San Francisco median home price now over $1.3 million – Basic home at this price range will get you 800 square feet.

The Bay Area tech driven frenzy continues to march forward with no stopping in sight. If you thought $1 million was too much for a crap shack then $1.3 million is going to be out of your price range. The tech gentrification is getting more aggressive and is pricing out people at an astonishing pace. We’ve noted the out migration of native Californians to other states is much larger than people suspect. Foreign money and high income households are the power players in these niche markets. This is simply a fact but also is tied to the bull market that has now entered into its eight year. There are now signs that we are reaching a plateau but this system only understands two states: boom and bust. There is nothing calm about the way our real estate system is now structured. It is about fast gains or big losses. All or nothing. You are either riding the big wave or crashing in fantastic fashion. People forget cycles and have the long-term memory of a gnat when it comes to these things. The Bay Area continues to drink from the cup of housing mania.

San Francisco hits another peak in price

The housing market in San Francisco continues to accelerate at a dramatic pace. Of course if it was expensive last year for your budget these higher prices are likely to do little for you. Incomes are certainly not keeping up to these dramatic shifts. The purchases are being driven by fast money and foreign cash. You also have zero down loans back in the game.

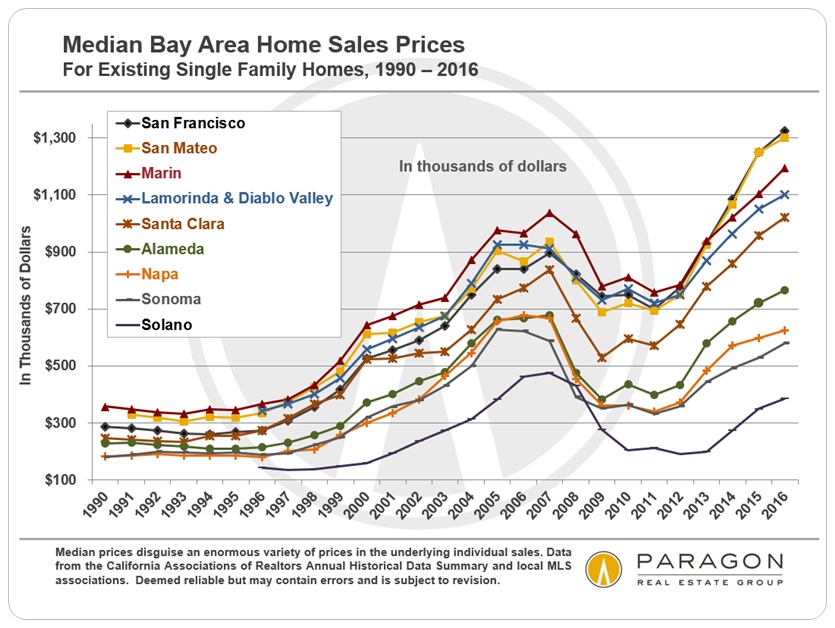

Take a look at how the Bay Area is doing:

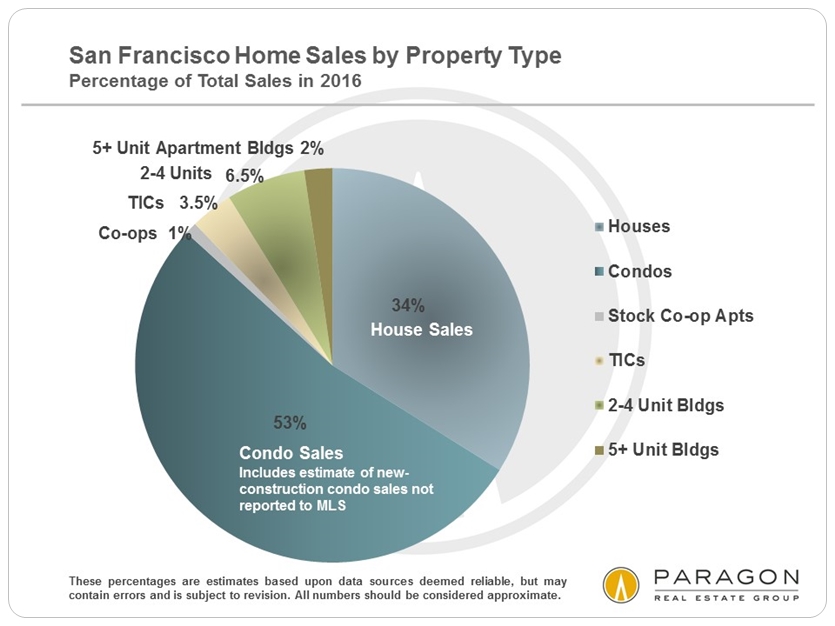

The last peak which seemed unsupportable to many now looks like a tiny molehill. This is probably a large reason why so many of the recent purchases are being driven by condos because this is all people can afford:

So you want a home. Only a home will do. Here is what you get for $1.3 million:

49 Ord Ct

San Francisco, CA 94114

2 beds 1 bath 844 sqft

“Nestled at the end of a quiet cul-de-sac in Corona Heights and just steps away to the famed stair walkways of Vulcan & Saturn, and The Castro Village center, this Victorian cottage captures a great sense of community in place – Wild Parrots soar overhead the magical rear garden – the quiet and stillness of this home are a precious thing in the middle of a city”. 2BR/1BA single-family home with one-car garage plus storage on a garden oasis for indoor/outdoor living and green-thumb enjoyment!â€

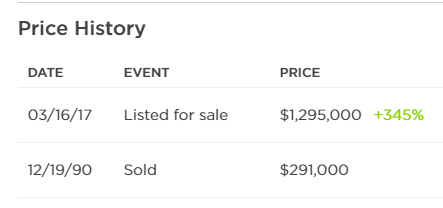

Look at the price history here:

The new homeowner is going to be paying 3 times the level of property taxes for the exact same place and services. Again, Prop 13 is a reason for this even though it is pitched under the guise of “kicking grandma to the curb†type rhetoric. They never mention that grandma is going to have over $1 million in equity if she chooses to sell which will put her in the top 1 percent of households globally.

So there you have it. 844 square feet for $1.3 million. Everything is moving right along in tech driven San Francisco.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

165 Responses to “San Francisco median home price now over $1.3 million – Basic home at this price range will get you 800 square feet.”

Buy now!! It’s the best time to buy. Buying at the peak is a great investment. Be American, support boomers, buy now! If you don’t buy now you will lose out and regret for the rest of your life!

Pay no attention to that man behind the curtain!

http://www.socketsite.com/archives/2017/02/san-francisco-and-oakland-rents-have-dropped-8-percent.html

Watch out for that plateau!

“the slowdown happened relatively quickly; the annual effective rent growth was still at 5.7 percent only one year ago”

http://blog.sfgate.com/ontheblock/2017/02/03/s-f-rents-down-more-than-any-other-large-u-s-city/

Could it be as simple as the fact that there are ‘more’ people, with ‘more’ money, than anyone here can wrap their heads around? When I drive down any city street I see nothing but buildings, thousands of buildings and shops everywhere and someone owns each of these buildings, and someone owns the land they sit on. And they collect rent and they may have more money than they can spend, so they help their kids buy a home. Millions of examples of wealth that doesn’t get reported or even talked about. But it’s out there and has been there for a long time, and expensive homes in good areas will be bought.

@ Jed – agree. What we need to fathom is how much money there is out there. I live in LA, take a drive down Abbot Kinney Blvd (Venice) or Montana Ave (North Santa Monica) Melrose Ave (West Holly) and you see all these shops with ridiculous overpriced merchandise. I used to say to myself: “how to all these shops stay in business” I then changed my tune to: “where does all this money come from”. I have 3 friends who are residential brokers in LA and they are all praying to get listings, because any listing priced fairly (according to comps) is selling in a few weeks with multiple over-asking offers. These are not FHA or NINJA buyers.

I think there is still 1-2 years of sellers’ market.

