Are we running out of rental housing? Forget about pent up demand for buying homes, the next big challenge will be on finding rental housing for younger cash strapped Americans.

One often hidden story in the housing market is the boring rental market. Sure, we talk about investors and regular home buyers but there is rarely any deep analysis regarding renters in the mainstream press. There is no powerful lobbying group for renters or massive marketing engine out in the market to give a more nuanced view on renting. Any true funding and advertising goes into the buying and selling crowd. What is interesting is that sales figures are still abysmal even with the big 2013 mania with prices (not directly with sales). The rental market is definitely hot since many would-be buyers are being out played for one bathroom crap shacks. You also have professionals unwilling to plunk down $750,000 for essentially a dog house with a yard. While the mania of last year is cooling off during a typically hot selling summer season, the rental market is still very tight. In fact, a good portion of new permits being issued are going to multi-family units as demand for rental housing is booming. In California, you have 2.3 million adults living at home so their likely first step into forming a household would be a rental. You also have many places like Arizona, Nevada, and Florida where investors have been buying up for years now turning their single family homes into rental units. With the tight rental market, are we slowly running out of rentals?

Where are we building?

I’m obsessed with following the numbers when it comes to real estate. I really find the industry fascinating. For most people, the one segment of the economy that is going to eat most of your paycheck is going to be housing, either through mortgage payments or rents. People that own homes understand that there is always additional costs when you purchase a home. Upgrades, repairs, and for many trying to keep up with the Joneses with the latest cars, technology, and furniture. Buying a home creates spending in a multitude of other industries so it should be understandable why the obsession on housing exists.

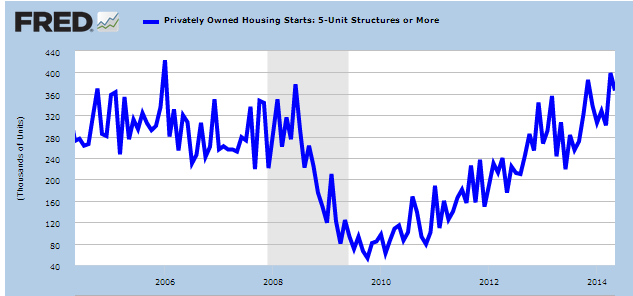

Yet incomes across the country are stagnant. Employment growth in a lucky month is barely keeping up with population growth. Yet smarter builders realize that we will need more housing units in the future and many are building out multi-family projects:

Multi-family starts are actually near a 10 year high. What this reflect is builders understanding the demographic changes hitting our country.

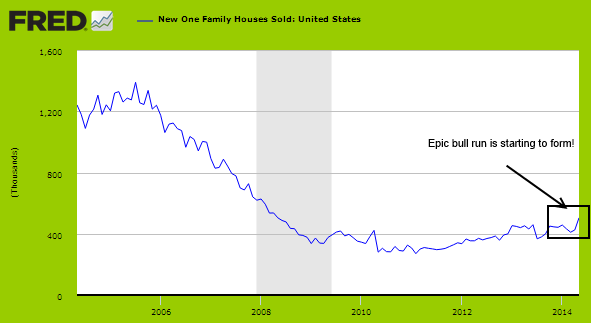

A few e-mails came through regarding the “epic†rise in new family home sales. So I went to the data:

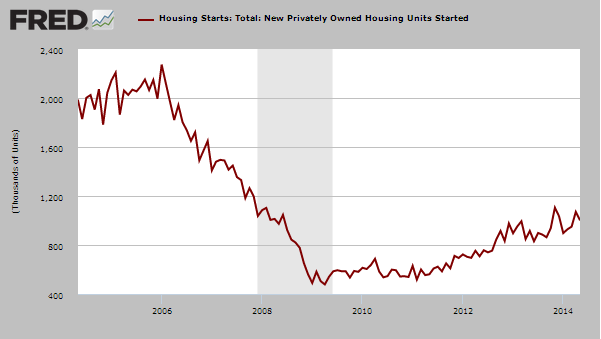

Does that look epic to you? At the peak, we were selling over 1.2 million homes per year. Today, we are barely bouncing off the 400,000 mark with a much larger population than we had 10 years ago. You would expect this to be even more robust given the stock market is near a peak right? Since you actually need an across the board employment and wage recovery, you simply are not seeing builders putting in that much money into this sector with single family homes. Keep in mind those multi-family starts versus single family starts:

We have certainly bounced off the bottom but we are a far cry from the over 2 million starts back 10 years ago. Much of the excess housing units are being sold off in this low inventory market. The question of course is what happens when you price families out? Many have no other option but to rent or live at home with parents.

Household formation is still weak

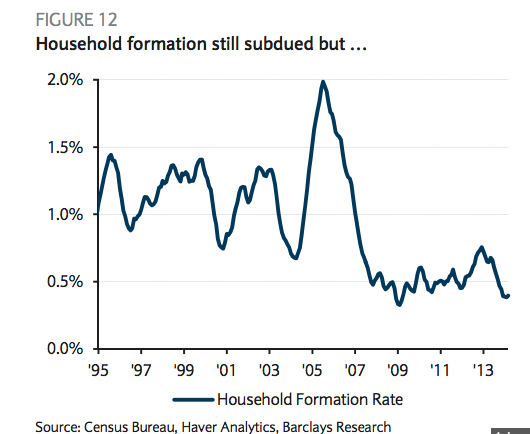

Household formation is another good metric to look at to examine pent up housing demand:

Household formation continues to be near a generational low. Until we start seeing this increase, there is little reason to believe that home sales will take off again. And keep in mind that when someone moves out into a rental, this is a new household formation. This would be the first step before thinking that someone is stepping out of their parent’s home into a $700,000 stucco box. We are simply not seeing this and that is why investors have filled the gap for all the years since the housing bubble popped. They very much have cash or alternative methods of financing outside of mortgages.

Not much building pushing vacancies down

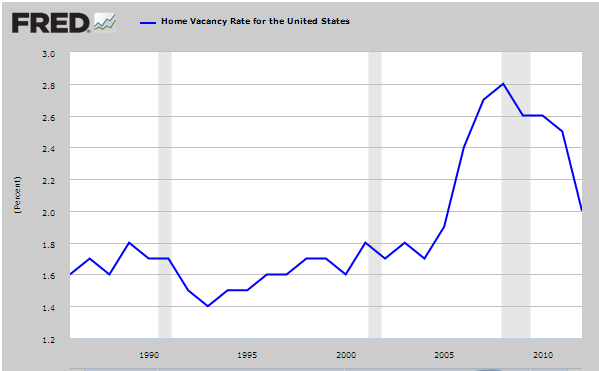

There has been little building of homes in areas with high demand. This is across the country. The home vacancy rate has plunged and this has soaked up excess capacity:

