Real Homes of Genius – Silver Lake back in action with 4 garage duplex. Raging gas prices and luring in the next round of dreamers.

The hipster mania continues in Silver Lake. Southern California is such an interesting place especially when you roam around Los Angeles. The entertainment industry being so close must create a slow moving cloud of manic optimism and apocalyptic failure whenever bubbles emerge. The oscillation between decline and bewildering dashes to purchase has been going on for well over a decade. People again seem to be fine that household incomes are stagnant yet somehow rents and home prices are all rising up. Did you notice gas prices in SoCal? They’re inching close to record levels. Notice the cost of the quality colleges in the area? Not exactly cheap. Of course all of this is being financed with easy money courtesy of Big Ben Bernanke. I had to post this property in Silver Lake because it shows the madness of the current market. Today we salute you Silver Lake with our Real Homes of Genius Award.

Gas prices and hipsters

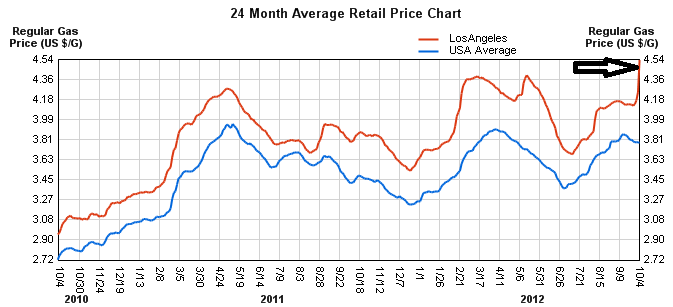

First of all gas prices are near peak levels in California:

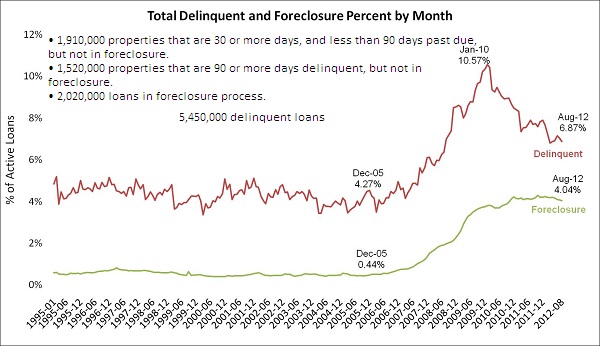

For commuting obsessed Southern California this is definitely going to put a pinch on the wallet. Yet when access to debt is easy, it doesn’t really matter that the cost of living is moving up because people are desensitized to go into massive debt. And by the way, we still have over 5 million Americans that are in distress on their mortgages:

Of course thanks to the Fed going all in on lowering mortgage rates, households are once again going into massive leverage to buy. FHA insured loans with the tiny 3.5 percent down payment requirement are the option of choice for maximum flexibility (aka households with little cash). They provide insane 30x leverage. What I sense in the market right now is capitulation. People get that incomes are stagnant. People get that the debt is out of control. Most understand that we have major demographic challenges ahead and many young Americans are struggling to launch their careers. Yet psychology and tribe mentality trumps most of this. People hear the stampeding herd, see a tiny shift in the wind and now are thinking they are going to be left out of California housing boom part two.

Let us go back to hipster Silver Lake since I am seeing properties hit the market with prices that bring back the memories of the mania. Take a look at this place:

2256 Earl St.

Los Angeles, CA 90039

Built 1961 – Square feet 1,344 2 beds 2 baths

This property was only put on the MLS a few days ago. I absolutely love the ad:

“Endless possibilities located up a long drive way on a large 9,000 SF lot. Resting atop 4 garages this unique offering features 2 bedrooms, 2 baths and wood floors both showing and beneath carpet. Purchased from the original builder some 40 years ago the current owner occupies the entire property as a SFR while tax records identify it as 2 units. A very comfortable home as-is or a great opportunity to think creatively and reap the benefits.â€

Bwahahaha! Endless possibilities along a long drive way. I mean this is like reading Hemingway if he were to craft ads for the MLS. So what is the going price? $750,000. A very comfortable as-is home?

Think creatively buster! Say you turn this into a duplex. How much are you going to get each month? Certainly nothing close to justify the $750,000 price. This is inching closer to ONE-MILLION-DOLLARS! People in California are so accustomed to nonsense pricing based on leverage. People have forgotten what it is like to save. A 20 percent down payment would require $150,000. How many people in SoCal have that saved up? Not many and those that do are unlikely to have this property on their radar.

In the midst of all of this, there is one group that is winning big:

“Bloomberg: - Margins on sales of mortgages have widened by about 50 percent since the Fed’s announcement from the average level this year, which already was elevated, said Kevin Barker, an analyst at Washington-based Compass Point Research & Trading LLC.

“It’s very good to be a mortgage originator right now,†he said in a telephone interview.â€

No wonder why I’m not hearing from mortgage lenders that often anymore. They are busy churning out refis, loan mods, and sales. Just like the early days of the boom, the big winners are in the finance industry and others are just trying to get some crumbs before the tide goes out again. Today we salute Silver Lake with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

70 Responses to “Real Homes of Genius – Silver Lake back in action with 4 garage duplex. Raging gas prices and luring in the next round of dreamers.”

Doctor Housing Recovery!

