Judgment day for housing shadow inventory already here – Foreclosure inventories reach an all-time high. FHA and GSE loans only game in town.

With the Federal Reserve promising to bailout the entire world it is hard to grab any headlines away from that kind of action. In spite of putting the American taxpayer at risk for global debt issues especially when we have big enough problems at home we have now reached an all-time high with foreclosure inventories. That is correct, the shadow inventory is still enormous and the number of homes owned by banks is now at record levels. Of course this was all predictable like seeing a pig work its way through a python. The large bet that has failed was the belief that simply holding onto overpriced assets for two, three, and even four years would somehow allow home prices to catch up. The suspension of mark-to-market accounting and other shenanigans are now coming home to roost and home prices are making post-bubble lows. In other words, the day of reckoning for housing is already here. Don’t look now but foreclosure inventories are at record levels. What does this mean for housing going forward?

Foreclosure inventories at record levels

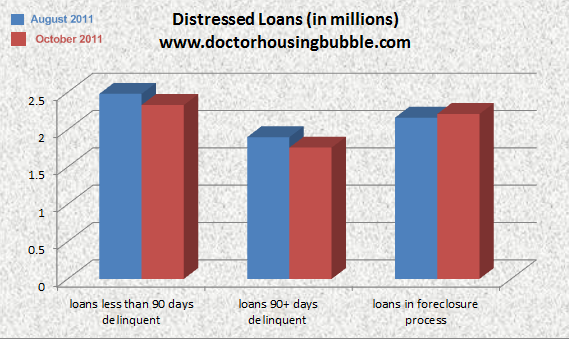

Foreclosure inventories are now at post-bubble records:

Total home listed as “foreclosed†has shot up to 2.21 million. The other two categories above show that there are still millions of other homes in the foreclosure pipeline. What this means is that for a few more years, we will have pricing pressure to the downside. Now most of the other two categories don’t even show up in MLS data since these are not completed foreclosures. But with five years of data it is very likely that these loans will go through the entire process and become REOs.

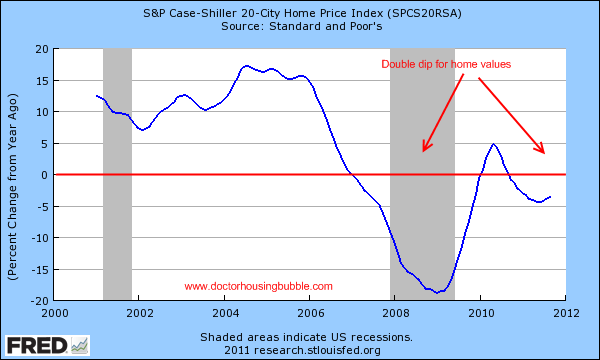

There is no debate that the housing market is now fully into a double-dip:

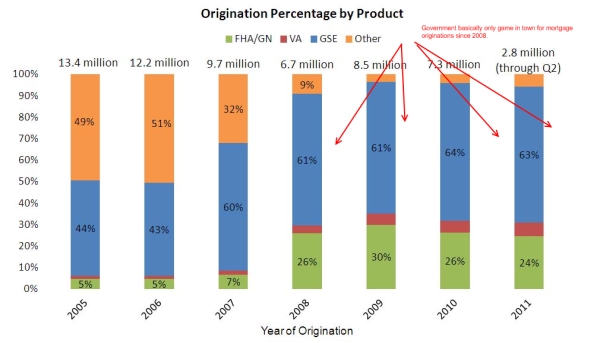

The trend for lower home prices has been baked in for nearly a year now. Last summer we had a mini burst of buyers thanks to artificial tax credits and low interest rates. I still view the current market as being designed for the nothing down leverage happy mentality that is present in our society. You have a large number of buyers purchasing homes with 3.5 percent down FHA mortgages and the default rates are soaring in this category. Just take a look at the below chart as the toxic mortgage channel was plugged up, suddenly much of this action shifted to FHA insured loans:

Source:Â LPS

How surprising is this now? If you can’t qualify for a mortgage with 3.5 percent down and mortgage rates in the 4 to 5 percent range then you have absolutely no business buying a home. Yet the lingering nostalgia for no-doc / no-income loans still runs rampant in the consumer psychology.

