The rise and fall of the American homeowner: Current homeownership rate is back to where it was 50 years ago.

Historically low interest rates and artificially low inventory has helped to boost home prices but the homeownership rate is in perpetual decline it would seem. There is a tendency to forget that the rise in home values was largely driven by uncharacteristic investor demand for many years. This multi-year buying has resulted in many homes being taken off the market only to be turned into rental units. The numbers are staggering but they are worth repeating: we have added 10 million renter households over the last decade while being neutral on actual homeowner households. The math is derived from the grim reality that since the crisis unfolded we have witnessed 7 million Americans undergo the process of foreclosure. This flies in the face of the constant drum beating that somehow buying a house is a sure bet. With most things financial, you have this survivorship bias where those that got smoked out of the market are silent while those that got lucky or timed the market correctly constantly voice their perspective. Yet things are good until they are not.

Housing becomes a volatile investment sector

Here is a quote from our banking top chief Ben Bernanke in 2007:

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency.â€Â

Most of the foreclosures that hit the market where in the form of prime mortgages going kaput. Why is the homeownership rate continuing to fall despite record low mortgage rates? The quote from Bernanke simply reflected the popular belief of the overall market. Just a few months ago we had many drinking the perpetually inflated Kool-Aid of the market. Now, volatility is at levels unseen for many years.

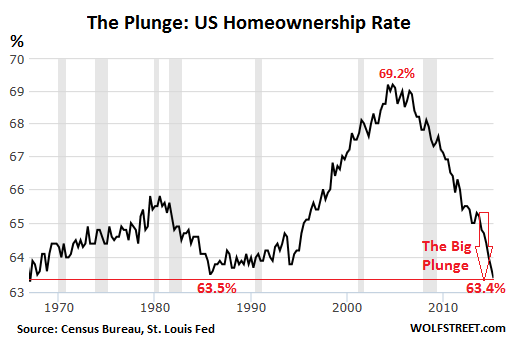

Despite the record rise in the stock market over the last six years, just look at the homeownership rate:

The current homeownership rate is back to where it was in 1965. We have erased a half-century of gains in this category. The growth in homeownership usually is pushed by young households in family forming ages. But things have changed with Millennials being saddled with massive student loan debt and many earning much less than their parents at similar ages adjusting for inflation. This is why we have many young adults living at home.

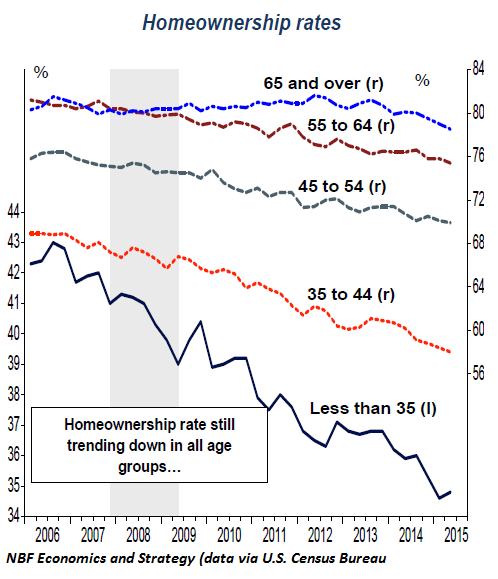

The trend is consistent for all age groups short of the Taco Tuesday older folks:

Even in the older age group, the rate has declined. Simply inflating prices for the sake of inflating prices is not good. I know some are laser focused on their crap shack invested hood and somehow feel that massive price mania is justified. But I have to remind many that you don’t get that equity until you sell and these people are house horny and get stuck on a certain zip code. This is how you end up with your 99 Cents Store shoppers in million dollar homes in Pasadena.

So where do we go from here?

Just like in 2007, there has to be a shock to the system. This time, we have plenty of things that can go bananas:

-China’s massive volatility and slowdown

-Europe’s economic mess (i.e., Greece meltdown)

-Oil bust (Canada now in recession officially and they have an even bigger housing bubble)

-0 percent interest rate environment pushing central banks into dangerous and unchartered waters (i.e., Japans infinite QE and the Fed’s QE)

-US demographic shifts (Millennials not house hunting like mom and dad)

-Cracks in financially backed political structure

There are many other things and the global markets are simply waking up to this. The trends from the charts above are clear. The homeownership rate dropping seems to be a trend that will continue short of the economy bouncing back. Of course you have your late lemmings buying homes at top price only to realize they’ve locked into a 30 year commitment for a crap shack. L.A. County is home to the most unaffordable real estate market in the world and some people pretend this is happening because of some sacred financial blessing. These people like Bernanke in 2007 act as if things can’t change quickly. I think global markets are showing that things can and will. We are now in a global boom and bust system where the booms and busts seem to happen at more regular intervals.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “The rise and fall of the American homeowner: Current homeownership rate is back to where it was 50 years ago.”

the surging ranks of america’s ultrapoor – cbs news via drudge

First !