I agree with your 1-2 years of a seller market left in the gas tank. After that, I would think a recession is a possibility, and with a recession should be a real estate slowdown. But, the price drop in the recession might be less than usual since so much money is being created by central banks.

It is all leverage, one way or another, directly or indirectly. Leverage is a 2 edge sword which cuts the same both ways.

It was just ZIRP and QE to help the biggest banks (who own the FED) to dispose of their non performing assets. Since that is pretty much done (to flippers/speculators), I think they will pull the rug by continuing to increase the interest.

I live in the Bay Area and for every Tesla whispering by there are literally 1000 people living in our internal 3rd world, riding a “Mad Max” bike with a “Mad Max” trailerful of junk to recycle, pushing an ice cream cart putting in maybe 20 miles a day for $20, etc. Most people around here lucky enough to have jobs make min. wage.

True, we have TONS of foreign money coming in here from China, India, Russia, etc. It’s not people who actually live here who are paying this for an 800 square foot “vintage” house. Chances are quite good that house will be bought by a Chinese investor and then be a “ghost house” with the yard cared for by a landscaping company and not lived in at all.

More anecdotes, big surprise. Alex, why don’t you look up some official wage statistics and report back to us.

Ugh. Alex….! How did the world shit on you? We KNOW you bet on the wrong horse when it came to a secure IT job!

He isn’t willing to do anything to better his own situation, so he justifies it by convincing himself that everyone else is in the same boat, unless they received a big inheritance. They couldn’t possibly have worked hard for what they have.

Here’s an anecdote for you, Alex: my sister just sold her Vallejo house for $3-something k. To a Chinese investor? Nope, to an American software developer. Not even a manager – just a lowly programmer. That $10/hour sure goes a long way these days.

John D : I was born in Vallejo. Small world. Surprising prices. My Grandfather built three houses in Benicia after the war near the baseball diamond.

Hate to think what those are selling for now.

Alex provides a valuable alternate perspective – the rest of you are too stuck in your world of privilege to comprehend.

Being “green”‘ and “groovy” and a “mom” implies a level of entitlement that you clearly do not understand. Being a mom requires cash, as does anything considered green or groovy.

The people Alex represents and references here can’t even AFFORD to be a mom. Let alone have anything “groovy”.

It’s sad you live in this world and can not see this. It’s around you everyday!!!!!!!

SoCalRulez – I put in my years as a tech, it built up to 10 or 11 hour days, lots of overtime such that I was even coming in on Sundays and working 7-noon. OK so overtime was 1.5X pay and those Sundays were 2X, but still I was never going to afford more than the studio apartment on Placentia Avenue in Costa Mesa I had, a motorcycle to get around on (1/3 the cost of getting around by car) and a treat being fried mushrooms from P-K Burger across the street. No time or money to go back to college, and the company I was with was very open about eventually getting rid of their technicians – why they mentioned this around me I have no idea.

It was a very regimented life. Clock in exactly on time, not more than a minute early and get a talking-to if you clock in a minute late. On breaks the same, you’ve got 30 seconds leeway and if you’re back a minute late, get a talking-to. Lunch the same, etc. The company was made up of “tribes” of different races, all against each other. Being in the white tribe was the worst because everyone else was allowed to tribe-up but Woe to you if you helped a fellow white in any way. Whites were steadily being gotten rid of.

Pay was 2X minimum wage, unbelievable now because a tech is lucky to make 1.5X minimum now. Also, now, you’d not get the bennies that were considered normal then – dental, medical insurance, a 401k, paid vacation time. Now you’d be a 1099 on 1.5X min. wage and pay both halves of your social security, medicare, and if you made enough, pay your income tax too. The same job now would no way pay for a studio apartment a bicycle ride from the beach, any sort of motorized vehicle, etc. More like live in a van and be one of the many working homeless.

I’m actually living better than half the people around here, sleeping under a roof, having enough to eat and enough to save some money, having some free time, frankly this is heaven compared to working as a tech in the mid-80s and really heaven compared to working as a tech now.

The class lines have become hardened. It’s very difficult to work your way into a higher class than you’re in, and very easy to fall. So the best you can do is make yourself as happy and healthy as you can within your own class, rather than wear yourself out attempting an impossible climb.

“…rather than wear yourself out attempting an impossible climb.”

In other words, you have a bad attitude and you’re lazy. We get it.

Unlike Alex’s assumptions, I inherited nothing when my parents died, and did my time in menial work (janitor, short order cook, delivery, etc.). I did five years in high volume support call centers talking down angry customers. I started a business that amounted to nothing after five long years of working nights and weekends filling orders. I also never stopped trying to improve my lot in life via tech schools and occasional (virtually free) community college classes. Without a degree, it took 22 years of hard work before I was able to afford my first house. Seven years later, that gave me the down payment for my current forever home. After 15-20 more years of hard work, I’ll have a comfortable, if not extravagant retirement. Apparently I’m “privileged”.

There’s a big difference between being poor by circumstance and being poor by choice. Alex is the latter.

John D – You got where you did with a healthy dose of luck, and also having the smarts to avoid college for the shitshow scam it is. You did helpdesk, that’s good paying work that it takes a fair dost of luck to get into.

I’m certain the business you started and stayed with, is being kept a secret because you’re kind of embarrassed about it. It’s something that’s not “sexy” like designing new fart apps. It’s something people think is boring, perhaps even the three-D’s, dirty dangerous, demeaning. You run a junkyard or you’re in steamfitting or pipefitting, or you’re a plumber. You know, the kind of shit people don’t want to shovel themselves, so they’ll pay you handsomely to shovel it for them. Shit-shoveling can be white collar too; maybe you’re in debt collections, bail bonds, or one of the endless layers in accounting, health care paper-shuffling, etc. As I said, the kind of work you’ve found you enjoy at least enough to do it, and where when people ask you what you do and you tell them, they immediately change the subject.

That’s the kind of work to get into, in my opinion. You can compete with the smartest kids coming out of MIT and IIT, and from all over the world to be the best programmer of new fart apps, or you can do the kind of necessary work that doesn’t make the headlines.

There are a lot of psychiatric cases on here, lots of basement-dwellers, who are overachievers in projection. They project their miserable and meaningless lives onto me. Yes, I get it, Son Of A Landlord, you’re the son of a landlord and thank God you’re so smart in your choice of parents; because your parents are landlords you’re a genius. We get it. Groovy Green Mom, one of the yuppie/hippie “Me Generation”, I see your entitled asses waddling out of Jamba Juice in Santa Cruz every time I go down there; I get it. You’re part of the wonderful flower children who made it illegal to cover yourself with a blanket there.

Let me say this again: In hippy-dippy Santa Cruz, it’s illegal to cover yourself with a blanker. Nights are cold there, but in the hippie-dippie multi-million dollar houses, it’s warm so those poor/homeless people are just trying to stay warm to irritate you, we get it.

The truth is, I’m one of the winners. I actually make enough to live and to save, and have free time. You have to be very very wealthy to have free time at all in my area. I do not blame others for what’s going on because it’s hard to pin the blame on individuals. This is why I call for a Socialist revolution where whole parasitic classes are wiped out. That’s the only just way to do it, and whether I think this is a dandy idea or not it’s coming.

To be a real loser here, I’d have to go out and get one of those wonderful $10 an hour jobs for a company, go out and buy a car and live in it because I’d not be able to afford a car *and* a place to live, and have utterly no free time or time to even think. The owning class loves this. Nope! I’m not playing. I like having free time to design better guillotines, figurative or literal, we’ll see.

“You got where you did with a healthy dose of luck, and also having the smarts to avoid college for the shitshow scam it is. You did helpdesk, that’s good paying work that it takes a fair dost of luck to get into.”

Help desk doesn’t pay at the entry level. Not anymore, anyway. The first gig I found through the community college, interviewed for, and got with no experience. About $14/hour I think. It wasn’t luck – I interviewed well and came across as friendly and intelligent. Right in front of me, the boss said “I like him” to the sales manager. That job got me another, and that one got me into writing (do what you want, and eventually they’ll pay you for it). It was a long, hard slog. If I had a degree, I’d be making $20k more than I am right now. I have also lost out on potential jobs due to my lack of a degree, even though I was better qualified for the work. This is becoming a non-issue in tech, but my field crosses over into creative, where many still think a degree means something.

