Searching for hipster homes in Echo Park: Being a hipster comes with a hefty price tag.

Being a hipster in Los Angeles is like being a drop of water in the ocean. Apparently one of the requirements of being a hipster is living in certain enclaves. Now in Los Angeles, a renting majority county, living in the right neighborhood is important. The HGTV housing erotica that is pumped out to the masses has conditioned many to accept the “fixer upper†world of crap shacks. Now typically when I say crap shack a bunch of Taco Tuesday baby boomers get offended but just remember that many hipsters actually want a crap shack. They are actively looking for “personality†in a property as if they were swiping right on Tinder. The market capitulated fully last year and now we are in the stage of euphoria. You can do no wrong with housing and Echo Park is home to many lovable hipster homes.

Echo Park

It is definitely an interesting time to be alive. I find it surprising that many people think that because Trump is a real estate guy that somehow he is going to enact policies that inflate California crap shacks. That is how distorted things have gotten. If Hillary would have won, it would have been “real estate will go up because the status quo remains.â€Â With Trump winning the narrative is “he is a real estate guy so therefore he is going to try to influence prices higher.â€Â If Kanye West ran and won it would be “Kanye mentioned in his song that crap shacks were only meant to go up in value so therefore things will got up.â€Â We’ve already noted that 2.3 million adults live at home with parents in California because of sky high real estate prices (both in rentals and housing).

Sellers are trying to cash out of this epic mania. Take a look at this gem:

840 N Rampart Blvd, Los Angeles, CA 90026

2 beds 1 bath 970 sqft

“Prime location in Echo Park, one block south of Sunset Blvd. One mile to Echo Park Lake, one mile to Silver Lake Reservoir, walking distance to popular restaurants and nightlife!â€

Nothing screams hipster villa like bars on the windows. The short description is tailored for hipsters. Go to the lake, eat some food, and get plastered. And all for $699,000. What is interesting is that the sellers realize they got a cash cow on hand:

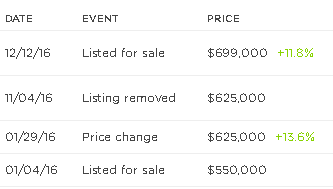

The place was listed for sale in January of 2016 for $550,000. They realized they priced it too low and then upped it to $625,000 a few weeks later. It didn’t sell so the listing was removed in November of 2016. The sellers realize that there are still plenty of house horny people out there and have listed the place for $699,000 back in December of 2016. So basically over the year, this small place had price adjustments of $149,000.

The market right now is still in a mania stage. The herd is foaming at the mouth to purchase properties even if it means mortgaging their lives. It doesn’t matter the quality of the place but the important thing is to get in. You don’t want to miss this train before it leaves the metro station.

It is interesting to see the older generation raking the younger generation over the coals if they have doubts about real estate. It seems like they are trying to justify their own purchase as the ultimate milestone in their lives. So what if a young professional doesn’t want to buy and would rather invest in the stock market and travel the world? Oh no! You have to follow the Taco Tuesday baby boomer pattern of buying no matter what. There are generational differences here by the way. Sometimes it makes sense to buy, and at other times it doesn’t. You can’t use dull catch phrases like “real estate never goes down†or “renting is flushing money down the toilet†because those are simple deflections that cloud the much more complicated picture here. We are talking $700,000 for a place with bars on the window!

But what is true is that the housing lust is very real in this market. Crap shacks look beautiful, freeway traffic looks like a deep tissue massage, and a 30-year mortgage looks like chocolate covered strawberries falling from heaven.

How long can hipsters support this market in Echo Park?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

167 Responses to “Searching for hipster homes in Echo Park: Being a hipster comes with a hefty price tag.”

I drive through Echo Park on my way downtown to work every day, and the only words to describe it are old, dirty and dangerous. Oh, yeah, and it’s filled with homeless people! The park around Echo Park Lake is filled with tents and trash! Ick!

“…filled with homeless people…”

Small correction: But they are “hip” homeless people..

http://homelessorhipster.com/client/HOH20.html

There you go! The “Homeless or Hipster?” page.

LOL “If Donald Duck had won. RE would go up because …..”

Housing to Tank Hard Q2 2017!

One thing that strikes me are all the comment suggesting they are waiting for the big housing crash to happen before they become a buyer. But, the same people said the same thing 4 years ago. In those 4 years, many homes have risen in price by more than 1/3rd. In the next 4 years, they could go up by another 1/3rd. That would mean the 1M dollar house in 13 is now 1.35M, and in 4 more years, that same home will be approaching 1.8M. If the pullback occurs in 4 years and the price drops 10%, you are looking a a price in the 1.6M area. You would be better off buying today, unless you expect home prices will drop within the next year. Since the CPI ( Consumer Price Index ) hit a multi-year high today, I doubt home prices will be dropping anytime soon.

JT, you keep repeating the same stuff…..”next correction will only be 10%”….well, sometimes you mention “10-15%”. Why is it only 10% today? Next week, will you tell us the next correction will only be 5%? Can you provide any backup for this claim? Of course not….just your crystal ball, eh?….Why are you so concerned about us losing out on appreciation?

I guess the housing bears have a crystal ball made by a different brand….Because they are claiming the next crash will bring housing down by 50%-60% (easily). Mhm, lets find out….

“they are waiting for the big housing crash to happen before they become a buyer. But, the same people said the same thing 4 years ago.”

I don’t see a problem with that. The bubble started to pick up at 2013 and it might take a decade or so until it crashes again. It does not matter to me if the market goes up by 20% each year not. If it crashes and its still too expensive i wait for the next crash. Or, i never buy and inherit the house(s). Its a common sell strategy to implement fear. Fear of losing out (“you are losing out on interest deduction, you are losing out on appreciation” or fear of never be able to buy “buy now or be priced out forever”). The fear may have worked with the boomer generation but i don’t see Millennials following the same bad advice that caused 7 MIO foreclosures in this country.

Be careful we might be talking to a bot Watson on these boards.

I’m in the same boat as several people here. Today’s home prices are simply insane. Even rents are insane.

But, even while all this insanity ensues, there are actually people paying these insane prices!!!

Are they the fools, for paying so much!? Or are we the fools for supposedly missing out on a buying bonanza!?

The fundamentals just don’t make any sense. Too many things have their hands in the market and causing it to be skewed from normalcy. Like super low interest rates (even though they inched up in Dec. 2016), FHA/VA/Etc. being the new “sub-prime” lender, etc.

Millennials value their time and effort. They also don’t like stress. The worth of owning a home does not make sense if you are going to have to work 80 hours a week and not enjoy it. And, I agree, correction is not set in stone. Who says it will only be 10%?? Those that are afraid that it will be more. All I know is, I live in the East SFV and my monthly housing cost is $1000 for a 3 bedroom house. Not leaving anytime soon. Investing my cash elsewhere.

Agree. While not a millennial (born in ’79) I like being able to live close enough to work to go home at lunch, or walk or bike to work. It seems some people aren’t calculating the externalities when it comes to living in the suburbs, beyond just their time, or time with their loved ones, it’s also detrimental to your health. I am just going to wait until a correction of some kind occurs, and get a 15 year mortgage. If that never happens before retirement, I will become an ex-pat with a large amount of pre and post tax $$

The housing market is booming. The stock market is roaring. There is simply too much inertia to rapidly turn this thing around. There is NO tanking anywhere in sight.

I went to an open house over the weekend and it was a mob scene. Lots of young, professional couples looking to buy a 900K starter home. Only in CA folks…

It’s not only in CA. Here in Bozeman, MT, building permits have been at all time highs the past two years running. I asked my local plumbing part supplier if things were looking to cool down this year and he just laughed.

When the crash comes, it’s going to be ugly.

feels just like 2000 and 2008 doesn’t it?

