Tech real estate driven mania: San Francisco median rent is $3,200 and typical home now costs $1,000,000: The hollowing out of the middle.

The rent is too damn high in the Bay Area. I’m sure many families in the Bay Area utter this on a monthly basis as they send their rental checks to their landlords. The median rent in the Bay Area hit $3,200 in the first quarter of this year. The booming tech industry has been a big win for Northern California real estate although for many, it may not feel that way. Investors have been a dominant force as well in Northern California. Investors have been dominating the US housing market for nearly half a decade and are now only starting to show some signs of pulling back. San Francisco is an interesting case study of an area undergoing rapid ultra-wealthy gentrification. The median home price in San Francisco hit $1,000,000. On a monthly basis I will get e-mails from tech workers talking about their two income households being unable to buy in the Bay Area. Interestingly enough San Francisco makes Southern California look like a bargain. What you are also seeing is a deep hollowing out of the middle class in the US but it is incredibly visible in places like San Francisco.

Rents in San Francisco

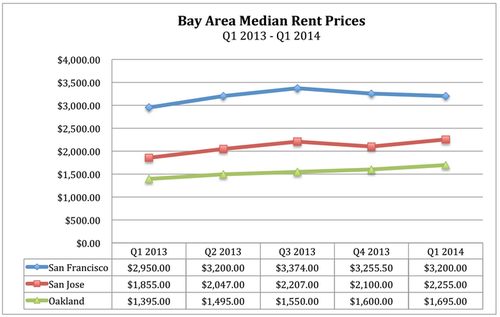

The rental market has been hot for the past year as well. For the Bay Area and San Francisco, a strong tech sector has created pressure on the local rental market. People work in good paying jobs and want to live in a city with international accolades. Or they simply don’t want to take on a soul crushing commute to purchase a home so they live in the city. So we have seen prices jump up dramatically over the last year.

In San Francisco, the median price for a rental hit $3,200:

Source: Curbed

The rental market is the market in San Francisco County. Only 36 percent of households actually own property in San Francisco County. Rents have to be paid from actual monthly generated income. While you might think that people are crowding into apartments, the typical household in SF is 2.3 (not exactly enormous). What you do have however is two good incomes but not enough to purchase that median priced $1 million home. Owning is left to those with solid incomes, investors, or those stretching to the very maximum.

Someone pointed me to this short video about the homeless in Silicon Valley:

Source: Bill Moyers

The video is only six minutes and worth the watch. The general gist of the reporting is that the middle class in many areas of California is simply disappearing. Some want to think that this is no big deal but there is a big impact with major consequences since a large part of your residents are suddenly mitigated to the outskirts. We have 2.3 million adults living at home. I’ve made the argument and data backs this up that many of those adults are living at home for financial reasons. Many are unable to even afford a rental, let alone buy a home in the state.

According to another set of data, the average 2 bedroom in San Francisco will cost you $3,800. Of course, a big push for higher rents is coming from the strong stock market and in particular, the renaissance with tech companies. We’ve had a great run since 2009 and in any business cycle, you are likely to see a contraction. It will certainly be interesting to see how this impacts the Bay Area.

There are two important questions to address at the moment:

-1. Is the current trend sustainable?

-2. Is a hollowing out of the middle class a positive development?

For many baby boomers, they have taken it for granted that the middle class in the US was here to stay. That clearly is not the case. On the housing front, we are already seeing some changes in the trend with rising inventory and investors starting to pull away. How this will impact the market is yet to be seen. What is very clear is that renting and owning in California is no affordable proposition. Consider it the sunshine tax.

One fascinating item in the changing dynamics of the market is that in Southern California, inventory is clearly rising yet in the Bay Area, many spots are actually seeing year-over-year drops in inventory. The tech boom is clearly causing added pressure to prices and rents. So what can you get for $1 million?

16A Henry St, San Francisco, CA 94114

2 beds, 1 bath, 1,161 square feet

This place sold in 2005 for $1,240,000 so you are actually getting a deal here since they listed it at $995,000. The Zestimate is at $1.249 million so I wonder if they are trying to drum up interest here. Any takers?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

100 Responses to “Tech real estate driven mania: San Francisco median rent is $3,200 and typical home now costs $1,000,000: The hollowing out of the middle.”

I am not convinced that these “hi-tech” companies are doing as well as they appear. The biggest offender of stock buy back mania is apple. These companies are grossly over paying for little companies and sopping up the mess by buying back their own overpriced shares via secured debt. I am not sure how sustainable this business model is over time…

Here’s an article in the LA Times about new FICO criteria designed to help mortgage borrowers (“…changes to FICO criteria are aimed at reducing the negative effect of overdue medical bills and at removing the penalties to consumers who pay off debts that had been assigned to collection agencies.”)

Yep, since people are having trouble qualifying for mortgages with the old rules, let’s soften things up so we can stick more buyers with mortgages they can’t afford. Real estate agents, you can be proud of this — who cares if a borrower had overdue medical bills or if a few of their bills had been assigned to collection agencies. We need more buyers, doesn’t matter if they’re qualified or not. And when prices start falling and people default on their loans, as long as we sell houses and make our commission, who cares, it ain’t my problem!

http://www.latimes.com/business/la-fi-fico-20140809-story.html

APPL issues bonds even though they have plenty of cash reserves to avoid paying avoidable taxes.

Remind again how taking on secured debt (not issuing bonds) and buying back overpriced shares to increase short term earnings per share creates future growth?

http://www.mercurynews.com/business/ci_26120468/google-executives-november-death-santa-cruz-yacht-turns

Oh yea, the executive team takes home bigger bonuses and invests in cocaine and hookers which spurs GDP growth under the new model… Got it!!!

