Real Homes of Genius: Bars on the window. Check. Garbage cans in the yard. Check. Bubblicious prices in Culver City. Check.

The end of the year is here and Southern California home sales are slogging along into the final months. People have lost perspective on value but it would seem that two things have happened. People are being rational and viewing current prices as frothy so are deciding to hold back. You also have investors pulling back dramatically this year putting a dent into sales. So the argument now goes, if some willing sucker paid this amount then it surely is “worth†it. Yet most of the entry level priced homes leave much to be desired and of course, aspiring property ladder climbers only hope to stay in the first rung of the ladder for a few short years until the equity gravy train comes along. In other words, timing the market. Good old fashion speculation. Some view real estate as this super secure investment yet somehow 1,000,000 Californians lost their homes to foreclosure since the bust occurred. $10,000 in the stock market is risky but half a million for a tiny box? Safest bet on the planet thanks to all the juicy leverage! So what does the starter home look like if you are aiming at buying in Culver City?

The first step into real estate glory

It is interesting to talk to people on the fence about housing. There is a group that is unwilling to put their money at work and buy yet somehow feels there is this massive outside group that is rich but dumb. This will sustain the trend. If you truly believe this, then why not buy? This massive group will be there in one or two years when you can jump off the equity gravy train. Another group feels that homes in Beverly Hills will suddenly drop precipitously. I doubt that. Even if prices fell from say $5 million to $4 million on a home does this really impact your decision? I think most of the action is in the middle market.

Take a look at this Culver City home:

9435 Lucerne Ave, Culver City, CA 90232

2 beds, 1 bath, 874 square feet

I love the effort that went into the photo. Bars on the windows and garbage cans in the yard. You also have deferred gardening here. But of course, it is in Culver City so let the buying begin. Let us look at the ad and the pitch being used:

“Ideal Culver City Location! This wonderful home is located simply a stone away to the heart of downtown Culver City. Don’t miss this great opportunity.â€

A stone away from downtown? Maybe a couple of Waste Management trash bins away from downtown. Here is a different viewpoint on the place:

Street parking might be a pain and you also have massive electrical wiring near the property:

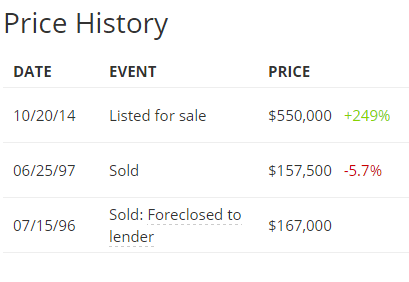

Then again, who cares since we are talking about Culver City. This place is listed at $550,000. Take a look at the price history:

20 percent down is $110,000 of cold hard cash. Your total PITI will be around $2,500 per month after plunking down $110,000. Good deal? If you believe it is, then why not go out and buy this place? Simple enough. You can easily look up this place and give a real estate agent a ring. The mentality right now is that some “other†buyer is going to step in and purchase this place so the gig continues. Yet when I talk with serious investors they are absolutely not looking to buy in these markets. Flippers seem to be more cautious with their purchases as the year comes to an end.

This place was built in 1946 and looks like it will need work. It last sold in 1997 for $157,500. The current sellers are in fantastic shape and have a lot of wiggle room in terms of price and coming out ahead. I have a hard time seeing someone paying $550,000 on this 874 square foot place and making it their granite countertop and stainless steel appliance filled sarcophagus. What I do see is someone pitching this place as a pit stop before moving into a much larger $700,000 crap shack. You have to love California real estate!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

84 Responses to “Real Homes of Genius: Bars on the window. Check. Garbage cans in the yard. Check. Bubblicious prices in Culver City. Check.”

the insanity continues…..what income is required to buy a POS like that?

The rule of thumb was mortgage = 2.5 x annual salary, so if you do the math after 20% down you should make $176K per year.

Wasn’t this the rule of thumb when interest rates were over 10%?

Obviously this rule needs to be rethought with 4% rates.

best part is the HUGE lot…….. 2,586 SF WOWZERS

recent solds in area show market value to be around …..drumroll please….. $700K+/-, so based on this list price this is a steal or approx. $150K below market.

