Welcome back California home flippers! Home flipping is back in fashion. 852 square foot home in hipster LA neighborhood bought for $211,000 in 2010 and flipped for more than double the price this year.

It was only a matter of time for flippers to engulf the market once again. House flippers never really left but the magnitude hit a temporary lull during the housing crisis. Apparently all is well in SoCal once again and bubble 2.0 is back in full fashion. It is only a matter of time before the cable shows shift from the insane Canadian housing bubble and start filming our local neighbors taking a plunge into the new bubble market. Flipping at these levels can only exist in a partial mania like atmosphere. The constrained inventory and rising prices is pulling many people off the sidelines and I have heard this said a few times already, “I’m not missing the housing market this time!â€Â Maybe it is the California sunshine that gets into our heads but we appear to have forgotten the housing bubble that just hit us a few minutes ago. Flippers are back in fashion and many hipster neighborhoods in SoCal and the Bay Area are bringing along a new party.

Flippers in Silverlake

Silverlake is a hipster neighborhood in Los Angeles. This was the nucleus of the housing bubble during round one and appears to be making a full fledge turn around. Let us examine our first exhibit today:

631 North Vendome St

Los Angeles, CA 90026

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 852

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1923

I remember this post because someone over on the Redfin forums posted this back in October of 2011. Someone bought this home in March of 2010 for $211,000 as a foreclosure. Not bad considering the home sold in 1990 (20 years prior) for $158,000 during another SoCal bubble. The initial comments were laughing since it was listed at $599,000 after your typical HGTV work. In other words, someone thought their work added $388,000 in value over a couple of months. Most rational minds saw the lunacy in this.

Take a look at some of the HGTV work:

Silverlake is a big hipster neighborhood and you see a good amount of HGTV style flips. Of course many in this area are unlikely to track the housing market as a profession or understand the magnitude of QE3 but something did work. I had this link saved in a folder and was just pulling up a few files. Well guess what? The home sold for $535,000 this July. Not a bad flip for an 852 square foot property.

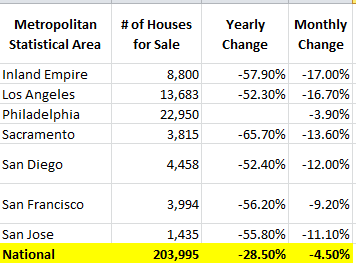

This is one of many examples I am now seeing and believe that the low inventory is causing another sort of mania. Think about it, home prices in California are up 12.9 percent over the year at a time that incomes fell. In essence the only push came because of low mortgage rates but how much can lower can rates go? Are these buyers geared up to stay put for 10, 20, or even 30 years? Inventory levels are back to where they were during the mania:

Last month 7,917 homes sold in Los Angeles County. In other words Los Angeles County has less than 2 months of inventory given the current sales rate. And prices are reflecting this:

Median home price

August 2011:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $315,000

August 2012:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $335,000

So prices in Los Angeles County are up 6.3 percent over the year and flippers are now out roaming the market in full force. The good news for all those home flipping TV lovers, you can expect a new line up to show up shortly. No need to watch the shows with Canadian buyers going into their full mania anymore. We’re bringing it back to SoCal!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “Welcome back California home flippers! Home flipping is back in fashion. 852 square foot home in hipster LA neighborhood bought for $211,000 in 2010 and flipped for more than double the price this year.”

If the Fed effort takes hold, mortgage rates could head even lower. Raising demand on a market with very small inventory. Do the math.

Sorry, this is an artificial bubble caused mostly by cash buyers. It is caused by the Fed, the easy money flooding the richest 1 percent. It is a SCAM and a FRAUD.

I’m in the Oakland,CA area and I’ve witnessed several buyers purchase homes in the $700K range with 20% down. Not cash. And they were the high bidders on the homes. Banks funded the loan with almost no hesitation. I read two of the appraisal reports and I have to admit they read like appraisals from 2006.i.e…getting massaged to hit the price target. So, yes, it probably is artificial. But what market isn’t these days????

Calm down guy! There is no bubble… yet. You cannot expect a constant decline in prices, markets fluctuate. Who knows maybe we hit bottom already.

HB mentions that incomes fell. They didn’t fall for everyone, including some clueless hipsters.

I noticed the same out this way: http://www.redfin.com/CA/Torrance/1104-Amapola-Ave-90501/home/7650922

Sigh.

Americans can be such remarkable creatures…

As long as interest rates stay below 4%… which is gonna be ATLEAST until 2015. Home prices are gonna find a hard bottom. Besides stocks and gold.. Real estate is currently the 3rd safest place to put your money.

By the 2015 the FEDs balance sheet will be between $4-5 trillion with a DV01 OF $5 billion and 60x leverage!!

Not a trick question, what happens to lending for 500k homes when rates spike? Hint…home prices don’t “shoot” up…

Interesting to note that Japan has had a mortgage interest rate of about 1.5% for quite a while now. I’m not saying we’re Japan, but we’re starting to look pretty close to it.

I strongly suggest that you reconsider the notion that stocks are a safe place to put your money unless you think that a Fed/Plunge Protection Team engineered market rise though 4 years of recession was actually perfectly natural and just the beginning of great things to come no matter that economies around the world are crashing.

Prices are up. Incomes continue to fall. 20% down no way. It seems that low interest rates and FHA insurance are just there now to enable leverage to “allow” people to buy houses at prices where the bank/government (I suppose more and more the government now holding toxic assets) doesn’t have to write down as much on the bad loans.

Only a little bit of inventory being let out like this tiny little house. Likely, leveraged buyers scrambling to compete over it. The value clearly isn’t there but the greater fool will buy it in desperation. What is something worth ? Whatever people are willing (and able) to pay for it. The key is they really shouldn’t be *able* to afford these kinds of prices – impose 20% down like sane folk (much lower default risk) and the market dies.