Let mess, a company borrows money and using its stock a a collateral, then, they go back and buy more stocks which drives the stock prices higher, now, using that “freshly bought” stock (at higher price now), the company can borrow even moar money and buy even moar of its own stocks… then repeat… I wonder, What? could possibly go wrong here…

“Let mess” was supposed to be “let me see”

I prefer “let’s mess”…

sometimes there simply is no conspiracy.

APPL cash reserves has grown steadily despite the stock buybacks. With so much cash in reserves, buying back stocks is smart.

AAPL has buying the majority of its stock off the open market, via ASR which thus far has allowed it to buy back at a discount.

By issuing debt for the buy back instead of repatriating overseas cash reserves AAPL saves plenty in taxes while still allowing them to execute their strategy.

“sometimes there simply is no conspiracy.”

Never said it was…

“APPL cash reserves has grown steadily despite the stock buybacks. With so much cash in reserves, buying back stocks is smart.”

Share buy backs are only “smart” if the shares are under valued. Growing cash reserves is a sign of one of two problems. Under investment in cap ex or under payment of dividends.

“AAPL has buying the majority of its stock off the open market, via ASR which thus far has allowed it to buy back at a discount.”

and…

“By issuing debt for the buy back instead of repatriating overseas cash reserves AAPL saves plenty in taxes while still allowing them to execute their strategy.”

Not sure what the “strategy” is other than pumping up eps… To believe management’s goal is anything other than quarterly bonuses and stock options is pretty naive…

Sounds as if they’re conspiraring to get out of paying their full share of taxes. But yeah sure, there’s simply no conspiracy.

I am curious with the glut of cash these companies and investors have it is making the FED and other Banks believe costs of all goods have to get ever higher in order to justify the real cost of all assests: homes, cars, etc.? I smell hyperinflation is at our doorstep.

all in my opinion

“I am curious with the glut of cash these companies and investors have it is making the FED and other Banks believe costs of all goods have to get ever higher in order to justify the real cost of all assests: homes, cars, etc.? I smell hyperinflation is at our doorstep.”

Given that the new tokens were not equally distributed rather they were funneled through a handful of financiers who passed a few onto some of their close friends, we will most likely not see hyperinflation of worker’s wages. I would argue that we have already seen hyperinflation for the few at the top. Luxury items like high end property, high end art, high end collectible cars, high end hookers, etc. have all hyper inflated in value already…

I’m in the Bay Area. In my job I see the financial records of many companies, including tech companies. Many of the documents I have access to are not available to the public. The tech companies I’ve examined are bleeding red ink. I believe the Bay Area economy is fueled by venture capital looking for return. Looking at the types of companies that are fashionable in San Francisco in particular brings back memories of the dot com bubble.

Tis true – although $3200/mo rent seems inexpensive for areas outside of SF on the Peninsula. If you’re a family looking for a house in a leafy suburb it’s not difficult to pay 2x that amount – certainly 4-5k/month for a typical 50’s / 60’s rancher isn’t uncommon.

Buying? again 1 million for a 3 bdrm house seems low on the Peninsula ( keep in mind most people in the SF Bay Area live outside the city so it doesn’t really represent life for most of us here – not those with families). Think about the numbers – say you put down 20% and take a loan out for the rest… that’s a big housing cost that needs to be met after taxes every month. Realistically to keep that housing number lower more than 20% needs to be put down. Actually just to compete for the privilege of owning you need waaaaaay more than 20% – more like 50%+. So who has 500k to 1m in cash as a down payment? The “middle class” (whatever that is)? It’ll be someone who went through an IPO, someone who just sold another house in the area, foreign money, dual income household making several hundred k /yr that’s really good at saving or… a lottery winner (?) I submit that “middle class” here is being an engineer, a dr, lawyer etc Anything service related is simply consignment to poverty. The wealthy are the successful commercial real estate developers, investment bankers, senior management at tech companies etc

Even more amazing, housing prices in craptastic Vallejo are ending up selling for way over asking price, bidding wars are the norm. Vallejo houses there seem cheap when comparing them to other areas, but keep in mind Vallejo is 2 bridges away from SF ($10 bridge toll) or a ferry ride ($13 each way) and the City was bankrupt a few years ago. They still don’t have money to fix potholes and they have fewer than 90 cops for a city of over 100k. Here’s a little 1k sq ft “gem” that sold for 70k 2 years ago and just went for 230k (check the crime map) http://www.trulia.com/homes/California/Vallejo/sold/7911732-811-Louisiana-St-Vallejo-CA-94590

I live 25 miles south of SF in the peninsula and have already seen my rent increase 30% in the last 2 years. I really doubt this kind of trend is sustainable. Feels like its 2006 all over again!

I would argue that if feels nothing like 2006 or any other time in recent history. I believe that this is the first time that we have had a “recovery” that has gone unnoticed by 99% of the population. I wonder if there would have been a “recovery” if there was no such thing a TV…

We have been in depression since 2007, told ya that 🙂

Maybe investors are trying to get their peak rents in before the market corrects?

Have you seen your income increase by 30%? Not likely. Average rent has gone up from 30% to 50% of gross income on average.

I have a friend who for the last 25 years has been purchasing rental properties in SF. I think he said he had about 50-100 units. He constantly complains that he can not raise the rent and that the older buildings are very costly to fix. $100K elevator repairs, etc. So when a renter leaves he can raise the rent, and the rent often doubles or triples. It took him 25 years to get to this position buying a building every few years. But now that the rents are going up, he has become a very wealthy man. 100 units at $2500-3500 month on properties that are 50-75% paid off. At the end of the day he earns about $100k month on these units.

When he hears bubble comments and people talking about the bubble, he just laughs it off. He said those are the people who don’t understand how to make money. It’s not about a short term gain, it’s about build wealth over decades.

