Short sales and the process of flopping – Short sale fraud will cost lenders $375 million this year. Short sale fraud and asymmetrical information keeps deals away from public.

Short sales are now a hefty part of the real estate market. Short sales are the process of selling a home for less than the stated mortgage balance. The process unfortunately has allowed a tremendous amount of fraud to occur and with more purchases going through the short sale route, this is simply another concern potential buyers must be aware of. One of the most blatant methods of fraud is through a process known as flopping. The agent will not submit the highest bid and at times, these homes suddenly turn into pending sales almost on the same time. The big losers here are potential buyers, sellers eating a larger loss, and the lender holding the note. Part of the shadow inventory is being slowly cleared out with lenders approving short sales and some are combating against the fraud that has been going on in this growing segment of housing sales.

The details on short sale fraud

It is worth the time to examine the process to get a deeper understanding of what is going on here:

“NEW YORK (CNNMoney) — Just as the housing market began to collapse near the end of 2007, a real estate agent in Bridgeport, Conn. asked Regions Bank if it would accept a $102,375 bid on a home that was underwater on its mortgage. Under the impression that this was the best offer on the home, Regions agreed to the short sale and released the mortgage it owned on the home.

Later that same day, the new owner — an investment group owned by another real estate agent — resold the home to a buyer who had been lined up before the short sale transaction went through. The final sale price: $132,500, netting the seller a cool $30,000 — a profit that should have gone to Regions.â€

The problem is of asymmetrical information. This is similar to investment banks selling off toxic mortgage backed securities to unsuspecting foreign investors or pension funds knowing the full extent of the troubled securities they were unloading. The assumption is typically that a listing agent will always want to take the highest bid. In these cases however, a lower bid is usually accepted from someone that is close to the deal only later to be flopped to a later buyer:

“In this latest twist on short sale fraud, scammers have found a way to rip off mortgage lenders by tens of thousands of dollars — sometimes in a matter of hours.

The scam artists, usually real estate agents, will secure a legitimate bid on a home, one where the borrower owes far more on the mortgage than the home is worth. Then they arrange for an accomplice investor to make a lower offer on the home.â€

This in a way is similar to inside information. A higher bid is usually secured or can be secured quickly. The process ends as follows:

“The agent then presents the lower bid to the lender and asks them to forgive any remaining balance owed — without disclosing that there was a higher bid made on the home. Once the short sale is approved, the scammer then sells the home to the higher bidder, often on the same day.â€

Now fraud has always been rampant with short sales. This may have been a miniscule issue when short sales were a tiny fraction of any market but today they are now a dominant force:

Source:Â Calculated Risk

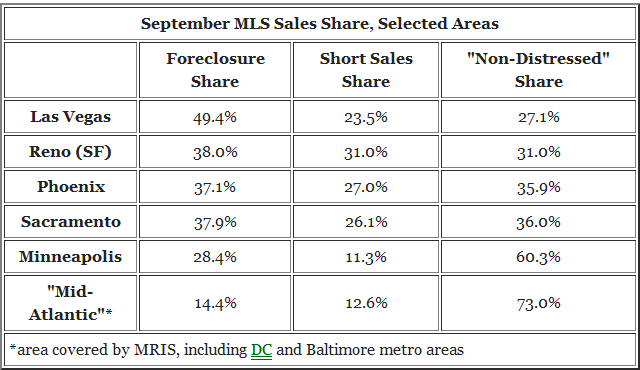

CoreLogic estimates that close to $375 million will be the cost to lenders this year because of short sale fraud. The shadow inventory is being cleared out little by little but fraud is happening on both ends because we are allowing the same system that allowed the bubble to blossom to also clear it out. Take a look at the chart above. In a place like Reno short sales make up 31 percent of all sales in September. Phoenix is up to 27 percent and Sacramento is up to 26 percent. These markets are also the hardest hit so adding fraud to the mix is only going to compound the issues.

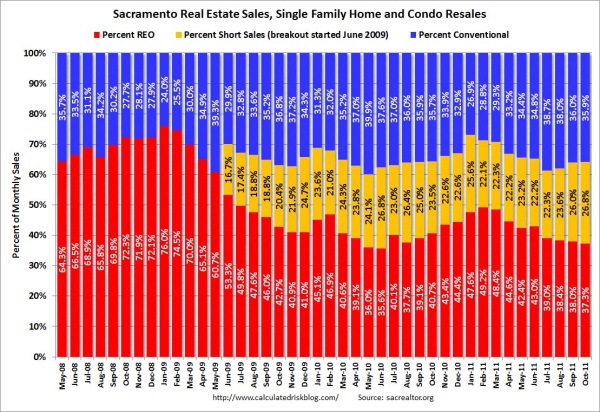

You can see the growth of short sales in a market like Sacramento:

Short sales are an ever expanding part of the market and because of this the temptation for fraud is growing.

