To buy or not to buy – Flippers, college degrees, and the tight housing market of California. Media now investing in flipper television shows.

You knew it was only a matter of time before home flipping shows made it back to the reality circuit. No longer are people watching Canadian real estate bubble shoppers and having people edit out any reference to the city (or country). 2012 brought out a furious jump in California real estate activity. A perfect artificial market with the Fed as puppeteer has boosted the market for the short-term. Remember however that the Fed was also instrumental in setting the stage for the first housing market boom by lowering rates and essentially ignoring the nonsense going on in the global mortgage markets in the early 2000s. So those that put all their faith in the Fed need only look back a decade or so. Yet the force of flippers in California is so intense that you can see it in the eyes of some investors that “this time is really different and we are back in the game!â€Â In Highland Park, we see an expert flip but also examine the current state of the housing market. To buy or not to buy, that is the question.   Â

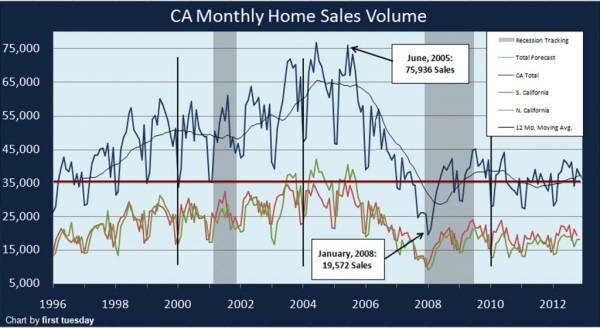

California home sales

First let us examine home sales in California:

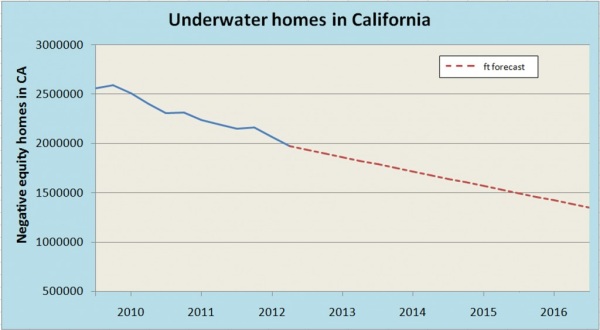

While home sales look like they are surging, they are surging from a very low point. We are essentially having the same level of home sales as we did in 1996 and 1997 with a much larger population. So in essence what is going on is you have a much larger pool of buyers contending for a very constrained amount of inventory. We can see this especially with the underwater segment of homes in California:

Source:Â First Tuesday

You have about 2,000,000 homes in California that are underwater. This is incredibly important. Why? First, you have slightly above 5 million homes in the state with a mortgage. So of those with a mortgage on their home, 2 million are underwater (that is nearly 40 percent of mortgaged Californians are still underwater). When we factor in those with a paid off mortgage the figure drops below 30 percent but you understand why inventory is constrained. Many of these underwater homeowners are still paying on their mortgage diligently and many would like to sell but rather not go through the short sale process. And many others are staying put while not paying a dime courtesy of the bank moratorium on foreclosures in certain areas.

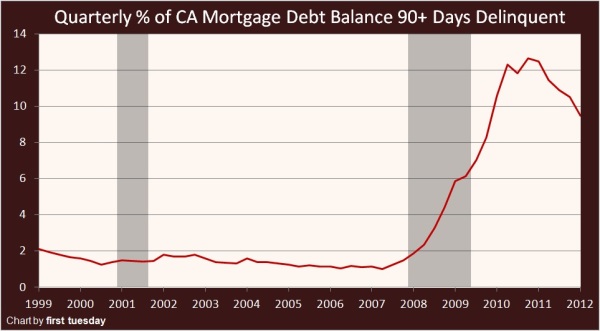

The number of mortgages that are delinquent is still high:

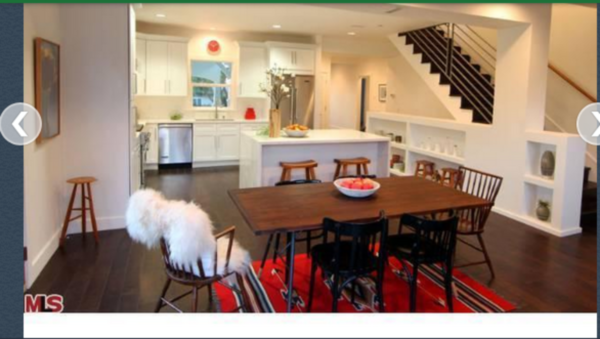

While the rate is going down, we are far from the 2 percent baseline. Yet some areas of the state are now seeing fierce competition from flippers and other hot money. Take a look at this flip in Highland Park:

1132 Le Gray Ave, Los Angeles, CA 90042

Bedrooms:3 beds

Bathrooms:3.0 baths

Single Family:2,334 sq ft

Lot:6,839 sq ft

Year Built:1924

This is an interesting flip because of the quality put into the place. Also, it looks like the initial place was listed at 2 bedrooms and at 684 square feet so a lot of work was done here:

This was no fly by night flip. This was done by experts. And take a look at what price they got this place for:

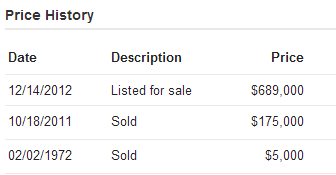

The home was picked up for $175,000 only one year ago and now it is listed for $689,000. What is even more astounding is the home was listed on the 14 of this month and now has a pending sale. This flip required a lot of money to be put in but with a $514,000 gain in one year, I’m sure there are profits to squeeze. And I spotted this over at Redfin and take a look at this post:

Get your DVR ready because the flipper shows are coming back to SoCal! And why not? Flipper activity is intense now and there is plenty of this going on in various hipster neighborhoods. For example, last year 3.7 percent of all homes sold again within a six month window. Today it is up significantly at 6.2 percent.

Fed policy makers come out against current policy

One of the biggest arguments regarding buying today revolves on the all powerful Fed. But even within the Fed there are now those disagreeing with current policy:

“Reuters: – “I do not believe that tying the federal funds rate to a specific numerical threshold for unemployment is an appropriate and balanced approach to the FOMC’s price stability and maximum employment mandates,” he said in a statement, referring to the Federal Open Market Committee.â€

“Reuters: – “Deliberately tilting the flow of credit to one particular economic sector is an inappropriate role for the Federal Reserve,” he said, adding that trying to influence credit allocation within the economy was a function of fiscal policy.â€

Dallas Fed President Richard Fisher is calling the policy a Hotel California policy which is very appropriate. We’ve talked about this where the market is now addicted to ridiculously low rates. They now have no choice but to continue down this path regardless of symptoms and spillover effects that we are already seeing. Even if interest rates went back to 6 percent which is much lower than the 8 percent 40 year trend line, the housing market would find itself moving lower yet again. In places like California, the impact would be dramatic.

But let us play a little bit of devil’s advocate here:

3 Reasons to Buy Now

#1:Â Â Record low interest rates

#2 :Â Federal Reserve fully focused on housing market

#3 :Â Buying into momentum

Two of the top three reasons to buy right now involve Fed action. The assumption is that this can go on for a very long time. We have many potential Black Swans over the horizon with our fiscal situation, our state volatile budget, and the higher education bubble. Those aspiring to be part of the middle class in California seem to have no choice but to go to college:

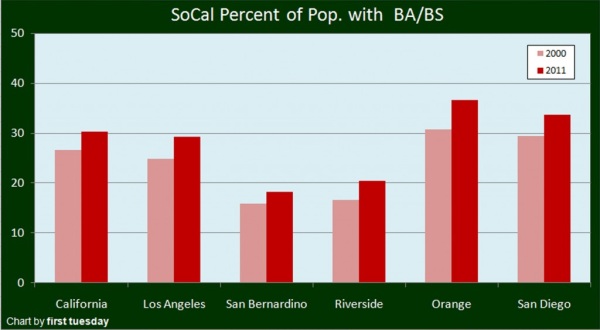

In California nearly 30 percent of the adult population has a 4-year college degree. This has gone up in the last decade and there is little reason to doubt the momentum has changed recently. Yet what has happened over the last decade is college tuition has soared. So you have those future young home buyers straddled by high levels of debt. Another reason given to buy right now is you would be buying or selling into momentum. Yet to play today’s game, you need to realize you are diving into a very low inventory market with multiple players trying to get a piece of the pie. One investor e-mailed me regarding short sales saying that whatever you see hit market is the crumbs left over after insiders took their bids on good properties. Short sales are a big part of the market but the best is not what is hitting the MLS. There are countless articles on short sale fraud and how the game is manipulated.

