What happens when investors pullback form the housing market? Cash sales volume down 21 percent in California year-over-year. Sales volume remains incredibly low as inventory builds up.

Big investors have been a critical component to the housing market going back to 2008. Over the last few years, we have seen the smalltime ragtag mom and pop investor creep back into the market trying to make money on flips. Of course as the deals run thin and appreciation slows down as it has, it becomes more difficult to turn a profit. It seems like big money investors have already received the memo and have started pulling away from the housing market. As expected, this has put a wet blanket on the mania from 2013 where bidding wars were common and begging sellers for mercy was typical. Inventory has picked up, bidding wars have started to wane, and sales volume remains incredibly low. This is a big point to focus on. Lending standards at the moment are fair and look at actual household incomes. This is good. However, given the housing lust nature of California buyers and sellers, why is sales volume so anemic? Take a trip to your local bank and they’ll throw money at you. Even ARM usage is picking up to stretch your budget. Of course sales volume is low because locals do not have the cash or income to support current home prices without the giant support of uncle cash buyer. Of course you have areas were foreign money flows in but this money is not blind and unlimited. If it were, don’t you think sales volume would be off the charts for the state? Inventory is there. What is happening is big investors overall are pulling back and this does have an impact on the housing market.

When investors start to leave

Investors are now making up a smaller portion of total sales and also are making up a smaller portion of total transactions. In California, this makes complete sense given current prices. Many big investors were buying for rental purposes and cap rates are simply not attractive. I’ve talked with a number of investors and they started seeing prices as getting frothy back in 2013. The actual sales figures confirms this is a bigger trend.

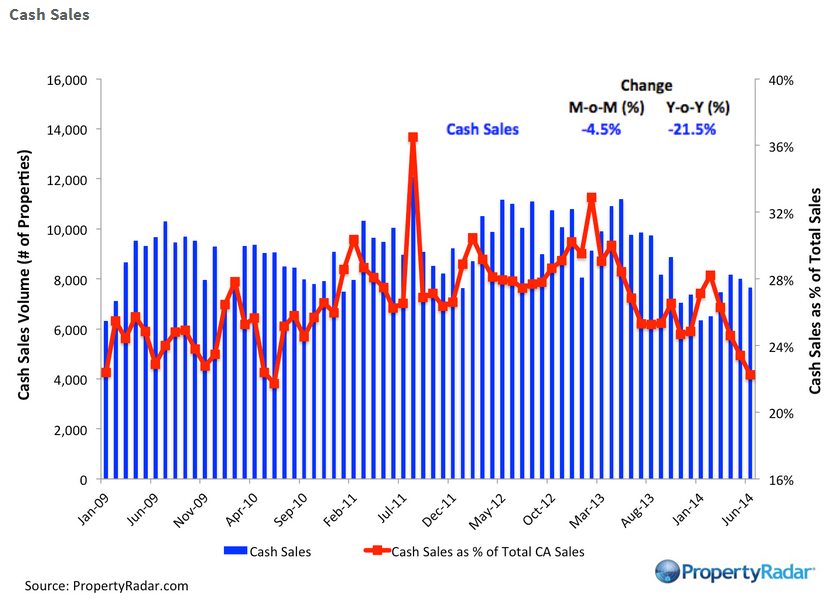

Take a look at overall cash sales volume in California:

Year-over-year cash sales are down 21 percent. This is a big deal considering in many months cash sales made up over 30 percent of all purchases. Take a look at the chart above. The trend is rather clear. If 2013 was the start of another hot run, why would the momentum not continue into 2014? For households looking to buy today, they have to examine a few things: household incomes, down payment savings, and mortgage rates. Unless you have the cash ready and willing for a $700,000 crap shack, you are likely going to need to make a trip to a local bank or mortgage broker. Last time I checked, all of my contacts in the mortgage industry require income verification.

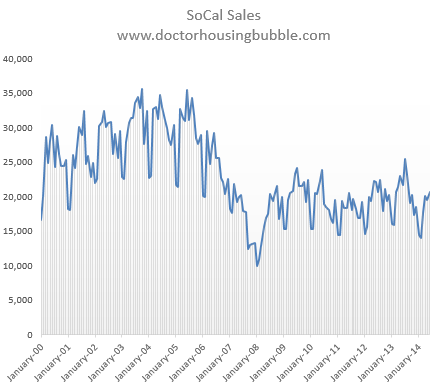

In spite of the boom in 2013, sales remain very low:

From 2000 to 2007 months where 30,000 or 35,000 homes sold in SoCal were very typical. Today, going over 20,000 is a big deal. Apparently once incomes were being checked, a massive pool of local home buyers were yanked out of buying. And it should be clear that it is not from want of buying. No, these households would once again go into full NINJA mode if they were given the chance. California is a lovely place to suffer from financial amnesia.

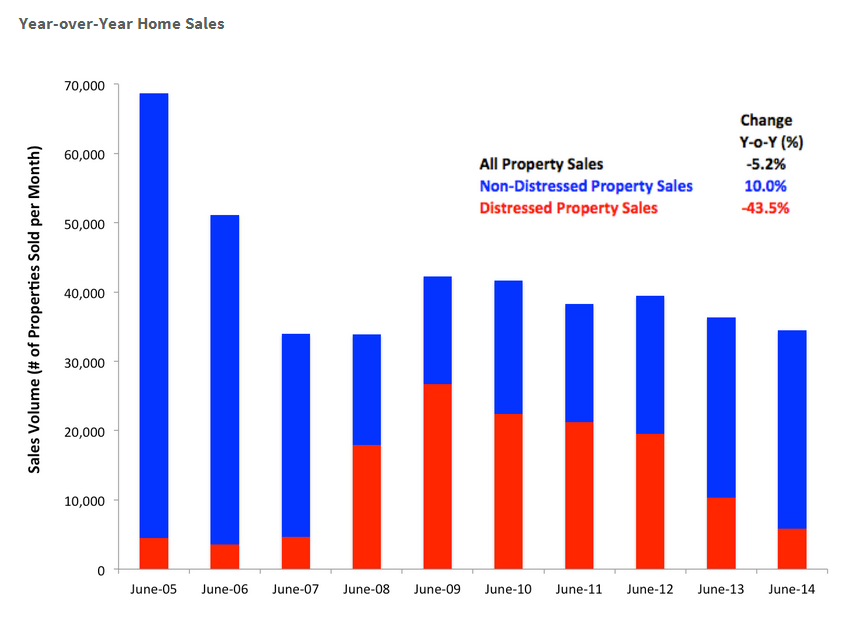

Take a look at sales volume in California overall:

In 2005, we had close to 70,000 sales transactions in June. 2006 we had 50,000 transactions in June. After the bust, we were lucky to have 40,000 sales transactions in any given June. You’ll notice that 2013 was actually a very weak sales year as we entered the summer. So what happened? Low inventory, banks leaking out inventory, and a big push by investors. Inventory is picking up, foreclosure re-sales are now a small part of the selling pool so this limits what banks are leaking out, and investors are slowly pulling back.

At current prices, buying a home is a big deal. It always is, but when you are shelling out $700,000 for a little stucco box with one toilet, you really have to think long-term here. Some try to boil it down in a way a five year old will understand with boring mantras “housing always goes up!†or “location, location, location†and assume this cookie cutter approach will apply to everyone. It obviously hasn’t since 1,000,000 Californians lost their home since 2005. The momentum from 2013 has hit a wall. Where does it go from here? Obviously many investors have decided values no longer are worth their troubles.

