Should I buy or rent? An honest look at rent versus buying calculation for California. Do not forget the standard deduction. How easy is it to save $100,000 in California?

One of the biggest reasons I see given for people buying a home today is the rent versus buying calculation. However, it is rather clear that people are overstating the benefits of the tax breaks. Many of these assumptions are based on a sizeable down payment. In California the down payment is a very large chunk given the high price for homes in many desirable markets. You have your FHA buyer that is diving in with barely 3.5 percent down or your investors going in all cash. The sweet spot number of someone with a high down payment, solid household income, and a high credit score is not exactly a big portion of the current sales market. A few readers ran these calculations and I appreciate the thorough analysis from both sides. It is actually a good sign that people are breaking these numbers down but we should examine it from all sides. In many areas like the Inland Empire, the numbers are supporting buying over renting. However, in more expensive markets the numbers are not exactly so clear.

The $500,000 home example

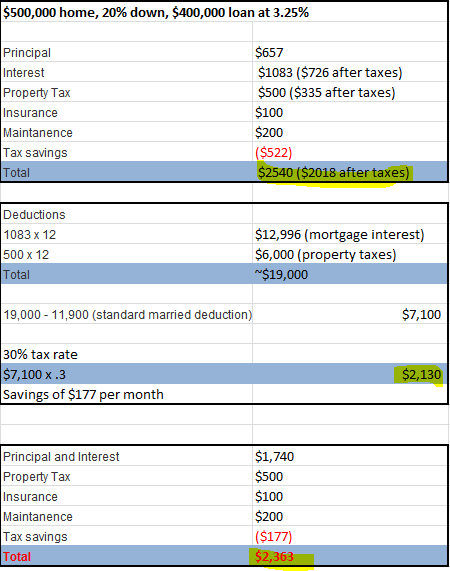

The California median home price is $287,000 but most of the discussion about buying versus renting comes at a much higher price point (nearly twice as high). Let us assume that someone is buying a $500,000 home with 20 percent down and has stellar credit and qualifies for a 3.25 percent down payment (APR is more likely to be above 3.5 percent but we will be generous here). Let me provide three boxes below. The first was an ideal scenario followed by calculating deductions, and finally the actual true payment:

First, what can you write-off when you own property? You can write-off the interest and property tax. The first example was very generous but also did not calculate the typical standard deduction. The vast majority of home buyers are married couples (not all, but many). Also, many that do plan to buy are planning on having a child and pausing household income for a short period (or paying for childcare but the bottom line is a big cost is added). So we are going with the typical deductions in the second box. In 2012 the standard deduction for a married couple is $11,900. What this means is you will need to itemize and have deductions larger than this to even benefit.

Some quick numbers:

-Less than 10 percent of those in the bottom 40% of incomes itemize

-Top 20 percent of incomes average an itemized deduction of $38,000

-Top 1 percent averaged $170,000

In fact, most Americans don’t itemize and the majority of households own their property. As you notice above, the big write-off on the $400,000 mortgage comes from the close to $13,000 in interest paid each year. Given the fiscal cliff that is coming up, this is one tax deduction that is primed for capping out at certain ranges. Think about it. For a typical mortgage on a US home interest is $4,500 to $6,000 (mortgages around $150,000 to $200,000 so we are even being high here).

So back to the example. Overall the monthly nut is $2,540 in the first case with a monthly tax savings of $522. As you can see once we actually factor out the standard deduction into the equation, the real tax savings comes out to roughly $177 per month.

Since the argument is about the monthly nut, you have the following net payments:

$2,018 versus $2,363 (a difference of 17%)

I think this is crucial to understand. Also regarding the principal reduction, in the case above it is $657 per month.  In one example a similar rental was $2,000. So you have:

Principal pay down:Â Â Â Â Â Â Â Â $7,884/yr

Savings from renting:Â Â Â Â $4,356/yr

Also, this only works assuming you don’t sell quickly. The average transaction cost in selling a home is still 5 percent even with all the available tools out there. People talk about lower cost options but the bulk of sales still carry this high cost. This alone will make it hard to sell in less than 7 years and make a sizeable profit.

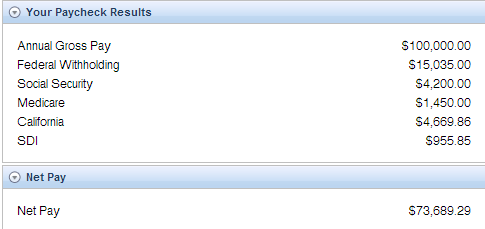

Let us take a look at the California tax break down for a married couple:

The above scenario is a married couple with no kids pulling in $100,000 a year. According to household data 25 percent of California households make $100,000 or more. Once you factor in the entire tax picture, that $100,000 gets boiled down to $73,689 (or $6,140 a month). For this household even the $2,363 payment is roughly 38 percent of take home pay. This is why so many people in this category are looking to buy yet sales figures aren’t jumping up dramatically because this pool is so small.

