Population growth, migration, and real estate: Los Angeles County had the highest number of international migrant growth between 2012 and 2013 while Texas boomed with domestic migration.

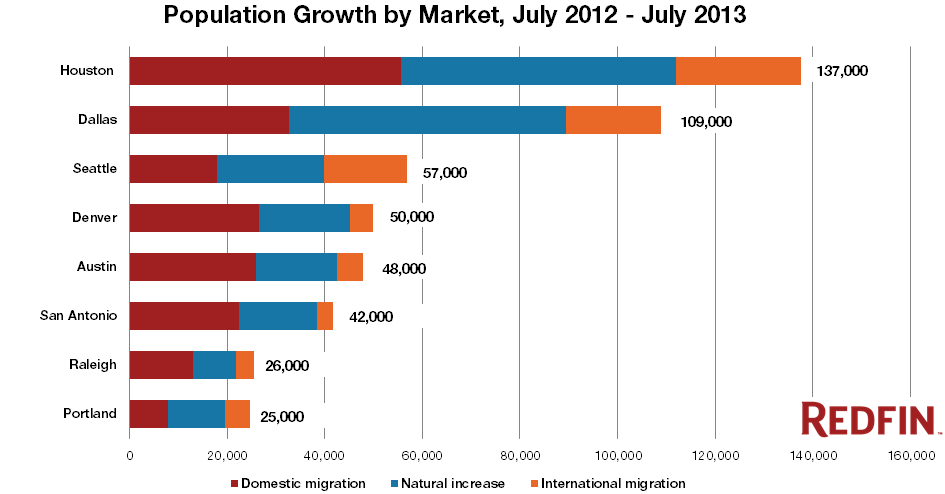

Los Angeles County by far is the most populous county in the entire country sporting over 10 million people. People tend to forget that L.A. County is also a renting majority county. This is a big deal for the biggest county in the nation. For comparison, the second biggest county in the country is Cook County in Illinois with 5.2 million people. I was reading a few articles this weekend focusing on migration patterns across this country. L.A. County drew in the highest number of international migrants between 2012 and 2013. As we know, a good number of people from abroad are purchasing real estate across the Southland in prime locations. L.A. County added 39,000 international migrants from abroad between 2012 and 2013. A small number for the region yet this has an impact on pricing since purchases are largely targeted in very select markets with air tight inventory. Another trend that is occurring is the boom in Texas. Texas is seeing tremendous growth from domestic and international migration. Some of the healthiest housing markets in 2014 show up in Texas.

Real estate and migration patterns

I had a Texas real estate agent e-mail me about Californians leaving the state to purchase property in Texas. The anecdotes were telling and revolved around working class families desiring home ownership on lower incomes. We already know that California has priced out a large number of families.  This is no secret. While some Californians are stuck in their golden sarcophagus of a home, many others looking for the chance of home ownership are actually heading to areas where real estate values are more affordable.

I have mentioned this a few times before but many of the readers on this blog are educated, professionals, and have higher household incomes than the typical family in the region. Most are aiming for the “prime†zip codes in the area. In fact, we are probably looking at cities where 500,000 to 700,000 people are living. But what about the other 9.5 to 9.75 million people? The reality is, most in L.A. County actually rent.

Let us look at some of the hottest real estate markets around the country:

We have four Texas cities appearing above. These markets are hot for a few reasons:

-Affordable real estate

-Growing employment markets

-Balanced migration patterns

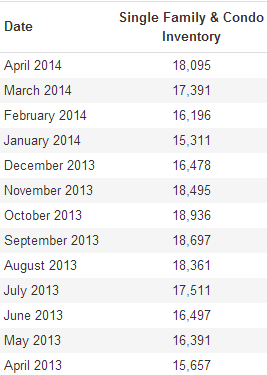

This is what you would expect of a steady growing housing market. Affordable housing that caters to all income levels in the region. California is seeing higher prices on record low inventory and turnover in the market. Investors are already growing weary of the market and are pulling back. Because of this we are seeing inventory creeping back into the market:

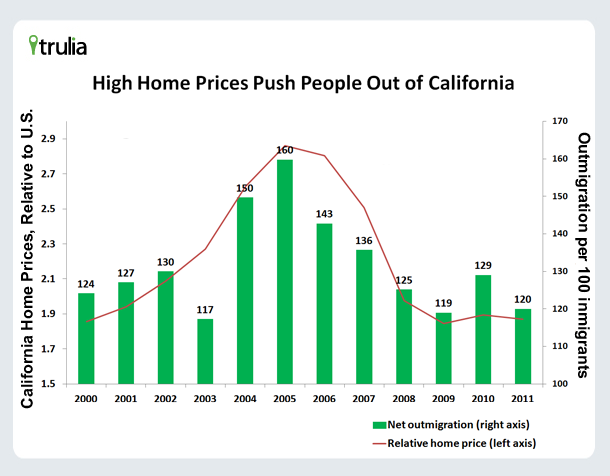

Housing inventory is up 16 percent year-over-year for Los Angeles. As it turns out one of the biggest reasons pushing people out of California is higher home prices:

Source:Â Trulia

Because of international migration and births the population grows slowly but not what you would expect from a booming state with plentiful jobs. California is aggressively pricing out the middle class and people are voting with their wallets.

I know some people tend to think that incomes don’t matter but they do. The Redfin data is fascinating because it is showing that some major cities in our nation are growing at a very healthy pace. This is balanced growth versus low inventory shenanigans combined with lusting investors. These other markets are growing because of economic growth and households actually buying properties in the markets where they work. This option is becoming less of a possibility for Californians where only 1 out of 3 families can afford to buy.