Today I’ll give you an example of a lower priced property where obviously, demand is not flying off the charts:

1040 W 3rd St, Santa Ana, CA 92703

2 beds, 1 bath, 1,076 square feet

I love the Instagram look to this photo. The ad is short and gets down to the point:

“Close to schools and downtown santa ana. Desirable area and close to parks.â€

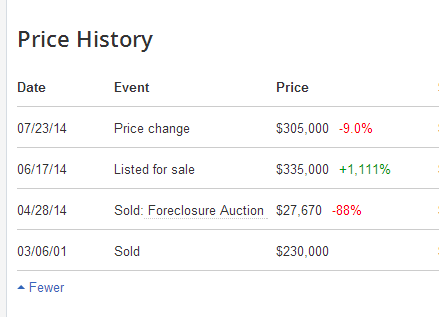

Someone listed this home back in June for $335,000. $335,000 in OC? Sign me up! Of course no one was biting:

The place is now listed at $305,000 after getting a $30,000 price reduction. The hot summer selling season is not hitting all areas and sales overall are down and inventory is building up. Investors are clearly pulling back their money so we’ll have to see how strongly this market can stand from regular old traditional buyers.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

123 Responses to “What happens when investors pullback form the housing market? Cash sales volume down 21 percent in California year-over-year. Sales volume remains incredibly low as inventory builds up.”

Housing To Tank Hard in 2014!!!

Housing to go up 30% in 2014…

Housing to go up 30% in 2014? Are you high?

No, housing will go up 30.99% in 2014 to be exact…just like showcase bidding on The Price is right. .99% more than your prediction 😉

“Are you high?”

Wrong question…

S&P/Case-Shiller housing price index shows unexpected fall in May.

Housing sales volume is plummeting.

Of course housing is going up 30% in 2014 — that’s what the real estate agents say!!!

http://news.yahoo.com/u-home-prices-down-may-consumer-confidence-strong-151932409–business.html

The real question is “are you serious”…

Answer – NO!!!

It’s 4.5 mounts since the Ides of March.

And 2014 is over 58% in the past.

Still waiting for the HARD tank…

42% is Still a ways off 🙂

If one digs trough all the macro data it clearly shows that the US entered a recession in April of 2015! And while digging take a look at “Homebuilders” stocks.

Yup go start digging.

No signs of tanking, here, in Seattle. The inventory is up, but the prices still keep rising in some places (The East Side). As hard is want prices to decline to a reasonable level, I don’t see the housing tanking until the bubble starts to pop and the institutions start the dumping cycle (stock, bonds) … We need a second quarter negative GDP to start making any difference…

Several months ago, I asked Jim Taylor about where housing would tank — i.e., the geographical scope for his prediction.

Jim replied that his prediction was for SoCal, Las Vegas, and Arizona. So he’s not yet made any official pronouncements for the Seattle ares.

However, at least one person has posted that Seattle is in a bubble, because house prices were higher than could be supported by income levels.

Oh yes, I think Jim may have included NoCal too in his prediction for a Hard Tank.

I was just in OR . The pacwest is seeing a huge influx of people fleeing CA.

My wife and I love Portland. We will be moving out of OC thank god. This drought is slated to last a while. People still partying like its 1999 when it comes to water here. The house we can buy in Beaverton etc. compared to here is crazy. The ONLY thing SoCal has is nice weather…..whoopie! It’s a desert!

I suspect median home prices are still rising due to a collapse in sales at the lower end and big demand at the high end. Recent new home sales data is slipping…so we are probably making the turn downward on pricing at all levels. Any tick upward in mortgage rates now would be catastrophic for sales. The Fed MUST keep buying Treasuries and MBS or we will hear another big bang in housing.

“The Fed MUST keep buying Treasuries and MBS or we will hear another big bang in housing.” How daft can you be?

You’re actually reading this site so you can’t be THAT ignorant of financial realities. The FED can;t buy any more MBS because none exist. NOBODY’S BUYING BECAUSE AFFORDABILITY IF FUBAR! There are no new mortgages to support billions of dollars a moth in stimulus unless you bring back NINJA loans, and even then I doubt there’s volume there. This shit isn’t that complicated housing is going to correct to income levels either way. The only question WAS if the FED was going to keep the party going a t the expense of an even more spectacular crash later. They wisely decided we have reached QEnough and are pulling back.

Bubble 2.0 was built on an even more unsustainable path than 1.0. Clearing the banks balance sheets and then letting the chips fall was/is the only option outside of imploding our entire financial system. FED did the same thing in the early 80’s. you think they give a shit about the value of your stucco shack??? They care about Chase, Citi, Wells and BofA’s bottom lines. And right now house values dropping is GOOD for the banks as it un-seizes the residential RE market and frees up more consumer $$$ for discretionary spending.

These grand proclamations about the FED protecting housing at all costs are beyond trite. If that was the case why in the hell did the first crash occur. Housing Bull stupid is all over this an other blogs JUST like it was before the last collapse. All the twit realtwhores are shitting themselves and rightly so. They add no value to the economy and the sooner we rid ourselves of this bloodsucker class the better. Brokers charging flat rates to make sure all transactions are proper in a fiduciary role to both parties is all the real estate market needs.

How low do you predict home prices to fall? Below late-2011, early 2012 debt crisis lows? Will rents crash first? Because all i hear is people complaining about rents going up and up and up in Los Angeles. Will a stock market crash go hand in hand with a housing crash? Will it break below March 2009 lows?

I still stand by my belief that 90%+ of people who bought in the past 5 years had great credit, good jobs and solid financial footing if they got approved for a conventional loan.

This is the biggest and one of the most instrumental differences between 2004-2007 run up. Buyers in that time period jumped ship cause they never could afford the home in the first place or saw rates falling to sub 4% and rentals for half their mortgage and bailed.

I highly doubt rentals will fall dramatically below 2011-2012 buyers mortgages. They now all uniformly have a HUGE buffer of 20-30% equity above their original downpayment. So the crash would have to be even more EPIC than 2007 before they even fell underwater at all.

FHA..of course is doomed.

Whoo-hooooo. Can only hope it’s all been about improving the balance sheets of the banks. Then we find out the real position and real intentions.

Older VI housing interests complacent about insane valued, lusty house buyers who will paid any stupid price, investors…. they’ve fallen for it. Allow the crash, and write mortgages in huge volume to younger buyers, and allow a house building boom on much lower land prices. Debt is the problem, but new debt on lower house prices is the solution.

@NihilistZerO, you are correct. When QE3 was first announced I did a quick calculation and came to the conclusion the Fed would pull the plug on QE3 by the end of 2014. QE3 was always about taking the MBS’ bundled with subprime borrowers and transferring those bonds to the Federal Reserve (i.e. the Fed acts as a bad bank for junk securities that no one wanted).

@zigzag, the Fed does not care about the interest rate on fixed rate mortgages. The Fed is concerned about the Federal Funds interest rate (i.e. the overnight rates). The Federal Funds rate is what controls the interest rate on credit cards, money market, certificates of deposit, adjustable rate mortgages, savings accounts, student loans, car loans and ZIRP. This is the interest rate the Fed has pledged to keep low for a very long time.

e b…

The Fed has been buying (semi) fresh RMBS. That is, the Fed wants seasoned paper — but is not interested in the troubled junk from the bubble.

You’ve got your wires crossed as to how the Fed thinks. It’s not ever interested in taking bad paper off of anyone’s hands — EVER.

Check out its charter.

By being such a lifter of all boats — on the money tide — the Fed has largely reversed the beat downs/ insolvencies of many bubblistas.

So bad paper is not being eaten by the Fed – – at least not in a direct sense.

Your basic analysis is totally off. The Fed re-rigged the entire balance point of the market. Instead of eating the bad paper — it has papered over the entire market.

Closed my BoA accounts and opened new ones in a “small local” one…

Early_2012_Buyer, the statistics says otherwise… During the collapse, 1Tr was in “good” mortgages (what you would consider credit worthy buyers) and “only” 800Bil in sub-prime…

To nitpick, the bulk of student loans are federal, and currently indexed to the 10 year treasury. ‘Private’ student loans are indexed to Prime/LIBOR rates, but they only make up roughly 6% of new loan originations in 2014.

RE: Blert

So the T in TARP stood for terrific??? Ignoring the fact that Treasuries themselves are Bernie Madoff worthy… And who gives a shit what the FED’s “charter” is. I’m merely observing their actions and those are always to protect the banking/asset class through bailout after bailout paid for by lovely inflation.