Props

nope

Surprised how hard oil is getting hit, with Canada’s economy so largely dependent on commodity prices they are going to be devastated.

Too many oil exporting countries relying on oil as the main source of revenue. With lack of demand and increased production, prices are bound to fall. Still can’t figure out why gas price is still expensive in California compared to the rest of the country.

Californians are paying more for gas because of California’s 2006 Global Warming Solutions Act, and a followup Executive Order establishing a Low Carbon Fuel Standard. These make it more expensive to refine gas that meet’s California’s standards.

We’re paying more for gas so as to reduce GLOBAL warming. (I doubt that it’s having ANY impact.)

http://instituteforenergyresearch.org/analysis/lies-damned-lies-and-nrdcs-magic-math/

http://americanenergyalliance.org/2014/03/24/lcfs-imposing-expensive-california-fuels-on-a-town-near-you/

https://en.wikipedia.org/wiki/Low-carbon_fuel_standard

The other 49 — and SMARTER — states have not followed California, so they’re paying less for gas.

I think we are seeing a glut on oil with China’s recent problems. If growth is not going to be like it was for the past several years that glut of oil is going to create a tipping point for the oil producers for some time in my opinion.

Curious if we will start seeing more license plates from the Dakotas start showing up in California now with the oil drop?

Perhaps the lower homeownership rate is not such a bad thing.

Put things in perspective:

50 years ago, this country was at the peak of its prosperity, and led the world in every indice of prosperity and in the well-being of its citizens.

We led the world in manufacturing and technology. Personal incomes were higher than at any time before or since, and still rising. We were 1st, or close to 1st, in life expectancy, literacy, number of people with indoor plumbing and electricity, and education. Our booming auto and aerospace industries paid lavish wages to millions of workers.

Inflation was low-to-nonexistent, and most people paid no more than a quarter of their income for housing. A little ranch house in a suburb like Lakewood, CA, could be had for $20,000 or less, while the same house today, in far worse condition, sells for many hundreds of thousands of dollars.

We still saved money, as a population, and a person could earn a decent middling income without paying $80,000 or more for a degree.

Since the early 70s, we have gone straight downhill, and disguised the deterioration in the living standards and earnings prospects of our population by driving the growth of consumer debt, which has exploded since the late 70s. The much larger houses and tons of bling bought on credit by a population earning less money and carrying more debt in every decade since, do not equal real prosperity, which disappeared with our manufacturing sector.

So the home-ownership rate is not a good measure of how far we have fallen. A better indice is the debt to income ratio, and the percentage of the population earning less than the income necessary to support a lower-middle-class lifestyle.

And the wealthy and corporations actually paid their fair share of taxes. Fair being debatable but that share had a lot to do with the health of our economy. I don’t see this as a positive indicator but it may mean we are reaching a tipping point. Straightening this all out will push everyone out of their comfort zone. Not sure we trust each other enough to do that but our hand may be forced soon enough. The essence of capitalism is not to share.

Thank you for pointing that out… Under Eisenhower, the top tax bracket was 91% – that is verifiable! Taxes were so high in the 50’s and early 60’s that the BEATLES sang a song about it. Want to make America GREAT again? Have the wealthy and corporations pay their fair share.

That 91% top tax rate number was just a number. Nobody paid it. There were deductions for everything. People that quote that are trying to make a point with merely a number and tons of missing information. We have closest to the top tax rate for corporations in the world today. Why do you think companies are moving everything offshore and refusing to repatriate money? It’s not because of our wonderfully low rates that desperately need raising. The Beatles were singing about the tax problems in the UK where they were citizens.

“Fair share” of corporate taxation won’t happen in today’s global economy. Either you cut taxes to keep it competitive with other countries or lose jobs to those countries.

Well stated! Ever since Pres. Nixon set foot on Chinese ground in 1972, our fate was sealed. We just didn’t know it, and largely still won’t admit that globalization and technology are responsible for the huge demise of that coattail prosperity brought about by the American-centric world of the post-war years.

If LBJ took us out of Vietnam and never started the war on poverty maybe Nixon would not have taken us off the gold standard

Laura…Life in general is all relative. 50 years ago a house was 20k not a great house but nice. Companies like Lockheed paid many employees about 12.50 a hour hardly enough to buy a very nice 50k home. What the difference was with a HS school diploma a relative could get you a job and benefits. Same true in the auto industry, but the workers got paid more but the union dues and other nonsense it still amounted to a lower to middle class life and nothing else. High end locations were expensive then and expensive now. I always say when I was young and drove thru Beverly Hills the real estate agents would say a industrialist lives there, a bank board member lives there, a owner of several business world wide lives there, a Hollywood mogul lives there, nobody from a working class live that life. Today same thing, only the million dollar home in 1965 is today 20 million, the person who lived in those neighbor hoods worth about 10 million in the 60’s today 100 million it is all relative.

