Reconstruction Finance Corporation II: Lessons from the Great Depression. Part XXV: Understanding what we own, Financial History, and the Dangers of Price Floors.

One good thing about the new information age is there is no lack of ideas on how to go about solving our current economic crisis. Yet I am a bit dismayed how some people have suddenly found economic religion yet sat by when the Federal Reserve expanded powers to unprecedented levels and cheered on the first cut of the $350 billion in TARP funds. It is a sort of reverse version of eat the rich where we eat the poor for the ills of our market. Some people are latching on to an idea with iron claws that poor people (aka subprime borrowers) somehow caused this entire global collapse. What is disturbing about this argument is the lack of math and analysis behind it. The amount of subprime loans pales in comparison to the amount of overall mortgage debt, corporate debt, consumer debt, credit default swaps, and other more exotic forms of financial engineered credit products. But some people love a good rallying cry and saying “subprime borrowers caused this problem” is an easy target since most subprime borrowers don’t have access to a public podium.

The argument during the bubble, if you can remember the mania, was that subprime was a tiny niche of the overall mortgage market so there was no need to worry about any market contagion. Subprime was contained and if any problems did occur, it was such a small portion of overall mortgage debt that it was isolated on an economic deserted island. Ironically, most of these people are now arguing that subprime caused all or the vast majority of the market problems. Keep in mind that $7 trillion has been wiped off from the S&P 500 and the United States real estate market has seen $8 trillion wiped away from the peak. Just with the S&P 500 and the U.S. residential market we have seen $15 trillion in wealth evaporate. You mean to tell me that roughly $1 trillion in subprime loans has caused $15 trillion in wealth to disappear? Is it any wonder why so many in our population don’t even understand the basics of Algebra but know who the last American Idol is?

Another interesting thing is occurring and this is more in the social trends department. I’ve talked about a few radio shows here in Southern California that pumped up the real estate market like a used car salesman. These shows normally occurred during the weekend. Well for the last couple of weeks, this regular programming has been replaced with Beyonce and Ludacris. Not sure if this is temporary but many that listened to the show realize how wrong these people were. They not only were wrong they were major cheerleaders for the real estate market for years. They were the real estate carnival promoters. Radio is in it for the money. And I am certain that many in Southern California got sick of hearing people so wrong about the market and probably tuned out.

What I want to discuss in today’s article is the Reconstruction Finance Corporation and panic moves during the Great Depression. During the Great Depression, President Hoover recommended the formation of a big governmental credit agency that would then lend money to banks, railroads, and insurance companies. This might sound very familiar but it would seem that people have forgotten many of the lessons from the Great Depression. It is important that we focus on what worked and what didn’t instead of demonizing one side or the other. This is high stakes poker here and decisions that we make today will last for years. The Reconstructions Finance Corporation (RFC) was chartered in 1932 during the last year of the Hoover administration. The RFC was disbanded in 1954.

This is part XXV in our Lessons from the Great Depression series:

19. The Silent Economic Depression

20. The Four Horsemen of the Economic Apocalypse

21. The Big Change

22. The Infection of Consumerism and Living Fake Lives.

23. The Worst Housing Crash in American History.

24. Economic Crises Around the World in Synchronization.

So why did the RFC come to be? I’ll refer to Frederick Lewis Allen here:

“Again Hoover acted, and again his action was financial. Something must be done to save the American banking system, and the bankers were not doing it; the spirit of the day was sauve qui peut. Hoover called fifteen of the overlords of the banking world to a secret evening meeting with him and his financial aides at Secretary Mellon’s apartment in Washington, and proposed to them that the strong banks of the country form a credit pool to help the weak ones. When it became clear that this would not suffice-for the strong banks were taking no chances and this pool, the National Credit Corporation, lent almost no money at all-Hoover recommended the formation of a big governmental credit agency, the Reconstruction Finance Corporation, with two billion dollars to lend to banks, railroads, insurance companies.”

It would seem that we are following similar patterns here. Yet the problem in our situation is that the big banks don’t even have any capital to lend – in fact, we are injecting capital into them. Last week we broke below the November market lows since two of the nation’s largest banks were pummeled under fears of nationalization. This is another fascinating part about consumer behavior. We already own Fannie Mae and Freddie Mac, two institutions that guarantee or own $5 trillion in mortgage debt yet people fear temporary nationalization? We own AIG, an institution with over $1 trillion in assets yet people still don’t think the government is involved? We are massively involved already. And the problem that we now confront is do we keep lending money to zombie banks or do we nationalize a select few on a temporary basis, clean them up, and set them back to the private market. Heck, even Alan Greenspan has recommended this course!