“The Fed has been buying (semi) fresh RMBS. That is, the Fed wants seasoned paper — but is not interested in the troubled junk from the bubble.â€

You give the Fed too much credit. These are the same folks who still can’t deconstruct the tranches of these instruments never mind pick out the non-troubled junk.

“You’ve got your wires crossed as to how the Fed thinks. It’s not ever interested in taking bad paper off of anyone’s hands — EVER.â€

Fed thinks? Really? I think that even you have to admit that in the end ALL paper is bad.

“Check out its charter.â€

So now I am supposed to believe what these fools state? (When Bernanke was asked directly during a congressional hearing if the Federal Reserve would monetize U.S. government debt) “The Federal Reserve will not monetize the debt.”

“By being such a lifter of all boats — on the money tide — the Fed has largely reversed the beat downs/ insolvencies of many bubblistas.â€

All boats have not been lifted. That is the fundamental problem.

“So bad paper is not being eaten by the Fed – – at least not in a direct sense.â€

Buying MBS from the major banks and depositing reserves back to the banks accounts at the reserve is pretty much how the Fed “eatsâ€â€¦

“Your basic analysis is totally off. The Fed re-rigged the entire balance point of the market. Instead of eating the bad paper — it has papered over the entire market.â€

That might have been the goal but I would argue that the temporary asset bubble will not hold over the long term without constantly increasing pumping. This is the nature of an exponential growth curve. We know that these do not go forever. We are currently back in recession even by the Fed’s funny numbers but we all know that they will not report it in the Q2 first print. They will later revise. We are running out of runway and without wage inflation we have no real chance to monetize (paper over) anything. This was a simple game of kick the can. It has been exciting to watch none the less…

Great news everyone!!! No recession!!! The magical nice even number of 4% has been drawn from the box. Boy do I love nice even numbers.

Well, we all expected this except for the pundits who are “reporting” it as a surprise…

We all know that there is quite a bit of “forecast” in this number and it will be revised as the “real” numbers come in. Any bets on which way?

Side note: The commerce department has once again revised the methodology and guess what? It “improves” the GDP number! Tail wagging the dog anyone? Life on earth is soooo much better now that shackles of math have been removed…..

Sales are destined to crater — better expressed as evaporate — as the flow of Red Chinese hot money looks to be in jeopardy — and 0-care has absolutely GUTTED the American buying cohort.

This latter factor can only be seen at the micro-economic level. One would have to pencil in the 0-care taxes on a case by case basis. There are no macro statistics to pull a trend from.

0-care taxation figures to run about 2%+ of the national GDP — yet this tax will only be paid by the SFH buying fraction of the population.

Hence, the heavy gutting is just around the corner.

New home sales fall sharply in June:

http://online.wsj.com/articles/new-home-sales-fall-in-june-1406210849

Pending home sales fall in June:

http://blogs.marketwatch.com/capitolreport/2014/07/28/u-s-housing-market-still-isnt-all-fine-and-dandy/

Paging Mr. Taylor…

Falling home sales do not necessarily translate into falling home prices. If a potential seller cannot get the price they want they can pull the home off of the market.

A recession, on the other hand, almost always forces prices lower. Job losses and economic contraction/declining wages means that the highly leveraged borrowers who stretched mightily to get that house can no longer cover the monthly nut.

OK

Do falling home prices translate into falling home prices then? 😉

http://www.deptofnumbers.com/asking-prices/us/

Excellent Ernst…I watch this very carefully when observing stats and trends. Off market has picked up ten fold, RE agents tried like the devil to get even further price reduction it hasn’t worked.

Yes some of these home sold by owner or pocket listing after removal or went to short sale but overwhelming went on hold till things get better or they don’t list again for a long period of time..

Which means falling inventory, which means, you folks hate to hear it rise in prices, and competition among buyers?

@r

The not falling prices means houses not selling and the inventory is building up, which means moar houses sitting on the market for longer period of time. This sets the panic to both the buyers and the sellers. “Pulling” from the market is a dead concept, buyers can more easily to “pull” from the markets. There is no “need” for a buyer to buy because the buyer can always rent in the worst case, but for the seller… if the seller need to sell (medical bill, job loss, moving out of state, downsizing, etc) there is no that many options, not every seller is willing to become a landlord… so, the prices will have to decline. And once they do, the panic sets in and, suddenly, no one is buying now…

This year is tracking 2007 so closely it’s spooky. Tighter FED, RE and stock markets not going up or down in any real sense, just levitating on miniscule volume. It’s almost as if they’ve planned it all… 😉

The rising prices the past few years has been incredible and unexpected. We bought with 10% down in early 2012 when rates were rock bottom and no one was touching real estate. People on this board were saying we wouldn’t hit 2006-2007 highs in our lifetimes.

If you lifetime was 2-4 years.. then you’d be correct. I’m not sure where things are heading from here… But I just got an appraisal and had my PMI removed after only putting 10% down in 2012. We actually had 35% equity based on our appraisal. So now I’m sitting on a home we can see living in for the longterm… with a 3.5% 30 year fixed rate… no PMI.. and a mortgage payment well below rental parity.

I’m ready to ride out any upcoming storm doom and gloomers are predicting.

2005-2006-2007 prices highs met? Hardly, that might be met in some cities not anywhere close in SoCal. I sold my house in Valencia, 2005, for $715K, an identical model just came on the market this week on my same street for $535K. And my faucets were not gold plated.

Prices are probably at or above 2006 peak prices in WEALTHY so cal neighborhoods. I wouldn’t call Valencia RICH… Upper Middle class.. yes. Culver City, Santa Monica, South Bay Beach Cities… these areas are pushing peak prices already.

that’s what I thought when I purchased in 2002 paid for mortgage taxes insurance maintenance and even anticipated up to a 35 reduction in equity I thought I would be okay too. 30 year fixed rate over 10% down lost it all and am still underwater good luck!

Make sure you sell at the top because your equity will evaporate on the way down…

Doctor, I have two words for you… “Rich” and “Chinese”…

Does anyone here remember the word of the week many moons ago “decoupling”??? I vote we bring back “decoupling”!!!

Glory be, the distress home sales are disappearing which means the banks have gotten rid of their REOs and bad mortgages. Now my friends at the Fed, can jerk the rug out from under you home buyers and jack up the rates and the banks will have great earnings. Boys and girls, banks make more money the higher the rates go up. Good times are ahead for the banks due to the interest rates going up. This is great. The only reason interest rates were kept down was to help the banks get rid of the REOs and bad mortgages. You must have been as dumb as a box of rocks if you thought that it was to help Main St. and the economy.

@Uncle Ben, not so true with REOs. Banks have 10 years to dispose of foreclosures. So banks can adjust what inventory leaks out to suit their needs. ZIRP is the enabler of this. Real inflation is about 4%. Official inflation is 2%. ZIRP is around 0.25%. So the Federal Reserve is paying the banks, via the inflation-ZIRP carry trade, to carefully leak REOs on to the market.

“Banks like higher interest rates” Well that was true back in the day, not now. From what I have been reading, looks like the derivatives for the largest banks (somewhere close to $200 Trillion) will blow up if interest rates go up since they are tied to interest rates. Derivative blow up will be way bigger than than the housing bubble burst.

PS Fractional Reserve banking is a ponzi scheme, Fed/banks creating money out of thin air. Watch HiddenSecretesofMoney episode 4 to get the low down.

No question slow down has been occurring for about 5 months now. Just about time for creative financing to appear. Mortgage loans are very tight as we all know, but does Wash DC ” KNOW This” why would they , Frank-Dodd was a disaster as was Alan Greenspan who again said “I didn’t really know how bad the fraud was?” This from the Fed chairman, need more be said.

Damnit, Robert, I’m going to make myself even more unpopular by agreeing with you.

It seems sometime last year that NAR started their drum-beat of, “weak sales are due to too restrictive lending practices.”

Yes, the FED doesn’t care about home prices. But your Congressperson and Senator cares a great deal about getting re-elected and there’s no better political chum in the waters than a down-turn in home prices on an incumbent’s watch.