“…and others are just trying to get some crumbs before the tide goes out again.” What exactly do you mean by this! We are in a housing recovery! The Fed won’t let prices fall from here! Housing can never go down… ahem… again… It is going to be like this forever! Quick, jump in now before you are forever priced out… ahem, again… It is great to know that we are at a bottom. Now I know that I can’t lose any money if I buy now!!!

Modern day humans have to be the dumbest creature on the planet. We deserve everything that is about to happen…

The problem is that for many of us, it is beginning to seem like the government will successfully keep housing prices artificially inflated throughout the relevant portions of our lifetimes – it’s been 10 years already and here in the Bay Area, prices did not fall all that much and are now going back up. You get tired of getting kicked out of rentals so the landlord can move back in. You want your kids to be able to go to the same schools and keep their friends rather than get moved around. So you think about just giving up and buying anyway – trying to fight a government action plan that is devaluing the currency and converting the banks’ bad debt to taxpayer debt in order to avoid allowing housing prices to revert to market levels seems like a losing plan after waiting 10 years for sanity to return with nothing to show for it.

I feel exactly the same way! When will this end? And with rents going up, it just seems like a loose loose situation for someone like me who does not own anything. The benefits of the current policies go to people who have already bought, or who have loads of cash.

Lose, lose…not loose…

This is why I don’t expect to stay in California much longer. The middle class is getting squeezed out. You either have to have a huge income or family wealth or be the recipient of some kind of public assistance to make ends meet here. It doesn’t make sense anymore, and a supercritical mass of the voting pool is too vested in the way things are to really inspire any hope that anything will change for the better. I have no doubt the state is headed for a major crash, and I hold little hope that it will inspire the necessary changes in attitude to allow for a prosperous rebirth after the dust settles.

Hi,

I had wanted a home for many years. I did a little research of the fastest growing

cities in Southern Cal and found that Palmdale, CA was at the top or close to it.

I looked in this area just this last Jan/Feb 2012 and my husband and I found a place which is really nice. It’s on the West side, 3 bedrooms, 2 full baths, living room, family room, office, pool and spa. It sits on 1/4 of an acre. The home is 22 years old. Our home is 2078 sq ft. We live in a NICE neighborhood. We got it for $220,000.00.

If we’d found this in the Los Angeles or Bay area, it would be worth almost a million. There’s a commute but to us it’s worth it. My husband takes the train to Glendale.

The housing prices at that time were lower, but I’ll bet there are some good finds

in this area. We opted to go with a 1 story home so that we wouldn’t have to use

the air conditioning as much and we wanted a pool to stay cool.

We’d been prequalified for the amount above. We pay $1409.00 a month which is our mortgage, home insurance and property taxes all in one. This is less than most apartments. I don’t know where in California you live, but if it’s in the LA area, you might consider Palmdale.

We also have a FANTASTIC REALTOR! If you would like her phone number just let me know. I can’t praise her enough!

Jim you’re exactly right. If you include waiting to buy during the bubble and waiting for the bottom, it’s been about ten years. We are only alive for so long, and kids are only kids for so long.

The housing bubble has been one of the cruelest events to middle class Americans ever. Very few people have avoided this catastrophe, both personally and financially. Personally it knocked 7 years out of my family’s life, we rented when when all the nesting instincts said “your family need it’s own home now… buy”.

Jim good luck in what ever decision you choose. I still say wait until January. I’m a firm believer the Federal reserve started the money printing again (QE-3), and the current ultra low interest rates to help Obama get re-elected by propping up the Dow Jones and start housing appreciation again. It’s just too bad people like you and I have to pay the price for this type of financial engineering and corruption.

Jim, please also remember that through out this bubble popping there have been many “up-turns”. First in 2009 when the bail-outs and foreclosure moratoriums started, then with the $8,000 tax credit. During the tax credit the bubble restarted just like it was 2004, the MSM. gleefully announced the housing bottom . Once the tax credit ended the dive started again and all the tax credit buyers lost.

Jim we are in the middle of another government induced “Upturn”. when the government shuts off the “sugar”. It’s going to go down again. Unfortunately you have to live through it and have to decide what you threshold level of pain is. My advice is to sit out the political manipulation until after the election, by staying put where you are you are giving yourself some more time. You can buy now and risk the next down turn. Either way, December and January are always the best time to buy.

Good luck Jim.

Greg, I feel the same way as you. I’ve been renting for 9 years, sold my house in 2004 because I was afraid that the market would bust. I was correct but never in my wildest dreams did I see a government that would allow this kind of rampant manipulation take place. They colluded with the bankers to propagate the housing bubble part II, while nationalizing the losses.

Whats the difference this time? Wages are not keeping up. My business is still being impacted by a rotten economy. If everything is so good, then why do we need QE3 ? If everything is so wonderful, why arent people rushing out to buy Mercedes and BMW’s ? In fact both companies just announced that their earnings will not meet expectations. Perhaps people are cutting out luxurious items to buy inflated properties. I’m not entirely sure but my contractor landlord is not doing as well as he once did.

I think this is all propaganda, and after the election it will go down hill quickly. QE3 is going to result in a rapidly depreciating dollar, perhaps hyperinflation. Unless the government is going to place in price controls on oil and food. We are quickly going down the slippery slope of communism. Just wait until the shortages start occurring.