Jeff,

I’m in Eastern WA, yes, what people call “flyover country” and the market is super hot. It is hot in the whole developed world, from Canada to AUS, to NZ and everywhere it is due to easy money. Play the musical chairs while the music plays; after that, we’ll se who doesn’t have a chair (or I should say homeless). Or should I say “swimming naked” to quote Buffet???…

And as often happens here, my nemesis Flyover is correct. Prices are crazy all over. I mean, they’re charging California rents in places like New Orleans (damp, hurricanes, violent crime) and bumfuct Ohio (nothing but harsh winters) and it just doesn’t make any sense. So it’s a bubble both for buyers and for renters. A Jenga tower, if you will.

(For our flyover country readers, “Jenga” is a game where you built a tower of out blocks and then see how many you can remove before it falls over. Think of the way your Grandpaw loads his pickemup truck and you’ll get the idea.)

@Lord Blankfein-

Seems like a great time to buy! With an unprecedented narcissistic cheeto in the white house, and deregulation working it’s way through the system again, on what was already a completely manipulated / over-valued market.

@jt – For some of us housing remains just out of reach, and the hope is that a pullback will let us catch up. For example; the homes my wife and I couldn’t afford in 2014 are essentially the same homes we can’t afford today, and our annual income has gone up over $70k in that time. To be honest, we’re starting to seriously consider moving somewhere else.

If they are out of reach, then that is the way it is. Just remember, as long as you are alive and your health is good enough, you are winning, and winning big. Owning a home in a great area is a nice thing, but being alive and well is what really matters. Your best move is just to enjoy your life and events unfold such that you can buy in the future. And if that never happens, so what.

I agree, and until there is a job-loss recession of major proportion, I dont see how home prices will take a nose dive. Of course, in the ups and downs of the ekonomy prices will perhaps fluctuate 10% around a mean. I purchased my home near Culver City for $470K in 2012. Similar homes are now selling for $725K.

Don’t forget what triggered everything last time. Credit markets froze. Then banks started closing. Then companies started laying off. Housing market collapsed.

The only way credit markets loosened again was the Fed bought 4 trillion dollars of bonds and it reflated everything. Now they they talk of reversing course. Raising rates and even selling off some of that 4 trillion.

It is easy to see this economy is a house of cards.

“You would be better off buying today”

LOL, HAHAHAHAHA ……who the fuck can afford a $1,000,000 house? That $700K house with bars on the windows is completely out of reach for me…..not even close.

I can afford a house in the $170K range.

A million for a house? In Santa Monica, you have TOWNHOUSES (actually, townhouse style CONDOS) selling for $2.2 million: https://www.redfin.com/CA/Santa-Monica/941-11th-St-90403/unit-1/home/79038509

I jeered over a year ago that SM townhouses were selling for a million. Today that seems a “bargain.”

I can’t imagine paying $2.2 million to share a wall with a neighbor, and to not even own the land under your townhouse. Being a condo, you at most have a “shared interest” in the land with the other condo owners.

It won’t happen because interest rates are no longer going down. The real reason housing has been exploding is the coordinated effort around the world to use ZIRP to expand the money supply. Now that those days are over, the bubble will begin to pop.

I think I’m older than most people replying to this article. I was an adult in 1982 and saw the runup in housing in Japan. I’ve lived in four countries in my life and have seen two major housing busts and believe me, 2008 and after was not a bust, just a correction. And for housing, it wasn’t even a big correction. I bought a house in south San Jose in 2009 (for cash) and sold it in 2015 for roughly double what I paid. I got lucky but I also rented in SJ from 2004 to 2009 because I refused to pay the asking price on any of the crap that was available for sale. I now live on the east coast in a house bought for cash.

A house is a place to live, not an investment. A car is not an investment but an expense. An investment pays you, often. Anything you have to pay to keep is an expense. Since a house doesn’t pay you, it’s an expense and a big one at that. Professional property managers know that upkeep is 1-3% of the value of the property per year and it comes in lumps when you can least afford it. Air conditioners and roofs break in a lump, not 1% a year. So the cash demands may be infrequent but large and average out to the 1-3% range. Where you sit in the range depends on the type of construction, the local climate and regulations, age and even luck. Buying a house as an “investment” is a sure fire way of identifying mental deficits in the buyer. Single family housing rental is dominated by amateurs who can’t count or calculate ROI. That explains why there are no stock exchange listed firms with a 50 year history of making money out of single family rentals. Apartment complexes and shopping malls cost enough to keep the amateurs out of the market so the pricing is more realistic.

When a family buys a house the only number that matters is the monthly payment. Long term falling interest rates make for a booming property market since ‘housing only goes up’ in most peoples very short memory and very limited experience. Falling interest rates or exotic mortgages make it possible to sustain higher capital costs for houses as time passes since the payments, as a fraction of average income, remains fixed. In Japan, housing prices and costs went up for a long time leading to an affordability problem in the middle eighties. More and more exotic mortgages showed up to ‘help affordability’. I remember the multi generation mortgage where a family supposedly bound their children to pay for the mortgage on the family home over a 100 year period. Everything to bring the monthly payment down so the game can keep on going. Same was true in the Bay Area in 2002 to 2008. At some point the land under the Imperial Palace in Tokyo was supposed to be worth more than all the real estate in the USA. A parking spot for a car sold for around $100,000. Property never goes down in Tokyo, right? In 1989 they had a small problem with the stock market and the cracks appeared in the real estate market as well. For twenty consecutive years prices dropped. Most people leaving high school in the 90’s know that a sure fire way to lose a lot of money is to buy a house in Japan. They tried to re-inflate the bubble because the banks have loans secured by property and banks ‘need protection from a declining property market’. What they have now is a mountain of debt in the government and in the hands of private individuals to the point where it is killing the economy. What remained true during this time is that lots of people went broke owning property and being forced to move. Selling at a loss is no fun whatsoever. Have you seen people in the bullet trains traveling two hours to go to work, each way? Guess why? They have a choice of traveling everyday to where the work is or to go broke by selling a house they paid to much for. Fun that. Moving means going broke. Working means traveling. Not working means going broke.

Being frozen into a house due to a declining market is ugly. My assistant in the Bay Area bought a house in San Jose in 2006. Her husband lost his work and found new work in San Francisco. He travels an hour or more everyday. In 2012 the house prices reached roughly the same level they were at when they bought the house so they sold the house for a small loss and bought another house midway between her work and his work. Guess what, he now works in Santa Cruz and their stuck again.

In most countries where I’ve lived or worked mortgage interest rates fluctuate with general rates and have very wide limits on the fluctuations. The US is almost unique in that you can buy a house with a fixed rate mortgage. Most people are exposed to varying expenses on their properties when interest rates change. In almost the entire world property owners have, for two decades, had the luxury of declining rates. Interest rates are now near zero and can’t go much lower. That means that from here on the trend will be up. I’m not claiming rates are going up quickly or immediately or by a lot, just that the trend is up. That means that interest will make up a bigger portion of the monthly payment in the future. If this happens faster than the general increase in income the only thing that can move is the capital cost of houses. That is a mathematical fact and the movement will be down. If I could time this, I would be rich soon but I can’t and I believe no-one can. The trend is not in dispute.

The mortgage rates are now even lower than they should be (in a normal market) since the rise in prices have insulated lenders from losses because properties that sell because of mortgage distress don’t cause capital losses. The risk premium built into mortgages is absurdly low because of this. So is the required down payment. Lenders are not in the business of making capital losses. They try to make sure that the borrower bears the loss by lending only such an amount as are guaranteed to be recovered even if the borrower were to default on the first payment. Since the house humpers demand 6% commission to operate an overpriced taxi service and help in filling out a few forms, the bare minimum down payment should never, ever be below 6%. Add legal fees, carrying costs for a few months why foreclosure happens and you easily get to 10% cost of a transaction. In ‘normal’ circumstances about 1% of mortgages go bad due to ‘life events’. People die, lose their work or income or get divorced and the house payment is no longer a first priority. That implies that the risk premium on a mortgage should be around 1% over the cost of money for the lender in order for the lender to break even. (I’m simplifying a bit.) Since nobody works for free the lender want to make a profit so he may want 3% over his cost of money to leave room for profit. From this 3% he has to pay the fees of the money changers, the paper tigers that process the paperwork, the cost of sending statements, marketing to stay in business and above all, the costs of things that go wrong such as fraud and non-payment. Their isn’t a whole lot of room to maneuver and still come out ahead on the margins of lenders.

