, so I’m there occasionally, and it is beyond a $hithole. Gang graffiti everywhere, high crime, trash and broken down cars in yards everywhere, and some of the poorest performing LAUSD schools in the district. I’d rather live in east L.A…. If that’s what people are calling an up and coming neighborhood, you can have it. I’ve seen better neighborhoods in mainland Mexico.

L.A. is a town where the big dogs with big degrees and big jobs play? If you like living in third world ghetto with simmering racial and ethnic tensions that will explode once the next big earthquake happens, the water spigot is turned off, and the economy collapses.

Big degrees? Who said that? Doesn’t necessarily translate to high incomes. Most of the people I worked with there didn’t have degrees and earned an ok middle class salary but never enough to buy a house. Even people with degrees didn’t do much better. Some people got lucky, but luck tends to run out or turn when you least expect it.

“Or move to Phoenix, Dallas, Atlanta, or Florida and wish that you could cut it in L.A.”

Or move to those places and be glad you got out of L.A.

Hubris and hype won’t be there to save the day when times get tough for any locale. That nonsense of cutting it and big dogs is ridiculous rhetoric that status obsessed people worship. When they don’t have an objective point to make, they reframe the debate by being diminutive toward others. Most people could care less about being seen and simply want a decent place to live.

Being that were riding the plateau before the downturn the douchebaggery from people like the poster above will be off the charts. The funny thing is i agree with him to an extent. LA proper IS an international city, a hub of the global economy. That said, Just like New York has Manhattan as well as Staten Island, LA has Manhattan Beach as well as Highland Park and other un-gentrified areas.

The achievers with the degrees can’t afford the prices. Most can’t even afford their student debt. The Bubble equation is the same as it ever was. Fresh and easy currency chasing yields. This is not and has never been a sustainable trajectory. Prime areas will weather better, but even there how many of the big earners wages are directly tied to the Ponzi. If the suburbs an inland areas go first how many will flee LA proper for a lower cost of living thereby crashing demand.

In short, EVERYTHING has to go right for these gains to be maintained. Economically, politically, demographically, etc. Let just ONE thing go wrong and the house of cards falls. Hedge your bets accordingly…

Wow. People seem to forget about quality of life. What kind of quality of life is there in LA? Traffic sucks, cost of living is high, schools suck, buildings are old, air is polluted, etc. But wait the weather is great. Actually not so much anymore, seems to be getting hotter every year. I believe most people live here because they have to, for job, family, etc. If you take the time to look around you’ll see there are much nicer places to live in Southern California.

Like where? Neighboring OC? I’m all ears! Please just don’t say Oxnard.

The wagon wheel gates are a nice touch …. and the bathroom design is right out of a Motel 6 catalogue.

” Guaranteed not to last ” ! LOL

“Guaranteed not to last”

Buy now before the next fire, storm, or earthquake turns it into rubble.

EXISTING HOME SALES PLUNGE

http://www.businessinsider.com/existing-home-sales-nov-2014-2014-12

That was totally expected, the news of 3% down, relax lending standards, and not much great inventory has buyers waiting for early 2015. My banking friend tells me that when all get aboard on the new standards it will spur a jump.

Already they have seen a huge pick up in calls the last three weeks on when Wells Fargo is going to get their employees and computers ready for the new loan program.

Interest rates will hover around 4% 30 year till about mid April, looks like buyers will have a nice shot at a home, sellers who foolishly raise prices will get burned. Inventory will be such that sellers who didn’t have a good 2014 will be ready to unload their property, new listings have to be in line with comps maybe +5 % but that is it.

I also talked with a loan officer for a large builder same thing he said, folks have called in at a rapid pace since Dec 1st wondering if they will do the new loans. he also told me no increases in pricing no matter how brisk for the first 90 days of 2015, they have to move inventory that didn’t sell in the last quarter. take care

2015 is going to be very bullish for homes and stocks. Yellen isn’t going to raise rates…ever.

Robert, the article’s statistics and forecasts are national. The West had the largest sales decline of 9.6%. Are the Wells Fargo loan inquiries local, national or both?

@robert, I will disagree about the 3% down payment being a boon for mortgages. PMI on a typical FHA jumbo SoCal mortgage $470K crap shack @3.5% down is about $510 per month. That $510 PMI is a killer surcharge, and almost guarantees a future mortgage default.

@ernst, is the problem coming up with an additional $10,000 or is it keeping up with a high monthly payment? If we believe that going from 95% to 97% LTV will spur a jump then we’re betting that the problem is not the high monthly payment but I’m with you and not so sure that coming up with a few less bucks up front is what’s fundamentally keeping demand low. It might be keep a few holdouts waiting until next year but will it be sustaining long term?