There has always will be a separation of wealth we over 325 million people more people mean more lower middle class. We are the ultimate capitalist country, Socialist, Communist (Lenin especially) have always exploited the myth of “in the long run capitalism will pancake the middle class” and yes this is true the problem, we really never have a middle class in this country it is a holding pattern to either stepping up to upper class or rich thru college degrees , property investment, inheritance, luck, and combo of all or a lotto winner etc.

The vast majority in a capitalist country work for a living or work and have gov assistance in other words in the long run they will be pancaked from the middle class and end up lower or poor class. It has always been that way, watch AMC and those 1938 movies where the actors enter those mansions with high ceilings and beautiful wood work, most folks in 1938 lived in row houses with a broken wood fence and a ally behind them. The good old days they are only good if you make enough money to enjoy life, otherwise the good old anything ain’t so good no matter what era or century?

What union dues and other nonsense? This is completely nonsensical. Destroying unions and off shoring jobs is the foundation that destroyed the middle class and started to surge towards the great income inequality we experience today. Laura is right on. I grew up in the 50s-60s. People had middle class jobs; their wives stayed at home to raise families and they still spent less than 25% of their income on housing. Here in San Francisco, whole neighborhoods were comprised of working class families and they could buy a house for under $30,000 (almost ALL were union jobs). In some of those neighborhoods those very same houses (now 60 years older) are going for $2-$3m. In 1971 a mansion sold in Beverly Hills for $150k; it was the largest sum EVER paid for a house there. Real estate is so damn expensive because it’s the last remaining physical commodity the US has left.

@MarkinSF

HI Mark. A while back I found one of my father’s tax returns from 1968. That year as a union worker at a chemical factory in SouthCentral LA, he made $5,900. He had a 3bd house in Westchester (near LAX) which he purchased as a new home on the GI Bill (WW2) for $10K. my mother stayed at home, me and my 2 siblings went to private school and we owned 2 old chevy’s… his union insurance paid for vacations, full medical, dental and orthodontics….

In 1975 we sold that house for $30K. today it would list for about $750K.

Yes, I know most people were lower middle class, which was not a bad place to be. Which is my point. Those houses in Lakewood were built for lower middle class workers. And they didn’t make $12.50 an hour until the 70s, when inflation was rampant. They considered themselves well paid at $5 an hour. Minimum wage was $1.25. I know because I grew up in that era, and it was not a bad life at all. You had a nice little ranch like those in Lakewood- small, but comfortable and modern; you usually had a decent car; OK furniture, reasonably decent clothes, and a decent school to send your kids to.

These days, it takes an upper middle class income to afford those little houses, that are no longer comfortable but are deteriorated 60-year-old crapshacks. The decent lower middle class blue collar jobs if been replaced by part time minimum wage service jobs, and the minimum wage of $10- $15 an hour now buys less than $1.25 an hour did then. The family that had a savings account and a company pension then has a series of part time jobs with no benefits and a pile of debt.

The real marker is the appalling rate of poverty and homelessness now. Sure, there was poverty then, but you could at least afford to eat even if you were living in a slum, and you didn’t need a car because the cities all had decent transit still, though it was dying fast. Food was cheap- poor families in my St Louis area had no trouble putting enough food on the table even if they wore clothes from the Goodwill and lived in decrepit 3-room flat with the kids sleeping on cots. For the better-paid blue collar folks, life was good if not lavish. A nice little house or apt, company picnics, nice public pools and parks, a new car every 4 or 5 years. Well I remember the parents of my classmates pulling up in their new Impalas and Olds 88s.

You might have had to save for the little house until you in your late 30s, but it was easier to save the money in that time.

We have lost a lot since then. Somehow, a degree from a for-profit diploma mill that cost over $100K and still won’t even get you a job that pays more than a notch above minimum wage, and a $35000 car loan, is not the same, especialy when you see that even with all the home owner assistance programs and the FHA loans with 3% down, you are STILL never going to be able to buy the house an assembly line worker bought in 1960.

Laura makes good points about the dynamics of easily available credit. I guess it was just a matter of time before that translated into mortgages, bc it is credit too. The banksters figured out a cheap way to make money by selling us “money” in the form of credit, and now as a nation we fake wealth seems available to any fool.

While I’m not a conservative, I am bearish with money. Grew up exactly the way Laura describes, in small modest houses and public schools. I watched older siblings jump into that credit card debt first year in college because the card companies were on campus giving them away, eagerly creating new “users.” I learned from their errors, took longer to get through college working 30 hrs week and paying cash for the education.