And keep in mind this is the ideal couple with at least $100,000 to put down and stellar credit that found a $500,000 home that is suitable. Last month in SoCal these were the sales metrics:

FHA insured:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 25.2 percent of purchases

All cash:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 31.5 percent of purchases

Jumbo loans:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 21.1 percent of all purchases (carry a higher rate)

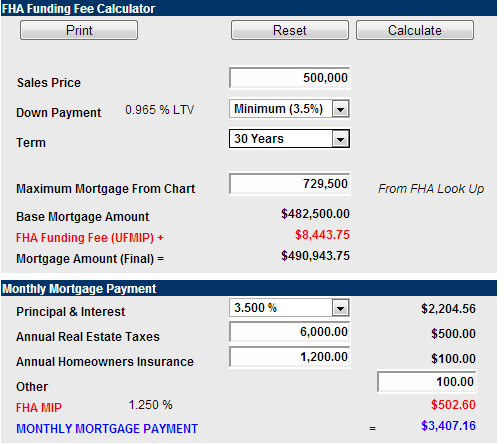

So if these numbers seem to make sense, why isn’t everyone moving off the fence? First, as we noted, only a small percent of households even make enough to get into the game in certain areas. Plus, how many households actually have $100,000 saved up ready for a down payment? Not many. The all cash buyers are not looking to sit down. They are looking to flip or rent the place out. Those buying with FHA insured loans face a very different picture. Now let us run the numbers with a 3.5 percent down loan:

Suddenly the scenario only makes sense if you have a sizeable down payment. $3,407 would be the monthly nut minus the $177 in tax savings and you are down to $3,230 for the monthly net payment. This adds on nearly $1,000 per month just by going with the very popular SoCal FHA insured loan. FHA used to be much cheaper to finance but since this fund is going bust they have jacked up insurance premiums. So in the end, you still end up paying for the cost of all those low down payment risky loans.

Why the $100,000 factor is big

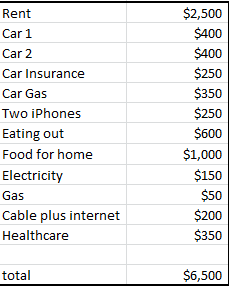

To plunk down $100,000 is a big deal. In California the vast majority of people blow through most of their money very quickly. Let us take that $100,000 couple again. Let us assume they rent a nice place for $2,500 a month:

This is a very rough example but given the cars you see out and around, the monthly nut of $400 per car is realistic. Remember the monthly take home of the couple making $100,000? It was $6,140. So this couple is already going into the red and isn’t even planning for retirement here. Keep in mind you see much more nuttier behavior with people leasing cars with monthly outlays of $600 and higher. Let us assume this couple manages to cut out $1,000 in spending here. Now they are spending $5,500 per month. That leaves them with $640 per month to save. How long will it take them to save $100,000?

$640 x 12 = $7,680/yr

$100,000 / $7,680 = 13 years

Let us even be more generous and assume they save twice as much per month (so it now takes them 6.5 years to save for this down payment). The hard thing here is that someone that is diligent enough to save $100,000 is not likely to let go of it that easily. Even for the $100,000 household you can see how tough this is. This household is essentially saving one year of gross salary. For the US in general with a median home price of $170,000 and a median household income of $50,000 the 20 percent down payment is $34,000, 68 percent of annual gross salary.   Plus, someone that can cut down more dramatically is unlikely to easily let go of this for a $500,000 shack in SoCal. This is why the market is largely dominated by low down payment buyers and all cash investors crowding each other out.

Rates would only need to go up by a few percentage points to wipe out that $100,000 equity. How so? Since the monthly nut is the argument. Let us run a couple of scenarios:

$400,000 mortgage

@3.5 percent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,796 (principal and interest)

@5.5 percent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,271 (principal and interest)

What would the mortgage have to be to get it back down to $1,796 at 5.5 percent:

$316,400 @ 5.5 percent = $1,796

Keep in mind that 5.5 percent for a 30 year mortgage is ridiculously low anyway. So some I believe are balking at dumping $100,000 to see it evaporate in a few years simply because of the giant unknowns coming up: fiscal cliff, taxes, incomes, Europe, less affluent youth, student loan bubble, bursting real estate bubbles in China/Canada etc. And as we pointed out, going with an FHA insured loan will jack up your monthly payment so much that the rent versus buy examples will largely favor renting in more prime locations (where most commenters are looking to buy and compete with hipsters and flippers). $100,000 is a big bet plus you also have to factor in the opportunity cost of this from other investments (i.e., bonds etc). In most of the US where the typical home costs $170,000 the risk of buying with a low down payment is more like a call option. However, in California’s mid-tier and prime areas the numbers pencil out only if you go in with a good down payment (and good means six-figures). That call option (FHA insured loans) is going to cost you money for an expensive state.

I want to thank readers from both sides for providing numbers and insight into this. If things were so clear cut the market would be booming with organic purchases and not a crowding out by flippers and low down payment buyers trying to squeeze in.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

74 Responses to “Should I buy or rent? An honest look at rent versus buying calculation for California. Do not forget the standard deduction. How easy is it to save $100,000 in California?”