It’s a government monopoly really when you think about it. On some level they control directly or indirectly the rates, the insurance, the max leverage, the inventory, and the policies which affect the market (like letting banks sit on their foreclosures longer, I heard 48 months now but am still trying to find the supporting law online).

Check out: http://www.federalreserve.gov/publications/other-reports/files/housing-white-paper-20120104.pdf

It says that banks can hold properties for up to five years and they may have the ability to extend this period and that making the properties available as rentals may allow them to extend this period indefinitely by showing “ongoing good faith efforts to sell the properties within the statutory and regulatory time periods”. As long as the banks and the feds right the rules, they will re-write them in their own favor despite the effects on the rest of the housing market.

Interesting mistake there…. “as long as banks right ? the rules.” Pretty sure you meant write the rules. If they righted the rules we’d be back to 20%, loans tied to income and, higher rates and mark to market. Yup the write the rules and rule over our rights.

Maximus, you are right on. Sellers/investors/flippers are dreamers, they think it is 2006. And yes, current buyers are desperate and fools, and or sheep. The media is the worst, where do they get this made-up information ? Another bubble for idiots.

This is the definition of insanity!! Those who don’t know history are doomed to repeat it. Are we as a society so impatient and short sighted that we can’t remember the lessons of a couple years ago?? These are strange times we are living in

Those who don’t know history are doomed to repeat it. Are we as a society so impatient and short sighted that we can’t remember the lessons of a couple years ago??

I think you already know the answer to that question. After all the american atention span has shrunk to what, a nanosecond today?

I have seen how crazy it has gotten first hand as I was looking to buy the last 8 months and lost out on several bidding wars.

That said, I have noticed a change. I am seeing things sit that are priced above 550K, especially above 600K. Yes, inventory is still razor thin, but maybe, just maybe, they are running out of people who can QUALIFY for the nearly 4000 a month in PITI that includes the mortgage insurance premium, that comes with a 650K average house..

In my opinion anyone and everyone who wants to buy with “other peoples money” has, and now as better deals come to the market, no one will be around to take advantage of them. Except for those paying cash who got so turned off, they stopped looking a while back, like me.

I can hope, can’t I? All kidding aside, I am seeing a change in the upper end but yes, it is still a frenzy below 500K.

Anything below 500K in a decent area won’t last long. During the last week, I’ve seen 30 year rates as low as 3.25%. The Fed has made it clear that nominal prices are not allowed to fall any further, they will simply make your monthly payment less and less…and this is working in spades. For anybody who has 20% plus down, these are truly good times. You can buy that 500K house with 20% down and your monthly cash outlay will be less than renting a 1 bedroom apartment in the same area. I remember when 500K could buy a place in Beverly Hills or Palos Verdes about 15 years ago. Things sure have changed to say the least!

Who the hell knows how this will all pan out. If owning and buying are truly the same monthly cost and you have job stability and plan on staying in your house for the remainder of the decade, buying today is a no brainer. No current home “owner” has any desire to be a renter today. This couldn’t be said 3 or 4 years ago. If you have been financially disciplined and have excellent credit and a good downpayment it might not be a bad idea to test the waters.

“You can buy that 500K house with 20% down and your monthly cash outlay will be less than renting a 1 bedroom apartment in the same area”

read below, i just showed that to not be the case.

@cantafford. I swear most people on this blog are bad at math. Did your little example take into account the tax break you get from writing off mortgage interest or property taxes? What about principal, how is this handled?

Let’s sit down for math class again. 500K house, 20% down, leaves us a 400K loan that you can now get for 3.25% for 30 years. Here are the monthly payments for our example.

Principal: $657

Interest: $1083 ($726 after taxes)

Property Tax: $500 ($335 after taxes)

Insurance: $100

Maintanence: $200

Total: $2540 ($2018 after taxes)

The monthy payment after taxes is $2018 and don’t forget $657 is principal, that leaves $1361 you are pissing away you never see again. How much is equivalent rent you are pissing away you never see again…$1900 or $2000? This is another perfect example why buying with low interest rates and monthly payments that are less than equivalent rentals makes sense. Fire away if you don’t agree with it, the numbers don’t lie!

A question regarding the tax savings, are you accounting for the loss of the standard deduction?

I am curious what happened to the 20% down payment in your example?

My math says that is $100,000. Which means at $2,000 per month rent, I could piss away this same dollar amount over four years as a tenant rather than overnight as a buyer. During these four years I would save all of the expenses you illustrate in your example and I would have my $100,000 back at $2,018 per month after taxes.

In addition, I will have access to all of my monies throughout this time period and in four years, I will not have to spend 5-10% to sell my home and get my money back out assuming it has not appreciated significantly, gone down or gone sideways…

What am I missing? Why would I want to buy now with all of this uncertainty?

@Lord. I’ve been a pretty big bear on the real estate market since 2007. But I have to admit that mortgage interest rates in the low 3% range is just too tempting to pass up. It really shifts the game. Your analysis holds water and I’ve seen a few people take the plunge lately for the exact logic you’re using. If I felt good about my income stream, I would buy at this time as well. The only downside I see is that housing could take another step down if we hit another hard recession. Which is likely. IMO. But the govt has set-up banks so that they dribble out inventory at a trickle pace for years to come and keep mortgage interest rates low for quite a while as well.

What we’re seeing now could go on for a many years to come.

lord,

LOL!!!! OF COURSE i thought of the government subsidy but the prices are still ridiculous….and i like your cherry picking math, it’s $535K not $500K and you’re using the very best mortgage rate that most WILL NEVER get unless you have a 800+ FICO.

so in REALITY you’re willing to put ~$107K down on a property that someone else JUST PAID $211K for???

anyway, my rent is $1140 on 1300 ft2, and $200 a month for maintenance, are you kidding me right now?? i’ve owned a home before bro and you are not being realistic…… BTW my weekends are totally free…have fun mowing the yard or is that included in the $200 a month maintenance cause my gardener was $100 a month in the 90’s?

you sound like a shill who’s watched an infomercial.