In the next 20 years those rents will be $4000-6000 month. He will have 200 units and the rest of us will be blogging about the impending bubble of doom.

“Housing to tank 2034!”

In the next 20 years those rents will be $4000-6000 month. He will have 200 units and the rest of us will be blogging about the impending bubble of doom.

This type of linear thinking is one of the reasons tge FED is able to blow bubbles so easily. Whose to say we aren’t at an inflection point where exponential growth has permanently stalled? To say the historical trajectory of economic growth for workers, especially in the face of AI and robotics, will remain assumes much. Much of the rentier class is likely shitting bricks as the destruction of the working class will ultimately lead to a systemic collapse. The only way oligarchy works is if somewhere workers earn sufficient wages to consume and grease the engine of the economy. IE, the Oligarchy in Mexico survives because the dollars sent back by the illegals support it. In the absence of this you have a Soviet situation where the economy rots from the inside. This is why the FED has been so desperate for wage inflation and is horrified that QE has produced ZERO wage inflation. To assume that a flat worldwide economy with a leveling off population can support the kind of growth we’ve seen in the past is pretty bold.

There’s a difference between a play that requires a lot of give in order to get some take and a bubble play that affords quick gain at the expense of the honest participants in the rest of the system.

First it was the dotcom (stock market bubble)

Second it was the housing bubble.

Third it maybe the rent bubble.

Fourth maybe the Shanty Town bubble.

Fifth looking like the Cave bubbles.

You missed camel dung bubble and Tulip bulb mania, can’t leave those two out…

The doctor uses the phrase “sunshine tax.” Years ago, I heard Sheila Kuehl use that same phrase.

Kuehl is a former California State Senator and Assemblymember. She lives in Santa Monica, and represented the westside. Someone had challenged her liberal policies, of always wanting to raises taxes to pay for programs. She called it a “sunshine tax.”

Her rational was that “California living” was better than elsewhere in the U.S., and that if you want to live here, with all that California offers (including, I suppose, “great” social programs), then the “sunshine tax” is the price you pay.

She seemed to imply that high taxes were justified for great California living, and that those who didn’t like it could always move. She seemed assured that most would stay. That they saw higher taxes as well worth the benefits of receiving all that California offeres. She seemed to lump great weather, and great government services, into the same item.

Kuehl is currently running against Bobby Shriver for L.A. County Supervisor.

I prefer Shriver. He entered politics, running for Santa Monica City Council, because he was heavily fined for his hedges being too high.

Both Kuehl and Shriver are liberal Democrats. But Kuehl seems an unrepentant big spender. Shriver seems more sane, because he’s seen that big government does, sometimes, go too far.

ah yea…

I will file this in the “who gives a f%$@” folder…

Sunshine tax!!!! We have that in San Diego. But the employers more than R.E. that deploys it……………………

The tech bubble has “helped” cities outside of SF to bubble up, too. A lot of tech companies moved to Austin, and that town has experienced a huge boom. Condo towers going up like 2008 never happened, even though the existing condo towers from the previous bubble (or current bubble that never popped?) never filled up. Comments on the article below tell the real story.

http://www.statesman.com/news/business/new-planned-downtown-tower-could-be-austins-second/ngx4Q/

Yep! My sis and brother-in-law work for (did) Apple. Steven was his boss. PA is where they live. The money some techies make up there is amazing! But R.E. is threw the roof. I’ll stay in So Cal. The water is warmer and it is sunnier. Living in the city of SF sucks. Unless you like heavy fog even in the summer, you can have it.

I live in the city and grew up in LA. I would take the City over Big Tijuana any day. If your not on the coast in LA good luck with that. The nightlife, events, food and culture makes LA look like Ensenada..

The price of homes is not sustainable, we are living in a bubble, I wouldn’t buy my home for the price its worth. Living trusts and Prop 13 help San Francisco more than LA, Rarely do you see homes for sale where I live, they are just turned over the children to use them as ATM’s…

Soon, without water, anywhere in California will suck….Of course their is much more up here than down there…

I heard those homeless folks are paying about $1,800/mo to rent those spots under the bridges in the Bay Area.

Housing to Tank Hard in 2014!!

@Jim Tank, no happening…

“Housing to Tank Hard in 2014!!”

Only if the stock market tanks. And I am not talking a 20%-30% correction. What is going to tank the stock market 60%?

The landing of any one of a dozen global black swans flying overhead should get the tanking underway nicely.

Luckily, the majority of sheep don’t even know what a black swan is. But they are certain to find out in their lifetimes.

I will Kill and Grill the little bastard before he sets foot on terra firma…

http://honest-food.net/2013/12/30/on-eating-swans/

my sister and her husband pay $2750 a month for a 777 sq ft one brm apt in a brand new complex in san mateo. he works for philips in foster city and she stays at home with their first child on the way

Seems like a new normal in Merika

Maybe in your part, but not in mine. 1800 square foot 3 bed 2 bath duplex rents for $1450/month. Want a new house? Construction costs are typically $100 – 140/sq ft. Montana…

@jeff

Great Montana is cheap. Here is what we have in CA cities that Montana lacks.

10,000s of diverse restaurants for many authentic Chinese, Indian, Thai, etc. food. 100’s of entertainment venues. Lots of single people. Yes that matters if you are dating. I general CA is full of culture and diversity.

Is it with the extra $1000-1500 month?

For me, YES! Worth every penny. The extra $12K year is like living on vacation. Maybe people visit CA and spend $6000 on a vacation for 2 weeks. For double that I live it for all 52 weeks.

Jeff, Sean1 is right.

Were I married, I’d have left California years ago. Bought a nice, cheap house in Middle America. But if you’re single, your network of friends, colleagues, and acquaintances takes on greater importance. Them and the potential for future significant others.

