Future FHA buyers to subsidize poor performing FHA loans of yesterday – Will the FHA make mortgage insurance premiums permanent?

FHA insured loans are now a major part of the mortgage buffet available to home buyers. This insured mortgage product has allowed many buyers to go in with 30x leverage when purchasing a new home. So it should come as no surprise that the FHA is now inching closer to a bailout. If we look at the actual FHA standing however, we begin to realize that the FHA is putting the screws around recent buyers for their lax products. First, mortgage insurance premiums are soaring to make up for the capital reserve account that now finds itself $16 billion in the red. Although on the surface you would think that over half a decade into the housing crisis, some would realize that low down payment products were a problem here we are relying heavily on the one insured mortgage product that allows cash strapped Americans to once again go into massive debt with very little skin. That game is however changing and this article will go into some more technical details regarding FHA insured loan products.

Subsidizing the past with future Americans

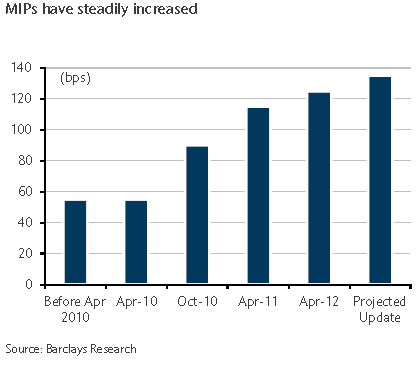

What is occurring in the FHA is symbolic of what is now part of our economy. Essentially we have turned into a massive moral hazard economy. Major subsidies to hide losses and pushing problems down the road. That is why the problems with the FHA which we have documented for years are now boiling over. Delinquencies for FHA products are horrific going back to 2008:

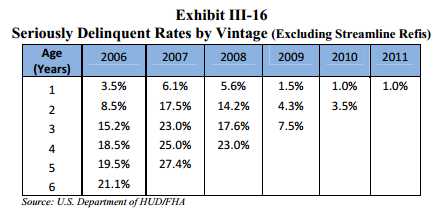

You’ll notice however that even vintage 2009 loans are going bad three years in. What is troubling is most of the originations came from 2008 onward:

It is rather apparent that the FHA insured loan market boomed right in line with the decline of the toxic mortgage market. At one point in 2009 FHA insured loans made up nearly 40 percent of the market! That is, Americans are so cash strapped that the only way they can purchase a home is with a 3.5 percent down product providing insane 30x leverage. This is on par to Lehman Brothers right before it imploded. Then again, we like repeating history like a chorus in a viral pop song.

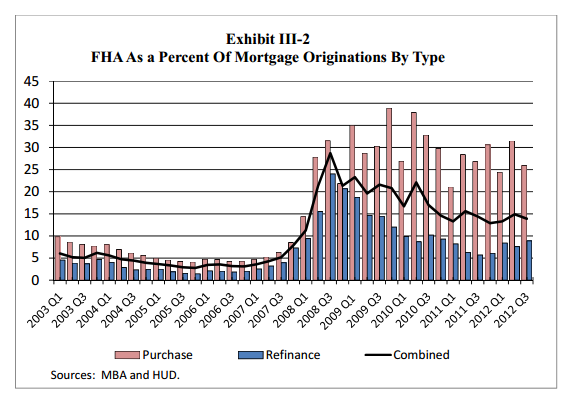

What is even crazier is the volume of FHA loans in states like California:

In 2010 36 percent of the California mortgage market was dominated by FHA. So contrary to the made up idea that everyone is flush and buying with 20 percent down, you have the glaring reality that the middle class is going massively into debt, investors are buying other properties, and then you have foreign money purchasing in certain enclaves.