Lucerne is a busier street so you have to deduct for that

Subject 4206-024-020 9435 LUCERNE AVE , 90232 0.00 672 / H1 157,500 06/25/1997 2 / 1.00 874 2,586 1946 View Deeds History of Trustees Deed ALL

1 4206-019-004 9016 POINSETTIA CT , 90232 0.32 672 / H1 $675,000 10/10/2014 2 / 1.00 853 1,561 1922 View Deeds

2 4207-020-010 4205 IRVING PL , 90232 0.14 672 / H1 $875,000 09/05/2014 2 / 1.00 780 3,198 1923 View Deeds

3 4206-010-014 9010 HUBBARD ST , 90232 0.21 672 / H1 $715,000 08/27/2014 2 / 1.00 780 2,427 1926 View Deeds

4 4205-008-013 3021 SENTNEY AVE , 90232 0.95 632 / J7 $734,000 06/02/2014 2 / 1.00 985 4,205 1957 View Deeds

Not necessarily. When interest rate are high, housing prices are low. The converse is also true. The idea is not to stretch your finances. I owned a home in 4S Ranch San Diego in 2004-2008 and used the same rule when I bought it. I’ll share a little antidote that supports said rule. My daughter’s school held a college financing event which was hosted by the friendly bank. There were about 100 -150 parents in attendance. The first question was, who has saved enough money to pay for your child’s education? I recall, my hand was one of a very few that went up. You would think I was from another planet from the stares of disbelief I got. Right then and there I came to a realization that I was surrounded by houses of cards.

Why bother attending the “college financing” event if you already had money saved for college? Were they handing out grants or something? Otherwise, you probably wasted hours of your life you’ll never get back!

yikes

This is what you can buy for less money than that, in a place which made it in the “best 10 towns” in Sunset magazine, a wine (over 120 wineries) and restaurant mecca, with dry weather and very mild winters:

http://www.wallawallarealestate.com/residential/404coyoteridge/404coyoteridge.html

Hmmm, not sure about Walla Walla, WA… Is 40-50 miles southeast (downwind) of one of the most contaminated places on earth (Hanford site) a sufficient distance to be out of the danger zone? Even if it is, I noticed there is a ton of agriculture throughout the region, even immediately adjacent to the Hanford site… As such, produce you buy might have been grown right next to the Hanford site. I might be a little more cautious (read: paranoid) than most, but I’m not sure the aggregate environmental risk is one I’d willingly take. There are environmental hazards practically everywhere, but the Hanford site is a pretty big one!

Besides all that, I gotta be honest: $529k is a lot to pay to live in BFE, even if the house is awesome.

Responder,

Pretty much everything you know about Hanford is politics. It is a form of extortion of government money in billions every year. These are clean money pouring in an area which is not polluted, where air quality is by far better than SoCal. There were no spills and no accidents. Most of the money, under the guise of cleanup, are for top nuclear physics secret research. The level of radiation is the same or lower than SoCal for water, air and food. No worry.

This brings to the area lots of PhDs and white collar top educated professionals with very high incomes. There is a whole constellation of top companies around Hanford getting enormous government contracts for decades now, and for more decades to come. Hanford is a blessing in disguise if you understand the politics behind it.

Unlike the millions coming to SoCal from third world countries who are a burden on taxes, the people working around Hanford are all top contributors. Information helps.

One more thing about environmental risk – what about the nuclear power plants in SoCal in case of a major earthquake? What about radiation coming from Fukushima? I am not paranoid, but I mention these as food for thought.

Most of energy produced in NW is hydro power – clean, cheap and renewable. The power rates are the cheapest in the nation.

In terms of house price, I mention what you can buy for less (I was looking at the price). If you want to compare apples with apples, a house like the one the Doc mention would be 70,000- to 80,000.

flyover, speaking of the NW, are not Seattle and Portland also in bubbles?

While houses may be comparatively cheap in, say, Salem, Eugene, Walla Walla, or Olympia, most Angelinos looking to move NW will want some place bigger — more choices in entertainment, culture, etc. — than is to be found in small towns. Something more like that found in Seattle and Portland.

People who love SoCal’s cultural diversity might be happy in Seattle or Portland, but not so much Walla Walla. Too small town, I think.