For a single person to move to some small town, where he doesn’t know anyone, and there’s little to do, few activities that are not family-oriented, well … the family man’s idyllic leafy suburbia is the single guy’s sterile suburban hell.

My brother in law, who lives just outside of SF, thought he would sell his home up there, then move down to SoCal, and get much more for his money. He came down and shopped for a home on the West Side, and the South Bay. He was shocked at the pricing. Very little for 1M. 1.5M got you something decent in south Redondo beach. Santa Monica … forget about that. He decided to stay in SF.

Very true. They should do a comparison of average prices by demographics and another by crime rate.

Much of LA is crime ridden and dangerous and those homes pull down the median price. If you are a yuppie wanting to live with your people you are looking at 2M minimum.

One has to wonder how much of this is due to stupid zoning laws. It would be easy (in theory) to build a bunch of high rise apartment buildings but my guess is the NIMBYs don’t allow them.

This is one of the reasons why we are in this mess, the artificial suppression of the inventory to prop up the prices. We have a plenty of space here, in downtown Bellevue, WA. Plenty of local one story shops, stores, restaurants and businesses that could be easily moved into commercial space of multistory building. I see no problem of replacing a couple acres of one story 80 years old construction, that is literally crumbling apart, with new 10-20-30 story buildings. We would have plenty of apartments for rent as well as commercial space will be used more efficiently. Even the new construction here, in downtown, is mostly 4-5 story apartments. They could’ve build twice a much if they were to build 10 story instead. They make no moar land around here, right…. right? Build dumb higher buildings, the problem solved!!!

Guy from Seattle,

Things are far more complex than what you say in terms of building higher high risers. Here is a little bit of food for thought:

1. Parking space (even if you have one car per unit). Technically it is feasible, but is it financially feasible?

2. Seismic code requirements increasing the cost exponentially. They built those and many units are still for sale and they were for years. There are not too many people able to afford the additional cost.

3. With cramming more people per square mile, what is the impact on traffic ? In Bellevue the freeways are parking lots till late at night. Yes, they do have a very good transit system but not everyone can use it. Even if they try to use it it might take longer than using the car (just trying to switch busses and wait for them.) Where it is feasible, everybody uses the buses and they are full. However, roads are still packed even with the billions spent on world class infrastructure.

See, there are lots of things to consider for a developer before he can hope to be on the plus side. Also in Washington there is no Melo Roose like newer developments in CA. The developer has to pay astronomical development fees for every unit (house or condo) upfront (on top of very high permit fees, for schools, roads and fire/police stations) and that raises the cost for homes and houses a lot. Can the developer pay those and sell the units for an even higher price to make a profit????…. Sometimes they can or they hope they can and they built high risers where the units cost over 1 million (i.e. Lincoln Towers). Are you ready to pay those prices? If not, the developers can’t demolish those old buildings and build high risers. With smaller buildings (i.e. up to four levels, there are less expensive codes, less fees, lower risk) and that is the reason you see them. Every developer wants to decrease the risk.

Everything profitable to be built will be built. Without profit there is no action. If the inventory is low, that means the prices are too low to give incentive for more building. Builders can’t wait to have demand. If you see lots of construction, that means the prices are high enough to allow construction. If you don’t see construction, that means it cost more to build than to buy an existing house. Remember, the inflation you see every day at the store is seen by builders with the construction materials everyday, because they can be exported. A house already built can not be exported.

Im seeing more price reductions in the Bay Area over the past two weeks.

Don’t worry folks, the Ebola is spreading. Soon we will have plenty of housing for everybody…

hahaha just like in planet of the apes

This video about homeless in San Jose is so full of shit that I don’t even know where to start.

So you can’t afford to live in Bay Area, but you’d rather move under the bridge than to Plano, TX. Interesting.

So you’re a convicted felon and you “find” bikes and repair them. Interesting.

Has it ever crossed anyone’s mind that if those people moved out of BA and there was noone left to serve the free meals at Google’s cafeteria, then the rates for the lowest paid jobs would have gone up?

It may sound shocking, but you don’t have to live in CA if you can’t afford it.

Excellent remark! Finally someone who is outside the matrix and able to think outside the box!

For those in CA who can’t give up the diversity and entertainment and the ethnic restaurants all I can say is that every state and city in US is offering that if you are so rich to eat out all the time and pay for entertainment . However most complaining on this blog don’t have enough money to buy anything, forget eating out to all those tens of thousands of restaurants. For that you need millions. Any safe, decent area with a decent small living area in CA cost millions. The other shacks spread in other barrios which lower the median/average price are not even worth living in them. Tijuana offers better areas.

CA has ONLY few nice spots along the ocean worth living in. However, if you don’t have ready few millions to pay, any place outside CA offers much more natural beauty, lower cost of living, in other words far better quality of life.

For those of you millionaires, you may discard my comment – I am talking those who have millions and houses paid for, not those borrowing millions. The second category are just debt slaves with no life.

People have an incredible ability to take pain. I don’t get it. Why live somewhere that the rents/homes are so expensive that it negates earning a good salary is beyond me. There are a lot of bondage types out there mortgaging themselves up to the hilt or paying too much for rent in relation to their income. Most can move and I don’t feel sorry for them when they whine, especially dual income professionals. Use your smarts! Deal with what is before you today and not what used to be or should be. People need to stop complaining about something they can change but don’t want to. Move to greener pastures, takes off those shackles. You can move, find jobs, raise a family in other parts of the country that are not so bubblicious. Don’t fall for their pleas for help, they choose to live here, they like the sunshine, they don’t want to live anywhere else, lick my boots! All I see here is 50 shades of stupid.

