When the euphoria in flipping slows down: Culver City small home with large price tag. Sales volume continues to slow.

People have a hard time understanding that low interest rates in today’s market are largely a reflection of a negative outlook on the economy. Central banks around the world are more concerned about financial assets and the secondary impact on real estate is just that, secondary. The market took a beating last week and you get people saying “hey, at least rates will be low for that $700,000 crap shack!â€Â This is the kind of isolated California logic that puts people into a bubble regarding macro trends. It is also the same kind of reasoning that caught so many people off guard during the last crisis. We recently noted that the L.A./O.C. rental market is the most overvalued in the nation. Why? Because local incomes don’t justify current prices hence the 2013 mania brought on by outside money forces (i.e., domestic investors, foreign money, etc). That money pulled back this year. Now you have locals blowing through wads of cash and all it means is people consume a large portion of their pay to live the SoCal lifestyle. A fake it until you make it approach supported by debt. We see this trend permeate into small homes in select zip codes as people go haywire just to get in even if the home is not exactly a “player†home. Today we take a trip to Culver City.

Culver City small home with big price tag

The rampant mania of 2013 has definitely hit a brick wall. It should be apparent that this momentum was driven by outside forces. Those forces have scaled back their buying. We are seeing more properties asking for pipedream prices yet sitting on the market for longer periods:

3 bedrooms, 1 bath 982 square feet

10757 Kelmore St, Culver City, CA 90230

3 bedrooms and 982 square feet? Those must be some extremely tiny rooms. Let us look at the ad:

“Located in one of Culver City’s most sought after neighborhoods, this adorable home has been meticulously upgraded and is in absolute move-in condition. Fabulous cook’s kitchen features a Wolf stove, Jenn-air refrigerator, Miele washer & dryer, recessed lighting and LivingStone countertops! Bamboo floors and recessed lighting in kitchen, living room and dining area while all 3 bedrooms have oak H/W floors, recessed lighting and ceiling fans.â€

Sounds like every top item from an HGTV upgrade was done here. Forget about boring wood floors. How about bamboo floors? Next we are going to hear about rhinoceros skin carpets and bald eagle pillows to welcome new buyers. I also love the name dropping here. All you need is the “Tom Hanks ate breakfast five miles from here†and you would be set.

Let us get another look at this home:

Google Maps always does a better job of showing us the full picture:

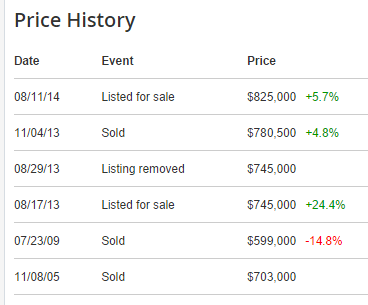

The Google photo was taken in 2011 pre-remodel. Let us look at pricing history here:

$825,000 for this place. Someone paid $780,500 back in 2013 during the mania. You factor in the commission to get this sold and you are breaking even here. But this place has a nice trip down memory lane. It was sold for $703,000 in the last mania in 2005. Then rational heads prevailed and someone bought for $599,000 in 2009. These are the big winners here selling the place for $780,500. Now someone looks like they want to head to the exits while one last sucker takes the bait.

Little by little it seems like the mania is waning. Sales volume is incredibly low and some sellers are being more realistic and chopping prices. Others are pulling back thinking 2015 will somehow be like 2013. Fall is definitely here and as expected the housing market has dramatically slowed. But hey, get that low mortgage so you can pay $825,000 for this 980 square foot beauty.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

122 Responses to “When the euphoria in flipping slows down: Culver City small home with large price tag. Sales volume continues to slow.”

What’s so great about recessed lighting? Why is that better than light fixtures or lamps?

It’s interesting how home modeling fads come and go. I remember that in the 1970s, wood-paneled walls, and wall-to-wall carpeting, was the mark of an upscale home.

My father went paneling-crazy in the 1970s. He paneled half the house. Dining room, bathrooms, basement, office/den. He even paneled the pillars in the basement, encasing cylindrical pillars inside boxy panels. And carpeting everywhere.

Then in the 1980s, paneling was out and brickface walls were in.

Today it’s granite countertops and red doors. Few people seem to focus on the bones of a house, its overall age and structural integrity. Just so long as it looks new on the outside.

@sonofalandlord – that’s a funny post. I needed the smile. Thanks!

According to the LA Times, prices for Southern California single family homes fell from $420,000 in August to $413,000 in September. That’s a 2% drop in just one month. It confirms Jim’s prediction that real estate will tank in 2014. Those are sobering numbers. It’s happening.

@ prices falling, 2% drop MOM is a sobering number? Haha.

Los Angeles County sales increased 3 percent from 6,496 units a year ago to 6,717 in September. The median price rose on a YoY basis 7 percent from $425,000 to $455,500.

All the folks care nowadays is stainless steel appliances, hardwood floors and granite counter tops. How about insulation, roofing, energy efficient furnace, foundation, etc. It is just the overall appeal that matters…

Don’t forget crown moulding!

Good post soal. It is startling how trends change. There are so many homes around my way that have been given a certain look with the window frames, kitchens, bi-fold doors… each flipper thinking they’re individual, but clones of all the others… which I will always associate with boom excess. It is going to look dated and hideous to some in 10 years time.. wanting to change it. Money is money.. I prefer to spend once for longer term, and spend wisely.

I just don’t get it. People leveraging themselves to the hilt to buy a 3/1 982 sq. ft. crap shack for 800K. That’s almost a million dollars for this small home in the burbs. I don’t even know how you fit 3 bedrooms in 982 sq ft home. Check out all the overhead wires running through the backyard in the listing photos: https://www.redfin.com/CA/Culver-City/10757-Kelmore-St-90230/home/6719447 Classy. Is this the fabled California lifestyle people talk about? I don’t think so. On a side note, Culver City is nice, but traffic there is abysmal.