Flyover,

I agree with most of what you stated, with the following significant exceptions: Maybe there are many politics involved with Hanford, including funds diverted for secret projects, but there is no denying that the Hanford site is a significant source of current and historical pollution to both groundwater and the Columbia River. I’m guessing many of the nearby crops are watered using water from the Columbia River. If not, they are watered with groundwater, which is confirmed to have been contaminated from Hanford, particularly in the immediate vicinity. My somewhat educated guess is that the lateral and vertical extent of groundwater contamination has not been truly and fully characterized, and I would be extremely surprised if contaminant plumes didn’t extend offsite for miles.

The impact to So Cal ocean water from Fukishima is real, but is drastically lower by an exponential margin when compared to groundwater and river water impact from Hanford (as in it’s barely detectable, so far).

Btw, nuclear contamination is never a blessing in disguise as you put it. It’s a huge mess that’s pretty difficult, if not impossible, to clean up. Hanford and Fukishima are two such examples.

Like I said, I really have no concrete idea what the health implications would be from living relatively close and downwind from Hanford, if any. I’m just saying it’s probably not a risk I would feel comfortable taking. Everyone’s different, however, and this is simply my opinion (I’m just expressing this opinion just like everyone else here).

Son of L.,

I don’t deny that Seattle and Portland might be in bubbles, Portland probably more so than Seattle. Seattle can not expand. It is very constrained by 2 major lakes (north south), ocean, mountains with national land. On top of that there is the Growth Management Act constraining growth artificially (a lot). Maybe they can build more condos but no more houses. If you live north or south from Seattle the freeways are parking lots, driving is from hell and you never know if and when you get to the destination. I used to live there and I know what I am saying. What also is pushing and keeping prices high in Seattle are lots and lots of good companies paying top dollars. In terms of diverse economy it can not get any better than that. It is not just high tech like San Francisco. It is very, very diverse with extremely well paying jobs. I have lots and friends and acquaintances there.

I don’t see any price depreciation in Seattle (maybe a stagnation in the worse case scenario). The economy is too strong and diverse. I could see a price deflation in Portland.

For Walla Walla, there is a lot of cultural life/entertainment. It has 2 universities, one college, 140 wineries, lots of good restaurants – pretty diverse for a small town (60000). It is not Seattle or LA but it has slow pace of life, low stress, or what I call quality of life. Very close to lots of mountains, skii, hiking, camping, etc.

Responder,

I understand what they say and I know why they say it. You can not compare Hanford to Fukushima since there was no accident at Hanford. In E. WA, winds don’t blow from the west, because of the Cascades shadow. The normal winds come from Columbia Gorge from SW. If there would be any particulates those would blow about 60 miles north of Walla Walla. The incident of cancer is no higher around Hanford than it is in SoCal. A certain level of radiation happens anywhere due to Radon gas. What they grow NE from Hanford are not produce, but wheat as far as you can see. They export that everywhere and no one refuses it (not even once). Most likely all bread on the west coast is made with wheat grown around Hanford and NE from there – the Palouse Valey. SoCal eats bread made out of the same wheat. Again there was no catastrophic accident at Hanford.

I understand that you make a risk analysis. The ONLY sure thing is that each one of us die. The ONLY variable is when. For everything there is an upstick and downstick. I understand your opinion. My opinion (since I used to live in SoCal) is that I have a much higher chance of dying in SoCal due to a car accident because of the heavy traffic, drivers who don’t follow the rules, or drink, or text. If that doesn’t happen, there is much higher chance of getting cancer from the smog every driver breaths in SoCal on the freway everyday (that smog is full of cancerogenic chemicals) than for me to be affected by Hanford radiation. There are residential areas around it and nobody has any side effects. If someone lives in SoCal close to the ocean (Malibu, Santa Monica) they don’t drive just on Hwy 1; they drive everywhere in slalled trafic everyday.

Then, going on the same line of paranoia, what are the effects on the body health for people living in a very congested/crowded place like SoCal? What is the stress level of super high cost of living and the effects on body, health, family life, etc?

IF, and that is a big IF, the radiation from Hanford would get into Columbia River, that would have effects downstream, that means Portland (no effect on Walla Walla). The irrigation around Tricities is mainly done from Yakima River because it’s fully within state borders – due to politics (the FED is kept out). They also have Snake River with lots of water.

I was just playing along in regard to paranoia about health effects for diferent places.

Hanford isn’t much of a problem? Uh huh. A little light reading while you brush your teeth. http://union-bulletin.com/news/2014/may/10/letter-clean-hanfords-nuclear-waste-toxins/

Not so sure that a letter to editor qualifies as reliable news source.