Just one shade Christie “S”…

I would move in my heartbeat somewhere else, but I have limited option considering my profession (software development). You could’ve notice that all the IT jobs are in the most expensive areas, and it is a problem… Again, I see the problem of high prices as a manufactured one (low interest rates, artificially restricted inventory, etc), not the social one. Just build moar dumb housing, What? is a big deal about it? Build moar rentals to make them moar affordable, it would remove the flow of buyers and loosens the housing market… Again, what saddens me is that the corrupt government “has” plenty of money to spare to build weapons and kill hundreds of thousands a year by raging wars oversees, but we don’t have the fucking money to build moar roads, water pipelines, high speed internet, etc, etc. Invest in the local infrastructure and start building in moar remote areas, I see no problem here… California has a plenty of deserts and sun, build solar power plants to desalinate water… Common, just cut $100 bils from the offense (sorry, defense) budget and spend it on infrastructure!!! You will see miracles…

I guess any requests to the government to support programs or reduce debt will likely make investors move cash and then we end up with the same problem. However, maybe if a program to help improve affordability was only permitted based on your wage maybe that would bar investors away? It really comes down to who should be allowed to buy based on income. NOT HUD per say. If these type of restrictions were made I would say that it would reduce or eliminate the flipper crowd and you would likely see a resurgence in the middle class.

The next thing is the developers need to stop looking at these developments for the sole purpose of flipping. Housing MUST remain affordable based on the income in the local regions for sustainability and to give employers a larger working class to choose from. Obviously housing construction costs will dictate what the type of housing will look like in the end.

all in my opinion

Please see my post above

“There are a lot of bondage types out there”

And Christie delights at being the “S” of S&M.

“The Great Recession” never ended pure smoke and mirrors by Bernanke and the Yes girl Yellen. There last straw was the bond buying of mortgage backed securities which was unprecedented in the history of the USA. It took roughly 4 yrs for the bond buying to hit the streets where the “common man” could get a wiff of the trillions the Fed has pumped into Wallstreet. I believe a few yrs ago we hit peak prices in gas groceries housing and many other publicly traded commodities. So this whole orchestrated “recovery” May wind down very fast. Every yr since water droughts have been tracked a bubble in the economy has occurred when a drought was declared in California. So like the big one we are all waiting for the big one. just wait and see..

Here’s an argument that San Francisco housing is an affordability crisis, not a bubble … and that it takes much longer for corrections to the former than the latter.

http://m.sf.curbed.com/archives/2014/08/07/gasp_sfs_housing_market_is_not_that_overvalued_after_all.php

Sales in my Bay Area town keep going up, sale to list avg is 113%, median down payment is close to 40%, and days on market down. I have yet to see a house that didn’t go pending the day the bids due.

There seem to be a lot of people (avg. nbr bids is 7) who not only don’t go into shock at 1M for an ordinary 3/2 (no view, special features) but who will bid it up to 1.4M.

The one odd thing is that a few comparable houses in the hills, with views, are going for the same price. (Not most of course. 2M+ is common but those usually incl. acreage not available in town.)

Living in the city, the prices are a bubble, if you can’t see it than enjoy your fall..

People sure have short memories. The poster above nailed it, we printed 4 trillion dollars to prop housing, the bond and stock market. The printing is about to end for a bit as we wait for the bubble to burst than provide more.. The looming issue is Water and can the bubble be kept full of air. I doubt it, no wage growth and now slack will grow based on the inventory pump now being over.

The government fixed the housing market, something we went to war over to become a nation is now embraced by our corporate govt. state. Think Britain and how messed up there housing market is. We will copy it…

Short memories. People don’t seem to remember that waaaay back in 2009, you could rent a nice studio in SF for around $1200. Prices there wax and wane. Around 35% of the Bay Area population is transient – moving there for a time for work. That’s why the unemployment rate is always so low – lost your job, get out! Prices fall and rise. It’s just that property holders there have gotten greedy esp. since a lot of properties are paid off.

The new tech boom is based on low interest rates as well. With a 1% cost of capital, you’ll invest in any 20 year-old’s half-baked idea as long as it involves a computer. With cost of capital closer to 3%, a lot of those marginal startups start to look like the turds they are – a lot of this incubator money will go away. The mature tech companies are in stasis in terms of hiring – the Googles of the world hire at a normal pace, whereas Ciscos and others are either stable or laying off for a total net gain in employment at those places in aggregate at about 0. Bay Area population will decrease as a lot of these startups start to implode.

Well… The fact that SPUR is a urban planning organization in San Francisco speaks volumes. This is like having the wolf explain to the farmer how the construction of the chicken coop is the reason for the lose of chickens…

These guys define a bubble as:

“prices are high relative to historical norms and cannot be explained by supply and demand. Prices are also high in comparison to rents.”

And they define a new economic term “affordability crisis” as:

“is largely driven by low supply and high demand, and also sees high rents alongside high sales prices. In this situation, prices are high relative to incomes and to other cities.”

The kicker is they get a comedian from Trulia to state that housing “isn’t really that overvalued when you consider current median incomes”.

Well… if it is a “affordability crisis” and not a bubble, then how is it possible that housing “isn’t really that overvalued when you consider current median incomes”? This short article contradicts its self in less than 100 words…

They seem to gloss over why A) inventory (aka supply) is “low” and B) why income is high (aka demand). The housing bubble, yes I still call it a bubble, is the result of A) a bank (aka Fed) induced shortage (the planning stooges don’t help either) and B) a Fed induced credit bubble (aka demand). Is this really news anymore?

Thanks for the laugh LCaution…

The key phrase is “median income” I think. Programmers fresh out of college are offered about 120K. Everyone earns a good living there. Google, Twitter, and Facebook, are the major employers in SF now, right? It wasn’t like this in 2002 when the dot com bubble burst. If 20% of the work force earns 100K plus but the remaining 80% earns 55K then it looks like the median income is up. The author is reimagining data to suit his purposes. These are big companies with thousands of employees competing for space and organic owners who won’t sell because where are they gonna go? Are you going to argue FB is really more valuable than Toyota? Or that WhatsApp is worth $17 billion? SnapChat 3 billion? When these companies come back to earth then there the median income will come down again. Gonna take a long time though I think.