Growing inventory, investors pulling back, and prices stalling out signifies things are slowly turning. A correction is very likely since California is a boom and bust real estate market. Contrary to what some believe, the U.S. does have other housing markets that don’t hug Pacific Coast Highway and to the point, the vast majority of this nation actually lives there.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

103 Responses to “Population growth, migration, and real estate: Los Angeles County had the highest number of international migrant growth between 2012 and 2013 while Texas boomed with domestic migration.”

The Fed has spent $4 trillion dollars to keep this so-called “recovery” going. The Fed has spent more than $4 trillion, its balance sheet, because it has also fixed interest rates at zero for four years, essentially donating to Wall Street free money. At the same time the Fed has been buying all the bad loans the banks have wanted to sell, which includes US Treasuries, in order to steer people into stocks and housing. It’s a giant ponzi scheme.

I don’t believe in the recovery they want to sell us today. The entire globe is trying to pretend that growth can occur when the economy is strapped down with figuratively ‘tons of debt’. One cannot fly with dead weight strapped to his back; one has to, first, throw off the debt, which is what the deflation cycle is all about. Instead, the world is trying to pretend that the deflation cycle isn’t real, just by ignoring it.

We still have a long way to go before we get back to Real Recovery, and can start over again. Higher rates, default and bankruptcy is the only road back to Real Recovery. Always has been; always will be. There is no easy way out and this is going to end very very badly.

Remember, deflation and depression is our only friend that can actually save this country.

Raise the interest rates and crank the default machine. Let the defaults and bankruptcies run wild. At the end that is exactly what needs to be done. The longer we wait- the worst is going to be.

Good Luck!!!!

Saddled with debt and declining cheap energy: http://www.theautomaticearth.com/debt-rattle-apr-9-2014-the-great-unwashed-american-energy-independence/

Who the hell cares? Who wants to live in LA county? Rich Hollywood wannabes, foreigners who know no better and have money to burn and like the LA scene of uppity wealth, and poor migrant Mexicans crowded 20 to a house or apartment dwelling. White and otherwise middle class people are moving the hell out of LA and CA in general. Rightfully so. CA has become a pathetic drain on people that want to work hard and get ahead. It’s an antithetical state to American values and ideology.

What I notice most about people that follow and speculate in real estate is they know nothing about the long term greater economy and how it works and where it’s headed. Kind of like the WallStreet guru trader clowns. America is losing it’s superiority in the world. BRICS countries are making moves out of the USD. Russia, China, etc. They will be buying and selling oil in currencies other than the USD. It’s already happening. And when it comes full circle it will be the death spiral for the America economy and petrodollar hegemony. Readers on this blog and commenters seem to be as clueless as the debt straddled American public. Real Estate especially has become like the stock market. And it will end badly once a gain, even in the precious gold child SoCal market. You think the rich and wealthy can prop up the entire economy of 33 million people? Yeah right! The economy is on life support. Without QE there would have been zero recovery in housing. And all those middle class earners with good income and good credit would still be on the sidelines waiting. Why? Because CA housing is not a good investment in these times. You’re better off moving out of state to other less expensive areas where you can actually have a backyard and a driveway and not pay a million for it.

Let’s face it……..a tiny percentage of people truthfully “OWN” their home anyways. Quit paying your property taxes and see how much of your house you really “own”. Home ownership in this day and age is for fools or people that can actually afford it and live within their means.

Beautifully said.

Pack your bags. CA is for optimists.

2020 LA Report, time for truth report:” The poverty rate in Los Angeles is higher than any other major American city. Median income in Los Angeles is lower than it was in 2007. Three decades ago, LA was home to 12 Fortune 500 headquarters. Today, there are 4. New York, in contrast, has 43 and has continued to add major employers in the last decade. We have developed a “barbell†economy more typical of developing world cities, like São Paulo, rather than a major American urban area. We are experiencing growth at the top of the income ladder and at the bottom, while the middle class shrinks year after year. Ten percent fewer people are employed in Los Angeles than two decades ago. Over the same period, national employment has increased 20%.Los Angeles is the only one of the seven largest U.S. cities where the number of jobs has

actually declined since 1990. Los Angeles County ranks last in California in creating jobs. From 1980 to 2010, LA added one million new residents but lost more than 165,000 jobs.” Welfare programs support many of the new residents and we need more tax revenue to keep the system going. Today is April 15th, please enclosed an additional $5k to help the needy.

@Gray. Your comment is true and explains why the middle class in SoCal shrinks every year to the point where only the very rich with tax loopholes can stay and the poor. Both, the rich and the poor, feed on the middle class taxes till there is nothing to feed on. The end result will be something like Sao Paulo. The trend will continue nation wide.

So many renters want to own. But, in a survival of the fittest world, only the highest income renters will get a shot at owning. The rest will either move away or live life in a large depressing apartment complex that dot inland Southern California.

And, so many renters will reenter the market bidding prices up once again. We are watching interest rates fall rapidly while so many are flush with six figure bank accounts. Looks like a large price move upward is in the works. It appears bidding wars are starting once again. Good luck to all the bidders.

Yes, renters want to own. I want a McLaren MP412C. That doesn’t mean I can afford one or that I would buy one if I could afford to. I like your optimism because it’s good for my bank account, but please provide data to support your completely unfounded claim that “a large price move upward is in the works” and “the bidding wars are starting again.” Based on the reality of prices and inventory of the markets I track, you are in la la land.

Housing and stock markets only go up. I am smarter than you because I invest in real estate and the stock market. You will need to invest all your stagnant income in the stock market and real estate market if you want to be paper rich like me. Cash is bad. Renting is bad. You need to get on the bandwagon or you will hear a knock on your door in the middle of the night. Play the game or else…

RE: What?