Bob, I feel your pain.

We are all just pawns for the Government and Banking elite in our country. Only problem is that the elite in government and banking are just not as smart as we are always being told.

Lets use our imagination for a minute. lets say the Federal reserve cranks up the printing presses a bit. Interest rates on housing goes from the current 3.5% down to 2.5% or even 1.5%. Housing prices might shoot up 12% for every 1% decrease. When interest rates are 1.5% there might be a 36% increase in housing prices from 2011 level. Plus the mania it would produce in housing would cause a new bubble which would probably push housing even higher.

Bingo, housing problem solved, prices now above the 2006 level.

Except for the hyperinflation that would crash the economy, resulting in civil unrest and violence, causing a Hitler like leader to emerge to restore stability. Isn’t that what happened to Wiemar Germany?

But for that brief moment Real estate would be good again. So I’m sure it would all be worth it (joking).

Jim,

I’ve been following the real estate market as a behavioral economist for a decade now. And your comment is one of the smartest I have ever read on the topic. Thanks for sharing it.

In exchange I will share the reasoning I used to justify to myself that I should buy a house for $850k…a price 3x bigger than what I imagined spending on a house before I moved to DC.

My monthly payments (taxes, ins, P&I) on a 15yr FR at 3% are around $5k. On my annual salary, I can afford that. And so I know that my housing costs (maintenance aside) will NEVER go up. For me, buying was not about investing. I know too little about the RE market to invest nearly a million $ in it. If you ever hang out with someone who does commercial RE for a living, you will quickly learn that average people like you and I know way too little about RE markets to make “investment” decisions in RE. I know that sounds odd because in most markets, smart people can educate themselves enough to make smart choices. But given the complexities of RE and the added complexities from involvement by the Fed, Congress, and the White House, I believe this market is just far to complex currently for the average person to make smart investment decisions.

That said, people like you and I know enough about ourselves to make purchase decisions (e.g., job stability, income, opportunities for additional income, other expenses, retirement ideals, family size, etc.). Therefore, we can figure out what we need and what we can afford to pay to meet those needs. The rent/buy decision for me came down to what I needed and what I could afford. I know it sounds stupid, like I’m a RE broker selling you on the idea of determining what house you can buy based on the monthy payment you can afford. That’s not what I’m saying. I’m saying that whatever house you buy, you should think of it as a purchase not an investment, and the threshold I use is the monthly payment…others might use the annual payment as their reference point. The point is that I think of this stuff as payments, not contributions to an investment. They are costs, not contributions.

I saved until I was able to afford to buy in the town I wanted to be in (schools, commute, etc.)…took me 4+ years. Now my housing costs are essentially locked in forever (maintenance aside). I don’t consider the value of my house into any decision I make. I don’t think about it as an investment because if it’s an investment, then I’m an idiot for making a $850k bet in a market where I am the chump that has less than 1/10th the information that the big boys have.

By treating it as a cost, I can say that as long as my job remains secure, and as long as I get raises that keep up with inflation (both of which are nearly guaranteed for me), that my discretionary income will increase over the next 15 years…thereby allowing me to spend money on things I don’t currently spend money on (like buy a new car, sending my kids to college, etc.). The key is that I am pretty secure with my job and I don’t plan to move, so selling the house is not on my radar…and therefore I don’t need to think about its value. It is an expense…and it’s at a level that I can manage, so it makes sense for me.

I sleep well at night and I don’t care about what the house down the street sold for.

I hope this helps.

Kurt

Kurt,

I concur, our human failure is letting emotions interfere with logic. I have one Q: Could you rent your place out for $5,000/month?

I know right? I live in Portland where rents and house prices are both rising concurrently.

here’s the $750,00 question .. the wall which was separating the two units, is it legal to demolish that? Is insurance, property tax cheaper for two units compared to SFR?

Your RHoG are back; great work, Dr.!!!

A two bedroom house, with a 4 car garage? Wow, this must be the dream home for someone who collects rare antique cars worth millions of dollars eacg, I can picutre the garage loaded with Ferraris.

Certainly, anyone who can afford this lavish estate can afford the cars that go with it!

I kin piture a gar-age full-a Hooos, the sirens of the houzing hoos is back. hahahahhaha

As a car hobbyist I’d love to have this house, basically a big garage and some living room on top of it. But not at this price, of course.

Multiple bids, hipsters could fight over the listing. I can imagine the march of fedoras up the driveway, eager to scoop up this vintage gem. Living room is perfect as is; stained popcorn ceiling and gold shag carpet could provide an edgy backdrop for a Terry Richardson photo shoot with actresses dressed as 70’s porn stars. Just bring a bucket of cold PBR’s, skateboard down the driveway! Submit!

Even the TV is retro. How cool is that?

Quite cool. I can bet that the kitchen and the garages are also like a time travel into 1975.

I’ve got some friends that live in Silver Lake. They bought in one of it’s “better” areas. The couple were young and had no children at the time they bought. They loved the cool cafe’s and shops. Now they have kids, and can’t afford private schools, so the kids have to go to the local elementary school. I checked out the school rating in the area, let’s just say that they are not exactly stellar. The schools in the Silver lake area score about the same as Compton and Pacoima. My friends are making the best of it, house is underwater, can’t move because all the money is tied up in the house and the schools for their kids are horrible. They are working over time to to get them into a magnet, or charter school. The kids are one of the few White kids in the school. I’ve heard that they are already being bullied because they aren’t Mexican.