When I did the “rental parity” calculation I also included utilities which cost more for a house than bulk apartment rates. So with $70k household income, a 2 BR townhouse, $1400/mo. rent (which is below market right now in my area), looking at current rates I would need a mortgage loan max about $200,000 for just monthly payment parity assuming $700/mo. per 100k financed (includes FHA insurance fees and approx. taxes). However, factoring in utilities costs and stuff (not even repair/maintenance), it would need to be more like $150,000 for true parity (outlay of ~$1400/mo, still more than 1/3 of income).

Comparable distance from my work is Gilroy, ~45 min commute time. Even in this area you won’t really find anything decent not eaten up immediately for under $250,000, at least not on the MLS. I’d consider going directly to the bank to get an REO with $20k saved up, but my credit is only 630. So I am effectively locked out of this market until my savings reaches a certain point (30-40% down they might deal with you).

Due to the election outcome we’re likely to continue on our current market destructive path. So all I can really do is save more (I’m lucky to have stable work even as the economy tanks) and wait for the collapse to continue. I wonder if I can jump into an REO with 20-30% down, with less than perfect credit (FHA the only option) ? Fundamentally I know I can afford the payments, but the inventory needs to improve (increase). I guess we’ve got a lot more to flush out, I hope in 2013 they actually do that because 2012 didn’t have nearly enough inventory.

Your FICO is far above the threshold that requires 20% down.

“Due to the election outcome we’re likely to continue on our current market destructive path.”

Um, I’m confused by that statement. What are you implying? That the present administration’s policies have helped “destroy” the market. Really? And the loser’s “let’s just let everyone foreclose” approach would have “helped” the market?

BTW, I’m on the letting everyone foreclose side.

It’s true, tax deductions aren’t as high as people home for since there’s already the standard deduction.

However, just subtracting the standard 11.9k deduction from the MID to calculate the difference is too simplistic. Most people have other deductions they would be able to itemize if they were already past the 11.9k threshold.

-state income tax

-charitable contributions

-car taxes

-some medical costs

Obviously this varies widely from person to person, but it’s likely that a high-income household has additional deductions that they would itemize if they had a large mortgage. This would especially be true in states with high income taxes (CA)

precisely. prior to owning a home, none of my other tax deductions were applicable because they never exceeded standard deduction. Now, the home tax deductions allow for that all to come off the top.

There was a time when you could itemize just about any form of interest paid in a given tax year. That didn’t last. Any guess as to how much longer the mortgage interest deduction will last?

Boehner just put it on the table as the number one bargaining chip. 3-2-1….

Historically speaking, Dr. H, where should the prices adjust to? Should we now be back to 2004 levels to account for inflation? Or 2000? Where did everything go off the rails, and will we be back to a normal range, even if the “normal” California inflated range, if interest rates return to historical norms? Or is it possible something else will prop up the prices even if interest rates do indeed increase?

BrianT: If if’s & but’s were candies and nuts, everyday would be Christmas.(Gen. Omar Bradely)

Historically the people in charge were cognizant and fearful of the consequences of their actions. Nowadays, they know all is lost if we go back to 2+2=4 so like lemmings they will all insist that 2+2=whatever they need it to be to get to tomorrow.

Short answer is; NO point in asking, something else will pop up until it doesn’t. Then watch out below.

Typically bubbles do revert back to where they started, this would be either the year 2000 or potentially 1996.

With all the monetarist meddling, bank balance sheet cooking due to lack of writedowns of the underlying notes, and ongoing tax credit crumbs and stimulus shenanigans the ultimate bottom has been padded. My guess is we will never see that collapse down to or briefly below the bubble’s beggining in terms of home prices.

Stagnant.

If the banks trickle out the foreclosures for another 5-10 years then we may bounce around seasonally – down 10-20% in the winter, up 10-20% in the summer without some domestic or exogenous shock. Barring stagnant employment and minimal income growth extending past that 5-10 year timeframe – we may have seen the bottom.

The Dr. has drawn parallels with the housing market in Japan over the last 30 years in numerous articles. Can anybody find a better prediction for our SoCal market?

Stagnant.

I am not free market ideologue, but I would love to see the banks forced to get the distressed properties off their books or suffer loses to shareholder equity.

Unfortunately, they have all the chips and being TBTF they can make all the rules by the sheer fact of their overweighted presence in the economy. Bernanke’s nightmares are inhabited by the banking monoliths.

So the dreamed for correction will never happen, at least not without bringing back a Glass-Steagalequivalent and/or banning mark to model accounting practices, but if it did we would see prices adjust downward and interest rates go back up to historic norms.

Stagnant.

Sure as hell hope I am wrong.

from the graphs and studies I have seen, 1998 looks about right

Try 1997

The real issue is whether or not this mortgage rate can be sustained? Those who got in at 3.4% will in many cases, be paying at parity. If the rates rise…..it will be interesting to see people paying a relatively low mortgage rate while their home devalues. But at these rates, you’re buying more house and paying less interest. So at least you’ve got something to show for your spending. All you buy with rent, is time.

“All you buy is time.” Yes, correct. I buy my time renting. We look for jobs out of CA everyday and we are renting, buying time saving our money (which could buy a whole house in most of the country) waiting for day we can leave Mordor, which is what I call SoCal.

