More than one-in-five working age Millennials live at home: California has two of the top four metro areas with Millennials living at home

The kids are not moving out. The high cost of housing is having a big impact on the Millennial generation. In high cost areas you are seeing homes being sold to investors (including foreign buyers) and those that do buy as owner occupied tend to be a lot older than previous first time buyers. Even from family and friends it is interesting to see a few homes sold in their varied neighborhoods only to be turned into rentals immediately – these were very standard single family homes in neighborhoods where rentals were rare (not anymore). Yet another continuing trend is the number of working age Millennials living at home with mom and dad. Mom and dad are your typical Taco Tuesday baby boomers and are “shocked†that their kids can’t afford to rent let alone buy a home. Given current prices Millennials are not going to be buying in many high priced markets for years to come.

California leads the way

In total, 2.3 million adult “kids†live at home with their parents in California. Across the U.S. the total is roughly 10 million. So California as a percentage has more Millennials living at home than the nation overall.

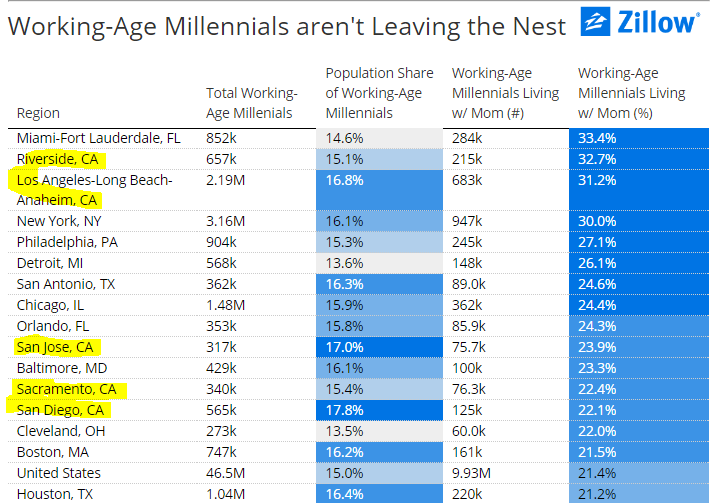

Take a look at the top metro areas where Millennials are living at home:

Miami has the highest percentage of Millennials living at home. This is followed by Riverside, Los Angeles, and finally the New York metro areas. So two of the top four areas are not only in California, but in Southern California. This makes total sense since Los Angeles is the most unaffordable rental market in the U.S. based on current rents and what families earn. In fact, there are only 4 markets were the percentage of Millennials living at home is above 30 percent.

And this isn’t a surprise since in L.A. a basic crap shack is selling for $700,000. In some cases you might be paying $500,000 for a box in an area with poor schools and high crime rates. Yet this is the cost of living in this market. So many Millennials just stay at home. They can’t even afford the current level of rent.

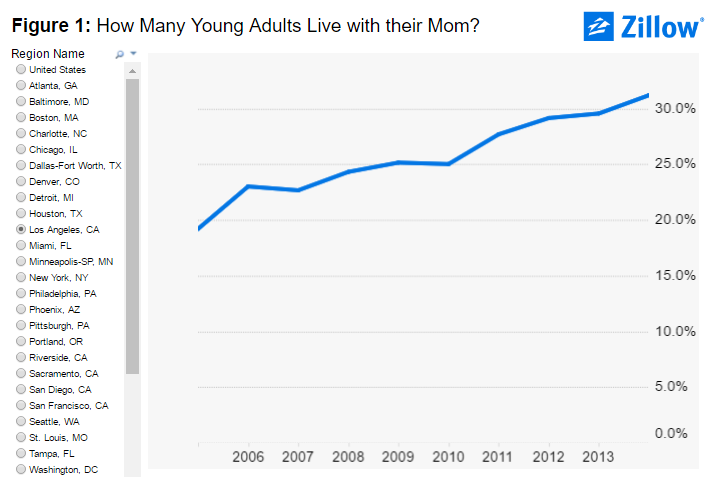

People ask how this is being done but it is very simple. More disposable income is going into housing and less of it to other consumption goods. The stats are startling in terms of how many L.A. households spend close to 50 percent of their income on rent. It is also shocking how much households spend on their mortgage payments. This is why I’m not surprised to see people living in million dollar homes shopping at the 99 Cents Store and also Wal-Mart – in many cases these people are house rich and cash poor. Yet they somehow can’t quit California and why would they? Many now have their kids living right back at home. In L.A. this trend has only moved in one direction:

So this brings up an interesting question in terms of how this impacts the market going forward. Does this matter? It does. People tend to forget that real estate prices are set at the margin. Some people might be surprised that sales volume is downright pathetic in California. The last time sales volume was this low was in 2008-09 when the market was full on imploding. Yet somehow, this is a booming market. Booming in price, not sales. The last bubble had booming prices and booming sales.

It is very interesting to look at neighborhood data in terms of mortgages. I encourage anyone to purchase a one month subscription to any mortgage data mining tool and scope out a neighborhood at the micro level. We did this for a Torrance neighborhood and of course the results are somewhat surprising.

Will Millennials drive the market higher when they get off the fence? Millennials were supposed to get off the fence a few years ago. Older Millennials are now creeping into their mid-30s. Not exactly babies. At some point you are going to have a sea of 40 to 50 year old hipsters unable to purchase property in California. Every couple of weeks I get an email from these “kids†asking about the process of getting the home with siblings when mom and dad eat that last taco. Say you have three kids and that $700,000 crap shack is to be split among the three. Each will get $225,000 to $230,000 depending on expenses (assuming an equal split) and that is enough for a down payment but can they cover the monthly nut? So far the evidence says no.

This trend actually provides more evidence towards the rental revolution trend. This is why builders are building multi-family units versus single family homes. Can’t argue with living at home rent free.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

131 Responses to “More than one-in-five working age Millennials live at home: California has two of the top four metro areas with Millennials living at home”

“…this is a booming market. Booming in price, not sales. The last bubble had booming prices and booming sales.”

I’m a little confused here, are you saying this isn’t a bubble?

He is saying that prices are high (bubble territory) while actual number of homes sold is relatively low.

If you go back to the previous bubble prices and sales were high as well. At least up until the end. Around late 2006/early 2007 sales started to drop off big time depending on where you lived and then prices started to tumble slowly after that.

Why things are different now is complex, there is no 1 simple thing you can point unlike in the previous bubble which was almost totally credit driven. This one got started with “vulture fund” REITs and investors who only started to back out of the market late last year I believe. Right now the market is being driven by credit as regular people have started to buy now that some of the crazier loans are being brought back all over again.

Right now its just a question of where the top is and what will signal that top. Will sales crater even further? Will foreclosures start to skyrocket 1st? Will the banks reign in the loopy lending and let the market crumble?

My guess is the banks will let things go on for as long as possible until another factor knocks the market down. I believe they know they’re going to get bailed out again. That seems to be about the take away lesson they learned based on how things played out last time and I don’t think Clinton will rock the boat too much at all in terms of economic policy where the banks are concerned either.

What will be interesting to see is if Congress (read: Republicans) approve another bailout. I think they will too. They know who butters their bread as well. The political fallout on both sides will probably be a real “treat” to watch as the economy gets dick punched again.

There is no bubble this time thanks to Fed and those that are buying long term bonds which are driving down mortgage rates. Add to the fact that you now compete with foreign buyers coupled with low housing starts and there’s your current market.

Low rates don’t matter if the home price is still too many multiples of local avg. wages. That is why when people talk about a housing bubble they’re referring to high home prices and not FED funds rate which only indirectly effects mortgage rates.

The 2016 average California home price is around $460K right now. While average yearly pay is about $62K for 2016. That means the average home price is about 7.5x the average yearly salary. About 3x average yearly salary is considered sustainable. CA always tended to go somewhat higher than 3x in the post WWII period but 7.5x is clearly boom if not bubble territory.

