SIIV – Super Ignorant Investment Vehicle: The Evolution of Progressively Dumber and Dumber Bailouts. 3 Emerging Trends: Bailouts getting costlier and dumber, layoffs accelerating, and embracing frugality.

We are in a process of financial de-evolution. I’m not sure what Darwin would call this but each subsequent day without missing a beat produces another more progressively disastrous “idea” to save the market. I am cautious about calling what we are seeing as ideas since it is better to define it as flushing money down the toilet which would be a better characterization of what the Fed and U.S. Treasury are doing to our country.

The genius crony capitalist now think it would be a magnificent idea to get mortgage rates to 4.5%. Now why would the Treasury want to do this? Well according to the Wall Street Journal:

“(WSJ)Â Treasury views this plan as potentially halting the slide in home prices by enabling borrowers to afford bigger mortgages, thus increasing demand for homes and pushing up home values.”

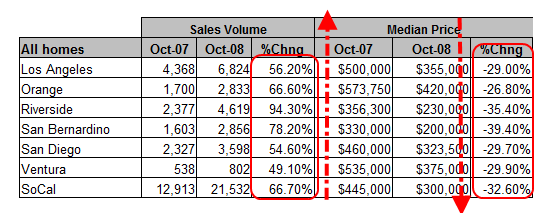

Bwahahahaha! The solution to the problem according to these bandits is to go back to the genesis of what caused this housing bubble. That is, people taking on bigger mortgages and home prices getting too high was the freaking problem!  These are the people running our country. In fact, dropping home prices are proving in certain areas to actually increase sales. I’m going to show you a chart for Southern California that may boggle your mind. See, as prices dropped sales actually increased:

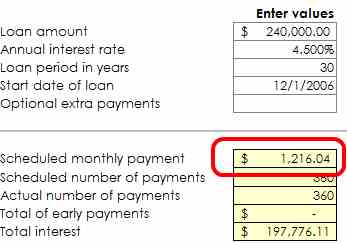

I know this is a shock to the MENSA members running our country into the ground but prices being too high is [was] the problem. So why would you want to institute a policy that would artificially keep prices high? And since these guys don’t think two steps ahead, this problem is doomed to fail. Why? Well interest rates eventually will be set by market forces. Mortgage rates are already at historical lows. So let us take a look at a poor sap that buys a home with a 4.5% 30 year fixed rate. In a few years when we have to face the repercussions of the squandering of our entire wealth in pathetic bailouts, rates will undoubtedly be higher since we are going to need to attract more capital to the U.S. since we are flat broke. So in the future, let us say rates go back to 6.5% the price of the home will need to reflect that. We are essentially screwing people once again and kicking the can down the road. This is patently insane. Let us examine a $300,000 home purchase at 4.5% with 20% down:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $60,000

$240,000 mortgage at 4.5%:Â Â Â PIÂ =Â $1,216

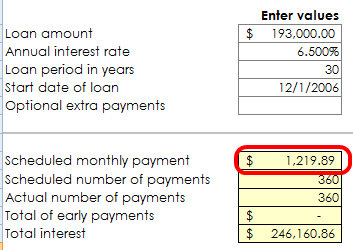

Not bad. But what if rates go back to 6.5% in a few years when this person wants to sell the home? How much would a person be able to afford if they want a similar monthly payment?

$193,000 mortgage at 6.5%:Â Â Â PIÂ = $1,219

You have lost an extraordinary amount of purchasing power here. The purchase price would now have to be around $241,000 if we are trying to maintain a similar monthly payment. Remember the original purchase price is $300,000. Do we really need to go through this exercise again when we just went through the pay Option ARM and subprime debacle that clearly screwed people over with a teaser rate? Do we really think housing is going to appreciate that much in the next few years? I doubt it. Look at Japan and you’ll get a glimpse into our future. Trying to institute these low rates is simply unbelievable but like I said, the ideas get dumber as we go along so next year they may be giving free mortgages with your next GM car purchase. Who really understands what the cronies are brewing in their ministry of bad ideas.