An ex co-worker just got a job in Austin paying the same as he made here in Pasadena. He said it like paradise. His house is twice as big, in a nicer neighborhood and costs less than the shack he sold here. He says the local school is nicer too.

Landlord gets it. Each day I apply and look for jobs elsewhere, I’m all for living someone where else with a cheaper cost of living. So yeah buying time too by renting.

We moved to Austin move than 6 years back as part of the first wave of people and recently moved back.

So what did I learn, well if you lived in SoCal for a long time (as I did before moving to Austin), you quickly realize Austin is not SoCal.

If you were a person who liked what SoCal had to offer this is what you need to really love Austin. This is what most people who sell Austin does not tell you.

1. Need a house that is at least 50% larger than here.

Simple reason you will be going out much less (after the initial enthusiasm fades).

2. Have to love or not care about bugs and scorpions

Every bug in the world is found in Austin and those little scorpions will get you.

They love the warmth of houses, and your sheets and you will see them crawl

the wall and floors.

3. If you liked the out doors here because of the weather you will hate the out

doors in Austin. Pretty much because there is hot and cold in Austin nothing

between. So you will most probably try out doors early in the morning (pretty

much will have couple hours you can be out) or in the evening when the bugs

come out. So get used to bug spray quick.

4. If you like the ocean, closest ocean is about 4+ hours away.

There is a saying in Texas, that only people who have never been out of Texas

thinks there’s nice beaches in Texas.

Lakes are not a substitute and they are most of the time quite empty. So you

get to swim and play in the mud (okay muddy water).

We got so desperate for water we actually did exactly that :-).

5. If you worried about earth quakes say hi to Tornadoes.

Earth quakes you have no idea until you get hit, well you have to worry about

tornadoes when there is bad weather.

6. Commercial space is very expensive in Austin. I have no idea why.

Actually even down town condos are crazy expensive in Austin.

7. If house prices come down more in California or if they stay the same without

going up for some time you will see a lot of Californians moving back.

What’s good:

1. House prices are cheap compared to California.

2. Austin people are really nice similar to places like Ventura or Santa Barbara

counties.

Even though old Texans hate people who move from California.

3. Texas may not have nice beaches, but the water is warm so its easier for

kids to jump in.

4. There are more jobs in some areas.

If you are a professional there are better opportunities in California coastal

cities than Austin.

5. Its different from rest of Texas.

6. If you are very religious (Christian) Texas is a better place.

Final verdict, we moved back to California with a salary only slightly higher than what I had in Austin. If I stuck around I could have made the company match my California salary offer. I personally do not regret moving back. Having lived in Austin I definitely do not envy my friends who spend 1/2 of what we spend here for a house or have bigger houses in Austin.

I love to get out with my family, enjoy nature and the beach. My kids are still in elementary and I spend lot more quality time here in Cali than I ever did in Austin. Overall with some life style adjustments it looks like we are saving not much less than we did in Austin. Guess while living in Austin, we wasted a lot of money trying to make our selves happy in Austin 🙂

What we really miss are some of the great friends we made there.

Ohh yeah .. forgot to say what most people said when we finally left Texas.

1. You Californian’s you are only here until you get a chance to move back

2. You guys are so lucky, you get to move back to California

I should have proof read my earlier post :-).

The grass is always greener. Peter is right. Be very sure you want to live eslewhere before you buy into the whole thing. I thought the same thing about New Orleans back in 1986. I even visited there a bunch of times before moving. After I’d been there for about 4 months, I could not wait to get back to CA. For a whole host of reasons. Weather, culture, bugs, people, opportunity, etc…..

CA is a big place. I would not live in Los Angeles, but I loved San Diego.

@Peter – thank you for your post. I keep thinking Austin, Atlanta area, and a few others. The points you make are the ones I keep forgetting about when I see mansions for the price of a dump here. It helps to have firsthand knowledge of the pros and cons. People’s attitudes are a biggie for me, but not sure if the weather extremes are palatable. Austin too cold. Georgia too muggy. But, neither are out of the question. Sometimes I think I will do a temporary move.

How could anybody even consider living in a state where they teach children that Jesus rode around on a brontosaurus?

I mean, the music scene in Austin is cool, but, really, that’s about it.

I lived in Austin for two years before moving back to SoCal and Peter gives a good coverage of the main points of comparison.

Yes, houses are inexpensive compared to here, this is well known.

But —

Property tax = 3.5%. No Prop 13.

Salaries are generally lower – California transplants seem to average a 20% haircut “because the cost of living is less here”.

Very sterile suburbs – if you live in in the Inland Empire or the more sterile parts of OC you’ll get a feel for what most of the Austin suburbs are like – recent-build sprawl housing with very little character. You have to drive everywhere.

Horrible weather – if you’ve grown up in SoCal it is hard to get used to Texas weather. Essentially you don’t go outside in the daytime more than a few minutes for 4-5 months in the summer, and a couple of months in the winter. If you’re outdoorsy this is a big drag.

No beach, no mountains worthy of the name. I found the landscape pretty boring and ugly. The hyped “hill country” is pretty blah to anyone used to the CA mountains.