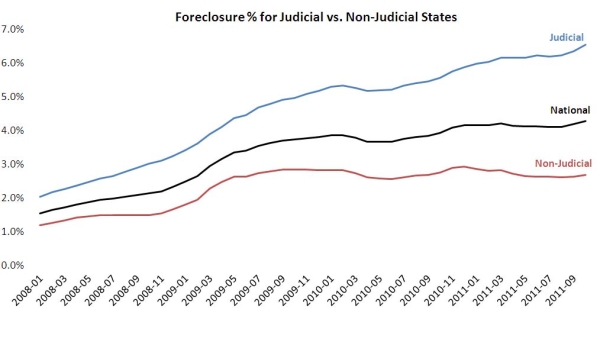

Judicial versus non-judicial

It should come as no surprise that non-judicial states have a lower inventory of foreclosures since they are clearing inventory out at a rate that is four to five times faster than judicial states:

Ultimately the demand for housing is coming from the lower priced market. In that sense, the 2.21 million foreclosed homes will provide households with lower incomes an opportunity to purchase a home that is within their budget. At least for those that purchase wisely, they are likely avoiding a repeat of the past. Yet some are still over paying in bubble markets and will likely realize their mistake years down the road. It took over a decade to build this bubble so don’t expect it to clean out quickly.

Over half a decade ago I knew the bigger issue would be the cognitive dissonance that would linger from a post-bubble world. Many now realize that what occurred in the housing market was a once in a lifetime spending binge induced by debt. Yet some still think those days are only around the corner. The global debt crisis will not allow that. This is why most of the mortgage market is now dominated by the government. How many foreign governments or investors are going to trust Goldman Sachs or Morgan Stanley when they drop by their door steps with new mortgage backed securities? I think some have learned their lessons well and the data reflects this.

The housing market was bound to have a day of reckoning and it looks like it is slowly unraveling. It was simply impossible to have a shadow inventory growing with banks just ignoring the reality. We are now going into year five of the housing bubble bursting. You have millions of those in foreclosure who have not made a payment in one to even two years.

Ultimately the burden falls largely on the middle class. The Federal Reserve has a primary mission to protect banks. That is their bottom line. They are not looking out for the best interest of homeowners or working Americans. For the cost of the bailouts and shadow loans, they could have paid off close to every mortgage in the country. Yet even principal reductions were never on the radar because to do that, it would be to admit a financially broken system. Instead they opted to give out $7.7 trillion in backdoor loans to banks and forced the public to deal with “free market†solutions. An interesting situation no doubt but the problems we are now facing are based on this two-tiered system.

The charts above show a massive foreclosure pipeline. You think banks want to hold onto millions of foreclosures for another five years? From the increase in short sales, REOs, and reduced home prices something tells me the answer is a big no.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

52 Responses to “Judgment day for housing shadow inventory already here – Foreclosure inventories reach an all-time high. FHA and GSE loans only game in town.”

I think the main problem is that the banks are not necessarily holders of the loans these days. Most of the loans now are sold to the GSE’s and in the past where sold to Wall Street to “MBSize†them. Now that banks have sold many of their MBS’s to the Fed and Treasury, the banks are mainly loan servicers. The real question should be how many of these shadow properties are directly (GSE’s) or indirectly (MBS’s on the Fed and Treasury’s B/S) are held by the government. I think this is the most important question regarding shadow inventory. I believe if the US government is backstopping the entire world, what’s the big deal of holding on to few million properties. I just wonder if the US treasury will be paying property tax to the local communities on these non-mark-to-market elevated bubble prices… 🙂

“I believe if the US government is backstopping the entire world”

This pretty much does seem to be what it has come to with all the bailouts, especially FED bailouts of the whole wide world (ihncluding tons of international companies and banks in 2008, now Europe). Your little desire to own an affordable house is nothing I guess on the stage they are playing on. I too wonder who owns the shadow inventory.