@dennis To answer your question, Wells Fargo was local inquires not National. Thanks

@ Realist… Yellen and the Board are more interested in Wall Street, than main street no question, but mfg. numbers, overall employment, and lower energy just about tells these folks that Dow 20k and zero funds rate won’t fly anymore, look for a slow but progressing interest rate hike from April to years end. I believe 3.5% funds rate at years end. have a safe holiday all

@ Ernst.. I haven’t study the full text yet but I think the PMI disappears after loan pay down or is reduce, not sure but will find out. Also yes, future defaults which will be absorbed not by the banks but guarantee from the Fed’s, this helps in banks taking more a chance with a buyer. Of course no matter who is stuck with a loser mortgage loan it isn’t good, I believe that these new options will help the housing market overall, but the real help must come from better jobs and pay, which so far companies have little interest in providing.

I think everyone on this site knows that all these new plans and talking heads of banks and Federal Gov. is not addressing the fundamental issues of this country, that being a service economy with poor pay and a prop up of Wall Street in the long run will just produce a worsen of this country as a world leader. Americans confused state of mind of their continued uncertain future and going forward in life is a very major concern.

@Ernst-

Your PMI numbers are way off unless you are citing PMI for an FHA loan. $470K PP with 3% down conventional you are looking at MI of about $266/month.

@CAB,

I wrote: “…typical FHA jumbo SoCal mortgage…”

I specifically stated FHA jumbo loan.

Admit it: You failed reading comprehension.

Ernst, I didn’t fail comprehension. You failed to understand my comment so admit YOU failed reading comprehension. The $510 PMI does not apply to conventional 3% down. That’s what I was trying to get across so check yourself. That is also why I stated “unless you are citing numbers for an FHA loan” which you clearly failed to read.

You wrote: @robert, I will disagree about the 3% down payment being a boon for mortgages. PMI on a typical FHA jumbo SoCal mortgage $470K crap shack @3.5% down is about $510 per month. That $510 PMI is a killer surcharge, and almost guarantees a future mortgage default.

My comment was saying that Robert has a point since 3% down CONVENTIONAL the MI is about half of what it is for FHA. That MAY be a boon for mortgages since the overall payment to the borrower would be lower due to less MI and the loan amount would be lower due to no FHA upfront MI.

Additionally with going conventional 3% down the MI falls off automatically @ 78% LTV based on purchase price or at 80% of purchase price if the borrower requests it in writing. A lot of the posters on here don’t understand that 3% conventional with lower MI is the recent change; 3.5% FHA has been around forever and the MI is too high for it to benefit anyone. There is a significant difference. Evidently this was over your head.

More articles on the slowing housing market.

California November Home Sales:

http://www.dqnews.com/Articles/2014/News/California/RRCA141216.aspx

An estimated 29,459 new and resale houses and condos were sold in California in November 2014. That was down 20.0 percent from 36,830 sales in October 2014, and down 11.9 percent from 33,429 sales in November 2013.

Southern California November Home Sales Fall Sharply:

http://www.dqnews.com/Articles/2014/News/California/Southern-CA/RRSCA141215.aspx

A total of 15,643 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in November 2014. That was down 18.8 percent from 19,271 sales in October, and down 9.5 percent from 17,283 sales in November 2013, according to CoreLogic DataQuick data.

From LA Times on Sunday Dec 21st.

“Highland Park renters feel the squeeze”

The link below is only excerpts. The entire article from LAT requires a paid subscription.

http://textsrhymesstrife.com/2014/12/21/los-angeles-times-highland-park-renters-feel-the-squeeze-of-gentrification/

The LAT article mentions that long time renters of old craftsman homes are being booted out so the landlords can refurbish the homes then rent for much higher or sell for $500K- $600K range. Many of the booted-renters are headed to Inland Empire where rents are cheap.

As a lifelong resident, it seems to me that the influx of foreign money and/or high tech jobs into LA will cause more and more of these questionable neighborhoods to gentrify and increase in value, although it will take time. Here we are hearing about Highland Park.

Ergo Boyle Heights. My wife’s son is in his mid-20’s, professional employed in downtown LA. Many of his peers are buying houses in Boyle Heights and they don’t care about Boyle Heights sordid past. They would rather own in Boyle Heights than rent in Downtown LA…

http://www.scpr.org/blogs/multiamerican/2014/05/28/16718/boyle-heights-real-estate-gentrification/

Ergo, Baldwin Vista. The next neighborhood of gentrification for all of the Westside Wannabees who cant afford the Westside (Venice, SM, Palms, Mar Vista, Culver City) but want to be 15min from the beach…

http://www.aheadofthecurvehomes.com/2014/03/31/southwest-la-neighborhoods-demystified-part-i-baldwin-vista/

So buy now or be priced out forever?