People are running to safety right now with 3 month treasuries coming in at 0.005%. Bwahahaha! We’ve become a big gigantic mattress for the world. Banks are flat out sticking their money here and holding on to their pants for dear life. Remember when the money was given to them for lending to the public? Never happened. Why don’t we go back and yank that capital out of their corrupt hands and use that to fund infrastructure projects and everything else we’ll be launching next year. If they aren’t going to lend it, might as well use it for something that will benefit the country. I have always been adamant against any bailouts but allowing these banks to maintain this capital was a big freaking joke. We’ve just been ripped off by Wall Street and the bankers. How long are we going to allow this to go on?

In fact, I know the big spectacle today was with the big 3 automakers. Regular readers know I have as much sympathy for them as I did for Paris Hilton spending a few days in county jail. Yet I can’t believe the rage some Americans have at auto workers when the true crime is being perpetrated by Wall Street banks and our own Fed and U.S. Treasury. Think about the ridiculous $306 billion back stop that was given to Citigroup on a Sunday night only a few days ago. Did we see the CEO being forced to ride in on a mule to explain to us how they would manage the money? What about AIG and their extravagant parties? How about all those capital injections from the TARP into the largest banks? Last time I checked, I didn’t see anywhere in the bill that stated, “money should be parked in short term notes while country implodes.” It is our money folks. We have a right to have it back if we are not satisfied in how it is being managed. Do you think any of these people are following the laws? They are the people who write the law! Thomas Jefferson is rolling over in his grave:

“If the American people ever allow private banks to control the issue of their currency, first by inflation then by deflation, the banks and the corporations will grow up around them, will deprive the people of all property until their children wake up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

If this foreclosure crisis doesn’t make you feel like we are quickly losing our national home, I’m not sure what will wake you up.

Layoffs Get Worse  Â

The employment situation is getting worse. We are finally starting to look at the employment side of the equation but I’m afraid it is too late. Too much money has been squandered and unless we are going to go and retrieve it out of Wall Street’s hands, we are going to be limited to the amount we will be able to spend since so much has been committed by the ministry of bad ideas. Today, these were some of the announcements:

Du Pont:Â Looking to dismiss 6,500 employees

AT&T:Â Cutting their work force by 12,000 jobs

State Street Corporation:Â Â Cutting 1,700 jobs

This doesn’t even include the 50,000 jobs from Citigroup or the 19,000 from JP Morgan or even the job cuts that will come from the big 3 no matter what happens. Bailout or bankruptcy a lot of jobs will be gone. That is a certainty.

State budgets aren’t exactly swimming in the green either. Earlier this week I went into great detail regarding the dire situation in California and the group of incompetent boobs running the state.  Many states are in a similar situation with their own set of circus clowns. The jobs report set to be released tomorrow will once again show much more damage.

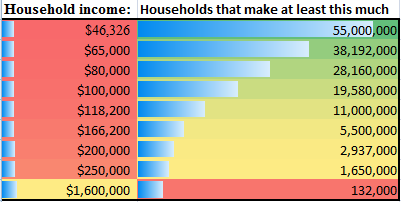

Until people realize that this is about the lower and middle class of America getting fleeced over by Wall Street and puppet politicians, we are going to continue to see poorly planned bailouts that reflect the interests of a very small number of our population. Do you realize that in our country, only 10% of all households make more than $118,200 a year? In places like California and New York that doesn’t go too far. The most recent Census data tells us that there are about 110,000,000 households in the U.S. So let us breakdown the raw numbers:

And this data is one or two years old from the Census Bureau so given the economic collapse, I would imagine that the numbers would still be accurate or even show lower numbers in many categories. So when these banks talk about the people, they’re probably talking about 100,000 households in a nation with 110,000,000 households.

Frugality Revisited

The unfortunate aftermath of decades of massive consumerism is that now many people conditioned on believing they are what they buy will have to come to terms with not buying as much. This is going to be a shock for most. We are so conditioned that things always get better as time goes on especially when it comes to finance that it is hard to believe that the current players have just set us back a decade or two.

