Southern California Housing Report: Median Price $250,000 down 50 Percent from Peak Reached in 2007. Prices Back to 2002 Levels. $41,000 Away from Going Back to 2000 Prices. Home Price Deflation.

The Southern California housing situation is deteriorating even further with the recent report showing that the median price is now back to $250,000; at this level we would have to go back to February of 2002 which means we have erased 6 years of price gains. And we are not far from 2000 price levels. The median price of a Southern California home on January of 2000 was $209,000. Many doubted that we would face a lost decade but here in California we are certainly going to have our lost housing decade similar to what Japan faced in their overall economy. In this report, I’m going to put to rest some misconceptions floating around and once again, we hear the bottom callers out in full force but their conviction is weaker since they have been proven wrong over and over again.

First, the new $275 billion Homeowner Affordability and Stability Plan will not help California, especially Southern California. Why? First, the plan virtually rules out all Option ARM loans since it will only cover loans guaranteed or backed by Fannie Mae and Freddie Mac. In a way, the plan will force toxic waste lenders or those who have these notes on their books further into their corners. Another point is the plan will only refinance loans up to 105% of the actual home value. Well, in SoCal where the median price is now $250,000 all those that paid the peak $505,000 price are nowhere near 105% ratios especially if they paid the negative amortization portion of their Option ARM. This I view as good. These toxic mortgages had no right in the marketplace. The plan will also open up the door to mortgages being reworked in bankruptcy court which is important. In addition, there is a portion looking to lower the balance of mortgages via the government and lender through a matching program. They are trying to get debt-to-income ratios below 38%. Overall, this plan isolates places like California and Florida which is the right move since most of the toxic products reside in these states. I’m not sure why the bottom callers think this plan will help California when the program will most likely help Americans in the heartland (aka, homes around or below $200,000).

Initial claims on unemployment still remain high with 5,000,000 Americans receiving some form of jobless benefits. These are definitely tough times and this will be the longest recession since the Great Depression.   California has one of the highest unemployment rates yet some people still think that this bodes well for housing prices and are calling bottoms. Insanity. They fail to examine the facts and spend two minutes to think through the logic and math of it all before blurting out “bottom!” These people calling bottom fail to realize that the Dow is now below the November lows. But what do you expect from people that justified housing prices on their way upward?

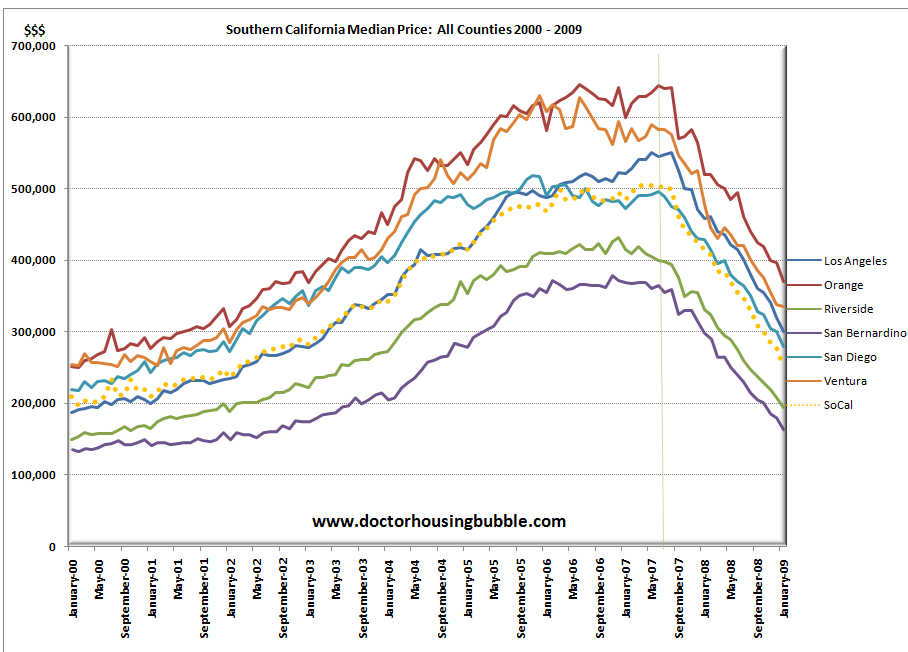

Before we move on, let us first look at a chart I put together looking at the entire Southern California region:

*Click for shaper picture

What is stunning is the velocity of prices falling is much quicker than the process upward while we were in the bubble. This is typical in bubbles. The crash is more ferocious than the mania. What do I mean? Let us look how long it took us to go from $250,000 to the peak of $505,000:

Median SoCal Price

February 2002:Â $246,000

March 2007:Â Â Â Â Â Â $505,000

[5 years and 1 month to reach peak from $250,000]

July 2007:Â Â Â Â Â Â Â Â Â Â Â Â $505,000

January 2009:Â Â Â Â $250,000

[1 year and 6 months to lose 5 years of gains]

And this is how bubbles burst. That is why I urge you to read the 10 reasons California will not hit bottom until 2011 because many factors are at play here. The media many times is quick to report headline data from certain sources which can be misleading. Sales have jumped but what areas reported record sales? Perris, Victorville, Temecula, and other areas in the Inland Empire. What is the median price for the Inland Empire?

San Bernardino:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $162,000

Riverside:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $195,000

And you’ll get many cherry pickers pointing out that the median price for the region is down because of these two regions but across all counties, prices are down from 40 to 50 percent from peak prices. Don’t think so? Let us look at two of the most populace and high priced counties:

LA Peak:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $550,000 (August 2007)

LA January 2009:Â Â Â Â Â Â Â Â Â Â Â Â Â Â $300,000

Drop of $250,000

Orange County Peak:Â Â Â Â $646,000 (June 2006)

Orange County Jan 09:Â Â $370,000

Drop of $276,000

So as you can see, even the counties considered to be “more prime” are seeing prices collapse. And they will continue to come down. People are having a sigh of relief given the California budget being passed but fail to even read the actual budget. Massive cuts and tax hikes are coming. How is this a sign of relief? Do you think this is going to help the California housing market? It will not. We have further to go especially given that 2009 will be the first year with major Option ARMs coming home to roost.

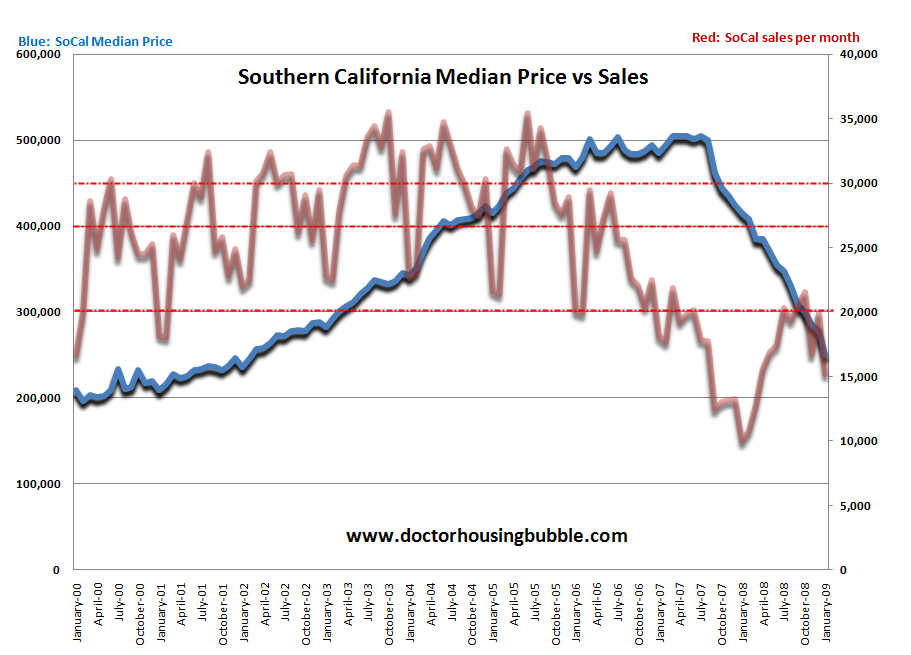

One of the headlines I saw today stated “Southland home sales surge” but let us see how this looks on a chart:

38% of all homes sales last month were in the Inland Empire. And keep in mind the home sales that did occur in the other counties were mostly at lower prices. Foreclosure resales now make up 58% of all homes sold for Southern California. But looking at the chart above, that “surge” doesn’t seem to really stand out. Sure, we are up from the absolute rock bottom point but the only reason homes are moving is that prices are being slashed to the point where the entire region is now off by 50%. That bottom if you recall was a point of massive delusion where many people simply refused to lower prices. I remember only a few years ago when people would comment on the blog thinking a 10% drop was impossible in California. Those days are long gone and so is that argument. The bottom line is prices are still too high given local area incomes, employment, schools, and neighborhood data. Given the severity of this bubble, we may see rent to PITI ratios come much closer in line. That is, owning a home at some point will only be slightly more expensive than renting a home.

I’ve added some grid lines to the chart above to show that not once since mid to late 2006 have we crossed the 25,000 a month homes sold line. Forget about 30,000 or 35,000 which we crossed many times during the bubble heyday. So the fact that we sold 15,227 homes in SoCal last month is nothing to shout about but since when have the mainstream headlines come close to being right this past decade?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

40 Responses to “Southern California Housing Report: Median Price $250,000 down 50 Percent from Peak Reached in 2007. Prices Back to 2002 Levels. $41,000 Away from Going Back to 2000 Prices. Home Price Deflation.”

That 1st graph shows the back side of the bubble is so steep (in decline) that when it starts to flatten out closer to horizontal angle the prices will be lower then the left side of the graph which starts at the beginning of 2000. Also my napkin math is showing OC 50% off in May 09.

For the ultimate confirmation that the high end of real estate has been affected (a euphimism), please check out the Villa Leopolda. It was “sold” last year to a Russian tycoon (a euphimism for a thief) for FIVE HUNDRED MILLION EUROS. Yes. 500 million Euros, which at the time was about $750 million for a single-family residence. Ok, plenty of rooms, huge garden, nice location, but still. Pretty damn pricey bit of real estate.

Well, our Russian lost about $6 billion over the last six months and has asked to cancel the deal, even asking for his $39 million deposit back. He has made a new offer of 300 million Euros.

So, there you have it. The most expensive house in the world as well as likely the biggest outright drop in price ever. 40% or 200 million Euros.

Wheeeeee! And morons on the Cote d’Azur keep telling me real estate here isn’t dropping!

The bursting of this bubble are of epic proportions. Each day the data gets worse and worse. To see median prices get cut in half, over 18 months, is much worse than the Great Depression. We have reached a critical juncture here, where most buyers now only purchase foreclosures. Foreclosures ARE the market in California. Capitulation in the highend markets will start this year, as sellers rush for the exits. After that, we drag along the bottom for years.

The Westside has already begun undercutting prices, as sellers try to get a jump on the traditional selling season.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

I could not agree with you more. The housing plan is a complete joke if you live in Southern CA. I was a little excited when I first heard about it and then completely disappointed when the actual plan came out. Most of the plans still provide no debt forgiveness. Meaning someone bought in 06 would have to be dumb enough to refinance their loan making it full recourse just to get a temporary rate reduction. I put nothing down and my house is down 60-70% in Riverside County. Even if they offered me a rate of 3% I’d have to say not to making my loan recourse which is why I will moonwalk away from my house. The math I’ve done says it will take at least 20 years and more likely 25 years just for my house to break even with what I’ve paid. I’d have to be a complete idiot to stay.