What’s to keep these short-term thinking NAR campaign-suckling whores from unleashing NINJA loans part deuce to the house horny?

Of course it won’t be NINJI this time. No matter, tweak it, re-brand it and unleash it.

Who’s really going to care/notice/complain?

DFresh… If more people agree with me ( family-close friends) when I started my road to success years ago, they wouldn’t be complaining now that can’t afford much in their life. take care

Really? Now you are forecasting NINJA loans coming back into the game to save the housing market’s current slowdown? Newsflash for you: big money in Wall Street doesn’t give a darn about junk neighborhoods in California. Most of their money is in true financial wealth like bonds and stocks. Housing is an afterthought.

Also what proof is there that NINJA loans are coming back or that they will even have a bloody chance in hell to work? The Fed has become the housing market and there is little evidence that investors are diving back into more aggressive loan products. For someone asking for evidence from others, you seem to be pulling at straws here hinting that the market is somehow going to introduce these aggressive mortgages once again. How about you provide your evidence for this prediction.

So when and where are you planning on buying DFresh?

Jay,

I’m on the record that I’m happily in favorable rent-parity rental. I’ll continue until the monthly nut is more favorable to buy.

Yes! I’m really saying that loosening lending standards will goose sales. How bold of me.

Who’s talking about Wall Street? Do you think they originate loans? For some reason I doubt you have a clue about what Wall Street does.

And, yes, sorry, my prediction has no proof. Wow.

Who’s talking about “investors” and NINJA loans?

Reading the smoke-signals from the powerful NAR isn’t pulling at straws. They have made public statements (i.e., they’ve made clear how they are using their clout they’re lobbying our elected whores in D.C.).

You make reference to “the market.” Do you know of what you type? Simply put, a market is the intersection of supply and demand where people can make money. High rents indicate demand. Lending restrictions are currently tight. Affordability has hit a cieling. There is money to be made.

It’s easy to loosen lending standards, Jay. All it takes is a change agent (NAR) and the motivation of policy-makers.

Housing will tank when Ninja loans or the like come back into play. That’s the final act of the pump and dump, then we get to do this again…

The next major stock market crash will take from everyone across the board. This time 401k’s balances won’t be replaced with inflated QE money. The market will not rebound like before. People will lose confidence in the market but by that time it will be too late.

“Who’s talking about Wall Street? Do you think they originate loans? For some reason I doubt you have a clue about what Wall Street does.â€

Uh, you do realize someone has to securitize those mortgages right? For now, the entire mortgage market has to meet QRM specifications and yes, banks are checking for income. In other words, you will need an outside source beyond the Fed, Fannie, Freddie, and FHA. Hence the big move was with cash investors. Seems like you need to brush up on Wall Street finance 101.

“And, yes, sorry, my prediction has no proof. Wow.â€

Yet you ask others for evidence to support what they are saying. How convenient for you.

“Who’s talking about “investors†and NINJA loans?â€

Apparently you are when you said:

“It’s naive to think NINJA loan madness (tweaked, propagandied and rebranded) part deuce won’t be back soon to inject some juice into sales.â€

Sounding a bit house horny are we? So DFresh, when and where are you planning to buy? You sure seem to provide a ton of reasons why housing will only go up in price so you’d be a fool not to follow your own advice and buy.

“Who’s talking about Wall Street? Do you think they originate loans? For some reason I doubt you have a clue about what Wall Street does.â€

Uh, you do realize someone has to securitize those mortgages right? For now, the entire mortgage market has to meet QRM specifications and yes, banks are checking for income. In other words, you will need an outside source beyond the Fed, Fannie, Freddie, and FHA. Hence the big move was with cash investors. Seems like you need to brush up on Wall Street finance 101.

* * No Jay, somebody does NOT need to securitize mortgages for their to be a mortgage market. Please first understand what the purpose of securitization is as a financial instrument before you spout off any further. Your WS 101 must be the limited edition 2006 online correspondence course.*

“And, yes, sorry, my prediction has no proof. Wow.â€

Yet you ask others for evidence to support what they are saying. How convenient for you.

* * You paraphrase like a chimp.

“Who’s talking about “investors†and NINJA loans?â€

Apparently you are when you said:

“It’s naive to think NINJA loan madness (tweaked, propagandied and rebranded) part deuce won’t be back soon to inject some juice into sales.â€

* * Apparently not because I don’t see where I wrote “investor.” Guess you think NINJA loans were what the investor class was using back in the day. sigh.

Sounding a bit house horny are we? So DFresh, when and where are you planning to buy? You sure seem to provide a ton of reasons why housing will only go up in price so you’d be a fool not to follow your own advice and buy.

* * My only prediction that I can recall about home prices was made in January when I predicted a 6% median increase year over year. I’m looking pretty golden on that call right now.

* * My libido for buying a home is honestly just not there. I used to read this blog, getting a hard-on that the coming “Sub-Prime Tsumani” was going to wash into my hot lap a 3/2 in Culver City for $400k. Today, I’d take $500k. The price is $700k.

* * I had a chance to buy in the Del Aire part of Westchester (off Isis) in 1998 for $250k. Today those homes are $700k minimum. Instead, I bought in San Pedro and sold for $460k in 2005. Damn!

Sounds reasonable. The NAR begain last year the drumbeat of, “slowing sales is due to too restrictive lending standards.”

It’s naive to think NINJA loan madness (tweaked, propagandied and rebranded) part deuce won’t be back soon to inject some juice into sales.

Banks laid off huge amounts of staff in their mortgage departments. That doesn’t seem like something that would precede the return of loose lending.

“Banks laid off huge amounts of staff in their mortgage departments. That doesn’t seem like something that would precede the return of loose lending.”

You’re right. Those lay-offs were the result of prior events leading to decreased demand. These weren’t’ rocket scientists, though. A canvassing of El Camino College is a great place to get a new crop. NAR gets lending standards loosened and we’re right back to filling those empty cubicles.

Well I agree with you there, however it was rather recent, so I don’t imagine the return is just around the corner.

It looks like the China housing bubble is popping:

Sharp falls in China’s once-booming property market

“One property developer’s office in the city was smashed up by buyers.

They were angry they had paid more for their apartments a year ago than their new neighbours were now paying.

“A lot in China depends on confidence, and it’s a matter of trying to get the middle class to think the value of their investment will go up again,” says Jonathan Fenby, China director at Trusted Sources.”

http://www.bbc.com/news/business-28244140

All about confidence and keeping people thinking values will only go up. Where have we heard this before?

“Decoupling” anyone?

What exactly is currently “coupled”?

“What exactly is currently “coupledâ€?”

Really?

Really. You know me, What? constantly on the crack.

This is an article (apparently) about middle class buying apartments in Red China. I don’t see the coupling of that with the price of RE in SoCal.

Is there a coupling of:

* Red China housing market and SoCal housing market?

* Psychology (i.e., “confidence”) of Red Chinese in terms of buying/investing/putting down roots in SoCal?

* Red China middle class and SoCal housing?

Let’s take a step back into history and review how was my new favorite term used? I am using in the same way as it was used then. The article means nothing to me other than it reminded me of my new favorite word…

The question is which bubble will burst first: real estate or the stock market?

Stocks First this time. Then real estate.

Jim Taylor, Who are you? What are your credentials? What is your track record besides being wrong for the past 1-2 years? Why should anyone listen to you?

Bond market will pop first. Bond market twice or trice as big as the stock market is. After bonds, the stock market will fall, the real estate, sub-prime car credit bubble and student loan bubbles will follow, and the dollar bubble explosion will finish it. So … stacking up on gold, guns and ammunition 🙂

@Seattle – the student loan ‘bubble’ is probably not a bubble in the traditional sense. The bulk of both outstanding loans and new originations are financed and/or guaranteed by the U.S. treasury.

While there is a private student loan market, it’s a fairly small part of the whole.

Well, what about bonds? Bonds are in bubble territory by any historical measure, moreso than stocks, far more than houses.

I agree

Good point. That’s the problem right now. Neither stocks nor bonds look like a good bet.