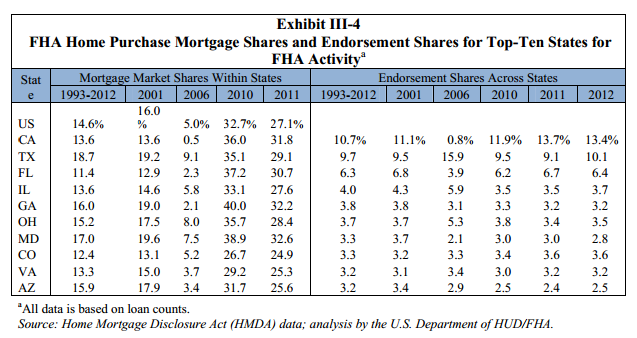

Guess who will be paying for all these failed loans? Those looking to buy at today’s inflated rates. The FHA is massively increasing mortgage insurance premiums:

What is essentially happening is current buyers are now having to pay a larger monthly nut because all the failed loans of yesterday. There are major changes hitting FHA loans but let us address few items:

“Tax and insurance (T&I) defaults: For many homeowners, taking all eligible cash upfront results in insufficient cash flow in later years for property upkeep, taxes and insurance. This impacts program performance by increasing defaults resulting from borrowers being unable or unwilling to make tax and insurance payments. The incidence of T&I defaults has increased in recent years and is incorporated into the Actuarial valuation.â€

Did you know you have to pay taxes and insurance when you buy a place? Shocking, I know. Yet people going with FHA loans many times do not have budget flexibility. So as taxes and insurance go up, they become more cash strapped and defaults rise. States would love nothing more than to keep home prices inflated since tax revenues are assessed on the price of the property. Courtesy of Prop 13, the state loves each new person that purchases at current market rates for those fresh new assessments. The above is from a FHA report. Another major change regards mortgage insurance premiums:

“Under a policy change made in 2001, FHA has been cancelling required mortgage insurance premiums (MIPs) on loans for which the outstanding principal balance reaches less than 78% of the original principal balance. However, FHA remains responsible for insuring 100% of the unpaid principal balance of a loan for the entire life of the loan, such loan life often extending far beyond the cessation of MIP payments. As written, the timing of MIP cancellation is directly tied to the contract mortgage rate, not to the actual loan LTV. The current policy was put in place at a time when it was assumed that home price values would not decline, but today we know that LTV measured by appraised value in a declining market can mean that actual LTVs are far lower than amortized mortgage LTV, resulting in higher losses for FHA on defaulted loans. Analyses conducted by FHA’s Office of Risk Management projects lost revenue of approximately $10 billion in the 2010-2012 vintages as a result of the current cancellation policy. The same analyses also suggest that 10%-12% of all claims losses will occur after MIP cancellation. Therefore, beginning with new loans endorsed after the policy change becomes effective later in FY 2013, FHA will once again collect premiums on FHA loans for the entire period during which they are insured, permitting FHA to retain significant revenue that is currently being forfeited prematurely.â€

Did you get that? MIPs are likely to become permanent right when these suckers went through the roof. Of course the FHA is simply trying to shore up their capital reserves but you have to ask why this is happening. Fiscal cliff? Another debt ceiling? FHA $16 billion in the red? Household incomes back to 1995 levels? Sure sounds like a booming market to me! This is happening for all the mistakes made only recently so those now buying with FHA loans are seeing massive jumps in their monthly payments. Take a look at a brief history here:

Mortgage insurance premium (MIP) increase and adjustments to upfront/annual MIP relationship

a. 1/12/2010 – Increased Upfront MIP to 2.25%

b. 10/4/2010 –

i. Lowered up front MIP to 1%

ii. Raised annual MIP to 85 to 90 basis points

c. 4/18/2011 – Increased annual MIP by 25 basis points

d. 4/9/2012 –

i. Increased upfront MIP from 1% to 1.75%

ii. Increased annual MIP by 10 basis points (up to 1.25%)

e. 6/11/2012 – Increased annual MIP for loans in excess of $625,500 by 25 basis points