Imagine what happens when they start taking losses due to changing market conditions such as houses that sell for less than the outstanding loan. The very first thing is the risk premium will be adjusted upwards to cover the new level of losses. The second thing to change is the down payment requirement will go up. This has an immediate effect on the resale value of houses because the amount of money per month to pay for the house hasn’t moved. The price has to come down till the arithmetic balances. That’s the only thing under control of the buyers. For the sellers that may be a shock that they don’t receive bids over the asking price. For a while they will get over the shock, eat some humble pie, learn a life lesson and sell for ‘less than its worth’. (Ha-ha) In the next round, things may be worse yet. Needing to sell because the job has moved elsewhere may no longer be an option since the outstanding loan amount is larger the offer prices plus other savings. If commuting is not an option, default is always an option. In 2009 and 2010 people in Sacramento bought another house while the first house was in the market, often within a mile from their existing address, and defaulted on the first house. They could do this because housing prices had halved and the lenders had not caught on. Next time round it will be much harder to do. Since the default came after the new house was purchased the credit bureaus couldn’t help the lenders catch this maneuver.

The 2008 correction got rid of some of the worst excesses in the market but it did not even come close to being a bust. This is partly because the US and Canada has been the ‘beneficiaries’ of hot money out of China and India going into real estate. When the US and UK market turned down, Canada and Australia hardly blinked. We never got any of the knock on effects that normally come with property price reductions. This time will be different because interest rates will rise globally to cover losses in loans. It will affect existing owners (outside the US) almost immediately and generally put downward pressure on prices for almost everything but specially commodities and farm products.

When prices come down the willingness to pay top dollar for a crapshack will disappear over time. People are very loss averse and the prospect of losing money is a disabling event for many, many people. It is the reason why so many people lose 40,50 and 60% of their money in the stock market. They can’t stand the idea of realizing a 6% loss and hang on and hope for a recovery while the prices keep dropping. This is the exact same way in which people ended up commuting for hours per day. They bought where it was ‘affordable’ and traded mobility for fear of realizing a loss. Once a property has depreciated for 20 years the hope that it will make a comeback fades away but the commute remains. The value of real estate will probably decline way below its rental equivalent due to fear of loss.

If you want to buy a house to live in realize that its an expense and if it makes money over time that’s a bonus. Be prepared to lose money and making bloody sure you can get out if you need to. If you buy for cash (I know its not always an option) then declining or rising prices just affect the costs. I don’t care if all housing prices decline by 80% or rise by 200% as long as I can sell here and move there into an equivalent property. That’s because I’m buying a roof and walls with room for my family and our toys. As long as I can trade it for a similar house in a different place I really do not care ‘what its worth’. When my viewpoint becomes widespread housing is priced normally, a necesary expense and not an ‘investment’.

“A house is a place to live, not an investment. A car is not an investment but an expense. An investment pays you, often. Anything you have to pay to keep is an expense. Since a house doesn’t pay you, it’s an expense and a big one at that.”

I prefer to think of it as forced savings with a negative return 🙂

@Credit Bear:

Agree that 99.9999% of cars are not investments, unless you own a vintage Ferrari, Porsche, etc. Even then, these cars need maintenance, proper storage, insurance and selling them and be quite costly (especially if you go an auction).

Houses (especially in areas like Socal) need to be thought of as investments. Shelter is a basic human need, so you either own or rent (there is no middle ground here). Most Americans are awful savers and their house will likely be their biggest asset come retirement time. A home that is cash flow positive is a great thing…in 20 years when it is paid off, it is all gravy (collecting monthly rent can be viewed as an annuity in your retirement years). Leaving your heirs property will also make life much easier for them. And then there are the countless tax laws and things such as Prop 13 that clearly favor home ownership.

When prices dip, I plan on picking up a beach close rental property in the South Bay if the numbers make sense. Having a well diversified portfolio is essential…stocks, bonds, precious metals and RE should all be part of that.

All the things you mentioned can be applied to any investment asset.

“Houses (especially in areas like Socal) need to be thought of as investments.”

You continue to dismiss the basic premises of investments: liquidity and low maintenance. Neither applies to real estate.

“Shelter is a basic human need, so you either own or rent (there is no middle ground here). Most Americans are awful savers and their house will likely be their biggest asset come retirement time.”

Investment 101: Buy low and sell high. Most here are against buying HIGH, not outright buying.

If Americans are awful savers, then they shouldn’t count on saving anything for their retirement, period. The rise of HELOC’s and reverse mortgages are proof of that.

“A home that is cash flow positive is a great thing…in 20 years when it is paid off, it is all gravy (collecting monthly rent can be viewed as an annuity in your retirement years).”

Cash flow positive in 20 years? Not when many use HELOCs and reverse mortgages to make ends meet or to buy luxuries. Even then, many in CA don’t stay in the same place for more than 5 years.

Good investments don’t require a 20 year wait. Stocks pay dividends right away. A company that expects 20 years to make a profit will be out of business within a fraction of that period.

“Leaving your heirs property will also make life much easier for them.”

That can be applied to any asset for which you can leave a will.

“And then there are the countless tax laws and things such as Prop 13 that clearly favor home ownership.”

Many asset have favorable tax codes, i.e. 15% tax rate on stock sales profits. That is why the rich invest in assets.

@POH,

Can you live in any of your other investment assets?

That is all!

@LB

Not liquid. High maintenance. No cash flow. Hence, one’s primary house is not an investment.

Not an investment LOL

Primary residence are the largest investment class in America

Not liquid? Have you ever sold a home, you can be pending in a few days and cash in hand in 30 days.

Home ownership is a key part to a diversified investment portfolio.

You have to be brain dead to even try to argue against this.

Renting is not the key to wealth LOL

“Not an investment LOL”

Another NTS post. I just get giddy in anticipation of reading your usual nonsense.

“Primary residence are the largest investment class in America”

Looks like you’ve read one too many real estate brochures. It is one of the most costly consumption items for sure.

“Not liquid? Have you ever sold a home, you can be pending in a few days and cash in hand in 30 days.”

That’s the exception, not the rule. Considering the 4+% commission and any remaining liens on the property, and that’s one heck of a transaction cost. You want to see how quickly I transfer the proceeds from a dividend or a stock sale to my account for 0-$20? And that’s the rule, not the exception.

“Home ownership is a key part to a diversified investment portfolio.”

Your primary residence is not liquid, has high carrying costs, produces no cash flow, and appreciates slowly (1-2% is historically the norm) relative to other forms of investments. Traditionally, its value increased by. If you’re that desperate for it to go high in value in short time, then you’re house poor.

“You have to be brain dead to even try to argue against this.”

Looks who’s talking — the poster blindingly spouting real estate marketing hype.

“Renting is not the key to wealth LOL”

Neither is your primary residence. And the money you saved from renting gives you a better chance to invest and build wealth.

You probably spaced out after my second sentence. Not unexpected.

I am young but have been watching the housing market for many years. In 2012-2013 I remember seeing a newer (less than 10 years old) 3 bedroom town house in North Hollywood for under $300,000 and thought it was a great buy. Unfortunately I was in college and was working as an intern. I know that time has passed but will return someday. Patience is a virtue. Save your money and enjoy your life.

Regardless, I do not believe anyone has become extremely wealthy buying a single family home. The down payment ties up your money that could be better served starting a Facebook, Apple etc. All started in a garage/small apartment with limited funds. If you focus all your energy into buying a home you are missing many opportunities this world has to offer.

When the Doc says “house humping” that is exactly what it is. They are too busy screwing that they throw all logic out the window.

That’s it! We’ll all just go out and start Facebooks and Apples! How come we didn’t think of this? Thanks, Manbearpig!