We are going to be rich,

Before you read about Hanford, try to read what would happen in SoCal in case of a major earthquake or tsunamy in terms of impact on the nuclear power plant next to Oceanside (next to the water). What would be the effect on that large metro area of one city next to the other????….

Heard on the radio news today…

* Recent California housing sales have been strong, especially among younger “millennial” buyers, partially because of the strong stock market.

* Wages have been going up, especially for lower income jobs.

* Also heard Ric Edelman’s radio show this weekend that the economy is in a “strong recovery.”

* Only bad news I’ve heard is on Tim Conway’s radio show today. He says that all his middle class friends are “broke.” Not as in they can’t afford Disneyland, but as in they’re struggling to meet basic expenses.

Some serious disconnect going on here. Lots of cheerleaders reporting on how strong the economy and housing markets are, amid some doomsayers. They can’t all be right.

some say the sky is falling some say everything is amazing…….neither of them is right, it’s always somewhere in the middle….

At $160k, that place is reasonably priced. At $550k, that place is a total dump.

>> At $160k, that place is reasonably priced.

The place sold for $157.5K in 1997. Let’s look the CPI changes since then.

From The BLS 1997 = 160 and 2014 = 235.2. The ratio is 1.47. Therefore according to inflation this place is worth $231.5K.

It is on the market for 2.375x what inflation says it should cost.

This seems crazy to me. I live in San Diego. Near the beach. I last bought in 1996 and I still live in the same place. Real estate is seriously out of whack price wise, both in comparison to inflation and in comparison to rent.

$231k, assuming the place has been updated and needs little to no work. I’m thinking $160k with this place needing a gut rehab.

Delightful neighborhood!

I wonder if the neighbors own crowbars?

The Fed has boxed U.S. into a tough easy-money corner:

http://www.marketwatch.com/story/the-fed-has-boxed-us-into-a-tough-easy-money-corner-2014-11-24

This mania is not ending anytime soon.

The FED “mania” is quite likely to continue indefinitely. This particular RE mania is all but over. In the end SOMEBODY has to rent/buy/foreclose on these properties. Easy capital cannot levitate assets indefinitely. Price discovery is essential to any functional economy. The longer you hold it at bay, the more damage you do. The FED pulled the plug in 2007 and it looks like 2015 will be analogous. The market has already front fun FED action this year. The rate raise is inevitable and with it this cycle will move more swiftly into it’s downward phase.

Why do you think a rate rise is inevitable? Japan has been at ZIRP for 20 years.

A safe place to park your money. Real estate doesn’t look so great per the above. The Dow is chasing 20k. That’s the mark until it does. Then it’ll tank while big money inflates another stream. How in the world are everyday folks supposed to keep up with this? Gambling with your future well being seems like an unescapable trap.

Coursely you are correct when you say the big boys run prices up. This is why the Fed’s monetary policies that change interest rates have not helped the middle class and the working poor increase and maintain their stanard of living. Changing interest rates is the wrong tool to guide our economy. It would be more efficient to use the income tax first to help the Fed with it’s mAndates of stable prices and full employment.

To read how this can be accomplished read the article “income Tax Can Help The Fed With It’s Mandates”. http://www.taxpolicyusa.wordpress.com

Hard to believe we are back for round 2 of the housing bubble less than a decade later. People never learn in SoCal.

No real shocker here.

Peak-to-trough for real estate bubbles is usually 5 to 7 years. The Federal Reserve and their banking cartel did not allow a normal market correction to happen. This is really a continuation of the housing bubble of 2003-2007.

Enjoy the ride…

insane! Worse, most people are only concerned with the ridiculous prices of homes in So. Cal. Perhaps more important is what kind of economic growth is happening there and what kinds of jobs? A big reason why L.A. is so unaffordable is because of median wages …. dig deeper! if the economy is growing based on service and lower wage jobs, that will become a huge impediment in home prices. The hi-tech start ups at Silicon Beach are just a grain of beach sand … look at the exodus of Toyota, Aerospace, the Movie industry … good paying jobs. The underlying economy and the kinds of jobs they create are the real pulse of where housing will head!

You must not have gotten the memo from other posters on this forum.