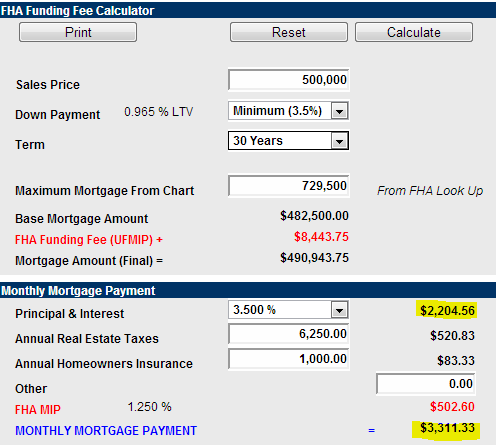

So in reality, people need over 5 percent of the purchase price just to get in even though it is only covering 3.5 percent of the actual principal. Let us run the numbers here:

I continue to see people only referring to the principal and interest here. In reality, when you add everything into the FHA loan for a $500,000 home purchase your monthly nut is $3,311. The FHA MIP is $500 alone and adds almost $8,500 in the initial closing costs. So you are looking at $26,000 for the 3.5% down payment and the 1.75% upfront UFMIP.

Now with the FHA running low on cash this is a cash cow for them but the burden is now placed on current buyers to make up for the mess created in the last few years (does this sound familiar?). Welcome to the current economy. And how many people actually have the $100,000 for a down payment? As we highlighted in our heavily commented California middle class article, not many because many are going with this much more expensive FHA insured loans product. Like an expensive credit card, people are stretching their wallets to purchase that home because incomes are certainly not rising.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

54 Responses to “Future FHA buyers to subsidize poor performing FHA loans of yesterday – Will the FHA make mortgage insurance premiums permanent?”

It’s not that surprising because we already saw the result of low down payment products; the walkaway point is, well, immediately after purchase due to effective negative equity. It’s a lot harder to walk away from 20% down, and for that reason defaults are more like 5% than 15-25% for high LTV products.

I am seeing still the disturbing trend of “oops we screwed up our risk management, but we already made the contracts so let’s push the cost on the next folks”. Let’s just print more money, bail it out, and move on. Lending is so crazy now, just because it’s government backed doesn’t make it less crazy.

Eventually these products become so bad they will have to restrict or discontinue the program; what will happen when that huge market segment doesn’t have access to leverage anymore ? What hopefully happens is what needs to happen: price corrections. But oh no that would mean less commissions and fees.

If we had just stuck to the tried and true 20% down … well it’s far too late for that now. Just pay a little premium (bigger now) and we’ll ignore your garbage credit and the 3.5% down you got from… is it from your relative or your credit cards perhaps ? We’ll just call it a gift… the gift of risk blindness.

If FHA makes mortgage insurance permanent, people can still get out by refinancing once they have enough equity. I have friends who just did this.

FHA becomes a real Roach Motel only if rates go up so it wouldn’t pay to refinance.

Of course, you are going to refinance at today’s rates to remove MI. But, think about in 2-3 years or sooner when mortgage rates could be 6.0%. Will you refinance from 3.5% to 6.0% to remove MI from FHA? No you will not…

If rates go up, there goes value. Loan to equity has zero chance in that environment.

Ofcourse, if someone is presented with this post’s proposition and is willing to sign, they fully deserve all the bad that will accrue.

Sadly, this also plays into the NAR/RealTard mantra of “buy now, or be priced out…” lawdy-lawdy.

Doc, thanks for staying up on these largely UNpublicized and telling trends!

Hi Doc, I always look forward to your posts.

As you point out, the market is completely dependent on subterranean interest rates and FHA financing availability.

I believe the reason for these idiotic lending terms is to give the banksters the time to move as much of their mortgage debt exposure from their books to the government’s (our) books. Low rates and FHA are two of the major tools in their fat cat burglar bag.

Also, a couple of points; the FHA upfront Mortgage Insurance Premium is added onto the loan balance, so the buyer does not bring it to escrow in cash. Also, and this is something that many don’t recognize, because the upfront MIP is financed into the loan balance, it does not represent cash into the insurance fund because if the loan defaults then the MIP that was financed into the mortgage balance is lost in the foreclosure process – it evaporates because it was built into the loan. Only monthly MIP actually comes out of the borrower’s pocket to support the insurance fund. This is one of the reasons FHA is headed for a bailout but few recognize this.