The desperate confirmation bias of the trolls is telling… The FEd has affirmed again and again that 2015 is a rate hike. Their hand is forced. Mortgage origination is near zero. 7 million still underwater in CA. The only good retail numbers are coming from the luxury sector. I’ve been considering moving even further into the IE myself. maybe Lake Elsinore. Things might get scary when the SHTF. Social unrest in a crowded metropolis is not my idea of a good time 🙂

NihilistZerO, Lake Elsinore may have good cat fish and bass, but not the climate for farming. The Emerald Triangle is unsurpassed. You could become a registered farmer up here and sell for medical purposes what you and your girlfriend don’t use on your own medication. The law will not bother you here like they did in L.A. No drought up here either. Google people really like it here as well. If the farm land is too expensive, you can always rent from the Google people, just like people do in The City. Of course you will need a good farm advisor.

jt is a poseur–possibly a real estate agent or a small fry flipper. His affect is that of a big money investor, but I just can’t buy it.

His posts all betray an incredibly simplistic (read uneducated) world view, and the writing is tortuous even beyond the expected roughness of an informal blog posting.

I make big money; I drive big cars. Everybody knows me; it’s like I’m a movie star. Buying rundown beach bungalows is how I make my cheese, started in the early 90’s when things were super shitty. Buy another one, every few years; now I’m up to 5, with cashflow up to my ears.

“I make big money; I drive big cars. Everybody knows me; it’s like I’m a movie star. Buying rundown beach bungalows is how I make my cheese, started in the early 90′s when things were super shitty. Buy another one, every few years; now I’m up to 5, with cashflow up to my ears.”

Oh, okay. Simmer down, Mr. Rap Super Star.

You’ve got mad skillz yo.

Feel better?

JT says: “I drive big cars. Everybody knows me”…big cars like garbage trucks….of course the whole neighborhood knows you.

@jt

Congratulations! That is the lamest comment I’ve ever read on this blog.

Not on topic, but I had the strangest experience in L.A. once. I was visiting a friend in Burbank a few years ago, and he took me to a party in (I think) N. Hollywood or somewhere nearby. A lot of 30somethings. Mostly single, etc. The woman hosting the party was going on and was really fishing for comments about how beautifully she had decorated the place.

She had recently moved in. I assumed she had bought the joint. Finally, she made a comment that clarified she was only renting it. But, she was excited about the fact that she was no longer in a complex and had a yard and a garden and such. She literally sounded as giddy as a one of those first-time home buyers you see in realtor commercials.

I couldn’t believe it. It was a watershed moment for me. I realized that in America you can diminish someone’s expectations to the point that they will view renting a free-standing home with the same enthusiasm as buying one. So long as you make the alternatives even worse.

Now, this is just one, anecdotal case, but I’ve always believed that where California is today so goes America in 20 years. I realized the fix is in. We really will turn America into a nation of renters–a land of monthly-payment financial zombies. Maybe I’m reading too much into it or being too pessimistic. I’d love to be corrected from this assumption.

I will spend about 360k to rent for 10 years. The alternative is to buy a 600k mortgage (total cost about 1.4m) to live in the same box. As this is a leveraged purchase on an asset that will drop from 800k to 400k during the 10 years I will lose what I put into the box and rely on some taxpayer bailout to fund the equity game. Given that I might move in 5 years I would rather rent from an individual that participate in the equity scam. If prices drop 30% I will buy but renting is cheaper now and I can focus my assets on cash flow in places less prone to hgtv lemming behavior.

agreed

Renters can’t get dates in China. You only get lucky if you are a debt slave…

agreed as well. I just inherited enough cash to buy the house I have been renting for the last five years. I am not interested in overpaying for it and instead will invest that money. I believe real estate is grossly over-valued in the town i live in (and would want to buy in – Sierra Madre) and unless/until that changes I am enjoying my below market rent (my landlord LOVES me and has never raised the rent). Or, i might move to Bend Oregon in the next few years…

Be careful Dave, posters on this site will see that you devaluated a 800k house to 400k a 50% drop? They claim that nobody believes houses will go down that much, so these folks play it safe.

They really do believe homes will fall at least 40 to 50% but they are now in the back down mode. Why because houses will not drop that kind of money and in ten years unless you buy now most will be priced out. The underwater people will be long gone, interest rates will be 7% and bank interest rates at 6%.

Money will flow in on a monthly basis, tech jobs will pay huge nobody will care about a bubble anymore, bank on it.

Yep, Texas is the promised land. What can I say. But I have been told by my neighbors not to talk to you folks, because they don’t want the California fruits and nuts coming to town. I have told them that Californians are only “manic-depressant” types, that need medication. The west side (Peoples Republic, Brentwood, and etc) will have mandatory diversity in housing. Because after all, they are told that diversity is their strength. Diversity means primarily income and the usual ethnic/racial and etc types.

Bwa ha ha…..Aw they are very nice people…Just vicious circles in La La land.

Tex…You are completely ignoring the vast cultural differences. I can’t think of a single peer in the Bay Area that would move to Texas, even my married friends would rather move out to Concord or Dublin and commute. The extreme right-winged Perry-Cruz politics of your state are a huge turn off to anyone with a brain.

The Bay Area with that Devil Google that drove up the rents so high in The City. Instead of Cow tipping you have Prius tipping. The common folk are raising up against the limousine liberal types. You will get a Sec 8 house next to you soon. The City council is listening to the people. Don’t think that you are safe. California is letting the inmates out due to the lack of will to spend close to $80,000 to house an inmate with a sea view of the Pelicans. Governor Moonbeam Jerry Brown let 100,000 out of the pen to help to balance the budget.

You are right on Easy Bay. Many Californians moved to Denver several years ago many moved backed to Cal, AZ OR Nevada they never looked back.

The culture shock let alone snow and hail was a huge factor in many saying they had enough of bible and 1960’s living.

There is nothing like living in a consistent climate, laid back have a drink by the pool, and enjoy nurseries being open year round.

Houston is now one of the biggest gay metro areas in the US.

