All praise to the new subprime – 1 out of 6 FHA insured loans is now delinquent. Offering 30x leverage with FHA loans.

Perfectly timed, the Federal Housing Administration (FHA) is starting to see significant delinquencies at a time when the housing market nationwide is appearing to recover. If you define “subprime†as the lowest quality mortgages on a totem pole, FHA insured loans now take that place. It should not come as a surprise given the FHA is insuring an insane 30x leverage market with many that are diving in with only 3.5 percent down. This is no surprise and even this summer, the FHA to assist in shoring up their dwindling capital base jacked up their mortgage insurance premiums. The FHA has completely deviated from their mission and is simply another method of over extending debt strapped and income restricted Americans into homes that they clearly cannot afford. What was once a tiny echo is now becoming a larger siren of impending financial issues. The FHA is heading directly into a bailout scenario.

FHA is the new subprime

Some astounding information is coming out regarding the deterioration of FHA insured loans:

“(Reuters)- Fitch Ratings sees a growing divergence between 90-day past due delinquency patterns for guaranteed and nonguaranteed loans as a potentially troubling signal of future losses. This may eventually force the FHA to look for opportunities to put back some defaulted loans to the banks, particularly if the agency’s funding status worsens and U.S. home prices fail to rebound quickly.â€

What stood out in the report is that eight of the largest US banks now have $79.4 billion in delinquent FHA insured loans. Of this, 83 percent represent government-guaranteed mortgages. If you need additional proof of this maximum leverage nonsense and that banks are willing to give loans out to a homeless person if they could offload the risk to the American taxpayer, read this:

“While delinquency rates for nonguaranteed loans have been improving steadily at these institutions, the trend for FHA-guaranteed loans is starkly different.â€

In other words, banks are cautious when their money is at stake but when it comes to government backed loans they are willing to make any kind of loan product so long as they get their cut. This is very similar to the entire Alt-A MBS process where banks bundled crap loans together and distributed their toxic waste around the globe deceiving investors. Now why is this a problem? Because FHA has essentially stepped in as the low-rung mortgage option:

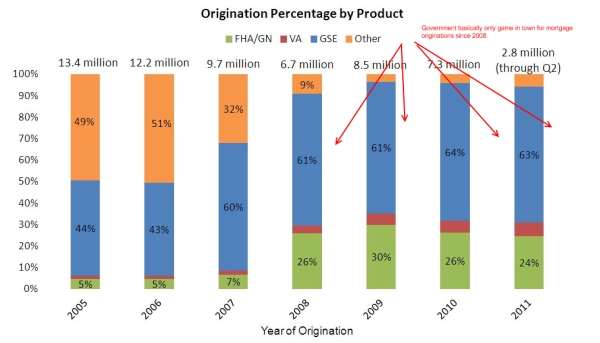

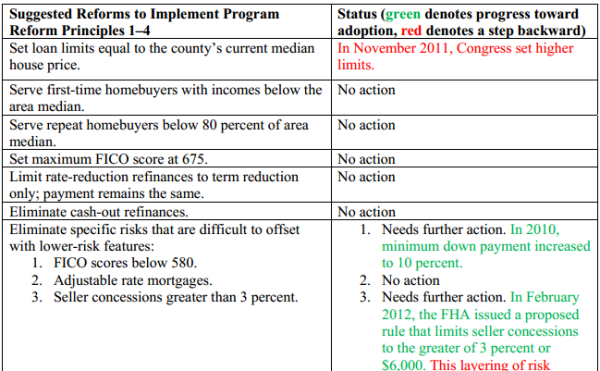

Since 2008, FHA insured loans have taken up a sizeable role in the loan origination market. In 2005 and 2006 FHA loans were only 5 percent of the entire pool. Today, they make up roughly 1 out of 4 originations and reached a high of 30 percent in 2009. In other words, these loans were made after the bust so home prices were already correcting lower yet they have entered the default pipeline rather quickly. Why? Because 30x leverage is freaking insane! Heck, we’re talking about leverage ratios that brought down Lehman Brothers. Some are so delusional to think that this is for the common good. How about we implement some sensible restrictions like the following:

Source:Â AEI, Edward Pinto

Of course these sensible items have been completely ignored for the sake of creating another monster that needs to be bailed out. Ironically, FHA loans have a mission for affordable housing yet we have upped the limit to $729,000+ in some areas of California! In a country where the median household income is $50,000 how is this even remotely close to sensible? It isn’t and we are quickly approaching another bailout.