Also, the issue of the property taxes relates to HECM (reverse) mortgages where FHA, for some reason, never implemented impound accounts and now they are finding “to their surprise” that these retirees are not paying their property taxes. As Gomer Pyle would say, Surprise, Surprise, Surprise!

I think you’ve hit this nail on the head!

At the risk of adding to the gloom here, this recent stat may be telling:

http://directorblue.blogspot.com/2012/11/but-its-all-about-fairness-144000.html

The author notes that he’s using the CA state comptroller’s most recent tax audits, and if his conclusion is correct then look out below. Only 144,000 CA households (representing 1% of the state’s taxpayers) are now currently paying 50% of the state’s income taxes each year? In any scenario economically, those numbers don’t seem feasible, at least for the long term. Sure, you could tax these households more, but if it drives greater numbers of them to leave the state, then who’s left to foot Jerry Brown’s bills?

What this really shows is the unbalanceness of income distribution. It shouldn’t continue but will and it it will get even more drastic. It’ll stop only when people say no, but that’s going to be a long ways out post depression, war, famine, etc.

Another attack-the-Democrat post. At least you’re consistent. What doesn’t make the least bit of sense is your hypothesis of the top 1% leaving the state if higher taxes were to be levied on them; the facts are they have been reaping the biggest rewards of living in California of any group. But, look, there doesn’t seem to be much trickle down. Go figure.

“Over the last two decades, the average income of the top 1% of Californians increased by 50%, after adjusting for inflation, while the average income of the middle fifth fell by 15%. In 2009, the average income of the top 1% was $1.2 million — more than 30 times that of Californians in the middle fifth.”

” In 2007, the top 1% of U.S. households received one-quarter of total income, the highest level of income concentration in almost 80 years.”

http://articles.latimes.com/2011/nov/23/opinion/la-oe-andersonross-99percent-20111123

Somebody get DFresh a monkey and an organ grinder.

The circle will then be complete!!!!!!!!!!

OK, so let’s take your assumption as correct – that no current high – earning CA resident and/or business will relocate after the higher tax rates take effect. What is your solution to the current CA budgetary deficit? The new rates won’t come close to closing the huge gap. Please outline the suggested actions that should be taken, and what you feel the ultimate outcome will entail.

mac

Even the blind squirrel might have found a nut.

1. Few pursuits allow for high salaries and economic and financial ignorance.

2. The few that do (social media, entertainment, sports, plastic surgery……..) are most likely more oriented in your state.

3. These specific concentrations most likely can’t be replicated elsewhere.

Where the real problem lies is these types of policies make it even more unlikely the millions ex- residents that would meet this criteria will never come back.

My kid just bought an FHA home and is stuck paying the MIP. I am thinking I could give him the money to pay against his loan to get below the 78% LTV limit. Then he could pay me 1% for the trouble. We both win.

Why not accept principle plus some of the insurance premium?

You can always hold that balance in “escrow” to pass along later. he might very well need it.

Why anyone would “own” a home in that scenario is amazing.

If I’m not mistakes there is a minumim time threshold that must be reached in addition to thre 78% LTV before FHA will remove MIP – 7 years rings a bell but don’t quote me.

Uncle Vito–your kid must have MIP for a minimum of 60-72 months even if you pay the balance down to 78%….

Hey everyone! Never been a better time to buy Xurbs of Phoenix!!!!! What could go wrong?

WOW!

That’s $42K in the scenario above.

For what? “OWN” a “HOME”?

Maybe some people are flat broke because of really stupid financial decisions.

Wow that MIP is a budget killer. In the neighborhood of a 20% payment upcharge, for the life of the loan. In addition to the upfront fee.

The FHA is trying to be a loan shark, but in light of their past performance, a really BAD loan shark! They need a bunch of thugs with crowbars to go around and collect…oh wait it’s taxpayer money!