AND like i said to the DR. keep this one on the radar as we’re gonna see it again.

P.S. that house is so small they don’t even have room for a dinner table, notice the “4” stools one of which is facing a wall….who falls for this?

@Martin, yes tax savings are all based on itemizing deductions, no more standard deduction.

@jb, the 100K down isn’t pissed away. This is what gives you the ultra low interest rate and monthly payment, kind of like the old days when it was standard. If you continue renting, what are you going to do with your theoretical 100K? Get 0.25% in a money market account or go all in on the Wall St. casino. I think you are gambling there much more than buying a house today. Forget about selling in 4 years, you need to stay at least 10 years for it to make sense.

@CAE, like you said if you are comfortable with your employment situation for the forseeable future then it makes sense to buy when rates are in the low 3% range. Also, the world has changed much. I don’t think we’ll go back to the days of real 4% unemployment where everybody can be gainfully employed. This is the new normal.

@cantafford. First of all, I have been one of the biggest bears on this board for the last few years. I have recently accepted reality that you simply can’t beat or outlast the Fed or other PTB. Their decisions are borderline criminal, but you or I can’t do diddly squat about it. Life goes on, many people are not going to wait another 5 or 10 years in hoping for normalcy to return. They are basing their decisions on the information that is available to them TODAY, nobody knows what interest rates, home prices, rent prices will be in the future. I can tell you are stuck in a nominal pricing world, low 3% interest rates do a number on nominal prices. Like I said, this is a great time for financially disciplined people (high credit scores and large downs). Not sure where you live, but $1140 rent for 1300 sq ft? Are you half way out to Vegas. Crunch the numbers for yourself for today or cross your fingers and HOPE for better results in the future.

I POSTED THIS A MOMENT AGO BUT UNDER THE WRONG THREAD SO AM REDOING

If my wife and I bought this house, we would have roughly 19000 in deductions but we would lose 11400 in the standard deduction leaving a net tax write off of 7600. The tax on 7600 for most people would be in the 15% but lets say we are in the 25% tax bracket. 25% of 7600 is a tax savings of 1850 on federal and about 760 on state for a total of 2610 a year in tax savings. However, in the example you give, the tax savings are approx 6260 a year.

So, yes, you do save 6260 a year on taxes if you buy that 500K house, but in order to take advantage of that, you must give up the tax savings ( basically a value of about 3600.00 for someone in a 25% bracket) from the standard deduction which nets less than half the tax savings you state when you account for this

@Martin, I am single so that’s what I was basing my tax write off on. Being married in this case does penalize you since the standard deduction is doubled; hence, your tax savings are less.

@Martin, one other thing regarding taxes. When you itemize you can take advantage of the various other tax write offs (chartitable donations, vehicle license fees, home office stuff you work from home, etc). These generally don’t come into play if you take the standard deduction.

@Lord Blankfein: Thank you for clarifying your position that this is a ten year proposition. I am still unsure if I want to lock myself into one place for the rest of the decade and I do feel we are all emotionally drawn towards ownership and home value appreciation, however I am not convinced that either are worth the price of the current uncertainty of my situation. I do appreciate reading your opinions – thanks again for sharing.

When you consider the tax savings for mortgages, I think you have to think about the AMT. Most people whose income allows for a $400k+ mortgage are just bumping up against the AMT, and the AMT severely limits deductions (no state income or real estate tax deduction, for example). Furthermore, if you refinance, the mortgage interest on the refinanced mortgages is no longer deductible for the AMT. You might even end up better off no longer itemizing, in which case your tax savings is zip.

I think counting on tax deductions going forward is a fool’s game. The only purpose of a tax deduction is for government to encourage private spending on this or that idea of a “public priority.” But the government needs tax revenue like a drowning man needs oxygen, right now, and for the forseeable future. A million $150,000 a year lawyer drones in DC need to pay THEIR mortgages. You don’t expect Congress to trim their Federal salaries and pensions, do you? Ha ha, no.

Furthermore, the governing philosophy of Democrats has never really been tuned to the idea of tax deductions, because the money involved, even if it is spent on what they consider worthy things, doesn’t pass through their hands, and can’t as easily be directed to their clients and friends. Additionally, if you spend money privately, you’ll generally only give it to someone who provides some actual value for it. That, too, doesn’t suit Democrats, who would much prefer to give it to people who do no work at all in exchange for it. (Charity cases are much more reliable voters than working men who can earn their own living, as the Romans knew very well.)

So going forward, look for fewer and fewer outright tax deductions accessible to the individual. (There will be plenty for Big Corporations who are friends with Democrats, of course, as always, but that’s not relevant for Joe Citizen.) What will be increasingly the case is brutal taxes, compensated (if you belong to the right groups) with generous government handouts. People who earn their own money and expect to use it to buy property privately are not one of the favored classes. They will be increasingly squeezed.

Martin

Gated.

http://www.sdlookup.com/MLS-120049212-3542_San_Miguel_Ct_Bonita_CA_91902

If my wife and I bought this house, we would have roughly 19000 in deductions but we would lose 11400 in the standard deduction leaving a net tax write off of 7600. The tax on 7600 for most people would be in the 15% but lets say we are in the 25% tax bracket. 25% of 7600 is a tax savings of 1850 on federal and about 760 on state for a total of 2610 a year in tax savings. However, in the example you give, the tax savings are approx 6260 a year.

So, yes, you do save 6260 a year on taxes if you buy that 500K house, but in order to take advantage of that, you must give up the tax savings ( basically a value of about 3600.00 for someone in a 25% bracket) from the standard deduction which nets less than half the tax savings you state when you account for this..

I’m getting more convinced it’s the listing agents involved in the foreclosure flips. I usually avoid conspiracies, but just saw another short sale turn into another magic foreclosure flip.

http://www.redfin.com/CA/Long-Beach/7135-E-Killdee-St-90808/home/7499571

This home was listed earlier in the year as a short sale at $499K. I saw it the day it listed and was told there were already 6 offers. Surprisingly, the listing agent had already updated the kitchen (on a short sale?).