Let us look at the other side of the argument:

3 Reasons to Avoid Buying

#1 :Â Artificially low rates and low supply

#2:Â Fiscal changes and taxes

#3:Â Speculation in current market

The low supply is making things look more competitive than they should be. As we highlighted before, nearly 40 percent of all homes in California with a mortgage are underwater. So the vast majority are simply sitting this one out. Low rates with FHA insured loans are increasing the pool of potential buyers to almost anyone:

-Those with a low down payment and stretching their budgets

-Conventional buyers

-Flippers

-Big money investors (i.e., Wall Street funds)

-Foreign money

If we refer back to the first chart in terms of sales, overall sales volume is simply back to levels last seen in 1996 and 1997. Yet it appears more constrained because the demand side is much higher and supply is extremely low (those 2 million underwater and banks just leaking out properties and manipulating the market). They are hoping Fed momentum continues deep into 2013.

Yet many of the younger home buyers simply do not have the resources to compete. We already see this via their income potential and their debt levels with student debt. You have many parents in California gearing up to gift their homes to their children locking in Prop 13 tax rates which creates an odd sort of legacy program. At the core of the US storyline is that you earn your success by your own merits, not some odd form of aristocracy that you gift properties to heirs like in European nations. Yet that is what you see here. So it should be no surprise that Prop 13 is now back under the radar for policy. And that is another factor that would sway some from buying. The state is largely half owners and half renters. So it is easy to see how the politics can sway to open this back up. We just showed that we are willing to raise taxes on everyone in the state. So why is it hard to envision taxes going up for half of the state? When Prop 13 initially passed it was done by portraying grandma being kicked out of her home because of rising taxes. Yet that can easily be fixed by exempting those cases.

To buy or not to buy, that really is the question. Flippers are diving in with a full head of steam and the shows are back to glamorize. How long can this go on? Hard to tell but with household incomes not rising they better hope that hot money continues to pour in.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “To buy or not to buy – Flippers, college degrees, and the tight housing market of California. Media now investing in flipper television shows.”

If I sell my home now, where will I go? The inventory is tight. As easy as it will be for me to sell my 500K(no debt) home(been in Burbank for over 20 years), it will be hard to get another decent home in Claremont. Rents are going up too.

exactly. Got about another three years to work and then will take a look at where all the kids are (Central Coast, Midwest, and LA area), what to do with my elderly mom and decide from there.

I wonder how many flippers have college degrees.

I like your question!

Love this BLOG SOOO MUCH!

A reality check with amazing data to back it.

In answer to the title,

NOT TO BUY, that is the answer!

If we stop buying , then maybe just maybe

it will all collapse and then we can move on to a

real market!

BTW, I WANT to buy soooooo badly

(and I can afford to buy, even at these bubble prices)

but I will continue rent, for the principle of it!

Bob,

This is MHO but… I don’t see how the market will come down. We already saw that this administration with the help of the FEDS (or strong influence) will NOT allow this market to come down. Both the Feds and States has put these legislation in place to help support the market (good or bad) to “kick the can down the road”. Examples are Mark to model account change, SB 1137, California Homeowner Bill of Rights, etc…

What the “regular media” doesn’t talk about is Wall Street and how they have now officially come into Los Angeles county and are buying up properties. These “buyers” have billions of dollar to spend and are not gun shy to spend it. These folks are propping up values and buying up a storm right now in the Greater Los Angeles area….

The problem…… THEY ARE NOT FLIPPING!

They are holding on the properties to cash flow them. Verbatim from a fund manager – “we ONLY care to make a 6% to 8% NET yield”. If that is the case how can ANYONE compete.

My opinion is this… most “mom and pop” investors will get priced out (just like the folks at the retail level).