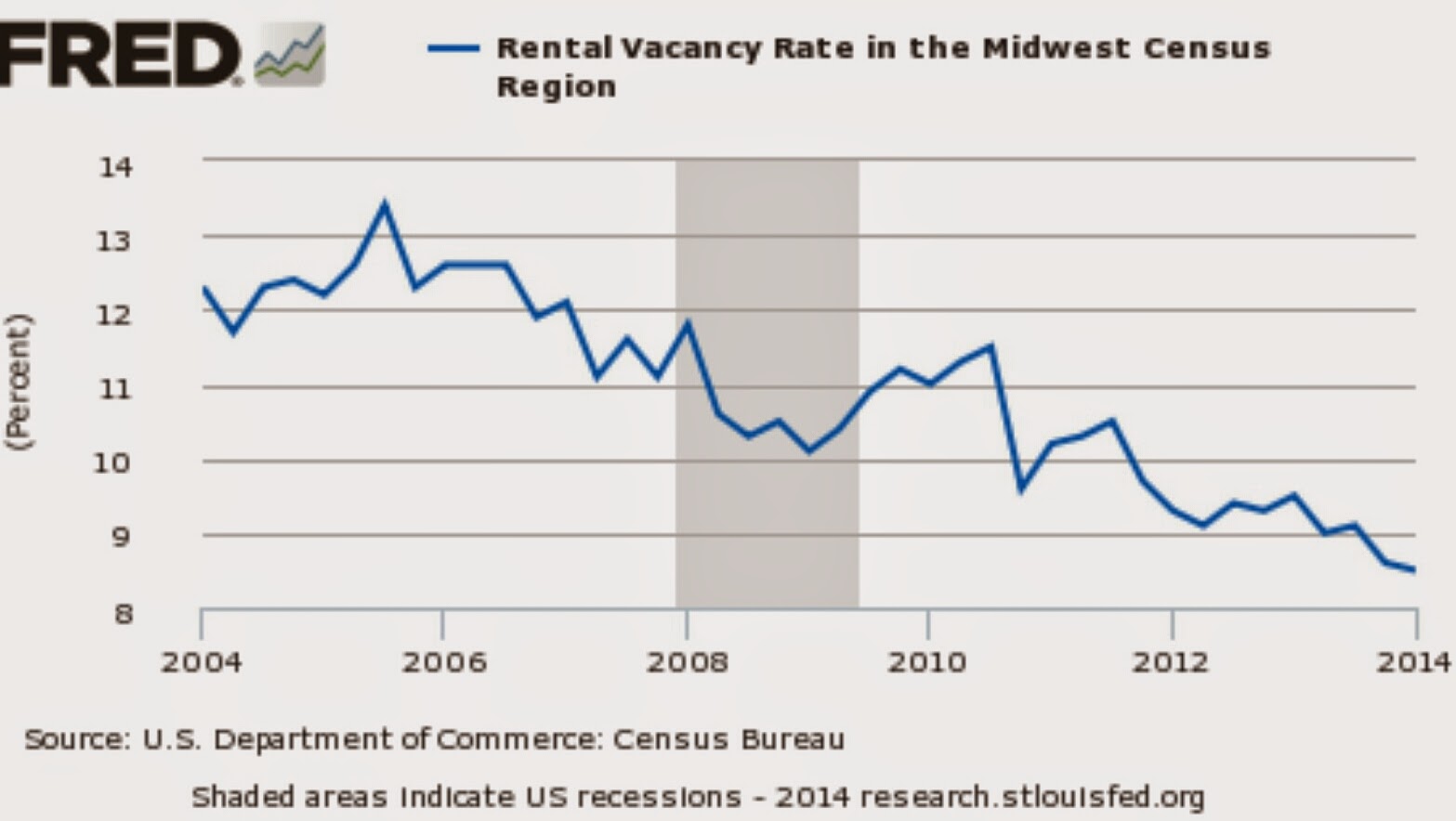

Higher prices and stagnant household incomes have also pushed families into rentals:

The demand is much higher on the rental side and is more in line with actual incomes of US households. People have champagne tastes but beer budgets. I still get many e-mails from people asking about buying advice (more like timing advice). I’ve always believed that you should rarely spend more than one-third of your gross monthly income on your total housing payment. California is a boom and bust market so good luck trying to time it but if you are comfortable with your monthly payment, go for it and buy that Great Depression drywall sarcophagus. Deep down though these folks are eyeing their next property on the revolving property ladder cycle. We know that people stay in homes from 7 to 10 years so this nostalgic notion that people will buy and stay put for 30 years until they have their mortgage burning party is more of a kick back to the Mad Men days when the “good old days†are more of a mythology story versus actual fact. Heck, talking to some in the industry they have already forgotten about the 7,000,000+ foreclosure graveyard we just passed up.

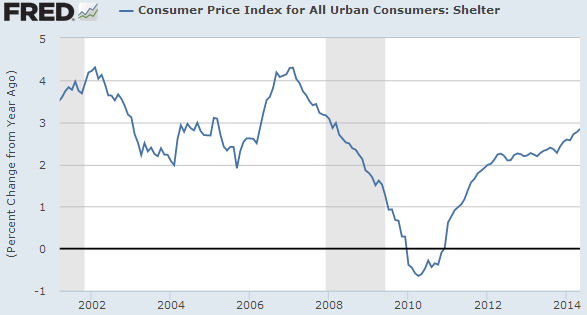

BLS measures rents or owners’ equivalent of rent and prices are going up

The current tight market has pushed rent prices up:

The rental market is tight and prices have gone up. The CPI although a poor measure for actual home prices, does a good job of measuring rents. It uses the owners’ equivalent of rent measure and this has certainly moved up.

What is interesting is that you are seeing a higher quality of rentals hitting the market. You are also seeing a lot of do-it-yourself folks putting up their home for a rental to capitalize on some cash flow.

Demand for apartments via Google

The hive mind of our society can be seen by looking into the search queries with Google. Take a look at searches for rentals and apartments:

Source: Google Apartments and Residential Rentals Index

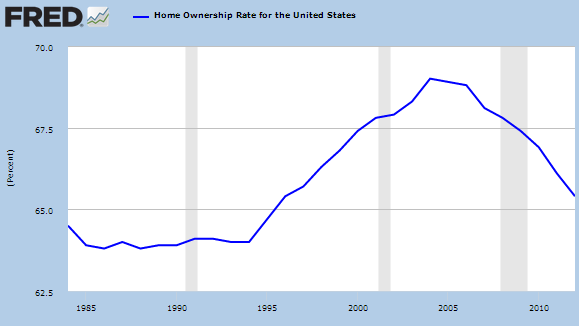

Compare this to the actual homeownership rate:

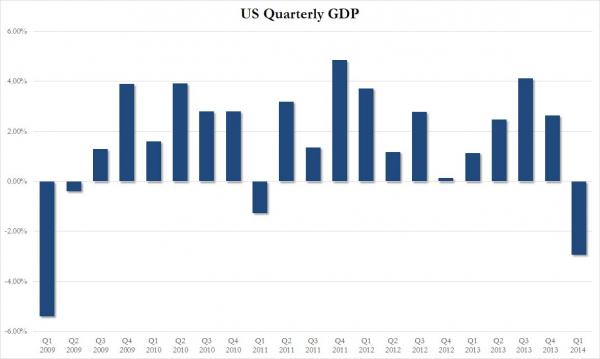

It is fairly clear to see where the numbers are. You would expect to see more rental housing units filled followed by a jump in home buying across the board if the economy were truly booming. GDP took a big hit in Q1:

The futures market is saying this was a one-off event (but it did happen and was much deeper than most expected). Both bulls and bears can agree that the middle class is shrinking in many metro areas across the country and we can see this with the net domestic migration out of California for lower priced states. A large part of growth in places like California is coming from foreign born migration and new births. It is an interesting time but also helps to explain the current real estate market. It does look like we are entering into an inflection point and rentals are a good measure of overall household economic well-being. Landlords are going to charge as much as they can get from local area families and families will ultimately pay as much as they see fit. Yet there is only so much you can charge before people start making economic tradeoffs (i.e., moving more inland, other states, with parents, etc).