CAE, I can’t tell if your point is that the Huston gay population adds to the city or detracts.

I guess that all depends on whether or not one wants to be part of gay community in Huston.

Even the mayor …

Having grown up in Texas(Dallas) and having lived there the first 12 years of my life, I would absolutely live in a tiny apartment in California over just about anywhere(Austin might be the one exception) in Texas. Moving to Texas from California is a no brainer………those having no brains .

Or…. Diversity means your new neighbors have a huge family, and all 20 of them live in the residence next door to you, with 19 cars and a few motorcycles…. four of the cars will be on blocks in the front yard in the next month or so…. Sorry Tex.

Yeah Tex… let’s just lock ’em up without addressing the underlying problems (bullshit Drug War is #1) just like Texas. That’ll learn ’em. You give agreat example of why people DON”T move to Texas and the CA’ers that do stay in Austin.

As for Gov Moonbeam, I ain’t his biggest fan but at least he had the sense to tell the Sherrifs “NO” when it came to $500 million in new jail and prison funding.

FUCK LOCKING PEOPLE UP FOR BULLSHIT!

The underlying problem is they are criminals. It’s pretty straight forward, if you break the law there should be no ” Get Out of jail Free” card.

The lifestyle debate between SoCal and other states such as Texas is an ongoing theme on this blog, and both sides seem to win the debate, as it often stems from subjective life experiences, good and bad. But one things for certain, our LA girls got you Texas beat, by a LONG SHOT. Sorry. Hey Big Tex, I’m sure you love your voluptuous 180lb cornfed ladies over there. And I’m good with my 120lb no tan line, golden skin beach babes. Just going to take a stroll down to santa monica pier this weekend and realize I’ll be mixing my gene pool w the right looking folks. I’m good over here. Very good. LOL.

Doc, your premise is correct…CA does a boom and bust real estate market. But how can you call for a ‘bust’ this prematurely? After all, we’re only a couple years into the ‘boom.’

Because the original ‘bust’ was blunted and drawn out (kicked down the road) by unfathomable and unprecedented levels of government intervention, on an absolutely massive scale. This prevented the chips from naturally falling where they may, as well as did not address the underlying systemic failures, flaws, and faults, merely delayed the inevitable as well as grew the problem.

Last boom was only 3 years. 2004-2006. There were ZERO transactions in 2007 just like now. Not every bubble is the same length. The fact that the measures taken to blow this one were even more extraordinary than the last, and it’s likely going to be a year shorter in length, portends an even harder crash.

Their are not many people crying cause they bought a house in 2003-2004 in Los Angeles. Prices may drop again… But anyone who bought in 2003 is already almost halfway done paying off their 30 year mortgage… That they could have probably refinanced to a sweet 15 year sub. 3.0% rate. They are now on the sweet end of the 30 year pay off cycle where they are paying more each month in equity than interest.

Meanwhile… Renters with money in stocks are gonna lose their shirts if housing crashes again too. And their rents are at all time historical highs.

The classical economic model states that there is no such thing as a bubble… in economic terms at least… There are some scientist that believe in soap bubbles but these are only flimsy theories at present. Therefore buy now or be priced out forevah!!!! This mahket is only going up from here.

“Their are not many people crying cause they bought a house in 2003-2004 in Los Angeles. Prices may drop again… But anyone who bought in 2003 is already almost halfway done paying off their 30 year mortgage…”

Yeah sure. As if 75% of the populace didn’t cash out refi up to the hilt. gotta keep up with the neighbor’s Benz. Bling, Bling!

“That they could have probably refinanced to a sweet 15 year sub. 3.0% rate. They are now on the sweet end of the 30 year pay off cycle where they are paying more each month in equity than interest.”

Bullshit. See above.

“Meanwhile… Renters with money in stocks are gonna lose their shirts if housing crashes again too. And their rents are at all time historical highs.”

So you think rents can remain at historic highs during a stock market collapse??? you’re a bit more creative than robert, but still a troll with no real financial understanding 😉

‘You LOSE! Good day sir!”

“That they could have probably refinanced to a sweet 15 year sub. 3.0%”

Would love to see the numbers but I’ll wager that most refis re-ammort to a new 30 year schedule. In other words, a 30 year mortgage becomes a 45 year mortgage. Especially with rates as low as they got the past couple of years, I bet even less folks than usual went the 15 year route. That and the poor prospects for future financial prosperity.

Sure you want to make that bet?

“In 2013, 15-year loan terms accounted for 27.3 percent of all refinance mortgage originations, up from 26.7 percent in 2012 and up from 8.8 percent in 2007.”

“In addition, 39 percent of the borrowers who refinanced during the fourth quarter of 2013 opted for a short-term loan, which is up 2 percent from the previous quarter and the highest since 1992”

Yep, I’ll still make the bet. Wake me up when those numbers get over 50%

“Healthiest”? You have got to be kidding, using a word like that – -any time houses are at these levels, even if not “as bad as a worst areas,” it’s not “healthy.” Affordable housing is good for everyone, not just having it be “less expensive than ridiculous.” Even in Austin it’s not “cheap” or even in line with incomes. When housing is more expensive than 20-30 percent of income, this negatively affects other expenses such as food, utilities, insurance, entertainment, etc. So no, it’s not “healthy” anywhere Doc, IMO (except Detroit maybe). Let’s not turn a blind eye to reality. Why do you think there are so many renters? Pretty obviously, the sham market is not “healthy.”

Interesting as to what “Healthy” means to different age groups these days? Nothing is “healthy” in California, with respect to living in comfort. It’s been redefined, maybe brainwashed by schools?

I like owning what I have, living well within my means, and if needed, I can live without help from anyone.

I live in the People’s Republic of Soviet Monica.

Yes, the city council keeps building low-income apartments for diversity’s sake. But those diversity buildings are mostly restricted to south of Wilshire Blvd., north of Pico Blvd., and east of Lincoln Blvd.