I actually did a 2 hour webinar explaining these changes. This is a replay but I do talk about the wall street buyers are distorting the market by buying properties at 85 cents on the dollar and how “mom and pop flippers” need to change to stay competitive. Maybe you’ll get value out of this?

http://www.youtube.com/watch?v=tJjsYSBq1ho

The FED can’t keep printing money and there be no consequences like inflation. They can keep the game up as long as inflation stays in check. When it really takes off, they will have no choice but to raise interest rates and then home prices will come down. The question is, how long can they keep this up? Why does Bernanke want to leave? Could 2014 possibly be checkmate?

I’m buying I been reading this Dr HB article all this year too much speculate not to buy.

out there inventory running low. I just purchase a property 330.000 in Rancho Cucamlonga

if I bought on summer July or August I could save 30.000 or more. I’m tired of waiting there allot of good deal out there. the good time to buy it the time you can afford.

Rancho what??? Lol!

Yes, better buy now before interest rates go up and house prices collapse further down.

http://www.vcstar.com/news/2012/dec/22/giant-investment-firm-plans-to-convert-scores-of/

This is what is going on around here.

I found this to be a very interesting article. This company has bought over 100 homes in Ventura county, in the last 6 months, not for flipping, but for rentals. With such an aggressive purchasing of homes, this explains the low inventory, and rising prices. I am sure that they are not the only company doing this, in addition to the small time cash flow investor.

What does this indicate about future rental costs for homes in this area? Can we expect rents to increase faster than home prices or CPI? I think that this is an interesting area to explore, as most folks seem to focus on capital appreciation. Is this the next great investment opportunity, or is it too late now that prices are rising, and the competition to purchase a house is increasing.

But that company doesn’t understand where they are buying, Oxnard. A city where 5 families will move into the house and destroy it and not care. Also, when they realize some renters don’t pay rent on time or not at all, their profit margin starts decreasing and it no longer looks as great as they thought it would be.

Paul

We lived in Thousand Oaks post two-story home sale and finally bought a one-story cutie (4+2+pool) in Simi in late Sept 2012 all cash. We just updated the kitchen, baths, flooring, paint, windows, roof, appliances, etc… It was stressful beyond the price tag.

We feel blessed. We;re here until we die (aka our toe-tag home). This house should have been priced at $275K max, not the $400K we paid. Inventory is tighter than we we bought. Ventura County is dry for us modest house hunters. We cut our sq ft in half and are purging belongings. Less is more.

I find it disturbing that the banks are selling these directly. This has to be criminal.

It is a crime for “YOU” to break the laws not for the banks.

I live here in Ventura County and I read this article this weekend. I agree with Tricia that Oxnard is not my first choice for investing. However, this is what is happening to inventories all over So. Cal.. Look at the return on long term investing. This company is smart because they are not flipping. They are holding long term. That interest rate is long term too. As long as rent is covering payments today, it is likely that it will continue to cover for the remainder of the loan term. Buying long term right now is a smart play, but I would suggest going with an area of great schools. Good quality public schools are going to be more and more highly desirable in a state where most schools are failing and under funded. Conejo Valley communities, Thousand Oaks, Westlake Village, Agoura Hills and Calabasas are quality investments. My wife and I just bought a house to rent out near a great school here in the Conejo Valley 1 block from an award winning school. The mortgage is $1940 per month. It was a fixer, but after improvements we are renting it out for $3,000 per month. The rent covers our property taxes and insurance, and even leaves money left over to bank for an emergency repair fund. Even if rents go down 1/3 of what they are today, it would still cover the mortgage. When we retire we will have a nice source of income. What this company is doing is spot on. They are looking at the long term investment, not the short term.

Where to go after you sell your CA home for some crazy price? To a better state, that’s where! With the rising taxes and insane regulations, I’m surprised anyone wants to live in The People’s Republic of California anymore. For 500k you could come live in the cheap Midwest with no state income tax in TN and put a sizable amount in silver bullion to boot

Umm sure, but then you live in TN with a big pile of silver. I can’t swim in the silver, I can’t change the attitude of those who live there, can’t change the dank weather and the bugs…what’s more important than environment? Homes are cheaper in other places because there is less going on. If you don’t like the CA life then obviously the sane thing to do is leave but this place is irreplaceable and very special and unique to many people, despite all it’s flaws. Affordability is too be found…if you are looking in the right place. I live in San Pedro and for all it’s flaws, I think we have all seen that its no safer to raise a family in a small CT town then it is here.

I’m sure Jerry Brown appreciates idiots who “think” like this.