By my mid 40s I finally bought a modest place that cost 2 1/2 times my annual gross income with large down payment in a less-than-perfect neighborhood in LA. Seems old-fashioned. And I timed the market – closed at the historical bottom of 2012 but that was not my intent, but without that bottom I would not have bought either, so it’s a little more than just dumb luck, it was a lifetime of having a good head with how I spend. I’m considering selling now bc market is peaking, but then where do I live????? Keeps me up at night!

So we learn financial habits, I learned from my parents and watched older siblings become that horrid cautionary tale of credit hell that decades later holds them hostage. Literally. I hope people today have learned a thing or two, and are teaching those things to family. Financial values are passed on, just like all kinds of other habits good and bad.

Laura, Robert.

One big difference between then and today is the amount of “stuff” people now own.

My Aunt/Uncle bought a little 1000 ft/sq tract house in Lakewood, Ca. (Near the Douglas Aircraft plant) in 1948 for $8,000. I remember her telling me that in the earlier 1950’s she was scared to death about how she was going to meet a $50/month mortgage.

My Aunt/Uncle lived a very sparse lifestyle even though they both worked. It wasn’t until the 1960’s that they saved enough to buy a console Stereo system. That was such a big deal that I remember she threw a party just so the neighborhood could come over and hear what Stereo sounded like.

For many years they had just one car. Minimal clothes and vacations were limited to weekend drives to Joshua Tree. Appliances were repaired, not tossed out.

Today, of course, multiple cars are the norm.. Every sort of electronic gadget with monthly data fees attached are common. And who lives in a 1000 ft/sq house?

Unions have succumbed to the same “disease” that is affecting big companies and our government for that matter. Unions used to be populated by leaders that shared the same challenges as the people they represented. Not so anymore. Today the leaders are fat cats mostly interested in money and power for themselves. This has turned certainly me, who used to be a Stewart in my past, into someone looking for a less craven solution. This isn’t helped by public sector unions who have done more to corrode the government, and themselves for that matter, than almost anything else. A government job used to be less than top paying but with the benefits and pension worth it as a package. Today they are paid like royalty. $140,000 administrative assistants anyone? And have pensions we truly cannot afford. The unions give handsomely to elected officials that turn around and vote in these Midas like benefits that they know will come to fruition well after they’ve left. It is a toxic crop we are left to harvest.

fensterlips – i call bullshit. the clerical staff in my office get paid about $35,000 a year not including benefits

I remember those days, and way more debt today and folks buy houses that are too big for their needs. Younger people would be wise to rent and not get in the housing trap. Not a good investment anymore I tell people. The smaller houses (under 1800 sq ft) are the best if people just have to buy as more people can afford them and easier to resell. People of all ages fail to save like years back, and even retirees are going in debt for home repairs or cars. We always saved up and paid cash, except the first house, but paid cash for the one we are in now incl cars. Never carried revolving credit card debt like many retirees. Sometimes bought second hand furniture or clearance.

I plugged some numbers into an inflation calculator the other day: In 1985ish I was young and single making $2,000/month and I lived in a one bedroom apartment in a very nice part of San Francisco, Sacramento St. between Fillmore and Steiner, and payed $400/month rent. In today’s money that is something like $4,600 and $900. Today with that income the rent would probably be something like $3,500/month which would not be doable on a $4,600/month income. Rent has gone up many times more than inflation. I managed to buy a small house, 600 sq. ft., in the Oakland Hills, sold it and moved up and eventually cashed out with enough to buy a payed off house in a small town in Sonoma County when I retired on my generous Public Safety civil service pension. All this pissing and moaning about Prop. 13, State spending, immigrants, on and on on this board are tedious and will not change a thing. If you think you have a strategy that will give you a good life in California pursue it. If you think the deck is stacked against you you may be right or you may just be paranoid, only your Mental Health provider knows for sure. Just stop bitching about it and do something or move on to some place you think you can prosper but please, before you do that will some of you whiners just GET A LIFE!

. I was lucky and a very little bit smart.

Congratulations for being born in an era when the economics for home buying were more manageable! You are the definition of the “I got mine” attitude. Ironically, your story seemed to be leading up to an empathetic punch line–then you surprised us.

Dan, the debate around Prop 13 and other important issues isn’t going away even if it cramps your comfort. No amount of complaining diminutively about complaining is going to prevent the change that might change your luck.

Dan,

I’m so glad to hear that you got yours. It’s reassuring to know that things worked out well and that it took just a “very little bit smart” to succeed. I hope that you’ll continue to enlighten us with your perspective, many people here have much to learn from you.

/sarc

Hope that pension never goes ‘poof’ nor does Prop 13 get repealed so that you can continue to have a lifestyle that you clearly deserve.