Housing, Stocks, Bonds, Commodities are the real options. My guess is as good as yours but my guess is that housing will follow the crash and not lead this time. Just a guess…

This is a different stock market bubble.

This has been a Wall Street phenomenon. The average Joe has STAYED OUT.

Yes, 401k’s are involved, but that’s not really the issue.

Yes, of course, there will BE at least a 20% retrenchment in stock prices. Look at the damn historical on the S&P.

You guys are assuming (based on prior stock bubbles) that this will have a direct and significant impact on SoCal RE.

Please present your arguments why.

decoupling is your answer…

RE: DFresh

Stocks aren’t going to be the trigger for Housing Bust 2.0, interest rates and a complete collapse in demand are. Pretty much just like last time. 5-6% mortgages at a time when sellers (including the specuvestors) will be looking fo the exits. Then, just like last time, it becomes a self feeding downward spiral as the jobs that Bubble 2.0 supported go bye-bye. Hot money will move on to other assets. The foreign oligarchs will take the haircut as a cost of doing business (laundering money) and move their scrubbed cash into the next speculative investment. In the spirit of Jim Taylor I repeat, TPTB DON’T GIVE A FUCK ABOUT THE VALUE OF YOUR STUCCO SHACK 🙂

You are truly lost: the first breaks always occur in high risk subordinated debt — Junk Bonds.

THAT’S the market leader.

A real estate investor is a different breed than a stock market investor.

I’m speaking from experience.

Either real estate or Wall Street can break with remarkably little impact on the other.

Mania can slosh from one to the other, too.

But tight money/ swing in financial passions always hits high risk subordinated bonds first. They are held aloft by hard cash payouts — by a crowd that wants the interest — never the hope.

So salesmanship can’t talk its way around the ‘nut.’ It has to be paid.

The typical high risk debenture is created via some corporate maneuver that paid up large to consumate some speculative deal.

So it embodies every aspect of animal spirits, of mania.

&&&

You might note that Yellen is on record as being very concerned about high yield debt.

%%%

Just as worrisome, Putin is taking Europe into a low grade version of WWII. The MSM is lying to the larger public about events unfolding there.

So far the Russian-Ukrainian war looks like a parody… almost like Control vs Kaos.

(Get Smart)

“So far the Russian-Ukrainian war looks like a parody… almost like Control vs Kaos.

(Get Smart)”

Yes, I too miss rental parody…

All these bubbles will pop, no prediction on the order. But the most significant pop will be the dollar bubble popping. You will wake up one day to find out that Oil is selling in something other than Federal Reserve Notes, then you might have a couple of days to prepare before all goes to crap. $10-15 gallon a gas easy. Food prices going up like crazy. I can see people saying dollar is gonna stay reserve currency for the next 20 years or so. I don’t think so, much sooner, definitely by end of this decade but much sooner wouldn’t surprise me.

sabfu

A TRADING currency is not necessarily a RESERVE currency.

Arguably all modern currencies are trading currencies, only a handful operate as reserve currencies.

As a practical matter, only one currency is the universal reserve currency: the US dollar.

A currency is deemed a RESERVE currency because traders/ bankers want to close out their books NET LONG in that currency — almost universally.

The BRICS are totally incapable of supplying any shade of RESERVE currency. There is absolutely ZERO chance that any of these currencies will become acceptable as NET LONGS on the over night books of the worlds traders/ bankers.

1) No-one, absolutely no-one, trusts their courts systems to rule impartially over civil judgements — particularly commercial trading / contracts, enforcing liens, patents, copyrights, … and all the rest.

This lack of trust is particularly intense BETWEEN the BRICS. (!)

2) All such talk about excluding the US dollar in cross border deals between the BRICS are pure lies, suitable only for the proles. Every trader knows that every single currency is “crossed” against its dollar value.

3) This reached its extreme with the creation and expansion of the Euro Zone. EVERY single entrant — from the very first — was ‘crossed’ into the new fiat currency based upon how (and where) it was trading against US dollars.

More generally, there is no such thing as a “Euro” — what you’re looking at is a Rigid Exchange Rate Regime — under which every participating nation agreed to reissue their national (fiat) currency in a new form rejiggered to trade at 1:1 in the forex market. At time zero that value was also == the US dollar. (France and Germany, at boot up)

All of this can be studied by inspection of the historical record and the relevant treaties.

&&&

SDRs — Special Drawing Rights — can never replace the US dollar. They are creature of index, being composed of the various major trading currencies. It’s even been re-jiggered as time went by.

As a derivative currency metric, it also has no sovereign backing it up!

The ONLY currency that meets the standard to be a reserve currency is the Japanese Yen — except that no-one trusts the Japanese to adjudicate fairly.

The BRIC currencies can’t even get to first base.

While some say that ZeroHedge is an asset of Moscow; I say that it’s a satiric financial blog. One should never actually take most of its screeds too seriously.

The US dollar is truly being trashed by Barry… but so are every other major currency. All of the fiats are being roundly abused. Every single investment advisor is trying to find a port in this storm.

Excessive Big Government — and its manipulation of the economy — has largely destroyed the ability of private wealth to find truth, the discovery of which is at the heart of creative free enterprise.

Doc: However, given the housing lust nature of California buyers and sellers, why is sales volume so anemic? Take a trip to your local bank and they’ll throw money at you.

Doc: More to the point, good luck finding a large pool of young buyers with $80,000+ for a down payment. For first time buyers, incomes absolutely matter and the CAR even realizes this.

_____

Is that true about banks still welcoming to borrowers? I thought some stress-testing mortgage applications might have begun to have an effect. In the UK, since April, the banks have switched from helping house lusting idiots get as big a mortgage as possible to “pay what it’s worth”, to now 2-3 hour interviews when applying for a mortgage, and interrogation over all aspects of income/debt/consumption/personal spending , and needing squeaky clean credit history; with surveyors instructed to be cautious when valuing. How great is that; UK hpc is on the way if they continue this new regime of careful lending – mortgage lending is plummetting.

Have a laugh about this. There are two sides to the lending equation. It requires lenders willing to lend, and it also requires borrowers willing to borrow. Must be debt revulsion when it buys so little, on overvalued houses.

_____

Cavuto: Mortgage Rates Tumbling, So Why Aren’t You Buying?

By Neil Cavuto

Cavuto

Published July 25, 2014

…Even bankers who are lending tell me they aren’t seeing a lot of customers lining up. “Caution is the word,†said one. “They just seem very tentative, even skeptical.â€

http://www.foxbusiness.com/2014/07/25/cavuto-mortgage-rates-tumbling-so-why-arent-buying/

“given the housing lust nature of California buyers and sellers..”

May I challenge your premise?

There has been lust neither on the buy-side or sell-side.

As has been pointed out/documented, the majority of the buy-side demand has come from:

* foreigners looking for a place to park money/invest/provide shelter/join an Asian community. That’s not house horny.

* WallStreet. They only lust for profits.

* Flippers. Give these guys some credit. Most know what they are doing. It’s business, not “lust.”

* 1 percenters. They can lust all they want. Strong hands.

As to the sell-side:

* Stupid buyers were handed 20 bonus IQ bonus through the re-fi gift. They’re staying put. Not horny to sell.

* Do we really need to repeat Golden Sarcophagus? Cat-food-Eating Prop 13 Lottery Winners?

* Boomers have no savings and don’t trust the stock market. Viola! Rent out rooms or your entire house!

* Foreigners put large down large down-payments. Staying put.

* yadayadyadaydaydaydaydyad

*

*

It doesn’t look like housing is slowing down on the west side of L.A. I got at least 25 sale pending alerts today alone, from Redfin, for homes I had been tracking. And, 2 of them were candidates for Real Homes of Genius:

http://www.redfin.com/CA/Los-Angeles/11326-Bolas-St-90049/home/6827853 The 405 Freeway is less than 100 ft from this home. A bargain at $1.1M.

http://www.redfin.com/CA/Los-Angeles/10949-Ayres-Ave-90064/home/6753726 $819K for a 920 sq. ft. box. This actually isn’t a bad price for this location, if you can add on to the house and make it a bit bigger. Check out the fascinating price history. The previous buyer bought it for $625K and got foreclosed on for $1M. Looks like he cashed out $400k in equity and left the bank holding the bag. The current owner bought it for $531K three years ago and is about to turn a $250k profit after expenses. God bless America!