Its worth pointing out too that wages haven’t gone up much if at all in a very long time, certainly since the last bust ended in 2009/2010. It should be further noted that most job creating since the “recovery” started has been min. wage jobs which you have no hope of ever buying a house with.

And a mortgage rate of about 3.5% or so (which is about as low as you can reasonable hope to get even with 20% down and great credit + income DTI), while significantly lower than the historical average of approx 5%, isn’t going to make a approx. $400K home affordable to someone who makes $62K or less. Not even close.

Foreign buyers are only driving up prices in a few select areas, they’re not responsible for the all price increases that have been seen state or even nationwide these last few years.

You sound like Ben Bernanke circa 2007, and we all know how that turned out.

Good article

Flip goes from Bad to Worse: http://www.zillow.com/homedetails/2175-Loma-Vista-St-Pasadena-CA-91104/20873172_zpid/

I posted this Flip Gone Bad a while back. The house was bought last year for $840k, and after much remodeling, relisted for $995k.

The asking continued to drop. When I posted it, it was down to $879,800.

Now this Flip has Gotten Worse. It’s been relisted at $849,000 — less than $10k over what it was bought for last year.

When you included the costs of remodeling, and the holding costs, and the selling costs, this flipper is going to take a huge bath. Wonder if he used “other people’s money”?

I visited this house a month ago. One of the upgrades was a new swimming pool. But the pool was too short to swim in. It was deep enough for swimming and diving, but maybe three laps from one end to the other.

What idiot spends money on a pool that’s too short to swim in? The backyard was certainly large enough for a properly sized pool.

An ameteur who probably forked out $30,000 to attend one of those flip and get rich “training camps”.

Does the city have a bizarre loophole for childproof pool fencing based on size, or maybe a recent water restriction limit? Any other reasons would just be sheer stupidity.

This is a great example of overpaying to get a “deal”. Flippers should be looking to pay no more than 80% of the after-repair value, and even that is stretching it. That leaves you with no room for error. A better price would be 70-75%. Then you can afford to make some mistakes, absorb any cost overruns or extended hold times, and still make a profit.

Has it been delisted and relisted? MLS shows the current listing active as of 5/20/16, but the last purchase date is a year before, 5/19/15. If that’s right, they just passed the year mark of owning that flip?

If they have, to me that’s borderline fraudulent to the average consumer to who doesn’t haves access to an MLS and the details. To them, they just see a house listed 5/20/16, nothing of its history and troubles getting sold, which gives them an advantage during negotiations.

I’m unable to afford in the neighborhood I rent in (South Bay) and have come to despise flippers who just increase neighborhood comps nonstop. I wish they would all lose money on every flip they attempted.

Uh, you seem a bit confused. Flippers don’t increase the comps. Buyers do that. All the flipper does is take a crappy house and upgrade it. The comps don’t increase unless someone buys it.

All you need is one buyer to screw up the comp in the area. Foreign buyers have done that throughout So Cal for the last several years, thank you very much.

Foreign buyers only started to become a major factor in the US mid to late last year and even then only in certain areas. The reason why is many of these foreign buyers were Chinese businessmen and officials trying to get what money they could out of China and overseas where it couldn’t be confiscated.

But China really started cracking down on those guys so they can’t get money out like they used to. At least to the country that was initially seen has most desirable for them: Canada. That country now has a bigger bubble on its hands the US had back in 2006 which is likely going to start to bust over the next couple years.

But back on topic: the Chinese still however have some limited success in getting money out to the US so that is why they’ve transitioned to buying in the US in a big way recently.

But now even that path is being cut off as China gets better at cutting off the overseas flow of money. They had a cash outflow literally in the tens of billions per month for a while and now its been cut down to far less than a billion a month. Maybe only a few hundred million or so which is very manageable for a country with a economy that size. Even to places like Australia the money is being cut off. Which is of course going to effect their housing bubble as well.

Kind’ve ridiculous situation really.

Thanks for your work. I enjoy your blog. Usually I agree with you but in this case we have different views. Clearly the issue here is the mindset and income of Millennials since the % is the same in Cleveland and Detroit. Some of this is because wages are depressed for millennials since the boomers have sucked the system dry and left nothing for them. Second they are very immature and stunted in development – people who are 28 think and act like they are 18 and as long as you keep living at home you don’t fully know what it is to be an adult.

Great comment.

They talk about the poor who live in developments as generational poverty. I guess the next class will probably fall into generational Millenials. Never able to leave home for any excuse.

One of my friends is late 20’s and he couldn’t afford the rent and moved back home with mom. But, he still goes bar hopping every weekend and sometimes weekdays, after work. As well as constantly eating out.

Guess this is why he couldn’t afford the rent!

Agreed, I am 25 and live in a decent 1 bedroom but I have a lot of friends who still live at home. They use the excuse “I live at home” to justify their shopping sprees and binge drinking. I used to live at home during college and I believe that is when I spent my money the most foolishly. Once you are on your own you gotta grow up real fast or they will cut off utilities lol. Two of my friends (who are brothers) just moved out and they are 28 and 30. There will be a huge shortage of leaders in the future if my generation cannot pull up the boot straps and pay for their own stuff.

Act like we are 18 at age 28? Come on….this isn’t anything any different then what the hippies heard from their adults and what 80s children heard from their parents. This is not about a generation that’s lazy. It’s about a generation that is broke because school cost are insane, the job market is flooded with available hands which drives wages down (supply and demand), and most that graduated (most) during the countries second worse economic crash. I’m not a Bernie sanders fan but it’s understandable why my generation flocks to him. The system has screwed them and they are blinded by a promise that it could be different.

Also, let’s not forget all of your generation folk that bought homes they couldnt afford and looked to little jimmy to help front the bill.

In Mexican culture, it is traditional for the children to live at home until they get married. This is why California has such a high percentage.

That, and also since they have to spend $600k to buy a starter nest. I wonder how many married millennial couples are living with family/roommates?

The point is the increase in change. I doubt the cultural makeup of Los Angeles changed to 50% more Mexican or whatever from 2006 to 2016.

We have been busy the last ten years. I produced five children in the last ten years. We also bring in our relatives legally due to family reunification priorities.

That’s great for you, although it still doesn’t mean L.A. became 50% more Mexican in ten years. Households of Mexican heritage may actually now have a lower share than in 2006 but I don’t care enough to seek out the stats.

Martha’s a troll, HC

Since 2001, more than 60 percent of babies born in L.A. County have been Latino. Most suburban cities in L.A. County have majority Latino populations such as Downey which is 75% Latino–most overwhelminglyfrom Mexico.

http://www.dailynews.com/social-affairs/20150330/5-ways-los-angeles-countys-population-is-changing

http://www.latimes.com/local/la-me-downey-latinos-20150805-story.html

I don’t blame them for not moving out. Rent is too damn high! Once upon a time you used to be able to rent an apartment to live and get out on your own…before all of the speculators and investors wanted to make a killing on rent.

They are smart for staying put with their parents. Waiting out should prove useful in a couple years and they will be able to get out on their own. Hopefully they are prioritizing saving in the meantime.

If they were “smart”, they would have gone to college with the sole intent of getting an education in a field with high compensation… If that were the case, do you think they’d be living with mom and dad when they’re 28?

In addition to housing, education is far too expensive. Only a small percentage of the population (<15%) is cut out to be doctors, engineers – those who build society and command good salaries. Most of the ones that are hungry enough to go that path come from poorer backgrounds, often outside the US or 1st generation Americans. Add on to that the drag of a vastly overpriced health care system and the odds are greatly stacked against ones success today – just as the elites want it.