The notion that today’s car is better than one that came out last year because it has a $50 plastic iPod slot is absurd because it will cost you $5,000 more. Doesn’t make sense. But if the core of a society is simply consuming blindly then anyone that doesn’t consume is usually at the fringes. Here in California, I know many of the readers from this state even though they had solid incomes and were prudent, probably felt like paupers in their groups because practically everyone around them were buying bigger homes and driving around in leased cars. Yet it was never really wealth. Yet the mind is hard to convince when you see everyone flocking together as a herd.

Frugality is coming whether we want it or not. During the Great Depression, there were many people pining for the heyday of the Roaring 20s but it never came back.  It couldn’t. It was one gigantic bubble just like the one we’ve lived through. All these bailouts and the gimmick of lowering rates to 4.5% keep on grasping at this notion that we somehow aren’t a poorer nation. We are. We can try denying this but the sooner we come to terms the quicker we can get to being productive. Yet so much of the money is being funneled into unproductive activities like propping up banks that should fail. Fail as in right now. Otherwise, we are going to have a lost decade like Japan where capital is diverted from productive activities to keeping pathetic banks on life support.

Think of wealth this way. Why did gold cost $35 an ounce during the Great Depression and now is going for $765 an ounce? Did it somehow become 21 times more valuable? Well gold is actually tangible and has a fixed amount. With a fiat currency our central bank can print as much as they like or create all these absurd facilities to channel the wealth to their own self serving interests. Yet that is the problem. Too much power is concentrated in a few hands. This is the end effect. There is nothing holding us back from printing or bailing out anything and everything. Isn’t it funny that we haven’t heard someone say, “well you know what, we only have about $1 trillion more left for bailouts.” They’ll never say that because theoretically they have nothing keeping them in check. They can print but our U.S. Dollar is being under siege by the people who we put into power to protect it. Don’t listen to their words. Every action they are taking is to lower the dollar value to hopefully help us with our enormous debt. Debt that is going to their crony Wall Street and central bank friends.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

42 Responses to “SIIV – Super Ignorant Investment Vehicle: The Evolution of Progressively Dumber and Dumber Bailouts. 3 Emerging Trends: Bailouts getting costlier and dumber, layoffs accelerating, and embracing frugality.”

You hit the nail on the head…too bad its going to take a depression to wake up the sheeple in this country. We are already in one.

i think inflation (depreciation of dollar) is inevitable. u.s. dollar is nothing more than some toxic waste poisoning the world. soon or later it needs to be cleaned off.

god forgive us when the world decided to throw dollar out the trash can. it will be armaggedon. (did i spell it right?)

inflation is inevitable. dollar is nothing more then some toxic waste.

Dr. HB: The twit this and reddit button bar still doesn’t seem to work. At least not for me.

The banking cartel called the Federal Reserve is destroying our currency, going against one of their own mandates. They are scum, all of Wall St. is scum.

I’m still shocked that these people are not being picked off with high powered rifles. The populace obviously has no clue about what the banksters are doing. This can’t end well.

It’s up past 8 trillion in bail-outs and guarantees now. Debt has to be serviced, defaulted on or forgiven. Since there will be no way we can service the debt, there will be a de facto default by inflating away the value of the debt. The $240K loan in the above example will have its value inflated away, As illustrated above, the higher interest rates that the revived inflation will at first produce lower values as in the example. However, if the pattern of the early 80’s is followed, when people notice the value of their “money in the bank” inflating away, they will want to get into hard assets, like houses and the value of those houses will begin to increase again as people flee the devalued dollar. When I got my first home loan, I bought the rate down to 18.5%!!! But home prices were going up even as interest rates went up. When prevailing interest rates are 18.5% as they were in the early 80’s, those holding a 4.5% or a 6.5% loan are watching the real value of their debt evaporate. Those who take on fixed rate loans at 4.5% may just be making the best investment decision of their lifetimes if they can hold on for the first few years. They will get to repay their loans with increasingly devalued, and perhaps eventually nearly worthless dollars.

Another good post doctor, thanks. The government is indeed just kicking the can down the road.

One of the things I don’t understand is why foreigners contunue to fund our irresponsible spending by supporting the USD buying T bills. And just where are they getting the money to do so?

>

I also read somwhere that the Federal Reserve may start buying T bills. Can they do that? Where do they get the money; from their failed banks or from the American taxpayer? An old adage comes to mind… don’t pee down my leg and tell me that it’s raining.