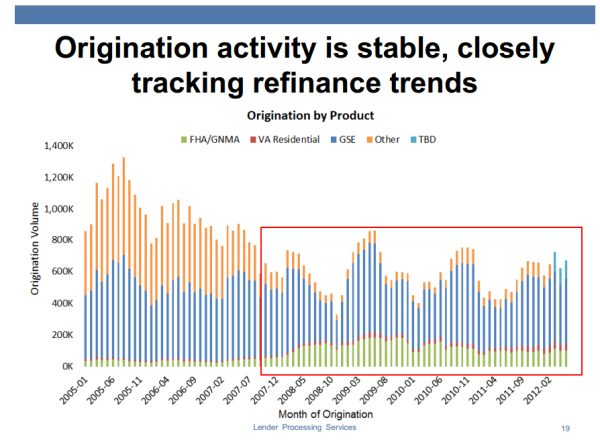

FHA loans continue to be a big part of loan market

FHA insured loan originations continue to be a big part of the market:

There is little appetite for more bailouts. Fitch Ratings actually feels that with worsening conditions that the FHA may need to renegotiate loans with banks that hold these loans. FHA might actually, to a certain degree default by paying less than the actual original principal protection. In other words this will transfer some of the loss to banks. If this plays out, banks are simply not likely to participate and this actually throws the entire purpose of FHA’s insurance into question. This isn’t necessarily a bad thing since collectively this is a boondoggle and such a poorly crafted program that it is now leaking money left and right. For anyone thinking that 30x leverage on a $400,000 mortgage at twice the national median home price is ludicrous they need only look at the very high delinquencies. They are simply yearning for the days of the toxic loan fiesta to come back. Just because you are checking W2s doesn’t mean you are practicing wise due diligence. That should be obvious given the massive delinquencies. 1 in 6 FHA insured loans is delinquent.

The young need leverage  Â

Banks are essentially in a symbiotic relationship with the government. The entire mortgage market is government controlled. I was talking with someone that jokingly mentioned that the slow progression of lower interest rates is a method for banks to collect closing cost fees and generate additional revenue on the back of the government forcing rates lower by encouraging mountains of refinances. Given refinancing volume, there might be a point to that.

The government and banks are intertwined. I mean come on, the entire mortgage market is now government backed and the loans are dished out by the too big to fail banks. You have similar mispricing of risk with the massive student debt bubble. And this brings us to the next point of the younger generation. It is very clear that as a group, younger Americans will be less affluent than say the baby boomer generation and this will impact housing moving forward.

Gen Y most likely to hold low-paying jobs in retail

“(USA Today) Chances are if you’re a working Millennial, you’re working in retail, says a study released Tuesday by Generation Y research firm Millennial Branding in conjunction with PayScale, a company that collects compensation data.

Retail sales associate is listed as the fifth-worst-paid job, at an average of $19,300 a year, only better than cashier, barista, hotel clerk and dietary aide, the findings show.â€

This is where you find arguments for steady rising home values to fall flat. The leverage to boost the housing market without a doubt has come from the following areas:

-Banks simply ignoring mark-to-market

-Banks artificially keeping inventory off the market

-Fed forcing mortgage rates lower

-Government ramping up low-down payment mortgages like FHA insured loans

None of the above reasons has occurred because incomes were going up. We’ve added jobs but many of the jobs added have come in lower paying fields. Many of the future home buyers are already saddled with massive debt:

“For an age group struggling with a poor job outlook and hefty student loans, many settle for retail while they look for jobs in their preferred field, says Dan Schawbel, managing partner at Millennial Branding. “A lot of them will end up in these retail jobs while applying for professional jobs and hoping there’ll be openings,” he says.