These fears of nationalization are nothing new:

“Already the pressure of events had pushed the apostle of rugged individualism much further toward state socialism than any previous president had gone in time of peace. Hoover’s Reconstruction Finance Corporation had put the government deeply into business. But it was state socialism of a very limited and special sort. What was happening may perhaps be summed up in this was:

Hoover had tried to keep hands off the economic machinery of the country, to permit a supposedly flexible system to make its own adjustments of supply and demand. At two points he had intervened, to be sure: he had tried to hold up the price of wheat and cotton, unsuccessfully, and he had tried to hold up wage-rates, with partial and temporary success; but otherwise he had mainly stood aside to let prices and profits and wages follow their natural course. But no natural adjustment could be reached unless the burdens of debt could also be naturally reduced through bankruptcies.

And in America, as in other parts of the world, the economic system had now become so complex and interdependent that the possible consequences of widespread bankruptcy-to the banks, the insurance companies, the great holding-company systems, and the multitudes of people dependent upon them-had become too appalling to contemplate. The theoretically necessary adjustment became a practically unbearable adjustment. Therefore Hoover was driven to the point of intervening to protect the debt structure-first by easing temporarily the pressure of international debts without canceling them, and second by buttressing the banks and big corporations with Federal funds.”

It is a curious coincidence that under two of the most supposedly free market administrations have we seen two of the most direct market interventionist emerge. Take a look at Henry Paulson and his $700 billion TARP plan and weekend bank parties with Bear Stearns, Lehman Brothers, and Merrill Lynch. I think what we have witnessed is strict ideologues inflexible to common sense notions. It is great to say the free market knows best but what use is it saying that if you can’t live by those ideals when times are tough? Now I’m not a strict believer in quick taglines because I realize some people are greedy and economically lustful and many will spend more than they should if they can get away with it. And that is what happened. It is sensible to have some common checks and balances to prevent outright orgies in financial markets but we flew to the other side of the equation.

And that is why with the RFC, Hoover had to suck it up and do what he totally believed against. That is, charter an entity that would do the lending that the free market could not. That is, socialize lending. Now during the first year in 1932, the RFC dispersed $1.5 billion and $1.8 billion in 1933. Another $1.8 billion in 1934. It is hard to simply lay these numbers out with no context. For that, let us look at GNP from the Great Depression:

The first stunning thing you will notice is that GNP fell from $103 billion in 1929 to $55 billion in 1933, a near 50% fall. To put that in today’s numbers, this would mean losing $7 trillion in GDP in the next few years. So let us run some numbers here:

1933 GNP:Â Â Â Â $55 billion

RFC 1933:Â Â Â Â $1.8 billion

3.2% of GNP

2008 GDP:Â Â Â Â $14 trillion

3.2% of current GDP:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $448 billion

So already we know that we are spending much more than what was spent during the Great Depression. First, we have allocated $700 billion through the TARP program. Next, we have passed nearly $800 billion in a fiscal stimulus program. Next, we nationalized the major mortgage lenders Fannie Mae and Freddie Mac and also one of the countries largest insurers through AIG.

We are much more active than during the Great Depression yet things still are deteriorating at a quick pace. What gives? As I highlighted above, we are stunting the market process of finding a true bottom by propping up home prices or trying to save select banks. All this will do is prolong the shaking out and will certainly give us a lost decade similar to Japan. As things play out, I am more convinced we will face something similar to Japan. Unless we temporarily nationalize banks and clean them out, this is going to be an extremely long crisis. I don’t think any of us likes the options presented to us but we must choose the best course forward. Otherwise, we will keep sinking billions into banks that are already insolvent.

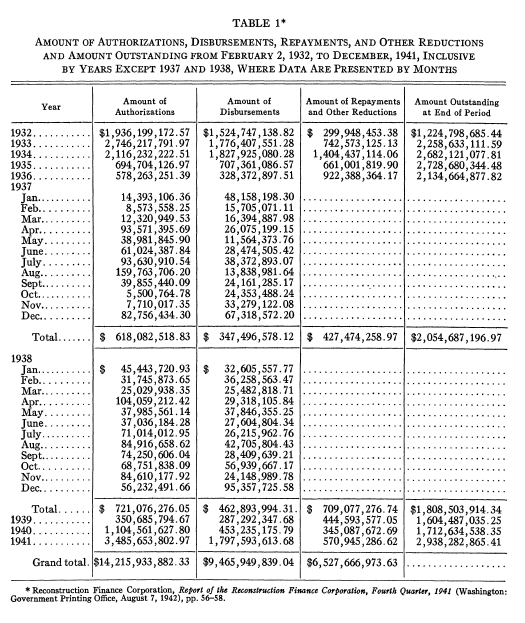

The RFC in a way was like the good bank idea that was being proposed. Create an entity that will loan to the market burden free of toxic loans. Yet how can we with a good conscience now create another institution with $448 billion to loan out to small businesses and the public? It is incredible how much money is being put at risk now. I understand the frustration of many and don’t kid yourself, we are going to be dealing with the fall out for years no matter what course we take. The RFC which was going to be temporary lasted over 20 years and morphed into all sorts of things. Take a look at some of the lending numbers:

For a time the RFC merged with the FDIC. RFC lending increased dramatically during World War II. So to think that any programs established will be fast is nonsense. Think of the first $350 billion in TARP injections. That is taxpayer loans to the banks. Want to take a wild guess when we’ll be paid back?

I also find it interesting how some people don’t even know what we have done. For example, part of the recent housing plan comes straight from money allocated from the TARP and of our nationalization of Fannie Mae and Freddie Mac. That is, we have already committed this money! I almost fell off my chair when I saw some moronic Congress person hoping that Fannie Mae and Freddie Mac collapses. We now own these agencies! It would behoove us if we make smart and prudent moves with them. We are now shareholders whether we like it or not. If anything, the recent plan although painful for most prudent borrowers to stomach, could have been a lot worse. One thing I like is that most option ARM folks in California and Florida are not going to get one cent. I like that. The fact that it is capped at 105% rules out many of the bubble states. That was my main concern. Frankly, if you can get someone in a $150,000 home to pay $200 less a month by increasing the term of their mortgage and dropping the rate by 1 percent, I find this more reasonable than injecting $350 billion into irresponsible banks and praying they do the right thing.

I understand the frustration that most feel. It is absurd. But keep in mind we have already committed this damn money and the time for anger was years and months ago when the bills passed or bad ideas germinated. Frankly, this is probably the best they could do. My fear was that we were going to get a plan that allocated funds to bailing out California or Florida home speculators that jumped into option ARMs. That would have lit a fire under me. It doesn’t look like that has happened and we better hope it does not because that would be a tragedy to our economy. Here is an interesting take on the RFC:

“In addition to the empirical evidence indicating that in general the RFC loan guaranty program has exerted a destabilizing force upon the economy, there are a priori reasons why one would expect this to be true in the future as in the past. A loan guaranty system operating with fixed rules such as eligibility requirements and a constant rate of interest would be expected to result in an excess demand for funds during periods of price rises and increasing marginal efficiency of capital. Since the quantity of funds demanded at the fixed rate of interest would increase during inflation, this would create the impression that the “shortage” of private funds was increasing.”

This is from a paper written in 1952 and some of the same conditions work in today’s market. For example, much of the bubble was caused by artificially low rates that actually did not factor in the true underlying risk of the credit products. Now, we have outside forces trying to stabilize prices while the market is actually trying to increase rates because we are now understanding the true risk of the products that were sold. The longer we blunt this price discovery, the deeper the recession will be. That is why those calling for suspending mark to market are delusional crony capitalist that are basically saying, “let us suspend reality until we can sell out our crap at bubble prices we paid.” Artificial price bottoms do not work. They never have and never will.

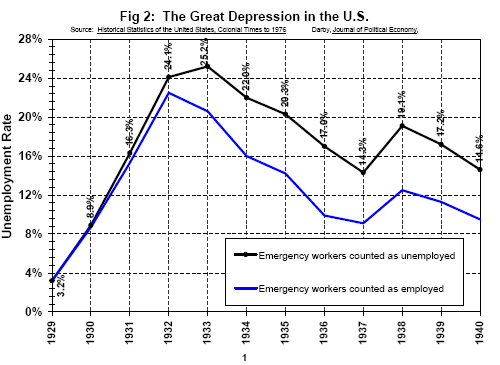

It is difficult to say how much the RFC helped but it did have an impact with the numerous programs pushed by the government during the Great Depression:

Without a doubt, there was an impact by the fiscal spending done by the government. Take a look at the above chart. It is interesting to note that our current true unemployment rate is now at 13.9% which puts us in line with the 1935 unemployment rate which counts emergency government workers. That is, our current unemployment rate is now at Great Depression levels. People will argue otherwise because they focus on the headline 7.6% rate but does it really feel like that? Of course not because it isn’t true. You mean to tell me that having 7 out of 100 workers unemployed is causing all these problems? Of course not. Currently we have 11.6 million people unemployed in the U.S. At the height of the Great Depression we had 12.8 million people unemployed. I know that we have to factor in the fact that we now have 3 times the population but just take a look at those humbling statistics and you’ll understand why we are doing such historical moves to solve the current crisis.