I want everyone to have theirs. What’d being illustrated here is that there used to be a margin for error. One could be a teacher, an artist — one could take time to discover oneself — make mistakes — and still have a chance at living comfortably. Now! We all have to be financial calculators in the flesh — and some of us don’t want to live our live slicing and dicing numbers and have our whole fucking reality revolve around money all of the time. Some people don’t want to be judged on what they paid cash but what they have created and done to make the world better. There was a time when this was possible. There is a reason they don’t put hitches on Hearses yet we all are forced to spend out time on this gem of a world — worrying about money. It’s gotten worse now that they 1% has separated themselves from the rest of us. We’re chasing pennies while they chase dollars and that’s exactly how they want it.

and the more I think about your post the more I hope that people have the energy to fight against Prop 13. Comments like yours certainly motivate me to take action and speak out against it whenever possible. It has viciously picked winners and losers, and worse yet created a generation ( I’m sure there are a silent minority of folks that know it is wrong, but will never for the sake of their children or own pocketbook vote against it) of smug Californians who think they deserve it.

Laura: sort of like squatting to own in a rent controlled apartment…. Ascribing such nefarious intentions to people who went out and bought a house to live in [or stay for years in a sub-market rate apartment] is over the top. Perhaps you’d like to see a renter’s/user tax to make it all more equitable and fair?

People have been trying to blame all of CA’s real estate problems on Prop 13 for over 40 years. It’s impact is way overblown, a “straw man” as it were. People were being taxed out of their homes before Prop 13. Reining in Sacramento greed is a good thing not the evil people want to claim.

If you’re an owner currently you benefit from Prop 13, regardless of whether you bought yesterday, 10 years ago or 30. If you’re a renter, you pay a fraction of the taxes that property owners pay when you vote for that feel good bond issue on the ballot. But you have the freedom to up and move.

The average time spent in a house is seven years. The turn-over rate is far greater than the number of people “cheating the system” by staying in their current houses.

There are all sorts of reasons for not moving: stability, refusing to “keep up with the Joneses”and chasing an ever larger roof over one’s head, economics or just plain being happy with what one has.

There’s no great plot to keep others out by staying in place and the jabs at these people makes the person writing such comments look petty, envious, greedy and mean spirited. That’s not going to get you anywhere. Taking action to get revenge on Prop 13 “squatters” will just blow back on you, Laura, when you go to buy or the property tax cap on your current house is lifted.

The current scarcity of available housing on the market stems from hedge funds and other institutions buying up properties with cash and turning them into over priced rentals. That’s more of an impact on the housing than some poor slob Prop 13 “lottery winner” just living his life in a house he loves and doesn’t want to leave. Prop 13 stopped having any impact on the state’s budget two years after it passed and for the next four decades we’ve been subject to sky is falling claims and hair on fire speculation that Prop 13 will destroy CA.

I’ve got a great idea: why don’t we just take their property under eminent domain and resell it to generate higher taxes on it? For the good of “the people”. That would teach ’em. \sarc

Don’t put the blame on home debtors. They’ve got plenty to worry about other than Prop 13 and doubt it even charts on their list of things they’re concerned about. I’d bet they’d be surprised to find they were so vilified simply because they committed their future earnings and sweat into securing a roof over their head.

The Rise Of The Rental Recovery In America and the Collapse of Homeownership In America.

Renting cycle is now hitting it’s 2nd level stage now, actually so the pent up demand thesis people on T.V. was always for renting not for ownership

There is a clip of me on CNBC talking about the real and only reason why Housing Demand from main street is at the weakest level post WWII and the Lowest Rate Cycle post WWII

The Fall Of Homeownership In America

http://loganmohtashami.com/2015/04/28/the-fall-of-homeownership-in-america/

Well said Laura L, you beat me to typing some of that out. That said, people will someday wake up to the fact that coastal RE is expensive. If you don’t have that solid 6 figure income, your just going to have to be ok living inland, maybe way inland like Waco TX.

We watch some show on TV where people buy these beaters in Waco, fix them up and have about $125k-$150k into a really nice house. As a young man in his twenties, I would have moved to a place like that, so I could build my life around an affordable home and area. That is just me though. Unless you surf, coastal living is silly IMO.

Here in Florida, I know several people who have stopped paying their mortgages and years later the banks are still quiet and not talking at all about foreclosure or any other actions. Not even a nasty letter, just the same mortgage statements with an ever growing past due balance.

Is the same thing happening in CA? I know banks hate to take over property for various reasons to do with their P&Ls balance sheets etc. But is part of the low inventory banks simply refusing to pull the trigger on home’owners’ who stopped paying?

It was happening all the same here in SoCal, but as the prices have risen suddenly more mortgage defaulters who have been stringing along the past few years are experiencing the banks finally coming to get the keys. But there are people who claim that shadow inventory either never really existed, doesn’t exist now, or both.

