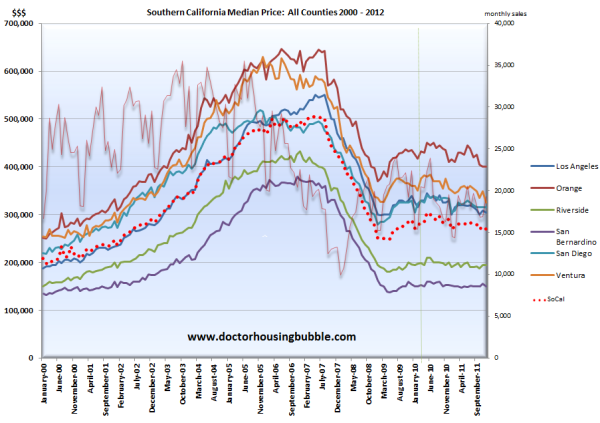

The rise of the investor and affordable home buyer class – Southern California has hit a lost decade when it comes to nominal home prices. Median home price of Southern California back to 2002 levels. Record number of absentee investors purchasing homes.

The median home price of a home in Southern California is down to $270,000. Would you like to know the last time we were at this level? You would have to go back to 2002 to find the first crack at the $270,000 mark. To sum it up we have now reached a nominal lost decade for Southern California. In reality the data highlights a much darker picture for the housing market here. You have two main groups buying up homes; first you have investors picking up low hanging fruit in locations like the Inland Empire for very low prices while first time buyers are hanging by a thread diving into the market with FHA insured loans. These are the two largest purchasing blocks in Southern California. Contrary to the rich foreigner myth or pent up demand meme, absentee buyers paid a median price of $200,000 for their purchases. Does this sound like they are eating up homes in Corona del Mar or San Marino in large numbers slowly purifying the market from shadow inventory? Let us dive into the figures.

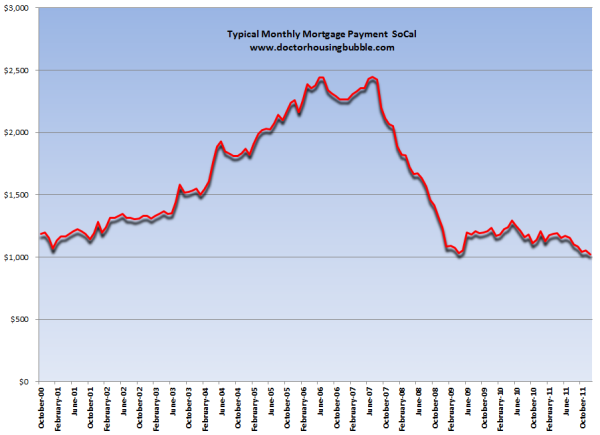

Typical mortgage payment at decade lows

Since a large part of buyers, 29 percent are paying cash, they are not factored into the typical mortgage equation. But those diving in to buy with a mortgage can only afford very little:

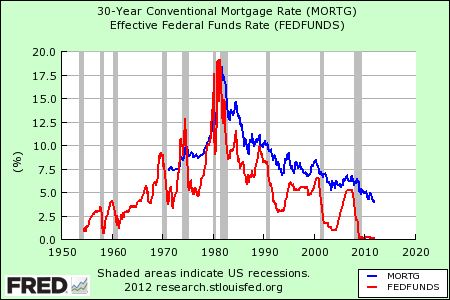

The typical mortgage payment of those who bought last month was a stunningly low $1,026. We would have to go back to the 1990s to find levels this low. What this tells us is two things. First, many recent homebuyers are not flush with large incomes. Second, it tells us the Federal Reserve’s artificial low rate policy may backfire when real rates enter back into the market. At this point, with artificially low rates many buyers are simply keeping the asset column healthy for banks but their own balance sheet is stretched thin. What they can pay out of their working capital each month is low and hence the amount committed to a mortgage above.

Part of this has to do with the still very weak economy and the lost decade in wage growth for households. The recent Census survey shows that a lost decade hit the country when it comes to household wages. This is the most important factor in determining a future healthy housing market. Just because we replace no-down no-doc loans with 3.5 percent down FHA insured loans does not mean we suddenly have a healthy housing market. Default rates by the way are surging for FHA loans as would be expected and the cost of bailing out the banks has cost us trillions of dollars either in outright handouts to banks or the hidden costs of currency devaluation and inflation through other items which will be paid over the next decade(s).