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

102 Responses to “Are we running out of rental housing? Forget about pent up demand for buying homes, the next big challenge will be on finding rental housing for younger cash strapped Americans.”

Your talking about home rentals but on another level, I’ll bet there’s a lot more people renting out rooms in their own homes. Nobody wants to bring strangers in, but people need the money and they’re doing just that. The best proposition is if the renters have their own door in and out and kitchen privileges. We’re closing in on John Steinbeck territory, we just need a good little dust storm to push us over the edge.

What you’re describing has been the norm in Hawaii for generations.

&&&

I have no doubt that native Americans are destined to revert down to Clown Housing — as is so common with illegal immigrants.

Naturally, such arrangements will NEVER show up in official statistics.

***

It’s the NORM for homes to be sub-divided — OFF THE BOOKS — and without any official sanction — during such harsh times.

This is how ghettos get started — even White ghettos.

In the 19th Century no-one deliberately built sub-standard housing. It just happened, one by one as up-scale family homes devolved into tenements. Three story urban homes were sliced into hack-job three-level apartments.

Some of these lasted into the current day — now the attention of This Old House (PBS) — whence to be restored to a single family usage. This entails a total gut out. During the process, one sees the bizarro hack-work that chopped up structure and ran new plumbing in the strangest ways. It’s all a fright.

&&&

Political manipulations in the real estate market happen in spite of their economic impact.

For one example: it’s now Code mandated that California SFH have fire sprinklers in all new construction. This functions as a TAX.

It’s one of the reasons why older homes (grandfathered) suddenly took on additional economic merit.

Most investors are totally unaware that this serious new, additional expense burdens all new projects.

If you scan CraigsList, there is a CONSTANT trail of employment ads for pipefitters!

Duh!

This is a wholly uneconomic practice. Sprinklered housing costs more — but doesn’t pay off. Alarms and automatic panic calls would make more sense.

BTW, running pipe in a wood structure often entails up-sizing the lumber, too. You just can’t stick the pipes through 2×4 joists. Running them on top ruins the practicality of the floor/ attic above as storage space. (Nothing is permitted to be hanging or sitting on sprinkler pipes — it’s Code.)

So this provision is more costly than it first appears.

It HAS TO HAVE a major impact on the construction of green field apartment construction.

The (resultant) required rents are such that the market can’t pay them.

So it’s devolution back to tenements, then.

At least this will occur off the books.

I am sure the local pipe fitting unions had nothing to do with this code mandate.

It’s interesting how most of the media is misreporting the supposed good news from May homes sales. While it’s true that May 2014 saw a 4.9% increase from April 2014, when comparing May 2014 to May 2013 there has actually been 5% decrease in sales from a year ago.

Unsold inventory has also increased 6% from a year ago.

First-time buyers represented 27& of buyers in May, down from 29% in April 2014 and 29% in April 2013.

http://www.worldpropertychannel.com/north-america-residential-news/existing-home-sales-may-2014-national-association-of-realtors-nar-median-home-prices-lawrence-yun-housing-inventory-levels-8317.php

People are doing this through Air BnB to skirt all sorts of laws. Although, the powers that be have caught on.

@ bubble pop I have 2 friends who own homes and are using AirBNB to make money from converted garages.

friend A in Santa Monica Canyon. Converted his 2 car garage in his backyard into a ‘beachside rental’. He rents it out for approx $1,500 per week with 2 week minimum. It is often rented to Canadians and other foreigners. Typically he is making $4K per month. Some people book it for a month at a time in the winter. He has kept it as secret as he can and then in talking to one of his neighbors one day, that neighbor told him he has converted his garage into a rental! Supposedly City of Santa Monica is cracking down on these illegal short term rentals but he has been doing this for about 5 years with no problems. [I think it is quite for any City to put a stop to it unless they blanket all the rentals with phony inquiries to try to determine where these illegal rentals are located].

friend B lives in the Del Rey / Culver City border. Converted her 1 car garage into a bachelor pad and rents it out for about $400 per week. Also gets a steady stream of short term tenants through AirBNB website. Her main clientele is well to do people who are visiting friends or family in the Venice, Culver City, WestLA, Marina Del Rey areas but dont want to be in a hotel.

My cousin lives in Signal Hill and he said that the building code enforcement there very weak, and about 20% – 30% of the houses on his block have converted their 2 car garages into rentals and are renting them out. He said it is evident by the gradual reduction of street parking over the past 10 years (on a street with no change in amount of homes).

More on Santa Monica – my mother owns a home North of Montana and it had a permitted patio built in 1975. We were planning to replace the patio and was informed by the contractors that now, you cannot replace even the roof of a patio (even if it was a permitted patio) without a city inspector coming to look at the patio – the reason is that many homeowners in SM have converted their patios into rental units and the city wants to inspect to ensure the homeowner has not converted it into a rental.

It may seem odd or hard to believe, but Santa Monica Canyon is not actually within the City of Santa Monica border. It is actually in the City of Los Angeles.

Strange but true !

this is standard practice in san francisco where the cartel is running the show…cartel being city government

Everyone here knows that affordability for prime areas is only determined by median incomes. People would never need to rent out rooms, garages or guest houses because their 1040 income must be the only determining factor to be able to make that monthly nut. Even if they could rent out a room, garage or guest home, everyone knows that only crazy people would do that when they could rent out an entire home in Phoenix for the same price! Insanity, right?

Um yeah, I’ve been preaching this for years. The rental market (especially in crazy housing markets like SoCal) is going to go nuts, has already gotten so much more expensive over the last few years. If there is any single good reason to buy a house right now it is this. OK sure pass on overpriced housing, then find yourself dealing with overpriced rents, somebody is going to rape your wallet. My wife and I bought in November of 2012, 1925 3bd/1ba 1250 sq ft for 225K. FHA loan at 3.25pc with MI means a payment of 1450/mo. A little more than I wanted to pay, and the house has a lot of “deferred maintenance,” but my “rent” such as it is, will never go up. It will actually go down 2021 once the MI drops off (we got in just before FHA changed the rules).

Your taxes will likely increase. Don’t count on Prop 13 being around forever (either at all or in its present form). Don’t count on MI deduction being around forever (either at all or in its present form). Your insurance costs will likely increase.

You’ll sell after a few years and will have transaction costs. You already mentioned maintenance and repair. Add it all up after the sale and then get back to us with the real adjusted gain. Likely none of us will be in this forum by then, how convenient.

Take it from someone who has been there, done that. You will be made to pay one way or another, either as a renter or an “owner”, there’s no free ride.

Prop 13 is not going to be repealed. Where do you get that idea? The public certainly is not going to vote yes on any other proposition to repeal 13. The last poll showed 2 to 1 of people in favor of prop 13. And no politician is going to support Prop 13 repeal as they all own property.