I know of only one low-income diversity building north of Wilshire, on 5th Street. And I know of no such buildings north of Montana.

Soviet Monica segregates its diversity.

Mortgage-origination free fall slowing down at Wells Fargo, J.P.Morgan:

http://blogs.marketwatch.com/capitolreport/2014/04/11/mortgage-origination-free-fall-slowing-down-at-wells-fargo-j-p-morgan/

Plunged compared to last year

Who need a mortgage when all us rich real estate and stock market investors have tons of cash to burn on the great deals to be had in the south land…

Don’t forget all the rich Chinese. They have bottomless suitcases full of cash. It will never end! It will go forevah!

One more…

Blackstone to slow down home purchases even further this year:

http://blogs.marketwatch.com/capitolreport/2014/04/14/blackstone-to-slow-down-home-purchases-even-further-this-year/

But but but “We still see a number of years of pretty good [home-price] growth. There’s definitely room for more appreciation. We think home prices will do better than most people’s expectations,†Gray said.

In other words, bait the hook and put out the fishing line.

Unfortunately, wherever Californians move, they bring with them the attitudes and voting habits that has turned California into such a pit. You’d think they’d realize that they themselves were the ones who brought this about. The western states, for their own survival, should not allow Californian immigrants to vote.

As if voting matters…

LOL @ What. I was going to post the exact same comment. Tad clearly believes in the false left/right, red v. blue paradigm.

Tad-

Take the red pill. You will realize that the American republic was subverted to a corrupt and thieving corporatocracy years ago. Voting blue or red doesn’t change anything. The system is broken.

Voting DOES matter! You just have to buy the right congresscritter for the right price and then they’ll vote as you wish.

Just ask Comcast, Disney, Big Oil if voting matters…

As I am now at the age where retirement is not far off….I know a lot of others my age and we talk about moving out of CA. Almost everyone agrees that by selling the house and all the retirement money from SS and/or pensions etc….other states are far more attractive for someone on a fixed income.

You come on over. I make a powerful chili.

Why not rent out the property here, assuming you don’t have to sell?

I’m just ahead of you on that plan. It’s week 2 for me in Montana. I just left Silicon Valley. House will be listed in the MLS in the next week or so. We’ll see how it goes…

I’m north of Wilshire in Santa Monica and I think there’s another low income building on 12th street that constantly advertises on CL. Regardless, I think City council does segregate diversity (that’s pretty funny) but I sure wish they’d get a bit more right minded regarding the homeless. I’ve lived in Samta Monica since 1977 and grew up on Montana avenue, so I’m quite partial to this area, but the city council really need to do a better job preserving the integrity of the community. We pay “premium” prices to live north of Wilshire and i caught a guy urinating on the sidewalk as if it was his own private bathroom. As this is my childhood town, I often tell my husband I won’t move. My husband always talks about moving to Texas. I see why. I’ve lived in Houston and I admit, I missed California. As much as we complain about the chains of renting, traffic, etc, it is an amazing place to live. But now that I’m a parent, it sure would be nice to afford a backyard. We’ll end up in Sherman Oaks (which is STILL nice) and are just waiting for this market to reset.

You will be waiting a long time because “prime” areas like Sherman Oaks only goes up forevah!!!

HAHAHA, love the sarcasm, What. Sherman Oaks, prime…HAHAHAHA!!!

What?, you should change your handle to What Sarcasm?

Sherman Oaks is part of the city of Los Angeles. A time for truth, by the 2020 L.A. Commission, 12/13, basically says that L.A. is going down fast to be a third world failed city and in need of big tax increases fast. This will have an adverse affect on L.A. city property values, but increase the values of independent cities that surround this failed city. Read the report for yourself. It is scary.

@Gray, forget the year 2020. 2/3 to 3/4 of SoCal is already third world. Except for the Hollywood Hills and a few other spot areas, the area east of Fairfax and west of the 605 is one giant third world slum. 1/2 to 2/3 of the San Fernando Valley is a third world ghetto.

This gives a clue why the middle class seek refuge in the San Gabriel Valley, Orange County, Pasadena, Burbank, Glendale, Torrance, Sherman Oaks and Culver City.

You got a long wait if you think South of Ventura Blvd is going to be affordable. As far as Texas, well the lone Star State has a great American history, but I can’t imagine waking up in Texas?

You saw a guy urinating in Santa Monica? Was it in broad daylight?

Even so, I got you beat. Early one morning, about 6 a.m., I was walking on Wilshire, past the alley between 5th and 4th. I saw a huge, black homeless woman crouched down, apparently defecating. She saw me and grinned, as though proud of her work.

Even so, I’m used to Santa Monica’s homeless.

Seattle’s homeless are far more aggressive. When I was in Seattle last year, I saw lots of homeless in the Belltown/downtown/Pioneer Square area. There the homeless get in your face, demanding money. If they’re across the street, they’ll shout for you to “Come over here!”

It makes you appreciate Santa Monica’s more laid-back homeless.

This is true. My husband was walking on the waterfront in Seattle (commuting to work) and got nailed in the face by a homeless woman. Didn’t hurt, just shocked him…she scurried away, before he could toss her into the Sound (just kidding). We are originally from L.A. and he worked in Hollywood for twenty years, he never got ‘smacked’. Ha! I blame it on the grey, it makes everyone grumpy. In L.A. the homeless seem mellow in comparison.

Recent article from LA Times

“…An increasing number of rent-controlled units are being converted to condos or simply flattened, leaving a dwindling supply and fewer affordable options for residents. Arie Shashou remembers simple pleasures from the decades spent in his Westside home: helping neighbors with small tasks; the daily chats with the former manager of the complex; the paintings that line the walls of his one-bedroom.”It was a happy time,” Shashou, 77, recalled on a recent Sunday afternoon. “I was hoping to die here.