“I’m certain the business you started and stayed with, is being kept a secret because you’re kind of embarrassed about it.”

Not in the least – it was an online store specializing in beach themed wedding decor, some of it expensive, which was successful for the first few years when people were HELOCing the crap out of their homes (2004-2006). Broke even after the crash and never came back. It was tough to quit because I never knew when a 5-minute phone call would result in a $500 profit on a giant clam or $5,000 on a truckload of merchandise being delivered to some 1%-er’s kid’s wedding in Mexico. I learned a lot, though.

“To be a real loser here, I’d have to go out and get one of those wonderful $10 an hour jobs for a company, go out and buy a car and live in it because I’d not be able to afford a car *and* a place to live, and have utterly no free time or time to even think. The owning class loves this. Nope! I’m not playing. I like having free time to design better guillotines, figurative or literal, we’ll see.”

In the real world, that $10/hour job will become $15/hour, then $20, then $30. It takes many years, but it happens. It only stays at $10/hour if you choose not to learn, not to move up (if that’s even an option at that company), and not to job hop. Stay at one place for 2 years minimum, 3 years maximum, until you can’t find better. The trick is not to get too greedy. Companies would rather pay a newb $60k than a middle-aged guy $100k, even if the newb can’t program his way out of a paper bag. It looks good on quarterly financials even if it hurts their long term profits.

If you’re happy without running water, more power to you, but I doubt it. It’s easier to lay around than work in the very short term. My personal take is that I’d rather work hard now, at a job I enjoy, and spend age 65-85 sitting by my pool sipping a California IPA, not in a dingy studio in a bad part of town listening to the neighbors fight.

Alex, are you really the best person to be giving out career/business advice?

john D – $14 an hour is a LOT of money especially back in the 90s which is when it sounds like you were doing it. That’s GOOD work, very lucky of you to get it.

Alex, Bernie had a good run last time. With the numbers of renters out there now, he, or a Bernie/FDR-like candidate will have a great run next time. I’ve seen it all before. History does repeat itself. Trump is the current Hoover with his Hoovervilles/Trumpvilles. This will happen as long as the Trumpville residents vote and are not disenfranchised for having a car or cardboard box as a primary residence.

Not that simple. If it were we’d never have busts.

No. People in general are poorer than they used to be, particularly younger age groups, as has been gone over exhaustively.

Also look at the chart of home prices in the article over time. Home prices should closely track inflation over time, not shoot way past it. Especially when wages and/or jobs haven’t improved much.

We’re clearly in another bubble and have been for some time.

tts – Exactly. Why the hell do you think kids these days are so into bicycles? Since when were high schoolers into bicycles if they could get a car? But tons of ’em can’t get cars, so they get their stripped-down “fixed gear” bike, and make like they’re too “elite” to be into cars, but the truth is, they know a car would destroy their finances.

when I was a kid, I could drive into the city and park for free. Those days are gone. Too many people, too many cars. The HASSLE factor of driving has changed. I think this is an important factor in the “kids don’t have a car these days” meme that has been floating around these last 10 years.

Sure young people may have less money, but HAVE you seen what they do with their time?

They stare at their phone and comment on other peoples sandwiches or pretty girls Instagram pages. They are mostly a bunch of brain dead morons. They only care what other people are doing.

When i was looking for a job I hit the pavement hard. I hired a resume writer to make my resume stand out and convey everything an employer looks for. THEN I created a website (no go daddy template, i used Adobe Muse) with my resume, a picture, some EXAMPLES of my work and college education (listing the classes i took).

That boosted my income $19K because I got a great job with an excellent employer.

Most millennials would just go online to apply for jobs and lose interest because someone had a video of a cute dog on facebook. As a millennial i say “sorry millennials but you suck, thanks for lowering the bar though.”

The Millennials I know commute on bicycles that cost around 8K (much more than my first new car) and complain that new tires cost them over $100 a piece. Fortunately, only 2 tires. My point is that an 8K bicycle is more desirable than a new car and there doesn’t seem to be a lack of money.

Seen It All Before Bob – actually, an $8k bike *is* more desirable than a car because a new car will run $20k+, and a used car will cost a few $k and nickel and dime you to death.

A bike removes a ton of hassle factor; just not having to worry about parking is a Godsend. Also no gas, insurance, registration, worry about fender-benders, etc.

A good pair of panniers means being able to do shopping, and a bike give you good exercise and you get to see so much more than you do in a car.

The only kids paying $8k for a bike I know of are the people into racing, though. Most of the kids are spending less than a grand. I bought my bike and panniers and special rack that they fit on for $500 all told, and I recently got some better tires and those came to just a bit over a hundred, nice tires though.

@SoCalRulez,

What world do you think I live in? I work for a living too. I’m just saying that I never botched and moaned about the economy like @Alex in San Jose does…he blames EVERYTHING on someone else…I bought a house and struggled like hell.

But he would rather point out the reasons why he can’t make it…that is giving up and a bad attitude. There is always options. Not everyone can love in the most expensive area of the country. California is not cheap by any stretch of anyone’s imagination…even my ‘privileged’ green and groovy lifestyle! Haha….

I recall the same things….during the go go years of the early to mid 2000’s. If it’s too good to be true, then it probably isn’t.

I know what you are saying jed. However how many people are leasing cars? Have maxed out credit cards and interest only mortgages? Paying 2000 for a sofa on a loan!/?

So many people now are living beyond their means.

I agree Jed. There are a ton of people with money especially in L.A. If there is another recession these people will grab any so-called bargains in cash before the average Joe has a chance. The separation of wealth is greater than it’s ever been. Not only is there a big gap between the top 10% and everyone else, we have more millionaires than ever.

“When I drive down any city street I see nothing but buildings”

and with “for rent” signs on them…..I was just in a strip mall get my dinner and 30% of the store fronts were vacant…..I counted them.

Today’s existing home sales report is just off the charts. There is so little for sale that big price jumps as well as bidding wars are widespread. The home shortage is so severe the sales are lower because many buyers are unable to get an offer accepted. It is possible that prices will move up severely from here. Good luck to the buyers.

You can blame the Democrats for this mess. The environmental policies as well as Dodd Frank means fewer new homes are being built. The result is skyrocketing prices for existing homes. Trump needs to reverse the Obama mess else homes will only be for the wealthy. Not what this country is about.

Until we see a massive spike in available inventory prices will continue to increase. With the exception of ultra-luxury properties there is very little out there, with starter homes being almost non-existent. I know people who are currently considering buying in the quasi-ghetto neighborhoods of South LA who up till now have never even driven through these places. When we talk about it they tell me there is zero inventory in the 500K range unless you go to crummy neighborhoods in East LA, South of the 10, or Van Nuys.

I think purchasing in a rough area is a mistake. Once the market slows down, rough areas turn into instant losers. Plus, you are playing with your life. You are better off renting in a better area. Life is too short for such a gamble.

Sales are not lower because the inventory is low; that is the NAR spin. Sales are lower because people can not afford the current prices, because China started to crack down on capital flight and because the interest started to increase. This is just the beginning. Wait till next winter. It takes a while to feel the full impact of what is happening.

Oh please, Alex. Stalin was responsible for so many deaths there were fewer people to put in prison.

Yes, we need another Stalin so you can get out of your artist’s space and into a nice Soviet style apartment shared with three other families.

Enjoy the lines at the grocery store.

Dweezil you talk as if the “Soviet 3-line system” weren’t already in place in tons of places here in the Bay Area. Lines are a way of life up here.

This is entirely the fault of unregulated capitalism. We need (besides the long-overdue Socialist revolution) strong regulations mandating housing for the working class. If you’re a fat-cat capitalist, which is going to pay you more? Making simple housing for the working class? Or making McMansions for your fellow rich? This is why strong regulations with some teeth behind them (as in, to the gulag with you!) to mandate housing for the productive mass of the people like first-world countries have.