>

At least energy prices have subsided. A good thing to consumers (is the price drop a bad thing because it is deemed deflation???). My personal opinion regarding crude oil is that we are at the tipping point.

Keep up the good work but don’t blow a gasket.

Comrade Housing Bubble,

Another outstanding post. I want to comment on your statement “All these bailouts and the gimmick of lowering rates to 4.5% keep on grasping at this notion that we somehow aren’t a poorer nation. We are.” Of course it depends on how you define poorer. If the unrealized, “paper” wealth really existed, then in indeed we are poorer. But I submit that the wealth never existed so we are not poorer. The only thing that changed is that we have become acutely aware of our wealth delusion. We are however, richer in the sense that we are again realizing that virtue lies within, not in material things (ok, call me a dreamer). Let’s just say that it’s long overdue.

~

Regarding the reduced mortgage program, it’s a total sham. The program provides low mortgage rates for new loans (not refi) with the existing high lending standards. What that means is that only the people who currently qualify (i.e upper income households with excellent credit) will get the low mortgage rate while doing nothing for low income households. This will have no affect on foreclosures yet transfers even more wealth to the upper tier households at the expense of lower tier of households.

~

Regarding the automakers, the concessions being sought by Congress are unworkable. So what if a car gets 40 mpg if it still costs more than the foreign competition? Until the US automakers can get their cost structure in line with the Koreans (yes, even the Japanese will get squeezed), then they are doomed to fail no matter how much money they get. The irony is that to get the cost structure down will mean massive layoffs and renegotiating pay and benefits; the exact thing the bailout is suppose to prevent. Of course, none of the CEOs with hat in hand are willing to admit this since this would probably get them lynched upon their return to the Motor City.

~

Be brave Comrades!

stan: Except that those “nearly worthless dollars” will be few and far between after spending $1,000 at the grocery store for one day’s worth of food.

~

I agree that these people’s lifeless bodies should be swinging from lamp posts.

I too have been trying to figure out this seemingly endless hostility towards the auto workers and the big three. Sure the heads of the big three mismanaged their companies and made crappier and crappier cars as the years went by, but is that news to anybody? Up until the economy collapsed, people were still buying their cars on a regular basis. And the big three didn’t perpetrate the kind of massive ponzi scheme fraud the banks, lenders and mortgage brokers did on this country and the world’s investors. They simply made worse cars than Japanese or European car makers did.

So why are we making them come begging for a paltry 34 billion ( compared to the bazillion gazillion dollars the Wallstreet dicks have gotten free and clear ) hat in hand, rattling their empty tin cups. Where did all that money that the banks got go? Did it help keep millions of people employed, like it would for the big three? Or did it just line the pockets of the smartest guys in the room? The Masters of the Universe must be laughing their asses off right now. They thought they had screwed us in every way possible over the years, but lo and behold, they found a way to bend us over again, without hardly a peep of complaint. Meanwhile the people who’ve made our cars for a century get treated like the scum of the earth..WTF?

Thanks DHB. Keep it up.

SJ

2 comments:

1) ” I know many of the readers from this state even though they had solid incomes and were prudent, probably felt like paupers in their groups because practically everyone around them were buying bigger homes and driving around in leased cars.” EXACTLY!!! I’ve been saving for a downpayment so I don’t have any expensive toys/cars. Meanwhile, I see my broke friends with nice things. It’s funny, I have a lot of money in the bank but can’t brag about it – so essentially, I have nothing to show for it.

2) I can’t completely blame the banks for hording their cash and not lending. What you omit is that they are not lending to people with low FICOs, and there’s a lot of people like that. Have you heard of a bank not lending to creditworthy poeple? (cuz I haven’t) For several years people were rewarded for ruining their credit scores. Now all the sudden it’s en vogue to have good credit again, but that takes at least 7 years to accomplish. The banks must be selective, and there is a diminished pool of suitable loanees out there.

In defense of the Treasury Department and their 4.5% plan, sometimes in a crisis you gather your brightest minds around a table and tell them to think-out-of-the-box. When you do that, you come up with crazy ideas, but some of those crazy ideas — whether individually or combined together — actually work.