That was before Shashou received an eviction notice in March. Shashou’s $825-a-month rent-controlled apartment, and 17 other units, will be demolished to make way for a pricey new apartment complex. Such evictions have surged in Los Angeles as property owners cash in on the recovery. Rent-controlled units are being converted or simply flattened. In their place, developers are putting up new condominium or apartment buildings, modern mansions or clusters of compact, single-family homes.

The evictions — allowed by the state’s Ellis Act — have exploded in San Francisco as well, accelerating a backlash against the city’s tech-driven gentrification. Two legislators there have moved to limit the practice; under current law, property owners are allowed to evict if they get out of the rental business or demolish their buildings.

In Los Angeles, owners filed to remove 378 rent-controlled units from the market last year, 40% more than in 2012, according to data from the Los Angeles Housing and Community Investment Department. That pace has accelerated this year.

“The people who make Los Angeles run — such as the hotel workers, the service workers, the teachers and the bus drivers and the regular working people — are being run out of Los Angeles,” said Larry Gross, executive director of the Coalition for Economic Survival.

Los Angeles passed rent control in 1979, after concerns that rapid rent increases were pricing many out of the city. There are roughly 638,000 such units left in Los Angeles — a dwindling supply because controls generally apply only to older buildings. And there’s little political momentum to expand rent control; the trend in California has been to scale back.

In 1995, the state Legislature barred units built after February 1 of that year from rent controls and ended strict regulations in some cities that prohibited rent increases if a unit was vacated.

The Los Angeles control rules limit annual rent increases for tenants in multi-family buildings built before October 1978. This fiscal year, the city allowed a 3% increase. Once a tenant moves, however, landlords can charge whatever someone will pay — but the cap on percentage increases still applies.

During last decade’s housing boom, Ellis evictions soared. Despite the recent surge, the displacements remain far below those heights. In 2007, Los Angeles landlords evicted 1,352 households from rent-controlled units, compared with 250 last year.

In response, the California Apartment Assn. launched an Ellis-focused website to dispel what the site calls “myths and misconceptions.” Ellis is a safety valve for landlords, the association said. The group says landlords invoke Ellis for myriad reasons: frustration with rent control; to move themselves into a property; to avoid bankruptcy; or simply to retire.

If longtime landlords want out, tenant groups argue, they can sell to another landlord. Longtime owners, however, probably would fetch less in a sale if properties couldn’t be converted to new single-family homes or condominiums for sale. And shutting the door on Ellis would put the brakes on redevelopment, said Michael Cohanzad of Wiseman Development, which used the Ellis Act to start evictions against Shashou and others…”

http://www.latimes.com/business/la-fi-no-fault-evictions-20140413,0,2351345.story#ixzz2yrw2WVf9

So 378 rent controlled units out of 638,000 were removed in Los Angeles last year, WHOOP DEEE DOOO!!! They need to ALL be taken off rent control to move the market back closer to an actual free market. Let the market decide the prevailing rent rates! If landlords ask too much, the units will remain empty.

I don’t think so. It’s a roller coaster ride. Once interest rates go back up, I think prices will come back down – at least to more realistic prices than they are now. Even in 2011 , pre foreign frenzy, we could have gotten a decent house in the Royal Oaks area for $850-$900k. We’d rather pay higher interest and less principal overall.

Prices are generally stickier on the downside. People seem willing to try and wait out a market rather than acknowledge a loss, even if it means carrying the property with a negative cash flow for a while.

For bank-owneds, it’s because they don’t have to mark-to-market. In many cases, best to just keep on not acknowledging that any loss occurred. For individual owners, humans tend to be loss-averse – they won’t walk away from the blackjack table even on a losing streak, because hey, it may turn around for them.

Unless forced to sell, a lot won’t. The cycle of new properties being bought to be flipped will likely stall, but that won’t necessarily bring down asking prices much if at all.

Bingo! There in a nutshell is the difference between the RE crash of the early-mid ’90s and 2008-12. In the earlier downturn owners felt selling pressure and prices dropped accordingly. Only the desperate or unconnected felt such pressure this last time and so those of us ready to buy found little available.

Housing To Tank Hard in 2014!!!!!!!!!!@

At least I hope I’m right! Perhaps my wishes are a SoCal renters dream… But with low interest rates, buyers today look at how much monthly they can buy. We have a decent down payment and would rather wait to buy once this nutty market adjusts.

A house came on the market in my neighborhood on Friday. I went to the open house out of interest on the weekend. What a dump. Backs up to empty space zoned commercial that they have just approved a 3 story hotel to be built on. Of course the realtard knew nothing of this. They wanted $400k for 1850 sq ft, 15 yo house completely run down, exterior had peeling paint, interior needed a complete renovation. Nothing was in good condition. Worn out and worn down. Smelt a bit musty too. It was a mess. I was in shock.

I pay $1700 a month in rent for my house – exact same floorplan one street away. My rental is in a better location, in better condition and is clean and modern looking. Why the hell would I mortgage myself to that tune then have to dump $40k+ into it just to make it acceptable to live in?

The realtard asked me if I wanted to make an offer “because it will sell fast, you know”. I replied “I don’t think so”.

And so it begins…in just another second tier city in China, overbuilt like all the rest. The wildfire sparked and spreads faster than anyone can imagine. :

“The real estate market in Hangzhou looks like it has just passed an inflection point. It is not so much that fundamentals have deteriorated—they have been weak for some time—as that people’s mentality has changed.

According to the National Bureau of Statistics, new home prices across the country are still going up, but percentage increases have now declined for three consecutive months, signaling a peaking.

http://www.forbes.com/sites/gordonchang/2014/04/13/china-property-collapse-has-begun

A PEAKING in PEKING, who would have thought! WOohooohoOOOHhhOOOO!!!