Finding out the details

Potential buyers have been figuring this out for a long time:

“(ModBee) Using public records, Finch determined the company holding the mortgage and sent his offer directly, suspecting that the listing agent had not passed it along. “I told them, ‘I think you’re getting scammed,’ ” he said. “I could tell it piqued their interest.”

The agent suddenly asked him to resubmit his offer and a contract was signed the next day, he said.

Finch shares the story to give others hope, he said. “If you think you’re getting jerked around, you can actually do this. It worked for me. I got the house.”

What a shocker that the agent then suddenly asked to have the offer resubmitted. Many readers have e-mailed cases or suspected cases of short sale fraud. What normally occurs is someone submits a bid and expects it to be a high bid. The place sells quickly but the closing information isn’t recorded for a month or two. The potential buyer checks in later and views that a lower bid was accepted and the home was re-sold again in that time period.

You even have creative methods of using option contracts to quickly flop a house over. Lenders are late to the game but it does seem like some holes are being plugged:

“(HousingWire) Freddie Mac will force parties involved in a short sale to sign affidavits making them liable for their negligent or intentional misrepresentations in the deal, an effort to be sure it’s an arms-length transaction, according to guidance released Friday.

The new affidavit will go into effect Jan. 1, but Freddie is asking servicers to implement the change immediately to fight fraud. However this, and other changes, are meant to expedite the process of getting borrowers in default relocated.

In August, the government-sponsored enterprise alerted real estate agents to the rise in shady short sale deals. The main concern is flopping. There is a growing trend of real estate agents on the buy-side of the deal failing to disclose other bids on the property, rigging the sale at a lower price.

The fraudsters can then flip it, sometimes the same day, and pocket the difference.â€

In the end, the finance and housing industry are still running on the same standards that created this incredible housing bubble. An industry that forged documents, lied to investors, and gorged itself at the public’s expense is back at it although on a much smaller yet equally blatant extent. And with many homes bought for cash and at times with investor groups, it is easy to tell where the advantage is today:

Source:Â DQNews

Last month in Southern California, one of the most expensive markets in the nation, short sales accounted for close to 20 percent of all sales being closed. In some cases REOs sell for 40 percent below the balance price while short sales sell for 20 percent below. If you are looking to buy a short sale, just be aware of the process of flopping and make sure you are working with a trusted team. In the end short sale fraud harms potential buyers by inflating prices, hurts lenders, and ultimately is another bill the taxpayer needs to pay in this endless game of bailouts.

What are your experiences with short sales on the buying and selling end?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

55 Responses to “Short sales and the process of flopping – Short sale fraud will cost lenders $375 million this year. Short sale fraud and asymmetrical information keeps deals away from public.”

The agent will not submit the highest bid and at times, these homes suddenly turn into pending sales almost on the same time. The big losers here are potential buyers, sellers eating a larger loss, and the lender holding the note.

.

I would expect nothing less than more fraud from the real estate community.

Indeed, it’s amazing how people just cannot process that Realtors and other real estate agents are simply another version of the fast talking used car salesman. These are the folks who day after day told outright lies to drive the bubble, willfully destroying the lives of millions to inflate their own paychecks. Even after the bubble had popped, it continued, and even today – go to a few open houses and you will hear time and time again how this neighborhood is special, we’ve hit bottom, it’s different this time, this area didn’t really have a bubble…

Just remember – a mortgage broker or real estate agent is not a fiduciary, there is no professional oversight, these are salesmen, plain and simple, and most of them would drown your grandmother for a commission. If you can remember that every second you’re talking to one, that s/he would certainly lie through their teeth to you and perhaps even happily kill you for the contents of your wallet if s/he thought he could get away with it, you may be able to profit from an encounter, otherwise, you’re screwed.

JEEZ, sounds like my description of an attorney!

Give me a break Mr. JIMATLAW… you sound like a disgruntled attorney. Not every agent is a crook just like every lawyer is not a crook or are they? But I can tell you people selling homes are just as dishonest if not more so than the agents that TRY to represent them. They lie to agents, and they are always convinced their house is WAY better than Joe Blow’s next door because they have purple carpet and pink shutters and therefore they should be priced WAY higher than the last house sold and if you do not agree, which any reputable agent would NOT, then they will find the agent who is most inexperienced to list it at their ridiculously high price. That also contributed to the bubble, however you forget that the bankers created the easy money and sucked in as many people as possible before raising interest rates. Easy money from equity lines to credit cards. Greed….That is what also drove the real estate bubble. Don’t put the blame on Realtor’s and Mortgage people. The banks created the loan programs not the Realtor’s and mortgage people. They only sold the products that the banks offered to the market place. There are plenty of hurtles in the way to keep fraud from being as dominate as you suggest. Banks do their own research and usually counter back at a price that they want. Even in a short sale. I have not seen a bank yet who just accepts an offer that is way below market unless there are some real issues that they know about the property. Which of course they do not have to disclose. The blame game. Do your homework people and figure out this is a mess could have been fixed or at least in the process of being fixed without all the bailouts. The banks should have been allowed to fail and be restructured, if that is possible. Instead we throw tax money at it and the problem just grows. We are no further down the road than we were in 2008. Government needs to get out of the way and let all this mess work it’s self out. Until then we keep throwing money at debt. it does not work. They are doing the same thing in Europe. MF global lost 1.2 billion of clients money…banks had secret loans, banks had different accounting rules than the rest of the world… problems everywhere….Bonus checks keep flowing in million dollar amounts to bankers…… There is bad seed everywhere.