Many Millennials in retail have college degrees. Almost half of merchandise displayers — better known as floor clerks — and 83% of clothing sales associates indicated having a bachelor’s degree, the PayScale data show.â€

The figures are not all that reassuring and certainly do not provide evidence to increasing home values. It also may point to the flailing of FHA insured loans. Many younger buyers may opt to go with FHA products because of the low-down payment option but with more transient jobs and lower paying jobs, one little hiccup and you quickly fall behind. We already see the rise of the temporary employment market. The student debt market is now up to $1 trillion and many have degrees from for-profit paper mills that provided little chance for higher earnings. Yet they are now saddled with incredible debts. The irony of all of this is that products like FHA insured loans have actually kept home prices more expensive when the market is demanding more affordable options. Those that usually champion these products are massively self-interested and fail to appreciate the massive costs hidden here. Even if you want to keep these products available, why not cap it out at the nationwide median home price and require 10 percent down? Some don’t want this because they want to swear allegiance to the new subprime flavor of the day so long as they don’t have to pay for it. Moral hazard galore.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

61 Responses to “All praise to the new subprime – 1 out of 6 FHA insured loans is now delinquent. Offering 30x leverage with FHA loans.”

If Obama wins and the houses remain in Republican control, FHA will not get the bail out and it will all be very interesting. If Obama wins and Democrats take control of both houses, FHA will get the bail out. Should Romney win and Republicans retain control of the houses FHA will get the bail out.

Anyone who thinks Government spending will fall under Republican stewardship in this economic climate is drinking the Kool Aid.

I think your drinking the Kool Aid if you don’t believe every senerio you mentioned is getting a bailout. The super rich rule the world not the government.

Yeah, we’re more of Plutocracy than a Democracy.

Why don’t we just call the FHA a bank and give them access to the Fed discount window and let them feed at the trough of free money? (sarcastic) You say bail out, I say monetary policy…

It’s probably too late already but eventually too much deficit spendind triggers a ‘call’ and interest rates shoot up. That cascades through the system and house prices march downward. Shadow inventory be damned…the prices WILL drop in a rising interest rate economy. This thing ain’t over by a long shot.

It was badly managed. The gubberment should have let the banks/insurance companies/investment houses fail… etc and used the bailout $ to buy and demolish empty uneeded substandard housing. They could have bought them on the court house stepsfor cheap. The land could later be resold.

Then that clears up tons of excess supply problems and by now the system would have ‘healed’…wash, rinse, repeat. The trick is for gubberment intervention to have a light hand. With politicans acting as tools it never happens that way. This 30/1 leverage is gambling.

> The gubberment should have let the banks/insurance companies/investment

> houses fail… etc and used the bailout $ to buy and demolish empty unneeded

> substandard housing.

I’m sure that almost any other use for that money would have been better.

After following the good Dr. for years, it is obvious that the purpose of all these economic girations is to fleece what is left of the middle class. Both parties are totally corrupted by the free flow of money, now sanctified by the Supreme Court. Twain said that Congress was the best money could buy, but even in inflation adjusted money, this situation is totally out of control. The founding fathers were extremely worried about the influence of bankers. Some things remain constant. But as Henry Ford said, (certainly no raving leftie, in fact a racist anti-Semite) when questioned about why he paid his workers $5 a day- Who do you think will buy my cars? Is there an organized conspiracy? Not likely, but all great white sharks have similar interests and desires.

Waiting for the 2nd housing bubble to pop. Yours Truly, Gen X/Y or whatever I am (born in 1976)

Viva la subprime 2.0!

GSE are govnerment loans as well. So, that is a total of around 90% government “backed” mortgages. Oh, I forgot VA loans, make that 95%. Just like China. I just hope I am around to see the collapse.

FHA -Thanks DHB, great topic.

OK, we’ve been outbid by many FHA no money down, throw it in the loan and overpay a-hole out there. We go in with a sensible offer ALL CASH, 10 day inspection, 20 day COE, and then some FHA buyer, overbids us. I am wondering how the appraiser “hits the number”?