I knew things were out of control when I saw a POS house on a buy street in Sherman Oaks for sale for $1.25 million. Hey, but they’re not making any more land!

Bwahahahahhaha. Eat it realtors.

Thanks once again Dr HB for cutting a swathe through the weeds to the truth. Dude, you rock! 🙂

The Husband and I were initially dismayed by the Housing Bailout Bill, as we’ve been waiting patiently, here in L.A, since 2000 for housing prices to be affordable to us, and felt that propping up homeowners in their unaffordable houses would only make the deflation of the bubble go on longer and longer.

However, after thinking about it for a little while, we realized that here in L.A, the number of people who had to take out some sort of Jumbo Loan far exceeded those that didn’t. As Fannie Mae and Freddy Mac just don’t do Jumbos, this means (for us anyway), that the prices will continue to come down just as they have been.

An LTV of up to 105% pretty much excludes most of L.A county right about now, and its heartening to see that you saw it the same way too.

Love your posts – keep up the good work

Good Doctor,

You mentioned in your report that 58% of all home sales are foreclosures, this is a staggaring statistic. It will be interesting to see where the bottom hits when only a small percentage of home sales are foreclosures, say 5 – 10%. Foreclosures are no doubt reducing the median home price; however, many more desirable homes and their owners are still delusional about their prices thus reducing the number of so-called “organic” sales. We will see a true bottom when the number of foreclosed home sales are low and these delusional owners drop their prices to pre-bubble levels. I think this will take many more years to happen (much longer than mid-2011), especially in the SF bay area where I am from.

This is statewide. This means nothing. In LA. Where it matters. Housing is still completely unaffordable.

DG writes ” Most of the plans still provide no debt forgiveness.”

>>>

Is THAT old thing about the general cancellation of debt stil floating about? Does this describe the situation?

>>>

“Promoting his policy of debt relief, (pick a name) initially also rallied many of those who had been foreclosed to his banner along with a large portion of unemployed and deeply in debt. Debt had never been greater than in 2009 since the previous decades of war and extravagance had led to an era of economic downturn across the countryside. Numerous people lost their homes and jobs and were forced to move to the cities, where they swelled the numbers of the urban poor. All had spent and squandered the wealth they acquired from the years of the tech bubble, housing bubble and gambling on the stock market.”

>>>

That quote is actually a description of the conditions in Rome in 63 BC – I just changed the year, put “pick a name” where ir should read Lucius Sergius Catalina, turned “farmers losing their farms” into “people lost their homes and jobs” etc…….

>>>

Oh and the idea didn’t go anywhere then either. Catalina ended up getting executed as a traitor.

>>

If you are waiting for a general cancellation of mortgage debt, you are virtually certain to be waiting forever.

>>>

First passing such a thing would be political suicide. 35% of the US rents. 23% own a house and have no mortgage. 38% own a house and are current on their mortgage. 35 + 23 + 38 = 96% of the US who are able to pay for their housing. At least 58% (rents & no mortgage) would NOT have any of their debts for housing reduced or get money back that they had paid. That 58% would probably be a lot higher because not all who have a mortgage bought during the bubble.

>>>

And forgetting trying to persuade that 58 – 96% that they should ante up with their taxes to pay down the mortgage principal for you. I am a Quaker, a progressive and volunteer at charities. And if you think that I am going to pay taxes to pay off your mortgage….well I guess the Quaker part goes and I go back to the kind of stuff my ancestors did in Boston and Virginia in 1775 & 1776.

