The rise of the wealthy renters – In San Francisco more households making over $150K/yr choose to rent than own.

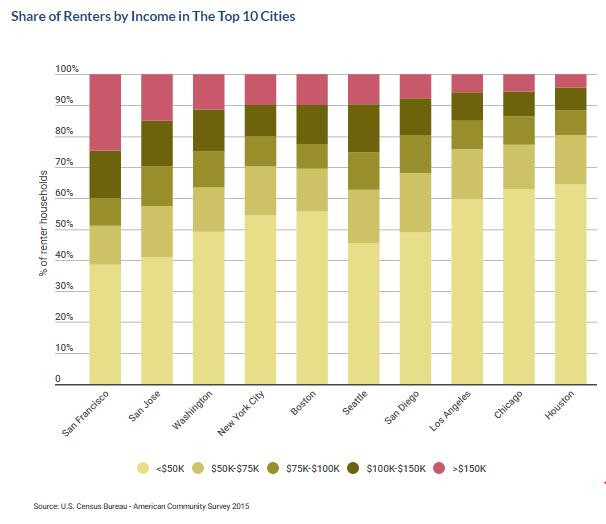

One of the typical lines lobbied by cane wielding house humpers is that renters are low income households that simply have no choice but to rent. The implication is subtle on some fronts but others choose to use a 4×4 of clarity by saying renters are simply poor people. Clearly these Taco Tuesday Jimmy Buffet loving fans have failed to take a look at rental rates in San Francisco. They also use an outdated model of the world where Don Draper was the model of success puffing away long and hard on that cigarette. Even in “prime†neighborhoods I am surprised at the lack of tech knowledge by some of these people living in million dollar homes. Some folks just have a hard time seeing that they bought a lucky scratcher at the right time. In fact, new data shows a rise in wealthy renter households. And in places like San Francisco, there are actually more households making over $150,000 per year that choose to rent than own. Clearly a household that is pulling in $150,000 or more a year is not “dumb†or low income.

The rise of the wealthy renter

People that can pull in high income today see the same thing that we see when it comes to housing. Why are they going to buy a piece of crap and lock into a giant 30 year mortgage? In many cases, they are working for tech companies that come and go. The iPhone came out in 2007 and some people act as if it was out for 30 years (interesting that the iPhone came out in the year housing bubble 1.0 burst). Things change at a much faster pace today because of technology.

The rise of high income households that choose to rent is something that is new:

“(RentCafe) In 2015, the number of renter-occupied households surpassed the number of owner-occupied households making over $150,000/yr (56,591 renter-occupied vs 54,445 owner-occupied housing units), a situation that is atypical, considering that overall in the U.S. there are 7 times more owner households in the top-income category than renter households. What San Francisco has going for it is a solid job market, with high-paying IT and finance jobs occupied by young highly-skilled professionals — a recipe for the typical profile of an affluent renter.â€

So it is important to read the fine print. Of course there are more households across the US that own that are also of high income status. But San Francisco is not one of them. What is interesting is that there does seem to be a tech bias here. People that are connected and can do research probably are more cautious into buying an overpriced crap shack and saddling their life to a giant mortgage. They realize the decision is more nuanced than some realtor with a beer belly telling them “don’t over think this and buy!†– of course they fail to talk about the massive down payment and then the giant mortgage. For a $1.2 million San Francisco crap shack you are talking about a $240,000 down payment and you still have a $960,000 mortgage! It is very likely that this group appreciates history and hasn’t forgotten that 7,000,000+ households lost their homes to foreclosure in the last go around too. So is it any shock that San Francisco has so many wealthy renter households?

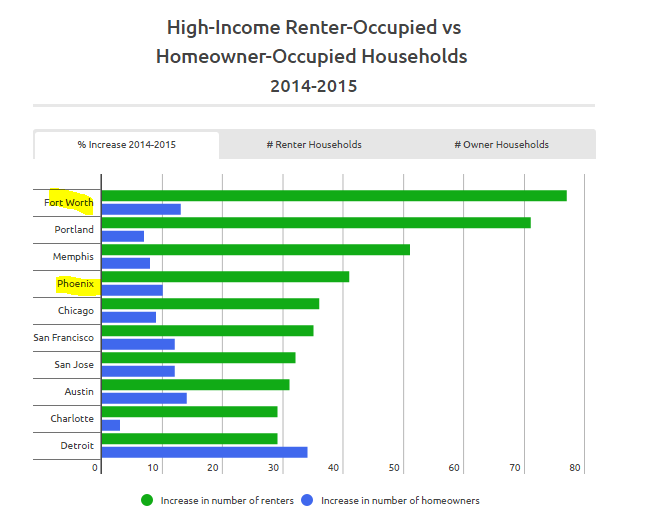

What is interesting however is that this increase of wealthy renters is also seen in less expensive markets:

Source: RentCafe

Why would a wealthy household in Fort Worth or Phoenix decide to rent instead of buy? What is clear here is that there is a trend of high income households being more skeptical of the numbers and not buying the general mainstream propaganda. There is no renting lobby but there is definitely a housing lobby. I think this election proved many people wrong and that generally accepted ideas do change. And some people are hilarious. They assume Trump being a real estate person is going to look out for housing. But what they fail to mention is Trump is a high density loving skyscraper kind of real estate guy. How does this help the single family crap shack owner in Santa Monica or San Francisco?

So when you think of broke renters think of San Francisco. Apparently making $150,000 or more a year makes you a chump.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

180 Responses to “The rise of the wealthy renters – In San Francisco more households making over $150K/yr choose to rent than own.”

Indications of no tank in the near future: https://www.redfin.com/CA/South-Pasadena/1415-Marengo-Ave-91030/home/7007768

The above South Pasadena house was listed at $975,000 — and sold for $1,333,000.

http://jlcollinsnh.com/2013/05/29/why-your-house-is-a-terrible-investment/

That’s one way of looking at it. I never considered my house as an “investment” as anything but shelter.

No mortgage and even with maintenance, taxes and insurance, still way cheaper than rent.

You can always rent for cheaper. If you are comparing apples to apples, it makes sense to buy if you are anywhere close to rental parity. To my knowledge, this has never turned out bad for the buyer. Rents in socal trend up over time, I see no change to this.

“To my knowledge, this has never turned out bad for the buyer”

well that’s because you have an agenda and aren’t really paying attention. My X bought in 2005 (against my advise i might add) for $415K and then recently sold that property for for $385K. She was using an interest only loan so she walk away with not much left of her $80K down payment. Sure she saved a couple bucks on taxes but not really all that much since interest rates were so low.

If you really believed what you are saying you should be out buying RE with both hands in this interest rate environment…..maybe you are.

Thanks Simbot. A nice read and a good reminder of how terrible RE is as an investment. This changes as soon as the market crashes again.

Loving the buying is always better fake news.

Rental parity did NOT exist in 2005. That is a fact. Next!

that isn’t a sign of a market, it’s a fucking casino.

$360K over asking……..THAT IS FUCKING INSANITY…..and must be money laundering IMHO

if the banks or morons like this get bailed out again there is going to be blood in the fucking streets…….enough already!!!!

If the banks learned one thing from the last super big bailout (trillions and trillions) it is that there are no consequences. I predict no consequences this time too.

It’s interesting how random examples of exuberance are touted as proof of no correction in sight, but at the same time random examples of capitulation are derided as no proof of a correction.

Wow, horribly dated and so close to the house next to it you could probably hear your neighbor fart. That house needs new ceilings, new kitchen, new bathrooms, new wall covering, basically a ton of $$$ in new everything. Someone’s new 1.3 million+ fixer-upper now.

Although i do not believe the market will not “tank”, your anecdote is no indication it wont happen.

That’s my crazy town! We bought in ’63 and have held on to it.