And the mortgage interest deduction is even more popular to the public than prop 13.

Expect higher sales tax but prop 13 and the MI deduction are safe.

It’s not an idea, it’s intuition based on the historical M.O. of government to change the rules of the game in ways formerly thought impossible.

I didn’t claim that these things will definitely happen, but rather that one would be a fool to discount the possibility.

Good luck with your crystal ball.

For more context, here’s a relevant and timely piece:

The Coming Global Generational Adjustment

http://charleshughsmith.blogspot.com/2014/06/the-coming-global-generational.html

Listen you all , institutions like Black Rock, Hedge funds and Foreign money are still buying new and old houses! Mortgage landing has tanked home sales continue household formations are back to the cave man days. Rent back securities will be stuffed in your 401K’s!

Well, they may be buying, but, much less today than two years ago when they were tripping over each other on the courthouse steps to increase their share. And, as far as those securities, I don’t see most in finance tripping over each other to buy them. The market has been somewhat lackluster since their introduction. Most in the business are probably in a wait and see mode. Sure, there will be dumb people who buy this stuff, attracted by the fictional predicted yields, but, not too many if they can’t match those numbers.

BTW, who “stuffs” your 401k? Don’t you decide where investments are made after careful study?

If you’re renting you’re screwed – unless you’re in some rare situation where your rent doesn’t get increased. But even then you’re probably still screwed down the line.

A homeowner might feel safer because he has a fixed rate mortgage or none at all, but property taxes are going to skyrocket. How else will cities and towns pay for the extravagant retirements of the municipal employee? Renters pay taxes in their monthly rent check, but it is a much smaller price, based on dollars per sq. ft. When the roof leaks or the septic system fails or the furnace dies, they call the landlord. When the neighborhood goes to hell with ghetto thugs moving in, the renter just moves and stays ahead of the curve. When a job offer in a better part of the country comes in, the renter moves to the better opportunity. The homeowner, often upside in his mortgage, is stuck there. The house is an anchor.

Please ignore the verbiage at the top of this article and head for the data at the bottom. Essentially, June 23 article by California Association of Realtors, says pending May sales worse than pending April sales. Note that this is forward looking by a couple months, so expect soft or even softer June / July numbers.

http://www.car.org/newsstand/newsreleases/2014releases/may2014pending

One thing we forget about (well, not on this blog) is how overstretched the average American is. This is bad news as they will have minimal ability to deal with any economic shock such as a recession, layoff in one family member, unexpected bills or reduced number of hours at work.

Cases in point:

A) 40-45% of auto loans are subprime now and this is an $800,000,000,000 market with the average car loan of $27,500. Talk about not living in your means. I wonder what will happen to these people’s credit when their auto loan goes south and the repo man shows up.

B) Student loans are up to $1,200,000,000,000. WTF? How do you pay this off working at a low paying fast food gig? You thought you were a “Phoenix,” but in reality, you are a “Red Robin.”

C) Medical costs, fuel costs, food costs are all rising faster then the official inflation rate.

I see households making $250,000 a year going after $1.1 million dollar houses here in CA. This is insane. Think of all the property and maintenance expenses. Think that many people are no longer putting 20% down, meaning they have to amortize a bigger part of the purchase price and often pay mortgage insurance.

Any small shock to the current system, such as an unexpected spike in inflation or in the 10 year treasury yield, or even a small recession will have outsized effects. I am holding on to cash right now. It is the calm before the storm.

if this is the calm before the storm then we are headed for the perfect storm.

1.1M home on 250k income seems pretty reasonable to me…

Not really. 250K income = 160 take home after taxes. Most of these people have a family and spend on kinds. Just the property tax on such purchase is $1000 a month. People who make $250,000 also want Pilates classes, their 5 series BMW and count on the stock market to go up forever without any down dips. They live on fiction, just a bigger version, than households who make $75,000 a year. Spending $1,000,000 on a house while earning only $250,000 assumes that everything will go right and there will never be any rainy days (I make north of this and am single with no children, would never look at anything over $750,000).

ak, do the math. Let’s assume you are correct and that $250k means $160k after tax. That is $13K per month.

At a 4% rate, the payment on a $1.1M mortgage is $5,250 per month. Add $1K per month in property tax, and you are paying $6,250 per month. Seems doable.

Also, it is unlikely you are going to put zero down, so assume 20% down on a $1.1M home, that makes the total payment $5200 per month on $13K take home pay.

i’d have to agree 250k gross income is not enough to for a 1.1M home given that a family with that income will have other expensive tastes. for example, food budget is prob +$1200/month, private school +$1,400/month per child, 3 weeks of vacations per year + $10,000/year, 2x bmw/mercedes/audi lease/loan payment +$1,400/month, holiday/bday/anniversary gifts and random luxuries + $7,000/year. not to mention maintenance costs on the $1 million home… all this adds up and leaves the 250k family with little left over for significant retirement savings (remember, the same family wants a similar lifestyle at retirement) if paying a 800k mortgage.

Granted, of course a more frugal family could swing the 800k mortgage on 250k, but the desire to live in a million dollar home is correlated with the desire to have all the other finer things in life. also, to me it really depends on what you’re getting for 1.1 million. If you are getting a kick ass home with backyard tropical oasis in a super prime location having top rated public schools, then maybe you’d be willing to sacrifice some of the other niceties.

I agree. People sound pretty jealous about all the life style things you are assuming. I take it your not pulling downing 250

Housing TO Tank Hard in 2014!!!@

Housing to go up 30% in 2014!!!

Housing to stay even through 2014.

Now we have all our bases covered!!!

Jim has never specified a “price” tank in 2014. If were talking volume. housing IS tanking in 2014.

Good point that demand in any sense of historical context has indeed tanked, although I thought he had mentioned something about prices a time or two. Anyway, everything and the kitchen sink thrown at the “problem” by the establishment, and this is best amount of demand that they’ve been able to gin up. Not good. Perhaps they can hold back supply forever without the knock-on effects getting too much out of hand. Probably not.

DHB: “There is no powerful lobbying group for renters…”

Santa Monicans for Renters Rights RULES the city of Santa Monica. It is virtually impossible to get elected into any SM city office — whether rent control board, or city council, or K-12 school board, or Santa Monica College board of trustees — without a SMRR endorsement.

Tenant groups are very powerful in Santa Monica, New York City, Berkeley, and San Francisco.

And as the ratio of tenants increases in other U.S. cities, so will the ratio of their votes, and of their political power. And with it, it will be ever harder to raise rents, or to evict deadbeat or destructive tenants.

Take heed, those of you who hope to get rich by being a landlord.

Outside of the places you mention, very rare. Yes, don’t be a landlord in NYC or SF, but, otherwise, a decent way to get return on money. I really really doubt, in today’s political climate, that socialist like rent control protections will be adopted outside of the liberal cities.

My neighbors are mostly young people in my apartment complex. They stay up all

night and make lots of noise. No respect for anyone. When you ask them to keep

the noise down so you can sleep at night they tell you to go get f_cked !

As I always say, renting should be a temporary means to eventually owning something .