Fannie Mae & Freddie Mac don’t pay property taxes. Property taxes that are in arrears to the county are paid by the buyer in closing. I know this first hand.

At this stage in the game most county assessors in California have begrudgingly reduced values already.

What? The buyer is saddled with those costs? At this point that could be several years of back taxes. Is the amount disclosed to buyers up front, or am I dreaming?

simply not a true statement. every Fannie, Freddie owned home I have ever closed on, the seller and buyer prorated thier share of property taxes. I have had Fannie replace a $4500 AC unit, 3-4% credits to buyers closing cost -recurring and non recurring, and do repairs as well. i can tell you this, it is the Realots involved that make the differance, many just do not want to ask or protect thier buyers. so blame your real estate agent if they made you pay the sellers property taxes.

“For the cost of the bailouts and shadow loans, they could have paid off close to every mortgage in the country.”

That’s right. Free money to everyone would have solved the problem long ago, and I’m not being sarcastic either….

But … but … but … then the banks couldn’t collect interest on it for 30 years. Don’t you care about the poor banks and their profits? Yes we basically could have freed near everyone from debt slavery and that would have reestablished the middle class (it would have screwed the renters no doubt about it, but that money now was all transfered to the banksters instead of the homedebtors, it’s not an improvement.

The hitch to that arguement is that I for one didn’t default on my loan so I am not part of the banaza. In fact, it bugs me that the system is rewarding irresponsibility and possible il-legal or at a minimum immoral aactions. This is a house of cards.

There are actually proposals out there to just pay everyone $500,000 (to pick a random number) with the requirement that if you are in debt, the money must be first used to pay off the debt. The cash comes from the printing press at the fed. This would eliminate the moral hazard. I find it an amusing notion. I think it would fix a number of things. 1) no chance of entering a Japan style lost decade or two. 2) the inflation it creates would get people investing again. Holding on to cash would be expensive. 3) low income people are historically under served by Ferrari.

Ah – But: The worst of the toxic dreck securities built on top of mortgages were designed to leverage the original mortgage 500:1* (then the “value” of the entire deal back-discounted as profit and bonused paid).

Because of this leverage, every dollar repaid (or written off) will destroy between 50-500 dollars of “value”. Therefore the debt must be preserved forever at *any* cost, preferably grown, or the whole pyramid blows up. Just paying the mortgage is actually deflationary 😉

*) “Extreme Money: Masters of the Universe and the Cult of Risk” by Satyajit Das.

The idea that ‘free money” thorugh “printing” would solve the housing problem or any other in the aggregate is pure idiocy.

First, it would be theft just as the bailouts of the banks has been. BUt second, those who advocate this absurd solution are either populist demagogues or economically clueless. Even assuming for the moment that the officials in the government could and wanted to create this type of inflation, it would ruin the other members of the middle class whose pensions and savings include these mortgage instruments. Additionally, the purchasing power of their wages would collapse as the cost of essentials would increase and more than negate any benefit of this absurd policy.

The good news is that if or when anyone is actually dumb enough to embark on this policy, the bond market will collapse the financial system into a deflationary depression before it can happen.

I have been following the blog here for some time now and i’ve come to understand that housing prices in many areas are not in line with incomes and that much So Cal real estate is overpriced …. but aren’t short sales and foreclosed homes supposed to be sold at discounted prices? Is the Dr saying that homes sold via short sales and through foreclosure are also overpriced?

SoBay Renter

I read in an REO association periodical, that said they are using SS’s and REO’s to set the floor on prices in neighborhoods. And don’t forget, if the recovery rate for these homes is at 90% of the list or loan amount, then it will work. (See the article I posted- Fannie/Freddie/FHA -90% recovery rate).

We put a fair CASH offer in on an REO (as a primary), and the bank knocked off $900. We told them where to put the pool/spa that needed at least $10K in repairs. Now the house is down $20K. The house needs more work than just the pool/spa. It has noise and other issues, too.

That’s the thing about BPO (Broker’s Price Opinions)…. Value is subjective. Not to this couple. We do our due diligence and have good data points.