I realize short sales are strange beasts, but it seems a little too coincidental that the home foreclosed at the short sale price around the same time I was told there were 6 offers and it magically appears back on the market, empty, with a $60K premium.

Even worse, the following listing is around the corner from me. I don’t ever remember seeing a For Sale sign out front, until last weekend after about a week of renovations.

http://www.redfin.com/CA/Long-Beach/3602-E-2nd-St-90803/home/7601201

A $280K flip profit that went pending in one weekend. Are banks not even trying to sell foreclosures in the open market anymore? Or are listing agents hiding inventory so they can buy the foreclosure and flip?

The short sale process is definitely an insider game. A realtor told me “If you see a short sale on the MLS it’s there because no one we know wants to touch it.” If you really want one you have to have good relationship with a realtor or do the leg work of finding someone who is losing their house.

As for foreclosures it’s a mixed-bag. Some banks want to see all the offers, some just want one… Crazy stuff…

JD in LB, We are seeing that same deceptive stuff going on around here, we see a house we like we check it out, but the asking price is too high. We keep an eye on it on trulia and zillow, the price drops we call on the house to put in our offer and are told it’s sold. We don’t see it on trulia or zillow, then about three months later we find it sold for less than the asking price but two weeks ago. This has happened to us three times.

hey Dr,

keep that property on your radar as that may well end up back in the foreclosure pipeline. i’d like to know the buying particulars, like down payment, mortgage type whether it was FHA etc. etc.

Granite countertops, stainless steel appliances. Submit! Submit! SUBMIT!!!

the more i think about it this home doesn’t pass the smell test. if you were to buy this with a 20% down payment that would be half of what the home sold for 2 years ago….who would do that? even still the payments with taxes are $2,500 a month and not “too” bad but with a 3% FHA loan were now talking $3,300 a month.

so i went to CL (okay not the best source) to see what i could rent a similar place for. the thing is i could only find apartments that small. i did find one 2 bedroom in a duplex at 900 ft2 and that was renting for $1,875.

who would buy a home without doing some research to find out the last sale price and then why would up pay 2.5X more than the last sale price? this makes zero sense to me.

I think hipster = driven by fashion not common sense economics.

That’s a fair question, but as the Dr says, this is a hipster neighborhood. Hipster=young. My guess would be: recent grad with a decent first job, generous parents/grandparents who are taking advantage of the last year to “gift” tens of thousands tax free (it’s gone Jan 1). No experience in real estate, wants a “home of her (maybe his) own. M and D want a “safe neighborhood” and an “investment.” Really, this is not hard. The flippers know who their target audience is.

In California, there is only one scam better than house flipping and that is SB1234 just signed by Gov. Brown. The bill will establish the California Secure Choice Retirement Savings Program for more than 6 million lower-income, private-sector workers whose employers do not offer retirement plans. The money is to be pooled with CalPERS.

There is only one small problem. CalPERS’ fund posted an annual return of just 1 percent last year, missing its own long-term annual target of 7.5 percent. It currently has an estimated long-term unfunded liability of $100 billion. But, don’t worry, the California rich tax payers will now bail out both the public and private sector pension programs. Great future for the Golden Bear. The only thing that can save us is Ben in his magic flying helicopter. Yet, it looks like Blackhawk down to me.

535k? For that little house? Meanwhile, back in my old neighborhood, 330k will get you this: http://www.zillow.com/homedetails/7-Quail-Cove-Rd-Charleston-WV-25314/22596562_zpid/

…so you can use that other 200k as seed money to invest for your child’s tuition (or blow it raising the child from 0 – 18 year of age, which I’ve read is what a middle class child costs these days).

The downside? Your neighbors aren’t hipsters.

The downside? It’s in WV.

That’s only if you’re not from WV. Friends and family make up for the high obesity, high disability claims, high litigation risk, and poor air quality Charleston has to offer. Sure, it’s not for everyone, but if you have a professional salary, you live like a god.

I’d rather live like a human than a god, lol! CA is home for me. I don’t believe in the myth of the American Dream. Don’t need a big ol’ house, my apt. is dandy.

I’ve been tracking # of active SFR properties in a few OC cities since 2010. In the cities that I track (FV, HB, IR, CYP) the # of active properties went down significantly and currently there are less than 1/2 compared to 2010. Initially, I thought it was because OC was such a special place to live. However, after reading DHB articles and comments, inventory shortage is happening all over the place. Considering the current unemployment rate, future job prospects, financial situation of younger generation, etc., it’s amazing how well this market is manipulated by our gov’t and bank.

Public policy has set us up for another big crash. The only way housing will meet consumer needs is if there is a 75% capital gains tax on flips. The proceeds should go toward buying mbs for working folks who have reasonable ltvs and debt ratios. But that doesn’t go along with the enrich the banksters and soak the consumers and taxpayers model our lobby driven government has become.

I bought a flip home in the IE which I hated, but given my strategic default that took 2.5 years to finish I had no real choice. I was putting $150,000 down (basically all the money I saved 1 year outside of foreclosure), but banks still will not loan money obviously if you have a foreclosure. Not only will they not loan money, but they will not allow you to purchase an REO owned by them unless you can qualify for the loan with them. I took out a private money loan because these guys were falling all over themselves to lend to me with my 720 FICO and $150,000 down payment even after the foreclosure. So basically anyone who actually did a strategic default, saved all their money and decided to buy a place can’t really get any REOs(unless they can pay full cash) and we all know short sales are a complete joke. If you have a 2 year timeframe then maybe a short sale is right for you. I almost was able to pay $155,000 cash on an REO for a place that would have been fine for now, but then someone bid up the price. It feels like there are almost no standard sales that are anywhere near the proper price range. Even the flip homes are priced to sell and typically they are in pretty good condition. As much as I hate flipping we had no real choice but to go this route. Certain areas of the IE are getting really competitive and it took about 25 offers before we were finally able to get a place which was finally accomplished by offering list price on a flip.