Note to @JN:

1.) The employment rate doesn’t matter in SoCal

2.) Local incomes don’t matter in SoCal

3.) This time is different

4.) Prices will go up 20% a year, every year forever!!!!!!!

5.) Soon the average crack shack in Compton/Lynwood/Paramount will be $5 Million dollars! Incomes will still be $25K a year in those areas but they will all be multimillionaires!

6.) This time is different

7.) Silicon Beach (even though it employs a few thousand high tech workers) will save SoCal and cause prices of everything to go to the moon!!!!

8.) If you don’t buy now you will be priced out of the market forever! Ignore the fact that local incomes have plunged from $62K in 2007 down to $53K in 2013 in the Los Angeles-Long Beach-Glendale region. Ignore that Culver City household income has plunged from $75K in 2007 down to $68K in 2013.

9.) SoCal is a global city.

10.) There is an infinite number of Red Chinese nationals willing to pay $20 Million dollars for crap shacks in the San Gabriel Valley, Irvine and DTLA.

11.) This time is different.

You forgot “This time is different”…

The usual SoCal housing better’s meme goes something like ‘this time and place is different while existing in a vacuum.’ All of the benefits of global connectedness with none of the risk!

“deferred gardening” LOL ðŸ‘

Housing To Tank Hard in 2014!!

Not today or the rest of 2014

The Immigration show needs to play out first. As the GOP publicly play into the blocking of this go nowhere issue, this Administration will dump the economy on them now that they control both Houses. It will probably coincide with the first anticipated rate hikes mid 2015.

…Pitiful.

nein nein nein!

Jim, you are a year early.

Weed crop. Check. Tacked on alum awning. Check. Industrial-grade HC ramp. Check. Suicide-inducing color scheme. Check. Postage stamp lot. Check. Cheek-by-jowl barrio setting. Check. Third-world curb appeal. Check.

Don’t lose out. Submit your highest and best bid today!

Housing market reminds me of someone name Joseph Goebbels once said and it’s even more so in SoCal Real estate market…

“If you repeat a lie often enough, people will believe it, and you will even come to believe it yourself.”

Example on how one may speculate on such a house. I’m not saying do this, but I could understand the thinking….

Rent? I have no idea, say $2500 after a bit of lipstick, again I have no idea about rents in the area.

Sale price 500k, 100k down w/ a IO at 3% = 1000/month. Prop taxes, 500/month

so that leaves 1000 left over on that 2500/month rent. say 500 goes to expenses and occupancy, (of course could be worse) but let’s just say.

that’s 500*12 / 100,000 = 6% / year.

and you hope that in 10 years the place at least is worth what it is now. if it goes up a few percent a year, that’s gravy.

if rents go up, that’s gravy too.

low interest rates just make thinking about these seemingly uneconomic ideas, economic.

Thoughts?

This is a 2 bedroom 1 bath and 874 square feet. I’m seeing a number of 2 & 3 bedroom 1 bath homes not renting. If you’re paying $2500, you want more than 1 bath. If you’re shacking up with a roommate (or two), you need more than 874 square feet and 1 bath.

Thoughts?

My thought is that place would be 25k in flyover and the taxes would be 500 a year. God forbid you might have to run the heat for a few months or not be close to the beach that you never go to. Does anyone even care about having a life anymore? It’s an epic mania. If you were to part that place out, what do you think you could fetch for the materials? I know…it’s the land, right? That’s a sweet location. 🙂

ya IP, a massive 2500 sq ft of prime real estate there for sure! It does look like a crap shack to me. Funny I rented a place a few years back in Manhattan Beach about 200 yards from the beach and probably went to the beach three times that year.

I think you’re right you need the second bath to get the rent unless it’s a couple who can’t afford to buy but want/need a house. I do think there are 500k places in Socal where my logic kind of works, but prob not the best example. I’m totally unfamiliar w/ the specifics of the Culver City market.

One of the most important factors in choosing a house is who are your NEIGHBORS.

You want neighbors who are as wealthy as possible. Wealthy neighbors mean people who maintain their property and hire private security patrols. Which in turn increases your own property values.

Wealthy neighbors are also less likely to create noise, over-crowding, and crime.

That’s one reason so many people want to live on the westside, close to the beach. The people tend to be wealthier than people who live in the flatlands east of the 405.

There are exceptions. San Marino is wealthier than Del Rey or Inglewood. But it’s more about following the money near the beach (and the beach’s cleaner air and milder temps) than about sitting on the sand.