I’m not exactly sure how to solve the current crisis. Yet I do know what won’t work:

(a) Price floors: Trying to put any price bottom on home prices will only prolong the misery. It is hard to even come up with any good examples of artificial market floors working.

(b) Capital injections into banks: The first $350 billion in TARP did nothing. In fact, we are now below the November market lows. Most of this money was never lent to the public. Why are we suppose to inject more money to institutions who were the root cause of this problem? If we want to lend the money let us do it ourselves through a good bank model.

(c) Avoiding foreclosure: Fortunately in the U.S. we have a healthy rental market. People can rent a home if they can’t afford their current home. Is this all that bad? We should actually be encouraging these kinds of programs. In fact, there are many investors and lenders willing to buy homes and to rent them out at fair market rates. Yet few will buy if there are artificial floors being put in place. The notion that everyone should own a home is absurd. You should own a home if you are prudent and can afford it. That is why the 20 percent down payment made sense for many years. It showed that you had the financial discipline to own a home.

(d) Trusting Wall Street: I still don’t get why we haven’t seen any high profiled people go to prison. We need to see a fleet of FBI agents stroll into Wall Street and take away many of the engineers of this crisis. Many homeowners have paid for gambling. They have lost their homes. Many Wall Street executives have received bonuses for their part in crushing the global financial system for a quick gain.

So as we go along with this crisis, we can expect stronger oversight on Wall Street. This is a long battle. We haven’t even started tackling the dark world of the hedge fund industry which you can rest assured will come up. If it isn’t apparent already, no one has a clean answer to this crisis. Yet we can at least avoid making the obvious mistakes from the past. The California housing market is off 50% and guess what? Home sales are increasing. We should avoid trying to make errors from the past that we already know will not work. That is one thing that we should at least strive for.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

15 Responses to “Reconstruction Finance Corporation II: Lessons from the Great Depression. Part XXV: Understanding what we own, Financial History, and the Dangers of Price Floors.”

I couldn’t agree more.

“Some people are latching on to an idea with iron claws that poor people (aka subprime borrowers) somehow caused this entire global collapse.”

That said, these folks get the most press as needing a bailout from the rest of us. They are adults and signed a contract with 72 hours to pull out. Now they need to deal with the consequences.

That being said, I cannot help but think that our Government with its bogus inflation numbers of which wage increases are tied to, help to turn most all of us into speculators. I turned down offers to go to my well of equity 2 and 3 times over, a lot of home owners did the same. Now we are being asked to cover subprime folks or so it seems that way. There will be backlash, that is human nature.

“I turned down offers to go to my well of equity 2 and 3 times over, a lot of home owners did the same. Now we are being asked to cover subprime folks or so it seems that way.”

Did you not just read what the good Dr just posted? This crisis has very little to do with “poor” people or “minority” people and subprime loans. I am surprised that this meme has gotten so much play with people when it is markedly false and unfair.

Wait until the Option ARMs hit that were used by primarily non-poor and non-minority people. Will they get as much blame as we are heaping on “subprime” people?

Those shows that you were referring to. They are now victims of the depression they helped create. That talk radio station fired all of its DJ’s and reformatted to top 40 music. Karma is a bitch.

Great web site, very informative … they are working to pit the prudent against the conned and not so prudent …

Stay focused on the perps …

——- The Blanket Trick ——-

The world’s nations got feisty they were doing quite well,

And this annoyed the USA,

They were gobbling ever more of the world’s resource pie,

Taking more and more each day …

Uncle Sam just smiled that knowing smile,

He had seen it all before,

So he got out his bag of dirty tricks,

And he spread them all onto the floor …

False flag operations and horrendous torture,

Lots of deceptions and devious guile,

When he saw the small pox in the blankets scheme,

He smiled a knowing smile …

He was driven to prevail and rule the world,

He had a ‘full spectrum dominance’ dream.

He knew that he could control the world,

With a variant of the blanket scheme …

So he altered the blanket of finance,

That held all the world together,

He wove in a credit bubble,

His touch as light as a feather …

And just as deftly and deviously as well,

He wove in leveraged derivatives too,

They functioned just like counterfeit money,

Soon the world was a fucking zoo …

“These nations are just like children.â€

Said Uncle Sam with a knowing wink,

“Why openly spank them when you can deviously tank them,

and put their economies all in the drink?â€

Deception is the strongest political force on the planet.

i on the ball patriot

The price bubble was inflated with the help of loose lender guidelines, allowing people to buy homes who should have been declined for a mortgage. Now that most lenders have returned to traditional underwriting, it’s just a matter of time for housing prices to drop to normal levels based on market demand, which is driven by qualified borrowers, not government subsidies.