720 FICO score with a foreclosure on your record ?!!

If that’s true I guess we’re seeing some extreme deception by the rating agencies. Like the kind of deception that the rating agencies did with rating the MBS AAA, before the bubble popped.

I was just listening to Bruce Norris and he was saying that people who went through foreclosure a few years ago are already getting their FICO scores up to the low 700’s! I’ve also read some very recent appraisals that look like they were written in 2006 and the banks went along with them……So, it does indeed look like the system is engaging in another bubble construction. Albeit, much smaller than the previous one.

CAE, I got my credit score about a year ago and it ranged from 720-800 from the three ratings firms. I think the worst hit to my credit was some 6-7 year old utility bills that I contested,but paid because I was allowed to do so. All payed by the way. No foreclosures, no short sale. no bankruptcy, no high debt and my low score was the same as someone with a 6 figure default.

This tells me that the credit agencies really don’t care about the real estate defaults.

Gosh, I guess people who don’t default on their underwater properties are really stupid.

Thanks for everyone’s insights and thoughts and a big thanks to Dr. HB for keeping the great data coming. I have a few quick thoughts that I was hoping to share:

ELECTION YEAR: The lack of inventory we’re seeing this year can very well be an anomaly to help prop up house prices, increase consumer confidence, and win an election. It’s very, very straightforward, which is why I, for one, am waiting until 2013 to property judge whether the dried up inventory will continue. My bet is that it will revert back to “normal”, if that’s what you can call the last 4 years, but we won’t have to wait too much longer to see. In the meantime, I would caution everyone to consider this possibility, as the shadow inventory is clearly still there.

INTEREST RATES: These are clearly being lowered to drive up “affordability” (aka – monthly mortgage payments). And if you look at Ben’s brilliant scheme you will see that QE3 will likely drive interest rates further down. Expect this trend to continue to create the illusion of stabilized prices. There is still quite a ways to go in reducing interest rates further if that’s what Ben wants to do and, as everyone knows, you can’t fight Ben’s power! I’m fully expecting interest rates to continue to trend lower, which likely help to offset a possible inventory increase next year once the elections are over.

FLIPPING: While I agree with Dr. HB that flipping is becoming more attractive due to the recent price increases, the reality of actually getting your hands on a well-priced flip is a whole other story. I invest with local house flippers and I keep hearing the same thing this year: “I can’t buy a property at a reasonable price and I’m not willing to overpay”. My point is that closing on a property at a reasonable price has become much more difficult this year for flippers due to the dried up inventory. Ultimately the lack of inventory at retail is allowing flippers to overbid, as retail prices have been going up, but watch out if inventory increases next year!

RENTING VS BUYING: No one in any of the posts above references “price depreciation” in their rent vs buy comparisons. If you’re absolutely convinced that prices have stabilized because of a lack of inventory during an election year then I suppose the math is correct. But if you prefer to believe the charts from Japan as a nice extrapolation for our current situation then you need to factor in price depreciation as an additional monthly cost vs renting. I’m currently renting for that reason and that’s what drove people to want to rent vs buy over the past 4 years. Of course, no one knows where prices will be for sure but it’s hard to refute Japan as a good model for what might happen here. Either way I am personally not willing to let go of the price depreciation line item until we see what happens with inventory and therefore pricing due to a “non-election” year.

MACROECONOMIC CYCLES: Did you know that models show that the typical economy will go through 2 recessions in the 10 years following a recession caused by leverage (sorry I don’t have the source but I read a LOT of data daily as a full-time investor so I can’t remember the source). You might want to research this, as it essentially points to the US going through a recession very, very soon. I believe QEx has delayed possible recessions over the past 4 years but inevitably the world economy will catch up with the US (ie. reduced exports, etc) and we’ll end up in a recession very soon (if we’re not already in one – as you don’t know you’re in it until after the fact). It’s clear that buying a house won’t be on everyone’s mind during our next recession and it’s important to take that into account when thinking about where prices might be headed in the next 1-2 years.

CONCLUSION: There are clearly a lot of potential negative price forces out there while Ben does his best to fight the inevitable. If inventories do continue at these levels next year then perhaps we’ll see price stabilization. But with the shadow inventory levels as high as they are I am on not betting on that. If you haven’t taken everything into account above when trying to make your bet on the future of housing prices then you might want to do so. In the meantime, I’m going to continue to invest expecting further price declines for all of these reasons.

FANTASTIC READ: If you have a lot of time be sure to read this very long article on how the deleveraging machine works by Ray Dalio (Bridgewater) – It’s the best summary of what’s likely to happen from a macro level that I have read so far, although it’s VERY long (but worth): http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2012/09/Dalio.pdf

Good luck to everyone!

Investor J

http://www.meetup.com/investing-363/

http://www.meetup.com/FIBICashFlowInvestors/

The Fed and this administration, with it’s printing of cash to stave off the on coming disaster so he can get elected, has done more to damage the fabric of the US economy than any in our lifetime. The Tsunami of inflation and debt that is headed towards our shore is insurmountable . Brace for the worst …there may be low rates now but if you look at the history of “easy money” and out of control spending in the history of the US ..it is a very un-healthy economy. Just read or watch any of Dr Milton Friedman – Free to Choose for a quick education.