I can see the beach from my balcony, but it’s been 20 years since I actually walked on its sand.

According to Hussman’s latest investor newsletter, the US stock market is now fairly valued (can be expected to deliver returns above riskless treasuries), assuming that ZIRP (zero interest rate policy) continues for another 30 years. If we are going to normalize soon, then according to his models, we are something like 115% overvalued.

So let’s say we really are stuck at 0% until we get a currency crisis a few centuries from now. Then the 21st century becomes the century of the low yield where all assets ultimately get repriced in a way that has never happened before in history. In that case, all the bears who proclaim that “this time is never different” are defeated, and the true contrarian standpoint is that “this time is finally different”.

Real estate globally has benefitted from the tailwinds of population growth, urbanization, and the commodity boom. They have conspired to make housing a profitable investment, even if it will ultimately turn out to be little better than automobiles, furniture, or electronics.

In the absence of a strong preference to live in certain places, the sheer amount of land available in the world is bound to make all houses worthless in the long run. When robots begin mining resources autonomously and build homes for a small fraction of what it used to cost, the only upward pricing pressure left with be scarce land.

While people are still flocking to urban centers for jobs, most jobs are already little more than a way to extract a tax from someone else. In insurance, for example, we induce fear in people’s minds about events that are unlikely to happen and make them fork over money to “protect” themselves.

At some point we will have built so much that renting your house will make about as much sense as renting out your car or laptop computer. At the latest, this will coincide with a dramatic or persistent decline in population. Until then, housing will be like many other businesses: doomed to become obsolete in the very long run, but profitable for an unknown period of time.

In your example of investing $100k, the 6% a year is a recovery of $6000 of the $100k that was handed to the bank, so you start making money after about 16 years. The IRS way of figuring depreciation is surprisingly sensible, when the unspoken assumption by most homebuyers is that their home will be worth more after waiting for 30 years.

The housing market is starting to collapse: here’s some fact vs. fiction:

http://investmentresearchdynamics.com/the-housing-market-fact-vs-fiction/

That home is worth maybe 100k at best in CA. and 30k to 40k in most other locations. I always think about having family and friends over to view your theb new digs and the new owners tell them they paid over 500k, the look on their faces is priceless I bet?

Don’t worry. Someone will pay $500K for that pile of crap. Similar piles of crap in Culver City/Palms/Mar Vista selling for $350K in 1989-1990 before the recession hit and those things plunged all the way down to $150K in 1997.

In the Bay Area that’s a $1.2 house.

Oops, I meant $1.2 million

This is where I came in…

Missed you What? 🙂

I’m thinking of “going short” RE in a personal way. I’ve been sitting on a pile of cash with zero debt for a few years. I drive a bucket and while no debt is great. It’s tough to work hard and not indulge in a little vanity. I’m looking at a truck -12,000 MSRP (year end sale). Being that I intend to pay it off in 3 years or so I feel like giving the Housing Market a big FU and continue sharing my rental at a very low cost. As much as I’ve wanted to put down roots for years, at this point I think I’m willing to enjoy my rental and my life. As Dr Housing Bubble has done “Forgetting the Housing Bubble” may be my new strategy 🙂

by “pile of cash” how much cash we talkin about?

It is your patriotic duty to spend your “pile of cash” on ho’s and blow! You will be doing your part in GDP expansion…

BTW – I think all bears are pissing in the wind at this point and I for one want to welcome our new overlords…

You know What?, I know as well as you do that this bubble is unsustainable but I have a feeling this is going to drag out. The party is most definitely over, but I feel we’re headed for some early 90’s style stagnation. The parallels are there QE coming to an end is similar to the end of deficit defense spending. You’ve got a GOP Congress and a Dem in the White House (likely to remain so in 2016 with Hillary) which is the only time the GOP is fiscally conservative. Civil unrest to LA Riots levels. Form the end of defense spending “stimulus” in 91 it took almost 5 years for a market bottom in CA. I still say Jim Taylor is right and the tank started this year, but I expect market bottom is far enough out where

I’m leaning towards staying in my rental and treating myself to the new vehicle. I’ve got an Asian landlord who was forced to move out of state who bought in 2006 for $600k with $300k of his own money he takes a $200k loss as soon as he sells as the place needs work. He’s basically trapped. The Chinese national’s loss is my gain. It’s time stop waiting on SoCal RE and let it wait on me. 2018 FTW 😉

NZO,

I think your strategy and timetable are spot on. I’m following that as well but without the new car, and piling up the savings.