That just means the realtor underpriced the property. Often underpricing is intentional and not out of ignorance nor a sign of the property suddenly being “worth more” than is was the day prior.

I’d check first to see comps and ask a realtor about trends in pricing strategy for the neighborhood. South Pasadena is a very desirable, small, community.

Our household income is about $280K/yr, and we rent. Why? Mainly because owning is an enormous ball and chain that would prevent me from advancing in my career and moving to where the opportunities are. My house horny Taco Tuesday boomer parents lived in a world where you lived in one house with a single job for 20 or 30 years, and retired on a pension paying $150K/yr thanks to CalPERS. What they don’t realize is that that stability and economic model is gone for America. Companies don’t give promotions anymore, you have to promote yourself every 2-3 years by changing employers. Moreover, they don’t permit their people to adapt their skills or advance their career. They hire you for one narrowly defined tech job, and when the winds shift, they would rather lay you off and hire a 25 year old.

Slim – Wise words!

Also, when buying notice it’s always “how big a house can I possibly stretch my finances to buy” while with renting it’s “what do I really *need*?”

So it’s not a $2400 a month rental vs. a $2400 a month mortgage, it’s $2400 a month rental vs $5000+ mortgage “because it’s an investment” – an investment that may or may not go up, and you’re biting your nails hoping you actually are there long enough to make a dent in the principal before TechCo, who you work for, goes belly up and your pay halves because you have to take any job you can get.

The really good idea is to rent and save save save. Save all you can and save some more.

By the way, the corollary to this is that, although my parents are retired on a CalPERS pension, they lived most of their adult lives as Dr. Housing Bubble’s stereotypical Taco Tuesday boomer trapped in a McMansion sarcophagus. Their house is worth $1 million, but they can’t afford to run the air conditioning when its 95 degrees out. They sunk every penny into housing, to the point where (according to my mom) they couldn’t afford to buy me infant/toddler toys when I was a kid. Even to this day, they do weird things like collect rain water, eat in the dark and steal sugar packets from restaurants. All of this while living in a $1 million house that is paid off…

Wow. Slim is making total sense here. It really isn’t always about affordability that keep millennials from buying.

Skylander, I’d argue that the “costs” slim refers to (i.e. reduced mobility, extended cycle risk) are also issues of affordability. It’s just that the outdated model of affordability only considers simple concepts such as rental parody in the moment whereas times have evolved to necessitate the consideration of more complicated scenarios.

The people I work for are like this. Wife shops at some cheapo grocery store for odd/near-expired stuff, they save sauce packets, etc. Now they have some idiotic habits like going out to eat, keeping a time-share, stuff like that, but their house is worth over a million and they are *not* living a “million dollar” lifestyle.

My parents were of the immediate Post-Depression era. They also had a paid off house in S. CA which they bought for 25K in the 60’s and had a generous pension (not 150K but close to half that). They lived like they were in the Depression. Free cookies and coffee at the bank? They were there. Free tacos at the local Happy Hour. They were there for the food and had the minimum drinks with the maximum food. Shopping at Ross, movies were too expensive, etc, etc. They lived that way because they were brought up that way. I’ve been told that for that generation, you should ask which books have the 1000 dollar bills tucked in them and how to find the gold buried in the backyard. To be fair, I live a lot better but still regularly wait for the free leftover pizza to show up in the break room after a vendor/customer meetings. My point is that many Taco Tuesday Baby Boomers live that lifestyle by choice and not by need. They just handle money differently than Milllennials. Be thankful if you are a Beneficiary of their Estate since they lived like they thought they could take everything with them.

Hit the nail on the head! I hope pensions will be the next crisis and wake up the younger generations.

https://www.youtube.com/watch?v=cNyU_sU3hPs

Could it be that those wealthy renters don’t see a return on sinking $1 million or more into a crap shack? These urban settings are increasingly overcrowded; government entities and services are stretched, over committed, and precariously dependent on more taxes and fees to survive; and don’t forget that these west coast cities are also one earthquake away from chaos and financial ruin!

One step closer to pension collapse:

http://www.zerohedge.com/news/2016-11-29/calpers-weighs-proscons-setting-reasonable-return-target-vs-maintaining-ponzi-scheme

They get a 150/year pension, own a paid off house and they can’t run the A.C.? Get real.

Slim, at that payscale aren’t your new employers willing to offer extensive relocation bennies? Like you, I found most all of my promotions by changing employers every 2 – 3 years. Most employers paid for the movers and the realtor costs. So over 8 different employers, only once did I choose to rent. That process served me well – there was only one occasion where I took a net loss on a purchase.

$280K a year, is that 4 people working?

I don’t know what anyone working would be doing to be worth that much…….i know business owners that don’t PAY THEMSELVES that much money…..let me guess, FIRE industry?

all though it seems everyone on the internet message boards makes about $180K ……I have NEVER meet anyone making that much in my life but i have seen many at places like here.

That’s fairly typical executive pay. CTO, CFO, etc. of a decent-sized (100+ employee) company. There are a lot of those. The high pay isn’t so much because the work itself is worth it (it isn’t), more that the stress is worth it and because you don’t mind stepping on people to get there – either you were a jerk working your way up, or you’re a jerk because you were college buddies with the CEO and people far more deserving than you were passed over for the position. You can also be fired for a mistake that any of the dozens of people below you are actually responsible for.

Or maybe he’s a public employee who job hops a lot and picks the cities that are really bad at budgeting.

MJ,

The population of Los Angeles County is roughly 9,893,481 people, distributed into 3,230,383 house holds. To be considered in the 95 percentile for house hold income (or upper 5%) in Los Angeles county for Household income you need to earn $222.5K. That means there are 162,120 households making $222.5K+ in Los Angeles County.

Source

http://statisticalatlas.com/county/California/Los-Angeles-County/Household-Income

Typically the high paying jobs are high stress where every decision made is worth money. There is a saying that the amount of a persons salary is typically in proportion to the amount of money that can be lost by bad decisions or reckless behavior. Project Management pays very well in commercial construction, design, planning, etc… Even county jobs can be quite high paying see

Los Angeles County Employee Salaries, look at the all the 130K+Jobs

http://transparentcalifornia.com/salaries/los-angeles-county/?&s=-base

Also fairly common for a couple both of whom have advanced degrees. When I was working for a large SoCal aerospace company the AVERAGE compensation for PhD level staff with 20+ years experience was over $200K. Add to that a spouse in any number of professional fields paying in the lower 6 figure range and you’ll find that a $300K+ household income is rather shockingly common in Southern California.

What they said above. Plus, don’t forget about the entertainment industry in LA. I’m no big fish in the TV industry, but I own a small company that caters to TV, and I’m in that top 5% range. A lot of my wife’s family members also work in the industry. For example, her uncle has a home studio and writes music for TV/Film, and he makes well into the six figures…much of it off of royalties from prior work.

The key word is household income. This is typically two working professionals each making six figures. The South Bay is filled with these people. I have lots of engineers in my neighborhood (aerospace, petroleum, etc). These guys aren’t dumb and generally marry other engineers, pharmacists, nurses, accountants, etc. People like this will only live in certain areas of the city…and these areas are expensive.

Being a sheep doesn’t mean not dumb.

Not all professionals only marry other professionals, LB. And in many households, one will often quit working to raise a family. You just can’t generalize people and invent statistics to support your point. That’s disinformation, plain and simple.

I am employed as a pilot and earned about $220K last year plus the company contributes 18% of my pay to a 401K. With our new labor agreement I’ll crack $300k within 10yrs. There’s a few hundred guys/gals who I work with that earn similar money living in the area.