The Army Corps of Engineers performed such a round table. The goal was to find a rapid way to repair levees when they failed. Some of the ideas came straight out of comic books and had no way of succeeding. But some of the ideas, crazy though they might seem at first, actually worked.

No, I am not in favor of the 4.5% plan for reasons you pointed out, as well as for other reasons. I just want you to realize that there may be more to this than we know.

As I always say, What did Hank Paulson know about how Goldman Sachs made money?

If this guy didn’t know that leverage of was the basis of all the wall street profits, no wonder he can’t figure out that more leverage and artificially low interest rates are the solution to everything.

If he did know…he’s a criminal running a Ponsi scheme

@Stan,

I don’t really understand real estate, but I do enjoy reading this blog & the comments. I was hoping you could explain why you think that taking a fixed rate 4.5% loan is great when the blog post says “So let us take a look at a poor sap that buys a home with a 4.5% 30 year fixed rate.”

I am getting ready to move to the Tampa area this summer so it’s of particular interest to me…

thanks,

Mike

I find it amazing that people thing that Detroit makes junk. Please provide an example! Perception is the problem.

On the other hand…..

http://www.freep.com/article/20081205/COL14/812050400

Reality: The creaky, leaky vehicles of the 1980s and ’90s are long gone. Consumer Reports recently found that “Ford’s reliability is now on par with good Japanese automakers.” The independent J.D. Power Initial Quality Study scored Buick, Cadillac, Chevrolet, Ford, GMC, Mercury, Pontiac and Lincoln brands’ overall quality as high as or higher than that of Acura, Audi, BMW, Honda, Nissan, Scion, Volkswagen and Volvo. J.D. Power rated the Chevrolet Malibu the highest-quality midsize sedan. Both the Malibu and Ford Fusion scored better than the Honda Accord and Toyota Camry.

Oh and they make lots of fuel efficient cars too!

http://www.freep.com/article/20081205/COL14/812050400

All of the Detroit Three build midsize sedans that the Environmental Protection Agency rates at 29-33 miles per gallon on the highway.

The most fuel-efficient Chevrolet Malibu gets 33 m.p.g. on the highway, 2 m.p.g. better than the best Honda Accord. The most fuel-efficient Ford Focus has the same highway fuel economy ratings as the most efficient Toyota Corolla. The most fuel-efficient Chevrolet Cobalt has the same city fuel economy and better highway fuel economy than the most efficient non-hybrid Honda Civic.

A recent study by Edmunds.com found that the Chevrolet Aveo subcompact is the least expensive car to buy and operate.

It is our money folks. We have a right to have it back if we are not satisfied in how it is being managed.

The fed and treasury attracted subprime borrowers like Citigroup, Chase, et al with teaser rates. Subprime borrowers like that will likely be delinquent. But the stupid lenders (fed and treas) won’t foreclose because they believe in a moratorium on foreclosure. So the borrower has the asset rent-free.

Great post. I, like many others, am furious at this situation. My country has not let me down. The government, greedy politicians and greedy populace has. I do not blame Europeans and others for feeling this problem is a creation from America. As I read the comments on this blog I see where people are getting more and more upset and making statements that include violence. All this turmoil so that the avarice of wall street and the American consumer can be satisfied. There are so many to blame. One of the main players at the epicenter of this debacle is ALAN GREENSPAN. Hopefully there is a special place in hell for many of these people!

My only debt is a house payment. No $ in the stock market and I have a secure fed job. I saw the writing on the wall back in 2002 thanx to Alex Jones. I started securing my assets and money back then. Glad I did.

Jason

This is very interesting. China is beginning to “tell us” what we should be doing with their assets…

“The important reasons for the U.S. financial crisis include excessive consumption and high leverage,” Zhou Xiaochuan, governor of China’s central bank, said in a statement. “The United States should speed up domestic adjustment, raise its savings rate and reduce its trade and fiscal deficits.” Wang Qishan, China’s deputy prime minister, was more blunt: The United States, he said, should stabilize its economy as soon as possible to “ensure the safety of China’s assets and investments in the U.S.”

http://www.iht.com/articles/2008/12/05/business/paulson.php

OJ WHO?