JimAtLaw – “Just remember – a mortgage broker or real estate agent is not a fiduciary, there is no professional oversight, these are salesmen, plain and simple, and most of them would drown your grandmother for a commission.”

You’re giving them too much credit for having a conscience. Many of them would drown their own grandmother for a commission. Some of the most dangerous pathological liars I’ve known became real estate agents during the housing bubble.

Wait a darn minute! I dissagree with you. The brokers and sales persons would drown you and probably eat you raw out back of their offices. Hey, they get hungry too.

A description of a corrupt politician as well.

JimAtLaw – “Just remember – a mortgage broker or real estate agent is not a fiduciary, there is no professional oversight, these are salesmen, plain and simple, and most of them would drown your grandmother for a commission.â€

Jim, I don’t know what state you’re in, but in California real estate agents are absolutely fiduciaries for their clients (seller or buyer) and owe them the “utmost care, integrity, honesty, and loyalty” under the Civil Code. Like any fiduciary, they must always put their clients interests ahead of their own. To do otherwise is a violation of the Real Estate Law, which can subject agents to criminal liability, civil liability and DRE discipline.

Unfortunately there are bad apples in every industry. My question is, ” is flopping fraudulent? Others may say it is but I say no, because there is NO law that says that it is. I equate flopping to buying a car for cash at a discount from one person, then re-selling it to another for a profit. There is NO law against that. We are condemning flopping houses because it hurts sellers, buyers, and banks? Banks have been doing this for years and still are, and they don’t care who they hurt. and we say it’s all ok for them to do it?.Who caused this whole bubble? Doc knows that, the banks and Wall Street did. The Banks made bad loans to home buyers knowing that they were going to fail. They then sold these loans to investors. The investors then traded these pool of loans on Wall Street and made astronomical profits. Then these bad loans started to become due while at the same time the real estate market began its slide. As a result these loans could not be refinanced since the declining values couldnt support the high loan values. People started defaulting on the loans. Since the banks were not getting paid they did not have the money to continue paying the monthly income due to the investors. As more and more loans defaulted banks were taking on a lot of financial losses. So they asked for a bail out on the premise that if they didn’t get bailed out the whole financial system would fail and we would have a world depression. They got bailed out while some homeowners continue to default others bit the bullet and tried saving their homes. Then the came the job losses..or off shoring of jobs. More people got into financial difficulty while the banks were using our Tax bailout money to pay for their bonuses, invest on Wall Street and acquired other banks. Then these banks started foreclosing homes only to be stopped temporarily by state and federal governments. Banks were asked to help homeowners by restructuring their loans to more affordable payments….this nturned out to be a big JOKE as banks ignored the request. Homeowners started getting angry at banks and more started defaulting on their loans. Many were able to stay in their homes for two years, more in some cases. Then banks started foreclosing, and homeowners started fighting back. Thanks to these homeowners fighting back that we learned about all the FRAUD that went on with these mortages and the banks involvement. We have learned that these banks do not have the right to foreclose on these home because they DONT hold the NOTES on the mortgages. You see when they sold these loans to the investors, they relinquist their right of ownership as they had already been compensated on these loans. The investors now own the loan, problems is that one investor only owns a fraction of the loan and in order for such investor to foreclose, he, she, or it, had to get the approval of every single investor in that pool of loan….and this alone created a problem for banks because they themselves are part of these investors. But to no surprise, banks continued to foreclose eventhough they know that they didn’t have the rights to do so. This is what we now call Illegal Foreclosures>>Recently landmark court decisions had ruled that banks did not have the legal right to foreclose on homes… still banks are ignoring these court decisions and continue to foreclose on homes. We are also learning that banks are buying their way out of court by settling cases of loan fraud before it went to trial. Why? because they did not want to be called on to show documents proving their guilt and once they did, it will remain as evidence for similar future cases in which they could loose.

Banks make more money by foreclosing on a home. Heres how.

A bank takes back a home from a foreclosure without actually using its own money to purchase it……ok, they don’t own the Note on the loan, yet they can just take over a home they dont owne without actually purchasing i,. like an investor would do at a Trustee Sale, thats not right…

Bank would normally take back homes from a foreclosure sale at large discounts

Then they would sell them on the market at large profits

In addition, since most of these loans are insured, they would also claim the loss from the insurance, so in effect, they are actually getting back the original value of the loan. In other cases they actually get more. For instance, let me illustrate the case of IndyMac who was sold by the FDIC to One West Bank

One West bank bought Indy Mac for 70 cents on the dollar..meaning a 30% discount.