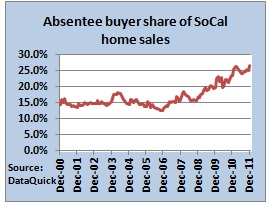

The rise of the investors

As mentioned, investors are dominating the market:

Last month the number of absentee buyers hit a record at 26.4 percent. Yet these buyers are purchasing homes for a median price of $200,000 so this isn’t your rich foreigner eating up million dollar properties as if they were eating cake at a party. These are more likely investors looking for cash flow properties. This data series only goes back to 2000 and has an average of 16 percent. Not too useful for the average figure over the bubble. I would be more interested in seeing the figure go back to at least the 1970s. My assumption would be that this figure needs to be in the single-digits to be considered healthy.

As stated before the $270,000 median home price now puts us into an official lost decade for home prices:

More expensive counties like Orange and Los Angeles are now back to 2003 levels. The trend is obvious and this is happening at a time when interest rates are comically low:

To clarify this is incredibly unsustainable given that we have over $15 trillion in national debt and have no signs of stopping on this path. 2012 is now here and we are making new lows on home prices. So much for all those claiming we would see a price bounce in 2009, 2010, or 2011. And the answer to this is obvious; when it comes to household incomes they are moving backwards and the only way this is covered up is by digitally making more debt cheaper by the Federal Reserve buying up mortgages no one in their right mind would buy. This story has been played out before and as you know, unintended consequences are bound to hit when you artificially juice markets.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

47 Responses to “The rise of the investor and affordable home buyer class – Southern California has hit a lost decade when it comes to nominal home prices. Median home price of Southern California back to 2002 levels. Record number of absentee investors purchasing homes.”

The foreign investor rubric is even more unlikely now that land prices are falling in China.Beijing is off 1% according to the BBC. China’s banking system is far less transparent than ours. One wonders just how much of China’s stupendous growth has been due to similar easy monetary policies. How much of a correction will they see? That is a big question that has enormous ramifications for China as a continued political entity. It may even precipitate the breakup of China.

That is a bunch of crap you wrote. China requires 50% downpayment to buy property. China is now #1 energy consumer and a super fast growing economy. China has trillions in surplus. China is one of the biggest buyers of Gold. China is now #1 in purchasing vehicles. I would not worry about China. I don’t even think about China. Instead I worry greatly about our once great country USA that has been decimated by Banksters.

While I agree I am concerned about the US economy and not anyone else’s, and by the banking and corporate Fraud allowed and encouraged by so-called “regulators”, and it is true that China is buying up gold…it is also true that they have restricted R.E. speculation, buying second properties, and their “trillions in reserve” has dwindled (used to purchase gold, instead of holding increasingly worthless US Treasury paper?) NOW to a very low amount.

You might want to rethink that assertion Matt is “full of crap”, indeed, he is exactly correct, and it is you that is a few years behind in your assessment of the Chinese economy.

It is slowing, has slowed, millions in the southern manufacturing region of Guangzhou are unemployed and restless 9Pearl Delta region), there is talk they may devalue the Yuan again to encourage exportation of their goods, because the world is now in a currency war to see who can devalue their currency more than their competitors, to make their exports goods attractive.

You see, if the US and European markets are suffering economically (and I hope you won’t argue with that assessment): exactly who does China export to?

I say Doc will be writing this again in 2013…until the California market bottoms at 1985 levels.

It is that awful. Until “Globalization” is euthanized and buried, and locally-manufactured goods protected from low wage labor by tariffs based on labor wages at point of origins, , the US standard of living will continue to crumble.

Which is exactly what Clinton stated when he carried G.H.W. Bush’s NAFTA to fruition: “This will level the playing field for the Mexican, Canadian and US workers”…meaning, for those with ears to hear: the US worker’s wages will be lowered.

The CIC is issuing bonds denominated in U.S. Dollars. The CIC’s 10 year dollar bonds yield over 6% and are backed by the CIC’s extensive holding of 10 yr US Treas. bonds yielding less than 2%. At some point the Chinese currency peg will cost more than the Chineses will be willing to pay, and at that point we will witness the largest Asian currency meltdown evah.

And consider how much they save each month from their income compare to US families. We are from Asia, we save about 50% of our monthly income.

“And consider how much they save each month from their income compare to US families. We are from Asia, we save about 50% of our monthly income.”

Lucky you. I’d starve and/or be homeless if I’d try to do the same: Those two items take about 80% of my monthly net salary and if I’m going to have luxuries like cloths or car, there’s nothing to save from.