Mucho love,

Just let the whole house of cards crash. If I were advising President Obama, I would urge him to form a “Doomsday Group” to plan for extreme eventualities. Now you would think the Defense Department or our intelligence agencies do this sort of thing, but after the last eight years I wonder if the federal government could hit itself in the ass with a snow shovel. We raise enough food to feed ourselves, and we could plant enough sawgrass to make cellulosic ethanol to make up for any oil we import from other than Mexico or Canada. Oh, and will someone please pay attention to the Great White North please? It’s starting to come apart up there. We need to start preparing the lifeboats.

Zack – those links are to a (ahem) DETROIT newspaper.

Just saying’…..

I think it is too late. We can’t recover from this, and the minority in charge, has done all the wrong things. I wish somebody would & could stop them. I’m afraid the only solution is revolution and a bullet in all their heads.

Yeah Big Finance gets a check without even having to ask that hard but the Big 3 (who really represent the actually PRODUCTIVE base of the economy) have to beg and grovel.

In governments like ours didn’t used to be these dramas used to be called show trials. Bread and circusses to distract the peoples’ attention while they get fleeced by the REAL players.

Much as I hate the UAW I do not believe in any way that we would benefit by exporting our high-tech manufacturing overseas and keeping (as the good dr. has said so many times) the portion of our economy that does nothing but transfer funds between themselves.

I would love to refi at 4.5%, regardless of future home prices. That would be MY bailout.

Who’s let us all down? The repudiation of Bretton Woods in 1972.

I love hearing that quote from Jefferson. And from Henry Ford, directed at the Federal Reserve, “if America knew how the banking system worked, there would be a revolution tomorrow.”

If only they had to print paper…too expensive. Just push buttons on a keyboard number pad. It’s easy to type 1000000000.

Ah, the weakness of a fiat currency backed by a nation with declining real value. Our greatest intrinsic value has been our political system and way of life, which draws talent from all over the world to create new value, but I fear that is not as valuable as in the past.

If only everyone understood that the Federal Reserve is an above the law private entity with no oversight. Who are these people? I wish I could see the face of my captor.

I agree whole-heartedly with Dr. HB. We have not bought a home b/c we are waiting, as many of the other readers. My wife and I make good income but I also feel like “paupers” b/c we live frugally, and don’t splurge like all these other irresponsible consumer fools, who must have the latest BMW but cannot even afford the rent on their $1500 apt!

OK, I broke my own rule and watched Cramer on Thursday night because Bob Toll was on. According to Cramer, housing will bottom by June 2009 and rated Toll a “buy”. (You can see the interview on the CNBC website.) I almost fell out of my chair on how delusional these talking heads are. It’s almost as if Cramer knows something and is intentionally trying to fool us but I really don’t think he is smart enough to pull that caper off. Then again, he could be the Dick Cheney of the financial world.

In the early 1980s, I had two things of note happen to me vis a vis the US auto industry and the UAW. My first experience was a trip to the local (RTP Area of NC) to look at and finally purchase a Cadillac. After being prepped and having some door moulding straightened, I drove it home where upon I noted that whenever I crossed some railroad tracks or hit some rough pavement there was one hell of a clatter in the passenger side door. I took it back to the dealership and a manager hoped in for a test ride with me. Yep, trouble in River City. They took off the door to find a coke bottle with a note in it. The note read: Well you rich s*n of a b**ch, I see you finally found it. The car went back to the dealer and I bought a Mazda RX7.

The second experience was with the loser brother of a rather pretty nurse I was dating who had come down to Chapel Hill from Michigan to see his sister. He had gotten out of a short prison term for auto theft, but he had something I didn’t…a job with GM. His dad was fairly high up in the union and used his influence to get his son a job. He was making roughly twice what I was making as a cancer researcher here in the RTP (NIEHS) and was bragging how he loved layoffs and down time because he got 95% of his take home pay whether he was working or not…for up to three years. You won’t find any sympathy from me for american union guys. Killed the goose that laid the golden eggs! Tough! Go work at McDonalds if you can add two and two.