One of the great things about CA is how many great attractions are within a day’s drive – SD, SF, Santa Barbara, Baja, Yosemite, Big Sur, Mammoth, the Sierras, Death Valley, Vegas. In Texas there is not much worth driving to; Dallas, Houston and the Gulf coast are worth maybe one visit and that’s it.

Isolation – LA, and CA in general, is one of the nerve centers of the world, culturally and economically. Austin is not.

Poor public facilities – libraries and parks I found very skimpy and inferior in comparison.

Culture – more insular, less aware of the rest of the world. Having big houses, I find people are most concerned with their big houses and not much else. There are regular eruptions of anti-science religious “controversies” in the schools. Texas state politics are not to everyone’s taste, to put it mildly.

There’s only one problem with that, it’s in Texas.

Oh, and property taxes are a bear there too.

Thanks for a solid analysis. One extra factor that keeps me from buying in S. Cal. is depreciation. Sure, the property might actually be worth more when I want to sell it in 5 years (as any Realtor will gladly tell you no matter what actual evidence suggests) but prudent people simply can not be sure. It’s fine to play games with a nice house in the Midwest that costs $200k and loses 25% of its value in 5 years. But when the house is $500k, that’s just too big of a portion of my financial landscape to risk it. As someone who’s been interested in buying a house since 2004, I can assure you, prices go down sometimes. I’ll know inflation is taking care of this problem just as soon as I get a huge raise. My apartment is very nice.

I think your estimate for gas on two cars at $350 month is very conservative for greater LA. I think the price of gas today is closer to $4.50 than $3.35.

“Estimates based on the Automobile Club of Southern California’s Your Driving Costs 2012 using an average of 15,000 miles per year at a cost of 59.6¢ per mile for gas, maintenance, tires, insurance, license, registration, taxes, depreciation, and finance charge. This average was based on a $3.357/gallon cost of gas (the late-2011 U.S. price from AAA’s Fuel Gauge Report). You may override this estimate by entering your actual gasoline costs and MPG in the form above.”

The example of a $500k house above rents for $2,900/mo in my neighborhood.

The after-tax expense of ownership of $2363 really should be $1706 since $657 of debt is paid off each month, thus improving the household’s balance sheet.

In 66 months the principle is paid down by $50k, and now each payment is paying down the loan an additional $130/mo. and the cost of ownership is $1576. Principle pay-down accelerates as time passes until the loan is paid off. Remember, one-third of all houses in the U.S. have no mortgage. People do this. It just doesn’t make headlines.

My sentiments exactly.

That’s because the media and all these whack jobs out here keep scaring people into not buying a house or whatever DUE TO THEIR PERSONAL POLITICS!!!!! You wanna house?! Get one!!!!!!!!!! And if it fails, who cares? Start over. This is America, your allowed to make mistakes! Booo hooo hooo, the numbers don’t add up, I don’t get it. This is a bubble. America is going to end.

I hear this all the time. We are still here. Stop listening to these negative morons and just live your life!

… By paying down your principles

One thing’s certain — price perception on commodities has had a seismic shift. We can thank to two massive serial bubbles (Bernanke’s working to facilitate the next one), which created not only sizable windfalls for retail investors, but also effectively nudged the baseline of what consumers consider “normal” prices.

I remember even just four years ago, hardly anyone bandied numbers around like 2400 a month or half a mil for a block house. Very strange market aftereffects, especially in light of the flagging US consumer .

God point. Kind of like how people have quickly come to think that $3.50/gallon gas is “cheap”.

A lot of people forget that oil was $20/bbl in 1999.

I’m getting tired of the whole gas prices are to high nonsense. People are willing to pay thousands of dollars for TV and other horse shit. But, dear god, I have to pay another dollar a gallon! It’s going to break the bank! Oh my God! It’s Ben Bernakes fault! I have genitle warts! Must be ole Ben Bernake!

I think your post explains why it’s working. People think half a million for a starter home is natural and affordable for anyone with a decent job. But once in it, it becomes apparent that something’s wrong with this picture.

I think we will see a shift when people start saying, “No, $150K is natural for a starter home and $250K is that dream home I want after I practice law (insert any profession) for a few years”.

you did not even add one other cost.

if you take 100k down on a 500k place, that 500k even in a super ultra conservative bond fund still probably earns 2.25% or so.

so thats $2250 a year – taxes you are not getting.

I knew Americans could deduct the interest on their mortgages, but I had no idea that you could also deduct your property tax!! That is unbelievable. As a Canadian who can’t deduct either on my prinicipal residence, the more I look at the American situation, the more I think most Americans have no idea how lucky they are. Not to mention, Americans pay less for gasoline than Canadians do and the bulk of your oil comes from Canada – how ironic is that?

Whatever we save in gas prices and interest deduction, we more than pay for in subsidizing the worlds health care. American’s are in the midst of a health care crisis that is destroying any potential for generating wealth in the middle class. American’s are on the high end of medical retail so the rest of the world can pay wholesale. Obamacare has done nothing except give the insurance companies a mandate to raise my premiums 30%.