I somewhat agree. This is the result of runaway central bank printing. It is fun if you own real estate. Fun for now. Eventually, this will end in an absolute inflationary run before a collapse. In the end, everyone will lose. Renters, owners, stock market and bond market investors. Everyone. Twenty years from now, the world will be an ugly ugly place. The debt levels are out of control.

You want to send people to gulags?

Tens of millions of people were murdered under Soviet Communism. More than under Hitler. And yet, you’re calling for a return to gulags? Seriously?

My parents lived under Soviet rule in Eastern Europe. You think everyone had nice houses under Soviet rule?

Alex, again you put the wrong diagnosis. This has nothing to do with capitalism. Capitalism has free markets. This is not a free market where a small group of international bankers play with interest and printing money (QE). The interest rate in capitalism is set by the free markets. Not here in US. It is set by crony thieves to transfer wealth from middle class and future generations (and millennials) to the banking cabal called FE D.

True capitalism needs money not currency. Since 1971 we no longer have money but currency. Money are medium of exchange and store of value. Without money you can not have capital formation. Without capital formation you do not have capitalism but thievery.

If you force businesses to sell below cost, that is not capitalism. In a nutshell it is called Venezuela or Cuba. If you force people to buy products from private corporations, that is not capitalism, it is socialism (see obamacare) or cronyism.

Please get some education in finance in order to understand the root causes. Proletariat slogans are not going to solve anything and are not going to make you better off.

I assume you are sarcastic…but if not, I am baffled that you and millions of other fools, long-for Soviet style solutions? BTW Dr HB, your humor is always stellar: the attention/memory span of a Gnat!

Millions homeless in the US, millions more living w/o running water, electricity, etc. The Soviets were doing pretty well, and outstandingly well considering they won a major land war and overcame the rest of the world being against them for coming up with an alternative to capitalism.

Stalin at his worst had a smaller percentage of his people in the prison system than the US does now.

Look up a book called Red Plenty, and brace yourself for more tankie Socialist romanticism because it’s very hip with the young folks now.

Alex is your typical secular jew – sending millions to their deaths in gulags is how they roll. Have you not read your history?

Alex. I don’t need to read “Red Plenty”. That is for snowflakes millennials and collectivists like you. I lived in “Red Plenty”. Big difference. I experimented the “beauty” of communism to last me few life times. Now it is your turn to enjoy it.

If you want to live in “Red Plenty”, go to Venezuela or N. Korea. Why would you want to go Israel, when Israel is not communist (Red Plenty)? Go there, live there and all appetite for communism will be gone – FOREVER. I recommend that to all your buddies from the Bay area.

“””You want to send people to gulags?

Tens of millions of people were murdered under Soviet Communism. More than under Hitler. And yet, you’re calling for a return to gulags? Seriously?”””

I think it would be good for the high-tech livin, Uber drivin Millenials on here to read about the gulags. Did you know Americans were swept into the gulags? John Noble, born in Detroit, was working abroad in Dresden during WW II, and stayed there after the Red Army overran it, thinking his American status would protect him. It didn’t. He was arrested in 1945 and for 9 years until 1954 he was in the notorious gulag near the artic circle, Vorkuta.

In the appendix, you will learn what the fabricated charges were that sent him there. He never knew until he got out. For 9 years, John Noble never had a piece

of fruit, a cup of coffee, not even a glass of milk. For 9 years, he slept on bare boards just like the ones Ameridumbs think only the jews slept on in concentration camps.

John Noble. I Was a Slave in Russia: An American Tells His Story. New York. 1960.

https://www.scribd.com/document/104473336/John-Noble-I-was-a-slave-in-Russia-1960

https://en.wikipedia.org/wiki/Alexander_Dolgun

I’ve read this guy’s book. Sounds like the kind of stuff that happens in US prisons.

If you think that republicans will magically fix housing prices then you are partisan-dreaming. NOBODY in his/her right mind would try to do anything to drop prices of homes. Can you imagine how unhappy owners would be if their homes suddenly became 20-30% less valuable? Do you want 2008 financial crisis again? By the way 2008 was the 8th year of republican president. So what is good. Financial crisis and affordable homes or economic growth and un-affordable homes? Partisan logic does not work.

Now partisan stupidity aside I do not see how house prices could drop in the near future. Some money must be removed from the market. There has to be either crisis in China, no more mortgages from Freddie and Fannie, removal of interest deduction, increase in property taxes or some newer and more attractive investment options. When people think that house is the best investment they can have almost all of their money tied in their house. This is crazy.

Imagine … if Trump cuts back on environmental regulations while easing the mortgage restrictions, more housing would be built and that would bring prices down with increased affordability. That would be a good thing.

JT, not sure from which state you are but here in California they are building like crazy. Literally everywhere I go I see large construction places. And now that interest rates are increasing I am sure the housing downturn is not far away. If I were you I would wait until the prices drop and then buy. Hope that this time not too many lose their homes though.

JT,

What mortgage restrictions are you referring to? Please give examples.

The Dems get blame for allowing another bubble to grow (as well as not going after the banks for fraud due to the robosigning mess and other predatory lending practices) but Dodd-Frank has nothing to do with it. Dodd-Frank helped suppress some of the more fraudulent banking practices which may have helped keep the bubble from growing faster. Neither do the environmental policies which are mostly common sense from a resource usage perspective.

Building more homes does nothing to ease a bubble either BTW. They built homes at a lightening pace during the last bubble and home prices just kept going up anyways. For a more recent example look at the housing bubble in Canada right now. They were building like crazy (its slowing down some in parts of Canada) and prices still just kept going up.

There is no such thing as enough supply in a financial mania.

And Trump isn’t going to do a thing about it except try to find more ways to funnel money to his friends and family. You’re delusional at this point if you think otherwise.

Untrue. I live in Vancouver and the regulations are so onerous that very little building gets done. Perhaps the most ridiculous: Before a developer breaks ground he must commission an archaeological dig. If any native artifacts turn up its immediately taken by gov’t.

@eddie:

Study on Toronto area but applies to all of Canada right now:

http://www.theglobeandmail.com/real-estate/toronto/demand-fuels-toronto-house-prices-not-lack-of-supply-study-finds/article34279980/

There is no issue getting building permits at all in Canada.

Supply isn’t limited at all, its a bubble driving prices there.

Yes Fake President Trump will fix everything once he drains the swamp of poor millionaires and builds a mega swamp for billionaires. The same guy who has spent more time golfing than Obama. Time to turn off Faux News. None of in the middle class win with Trump. The only good thing here is that Yellen and clowns will raise interest rates because they hate Donnie like the rest of the world does. This and the inevitable wars created by Banon (Cheney protege) will bring down home prices.

It is unfortunate America was presented with Trump vs. Clinton. They both absolutely suck. I am not a Trump fanboy. It is just Clinton was even worse than Trump. But, they both suck. So, I crossed my fingers and went for Trump.

I am hoping for something better in 2020. While I am a Republican, I would vote for a decent moderate Democrat in the next cycle. It would be unfortunate if the Dems offer a left wing disaster. They just might.

Gibbler,

Nothing wrong with lower home prices. It is good for the millennials, middle class and the economy. Yellen has far more influence on real estate prices trough interest than Trump – that is true 100%.

“None of in the middle class win with Trump”

Way wrong there bucko!! When Trump scrapped the Obama-ination know as the the TPP working people of the world just scored a home run.

So now we know you’re wrong, I just proved it right there.

Sounds like somebody is still butt hurt about the Trumpman becoming OUR president. When Obama ran in 2008, I actually bought into his BS that he was going to reel in Wall St. and be a champion for the middleclass. He failed miserably at both. Hillary would have even been more extreme catering to the global elite while the middle class would have likely become extinct after 2 of her terms. The Trumpman is good for the working man!

We love Trump! Trump 2016!

Bernie would have been the FDR-like savior of the middle class but Bernie was not a choice this time. We went with the Hitler wannabe instead of the Globalist/Corporatist. A hard choice in my opinion. Both would end in disaster.