Hunan , Chinese buyers don’t know don’t care and don’t give a shit.

Its a piece of Americana in SoCal! Life’s good, until its not.

The oft fabled monied-Chinese aren’t buying in 90230, nor anywhere else in Culver City. There could be a few rare exceptions.

Love that the Doctor calls out “isolated California logic.” Hard for most Californians to imagine that most Americans don’t embrace the mentality of most in the Golden State.

But to call out the Doc, I can’t believe that he referred to “rational heads” prevailing to pay ‘only’ $599k for 982 square feet. We’re still at $600/square foot, right? Closer to $199k in one of many lovely Florida coastal towns. Not too rational yet, but perhaps rational by California logic.

I tend to find the people buying at these insane prices tend to be people that didn’t grow up in CA. The non-Californian California residents just seem to think that higher prices mean that it’s worth more. I know many east coasters who move to CA and pay east coast prices for apartments and homes. Same for foreigners. Realtors know about this and scam these folks accordingly. People who grew up here remember that a lot of these areas were crap when we were kids and wouldn’t dream of paying $800K for a shoebox. Until recently, I was living in the East Bay, and people were paying $1 million for houses in Oakland – OAKLAND! CA did not repeal the economic cycle. We have busts, big ones, and the next one is coming. Silicon Valley is in a boom right now, but when it busts, we’ll see how many jobs were lost to other states due to high costs for everything in CA.

Same in Sacramento except its the Bay Area transplants buying up anything at any price, has been that way for years. Literally just about every single house sold in my zipcode is to a Bay Area transplant. They don’t bid down, they don’t care what the price is, they just buy it. To them its a bargain compared with BA real estate prices.

Sucks for locals trying to move into either a different neighborhood or a move up home.

Local Realtors DROOL at the mouth when taking BA transplants looking at houses. They know their commission will be fatter than if they “represented” a local. Locals are pretty much left to fend for themselves whereas the BA transplants are given the royal treatment and ass-kissed, all the way to the bank.

@ Calgirl, please explain why the “commission would be fatter” for a BA buyer for the same property.

Do you really think an agent cares about 2.5% of the difference in sales price that you claim the BA transplants will pay? How much more will they pay? $20K? Really, $400 will make the agent just DROOL over an outsider moving in vs. a local that knows the area and will be easier to deal with because they wouldn’t have to show them as much to educate them on the areas?

Coming from someone who knows, the agent cares about who is qualified and willing to buy. An extra few hundred for a higher sales price, if that is what you meant, is not a deciding factor for the agent.

Lots of price reductions in my neighborhood. I see a 10% correction coming before spring.

I think 10% in the prime areas is a given. It’s going to be even more in the Inland areas as sales prices are already down 5-15% in the Inland Empire. And that’s upper tier IE areas like North Upland, Rancho, etc. Once they go down over 20% it starts affecting the Sam Gabriel Valley as people start finding the extra drive worth it. And the SGV is short on Chinese willing to overpay. Lot’s of listings sitting in prime areas of Rowland Heights, Hacienda Heights, etc. Once LA county suburbs start to correct the negative feedback loop with be at full speed.

It seems like we have a liquidity problem, this is @What? driving the stocks down… Watch carefully for the next FED’s move… I bet we will see untapering the taper, it is just about time 🙂 🙂 🙂 . The show must go on 🙂

The interest rates were still at zero, the last time I checked, the new 10 and 30 years notes head for the “all time lows” again. I see the FED to start “untapering” the taper in a few months…

Some motivated sellers will start to accept meaningfully lower prices in 2015, and those buys will largely go to people with cash or the largest down payments. It will take longer for prices to come down more broadly, as it takes time before sellers accept there is a downturn. Though rents have peaked, the gains made in the rental market will nonetheless further slow the decline. It will be a little while before the Average Joe will be getting a deal on a house in SoCal.

Don’t shoot the messenger. This weekend’s ocregister had the following article about rents to go up over 8% by mid 2016:

http://www.ocregister.com/articles/rents-638031-apartment-percent.html

They acknowledge stagnant incomes and renters being tapped out. I guess that just doesn’t matter in socal.

This place is different

I have been seeing more bank owned properties come on the market which probably means defaulted owners are finally getting the boot which only means the need for rentals will be climbing.

“Then rational heads prevailed and someone bought for $599,000 in 2009.”

If that house is worth 600k to someone deemed “rational”, I think we need to redefine the term. “Rational” would be a sale price that supported the math of a tear down where you could rebuild a 3 story that makes better use of the space. “Prime” SoCal has a lot of not-so-prime houses that aren’t getting gutted because of the Bubbles.

My only question is WHEN do the flippers get flushed?

After they get burned. They have to learn the lesson the hard way. Once they realize they cannot flip the house they have recently bought, they will run to the exit… Some might even try to rent the flips out. But we just need to wait for all these newly built apartment to come to the market to fix the problem 🙂 …

“Lots of price reductions in my neighborhood. I see a 10% correction coming before spring”.

Depending on where you live, I think that 10% reduction is already showing up in the closed comps from this early summers market top. By next summer, I am certain some markets will be off 20% from last June if the Fed finally eases us off the QE / Bond buying juice.

The market in the Bay Area just keeps getting hotter. I am starting to feel like it will never come back down to 2012 prices. I wish I had bought then instead of listening to some of the commenters here who said that prices would continue to drop.

That is the problem. People can not understand that waiting for that 20% correction they might still pay more. If the prices increased year after year for more than 30%, even if you get a correction you end up paying more. That is the sad reality. What I noticed so far is more like 50-60% increase from the low of 2009.