As I always tell my kids…your choices of profession are going to be Engineer or Engineer. They all went to school as Engineers on career day.

corona,

Engineering is a shit job now, I’ve been in engineering my whole life and my entire industry was gutted and shipped to China so save a nickle a part. I’ve even heard engineering referred to as a “commodity job” and most companies are doing all they can to import every HB1 visa holder to reduce incomes. If you wanna go work at a defense contractor you can make a pretty decent living in engineering but then again that’s just corporate welfare in disguise.

As it is now I’ve not been able to raise prices for over 20 years…..that’s right i earn the same money i did in 1997. There is no fucking future in America if you play by the rules, if you lie cheat and steal you may get ahead but if you are honest and live within your means you are a sucker and a fool.

i personally know a couple who bought a house they couldn’t afford and when the shit hit they fan in 2008 they lived mortgage free for 48 months all the while the property taxes were paid. When they did finally have to move out, the moved back in with mom. Mom just died recently and now they are living rent free once again…..no, these people do not have jobs.

nice gig, if you can get it.

p.s. most people i know don’t have jobs but have the inheritance house.

@junior_bastiat, I came from China around five years ago to attend graduate school and became an engineer working in a large IT firm in Culver City. Being an engineer is tough, man. I don’t think many American kids want to be engineers. If I were an American, I would not try software engineering as a major. You work on the creative projects but you get paid not much. My two best friends, one white, one Jew, live with parents or live in mom’s two million dollar vacation home. They are both way happier than me, even though they make little. I often say to them “I am so jealous of you guys.” At the end of the day, all you want is being happy and feeling fulfilled. What’s wrong with living with parents? I miss my parents.

@adam – you are right, most americans are too soft to be engineers. They don’t want to put in 50-70 hour weeks, they want to live on instagram. Even when I was in college in the early 90s most american born students didn’t have the desire – they probably had the ability, but just weren’t hungry – they had it too good growing up. Now maybe because of my age I may have been in a sweet spot in that I’ve been able to work on a lot of interesting stuff and make good money doing it, and maybe those opportunities are fewer out there for the younger guys. Another aspect is that after about 10-15 years most “engineers” go towards management because they were likely never very good or didn’t like real work so if you make it past that mark and are good you become a rare commodity and don’t have to play politics because its your real output that gets you paid.

I always say be grateful for what you have and not dwell too much on what you don’t, so maybe you are benefitting from the increased salary and life experience in this country vs. China? Getting out there in the real world and living is superior in my view to living in your parents basement, no matter how good Moms cooking may be.

In this job market having a degree is no longer that big of a deal. Its not the guarantee of a job that it used to be at all.

I know plenty of people with degrees who have crappy low paying jobs outside of their chosen career path because that is all they could get.

Its also worth noting that most job growth that has occurred during this “recovery” has been in the minimum wage sector. There is still less blue collar jobs now than there was back before the bust occurred in late 2006/early 2007! Yet at the same time the population has grown as has the number of college graduates.

Its a situation that has created a sort of race to the bottom where employers now hold all the cards and employees have even less bargaining power than before. There are hundreds of people who’ll happily take your job for even less pay than you. So forget about asking for a raise or any sort of job loyalty since most everyone treats their employees as disposable trash now too.

Your only hope to move up the income ladder is to work just long enough to get some experience and then apply elsewhere for a higher wage. Even that doesn’t work all that well anymore. And its not a work pattern that is all that financially stable or locally consistent enough to justify buying a house and raising a family either.

In my opinion, I blame Glass-Steagall Law for being repealed. We are just living with the outcome of the mess and that is the speculation, which for the foreseeable future won’t change unless this law is re-enacted as intended. However, why would anyone want that if it would mean going back to fair valuations?

Older millenial engineer here wanting to throw in my 2 cents. I worked for a defense contractor in the San Gabriel Valley for 7 years and was ABSOLUTELY APPALLED by how many of my young coworkers lived with their parents. It must’ve been at least 40% although it felt like more than that. The cultural thing was a big factor. The asian and hispanic kids had no issue living with the parents and their parents were happy to cater to every need. Seriously, the guy who sat across from me still had his mom packing his lunch in his late 20s! If you don’t mind your parents and get to save thousands a month by not paying for rent, food, utilities, etc. why wouldn’t you live with them?

Most of these people did eventually buy and move out once they married. The engineering salary and savings from living rent free meant that they could afford to buy a 700k crap shack after a few years.

Had a door repair man guy out to the house I rent a few weeks ago. He was telling me how shocked he was at when he goes to jobs how many grown adults live with mommy and daddy. I have a few mommy moochers on my street. One a few doors down in particularly disturbing. Jonny boy looks like a meth head. Doesn’t work. Mommy bought the house last year she must be pushing 85 at least and can hardly walk. The house is a mess – guess Jonny boy prefers sucking on a meth pipe to house maintenance. Wonder if mommy knows her son is a loser or ifs she’s just another enabler.

If Mommy is 85, how old is her meth-head, moocher son? In his 50s?

Life is all about choices, and the millenials could choose instead to move to another state where they could still find a job and housing would be affordable. It’s a way to get started.

Right about that. Or even fly to a job and come back on the weekends. I did it so long I knew shuttle drivers, and others commuting by first name. Went to Texas from Michigan in the 70’s. Been all over the world. I refuse to be broke. Hard on the family but it’s better than being unemployed.

2010’s are not at all comparable to the 70’s economically speaking so your personal experience is waaaay out of date.

Hell up until the late 70’s wages were still growing in line with productivity and inflation! That hasn’t been true for over 30yr now! Going on 40yr actually come to think of it.

Once you factor that in suddenly its no surprise at all why most people 30 and under are doing so poorly financially speaking.

Moving is expensive and most of the states that have a lower cost of living also have few jobs that are usually only really open to locals and pay quite a bit less too.

It is not at all a viable solution for most people and for the few where it is maybe practical there is still lots of risk. I’ve known several people who ended up on street that way because they’d thought they would be able to land a job in a month or 2 and were instead out of work for nearly a year.

Who the hell can save up enough money to work and pay rent for that long? Especially when most people live paycheck to paycheck. Its a sick joke recommending people move out of state most time to work!

Sorry but it’s viable for all but the poorest folk. You’d be surprised what you can do when you stop make excuses for your failures and start giving yourself a reasons to succeed

This is why long term housing prices will always revert to being a derivative of local incomes. Once they lose that relationship (as they have in much of California), it is only a matter of time until there is no more greater fool to buy the home being sold.

I am a millennial who grew up in a housing bubble. So I moved away in my early 20’s. I couldn’t believe how much higher quality my life was with affordable housing in flyover country. Salaries were the same, job opportunities were the same, just that rent and home prices were a fraction of bubble prices.

I dont think any of this portends of a huge disaster coming. It seems that house ownership and demographics are changing slowly before our eyes… everyone is waiting for a crash but perhaps it is just a slow burn into a new landscape of multi-generational families, homeowners renting out garages and bedrooms and apartment rental fiefdoms. And the developers and city gov’ts will gladly cave into high density (more than 4 stories) apartment complexes.

I’m with you on this one. I’ve been waiting for the housing crash to hit for years but realized that it may not ever hit. The best case scenario is that they will stagnate for a short period of time then proceed creeping up. Look at SanFran during the housing crash of 2008. Prices did not come down but instead leveled out for a while then surged up again. This is becoming a state-wide trend now especially in metro areas. Millennials entering the workforce are opting to rent; fueling the demand for apartment complexes and foreign investors are exhausting the single family residential housing supply which in turn fuels that demand (although developers are opting to build multi-family units). There is no end in sight!

QE, NIRP, trillion dollar debts, bailouts, bail-ins, zombie foreclosures, ghost cities in China, lower wages, tech replacing jobs daily, cranes everywhere building multi-family units in every city, retiring boomers with nothing saved except their houses. Lots and lots of headwinds out there for housing. Nothing normal about what is going on. It will come down. It will come down in spectacular fashion.

The problem is more demand than supply. This is it.