Actually, for the little guy, from what I’ve seen, the best bet is to buy a place you can live in AND rent out, like a duplex or a house on a big lot you can put a 2nd house on or something. You essentially have tenants pay for it all. As you get things paid down, you can loop your money around into a house for yourself so you’re not living with tenants in your hair all the time, or buy a second live’n’rent and rent out all of the first one.

I agree. 100K (or 20% down payment at today’s prices) would represent the life savings of many middle income households. If most professional investment advisers recommend against parking so much into a single stock at the heights of the stock market, why do it with a single property at the heights of its market?

When buying a house, I’d make sure that I have enough savings left over for financial flexibility (emergencies, job losses, or another buying opportunity). For many families, today’s market is not conducive to this.

Making money in CA RE doesn’t require much intelligence. Buy in a decent area and hold for the long run. It’s that simple.

Becoming the next Apple or Facebook will require over the top intelligence, luck, timing, etc. And where are you going to live while starting the next big thing? In a van?

“Making money in CA RE doesn’t require much intelligence. Buy in a decent area and hold for the long run. It’s that simple.”

As the saying goes, a fool and his money are soon parted.

“Becoming the next Apple or Facebook will require over the top intelligence, luck, timing, etc. And where are you going to live while starting the next big thing? In a van?”

Or you could do what has traditionally been successful: graduate from college, get a good job, save up, invest in liquid and low-cost assets like traditionally has been done, and wait for the right time to buy a house. Anyone thinking that real estate is the key to wealth might as well gamble away their life savings at a casino.

“…Prime location in Echo Park…”

If this is an example of a “Prime” location, what on God’s green earth does “non Prime” look like?

Echo Park and environs is one of LAPD’s top 5 regions for crime increases in 2015.

Robbery up 77% !!

http://www.laweekly.com/news/heres-where-las-biggest-crime-increases-are-happening-6549370

it’s the illusion. Close your eyes and imagine what it “could” look like.

Now open them and be thankful you were unable to see it from the salesman’s point of view.

Excellent point! I’m guessing the barrios of Tijuana?

The kool-aid is being passed out with both hands. I think we’ve finally reached a boiling point as the grand majority of people simply cannot afford housing. Nothing goes up forever, let’s hope Trump allows this bubble to pop.

A to the M.. E… N.

I guess to each their own. As one born and raised in the L.A. area, who hadn’t lived there for years but was a frequent visitor, there was only one reason to live in So. Cal., the beach!!!! If you aren’t within a short walk or a 15 minute drive to the beach, there is no reason to live there! In fact, it would be quite depressing!

Having lived near the beach, it’s no longer like it used to be years ago. Now on weekends and during the summer, the beaches are packed and traffic and parking is a nightmare.

“So what if a young professional doesn’t want to buy and would rather invest in the stock market “?

Not too much luck either. The stock market is as inflated as the RE market. Just as an example, I checked this morning the Exxon stock and it has a PE of 44. If that is not the mother of all bubbles I don’t know what else.

The reseting of all this mania caused by 8 years of easy money will make 2008 a walk in the park. Trump has a really hot potato in his hands thanks to Obama and the FED. After the reset, the vast majority will be destitute (EQUALLY poor since they like equality) and the 0.001% who engineered this bubble will make out like bandits or will hang from lamp posts. My bet based on history is for the former.

none of this makes any sense. have a look at Caterpillar stock, it’s at $99/share, not that far from it’s all time high and it’s doing this with 49 quarters of falling sales……this makes no sense.

Speaking of the stock market, supposedly the Snap Chat IPO is going to be valued at over $20 Billion dollars!!! Snap Chat!? $20 Billion dollars!?!?!?! LOL!!!!

http://wolfstreet.com/2017/02/03/snap-ipo-not-just-toxic-financial-results-third-class-non-voting-shares/

and that $20 billion isn’t even the best part of that charade……they haven’t made any money and aren’t sure if they ever will.

We bought in a cheaper part of the South Bay in 2012. Pretty much hit the bottom and the house has almost doubled. Interesting part of our neck of the woods is that a house that gets listed at $25k over value gets no looks. A house that gets listed at value or $25 under value quickly gets bid up and sells instantly.

“…A house that gets listed at value or $25 under value quickly gets bid up and sells instantly…”

That’s because Walter Mitty fantasizes that he is a master negotiator. After all, he spends his days at Starbucks mingling with the hipsters and has browsed “The Art of the deal”.

Just wait until his new neighbors see his leased Mercedes in the driveway. They will all think he is an important rich person.

Next step: Idle conversation with the neighbors about the hassle at LAX and how it’s so cool to always fly private.

Yep from my observation, 2012 was the last of the “buy window” that was from 2009 – 2012. I’d place it more like 2009-2011. Where I was living at the time, places were going for a song compared to now. People were still holding massive garage sales as they were being evicted from houses they’d bought with liar loans.

On the west side of Los Angeles, even if you missed the bottom in 2011-2012, you could still have done well buying later. I’ve seen many $650k-$750k homes purchased in late 2013 to mid 2014 get resold recently for $150k to $250k more.

I do not get this secret obsession with owning the home. Even people who clearly see that prices are bonkers still secretly want to own the home. Why? Why?? The last time I checked the amount we spend on rent is lower than property tax + HOA fees + utilities would be for any decent house that we would want to own. Housing now is the way to “park” money and as result it is completely disconnected from reality.

I think the housing mania took center stage with the DOT COM bubble. Homes in San jose were going up faster in a year than I thought possible. Used to hear they were making 64 millionaires a month back then. So yes I think this played a part in this hype and then just continued on ever since.

Hey BA dude,

It’s funny, my wife and I were talking about this exact subject today. We’re at roughly $100K right now, have about $60K equity in a rental out of state, and might be coming into another $30K to $40K shortly.

So, what to do? Even if we have $200K, are we going to go get some shit condo for $600K? Fuck that. Do we move out of state? Maybe. I can’t decide where. Phoenix and Dallas sound nice from the standpoint of cheap housing and international cuisine / sophistication. But can I stand desert heat? I don’t know.

The southeast might be good. Haven’t been. Worried about oppressive humidity.

I could like Oregon if it weren’t for their massive housing bubble and the culture that’s a bit “eh” for me. Everyone seems to be in uniform up there, full beard with a beer t-shirt is mandatory. The downtown is a bit too tweaker/junkie as well. It’s like Union Square in SF, but worse.

There’s the midwest, but then you’re looking at cold winters. That might be the best choice.

I even try and figure out the safest place to be if climate change starts having serious effects quickly.

But back to your point, my wife thinks that perhaps we should just go to a suburb with good schools and rent a house. I think there’s merit to it because I’m not sure I want most of my cash going into a property… and then amassing major debt.

I think there’s a lot of us in this predicament. Decent salaries, but no f-ing way we’re getting a house in LA or SF.

Actually, in Dana Point and San Clemente, you can still pick off a nice 1950s built home on a quiet street in the 700s. How can you beat that? Just find a job in Irvine-ish, and you are set for life.

Another possibility is West Torrance. A smart buyer would try to purchase in the south-west part of the city, near the south Redondo Beach border in the 700s. Just make sure it is a quiet street. This would give you access to the South Bay, Airport, and WLA job markets for a song.

” my wife thinks that perhaps we should just go to a suburb with good schools and rent a house. ”

I call that chapter: “And Then the Millennials Grew Up”

When the hipsters and millennials move to the suburbs and have kids… it’s already happening… but give it 5-10 years and this will be bananas

“Phoenix and Dallas sound nice from the standpoint of cheap housing and international cuisine / sophistication. But can I stand desert heat? I don’t know.”

I had three relatives in Phoenix. All three hate it there, two have already moved to San Diego county, the third is counting the days until he can do the same. The heat is what got to them.