@Gibbler @Flyover: I agree that we’ll see lower home prices over the next few years. The slide will likely start this Summer. I’m already seeing some price reductions in East Ventura County, and homes seem to be sitting on the market longer. Okay, that’s my obligatory post on house in this forum.

@interesting: Wrong bucko! The Repubs can’t even agree on a replacement plan. The “Freedom Caucus”, which is owned by the billionaires, have interjected their own demands into the negotiation. The CBO has basically said that the Trumpcare plan will cost way more in both lives and money. Minutes ago, the White House just pulled their proposal, which proves YOU wrong. Most here understand that the parties only work for themselves. This garbage about Dems vs Repubs is just that – garbage.

@Lord Blankfein: “OUR” president? I’m sure you showed OUR former president Obama the same respect? Trump is a fraud and is only in it for himself. He’s a salesman that has convinced his base that he’s doing it for them. Hillary was no better and I’m shocked that she was the best that the Dems could do (really?). The ONLY reason Trump won is because of Russian hacking to influence OUR political system. The irony is that they’ve convinced the loons on both sides that it’s a mortal sin to even bring up hacking of the election.

@Gibbler: Yes, the middle class has always paid the price. This time is no different except that it’s very blatant and in our face. Trump is one of the elite, no matter what he says. Same shit, different day.

@Janum,

I see you are in the butt hurt camp also. Fist of all, I considered Obama MY president and I would have voted for him is he was eligible to run for another term. I vote with my wallet and Obama rewarded me handsomely.

“The ONLY reason Trump won is because of Russian hacking to influence OUR political system.”

Umm, no. I would suggest laying off the MSNBC. The ONLY reason Hillary lost was she was a lousy candidate who was completely out of touch with her voting base. People were sick and tired of the same Clinton/Bush/Obama BS we’ve had for decades, Trump was smart enough to realize this and get those votes. You should direct your anger at the DNC, not some hackers…they just exposed the rotten truth.

Now let’s all say it in unison, the Trumpman is OUR president and we will support him!

Income inequality became much worse after 8 years of under Obama and the Democrats and only a goober like Gibbler would blame Trump who has been if office less three months? Gibbler needs to turn off the fake news spewed by the demented drag queens on leftist globalist propaganda outlets like MSNBC and CNN. If anyone is to blame for the housing mess in Commiefornia, it’s Jerry “Moonbeam” Brown and his band of communist hacks in the Democrat party who have controlled California for decades and turned a once beautiful state into turd world cesspool much like some corrupt banana republic in South or Central America.

“Today’s existing home sales report is just off the charts. There is so little for sale that big price jumps as well as bidding wars are widespread. The home shortage is so severe the sales are lower because many buyers are unable to get an offer accepted. It is possible that prices will move up severely from here. Good luck to the buyers.”

Hurry and leverage yourself up with properties. Can’t possibly lose.

“You can blame the Democrats for this mess. The environmental policies as well as Dodd Frank means fewer new homes are being built. The result is skyrocketing prices for existing homes. Trump needs to reverse the Obama mess else homes will only be for the wealthy. Not what this country is about.”

Too funny. Who presided over the bubble years of the early to mid 2000’s when there was no Dodd-Frank Act? Hint: his party’s mascot was an elephant.

If you can afford to, you might want to consider buying a clue. Bush and the repubs tried to stop some of the most insane lending standards in the 00s but were smacked down by the demoncrats who claimed having lending standards was “raciss”. Granted they didnt try nearly hard enough because everyone was getting rich off the madness.

No big fan of Bush, but you can read the truth and weep:

https://georgewbush-whitehouse.archives.gov/news/releases/2008/10/20081009-10.html

Maybe youre too young to know the truth so no worries on that. I lived through it, saw it coming and got out with some $$. From my perspective a lot of factors conspired to create housing bubble 1.0. A stock market crash caused many to look elsewhere to put their money, followed by 9/11 which spooked the fed to cut interest rates to insane lows and it was off to the races. Interesting to note that what happened in the US mirrored what happened in Japan about a decade earlier – huge stock market bubble which then went into a massive housing bubble. We seem to be special in that we have an echo bubble now whereas Japan never had such a thing – maybe because we’re just a more naturally manic culture. This echo bubble is largely driven by China though, as it struggled to keep prosperity after the global financial crisis of 2008.

Come on. Bush and a Republican Majority and controlled both the Executive and Legislative branches for 6 years before we were driven onto the rocks in 2008. Now instead of blaming the drunken captain and his drunken officers, some try to blame the lowly seaman who had no control while he was swabbing the decks. Really? BTW, we have a Captain Bligh as our Executive Leader now and unlike on the Bounty, we have a drunken Legislative Branch. We are doomed.

Captain Bligh: Now don’t mistake me. I’m not advising cruelty or brutality with no purpose. My point is that cruelty with purpose is not cruelty – it’s efficiency. Then a man will never disobey once he’s watched his mate’s backbone laid bare. He’ll see the flesh jump, hear the whistle of the whip for the rest of his life.

@junior_kai

The main culprit for the previous bubble and the ongoing echo bubble is the Fed. However, Bush was not an innocent bystander as the economic success of his administration of further inflating the bubble. I recalled Bush publicly touting record home ownership during his tenure.

“’The Bush administration took a lot of pride that homeownership had reached historic highs,’ [Secretary of Treasury] Snow said in an interview. ‘But what we forgot in the process was that it has to be done in the context of people being able to afford their house. We now realize there was a high cost…Lawrence B. Lindsey, Mr. Bush’s first chief economics adviser, said there was little impetus to raise alarms about the proliferation of easy credit that was helping Mr. Bush meet housing goals….’No one wanted to stop that bubble,’ Mr. Lindsey said. ‘It would have conflicted with the president’s own policies.’â€

http://www.nytimes.com/2008/12/21/business/21admin.html

Add the fact that Bush’s administration got the ball rolling on the massive bank and corporate bailouts that continue to this day at great expense to taxpayers. Mind you, I don’t much esteem for Obama either as has proven to be every bit Bush’s successor as far as economic policies are concerned.

Meant to say: “Bush was not the innocent bystander of the economic fiasco as you claim. The economic success of his administration depended greatly on inflating the RE bubble. I recall Bush publicly touting record home ownership during his tenure.”

@PrinceHeck – you are correct, the fed blows the bubbles. And yes, Bush did take credit for the housing market – they all do. Clinton took credit for the dot com boom, when he had absolutely nothing to do with it. Same with Obama and the current insane markets we’re seeing. My point is, pinning bubble 1.0 on bush is nonsense. There are some individuals who I believe directly and knowingly contributed to the fiasco, like Greenspan, Angelo Mozillo, and Franklin Raynes (sp?). Most were clueless though IMO. I battled on the internets far and wide back in 2004 that we were in a bubble and that it was already starting to pop and got nothing but hate. 1-2 years later and all the haters accepted the obvious. We’re definitely on the same page – end the fed NOW!

Your trolls are improving, you hit all the triggers!!!

https://www.youtube.com/watch?v=hPIxrzmatq0

an all time classic!!

You can thank Democrats for creating jobs and low unemployment in California. If you can’t handle it, then go to flyover country where if you are anything but white they will shoot you!

Dragant: go to flyover country where if you are anything but white they will shoot you!

Idiot. Whites in flyover country do not go around murdering non-whites.

OTOH, if a white guy wandered into any black ghetto, then yes, he is risking his life. Never mind what would happen to a white gal.

Nothing goes up forever. The grand majority can’t afford this nonsense, so something has to give. Nobody owns a damn thing in California.