Where it gets lost is people start arguing over how to increase the supply. Yes there are multiple reasons why the supply isn’t increasing and may never be increased.

I agree. The current model of development doesn’t seem to fit with today’s and future standards. I guess people need to get used to living with no backyards and have small porches in large cities as all land becomes more important for growth.

Water usage including pools will soon become irrelevant due to the steady increase in density of available families. Not saying they will all go away but people with a budget will likely side with just a yard or portable pool than a full concrete one.

The last downturn was mitigated and ultimately halted by record cheap debt instigated by the Fed. If and when prices go down again despite record low rates, what will the Fed do to prop housing again? What investor who already isn’t saturated with debt or won’t be hurt by the economic landscape – most likely another “great” recession – will have the guts to step in and stop the fall?

I speculate that the FED or goberment will probably use some scheme to forgive college debt if you buy a house? Seems like a great up sell. With the HARP program why not institute a similar program to get rid of college debt or reduce in order to get millennials to buy homes?

Beware the ides of June!

It makes perfect sense to live with your parents until you marry. Having said that, it goes without saying that you need to be 1) educated, 2) employed, 3) saving like hell for a downpayment and 4) working so hard you’re never home. Then it can be a very positive thing to do. I know several millennials who live with their parents and they’re only home to sleep and have maybe one hour of face time. When the next crash comes they’ll be ready to buy. It seems like the only way it can be done.

When the next crash comes they’ll lose their jobs and then burn through any savings in less than a year.

Unless they happen to be lucky enough to work a job that pays high 5 or low 6 figure incomes which they then save the majority of because they still live at home. But virtually no one who makes that sort of money would do that. Its the people working minimum wage either full or party time who are doing that. And its most millennials who are in that situation.

I actually start believing that prices will never drop much. There will be a slight correction of 10-20%, but you will not see 50% off current prices. I am tired to live tight in my condo with two kids and will try to sell and upgrade to a single family home anyways. Life is one, I do not want to just sit around and wait until prices drop. I want to have comfort and kids growing up in a place where we are comfortable. Kids who live at home with their parents are smart, off course assuming that they work and save up for down payment. This is just how it is….everything is too expensive. I save on food and clothes, do not buy as much and do not go around the mall. What else is left to do to survive?

We are taco tuesday, it seems, complete with an adult son living with us. He just graduated from university with a BA and no debt (yay!)and nearing 30. We bought in 1988 during the madness. Our 1951 crap shack suddenly shot up – sold it in less than four hours – and we decamped across town to our present almost paid for 1963 crap shack two story. And yup, it looks like it is about the same as the peak in 2007, but unlike then there are a scant few for sale signs posted. I have no doubt we could sell and move out of state in princely fashion – there seem to be a lot of young quants with prams and Sienna vans on the prowl – but I my next project is to assist my son in finding an income that will allow us to pass the ranch on to him some day in the future. Oh yeah, that plan definitely includes him moving out for the remainder though.

If your son is nearing 30 why would he need your assistance in finding an income?

Be careful your son marries well (if at all), or else that house will belong to his ex-wife.

So we boomers sucked the system dry??? Check your demographic statistics. We boomers were the generation of zero population growth. Couples with more than two kids were fertility shamed. So what happened? We had smaller families, were able to return to the workforce sooner and had fewer child raising expenses. We accumulated wealth. Then tens of millions of illegal immigrants came. Reagan gave them amnesty. They were poor and had tons of kids. Then tens of millions more came. And had tons more kids they couldn’t afford but Uncle Sam took care of everyone. It wasn’t us baby boomers that procreated like crazy so now rents are skyrocketing because there are too many damn people! I’m not blaming the Hispanics, they simply took advantage of the easy entry and generous social service system, why wouldn’t they? But don’t blame the boomers for the fact that this country is going down the same toilet as Greece. The offspring of all these immigrants are now controlling California, they’re the new majority. Thank the new majority for the decline of quality of life in this socialist state. They brought their hell-hole lifestyle and political views with them. We baby-boomers are just as disgusted with the fact our kids can’t afford a house in Southern California anymore as the 20 and 30-somethings. I sure as heck didn’t vote for the the legislators running this state now, don’t blame me.

I think the influence of the Boomers on the economy is simply based on your existence, rather than your specific actions. I certainly don’t blame the Boomers (my parents,) but the whole generation is essentially a bubble that’s going to be popping over the next decade. Zero Hedge had a really interesting article recently that linked the Boomers with the P/E of the S&P that’s worth a read (sorry I don’t have the link handy.)

I think the author of that line might have been referring to our contemporaries on Wall Street, and other reptiles born around 1950. I have been maintaining for some time now that us baby boomers had one shining moment; anti-Viet Nam war activities. After that, it was follow the F.I.R.E. money….and a typically traditional (read predictable) descent into shear Babbit-ry. Result: societal bankruptcy and now Trump-o-mania. We allowed ourselves to be co-opted. We need to make it right for the kids.

You can add that the only baby boomers who have prospered since 1980 are the best paid members of the “salary class”- about 10% of the population if even.

The rest, including many STEM professionals, have either been hit very badly from the massive loss of high-wage blue collar jobs that disappeared by the hundreds of thousands in the 80s, and which bleeding doubled in the 90s forward. I can remember when the Los Angeles area in particular, was truly the Golden Land. It had hundreds of thousands of high wage jobs at McDonnell Douglas, Northrup, the shipyards at Long Beach, to name just a few places that employed tens of thousands of men in hundreds of different niches, and in which a guy who’d graduated high school and had a decent work ethic, could earn a high wage, while the housing in the LA area was as cheap, if not cheaper, than anywhere in the country. When they were built in the 50s, the famous little houses in Lakewood, CA were nicer and cheaper than the similar house my parents bought in the St Louis area at about the same time, while people who rose higher in the middle class could afford truly balmy lifestyles in the western burbs of Los Angeles, and the San Fernando valley was a truly good place to live.

Those days are past, were really on their way out in the 70s, and we’ll never see their like again. You must understand that the post WW2 boom was very anomalous in that we were a huge country with a small population, a lavish endowment of natural resources still in the ground then, and a manufacturing infrastructure that was almost new at that time.. and that we were spared the devastation that was the lot of Europe in WW2. We had NO competition. People of my parents’ generation, who are the people who truly benefited from this bounty, arrived at adulthood in an economy with a massive demand for labor and a shortage of able bodies to perform it. But the party was just about over by the time I and my age cohorts arrived at adulthood in the 70s, and by the 90s, we were losing good jobs and replacing them with crud jobs that paid half as well, while the “wealth gap” began to yawn. Most boomers never recovered the economic stability their parents enjoyed, and to which they thought they might aspire in the first decade of their adulthood.

But we have not truly digested the great shift that has transpired, as you can see from the three major presidential candidates, all of whom are old, and are married to the post-WW2 paradigm. They don’t get that what they consider “normal” is over and has been for quite a while now, and they will all sink us further into debt and possibly start another global war trying to recover the fantastic prosperity of the 50s and 60s, something that never lasts more than a few decades anywhere.

Laura: Bingo. Perfect post!

Boomers were the politicians and businessmen who enabled and exploited the invasion. Many boomers suffered mightily from it, so people have to remember that an entire generation can’t be painted with a broad brush. I know a number of good, hard working millennials, theres good and bad in every generation.

Seeing the system being looted via government pensions has to cause some younger folks to escape from the system rather than watch their life’s labor feed the corruption. Hell, I’m an Xer and I’m looking at possibly moving to another country at some point. Tired of the relentless cultural and economic decline.

Actually, no, boomers were not the generation of politicians and business people who enabled this, for it was underway by the time we were adults. For example, the off-shoring wave was foretold by 1965, when a group of people my mother worked with, who were in that year trying to raise money for a metal-plating company after the concern they worked for was bought out by a huge conglomerate and then shut down, were told that their business was not competitive here in the U.S. and that all such work was going offshore to cheaper labor markets. By the mid-seventies, when most boomers were still under the age of 35, the trickle was turning into a wave, and upcoming boomer politicians and business leaders fell into line with their elders.