Here comes the solution I’m afraid BULK SALES OF REO’S a’comin to deep pockets as rentals:

http://lowes.inman.com/newsletter/2011/11/30/news/164224

There are probably many contracts with REO Listing Agents already signed and that are in the process of getting ready for market, but this is really bad news for us buyers. We’re paying cash and can’t find a modest home now.

That’s the real problem. The middle class no longer has ownership over anything (jobs, homes, education). I take pride in many things but not this house I rent. Neighboorhood blight will follow suit when everyone ceases mowing and watering their rented lawns and the landLORDS stop the run away upkeep needed. Hope the wealthy are happy in their gated communities 🙂

Candace

Our former oversized McMansion view home was in a gated community, and most of our neighbors were screwed up, trying to fix their issues with money and stuff. I didn’t like them as human beings.

Be happy for being alive and healthy. The rest is gravy. We’re looking for a home in a blue-ish collar neighborhood. I think the people will make better neighbors. No more Docs and their Stepford Wives. Been there, done that (twice).

The 4th and 5th years of a bear market are when the popular psychology becomes convinced of the markets dismal future. I still remember 1994 and 1995 in SoCal. People didn’t want anything to do with real estate.

It should start to get really ugly this winter as a down market coupled with a seasonal down turn tends to look awful.

This last bubble was exponentially bigger than the late ’80s housing bubble. And the overall economy (Socal, national, world) was in much better shape back in the mid ’90s. Until a stable job market comes back (if ever), more and more people will want nothing to do with housing. If you buy today, it’s almost guaranteed you lose equity in the next few years. And if you need to sell for any reason…it could get ugly.

Unless you absolutely NEED to buy a house today, the average person will be much better off renting for the near term.

if you are young… buying now isn’t a bad idea. by 3-4x income… single earners income.. not household income. So if one person loses a job or takes time off for kids… You can still make the mortgage.

That’s what we did… My only regret would be the “fear” that I might have been able to buy that slightly more upgraded home around the block with the hot tub already installed and the spare game room… for cheaper next year.

But the grass is always greener… I also bought a 2009 Hyundai Sonata before they upgraded to the 2011 model.. which was a lot slicker and cooler model.

My Sonata is worth a good $7K less than i paid for it… But so is life…

We age too… Most of my family past away or got ill in their 50s and 60s… I don’t think they regretted some poor investments on their deathbeds…

i see the whole bunch coming down to the 50,000 cash range…crap or quality…

I paid $386K in 2004 for for a house that’s probably worth $280K now. It’s been brutal on my net worth. However, I only owe $180K, and I just refinanced with a 15 year fixed at 3.25%. My interest is now under $500/month! I’m paying extra principal, and my balance goes down $1100 each month. Hopefully at this pace I’m staying ahead of the depreciation.

You can pay the house off tomorrow but if it your house keeps depreciating you will still keep losing money whether it’s in your bank or in your house.

This is the conundrum people face right now. In many cases, they can buy , that is…get mortgage payments, for what a similar place costs to rent. Or perhaps even less. This causes many people to take their eye off the ball. The ball being their capital investment.

It’s a lot like buying a Prius because it gets 45 mpg when you already own , as in no payments, an SUV that gets 17 mpg. Because you fill-up every week, the cost of fuel is always on your mind. But the real cost is when you buy the vehicle.

At least he is not paying the Bank interest anymore if he pays it off sooner.

and thank you for allowing them to print up 10 to 100 times that 386,000 you borrowed of debt dollars that competed equally in the house buying and bid process, after you “bought” with every dollar of savings, because you borrowed to buy a 45,000 dollar house……………..

If U.S. citizens knew how much money Benanke at the Fed has created and provided to foreign banks over the past 3 years they would be horrified. At last

count, it is over $1 Trillion and rising. The latest annoucement of a huge infusion

into Eu was met with a big jump in the U.S. stock market, propelled by investment

banks and hedge funds and supercharged by the co-located (i.e. located at the

exchanges) high frequency traders. The rally showed how grateful these folks

are to the Fed for putting U.S. taxpayer money on the line to prop up our own banks’ inventories of foreign assets which are at severe risk of default if the

Eu banks go under. The Congress and the President have really become very minor

players in this country’s financial future. Whatever happens 5 -10 years out is

most certainly going to be a result of what Bernanke and the Fed are doing right

now as they create the largest federal debt bubble in world history.