Then as we follow Foreclosure Radar (we’re looking wholesale as well) we will see one of the homes we were outbid on getting served an NOD. Nice! It just irks me to no end, they overpay (to wipe out all us honest folks), get in, and start defaulting.

OK, some good news. We put an offer in on a regular sale home. We think among everything else wrong with the house (the floor plan and location rocks), there probably is aluminum wiring. Our first quote with a discounts for this cr*ppy economy is $9K-10K. Wow, that’s a ton of dough. We can’t even get the place insured until we have proof we are addressing it. God knows it has copper plumbing. We’ll know tonight.

The owner is in an Assisted Living Facility, and has a Trustee handling the transaction. I’ll tell you right now, we aren’t going to the Trustee’s high, but will meet in the middle. The house needs everything. They are lucky enough to find a cash buyer. A lender would be demanding. Even the pool, the trees lifting the concrete, etc… are expensive fixes.

Well, if house prices come down to what they were , then this wouldn’t be an issue. Why is it so important to prop up a few big banks and their multi million dollar executives? There are plenty of smaller banks around that can pick up the slack.

Bank of America should chnage its name to Bank of Offshoring America.

““For an age group struggling with a poor job outlook and hefty student loans, many settle for retail while they look for jobs in their preferred field, says Dan Schawbel, managing partner at Millennial Branding. “A lot of them will end up in these retail jobs while applying for professional jobs and hoping there’ll be openings,†he says.

Many Millennials in retail have college degrees. Almost half of merchandise displayers — better known as floor clerks — and 83% of clothing sales associates indicated having a bachelor’s degree, the PayScale data show.—

Has anyone else noticed how horrible service has become in most retail outlets and other services where you have to deal with someone face to face? I’m guessing that I’m transacting with a lot of young people who are pretty angry about their situations, and can’t help but to show it. Their immediate supervisors could probably care less, too, because they just got promoted through the revolving door, and have to manage these kids, while they spend half of their time in their office sending out resumes themselves, because they’re not getting paid much more than minimum wage.

This is why I’m always kind of stunned at the relatively high quality of service at Starbucks at various locations around the country. How does that guy inspire such good work out of his people? It’s not as though they’re getting rich pumping lattes.

Mike M,

“This is why I’m always kind of stunned at the relatively high quality of service at Starbucks at various locations around the country. How does that guy inspire such good work out of his people? It’s not as though they’re getting rich pumping lattes.”

The answer is simple, they get medical and retirement benefits at Starbucks.

“The answer is simple, they get medical and retirement benefits at Starbucks.”

Yeah, but, still, that doesn’t explain everything. I drive into one in the middle of nowhere Pennsylvania once or so a month, and, it’s the same pretty damn good cheerful service I get in my upscale NYC burb. I admire his management for that.

As I was walking into Rite-Aid the other day, I was approached by several Rite-Aid employees, (are they union?), that were handing out information on what the company plans to do with employee health benefits. Essentially, they want to eliminate benefits for dependents and retirees. Is this what is going to happen? Companies that provide health benefits now will drop them like a rock to improve their bottom line with the idea that health care can be obtained through Obamacare? What is this country going to look like in 5 years?

that’s right – you beat me to it brian. I don’t drink coffee, can’t stand the stuff, but SB would get my business if I did for those very reasons – they know how to treat their employees decently and ethically.

Catch is, they have to work 20 hrs per week to receive benefits. They give a lot of employees 19 hrs!

Starbucks treats its employees as assets. The benefits are such that employees can actually live.

Average hourly compensation has been flat in America for 50 YEARS (after adjusting for inflation), while CEO pay has grown exponentially during that time and corporate profits are at an ALL TIME HIGH. http://finance.yahoo.com/blogs/daily-ticker/middle-class-broke-pew-study-reveals-real-problem-155018682.html

Ever been to In-And-Out Burgers? You get insanely amazing burger with drink and fries for under $5. It’s cheap. Yet, the company pays their part-time people $10/hour, managers make over $100k and there’s 401k benefits and others. So, what do you think the service is like from pimply-faced teens? Amazing. They are polite, attentive, proactive and courteous.