The problem with most “jobs” today is the employer will pay you just enough until they find someone to do it cheaper (younger worker and/or outsourcing). Through collective bargaining we’ve eliminated that possibility along with age descrimination, favoritism, etc. We are just a number. But there’s strength in numbers.

I see a lot of anti-union sentiment on this blog but for the 10,000+ brothers and sisters at my airline it has worked in their favor.

I was the same way, didn’t know anyone making that type of money until after grad school. We crack over 250K but varies a bit depending on bonuses. My wife is a lawyer at a top Big Law firm and I am a CPA but work in finance. We cracked 290K one year when my bonus was HUGE but I don’t anticipate that happening again.

I grew up poor, my circle of friends make 20k up to high six figures (Doctor’s, Lawyers, and business owners). A lot of people out of Grad school got 90k jobs, a few years ago so I have no doubt most of them are over the 100k mark by now. The one thing in common is that they have advanced degrees or are entrepreneurs, no one makes 100k sitting on a couch unless you have some odd job that pays you to lay around.

Anyways, point being is that many people can make 280k if you have a two professionals working. Most of these people have to work hard though and requires many hours, no one pays you for nothing.

mumbo, I work at a company with about 1500 employees and personally know several, non executives that make about 180k year. It’s not that difficult in IT.

SoCalGuy is a well paid pilot who earned about $220K and claims that he’ll crack $300k within 10 years. Most planes are flown on autopilot now–what happens when airlines decide to make eliminate pilots and rely on computerized flights entirely? Planes that fly themselves is inevitable in a world of self-driving cars and automated shipping. It’s a just matter of time before the aviation industry will eliminate pilots in favor of automated aircraft.

Samantha,

Automation has already changed aviation but it’s not going to change much more for a long time (at least not before I retire and perhaps not even in my lifetime). When my dad started flying there were 5 people in the cockpit, now we’re down to 2. Computers have reduced fatigue and workload while increasing safety. What I get paid for now is management skills and above all else, good judgement. When computer artificial intelligence gets good enough to replace me then every job is in danger.

The funny thing is people have no idea how old our infrastructure really is and what it would cost to develop this autonomous system you are proposing. In other parts of the world it’s even worse. How do you think these planes keep disappearing in S.E. Asia without a trace? Boeing spent $32 billion and 10 years just to develop the 787. It’s certified for two pilots and will be flying for the next 25-30yrs easy.

Until I see a city bus driving down the street without a driver I’m not worried. Hundreds of people in a metal bird barreling through the sky close to the speed of sound without a human at the controls? Not happening anytime soon.

Besides, we have a binding contract and the airline is making billions right now. Any attempt to replace us wouldn’t be permitted or there would be a strike bringing them to their knees.

If I had to do it all over again I would have been a harbor pilot. Those guys bringing in the ships in SF are pulling down $400K+. Just google it.

Samantha,

Definitely not before I retire and not likely in my lifetime. Automation has reduced workout/fatigue and improved safety. What I get paid for is good judgement. When artificial intelligence matches that of a human we are all in trouble.

It’s not even the planes, it’s the infrastructure. We live in a first world country but use technology to control the skies developed in the 50s. And never mind us, look at the rest of the world. How do you think these planes keep disappearing in SE Asia without a trace?

One day automation will replace a lot of jobs but this isn’t McDonalds we’re talking about. My son was born a few months ago and I’m sure when he gets his first car he’ll still be driving. Sure, it will keep you in the lane, match speeds in traffic, etc., but there will be human element required to take over in a moments notice.

I agree with SoCalGuy in that it’s not going to happen anytime soon, although the driverless buses may be here a lot sooner than you think.

The planes can easily be retrofitted. But as an airline passenger, I’d rather have two guys up there (and pay the trivial extra amount for the ticket) even if they do nothing whatsoever the entire flight.

I agree Slim. Most of my single techie friends would rather rent and put the money into stocks in order to remain mobile. I continue to rent because the low end of the market is grossly overvalued (low end being less than $500k). I went looking to buy in an “upcoming” area of San Diego called Azalea Park, which is below City Heights (crime capital of SD county). $400k+ houses and there was a schizophrenic shopping cart pusher out front, 5 junky cars per house, graffiti everywhere, etc! It was at least 10 years from gentrifying. I can’t figure out how those type of areas can fetch such high real estate prices. Is it because buyers can make money renting to section 8?

Not totally true, they will offer to move you up or around if you tell them your quitting … :/

I remember the days of the dot com blaze. You enter a house outside of Silicon Valley owned by a techie, but the whole place was empty except for maybe their bedroom and kitchen. yep maybe they didn’t see the writing on the wall and should have been renting.

…. And it was the biggest house they could possibly borrow money to get, and that’s why it had no furniture etc – they were living on instant ramen and stealing toilet paper from work.

Alex in San Jose,

That income debtor for ONLY renters in SF sure doesn’t support your ridiculous agenda that tech workers make $10/hr.

Incomes have been going up and at an accelerated pace. We are entering the start of an over heated job market in 2017.

Good luck with trying to point out actual incomes to Alex.

I’ll change my mind the minute I actually see ’em. $10, $12, maybe $15, that’s what a tech degree’s going to get you.

You’ll need to go somewhere besides a soup kitchen or underpass to actually see ’em 😉

Considering that a lot of these techie folks are working 12 hour days, what difference does it make to buy such a large, expensive house anyway? All you can do is shower and then collapse for 5 hours of sleep before going back to the Salt Mines. Might as well just rent a smaller, affordable place and save your pennies…

At a wild guess, it’s the inability of some people to separate an individual’s personality from their “stuff” when determining their value as a person. Your buddy’s 335i literally makes him a better person than you and your measly 320i.

I never understood the attitude of “how big of a home (mortgage) can I stretch into’. Maybe it is my being a baby boomer whose parents told him so may stories about their days as children in the depression (which was the case for my parents). In any case, when I was house hunting in 2012, I qualified for a $650K mortgage. And of course the realtors had a hard time understanding why I set a limit to myself on homes under $500K. Fortunately I was able to buy a nice home on 7,000 ft of land for under $500K. Low and behold, my wife got laid off and is starting her own professional practice. This means I am paying the mortgage, taxes, insurance as she gets her practice going. With a P+I of under $2K I can handle it. As a matter of fact it is only $400 more per month than the 1 bedroom apartment I was in in LA. T+I is another $550 per month.

My home would now sell for $725K.

Absolutely. Our goal for the last few years has been to buy in the summer of 2017 (we’ll see what the market is like,) and, with my pretty high income and no debt, the bank is willing to give us nearly a million bucks. lol I’m a business owner, and my wife stays at home, so I’m not going to bet it all on a house that would kill us if my business went south. We’re looking at homes for half that price, and, even still, it makes me nervous.

QE: The same. That Depression era DNA running through my veins has served me well. “Moar” always costs “more”.

The loan officers at the banks always want to sell the biggest loan they can. But you guys are thinking about it the right way, in terms of what can be thrown at you in the way of misfortune, and still be able to keep the house.

Yeah, it’s crazy. I always remember my Grandma (who grew up as a teenager during the Depression) telling me about her parents who moved to Watts/Compton in the 1920s. They were coal miners from Scotland. They paid for everything with CASH: car, 1st house, everything. Saved their pennies and refused to go into debt for a better lifestyle. It was really only my Baby Boomer parents who’ve lived the “Good Life” in Cali, while myself as an old Millennial/Young GenXer feel far more of an affinity for those older generations who struggled through the earlier decades of the 20th Century. Not that life is the same as The Great Depression or WWII (it’s certainly not), but I carry my Grandma’s immigrant values of thrift, hard work and humility with me. They stand to serve me well…

California set of rules should never apply to the nation, housing there is a whole different ballgame. Renting is only for short term or circumstance but should never be a alternative to buying your own home. Like leasing a car, you always feel as though I can’t go over 10,00 miles a year and hope nobody dents the door. How can a person feel secure in a rental property you can’t, it isn’t yours.