>>>

Second, Congress could pass any idiotic thing it chooses ordering lenders to forgive part of your mortgage, but that does mean the courts will allow it and a general cancellation of debt would only last for about the 30 minutes it took a Federal Court to enjoin it. After that it would sit there unuseable and unenforceable until the US S. Ct tossed it out as unconstitutional. And yes – it WOULD BE unconstitutional for the government to tell lenders that they had to forgive the 60-70% of all their mortgage where the mortgage is more than the house is worth without going through due process and some type of court proceeding. Little thing called “taking of property without due process” and that value of that mortgage to the lender is “property.” Now the lender can be ordered to take less on the mortgage IF you file bankruptcy and it is a reorganization and not a liquidation and IF:

>>>

(a) the law gets changed back to what it was 15 years ago and the bankruptcy court can cram down the mortgage on a primary home as it does regualarly on 2nd homes, cars, boats, planes, business real estate, business equipment etc: or

(b) that is your 2nd home and you can file bankruptcy and have it crammed down now.

>>

Going through the bankruptcy court is due process that allows the cancellation of all or part of a debt and that satisfies the Constitution. It cannot be done by an across-the-board statute or decree from the FDIC or Treasury or anyone else.

>>

(And yes, I know what I am talking about in Con Law – I practiced some in that area of law for decades as did my husband – Univ of Chi/former student of Scalia/argued before the Court. We give the odds of such a general policy surviving the US S CT somewhere aroung a minus 100 on a scale 0 -100.

I’m not waiting for cancellation of debt…. I’m moonwalking away from my mortgage. Effectively that will cancel my debt. It make no sense to stay in a home worth 70% less than you paid if you put nothing down. I hate to lose my 800 FICO score, but as I believe Dr. Housing Bubble has stated FICO scores are not a good indicator of who will default. At this point I find defaulting to be the most responsible thing to do financially. This market will take decades to recover.

Thank God the plan doesn’t work for people in L.A. With any degree of luck, it will not work anywhere.

Powers That Be have decided to “rescue†borrowers by reducing their principle by $1000 a year for the next five years, provided they continue to pay on their loans. The government will also give these borrowers a $1000 per year if they make their payments on time.

So, if I understand this properly, Joe and Jane have a $480,000 house that the bought in January 2005 on a 6.25% conventional loan with 20% down (I’ll be charitable). Assuming they live in Anytown, USA, their “investment†is now worth $336,000 (assuming a 30% reduction in value over the last 12 months and a mortgage that was written for $400,000). Provided they have been paying their P&I payment of $2463 per month as scheduled, Joe and Jane’s note is worth $368,000. They are upside down by $112,000 (the original $80K down payment, plus $32K in lost value).

Conventional wisdom says, that with their 740, Joe and Jane probably subscribe to the old fashioned ethic that one should work hard and pay their bills.

Let’s say that the program kicks into effect, and in May, Joe and Jane enter the program. They have paid diligently, and their note is down to $366,000. Thanks to a Federal guarantee and their 740 FICO score, they are able to refinance the existing principle at a rate of 4.0% for 30 years. Their P&I payment drops a whopping $716/mo. The lender “does their part†by doing the refinance gratis (except the $1000 the feds give them), adding nothing to the principle.

Being good Americans, rather than save this money, Joe and Jane support the American worker by buying a new Buick SUV on 48 month paper (just about $716/mo).

For the sake of this argument, we will also assume that the aforementioned rescue program is a raging success, so the housing market bottoms in May 2009. Thanks to a leveling in forecloses, supply becomes constant. There’s no appreciation, but the market has bottomed. The recession begins to ease, and prices remain steady for the foreseeable future.

Where does this leave Joe and Jane? Assuming that everyone remains employed and continues to work hard, Joe and Jane will break even on their house in January of 2013. Selling the house is another matter. Assuming a 5% disposal cost on the $336,000 house, Joe and Jane can walk away from their obligation debt free at a dry closing in December of 2014.

Now, about the lender. They are currently holding a $366,000 note on a $336,000 asset. They are happy about Joe and Jane’s 2009 refinancing. Had the couple kept their original loan, they would have owed $305,000 in December of 2014. Under the new loan, incentives included, they will owe $317,000.

By convincing Joe and Jane to take the new note, they reduce their interest charges by $31,248, but have managed to have Joe and Jane pay back the $32,000 in lost equity. Factoring in the $1,000 the bank gets for the loan modification, and the 3 years of “pay for success†inducements at $1000/yr, the bank actually makes $4752 on the deal.