The new four letter word in America is….Rent

This is why I am closing on a condo a week from now. I am retiring, and want to fix my housing costs for the rest of my life. Sure taxes and maintenance will creep up a bit, but, not as bad as rents, I’ll bet. We’ll see. All I can say is, sure glad I’m not 25 these days.

I hear you Mike. I will be out of escrow on my place near San Diego July 15 and delighted to be paying about 2K month mortgage instead of 4K rental in Los Angeles. With all included, monthly cost about $2700 mo. for the house which is what I was paying for rent about 8 years ago.

Ha, I’m actually paying 25% less than rent, for a larger and recently renovated space. (hello, granite kitchen, and central air!)

Have fun with HOA inflation.

Condos are a money pit.

Greetings from Bozeman, Montana. I just escaped Silicon Valley a few months ago and am happy to be out of there.

Despite a lot of new construction on the margins of town, there seems to be a lack of rentals available in Bozeman. I have a couple of duplexes and posted an ad last week for a unit. There has been a reasonable amount of interest, but what surprised me was the immediate desperation that many of these folks were expressing. This is the first time that I have seen this kind of sentiment expressed by more than one or two prospective tenants.

I don’t know what the influx/outflux of people here is doing. It’s been on a general growth trend for the past 20 years with the usual ebbs and flows.

Those of you who are naysayers regarding being a landlord – fine with me. But I don’t see any other investments that offer the same ROI. Since I don’t mind doing my own maintenance, my only big expense is property tax. And on a percentage basis, it’s much higher here than CA. In my city it’s about 1.7-1.8% whereas Santa Clara was 1.1-1.2%.

On a macro level, I don’t see the number of renters going away for all of the reasons expressed by our Doc here and many of the commenters. I also find it difficult to see rents going down. As the price to purchase or buy a rental property has been increasing, investors naturally have to continue to try to push rents higher… Does anybody here think rents are going to go down? If so, I would be interested to hear about it.

Well you have MSU there, right? It always seemed to me that a college town would be a great place to rent something out, you’ll have a fresh stream of students coming in every year who won’t be buying a place…if only it weren’t for the fact that they have the potential to trash the place…

MSU, yes. About 50k people here and in my opinion it feels like a college town. And it is surprising to see how sloppy college kids are. But that’s the market for a 3 bed 2 bath duplex/apartment here. Rent for that here runs 1000-1500/month.

Man, that has to be a lot of money every year cleaning and repairing and painting after those kids leave for the summer.

Mike,

Maintenance costs were about $1000 last year. Paint is what, $20 a gallon max. I’m not going into the poor house due to cleaning up after some lazy renters. Now if somebody decides to turn the unit into a dog kennel or meth lab, that’s another story. Even the former is a straightforward fix – you tear out the carpets, seal the flooring, repaint and install new carpet.

Property taxes are about $4500. Insurance $700. Gross rent about $25000 on one duplex. Those are the company financials..

There is no sales tax in Montana so property taxes here are a killer. Makes me wish for MT to get a prop 13 deal going…. It’s an odd dynamic, particularly when you realize that tourism is big business here but the state isn’t taking their cut from the out-of-state vacationers.

Wow, yeah, the town of Bozeman or the county or whatever could be doing very well just taxing the whole Big Sky ski economy 1 or 2 percent on transactions. Beautiful place.

Totally depends on where you are. I know in Seattle they are grossly overbuilding rental apartments, basically projecting that Amazon’s growth will continue on its current trajectory forever. This for a company that doesn’t turn a profit. Eventually the Amazon bubble will crash and Seattle is going to end up with a glut of rental apartments. I saw it in San Francisco after the dot-com crash – came home one day and the management of my apartment building at the time had slipped a note under my door offering to lower my rent by 20% if I would sign a 6 month lease, 25% if I would sign a 12 month lease. This was circa 2002 when it was clear the dot-com bubble was not going to reinflate, most startups had burned through their last and final round of VC cash with no hope of more funding, and the established tech companies were facing the reality that many of their newly found customers had vaporized, and the layoffs had started.

The current stock market bubble is inflating all asset prices, residential real estate purchases and rentals alike (just like the Fed planned when they propped up the stock market). But current valuations are not sustainable, and at some point rents will come down. Timing, of course, is difficult to predict. But you can’t have multi-billion dollar market cap companies running continual losses. It just doesn’t happen.

Stick with sales and leave the P&L’s to us lowly finance guys. Looks like a typical retail hockey stick earnings to me…

https://www.google.com/finance?fstype=ii&q=NASDAQ:AMZN

In San Gabriel Valley renting means a 5BR home is able to be rented out to 7 families. (As there is a garage and dining room that function as a bedroom.). That is $1000-1200 month per family. $7000-8400 month!

Being a slum lord is profitable. And there are many people without credit or documentation that you can take advantage of.

This has been going on for years.

We bought a brand new tract home 10 years ago and 2 of the homes on our street of 14 had 3 generations living in them.

They would leave their 3-car garage doors open all day and night, inside they had 2 sofas, a makeshift kitchen and a few mattresses on the floor. One house even had a “tandoor” indian oven in the garage.

They had no blinds on the front formal living room, and driving past you could clearly see in – 2 x bunk beds = another 4 people. Plus the one bedroom downstairs and 4 more bedrooms upstairs.

9 cars parked on the street and driveway at one house, 11 cars at the other. What a joke.

No back yard lanscaping ever put in, and the front become an overgrown, unmowed mess within 4 weeks. They even tore out the shrubs and tree the builder had installed and concreteted in the front yard. It was a horrific eyesore.

Really nice homes and development too. Slum-like from day one.

this is one of my main “deal breaker” pet peeves. when i see a perfectly decent SFH in an ostensibly fine location, but a large % of neighbors have 4+ cars parked in their driveways and at the curbs in front. this is not uncommon in the older parts of Irvine, to many, a premium area in general, but definitely with these “problem” areas.

… or felons – we’re producing them like gangbusters

Jeff…Montana, have a few people I know up there, very stable and what is called quiet money folks. Billings is where I know a little more about, but you escape to a really different culture and environment, good for you.

Watch out for the ever changing weather up there, enjoy nature at its best and buy a house when you can, rents always fluctuate no set pattern with landlords, that is why renting for the long term is bad for your fiancés and health!

Like everywhere, there is no shortage of money around here. Ted Turner and Huey Lewis own ranches nearby, as do many other ‘big money’ folks. Lots of upscale housing all over the place and lots of construction of high-end homes. Not like Vail or Aspen, but well above any kind of national median.

One sure sign of money floating around – I’m working with an architect on a house plan. He starts telling me about all of the unusual features people have been asking for lately: indoor gun ranges and “safe rooms” were his highlights. I tell him I want a locking door into the basement so that I can put some valuables down there. He starts asking me if I need a concrete ceiling in the basement, and just how ‘secure’ I am trying to make it… I thought a deadbolt would be sufficient…

Those folks all leave in the winter when it’s 30 below zero…

I will say that there is a stronger sense of community here than there was in Santa Clara. Of course in Santa Clara about 1/3 of my neighbors didn’t speak English. Don’t come to Montana if you’re looking for racial diversity and all the good/bad that goes along with that.