The FDIC guaranteeds 80% of the original loan value, so One West is already made a 10% profit. But heres the kicker. If One West forecloses on an Indy Mac loan, they foreclose on the value of the original loan amount and not the discounted amount they bought. So let say the original loan amount was $500,000 and One West bought for 30% discount. Their new loan amount would be$350,000. But the FDIC HAD GUARANTEED OR INSURED 80% OF THAT LOAN SO, $500,000 x 80% = $400,000

So if One West bank forecloses at $350,000 they make $100,000 right off the bat. They then turn around and sell the home on the open market and make more. If theres a 2nd loan on the loan, they can go after the homeowner for that loan, or if the loan was a refinanced loan instead of a purchase loan then they can go after the homeowner through the IRS 1099 (phantom income claim) ……So to those of you who are sticking it out to the banks, I support you…..

We made a short sale offer two months ago and are still waiting for the BPO from the bank. What is interesting about the short sale process is how the banks uses Real Estate agents to price the value of the home. This seems to be a multi level process with local REal Estate agents providing the bank with a BPO and then the buyers paying for an actual appraisal as part of the loan process.

Cash is very attractive these days. Getting a home loan is still not so easy to do.

Perhaps the “investor” paid cash to the bank and the next buyer had to get a loan?

CASH IS VERY ATTRACTIVE???????? I offer all cash no contingencies save clean title. Have made 6 offers in Palm Springs area, three over the selling price(my offers were called back up offers) the bank never saw. The other offers were beaten by 5k and less. I do find it funny how every single case i was the listing agents client that beat me out. I also find it funny how i was never given the chance to submit a higher offer. This area is ripe with fraud

You are absolutely correct. Short sale investors pay CASH, and therefore usually get better prices and terms from the bank. Most of the comments here show a lack of knowledge about how the short sale process actually works and what is most beneficial for the distressed seller. Most of the comments also seem ignorant of the fact that the presence of a “middleman” is what makes most commerce possible in a capitalist economy. Saying that short sale investors are responsible for bank “losses” is like saying that sneaker wholesalers who get the product to the market are responsible for the Chinese Nike factory owner’s “losses.”

Of course, there are many real estate “scams” out there, and some realtors are not nearly as moral and ethical as they claim to be. Remember, though, when someone starts pointing the finger and scapegoating a certain group, they usually have something to hide. Do you think that the GSE’s and CoreLogic have anything to hide? If not, you’re dreaming.

Why don’t banks set up their own real estate arm and insist that short sales go through them?

Banks kind of do this by giving a select number of realtors so much of their REO business that the realtors are kind of captured by the banks. But many realtors don’t want to be the listing agent for REO’s because it can be more trouble than it’s worth. Banks are notoriously cheap about paying their realtors.

As they should be. A 6% commission on a $1M house is unconscionable.

That sounds like a damn good idea, since it’s the tax payers money that is bailing out the banks, I think they could care less how much they lose, and the scamming realtors want to keep all the commission. FRAUD, plain and simple.

Banks will not set up their own real estate sales outfits because they want at least one intermediary between them and the eventual buyer. The more, the better (to protect them from liability for misrepresentations).

There’s a 3 bed/ 3 bath 1900 square foot condo at the Aventura Marina in Aventura, FL listed at $350,000. Interestingly enough it’s a short sale, but not all listing services note it as such. Let the buyer beware.

This happened to us several times bidding on investment properties in Phoenix AZ back in 2009-2010. Would submit all cash offer, usually full price or close to it; listing would go pending very quickly…closing price would be less than our offer, sometimes significantly.

Question for the doctor:

I placed a full price offer on an approved short sale two months ago, Los Angeles area. Still waiting for the bank response. Selling agent keeps saying no response yet.

Is this normal? I thought if the price is approved it should go fast.

I am a Realtor and in representing buyers have thought for sometime that with Listing Agents of Foreclosures, they submit offers to the bank that come from their own teams which result in more commission for Listing Agent. As foreclosures became less and Short Sales became more of listing inventory, it is almost certain that manipulating of offers for many reasons (new ones born everyday) is a definite. Are all Listing Agents this way?. No. No one is saying that but as the industry gets more tangled with all this stuff and disease, everybody loses. The DRE seems to have no check points, clue or controll over fraud. The banks should do the Short Sales themselves with the current owner so those people can stay in their homes. Why agree to a short sale with someone else and displace families from their homes? It is a lose for everyone in the long run.

More confirmation that there is no integrity in the banking, mortgage handling or real estate profession.

Real estate agents have been an integral part in scamming the market at the front end and now the back end. Your article uses polite words like “fraud” and “investor accomplice” but should use common words like thievery and crooks to describe them.