Everybody in IT does not make good wages. That is the problem when labor markets get swamped with cheap foreign labor. Kids coming out of college with degrees are not regularly pulling $120,000 salaries. These are only the few top-notch programmers who have already developed their own applications and successfully marketed them. I can point out a dozen health care companies in my local area who spend half that money on an annual basis by hiring people here on H1b visas.

RM is spot on…

You have to remember that salary is only part of the comp. There are hundreds if not thousands of programmers with 3-5 years of experience running around SF with seven figure stock options they can cash in from earlier startups. In a town that barely builds 5k units a year you can see how this is a problem.

If you’re in tech and in senior management and you bought a home before the last tech crash, then you’re in a good position. A few highly skilled specialists can also pull in good money. Of course, even these highly salaried people are subject to losing their income through replacement or layoff. One could argue that with higher salaries come higher stakes…you’re a target for others who want to move up the ladder or for the next round of payroll compression.

Everyone else is on contract, contingent, or not making enough. People just out of college are not pulling in 120,000. They may be making a good salary for their age group but not in the context of the cost of living in their area. That is why young techies are living in group housing situations in SF.

Fair enough — let’s take a look at what Google pays, http://www.glassdoor.com/Salary/Google-Salaries-E9079.htm. Most people can’t compete salary wise with even a lowly account manager. This is the type of money flooding SF.

Yeah and the landlords see that these guys make $120K and raise rents accordingly making the standard of living for these guys the same as the guy making $40K living in Cleveland.

I was talking on the phone with a business associate from the Midwest the other day and near the conclusion of the conversation, she told me to enjoy the rest of my day in paradise. I’ve lived in other parts of this country including the Midwest and know better than to buy into the hype of California exceptionalism. Life here has its fair share of difficulties, climate means only so much if one is to take a comprehensive view. Not sure what’s worse, people who haven’t lived here thinking it’s milk and honey or the people who’ve only lived here thinking its objectively the best place to live. There’s no shortage of arrogant a-holes here, especially in prime areas.

People that live in The City are so so different than the westside groups and of course another world away from SoCal. Life in The City can not be compared to the pedestrian(for you westside village bubbas, it means unsophisticated) lifestyle of those outside of The City, such as SoCal. It has always been that way. There is grand canyon gulf between The City and those to the south. I don’t mean to imply that those on the westside are like those in the Ozarks of Arkansas.

It seems to me that San Franciscans think a lot more about L.A. than Angelinos think about S.F.

Sometimes I’ll meet a San Franciscan, and he’ll ask me, “Tell me, really, what do people in Los Angeles think about San Francisco?” Really, I don’t think most Angelinos are even aware that San Francisco exists.

As a former New Yorker, my impression of S.F. is that it’s a rather small city. Quaint. I do like its cold, foggy weather. I hate L.A. weather. If S.F. were cheaper than L.A., I’d even consider moving there, instead of to Seattle.

Last time I was in SF, I walked with my client from his nice hotel to the federal courthouse. Right through the Tenderloin. I ran into so many sophisticated people!

I am not surprised of your inaccurate understanding of a native southern Californian’s view of San Francisco since you are a New Yorker and NOT a Californian. My guess is that the person you were talking to was a transplant as well. We ALL loved two places to go to when I was young, Baja California for surf and San Francisco for the music scene… So I guess you can speak for New Yorkers and I will speak for LA…

Those of us in SoCal think SF is a trendy city that is expensive but very progressive. Many of us would like to live there but its a substantial relocation. SoCal has a high respect for NoCal.

As for the rest of the United States, most people associate SF as a 100% gay city. Anyone who moves there is most likely homosexual. It’s a stereotype – not one I agree with. But that’s how much of the close minded people think. It’s one reason I left the Midwest, lots of prejudice people. Not just against the gay community, but against anyone who isn’t a WASP.

you are a bunch of Philistines, no appreciation of the true culture of The City. Our high prices(partly due to environmental rules) keep out most of the Philistines. I hate to go to SoCal and I am not shy about telling them what I think of their cultural desert.

As someone who has lived in both places, I totally agree. Most SF’ers have this stereotype about LA as having no culture, superficial people, etc. LA people do not give a rat’s ass about SF except as a nice weekend getaway. I lived in NYC for a time and when I came back to visit SF, I thought, “What a quiet, little town.”

SF people tend to be really snobby about where they live and look at it as some sort of accomplishment. They also think that for some reason they live in a global cultural hotspot, which it isn’t by any stretch of the imagination. Sure, there are a few museums but the tech wealthy have not supported the arts and culture to the extent that the wealthy in NYC and LA have, and IME, a lot of techies look down on arts and artists for some reason. SF has MOMA, but LA has LACMA with the new Broad addition, MOCA, Broad Center for Photography, numerous playhouses, comedy spots, music venues, art galleries of all sizes in every neighborhood with thriving underground arts and cultural scenes of every type. With gentrification in SF, it has pushed out 99% of creative types to places like Austin, LA and Portland since these folks are low in the income scale.

The term “lemmings†is used a lot in regards to “investing†and I found this little old video that chronicles the cycle of these strange small creatures.

https://www.youtube.com/watch?v=AOOs8MaR1YM

It reminds me of my 4th grade teacher at Grant Elementary School who would play these old educational movies for the class.