This “rim-shot” reply is posted a lot on this site. Can you show me where anyone has said this on this site, other than a snide remark?

I’m trying to figure out what your point is by bringing up gentrification as it pertains to someone deciding to buy a house because that was the take away I got from it. What do your anecdotes mean for someone looking to buy? Should I buy now or be priced out forever? Will you directly answer the question?

HI ‘r’

my point is that for neighborhoods that are gentrifying that there will be long-term increases in home value. Does it mean buy now? no. But given a persons individual circumstances, buying now could make sense. Buy now or be priced out forever implies ‘housing can only go up’. it would be just as silly to say ‘housing only goes down’.

Well said QE.

Should have a nice view of the ever-expanding homeless encampments along the arroyo, as Garcetti has pushed them up this way to make DTLA a little more scenically acceptable to his developer friends.

Big enough for me….

That’s what she said…

Stocks can and often go to zero, that does not happen with real estate.

Whats funny is folks says real estate is not an investment, yet always compare it to stocks.

WRONG, tens of thousands of houses in Detroit, Cleavland, etc. are worth nothing or maybe a few thousand dollars at best.

What is more often said here is that residential RE should not be SEEN as an investment…..people who buy when prices are reasonable, affordable, when buying is a viable option to renting AND who buy a house to live in for at least 5 years or so tend to do OK…and in fact historically RE has NOT been a good investment.

http://www.cbsnews.com/news/history-says-home-real-estate-is-a-bad-investment/

That being said I sold my last place (in northern Calif.) in early 2007 for nearly triple what I paid for it in 1997, but do not expect or want to see that again in my lifetime and I bought the place to live in NOT to make quick money, finance my retirement, etc…and sold in early 2007 thanks to what I read in blogs similar to this one. Winter 2014 is feeling a lot like Spring 2007 to me.

A source…

_____

Patrick.net: It’s true that house prices do not fall to zero (except in Detroit), but your equity in a house can easily fall to zero, and then WAY PAST ZERO into the RED.

“…but your equity in a house can easily fall to zero, and then WAY PAST ZERO into the RED.”

Said it before I could. The fact that so many here are naive enough to think the specuvestors and REITs are doing anything besides playing with other people’s money is hilarious. Why would anyone do anything other than leverage in this environment??? Do you bulls REALLY believe that the rentier class put all their equity into these properties to won them out right for sun 10% cap rates???

Damn. 2007/8 is so fresh in my mind. read all the same buillshit new pardigmn arguments on Housing Panic. It’s gonna be another fun “I told you so moment” in 2015/16.

Some examples of the madness going on in Auckland NZ might interest you…..

Sheds and rubble sells for $1.4m

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11366443

Million-dollar hovel bought by builder trio

http://www.nzherald.co.nz/property/news/article.cfm?c_id=8&objectid=11341097

Villa value up $1.1m in two years

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11341096

Auckland has achieved a remarkable increase in population density in the last decade or so, but as is the case with Vancouver and similar examples, most of this is by way of overcrowding at lower income levels as a response to the unaffordability of housing.

Tor a Chinese family of 6 that’s a big house! Well worth it!

DHB, I hope this isn’t your last post of the week. Please do one on Christmas so we can multitask while hanging around…

awesome

I don’t get it. Can’t someone buy the house, tear it down, build a new 2000sf 2 story house on this 3000 sf lot and resell for $700k ? Or are the permits and such too costly?

I’m not that familiar with Highland Park, I would imagine this baby gets snapped up for 250K. It’s likely cheaper than comparable rent. And you can always add on 2 more bedrooms and a bathroom in the future and sell it to a hipster couple for a tidy profit. If you can come up with 20% down, your mortgage payment is about $950/month.

Yes you’re obviously not familiar with HP. There are tons of 1/1 rentals cheaper than that monthly nut and no need to lock-up $50,000.

Are you talking apartments or houses here for your rental price? Big difference there you know. I seriously doubt you will rent a house for less than $950/month. I looked on CL and didn’t see anything, maybe I wasn’t looking correctly and you can show me some examples.

Of course you couldn’t find any examples because a 1/1 detached is rare, therefore what else is the next logical thing for comparison assuming an owner occupant scenario? Renting a 1/1 condo or apartment.

I did a back of the napkin estimation for the monthly PITI nut assuming 3% or $7,500 down conventional with PMI and it comes out to something around $1380/mo. @ 4% 30 year fixed. I’m not factoring potential tax breaks due to variance in tax scenarios although standard deduction might work out more advantageous for the likely buyer at this price point anyway.