One can argue that if not paid the bank is your landlord, but the comfort that if you can make some money on it you sell and if you can afford the payments you stay, after all everybody needs a roof over their head, make sure it is your roof you can stand on, and not a landlord looking down on you?

Robert, I’m pretty sure you would sell any pile of condemned rubble at any price to anyone, no matter how much doing so would hurt the buyer and their family. I once took the 9 college units necessary to become a realtor in CA, and agents like you are the reason I never followed through. I wouldn’t want to be in any way associated with them.

I’ve rented in a dozen different places – apartments, condos, and houses – and always felt perfectly secure. In that phase of my life it was necessary to move a lot. I’ve also bought at the bottom, rode it to the top, and just now bought near the peak. If you can’t live where you want at rent parity, then you shouldn’t buy in that area – period.

John D…Most know that I dislike most RE agents because they don’t know their craft, commission selling is a patient,art not a way to get rich quick.

I have invested in RE since 22 years old today many years later I’m in the 5% of wealth class. Good for me right you say? wealth in RE is a series of timing, research, luck, not using RE agents on the buy end.

Renting is for (“not sure I should buy now”), safe bet folks who don’t want committing to anything in their life, you know, don’t ever marry the girlfriend just tell her lets wait 10 years?

It is simple John, the players in the world don’t rent sir, they own something anything, you use banks as a means to leverage than sell, in life the roller coaster dips than soars high than comes down. levels to a stop.

When you get off you remember the peak moment of the thrill, you thought you were going to die, it was scary, but most never die on a roller coaster.

I have been their ups and downs, but many more thrills than downers, I believe under Trump the economy will soar, interest will soar (now at near 4.45%) and raising this spring. If you have the means buy now, many homes never sold in the past 1.5 years, the 2005-06 crowd who are listing or delisted but getting back in want a offer to get from under.

Renting (for most not all) should only be a stop gap to get your bearings and survey the landscape for the best purchase you can afford and location you can live with. take care

I’ll give you an example. A couple has a combined gross income of $5,000/month. In 20 years they have never been able to save a dime, living paycheck to paycheck, and probably with credit card debt as well. They have three kids and so can’t rent anything smaller than $1,500/month in their area. Let’s say that through gifts and borrowing from a 401k they manage to scrape together enough to get an FHA loan on a similar house, and barely qualify for the $2,000/month payment – $500/month more than they’ve ever had to spend on housing. $500/month that they’ve never been able to save. Sure, the numbers work on paper – they SHOULD be able to afford it.

Do you honestly think that purchase is a good idea?

If you carry a mortgage, the bank is your landlord.

Bubble Pop… ” Bank is your landlord” you pay the bank off you have no landlord, you rent and pay, you rent and pay, where is the payoff? You have paid off the landlords mortgage where does that leave you, searching for another place to rent,

Like when I was in the auto racket, lease your way to nothing after 3 to 4 years simple really, turn the car back in and we will call you a cab to get home?

Even if mortgage is paid off taxes and HOA fees may still be almost 2K a month. There are apartments that cost 1.2Mil with HOA fees of 500-700 a month.

This is the reason why next to regular apartment building we see Jaguars and Audis when few years ago all cars were just regular Corollas, Civics and what have you.

This is my Family 200K (Wife is in sales it varies a little year to year) with children and we purposely rent (2400k monthly) because we need to save for retirement, pay for childcare, and still like to eat nice meals at home and travel occasionally with the family (expensive with 5 people!). We live in Central LA so that we have limited commute times to cut down on childcare costs and have more quality family time.

We have the ability to make a down payment and have family that is willing to help with any immediate oe unexpected costs/fees (closing, moving, etc…).

The numbers don’t make sense to purchase a home at these prices. I do want to retire in 20 years. We would purchase a place if the it made financial sense. It does not right now.

We got rid of storage, cable (Sling FTW), and renegotiated our car insurance for another $3600 net savings, that will be in the kids college fund.

We’re nearly in the exact same financial numbers situation as you, although my wife is at home, so all of our eggs are in one basket, and that’s why we moved from LA up to Portland. It’s very bubbly here too compared to median incomes, but the difference in house/neighborhood/quality of life is astounding for our financials. It’s not cheap like my original home city of Indianapolis, but it’s still a pretty good balance.

Always good to analyze spending periodically and eliminate or re-negotiate. It’s like giving oneself a raise and it’s pretty painless, especially after adding up the money not spent totals.

The chart missed Honolulu, which is key in real estate charting.

http://jlcollinsnh.com/2013/05/29/why-your-house-is-a-terrible-investment/

Hi,

I have a few question off topic that I would really appreciate if someone could answer for me.

Im starting to learn the concept of compound interest. I have an app that tells you how long it will take to pay off a loan and the amount of interest you will pay. Im only taking the numbers as a guideline because it is affected by deposit and interest rates.

However assuming I borrow £100000 at 5 percent. It would take eleven years at £1000 a month and I would pay about £40000 interest. If I borrowed £200000 at 5 percent. It would take 30 years and be an interest of about £186000.

1. Are those numbers correct?

2.Can someone explain the Maths of why borrowing twice as much and paying the same amount would take three times as long and pay an extra interest of about £146000?

3. Assuming those numbers are correct. Wouldn’t I be better buying a house worth £100000 and paying it off over ten years and then selling it and buying the £200000 house with a smaller mortgage and owning in twenty years? ( I know in life that isn’t always possible because of work/schools/commute/etc… But if you had the choice. It would be better for your bank balance)

I live in a quiet part of Scotland where property is cheap and cant see house prices increasing dramatically.

Thanks

You are always better off financially buying or renting the cheapest/smallest house possible. Your own home is a liability, it does not pay you. If you buy a home someone else is renting it is an investment. This is a basic principle. Owning a bigger or fancier home is a lifestyle choice, not an investment.

Liz… Lets explore, my first home purchase was in Simi Valley Ca. 1970. Three homes to chose I could afford, one was 1600 ft., 1800 ft., 1900ft. price difference was $3000 for the bigger house. I chose the 4 bedroom 1900 ft. house at $27,500.

Today 2016 the $27,500 at $3,000 more is worth $579k, the 1600 ft. house 3 bedroom is at $395k and 1800 ft. house 4 bedroom is at $459k.

You buy the best and biggest you can afford if you want to make money on your house, it is all about price sq., ft., with buyers, how much house can I buy (that is Americans for you), show off to the brother-in-law, you as the seller always want to be in a position to times your sq. ft. purchase ( lets say 150 a ft.) against your sq. ft. sell of the home (200 a ft. or more) at least $50 a ft. profit. stay safe

The answer of “why” it takes three times as long and the difference in extra interest between your payment durations lies in the changes to the principal as it’s calculated over those different durations. I would suggest using a loan calculator that allows you to see the “amortization schedule” for your sample loans. The website that I use to do this is http://www.amortization-calc.com/mortgage-calculator/ Type in your loan scenario at the top then note that there are two tabs at roughly the middle of the page – click the second one.

Thank you both for your advice.

Rents are so obscene on SF and LA. I would be bummed out after 5 years in a high price rental thinking about how I threw that $$$ away rather than pay down a mortgage…ugh.

Oh, yeah? And you wouldn’t be “bummed out” after 5 years when your house lost 50% of its value and you were suddenly underwater on your mortgage? During the last crash, the median housing price in LA went from 530K to 290K within 5 years. All signs point to us being at the top again. I choose to “throw away” my rent money rather than lose hundreds of thousands of dollars in home equity.