Simply, our values in this country are out of whack. We pay people crap, expect them to be grateful they’re not part of the 8% unemployed, and the wealthy pocket more profits, move them (and jobs) offshore and buy more and more government favors.

In and Out managers do not make over 100K. Talk about hyperbole. This information is out there and public. The median manager’s salary is ~ 80K. Still pretty damn good.

It’s not just face to face. It’s over the phone as well.

I was just remarking last week how in the past year or 2 it’s become common to talk to someone on the phone (whether foreign or domestic too), where they’re so obviously reading from a script and if you ask a question that they don’t have a scripted line for – they’ll just start repeating some other part of their script! I’ve also noticed a great uptick in the likeliness that if you have a peculiar or particularly difficult question or problem, your call will be mysteriously dropped. I’m convinced now that at most call centers the workers somehow have an incentive to simply drop a call if it’s too difficult.

Without going to a S&P report, I’m going to guess that when you sell a 25 cent cup of coffee to someone for 7 dollars, then you can afford to have enough men on the floor so that the work volume per person isn’t so bad. That means less stress for employees, and less stress equals nicer, more confident workers.

I’m going to further guess that if you examine profit margins for different retail companies, that those with exceptionally high margins (Apple (or Apple Store)), are going to have nice, unstressed out employees, while those places barely squeaking by on profit are going to have stressed out, mean employees.

As far a Rite Aid goes, they’re working on a dying business model, where they strive to make a profit by filling prescriptions. Over the last 30 years, both private and government insurances have raped away any profit there is to be had at filling prescriptions retail. In other words, if Walgreens posts a 7% profit for a given four quarters, Blue Cross of California, Aetna, Medical, and administers of Medicare Part D programs are going to see that and say, “That’s mine – I want it!” and negotiate lower reimbursement fees until that profit gets back down in a 0 to 2% range.

> Has anyone else noticed how horrible service has become in most retail outlets

> and other services where you have to deal with someone face to face?

Not really. I mostly buy online these days.

I work with millennials at times. It is always quite a pleasure.

Most places I go the service is fine. What there is of it though. Many big box retailers are understaffed. I get coffee at 7 eleven if I buy out (pretty rare these days) and the grocery chain offerings and the service is prompt, courteous and attentive. One exception I run into is Best Buy. Yuck. There either arrogant or imbecilic as a rule with the welcome exception.

I just don’t understand how long my generation (born 1978) is supposed to wait for this second collapse. Since 2006 I have been following housing, and waiting, and waiting…my kids are getting older, I’m getting older. Finally went house hunting in this horridly short inventory situation, found a great house, not perfect but great. Putting 10% down, conventional loan but I am sick over it, feeling like there will be another pop but not wanting to slowly die while waiting for it…ugh. I am getting $176/sq foot a so-so area of the South Bay…it’s a good deal, for now. Let the chips fall where they may.

Candice,

Go ahead a “wait” your life away that’s easy. You are going to actually have to do something if you want things to happen for yourself and family.

You sound like a Realtor, stoking the housing addictions that Americans have bred into them. A kid can’t be happy in a rental? Really??

That said…the $ per sq ft sounds decent to me.

$/sq ft is near what it costs to build, so have some confidence that there is some value there.

I don’t understand why you are worried sick about not owning a house. Renting is super cheap and getting cheaper due to the massive flood of rentals hitting the market. Speculators, investors, and people who cannot sell figure they can just become landlords and rake in the dough. One glitch is that everyone is trying to do that so the excess supply has created what my friend calls “Renters Heaven.”

I sold my house in 2007 and have been a Happy Renter since then…not worried about repairs or property tax increases which are soaring. Think it over carefully before you jump into a 30 year obligation.

What a huge myth that rent is cheap! Rent nationwide is the highest in history. Find me a one bedroom apartment in Los Angeles for under $1200 a month and i will show you a roach infested, dangerous neighborhood. Is it cheaper to rent in some high priced fortress zip codes… Yes! But 90% of the US is at rental parity or better.

Where in Southern California is rent super cheap? And where is it getting cheaper?

I live in the east bay and my rent has gone up $650 per month in the last 3 years.