Some credit unions offer 95% LTV with a MIP buyout in CA. The numbers work better for you if you can get a decent price on what little is out there to buy. Up front costs are a wash and you don’t get nailed with no write off of the FHA MIP expenses that are set to go off at the fiscal cliff. The loan rate is not scrapping the bottom but still good enough to be cheaper than paying rent.

“cheaper than rent” – prove it by showing us the numbers on an apples to apples comparison.

Can’t find or unable to do an exact apples to apples comparison?

Credit default swaps here we come again!!!

On the bright side, I think there is a 50% chance, or better, that mortgage rates go lower, fiscal cliff or not. Go to stockcharts.com, put in symbol ‘$tnx’ (yield on 10-yr treasury bond), and put in 3 years for the range of data. 10-yr treasuries are within a few basis points of their lowest level ever, and the USA federal govt. is still running massive deficits, last I looked. They can’t make ends meet as it is, and need the fed’s QE-x to finance their profligate spending. They will not allow interest rates to rise.

My advice would be, if you decide to buy, to get a 15-yr fixed product. You will be building equity, assuming housing prices do no worse than go sideways. Then, in two years, you will probably be able to refinance at a lower rate!!!

Someone that has no down payment, and is forced to go the FHA route, is even more in need of a 15-yr loan, as opposed to a 30-yr. With a 30-yr loan you are building negligible equity the first several years.

Jason, with the super low mortgage rates you actually do pay quite a bit of principal right off the bat. Here’s a little example:

400K 30yr fixed @ 7%: monthly = $2661, principal = $328 or 12% of payment

400K 30yr fixed @ 3.5%: monthly = $1796, principal = $630 or 35% of payment

I wouldn’t consider that neglible or throwing money out the window. Another reason we are seeing this crazy market.

Have you considered a job as a realtor?

Joe, you are an idiot. I provided my proof in numbers, you resort to name calling. I’m still convinced most people (including people on this blog) are bad at math. Crunch the numbers instead of stomping your feet hoping for nominal 1998 prices.

I’m one of the payers of California’s “outrageous” taxes and I say come get it. I am able to pay the tax and don’t mind doing it for living here and having the services I do. I don’t expect something for nothing. I make over 125K a year and sometimes much more. I am able to pay the $100K down and more. I like it that my trash is picked up and disposed of with stuff recycled, that the roads are fixed, that emergency services are available, that the sewers work and clean up the shit before it hits the ocean. I like the public parks and the great education that is available here. My family is here, my past is here. I am a citizen and I want to pay my fair share to keep this state great. Brown is just the latest governor, others have been Republicans so shut the f*ck up about “lefties” being in charge is the reason Calif is screwed. Don’t make yourself look like foolish blaming one party for the mess – we’re all guilty. I am able to pay for the services and don’t mind doing so – if you don’t like paying for what is available here please head to Texas or Alaska or wherever your teabagger dreams are telling you is so much better. We won’t miss you.

im sorry but if that is the intelligence you are bringing to the table you need to get a life. in other words, shove off pal.

So your idea is that in other places — Texas, Alaska — the roads aren’t paved, the trash isn’t picked up, the kids’ SAT scores are higher, and there are no parks?

Don’t get around much, do you? You remind me of those sad people who lived in East Germany before the Wall came down. They were 100% certain they lived in a much nicer place than that rat-infested Dickensian pesthole, West Germany. Because after all, the government and newspaper told them so, every day.

When they saw the West with their own eyes, afterward, they were so dazed and hurt. But…but…you mean they LIED to me? Gosh, how could they?

Whatever helps you sleep at night, dude. My advice is to stay at home and only watch MSNBC and read official government bulletins. Particularly if you have high blood pressure or anything.

Exactly.

California’s problem is there are way too few “useful idiots” in the world that have this idiot point of view.

With all due respect, I think you mean too *many* and that is how we keep getting the same criminals and cronies sent back to Sacramento each election cycle.

As long as the makers (tax paying businesses and inviduals) continue to leave at a rate greater than than the takers (consume more from the system than they put in) come in, the outcome is ineveitable.