The hottest I’ve ever experienced was about 117 in the so-cal desert. When I got out of the truck and felt it, it was so ridiculous I had to laugh. Actually living in it, running errands, having the AC dry me out 23 hours/day (with the other hour spent walking between buildings and a 160-degree car), etc. isn’t something I would ever consider. They could give me a house and I wouldn’t move there.

I think that we should stick to renting. Long term rental prices would get back in line with income. It just cannot be the other way. Buying RE is now similar to buying gold. It is all speculative and not based on value. Renters on the other hand can stretch their budgets for some time but not for too long. Here in Bay Area I am already seeing signs of rental prices slowly going down from absolutely stupid levels back to moderately crazy.

@Mike: Lived in Phoenix for 19 years. Starting at about 2005, 2006 it just started getting hotter sooner (100s in April/May) and longer (under 100s by Halloween) At night it would cool off to 95 degrees and when we would wake up to drive to work it was a nice, cool 96 degrees!!! And then we started getting this giant dust storms called “haboob”, once a year, then twice and then three or more.

By 2013, we had enough. Sold our house (over asking, small bidding war) and moved to San Diego. Weather wise, it’s much better here than Phoenix. Price wise, prices are insane. But not as bad as L.A. or San Fran. But getting there.

So, we’ve been renting a house in the burbs of San Diego. 20 min drive to work morning and afternoon. Whereas in Phoenix we were commuting 45 mins each way. Luckily we have a reasonable prop manager/landlord and our rent has not increased in the past 4 years.

We watch home prices continue their upward climb and it just makes no sense how folks are affording to purchase million dollar houses being built all along the 56 and almost all other areas of San Diego county. How can salaries keep going up by more than double digits to keep up with the same increase in home prices!?

It just doesn’t make financial sense!

NoTankinSite,

I have no idea why you assumed I or anyone else here is a millenial (hint: I’m not). And quite frankly, I find these types of broad generalizations stupid.

Are you the same person as everyone else within a 5-year age gap from you? Of course not. I can deal with some types of generalizations as we have sociology departments for a reason. But “hipster” and “millenial” can include so many people as to have no meaning.

How many urban folk in the mid-to-late 20’s wouldn’t be considered “hipster” by someone? Not many.

Try Las Cruces, NM. Yes, it’s a desert, but serene. Living on the east side of the 25 hwy is better. The town is not too small nor too big. Home prices are at the lower end right now. It’s not like Lake Havasu where it stays hot throughout the night. It cools down enough. The nice areas are Las Alturas Estates (1-2 acre) and Shadow Run Estates (1-2 acre). If you want to live a little further from town with 2-3 acres, there are the Talavera Estates where you can have horses, etc. Beautiful views of the Organ Mountains to the east. White Sands is only 55 miles away. New Mexico State University State brings a lot of innovation to Las Cruces. Houses are affordable. Something to consider. A lot of people are just learning about this city. It does have poverty as well, like any city. Good luck.

Classic herd mentality. Buy when others buy and sell when others sell. That’s why there is only one Warren Buffetts in the world.

Even the great Warren Buffet was a little clueless on CA RE. Instead of buying one Laguna Beach house, he could have bought 20 of them. His returns would have been much greater than any of his stock investments. Would have, could have, should have…

Buffett takes calculated risks by diversifying his assets rather than sink everything into one risky bet. He is richer than any real estate mogul.

What are you talking about?

For Warren Buffet to buy 20 Laguna Beach homes would be equivalent to me going down to the liquor store and buying a 12 pack of beer. Pure chump change.

I agree with the previous post. West Torrance has the best value for the money 💰 in the south bay. It has schools that are equal or even exceed other local Bay Area schools in terms of academic excellence. It also has quiet streets, a mall and a superior micro-climate (i.e. less foggy) than locations a little bit west. The low price for homes in West Torrance, especially less than 2 miles from the beach, is an astounding observation🕵

“What are you talking about?”

No, what are you talking about? Unless you’re Bill Gates, you’re not fit to question Buffett’s investment acumen. In which case, you wouldn’t be posting here.

“For Warren Buffet to buy 20 Laguna Beach homes would be equivalent to me going down to the liquor store and buying a 12 pack of beer. Pure chump change.”

For the equivalent of those 20 LB homes, he could have bought controlling shares in companies that would someday become or be acquired by multi-billion dollar organizations. Already, you’ve proven your narrow financial outlook.

Bravo! I’m hanging on to my rent controlled apt which essentially is a monthly property tax bill for a starter home. My husband’s pride is injured, as he’d rather prove to his social circle that he’s a provider and financially fit enough to be homeowner. But I cannot abide by that nonsense, take on the albatross of a monthly expense 4 times what we pay now and a crippling commute that would reduce my QT with my children to near nothing. Call me stubborn but I’m not going to throw in the towel and buy–essentially to pile into this rare cocktail of circumstances that has caused CA real estate to spike beyond affordability for the locals.

Milestone, hardly. More like MilLstone

As soon as everyone accepts that the economy – stock market, housing etc… are only going up from here, there will likely be a correction. Historical precedent being that the average bull market lasts no more than 8-12 years. Depending on when this got legs, we may have years to go before a meaningful correction happens. When it happens, I think it will be a la Japan, with the longest recession in history, where housing, wages, etc… remains flat.

So like everyone else has more or less said, only buy something if you are certain you are going to be there for at least 10 years, and are prepared to lose your down payment / be underwater for awhile. I imagine either/both happening would be really depressing. I feel like the strongest signal was the pull back on the luxury market / all cash buyers.

“where housing, wages, etc… remains flat”

inflation adjusted wages HAVE BEEN flat for 2 decades. the charts are all over the internet that prove that.

the workers income share of the economy as a % of GDP has been falling for 45 years, debt creation and ever lower interest rates have hidden that reality. We now will soon enter the flip side of that with 10,000 boomers a day being net sellers of assets….but sell to whom? The millennial with $50K in student loan debt? The rich immigrant?

I have said it before, the only people i know getting homes are the ones who inherit them…but that is just in my world.

I know of a high-income couple buying using an FHA loan, the toxic loan drug of the 2010’s. Guess what, delinquencies are jumping up among those loans. But since “all cash” investors have dominated the market during the current “recovery”, I’m betting that FHA loans will make up a small percentage of failures during the next downturn. But like the previous downturn, those subprime loans will be blamed once.

“FHA loans will make up a small percentage…”

Wake-up. Low DP and looser credit standards. FHA loans are underwater from Day 1. Figure minimum 7% sales costs. and FHA buyers are typically dim bulbs to start with (1st timers)

@QQQBall

Perhaps you didn’t understand my statements. I don’t believe in the viability of any toxic mortgage if the borrower has no long-term economic stability either. Many of them will undoubtedly fail. However, they represent a small number of risky real estate purchases during this current market cycle. Many were many by “all cash” speculators and REITs. That group is whom I believe will suffer the most during the next downturn.

“…where housing, wages, etc… remains flat.”

Why should housing remain flat? In Japan, RE prices decreased a lot over decades in absolute value. Adjusted for inflation, they lost more than 3/4. So much for the 10% corrections some pronounce on this blog. I see more of a bloodbath. You can not built an economy/market based on what the Chinese crooks can buy; at least not forever. Eventually, the gravity (fundamentals) will take over.

Even if it happened 5 years from now, a loss of a 100K down payment. based on today’s prices, would likely represent the majority of a family’s life savings. If a family spent 5-10 years saving that much up, what’s the rush in putting all into a single asset?

Absolutely, a bubble requires the very last retail buyer to go in before it can burst. And I don’t recall a single presidency ever escaping a bursting bubble in the past 3 decades,

A house is a work of art. Imagine living in an English Tudor home in Burbank with thick wall and ceiling molding and hardwood floors. The house will talk to you when the wood contracts, you will never feel lonely in this house. Tradition. Built when Cadillac came out with their 1926 Cadillac Series 314 V8 that will fit in the detached garage. Oak lath and thick plaster walls and ceilings with outside walls of thick redwood plants overlaid with thick stucco concrete. Just the house that can stop a M1921 Thompson .45.