If it was an investment, anyone would be bummed. But if you bought it as a long-term home because it’s perfect for you and your family, and you know the chances are vanishingly small that anything better will come along, and you can do it at rent parity, you absolutely should. In the end (20+ years) you’ll still be ahead over renting. Can’t get around the math. Can you do better financially (rent for 5-10 years and then buy, never quite happy with where you live)? Sure. But there’s more to happiness than money.

Stress can come with a high cost. Foreclosure and fear of losing a house doesn’t make for happiness either.

Today’s “rental parody” can be tomorrow’s non-parity. Of course this is the rub that gets the house betters’ tits in a twist. They need rents to always be on the rise in order to meet their pro forma rationalization. Rents have hit a wall. Landlords increasingly handing out concessions. Tons of new inventory coming on line with more soon. This is how it always begins. Good luck.

I’ll happily sit in my rental waiting for the coming crash, save a few more 10s of thousands of dollars while my landlord pays for repairs and maintenance. This year the poor dude has had to fix: garage door springs and opener $850, hot water heater $1400, dishwasher $500, Oven $650, Air conditioner $1900, irrigation system $350…

I will buy when prices correct 30% or more. Been through one severely underwater foreclosure in the last crash when I was married to Mr. I’m entitled. Never again.

John D, I agree. Happiness and quality of life have lots of value!

We didn’t stretched ourselves to buy a house and then be stressed out and not enjoy it. We bought a lot less than what the credit union would give us and our mortgage is less than most good apartments. We are 100x happier than when we were renting an apartment. Simple things like not hearing your neighbors through the walls, husband having his big garage finally, having a front and back yard, being able to hose down the cars real quick on the driveway while listening to music under the sun. Intangible things like these that make us feel like we are “home”…

Glaba, everything you cited can come with a rental house. You don’t have to buy it to get it, my tenants will attest to it.

Hotel California, but your rental house would most likely be more expensive than our mortgage (a little less than $1500 a month).

Rents will be going up even more as Trump gives these people tax breaks and incomes continue to rise on their own.

Even a 3% raise means rents can go up 9% if 100% of the raise goes towards rent.

Would this be the same Trump who says one thing and then something different with no actionable history for anyone to relay upon, or would this be the imaginary Trump you see in your crystal ball?

i don’t think i ever got a 3% raise in the history of my career except for the first 2

Hotel CA,

You are going to need to be a little more flexible in your thought process if you plan to be sucessful in the new few years.

There is absolutely not question that disposable income is going up with tax breaks…. the only question is how much.

Fight the fed and fight that at your own peril.

Nice try dodging the question by diverting to the Fed.

Apparently you’re referring to the Trump in your crystal ball. Not the Trump who is so far planning to “drain the swamp” by putting establishment hacks and Goldman’s best people on the job. But hey, you know exactly what this guy is going to do, maybe you can report back to let us know what his next tweet storm will consist of. Or maybe you’ll just resort to an ad hominem attack toward me, that would be far easier.

@NTS

Because the last round of tax cuts put so much money back into consumer’s pockets and created an economic boom? Man did that $300 refund check make me want to go out and upgrade my living arrangements. Now, was that the Fed, Bush, or Congress that authorized that refund check?

Speaking of Trump appointees, Mnuchin wants to release Freddie and Fannie from government conservatorship. With less government funding, how much more debt can the RE industry run up?

If tax cuts create wealth, then what has been the end result of massive upper-class and corporate tax cuts over the last 40 years? Shouldn’t we all be going gangbusters by now? A thriving Middle-Class, social mobility, the gains ‘trickling down” to the rest of the unwashed masses- where did it all go?

@donpelon

In the immortal words of Bush, Sr., trickle down/supply side is simply voodoo economics. It didn’t create prosperity under Reagan, Bush, Jr., and Obama. Inevitably, the insanity will continue under Trump.

The problem is that the home prices can swing so dramatically in those areas that you can still end up ahead renting for 5 years, depending on when you buy. That’s the whole crux of it, really. California real estate has become so speculative that it’s a scary decision to buy a house, unless you absolutely know you’ll stay put for a decade or two.

Starting at the same point, most “buyers” will be throwing away their money on five years of paying mostly interest, taxes, insurance, and maintenance plus repair costs. Sounds awesome!

Sign me up! I want to do my own part to help levitate and rationalize the value of over-priced real estate purchased near or at the height of the current echo bubble.

Prince, after you’ve mortgaged up, don’t forget to come back here and spread the new gospel. There are former real estate agents, landlords who “can’t see”, and other newer minted debt serfs here to help you keep your fingers and toes crossed. They may even lend you a crystal ball from time to time.

I couldn’t agree more, Renting is wonderful. I think everyone should rent. Renting is a rewarding and fulfilling experience. I thank you for all for championing renting. Now if only people would rent more than one place at a time, that would be even better. 2 or 3 rentals for all!

Poor ol’ Truthster….

Nobody’s stopping you from buying as many houses at current price levels and paying rent to the bank. It’s just that some of us don’t believe that the government and Fed will always have your back when the inevitable downturn hits.

We’re not “championing” renting as you’re misconstruing. Pointing out that there are no free rides isn’t taking a side.

Is this really a surprise when 60-70% of real estate in major CA cities are rentals???

Shocking ! LoL

Housing to tank in…. (wait for it) …2019 according to Zillow

http://www.businessinsider.com/housing-market-to-be-a-buyers-market-by-2019-zillow-says-2016-11

Perhaps along similar lines, this well known economist predicts that stock market will continue to rise over 20,000 points due to ‘Trump delirium’

http://www.marketoracle.co.uk/Article57256.html

My family is in this boat. Rent now in the East Bay is roughly $2800/mo for a place that could sell for roughly $1mil. To purchase we would need to raid the piggy bank and cough up $200k for the down PLUS we would still have to finance $800k. That’s a monthly blood letting of almost $5000/mo (Mortgage + Property tax).

Even with the mortgage interest deduction this is still a hard pill to swallow. Especially with one kid in daycare and another on the way.

Question for the crowd: If rental trends continue this way how long do you think it will be before Prop 13 is repealed? At this rate it seems like its only a matter of time before the homeowners that benefit from Prop 13 are outnumbered by those who don’t.

Prop 13 will never be repealed. It is an effective way of keeping younger generations as debt slaves to older generations. The secret to life nowadays is to marry rich….

You can marry more money an in hour than you can make in a lifetime! It worked for two of my sisters and my aunt!

I think your question begs another question. How long do you think it will be before the State of California and/or its municipalities end up in a dire enough of fiscal situation which will lead to the effective dismantling of Prop 13?

Seasons change.

well said

Houses in the east bay that sell for $1M, rent for $3800-$4200.

If your rent is $2800 it is WAY WAY WAY under market.

Your landlord is either an idiot or generous.

NoTankinSight, Are you a Landlord? Landlords are typically neither stupid nor generous. I am a landlord….The problem is people have no money to pay more. If i increase the rent my good renters leave.

Long story short? This isn’t the time to buy. Lol

Why are you brainwashed leftists blaming Proposition 13 for high rents and high home prices in California? Prop 13 has absolutely nothing to do with the housing supply or housing costs in California.

If Proposition 13 is repealed, landlords will just pass on their increased property taxes on to their tenants.

Besides unlimited foreign money coming from countries like China, housing prices are being driven up in California thanks to high development fees, labor regulations, and more stringent building-code requirements. The average cost of homes in California is two-and-a-half times higher than the rest of the country, and rents are 50% higher.

Typical development fees in California average around $52,000 and in San Francisco development fees are $72,600 per home.

California Environmental Quality Act (CEQA), the state’s broad development review mandate, has been at the heart of California’s housing shortage ever since. It obliged local municipal bodies to consider environmental impacts before approving new housing projects, and if any were found, to require developers to come up with a plan to mitigate those impacts. CEQA has become a bludgeoning club used by anti-growth and NIMBY interests, as well as labor groups, to either block development outright or hold developers hostage to their concessions.