Let’s not forget this dump clearly needs some cosmetic work so there’s going to be expenditure just to get it to a comparable move-in condition that the average apartment rental is going to be in. And if what can be seen is any indication of what can’t be seen, there’s a high probability of expensive repairs lurking around the corner.

That’s probably a more realistic scenario for comparison since just about anyone mortgaging this place is likely to be a marginal buyer who’s going to stretch to the max.

Why would that owner occupant want to lock up their money into this crap shack and pay significantly more monthly than they could to rent a decent 1/1 apartment or condo that doesn’t require a $7,500 deposit? The story would be slightly changed should it be a completed flip at this price, but it’s not. The only sane option left is buy and flip, except prices are falling.

Comparing an SFR (even if it is a 1/1) to an apartment is not a valid comparison. A detached home will always hold a premium relative to a condo or an apartment. The place sure needs some work. There was a time not too long ago when people wanted to buy a fixer upper to earn some sweat equity, maybe that has been lost with all the flippers and HGTV wannabes.

Your 1380 PITI number is with 3% down. Do the same calculation again with 20% down (the gold standard) and then factor in the principal you are paying down. When all is said and done, it is likely a wash with 1 bedroom apartments that I saw on CR that went for about $900 per month. And believe me, these weren’t luxury apartments by any standards.

The whole tying up your money argument is nonsense. Putting 20% plus down was the standard until recently. Everybody benefits this way. Homebuyer has a smaller mortgage and has a cushion for protection if the market drops. Banks (tax payers) don’t have to pony up money to clean up the mess ala housing bubble 1.

Every single Dr. HB home of genius somehow magically seems to sell. Why don’t we keep an eye on this one to see what happens.

I don’t see how you ever unlock equity by selling with this place. A 1/1 at 480 feet is pretty ridiculous. It’s for the niche buyer. If the market trends down slightly or goes sideways, your limited pool of buyers will become even smaller. This place is a trap.

“Comparing an SFR (even if it is a 1/1) to an apartment is not a valid comparison. A detached home will always hold a premium relative to a condo or an apartment.”

It’s not an invalid comparison although it is somewhat loose. It’s the best available comparison we’re going to get considering that 1/1 SFH is quite rare and it’s very reasonable to assume most potential owner occupant buyers of a 1/1 SFH would also seriously consider a 1/1 condo or apartment. That there is a premium for the SFH advantages is not in dispute. What’s at question here is the perceived premium expressed in financial terms. Is sharing no walls, a postage stamp outdoor space, and a private garage worth a nominal $400-$500 more each month ($4,800-$6,000 a year) and a $7,500 “deposit” considering the condition this place is in?

“Your 1380 PITI number is with 3% down. Do the same calculation again with 20% down (the gold standard) and then factor in the principal you are paying down. When all is said and done, it is likely a wash with 1 bedroom apartments that I saw on CR that went for about $900 per month. And believe me, these weren’t luxury apartments by any standards.”

An owner occupant buyer with $50,000 at the ready to put down today is not going to place that bet on this place. In its current condition at the current asking price, an owner occupant is going to be a marginal buyer with the smallest amount of down payment because they don’t have or want to risk $50,000. That places all of the pressure onto the sale price. That’s also why the monthly nut comparison to a 1/1 apartment is reasonable because security deposits aren’t $50,000.

“The whole tying up your money argument is nonsense. Putting 20% plus down was the standard until recently. Everybody benefits this way. Homebuyer has a smaller mortgage and has a cushion for protection if the market drops. Banks (tax payers) don’t have to pony up money to clean up the mess ala housing bubble 1.”

Can you explain exactly how it’s nonsense to observe that collateral held by a mortgage obligation can only be truly recovered through disposal of the property? I couldn’t agree more that 20% down is prudent and responsible. Perhaps where we depart is that I think the standard was largely abandoned a long time ago, especially in L.A. and even more so in marginal neighborhoods such as HP, which leaves us with prices that are no longer kept in check by the 20% standard.

“Every single Dr. HB home of genius somehow magically seems to sell. Why don’t we keep an eye on this one to see what happens.”

And singing artificial fishes mounted on plaques somehow magically sold bucketloads as well. People buy things all of the time that they end up regretting later and/or could have got a better deal for had they waited. Houses are no different. Just because someone buys something it doesn’t objectively mean anything other than people are buying things at certain prices. When this house does sell, please let us know if you find out how much of their own cash the buyer brought to the table at closing.

The old adage at work here … fool me once, shame on you, fool me twice, shame on me! That is exactly what is going on in Southern California The one’s with big smiles on their faces or who are going whew and wiping their brow, are those who cashed out at these prices and have managed to put some money in the bank! Unless you’ve got the income to support the lifestyle, it seems infinitely more wise to have a modest house somewhere else and be able to have a bank account flush with money, than to live in an expensive shack in California, and have nothing in the bank!