Having the chance to take a job in TN or CA years ago, it’s comical who would take CA.

There are no fireflys in California….

So now is the time to buy in Pedro?

I’m glad you feel safe in San Pedro, but that probably means you’d feel safe anywhere. I lived in RPV and grew up in the South Bay. I’ve never felt safe driving through San Pedro. That place is a ghetto.

I’d rather be poor in Pasadena than rich in TN or anywhere in the MidWest. No Gracias!

Me too.

Good for you. I left Calif. and bought a property for 75000.00$. 2300 sq ft home on 50 acres with a 5 acre lake. 147.00 a year property tax one utility bill averages 112.00 a month. No body bothers me until I punch the remote on my electric gate securing my 500 ft drive way. You stay in gang banger land and maybe some day I will read about you on dreamindemon.

Greg, I know that in the hills of eastern Tenn the folks can make some good “white lightning”(but the price of corn is so high now and the quality used by many is subpar), but I think that the promised land is Texas compared to Tenn. Northern Dallas has some good neighborhoods. But thanks for the advice.

Agreed, Greg. I rent in small house in Studio City for $3K a month, and, although I’ve been living in L.A. for 15 years, and my wife was born and raised here, our new (first) child is really forcing us to reevaluate things. My business has transformed over the last few years, and it is all internet based now, so we can really live anywhere that has a good internet connection.

I’m originally from the Indianapolis area, which is an up and coming city with great art programs, better schools, a decent nightlife, etc. Right now, we’re looking at beautiful, 3500-4500 sq. ft. homes in the nicest areas of town for around $400K, and there are restaurants and shops to walk to, a trail system that connects the whole city, and some fantastic museums…and even better museums only 3 hours away in Chicago. At $400K, we’re talking about amazing city homes literally down the street from Peyton Manning’s home, not tiny fixers in gangland or suburban cookie cutter houses an hour away from town. Craftsmen homes, mid-century modern, English tudor, you name it, it’s all in Indianapolis in great in-town neighborhoods for great prices.

I’ve been reading this blog for years, waiting and hoping for Los Angeles real estate to make sense, but everything here is out of touch, and I think we’re finally going to get out of this mess. Sure, Indianapolis doesn’t have 20,000 things to do every night, but it does have a lot going on these days, and I can only do one thing per night, anyways…and, we actually like the weather, too. I’ll still visit L.A. a lot for business, but I don’t think I’ll miss it.

Thanks Kermit. Looks like Cash is King. I don’t like what is happening, but understand it.

Can we please end the Prop 13 complaints? One percent is enough tax to pay and leaving it to the kids means that likely it will be sold anyway as how can a few children with families live in the place?

Lets fix our states overspending problems first then get to the root of the problem. We have a lack of well paying jobs as large companies leave the state in droves due to the high taxes.

We could have a renters tax to help (even if it is a moderate amount) as they use the public services and schools.

You’re not thinking it through. Landlords pay the property taxes with some of the rent money that is collected each month from the renter. If you rent your name isn’t on the tax bill but you are paying for it. So let’s get over this silly idea that renters don’t contribute to roads and schools and services.

Thank you for renting.

Rents do not track to cost of ownership, taxes included. That is why this blog exists.

Thank you for this. I often notice that this type of thing has to be continually pointed out, because many times people seem to ignore the connectedness of expenditures & income being passed along to employees or consumers & visa versa.

It’s as if at times people talk as if every individual in a market is operating in a vacuum totally disconnected from where their cashflow is going to & from.

Yeah sure, tax renters, who already don’t get a tax break and who already subsidize FHA loans and homeowners, before property taxes are even considered.

To my previous landlords: I paid, mortgage, taxes and PROFIT.

And you greedy thoughtless person think I should, a single person with one income, pay more.

Well, one thing is to cap salaries at the UC and Cal-state and Community College, yeah its an expensive state but something has to be done. Two, push more average joe students thru the community college system. Also, some folks don’t need a 4 year degree. A lot of babyboomers that are machinists or welders or plumbers and so forth are aging, the high schools and community colleges need to gear up for the trades more.

Be careful of whose salaries you are referring to!