Possible evidence of buyers locking in low rates before the rise that everyone sees coming. Once 30 year rates pop over 5% there will be far fewer sales on those alerts.

Incorrect. There will be a burst of buying activity on alerts of interest rates headed higher (at least to around 5%). This will be somewhat short term (maybe six-12 months) as people are motivated by fear to jump off the fence.

After that, if rates escalate closer to 6%, then we’re having a different prediction party.

“It doesn’t look like housing is slowing down on the West side”

Anecdotes, like Kool Aid, are delicious.

I believe SM and Culver City are West side? When observing the lines on the chart moving in a downward pattern, keep in mind we are at the “peak” of selling season:

http://www.zillow.com/local-info/CA-Los-Angeles-Metro-home-value/r_394806/#metric=mt%3D30%26dt%3D1%26tp%3D5%26rt%3D6%26r%3D394806%252C26964%252C51617%26el%3D0

Prices are way too high and the inventory is terrible. I’d like to see a 15 to 20 percent reduction in asking prices before buying can appear appealing.

I know a bunch of sheeple. In case you don’t know, these are folks that can’t think for themselves and just follow the crowd. Example: “Housing always goes up”. They all lost their homes between 2008-11. I invited some of these folks to my mortgage- burning-party. They all had an excuse not to show-up. Is that coincidence or is it envy? Believe it or not, some people buy a house to just live in it.

I hope prices drop soon because in a few months it’s gonna be colder than a well-diggers’s a$$ here in Illinois

Question, if the majority of home sales are all cash buys, can someone explain how this can still be a bubble? Last time bubble was created by fancy financing. I do feel prices are extended relative to average incomes earned. I live in Stockton Ca, which was the epic center for home foreclosures and I just received my tax bill that said my homes value increased 20% in the last year. When I first bought a home in 1999, homes were lucky to increase 4-5% per year! slightly ahead of inflation ( depending on which formula you use to calculate that number). I am having a hard time believing my home increased 20% especially in a town that is bankrupt and about to lose its golf courses and a skating rink.

http://www.recordnet.com/apps/pbcs.dll/article?AID=/20140708/A_NEWS/140709874/-1/A_SPECIAL0267

How is that possible? Prop 13 restricts your home value assessment each year to a 2% increase. They can’t raise your tax base 20% in a year.. .it’s against the law.

I’m guessing reversing a Prop 8 reduction.

The assessor can go higher than 2% from the previous year if the assessment that year was based on Prop 8 (decline in market value) rather than Prop 13. This is what my county (Alameda, in SF Bay Area) explains about property assessment increase of more than 2%:

Why Assessed Value May Increase More Than 2%

By law, the Assessor must annually enroll either a property’s Prop 13 value (factored for inflation by no more than 2% annually), or its current market value on the lien date (January 1), whichever is less. When a property’s current market value falls below the Prop 13 value, that lower value is commonly referred to as a “decline in value” assessment, or simply the “Prop 8 value.” Prop 8 assessments, are TEMPORARY reductions for one year. Once a Prop 8 reduced value has been enrolled, that property’s value must be reviewed on every subsequent January 1.

As the real estate market begins to recover, the temporary Prop 8 value will be increased until it is restored back to its Prop 13 factored base year value. Increases to a Prop 8 assessment are not subject to the 2% increase limitation as are Prop 13 values. A Prop 8 value may be increased or decreased, depending on the market activity in your neighborhood. However at no point can the value be increased above your factored Prop 13 value.

The bubble has nothing to do whether the homes being purchased with cash or mortgages. The definition of bubble (sometimes referred to as a speculative bubble, a market bubble, a price bubble, a financial bubble, a speculative mania or a balloon) is “trade in high volumes at prices that are considerably at variance with intrinsic values”. It could also be described as a situation in which asset prices appear to be based on implausible or inconsistent views about the future.

In a couple years the “all cash” mantra will be what people will look back on and ask “Oh, they weren’t really all cash? Just more creative financing?”

I’m wondering how serious this drought in the Southwest will really turn out to be and if it really is as bad as some recent news articles are saying, what effect, if any, will it have on short term home prices. Are they exaggerating the problem or are they underestimating it? From some of the recent articles I’ve read, it looks like it’s more serious than they think. The way I see it, if the southwest doesn’t get rain for another year, things are going to get really ugly. The way American leadership works is “let’s wait until things break before we fix them.”

This could really be the issue that makes all this discussion of home prices in California moot. If there’s no access to fresh water, it really doesn’t matter what home prices are because you simply can’t live in a region that does not have fresh water. Will there be rain at the last moment? Will it be enough to replenish depleted aquifers? This is the issue that could be the nail in the coffin of the glorious west coast living. It will be interesting to watch.

Many commentators here have dispelled the water shortage myth as it relates to impact on quality of life/access to drinking water for SoCal inhabitants.

There’s plenty of water and plenty of water waste. Not an issue that some modifications of access/conservation/allotment wouldn’t solve in six months time.

A water shortage denier? Granted swapping out crops and better conservation would help. Ripping out all of the Bermuda grass lawns would help — but the fact is rain isn’t falling on LA or in the mountains and in the end the Colorado river and Lake Meade and the Owens Valley will dry up and die.

http://wattsupwiththat.com/2014/01/18/californias-drought-situation-in-pictures-what-a-difference-one-year-makes/

http://www.huffingtonpost.com/tag/california-water-shortage/

http://www.newrepublic.com/article/116898/californias-drought-these-statistics-show-just-how-scary-it

Would you be kind enough to provide links to support your assertion that this is all a myth. I’d be interested in reading the material. Thanks!

Lake Mead, http://www.usatoday.com/story/news/nation/2014/07/26/lake-mead-falling-in-sign-of-drought/13079009/

Colorado River, http://www.latimes.com/science/sciencenow/la-sci-sn-colorado-basin-groundwater-20140725-story.html

Owens Valley, “In February 2014, after three consecutive years of below-normal rainfall, California faced its most severe drought emergency in decades with fish populations in the Sacramento–San Joaquin River Delta in unprecedented crisis due to the decades of massive water exports from Northern California to south of the Delta via state and federal water projects.”, http://en.wikipedia.org/wiki/California_Water_Wars

I was up in Cambria over the weekend. They expect to be out of water by the end of the year — according to the hotel owner.

http://kcbx.org/post/navigating-cambrias-water-crisis-avoid-disaster

Sounds like a great reason to raise your nightly rate just a wee bit ahead of any increase in his water rates.

Wait until said Manager puts a meter put on your shower-head before we buy into the hype.

tolucatom is one of those arrogant white libtards who lives in affluent Toluca Lake who has a lush garden surrounding his comfortable home and has not had cut back water due to drastic mandatory water restrictions like those imposed on residents in the Sacramento area. While Sacramento has two large rivers that flow through it year round, Toluca Lake and Los Angeles is a dry desert where residents are totally dependent on having their water shipped in from hundreds of miles away from northern California via the state water project. Why aren’t arrogant white libtards like tolucatom forced to be under mandatory water restrictions and heavy fines for their over water use?

Don’t worry, instead of covering up the huge open trenches the water authority uses to transport the water hundreds of miles, and instead of demanding idiot central valley hicks cover the 3 ft deep 100 ft wide open pools they use to store the water, they will be punishing city-dwellers who shower too often with 500 dollar fines.

It’s incredibly disgusting, corrupt, and entirely expected of californian politics.

Evaporation loss on the county-scale is OK, but watering the two potted plants that make up the “lawn” of a typical bay area dwelling is worthy of budget-busting fines!

Dude, calm down.

The canals were built at a time when people didn’t think that we’d ever be in this serious a shortage.

As for why Bay Area residents should pay fines if they overwater – Bay Areans are wealthy and are using the water as a luxury. Farming depends on water and is not a luxury to the largest economic sector of the state.