I like the fact that the lenders are taking it in the shorts with short sales.

If there are honest real estate people, they sure were silent when the mess was being created and have been silent in the continuing fraud to come out of it.

These “professionals” still maintain that the economy is getting better, the bottom has been reached, and now is a good time to buy.

Do banks provide financing on their own short sales? What about foreclosures, is there any way to finance the cash amount due at auction in CA, such as a 30-day short term loan until closing and transfer of title?

That’s been going on for years. In March ’08 I offered 525K on a foreclosure with 50% down. The agent sold the house for 470K 3 months later to her own client. The agents cherry pick the offers, usually from their own client to get a double dip commission. Usually the buyer will pay a few dollars under the table to save a big chunk of money. I have personally seen this 7-8 times. The broker/agent usually won’t show the offers to the bank from other realtors even if it is more money, so they can get the full commission from their own client. The banks usually don’t seem to care.

The same thing happening to me and I’m all cash

Mâke your offer good for only 72 hours and then move on.

I am a Realtor. no one listened in 2005 when I screamed fraud or bubble, the stories in the media were all about how high can it go. Realtor bashing now is poor sport and many of the above comments are ignorant of the facts. While our rung on the ladder may not be so high up, whose is? Accountants? The ones manipulating balance sheets for extend and pretend? Attorneys? Who are demanding rights for deadbeat borrowers who stay in homes for years without a payment? Talking heads on CNBC? Elected members of the legislature? Please, at least my rung is higher than that.

It is pretty basic: the whole world gorged on debt and gardeners making $3500 a month were given $500,000 mortgages which were sold over and over on down the line and are now held by you and me as taxpayers. Blaming any one group is moronic. Blaming Realtors for having a positive outlook when you walk in the house proves you just don’t understand the beast. What should we say “NYC in flames, missiles on the way to LA film at 11”? “Don’t buy this cracker box you’ll lose your shirt”? I didn’t run across those selling techniques back in Realtor 101.

People want to buy a house and are out at opens, we would like to sell them one, if you don’t like the patter then stay home and tweeze your nose hair because you are missing the fundamental point:

With rates this low there NEVER has been a better time to leverage yourself with a loan. Houses have come down up to %50 from the peak and yes, in my humble opinion they will fall much further but you have to live somewhere and in 10 years you will look like a genius. If you think 10 years is a long time-have kids, it will fly by. 10 years is also about how long it will take to get one of those loans right now.

As far as how we got here; let him who is without sin cast the first stone. WE WERE ALL SWEPT UP IN IT AND ONLY HINDSIGHT IS 20-20.

As for the short sale process and as a expert (in REO too) I can tell you, offers are up %1000 in 2011, how many banks do you think hired %1000 more staff? They are swamped and cannot get to them all, especially as they are also trying to conform with Federal guidelines that change daily. I run a tight ship with a smart staff and I average about 7 months to get a short sale approved. That is just the way it is.

The real shame here is the suspension of capitalism, we are artificially maintaining a scenario for elected politicians to appear to be doing something, anything to look like they have a solution. There isn’t. Prices need to fall and a bottom put in by good old supply and demand. Keeping a massive supply of homes in the foreclosure process prevents a bottom, hurts municipalities that do not get tax revenue and maintains an artificial price decline that is slower than it should be. But of course “we have to keep these folks in their homesâ€.

Oh, by the way, the bottom rung on the ladder is all the folks who cashed out in a refi and then stopped paying the mortgage, insurance and property taxes.

“As far as how we got here; let him who is without sin cast the first stone.”

Never even considered buying during that stupid bubble. I am pure as a mountain stream.

Am I first? Do I win something?

So… what you are really saying is that “it is a great time to buy”!

It SHOULD be a great time to buy..but it isn’t. Record low interest rates and record low new home sales, per this chart. The Fed has failed.

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2011/12/Home%20Sales%20vs%20Rates.jpg

My statement that it is a great time to buy was indirectly calling our RE poster out on his BS.

“As far as how we got here; let him who is without sin cast the first stone.â€

————————————————————————————————-

I’m recent graduated and have played no rule in today’s housing bubble.

Watch out, here comes a stone at you!!

So prices dropped again YOY, something like 5-7%, right? But where? Not in Santa Monica! Not in Pac Pal, not in Man Beach.. at least, SFR 3B places didnt really drop.

I’m not sure they will drop (significantly) Prices in these ares should be back to 2003 prices or better, right? But they aren’t not listing there, and not selling there….

So I want responders to post their best guess for when these prime areas will actually drop. What more will it take? Also, what is the target? 2003 prices? 2000 prices?