HAH. Loved that last line.

in the roaring 20’s one had to be concerned about the “tommy gun” when there were fast Cadillac’s. Those were the days.

Houses are still selling quickly in my neck of the woods. I bought my house in the summer of 2013 for 540 and same model around the corner just sold for 689 (listed for 686). Sold in 5 days. Will housing tank? Nobody knows. Could be this year or could be in five years. I still think if the mortgage is close to what you would pay for rent, then why not? That was our deciding factor when we bought 3 years ago. For us, the price of owning was about $300 more a month over renting and what we get in mortgage interest deduction, more than makes up for that. For me, I like the security of knowing the landlord tells me I have to move.

Mortgage interest rate deduction are that important when rates are this low? Mortgage payments close to rental parity only IF you pony up 100K as down payment. Unfortunately for current RE bulls, many can’t or won’t afford this risky bet. Keep telling yourself that housing is hot while the grim figures don’t bear it out: lowest private homeownership rate in decades.

We bought our home last year for the same reason… rent is outrageously high. We looked at the cost of renting vs the cost of buying in our price range ($650k or less,) and it made sense for us. We have an FHA, put down 3.5%, and our entirely monthly payment (mortgage, pmi, taxes, insurance) is STILL $400-600 LESS than what we would pay in rent for an equivalent house in our area.

Ck

If you are so happy with your new purchase and confident in your savings figure why come visit us and even comment?

Only 3.5%, but the mortgage payment and associated fees are still hundreds of dollars below rental parity? That sounds more like the exception to the rule.

Meanbearpig, ignore reality and get back in your echo bubble

CK, there is no way….I would let someone else do the math. Something is way off on your calculation. Even if you put 20% down you cant even come close to rental parity. The market is so overpriced its just a matter of time until it all crashes down again.

CK,

That is good thinking… and guessing the loan is non-recourse.

Just one person’s experience here: bought a year ago and put down 200K (about 43% of total purchase price). I had 200k to spare because I’d just sold a condo for 150k over what I’d paid in 2012. I fully expected to become a renter again, and I only had about 5 weeks to find my next home. Geez, I knew rents in LA were high but the only one-bedrooms I could find that were under 2k per month had the bars on the windows, windows painted shut, some had no laundry onsite. It was depressing as hell. So I went out and found a townhouse with relatively low HOA dues and yes I have shared walls but it’s also a friendly and secure place, and now my total carrying costs are around $1950 for a 2 BR. That’s what it took to get below rental parity. Did I buy high? Probably yes. But I am employed and live near work so don’t spend much time commuting. The association only allows a small percentage of to be rentals, so my thought is to keep saving, because I can based on my income to housing cost ratio, and to just live with the decision I made to make such a large down payment, and own this place very long term, and maybe someday I rent it out for more than my carrying costs as it would be a very desirable rental. And I still save each month and when the next downturn happens, I just might be able to buy a SFH – maybe. However, I also fully expect that when the next downturn happens, all the cash investors and flippers will descend like vultures and I would have very stiff competition to purchase at that time. So if right now is like 2008, then the next 2011-2012 is a few years away. But no one knows, the economy and political scene is so crazy bonkers.

“However, I also fully expect that when the next downturn happens, all the cash investors and flippers will descend like vultures and I would have very stiff competition to purchase at that time. So if right now is like 2008, then the next 2011-2012 is a few years away.”

Except that history doesn’t bear this out. In the previous downturn, investors didn’t return until prices went down a good 30% and only after the Fed and government stepped with extraordinary measures. 8+ years afterwards, flipping is back but only after prices have doubled from the through. Debt is at an all time high, and you can bet that many of those “all cash” investors are levered up.

If those “all cash” investors are already levered up, where are they going to find the money to buy during the next downturn? What can the Fed and government that they haven’t tried or already not doing? As former Countrywide CEO Angelo Mozilo said, he has never seen a soft landing in 53 years.

“if the mortgage is close to what you would pay for rent, then why not”

not even close in my neck of the woods. Renting is far cheaper.

I wonder what will happen to that mortgage interest deduction when/if Trump passes tax reform and increases the “standard deduction” to $30,000 for a couple filing jointly?

Here in NW Florida it looks like housing is booming,new ones being built every day.Lots of you guys from the left coast are moving here where you can buy a real nice big house for a little over 200K ,

700K for a 940 ft extremely dated 2/1 in Echo Park??!?! Echo park is a toilet. It is basically New Tijuana, filled with illegals, gang-bangers, and homeless. I have seen prostitutes on Glendale Blvd numerous times. And that’s during the day. These weren’t the “Pretty Woman’ high dollar type, these were toothless crackwhores with flys buzzing around their mid-sections. Different strokes for different folks I guess. I know hipsters in Echo-Park that refer to the graffiti everywhere as “art”.

Out of curiousity, I searched for the cheapest house in Los Angeles. I found two houses listed at $260k.

https://www.redfin.com/CA/Los-Angeles/632-E-118th-Pl-90059/home/7321239

https://www.redfin.com/CA/Los-Angeles/1145-46th-St-90011/home/6921692

Unless you want to count this $100k house in Slymar (technically not city of L.A.): https://www.redfin.com/CA/Los-Angeles/13691-Gavina-Ave-91342/unit-400/home/103444939

But since it has $1,416 a month in HOA dues, it appears to be a condo, despite being an unattached house.

Son Of A Landlord: That $100,000 one is a manufactured house in a MH subdivision. The $1000 is the land lease.

Why that’s not mentioned in the ad is curious. I looked at a lot of the listings in that area when I was house hunting and just curious. Santiago Estates.

The most expensive listing is, of course, that $250 million house in Bel Air: https://www.redfin.com/CA/Los-Angeles/924-Bel-Air-Rd-90077/home/6830113

Runner up at $88 million in Bel Air: https://www.redfin.com/CA/Los-Angeles/10250-Sunset-Blvd-90077/home/6824684

And $85 million in Bel Air: https://www.redfin.com/CA/Los-Angeles/630-Nimes-Rd-90077/home/12264742

“Crap shacks look beautiful, freeway traffic looks like a deep tissue massage, and a 30-year mortgage looks like chocolate covered strawberries falling from heaven.”

Indeed. You know the insanity is peaking when they bust out with the shared appreciation mortgage again. LOL!

That’s been around for a couple of years

Trump effect on Ca is coming and will affect values. Dodd-Frank will be dismantled and banks will be more free to decide on lending. Presidents have large influence on banks and Trump’s dislike for CA politics will reflect in banks devalued appraisals of luxury homes in CA.

Also sanctuary money will dry up forcing even more taxes by the state to pay for these non-citizens. The result, a major shift in CA real estate and companies moving away, many of you may have a chance to buy a CA home the question do you want to live in a sanctuary state not supported by federal money and more rampant crime?

This going to be interesting shift and by early 2018 we will see if this TRUMP EFFECT REALLY DOES in CA and isolates it from the rest of the nation even more.

“do you want to live in a sanctuary state not supported by federal money and more rampant crime?”

Actually, California gets back less in federal money than they pay in taxes. Being the 6th largest economy in the world it would be a net benefit for them to stop paying federal taxes and not take the federal benefits. Funny how it’s all blue states that give more in taxes to the feds than they get back in benefits. Their money subsidizes all the red states with low taxes.

https://wallethub.com/edu/states-most-least-dependent-on-the-federal-government/2700/

really? California least dependent on the federal government? Lets see what happens when the next earthquake happens…….which is WAY WAY WAY over due……but in the meantime there’s this…..

Gov. Jerry Brown on Tuesday said the state is projected to run a $1.6-billion deficit by next summer

http://www.latimes.com/politics/la-pol-sac-jerry-brown-budget-trump-risks-20170110-story.html

“stop paying federal taxes ”

Ha! Try that and very soon everyone in CA will learn the hard way that they are simply serfs to the FED and their goons from IRS. They will learn once for all that in the last 100 years since the FED was created we live in a debt bubble. The FED was created by the banks and for the banks. The debtors are the slaves to the FED. The rest is just background noise of democrats vs. republicans – smoke screen.