As state-run China Central Television explained, the problems in Hangzhou, once the world’s largest city, began on February 18. Then, the North Sea Park development began offering deep discounts. Rumors that the developer had cash problems started a chain reaction across the city. It did not matter that North Sea Park issued denials. Other developers began offering either deep discounts or large incentives, but the tactics did not work. By then, there were almost no buyers.

Now, the problem of no buyers is spreading across the country. Sara Hsu notes China’s residential markets are becoming inelastic. “Once consumers stop buying,†she writes, “deep discounts are ineffective in drawing them back.†People aren’t buying because they believe prices will decline further.”

The 2020 L.A. Report states, in part, “As a consequence, Los Angeles is sinking into a future in which it no longer can provide the public services to which our people’s taxes entitle them and where the promises made to public employees about a decent and secure retirement simply cannot be kept.

City revenues are in long-term stagnation and expenses are climbing.

Year by year, our City—which once was a beacon of innovation and opportunity to the

world—is becoming less livable.Consider the following:

A TIME FOR TRUTH

As the result of two decades of slow job growth and stagnant wages, 28% of working

Angelenos earn poverty pay. If you add those out of work, almost 40% of our

community lives in what only can be called misery. The poverty rate in Los Angeles

is higher than any other major American city. Median income in Los Angeles is

lower than it was in 2007. ” Bottom line, L.A. is sinking fast. Go read the report on the internet before you buy. Get out of town before it is too late. http://www.la2020reports.org/reports/A-Time-For-Truth.pdf

Thank you . I now decided to take up the offer on that Riverside house, or maybe I get a little rancho in Corona. The San Fernando valley(L.A.) does not have a future.

I’ll bet the Valley starts secession talk again.

The human beings in leadership are thieving, greedy, disgusting pigs and it’s destroying our society.

We outnumber the 1% and yet we are too stupid to do anything. A Bugs Life, anyone?

What do you think about ‘Mobile home park for retirees in Orange County’ ?

We are planning to order a new manufactured home and set it on a leased land lot. To be able to retire in CA, is manufactured home a good alternative. We don’t have to put out a lot of money upfront and the land rent would be the same as property tax and HOA that we would have to pay for a condo or a single family home.

I think that’s a bad idea. Your land rent will increase significantly over time and it is unlikely that you would ever recoup the cost of your initial investment. There are too many variables at play when talking about placing a home on leased land. You are completely at the mercy of the landowner. Talk about feudalism.

In the south, we would call it “trailer trash”. Better think twice about this one. Respectable folk live in houses, not tornado magnets.

What does an Arkansas divorce and a tornado have in common? Someone is going to lose a trailer.

@ Landlord — Two urinating gents in one week outside my building. I was shocked. The first one was at 11am, he was wearing sunglasses and talking on his cell phone — not even trying to be discreet. I couldn’t believe it. Of course our homeless are mellow, they’ve got happy bellies and every doorstop to camp out on…we feed them well in SM! One landlord told me SM busses them in from the southbay. Lucky us. Hey, but at least we get to pay $2.1 million for 1300 sq ft, 2 bd/ 1 ba house in 90402! Still, I love this town. Santa Monica or like NYC, I’d rather live in an apt where all the great restaurants / culture are at my feet, than have a 4 bdrm house in Memphis.

I think you are contradicting yourself in the same paragraph. You talk about people urinating in the street in broad daylight and you call that culture you can not part with.

It doesn’t make any sense to me. I know SoCal very well, I lived there for many years and comparative to 20 years ago, today it looks like a third world country – I don’t see too much culture.

In L.A. what 95% of people think of as culture is the availability of small proprietor ethnic restaurants.

Look at this bullshit:

http://www.redfin.com/CA/Los-Angeles/518-S-Van-Ness-Ave-90020/home/7090550

Public records show that it sold for $1,011,500 on April 1st, one week later it is listed at $1,570,000. And that asking price is $240,000 over the September 2007 bubble peak sold price of $1,330,000.

Love how the listing talks about “words can’t describe the property enough and must come and see”, meanwhile it has security bars on the windows and looks like a complete dump from the outside. Try a little curb appeal if you plan to reel in a sucker, you morons!

What an ugly, architectural nightmare that dump is.

REALTARD BS at its best.

They’re trying to justify the price by calling this Hancock Park, which ends just west of Larchmont Village. This property is very much to the east of Larchmont, close to Western though not quite McArthur Park adjacent.

And far, far too close to South Central, er, “South L.A.” for comfort. Which likely explains the security windows.

They can call that location Hancock Park, Hancock Park Adjacent, Larchmont etc. all they want, but that’s basically the eastern edge of Windsor Square which is generally a very nice community…but this is too close to the barrio apartments of St. Andrews Square / northwest Koreatown. LOTS of sketchy criminals, drug dealers, dope fiends, and general scum abounds.

And of course, Hancock Park and Windsor Square and other neighboring communities that are almost prime, prime, and ultra prime yet surrounded or bordering shithole barrios and ghettos are an absolute magnet for burglars, muggers, thieves et al.

“Words can’t describe” I got words to describe I just don’t want to get thrown off this site?

Sobering article in today’s times about the affordability of renting: http://www.nytimes.com/2014/04/15/business/more-renters-find-30-affordability-ratio-unattainable.html?_r=0

Rent control will come back in a big way, that or homeless population balloons to gigantic proportions… we should really mandate rent control in all cities, whether its Belair or Riverside make it the law

High rents have little, if anything, to do with homelessness.

A large majority of the homeless are drug addicts, alcoholics, mentally ill, so some combination. Well-adjusted people who find themselves homeless don’t stay homeless for long.

Furthermore, the high rents in Santa Monica, Manhattan, or San Francisco have nothing to do with homelessness. Nobody is tied to Santa Monica, Manhattan, San Francisco, etc. There are plenty of cheaper places in Nebraska, Arkansas, or Mississippi.