Personally I don’t like it. I would like to see 12%interest and a major correction. However, I am a realist and I know that is just wishful thinking.

BA prices are crazy because of the #’s of startup employees streaming in. Startup investment is high because of low interest rates. Cheap money also means higher housing prices. Add that to BA people’s insanely strong nesting behavior, and you get high prices. Once interest rates rise, housing there will drop. If you remember back in 2009, housing was dropping due to lack of financing for both housing and business investment. The next pullback in VC will have the same effect, but will be even worse because many non-tech companies have moved staff outside Bay Area.

I am a native of the SF Bay Area and have witnessed the dramatic changes here over the last 33 years. Here are a few of my observations:

– Entrenched Boomers and early Gen X’s that bought houses during the 60-90’s aren’t selling. Most would be utterly priced out of the market if they had to buy today.

– Late Gen X’s & Gen Y’s forced to live “adolescent” lifestyle due to cost-of-living. Engineers in their 30’s living 4 to a townhouse to afford Bay Area living. Delay of family formation.

– Immigrants from Asia, India, Middle-East, some Eastern Europeans, Mexico are replacing natives and are willing to live a LOWER QUALITY of Life.

– Good cities with good school districts (see the Peninsula) have SFHs priced above $1M. Decent neighborhoods with OK schools have SFHs priced $600k-$1M. Ghetto areas have SFHs priced below $600k

– Middle class has absolutely been gutted

– Companies are off-shoring all mfg. Tons of commercial real estate unused. Parking lots 2/3 empty at many companies.

– Melting Pot theory is FALSE. NO assimilation into “American” culture. Strangers living side-by-side.

– SF Bay Area is the new Gold Rush. Get in, make your $$$$$$, then get out if you can

Joe,

Good points there. I got out of Santa Clara back in April. There really is a lot of vacant businesses – small/medium companies that have gone bust and left behind their buildings. If you look around Palo Alto you won’t see it, but if you go a ways south to Sunnyvale and Santa Clara, they’re all over the place. I would say that it’s impossible to get them re-zoned to residential, but I do know of one major development where exactly that is happening – the corner of Lawrence Expwy and Monroe. I haven’t been by there in 6 months so maybe they’ve finally broken ground.

Bay Area real estate just looks bizarre from the outside. $850k will get you this in Montana: http://www.realtor.com/realestateandhomes-detail/251-Westlake-Park-Blvd_Bozeman_MT_59718_M77757-37034?row=4

First generation immigrants from all of the areas you’ve cited are absolutely notorious for massive tax evasion. [ BTW, this tendency didn’t start yesterday. It’s been ‘in-the-system’ from day one — a century ago. Al Capone was just the tip of the iceberg. ]

[ They all hail from lands notorious for capricious taxation — so every citizen becomes contemptuous of all tax authorities — to include those of their new land. Russians are arguably the worst. Take a gander at how Putin enforces Russia’s income tax law. ]

Because they are the right kind of minorities, the IRS suppresses its internal statistics.

As you might imagine, housing becomes strangely affordable for those paying only token income takes.

The OTHER twist: immigrants don’t take American zoning laws seriously at all.

So you end up with ‘clown houses’ and multi-family dwellings in single-family neighborhoods. Their driveways become absolutely packed with cars and pick-ups.

In short order, the natives leave town. Enforcement of all zoning laws simply skips over immigrants. Like most American laws, they are only enforced against native Whites.

Other dual-track norms: illegal aliens don’t have to carry auto insurance — or pay annual vehicle registration taxes. The PC police departments are instructed to not pull them over. I’ve seen as many as five, over-loaded, (illegal alien) clown-wagons — with ancient registration tags dated back years — streaming along in rush hour traffic. Such a sight is nothing special in California.

This dual taxation scheme goes a long way towards explaining why immigrants — especially wealthy immigrants — find California real estate so ‘charming.’

I agree with the melting pot being false – but only in the Bay Area and New York. Most other parts of the US, people of different backgrounds mix very freely. The Bay Area has this weird tribalism based on career, racial/ethnic background, religion, place of residence, education, 9’ers vs Raiders, etc that keeps people apart. Talk to newcomers and they’ll tell you what a cold unfriendly place Bay Area is. For me it’s a quality of life issue – I like living in places where people are warm, where people like meeting others who are different from themselves, where you know people who have different careers than yourself.

I noticed the same thing and in the past when I said that – “instead of prices it is the quality of life going down”- the fellow bloggers jumped on me.

Now they wait for a future of low prices in the coastal SoCal. What they are going to see in the future will be low quality of life instead of low prices – same like SF.

I’ve (from Germany) just been last week in the SF-bay.

yes – in downtown Mt.View – the mix of people is very different compared to 9 years ago.

(~9 yrs ago – that’s the earliest reference I have/remember)

What I heard from a friend living there is exactly what you describe.

regardless of having a house worth 1.5mill$ – it makes no sense to sell – because you can’t afford the property tax on a newly bought house. And another house just costs the same insane $$$.

AND – the other is the ‘condo-mania’ – where rents for condos near CalTrain-MtView cost 5000,- USD and more per month – again: five-thousand-bucks per month !

Sure – at those prices you need TWO with an income (be it a couple or work-mates)

Have/want kids ? – an economic non-starter.

Funny – compared to that – here in Germany (Munich) – things are just visibly starting to get crazy. But when I see/hear what’s going on in the Bay-Area – I easily can forsee what’s coming here too.

(you can ‘finance’ here a 1mill-Euro SFH for 1.45% 10yrs-fixed)

You have to go with your gut. I read this blog for a year and patiently “waited for Godot” I came to the realization that in my situation I would be happier as a homeowner and I don’t care about the price. I paid cash for a very nice, reasonable, newly built home and love it. Doesn’t matter If prices fall I still have the asset. I can care less about the value of the home. It’s a home not a piggy bank.