You’ve just ended a sentence with a proposition. Disgusting…

In 13 years my pay at a Calif CC has gone up 50% and my medical went from ‘free’ to $4000/yr, my end. Meanwhile the college President’s pay went up 250% and he still gets free medical and a free car. It’s all about screwing the people at the bottom to benefit the people at the top. In this proto-Communist ‘state’ the people are being raped by their elected betters and their minions. Folks are extra stupid here but the country elected the Kenyan, didn’t it….

Your calling people stupid and you think Obama is a Kenyan? Yikes. Perhaps your college prez should go be a Congressman. they’re fighting like dogs to keep their taxes from going up.

San Diego and Orange County are the least hispanic of the counties which is why they have 4 year degrees more., not being racists but hispanics are more likely to immirgant from Mexico or Central America with low jobs skills and 2nd and 3rd generation hispanics which the Inland Empire has a lot of are more likely to drop out of high school or not finished college.

Immigrant is a noun not a verb and your last sentence should exist in pluperfect or past tense not both as every high school grad knows.

I don’t like illegals either but imo hispanics aren’t the problem with the OC. Assholes are the problem with the OC

Well, I’m not against with changing prop 13. I think that rising property taxes and then lowering income taxes and corporate taxes would make the state more competive. Its just the poltical parties in Ca are either too liberal or too conservative to effect a deal of rising property taxes and lower income taxes and corporate taxes. I doubt that some of the income taxes now can’t be lowered because of the passage of prop 30.

When I was in junior college (Santa Monica College 1977-1981) the school had terrific trades education. I took classes in welding, machine shop, there were also classes in auto repair, auto body, construction technology, pattern-making (students who took classes in pattern-making were highly sought after in the aerospace industry for making metallic mold patterns, etc). It was my welding teacher who inspired me to go into the school’s engineering program. Later I attended CSULA and received a degree in mechanical engineering and did very well as a professional who had hands on experience with welding and machine shop. It would be interesting to see a study on how many city colleges offer real trades education today (then and now).

Prop 13 and mortgage interest deduction have single handedly shifted wealth from the working class to the rich. It has nothing to do with passing down property to children.

Increased burdens have been put on income tax and sales tax (corporate tax is irrelevant once you realize that Google has sheltered close to 10 billion dollars in Bermuda to avoid $2 biliion in taxes).

These burdens in income and sales tax take more money away from the working class and don’t bother the rich as much who pay a lower percentage of income into sales tax, and use tax deductions to eliminate most of income tax burdens through investments and secondary property and investment property mortgage interest deductions.

I am a strong proponent of eliminating both Prop 13 and mortgage interest deductions (especially on second homes and homes over $1million), however this would have to be done with some care, some phasing of effect, and most importantly with some adjustment to income and sales taxes. This would fix the argument of “giving the government more of our money won’t solve anything” and also do a HUGE service in discouraging income properties for the rich, and keeping property values at a sustainable level on par with income.

Wow! A statist ideologue if I ever read one.

Prop. 13 is essential for the common land owner. Why? Because you know what you are paying during the time of ownership. Without prices known, prop. taxes are at the whim of politicians, elected or not.

I pay four times more in property tax on my modest, ranch style 50’s house purchased 10 years ago than my parents house purchased in 1966 (which is a multi-million dollar estate now), and I’m completely fine with it…why?, because I know what my tax bill is going to be every year- a two percent increase from the previous year and, perhaps, a bond measure here and there.

The same rule applies to commercial properties. Why are so many people brainwashed into thinking commercial property owners are “rich”.

Uh, I think Disney pays the same property tax on Disneyland as Walt did in ’57.

It has everything to do with my 96 year old mother being able to live in her home that she has owned for 54 years.

Out of curiosity, would you agree to what Andy mentioned below – about restricting prop 13 to private ownership only?

We need a split role on Prop 13. The biggest unintended (or fraudulent) consequence of prop 13 is that it did not exclude businesses, which can use trusts and transfers to sell property and never have the rates go up. Corporations live forever giving a tax break that dwarfs the benefits home owners receive.

The money to pay for roads, schools, sewer hook ups, maintenance and all the rest of it has to come from income tax and sales taxes due to the loss of money after Prop 13 due primarily to the corporate loopholes. Not to mention that while granny staying in her home was the primary public talking point, the implementation of Prop 13 has given a privileged status and advantage to those who bought long ago at the expense of everyone else. Look at home prices since 1978. We can easily reform Prop 13 to split role with corporations treated differently than homeowners, and put in protections for retired or over 65.