Funny thing is that by salary alone, I’m a “well-to-do” and I live in a 550 sq. ft. apartment, nothing luxurious nor in expensive area. High income is meaningless if cost of living is even higher: The difference is that makes life easy or not.

YES! now 1 million people get principle write downs! Check out this BS:

http://finance.yahoo.com/news/donovan-very-close-foreclosure-deal-172113197.html;_ylt=AoF.O8oMnL_ScsE4UPp7RMeiuYdG;_ylu=X3oDMTQ0cGphMDQ1BG1pdANGaW5hbmNlIEZQIFRvcCBTdG9yeSBSaWdodARwa2cDZDEzZGJjNDUtMTgzMC0zYmQ5LTg2N2MtYTI2ODQ4NWRkNjE3BHBvcwMxBHNlYwN0b3Bfc3RvcnkEdmVyA2YwNDJlZjkwLTQxZmYtMTFlMS1iZmZmLTMzNTRjYzY4NWIwOA–;_ylg=X3oDMTFvdnRqYzJoBGludGwDdXMEbGFuZwNlbi11cwRwc3RhaWQDBHBzdGNhdANob21lBHB0A3NlY3Rpb25zBHRlc3QD;_ylv=3

As an American citizen who buys only what he can afford, pays his bills, and has suffered the loss of 1/3 of his annual income due to Federal Reserve efforts to coddle the deadbeats and the badly-run banks who foolishly lent money to them, I deserve monetary compensation in an amount equal to the average mortgage principal reduction granted to any overextended borrowers should this travesty come to pass, as do all other honest, prudent Americans.

It amounts to only $25K per person. Not going to help those underwater by $100K +.

Funny, I was an underwriter back in the height of this crap and it’s beyond me that people worry about interest…sure…in the 80s you might have to rent or just buy with rates in the teens (those were the day…).

If you cant afford the princ. payment if I gave you a 30 year loan for free…what does the interest matter?? I cant afford the 3500/mo prin. payment but let’s worry about the 5-6% rate….

The ONLY WAY we can get out of this mess is called “TOUGH LOVE” (well, my parents call it something else but keeping it PG).

Let them fail, let nature take it’s course…lets poop or get off the pot! This favorite game with bail outs not only kills people’s attitude towards the Govt. for generations but prolongs the inevitable.

Nature is extremely efficient albeit harsh. Let her work her magic.

BAC, CIT, AIG…..should be RIP!!

Now we have a bigger mess by playing favorites….TRY THAT WITH YOUR KIDS…SEE HOW THAT WORKS!

the central–I think the issue with interest rates is ‘to whom will you sell your house’? Few hang around the full 30 years. And now, mortgages are nontransferable, unlike decades past.

If the economy improves, and interest rates go up about as fast as wages, would-be buyers won’t be able to pay more principal, just a higher total of principal plus interest. For example, on a $270,000 house, with 10% down, they borrow $243,000. If interest rates go up just 3%, that would be an increase of $670 per month.

I just don’t see average wages going up by $670/month any time soon. In fact, I don’t see either wages or interest rates going up, since we’re in a recession. If the economy improves a little, the fed will slow the rate of money supply growth, killing any growth. After their front man, Barack, is reelected, of course, lol.

What’s really bothersome is that the practices of 5 years ago are still ongoing today. A custodian at the school district I work at just bought a new house only (sarcasm intended) an hour away in Victorville. A $180k price tag for a 7,000 lot size and a two story house. When asked why he didn’t just buy a home on the other side of the block for half of the price it was because he did not have to put any money down.

Another custodian (no he did not buy) was told by a realtor that he [the realtor] could put him into a home for only $2500 down.

It’s almost like 2006 all over again. What bank(s) are giving these people loans?

Lastly (for now), I’m not sure about where any you live (I’m in Covina), but I am astounded at the amount of condos for $300k+ that are being built in this area and surrounding cities. I guess when you know the government will bail you out that you don’t have to worry about whether or not someone buys what you are building.

The bank’s name is Fannie Mae…

You nailed it. Extend and pretend has made us like Rome,…. “late” Rome

Just so long as the bankSters come out ahead, that’s all that matters. After all, they are the most important and productive members of society. 🙄 [roll]

PS: The Proverbial Rich Foreign Buyers are not “saving” So-Fla either… as their home currency is generally hosed too.