I want to move my family to a nice place in So Cal, but I cannot afford it. I’m too old to play fake it till you make it. It’s hard enough to pay the bills in Illinois where the winters are so gloomy and depressing. When I win the lottery we will load up the truck then come on out and go house hunting 🙂

@john…we made the move from Chicago area to Corona. It’s reasonably priced with decent schools. Sure beats the hell out of Midwest winters. Commute can be murder from here though if you go to LA. Irvine is closer but requires tolls. Try and work out of the house and life is pretty darn good.

Geez frikkin a, Iowa is better than California. We have cheap houses, 3/2’s for $100k in safe neighborhoods with Americas best schools, very low unemployment, no traffic, great morals and people, and cheap cost of living.

Those Cali crap shacks are a joke.

Unloaded…..Different strokes, I guess you could say why pay $50 for a steak at a high end LA dinner house when you could get a steak in Ames Iowa at Zizzler for $12.95.

It is all realtive and trade offs in life, CA lifestyle not the cup of tea for everybody, but for the many, they wouldn’t trade places to live in Iowa for all the tea in China.

Dude, I’ve worked for Iowa companies the last 10 years and go back several times a year. You can write off 6 months of the year. The wind is brutal…nearly all the time. And, that’s just the weather.

A 10% correction before spring sounds about right, but I doubt that spring will be the bottom.

Dennis….10% isn’t going to do it, our friends try 10% still no offers, now they just reduced anther 5% let’s see what happens now?

Robert, Spring is four months away. Give it time.

I really doubt we will see that. Flat prices is @What? I see for 2015 and drops starting in 2016, unless the FED turns on the printer press again (QE4+), then the tank hard will be postponed for a few years…

Stocks keep falling… Is the stock market (housing, etc) to tank hard or the FED is about to step in? Remember, the FED told they will stop QE in October (the last 15bil/month), Lets see if they can stick to their promises.

Just wanted to let everybody know, if the FED sticks to their promise and ends the QE this month and starts raising the rates in 2015 (I mean moar significant raise than 0.5% a year), I agree to admit that I was all wrong in 2014 on the housing to tank hard. But if the FED untapers the taper and doesn’t raise the interest rates, all the housing to tank hards will have to admit they were wrong and that “the guy” got the crystal ball 🙂 🙂 🙂 …

Seattle….Nice backpeddle (don’t fall down ) you said rates will never raise before 2016 now you say it may go up 0.5%, please stay consistent when proven right or wrong then accept defeat?

C’mon, @Robert, 0.5% a year is not a raise, it is BS… How about 0.1 % a year. I am talking the meaningful rates hike to the historic norms

Interest rates will be the nail in the coffin – the real action is gonna be fundamentals. Outside of a few areas, I don’t see where median income has increased, and where it has, it has been speculation-based. I think we’re gonna learn next year that the economy was not appreciably helped by low interest rates over the last 5 years.

No interest increase!…. No need to do that when they are more afraid of deflation rather than inflation. The QE is already replaced with stealth QE (higher dollar). They might start soon QE to infinity when they see the corporation profits decimated by higher dollar.

It is not what I like to see but this is what I notice.

Fed will stick to their taper plans, else lose a lot of credibility in my opinion. Also because I believe they have spread the losses to the wider public, Reits, bubble-heads doubling down into real-estate “It’s not earning anything in the bank”, all sorts of yield chasing. Also China is tightening stimulus in lock-step, as I read it.

If it continues, sme of this market shakeout might see many a prime home-owner suddenly looking at how less wealthy they are than before, and more amenable to selling their home and accepting a lower offer.

The only additional stimulus the Fed has implied it might use, as I understand it, is via dividends from all the existing QE, to buy Mortgage Backed Securities (etc) at the end of the official taper. Could amount to a few $10s of billions over a year, perhaps, if they decide direct it to stimulus.

I have glimsed top end reports from the last real main recession (without stimulus)… and can hope those who have been investing in over-valued assets, buying at extreme high prices, and treating money as an irrelevance, discover it is money/credit that is becoming scarce.

_____

[Restricted] Bank – MARKET INTELLIGENCE BRIEF – AUGUST 1993. This report has been designed for use by the staff of the [Restricted] Bank Group and is strictly confidential. 11-pages.

Effectively saying the time had come to squeeze and pull the rug on all but the cash.

Housing To Tank HARD in 2014!!! Still got over 2 months left. I am more assured of this now than ever!

C’mon, @Jim, the 2014 is almost over… Are you afraid of the ideas of March of 2015, or 2016, 2017?

@Seattle,

Its IDES of March! Not IDEAS as you write week after week.

And again, “tank” does not necessarily refer to current asking prices. As a lot of delusional sellers will soon find out.

I wouldn’t get to hopeful in terms of prices Jim. Though -15% is VERY possible in some areas. The tank in transactions/sales volume I expect to be much more than -15% over the next few months.

I guess it depends on what tank you’re looking for 🙂

I would expect the prices to stay flat for the next couple of years, unless the FED steps in with QE4 / MOar Stealth QE

Stocks to tank hard!!!…

Profits will be decimated by low demand and higher dollar.

Prime RE dependent on the stock market will suffer.

And I predicted a 6% yoy median increase in January. Who’s looking better now, Jim?

P.S., I also threw in a 10% correction in the Nasdaq by October (made that call in July). Looking good on that one, too.

As long as GDP growth is greater than inflation (the fake CPI numbers printed by the government), housing tanking this year is unlikely unless the stock markets continue to crash.

Im still trying to figure out how the Fed is going to deal with all those mortgage backed securities? What they own is about 70% of all MBS’s!

Market is correcting and so are your 401K’s and next your uber valued real estate.