As currently stands, even homeowners don’t pay their own way with property taxes. 1 percent does not cover the cost. So this idea that renters don’t pay their fair share, and home owners are getting soaked is a joke.

Prop 13 let people stay in their homes, but it also lowered property taxes on major corporations like Lockheed, Boeing. Prop 13 should be changed to eliminate corporations from the 1% restriction but leave the private property owners alone.

Yeah

I’m sure that will work wonders to maintain the under burdened employer in your state.

God, I hate California…

Thanks for this useful and relevant comment

Dang you New Yorkers are jealous.

Just wondering what input the experts or others would have:

I recently moved to San Francisco and purchased a condo there – to my surprise, I’ve discovered the market has risen around 12% over the 2012 calendar year. Just being able to get a 30-year FRM at 3.5% was a big incentive for me to buy. Anyway, I had actually just relocated to the US and all I had heard about was that the national market was still in a trough. Fundamentally, I’m assuming the “job growth prospects†have picked up the SF market earlier than others. Basically two things I’m curious about:

1) Will other pockets or the US as a whole see anything like what SF saw this year?

2) SF still seems to be many analysts’ prediction for a “hot market†for 2013 – any thoughts on that?

AJ, you’re in good shape.SF real estate has weathered down turns better than almost anywhere else in CA over the last 50 years. It has a lot of buying pressure right now as rates are getting even lower and there are good jobs in the area.

Hang on, you could see a real jump in price for 2013.

The wealthy in the US have had an aristocracy for many, many decades now. Prop 13 got nothing to do with it.

I’m already seeing mortgage rates dipping below 3%. We are on the Japan Path. Japan has a 1.5% mortgage rate. Anyone who thinks this game can’t go on for at least another two years has not been paying any attention to history. The Fed is now the buyer of crap MBS’s and Fed debt. I bet a lot of homes in CA see a 20% rise in price in 2013

And here we have it. Merry Christmas everyone.

http://www.sfgate.com/realestate/article/Fed-wants-mortgage-rates-even-lower-4144320.php

mmmm taxpayers, just think prop tax on sample house in that area 1000 per month 2% or better w/voted tax addon, will go up in 2013 you watch

Home prices post biggest jump in 2 years

http://money.cnn.com/2012/12/26/real_estate/home-prices/index.html?hpt=hp_t3

looks like the Bernank plan is working, but of course for how long? A prior post showed Fed considering even lower mortgage interest rates also…..

CBS News reported last night that wealthy chinese families are sending their children to college in california. Instead of paying for room & board on campus, these families are investing their money in the housing market including condos designed for chinese buyers in Irvine. The reasoning was that they could get a better return on there investment by putting there money into US assets including real estate, & in turn this helps the US ecconemy as these chinese buy our products & services.

So how much spin did CBS News put out there.

The Japs thought this was a good idea in the 80’s and got burned. Many assets were bought back buy domestic investors at severe reductions. In an era of globalization where every one Chinese-New Money-Immigrant is offset buy 100 domestic workers receiving lower wages and paying higher food and energy costs, how can values rise in perpetuity???

I seem to remember having these same discussions in 2006…

They spun the reasons for putting money here rather than back into China.

Because they know they have a 0.09% up to 100% chance of losing everything in China.

If they park the money in real property here, they stand a decent chance of keeping it.

When the global ponzi collapses, you better have your eggs in a basket that won’t fall apart. No matter how much we gripe about the US and how untenable the fiances here are, they will always be a better alternative than the rest of the planet. Not because we are better than anyone else, it is specifically because we “the sheeple” will sit in our arses and take whatever the .gov gives us.

Spanish house price decline accelerates to 15.2% year-on-year

The last time I reported on the Spanish housing market in August, we were in the midst of a bank deposit run caused…

14 December 2012 at 11:37

It’s a Global correction that will last at least one generation.

John since you use the word statist, I bet you are a Republican. Lots of Republicans love Texas and in Texas you pay high property taxes, so why don’t you support getting rid of state income tax and have high property taxes.

Native Angeleno Cynthia. This is my state forever, thick and thin.

Leave a Reply