This house is perfect for a Tiny House Nation HGTV promo ad… just attach the wagon wheels so it’s mobile too!

Gringo’s Guide To Highland Park Gangs

https://highlandparkgringos.wordpress.com/2013/02/13/gringos-guide-to-highland-park-gangs/

“No, dear Gringo that’s not afternoon fireworks you’re hearing, that’s gunshots. Yes, our little hipster hamlet has a teensy weensy gang problem. This past summer there were 14 gang related shootings within as many days, I know totes scary right? Seems like the Huffington Post missed this little fact when naming us the hottest neighborhood in the USA.”

Maybe they meant it was hot as in weather capital of the world hot because it does get hot in HP during the Summer.

did you see how incensed everyone got when a palm tree “caught” fire in Echo Park on 4th of July? good times.

Aside from taxes based on increased property values, how do higher rents and increased housing costs benefit Southern California, and its economy?

On the first of every month, a big portion of household income is deleted by housing costs. Money that could be spent into the local economy, is alternately dropped into an abyss of rent/mortgage collection. Less money is left for spending, and an even lesser amount is available for household retirement plans.

I understand that local politicians are focusing on minimum wage hikes; but driving down these housing costs, would in effect be similar to wage increases, and would affect an even greater amount of people. Anecdotally, we don’t appear to be a nation of “savers”—if the people have extra money, they will most likely spend it.

Just ask the board members of the corporations who’ve left the area how much affordability factored into their decisions to relocate to other regions. I guess they didn’t get the memo that everyone wants to live here and this place really is different. Or maybe they simply aren’t big dogs with big jobs…yeah that’s got to be it.

The recent buyers of the past couple of years who comment here are desperate to keep the pyramid going since they’re at the bottom of it. The other vested real estate interests would also obviously come up with all sorts of excuses as to how keeping prices inflated are good for the local economy. They will likely try and have you believe that the money comes back into the economy because landlords and banks can’t help but spend it all back into the community.

But hey, don’t make any attempts at critical thinking and suppressing emotional inputs, just label the messenger a hater because that’s the easy way out.

So true. Any single person making under $100K would be hesitant to transfer out to CA. I met an ATF agent, he’s ok with it but he told me how none of his colleagues wanted to move to CA. Same is true for corporate wages. At some point you have to pay workers enough to live. If a company has locations in Texas and CA, say a tech company, you’d have to pay the CA worker double. Is that worker twice as productive as the Texas worker? If your workforce can’t justify it’s salary in terms of productivity, then it’s unsustainable.

Looks like even the strong hands of Chinese elite are no longer climbing all over each other to seek international world class city status in the entertainment and weather capital of the world. Don’t they want their kids to be big dogs with the big degrees and have the big jobs?

Apparently not. Surfing the price wave down in Arcadia, and this is just the tip:

https://www.redfin.com/CA/Arcadia/1743-Vista-Del-Valle-Dr-91006/home/7226634#property-history

https://www.redfin.com/CA/Arcadia/314-E-Norman-Ave-91006/home/7240216#property-history

https://www.redfin.com/CA/Arcadia/1016-E-Camino-Real-Ave-91006/home/7968543#property-history

https://www.redfin.com/CA/Arcadia/86-W-Longden-Ave-91007/home/7239110#property-history

https://www.redfin.com/CA/Arcadia/2121-S-Santa-Anita-Ave-91006/home/7238971#property-history

Most of the people I work with in my lab are Chinese from Mainland China. They all have advanced degrees and they are certainly not wealthy or even well off. Like most of the Chinese that have come to this country in the last 20 years, they came here looking for work in universities or to further their education.

China has 1.3 billion people–most aren’t million or billionaires. Most are like the people I work with. They will never be rich, but they put all of their effort into their single child.

Several of my colleagues have had kids recently graduate from Ivy League schools and the kids of all of the rest have attended or attending good universities. So you can be sure that they will succeed just like earlier Japanese and Chinese American immigrant kids did.

Many of these young people become physicians and are living the American dream because they appreciate where their parents came from and what it took for them to make it here in America.

American kids are clueless to what they possess. There are hundred of millions of Asians who would give their right arm to get a visa to America.

In many ways the anti-Asian prejudices of the 19th and 20th Centuries is alive and well in America today. Only the details have changed. The difference today is that Japan and China aren’t backwater nations with puny economies and uneducated masses.

I once remember there used to be a great American automaker, I think its name began with “General”….People used to laugh at Toyotas. Those were the days.

I like this selling point for the house on Santa Anita: “great feng shui for health and fortune. This mansion has everything you dream of.”