Party like its 2007!

The price reductions are a marketing ploy to keep the MLS listing at the top of the list with new listings.

Hi Doc; you think that someone will overleverage themselves? Over fifty percent of homes sold last year were 20% or more down. People complain about how outrageous the home prices are in LA… but shouldnt we rather be in awe about how much money people have? The Doc is usually writing about Culver City or WLA … what about the rest: Malibu, Palisades, Santa Monica (North of Montana Avenue) Bel Air, Holmby Hills, Mandeville Canyon, Brentwood, Bel Air, Palos Verdes, Rolling Hills, Manhattan Beach, Hermosa Beach, Redondo Beach, the home prices in the aforementioned put Santa Monica, Culver City, West LA to shame. As these areas become over-priced, buyers with money will seek out the lower rungs, which is Culver City, WLA, etc. I predict there will be very few defaults in all the above locales when prices drop.

I look at that list and think: There are an awful lot of places where rich people can put their money, and I’m not sure there are enough rich people to fill those areas.

The places you listed are not the same. Owners have different wealth profiles. The Palisades is not the same as Manhattan Beach.

The similarity between the areas you mentioned might be in the banks’ reluctance to begin foreclosure proceedings.

I’ve been seeing something lately that I haven’t in a while.. contingencies. Anyone else?

Yup. I have seen more “contingencies” too.

The listing agent forgot to mention that this house is a hand-flipped sustainable artisan crapshack.

Housing and stocks will tank hard in 2014….it already started. Get the champagne ready.

Great entry Doc – amusing entry lol – but also very relevant.

I’ve had it with Realtors/Estate Agents lavishing it up beyond belief. Also great there appears to be some alarm with the asking price they’re seeking. Unless someone comes along to put in over-asking-price offer… they seller running a fine line on break-even. The previous owner the one to have cashed out at best price. Let’s have some more recent buyers finding this market is stalling, or older owners undercutting more recent buyers on asking price.

Check out this scene from a film with Gary Oldman – it’s right at the very start of the film.. Gary Oldman a Realtor taking a posh couple to view a house. It’s only a minute or so duration. I have transcribed the first part, so you cen get through the thicker part of the London accent. I would prefer some Realtor having a laugh with a listing, rather than Realtors taking it oh-so-seriously with their annoying approach trying to polish brass into gold.

______

Well it’s 1935 or thereabouts. It was bombed during the war and patched up with plasticine and blu-tack. The interior guttering is a unique feature which is caused by the raging damp, but Lattimer and Haynes are supplying windscreen wipers for your television set, you got otter traps in the cellar and a free-aqualand course at the local tech college. Well I’m not saying it’s damp of course but if the water levels rise any more you could find yourself selling a house-boat in a couple of years.

– The Firm [1988].

http://www.youtube.com/watch?v=VznoshagNbI

_____

At it was filmed in 88… the couple he was showing the upper-end prime house to, would have been buying at the top of the market… Gary actually did not need to do a hard sell.. could treat them with a bit of contempt, because buyers were pushing and falling over one another to pay crazier prices with their bubble head view of the world. Looks like EAs will soon need to work a lot harder, but hopefully they can get more realistic instead of giving it the every house a ‘dream house of wonderfulness’ approach – when many of us want hard value first.

i hope so @ Jim Taylor especially in the bay area!!!!!!

Give it up Jim, it’s just not going to happen. Lower mortgage rates will make sure of that. But keep the dream alive and maybe one day you will get that crapshack you so desperately want, but it may come with a 6%+ mortgage attached. Be careful what you wish for.

6% interest rates would be a welcome change to those of us sitting on the sidelines with a healthy cache.. of cash. We haven’t seen 6% since..2002. 2001?

People like Mr Seattle probably aren’t old enough to remember what a market with 6% rates feels like.

Would anyone here complain about a return to the California housing market of 2001?

I bet many here now look back fondly on the times of the dot com burst and waning

fallout of the defense contractor shuttering in many parts of San Diego and so cal.

It sure was a damn good time to buy real estate in So Cal. Those who did have made out like bandits ever since.

Oh and before that.. we had 6% rates in 94/95/96?

Was a great time to buy in So Cal and almost anywhere … as long as you were prepared w 20% down and solid employment.

And by “prepared” I mean that you saw the late 90s (and early 2000s) recessions coming and had aptly prepared your finances for buying opportunities.

Kinda like… well… what one should be “preparing” for right now?

Don’t you think that 6%+ mortgage will grantee lower prices?

Low mortgage rates are a non-issue in this contrived market. Wells Fargo’s(largest lender in the US) pipeline hasn’t been this low since 2009–even at these historic low rates.

Someone who has NO clue about the inverse relationship of price to interest rates. I wait upon the day interest rates are 6% +… It really doesn’t matter anyways, massive deflation is coming, home prices will plummet…

The mathematical inverse of interest rates to home prices might apply if we had 100% of buyers financing 100% of the loans.

However we don’t live inside a math equation and not every buyer finances.

If interest rates rise, prices may drop, but as prices drop, cash buyers will slowly trickle in preventing the inverse relationship you might expect.

Furthermore, if interest rates hit 6%, I’d suspect it’s because the US economy is humming along which will also help prop up housing.

I think that a “massive deflation in the quality of life” will come first…..in my humble opinion

@MB, if interest rates rise there might not be as many cash buyers swooping in as you think. After all, they’ll be earning more interest on their cash. Why spend it on a depreciating, illiquid asset? It may be the opposite of what you suggest. We had record cash buyers with historically low interest rates.

@MB

If interest rates were to rise to 6%, it’s also likely that investors would put their cash in CD’s, interest-bearing accounts, and other liquid investments that are much less risky than real estate is. A major reason for real estate over-speculation was the desperate search for yield in a ZIRP environment.