It’s stressful for me to even think about their situation.

“My friends are making the best of it, house is underwater, can’t move because all the money is tied up in the house…” Really! Your friends have no money! There is no money tied up in the house! The definition of “underwater” is that they owe more than they can sell for in the current artificially held up market. The good news is that they can move any time they want!

“Now they have kids, and can’t afford private schools, so the kids have to go to the local elementary school. I checked out the school rating in the area, let’s just say that they are not exactly stellar. The schools in the Silver lake area score about the same as Compton and Pacoima.”

This is a big problem in Silver Lake and Echo Park: folks who purchased before they had children and who now are unwilling to send their kids to the neighborhood schools. I’ve lived in Siver Lake and Echo Park since 1980, I’m intimately familiar with two of the six elementary schools, and have been involved in school issues for the last 15 years as a parent, a volunteer, and the founder of a Parent Teacher Organization. I worked for about 6 years to get the White families in my neighborhood to consider sending their children to Mayberry Elementary, where my son attended. My experience with Mayberry was excellent, and my son benefitted tremendously from his 5 years there. Three of the teachers he had there had a profound effect on him that I expect will help him throughout his life. The main objection that I hear from the White parents is that they feared that their kids would be ostracized because of their race and language. I can tell you from my experience at this school, and in being involved with other schools in the area, that there is no basis for this fear. I spent years helping at the school at lunch time and during recess, as well as being president of the SSC for 4 years and a president and member the PTO for many years. I never saw anything like that happen, even though 20% of the population was non-hispanic. I never heard the kids speak anything but English on the playground or in the classroom. The reluctant White parents that I worked with, for the most part, made no effort to do any serious investigation into the quality and character of the school. Most of them were not willing to go against the tide of their peer group, most of whom were trying to secure places for their children in charters.

A significant cause of the difficulty that LAUSD schools are having in racially mixed neighborhoods is that affluent parents are willing to spend significant amounts of money and time supporting a private school or a charter (yes, charters raise private money and require parental involvement), but they are unwilling to do the same for the school right down the block which has, in large part, the most highly qualified and effective teachers. If these parents stood up for their kids, made their presence known at their neighborhood school, and were open to exposing their kids to the real racial diversity of this city, these schools would be transformed within a school year. The problem is not that these schools are bad, the problem is that they have been made into ghettos because of the fears of the affluent, educated parents.

Finally: I know a lot of kids around here, gifted and priveledged White kids, not so priveledged white kids, Hispanic kids of all socio-economic levels, Asian kids, Black kids. The sweetest and most unassuming, unpretentious, lovely kids are often the little “Mexican” kids. I much prefer that my son hang out with the “Mexican” kids because they are nice, they love their families, and they mostly have great values. When you throw out unsubstantiated and inflammatory statements like your last sentence you do nothing to help anyone solve a serious problem. All that does is add fuel to fire that has done tremendous damage to my neighborhood and continues a legacy of mistrust. If you want to make an accusation like that, find out the name of the school and go spend enough time there at recess and lunch so you can make an honest determination. That might be helpful to everyone involved. Your parting shot was gossip that tends to inflame prejudice, regardless of how well-intentioned it was.

Joe, I’m sorry that you think my comments were inflammatory. They may not be politically correct, and I may not be putting any effort to sugar coat what I have heard, but they are still facts.

When parents check out the scores of the local schools and see them receive scores like 2.5 – 3.9 out of a scale of 10, what’s there to ask? Most parents just run away as fast as they can. Who can blame them.

As for the bulling, it’s real. You can say that it doesn’t exist, but that doesn’t make it so.

I’m glad that it was what you were looking for in a school for your son, and god bless you for all of your effort to help the school that he was in.

Joe, I think I found you on the web, I didn’t know that you’re a realtor!

At Sotheby’s international no less. I guess you do have a vested interest in propping up the area. (Troll)

Hey everybody, take a look at this beauty! $679,000 for a 1032 Sqft house on a 3729 Sqft lot. Don’t forget to mention the stellar schools.

Joe, maybe you can give us the inside scoop on this place, was there a bidding war for this gem? Is it a short sale? What’s going on with the bank ?!

Joe, I’m only asking because your web site says that you are well know for your integrity and honesty.

http://www.thelightfoots.com/1622-N-Benton-Way-a262000.html

Thank you, Joe. This blog is full of bigots I have noticed..

It’s interesting to see Joe Lightfoot of Sotheby’s International real estate trolling around a housing bubble blog.

My first question is why?

Is he trying to learn something about the world of Southern California real Estate? To see how fast a segment of the population is catching onto the smoke and mirrors, or did he hear that there was an article about his home turf, in Silver Lake?

My guess is that he has come here to defend his turf.

What does he feel needs defending the most… judging by his comments it’s the schools?

From my perspective the schools are the real Achilles heel of the Silver Lake area. By viewing the school scores through Zip Realty, of the 5 public schools in that area they rate 2.5, 5.2, 9.5, 4.4 and 4.3. As I found out through one of Joe’s listings, there is actually one really good school in Silver Lake, the Ivanhoe elementary school, which Joe proudly proclaims in large bold print on the listing’s opening paragraph of one of his listings. One wonders why he doesn’t do it for his other listing in the other Silver lake school areas. (I think the answer is obvious, they suck).