THANKS

Dasher, prices are falling in those prime areas. You are probably confusing non realistic list prices with current market prices. Here’s a little crap box in Manhattan Beach that was profiled a few months ago on this website:

http://www.redfin.com/CA/Manhattan-Beach/1801-5th-St-90266/home/6702450

One of the posters on here even mentioned they put an offer on it. When all the dust settled, it ended up selling for 570K. That’s still inflated, but seeing a SFR detached house sell for that price in Manhattan Beach is almost unheard of.

All the places you listed are highly desirable. The majority of new buyers in those areas are the 1% (many with 500K plus salaries). These people generally want to live amongst each other and won’t be that concerned if they buy a place today for 2M and it’s worth 1.7M in two years. Contrary, a 15% drop from today’s price will likely devastate most middle upper class people.

My advice to you is don’t fall in love with any of these 1% cities. You aren’t the only one waiting to snatch a deal in any of these places. I would highly recommend setting your sights on cities one wrung below the 1% ladder, you will get much more for your money. For the South Bay, take a look at South Redondo…much cheaper than MB and much better if you ask me. It won’t hurt to take a look, I think you’ll be in a perpetual futile waiting game to jump on “cheap” westside 1%er real estate.

My crooked landlord/real estate agent flopped the house I was renting from him back in 2009. He “offered” it to me for ~ $100K under market value if I would “rebate” him $25K! I just gave my notice and wanted to move out ASAP. I told him if he said anything more, I’d have to notify the authorities or the FBI. Funny how he listed the property but I never saw one prospect take a look at the house while I was still renting. He ended up “short selling” it to an accomplice, who was shrewd enough to negotiate splitting 50% of the profit after the flop but within a 3 month time limit. Turns out, they did not sell it within 3 months, the accomplice ended up renovating the place and selling for a nice profit, and the real estate agent only got the sales commission. I have to imagine this type of flop is happening over and over again with unscupulous real estate agents.

Am I the only one here who has read this and thought, hey, at least these houses are actually selling in this market. I mean, how many people are really being screwed here?

As far as how we got here; let him who is without sin cast the first stone. WE WERE ALL SWEPT UP IN IT AND ONLY HINDSIGHT IS 20-20.

I’ve got no problem casting one back at you and calling BS. I can tell you my family and I had nothing to do with the bubble and were not a part of any of this horse#$@!. We saw it, couldn’t understand the logic, didn’t partake, lived within our means and followed basic economic principals. Now we are a part of cleaning up, once again, other people’s (uh, your) mess. Don’t try to make yourself feel better by justifying your crap behavior with “everyone was doing it.” So sick of hearing that drivel. We weren’t. You just moved back down another rung.

I am indeed fortunate to work in an industry for which everyone is an expert, even folks who only open their mouth to change feet.

I think some posters are missing my fundamental point, I am not insinuating that we are all guilty therefore cannot cast the first stone, I am stating that the whole system was geared to making loans to people who should never under any circumstances be given one. My comparisons were not to individual buyers who seem to have taken umbrage above rather the banks, mainstream media and talking heads that all assured us there was no end to the upside.

So, as for being a good time to buy. I have been doing this a a pretty high level longer than any of you, unfortunately I have more than enough candles on my birthday and I can only repeat Baron Rothschild’s excellent advice “When there is blood on the streets, buy real estate”. Streets seem pretty bloody to me but hey, everyone has their own crystal ball, make your own call. But do me one favor, lose the senseless bashing of people’s professions. Car sales men and attorneys, even Realtors put food on the table for a family, no industry is free from thieves and morons, some of the posters here are proof of the latter.

Great blog, I would love to see more on the dark under belly of the real estate market.

Once again showing my ignorance, but surely this behavior is illegal, which means that anyone who engages in it can be prosecuted, even way after the fact. Unless, of course, the district attorneys in question have all been bought off, which I suppose they have. But I just thought I’d ask if you guys think these crooks will ever get what’s coming to them.

I disagree with the statement made by the Christian Stevens…

“Oh, by the way, the bottom rung on the ladder is all the folks who cashed out in a refi and then stopped paying the mortgage, insurance and property taxes.”

Really?

Why?

The smart people ARE the one’s that took the FS’s money and ran.

An paid appraiser said the property was worth that much.

A paid loan underwriter approved the loan as safe.

A paid loan originator’s agent approved the loan.

A paid reseller resold the loan.

A paid packager packaged and traunched the loan.

A paid rating agency rated the packages and traunches.

A paid broker sold the traunches.

The people that walked away made a business decision–that is it, that is all that they did.

No one forced the seven individuals or their respective firms to behave as they did. To say that individuals were wrong in taking advantage of the systematic greed for their own individual enrichment is disingenuous.

If someone walked up to you and offered you twice the market value for your car, would you turn it down?

So get over it people.

I am not a big fan of RE agents–and don’t agree at all with their compensation basis-model; but blaming the RE situation on them is like blaming bartenders for alcoholism.

I only wish that I would have been smart enough to have taken advantage of the S.O.B.’s.