Besides, I think that the bulk of investment properties were purchased with borrowed money from investors. Those same investors might consider the lost opportunity cost of parking their money in real estate.

Some people really are deluding themselves. Those who called out MB are making sense. We saw the search for yield crowd come in because *both* prices dropped and rates were low. If rates get lower and prices drop again, then maybe MB is onto something. If rates rise, who the hell in their right mind wants a PITA property to contend with? No one, that’s who. The search for yield was all about the best choice on a menu full of turds. 6% in a financial instrument that is more easily liquidated, tradable and comes with less fees is the way to go.

Hunan, I am the other Jim and nothing would make me happier than a stronger real economy that requires a 6% 30 year fixed rate. If that made home prices correct 30%, so much the better. Then maybe I could help my kids buy homes. Rates are 3.75% or less for a reason. The real economy sucks for most people. I know very few people that are making more now than they did 10 years ago and adjusted for inflation, it is a wash at best.

Interesting article, “Americans facing post foreclosure hell…”

read entire article on link, or first few paragraphs below.

http://www.reuters.com/article/2014/10/14/us-usa-housing-foreclosures-insight-idUSKCN0I30BU20141014

(Reuters) – Many thousands of Americans who lost their homes in the housing bust, but have since begun to rebuild their finances, are suddenly facing a new foreclosure nightmare: debt collectors are chasing them down for the money they still owe by freezing their bank accounts, garnishing their wages and seizing their assets.

By now, banks have usually sold the houses. But the proceeds of those sales were often not enough to cover the amount of the loan, plus penalties, legal bills and fees. The two big government-controlled housing finance companies, Fannie Mae and Freddie Mac, as well as other mortgage players, are increasingly pressing borrowers to pay whatever they still owe on mortgages they defaulted on years ago.

Using a legal tool known as a “deficiency judgment,” lenders can ensure that borrowers are haunted by these zombie-like debts for years, and sometimes decades, to come. Before the housing bubble, banks often refrained from seeking deficiency judgments, which were seen as costly and an invitation for bad publicity. Some of the biggest banks still feel that way.

Not applicable to CA. We are a non recourse state.

California is a non-judicial state. The majority of CA homeowners won’t have to worry about a deficiency judgement.

…for now

Just like I said… The San Francisco FED: “If we really get a sustained, disinflationary forecast … then I think moving back to additional asset purchases in a situation like that should be something we should seriously consider…”

http://www.reuters.com/article/2014/10/14/us-usa-fed-williams-idUSKCN0I31Y720141014

Now, the interest rates and the FED taper to Tank Hard in 2014!!!

All the BS news networks now cream for moar “stimulus” from the FED or delayed “rate hikes” as the stock gains keep fading… 🙂 🙂 🙂 … Now, either of two will happen, the fed will untaper (delay rate hikes, new QE, etc) or the economy will gradually start going down the toilet… I am inclined moar towards the first scenario, lets see if @Jim Tank, @Zero and @Another guy from Seattle were right and the second scenario will play out. I believe, the FED cannot taper, they can BS the markets as long as they want, but, once they taper for real, everything will tank hard not just the Housing.

So tell me Seattle Dude, if they untapped what will they buy and what will that mean? I’ll answer my own question… Stocks will stay levitated and inflation and the expectation of will rage. Considering there are no more greater fools and the FED has PROVEN QE cannot create the WAGE inflation they desire, housing will CONTINUE to Tank Hard. If they raise they can save the dollar and the economy on the margins, and housing will still Tank Hard. All the Fed can effect is mortgage rates. Much sooner than later prices will adjust to the 99.9% NOT benefiting from the Ponzi. All the FED can do in the long run is influence what percentage of the monthly nut goes to interest or principal. How can you not grasp this??? It’s All been an illusion dude…

@ZeroShill ” If they raise they can save the dollar”

Remember, the FED has never done the right thing since they were created moar than 100 years ago. The right thing to do was not to monetize the .GOV debt in the first place, the QE (1,2,3 +) was a mistake in the first place, it created nothing, but re-inflated the bubbles (stocks, housing, bonds, etc). All I am saying is if the FED unleashes the new wave of funny money (QE4+), all that funny money will have to pour somewhere… Remember, the housing bubble of 2008 was driven by the main street, where as the bubble of 2014 is driven by the wall street.

@ZeroShill ” It’s All been an illusion dude…”

The whole rekovereeee was as illusion. I have stated it 100 times already, we have been in recession since 2007. You mistake is that you underestimate the power of the FED. Whether you like it or not, the FED criminal cartel controls everything, not just the money supply, but the whole economy and .GOV. Like I said, the same reason that elevated the housing in the first place (it wasn’t wage inflation, was it) will not let it collapse, unless the FED removes the punch ball (QE + ZIRP).

Don’t you underestimate the FED’s destructive policies…

NihilistZero, totally and 100% agree. The people that keep pimping housing have an agenda, or live in fantasy land. Housing was never meant to be an “investment”, and is not really an asset per se. If the Fed pumps and stimulates through QE, they will have lost all credibility. You are right, either way, the Fed is f@cked…

NihilistZero, you should come by http://www.gunsgrubandgold.com for your investment savvy…

Spot on, N0 – this guy is suggesting that the fed will do more of the same which has failed after three tries. But, hey, next time it really will be different and the Fed is all powerful, operating in a vacuum. Maybe we can ask the Fed to fix Ebola.

As I’ve said before, SeattleDude’s trolling is pure weaksauce. The funny thing is he understands SOME of the issues, but uses that knowledge to draw completely asinine conclusions off of said data. He’s “little r” robert with a better grasp of the English language.