I don’t worry about health care. Either my employer pays for it or I don’t. If I have to go to the hospital, I go. If I can pay it, I will. If not, the bills will go in the trash!

It might not be that way for long. Some kind of tax reform is coming and it very well might involve capping deductions. Most of the difference in gasoline prices is also excise tax related. Lucky? No. Just differences in taxation policy.

Oh wow, the mortgage interest deduction. Quick honey! Pack the bags and the kids. We need to get to the US now!!!!

Maybe you should move to Cuba, where they will take good care of your socialist opinions for free. You could live on sugar cane and cigar tabacco

I’m not completely sure, but I believe the bulk of our oil comes from within our own borders.

Question: when interest rates go up, say to 5.25% and that same $400k mortgage needs to decrease down to $316k in order for buyers to realistically buy as they are today…will these housing drops really occur in spots like Sherman Oaks, Encino. SANTA MONICA (where I live) or the Palisades???? I’d LOVE to see a $100k drop in property values because as a renter who DOES have the $100k downpayment…my husband and I are sitting on the fence hoping that once rates increase, prices will drop a bit. But, we’re not talking $500k for a house — we’re talking $800k to $1million in the valley! And, that’s only because we can’t afford the $2 million price tag in our neighborhood for a 1400 sq. ft “cottage”. :(.

So, we’re sitting on the sidelines waiting to see if prices do drop when rates go up. I hope we’re doing the right thing…. Your comments are welcome.

keep saving, and diversify your assets (a house is not an asset).

Sure it is. A house is always considered an asset when someone goes to sue you or your creditors come after you.

A house is not an asset?? Really? I’m in SoCal and I have 3 houses that I rent out for $3000 per month plus one that I live in. No mortgages on them because I paid them down early by cutting my expenses (i.e. my lifestyle). My first property was a small single family home purchased in 2001, which I lived in for a few years, and I’ve added 3 more properties since then. These rental houses do better than my stocks in general.

I’m mixed about buying vs. renting. I am SO happy for renters because that’s how I keep my properties occupied and the tenants helped pay them off for me and now provide me with income. But since I’m a real estate agent, I also make money from people buying homes. One of my tenants bought a house from me…why? Because it made sense for her. She bought a small home she could easily afford and could fix up over time.

Here is my opinion…I think your above example about a couple’s average expenses is on target for what most people spend but it’s is ridiculous. If you are serious about your financial future you do not buy new cars, you do not spend that much money eating out ($75 per week is enough), you do not spend $1000 a month on food ($400 is plenty including wine & beer)…that’s $1000 savings per month.

So many buyers are crazy about stainless steal appliances, 2 sinks in the master, a dining room big enough for the over-priced dining set they bought (on credit), will a bounce house fit in the backyard, each kid needing their own room and bathroom, need a guest room, a family room with a wall that fits the big flat screen, etc. Buy a home you can easily afford, a starter home or condo, fix it up with a little of your own time and effort, buy it on a 15-year loan and pay it off as quicker if possible then rent it out and buy another one, etc.

Correction on my post above…the savings by doing some minimal economizing of your lifestyle is $1400 per month, not $1000 per month.

Additionally it is ludicrous that two adults spend $2500 per month to rent. Rent the cheapest place you can find and save your money to buy a property. (If you have kids rent the smallest, cheapest place you can find in a safe area with decent schools.)

Good for you Shari. I guess if you lived in a cave like these economic Einsteins, you would have never gone after your dreams. I guess that makes me a “Socailist”, as Brenda says.

What you are not factoring in is hidden equity. I understand it is impossible to determine if a home is going to lose value, but hidden in the P&I is typically money that is going to pay down the price of the home. Money that is recoverable at final sale (especially for those who plan to live in their home more than 10 years). When you terminate a rental agreement, you walk away with only the money you saved.

Assuming the home doesn’t depreciate, that is. If it does…you never build up that ol’ “hidden equity,” you’re just trading less valuable today’s dollars for yesterday’s dollars you borrowed to buy the house — at the ruinous exchange rate of 1 to 1.

Doc, you nailed it.

Digressing from interest deductions which don’t apply to cash purchases and, as far as I know, to leveraged income bearing property, what about the current flock of flippers and their ROI?

I wonder what will happen to the flippers left holding the overpriced shite when they reach this current bubble’s market price zenith? Someone always pipes in to proclaim how they are going to get 8 or 9% annually on a rental property they just bought for cash, but I cannot imagine all these investment buyers are going to be managing single family dwellings over a ten year time frame. Then what? Still holding an overpriced property but happy with 8-9% after all costs or stuck with a bloated pig?

That pig is going to fly and turn into a cash cow or at least a pretty purse.

Time has shown that in SoCal there are always buyers for bloated pigs aka “Real Homes of Genius.”

Sorry for the jaded rant. It is therapeutic.

Ironically there was an ad on the side of my screen on this site that said, “Become the Bank! Earn 12% by purchasing private mortgage notes….”

Ha, ha. That makes me think some 1%er is trying to unload shite mortgage notes onto the middle class.

This illustrates why the Federal tax deduction for both mortgage interest and local taxes should be eliminated.