Some very apropos lines from the movie…

“It’s not given to man to understand all of nature’s mysteries, but nearly as he can surmise it would appear that the lemmings consider this body of water just another lake. And if it is another lake, then it must have a farther shore. And so they strike out boldly. But, gradually strength wanes, determination ebbs away and soon the arctic sea is doted with tiny ebbing bodies. And so is acted out the legend of mass suicide. Except; nature, in her infinite wisdom, has spared a few. Back on the arctic plain there remains a small handful that did not make this fatal journey. And, in time new generations will take the place of those that have been lost. And yet when the population cycle mounts to another peak, the lemming legend will be told again and will come to this same amazing climax.â€

Hmmmm…

that’s deep. you smart cookie. definitely not a lemming

Yeah, What? is smart, so he probably already knows that film was completely faked by Disney. They killed a bunch of lemmings by driving them over a cliff, creating the whole “lemming mass suicide” myth/urban legend from whole cloth…

No, I consider myself a borderline retard. What really scares me is when everyone else in the room is actually dumber than me…

It wasn’t the fall that killed them, it was the sudden stop at the end…

Actually, if you had watched the video you would know that they all “survived” the fall only to continue on their epic swim in the arctic sea. Hearty little creatures…

So ok is housing going to tank this year?

我ä¸çŸ¥é“

Wǒ bù zhīdà o

The Bay Area housing market is really an amalgam of a few dozen or so distinct markets. The Atherton, Los Gatos, Monte Sereno, Los Altos, Los Altos Hills, and Palo Alto markets may take small hits in the future, but unless CA devolves into an Escape From New York-style civil collapse, those areas will always recover quickly. There is simply too much domestic and foreign money chasing too few properties and access to Silicon Valley and San Francisco is too convenient. Short of a societal collapse they will always be fine.

The second tier markets (San Jose, Redwood City, Fremont, etc.) that will take deeper hits, but in the end they too will recover as long as CA doesn’t become an economic basket case. The Bay Area climate is more uniformly pleasant than Southern California–you don’t have to be near the water to avoid the worst of smog and heat. The limited geography and building restrictions mean that there is no way to build enough housing to satisfy the demands of all those who work in Bay Area cities.

The key question is: how long can California’s politics avoid driving the state’s economy off the cliff? If and when that happens, it could take decades to rebuild the economic strength to fuel the income levels required for a vibrant housing market. CA is 1/8 of the country’s population and 1/8 of the country’s GDP. If it tanks, it will have a tremendous impact on the country as a whole.

You’re totally missing the larger issues. If housing costs continue to rise at such a pace, the larger companies won’t be able to attract talent. Most of the more mature tech companies cannot pay ever increasing wages to staff. Many of the successful non-tech companies cannot do that and are leaving the Bay Area. If you have to pay an entry-level worker $100K just to be able to survive, or pay public sector workers that much, then you’ll have a mass exodus of non-tech and mature tech companies to greener pastures.

Housing costs in CA have been ridiculous since the 1970’s and haven’t reduced demand one whit. In addition to the desirable climate, political issues drive CA housing costs. Land use restrictions, rent control, environmental regulations, and a myriad of other laws that make land development here more expensive than most places in the country. You are right that CA is bifurcating into distinct classes: upper and lower–with the middle class slowly dying. Yes, eventually this will impact housing prices, but it will take a catastrophic financial implosion of the state government to catalyze that. That is my point: not that things are fine in CA, but that Bay Area real estate in particular will remain relatively strong until the end. It is just too good a place to live and there remains enough work to keep demand high.

You will be right about CA housing in the longer term–and I share your pessimism. But just like the stock market doom and gloom brigades (who have either missed a huge run-up or have gotten killed shorting the market), the timing of the collapse of CA housing always seems to be 6-12 months out. I wouldn’t buy right now, but I’m not going to sell and rent back for the next 5 years either. The corrupt politicians in Sacramento have not used up their entire bag of tricks to postpone the day of reckoning.

Only when the state government collapses will housing finally correct.

2) The wealthiest people in the world want to live and work in CA. They will continue to prop up high end housing prices. There companies will continue to provide adequate income for their workers. Compain

High taxation drives out wealthy taxpayers and corporations that can move

Land use restrictions and regulations drive up the cost of construction

2) Deteriorating infrastructure Poor schools

My PMI is officially cancelled. Got an appraisal done on my home I purchased in 2011 with only 10% down in the Los Angeles area. It appraised for $155k over my 2011 purchase price. I only put $20k into the home in updates since I bought. Sitting on a 3.9% 30 year fixed… No PMI… And a mortgage payment about $1000 lower than comparable rentals.

I have to admit I got lucky as hell that homes appreciated as fast as they did… But the main reason I bought at the time was due to rental parity. Glad I trusted my instincts on that! Now I am sitting pretty in a great school district and in a home I can easily raise my family in for the long term. I am prepared for prices to fall again… But I won’t be selling because my PITI is so low compared to rents. Probably will only cash out when I plan to move out of state.

Filing this one in the nobody else gives a shit folder.

Fair enough — let’s take a look at what Google pays, http://www.glassdoor.com/Salary/Google-Salaries-E9079.htm. Most people can’t compete salary wise with even a lowly account manager. This is the type of money flooding SF.

Hello Doc.

“The City” aka San Francisco is mentioned in the article about rising rents, however, many renters in the midwest and southeast are also experiencing significant rental increases.

http://online.wsj.com/articles/nashville-rent-increases-have-residents-singing-the-blues-1407708778

…Renters in some of the nation’s biggest cities, including San Francisco, Miami and New York, have long complained about sky-high housing costs. But in the past few years, the cost of renting an apartment has been climbing in a number of midsize cities as well, squeezing residents who are paying a larger percentage of their income to rent.