Wondering if you will do a detailed break down on Obama’s housing plan? I live in California, and up until 6 months ago I was looking for a home. Now I’m just hoping that I can keep my job! Great blog, enjoy reading it, even though it gives me waves of worry.

@fred – a talk radio station, by definition, doesn’t have DJ’s. Performers, talent, personalities, etc., get rather offended as the “jocks” as they call them are often low-talent and hackish and just read a few prepared statements between ads and music. The hosts of the shows that all got dumped would go on mostly extemporaneously and keep their shows rolling for four hours, minus 20 min or so per hour for ads. Most of them are accomplished comedians. I don’t think the weekend shows really bit into their ratings much since the shows themselves on the weekends were often the radio equivalent of infomercials. (and yeah, I’m just cheesed off that they’re all gone. Well all of them but Leykis. His show never really impressed me much. Too lowest-common-denominator)

Unemployment numbers don’t give the real picture. There are many self-employed workers and small business owners that can be considered unemployed that have been impacted by the housing crisis, financial crisis, credit crisis, etc. None of the self-employed, small-time entrepreneurs are figured into any of the unemployment numbers that I can see.

In the 80’s there was a national(?) business radio. I was working during the 1987 crash and listened to it all day. People got bombarded by oil futures pitches, then the gulf war destroyed thousands by spiking the oil futures and crashing the minute the ground war was reported to be going well. I don’t know of any national business stations any more…

I think this has been mentioned by Comrade HB before, but I’ll post it here anyway. A good place to find less “manipulated” statistics for unemployment and other things is Shadowstats:

.

http://www.shadowstats.com/alternate_data

.

Even the BLS’s own U6 shows unemployment at 14%.

.

But when Shadowstats adds back in “‘discouraged workers’ defined away during the Clinton Administration added to the existing BLS estimates of level U-6 unemployment,” we come up with a whopping 18% unemployment rate! CHB asks if it really “feels” like we are dealing with the “official” 7.9% unemployment rate, and the answer is no. But 18% is obviously far closer to what I “feel.”

.

Other related news: Micron in Boise is firing another 1,500 on top of the 1,000 it fired last August. GM is shuttering three plants in Mexico. Bankers are clamoring for a raise in salary to compensate for “the clampdown on the bonus culture.” The Baltic Dry Index is barely above the cost of operation. Restaurant chains are going under because people can’t afford to eat out anymore (RUTH, DIN and RT stocks all down 90%.) AIG lost another $60 billion on top of the $150 billion in taxpayer money it already received, yet the taxpayers hold no voting shares. And American Express is offering to pay card holders $300 if they cancel their accounts.

.

But they’re still yelling “bottom!” on CNBC! It’s time to buy, buy, buy! (So long as you buy what the shill has a position in.)

Wall Street bankers going to jail? Who do you think is running this country? Do you expect the sleaziest, greediest, most psychopathic bunch of criminals in history to “get God” and volunteer for prison. When is the last time any Wall Street banker was convicted of anything? Boesky? And has a Wall Street bank EVER been convicted? Not that I know. They pay fines but specifically admit no guilt.

Ha, ha. Welcome to the American Democracy. Check your dream at the door.

Fantastic article. It was nice to hear someone give an accurate account of what is going on, rather than chastizing one view or the other. It is quite a pickle we’re in, and hearing you say that you do not know how to solve this problem just reaffirms how silly so many people sound when they speak of all the “wrong decisions” the Obama administration is making. They don’t have a clue either.

Frosty Heidi and Frank made it to the Dr.’s website. Unreal…….Ah…Frank Army?

What’s The Property Financing?

Property investment is a term that most people are familiar with. People usually invest money when they have a surplus or when they are planning for the future. The very careful ones opt for government securities and the adventurous ones go for stock markets. Where does the property investment stand on this line between the secure and the risky?

If anybody is thinking long term then property has no parallel as it has been seen that in a larger time frame land never betrays. Property can be used to get rental income or can be used to secure a loan for any business venture alongside the property. Property investment also requires detailed research before the deal is drawn. Bear in mind that if the property is upon a disputed land then there are risks of recurring loss. On the other hand, if the property is situated at a location where many facilities are accessible then the prices will appreciate significantly over time. Any kind of Property Investment has been and shall always be one of the best kinds of solid investment opportunities.

Leave a Reply to ExpaT