I believe that’s going to be the first thing to be zeroed out when the temporary solution to the upcoming fiscal cliff is devised. Watch the RE industry squeal like stuck pigs when it happens, but they have only themselves to blame in the end.

Great analysis Doc. Once again, everyone needs to crunch the numbers of their own situation in the neighborhood you WANT to live in. If you can’t really afford buying in the neighborhood you like, rent. There is more to life than taking a spin on the real estate wheel of fortune. Unfortunately, that is what buying a house has become, as bubbles are created and popped. Is it better to rent in the neighborhood you like and enjoy life rather than sweating it out in a marginal neighborhood, eating top ramen in order to make your mortgage payment.

Also, if you put $100,000 down on a $500,000 house, you have already lost $25,000 or 1/4 of your down payment before you get the key, due to leverage from a 5% sales commission when you sell it. If you are not planning on living in a house for at least 5-10 years, you will lose. Unless, we get hyperinflation. If that happens, all bets are off, were all screwed.

http://Www.westsideremeltdown.blogspot.com

So what does $500k buy you in LA? You can get a nice 2-3BR pretty far out in the valley or in a crappy LA hood. But the reality is, even semi-desirable hoods in LA proper with crappy schools are pricing 2BRs in the 700s and up. And if you want 3 or more BRs and good schools? You’re talking $900k and up. This situation is not sustainable. Walk around any run-of-the-mill LA hood and you’ll see street after street peppered with recently-remodeled houses and luxury cars parked in their driveways. These people aren’t millionaires. They’re debt addicts, who can’t possibly pay for their opulent lifestyles with their take-home income. Unless you want to settle for a long commute or living in a questionable neighborhood, your choices are to rent or hop on the crazy debt train. I don’t care what the interest rates are and how much inventory banks are holding back – Buying a standard SFH for over $700k doesn’t make any sense financially.

Man, you’ve got it nailed.

Looking at homes in L.A. is like shopping for basic essentials at Brookstone if they sold them. There’s some nice looking stuff on a few of the shelves but the prices are just seem out of whack and in many cases a lot of it is cheaply made junk or old technology marketed to look current.

You see people in the store but wonder who the heck would settle for actually buying anything there. Given that, it’s the first store you expect to see closed up at the mall but they’re still around to everyone’s amazement.

That’s what L.A. reminds me of.

Riding around my area in Encino (around the Encino post office), i’m reminded of the character Wemmick in the Charles Dickens novel ‘Great Expectations’. Wemmick had his small cottage aesthetically dressed up as a castle, with a miniature Gothic door, fake Gothic windows, a miniature draw bridge, and the top was a faux battery, mounted with guns. At work he was obsessed with ‘portable property’.

Some of the ways these Encino residents have dressed up their little shacks, with expensive design features is amusing.

We have very low inventory right now but there are 3BR/2BA homes in good condition (well maintained but outdated) in quiet neighborhoods in 90808, 90815 and 90807 under $500k. Great schools, too. (API scores over 800)

Hi Pwned Not sure I entirely agree. I have been looking at houses in parts of the 90016 zipcode which is just east of Culver City, say from Robertson going east. The zip code goes all the way east of Crenshaw, but I a talking about the zone of Robertson to LaBrea, Rodeo Rd to Coliseum. In this area, very few homes have bars on the windows, I see the same types of cars in the driveway as Santa Monica or Culver City. I even drove around the neighborhoods for 2 hours at night and did not see any riff raff anywhere except at the bus stops along LeBrea and LaCienega. Many of the houses are on 5K – 7K lots with 3bd 2 ba. very few mcmansions (which is a good thing). Also the MTA line along Exposition Blvd seems to make a nice ‘barrier’ to the lousier area along Adams. Nice houses in this area (most built in 40s, 50s) are in the $450K – $550K range. Some of these areas have a real pride-of-ownership attitude which I think helps repel any negative influences. Given the schools are probably not good, but as a single man with no kids and a 15 min. drive from the beach, I think it is a good area.

Schools are awful in that zip code – most receiving very low scores. Also, that area has much more crime than areas west, and if you look even slightly west the prices almost double. There’s a reason you can buy houses there for around $500k. My point was that if you want to settle/don’t care as much about more crime and bad schools then you can find $500k homes. Obviously you can find something WAY cheaper in truly crime-ridden “ghettos.” But if you want anything in an above-average neighborhood, of which there are many, you’re looking at $700k+. Good luck with your house-hunting though! If you don’t have kids and are looking to settle down for a while you may find a well-maintained home for a decent price.

When life happens and you have to unload your albatross in a hurry, you might find out real quick that being in a good school district matters whether you have kids or not. It’s part of the location factor because most buyers factor it into their buying decisions.

It’s foolish to disregard a fundamental purchasing factor for your future prospective buyers. Someday you will want to sell the house. Then again, this mindset reminds me of the monthly payment buyers who turn around one day and realize they can’t offload their albatross without taking a lot of pain in the process because they failed to make wise financial choices.

Here’s a great tool to look at crime data and arrive at your own conclusion. As negative of an image LAPD has, their online crime maps tool is very resourceful. Google “Los Angeles Crime Maps”, and it’ll take you to a site where you can select LA neighborhoods and easily navigate historical crimes and type of crimes.