“Wild Parrots soar overhead the magical rear garden”…they forgot the rainbow unicorns…

Now all RE bulls like JT and TR should buy this “fantastic, magical” deal before the “parrots” fly away…:-))) LOL

Meanwhile, the existing home sales tumbled in February. So much for those saying that higher interest is not going to affect RE on the downside. Now wait few more months to see the effect of the interest increase we had last week.

http://www.zerohedge.com/news/2017-03-22/existing-home-sales-tumble-nar-warns-prices-becoming-increasingly-unaffordable

What is going to happen after 3 more raises they plan this year and 4 more next year???!!!!…

What everyone on this blog agrees is that those who buy don’t do it based on the average income. There are 3 other sources, or I should say 2 if you don’t have a printing press:

1) Capital from China, where stronger measures are implemented to prevent it,

2) Selling of stocks. Here, are they going to continue? Are they based on fundamentals? Here is an example for BP stock:

https://www.google.com/webhp?sourceid=chrome-instant&ion=1&espv=2&ie=UTF-8#q=bp+stock+performance&*

Today, the PE for this stock stands at 1398. If this is not the definition of INSANITY, I don’t know what else. I thought a PE of 14 is high when we still had a market. It looks that the FED insanity of zero rate created the mother of all bubbles, not only in RE but stocks, too. This is not a dot.com startup which takes time to start producing profits, but a long established blue chip company. It is a monetary policy result, and it does not have anything to do with the performance of the economy and people finances. It is monetary insanity on steroids.

The FED now realizes that they are way behind the inflation curb and tries to play catch up. They are so much behind that trying to catch up will blow the bond market (3x the size of the stock market).

This whole experiment started by Bernake is the most stupid experiment in the history of finances – trying to cover something structural with paper instead of letting the markets deal with it. Eventually the markets will prevail. We’ll see how soon.

Thank you!

Your explanation flew over the heads of many RE bulls.

I am curious if the FED did it differently I would think giving money to banks to at least cover the lent out amount to avoid bank failures, but then restrict lending to a crawl.

Housing would then be priced at mark to market and/or market forces would make their own price discovery.

Depending on what type of exposure the other smaller lending firms had in the game would be a different matter. You can’t save everyone and each firm needs to be responsible lenders, which in this case would have helped clean the swamp of the corrupt and incompetent.

As for the borrowers the HARP program should have never have happened. I understand by reducing the principal balance helps but that is not fair if responsible borrowers make sacrifices while still making their payments.

Hopefully this time around we might do something right for a change. Ah hope and change.. Where was it when we needed it?

Yes. Insane P/E ratios. But hey! A dividend yield of 7.11%? It’s like wild parrots are flying over my head since I can’t get that kind of return anywhere else. Except maybe real estate. Buyer beware for both.

One more interesting bit

31% of millenials living at home in SF

http://sf.curbed.com/2017/3/22/15025398/millennials-san-francisco-living-at-home

Or that 33% don’t have at least 2K for emergencies. But they can buy expensive SUVs, dinners, and shopping sprees…

Millenials are buying less cars (and virtually no SUV’s) than previous young generations + millenials go out and spend less in general since they have less money in the first place.

By and large they make McWages so even with the insane 84mo car loans you can get today they still can’t afford a SUV.

@tts

Sorry, I meant 33% of the population, not just millennials. This is the byproduct of efforts by the government and Fed to artificially engineer a recovery. Instead of saving, they’re borrowing their way to prosperity.

It could be the 10% Trump Bump in the Stock Market is overwhelming the piddly 0.5% interest rate hike. So much cash out there for down payments and for the Jan 2017 reported 23% all-cash buyers. If (only) I had $3M in the stock market and was living in a $1M house, Id look to balance my portfolio and buy another house.

It’s not just the price of the crap shack, which is crazy. Once you’re in the crap shack, it’s a neighborhood that has the cramped grocery store from 1954 with no parking, and sky high prices. The bars and restaurants with no parking, so you better like that neighborhood tavern, and the old drunks in there, and that overpriced “Trattoria” or even worse, Tapas bar, the biggest scam of all. But the neighborhood is “charming.” Charming means that your world shrinks to a narrow little area. And you have to kid yourself that public transportation is fine. It’s not. And where do you go? The cramped Target that everyone else goes to.

At least in LA there’s great patio weather. SF doesn’t have that. It’s patio weather with a sweater and jeans, which isn’t the same, except in September, part of October. Can you get a little propane heater? Yes. If some bum doesn’t steal it, and assuming you even have a patio, which you probably don’t. Damp, dank and overpriced. With mean people.

I give that rant a 8.5/10! Loving that venom, keep it coming – you nailed it with the Trattorias and Tapas, lol!

We really need to get rid of Prop 13 and Limit CEQA. Prop 13 is locking up a lot of homes and businesses from selling and keeping inventory low. CEQA is used by every NIMBY and environmental group to stop any building.

FYI: You can sell your Prop 13 house and do a one-time transfer of that existing low tax base to your newly purchased property, or one time transfer to an adult child. So Granny can cash out anytime, buy an in-state property, and pocket the rest to live on if she really wants too, AND keep her Prop 13 in place!

The problem is, Granny likes her digs/neighborhood just as much as the frothing horny house-hunters! So, she rents out her empty bedrooms to Asian students & gets a reverse-mortgage “credit line” just incase she out lives her retirement funds while enjoying her Golden Years. In the meantime, everybody else keep paying more for less….

Of course granny likes were she lives, but this whole property tax cap transfer thing is keeping a lot of properties off the market that would have been sold. Disneyland is still paying property taxes from the 70s not from todays values, also a lot of old commercial builds stick around with no improvement because they opened up in the 70s and are paying a couple hundred dollars in taxes so noting is done to them. This whole prop 13 this screws up the natural cycle and incentiveses NYMBYism, because I got mine now screw you and I don’t want anything that will lower the values of my home like more homes.

I imagine Golden Ticket Granny to be like the granny in the Tweety and Sylvester cartoons – the part where the tells the dog to keep an eye on things or – makes machine gun motions while making a sort of machine gun sound with her mouth – hehe hardcase ol’ granny LOL!

Consider the cost of being in a rest home and then understand how cheap it is to keep the house. In fact some families decide to become a care taker for end of life parents. Might be a viable option for some families.

My only regret is that I should have held onto the So. Cal. property longer … I sold in 2014, the same day it went on the market with a bidding war that drove the price up and up! Can’t imagine what it would bring today. But, then again, am under contract to sell another home in the Denver area and it was also bid up accordingly. A good time to be a seller!

Housing To Tank Hard Soon!!!!

http://www.zerohedge.com/news/2017-03-22/existing-home-sales-tumble-nar-warns-prices-becoming-increasingly-unaffordable

jt is a funny guy

Might start seeing new TV episodes when the dust settles.

The Biggest Crashers

Shackles

Art Deco to Dud

Money Pit

…..

Note that it was last purchased in 1990 for $291k which would be equal to the cost of buying it at around $542k with todays dollar in 2017, so this crap shack has always been relatively expensive because of location but now it’s at almost triple the rate of inflation!!!!

It seems like even if we saw a 50% “Bubble Burst” which seems highly unlikely most properties in the Bay Area are still unaffordable to the Average Joe making under $150k a year especially in SF.

I wish it were as simple as a unilateral relationship between inflation and real estate. I honestly do not get the draw of living in SF. From Atherton to Santa Clara, I do get the draw. Typical real estate locations may support that unilateral relationship.

I agree about not wanting to live in San Fran even if home prices were sane. It can be a fun place to visit, but it would get old stumbling over homeless people and inhaling second-hand marijuana smoke everywhere you go after a few weeks. Also, public transport is slow and you get packed in like sardines during rush hour. There is no sense of personal space. Last time I visited, we found ourselves Ubering more and more because of how much more convenient and clean it was. Sure, San Francisco has a lot of culture and art, and fun sidewalk cafes to eat, but I’m not sure any of that makes up for the downsides of living there.

You need to factor in mortgage interest rates also. Rates in the early 90s were 9 or 10% compared to present day 4% (3.x% last year). When you factor this in with REAL inflation numbers (not .gov BS), population growth, no building, no land, silicon valley becoming a monster, the wealth concentrated in the top 10% of the population, foreign money coming here in droves…today’s price is much higher than your inflation adjusted price. I personally think the Bay Area is overpriced and would not live there for various reasons. I would much rather live in a low key socal beach city. Cheaper, better weather, better women and not the extremist attitudes. All my $0.02 of course.