Metro areas including Nashville; Raleigh, N.C.; Louisville, Ky.; Columbus, Ohio; and St. Louis were among the 10 regions with the strongest rent growth in the second quarter of this year compared with the previous quarter, according to real-estate-research firm Reis Inc. …

…Economists say landlords in these southern and Midwestern cities are able to pass through large rent increases because of strong demand. “Job growth has picked up, unemployment’s declined. There’s still solid demand created by…people losing single-family homes and going into rentals,” said Mark Zandi, chief economist at Moody’s MCO +1.52% Analytics. “That’s giving landlords the upper hand.”….

Im thinking of moving to thailand I wonder if the market is inflated there!

The bay area housing market is out of control due to insane restrictions on supply.

The municipal, county, and state governments have each imposed their own level of corrupt red tape designed to drive up property values with the aim at routing around prop13’s property tax caps.

In order to build in the bay you need the capacity to sit on empty or partially-completed property for 10 years while your legal team fights the 2 dozen agencies demanding a bribe, the zoning commissions, and a half dozen self-interested parties and “socio-environmental justice warriors” just for the privilege of building ON YOUR OWN LAND!.

All this is, of course, assuming there aren’t flat-out bans on construction of new units. Isn’t it marin which refuses to allow new sewer lines, thus permanently fixing the number of properties to the same level for decades?

San Fran is my absolute favorite:

People whinge about rents, get pissed when developers swoop in on under-utilized properties, but refuse to raise the height limits, and actually respond to this by restricting building even further!

If I don’t see a correction in 2 more years I’m gone.

Well, you might as well start packing, because things will not change fast enough in SF or the proximate outlying areas.

SF’s housing policies are in major need of reform, and the artificial restrictions in supply only serve to benefit wealthy homeowners. Rent control policies in SF, while well intended, only exacerbate the supply problem and lead to slumlord conditions in many neighborhoods as tenants squat in units for decades and keep valuable supply off the market.

And as noted, local restrictions and other forms of red tape have slowed new construction, which is only finally beginning under Lee’s administration — but will never be enough to satisfy the pent up demand for SF real estate. It all comes down to simple economics: extreme domestic and international demand combined with very limited supply = exorbitant home prices and rents. As the social media tech juggernaut continues its unprecedented run and avalanches of Wall Street money continue to pour into California, this housing trajectory will continue.

And now the upward pressure is spilling over into the East Bay area, as Oakland and adjacent areas are on the rise. IF you wait too long to get out of SF and into a more affordable investment in the east bay, it may soon be too late.

And yes, the middle class is disappearing at a rapid rate while SF and the peninsula get increasingly gold plated and hyper-gentrified.

“If I don’t see a correction in 2 more years I’m gone.”

You may leave now based on the picture you described. If what you say is true (I don’t doubt it), you already answered your dilemma. Prices will continue to correct upward.

Lower supply coupled with higher demand (more millionaire from stock options) is a sure way for a correction to higher prices. The interest rate for mortgages is not going to affect the prime area of the City of SF since most buyers for the few properties available come with cash.

A crash in stock market might stop the increase by lowering demand.

Again, I am not talking about So Cal market or US RE market in general. I am talking about the narrow prime market of SF.

Based on what you wrote, in your sub conscience you agree with me but are afraid to admit it in black and white. You just say the same thing in a round about way.

“A crash in stock market might stop the increase by lowering demand.”

The stock market will NEVER crash! NEVER!!!

SF is badly in need of rent controls. The city council in LV enacted those when they saw their Housing Bubble out of control and it has done much good in controlling the prices, holding them down in the realistic range. My city is considering it. I suspect rent control will become more prominent as time goes on.

SF already has rent controls, very strict ones. This is one of the reasons we’ve ended up with rents nearing 5 figures a month and a tenement/sublet society. Anyone wanting to buy into a rental property in SF will be in negative territory for decades waiting for old tenants to vacate unless they use the ellis act and are prepared not to rent for 5 years.

The “official” rents for those who want *gasp* privacy and first-world living start at almost 4k, but most “natives” who don’t live with parents utilize their network of connections to room up with people who have been on the same rent controlled lease since the mid-90’s.

Many long-time residents rent out a room for more than the rent charged to them by their landlord due to rent controls, effectively paying negative rent.

Judging by the figures I’ve heard rattled off by long-time renters, I believe it actually does come out a considerable net positive over 10 years to utilize the ellis act to force resident turnover. The issue is not ellis act abuse, it’s the rent controls preventing the fallout of local political policy from impacting the people who vote for that policy.

NOt too long from now, US will be hit by another crisis, by then, probably $20+trill in debt, Feds balance sheet $5-6 trill, and will need to come up with trillions more to cover the collapse in the markets

This time, unlike ’09, the markets will not be so kind to US, rates will pop and default will loom, leading to necessary cutbacks in spending affecting everyone, these cutbacks will lead to an even bigger crisis, housing prices may drop 50%+ this time, but again, no bailout to bring em back… should be a fun reality trip!

Urgh, 16A Henry…

Sold: $1,310,000. (09/05/14)

San Francisco Housing Bubble 2.0 Goes Schizo: Y/YMedian Price Up 27% to $1,073K, Sales Volume Down 20%

December 18, 2014

..So I read with fatalist amusement in SF Curbed that the most expensive home on the market in early November is still on the market. At the time, SF Curbed described it this way:

continues

http://davidstockmanscontracorner.com/san-francisco-housing-bubble-2-0-goes-schizo-yymedian-price-up-27-to-1073k-sales-volume-down-20/

Longer/alternative. http://wolfstreet.com/2014/12/18/housing-goes-nuts-san-francisco-home-sales-plunge-20-prices-soar-27/

Other:

Nov 2014

http://wolfstreet.com/2014/11/26/california-housing-market-cracks-in-two-top-end-goes-crazy/

Dec 2014

http://davidstockmanscontracorner.com/its-official-washington-fueled-home-price-inflation-strangles-us-housing-market/

Leave a Reply