This is not a generational thing, you see. This is a class issue. The stone fact is that business leaders never, ever wanted to pay anything like the kind of wages that were prevalent in the lush 50s and 60s, but they were up against what was, for them, a very unfavorable supply and demand situation, for there had been a massive “birth dearth” during the 1930s depression, and the generation that arrived at adulthood c. 1950 was a relatively small one, and the previous generation, born 1900-1925, was not huge…. at a time when our productive machine was running full tilt and very badly in need of bodies. Therefore, workers and the confrontational unions that represented them had a lot more bargaining power, and the large unions were able to keep both trade restrictions and immigration limits in place. During that time, both workers and the companies they worked for grew very complacent, with workers demanding, and usually getting, ever more lavish awards, while the major manufacturers, notably the automakers, took their market share for granted and produced every shoddier products.

By 1975,when the largest wave of boomers entered the job market, the country was hemorrhaging manufacturing and jobs, and markets for their products, too. I remember the 70s being depressed years, and when the economy began to recover when oil became cheap again in the 80s, our manufacturing did not, but continued to move away.

Laura, you’re right, the 1965 immigration act by the scumbag Kennedy opened the doors. I guess my point is that every generation has the opportunity to change things when they get the reins of power, and they do not. The monied interests and those that want to be in that group figure out ways to exploit the system and thats why we are in the sinkhole that we are.

Life quality here is great. Long Beach has beautiful weather and nice grocery stores. But in So Cal it is hard to meet genuine people, in my opinion. They are rare. Even my Jewish friends wish to move to Nor Cal or east coast. Most friends I met are from Nor Cal. I am stuck here because of my h1b visa and green card application.

Life is a competition. As I said I am jealous of my friends. However, I know I have no choice and I must survive. I don’t like an engineer job but I have to do it.

Most local college students here will not understand because of their decent childhood experience, which I believe we all deserve as a human being.

I don’t think it’s Hispanics paying cash for million dollar houses all along the Western coast. If it is, then how can this Hispanic get in on that million+ all cash action!?

No, I think you should be looking further west, I.E. China!

http://www.chicagotribune.com/news/opinion/commentary/ct-baby-boomers-american-economy-20151107-story.html

Strategery,

That article is a big pile of B___t.

The boomer generation is a name given by Wall Street to a number of people born between year X and year Y – an artificial construct. These people don’t know one each other, they don’t act as a group but each one individually is trying to take advantage of the opportunities available to them (no different than millenials or gen X, Y, Z) – all people act the same way. You would be an idiot or a lazy bum if you would not act the same way.

The globalist bankers who control the whole financial system and the media is trying to brainwash people like you to believe that grandma is at fault for your lack of opportunities today. Of course they would not tell you that they are the real reason for most young people misfortunes. They have the power to increase globalism or restrict it. They have the power to change laws. They have the power to restrict the size of the federal government who strangles the economy with taxes and over regulations. Your grandma does not have the power to change any of that. Of course you need critical thinking which the readers of Chicago media don’t posses.

Salary and jobs for the millenial are outsource to Asian countries, how they can afford to buy a house. They cannot demand high salary otherwise they will get fired in their jobs.

Housing To Tank Hard in 2016!!!! Sorry- just wanted to beat Jim to the punch on that one…

😉

Housing to tank, never…

“The new home sales report for April was very strong at 619,000 on a seasonally adjusted annual rate basis (SAAR), and combined sales for January, February and March were revised up by 44 thousand SAAR.

This was the highest sales rate since January 2008.

Sales were up 23.8% year-over-year (YoY) compared to April 2015. And sales are up 9.0% year-to-date compared to the same period in 2015.

Read more at http://www.calculatedriskblog.com/#YqZyx5OBvPwp3YC1.99

Housing to true end users tanking! Housing to money launderers and REITs with no care about outcome or local economies still going strong!

The scale of hot money fiat trying to escape devaluation is on a scale only seen in Tulips before. When it breaks, not if, the action on the courthouse steps will be furious. Cash on Hand will set the price, so stuff the mattresses with Tubmans, Grants and Benjamins.

If you want me to predict the when, I can assure you it will be they day after my bed catches fire, the way my luck goes.

Things are pretty jacked… In fact not only CA… but most of East and West… Oregon, WA, CO, is so freaking expensive to rent or buy right now. Unless you move to Nebraska, ohio your are F’d. I mean even TX in Austin and Dallas is crazy stoopid high.

Credit card debt is high for people, people paying 50-60% of income in Rent and healthcare, then have car issues… or overspent, they buy groceries with credit cards…

Going out to eat a burger for two is like 50 bucks now. I am sorry for the people who work in service, but I will not be leaving a tip anymore, maybe a buck. but Damn.

I’m a millennial, and NO I don’t live with my mommy. BUT I would if I could; saving the effing 40% of my income I pay for rent would nice. But even then I’d probably pay 15-20% of income in rent to parents as they are not loaded… just making it by. paying only 20% in rent is a dream…

Sorry to burst your bubble but I’m afraid there is no bubble bursting in the near future. This surge is real estate is unprecedented in a sense that the global economic conditions is what controls the housing market not solely the American economic conditions of previous housing booms and busts. Before, US unemployment and average wage governed the market but since the market is open to almost every investor in the world and since lots of emerging countries in the last few years are gaining an economic foothold, tons of foreign investors are flocking to the US to buy up as much as they can. Americans are no longer competing against each other but rather each other AND the new foreign players (who almost all have waaay more money than the average American). It’s as if minor league baseball just added a few more teams and they’re all former major league teams. It’s a COMPLETE RESTRUCTURING.

I’m beginning to wonder about the source of all this foreign money. it seems to be ever flowing and immortal. What if all of these foreign “investors” are buying American homes on margin? What do we really know about Chinese banks?

Complete restructuring… like no rules, no economic fundamentals and a whole lot of financial engineering, debt and corruption.

The Japanese thought the same way when they embarked on their own U.S. property buying binge. Only trails of tears remain from this 30-year old mania. Current foreign investors are not any more savvy buyers than their predecessors were. The list of Chinese investors losing money chasing bubbles is making headlines all over the financial world.

as long as china is the manufacturing capital of the world, chinese buyers will have capital. the price of china real estate in certain cities are more expensive than los angeles and new york. in shanghai, beijing , shenzhen you are paying anywhere from 500 usd per sq ft to 1500 usd per sq ft, plus you do not own the actual land. china is also now starting to implement a property tax when they did not before. so with 99 year ownership, property tax , unstable / communist government the rich from china are moving their wealth anywhere except china. if you look at canada, austraillia, taiwan and some parts of the US chinese buyers have pushed prices so high where governments are now implementing taxes on foreign buyers. if you put yourself in the shoes of a chinese wealthy business man you rather have your money in the land of the free instead of a country that one day supports you and next day might kill you. in china when the new president took over 2 year ago he went after the old cabinet and jailed a lot of them for corruption, but the truth is the current president is tying up loose ends where the old cabinet will no longer be able to come back against his agenda. in the panama papers his relatives were listed with off shore accounts. this says a lot about the government in china. until china is no longer the manufacturing capital of the world or a large world recession / depression arrives the chinese have to much money to spend.

I wouldn’t doubt that the Chinese would continue to buy; Taiwanese were buying in Irvine over 20 years ago. What I doubt is the long term ability to overpay for RE to keep prices high indefinitely. Their economy is deteriorating, and the government is increasing capital controls. Corporate bankruptcies are rising, and the Yuan is being devalued rapidly. After the initial exodus, will there be enough money to sustain subsequent waves of capital flight?