In case you missed the statistic from the last thread – From the mid-1980s to 2005, California’s population grew by 10 million, while tax filers paying income taxes rose by just 150,000. Sounds like a sustainable trend, huh?

Sooner or later, a tipping point will be reached, and the system breaks down.

<>

Tell yourself that in 10 years. This place (CA) is headed for disaster.

Best comment in the history of this blog!

I like knowing that I can go to my local library and rent movies, CD’s, and books for free! I love the parks in my area too. I get tired of hearing from these negative nannys that never leave the house because they are too afraid. Why live like that?

FYI-your library trips aren’t free. Someone else paid for you.

Amen.

There are two fundamental rules for government tax policy: tax what you want less of, subsidize what you want more of.

Subsidizing the risk of loans made to those who will default just gets you more of that.

The government’s whole approach to trying to hide the decline (to coin a phrase) is to throw more money after the bad. That way lies madness.

I will admit that paying PMI is something I am willing to live with. On a conventional loan, even if LTV is 78% then the PMI must be paid for 2 years. On an FHA even if LTV reaches 78% then PMI must be paid for 5 years. So, why would I pay this? Well call me imprudent if you want…. I am able to put 10% down on a $450K home. In order to have some safety margin, my monthly payment (Principal, Interest, Taxes, Home insurance, PMI) will be 1/3 of my take home pay. 10% down may be bad but my monthly nut is 1/3 of take home pay, that is not bad, right?

Now as far as ‘why not wait until you have 20% down – I no longer believe that prices will be lower or even the same in 2-3 years. And lets face it the shadow inventory is nowhere to be found. Should I wait 2-3 years to see what happens?

The homes I am looking at in western LA and being self employed I will stay in it for 5-10yrs and not need to worry about relocation. DO YOU ALL KNOW WHAT IS HAPPENING TODAY. Solid homes with new kitchens and windows, new hardwood floors (within the past 10 years) are “FLYING OFF THE SHELF” (in the $300K-$500K range). I went to look at 2 homes last weekend and both HAD OVER 100 WALK-THROUGHS and 3-5 OFFERS BEFORE THE END OF THE FIRST DAY OF OPEN HOUSE. Good houses are in escrow within 2-3 weeks of hitting the market. Prices in LA have risen YOY now by approximately 5% in the areas I am searching. Could things go south in a few years, yes, but I would have paid $50K in rent during that time as well…..(so few people on this site talk about the cost of renting).

Anyway, PMI will cost me approximately $400 per month. If me and my partner cut back on 2 night-out-for-dinner each month, that is almost half of the monthly PMI. A friend of mine purchased a 2 bedroom home in Playa Del Rey for $620 two years ago and I thought he was insane…..he can already sell it for almost $700K today.

“A friend of mine purchased a 2 bedroom home in Playa Del Rey for $620 two years ago and I thought he was insane…..he can already sell it for almost $700K today.”

LOL…did I step in a time machine and wake up in 2005? It’s funny yet really scary hearing these statements again. At that rate, in 5 years it’ll be worth 1.3 million! I’m sure everyone on the westside will be able to afford that with all the massive raises they’re all getting, right??

Daniel, do what you think is right, not what someone else will tell you. Obviously in 2006, there was a housing bubble. So, why have home prices stopped “collapsing?”

Well, most local municipalities collect revenues off of property taxes that pay for fire, police, schools, libraries, and the like. It’s unfortunate that most people on this board don’t care for those things, but I do.

I’m personally glad the FED has stepped in to back stop the housing market and is trying to stop a potential deflationary spiral. We need people to find gainfull employement, sure. But, how do we get businesses to spend again? Hoarding cash does nothing for the economy………nothing!

Rember, your income is my income. My income is your income. If I don’t get a sandwhich at my local deli, then he doesn’t buy as much bread from the baker next door and so on.

Until things get rolling, things will be tough, but I highly doubt current home owners are going to sell for less than they can get because “things are bad.”

Good luck with your future home purchase and I hope all goes well with you.

Housing prices when they rise are not inflationary, according to the FED. Also, according to the FED, housing prices falling are not deflationary.