Chestrockwel…First of all the word “housing bubble” is a trend word or phrases used today to get your attention, like theater of war sounds nice it really means war zone not so nice.

So gets this out of your mind to think clearly, so called hosing bubble and you are right was fancy creative mortgages laced with out and out fraud, the gov’t came to the party late as usual, but the Fed Reserve which answers to nobody (not really needed BTW) , Frank-Dodd, Country Wide etc.

Today none of that can happen, you are now in a cycle of ups and downs in RE driven by a no direction administration and teleprompter (transparent?) President who not only bought a 4 million dollar house last week, but today as I type is looking at another 4 million dollar house in Martha’s vineyard? (Recession anyone)

Housing will rise and fall on the principals of capitalism, higher interest rates, volume of sales just talk, the real numbers will be full time jobs, higher wages, reduce debt, higher bank interest rates for savers, till you see that we are in a funk not a bubble.

@r “till you see that we are in a funk not a bubble”

“till you see that we are in a bubble not a real economy”… here, I corrected it for you, you are welcome…

@robert. Links please. You won’t be able to provide any because there are none to support your claim that Obama bought a house. There are rumors but you don’t state that. It’s hard to believe anything anyone writes when they are caught spreading rumors as fact. Also, I’m tired of people acting like victims — “everything would be good if it weren’t for the president victimizing us.” For the record — it was the other previous president that got us into this mess. Oh he had direction for us — straight to hell — 4 trillion dollars burned in its fires for wars started on lies and oh yes, he was the one who said every American should own a home and set forth with his crony’s to do just that.

tolucatom needs to quit being a Democrat libtard and admit it was Democrats like former Congressman Barney Frank and his leftwing radicals that forced banks to lend to homeowners who otherwise would not qualify for loans:

http://www.boston.com/bostonglobe/editorial_opinion/oped/articles/2008/09/28/franks_fingerprints_are_all_over_the_financial_fiasco/

tolucatom needs to admit that neither Obama or Eric Holder sent one banker to jail and it was the big Wall Street Banks like Goldman Sachs that were the top contributors to his presidential campaigns:

https://www.opensecrets.org/pres08/contrib.php?cid=N00009638

tolucatom needs to admit that the Obama administration has increased the national debt more than all of the presidents combined:

http://allenbwest.com/2014/02/obama-us-debt-6-666-trillion-creep/

In my experience it’s always the right wing people who immediately go to slur level. Yes, Clinton and Frank had a part to play. Obama didn’t send one banker to jail and that is a shame. But then again he didn’t go after Cheney or Bush either. The bottom line for me is that both parties are beholden to large interests. But to blame Obama alone is not fair. Reagan, Bush, and Clinton all had a vision for America that lead to short term gain and long term pain. Yesterday a 90 year old water main broke in Westwood. In New England they are trying to keep 200 year old dams functional. None of the visions for America included infrastructure. A French contractor was asked why he spent so much money on paving materials when he could’ve gone with lower cost, lower quality materials. He replied, “Why, because French people will be driving on these roads.” I remember when the choice was Carter and Reagan. Carter laid out a tough medicine approach which included solar and wind power investments. Reagan offered feel good bromides and “trickle down” economics. We now know “trickle down” is not a long term solution. Obama has flaws. I’m tired of his community based approach to everything but he was given an unprecedented disaster. The economy collapsing, 2 wars, a public coming out from under anesthesia, and a faction of Americans who wanted to make sure Obama didn’t succeed for any number of reasons.

Eric Holder’s law firm represented (nearly) all of the mega banks at the center of the storm!

He’d have to pursue himself and his buddies if he even began to turn over any rocks.

These links are of public record, you can Google around to dig them up.

As for the mega-banks and Wall Street generally, it’s massively DEMOCRAT. I worked there. My firm was massively Democrat, from day one.

Warren Buffett, Bill Gates, on down the line — the billionaires are almost to a man Democrats. The notable exceptions, the Kochs, get all of propaganda attention.

Republicans stopped being the dominant political affiliation of Wall Street eighty-years ago — during the FDR administration. It was at that time that Wall Street came under the sway of the SEC — whose first head was Joe Kennedy — a life long Democrat and father of JFK. Robert and Teddy.

Big Business is overwhelmingly Democrat. The list is too long to post.

Bush alone was not responsible for the Iraq War. He, like all presidents, was but a front man. No one man can get the U.S. into a war these days.

The Iraq War was the result of decades-long U.S. foreign policy. All sort of interests — the oil industry, military-industrial complex, private contractors, Israel lobby, and others wanted the war.

Clinton supported many bombing missions over Iraq, and the economic sanctions that reportedly killed (some say) a million Iraqi children. Probably an exaggeration, but still, there were likely many.

In 2002, among the talking points for attacking Iraq, was that it was close to developing a nuke with which to threaten Israel. And that Saddam was paying $25,000 to each family of a Palestinian suicide bomber. AIPAC was very much pushing for war.

Then all the private contractors who made a bundle on the Iraq War. Paid tons of money by the U.S. government to rebuild Iraq, provide mercenaries, etc.

Then the theory that Saddam was about to switch the currency to purchase his oil from dollars to Euros, which the U.S. put a stop to upon invasion.

Bush alone can’t be blamed for the Iraq War. He was small potato. Nor is there any reason to imagine that a President Gore would have avoided war. The Clinton/Gore regime was very pro-war. During their war against Serbia, Madeline Albright famously said, “What’s the point of having this great military if you don’t use it?”

Many powerful interests, from mainstream liberals to mainstream conservatives, pushed for war. Of course, after it was a done deal, liberals, Democrats, the Israel lobby, even some conservatives, tried to rewrite their past, and the war became Bush’s alone.

AIPAC ran away from the issue: it was radioactive for Israelis to even be involved at the fringes on the issue. The football was being kicked around by the UNSC and the White House — who’d give 10 seconds to listen to a DC lobbyist?

Jerusalem can take care of itself.

The DC worry was that Saddam would hold sway over all of Arabia: KSA, Kuwait, the Emirates, Jordan and Yemen. — the latter two were already in his orbit.

You can start to see how insignificant Israel’s concerns were.

Both American parties were on record as wanting to depose Saddam.

Go to YouTube. There are no end of recaps — quote after quote — especially of liberal Democrats: Gore, Clinton and on over.

The ENTIRE matter was triggered by Saddam — Just as WWII was Hitler’s idea of clever policy…. and now the Russian invasion of Ukraine is Putin’s idea of clever policy.

None of the current hot spots are Barry’s idea of good politics. None the less, they have erupted because Barry wants to stay above and outside the fray.

ISIS is an extreme example: a HUGE fraction of its manpower was trained at British, American and Jordanian expense — for the express purpose of going after Assad.

(2012-2013)

Once across the Syrian border, they turned off to the Euphrates valley, went rogue, and joined up with ISIS.

THIS is the source of the over-night increase in ISIS military power.

The rest are mercs financed largely by Qatar — not Kuwait or KSA.

This current fiasco is a perfect example as to how much DC does NOT control events.

AIPAC stays on topic (Israel’s economic picture, primarily) — and shuns controversies that are no win propositions for Israel. You’ll note that Israel stayed entirely out of the 2012 presidential race…. even though Bibi can’t stand Barry. (and vice versa)

Barry never intended that his anti-Assad troops would go rogue. But they did. Fortunately for him, the MSM is totally burying this line of inquiry. It is the talk of Arabia, though. It’s a huge reason why Maliki is smoking mad at America.

But, then, Barry hates Maliki and Karzai, too. He’s on the outs with KSA, Kuwait, and Cairo. It’s a personal thing at this point. Even Ankara has stopped picking up the phone.