Recently saw a Redfin SFH listing in OC for the relative “bargain” price of $350K. Turns out that the ceiling and walls were trashed, and the pool was covered in tall grass. I’m betting that the house had been abandoned for years prior to hitting the market.

Many people seem to feel that it is their god given right to own a home. In reality, only a small percentage of people can actually afford to purchase a home in LA and surrounding areas at today’s prices. Jim is right. Instead of pining away for a pre-WWII stucco crap shack that is unobtainable at today’s prices, consider other options. There are plenty of nearby states like AZ, TX, NM, & NV, where you can get a beautiful home for 250K or less. There are even some nice parts of California that are still affordable (Mostly inland or up north). Many of these areas have better schools and a better sense of community then LA. Personally, I saw the writing on the wall and left LA a few months ago after living there for 20+ years. IMO, the place is going straight down the toilet and is starting to resemble Tijuana, but with higher taxes.

La is not the worst, San Fran is a lot worse.

People forget about boom and ust. We are at the height of the latest boom cycle fueeld by investors. Unfortunately, many people will really get burned AGAIN in the bust cycle. Although this time, the government has no ammo left in its arsenal except hope. Should be interesting.

http://www.westsideremeltdown.blogspot.com

Well I finally bit the bullet, after 2 years on this site, I am buying a home and we are in escrow to buy in western Ventura County (Camarillo). I am scared to death because I feel like the market is possibly at a top…but I also felt like it was at a top for the past 2 years, and all it has done is gotten more and more expensive. And while I do realize a top could be here for all the reasons various posters have made, (incomes, etc.) those reasons have been present for the past 2 years as well and no drop has come despite a lot of signs pointing to a market top. Just more gains…

But I also see plenty of reasons why prices may not fall, may still increase from here and perhaps move sideways at worst, and those reasons are lack of inventory and lenders realizing foreclosure does them no good.

A recession would be needed to knock prices down and while the economy is not great, the slow growth we have had does not lend itself to an epic fail, like the last boom did.

I really do not know to be honest, but we found a house we really like and decided to jump in and I am hoping that it is not the wrong time, but I did not want to rent another 2, 4, 6, or 10 years waiting for a crash, because the problem with the crash is you have to wait until it bottoms to buy, and we have yet to see a true down turn in pricing, and when you do reach a bottom then there are a lot people who want to get in and it bids up real quick.

I have mainly decided to buy because I have realized timing the market is next to impossible. We found a place that suits us really well and we are not buying with the idea of investment, but because we want to live in that particular house and there is no guarantee that house will be for sale again if and when the market crashes.

Regardless of prices over the next few months or even years, buying a home that you plan to live in for a long while seems to make sense because it is an asset that you will eventually own even though you do still need to pay the property taxes and insurances on.

Anyway, I will continue as a reader on this site and comment occasionally, but I have realized I could spend my entire life hoping for something that is not going to happen if I waited for a crash, because while it seems like the FED and TPTB have no more bullets in the chamber if a downturn would occur they make up the rules as they go and every other economy is worse than ours, so by default we are the strongest weak economy there is.

Good luck to all in however you approach this market and hopefully everyone is able to find and buy a place at a price they agree with at some point. All I know is that housing and the booms and busts of the last 15 years has been the single most anguishing difficult thing in my 35 years and I am hoping that it is no longer something that will be on my mind.

Congratulations Bryan, it’s exhilarating and sickening at the same time. That’s how I felt a year ago when I bought my house, thought it could be the top but also reasoned that single family homes are scarce and land in good areas is only becoming more valuable. I’m prepared to weather the storm if/when it comes, you have to be practical about it. This site has a lot of good information but it’s also skewed towards the worst case scenarios. So you just need to safeguard yourself the best you can and hopefully those numbers work out for you.

Bryan: Congrats on the purchase. I hope for your sake that prices continue to rise. I hope for my sake that prices tank (I already have one house, but want a different one or more than one for rentals). It will be interesting to see what happens. At the very least, you got a good interest rate.

I placed an offer on a house in Woodland Hills a few weeks ago. I offered list price. I was informed there were 14 offers. The seller then wanted us all to make our “last and best offer.”

I simply resubmitted my offer of list price. I was actually happy when I didn’t “win” the house. I resolved early on never to offer above list. I’ll buy a house at a reasonable list. But I refuse to play bidding war games.

Bryan congratulations. You made a decision that was best for you and your family. You are right, no one knows what housing prices will do. They may go up or go down.

Bryan I think what matters most when purchasing is can you afford it over the long haul, because it’s a home and you’ve locked in your costs. If the rest of the market rises and falls, you are still locked into your costs. Maybe the scary part is unforeseen home maintenance and other life realities such as needing a new car, saving for retirement, sudden medical expenses. That’s true for everyone, so enjoy the new digs and enjoy life! There is probably some peace of mind with locking in your home costs, so you can plan around that.