Math. Interest rates are low because of the fed, but really because there is no commercial demand for money. The economy is going nowhere, perhaps down again. If you buy a property today at a mortgage rate of 3.5%, what happens to the value of the home when rates go to 5, 6, 7 and 8 %? If the fed backed out of the auction picture, US debt would sell for way, way less on face value than today, meaning that the fed is the biggest buyer of tres. paper in the auctions. See the point? You buy today – who will you sell to next year? Who will qualify when interest rates are rising? This is an interim musical chairs sesion which will be crushed if the fed backs out and rates go up on fed paper. A comparison: Walmart stock pays a huge dividend. It is priced like a bond. Next year, taxes on dividends go to regular income tax levels. What happens to Walmart stock if the dividend does not go up? Walmart stock will decline becasue people holding for the dividend will sell – probably to tax free institutions, but wait, they don’t have any money because donations are down. Get it? Be very, very careful about being the last buyer before rates go up on your potentil buyers. BEst of luck now, but watch out that the inventory of distressed property is being held back by the fed buying the paper or declaring that banks do not need to count the bad paper againsgt their assets – in effect, you buy today and MUST flip fast or risk getting stuck. This may also be seen as an effort to stop the decline in prices by creating a false comp model based on the withholding of short and foreclosed sales from the market, just as the fed going into Treas. auctions. Taxes are going up next year no matter who gets elected. Avilable income is going to go down. Be grateful that Cali real estate taxes are limited. The false comp model based on very few sales over a short time makes the bad assets of today worth more tomorrow. Just don’t be the last holder before it crashes again. I am looking for a further 25% drop in later 2013 when the flippers can”t find any buyers but themselves and the renters can’t afford the maintainence cost of the property becasue of increased costs of the larger-mortgage finance of sales and the decline in spendable dollars because of the rise in state and federal income taxes. You may also see gas go to 6 or 7 dollars a gallon and that will finish off the sub 500K real estate market by itself. Thus, I see that 25% fall from prices of March 1, 2012 by March 31, 2014. The only thing that will stop it is mortgage rates at 0% on 15 year fixred.

Please use paragraph breaks when writing longer posts like this.

How much lower can rates go? Well in Obamanomics they can go negative. As long as you make the principle & escrow payment, the negative rate can go right into YOUR pocket as a monthy check rebate. Your lender will PAY YOU for taking an overpriced piece of crap house off their hands. They’ll get a write off on what little federal corporate taxes they pay anyway.

You’re going to need the rebate too because you’re soon going to get the MOATH (Mother of All Tax Hikes). Enjoy Socialism, it’s good for everybody isn’t it.

Has someone ventured to say what is really going on? Our Dollars are worth less and less. Some day they may be even worthless. All of these prices are based on a dollar, which is losing value daily. QE3 will really screw up the real estate market.

I agree with Patrick and Investor J’s take on what’s going on. We’re renters sitting on the sidelines in Socal. When (if ever) housing returns to free-market fundamentals, we might start thinking about buying, but right now this is a rigged, centrally planned RE market.

Something’s wrong when prices go up (inventory controlled by banks) interest rates go down (Fed) and wages stagnate or go lower (outsourcing and weak econ growth)

This is a fake bubble in an election year. Let’s see where we are in 2014-15.

Meanwhile, QE3 drives down the value of our currency, with severe inflation a certain result eventually.

Instead of housing taking the hit from the 2008 meltdown, they’ve thrown seniors and retirees under the bus by slashing interest rates to prop up housing and the banks.

Low 30 year mortgage rates also means next to no interest earned on savings and investments, but what the hell, those old folks are one foot in the grave anyway.

What’s going on now in housing is an illusion. If you must buy flip for a quick profit; go ahead and play that game. Otherwise, you’ll be underwater in a few years.

Keep your eyes on the rest of the world’s economies. and when other countries start abandoning the dollar for things like oil, we’re really in trouble.

Another renter here. I’ve been waiting to jump in the market since 2005 when I realized there was a bubble. In Laguna Niguel, I pay about 2k a month to rent a 2 bd condo with 2 car attached garage. I can now buy for less money than rent, even if I buy a small house. The thing is, I know the market is rigged and I know as soon as interest rates raise up to 6% we will see a large price drop.

I have 20% to put down but I’m not crazy. I will not risk my own money. I am considering buying with one of those 3% loans or maybe even my VA loan with 0% down. The fed is forcing my hand. I am thinking of going in with nothing down since it is cheaper than renting and if the market crashes in a few years, I’ll just stop paying until they kick me out. I’ll have so much money in the bank by then I wont have a problem buying a realistically priced house, maybe even with cash.

So here I sit, a responsible renter who has no debt, pays his credit cards off every month. 800 credit score, and I am considering buying with THEIR money, and if the market drops, I will sacrafice my credit score and stop paying until they kick me out. The fed is forcing my hand. If you can’t beat them, join them 🙁

Anyways, I think I will wait until at least after the elections or early next year to see how things are going but Bernanke came out and said, with QE3, he hopes to make housing prices go up again so people will feel rich and start spending. This fed is hell bent on keeping this rigged market from crashing.

The Fed is forcing many people into the position you are talking about. Even if home prices drop, will rent drop much? As you said, buying is cheaper than renting. I don’t think it really matters who gets elected in November, neither candidate wants Housing Bubble 2.0 to explode on their watch and they sure as hell don’t want Americans to feel any long overdue financial pain. I think low rates and low inventory might be here to stay for a very long time.

Good plan!

You are exactly right. The extra PMI you pay on a low down loan is the insurance premium for walking away. Why on earth would a person put down 20%, in SoCal, in the current economic and fiscal environment? I cannot imagine the optimistic shortsighted thinking that made the decision to plunk down 20%.

I am in the same situation as you, except for the fact I don’t want to own in SoCal because I want to leave. Husband looks for jobs in places not SoCal every week. (He has a special job, hard to find. I am a property manager, easy job to find.) I hope we can leave in the next few years so I happily rent while I plan our escape.

This is the best article I have read on this mess. Whoever wrote this knows what they are talking aout. I live in San Diego and I have been trying to buy a house for 12 months now and I am getting close to giving up. I have been over bid many times even when offering way over asking. The inventory where I live is down about 95% in the area I am trying to buy. Prices are up so much that the houses will not appraise at the asking price . Prices are often 50k over appraisal. Unless things change, I am basically priced out of this market. My agent has been in business since 1977 and she has told me that the banks have rigged the market. She said this is the worst market she has ever seen in her career. My only question is what will bring this market back to reality and how long will it take? Anybody?