QE is DEAD for this cycle. It’s not a matter of the FED doing “the right thing” as much as what serves their interests. The FED is the big 4 banks, and another round of QE and the continuation of this malaise does NOTHING for them. The economic activity that will be unleashed a year or so after deflation takes hold does EVERYTHING for them! People taking out loans in volume is required for the banks to maintain their oligarchy. Apparently this all goes over Seattle Dude’s head. I have no time to waste debating fools. The comments I’ve made so far exposing his ignorance are sufficient.

QE dead, eh NZ? And this is from a hawkish one of these ass clowns…

http://www.marketwatch.com/story/bullards-surprising-suggestion-to-continue-qe-lifts-markets-2014-10-16?dist=afterbell

Re: CAB

Talking the markets back and actually doing it are 2 different things. In the end it doesn’t matter as there is NOTHING FOR QE TO BUY. Unless they provide DIRECT stimulation to consumers .gov (as they did in 2010) can’t spend enough to prevent deflation anyway. Even Ron Paul pointed out that while he wouldn’t support such policies, the only way you could possibly get the desired result is if the fiat went DIRECTLY to consumers. Friedman knew this that’s why he supported the EIC. In the absence of those policies all another round of QE will do is hasten/worsen the asset crash. The current FED talk is methadone for the junkie.

Housing in SoCal to tank hard in 2014…:-))))….!!!!

http://www.dailynews.com/business/20141013/southern-californias-home-sales-hit-5-year-high-but-low-end-doesnt-look-so-good

So the article says it was a 5 year high FOR SEPTEMBER 🙂 LOL! How many stock market and pimco cash out’s parked $$$ in luxury SoCal RE skewing these numbers. They admit the low end is dead. Basically the botyom80% of the economy is dead on the vine. How long do you think they can keep up the charade?

Till 2016, Howzing to Tank HArd in 2016!!!!

We have more to worry about than most discuss here. I don’t think deflation can be contained since Europe and America used the same remedies for the crisis. Europe is always the canary in the coal mine.

Europe Is Flirting With A Bizarre New Kind Of Economic Meltdown That Hasn’t Been Seen Since The 1930s

Read more: http://www.businessinsider.com/europe-and-deflation-2014-10#ixzz3GDgHmlAN

We’re ready to just buy because the interest rates are still low, but are we falling into the trap? Our family is growing, so we’re getting antsy. Ok, so no one is talking about the banks holding foreclosures. Is that also part of the limited supply? What if the Feds find some other means of inflating the housing market while interest rates go up?

Getting antsy is what gets people into trouble. I know the housing interests are hard at work trying to convince folks that Junior won’t get good grades unless his parents are locked-in with debt and kids can sense if the grass in the back-yard is mortgaged or leased. The responsible thing to do is to not make rash decisions based on fear. That’s not the same as holding out for a better deal. Ships come and go all the time.

Thanks, Skeptic. Yes, Junior doesn’t know we rent (cheap too, by the way, in a great neighborhood). Besides, you can still send your kids to a school in a good school district if you ‘rent.

PS: No one is talking about school districts. Good ones are limited in the LA area. This also drives up housing prices.

“Crap” Shack

I hear a very similar story almost every week:

“Almost every listing in Toronto seemed to be selling over asking in bidding wars in September if it was priced well and showed nicely”

Seems like people have a really short memory if spending money that was just borrowed to them. I would like to know how many smart people are living from the house flipping itself. The story says it all. One mania comes after another. People will enter bidding wars or pay absolutely insane amount of money for a shack.

Buyers remorse when they received their first mortgage payment. You mean I have to pay for this for the next 30 years?

if buffet is saying buy, you buy

if you are responsible enough to make payments over 30y, you are essentially shorting this ath dollar by grabbing as much money as you can, hand over fist

and if rates keep dropping, you refi in to lower payments // if they don’t and we start to inflate, your payments become miniscule relative to the cost of everything else

i imagine most of the people on this site are middle class

yellen tipped too much when she said the only way you can become wealthy is through asset ownership

the middle class can get wealthy through hard work + real estate; the superwealthy own businesses and play in the high end

housing appreciates in prime areas. it just does. california is a prime area.

either move out and buy or man up and buy. but don’t stagnate, paying rent. that’s what they want you to do

so much wrong with this comment, don’t know where to begin.

Buffet is a piece of crap phony capitalist who sucks of the .GOV tits… Listen for what he says and do exactly the opposite.

Sorry, but I call bullshit. Housing appreciates? Is that before or after you run the terms of your loan and try to sell at a profit? So in essence you are indicating that if I purchase a home today for $300K, and through the life of the mortgage, property upkeep, taxes, etc. (which are all liabilities), I somehow will be able to sell that house for $900K + in 30 years? So basically all current “starter” homes in the next 30 years will be upwards of a cool million? If that is the case, life as we know it we be shitter beyond belief… welcome to Zimbabwe…

housing appreciates because america is cleanest shirt. people want to be here, period. so foreign investment finds its way here – in to our colleges, and inevitably in to our assets, which yes – includes real estate.

in spite of consistent wage stagnation over > x years, real estate has still found a way to go way, way up, over the long term. the rich are getting richer and are finding new and exciting ways to fleece the middle class of all their $

right now, that’s in increasing rents, and keeping inventory off the market. and you data junkies can’t deny that they are way, way up, yoyoyoyoyoyoyoy

i don’t listen to what people are saying, i look at what they’re doing. and in irvine, they are building apartment complexes left and right. why? because there’s $ + margin + long term roi in rents. why build a sfh – a one banger for everyone involved, when you can build apartment complexes – a one banger + residuals?