Americans are no longer competing against each other but rather each other AND the new foreign players (who almost all have waaay more money than the average American).

That’s sort of how it’s long been in the Caribbean. A poor native population, unable to compete against all the rich foreigners who buy up the best beachfront property.

Most Caribbean nations and islands have a small, wealthy Native Elite, mostly in government jobs, but also in a few professions. They welcome foreign investors and tourists. The majority of natives are poor, low-wage workers, serving those wealthy foreigners, often in tourism jobs.

But unlike in the U.S., those Native Elites protect the Poor Natives from labor competition. I did some research, and apparently it’s pretty hard for foreigners to get a work permit in the Cayman Islands. Foreigners are welcome if they bring money, but they are not allowed to work there unless they bring a necessary special skill.

Here in the U.S., wealthy foreigners compete with natives in bidding up the best real estate. But poor foreigners also compete for jobs, driving down the wages of native low-wage workers.

Yet there are native born Americans who benefit, so I don’t see this ending.

I think another thing we underestimate is the number of families, or friends who pool their money together to purchase the homes. I can only imagine what the dinner/holiday conversations must be like, say, in China. And how many m/billions decide to team up to park their precious money overseas. Those smart realtors who speak Mandarin must be making a crap load of money.

I have $285K downpayment saved up, but I dont think its worth using it to buy anywhere in over priced Los Angeles.

I work in Culver city area, and not ready to commute 4 hours round trip by moving out to the IE or deep SFV…

What would a smart 30 year old millenial do in this case? I feel like I should invest in another state in the mean time, but dont know where.

what are the best auction sites for buying out of state property?

Thanks in advance for any insight from fellow millenials

Even if you do buy right now, there’s a pretty good chance you’ll be buying at the PEAK of the market. How much higher can the price increases spiral upwards to Icarus-like levels of absurdity…? Do you really want to be the poor sap holding the bag when the music stops? Price increases are slowing down by many indicators, so your best bet is to wait for prices to plateau, or drop in the next few years, then see what you can find. Keep saving, you’re doing much better than most…

How about just moving to different state? You could buy a home outright in many other places. Even if you take a hit on salary, your standard of living may just be quite a bit higher. You may also be in a better situation when the next recession/depression hits, simply due to not having a mortgage payment.

I went from silicon valley to Montana and don’t regret it.

Buy 2 rentals for cash $100,000 each. Collect rent. Watch TV.

There is nothing wrong with shacking up with your parents while one works and saves money to get your own place. The problem is when the kids are in their 30’s and unemployed or under-employed and still live with their parents.

Supply and demand. More people would live in California of prices and taxes were lower. I’m in late 40s and rent. Sucks but that’s life. Make more money or move

I was here a few years back and bought in 2010 (L.A.). I sold late 2015. We did good.

However, we pretty much lost our appetite to purchase in this market. I never felt like my last home would continue to go up up UP! because I personally would never pay a certain price for it. We did place a few offers at a price we were comfortable with but the sellers would not accept. A couple are still sitting on the market after price reductions. According the them, “there are comparable sales to support the price”. Meh, ok.

We are staying at home with our boomer parents and giving them half of what the insane rent would be on a crappy section 8 apartment. There is room for us at the house. They love having us and welcome it. I do not know why some of you assume living at home makes us bums. We aren’t poor. We are just smart! I have news for you, some families are actually very loving and can get a long very well.

Also, it seems like there are a lot of you who say, “If you can’t afford the prices, then there are plenty of great places across the land you can go.” Lol this is completely insane! I grew up in So Cal my entire Old Millenial life!! I’m not leaving. Forgt it! I love So Cal!

Third, I am a potential buyer in this market. Not goanna happen unless the price is something I am willing to pay. Most houses I am not willing to pay listing price for today.

Lastly, people are starting to talk. Period.

What I have decided to do is wait till the first monthly Case/Schiller report comes out that shows a decline. At that time, I will start taking a closer look. Like I said, I am willing to pay a certain price depending on the property. If it takes time for sellers to realize that, so be it.

Totally with you. My parents live in OC and we live and work in LA. They have encouraged us to consider moving with them for a bit because my mom really wants to see her grandson more often. They have a big enough house for us but it’s still not an easy decision due to the fact that wife and I have been out on our own for so many years. That and I would have to commute via Metrolink to LA. It’s nice to know we have the option though and I wouldn’t feel like a loser (my bank account would grow). They live in a cul-de-sac of about 12 homes and at least 3 of the homes have 2-3 generations living in them. Smart.

Good comment. I’m not sure why you sold though. Prices probably won’t decline until the next recession hits, which may not be for a few more years.

Here’s the latest Case-Shiller report for SF:

http://us.spindices.com/indices/real-estate/sp-case-shiller-ca-san-francisco-home-price-index

And LA:

http://us.spindices.com/indices/real-estate/sp-case-shiller-ca-san-francisco-home-price-index

Looks like SF has already hit the last highest peak (2006), but that still took another year of coasting before we see a sharp decline. LA may still have some ways to go before it reaches a stagnant plateau before sharply bottoming out (if it indeed pans out to be another RE crisis…)

Mostly, people with vested interest in real estate transactions would say that the prices would never go down.

But if we think objectively, prices have been busted many times in socal although the reasons have been different.

It’d be interesting to see when and how does it happen next time. But never say never.

The general housing price in socal is way out of line.

Yes you are absolutely right in a sense that the market has gone up and down in the past for various reasons, however, I believe that despite this, one cannot deduce that it will come down anytime soon because prices are creeping at all time highs. When making comparisons domestically, yes, you could say a collapse is imminent. However, the market isn’t being governed by domestic forces as it did in the past (or those forces don’t hold nearly as much weight). We’ve become an increasingly globalized nation in the last decade so we must consider the global forces that have a huge influence over our market. To us, our real estate is outrageous but put yourself in the shoes of a person from an emerging nation. You have new money and want to invest it assets but your current nation is not stable enough to gain your confidence plus all the real estate in your countries’ big cities are grossly overpriced and have been for years with no signs of dropping. Parking your assets in the US, a nation of stability, prosperity and safety is a no brainer; especially if the property you’re buying is cheaper relative to the properties you have in your home country. Despite the increasing prices of real estate, we still have some of the cheapest properties when compared to what’s available globally. Unfortunately, most Americans are too consumed with America to even begin to understand this.

I just talked to my cousin that works at PwC in Mexico, him and his wife got approved for a U.S. visa last month. Guess what they will be doing this year? Buying property in CA or TX with a budget of 500k. He asked why my wife and I don’t own since he knows we have an income of 250k, and he thinks it’s amazing compared to his. I had to explain to him that we had to pay off a Stanford Law Degree and Harvard Degree first before we could buy. He didn’t really get it.

I do think we will have a correction but with the Global economy, too many foreign buyers such as him will prop up the market and I don’t think it will drop as much as economic indicators suggest. Unless the gov does something about foreign buyers, this will continue to happen. They don’t even plan on living here, they just want to park their money, I’m sure he has even more saved up. He gets paid very well and his living expenses are a joke compared to ours. Maybe I will have to rent his home lol, this will be a true joke.

I wonder what a Trump administration would do in regard to this issue. Pretty sure a Clinton administration would be all for the status quo. Her latest offensive which attempts to link the bursting of the last housing bubble as a negative has him spinning it as a positive. Shenanigans such as the current state of foreign money parking sometimes have surprising ways of being corrected. Less than one year ago, hardly anyone would have predicted Trump would be the Republican nominee, much less be practically tied with Clinton in the polls. These are good examples which prove you can’t reliably count on things to last forever, such as low rates, high home prices, and government provided homeowner welfare such as Prop 13.

“I wonder what a Trump administration would do in regard to this issue.”

Can’t reveal the details but it will be great and you’re gonna love it!

I really hope you are right. This current environment has sucked for about 8 years now…and I am someone who is doing really well!