May be much less Machiavellian than that (but no less upsetting). The stock market seems to go up whenever Fed creates more money and the value of the dollar goes down. You can say this is the evil banksters showing their happiness, but a simpler explanation is just that the fixed assets of all the businesses in the market are now worth that many more depreciated dollars.

@fajensen Can you explain this cataclysmic outcome a little more for us non-economist doctors? I have heard this before– both the fact that we could have paid off nearly all mortgages with TARP funds, and the fallout if we had. I do not understand the actual mechanism whereby this would have collapsed the economy or killed the banks…

@LordBlankfein – I’ve read enough doctor here the past 2 years to agree with you.

My question is: for somebody with a stable professional income, who wants to settle in LA westside (Santa Monica, PP, or Manhattan beach) when do you step in and pull trigger?

These markets have corrected some, but not much. There is a limited supply and lots of demand for the exclusive enclaves. (Entertainment biz? who knows, Greater LA county has about 20M (?) people, so there is always money…)

How does one judge when these perma-bubbles have corrected adequately to buy, while still trying to capture a decent rate?

I do not believe the chicken littles (DarkAges et al) but I do think things are still getting worse, not better…

Dasher, to answer your question regarding the super frothy markets on the westside I think they are still coming down and probably will for the next few years. The million dollar quetion is how much will they come down? There is lots of entrenched money there, long time owners who own their own personal goldmine, and professionals who want to jump in to say they own in those toney areas. Many of the new buyers are sitting pretty when it comes to finances (two doctors, entertainment industry elites, successful business owners)…to these people it really doesn’t matter if prices go down another 15%.

I personally would not want to buy in any of these areas due to the inflated prices. Have you ever considered the cities one notch below the 1%? I think this will make far more sense financially.

For real. Prices are stuck in Burbank. I could now mortgage for slightly more than rent. With the tax write off maybe break even. I’m giving this thing longer but it is frustrating that we are being played. Tired of my landlord, but don’t wanna slave for a bank. Ugh.

Dasher, I think the time to jump in is when you can find something that costs less to buy then rent. As most people here know, renting is a function of the true amount of cash in people’s pockets, and a mortgage isn’t a true indicator. Some people say that PITI is an equivalent, but you usually get most of the property taxes back in deductions, and a chunk of the monthly payment goes to principal, which is a form of forced savings.

I also agree with Lord Blankfein that it makes sense to look at cities that are one notch below the 1%, namely Redondo, El Segundo, Hermosa, and parts of Torrance, all of which have safe neighborhoods, good schools, and are close to the beach. Prices in these areas are getting close to rents. Manhattan, SM, and PP still have a ways to drop. (maybe 15-20%)

For the Westside, areas like Westchester, Playa del Rey and Mar Vista fit the notch below the 1%.

How about Venice?

what about Mt Washington

How lame do you have to be to steal a frigging nick?

You can add to the pile, redefaults showing over 45% as of today.

Defaults persistantly high. Looking at the chart below, where would you price mortgages if it was your money? 10%? 15%? This is why the GSEs are the only game in town.

http://research.stlouisfed.org/fred2/series/DRSFRMACBS?cid=32440

I’ve noticed the flips have taken a climb up about $25K-$50K in my area. I know inventory is tight, but that’s insane. Although at least right now, they are using better cabinets (quality and dark color) and engineered wood flooring, and not being so cheap. Any feedback would be appreciated. What are you seeing?

I heard Diana Olick say that within the last two years of lenders tighting up on underwriting, the loans are performing well, so all those cry babies about the

lending standards being to strict may have an issue winning their case. (Paraphasing)

25-50k seems about right in the area’s we’re looking in. The work isn’t always horrible, but the workmanship is typically slop. Occasionally I’m seeing real hard wood, but usually pergo. Never any granite, and all the same thin/hallow modern cabinetry. Looks ok, but I know it’s cheapo.