Bush had his own troubles: Paris and Ankara stiffed America in 2003. It turned out (Food for Oil) that even Canada was on Saddam’s ‘pad.’

tolucatom…Thanks for the feedback, look I give no pass to Pres. Bush- VP Cheney, Iraq was a disaster and now joins Vietnam as a American tragedy, for which many politicians in both parties should be before the World Court but like Alan Greenspan, Dodd-Frank, Goldman, Country Wide, GM ( gov’t bail-out when people are dying in their cars) etc. they skate and this congressman from Ill. Blokovich what ever his name was gets 15 years for using the F word to many times and scratch my back politics like they all do, go figure?

Pres. Obama just plain and simple didn’t deliver, as a x professional player, when the manager or coach starts with, “I never got the tools to produce a winner you are history”, excuses are not a reason to retain employment in this world, President Obama ran out of excuses 4 years ago?

Robert, you and many others here have taught me a lot of the past year. I have no bone to pick with any of you. Most of you are far more informed and talented than I am about finances. But I have been BS’d most of my life and in my old age I just want the truth and facts. I want accurate information. Guys like me just can’t afford to make decisions on bad data. I have a client who brags about being data drive, He’s hooked up to the data (ecommerce site) but what discovered is that he’s making business decisions based on bad data. Yes, he’s hooked up to data but it’s bad data. I don’t want to be that guy.

WHY RENTS KEEP GOING UP….Investors are buying instead of first time homebuyers. Investors rent those places out to what would be first time homebuyers and others who have no hope of buying ever. That is why rents are stable or going up.

First time home buyers are priced out of this market and are forced to rent, they are not renting out of choice. This adds more potential renters to the renter pool. Demand for rentals is high due to the fact that first time home buying is at a stand still.

As more first time home buyers gets priced out of the market it adds more rental demand. Rents are good for the investor for this reason. Rents will go down when first time home buyers get back into the home buying market…not likely soon with wages and student loan debt as they are today.

If housing tanks it does not mean rental rates tank, they adjust but rarely put an investment in jeparody. Rental rates adjust when there is mass conversion of renters to homeowners or large scale depression/job loss. Good jobs=good rents…the bar is so much lower for renting than buying so almost any stable job is a good job.

Investors drove prices up, priced out first time buyers, now they rent those units to would be first time buyers.

And we have a winner!

Fed gives free money to the same billionaires who crashed our economy through QE and ZIRP. With the public completely out of money AND debt capacity after 35 years of “trickle down” “free trade”, and with interest yields through the floor, they descend upon and manipulate the **** out of our housing market.

Enron is NOTHING compared to this price-fixing scheme.

Recent post in CR on seasonal pattern for home prices.

“There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced since the housing bust. Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a larger than normal seasonal pattern mostly because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter…”

In conclusion: “It appears the seasonal factor has started to decrease, and I expect that over the next several years – as the percent of distressed sales declines further and recent history is included in the factors – the seasonal factors will move back towards more normal levels…”

http://www.calculatedriskblog.com/2014/07/a-few-comments-on-seasonal-pattern-for.html

The segment of the market that I watch, which is the under 2M segment in premium South Bay and OC beach cities, continues to do well. Sales are lower, but prices continue to march higher, and in many cases, substantially.

jt… It is very crazy, last weekend saw a new house $1.6m nice place really worth about $995k, but okay I say to myself it will sit. Got a beep and the place sold, it was on the market 47 days, 3 resales ( 2 years old) with all the bells and whistles priced at 1.1m to 1.4m still sitting (5 months), same street same approx size, I’ll never get the mind of a buyer?

My God the silly comments have really increased.

Rents going up in the face of falling wages for 90% of the population. I know we all have forgotten the lost art of mathematics but really? Potential first time buyers/renters have no money that is why they are not buying/renting. Most of the ones that I know are couch surfing.

The fact that the masses are not participating in the markets is an argument that a crash in not likely? Ahhhh in business school we all remember the case study of the Dutch tulip bulb where the wealthy class were the only participants and it is the classic case used in school to study bubbles and their collapse.

Did the water in LA get tainted? Where are all these silly arguments coming from? I would understand if you are trying to be the shill incarnation of “What?” but it is getting pretty silly…

“My God the silly comments have really increased.”

This is the internet, what do you expect?

GDP advances 4%, look folks interest rates are going up and homes that are sitting at 4% for 6 months without a offer are wipe for picking if you can afford it, offer now.

Higher home prices and 5.5% mortgages are round the corner and believe it or not there are people who can afford these payments, make a offer to desperate sellers who want to get from under their 2005-2006 mistake, windows of opportunity are now, because of bad spring and summer so far sellers want to listen to you.

If you truly have 20% down, steady job, good credit, some cash laying around you can make a deal. Waiting means maybe rates won’t climb and prices will drop to 2008-2009 levels, you have to make the call of course, but if you need a house and can do it at least find a house you can handle and offer, all the seller can say is yes or no?

I am a buyer that looking for houses. I am curious where those foreclosure houses (REO) go? When would be a good time to buy then? about the craziness of all the buyers. I have to say what my agent said. A lot of time, buyers bought houses not from what is reasonable. It is because they feel it, they love it. they want to spend more than it worth to buy it. I know I am too calm to fall in love with a house that way more expensive than rent one. it feels like if I rent, the owner is buying the actual money to let me live there now. But, who don’t want a place that belongs to you only? so I am still actively looking. I really wonder if any profession could give an clear answer? Thank you!

*paying extra money… I meant..

watching …Believe me when I tell you no matter how rich it is human nature to look at prices and want to get a deal. Buyers are emotional about a car, a TV, a house, for example why, they mean power, a dream to own something, letting people know they made good decision’s in life, see I have the car, the house, the big screen, I have made it?

Problem many don’t make good decisions including their choice of spouse thus 51% divorce rate and the remaining 49%, 27% of those wish they could leave.

So your question, you don’t want to pay to much for a home but still want a home.

Always ask yourself when buying anything will it impact my happiness, can I still go out with family and friends or stay home because I bought to expensive car or house.

Your fiancés have to make sense, can’t tell you how many times a couple at the dealer said leasing a car at $399 a month for 48 or 60 months wasn’t a big deal, if you have to do without to make that payment it is a big deal lower your sights or don’t buy.

I tell people to buy a house now or make a offer only if you are in position, if the house you buy is in your comfort zone no matter where it is located, no matter how many bedrooms, baths etc., if you go to bed at night and say the first of the month I can always meet that payment fine, if you stretch to make that payment in this economy pass on it?

tolucatom ….You are a good American because you exercise your right to free speech by posting on this or any board. Talent is many times timing and luck in life, and yes share data, but all the graphs and data in the world can’t make up for a slick Politician, RE agen’t or salesperson, who can change your mind in a NY minute.

I’m a independent I don’t mind telling you, which means I can sit on the fence and not really let someone know what I really think, so not being part of a two party system affords me to have wiggle room, kind of a cheap way out you could say.

I just couldn’t commit to either side anymore, the money, the lobbyist, the half truth to be elected and the constitution being circumvented by both sides, well I’m as American as you can get but not a fan of the gov’t does that make sense, can you be American and challenge the system?

Thanks Robert. In my opinion being an American means challenging the system. Stress tests if you will. I’m with what you’ve written. The challenge is that there aren’t meaningful debates anymore between leaders of either parties. Just yelling, hard line intractable positions, and dehumanizing characterizations.

For example, I have been called a number of names on this forum already (joined yesterday). One person created a profile about me and posted it as if it was fact. I tell you that person couldn’t be more wrong. Yes, I live in Toluca Lake but I rent. I lost 40% on the last house I owned because I just had to own a home and was completely into self will run riot. I just lost about everything in a divorce. My wife of 16 years left me to find her bliss.

So the person who thinks he has me all figured out has made me a monster in his mind because see it’s easier to hate someone when you dehumanize them. That’s why the gangster youth I mentor refer to women as ho’s and friends as homies.

You never hear them use a persons real name. Why? Once they start using a persons real name it’s harder to be cruel. Best to refer to people as homeboy, homie, dog, and ho’ in case they die or you have to kill one of them, or pimp one of them out.

I never thought I’d see that ghetto gangster mentality become part of the fabric of supposedly intelligent American discourse. Hope that all makes sense. Thanks again.

Leave a Reply