If ones kids were in the Ivanhoe’s school district they’ll be fine for a while, it scores 9.5 which is stellar. The school scores for the Middle school and High school are 4.3 and 4.4. These are extremely low scoring schools by anybody’s standards. In my suburban area of Los Angeles County, most people would run away from schools that score this low as fast as possible.

It’s obvious for any parent that does an ounce of research that in Silver Lake you get high prices for housing but extremely low scoring to unusable schools. If one is going to spend close to $700,000 for a 1032 Sqft. House why not go to La Canada or La Crescenta, or South Pasadena, at least you get the safety of the neighborhood and bragging rights of the stellar schools.

I have no doubt that the schools are a huge problem and dilemma for people who bought high priced homes in Silver Lake, and then became parents. Believe me I’ve heard the regrets from one of my friends, (yes the ones whose kids are getting bullied in school because their not Mexican).

Joe, you say my statements “do nothing to help a serious problemâ€. Well actually they do help a serious problem; they open people’s eyes with facts and warn people about the serious problems that are in this area.

My only suggestion to you Joe is if you’re as you claim, “Known for your integrity and honestyâ€â€™ please let everybody in your post know that you’re a Silver Lake realtor for Sothbey’s International. Otherwise people will just think you’re just another snake in the grass realtor.

http://www.thelightfoots.com/1622-N-Benton-Way-a262000.html

“It’s stressful for me to even think about their situation.”

LOL

Poor white minority kids! I’m sure they have a very tough life with these “mexicans”

How do you feel about the token Mexican kid at the all white school being bullied? Or you don’t?

I relate a story of minority White kids being bullied in a public school in Silver Lake that is overwhelmingly Mexican. The kids are being targeted specifically because they’re minorities, and look at all the venom and hatred drawn out by Joe Lightfoot the Silver Lake realtor, Gherhardt, and Brian.

Are they angry because I dare to talk about what I know?

Are they angry because I don’t feel the need to keep quiet about a taboo subject?

Are they angry because these facts challenge their assumptions about how White Americans are treated when they are in situations where Mexicans are the dominant race and nationality?

Joe, Brian and Gherhardt obviously think that they can silence the discussion by crying raaaacism!

Guy’s I think part of what you’re really angry about is how the internet has ended the Liberal control of free speech .

Question: Whats the definition of a racist?

Answer: Someone who’s winning a debate with a liberal.

Yep. I love the stained popcorn ceiling too. I think I might add that to my house. Hipsters in Silverlake? They better hope they do not get mugged. Look at that bulletproof screen door. They likely have 20 illegals living in that spacious 4 car garage.

Why that looks like the Mustang Ranch, it do…………endless possibilities

Well, I said rates could go lower….and whatdya know

http://www.sfgate.com/realestate/article/Mortgage-rates-fall-to-new-record-low-3920591.php

In looking at the picture of this property, I notice that the photographer positioned himself in such a way as to frame the attractive view from the room, but at what cost?

The room and furniture are drab, and the security door does not add much.

It is obvious to me that this property is all about the view. Interesting!

Looks like the Greater Fool theory is alive and quite well in SoCal – I’m seeing some of this in my locality in North Portland, and as long as the banks keep the inventory off the markets prices will continue to rise.

Nice street appeal, looks like it has a tin roof

Truly, this property is full of potential. Nothing but potential.

Rates can go negative….they’ll send a rebate check if you make your payment on time. really

I don’t know how tight the zoning is in Silver Lake but those four garages sure look like they would make a great oil change/carwash emporium.

Lets use our imagination for a little bit.

Say the Fed cranks up the printing presses a bit higher, rates fall from the current 3.5% to 2.5% or even 1.5% . Banks keep dripping the inventory, wouldn’t home prices shoot up?

Maybe 12% in price for every 1% decrease in interest rate. at that rate prices should be at least 36% higher then the 2011 price range.

Bingo were back at 2006 prices, plus the mania would probably cause prices to shoot up even higher.

Mania back, Housing problems solved.

At least until the entire country is engulfed in massive hyperinflation, printing presses crash and the country brakes down into civil unrest and that leads to a Hitler like leader to restore stability. Kind of like what happened to Wiemar Germany, isn’t it.

But for that brief moment real estate would be good again.

so there is a price for recreating the mania/er liquidity event…namely the commercial real estate marketwhich deals in real money must suffer. keep flipping cuz that price of fuelis going to soar…

Someone posted recently that we’re in an interest rate bubble. Indeed that seems to be the case. Lower rates is working wonders with re-capitalizing the banks, holding up real estate, and boosting stock indices, and somewhat boost to GDP. Usually human nature is such that we tend to stay too long with a good thing (one definition of a bubble). I’d be surprised if even the big brains at the Federal Reserve are any less human in their capacity for error.

IMO the more likely erroneous outcome than Fed policies pushing rates to 2.5 and 1.5 percent is the Fed’s actions keeping rates in the mid-low 3 range far too long.

Inflation will take root and the Fed will be behind the curve. There will be inflation + stagnant growth + stagnant wages. It all will mean further deterioration of the standard of living for the 99 percent.