William H. Macy, as “The Shoveler” in the movie Mystery Men said it nicely: “We’ve got a blind date with Destiny — and it looks like she’s ordered the lobster.”

I know HSBC is requiring 35% down and a 720 FICO for a mortgage in CA (not sure if it’s a nationwide policy).

To diogenes: Nice try, but your first “true story” is as old as the hills. I remember hearing that urban legend for the first time over thirty years ago. The second “true story” is so full of inaccuracies that I have to assume your claimed role “as a cancer researcher” must have been as a research subject or a member of the (likely non-union) janitorial crew.

When did become un-American to be frugal and content, rather than in hock and endlessly acquisitive?

I thought we did everything right; we saved our money, paid off our debt, lived frugally, and still waiting to buy an affordable house where we live in Socal. Now my husband just got laid off this week. I had a baby less than a year ago & a 6 year old. I stayed home to save money on childcare. Now, we need to use our savings for living expenses & healthcare (1200 per month!). We will only receive assistance once that is depleted? I am so upset, crying as I type this. There is no bailout to help us. Please let me know if there is.

Idled workers occupy factory in Chicago

CHICAGO – Workers laid off from their jobs at a factory have occupied the building and are demanding assurances they’ll get severance and vacation pay that they say they are owed.

About 200 employees of Republic Windows and Doors began their sit-in Friday, the last scheduled day of the plant’s operation.

Leah Fried, an organizer with the United Electrical Workers, said the Chicago-based vinyl window manufacturer failed to give 60 days’ notice required by law before shutting down.

-snip-

more at:

http://news.yahoo.com/s/ap/20081206/ap_on_re_us/workers_takeover;_ylt=Ajkun7GvooGOygeq.YL5FeBvzwcF

Is it me….or is that a pretty big story?

Dr. HB-

Nice one, once again. The Empire crumbles in front of our eyes. I like the violent undertones of some of the comments, as I think there will have to be some good old fashioned violent protests and riots to stop our “elected” officials from continuing to do everything in their power to destroy the United States. Visions of an Amero equivalent being foisted on the public come to mind. Why else would our government be doing do everything in its power to destroy our currency?

@ eternal summer,

It seems the only bailout for you and your family is to move-in with family like many of my friends and family have done because

1. they have been recently laid off from their job/carreer and have had no luck in

finding work.

or

2. in efforts to save for a down payment for these (still) ridiculously priced

homes in the decent areas of LA or OC they are trying to live rent free.

Good luck and Take Care, RL

about the violent/protests….

i talked to my dad after hubby was laid off & mentioned about going after the people that received bonuses, etc….after companies got bailouts/went bankrupt he said that would not happen since everyone wants a shot at being that guy with the golden parachute….y/n?

what does it take to be one of these aholes that walked away with beaucoup bucks destroying the economy?

i hope you wrote all your state reps…harman, feinstein, etc….to tell these geniuses how “grateful” (sarcasm) you were for the bailout since it has saved so many jobs….

Robin,

>

Careful there!

Actually, the rest of the world is so P’d-off at Wall St.(aka Washington D.C.) for peddeling the worthless junk that what you suggest may just happen (from external sources). This, obviously, will lead to other problems. Find a fox-hole, fast!

The best the American people can do is demand justice for those responsible for the crime. You won’t get it from this administration’s justice department. Maybe the next?

Gold, etc?

wall st. paid $7b seven billions in bonuses etc.

Where do the vip’s stash their Loot? in ..05% t bills>?

eternal summer,

What you are going to want to do if you have not done so is have your husband file for unemployment insurance. This isn’t much. Maybe $300 to a max of $450 a week depending on his salary. This may hold you over for a few months until he can land on his feet. You can find that information here:

http://www.edd.ca.gov/Unemployment/

It is best to file online since they are having an inordinate amount of phone calls as you can imagine.

Mike,

Let’s say you buy a $200K house and somehow get a $200K loan to do it. Maybe over the next 10 years we have massive inflation, and in 10 years, $200K will now buy you a motor scooter instead of a house. If you have a 30 year fixed rate loan, the value of your payments are trivial and the value of the remaining balance of the loan itself is nearly nothing. The “flip side” is that if we have deflation, the house you bought for $200K might only be worth $100K and your paycheck might be cut in half as well, and your payment on a house that is worth less than the loan would be crushing. What’s your “crystal ball” say? I just don’t see how we can spend all this money we don’t have, and not eventually have inflation get us.