Short attention spans indeed. I know someone who bought and lost at the peak and is now buying again. Pain is temporary I supppse. But despite personally being a housing bear or more appropriately, a house price skeptic, I can’t help but wonder if newly legal pot will blow more air, or smoke, into this “bubble” a la Colorado? http://www.latimes.com/local/abcarian/la-me-abcarian-cannabis-jobs-20170322-story.html

Miss American Pie, It may cause a spike but I wouldn’t hold my breath for a mass migration from CO OR, or WA. In Colorado, I see the most painful part of this is in the warehouse districts where the grow houses have been gobbling up all of the available grow space and driving up what used to be cheap rents. Commerce City now smells like skunk city.

Miss American Pie – it works for the casinos!

You might have to be on something in this type of market. Isn’t it the idea to create business and new jobs and have a cannabaextended market rally for the new economy?

Are we making a big mistake?

My wife and I just went into escrow on a 2K sqft house for 680000 in OC. We’re putting 200K down. Mortgage comes out to a few hundred below what we current pay in rent. Taxes, insurance and HOA, puts us ~700 above our current rent. About 19% of our gross income would go to mortgage, prop tax, insurance, HOA.

We’ve held out from buying for 2 years now. Countless times these past 2 years, I would tell myself, “this is the tippingpoint, prices can’t possibly go any higher”. In the meantime, prices have gone up ~15%.

We really like the house. It’s in a safe, family friendly community. We can easily see ourselves staying 10+ years in the house. I’ve suggested moving out of state to my wife, but that’s not going to happen for various reasons.

So, here we are. Are we making a mistake? Will I be kicking myself a year from now while I walk past the 3000K sqft houses that I could’ve bought with the same money?

No one can say for sure about if its the right move. If your job is stable AND you plan to live there 10+ years, that will mitigate the risk.

No, you are not making a mistake. You are buying a home not an investment like everyone preaches. You are making a good down payment and at 19% of your income (unless you have lots of other debt payments) you are not stretching. If you love the home and can see yourself living there for 10 years then you really have nothing to lose. Paying $700 more than your rent will be offset by the equity you are building plus tax deductions. I guarantee you in 10 or more years that rental parity will disappear and you will have built equity and survived whatever correction in the market happens. Other benefits are you don’t have to move again, deal with landlords, you can remodel whenever you like. In the worst situation (market collapses, you lose your job and have to move) you should be able to rent out your home and still cover the PITI.

Agreed, thanks! The hardest thing for me to get over is the “treating it as an investment” bit. My biggest fear has always been that we plunk down a large chunk of our savings and watch it disappear. I need to re-wire my brain to think like you said. We are very happy with the house.

Or you need to sell in some number of years from now and the market is lower than your purchase price. The closest thing to a rent parity comparison is a zero down mortgage.

Anyone who gives you a definitive answer has an agenda! Your instinct has less to gain.

Especially anyone who makes it seem like just renting the place out in the worst case is an ideal alternative. Being a landlord sucks!

StuckInOC, does not sound like you are making a mistake at all. Congratulations! Hopefully, everything goes through smoothly.

May I ask you how much your monthly cash outflow will be for PITI?

I quickly ran the numbers on a spreadsheet and PITI should be around 3,8K?

(Assuming 1% of purchase price for PMI/homeowner insurance, 1.25% property taxes, $300 HOA’s per month, interest rate of 4%, 30y conventional loan)

“2K sqft house for 680000 in OC. We’re putting 200K down. Mortgage comes out to a few hundred below what we current pay in rent. Taxes, insurance and HOA, puts us ~700 above our current rent. About 19% of our gross income would go to mortgage, prop tax, insurance, HOA.”

HOA Is a really low $50. PITI is looking to be closer to 3300.

You are having the typical buyer’s remorse for the largest purchase of your life.

Close to rental parity. Check.

Large downpayment. Check.

Easily afford it. Check.

Good, safe area. Check.

Can see yourself staying for the long term. Check.

No longer subject to rental uncertainties. Check.

Enjoy your home, you should rest well at night.

Thankfully you have the approval of random people on the Internet who will be there to help if it doesn’t work out!

Except that he’s right.

What city is this?

“Prop 13 is a reason for this even though it is pitched under the guise of “kicking grandma to the curb†type rhetoric. They never mention that grandma is going to have over $1 million in equity if she chooses to sell which will put her in the top 1 percent of households globally.”

This needs to be repeated until we fix P13. It was a lie to begin with, and has had awful intended consequences.

Amen brother, don’t forget Disneyland is paying property taxes from the 70’s, Micael Dell bought the Fairmont Miramar Hotel and kept the old property taxes because he arranged the purchase so no one person owns a majority so the property was not re-assesed.

http://articles.latimes.com/2013/may/05/local/la-me-dell-property-20130505

I think most of us agree a crash is coming. Just whether it is this year or the next two years. I believe the authorities will do all they can to stop it happening. Partly because they will want to stay in power and also because it will be a depression not a recession.

My question is will they be able to repeat 2008 where they managed to stop it becoming a recession/depression? If so how would they do that happen?

That’s exactly what I keep asking those who wholeheartedly, if not blindly, believe that the government and Fed are omnipotent that they can indefinitely defy market forces.

I think unfortunately most people are “asleep/sheep”. Im not saying my or your solutions would work. However most people arent even aware there is a problem. Though I think people are starting to wake up.

I think I read somewhere this idea of a international debt organisation that could absorb all of the debt from different countries?

That international organization are the Fed and the ECB. How many times have we seen Greece rise from it’s deathbed when a debt payment comes due? As we see now, those corrupt globalist organizations are giving rise to nationalism.

Be sure to watch tonight’s episode of Flip Or Flop. Particularly the episode that airs at 9:30, which is a repeat of last week’s episode. They buy a 900 sq.ft box in Palos Verdes for over 900K and put in over 100K in renovations, trying to beat the local comps at 1.3M. At the end of the episode, the house “had not sold”, which I believe is a leading indicator of flips turning bad and people coming to their senses. BTW, there is a house down the street from me (Woodland Hills) that is close to a noisy major street and is listed for 1.8M and I swear to got it’s not worth anymore than 900K on its best day.

https://www.zillow.com/homedetails/2880-Via-De-La-Guerra-Palos-Verdes-Estates-CA-90274/21342498_zpid

Boom! Dropped the mike….

Might want to check on Mike and make sure he’s okay….looks like the place is on the market now as a rental.

In case anyone is interested, after 3 years of being an anti-Jim, I am now on the side of Jim Taylor. Housing to tank hard soon! I’ve never been wrong and I’ve never been right. You decide, and continue to post your excellent opinions on this blog.

What makes you on the side of JT now?

IMHO, the stock market and the Trump Bump is teetering so the mad money flow from internally is coming to an end. Also, China is clamping down. I don’t think just the rise in employment or wages can balance this. It may not “crash hard” immediately but it is starting a slow crash (ie 1-2 years).

http://sfist.com/2017/03/22/linkedin_map_shows_where_people_fle.php

People *are* leaving No-Jobs California.

If they’re smart they’re moving someplace where plots of good arable land are at least nearby, so they can go largely self-sufficient when the tech job they left California peters out, they have something to fall back on.

Reality check: In 2016, California was #1 in job creation among states in absolute numbers. As a percentage, it was still in the top 10.

If enough of those jobs created don’t pay enough to make up for the cost of living disparity… then who cares? Wake us when wages catch up.

Dude, not everyone shares in your “back to the land” fantasy. Let it go. Letus know when you buy some arable land.

My sister recently accused me of not being crazy anymore, so to prove her wrong I think I will go out and buy a house today.

Showed up on my Yahoo home page today:

Renters Now Rule Half of U.S. Cities – The American Dream increasingly involves a lease, not a mortgage.

https://www.bloomberg.com/news/articles/2017-03-23/renters-now-rule-half-of-u-s-cities?cmpid=yhoo.headline

“Affordable housing is a oxy-moron”. Priceless

Here’s an example of the kind of CA house appreciation JT has been talking about:

http://www.sdlookup.com/MLS-170009356-4215_Corte_Favor_San_Diego_CA_92130

Check out the sales history and you’ll see these folks did quite well.