Maybe not brainwashed but burnt out on subsidizing the chosen ones’ houses. What are you afraid of?

I am definitely not a leftist. I am just not into freebies for anybody, whether they are rich/poor, old/young, black/white. Prop 13 is clearly a freebie for any one who bought a house way back when. Low taxes and low interest rates are killing this country. Not too mention any money taken from taxes is promptly bonfired by ineffective goverment. No matter what we do, we are fucked.

The low taxes & interest rates keep the prices high. That keeps younger generations and less fortunate unable to buy housing and put their foot in the door. Raise rates & property taxes and landlords/old folks will flee and create plenty of housing for younger generations sitting on the sidelines.

@Don Ciccio

High housing costs due to cheap and easy credit-induced RE over-speculation also stifles consumer spending, which contributes to low economic growth.

Prop 13 needs to be overturned and its just a matter of time until it happens. I inherited a house with a little bit of oceanview. My properity tax is a joke (few thousand bucks)…….The market value according to zillow is incredible. On paper I am a multi millionaire. If a first time home buyer struggles to buy their first overpriced condo they’ll get hit with a higher property tax bill then me! This is criminal. People will soon look back and ask how was prop 13 in place for so long.

We have rented since day 1 in SF Bay Area! This year we will make about $240,000 between us…but wife literally just got laid off 2 weeks ago! Luckily we have a rent of $2,600 a month on a great but small 3 bedroom home in an A+ neighborhood. This crapshack I live in would sell for $1MM+. An arrogant realtor friend of mine argued with me on Facebook the other day about renting. She said, “good for you keep making someone else rich” What an idiot. It would cost me $7K a month to run this crapshack with mortgage, Mortgage INS, upkeep, taxes, etc….typical realtor. Only goes up and has no sense of calculating numbers. Bummed I missed the boat in 2010 but my wife was laid off then too and loans were hard to come by. But it’s all going to tank hard again soon and I’ll be happy right where I am!

As a landlord, I thoroughly applaud your decision to rent.

I’m going to assume you’ve done the calculations of what happens with your overall finances and nest egg by comparing your rent scenario and home ownership scenarios over x number of years.

And there is no way that I’d be buying anywhere in CA right now…

Renting is certainly a practical option, particularly in a market like Houston where prices are rolling over and the options for a nice luxury apartment are better than ever. Houston developers over-estimated the pool of luxury apartment dwellers, much like they over-estimated the longevity of the shale oil boom. 2 or 3 months free in many new developments now as they look for occupants.

http://katylocator.com/houston-luxury-apartment-glut/

“Owning” a house is an overrated experience for many, many people. It can be a lot more attractive to rent, and let someone else mow the lawn, fix the roof, and paint the shutters. Left to my own devices, I would never again own property of any sort. It really is cheaper and easier to rent. YOu can say the same for employees.

Brian,

That’s surely one way to look at it. An alternative way to look at is – my net worth has gone up by 1.2 mil in the last 5 years, over 80% of that is from property appreciation.

Could it collapse? Of course, there are no guarantees.

And today I was checking on the install of a new dishwasher and garbage disposal in one of the rentals. IMO being a homeowner and landlord beats a 40 – 60 hr a week job, but I never did like my original job.

“let someone else mow the lawn, fix the roof, and paint the shutters.”

I actually like mowing the lawn. Especially after a toke. We have a great handy man $25 an hour to fix the roof. I’ll go ahead and paint the shutters. Taking care of a 3k foot home on a half-acre lot takes maybe an hour a week. And I like doing it.

For the people out there who can’t or won’t save any money (the vast majority), long term renting is NOT a good idea. One day they will wake up in their rental and realize they will be working until the day they die since they have no equity in a property. Owning a home to the average person is nothing more than forced savings. This is not rocket science here!

I think the “forced savings” angle is a great reason to buy. It’s the only chance some people will ever have of a decent retirement. However, those same people are using FHA loans to buy, and FHA loans + peak pricing is a recipe for foreclosure. Those people should definitely wait.

The same can be said for owners who pay exhorbitant rents (mortgages) to the bank. Try saving money when housing costs eat up close to 40% of gross pay in overpriced markets.

Buying and renting depends on current market conditions.

If you rent a 2/3 bedroom house in Santa Monica, it can cost you $5K/month. If you can afford that, then you should be able to come up with 20% of $1mm house and pay a couple grand more for the mortgage. Hell, will SM tank in the next few years? Not likely. It may go down 5% but not for long..I wish I would of bought another house 15 years ago….Property has a lot of downsides, but more upsides if you are willing to hold onto it!

If there is a major earthquake on the Santa Monica earthquake fault line that runs through the city, the value of your housing investment can quickly turn to zero.

http://www.latimes.com/local/la-me-earthquake-fault-building-20131230-dto-htmlstory.html

GGM,

The lowest Trulia listing I can find in Santa Monica for a 3 bedroom is 1.4 Million, and that is not a sexy house in the sexy part of Santa Monica. That means $280K down, so a $1.12 Million Mortgage. At 3.5-4% interest on a 30 year mortgage, that is is a $6,500- $6,900 monthly rent. That does not include upkeep and insurance. $80K a year.

But I forgot about the “fact” that housing prices never fall, and that the interest rate mortgage deduction will make it all much more affordable.

That is a lot of money to commit for a place that most people who can spend that kind of money would not want to be locked into for many years.

I make 100+K as a Nurse. I only pay $700 for rent (2BR 1 bath) in LA. It doesn’t make sense for me to buy at these prices.

I made $100k as an RN living in OC. It made no sense to buy ever on my income. $100k as an RN in LA is nothing. Im sure that includes overtime, doubletime, crappy weekends, xmas eve, whatever. I did hospital nursing for 8 years on nights because I thought the extra $10k a year I made was worth it! $&@$ no it wasn’t! If you’re young and single enjoy your life as an RN making that kind of money. But if you want to get ahead making $100k as an RN in LA isn’t that great.

Im in the midwest and RNs make nowhere close to RNs in CA but I could actually afford a decent sized house in a great school district (not just good) on just my income. And said house would have a basement, 2 car garage, a nice big yard, outdoor patio, firepit, lol etc. They call this flyover country, well people can keep flying over it!!!!

I am lucky, I no longer work in direct patient care. I work a 9-5 office job like everyone else, but still an RN. Renting makes sense to me as I am able to save more. I don’t really live beyond my means. As of this time, I already have 500K in liquid cash, my 401 K is already a million and I own properties abroad. I travel abroad 4-5 times per year. No student debt/credit card debt. I am planning to retire at 50 ( I am only 36 years old). Life is good.

Your choice of course, but with 1.5 mil you can retire right now.

RL,

I am very impressed. You said “I already have 500K in liquid cash, my 401 K is already a million … I am only 36 years old”. Making the maximum contribution to a 401K starting at age 21 (a feat in itself) one has to get an AVERAGE return of better than 16% over 15 years to reach a million bucks by 36. Kudos to you. Please tell us how you invested to achieve such stellar returns.

$700 a month for a 1 Bedroom in LA is a KILLER deal!!! I agree, keep renting and save your money.

What kind of neighborhood do you live in where you only pay $700 for rent (2BR 1 bath) in LA? It must be ghetto where you’ll either be mugged or killed?

Finally! Something I can comment on that relates to my ridiculous situation. In some calculations, we just make the cut off for the oldest Millennials (mid 30s). We make just north of $150k. We have no debt and $200k saved for a downpayment in sunny San Diego. Spouse now works from home so location is not that important. I will get a job soon so income will go up. We’re in a good position to buy now…but we haven’t and probably won’t for a few years (until kid starts kinder).