The rich foreign buyers are supposed to save other countries too. Czech Republic, Hungary, Thailand, Mexico, etc. In fact, aren’t rich Americans supposed to buy relatively cheap houses and condos in other countries? So, where are all these rich people supposed to come from? There aren’t enough rich people in the world to keep the worldwide housing bubble inflated.

After reading the great post, you need to ask two questions: why investors buy these properties? is this a good buy now? My view is that the housing market will be stable for the next a couple of years from the banks view and prices. The interest rate will stay low. The investors in real estate are usually smart money. If you look at the price, US real estate is probably the cheapest among all the western world. if you want to buy and can buy, and you don’t, what are you waiting for? Remember the price at some areas came down for 60% from the high, and its not gonna be 100%.

zzzzzzzz

Your RE babble is getting really old…

You know what?

I put out 5 offers last year, I didn’t get none of the properties. There are always other offers on the table. Every one of them were sold equal or above the listing price. Again, nice quality property always gets buyer.

“You didn’t get none of the offers” That would be a double negative… There are plenty of fools that think that they are going to make boat loads of money on these “investmentsâ€. The good news is that these greater fools are saving you from making bad “investmentsâ€. A fool and his money will soon be parted…

Pete – “why investors buy these properties?”

Who cares what investors are doing? Are they infallible? Many “investors” bought property while the bubble was inflating. Many of them now have multiple foreclosures.

Not all real estate investors are smart money. Look at Dr. HB’s last article about the housing bubble in Vancouver, Canada. We have people chiming in saying that Chinese are buying property there at super inflated prices sight unseen because they don’t know if their government will confiscate their money. This is irrational behavior that usually occurs before the bottom falls out of the market, kind of like the stock market back in 2000.

If I had a bunch of disposable money that I needed to put somewhere, buying an overpriced Vancouver house right now would probably be the last thing I would do. Even gold at current price seems like a much better investment. I’m still not sold that Vancouver will get a free pass and avoid a major housing correction.

All I can say is that the news is best at the top, and worst at the bottom. If you want to buy, this is a lot better time to buy than 2005. Remember there were a lot people buying in 2005. It’s funny and interesting how people think. They don’t buy when it’s cheap, they buy when it’s expensive.

Pete-“They don’t buy when it’s cheap, they buy when it’s expensive.”

‘Cheap’ is obvious only in hindsight. Ask millions of dotcom stock buyers that lost everything buying cheap internet stocks on the way down.

For a big money guy that wants to buy 10 or more houses, they could sort of average into the position, by buying one house a year for ten years. But for the average joe, a lot is riding on getting it close to right.

In my case, I blew it badly, but my employment has been stable so I’m not forced to move any where, yet.

I follow several CA real estate investor groups and they absolutely love the $200K and under properties because they almost all cash flow as rentals. They are trying to lobby congress right now in order to be able to buy a lot more properties, if they can. But I think hedge funds will be allowed the first crack at them. And then sell them to investors. The basic logic they’re using is past historical performance. CA always cycled back up in the past. So buy the house as a rental now, and then reap the big money when the market takes off again. Believe me, they drank the whole pitcher of Kool Aid on this one!!

“After reading the great post, you need to ask two questions: why investors buy these properties? is this a good buy now?”

No.

But when you have truckloads of cash, you _have to_ put it somewhere. Investing in actual production is a no-no: You’d really have to be smart to compete with Chinese and standard investor isn’t that smart.

Investing in stock markets (or any other financial pyramid scheme)?

You’ll basically lose everything as there’s absolutely nothing to back any of those up, 100% imaginary value. OK as long as people believe in those, 0 after that.

That leaves commodities or real estate and if you have 200 millions, losing 20% of that isn’t so bad deal if the other option is (a serious risk) to lose everything. Most housing will be worth something all the time and much easier to sell than stock of a bankrupt company. Also better protected from inflation than truckload of bills.

I could claim that _that_ is the real reason investors are buying houses: it’s less bad choice than the rest of the choices. In this case not choosing is also a choice, very bad one.

Maybe I am missing something but you are not making any sense. If housing is measured in US dollars and its nominal value in US dollars is going down how is can housing be a better hedge against inflation than US dollars? It would make more sense to keep your paper dollars that are depreciating relatively slower than the house. I am not convinced that these “investors†are all that smart regardless of ethnicity/country of origin.