Highland Park is the hood, no ifs and or buts. You’d have to be crazy to put good money down there. It’s a joke hearing outsiders talking about gentrification of neighborhoods that will never be safe.

Hint, except for the highly educated and well off Asian immigrants, which immigrant group is responsible for the population growth in L.A. (and the hoods)? Mexicans, illegal and legal.

They occupy the hoods, along with the poor blacks. Where exactly are they going to go? Watts, Compton, Pico Rivera, Highland Park….

It would make more sense (and be cheaper), to buy a nice place WAY out of L.A. (e.g. IE), and then just rent an apartment in town and stay there during the week. Putting HUGE amounts of money in a speculative hood of a neighborhood will only result in you becoming the victim of a property or violent crime.

And you’ll end up with a worthless shack in the hood when the bubble pops.

This has to take the cake as crappiest post on this board, ever. Have you no eyes or culture? Why don’t you drive through South Central or North Long Beach, and see what a “hood” is. Stop insulting HP, it’s the farthest thing from hood.

My best friend lives in Highland Park, and I’ve frequented it for years. He still hears gunshots from time to time, and I certainly wouldn’t want my wife to walk alone at night in that neighborhood. A single street of nice restaurants doesn’t make a nice neighborhood, and wouldn’t live there with my family for over $250K max.

According to Wikipedia:

http://en.wikipedia.org/wiki/Highland_Park,_Los_Angeles

The median household income of Highland Park is $45,478 and the population is 72.4% Hispanic. 58% of the population was born outside the USA–2/3rds of these folks were born in Mexico or El Salvador.

This in not the definition of diverse, it’s the definition of the HOOD. How many of these born south of the border residents are sending their kids to UCLA? How many of the 72% are making it as the “big dogs” with the “big degrees” and “big salaries”?

You’re trying to make the ridiculous comparison between this hood and the S.G. Valley (e.g. Alhambra) which is filled with overachieving Asian immigrants where everyother kid is either attending UCLA, a UC system school or, heaven forbids, a Cal State school (but still majoring in a STEM subject or business).

Get real. Most Highland Park residents probably couldn’t even qualify for a Cal State school and their SAT scores would be lucky to be in the 20th percentiles.

Not insults, just REALITY. Accomplishments must be earned. You are clueless.

Gangland Park is super Ghetto. Just ask the local PD.

@zzy, you posted reality. Many of the SoCal’ers are dreamers. These SoCal’ers dream their hood is going to gentrify to $1.5 million crap shacks. The reality is what you posted.

“It would make more sense (and be cheaper), to buy a nice place WAY out of L.A. (e.g. IE), and then just rent an apartment in town and stay there during the week”

All the Elitest pricks like to shit on the IE. I’ll take half the mortgage cost in exchange for more property, less traffic, a more laid back lifestyle in general while still being an hour or so from the best amenities LA and the OC have to offer. I’m not down on LA. I go there when I want to enjoy the city. But sure as hell ain’t no paradise for even the 6 figure earners. What’s a great area and amenities if you never have time to enjoy them? Unless your pulling in serious Money (and even then it’s questionable) quality of life in LA sucks.

What model of car is that out front, on the streetview? It looks like an old 1985 Toyota Celica-Supra like I used to own in the 90s. http://en.wikipedia.org/wiki/Toyota_Supra

> Siggy: There are tons of 1/1 rentals cheaper than that monthly nut and no need to lock-up $50,000.

This exactly. ^

It’s a Supra. Back when Toyota’s were built with a soul.

Supras have this mystique about them I’ve heard. What about the Scion FRS? It’s a take on the 70’s Datsun Z cars. It’s only 200 horsepower but weighs 2800 lbs. Not the ideal car but a nice little toy for under $30K.

i bought an FRS with my condo profits. fun little car great handling

“In 2015, those who lost their homes in the housing crisis of 2008 and 2009 will begin to hit the seven-year point where most default events fall off their credit report. And many are trying to find their way back to homeownership. Many prospective buyers, and some lenders, think borrowers who defaulted must wait the full seven years before another mortgage can be approved. In fact, it may take seven years for a default to fall off a credit report, but Fannie Mae and Freddie Mac guidelines state that a borrower may be eligible in two to four years.

In a promising start, the Federal Housing Authority (FHA) has launched a “Back to Work Program” designed to shorten the time frame from three years to one year for a borrower with a foreclosure on their record, if the borrower can prove that the foreclosure was due to a decrease in income of 20 percent or greater.”

You all come on over to Oxnard, the new Newport Beach of the coast, and I can get you into a good deal next year. Forget the inner city crap neighborhoods. You deserve a beach community.

Carlos,

All due respect, not trying to pick on you directly and I think i read somewhere you are a realtor in Oxnard, and if true I can appreciate that you are trying to drum up business for yourself but Oxnard is not really a beach community, and no where close to Newport Beach, it is somewhat comical that you even mention the two cities in the same sentence.