Take a look.

http://www.sdlookup.com/MLS-120049212-3542_San_Miguel_Ct_Bonita_CA_91902

The next law that will be passed if interest rates rise… Is assumable interest loans for everyone. That would make rising interest rates not matter for the housing market.

I don’t think that would be the case, but only for one reason, you would be messing with the big money guys and they OWN Washington D.C..

I never owned real-estate. A 4 year lawsuit to collect on 6 month’s work, plus 2½ years out of work because the government flooded the IT market with cheap labor (not eligible for UI, as I was a contractor) forced me to miss the entore RE bubble. As a result, I am paying about $1,200/month for a 1,200 ft apartment in Warner Center and am commuting 140 miles a day to keep my kid at the same high school instead of changing schools every year like I did growing up. I have saved up some money over the last 4 years and would like to buy a home, but not at these prices. I would pay a reasonable price for a home, but not the current market price, so I will continue renting.

I believe the prices will not drop until the government stops propping them up with my tax dollars. Why am I paying for these houses with my taxes? More cheap labor dumping is in the works from both parties. I will never own a home.

My strategy when it comes to buying a house is always buying something that I can afford, regardless of what the market condition is. I think most people out there who are bidding on a house right now are not aware of the games that the government and banks are playing right now and they are blindsided by the low interest rates and the “rising” home prices due to low inventory. The government and banks are greedy animals and they don’t care about people like us, they only do what’s good for themselves, the 1% group. The cost of rent is high because people who foreclosed on their homes the past few years can no longer qualify for a mortgage so they have to rent. Then there are smart people like us who can actually afford to buy a house but refuse to play the games of the banks and the fed, so we have to continue to rent. Those who go out there and overbid on a property that’s not even worth as much as the starting list price will find themselves foreclosing on their homes in a couple of years. This is more of a selling time than a buying time, if the bidding war continues in the RE market. I’d say hold on to your money and be prepared for the worst some time next year; the worst includes layoff, stock market crash, home price crash, tax.

To understand the housing market, one must understand the Fed. The Fed is not your friend or your benefactor. It was not created to “help” the economy. The Fed works for the banks, period. The banks are insolvent because of the real estate collapse. The only way to make the banks whole is to reflate and SELL real estate to clear out the toxic paper sitting in the banks. What happens when the banks are solvent via the liquidation of the toxic assets facilitated by the Fed through artificial interest rate manipulation and controlled inventory release? Interest rates will go up. If you think the Fed really cares about you, just remember the early 1980’s when TBills were close to 20% and mortgages at 16%. If the Fed is your friend, why did it promote the real estate bubble in the first place? The Fed works the economy for the banks and financial sector. It could have easily raised rates during the bubble period. Do you think the Fed did see what was happening in Arizona, California, Nevada and Florida.

There is a wise, old saying: “Don’t fight the Fed”. But, do not forget its corollary, the Fed is not your friend.

I agree totally. This is not about making bubble prices “affordable” to the average Joe via ultra loose monetary policy. It is about getting all the bad loans off the books of the banks and onto the books of FHA, Freddie or Fannie. Once that happens suddenly the priority will shift. A bank will do far better with one car loan at 10% to a credit worthy individual than 3 car loans at 3%. You make the same or actually more and with 2/3rds less risk.

So Jeff does somebody like me have any chance of buying an affordable home in san diego in the next couple of years? Or will the market stay over heated with flippers buying up evetything decent ?

The Fed has said they will keep interest rates near zero or lower until 2015, as well as buying up billions of MBS each month. Does that spell panic to you? The Fed and the banks are in a big hole, no growth and a time bomb ticking on the banks toxic “assets”. That is why they all in on the QE infinity. If I were you, I would wait it out to see what happens. Your other problem is that, apparently, there are no decent houses in San Diego for under $500,000. If I were you, I would move to Houston. I am not being flippent. It makes no sense to live in a state that has everything going against it, except weather. In the past month, how many times have you been to the beach? Do you surf every weekend? What is the point? After the election, the job cuts in the defense industry are going to be brutal, and that is all about Southern California. Houston is an oil town and will continue to benefit.

I am 65 retired and made both an economic and quality of life desison not unlike my recommendation to move to Houston. I live in Merida, Mexico. Yes, Mexico, where you get decapitated on a regular basis if you believe the news. I bought a house for $60,000 cash, mid century, that would sell for well over $500,000 in S. California. My yearly real estate taxes are $50. The city has many more amenities than my home town in the US. All the big name stores and the beach is 20 minute drive away. Think long and hard about where you want to live. It is one of the few choices you have left.

@ Lord Blankfein

Yes, let’s sit down for math class. Martin even asked you about the standard deduction and you didn’t understand. If you DO NOT itemize you DO get standard deduction. For most people, mortgage interest and property taxes are the largest deductions, so most renters DO NOT itemize and therefore DO receive the standard deduction which is $11,900 ( married filing jointly) or $5950 (for singles) for 2012. Therefore any tax savings from itemizing is calculated by subtracting the standard deduction from the total of the itemized deductions.

Using your example above:

—————

500K house, 20% down, leaves us a 400K loan that you can now get for 3.25% for 30 years. Here are the monthly payments for our example.

Principal: $657

Interest: $1083 ($726 after taxes)

Property Tax: $500 ($335 after taxes)

Insurance: $100

Maintanence: $200

Total: $2540 ($2018 after taxes)

……………….

Your total deductions for the year are:

1083 x 12 = $12,996 (mortgage interest)

500 x 12 = $6,000 (property taxes)

for a total of $19,000

Therefore your tax savings over a renter who gets the standard deduction

19,000 – 11,900 = 7,100 (more deductions)

And using your 30% tax bracket is

$7100 x .3 = $2130 per year

or $ 177 per month, not the $522 that you show in your example.