I live in Santa Monica, but if I couldn’t afford it, if my only option was live on the streets or move to a cheaper state, I’d choose the latter. Given those as the only options, just about any normal person would.

Just cut off the food stamps and county assistance and you will be surprised at how fast the homeless will leave for another place. This is what you get when you have pot and public assistance. Apparently the liberals like living in Santa Monica for the culture with the homeless. They can have it. In San Marino we do not have those problems. The San Marino City Council page states: “San Marino was formed to protect your personal rights and to control the growth and activities of the City in such a way that each individual resident will be guaranteed a pleasant place in which to live with a minimum of nuisance, with assurance that his property values will be protected by stringent zoning regulations. It is your City Council’s desire to acquaint the old and new residents with the history and background of San Marino, its many advantages and some of your responsibilities as a citizen. ”

“This community consists only of single family residences: there are no apartment buildings, condominiums or townhouses in the city. All homes must have a 2-car garage. No fast food or drive-through restaurants are allowed in San Marino.”

Hey Ashly.. if LA cut off food stamps and public assistance.. Those homeless might just take a couple hour walk east to San Marino to hang out! 🙂

They gotta go somewhere… and unless you plan on rounding them all up in buses… They’ll migrate where ever their feet can take them and the weather is nice.

As a mostly conservative/libertarian person, I wouldn’t want to live in San Marino. Some of your stuff sounds nice, but I hear some of your zoning restrictions are REALLY stringent.

I hear they fine you if you don’t cut your grass. They fine you if you park your car in the driveway. They have all sorts of restrictions on “your” private property.

I wonder, do they have strict rules about lawn displays? Were I to own a house, I’d want to be free to put up whatever displays I’d like on Halloween and Christmas, as big and brightly lit as I want.

I live in a condo and hate the HOA rules. One reason I’d like to move to a house is to escape restrictions, not go from one set to another.

Are you for real? I mean seriously? It is because of rent control that LA is a dump. Rent control prevents progress and encourages run-down substandard properties run by slumlords. Compare LA to Culver City, Glendale, or Pasadena, all have no rent control and all are better off then LA.

If you want to assure that your city will suffer a severe rental housing shortage and sky-high rents, just mandate rent control. Within a generation or less, maybe even a decade, junk 3 room apts will have waiting lists, landlords will become extremely selective and impose a thousand nit-picking rules on tenants so they can evict them and hike rents, and everyone who makes less than 125% of the area’s average income will have a hard time affording even a studio apartment in a decrepit old corridor building.

The reason housing, whether rental or owner-occupied, has become so expensive throughout the country, and totally unaffordable in certain cities, is because of layers of government interference designed to prop up asset prices artificially and make it possible to pretend people can afford what they cannot afford.

Former director of the U.S. Census Bureau Steve Murdock told Texas business leaders in Austin Wednesday to pay attention to demographic population changes in Texas.

Murdock said racial and ethnic changes to the population can have dramatic effects on the economy.

From 2000-2010 the population of non-Hispanic white children under the age of 18 in Texas decreased by over 180,000. In that same span, the population of Hispanic children increased by over 900,000. Hispanic populations grew in almost 90 percent of Texas counties in the past decade.

“If you don’t take into account these and other demographic trends as you plan for the future of your companies, as you plan for the future of the areas that you live, and as you plan for this state and nation, we will be much less successful than if we do take them into account,†Murdock said during the keynote address of the Texas Association of Business’ annual conference.

Texas is not growing in domestic migration but international immigration from Mexico and Central America and birth rates from second and third generation Hispanics. In fact Steve Murdock Texas demograhics by 2050 56 percent Hispanic, 29 percent non-Hispanic white, Asians and others 13 percent and blacks 9 percent. California about 60 percent Hispanics, 15 percent Asians and others, about 25 percent non-Hispanic white and 4 percent Afro-American both states are heading to Hispanic majorities and lying about domestic mitigation to Texas like Dr Housing Bubble does not changed the facts. In fact Houston and Dallas receive more international immigrants than Orange and San Diego. Domestic migration has little to do with Texas growth. Immigration from Latin America Texas has now 1.8 illegal immigrants second to California and Check out the study by Dr Murdock lecture at El Paso. The biggest group rates in Texas were birth rates just like California to 2nd and 3rd generation Hispanics.

And on our current course, we’re headed for what might be called Demogeddon. In today’s Texas workplace, NHWs dominate the managerial and professional ranks, partly because they make up almost two thirds of all Texas workers with bachelor’s degrees or higher. But as NHWs age out of the labor market, there aren’t nearly enough Hispanics earning such degrees to take up the slack. By 2050, the demographers project, Hispanic workers will outnumber NHW workers almost three to one, and the median income of Texas workers will actually decline, because Hispanics will remain concentrated in low-wage jobs. “In the absence of change,†the authors conclude, “the Texas labor force as a whole will be less well-educated, work in lower-status occupations, and have lower incomes in 2050 than 2010.â€

Those declining wages won’t just affect Hispanics, they’ll put a lid on the high-powered consumer spending that Texas businesses currently enjoy. By 2050, Hispanic households will outnumber NHW households two to one, but they won’t have the income or accumulated wealth to spend like today’s NHWs on consumer-economy staples such as new cars and homes; instead, future Texas families “will be poorer, with less income, higher poverty rates, lower net worth, and fewer assets and will have housing that is of lower value . . . when compared to 2010.†In fact, NHWs, who currently possess 82 percent of total household equity, will continue to hold well over half of it a generation from now, when they’ll make up about a fourth of the population. But NHWs may need that extra cushion in their old age, because the tax base required to pay their benefits will erode alongside wages and consumer spending.

This is also a problem that California could faced as well.

Leave a Reply