Oxnard does have a pretty significant gang turf/territory issue and while probably not quite as significant as major LA gangs Oxnard is not light on crime and murder…

Anyway, just did not want readers who did not know any better to get sucked into this mythical Oxnard that you are talking about in an attempt to make a sale, I dont fault you for trying to make a sale, it is your profession after all ant that is how you get paid, but you should try to be a little more upfront than pretending that Oxnard is this quiet beach town that just has not been discovered yet.

Oxnard does have a few positives, but for the most part, it is an old run down town that is very over crowded and has pockets that range from extremely dangerous to less dangerous, then just a few pockets of affluence right on the beach or next to a golf course, other than those two areas most everything else is sketchy and there is not much if any separation of the affluent and not so nice pockets…

Truth in advertising, please…

looking forward to 2016 reality based living wage pricing…

Gentrification. What an offensive term and concept.

That’s PC for “let the white people move in and drive up the property values and kick out the “people of color”. Let them eat cake.”

Or, the old neighborhood is not hip enough so we’ll kick out the “not really ethnic enough” mom and pops and bring in “authentically ethnic” places run by white people pretending to understand ethnic culture (you know, they watched a show on TV about Thai cooking).

I’ve been reading everything on this site for about 6 months. Must say I love the reply board more than the posts…..

With me owning a house in the Detroit/Baghdad of So Cal are we heading into a bubble 2.0? SB is the first to go bust and the last to recover, so I really need some much needed wisdom. Thanks!

P.S. I bought @$146. Psf and comps in the area are from 140-220 per sq ft

Some people may consider selling by summer before another possible downturn occurs in the economy and housing market. It would also depend on what your next decision would be regarding buying or renting if you choose to sell. I think Bluto had made a good point as stated above in saying Winter 2014 (or 2015) is feeling a lot like Spring 2007. We know what direction the market went after that. I would agree there are similarities.

@RaiderCL, the economic downturn is in progress. What I mentioned several months ago is that the decline in oil prices is one of the harbingers of a global economic slowdown. China’s energy usage is down year-over-year, yet the Red Chinese government keeps reported a massive 7.5% GDP growth (this is not possible). U.S. energy usage is down year-over-year, yet the U.S reports massive GDP growth while ignoring the massive increase in EBT (food stamps aka modern equivalent of Depression Era soup kitches).

Texas, Oklahoma, North Dakota, Louisiana, Pennsylvania and Alaska will soon be decimated by the declining oil prices. This will eventually hit SoCal as the SoCal ports of Los Angeles and Long Beach are the biggest import/export ports in the U.S. This eventually percolates through the local economy hitting the Inland Empire as the IE acts as the distribution warehouse.

if you like your house and you can afford your payments don’t sell. your house is not a rental property. it’s a home

Well I like my house. I like $$$ more. On the upper end of comps I would get 50-80k. I am in my 20s and could always go back to moms house and wait for the downturn. I just don’t want to sell and the prices for the next 5 years keep rising.

You think LA is bad Atlanta is worse its voer 50 percent Blacks. There are plenty of ghettoes. You have been watching too much the Housewives of Atlanta where blacks have money. In fact Gwinnett County next to Atlanta use to be all white, now it mainly black, latino and Asian and the free and reduce lunch went from 22 percent to 55 percent. you might as well stay in San Diego and Orange County then go to Gwinnett Phoenix is probably the best since it doesn’t have too many blacks or Asians, only latinos. Its a little higher income verision of New Mexico.

1

2

3

4

5

6

7

8

9

10

State

North Dakota

Nevada

Texas

Colorado

District of Columbia

Florida

Arizona

Utah

Idaho

South Carolina with the exception of Texas, South Carolina and Florida most of the fastest growing states are mountain states, more latinos than afro-americans but conservative Republicans just love the south but most people prefer Colorado over ltots of the south including Georgia.

People prefer Colorado and Washington states over Texas because weed is legal in Colorado and Washington. But nothing beats the Emerald Triangle for farming conditions. Take another toke Cynthia.

I see no difference between the Emerald Triangle and Oregon — except that taxes and the state’s financial liabilities are lower in Oregon.

Just as I t see no difference between the Inland Empire and Arizona or Nevada — except that taxes and the state’s financial liabilities are lower in Arizona and Nevada.

If you’re not living in coastal SoCal or the SF Bay Area, you’re likely better off in some other state.

Just see in 5 years no great growth in the south, folks will go to the whiter states in the west and mountain region. Washington and ORegon will knock off South Carolina and maybe Florida that gets latins and retirees. and Texas will go down if oil continues to dropped and folks get smarter and moved more to nicer Colorado even with the cold weather.