Using your equivalent rent:

Rent: $2000

Renter’s insurance: $15

Total: $2015 per month

—————

Recalculating the monthly nut on the $500k house:

Mortgage payment: $1740 (principal + interest)

Property tax: $500

Insurance: $100

Maintenance: $200

Tax savings : (-) $177

For a total of $2,363 per month

You pay $315 more per month (or $3780 per year) to buy than to rent in your example.

……….

Calculating the tax savings by itemizing over a taxpayer filing as a single using the standard deduction:

($5950 – standard deduction for a single person)

$19,000 -$5,950 = $13,050

30% tax bracket

$13,050 x .3 = $3,915 per year

or $ 326 per month

substituting that in for the tax saving in the monthly nut recalculation gives you a payment of

$2,214

Still more than renting the place at $2000 a month.

Thanks for pouncing on that.

I like apples to apples comparisons but when people think they are doing apples and apples but are actually doing apples and bananas, I get a little perturbed.

You have one giant glaring mistake in your example. You CAN NOT lump principal into the category of money pissed away you never see again (i.e. mortgage interest, property taxes, rent, etc). Even with your revised tax numbers, it’s cheaper to own versus renting when knocking off the principal. Principal is tangible, if you pay it all off you own the place outright, if you sell the place you get credited for your principal…the same can’t be said for rent!

My example is based on being single, I assumed 33% tax bracket. Like I told Martin above, when you itemize you can take advantage of other tax write offs you can’t do when taking the standard deduction. Any other questions?

Principal is not tangible. Your principal payment once made to the bank is not something that can be exchanged or redeemed. Sure you pay off some loan principal with each payment, but this means nothing if your house is underwater or will lose value in the future. That principal payment is just a gamble, you are betting your house won’t lose value.

Regarding reponding to Martin’s question and not understanding…not sure where you got that. I just read his question and did respond.

Again, simple math my friend. You are better off buying that 500K house today with 20% down than renting it for $2000/month. This is true today, who knows if it will be true next year or 10 years from now.

Lord,

While I agree that one could add back the principal in this example as you suggest, I disagree that owning is better. One must not ignore the $100K down in such example, which is immediately gone, illiquid, at risk and likely to generate no return near term. Go ahead and exclude the principal, but add $3K to $4K per year in muni interest and/or dividend income in your rental model, not even counting value of liquidity or the 5%- 6% hit on the ultimate sale of the housing “investment.”

My 2 cents.

Jason

Blanket statements that say which is better renting or buying are really off base unless they take into account all of the details.

With regard to your example, for the past few years i have been polishing a rent vs own spreadsheet that calculates the NPV of the difference between home investment & rental cost, taking into account all the variables.

The after tax break monthly payment depends heavily on how much you can itemize. My wife and i are young / healthy, do not have many medical expenses, so we can itemize generally around 4k$. that leaves 7900$ difference. Most Americans can do not have enough expenses that they can itemize to take full advantage of the MI tax break.

example (for married couple as most homebuyers are)

itemize-able expenses $ After tax monthly payment

2000 2265 $

6000 2155 $

11900 1993 $

The real variation people need to look at though is DOWNPAYMENT, AS MOST single family home buyers do not have 20% down on 500K, that is why 30% of homebuyers are using FHA low down options. Ok, if you have 20% down the after tax payment can be similar to the rental payment, but what if you don’t.

example (assuming 6k itemize-able expenses, 2% inflation, 4% savings invest rate, 2% home appreciation rate):

% dwn after tax pmt # yrs breakeven # yrs breakeven (w/ initial-15% decline)

3.5 $2991 7.8 16.9

5 $2956 7.2 16.5

10 $2548 4.5 13.8

15 $2385 4.1 13.2

20 $2155 3.6 12.5

My point is that a large # of people are buying based on some general concept that it is cheaper to buy than rent right now and that is simply not supported in all cases. It varies greatly depending on where you buy, down-payment, comparable rent ect… With a low down payment the break even point may be further out than many are realistically able to stay in the home. A small drop in prices of 10-15% can have the effect of doubling this time period.

I’m not dinging your analysis, just saying that there is more to look at than your single scenario.

Math doesn’t mean squat when the FED says 2+2 is whatever they say it is.

It comes down to this equation.

Rent vs. Buy

Buyer + Buyer ability to pay mortgage (Renting “$$” from FED) + middleman (Servicer) + FED.

Renter + Renter ability to pay rent (Paying for Landlord meals, loans on $$ he rented from the FED + all of his middlemen (Tax Acct. Tax Lawyer, Managmnt Co., Etc Etc Etc + REIT middleman + FED

Improved chances of survival depends on shortest link to the taskmaster FED.

I just bought a house in the IE from a flipper. Now I only have to worry about me coming up with money to pay mortgage which for me is same amount as rent and what the FED will do.

Renter has to lay awake at night when the SHTF in the not too distant future and worry about his source of income, his landlords sources of income, and what the fed will do. (Don’t bother replying that a renter can get up and leave. Where too? everyone is in the same mess WTHSTF.)

YOU don’t own your house & you don’t own your apartment, all of it is rented from the government. Cut out all the middlemen you can. It is you versus the FED.

Im Not POTUS, I like your thinking. When it all hits the fan, being an “owner” will be a better position to be in. I’m sure few will argue with this. Being allowed to squat in “your” house will be a high probability. Being able to squat in a rental ain’t gonna happen for too long. As we’ve all seen too, owners are treated much better than renters by the Fed and PTB. If it comes down to owning and renting for the same monthly cost…owning makes sense today and for the future.

I used to live in California. I moved 12 years ago. I now live on 50 fenced acres in a 2400 sq ft house with a 4 acre lake. A 3000 sq ft steel commercial shop, 8 steel out buildings a 1000 ft driveway with a remote elect gate a 400 ft deep well. the electric bill average’s 110.00$ a month and the property taxes are 150.00$ a year. the original cost was 75000.00$. Move while you still have the chance before Obama finds out about it.. Its located in north Arkansas in a resort area. Living in California leads to retardation and a handicapped mind set.

Leave a Reply