What you’ll learn is, you can’t escape petty theft in LA, but you can mitigate more violent crimes such as aggravated assault, rape and homocide by living in the right neighborhood.

There are two general rules from westside to downtown LA.

1. The more eastward you go, the more ghetto it gets (with exception of a few neighborhoods).

2. The closer you are to a major freeway entrance/exit, the higher the crime rate.

Feel free to do the analysis on crime maps yourself for proof.

Great post, did my own quick calc.

What 10 years of ownership has gotten us:

Most CA homes are old and much more disposable income goes into maint. All the little things you do and improvements you want or need to make really add up but are forgotten over the years. Several years of watching values go down also mean you stop putting money into your house which means the next owners pay to fix.

*Insurance, HOA, trash, gardener, higher utilities cost us more than $500 a month thats over $50,000

*Hidden cost upgrades, maint. (forgotten over time and always not captured) we track everything, $36,000 probably a little more.

* Prop tax is almost a wash with tax savings which will decrease every year.

*My Principle paid after 10 years $82,500

*Cost to own and maintain 50k+36k=-$82,513

*Interest paid out $160,000 or thrown out like rent.

What could we have made investing?

So after 10 years of paying a mortgage other than our own down payment, we break even (unbelievable).

Still have a small amount of equity but not enough to sale, pay realtors and move up. Without values going up people like us are stuck.

This.

Austin has low according to the US census is only 53 and high price OC has higher homeownership at 60. Its the nice suburban counties in Texas where you have high ownership and the large houses.

Austin has 50,000 plus UT students renting with an 800,000 population. That would be the equivalent of OC having about 200,000 students. If you exclude student rental housing, Austin has a very high individual homeownership.

The prices in CA. are still crazy, and are unsustainable. The wages here will not sustain the crazy prices. I’ll rent for the rest of my life before I pay 500K for a house in the hood. I hate California. Sure, the weather is good, there are no bugs….but the state is bankrupt, the schools are shit, the government is totally corrupt, the police force are like a plague on the populace, I could go on and on. Illegal immigration has ruined this state. You can’t keep giving away free cheese and ever hope to balance a budget, especially once you’ve gotten the free loaders used to getting the free cheese. I have no idea how any of these problems can be fixed. The left has no grasp of economics and thinks that printing money can be done indefinitely without any repercussions. It sickens me to think about this stuff. Honest hard working people have been screwed over and over and over, with no end in sight……

So true

There are a lot of nice 3/2 1200+ sq. ft. houses in Lake Balboa, and other areas in the SFV for $300000+. But people who live south of Mulholland think we are in the boondocks and are not cool and would never think of living out here or even driving here. So buy a piece of crap and whine and complain about the cost or live beyond your means and never own a house. Eventually it will be CHEAPER than rent. (If you dont take your equity out) Brand new leased BMWs, dining out, pretending you are rich or a movie star, it all gets disgusting the moaning and crying. Yes its hotter in the summer, but we have more space, are friendlier, less coarse and more laid back. If you really want a house, you will be surprised what the valley has to offer. And btw, we are in the city of Los Angeles.

A mortgage of $490,943.75 over 30 years at 3.5% = the borrower has to repay a total of $792,913. (That’s the capital sum repaid over 30 years and a total of $302,419 interest.

If mortgage rates were to tick upwards.. let’s say 6% at some point, but let’s smooth that down to 5% for now.

A mortgage of $490,943.75 over 30 years at 5% = the borrower has to repay a total of £947,907 (best part of a million dollars), (That’s the capital sum repaid over 30 years + $457,413 in interest.)

Factor that in to your buying is better than renting arguments. I think renting is so damn cheap compared to the nightmare of how much to repay when buying at such insanely high prices in this market.

Interest rates will never be 6 percent again. Here is why>

Total interest on US debt paid in fiscal year 2012: $359,796,008,919.49

In the year 2000, interest on our debt was $361,997,734,302.36 on total debt of 5,674,178,209,886.86.

So we paid interest on our debt at a rate of about 6 percent in year 2000.

What if interest rate go back to 6 percent?

If rates went back to 6 percent, interest paid on a total 2012 debt of $16,278,932,378,520.93 would be:

($16,045,678,692,730.63x.06) =

$976,735,942 billion U.S. dollars

These figures are all approximate, of course. Interest on US debt is paid monthly and interest rates vary during the year. But could we afford paying close to one trillion dollars just in interest expense each year?

How could they ever let interest rates rise?

We are Japan from now until…?

The last time interest rates in Japan were 6 percent was in 1992. Starting in 1996 interest rates sunk down below 1 percent. They are now zero.

Hermes Maldonado loves Southern California so much he has purchased homes three times. The third home Maldonado purchased came after two foreclosures and two bankruptcies, refinanced four times, took on a second mortgage, put a Cadillac and Mercedes-Benz C300W in the driveway and racked up about $45,000 in credit card bills and other debts.

http://articles.latimes.com/2012/nov/14/business/la-fi-rebound-buyers-20121114

Leave a Reply