For those who keep saying on this site week after week that this year, next year, the following year and on and on that the interest will increase, I kept saying and I say again that interest increase will not happen for many reasons. So far they didn’t and they trend lower even after the QE tapering is done. Bellow, a well known economist is explaining more elegant than I can do it, why interest is not going to go up in the foreseeable future:

http://www.financialsense.com/contributors/gary-shilling/interest-rates-deleveraging-corporate-profits

we are following Japan’s path to a T….interest rates will keep trending down for the next 30 years til they hit zero %

The last two crashes in 2000 and 2008 (as well as others that came before it) were caused by the Fed raising the interest rate in an effort to slow down the economy. The economy used to be hard to control. Every time they push on the gas pedal they end up going too fast and are forced to hit on the brake pedal (raising interest rates), which caused a crash, forcing the Fed to slam on the gas pedal again. This time around, we had three rounds of QE because all of a sudden the gas pedal no longer works the way it used to. Let go of the gas pedal for a while, and things slow down, so you press down again. The economy is much easier to control now. Money Supply growth remains over 7% year over year. Is Yellen going to be smart enough to keep it growing at a steady annual rate to prevent the next bust?

Wrong.

The 2000 crash was caused by dotcoms with no income.

The 2008 crash was caused by derivatives full of home buyers with no income.

“There is a group that is unwilling to put their money at work and buy yet somehow feels there is this massive outside group that is rich but dumb. ”

Doctor, I enjoy this expression. It is kind of a contradiction. With few exceptions when people inherit money, the people with money are not dumb. If they would be dumb, they would not make money in the first place. Usually, those with money understand the financial system, read a lot and they have the brains to process the information.

For that reason, some sellers could wait in vain that a wealthy, educated buyer will come to buy a property like the one you show above just because the weather is so “awesome” and every person wants to live in a “diversity” neighborhood.

Tijuana has the same “awesome ” weather like SoCal, and Ferguson, MO has plenty of diversity and the rich don’t step on each other’s toes to buy in those places.

There is something more than weather and diversity to convince the rich to buy. Usually the rich are not suckers.

SoCal used to have a world class economy which is being eroded now for decades by the liberal politicians CA has. You can not continue importing tens of millions of uneducated people from third world countries and expect the economy to stay world class and compete with Japan, Germany and even China.

The pictures the Doc posted above are going to be the new normal for SoCal. It is just a matter of time. Detroit did not fell in one year. It was a gradual process which took decades. People ignore the reality for their own loss.

As a long time RE investor and business owner the number one road to independence is timing, watch trends and history of the prospective investment . #2 You got to know when to go all in or fold and wait for another opportunity. Any person who has made money has lost some along the way ( so called smart people), in the end it has to make sense to try to leverage a great investment in tricky times, or sell for no gain or loss when little hope exist.

Buy a 1m dollar home and hope to sell it for a 200k gain long term gamble (CA RE investment), or leverage 1m dollars, buy 5 200k homes out of state at quicker turnaround on your investment, most likely bank the same 200k, investors make that call everyday.

Also…Dumb is a interesting word “btw”, can a dumb person become rich you bet your bottom dollar they can it is called luck (walking right into it) and not realize you made money. Remember that money makes money, it can buy you out of dumb decisions and make you look smart, it can mask a really dumb move or investment.

That is why the proverb “never judge a book by it’s cover” is so profound, the person who drives that Bentley maybe is smart and knows what they are doing or maybe they were dumb , got real lucky, and will never make another dime in their life and lose it all?

Lol, I knew a guy with a Bently. Turns out he stole the money for it and had to give it back during the clawback. I always thought it was odd that his office was so uncluttered from anything resembling actual work.

flyover…You post some interesting views good for you. But the analogy of Detroit and So Cal. being mention in the same breath, I just want you to think.

You live in Detroit and you win the lotto, do you dream of a conv. year round, fun and sun, or stay because you are told So Cal. is such a bad place for folks with money?

Robert,

You took 2 words out of context. Please read again.