Housing prices here are way up from 12 months ago, and 12 months ago they were up significantly from the year prior. I don’t follow it closely enough now to know if they’re still trending up. One other interesting thing here is that you can’t find out what places sell for via the county records. You just get to see what value the county decides to value a property at, which is some kind of statistical average for a property. It’s bogus. I built a duplex for 340k and they have it valued at 500k, so I pay the taxes on the 500k.

Since WHEN are the property records detailing sales with purchase prices, liens, loans, and the owership record, not available? That sucks, and it’s very anti-freedom. I really relied upon Cook County property records to do searches on buildings I was considering buying into here in Chicago. I badly needed to know what recent selling prices were, and, most of all, how many foreclosures there were pending in any condo building I was considering.

And taxes based on current value rather than the price you paid? Heinous. That means that you cannot buy and depend on your expenses staying level, which is one of the principal reasons to buy to begin with. It means that a lot of elders get blown out of houses that they struggled for 30 years to pay for.

Bozeman is nice but very cold in the winter. Like you said minus 30

Walla Walla is nice but has mild winters

http://www.ci.walla-walla.wa.us

I will not argue with the good Doctor, but here in Torrance I see a lot of vacant rentals with “room available” signs. My landlord has been increasing the rent by less than 2% a year on 6mo lease term for the last 4 years. At the same time, it’s one of the most family-friendly apartment complexes I have lived in, with very responsive maintenance, and costs less than 15% of my personal gross income. In a situation like this, there’s no way I’m buying into this RE madness which is going on in SoCal.

I agree with Mr. Robspierre here. My rent hasn’t nudged in 2 years. Maybe because I pay two months ahead and have a good credit score. I wonder how many “prime” renters there really are.

Also, over a 1000 rental units have come online here in Pasadena over the last year. This will absorb about 2,200 inhabitants of this city which has a 50% home ownership rate. I doubt the population of Pasadena is growing by 4,500 people a year.

One thing I’ve observed recently is how one’s expectations change when one looks at the same house as a rental instead of a potential purchase. For instance, I’ll see a drywall/stucco crapshack for an outlandish price and won’t be that surprised by its condition or the price. I’ve been trained by the current market to look past that–to see the potential, the opportunity, the dream! (Okay, maybe not.) Still, I take it for granted that it’s a buyers market and that, if purchased, the house will need major updating.

But, lo and behold, later I see that same drywall/stucco crapshack on the rentals market offered for an extravagant monthly rate and suddenly it looks different. I have many more choices as a renter, because I have some mobility. I expect a certain level of cleanliness, for example. I don’t expect half-finished upgrades.

I’m not going to predict whether rents will go up or down. But I can say that turning a house into a rental is not a simple matter. You may get your asking rental price, but if you have to stuff 4-5 relative strangers in there to do it, don’t expect collecting rent to be easy.

Teresa,

I can appreciate where you’re coming from, but my personal experience is just about the polar opposite. In 2011 I was looking for a home to rent. Problem was that i was working next to Google and there were almost no rentals. I couldn’t find a decent home to rent for under $3k a month, mostly because I have two dogs and only a fraction of rentals were dog-friendly. Even without the dog situation, renting was difficult to justify versus purchasing from the financial perspective. Rather then $3k/mo in rent, I put down $200k and had a $2k mortgage.

My home standards are much higher when I’m going to buy as opposed to renting. In 2011 (and because of having dogs) I had much more to choose from by buying versus renting.

Still today I think there are far more single family homes for sale than for rent. Sure, there are more apartments for rent than sale, but I think this blog is focused on home moreso than apartments.

I will make a prediction – rents will go up, in general, pretty much everywhere in the US. And collecting rent – what about that do you think is difficult? Are you a landlord that has had problems with collection? It happens, but it’s a business and business isn’t always smooth.

Given 8.6% RE average return vs 13.4% stock return, 200k invested gives 816k more over 30yrs. Minus 360k lost from paying 3k vs 2k a month.

456k net difference, and it’s cash, not ‘golden handcuffs’.

Obviously, there are some other factors, but in general, renting can be a more economically sound strategy.

You also have many places like Arizona, Nevada, and Florida where investors have been buying up for years now turning their single family homes into rental units.”

if this is true how can there be a shortage of rental units? These were homes previously occupied by owners that are now rentals. Right? Wouldn’t there be extra rentals out there now? Or are the banks just hiding this information as well and lying to their investors that they’re selling these securitized rent rolls to?

Well, let’s see. US population growth continues upward, yet new construction is stagnant. Ergo – more people than roofs to cower under.

You either own or you get owned. Even if you bought at the peak of the insane bubble in ’06, you would not be in bad shape if you used legit financing to get the deal done. You would be 9 years into paying the property off and in many areas values have come back up to near to near peak. On a $500K loan you would have already paid off $100K.

Renting is a terrible long-term strategy. If you can’t afford to get what you want in SoCal, move along it’s a big country of which 95% is affordable. There are plenty of nice places to live much cheaper. If you stick around as a renter in SoCal two things are going to happen – your rent is going to go up and so are property values, so you lose over the long run.

Really? I am not sure. Maybe yes, maybe no. You assume the $15,000 someone here in CA saves by renting a $600,000 house rather than buying it gets flushed down the toilet. If you save and use this money wisely, you can come out ahead. Also, remember, mobility is also a positive with a rental.

All things considered, I would rather own, but I don’t want to overpay nor become stuck underwater for 10 years.

Can’t help but agree with ak. If you take your savings and invest them, you could be better off, even considering the tax write-offs.

Plus, free maintenance, mobility and low risk when renting, whereas buying a the top of the housing bubble can put you underwater for a very long time.

hard to measure because you could have rented for last 10 years and saved much more than the example you gave along with the same tax write offs..start an llc with a home office and your rent is a write off….

Owning is not the answer to rental issues..Its a propped up market being held up specifically for banks to unload their junk at higher market prices….when rates jump and stagnation keeps growing, a home is not a better deal….

If people think homes are going to go higher from here they are smoking some good hopium….investors dump their stock at the top not the bottom…

Over the long run in coastal SoCal areas homes are most certainly going up and so are rents. You can buy and lock in your pmt and eventually pay your home off or you can be at the mercy of the rental market. To everyone who did not buy the dip a few years ago, why not? What are you waiting for? Even if you would have bought at the peak you would be close to even and 8-9 years into paying off your property.

Sure there may be pullbacks in the future. Good luck timing the market. Buy what you can afford and ride it out, you will without question magnify your net worth substantially over time and eventually have no mortgage pmts. If you can’t afford SoCal coastal, might be time to look elsewhere.

Doc, I’m in an upscale part of Phoenix, and there are a shit-ton of for rent signs in each area that I follow. As many signs as I have ever seen here in 18 years. Rent’s have risen maybe 5% since 2008 –Craigslist rules for finding private landlords who are desperate for renters with good credit. I pay $1100 for the same street where I once owned and paid a $2200 mortgage.

Places that are affordable to buy don’t make good rental investment. I was going to pick up a few Az. rentals but It did not work out on paper. I bought ca rentals…rents are good and plenty of demand.