Thanks for all the well wishes and supportive statements…this is for lack of a better term terrifying in so many ways, but the place we are buying is great and the down payment we have saved goes a long way toward making the PITI payments at or just slightly above current rental parity.

As others noted to be sure, the monthly payment is comfortable, and we like the location and amenities very much, so we are jumping in. Hopefully it is not bad timing, even being on the other side of glass now, I am still hoping for a normalization to the market, hopefully it will simply just stabilize and incomes will rise so people like me and those behind will not have wonder and question whether it is a good time to buy, it very much feels like walking into a casino and wondering if it is a good time to gamble, its all timing right now and you can only hope you don’t get burned. Long term though I think most of us know and agree buying is more financially sound than renting…short term is a whole other ball of wax.

“because we want to live in that particular house and there is no guarantee that house will be for sale again if and when the market crashes”

can’t stress how important this is. I just hope your neighbors are okay. That is the true wild card. My next door neighbor is from Hell. I’m not kidding. Hope you are luckier.

I’m not going to stroke you with platitiudes like these other people. Based on your statements, it comes across that you’re trying to justify impatience by claiming impossibility in timing the market. Contradictions around how on one hand there are thoughts about pricing/rental parity/timing but at the same time no worries because it’s not about an “investment.” I call bullshit. We don’t find ourselves reading this blog because we don’t care about the price.

Reminds me of a poster who was trying to justify his recent purchase about a week or two ago. Just as with Bryan, he was making all sorts of wild claims to rationalize buying despite historically high valuations. Defensive posturing belies insecurities about their momentous financial decision.

Bryan…I hope you bought a house on the basic fundamental of buying a home. What is that basic, you can afford to make the payments and ride out a storm of recession in housing or workplace and if you have to live in that home the rest of your life you are happy to do it.

If you bought the home on the premise of, you can sell it at anytime for at least a break even, than you are a investor and I hope you apply the rules of investing, buying a house, “I’m scared to death” and I hope the market doesn’t collapse. Hope, luck, wish are words investors don’t say, I would be scared for you as to why you bought this house in the first place? Stay safe

Jeff, Hotel, Prince, and Robert…

thanks for the replies, I do appreciate them…I posted for comments to the contrary but my problem is I feel like I could end up waiting forever to buy if I have to wait on what makes sense, it is budget, albeit, tight and We are able to ride out any storms and in a position where we feel like we have to make money. I understand values are high which is the reason for being “scared to death.” But we also realize we could end up waiting a long time for rational pricing to come back to the market even though it should. And in the mean time we are still renting and paying good money to do so. To be honest I am not really happy doing either, renting or buying, but I have to do and they both cost a good deal of money. So for me it feels like it is the best move I can make at this moment going forward, even though it may not be the best move we could make if things were rational or guaranteed. The problem is for me is things are not rational and the longer I wait for them to be the harder it hurts if they dont become rational. That is why we are buying.

I would love for the market to make sense, but it does not, and who knows if it ever will.

Thanks all for the comments, hopefully I addressed them back, but I definitely did not buy for investment, I bought for a stable place to live and I have a stable job with stable income that should weather financial storms and eventually be something that is owned after 30 years.

Who knows though, despite me thinking it is my best move right now, it may be a catastrophic mistake I will regret, and maybe i should just pull the plug right now.

The lender did say we cannot get a fixed rate and we can only take on an ARM, maybe I should bail out now, and hope for better prices in a few years.

1965 is an interesting year in terms of homeownership. The WW2 generation was fully housed by then but those initial postwar houses were small for a family whose baby boom kids were now teenagers. The US population was about 190 million and 1965 was the year immigration was ‘opened’ to third world nations. So we got the property ladder.

There was also still land to build on around our major cities. In the Bay Area there was still land available for new, larger homes in Marin and Santa Clara County and around Washington, D.C. the new larger homes ‘just outside’ the Beltway but still in Fairfax and Montgomery Counties. So there was population growth for the WW2 generation to sell their old homes to and new, larger homes to buy for 2.5 to 3 times a 45 year old man’s annual income. There wasn’t really price appreciation for existing homes yet. People paid more for more square footage/fancier construction not location.

In fact, San Francisco was ‘too foggy’ back then so moving to Marin or Palo Alto was a step up.

My kids will never own a home in their home state. Smart boys, good citizens. Enough said.

Real estate values in the largest U.S. cities are now going down

http://www.bloomberg.com/news/articles/2015-09-03/almost-half-of-homes-in-new-york-and-d-c-are-now-losing-value

I saw that today…very interesting. We see these small increases in median price…but that doesn’t mean everything is going up. It will be interesting to see if reports like this one start to become more common. The insane YOY price gains just can’t be sustained…people run out of money to support it. And as those YOY price gains slowly approach zero…they’ll eventually pass it and become negative, and that’s when the psychological impact happens.