It is funny that CA wants to separate themselves but forgot that the democrats supported the FED the mosts. Do they think that the FED will accept them living the plantation?

Living In Reality – It’s called “divvying up to help out the retarded kids”.

What exactly Trump effect is? Loud amateurs in high places? In that case prices of some stocks or real estate would rise quickly and high with subsequent crash and huge profits for hedge funds. In any case all politically motivated market participants on either side will be losers.

The Trump Effect can be summed up as GPE – Gold Plate Everything. Just gold plate all your shit. Hell, gold plate your shit. Make everything as loud and gaudy and shiny as possible, and all will be well. It’s the “impress the peasants” school of economics.

Good article about real estate:

http://economyandmarkets.com/exclusives/american-home-values-cut-half/?z=601216

Good article?

More like the biggest waste of time that will lose you money if you follow any of the advice.

Good old Harry Dent. He’s been right about many things and his premise is spot on. demographics is destiny and as I’ve mentioned already 10,000 boomers a day retiring for the next decade or more.

And they are going to sell all those assets to who? Explain that to me like I’m a 2nd grader and use pretty pictures and graphs if you have to….

But i think making a prediction is a fools errand, this will end sooner or later but who knows when….I certainly don’t

It must be hard for him to edit that BS marketing piece every year to say it’s the current year… I have more respect for Jim Taylor.

Great article. Thanks Flyover!

“It must be hard for him to edit that BS marketing piece every year to say it’s the current year…”

Exactly. But Flyover is new to the internet so I guess he gets a pass? Yet again?

“It must be hard for him to edit that BS marketing piece….”

Oh the irony.

I am amused each week at the housing junkies! Really, how silly is everyone? Reality is, many haven’t seen a decent raise in their pay checks for decades. I read that over 1/2 of all workers in California are’t covered by any employer sponsored retirement plan. The average Californian has over $5k in credit card debt, and I doubt most pay off their balances each month. Roughly 30% of Americans have no savings, and another 60% have less than $3,000. So, how many of your house humpers are technically house poor … i.e., you have nothing other than your house, you have no idea of how you will ever retire … oh the house is your piggy bank, you can’t pay all the bills or make minimum payments each month, and so on???? Really, be honest here. I’ll bet more than anyone would like to admit are basically slaves to the house!

If I weren’t renting and living below my means, I would say yes to all of that. I can’t imagine plunking down $100-200k and still having a $4000 month mortgage, and another $10-15k for an average 3br/ba construction in Irvine where they still have PLENTY of land. My expenses would easily double, and slight correction, not a crash would have me underwater for a decade in all likelihood, like the people who bought in 2005-2006 and are just now able to sell.

I bought in 1993. So I have great equity and a small payment. It wasn’t always like that. We struggled as the interest rates were high when we bought and my spouse and I were scrapping by with a new baby. I went back to work 8 weeks after I had the kid…no luxury of even 12 weeks off, we couldn’t afford it to make the mortgage nut. But the rents were on the rise then so we cobbled together a down payment from 3 relatives and bid on a bank owned property. It was a real fixer upper but good location and school district.

So don’t believe it was ever easy in So. Calif coastal property…it never was cheap, the purchase price was 4x our yearly combined salaries…which sounds crazy and for about 2-3 years it FELT crazy….but now we could sell it for easily 1.2 PROFIT.

So there you go…thats why you do it. And pray everything goes to plan. And now the mortgage has been refinanced (2 or 3 times) and the mortgage for a coastal bungalow is…$729 a month. I can swing that and sleep well at night.

i reckon you have one of those ‘advantage’ cards with the nice mountain scenery…?

4x income, wow that’s crazy, you were so lucky! These days crap shacks in bad neighborhoods are selling for 10x average incomes.

FYI, people aren’t buying them at 10x income they ar buying them at 3-4 times income,…

And so it goes. . And so it goes,..

Purchases prices 4x the Income…. It was basically a no-brainer to buy back then because it was so ridiculous cheap. Older generations had it so much easier and somehow screwed it up for their offspring. That’s why I strongly believe we need to change property tax laws. Millennials should not have to pay property taxes and older generations should pay based on market value… something like that. At least that would be an attempt to balance between generations. Right now, this market is discriminating young potential buyers. Hopefully, we get a economic crash never seen before.

I am not against Prop. 13. I believe it is very good. I am against the other owners to pay ten times more in taxes for using the same services. That is VERY unfair. That is crippling for the young couples who have to raise a family, save for college and for retirement at the same time. That is just extortion by force to reward the crooks around the politicians.

There is not a revenue problem for the state. It is a spending problem.

Look at Switzerland: Schools and infrastructure far better than US and $1,500 property tax maximum (yes, they do have excellent schools and fire stations). That is scaled down based on income. However, the Switzerland middle class does not have to support all the imperial wars fabricated by the bankers; and they have plenty of bankers, less evil than ours.

Flyover, you are absolutely right. I have relatives in Switzerland and everything you said is true.

I also think the younger generations should not be milked and deserve a chance. The unnecessary IRAK war should have been avoided. We would have saved 3 trillion$. Next time the economy crashes, dont bail out the banksters. If they are too big too fail they are too big to exist.

Older generations only had it easier in the eyes of millennials who want everything now.

Life has always been hard.

You need to put your head down and work for it.

If you are YOLO…. you can pretty much forget about home ownership and a stable retirement.

Brian, referring to your comment…’ It was basically a no-brainer to buy back then because it was so ridiculous cheap. Older generations had it so much easier and somehow screwed it up for their offspring’

1993-94 was not a period of time of confidence in the So. Cal. marketplace. There were literally 150 houses for sale in my zip code (90405) area. No one was ‘snapping up properties because they were so cheap’.

The aerospace biz. was leaving, Charles Keating’s savings and loans banks were defaulting back to the government, who set up a whole system to deal with the assets of the banks (remember the RTC? Resolution Trust?) and the interest rates were 10-12% There was no a sense of optimism…even in Santa Monica. Which BTW, was a little trashy on the South end.

So people who were buying were doing so with some trepidation. And indeed…my house value went DOWN for at least 18-24 months…that was a crappy feeling and we questioned our purchase that I was working tooth and nail to pay the mortgage on everyday.

@NoTankinSight,

“in the eyes of millennial who want everything now”

I admit seeing the economy crash and house prices go down by 40% is something I want now. But I am willing to wait another five to ten years until it happens. So, I disagree with you, I am actually very patient.

“life is hard. You need to put your head down and work for it”

No doubt about that. I worked hard for all the cash I have saved in the bank. That does not mean I have to buy an overpriced crapshack to support housing bubble 2.0.

“If you are YOLO”

I like that one. I had to google what that means. YOLO (you only live once?) Than I am as yoloist as they come. To me YOLO means not being a debt slave. Save your money and don’t follow the advice of boomers who greatly benefited from prop13 and affordable housing prices. Enjoy your financial freedom and travel. If you get the chance, live in another country for a few years. It will open your eyes. I studied abroad and lived overseas for a number of years. We have a brainwashed society here in California when it comes to housing. ReInflating bubble 1.0 is called a recovery. An highly manipulated market which inflates housing prices is a good thing here. I always asked myself why is it that employers want to know if you own a house or why your boss keeps saying you should buy a house. Employers want to control their employees. Being a debt slave is a great way of controlling you. You can’t shop for the highest paying job and move away that easy when you are tied to an overpriced crapshack. Employers do not want their good worker bees to move on to the next beehive who pays more. So by overpaying for crapshack it makes you stay put. If you sell a recently purchased crapshack you lose money if you try to rent it out you lose money. So you continue to be a good worker bee to make the horrendous monthly payment. Your employer wins.