Housing inflation is based upon comparable rents only. Does not matter weather a house is worth 100K or 500K as far as inflation goes, it matters how much it rents for.

I still get a kick that the FED has convinced 99% of all Americans that it is bad for their savings to be worth more next year and their earnings to buy more next year. Productivity gains should improve our standard of living even with stagnant income but everyone has been hoodwinked and now think prices declining are bad.

Yep, bad for the Federal Government who owes 16 trillion, but good most of us.

I’m actually glad the FHA exists. We plan on buying a home soon. It just makes sense where we are at. We can’t wait for ever to buy a home. If it’s true that we have high inflation over the next few decades, fine, we’ll make out great. If we do have some collapse, which I don’t think is going to happen, great at least I have my own home instead of some nut bag landlord.

When I was down in Florida, we payed on average $700 to $850 a month for dumps. One apartment turned condo, kicked us out. Moved in with someone, they wanted to buy a house, so we left. Moved into a wanna be landlords condo, he forclosed on it. No thanks, we are done with the apartment hopping game. It never pays and we are never able to “save” any money moving around.

The rent to own parody here is either even or a better deal to own! With interest rates as low as they are you can’t go wrong. If they do go lower, refinance! If they go higher, then you win out! Either way, it makes sense for us.

I’ve been out to San Diego and loved it. If you want to stay there, then buy! If not, MOVE!

Hello Best Buy Yet – I agree with your comments (see my post just before yours).

When rates go up, the buying power of prospective buyers goes down. Assuming the max loan is based on a max payment (which is determined by wages which have been stagnant at best for the past few decades), every percentage point of APR translates to about 10% less principle available. So when the government programs start drying up and the true risk of lending is priced back the mortgage market, and we see rates rise to and then exceed their historical norms (because the pendulum never stops in the middle), there will be millions of people who felt like they got a great deal that but will have absolutely upside down mortgages. I have my doubts as to whether it’ll spike the foreclosure rates but if you ever change you mind on having moved here, if you’ve bought, you will be stuck.

I agree with your comment that if rates rise, that would push the prices down……………in theory.

I witnessed first hand from 2004 to 2006 prices of EVERYTHING went up as interest rates ROSE from 1% to 6%.

It wasn’t until everyone panicked and liquidity froze, that things started to spiral down.

Again, stop trying to predict the future and do what you need to do for yourself NOW!

What if we are like Japan, and rates never rise for 20 years, but home sellers refuse to sell “cheap?”

You gonna wait 20 years? How about 30? How about 5? Then what?

None of the above. I’m abandoning California in the new year.

2004-2006 should not be taken as any visage of normal. By that point in history, the majority of loans being written were being done so with underpinnings of fraud. That was the height of the bubble insanity. You know, when a median home in Orange County cost between 10 and 14 times the median wage in the area? The reason prices were able to go up while rates climbed as well is that prudent risk management in lending had been completely thrown out the window. If that ever happens again, SELL SELL SELL. Take the profit before the impending the collapse, then buy back in when things stabilize afterward. My honest opinion is that they haven’t yet. So long as a the rates are well below historical norms, and the monthly nut on a middle class house exceeds the ability of a middle class income, I honestly see no upside potential.

Somewhere some NAR stooge has read this and is now licking their chops, laughing, and muttering something about “made my day”.

Why are you so angry all the time? Don’t you ever have anything positive to say? Do you get off on other people’s misery?

Patsfan, where you that kid in the playground that refused to share his toys? Hummmm, I think so!

Actually thought these these two commenters were worth reading, since they intially started out making valid positives towards owning a home – but then these sentences cropped up:

“DO YOU ALL KNOW WHAT IS HAPPENING TODAY.”

Well yeah, yes we do – that’s why we come to this blog, actually. But why all the screaming caps here? Someone trying just a bit too hard to convince others of their position, perhaps?

“…homes with new kitchens and windows, new hardwood floors (within the past 10 years) are “FLYING OFF THE SHELF†(in the $300K-$500K range). I went to look at 2 homes last weekend and both HAD OVER 100 WALK-THROUGHS and 3-5 OFFERS BEFORE THE END OF THE FIRST DAY OF OPEN HOUSE.”