Yes, most real estate agents and mortgage brokers are worse than used car salespeople. Don’t forget, you don’t even have to have a college degree, and so many are bored house wives. When short sales first hit the market in 2009, it was an”honest” way to go, then all the sharks jumped in, the opportunists to make a buck. The first clue is the company representing the property is always some made up name like “Mile High Properties” When you see that, run, don’t walk. Short sales should be illegal. How could the real estate market recover when the constant scams continue ?

With rates this low there NEVER has been a better time to leverage yourself with a loan. Houses have come down up to %50 from the peak and yes, in my humble opinion they will fall much further but you have to live somewhere and in 10 years you will look like a genius.

Really?

Christian, you almost had me until this statement. Obviously, you are intelligent enough to make a very good comment here, but if you’ve been following the good Dr you remember him pointing out that these low rates will come back to bite you eventually.

When interest rates rise, and one day they will, prices will go even lower.

It’s better to wait and buy with higher rates and lower prices than to buy now with bubble prices (like here in SoCal) and cheap interest. When you sell later, at a higher interest rate, your price will probably be lower than what you paid.

Mikem,

Historically, home prices for the most part rise when interest rates rise… And fall as interest rates fall…. I know it sounds backwards but its true for the most part….Look it up! The reason is interest rates rise and fall as a response… When home prices are falling… The govt lowers rates…. When home prices heat up and rise… Rates will rise to combat inflation. Rates will not rise until home prices start rising again.. And they will only rise at a rate to keep housing from over-inflating. My bet is rates fall to 2% this decade before we hit 8%… But if we hit 2% rates housing will have fallen another 20% first. And if we hit 6% housing will be up 20% first….

CaliOwner, I am always amazed at your posts. Regarding rates and home prices, you have it backwards. What happened from 1980 to 2007? Rates went much lower and home prices went to the moon. Even a fool would have to admit that if rates went up from here (even to say 6 or 7%), the effect to home prices would be devastating, especially to bubble areas like Socal.

If you think the Fed’s entire monetary policy exists to keep your home price inflated, you have another thing coming. They are creating a monster right now that might be not be able to be controlled. Wait and see…

Oh Lordy,

Of course if we woke up tomorrow and interest rates were 6 or 7% home prices would drop like a rock.

Interest rates historically rise and fall no more, no less than 1% per year.. That’s about all the economy can stomach. Again look it up! Maybe a few years rates changed 1.5% in a year.. but that’s the exception not the rule.

Look, I made a decision to buy a home this summer… A very stressful decision that over the long run I still believe will have relatively little downside. It’s not gonna cripple us financially because I bought 3x my income and on my salary alone.

I still remember Doctor H. saying summer of 2011 would be the bottom.. back in 2007-2008 when the housing market was busting. Buying after a 40% drop has little longterm risk.. and if there is much more downside…. like 20-40% more.

Look out because all kinds of new laws will be passed… runs on banks will occur.. foreclosures will rise to 2007 levels all over again.. and unemployment will be 50%… and most renters will lose their jobs too…

There’s a ripple effect to all this doom and gloom.. It may comeback to bite those in the ass that are rooting for home prices to fall another 40% when their jobs get axed.

I’ll go a step futher than christian stevens above. (but I’m not a real estate agent.) My opinion: I don’t find this to be fraud per se. If banks (lenders of any class) had agents actively trying to clear bad mortgages from their books, then this *might* be fraud. But the banks have no such agents. Real estate agents involved in this are actually finding buyers and price discovery (although not pure) is closer to reality then the idiotic original valuations on mortgages that should never have been written in the first place. The fact that real estate agents “hide” prices from the mortgage holders and is seen as fraud is really just simple jealousy on the part of the lender. I’d equate “flopping” with a “finder’s fee.” It’s no different than a flea market sale. You go to a flea market, you see an item that someone else doesn’t know anything about and you take advantage of that. Everyone dreams of finding that one special item which “the owner” of the flea market knows nothing about, but you know it’s worth a lot more than “the flea market owner” has on his tag. Now, if the banks want to hire agents to do the same job the real estate agents are doing, they can, and then they could more legitimately cry “fraud”. But right now, what this article calls fraud is actually closer to real free markets than those lenders holding bad paper and getting bail outs are suggesting. If the lenders have a problem with this practice by real estate agents, they should not have bought into the “pump and dump” scheme which the paid off people in congress and the Fed pushed on them this past decade in the first place. Congress, at the urging of the Fed, passed stupid laws forcing bad loans on everyone. Lenders should have had attorneys general prosecute those idiots for even writing legislation to force so much debt into the market with malice aforethought. Sadly we don’t live in that kind of world. The lenders need to shut up on this one and hire their own agents directly or by contracted 3rd party (which incidentally is exactly what real estate agents are!!!)…they can’t have their cake and eat it too. If anybody wants this to change I suggest you call your attorneys general and demand they start indicting people like Corzine, Blankfein, Dimon, Gingrich, Obama, Bush, Gensler, Et al etc etc etc (the list is far too long) for fraud and other high crimes and misdemeanors. Until then we live in a lawless land. Flopping could be considered fraud in another context and another time, but not currently, “flopping” is filling a void left by the malevolence of lender’s CEO’s.