Dr. H-first thing i did was file online for his UE benefits…we’ll see where that goes

RL-don’t think I haven’t thought of doing that….

I had my own domestic manufacturing business before I decided to lay low and have my 2nd child. I am thinking about cranking that up again as I still have my studio. What worries me is my former sales rep says business is off 25%….and retailers who carried my line are dropping like flies…..but the good news is international market strong-Russia, Middle East, etc….I may have to risk what we have to take a chance on this…..

I am upset, for sure, but thanks to this blog & others and my unhealthy obsession with real estate, I was able to be really frugal these past couple years as we saw this storm coming.

Re: DHB 12/4. Let’s consider some numbers.

~

100K mortgage. Fixed 30. Two rates: 4.5% and 6.5%

~

~

4.5%

monthly payment: $506

total interest paid: $82,406

interest as percentage of principal: 82%

principal paid by month 72: $10,861

interest paid by month 72: $25,619

~

break even**: year 14 1/2

interest paid at that point: $56,000

~

~

6.5%

monthly payment: $632

total interest paid: $127,544 (127% of loan value)

interest as percentage of principal: 127%

principal paid by month 72: $7,934

interest paid by month 72: $37,574

~

break even**: year 19 1/2

interest paid at that point: $105,000

~

~

** “break even” meaning the point in the amortization where each month, the borrower pays more to principal than interest.

~

A quick look shows:

~

a) Per $100K, the difference in monthly payment is $116.

b) The real difference is that at the end of six years (72 mo.)–which is around the average for how often Americans move–the borrower with the 4.5% loan has paid $10,861 to principal, while the borrower with the 6.5% loan has paid only $7,934.

c) The 4.5% loan is a more rapid equity builder.

d) The 4.5% loan also saves the borrower 45% of interest as percentage of principal.

~

Doc, I think this is what that financial uber-minds are looking at as they push for lower rates.

~

I agree that there are a lot of people in houses, or trying to get in, who really shouldn’t be considering a house purchase for various fiscal reasons.

~

I also agree that house prices have to come way down, especially in inflated markets, to get more in line with income. Many people are now concentrated in highly bubble-affected areas. Prices. Must. Come. Down.

~

But here’s my larger point.

~

Why not take the lower interest thing a step further?

~

We have seen a proliferation of **interest only** products over the past x years.

~

If we’re all bailing out the banks as it is, and we know we are, then why not have **principal only** loans for people who need to be saved from their own or others’ improvidence, greed, or failure to look at numbers?

~

That is, for a fixed period (12 to 24 months), primary home owners in trouble can refinance to the Compass Rose Emergency National Housing Loan Program (CRENHLP!), where the last one to two years of the amortization curve are shifted to the front of the loan. That is, during this adjustment/equity building period, the borrower pays far more to principal than to interest. (See any mortgage calculator with full amortization tables, and run the numbers yourself.)

~

There are incentives for everyone. The borrower builds equity quickly, making jinglemail far less attractive. After one to two years, the “reset” is to the usual front end of the amortization curve. The bank thus has incentive to choose borrowers who are more likely to go the distance, rather than those who will be profitable on the front end/few years, then who cares, because they’ll just have to refi into more lucrative packages, right? Right? RIGHT? And the government would have the respite of having to give tax breaks for the next year or two on these mortgages.

~

Of course the whole point of mortgages is to front-end-load the interest payments in the first years, because Americans are mobile. Lenders want to keep resetting mortgages to the most lucrative part of the amortization curve. The front. Bankers and lenders have built their industries around turning every median ($200K) house sale into a half-million-dollar financial transaction. But it’s also the case that with wages frozen and the prices of everything going up, the only way to keep most people even remotely arithmetically connected to the possibility of house bying is with these outrageous loan terms (30+ years) and the vast and lucrative interest loads that go with that.

~

rose

Leave a Reply to scared Indio