The price to pay should be measured by your monthly costs. If after 10% down you are paying more than 80% of the going rent in your area, don’t buy.

A better option would be to buy land, at least several acres, with any kind of fixable dwelling. The land must have trees enough for fuel. It must also have a good water source for irrigation, any livestock and personal comsumption. If housing busts again there will be much more severe economic consequences. The levies of our economy cannot contain any significant inflation. You’ll be heading for the hills if you’re wise even if you don’t own that little farm.

If you’re gonna gamble, might as well do it with someone money that’s not yours.

I agree with the post except the conclusion. Furthermore, the private sectors are now in bed with the government. Military-industrial complex, healthcare-industry complex, education-industry complex, etc. anything you can name. Government has a printing press that can make the payment. Unless the current system is totally abolished, which I am not counting on, the price of everything will not be lower, and eventually will be higher. There are many holes that need to be plugged with real freshly printed money (in these days a few keyboard strokes), but they will be plugged eventually, and it just takes time. Paper money today is more valuable than that 20 years later, no matter how you look at it. To store the value of money in something real that you can touch can not be a wrong thing to do. Warren Buffet said the same thing over and over, and he is still the best guy to give advice in money matter regardless.

As for housing, we have been in this hole for 6 years so far. Whatever that means to you is up to you to decide. But I cannot see it will be the same in another 6 years because of precisely the reason I cited above.

I bet if Warren Buffet wanted to buy a house, he would look through the newspapers, and find the ‘motivated seller’ ads: those needing to sell from divorce, or death or illness in the family, etc. and patiently wade through hundreds of those to find that one value property that’s being sold at a discount.

I suppose since the inventory isn’t that great, presently, this method doesn’t work as well as it once did, but I would still expect Buffet to patiently go after it.

I do not understand what you are trying to say. Is that what price is? is that what the market is for? There are a lot elements reflected in the price which is a reality, not perceived one. whatever you want to do with that price is up to your decision.

Pete,

I think the reason you’re not ‘getting’ what I’m saying, is that you are thinking my comment was somehow a retort to the subject matter in your post. It wasn’t. It was just an incidental comment, musing on Buffet’s love of a good deal.

Trying to find motivated sellers and get a house cheaper than its current market value was a technique used by small time investors, years ago when pricing had more to do with fundamentals, so that there was a higher probability of achieving positive monthly income, after all the bills were paid. And if a really sweat deal came along, you could get cash out at closing, and still achieve positive income, even taking into account a given average time the rental is unoccupied per year…

I’m not an investor, but enjoyed reading about that stuff when i was young…

The big banks and their wholly owned governments (all levels) will continue to take steps to make cash flow into the banks to prop them up (just like the slow, endless dropping of mortgage rates generated endless refinance and immense amounts of their profits over the last five years). The realtors are now the second largest group of contributors…lobbyists…and anyone who doesn’t understand how that money “leaks” all over Washington and to certain Congresspeople, well…better learn how it really works. (The US chamber of commerce is first and foremost in this pile of money).

Here’s the latest for the subprime fha cash back to buyer mess, exactly as drhb discusses, this is from today:

http://lowes.inman.com/inmaninf/lowes/news/138306

To what extent in Southern California FHA finance still means in practice, zero down or cash back at closing, depends on the submarket. Where there’s no personal liability for the debt if a buyer then can default strategically on his fha 100% loan, faced with market decline, why would a buyer in their right mind put any money down whatsoever if the home can be FHA, and Seller can be enticed (in exchange for too high a price, again) to throw cash in as a “concession”? Then again…buyers should be aware that FHA forbids absurdly excess cash disclosed or (as used to be common) under the table from seller to buyer. Right, you go ahead and believe that doesn’t go on to get sellers of crap the highest price at government expense (ultimately, taxpayer expense) from buyers who still want to walk away with cash at closing with near zero or zero down.

Last weekend, WSJ had an article on economic indicators pointing to recession- UE rising, ISM below 50, and misery index at above 7%. A double-dip recession will pull FHA debt under to default status. With no FHA, there will be no buyers in the mid-range. Top and bottom may not be affected as much.