Amazing that you don’t find flopping fraudulent. When you have realterds that are willing to flop, what do you think they’d do to you? Let’s say your are selling your house and listing it for $500k. 2 buyers submit offers. An offer from a buyer working with another agent for $500k, and another offer from a buyer that is working with your agent for $450k. Your agent presents the $450k offer to you and never tells you about the other offer. Why would the agent do this? Because the lower offer pays your agent $27k, while the higher offer pays your agent $15k. So you are worse off by $47k, but your agent is better off by $12k. But according to you, being represented by one of those jackals is closer to the free market. One day when you sell a home, hopefully you’ll get a realterd your deserve.

Why would I leave one of my larger assets in the hands of an agent? And if I were to use an agent, Caveat emptor is the rule. The emptor (Buyer), in this case, meaning the one buying the services of a representing agent. Due diligence. The local county clerk’s office can tell anybody all one needs to know about your neighborhood values and if one was dumb enough to settle for a 10% discount on the word of an agent, then you “get what you pay for”. Banks aren’t any different…if they want top value for their over valued paper mortgages then they should be getting into the real estate broker business and opening up their own websites & offices to clear them or at least hire an active 3rd party to do so.

BUT THEY WON’T because the shadow inventory is so huge that if they did that prices would be halved again OVERNIGHT. A pickle to be sure. So now they’re reduced to complaining and crying fraud seeing real estate agents getting paid for truly more work then the lender ever put forth AND after their own robosigners (and many other variables) got them (and all of us) into this mess.

“But retail banks aren’t supposed to be in the real estate business” one might say.

Yeah, and they weren’t supposed to be in the investment banking business either, but they were allowed to be after Sen. Gramm came to town and then they promptly and without delay blew up their own industry. That’s the real fraud. The real fraud continues to play out right now, but you’re not going to see it on CNBCABCCBSFOX.

You lost any little shred of credibility you might have had when you invoked the local county clerks office. They have no idea what properties are worth. They’re just hoping (praying) no one challenges the assessments.

The point is that if a realturd screws you over, you will never know. 10% or $10k. They were sticking it to their clients before the housing bubble. Personally I would like to see all jackals involved in the bubble and it’s aftermath prosecuted and sent to jail. You would like to overlook realturds involvement in the fiasco for whatever reason, maybe because you are one.

I’m with you on this, GTO, even though it makes me gag a bit. As I posted above, at least these sleazy agents are moving property in a frozen market, and they are just taking their share in the transaction. If anyone has been following the bank held market for the past few years, you must know that they won’t or just can’t (from incompetence, more than anything) sell these properties, so, at least some enterprising souls (do RE agents have souls?) are creating a market. Capitalism is a messy and dirty process, most to the time.

Lost out on 3 houses in Palos Verdes to insider trading deals. Sucks for the ultimate “shareholders” of these banks as our offers for two houses, sold as is, (one all cash and one nearly all cash) were for $70k over the ultimate selling price. The third house, we gave up on as the agent was m.i.a. Saw that one sell for way, way below market as did all these others. Also sucks for us as we didn’t get a fair shot at purchasing any of these sweet deals on the “open market.”

I am wondering how many of you guys who claim to have been cheated have reported your experience to the attorney general, the district attorney, or the press. And how many of you have thought of contacting an attorney?

I would document everything and go after these crooks. If they think they can keep getting away with it, that’s exactly what will happen.

If this kind of thing had happened to me, that’s exactly what I’d do.

Everyone wants an easy scapegoat to hang on a stake. Sure a Realtor makes an easy target for that. Many states and the NAR board work hard to assure there are no double contracts and ethics are maintained. Having said that; there will ALWAYS and I repeat ALWAYS, be some persons who try to take advantage of the system. That is as assured as death and taxes. Not just Realtor’s, but BUYERS AND SELLERS and OH YES, ….. BANKS. If they acted unethically, (even if legally) than I have no pity for them. I operate as an agent and sell by day that I can sleep by night. One gentleman stated that it was the greedy Realtor’s who drove the market to a breaking point. That is an extremely dangerous and naive statement. So where do we start? I’d run out of time with all the dynamics,.. Government parties pushing on the banks and creating laws so banks would make risky loans? Hedge fund managers that grouped and traded them, banks that capitalized on them, and Home Owners that used it to treat their house like an ATM card and live beyond their means. The REAL PROBLEM is we have become a society that, 1) doesn’t take responsibility for anything anymore, secondly thinks it is self entitled and thirdly is lacking in integrity, principles and ethics. Just because you can, doesn’t mean you should.

Leave a Reply to Nobody