Bankster Ben and QE3

Ben Bernanke, reverse Robin Hood, more FED largesse for the poor banks.

Although the average rate on a fixed 30-year mortgage reached 3.4 percent this week – a record low – mortgage rates could be lower if banks passed on the full drop in their funding costs.

“For banks which are mortgage originators this [QE3] was some of the best news they could possibly have heard,†said Steven Abrahams, mortgage strategist at Deutsche. “They will continue originating loans and selling them into the market at a significant premium.â€

The interest banks pay on mortgage bonds has dropped from 2.36 percent on September 12, the day before the Fed announced its program, to as low as 1.65 percent last week. It edged up to 1.85 percent on Monday.

That means the profit, or spread, banks earn from creating new mortgages for homeowners paying around 3.4 percent and selling the loans into the secondary market has risen to around 1.6 percent. That is higher than the 1.44 percent spread they pocketed before QE3 and significantly greater than the 0.5 percent they earned on average in the decade between 2000 and 2010…

In 10 years the inheritors of the deceased will be looking to liquidate the homes.

In the meantime, today I saw a 1986 home (26 yrs old) asking $855,000. Our agent said it was a tear-down and not worth the price. We also just saw a 2006 $1.1M house with rolls in the rug. Seriously…”million” dollar house…with rolls in the rug. And…the worst school district in the State. Everyone wants a “million” bucks for their house.

I’m buying me an RV camper.!!

Bellevue, WA.

You’d probably lose a lot less money with camper, I was planning to do the same.

Cramped space yes but the investment is low and depreciation is even lower. No rent and no property tax either and easy to move.

The goal seems to be to squeeze the middle class to death: Upper part of it gets rich and the lower part moves into trailer parks as they can’t afford anything else anymore.

Trailer costs less per sq ft than most apartments nowadays and that shows the scale of the bubble.

Nice ceiling and rug, though, who would have guessed it was built just 50 years ago?

More evidence the party’s over:

http://atimes.com/atimes/Global_Economy/NJ06Dj01.html

The article pointed out the relative equivalency in tuition between a Cal State school and Harvard (given the largess of its foundation). Even more crazy is cost equivalency with the ITT Techs of the world.

For all of you who don’t like math. The crash happened in 1929 and we entered WW II December 1941. My understanding was that we weren’t at pre crash employment until 1943. Probably had something to do with so many being employed by the US military… Ok class, what is 1943 – 1929? That’s right! 14 years! Okay, the great recession started in 2007. Now, what is 2007 plus 14, give or take? That’s right! 2021! We would be lucky to get back to 2007 employment numbers before 2021. We just need some kind of world war to start and then just maybe…

I have two comments about 1929, one is positive and another is negative. In 1929, the crash was deep, and it took years before the Fed started to print money to plug the holes. The printing money started in 1933. Ray Dalio wrote about it, talked about it. He considers the Fed printing is a turning point. The second point is that during that period, USA is the exporter of everything, while Europe was in disarray. In 2008, Fed wasted no time and started QE right after the crash. Fed is determined to print till the end of life. The first a few trillions are for plugging the holes, which is deep. The next a few trillions will leak into the real life. Gas, food, gold, oil, land, farm, pig, house, etc. anything you can touch will go up. So is stock market. So is wage. You can adjust everything with anything, you can say future will be so and so, but the reality is the price sticker on the day. How about that gas price at $5? If you are out of gas, will you not fill it up?

I really don’t understand your comment. So are you saying to minus 3 years from 2021? Ok, that leaves us 2018. That is still not the same as 2012! I am not convinced that massive printing will fix the problem. We really are pushing on a string at this point. It appears to be more of a transfer of bad debt (MBS’s) from privately held to publicly held. Maybe this is the Fed foreseeing another dip in housing on the horizon and they are helping the banks unload worthless assets.

The other thing that you are missing is that the Bretton Woods agreement hadn’t happened until after the war. I think the only positive difference from then and now is that the US dollar is the world reserve currency.

The slack in the labor market is not going to change unless China, India and South East Asia are in a war that decimates their manufacturing base. We are not likely to see wage inflation anytime soon. I’ll say it again, we would be lucky to see employment back to 2007 levels by 2021…

My point is that Fed, government and banks are working together to stabilize the housing, and prevent housing price from falling. They stopped foreclosure, they changed accounting rules, and cut slack for banks not to mark to market. Fed is starting to print massively right after the crisis, which didnt happen in 1929. it’s hard for individual not to join them, and keep fighting the Fed, banks and government. For any crash to happen, there has to be sellers. Just lack of buyers will not lead to crash. Plus, the mortgage rate is negative, and there are a lot buyers out there. Otherwise, how do you get bidding war? One more thing, why people keep saying rate will be 5%, or 6%? Fed told everyone in a mega speaker that the rate will be low for extended time. Fed set the interest rate. Government makes the rules. We just follow.

I agree it will take some time for everything to recover. If you look at the median income over the last decade, you will notice it increased over 20%. This has happened when we had tech bubble, housing crash, recession, depression etc.

http://www.davemanuel.com/median-household-income.php

Printing is the game in town, whether you like or not. There is old saying “don’t fight fed”, or ” if you can’t beat them, join them”. I guess it’s easy said than done.