Our attempts to put everyone in a home failed miserably ending in mass foreclosures, the sub-prime mess, and may have led to the single largest wealth transfer in history as hedge funds bought up large quantities of real estate for pennies on the dollar. Simply allowing the natural course of supply and demand to take its course wasn’t good enough. We have artificially tried to maintain the good-life and either intentionally or unintentionally fool everyone into believing things would get back to the ‘good-old-days’! Now, we are seeing the ill-effects and reality is catching up!

The problem is we try to put everybody in homes without trying to tie housing prices to incomes. As real estate falls into the hands of a smaller, rich investment class, prices go up and naturally home ownership rates fall. The easiest way to make home prices more affordable and stable in the long run is to raise interest rates and put limits on foreign/investor money. That would create a shock wave through the economy as home and land owners, rich and poor, would lose large amounts of money on their investments. The FED is in too deep, they need to keep the party going. Lots of people are going to lose either way. It sucks.

We are witnessing yet more mad escapades caused by cheap debt. Mal-investments galore with little or no lift to the economy. Investors should take advantage of the free market. Like the Japanese 3 decades earlier, they’re liable to take a bloodbath on overpriced properties. I’m more disgusted by the repression of the free market by the Fed and government. Not only should interest rates be allowed to find their natural level, but other extraordinary interventions (i.e. suspension of mark to market accounting, foreclosure moratoriums, sponsorship of Fannie and Freddie) should be eliminated.

The solution to restore this countrys economy and to some extent its culture is 2 fold: deflation and decentralization. We need to bring down the cost of housing, healthcare, and education. They are government sponsored monopolies to a large extent that are sucking the country dry. By decentralization I mean weakening the federal government – and state governments as well – creating a more dynamic local government that is more accountable to the voters rather than unelected judges and bureaucrats making calls about what businesses are legitimate (i.e., paid off the mandarins) or not. The two go hand in hand. Feds create these outrageous student loans, home loans, you name it and prices go through the roof. Strip the power from the feds and we get a much healthier economy and middle class.

Hello Doc;

follow on to your comments on the insane home prices in LA, LA, LAnd. Homelessness numbers increase in LA. $33 / hour needed to afford a 1bd apt in LA.

http://observer.com/2015/09/homelessness-grows-in-la-as-affordable-housing-disappears/

Yet I have learned to love LA and forget the housing bubble 🙂

Congrats on your purchase Bryan. I think you will be fine as long as the monthly nut is manageable and the big fish have skin in the game in the form of equity funds and reits. I don’t see the market tanking as long as the big fish are in it, they are the ones pulling the federal reserve’s strings after all.

It’ll be interesting to see what happens. The housing space is getting hit hard right now:

http://www.housingwire.com/articles/34849-black-monday-hits-housing-mortgage-finance-worse-than-dow-nasdaq

Prince Of Heck and junior_bastiat both of you are correct on paper but wrong in the the real world. There is a difference between what we want and what we get. I agree that at the end of the day free markets- true free markets in which strings are not being pulled by powerful interests should win the day. Allow the vagaries and viciousness of free markets to determine the winners and losers. But in all honesty, in the real world that won’t happen. I mean do you really think that the various players (The Fed, Federal government, bankers, realtors, etc.) are going to allow that to happen?

It’s a given that the economy will never truly be free-market based. But you overestimate the long-term effectiveness of such enormous Fed and government financial engineering. Neither the government nor the Fed nor were able to prevent past RE bubbles from bursting.

If QE and ZIRP were so wonderful and risk-free, why wouldn’t the Fed lever up on its balance sheet to infinity? The stock market is undergoing wild swings not only due to worldwide economic turmoil but also because of the very threat of interest rate lift-off.

Do you think that the bankers, realtors, Fed, and government can insulate American multinational corporations from the troubles in China, Canada, Europe, and Australia? What do you propose the Fed and government will do in addition to QE and ZIRP?

What makes you think they can’t do endless QE, ZIRP and whatever else they can come up with. My friend, you still think the playing field is level. Just when you have them cornered and you are about to say checkmate, the Federal Reserve and the bankster mafia just adds more chess spaces.

“What makes you think they can’t do endless QE, ZIRP and whatever else they can come up with. My friend, you still think the playing field is level. Just when you have them cornered and you are about to say checkmate, the Federal Reserve and the bankster mafia just adds more chess spaces.”

Players such as the Fed could potentially do whatever they want, but it comes at a cost to the status quo from which they benefit. That cost might be more than they would prefer to bear. There are competing global interests to be contended with. Adding more chess spaces might seem simple on the surface but now the board requires more effort to manage with the increased risk of missing side moves taking place outside of view.

You put waaaay too much faith in the central bankers. They clearly can’t wield the power they wish the could.

Leave a Reply to CourselyGraded