I believe that has all the hallmarks of something they call a “bubble.” Perhaps you’ve heard of the term? It’s actually part of the title of this blog.

“The rent to own parody here is either even or a better deal to own! With interest rates as low as they are you can’t go wrong. If they do go lower, refinance! If they go higher, then you win out!”

I think you meant to use the word “parity” here, not “parody.” But come to think of it, maybe your original word works much better, in context.

“Hello Best Buy Yet – I agree with your comments (see my post just before yours).”

Quel surprise – either sockpuppetry or another RE circle jerk.

Thanks god. I thought I was going crazy. I have been so furious about this. We moved back to the US in June and looked into loans at the end of Oct. The loan broker sent me the pre-approval letter and fired off a bunch of numbers at me over the phone. After it all didn’t make sense about the monthly payment so asked the broker to email me the breakdown. Being a little clueless about MI I was shocked to see the MI to be 23% of the monthly cost. But I still looked at houses. Trying to justify the cost. Approached a few agents. Expressed my concerns that it is a huge amount. Broker said at the time MI could go away after 13 years. I’ve been through 3 agents now. The first told me I’d regret not buying now with low rates. Bye bye. The next guy tried his hardest to make a 1100 square foot badly flipped house seem possible for a family of 4. Just think of all the possibilities! Emailed him and expressed some concerns about the the market not looking quite right. He never returned another email. And today I received this after expressing doubt: “plus the cost of money is just ridiculous. We haven’t seen interest rates this low in 20 years or more. This means that the monthly cost of owning a home is way down.”

I replied posing questions about the effect on prices if rates did rise. No reply. As much as it really pains me because we have 2 young kids, I am resigned to continue renting. We have fico of 800 not one late payment ever and can’t save a big enough deposit with the huge amount we are paying in rent.

It dawned on me – when I saw it was announced a couple of weeks ago they were changing the FHA rules due to the shortfalls – that WE were going to pay for all those bad loans over the past few years. YES! MORAL HAZARD! Freak me. I am so angry about this I have been forced to post really really long stupid rants on a great blog. I feel so ripped off. My kids are being ripped off.

The only good thing that could come of this is that all those cash buyers who are in there right now buying up and inserting speckled granite for their flips are the ones who are going to take a haircut. Not only is the government taking on the one hand the flippers are standing there taking from the other. Depressing all round really. Sometimes think we should just jump in with all the other idiots. No harm these days in ruining your credit if things so sideways. \

@tapis volant:

You wrote: “I replied posing questions about the effect on prices if rates did rise.”

One thing I wanted to pass on to you. If you purchase your home with a Fannie/Freddie loan bear in mind that they have due on sale clauses; which means the loans have to be paid off and the buyer will have to get a new loan when you sell to them at the market interest rate at that time.

On the other hand, if you have an FHA loan, it can be assumed by your buyer AT THE EXISTING INTEREST RATE and you will receive a release of liability severing you from any future credit impact should the buyer of the home default. The liability release also allows you to get a new FHA loan immediately.

Ultimately, this means that if someone is willing to make your payment and can qualify – you can get out. They don’t even have to make the 3.5% down payment on an assumption. So the question is, “Is your payment low enough to entice someone to take the home off your hands?” Rising interest rates will not necessarily trap you in a home if you have an FHA loan.

See Chapter 7 p. 385 of HUD’s underwriting manual on assumptions here:

http://www.hud.gov/offices/adm/hudclips/handbooks/hsgh/4155.1/41551HSGH.pdf

Thanks Pain. I wish my agent knew this much. Or my broker. Interesting bit of information and a reminder to keep learning as much as I can. buying a house in this country feels as stressful and precarious as dealing with the health insurance industry. I’m literally too scared to use our policy in case I have missed some vital piece of information and it results in disaster for us. Suck it up kids. There are no antibiotics until we visit grandma next.

Leave a Reply