The lucky folks that bought in desirable areas and held on to their home as a place to live can reap substantial price benefits, should they choose to sell.

The good news about a good investment in your single family home. Over several decades, as long as you bought a solid zip code, you will make a lot of money. The bad news is when you make all that money, you will be old. Real estate is not a get rich quick scheme. It is a conservative very long term investment. If you try to do a short term real estate investment, you might lose because of the high transaction costs and timing. But, in the very long term, short of an economic collapse or out sized earthquake, you should be good.

Like all investment, real estate is all about timing..

My friends bought is 2004-2006 period are still under water…

Almost all people who bought during the last bubble either lost it all or are still underwater. JT’s advice is the worst. If you buy now you are screwing yourself again. Wait until the economic meltdown happens. Housing to tank hard! I have no doubt our terrific president will screw it all up big time. That’s why I like him! The crash will save us!

To get another house like it they have to spend around 1.2 mil with bigger fees and taxes to boot. Maybe they’ll rent for now and buy back in later at a lower price. Only other option is to move to a less desirable area and then they lose what made the house they sold so supposedly desirable. It’s not winning if you end up paying more costs for the same thing or pay less for something less.

Los Angeles and Orange County seem to be following other important national and world cities in becoming a city of the rich. We’ll have to wait and see how that plays out, but it certainly doesn’t bode well for the average person attaining the American Dream of home ownership in LA/OC. Excessive central bank money printing combined with the trend towards a city of the rich makes be believe we will experience only moderate housing price drops when the next recession hits.

“Los Angeles and Orange County seem to be following other important national and world cities in becoming a city of the rich.”

But why would a rich person voluntarily want to live in LA? Is there anything else in LA besides traffic, homeless people and overpriced crapshacks?

Real estate has crashed many times in SoCal in the last few decades.

The current prices are all propped up by central bank

It’d be interesting to see how things turn out in next few years

One thing is sure.. if the middle class can’t afford a decent house, the place becomes inhabitable for all people including rich…

I can tell you from what I see:: I don’t see high paying jobs staying here for long… it’d be taken away by automation, AI and outsourcing .. Then we’d see who buy these expensive crapshack..

Smart money has already exited the market

“Excessive central bank money printing combined with the trend towards a city of the rich makes be believe we will experience only moderate housing price drops when the next recession hits.”

Well then, why didn’t we print ourselves to prosperity much earlier? Ink and paper have become more valuable than oil, gold, and natural resources.

@ David G LA

“The HASSLE factor of driving has changed.”

It has but that doesn’t matter much since the You-Need-A-Car-To-Work-And-Get-Anywhere issue hasn’t disappeared at all. And don’t even bother talking about taking a bus or riding a train. They’re either unavailable in many areas or so damn slow as to be impractical most everywhere. Public transport might as well not even exist in the US.

@ Manbearpig4lfe

“Sure young people may have less money, but HAVE you seen what they do with their time?”

Yeah they work. Quite a lot actually. Employment stats for that age group are trivial to come by. The jobs just pay crap so all they have for entertainment that is affordable is whatever dumb stuff they can scrounge on their cellphone and the occasional drink at a bar.

@Seen it all before Bob

“The Millennials I know commute on bicycles that cost around 8K”

Your post reads like one of those fwd:fwd:fwd insane emails that you’d have to be mentally broken to believe.

Ha! I just know successful Millennials who believe in the environment and live in S.Cal and Boulder.

The 8K bicycle is always mounted on the back of a 6K used Subaru. Stereotypes are true from my limited viewpoint.

Looking forward to the tax reform bill coming up. Mortgage interest deduction could be on the table and passage will signal time to take profits.

Trump has said that he would raise the Standard Deduction to 30K for a married return. It may not be worthwhile to itemize anymore. It won’t in my case.

Under Trump’s proposed tax plan, the standard deduction for a individual would be 15K and 30K for a couple. This will eliminate most itemized deductions along with the majority of property tax write-offs. So basically the tax benefits of owning a home will be insignificant for most people under the proposed new tax plan. I assume one will still be able to deduct the property taxes paid to the state or some portion of it. In my experience the tax-benefits of owning a home are highly over-rated anyway, unless you use it for business.

Notice that I am posting more than in the past? I can do that because I have lots of time on my hands. I just retired 3 weeks ago from last Friday. How? My so called beach close “crapshacks” allowed me to retire in my early 40s. My wife does not work, and I have a lot of kids in tow. Some of my friends have also done very well with real estate.

Back in the 90s, when I just graduated from college, everyone ran around and said the same misinformation about owning real estate. They all said it was smarter to rent. They all said I would be better off in the SP500. They laughed at my old junk cars I drove while I pumped every penny into beach close rental homes. They said I was stupid because of so called rent parity. And, they laughed Now, I have the last laugh.when the real estate market backed off in 2008. I stepped in and purchased another beach close home.

Right now, I am remodeling one of my beach crapshacks in choice Newport Beach area. That is how I fill my free time.

That would be most awesome – we need to dis incentivize the treating of housing like its a game of monopoly.

jt… Most people aren’t saying it’s smarter to rent the way you put it as if that always applies to everyone in every situation. Seems like your free time is spent putting words in other people’s mouths in order to promote ego. Even Alex has a lot of free time on his hands and you won’t find any of us impressed either way.

Saw these headlines a few years ago and now we see them again. http://www.nbcsandiego.com/news/local/BAY-RM-San-Francisco-Nearly-Tops-List-of-Nations-Median-Home-Prices-at-835K-Study-417068933.html

Good news everyone! There are jobs in flyover country!

https://www.bloomberg.com/news/features/2017-03-23/inside-alabama-s-auto-jobs-boom-cheap-wages-little-training-crushed-limbs

Sheer numbers of people looking for a house in this country and throw in foreign buyers with a down inventory equals crazy prices to continue. Yes even if lets say only the 10% of wealthy folks were in the market at any one time and had a pool of 2 to three million buyers nation wide and about 1 million foreign always looking, than you see that this is going to be tough for the lower to middle class what is left of it.

A catastrophic event such as climate disaster, war with China/N Korea/Iran, wall street collapse affecting tech world wide, would change the scenario, other wise many are still making crazy money at the top and if you are in there the club than bring on $1.3 million for a dump house, and $800 dollars a month for a German lease car???

You forgot to include a sharknado as another possible black cloud on the horizon. Total game changer IMO.

That average LA home enters the 600K club.

http://www.laweekly.com/news/los-angeles-median-home-price-has-reached-nearly-600000-8061540

Once a hot condo market miami…. flushed with foreign money is now is trouble..

http://wolfstreet.com/2017/01/29/condo-speculation-collapses-in-miami-dade-condo-glut/

Wasn’t someone looking at this house in Santa Monica? Listed at $1,595,000 on busy 11th St?

http://www.themls.com/mlslistingphoto/listing/slideshow/#/17-207312

Just sold for $312,000 OVER asking….

????

The Bay Area has surpassed it’s 20 year job target in just 5 years. Check out the report at SPUR. There is the answer to all population related issues: high housing costs, lack of availability of housing (purchase and rentals), traffic jams, long lines on BART and at grocery stores, etc…Jobs in a community used to be a good thing. Here in the Bay Area it is playing out in the reverse.

Most of my non-US co-workers are playing the flip game. Buying properties with minimum downpayment to sell them a year later for 10-20% gains which they park in overseas accounts away from Uncle Sam. If the music stops and $HTF, their plan is to buy a one way ticket back to their home country and make out like a bandit…

Atleast these are the more prudent “investors” who have a contingency plan.

The ones that really worry me are those who refuse to even consider that what goes up can also come down. They’re banking on the govt. to bail out the “ownership society” no matter what! There is no sense of community or responsibility to society. It’s a wild west.

Leave a Reply