I know that inflation adjusted income didn’t go up. But nobody lives in an adjusted world. If you adjust everything with gold price, everything is down. All I need to know is that today’s money is worth more than tomorrow’s.

one more, historically, housing is local. No Internet, buying a house is a lot physical work. Under those circumstances, average housing bust is 6 years based on the Rogoff book. Today, information is free and fast. I have not seen any study about effect of internet on housing business. My personal experience is it is a lot easier to buy and sell with Internet. The point is that we move a lot faster than historic norm today due to technology advances. The normal cycle could be shortened. That’s just a guess.

About 3 months ago I was in escrow on a place (I backed out), I was going to do a 90K mortgage, the rest cash. The lender I had been working with for the last year basically dumped me once he learned the amount of the mortgage. He actually said, “I am not very competitive on the lower mortgages but we can go forward if you’d like”. Not wanting to shop around AGAIN, I was willing to pay the few extra hundred dollars so I said I would stick with him. He never returned my calls or emails after that.

Clearly if you have the luxury to be an ass to a paying customer, business must be good.

Another sign there may be a change in the market. We looked at a house 2 months ago, listed at 579K 1800 sq. , it had come back onto the market as it fell out of escrow. It had been in escrow for 45 days due to problems.

When we went to look at it it was newly “re-listed”. Apparently the first time it was listed it had 7 offers so when it was relisted they expected it to go fast. Well, it sat and sat, no offers, they dropped it to 559K a month ago, it sat and sat and just went pending. Won’t know the price for awhile.

Going from 7 offers at 579K to none at 559K in just a couple months is a serious sign. The house was very nice actually and it was in the “Sports Arena” area of San Diego, which is not too bad of an area but not the area I want. The house once sold for 802K in 2005.

Martin, I think it all depends on the area and selling price. Anything in the 500K and under range in a “decent” area won’t last long. When you start going into the premium areas, that 500K price might get bumped up to 650K plus. I’m actually in escrow right now too, outlasting the Fed is futile. I was one of five offers on the place I ended up buying. What really really helped me was having a massive down payment, 800 FICO and no contengencies. This is where being financially responsible for the past years has paid off, the seller went with the strongest financial buyer.

At this point, I’m going to put the whole housing bubble chapter behind me. Prices should have been allowed to fall further, but the government and PTB said otherwise. I think low interest rates are here for a long time, any significant increase in rates would devastate the entire economy. For the all the people on this blog saying wait until rates go up to 7%…if that happens anytime soon, most people won’t have a job and buying a house certainly won’t be a priority. If you are truly thinking about buying, the above average to premium areas is where you should be looking. As time goes on, these areas will likely be even more sought after for various reasons: safety, schools, proximity to job centers, climate, etc. Good luck everybody!

Is that a sign-off? I’ll miss your insights, Lord B. Good luck. Putting the bubble behind you and getting on with your life is a great idea.

I look forward to not thinking about the housing market too, hopefully someday soon.

I am mostly focused on the 550 to 650K price point and in that price point, there has been a big change in the last couple months. It could simply be nothing and next spring everything flies off the shelf with multiple offers again. Or, it could be more than that. At the very least, I will have a better selection.

Knowing that money is no longer actually money but is in fact, Credit which is controlled by the FED ( and knowing the FED is whacked out),I am inclined to try to buy something before next spring.

Thanks Dfresh. I’ll still be lurking, but definitely won’t post as much. Like everybody else here, I just want to get on with my life and forget about the housing bubble. I read your post below and agree 100%, anybody who is waiting for that bargain basement 400K price for 3/2 on the Westside will be waiting indefinitely. I can’t see nominal prices changing much for the rest of the decade. If you can lock in a monthly payment close to rental parity in a good area, it’s time to jump in. Owning a house gives financial stability (fixed monthly payment other than maintenance), not sharing walls, having your own washer/dryer, your own garage, able to customize things to your liking. I couldn’t say any of this for my rental apartment…and all those things are definitely worth something.

This chapter should have ended differently, but it wasn’t allowed to. I’m going to forget about the “what ifs” from here on out…what if prices go down, what if inventory is released, what if we go into another recession, what if I use my downpayment and go all in on gold or AAPL, what if rents go down significantly, etc, etc. Every year counts on this earth, make the most of it! Base your decisions on what you know today, not what might happen in the future. I would guess 90% of buyers in California think this way, trying to outlast them is a lost cause. Good luck!

Martin, I posted a house to you in Bonita, the best in south, 3100 sf, 1 acre land, gated. Good school in the area. The listing price is 495. It’s only there for 4 days. I have been to the area. It’s more like a family oriented, not hipsters. Many People know the value when they see it. Once they see it, they act. People’s value system is also different. I won’t pay half the price for the house you described. Also, the rate is so low, you want to maximize your borrowing so that the negative rate will help you pay your mortgage over time. Well, good luck to you.

I did see that, thanks. I have a well established life in S.D. and want North Park, South Park, Talmadge, Kensington or if the house that meets our needs, Serra Mesa and Linda Vista. Bonita, although a decent area, just wouldn’t do it for me.

The government is the bank and the banks are the government. Remember that and you’ll always have a reliable starting point to return to when the noise gets to be a bit much.

It sure interesting to witness the SoCal sheeple trying hard to ignore that the weather card is increasingly being trumped by the unaffordable card.