Unless you believe the big ol US of A is finished, all these assets including stock, bond, real estate, commodities will have values. These will have intrinsic values, not the one you assigned to them. The value of dollar will decline regardless. The real asset value will increase. Suppose you have a piece of land you want to buid a house, you need to calculate the cost for everything. None of these costs went down much in the last a few years. That alone makes you wonder how far the housing price will go down.

I am not trying to convince anyone to buy a house, but I am not convinced the price will go down much from these levels. It has been down quite a lot already, and pain will gradually subside. I also know that college tuition went up a lot, so is the medical cost. I am not convinced they will come down either.

Pete,

Have you ever taken a math class? It is as if you think that everything can go up. This is not always the case. I am talking about real verses nominal. If cost of education, energy, commodities, etc. is going up in real terms (adjusted for inflation) then how would people have extra money for increasing housing in real terms? There will be a crowding out of available income for other expense items. The only way everything to go up in real terms is that income would need to go up in real terms as well. With the slack in the labor market I do not see how you could argue that income will be going up in real terms anytime soon…

Since Nixon the financial sector has become more than just a little bold. The job they have devolved to is to obfuscate the off shoring, theft, insurance fraud, money laundering, and bribes under a blizzard of ‘legal paper’ and media. It’s the fleecing of a nation and a world.

Remember Japan had a 15 year downturn before stabilizing-at least their land is really limited-they are an island nation.

So, where in So Cal besides the I.E. can you buy a place for 270k? Anyone really want to live in those areas?

Under $270K?

West Covina, Whittier, and La Mirada for starters. All zoned to high schools with 770+ API test scores I believe, all within a one hour rush hour commute to downtown LA.

http://www.redfin.com/CA/La-Mirada/12125-Los-Coyotes-Ave-90638/home/7764655

http://www.redfin.com/CA/Whittier/Undisclosed-address-90604/home/7820146

http://www.redfin.com/CA/West-Covina/2429-E-Mardina-St-91791/home/7944744

…and who wants to live in those areas!

Hey “Fake What?â€, I realize that imitation is the best form of flattery but, it is pretty sad that you are so embarrassed with who you are that you have to pretend to be me…

A ONE HOUR commute? Who wants to live in some inland city and drive AN HOUR each way to work?

Just rent near work, save your down payment and try to make 3% a year, instead of losing 3% a year on your purchase. Save those two hours a day by not commuting, save the .55 cents a mile (total cost of driving average car), save your lungs not breathing highway smells.

In Camarillo you can buy a 3+2 townhome for around 270k, in a pretty nice area. These home are small though (1058sq.ft). In Oxnard and Port Hueneme you can buy a little more for your money but the areas are not as nice.

226 Flint Ct

Sonoma, CA 95476

Date Event Price Appreciation Source

Dec 30, 2011 Sold (Public Records) $360,000 -9.2%/yr Public Records

Oct 09, 2007 Sold (Public Records) $540,000 -6.4%/yr Public Records

Jun 17, 2005 Sold (Public Records) $629,000 25.2%/yr Public Records

Apr 29, 2003 Sold (Public Records) $389,000 17.8%/yr Public Records

Jun 15, 1998 Sold (Public Records) $175,000 — Public Records

The above tract home recently sold for 360K . This home was purchased back in Oct 2007 for cash as an investment the cash buyer thought he made a great deal since the prior owners had spent over 200K remodeling. This is one of several all cash deals that have gone bad recently and my guess is that there are many more bad investor stories around but they get little or no media attention.

The declines still haven’t washed everyone out yet. That tells me we still have a ways to go before we hit bottom. Nobody wants to catch a falling knife.

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdowthe90402.blogspot.com

I imagine an investor only cares if they’re making a positive income from the property or not.

If some dude buys a 400k house with cash, and rents it for 2,500 per month (30k per year). Does he really care that much if the price of the house falls to 300K and stays there for several years? Sure he does if he is planning to resell it quickly; but i imagine most investors (not speculators) are in for the long haul. More than likely he sees it as a long term investment: 30k x 15 years = 450k; 15 years from now will that house still be only 300K? Probably not.

Obviously it’s better for the investor only put enough money into the property so that the monthly rentals cover the mortgage, taxes, and maintenance. Then the investor waits 15 or 20 years. Do they care if the property value drops for 3-5 years? Perhaps they think inflation, which might happen 10 or more years from now, will take care of any short term falls. There are no guarantees, but it’s still pretty hard to loose money on the scale of 15 to 30 years.

Let the renters eat the short term loss for you.