“As marijuana legalization took hold in Colorado, the estimated percentage of regular cannabis users in the state jumped to the second-highest level in the country, according to new federal data.” Reason for Colorado population growth. Attracts all the lazy pot heads. No such draw in Texas. I raise grass fed, free range cattle, and the grass is not of the Colorado variety.

Colorado used to be a nice and affordable place to raise a family. Not anymore. I’m a co native and I love my home but the legal pot is obnoxious. Medical is one thing but there are dispensaries on nearly every major street in this city. We are thinking about moving elsewhere because even making six figures between the two of us, we can’t afford to buy in a decent neighborhood. Colorado will eventually become less popular because the cost of living is becoming simply ridiculous here.

Decided to take the kids to Disneyland for xmas break. So cal… What a horrendous dump. Staying at the Hyatt regency orange and this huge hotel is crawling with rich chinese. The women are literally dripping in Prada and Gucci.

The men have cigarettes hanging from their lips and the male children are 300 lb little buddahs, overindulged no doubt.

They exit the hotel to waiting limos where obvious real estate agents are getting out of the car to greet them.

Downturn? Ive never seen so many filthy rich foreigners.

“So cal… What a horrendous dump.”

Maybe next time you should be a good parent and take your kids to a nicer vacation spot. I can think of a few:

Gary, Indiana

Racine, Wisconson

Buffalo, NY

Toledo, OH

Duluth, Minn

I heard the weather is fantastic this time of year. If you hate socal so much, please do NOT come here (we have enough people and traffic as is). Thanks in advance.

Those places don’t sound appealing. Maybe a vacation to Australia or new Zealand would be more to my liking 😀

Although I don’t agree with a blanket statement that all of SoCal is a horrendous dump – it’s far more complicated than that – not to worry calgirl, some people would rather ignore the problems in their own back yard and deflect our attention to the back yards of others. You know – if you don’t love it, leave it – instead of let’s acknowledge the problems and figure out what to do to solve them.

I’m sure some people will come up with a way to spin our weather today in the 40’s as fantastic. But hey, I understand that some leveraged people at the bottom of the homeownership pyramid feel so much pressure from holding up all that weight and so desperately are counting on getting to the next rung that they’ll say anything to convince us that skepticism can be safely ignored in the context of this time and place is different. Here’s to hoping that their rhetoric comes with a lifetime unlimited warranty.

Siggy or whatever alterego bear blogger name you go by:

Thanks for the nice dissertation that had nothing to do with my post. If somebody badmouths MY city, I sure as hell will respond in kind. I think Calgirl stated she lives in Sacramento…do you see me belittling Sacramento? Sure there are plenty of bad areas in socal, but calling all of it a horrendous dump is just plain stupid and will warrant a response. Thanks for playing sheriff.

“Siggy or whatever alterego bear blogger name you go by:”

There one of you goes again, placing labels and using distracting non sequiturs about screen handles. Talk about having nothing to do with anything…

“Thanks for the nice dissertation that had nothing to do with my post.”

You’re hilarious, I wrote a blog comment, not a ten page essay. Who said it was all about you?

“If somebody badmouths MY city, I sure as hell will respond in kind. I think Calgirl stated she lives in Sacramento…do you see me belittling Sacramento?”

Funny thing is, you didn’t write anything “in kind” about Sacramento. I didn’t know that making condescending references to non-related areas works just the same.

“Thanks for playing sheriff.”

Thanks for squirming and try not to get wet in the rain today.

Ps. Disneyland packed to the bursting at nearly $100 a head. Walked through that fancy Disney hotel – the one at $500+ per night – hundreds of families checking in and out, no chinese there. Mostly americans/hispanics. Downturn? Or just racking up the credit cards? Mind boggling to me.

What is a “downturn”? Is it when the stock market nearly triples in value since the ’09 recession bottom? Is it when home values re-attain previous peak values?

calgirl you were witnessing a combination of the wealth effect and people’s engrained propensity to spend spend spend. Along with the onshore flow of yen-for-dollars.

Own a million dollar house in the hills of Mt. Washington just on the border of Cypress Park. There are fireworks down below, and there are also the occasional gunshots (the difference is clear as the latter is often followed by police choppers circling overhead).

Highland Park is seriously on the move though. Figueroa will be one of the more interesting streets in LA.

Cypress Ave has some cool little storefronts oppty. change. Needs another 5+ years, because it is flat and the lots are small, but with easy access to all of the eastside and DTLA, change is inevitable.

El Sereno has great potential as well.

Did anyone mention that it is just a stone throw away from Historic Route 66?

LOL

Leave a Reply to nzgsw