My point was that SoCal no longer has the world class economy it used to have and they continue hemorrhaging good paying jobs. You can not have a linear type of thinking in face of obvious continuing changes. In that respect you can not deny that Detroit also had lost good jobs for decades. So, there is a parallel. I did not say that prices in SoCal will become as low as Detroit. I was just saying that they will trend lower, if not in absolute value at least in terms of purchasing power due to massive inflation.

I don’t see massive inflation or higher interest for reasons I already stated.

In terms of climate, it helps but it is not everything. Otherwise Tijuana would have high prices and rich people would not live up north. Actually, the evidence shows that there is a higher percentage of rich people living up north.

flyover….Fair enough, have a safe holiday!

The price is clearly insane anyway, but it’s zoned R2. They’re looking for someone with deep pockets to come and build a duplex on this expansive and beautiful 2500 sf lot.

Hi Doc, looks like a Real Homes of Genius.

Keep in mind, Culver City is a spill-over neighborhood for all the folks who have some money but can no longer afford Malibu, Northern Santa Monica, the rest of Santa Monica, Venice Beach, Venice, West LA, Mar Vista, Palms, etc.

For you you in flyover-ville, here is a brief tutorial on the Westside which will help explain our high home prices…

hilarious (Filmed in Venice and Santa Monica)

https://www.youtube.com/watch?v=2UFc1pr2yUU

I wouldn’t say that Mar Vista, much less Palms, are any better than Culver City.

I think it’s so funny that people look at someone who would buy this crap shack as dumb but they themselves are renters in this over inflated rental market…there is dumb and there is dumber…all you need to figure out which one you are. Here’s a clue…neither one of you is “smart”!

Interesting comment there. We currently rent. We also own a place, but rent out that place because we needed a bigger/nicer place to live and house prices are ridiculous currently. We can easily afford to pay off our current mortgage (purchased in 2009) in cash, and then some. We have 20%+ down payment money for our next place. I’m not bragging, especially because I know there are many people with much more money than us. However, I’m illustrating to you that not all renters are insolvent losers who can’t afford to buy anything.

You might be careful about calling others dumb, given that you are apparently incapable of incorporating logic into your pseudo deductive reasoning. If someone does not currently own a house, and their only choice is to buy one at an inflated price or rent, how is either choice “dumb” as you infer? That’s pretty nonsensical. Most people have to choose one or the other. Other options, such as living with relatives or homelessness are often not viable.

Sometimes you have to choose the lesser of two evils. It’s a no-brainer when renting is much more cost effective than carrying a mortgage. Either that or you were not fortunate enough to have been born to wealthy parents or when prices weren’t unreasonable.

The lower end McMansions are sitting on the market right now. Seems like things are slow these days in SoCal.

Responder…Overall in my experiences renting is a means to wait, save, and buy your home if it makes financial sense for you or your family.

That said, when I owned business and we had to credit check all the time, the homeowner or renter, many times the renter was sitting on a portfolio that allowed them to buy a home, whatever the reason they chose not to.

Renters have the perception of like a unmarried person something is missing in their life, actually to many of these people I have crossed paths with nothing is missing, they just chose what makes them fell secure or just want to be alone with no strings attached.

So how many of you commenters are trying to sell a home or multi-family unit in Los Angeles?

I bet it is very few commenters on this site and not me. I’m just a wet-behind-the-ears homeowner.

My future plans, if I ever do sell my home is to use the money towards buying a duplex or triplex, live in one unit and collect rent on the other(s).

QE Abyss…My wife said no internet for the holiday but she is out had to let you know your post of:

My future plans,” if I ever do sell my home is to use the money towards buying a duplex or triplex, live in one unit and collect rent on the other(s).”

Very, very, smart choice, I wish you the opportunity to accomplish this strategy it is a win win for you, go for the triplex if you can swing it, Good luck

Yes, I’m sure being a on-site landlord will be a dream come true.

In flyover land you can pick up that exact same house all day long for $40k. Spend $50k will get you a 3rd bedroom. These homes are in the lower income suburbs though . Those are the type of small starter homes built right after WW2 in the 1950s. Nobody builds a 2 Bedroom starter home anymore.

You can get a 3 bedroom starter home in a new upscale suburb that has good schools for around $180k to $200k though.

I am guessing you are really paying for the lot and not the home in Culver? A home like that can probably be built for $100k for materials and labor?

.

Leave a Reply