Like most of our peers, we spent the 2010s constantly moving between cities (for graduate school and work), saving, and paying off massive school debt. We started causally eying homes in 2014 and were floored to see prices surge. It kept delaying our actual purchase because the bar to entry was rising faster than we could earn or save. Now we rent at a very reasonable price in San Diego and realize that this is a wonderful life. We can live well under our means without stress and save money for our child (who is disabled).

We are heavily criticized by our families and to some extent, I agree with their position. I wish we could afford a home in this school district but it just feels out of reach. And in fact, the only people among my peer group that owns homes are friends in the Bay Area whose startups were gobbled up and turned them into instant millionaires. As millionaires, these people all bought…modest homes and small condos that can’t even compare with the now multi-million price tags of their parents homes. It is so depressing.

What you have is a virtue that pays in the long run. There’s a powerful housing industry occult which permeates especially well throughout coastal California “culture” and is at total odds with prudent behavior. There are a lot of deceptions around here trying their best to convince us we’re the crazy ones for being skeptical. All of the arguments basically boil down to “buy now or be priced out forever.” I bet you also have “well meaning” people trying to guilt you into mortgaging on the notion you’re harming your child’s upbringing.

If and when you finally buy your first home in CA… you will feel extremely uncomfortable.

This happened when I bought at the bottom during the past 2 cycles. You always think you paid too much.

That’s the bottom line. So next time don’t miss the boat.

Talking about the critical nature of others to pressure people to buy, nothing about boats and timing.

Next time don’t miss the point.

Sadly, you overestimate Silicon Valley tech workers. As a tech worker myself, I’ve found (to my dismay) that most scientists and engineers are no less delusional when it comes to housing. My guess is that most of these upper income renters actually *want* to buy but can’t afford to buy in the Bay Area yet.

Is there information available to determine how many Section 8 renters are out there?

By City, By County, By State?

I can’t see how section 8 will ever save the rental industry long term especially in a depression.

How could you by any stretch of the imagination define $150k/yr as wealthy today in SF? If you have a mortgage in SF you’d be barely making it , if at all, at $150k per year.

I would almost consider this a call to the landlords that the peak in rental rates maybe either plateauing or reversing.

Nearly every renter wants to buy a home. But, they rent while they get themselves in the financial position to buy. The biggest problem is a down payment large enough to get them into an area they feel good about buying into. Now that Trump is in the white house, help is on the way. The super tight mortgage qualification standards put in place by Obama has really stopped people without large down payments from buying. Trump will bring back the low down mortgages and ease the credit standards. Renters will be able to buy again which will help them build long term real estate wealth.

Huh? Low down payments and relaxed standards have been around a while. That’s partly why the echo bubble has been going on for so long. Those renting now don’t believe that buying at current prices make financial sense. Real estate wealth? More like real estate debt.

Okay, this is just bizarre. An agent comes to a site where there can’t possibly be any potential clients, yet still spouts this sort of complete nonsense. It makes me think that A) you’re trolling, B) you are so immersed in your mindless marketing culture that you’re on autopilot and can’t help yourself, and/or C) you actually believe what you’re saying.

It’s factually and morally wrong. The low down mortgages never left. The qualifying standards are there for very good reason – people who are incapable of managing their own credit and who can’t meet the current (perfectly reasonable) back end and employment requirements have no business buying property, regardless of the state of the market. Not only will buying at the peak with little down not lead them to “long term real estate wealth”, it virtually guarantees short sale or foreclosure, just like it did with the last bubble. But I guess you’re hoping that history repeats itself? As long as you get your commission…

This attitude is the reason realtors get put in a category just below ambulance chasers and used car salesmen.

Wow, you think relaxing lending standards so that under qualified people can buy overpriced houses is the way to go?? I agree that the downpayment size makes it difficult, gut that’s why we need higher interest rates to push the prices down.

” Trump will bring back the low down mortgages and ease the credit standards.”

Does this sound familiar? Low or no down-payments and less than desirable credit ratings? I wonder what that will lead to? History is always said to repeat itself. I also believe that when mortgage rates start to average 5-6% we will see a new wave of creative lending products making it easier for people to qualify. I for one can’t wait to see how far they can stretch a mortgage, 40, 50, 60 years?

In the late 80’s we considered a 50 year mortgage. Interest rates were at 12% and housing prices were still rising at 10% per year. I haven’t seen 50 year mortgages lately.

jt you lost me at how super tight mortgage standards are the problem. Those tight standards keep us in part out of the housing crash of the 00’s. While I agree the biggest hurdle is the large down payment, the real way to remedy that is to raise interest rates and taxes. This will lower housing prices by making landlords run for cover and open the door for responsible younger people to buy homes.

It will create lots of problems for Boomers & Gen X’ers who live month to month on their paper wealth though.

So much resentment for the previous generations and current homeowners. If your lucky one day the shoe will be on the other foot and you will be the one defending Prop 13 and sitting on paper equity.

It’s actually quite the opposite.

When house prices drop 100% cash investors go through the rough and you won’t be able to buy. As it stands now 100% cash investors are about 20-30% of most markets. Any material drop and cash buyers go through the roof…ever time. More landlords… more renters.

Saying interest rates are going up are like saying no more making big commissions off of high priced houses for realtors. I don’t think realtors like hearing that cause it probably sets the expectations for lower prices in the future.

Have been emailing/talking to realtors for years….I am so bored by their cheap sales pitches. “You are throwing your money Away,you are making your landlord rich, you are missing out on tax deduction and home appreciation, soon you will be priced out forever, prices will never go down Again, this time is different….” Are they all ready from the same scripted flowchart? I am trying to put myself in their shoes. Rather than emailing the same bs over and over I would try to get the seller to reduce the prices. Isn’t it much better to sell at a lower price instead of wasting time and ending up without a sale?

The problem with your argument is that it sounds reasonable and logical (Oh, the irony !). Unfortunately, the bigger the tag of sale price , the higher the margin and commission for realtor. I have not been successful in purchasing a house yet in bay area (have been looking for a year) because of all the ridiculousness in pricing. Just not able to justify how asking price can rebound and double over the course of 6 years – Nothing new i say that have not been mentioned on this site.

I digress, You should set a limit and communicate it to the realtor – it is their job to find listings for you at the price you feel comfortable based on your finances. If he/she can’t , just move along. However, based on the current trend you might have to wait a lot for your phone to ring. In bay area – Prices are going up drastically , number of sales is going down marginally. I just don’t know what to make of it and i do fall in so called ‘educated’ segment with a bachelors in engineering and masters in business. Till i figure out , renting it is – ‘priced out forever’ my a$$.

Johana,

Why not take ownership and tell your realtor that you want to buy for 3-5% under asking price.

Then they will get to work for you. They work for you… tell them what you want.

Typical mlllenial.

Paying 4-5% below asking price will mean you probably only overpaid by $200k instead of $220k. It will be 2030 before your home is worth what you paid today. If you have any communication with a realtor in 2016 your message should only be that their inventory is double what it should be. Once they get that message the market will start getting back to where it should be.

@NoTankinSight, I hope you meant 30-50% below asking price? 3-5% below asking price is not even enough to get me off the couch and look at an the pictures.

I am also sincerely hoping that was a typo. Agreed it should be 30-50%. Honestly that is where things should be if you believe housing should be linked to basic earnings economics here on Planet Earth.

If you think housing is going to drop 30-50% you should not even both with a realtor… or even bother looking at housing sites.

Just ignore everything until it actually happens.

In the mean time, I hope your rent doesn’t increase too much.