“Stable retirement”

If you think buying an overpriced crapshack provides a stable retirement, please go out an buy! My boomer parents bought long before housing bubbles were in trend. They benefited from prop 13 and cheap prices. One day I will inherit it along with prop 13 taxes 🙂 so why should I waste my money by buying an overpriced crapshack now? Just to see my downplayment I worked so hard for vaporize during the next crash?

@GreenGroovyMom

First of all: for obvious reasons, a 10-12% interest rate would be the best thing for us. It does not help your argument at all. Its sad that I have to explain it but I will do it anyway. In a 10-12% interest rate environment house prices would not have been as inflated as they have during bubble 1.0 and bubble 2.0 (current bubble). Its of course better to buy a house for a much smaller price tag and higher interest rate than the other way around (savings on property taxes and smaller downpayment). You don’t have to worry about the high interest rates….you just refinance when the rates go down and in the meantime have a higher tax deduction when you itemize. You benefited from 10-12% interest rates. Your purchase prices was tiny compared to today and your already low property taxes are locked in thanks to prop13.

Second: you already confirmed buying in 1993 was a bargain compared to nowadays. You stated the purchase price was 4x your income. Today its more like 12times the median household income. Instead of acknowledging how lucky your generations was you brag about the profit you would make if you sell. You are directly benefiting from the housing bubble and want younger generations to massively overpay to keep this bubble going. Typical boomer mentality. Selfish, greedy and only interested in their own benefit. Screw the younger generations.

But there is hope for us….boomers get older and older and older….the expiration date is coming closer. Also, we might get that nice, big crash soon.

Brian,

I am a boomer and I agree with you. You are correct 100% in what you say. I did take advantage of those circumstances the same way I am sure you will take advantage when conditions will be better.

For me, I am not bragging because it is nothing to brag about. I just bought low and sold high. I never bought at the very bottom and never sold at the very top. I just got the direction right. That is enough.

When everyone will sell, you have to be prepared by living frugal and have financial discipline.

Brian: But there is hope for us….boomers get older and older and older….the expiration date is coming closer.

How pathetic that you base your financial hopes on the older generation dying off. People die at every age. You might die today. Over the course of my life, I’ve known people who died in their 40s, 30s — even as young as 19.

But if you want to talk odds … I’m in my mid 50s. My parents were both active into their mid 80s. My mother lived to 92. Based on genetics, I’ve another 30 years before I enter a retirement home.

Many of us Boomers have great health plans, and will be around for decades to come.

So you have a long wait, Brian. You might well die waiting.

@Son of a Landlord,

nobody said anything about dying. Boomers are between the age of 53 and 71 in 2017, right? Apparently they are retiring in droves….something like 10,000 a day. The idea is that when they “expire” permanently from the workforce that they downsize. The “hope” I was referring to is that these retiring boomers sell their large houses and move to retirement communities/homes or move out of state to get more for their buck. If hundreds of thousands boomers sell their RE in California to move away it should help increase inventory. Its wishful thinking and might not help the housing crisis at all but we will see.

Just to make it clear….i wish you a long, healthy life Son of a Landlord.

A person at, or nearing retirement might be smart to consider selling at, or near the 10 year height before the market turns course again, they wouldn’t have to even leave state, there are several 55 year old and up only, retirement communities in relatively nice places, including Irvine, Laguna Woods, Huntington Beach, etc.

We first bought in 1988 with similar circumstances. House was 7X income, interest rates were at 10.5%. we did it and were fortunate like you to ride the interest rates down so every couple of years, our payments actually declined. Good move vs renting at the time since rent rarely declines. Today, unless rates go negative or inflation and wages go wild, it may not be a good time to extend yourself into the same situation.

@Brian…I hear you that the trade off to huge interest rates was locked in low prop taxes and reasonable (4X earnings) purchase price. Im talking to the folks who think that is was ‘super easy to swing it’ in the old days. Even when 23 years ago was the old days.

That $3300 a month mortgage for a bonafide crap shack in 1993 did not feel ‘super cheap’…esp. since renting a parody home was about $1500/mo.

We all know the real price of low interest rates and no doc loans now….

The prior comment may reflect my conservative bias due to aging.

4X annual salary. You’re going to take heat for complaining about that since now it’s 10X annual salary on average. Order of magnitude difference besides the other extenuating circumstances like higher health costs, stagnating salaries, and schooling costs through the roof. Just to start. The world has forever changed in those 30 years. No parent can tell their child to just do what they did.

Sure they can. It’s called denial, and it’s one of the stronger human emotions. Heaven forbid parents realized they sold their children out by supporting (or not opposing) Prop 13, NAFTA, CAFTA, military industrial complex, deregulation, ZIRP, QE, etc..

Instead they saw their 401k’s lose half their values and demanded the bubble be re-inflated post-haste!

Mortgage and auto loan delinquencies are up. .

News from the housing (hosing) market

==================================================

The Story on Inventory

Limited housing inventory continued to push home prices up in 2016, but the year ended with positive news that might pull potential buyers into the market.

Home prices, including distressed sales, rose 7.1 percent from November 2015 to November 2016, according to CoreLogic, a leading provider of consumer, financial and property information. For regions struggling with limited housing inventory, Housing Starts may provide some hope.

Housing Starts Surge

December Housing Starts surged 11.3 percent from November, the Commerce Department reported. The welcome news follows a disappointing pullback in November and a nine-year high in October. For all of 2016, average monthly Housing Starts were the best since 2007. Building Permits, which signal future construction, fell short of expectations in December.

Existing Home Sales and New Home Sales followed a similar path downward in December. But the latest reports still had good news to share.

Existing Home Sales closed out 2016 as the best year in a decade, though December’s numbers were below expectations. The National Association of REALTORS® reported that sales in 2016 were 5.45 million units, above the 5.25 million in 2015 and the highest since the 6.48 million in 2006.

New Home Sales fell 10.4 percent from November to December. It was the lowest level since February 2015 and down 0.4 percent from December 2015. Although the news was disappointing, data showed a near six-month supply of new homes for sale, which finally signals a healthy balance between supply and demand.

Expanded housing inventory along with expectations of higher home loan rates in 2017 could slow home price gains.

For the many house humpers in SoCal, let this be a reminder on your housing will always go up philosophy..

https://www.wsj.com/articles/with-15-left-in-the-bank-a-baby-boomer-makes-peace-with-less-1487259894

All good points. Its amazing how everyone justifies mortgages based on rental prices. Wait until there is a real decent yield bond market again and people can earn 5% for doing nothing but buying a piece of paper.

Why is someone going to try and earn 4% on a single family when they can get 5% with no hassle or expense. The bond market on an international level is the linchpin under the rental and condo boom. Pull it and prices will fall. Single family homes are bound to follow.

If trump could actually squeeze china this would raise prices on consumer goods but export deflation in almost every other category including housing as their economy hit the skids.

I’m praying for such a recession. Many I know are fearing it. Fearing that their get rich quick scheme of buying high and selling low will evaporate and that the dreaded opportunity of working a job where people make useful things instead of shuffle paperwork and money.

“Its amazing how everyone justifies mortgages based on rental prices.”

Buying at or below rental parity is the golden rule for places like socal. As I have said many times, show me ONE example of this that has not worked out in the buyer’s favor. Many, many properties where at or below rental parity back a few years ago. Everybody should have thought about buying.

I remember the early 2000s where you could get a 5% return on CDs. I highly doubt we will see those rates in our lifetime again. The gov is between a rock and a hard place given events that have transpired over the last 15 years (adding monstrous levels of debt). I would welcome 5% rates on CDs in a heartbeat, most wouldn’t benefit since they can’t save a few bucks even if their life depended on it.

@freeandeasy

Or wait until the rent bubble during this cycle bursts. Already, many developers in overpriced cities are learning that there is little no demand for apartments at luxury prices.

Rental parity means squat when it requires a lifetime of savings just to meet the 20% down payment requirement.

To all the people waiting for a big drop … you just can’t tell when that happens. It could be prices are near a top and they will turn lower shortly. Or they might be headed up for years and years before they turn down. Truth is, no one knows.