@HC

Clinton playing up the victim card had me scoffing. Hypocrisy at its finest — especially when she indirectly benefited from government bailouts through Goldman Sachs.

It’s mind boggling that people’s would think that a global recession would affect everything but real estate. Is buying U.S. real estate the first thing that foreigners think about when facing financial hardship? Or, unlike previous generations who paid too much, this current wave of buyers won’t walk away or be foreclosed on? Has money started growing on trees since 2009?

I personally regard the bursting of the last housing bubble to have been a great thing, because I could not have afforded my beautiful old Chicago condo if it hadn’t happened. I’m sad and disgusted that housing prices are ramping back up because A. It makes it very difficult for young families to buy their first home; B. It pushes up house taxes; and C. it makes it more difficult to buy a “move up” property even though your current equity has inflated, because the move-up property has inflated so much more.

The current house inflation is the result of inflationary Fed policies and government programs (TARP, REO-to-rental, ad naseum) designed to drive prices up to Great Rampage levels, to save the financial firms, who otherwise would have been facing insolvency. That should have been permitted to happen, and it would not have been the disaster the banksters claimed… except, of course, for them.

Now we’ve blown up a much bigger and far more dangerous credit bubble, not just a “housing bubble”, resulting in economic deformations and malinvestment that is driving money away from productive investment and into “casino” financial products, while inducing corporations to asset-strip themselves by spinning off layers of debt for exceeding their worth, to buy back their own stock. In other words, policies designed to drive inflation have not only destroyed seniors and savers, inflated most wage earners out of the value of their shrinking paychecks, but have created the most dishonest and opaque financial markets in history. A whole economy where everything we know about our money is a lie, where no one can form any solid idea of what anything is truly worth.

My fear is that it all ends with nothing being worth anything but food, warm clothing, and guns. Oh, yeah, and booze & drugs.

@Laura

I agree that the current bubbles are bigger and more widespread than ever. When the inevitable recession hits, the more solid corporations will survive but probably not without taking massive losses. The weaker companies, such as tech unicorns and bio-tech, will go by the wayside. Workers will be the hardest hit.

China is ahead of us in feeling the early effects of massive debt burdens. In trying to escape the fallout, their investors launder their fortunes in international markets. But where will they run to once the recession hits American, British, Canadian, or Australian shores?

I am empathetic to the tougher environment many face. but not necessarily sympathetic! Life is full of choices! Excuses abound for why people can’t/won’t take responsibility for their lives! If you want to live and play in So. Cal. or S.F., you need a high paying job! Otherwise, you need to go somewhere else. If you are Mom and Dad, aiding you kids because you want them near you, you are doing your kids a disservice! I left So. Cal. decades ago for a career, even though I grew up on the beach. My kid’s have left home as well to pursue careers and lives! Yes, affordability is a crisis in places like L.A. and S.F., but whose making you a prisoner?

For the vast majority of American history, families lived together- 3 generations under 1 roof. Grandma and Grandpa looked after the babies while mom and dad went out to work, while the elderly had a family support network to take care of them as they aged- not necessarily a bad arrangement. It was really only after WWII, that young people in their twenties were able to move out to newly built suburbs, buy a cheap house and live independently with their new Nuclear Family/American Dream/Boomer Babies. It’s looking like this brief 50 year period was maybe the anomaly- not the norm. Although, the mentality became ingrained in our culture that anyone still with their parents after 23 was some sort of a total bum/loser. Clearly, since the turn of this Century things have really started moving back to the historical norm of the multi-generational living arrangement as prices again become too high for an 18-year old to simply move out and make it on their own.

Indeed, perhaps we are moving back to how most of the world lives. In Italy and Japan for example it’s completely normal to live with your family until marriage in your late 20s or early 30s. High living costs and dense housing necessitate residing at home and saving until a later age where one can really only buy a small apartment- not a McMansion. My wife is Brazilian, and this arrangement is completely normal. Close family ties are culturally valued. Her brothers who had kids and got married moved out, but the siblings who are single (one in his 40’s with a professional career) still live with mom and the cousins. Everyone works and contributes to the communal family living situation/financial pot. I’m not saying the American way is any better or worse than these other examples- just different. However, it may be becoming unsustainable in the near future as the long-term trend…

It is not about how much money you make (for the most part), it is what you do with it. I know more than a few Xers that still live at home, morbidly waiting for their parents to die off (one of whom is a 38 year old who has yet to graduate college but is seeking to become a doctor). I lived at home until i was 26 much to the dismay of many. I was criticized for not going out and living it up. I was also told I shouldnt put so much down on a house and put it into the market. I got along with my parents and it really wasnt a bother to live with them. Living with them also allowed me to save up a 6-figure down payment on a house. Since that purchase (at the peak I may add), I have still been diligent about paying down my mortgage (now paid off0 while renting out a room earning over $60k in rent over the years. I was the exception to the rule (as may readers of this blog are). I will take the cash flow now the house is paid off and have a renter. My ‘sleep at night’ factor is quite high. MOST of the people living at home, especially in SoCal, spend their money on frivolous things and not $285k downpayments like fetty-wop. most are trying to be like the kardashians or keeping with with the facebook joneses. A weekend night out is several hundred dollars in West LA. Do that a couple times of month, as well as making sure your are current on your BMW lease and your parents house is just what the doctor ordered to keep up the superficial life. I have had the opportunity with job offers in SoCal but know I can get ahead more in a fly over state. the congestion and taxes are a bit too much for me as well. While I have great friends there, it will always be a place to visit, not live.

Oh look, more infinite wisdom from the housing industry “experts” At this point, either they are dead right and we on this site are dead wrong. If they’re right though, I can’t wait to see $1M crap shack in West LA get even more expensive factor in higher interest rate…What a time to be alive in this country…

http://finance.yahoo.com/news/toll-brothers-fed-interest-rates-good-housing-stocks-160759168.html

Unfortunately they might be right. When a interest rate hike is announced a panic occurs among potential home buyers to get a property & mortgage locked down at the lower rate. RE agents and mortgage brokers encourage this feeding frenzy.

I agree with you future buyer, first time home buyer and future buyer will be priced out unless the government does something about the foreign buyer. How can you compete with a cash buyer. It’d really hard to accept the fact that Americans and/or naturalize us citizen are priced out in their own great country. I’m on a business visa and own a property here, rented by the college graduate American. I don’t know American politicians are very smart but they cannot do something about this offering buyer. Don’t tell me American cannot buy this houses and real estate here are dependent on foreign money.

I like the way “Asian businessman” above who is buying US property to rent it back to Americans is bitching about the fact that we can not buy our own homes. Am I in some kind of bizzaro world? Unreal.

LAr my apologies for my wording I’m not bitching or something. I’m just stating the fact what’s really happening in this great country and every state n California. Politicians need to do something about homeownership and home buying specially for the first time home buyer. If you’re familiar with California’s RE landscape that’s what really happening, check OC and other parts of la county and most of la most of the buyer are foreigner and they bought those houses in cash. In my experience alone I was outbid so many times by my countryman/foreigner and fed/bank and investor who’s cash buyer like me, What’s happening is that become a bid war out there. How can you compete with this cash buyer. Wake up don’t vote a politicians that will sell this great country to a foreigner.

I’m not sure that Wang bu is a real “Asian businessman.” Might be a troll.

I understand what Wang bu is saying and I think he is right, but I doubt that anything is going to change in the near future or with the next administration. He is trying to give us a perspective that he sees first hand and, although, he has benefited from it personally, it is changing the landscape of our buyers and real estate on the California Coast and other desirable areas. I’m looking at the Carmel, Monterey and Pacific Grove area and the same thing is happening–it’s very difficult to compete and it’s hard to find a nice home at a price that local buyers can afford to pay.