There are few points in the market cycle when offers 3-5% below asking are anything more than a waste of time. In the current market, doing so for a property that is already well-priced based on comps (not upgrades, which will get a seller exactly zilch over market) will make it much more likely your offer won’t be accepted, unless there’s something else you can offer the seller – depending on their circumstances. The time to offer below market is when prices are dropping. Even then I would offer at least asking if it was a true gem that I planned to use as my primary.

I don’t pay rent, I’m a landlord. But lashing out at people with a snarky, “Hope you enjoy your high rent” is the equivalent of a snotty child taking their ball and running to their mommy after a name call.

But if I was a renter, I’d opt for high rent right now though than be a lifelong lemming that purchases real estate at a market peaks. All because someone shamed me for not being a homeowner.

It will be fun with the mean reversion happens so the house jockeys all go away. I’m so sick of house jockeys.

One of the issues that most older homeowners are unaware of are the Medicare rules which will take your house if you get sick in retirement. My in laws both died recently, one after a long illness in a hospice. Their small condo in NJ was worth less than $50K. Their estate was sued by Medicare for the cost of the care they provided.

If you are in retirement or getting close to it, transfer your assets before they get taken by Medicare. After what I have seen I don’t want to be in a paid off house in retirement. Sell to your kids and rent it back.

That won’t work either. They’ll take your liquid assets also, so there goes the rent money to the kids.

There seems to be a misconception that housing prices and rents generally move the same way and a massive decline in housing will cause rents to follow. As having been a landlord through the last crash, I can tell you that is not the case. First of all rents generally never go down. When was the last time your landlord decreased your rent? Sometimes they don’t go up, but generally they do not go down. That doesn’t mean you won’t find a cheaper place if you move, but your current lease or month to month most likely will not get discounted. I have never lowered a rent, or rented out a property for less then the previous tenant but there have been periods where I did not raise rents because of perceived softness in the market or an excess of vacancies in the vicinity. In regards to a crash, during a housing crash more people lose their homes to foreclosure, short sale, etc. These people have to live somewhere. As housing inventory rises dramatically the pool of renters actually increases substantially causing more demand for rental properties. This was the case during the last housing debacle.

Does one landlord’s anecdotal experience set the stage for all others? Probably not, for all anyone knows, your rental(s) were the exception.

Yes Hotel Cali. I’m sure my rentals were the ONLY exception. I’m sorry if real-world experience does not fit into the picture you paint of falling rents, vacancies piling up, and housing teetering on the edge of collapse. I for one am all for a housing correction. I would love to buy more property, but a correction is just not here and I don’t see the signs yet.

We left Florida this year due to an ~6% rent increase from a mega landlord. Our income was down 15% over the previous year and we had had enough. We voted with our feet. My husband finally accepted an out of state offer and we are glad we did. We are still renting in a more affordable area and would move again if we had to.

BS, I am a landlord too, ALL of my rents went down, even at a complex I own across the street from a college campus.

I started staging units in 2008/09 if I was lucky enough to get prospective tenants to actually show up after they made appointments on rare occasions to rent a unit. It was a brutal year or two trying to keep buildings full. I only made it because I buy high cap deals, do all of my own management and repairs, and am a hardworking scrappy guy. Other landlords weren’t so lucky.

Rents go down in spades, it is crazy to say they don’t. I’ve lived through it as a landlord.

WOW!! when i go thru the posts here it really hits home at what a loser i am. All you people make so much money i don’t even understand why you are here.

the RN who has “$500K liquid cash and $1.5 million” already in her retirement fund and then multiple “properties abroad” really hit home.

the thing i can’t wrap my mind around is WHY THE FUCK ARE YOU HERE? If you guys have all this money and have these great careers WTF are you doing at this site?

I don’t get it. If i had half the wealth most of you talk about the last thing i would be doing is fucking posting here…..WTF am i missing?

Don’t feel bad about yourself, it takes a lot of dough these days to ‘retire.’ Plus it’s all relative. Most people on this board seem to make way more income than I do. Even though I too have a little over $500k liquid and conservatively $1M equity in properties (even at 2012 prices.) However, I live on one side of a semi-ghetto duplex behind a freeway I own and live very frugally (old pickup truck etc.) So an outsider could see my situation as a self-made 36 year old RE inventor that has a relatively high net worth for his age and think I’m a step away from retirement but I’m not either. Actually in all fairness a proverbial outsider thinks I’m a poor tenant renting here, which is fine by me! Nothing to prove.

Ironically, all of my friends with zero net worth but a higher earned income than me live high on the hog/beyond their means but they will never retire. They’ve also lost homes and assets in the past because they constantly overextend themselves, while my wife and I live a relatively spartan lifestyle. I have a ways to go. Of course it all depends on lifestyle but I could never ever retire with my $1.5-2M, unless I wanted to stay in the hood which I don’t.

I’ll take my time capital any day though, nothing beats the independence of not having an overbearing boss etc.

“it takes a lot of dough these days to ‘retire.’ Plus it’s all relative”

I don’t wanna retire, i love my job, I just wanna stop having to work for less every year……It’s been decades now.

Mumbo Jumbo, I can only imagine that is infuriating. I cannot relate but I know a lot of talented/smart people these days cannot find a niche–as if this economy has no place for them. I for one know that if I wasn’t a real estate investor I would have trouble finding something to do for work. I am lucky in that sense, doing what I truly love.

mumbo, somewhere in between the lines I think you got an answer to your question.

Some people just like to talk about themselves.

Yep. Just like the berating “you missed the boat” a-holes we get around here, clearly they think that talking their book on this site is enough to prop up entire markets.

Motel California, Does that really bother you that someone could answer a question posed to the audience by using their own personal experience?

Real story, I was the guy hiring back those Programmers, DBA’s, UNIX guru’s, etc. at $.50 on the dollar after the dot com bust! Get real people … there isn’t a soul out there who can say with a straight face that they have job security for life, that they will rake in those lofty six figure incomes forever, and that the economy will hum merrily along!!!! And, all those $1 million plus home could become giant boat anchors! I sold the So. Cal. dream home, took my $$$$$$$ profit, and left! I don’t want to be anywhere close to L.A., S.F., Seattle, or Portland, when things go south the next time!!!!

Fact is, incomes wax and wane with the company/industry/economy and you cant bank on anything long term unless you’re a government drone, in which case you are going to endure a soul crushing existence.

I have a solid income and net worth but I’m on here (and other blogs) to warn would be buyers to sit tight, prices will come down. Did the same in bubble 1.0 in 2004-5. Didnt buy in this last downturn because my job visibility was limited and where I live my rent is so low that buying just wasnt that attractive. The next bottom I will probably buy and retire since I’ve been banking the money I havent had to throw at a mortgage or inflated rent. I dont want to see younger folks get screwed, hopefully in the future there will be less speculation in housing, it benefits a few insiders and lucky gamblers but most of society gets screwed.

Where did you go? And do you miss anything at all about So. Cal?

Historically, buying a house is a good investment for the long term. I do mean investment in the sense of security and not necessarily in terms of most return-on-investment. Historically, rents always rise over the long term. If you don’t want to or don’t have to move over a 20-30 year period, a fixed rate mortgage will always be cheaper. In my case, when I bought our house in the early 90’s the mortgage was $2000/month (P&I&property taxes) and rent on a similar house was $1700/month. Now, 25 years later, the P&I&T is around $1500/month (Thanks to interest rate drops) and rents are at $3500/month. The pot of gold at the end of the rainbow is to pay off the mortgage in a few years and only have taxes to pay at $250/month. Taxes will go up before I die and there is upkeep which I do much of but the total payments when I retire will be likely $500/month and not $5000/month. Could I have invested the money in stocks and had a better ROI? Maybe, but a fixed rate mortgage was more of a sure bet for when I retire and don’t have income. Also, even though I don’t live as frugally as my parents, I will have something to pass along to my kids.

Leave a Reply