” There are no guarantees, but it’s still pretty hard to loose money on the scale of 15 to 30 years.”

Look at the Japanese real estate market from the peak of their bubble.

YES!!! , I do care if my investment falls 25% in two or three years.

If I have 3 million dollars and I can buy 10 300K houses today or if I wait a couple years and I can buy13 AND have a couple years of no landlord headaches, I am going to wait!

Weather it is a 5% bond or a share of General Electric that yields 3%, what it is worth a few years from now is a big deal!

But I suppose, Yes, if I am stupid enough to purchase an asset that is likely to decline, I would want to hold on to it as long as it is income producing.

Trading loss of capital for ROI? This is idiotic. Perhaps this is why T Bills are still pretty popular. Return of capital trumps return on capital.

Say you lose a few percent a year on the capital, but you get 7% return. Factor in inflation and cost of managing and maintaining the real estate, etc… and you may be at break-even after 3 to 5 years of ownership. This is a good deal???

DHB: “Part of this has to do with the still very weak economy and the lost decade in wage growth for households.”

Longer than that, for many! The bottom 2-3 quintiles have been stuck in the mud since 1970.

http://en.wikipedia.org/wiki/File:United_States_Income_Distribution_1947-2007.svg

Can someone here tell the people of Vancouver that RE is retarded up here. Some areas have seen a 300% increase in 5 years. And we have people saying its different here. Is mnd boggling what people here think. Absolutely insane.

Dr H

What was average European mortgage rate years 1700 to 1860 and in US 1946-1968 or so in economies growing at 3% per year. Home buyers buy payment plans. Please publish table showing If mortgage rates are at 4% 30 yr fixed now, and payments are still unaffordable for Californians, if mtg. rates rise to 6% thru 2015 home values would drop further so payments come back into affordable levels (e.g $500k home price now, $400k loan = about 2000/mo payment would rise to 2400/mo unaffordable, thus home prices would drop to 400k if mtg rates rise to 6%/yr, bringing mtg payment back to an affordabe 2000/mo .) Take table up to 7% mortgage rate. Thx.

It has been quite interesting to read this thread, given that I am a full-time cash flow investor. I have NEVER invested in real estate (commercial or residential) in CA because of the inherent volatility of prices. If you’re truly a cash flow investor and you’re truly relatively low-risk then you don’t invest for the future “gain” of home prices in CA – you invest for the present cash flow that exists regardless of whether it’s a home, commercial real estate, or a widget! And clearly investing in CA still has a LOT of downside risks due to the inherent volatility (ie. bubble) in this state.

I would suggest that everyone who has only thought about investors buying CA homes think outside of the box. For example, if you could buy OUT OF STATE homes in non-volatile and non-sexy markets at pretty good discounts then you could protect your downside risk by buying at the right price with 50% of “padding” knowing that these markets might decline another 5-15% (some have ONLY declined about 5-10% from the peak but they never really appreciate much during up cycles). You can typically net about 8-12% cash flow with 50% padding in non-volatile markets at the right price points (ie. $50-100k range in Mississippi, Tennessee, Missouri, etc) so you’ll yield decent cash flows, have deferred taxes thanks to depreciation and 1031 exchanges in the future, and won’t have to worry about buying an asset that will be worth less than you paid for it in 3-5 years. If you doubt the 50% padding then you’ll have to do your research but – trust me – it’s out there.

Of course, MANY people don’t want to do the work of researching out of state markets, finding good teams to buy and manage properties, etc. And, of course, there are risks. BUT investing in buy and hold single family properties DEFINITELY makes sense in some very specific markets right now for cash flow investors.

And one more note – I know at least 1 person is going to reply with quick comments that make it sound like this isn’t possible. To them I would say this in advance: Anyone who replies by either doubting what I have said above or telling me that 50% padding isn’t enough hasn’t researched these markets, doesn’t understand these markets, and has looked at historical data in these markets to draw the proper conclusions.

I hope this helps some of the posters above understand how and where real estate investing can make sense right now. CA is a whole other story!!

Good luck to everyone,

Investor J

http://www.meetup.com/investing-363/

http://www.meetup.com/FIBICashFlowInvestors/

Invest

Out of state purchases also have a driver in the increase in the population of migratory retirees (summer in CA, spring/fall in the old family place, winter in FL.) Most try to work their schedule to spend 6 months and a day in FL for tax purposes. I also know several winter in MT/CO, spring/fall in the old family place, summer in Destin/white sand beaches.

Leave a Reply to Pete