Rentals is where our ecomony is going. The big players bought in at pennies on the dollar. You can’t afford a house, they have a rental for you. Rentals rarely go down in price they linger and level out. The big players bought at phenomenal prices that you or I could only dream of paying. Some say that the big players are tuning up for new buying programs that will bring in new buyers for all these rentals as they unload on new buyers at handsome profits or that they have bought up all these rentals as part of the new ecomony of America turning into a nation of renters…hard to know which way things will go but rentals are a good investment when they are bought right. Not too many places to get a return on your money now so rentals are an attractive investment.

Let’s play this out. It all an algorithm of supply and demand, job growth, wage growth, population growth and government action (which controls interest rates),US economics, and world economics since each nation owes the other so it’s one big game of rob peter to pay Paul. Due to the numerous factors and their correlation with one another it’s no surprise most people cant time the market right. It’s not easy. That being said, you need to analyze each of those factors for your area to determine if your rental will stay “in the money” or if you are at risk. I personally don’t envy any homeowner or landlord at the moment. Both parties are screwed. Private equity firms didn’t buy up a ton of real estate because they thought the rental market was the next best venture. They bought assets at a discount (albeit temporary since any increase in interest rates will quickly have a negative effect on home values) so they could securitize the cash flow and exit with a lot of cash all right before the fed raises interest rates and asset values suffer. When asset values suffer these funds will have to analyze whether or not the fund is still “in the money” or whether the drop in asset values will necessitate shutting down the fund. If these funds are shut down, there will be a flood of affordable housing via fire sales which will in turn have a negative effect on rent rates. If these funds don’t sell, they will only continue to drive increased completion in a rental market. What does that mean for non private equity backed asset holders? If you are the average investor or homeowner you will see one of two things, increased competition on rental rates as these firms will be the first to lower rent as long as it keeps their funds cash flow positive. They will operate on margin to maintain profitability in order to keep the fund afloat. The only way rental rates will increase for everyone is if job growth and wage growth continue as well as population growth (although population growth needs to be coupled with wage growth for true rent increases). I’d say this is unlikely given the contraction of the economy in Q1 as well as recent lackluster company performance. Job growth has been minimal and what has occurred has not replaced what was lost. Wage growth is dismal with many of my friends at large corporations getting zero merit increases this year. As a result, the likely outcome will have private equity exiting real estate in time to make a ton of profit (this is already happening), leaving the purchasers of their securities and all other homeowners and landlords to deal with the inevitable housing bust. This mess all started in 2000 and it’s not over yet. Save your money for the rainy days ahead. If I had property right now, I would sell it before things get ugly.

Erin,

I hate to break it to you but you lost Christie at “It all an algorithm…”

My rent rises and I am moving to points north.

I will buy if the market corrects to a point that makes sense based on 30% of gross income towards housing. But I ain’t gonna be your slave or take more than 15 years to pay off a box west of the San Andreas.

Doubt it will happen with a return to market fundamentals, but some exogenous shock less than a black swan event will surely shake the future of housing soCal style.

Wow, lots of appetite for rentals here. I’m gonna go get my popcorn and sit down. This is going to be interesting.

We haven’t had a landlord raise our rent in several years, because we’re ideal tenants who take good care of the house and pay rent early. We’ve only been in our current 4 bedroom house for six months, but our landlord is always mentioning how she hopes we don’t leave. I’m not really in any hurry buy. I’d have to put something like $130K down for a house like this, and my monthly payment would still be several hundred dollars more a month than our current rent, and that doesn’t include maintenance. If I knew we’d be in California for 10 years minimum, I might risk it, but I own my own business, and it seems risky with the market going up and down like it is. If business changes, I don’t want to be stuck.

I’m not sure where you’re getting that there’s a shortage of rentals. You have one graph showing rental vacancy rates and that’s in the midwest and it’s still showing over 8%, which is pretty high.

I rent in Denver, a market that’s been pretty hot, and I keep an eye on the market all the time. For a couple years the market was tight (2011-2013). I recently moved into a brand new building and there were some buildings offering move-in deals. The rental base is up big this year. I just checked craigslist again and there’s even more buildings offering rent deals than just 4 months ago, when I was looking.

I’ve read similar things about Vegas, Phoenix and SoCal. Bloomberg ran an article a few months ago that said landlords were losing pricing power even in NYC.

Sorry but I don’t buy your thesis.

There’s always a…VAN DOWN BY THE RIVER!

http://wn.com/Livin%27_In_A_Van_Down_By_The_River__Matt_Foley_Motivational_Speaker__His_Full_Scene

I live in PHX area and am seeing in last 18 months a pickup in building both single family homes and apartment complex? what is driving this? I have to wonder if it has something to do with illegal immigrants and their families. Yeah the lower rates might entice people to move up … but who is buying their SFH … and who is moving into all these new apartments? I don’t see the demographics in population growth … other than illegals. Could this be why Obama and the Feds are pandering to illegals and now allowing them to come in by the thousands per day — essentially turning US border patrol into a “Welcoming Committee”? Is perhaps the US economy and RE market a PONZI scheme living on borrowed time, that they need new people coming into the country to live to support the RE market to keep the game going? Illegals have to live somewhere … so a massive influx in them requires some new housing — especially apartments. (BTW — I’ve come into contact with a few here illegally and majority are not savers but will gladly sign their life away in debt even if having a modest income to ‘live the American dream’ — thus creating a boost in demand for things like cars and houses. And given our corrupt governments usage of bailouts when the bubble popped in 2008, who is to say that the Financial Industry won’t get bailed out again — again at tax payer expense — when this current bubble pops).

North American union woohoo

No on Phoenix Growth, This is a hype from the developer boys and EASY money

from the Banks. Not sustainable, notice no Condos. Apartment Vacancies can be

alleviated by lowering market rents, Condos will sit empty. Want to buy a SFH in Phoenix, wait 18 months, the Tide will going out and will lower all boats.

Desert Fox… sorry to rag on you but think about it, illegals buying new houses and renting, how do they pay for it on pesos?,

Try renting or buying new, they check you out like you applied for a FBI job. Illegals supporting the RE market, yes lets see, new homes Paradise Valley and N. Scottsdale 2m to 3m only farm workers, car washers, dishwashers,need apply?

true they aren’t going to be buying the higher end housing. but they could be in position to either buy or rent a basic SFH so that the owner of that home has $ or cash flow to push into other RE investments — like buying a higher end home. and def can have illegals moving into new apts that are booming up in PHX over the past 18 months. On the other hand, perhaps the demand is also supported from getting more of an influx from legal folks who lived in CA for a long time and are giving up on living in that corrupt liberal cesspool.

What we all have to be concern with…The administration wants to give $500m to factions groups who all their lives can’t get along.

Last I look this country is in dire need of a major facelift, from roads to air-ports, to high-speed transportation etc. But why do that, it only creates jobs for the next 20 years, we don’t need stability do we in the country?

George Bush indebted us to the tune of 1T for his playtime in Iraq. What’s another 0.005T to help put a spit shine on his disaster?

DFresh….Nothing to do with who you support in this case especially, President Bush can never escape the disaster of Irag. The whole invasion was based on half-truth and out and out lies.I don’t like throwing money at this problem 500m no way, but it is undeniable, Bush pays the price for his war and tarnish legacy.

Like Vietnam, we can’t forget those who lost lives,limbs,their sanity for what?