No way FHA is going to default. The “default” will be similar to Fannie/Freddie’s “default”, where we are in the absurd situation that some are claiming that those entities are profitable again, after the taxpayer has bailed them out to the tune of around 200 billion dollars, and counting. They’ll just tell the accountants and auditors to get, ahem, “creative”. Those guys are well practiced at that kind of shell game.

Additionally, I don’t know why you are saying there will be no FHA buyers in the mid-range. The limit is $729,750. That’s not a low price.

Eek. I mean low range. Lots of FHA buyers in the low range.

If the Dr is right, how would a bailout for FHA happen? Would these shitheads go about it like they did TARP? Also who’s watch is this on, does Obama get the credit or Bush? I don’t care about the parties anymore, both are pieces of shit to me. They are not about the people, as they say they are.

Maybe someone can tell me at the income level one is considered middle class, from low to high. Especially here in California, I feel it’s shrinking more and more.

Don’t know what will happen after the election, I’m just tired of hearing of how these bankers whatever the situation continue to come out ahead at the expense of we the people. I’m glad that the good Dr. keeps us informed to all the tricks they pull out of their hats, and exposes their illusions. Sure as hell the media doesn’t do it, or the nightly news.

The L.A. times did an article recently on how the middle class was declining. The middle class was defined as a household up to 3 with a *household* income between $39,000-$118,000 a year. Yea well you won’t even be able to reasonably afford buying a house here on the $118,000 a year *household* income. Those income figures were nationwide, but they seem really low to me when applied to California, I’d define the middle class up a bit higher, maybe not up to the infamous $250k but higher than the 118k for sure.

As a buyer in waiting, the FHA is one of the more frustrating aspects of our current housing market. I’ve been diligently saving my 20% plus, and I cringe at the thought throwing away my down payment in an inflated market that subsidizes poorly qualified buyers to keep prices unaffordable. The one time I sent my congresswoman a letter asking her to help my family be able to afford a home and vote against maintaining the $729k loan limits for FHA loans (last year), she sent me a letter thanking me for supporting the higher loan limits to help families get into homes.

In every forum I read, the FHA posts are all about the buyer stretching their budget to afford a place and trying to barely squeak by with their credit. It truly has become the new subprime, a way to get around conventional loan requirements.

The government IS bailing out the housing market by this process being criticized. The purpose of these still easy loans IS to keep the housing market from imploding. The need for such strategy is that the force and weight of bank owned homes must be meted out as fast and as efficiently as possible. Economists grasp that our economy is at greater risk than even some pessimists understand. The shadow inventory is real. A real collapse in the housing market guarantees chaos. You think the bubble burst? Nope, the bubble sagged and still sags, but a burst bubble is an absoute collapse. And that IS still possible. The situation at hand enables more buyers, more pumping to keep the ship afloat. Raising the down payment prunes the buyer segment which is desperately needed to pump the market.

There is no housing recovery without as many buyers as ‘safely’ possible. Measuring what is safe is an activity normally given to free markets. So in this economy all bets are off. All improvement comes through top down market manipulation strategy. A virtually impossible yet instinctively compelling demanding action from political leaders, hopefully with ‘helpful’ advice by our not so good Keynesian economists. The housing market has been put on its head and politically twisted into panic induced virtigo. It is in no position to ‘find itself’. Our government is finally acting within its element in ‘getting’ this. The scary thing is, they still don’t fully acknowledge their role in creating the monster. That should scare the crap out of every American. We hang by a thread. Any Black Swan event now could bring us all down. Really deeply down for a deadly bloody sickening landing. This is a ‘don’t you dare move’ moment. Let the market gradually exercise itself or this patient will surely die.