Joe, I could not have said it better myself. I’m frankly getting annoyed with the weather card. I’ve had several people be disappointed that I’m saving up to leave California, citing the “beautiful weather”. What’s the point of good weather when you’re working too much to enjoy it? The only way I see that being beneficial is if you’re homeless, which may happen to many Californians if this keeps up.

think that in the governments 40 year make housing affordable scheme of agencys and governmental rulings that included signing a decades long contract to enslave yourself to bank profit making mortgages and housing became unaffordable till today where givernmennt is trying to drive house prices up..?

I been reading Doctor Housing Recovery website for year saying price will drop shadow inventory are high and artificial interest. as of now I’m still renting in Rancho Cucamonga try to buy a house and low inventory. a good price coming people snap right away every agent toll me hurry to buy before price go up. I see very low inventory in Rancho Cucamonga area mostly the house show up are in corner street are next to freeway.

Its Suzanne on the phone again. She says shes found our dream home and with interest rates at -10% she says we can afford it. Come on, honey it does have four garages!

http://www.youtube.com/watch?v=zcTjhXSmnmc

I used to pity Fictional Henpecked John, but maybe he and Fictional Shrew (yeah, I know they’re not real people) fictionally scored…bought the big house, maybe heloc’ed it to the max, bought new furniture, cars; when RE bubble burst squatted for years (maybe still squatting, John could be in the Fictional Big Garage, working on classic Mustang he bought with Heloc loan (arranged by Suzanne’s “friend”), Wifey out shopping again), not making payments for months/years allows them to save cash to eventually buy another house, or rent something nice. Fictional John and Shrew laugh; possibly they did better than Real People who were financially prudent and scoffed at Fictional Suzanne’s “research”. Kinda tragic, huh?

Well I also saw the bubble coming back in 2004 and finally just the other week put in an offer on a house. While I agree with the sentiment that prices aren’t where they should be, I can’t see any change on the near term horizon. Coming to the realization that waiting this thing out might leave me as a senior before I actually buy a house based on sane valuations was a godsmack. At any rate, I have been waiting 8 years, and it seems likely I will be waiting 8 years. If you are waiting 16 years of your life, you have to ask if that in and of itself is any more sane than just going with what it admittedly a somewhat crazy situation.

I choose to look at the the debt as a means of devaluing everything which in effect is the only somewhat sane path if you aren’t going to let housing values revert to their pre-bubble prices. At least if inflation goes crazy I can expect the amount I am spending on a house to be more bearable so long as my income keeps up.

This “capitulation” of which the Dr. speaks is not what we all had in mind. That dream of a final down-draft of home prices past the median towards true bargain-basement prices in desirable areas is over. The melt-up market is at work (stoked by the Fed, restricted inventory, accommodative FHA, etc.), killing off any optimism from fence-sitters for blood in the streets panic selling. That happened briefly in ’08, never to return. Make no mistake, real estate as a reliable 7+ percent yoy asset class is dead for the foreseeable future. But there will be no final down-draft. No “tsunami.” No final opportunity to pluck a 3/2 out of the Westside for $400k. Sorry, kids. That isn’t the way the final chapters of this saga will be written.

We all suspected but never could quite believe it would be be like Japan. But it is. Amazingly enough. It’s Japan.

Check back for more pictures of this same property in a month or two.

It will be on Trulia/Zillow listed as an instant cash cow-banana tree shaker-investor’s dream duplex with a very loooong drive get away.

I agree with upnorth and Dfresh. I have been building savings (‘paying myself’) and am now in the market to buy. I am single, 50 yrs old, first time buyer. No debt, no school district to concern myself with, and excellent credit score. I plan to buy in WLA area and live in it the rest of my life (self employed)

But what has changed reading this site, is I am likely to buy a duplex (2 small houses on 1 lot) so that I have some cash coming in (after taxes, utilities, etc). This way, I have some financial security rather than SFH. My next step is to sit down with a few financial professionals to make my choice on FHA 3.5% down or 10% down conventional or 20% down. From what I read they all have their advantages.

With low down payment I sit on my cash in this uncertain economy. With 20% down I reallocate most of my cash into the down payment, with little cash reserve. Price range $500K – $600K.

Side note: My mother turned the back 2 bed/1bath of her house into a full rentable unit by investing $30K in a full kitchen in one of the bedrooms. She did that 15 yrs ago and made $15,000 yr renting out the back part of her house in a ‘house share agreement’. That is another option for me – buy a house with an extra bed and bath in the back extended in the backyard and add a kitchen and turn it into a house share. As you can tell, I am determined for the first property I buy to make me some money. I am willing to be a landlord for 1 tenant, even if it means only $1K per month rental income. From the posts on this site, everyone seems to be mad as heck about these FHA loans, does anyone have anything positive to say about me doing a FHA 3.5% down now?

I am a mortgage lender. It has been busy for 10 years– bubble loans then and bubble refi loans now… We are running out of $107,000 homes for 20-somethings to buy, so Benny Bernanke had better figure something to jump-start the step-up market. He will, so it will be busy in the future… Maybe it is 2% mortgages and maybe it is cash incentives. Housing needs to stay stable at a minimum to get people to buy more build-a-bears and iphone 14s…

Leave a Reply