Dfresh is another delusional leftist who blames Bush when it’s Obama who has increased the national debt increased by more than $6.5 trillion since he took office.

It’s the largest increase to date under any U.S. president. Obama has now presided over five of the six largest annual budget deficits the U.S. government has ever run, according to data by the U.S. Treasury.

In Afghanistan, Obama intensified the war even as he promised to end it. Immediately after taking office, Obama signed an order increasing the number of troops in Afghanistan. A few months later, he increased it again, a move known as the troop surge. Seventy-four percent of the U.S. military personnel who have given their lives serving in the Afghan War died after Feb. 17, 2009, when Obama announced his first increase in the number of U.S. troops deployed in Afghanistan.

If the market stays steady or doesn’t come down much then at what point does it make more sense to buy vs. rent? Also, do you see more SoCal homes in the 400K-550K range becoming more available in the next few years for purchase. This seems like the price range for families who make around 100K a year. Areas I’m interested in are Woodland Hills, West Hills, Agoura, Oak Park, Thousand Oaks, and possibly Newbury Park.

Dan…As a former owner of much property in that part of the world, with the cost of land, LA or Ventura county requirements, and builders infrastructure I sadly tell you very little chance of production house at $400k or so.

No question the price point for many families should be $250k to $400k tops for 1700 to 2400 ft. houses. But again not going to happen, you see Dan, the banks have huge investments in high end mortgages and if they were to build mass areas at this price point, the values of many, many thousands of homes would be at stake.

That Westlake Village house that is 2600sq.ft. at $1m or more would devaluate to maybe 500 k to 600k at best. With so many houses at even much higher prices, the natives would not only get restless they would storm the counties. It is one thing for a market to devalue for economics concerns, it is another for the state or county to now back up and sell land cheap to devaluate a region so folks can afford a home, won’t happen in 21st century prime CA. locations especially or probably anywhere else.

Robert,

I didn’t mean new home construction in the areas I mentioned. Just was wondering if there would be more inventory available of used homes in the 400-550K range. Right now it seems nothing around that price range is available for a decent single family home. I’ve come to the conclusion that you really need two solid incomes to make it anymore.

Thanks to manipulated supply and

monetary policy, including the ’08

bubble sellers getting no safe money

return on their proceeds and footing the

bill for loss sharing, the banks and bankers’

funds firms’ collateral and property’s

values are artificially inflated with supply

reduced.

And, they thus bilk the rent.

It would make gangsters selling

favor and protection favor, but then,

there’s obviously a manner of overlap.

They want people to look for fault

amongst themselves and to think

that’s the government.

My husband and I earn a combined income of $154,000. Nice combined income right?

This year everyone in my large company of 6000 earned .5% COL/merit increases.

My husband has just been informed another 12.5% is going to be deducted out of his own pocket towards retirement.

After taxes, social security tax, CA disability tax, state income tax, health insurance contributions and retirements, we take home $101,000 a year. A third of our income just gone…. And that’s before the day care expenses kick in.

No way in hell are we mortgaging ourselves to the hilt on an overpriced house, especially in these uncertain times. Will continue to rent for a while.

Main reason housing WONT tank hard…people who purchased this time around are all cash. No mortgages to collapse the system means this is the “new normal”. Only thing to crash now would be a deflationary spiral from the debt bubbles created in the larger system.

I would think that a CPA would know better than to state “people who purchased this time around are all cash”…

Haven’t half the articles posted on DHB been about the number of cash buyers? So if people are buying with cash, there is no mortgage and there is true price discovery. FMV is what a willing and able buyer purchases property, in this case, for a home. So in bubble 1.0, FMV of “willing and able” was using money that essentially wasn’t theirs to start with. When they reneged on their contract, prices came down and more solvent/capable buyers came in with this new normal market. And if their paying cash, you won’t see a dip unless greater economic factors push the market down (ie, significant 10+ percent rate hikes, derivatives bubble pop, deflationary spiral, asset price collapse, etc).

Class is out of session now What?

I’m guessing that What? is referring to folks who ultimately leverage the purchase whereas the sale is recorded as a “cash” purchase. There’s evidence to suggest that a significant amount of this has been going on.

In the case of Doc’s articles, the emphasis on “cash” purchases is really about exposing the higher than normal amount of specuvestor activity in the marketplace.

Even if the majority of purchasers were paying in cash they have on hand and end up holding, the resistance (foreclosures, short sales) for them to sell into momentum is less than leveraged “owners” who are upside down.

By the way, actual price discovery would happen in a market where the real supply isn’t being kept off the shelves in order to create scarcity.

All “is it a good time to buy†sheeple, please do not read this comment as it will bore you to tears.

I am just thinking out loud here. I wonder if it is truly possible to continue with the status quo for the foreseeable future. Is it possible for the financiers to control the markets over the long haul given that many markets trade at the margins? If it is true that there was an attempt to crash the bond market via a coordinated dump of treasuries by certain parties and the Fed quietly sopped it up via the Belgian mystery buyer, what would it take to actually bring down a contrived “market� The power to print is a mighty power especially when there is a huge slack in the labor market. There is no wage inflation to be seen and that truly puts a wet blanket on the likes of runaway inflation. Yes, in the long run printing does not create wealth it simply transfers wealth, but maybe we are truly at an inflection point. Is it just possible that we hit our full “economic†potential some 40 years ago and that we have been simply moving deck chairs on the Titanic ever since? A telltale sign is the belief that not only housing is no longer constrained by income but that rents are no longer constrained by income. The “American consumer†has been on life support for the past 7 years and the relentless march to squeeze evermore has only intensified. Many moons ago when I still believed in economics, math and gravity I would have said that this time is not different and that this “bubble†will burst but I am not so sure anymore. I wonder if these “bubbles†are just figments of our imagination and that the “real economy†has been in the depths of depression/recession for the past X years. Maybe since the bubble/boom is not real there is no bust/tank on the other side. Just some food for thought…

Here is a decent explanation of our ‘new ekonomy’

http://www.youtube.com/watch?v=j2AvU2cfXRk

like i said many threads ago … we are in a depression …. have been since 2007 or 2008 or 1980 even.

its all about asset preservation not asset growth now. turd world nation here we come. woohoo

So this will be interesting at this price…plus location…plus bubble in the market.

I live on the street within a 3 blocks…I rent a similar house with a roommate, we pay $900 each.

http://www.zillow.com/homedetails/1027-Eagle-Ave-Alameda-CA-94501/24863746_zpid/

Will it go at $449,000 or is that too much for a traditional buyer…if yes…then a will renting it out pencil out for an all cash buyer to drop almost a half a million to MAYBE at best get $2,200 a month in rent?

Since it’s on my street this will tell me a lot…to be honest if it was listed around 300-350…I would consider getting my act together and trying to buy it.

Great piece!!!!

“In California, you have 2.3 million adults living at home so their likely first step into forming a household would be a rental. ”

This is not the pattern i’ve seen in my bay area office.

What i’ve seen is young professionals leveraging their ability to stay with parents to accumulate upwards of 100k to put down and move directly into a house.

This is about the only way to save such an absurd down payment in a human lifetime and is only available to people with established local families.

The long-term effect will make California increasingly insular.

Leave a Reply to Tired of the BS