We hang by a thread for the sake of the 1%. If the government had formed new banks with seed money, equivalent in magnitude to the bailout money thus far, during the liquidity crisis, and let those banks leverage up 7 to 10 times (since they would have had pristine balance sheets), there would have been plenty of liquidity to run the economy. They could have temporarily backed these new banks to gain confidence, and they could have issued equity shares to all American taxpayers (since after all, it was our money to begin with). Countrywide et al, along with its bond holders, equity holders, etc. could then have been aloud to burn for their sins, whilst mortgage borrowers would have scratched their heads, musing why their monthly payments never got deducted from their personal accounts anymore, and finally would have decided to start throwing their wind falls into iPhones, Priuses, and energy efficient windows. — Not that I’m blaming banks anymore than I am people that took out loans they couldn’t afford. Last I read on some refi paperwork, it’s a federal crime to lie about your income to secure a mortgage… — Of course, it probably still would have pushed Europe off the cliff it was next to, so there’s no pain free way to deleverage, but at least some of these 1%ers could have shared the downfall, and made it a little softer easier for everyone else.

problem is DTI’s! FHA still allows DTI’s of 50% to 55% of gross income. i can bet with food, fuel, living ness’s these average FHA buyer will fail a net income minus all monthly expense test. it just does not make sense anymore. cant build home becuase the materials,labor,gov fees, and profit cost are more than to buy an existing home. heres the kicker the existing home is still over priced…. dead economics walking.

Fed will ease, print… a fresh start for all. No end game, No fiscal cliff, no Euro collapse, all avoided at the last minute with political photo ops, creative accounting, details to be provided at a later date, media loses interest by then, Snooki baby photos or a Kardashin romance story gets more hits. What could go wrong?

Yup. Nothing to see here. Move along. Move along. The crash already happened. If you are waiting for another one, that ship sailed a while ago. The forecast is for muddling through with scattered transparent attempts at political opportunism and possible unexpected rays of hope.

I’m all in PTTRX, Pimco Total Return bond fund. Should perform well while they keep QE’ing…

It is 3% off from its all time high! Hopefully, you bought low. Personally, I think you’d have to be nuts to buy bonds now. QE will end. Inflation will return. That is not a good thing for bond holders.

Better stick with extremely short term bonds or expect to get nailed big time with interest rate risk.

Hi Everyone.

Wanted to report a few days ago, we got under contract to buy a one-story 4+2 home for cash. It needs work, but the floor plan sang to us. With our lost years behind us, I burst into tears of joy. We’re going home… (30 days to COE and we are soooo HAPPY!)

We have been locked out of this market due to price or people having the buy and default mentality,so they didn’t care about overbidding all us honest folks. Finally, we’re back into a home, and best yet, we’ll own it free & clear.

Congratulations! DId you have to overbid? How muh over list price did you pay? What made this one a success?

Good for you! That is the way to do it! Go COE!

Time to change your pen name.

Mad as Heck Great news, now change your name to “Happy as a Clam”. Was the home a forclousure or a standard sale? What is a COE? Are you still in the Conejo Valley?

DHB

I have a couple of questions for you. You seem to give the impression that the housing market has “bottomed”. Is it your position that we have gone back to the $100,000 adjusted for inflation?

http://www.ritholtz.com/blog/2008/12/classic-case-shiller-hosuing-price-chart-updated/

My understanding of the economic boom bust cycle includes capitulation at the bottom. Do you believe we have seen anything close to capitulation?

Another question I have is where will the housing recovery come from if we are currently at a bottom? I think we all can stipulate that the current cost of housing is still relatively high (see link above). I also think we can all stipulate that rent is relatively high based on the rental parity claimed by so many.

Let’s assume inflation adjusted wages stay flat. Let’s assume fixed population (growth at the same rate as inflation). Let’s also assume zero percent savings rate. Now, what is more likely going to happen with the cost of food/fuel going forward in relation to inflation? I believe historically (I have no proof) food/fuel adjusted for inflation had actually declined until the past decade. Let’s assume that food/fuel rise faster than inflation, as is the current situation. Will other consumption/savings be crowded out if this is the case? What other consumption will be crowded out?

I am not able to see how we have a real recovery without a fundamental change in our economy like the industrial revolution, which provided the opportunity for women to enter the workforce increasing household income significantly. The invention of the Internet has not had anything close to the impact on household income growth, as did the invention of the washing machine.

The growth we have seen over the past 30 years has been based on fiscal and monetary policies. We are now at the end of the deficit spending easy money economic growth road.

Leave a Reply