Granite’s for the boneyard. Trendy crap.

Yes, there are many flips here in La La Land, sad to say. The so called investors/opportunists are now sitting with their “redone” properties. Most buyers that have been looking for the last two years, including myself have watched this whole process. The best part is, these done properties are not selling, hope the greedy investors lose. These homes all look the same last years granite counters (not very original) and the same dark kitchen cabinets, if you look at these houses, they all look the same inside. And for those complaining that their property is not worth what is was, no one made you buy it, take responsibility.

“You think banks want to hold onto millions of foreclosures for another five years? From the increase in short sales, REOs, and reduced home prices something tells me the answer is a big no.”

Judging from the stated inventory levels (which continue to decline as they have since early 09), it would appear that the answer is “yes” … at least to some degree.

Just remember, FASB has said repeatedly that Mark to Market will remain suspended at least until 2016. In 2016, they will decide whether to re-enact it, or continue to suspend it for another few years.

Bottom line, the past 2.5 years has brought us nothing but a drip drip drip of foreclosures into a slowly declining mountain of stated inventory…resulting in flat to slightly declining prices. Dont expect that environment to change anytime soon.

I wish people would stop talking about bailing out banks and the Fed, as if these were actual living things. The taxpayers are bailing out a small group of bank and Fed owners. It is very different psychologically to bail out a non-human entity and to bail out a group of ultra-rich individuals. In this context, banks are simply a shell to disguise ownership of loans and responsibility for economic collapse.

We will never need to bail out the federal reserve bank, because it can print money. The fed is used to bail out other institutions. It is called the lender of last resort for this reason. If we go to a gold standtd then there is no lender of last resort, except maybe DeBeers.

Try this one on for size. Goldman Sachs sells a tranche of paper (CDOs) backed by worthless mortgages and pockets a big fat commission. The payoff of the mortgages goes where? To the seller of the property, whomever that might be. Then the holders of the CDOs of bad paper were bailed out, many were in the hands of China, by the US Fed. or more bluntly, you… What is wrong with this picture? Everyone is made whole except you, the sucker taxpayer. Biggest robbery in the history of mankind. Trillions…

Over 7 trillion!

Great info. The housing market is one key factor, but, unfortuantely, there are others as shown here: econpi.com

The cause of the disease is the central predatory banking system designed to enrich its owners along with their cronies and mop up the added value of your labor and life savings.The notion that the masses own anything of real value has gradually become purely fictitious since the inception of the Fed.

Clearly the FED and all central banking must be destroyed as soon as possible.

Anyone who does not understand that one fact is a part of the problem.

I am part of the problem, then. I believe in the immense value of a fiat currency to our national sovereignty and our ability to solve problems quickly. A return to the gold standard would set this country on the path to ruin. The fed would no longer be able to correct liquidity imbalances in the markets, and the markets would be at risk of freezing up in a crisis. I’m pretty sure we’d lose our status as the global reserve currency. This would in turn make it harder to borrow money and probably would actually bankrupt the US government. Currently, it is not possible for the US government to go bankrupt (unless acertain political party wants it to) simply because the Fed can print money as needed to buy US debt.

DHB, the timing and intensity peaks and valleys of the housing market are reminding me of the infamous Credit Suisse chart showing expected ARM recast dates. To the extent that one believes that ARM recasts are a major underlying factor driving foreclosures, then we may look forward to a substantial decline in ARM recasts in 2012 almost returning to pre bubble rates by the end of the year. 2011 was projected to be the worst year for recasts. Add 6 mo. for the amount of time it takes for people to (stupidly and unnecessarily) drain bank accounts and 401ks to service the mortgage, and we may be looking at thing looking like we are coming out of the woods in 1H 2013.

I’m hopeful that we are at the end of the beginning of the unwinding of this mess. The country has been more sober than usual for the last 4 years. It seems to me we are due to start receiving the dividends of sensible behavior.

And, as a REALTOR, I ask why the National Association of Realtors isn’t working with banks to get these shadow properties to market. Even in upscale neighborhoods we have homes that are abandoned and not listed…That brings down everyone else.

Leave a Reply