everyone who isn’t playing their game keeps watching their purchasing power shrink

while bankers and insiders make millions off a 7 year bull market

where is that $ going to find itself? you’re kidding yourself if you think those gains aren’t finding their way in to prime re

to think that wages will never, ever increase (+ subsequent ^ re prices) is a joke

to think that your $ pp will remain the same over the next 30 years is a joke

$ is being created every single day and it finds its way in to this country and ultimately our real estate

but keep waiting for your crash if it ever comes. and i’ll just give you that it does. 20% even.

where’s the inventory? do you expect the chinese to liquidate something they already own straight cash? no distress = no inventory

let’s say a couple great homes come on. you expect no bidding war? ask anyone who has tried to buy a property that isn’t absolutely dreadful recently. is it a one offer and done deal? hardly.

once bitten, twice shy. everyone is making their payments. nobody is taking out a second mortgage to own a second home anymore. if re crashes, a higher % will ride it out.

i’m not saying it’s going to get all bubblicious again. i’m saying it’s going to go up over the long term.

but keep waiting.. and fight the 100 commenters+ on this site for a property you actually want – that is, if it ever comes on the market

http://www.jparsons.net/housingbubble/

You don’t listen to what other people are saying but you come on a housing bubble site to get other people to listen to what you’re saying. Interesting. Also interesting to see that ad for a hard money lender on the link you provided. Just goes to show that the housing interests with much at stake are worried. Why else come here if there wasn’t some fear and doubt. You gotta talk up your trade because you’re concerned, we get it.

Can you fit any more silly platitudes in there? Did you also give that advice to folks back in the early oughts that were forced to sell in the late oughts? No one knows where they’ll be in 30 years, so it’s unrealistic to project out that far. There’s a reason why mortgage rates track the 10 year T. The traditional 30 year ammort is simply the upper bound to getting the monthly nut lower.

So. Cal. real estate has been overpriced for years. I am a native Californian who moved away 30 years ago for a career, but I had family whom I visited regularly there through the years and stayed in touch with the economy there as well. I recently sold a home there when the inventory was low and prices had apparently peaked. Early, on So. Cal. real estate was much more expensive than Colorado, but incomes were higher in California. Now it seems incomes in Colorado are on par or better, and $700k can still buy a lot of home in Colorado, compared to that shack in the flatlands of So. Cal. To this day, I simply don’t get it … there is no privilege anymore to living in L.A. and the ‘California lifestyle’ is only for those with hefty incomes. L.A. is a trap for the majority of its residents, who have become self made victims of an illusion. The ‘Beach Boys’ California Dream that was So. Cal. 30 years ago, is gone forever!

JN, we still have plenty of self-deluding natives that thrive on local hubris and plenty of transplants with dreams of greener grass on this side of the fence.

Agreed completely, which is why we’re getting out in the next year.

I think people are not really breaking down the numbers on how much it really cost to buy a house over 600k. If you use any amortization calculator and see the 30 year loan breakdown, it’s shocking you will be paying for 30 years. You musts also ask yourself will you be able to sell higher than what you bought it for given how high prices already have gone up. Buying now would be like last to arrive during the gold rush. All the gold is already mined. I say wait until prices comes down low enough to where you are not slave to the mortgage. If not just rent and enjoy life.

Good commentary below:

http://www.marketwatch.com/story/30-year-mortgage-rate-seen-hitting-17-month-low-of-38-2014-10-15?siteid=YAHOOB

Based on that, are RE prices crashing? Mortgage application at 4 months high, increasing due to low interest. What are prices doing when interest goes down and monthly payments go down??? Sales the highest in years…

I told everyone that interest is going down or stay the same regardless of what the FED and media are saying. All I’ve got where angry insulting comments like I would be the the head of the FED.

Guys, it doesn’t matter what you and I like to see. In business you have to leave the emotions of frustration aside and act based on the objective reality – there is no free market and market fundamentals for the last 100 years since the FED was created. You either understand how the manipulation works, or you are thrown under the bus.

Disclaimer: I like high interest so my money can buy more. However, what I like it doesn’t matter when I am just a commoner. My ability to differentiate between emotions and logic, market fundamentals and manipulations, wishful thinking from reality, over the years helped me a lot.

Just like I said, do not expect any meaningful rates hikes any time soon in the future. The rates hike will be the last nail in the coffin of the rekovereeee… Stealth QE all the way to 2016 🙂 🙂 🙂 … Haven’t bought a house yet?

And QE4 will come soon to rescue the stocks… Show must go on!!!!

Anyone heard from Keith @ HousingPanic? I’d love to hear what he has to say, as he has been right every time. Right against the mainstream and right when bears said it could fall more.

Keith did make a post at Housing Panic in December, 2010 that went against bear sentiment and exhorted people to “buy. buy, buy,buy” (his exact words). I somewhat agreed wit him and nearly bought/won an auction home in 2012. However it was hard advice to follow as while I had a large down payment (which I have since doubled) tight lending standards hurt me as I’m Self employed.

Keith made a post in June 2013 sating “Welcome to Housing Bubble 2.0” where i think he predicted a two year run, so that is looking spot on. He became a bit of an Obamabot in 2008 predicting a “Morning in America” presidency fro the chosen one, so obviously his political prognosticating doesn’t match his economic forecasting LOL. But i expect he’ll post again at the old Housing Panic when this one goes “PoP”. I’d expect something by summer.

I don’t know if given the opportunity I would have borrowed the extra 15K to win the auction. It was for a West Covina house on a hillside with lots of potential and a big lot. By not winning I made another investment which will quadruple or more my money over the next couple of years and I paid down debt. Though that house is “worth” much more now, it needed work and I’m not confident I’d be much more than break even after the pop. Much like I’ve explained to SeattleDude, once the upwards momentum it removed from a ponzi it’s game over and there’s nothing left from the crying. The moment velocity goes flat, not even downward just flat, there are no more gains to be had in that cycle. We passed that point earlier this summer.

Leave a Reply