Thanks Lois you got my point. Im just hoping somebody step up to stop what is happening in California and to this great country. It pain me to see that most of the home owner are foreigner and they really manipulate the market, In turn, affected the hard working first time home buyer American. If the state of California investigate all the homebuying transaction and the flippers they will be surprise how easy it is to manipulate the RE market.

Can anyone recommend a “mortgage data mining tool” like the one used to get the mortgage data in Torrance? I don’t know how expensive it is, but it seems like a really good tool for a prospective home-buyer…

It’s going to get worse.

WELLS FARGO launches 3% down payment mortgage…

First-time buyers and low- to moderate-income buyers have largely been sidelined by today’s housing recovery.

The common cry is too-tight credit. Lenders have kept the credit box restrictive because they are gun-shy from the billions of dollars in buy backs and judicial settlements stemming from the mortgage crisis that they still face today. Now, the nation’s largest lender, Wells Fargo, says it is opening that box with a new low down payment loan — a loan it claims is low-risk to the bank.

“We are fully underwriting the borrowers, we are partnering with Fannie Mae to originate and sell these loans, we are ensuring the borrowers have an ability to repay and that they’re qualified for home ownership, but we’re simplifying things for the homebuyer,” said Brad Blackwell, executive vice president and portfolio business manager at Wells Fargo.

Branded “yourFirstMortgage,” Wells Fargo’s new product has a minimum down payment of 3 percent for a fixed-rate conventional mortgage of up to $417,000. Down payment help can come from gifts and community-assistance programs. Customers are not required to complete a homebuyer education course, but if they do, they may earn a 1/8 percent interest rate reduction. The minimum FICO score for these loans, which are underwritten according to Fannie Mae standards, is 620. Mortgage insurance can either be rolled in to the cost of the loan or purchased separately by the borrower.

Blackwell said either way, the monthly payment is less than a government-insured FHA loan. More importantly, it’s simpler than other 3 percent down payment products already in the market, some of which have specific income and counseling requirements.

“We’ve taken all the complexity of the home mortgage lending process, removed it from the front-line consumer, so that it’s easy for them to understand and Wells Fargo is taking care of all the capital markets and other types of complexities behind the scenes,” added Blackwell.

(more)

http://www.cnbc.com/2016/05/26/wells-fargo-launches-3-down-payment-mortgage.html

I was born in Los Angeles, CA to poor chinese immigrants who came to the US in 1971. I am now 37 years old and most of my friends choose to be single and live at home. Majority of my friends earnin the range of 70k to 125k per year and still are not able to afford a home or rather not because they are single. The ones that make over 100+ a year and are single rather rent and date then settle down. I always ask them why not buy and most do not want to be stuck being screwed on a 30 year 3 to 5k mortgage payment especially when they can rent for 1500 to 2200k per month with no commitment. They are in no hurry to give up the life style of work , gym, hook up and hang out. They rather spend their income on things that are more entertaining and hook up with different people all the time. The bachelor / bachelorette life style is not like during the gen x or baby boomer are where all your friends are married and have children. Now a days majority are single and happy while the married with kids are STRESSED out from high COST OF LIVING. Why would millennials sign up for 30 years of hell especially when they are single? As long as their are so many single people out there no millennial is eager to get tied down. Since I am in between millennial and generation X (1978 birth) their is no incentives for us to settle down. Why would we pay a 30 year mortgage and leave our inheritance to our siblings ? If millennials never settle down we will never buy housing.

I know a couple guys like you mentioned. Late 30s, making good money, no desire to get married or buy a house. There life is work, gym, serial dating, going on trips and driving nice cars. Most of these guys live the beach lifestyle and rent in Hermosa. They are having fun and that’s all that counts. That’s the life they choose…doesn’t sound too bad to me!

I was born in 1977, and, being a single musician for all of my 20s, I understand where you’re coming from. I lived a life of fun and little consequence. However, that lifestyle can quickly loose its appeal. I was fortunate enough to start a successful business in my 30s, and now I’m happier than ever with a wife and child. Granted, we also moved out of LA.

If this behavior is the new norm for men now into their 40s, then I think pharmaceutical companies selling antidepressants have an even brighter future than they have at the present.

Marriage will cause men to need anti-depressants faster than living the single life with income being equal.

I know plenty of 30-somethings who spend their money on toys and party every night, but I’m not sure I’d call them happy. When they’re lonely drunks in another 10-20 years, we’ll see how it all pans out. They’ll probably get married in their 50s to women in their 20s, and then they may have the stressful marriages you speak of.

Well if I were you better get a home for yourself

Whine, W[h]ine, Wine, WINE! Never in human history have so many people lived in such comfort, safety, affluence and luxury. Even “poor” people in L.A. live like Kings compared to most of the population on this planet. Food is cheap, safe and available. Housing, ditto. Electricity, potable water and sewage systems, ditto.

Young people living today in America have never known suffering or real poverty–they’ve never had a “hard” day in their lives.

But because they can’t “afford” a house in a certain desirable neighborhood in California, they’re having a meltdown! What a bunch of entitled spoiled children. The future of this country is bleak because we’ve got competition now, something that America didn’t have in the past.

Lazy Americans are going to get their butts kicked by hard working Asians. It’s already happening. The Europeans are history and are sinking under the weight of their social welfare delusions.

So go ahead and WHINE. Of course you’re entitled to “affordable” housing and 15 bucks an hour. And cheap education and FREE healthcare. Oh, and “safe spaces” at school.

I’m enjoying this slow motion train wreck.

I agree with each of your points, zzz, but I’m not enjoying this slow motion train wreck.

@HC

Clinton playing up the victim card had me scoffing. Hypocrisy at its finest — especially when she indirectly benefited from government bailouts through Goldman Sachs.

It’s weird that people would think that a global recession would leave real estate unscathed. The first thing that foreigners think about when facing imminent financial hardship is to buy U.S. real estate? Or, unlike previous generations who paid too much, this current wave of buyers won’t walk away or be foreclosed on?

Clinton is effectively making the case that housing prices weren’t way out of line. I think that’s a mistake.

Don’t you find it interesting that on one hand we are often reminded how large the share of so-called “cash” buyers is in this cycle, therefore implying some increased level of stable marketplace dynamics, yet in a deflationary wave of selling, non-mortgaged owners would be better equipped to take on losses. When there’s a fire in the theater, this cohort is just going to sit there and not also rush for the exits, of which they are sitting closest to?

The idea that hot money flows (whatever the sources and motivations) won’t sell strikes as naive at best and outright delusional at worst. Reports from Miami’s (among some other everybody wants to live here global locales) housing market are becoming increasingly impossible to spin any other way but as the ominous crest we know asset bubbles eventually come to. Take nearly every talking point for the “this place is different” narrative we often get here regarding L.A. and it fits with Miami. Excuse me, prime desirable coastal. Next thing we will find out what’s different will amount to alligators and humidity.

@HC

I agree — mania can work both ways. I doubt that who one is susceptible to the fear of being priced out forever is immune from panic selling. Earlier this year, many Chinese buyers panicked and sold their stocks at a loss when they believed that their stock market was crashing. Mania is indeed color and racially blind.

The rich are willing to lose money on their purchases — just because they can afford to. The asking price of expensive properties are being slashed on a regular basis — many below the original purchase price. So I wouldn’t be surprised that those rich foreign investors who launder their money through real estate will not hesitate at taking a losses either.

Here’s how much you need to make to afford rent in every state

In Hawaii, the most expensive state, a household would need to earn more than $71,000 per year in order to afford a two-bedroom apartment without going over the 30 percent threshold.

Nationally, the report concludes, the housing wage — the amount that a worker would need to make working full time in order to afford a one-bedroom apartment comfortably — is $16.35.

San Francisco Hourly wage needed to afford a 2-bedroom apartment $44.02

Annual equivalent$91,561.60

(more)

http://www.vox.com/2016/5/26/11786088/housing-income-rent-map