But wait, there’s more. By paying on time, Joe and Jane get their $1000 in annual incentives for 5 years, courtesy of Uncle Sam.

The bottom line: you and I just spent $9752 to keep Joe and Jane in the home that they would have probably continued to pay on anyway. The only party that did well was the lender.

If there’s any degree of comfort in this, it’s that it’s the rosy scenario. There aren’t many Joes and Janes out there with 740 FICO scores and 20% down payments. A sizeable number of people who bought recently did so without the benefit of a down payment or a 740 FICO score. For those people, they aren’t holding the bag for the $112,000 in lost down payment and equity. The lender is. Those people should walk away from their “investments†immediately.

Joe and Jane should walk away too, but they may not. Old habits are hard to break. At least that’s what the Powers That Be are hoping.

We shall see.

58% foreclosures, 42% short sales.

I love this site, truly. But I’m confused. A coworker put her home in Hermosa Beach on the market and said she had an offer in one week. She says it’s a done deal and has made an offer on anther home in San Clemente. Her realtor told her that home sales in OC are up 50 percent.

I’m just a renter waiting for prices to become more affordable so her story doesn’t seem to add up with all the stories in the news and on this blog. Is she just lucky?

AnnS, you are incorrect, eliminating debt would be quite easy.

Step one, nationalize the banks. Step two, do whatever you want, since it is now government property. In a proper mortgage Jubilee, renters will also be given property that is currently abandoned/empty, and they will benefit as well from lower rents.

To avoid nationalization and legal challenge, the federal government could also simply write checks to cover the value of the debt.

The alternative is the chaos and panic of an uncontrolled and rolling crash, which we are now seeing. You tell me which is a better choice.

Agreed. Only the worst parts are affordable to the richest that live there. The medium and better parts are still outrageously unaffordable compared with local rents.

Dr… your Brian Threaded Comments wasn’t implemented correctly. You need to put try to post a threaded comment and you’ll see what I mean.

Chuck

What are people seeing in the more affluent areas of Los Angeles? I’ve been keeping my eye on La Canada and have seen some downward movement in asking prices but nothing substantial. It’s very typical to see homes listed for $1 million that sold in 2002 for $500,000.

My presumption is that, on a percentage basis, all neighborhoods will eventually fall by about the same amount. I’m just not seeing it fast enough in La Canada.

Anyone else keeping an eye on more expensive areas that want to share what they are seeing?

Home values are about to pull out of this deflationary death spiral. They may not appreciate much, if any over the next year. But the bottom is here.

Here’s why:

Home values AND interest rates are at historic lows, so real estate is very affordable to anyone with good credit and steady employment.

If not, FHA has a great new program for people with fair credit, high debt to income ratios, and little money for a down payment.

New home buyers are being bribed with $8,000 checks from the IRS.

Foreclosures have been halted, both by the big banks and by Freddie Fannie.

Obama and the Democrats in Congress are literally throwing trillions of dollars at the problem.

Even the perception of a low will bring fence sitters out in droves to look at new houses. They have been sitting on that fence for two years and they’re getting tired of waiting.

Who cares what the pretty little charts look like? Charts follow the fundamentals and the major fundamentals are controlled by the government.

The Republicans wanted more guns. Now the Democrats want more butter. After the passage of Stim 1, you know who controls the show.

If that’s not enough to convince you, here’s another reason everyone seems to be overlooking. The dollar is trading at historic lows. To anyone outside of the U.S., real estate prices look like a half-off fire sale.

If we don’t start buying up U.S. real estate in the Spring, the Chinese, Saudis, Europeans, and anyone else with a little cash who can get into the U.S. will start buying U.S. real estate instead.

Personally, I’m staffing up for a nice April home buying surge. I just hope interest rates stay down so I can do a few more refis too.

AscentHomeLoans.US

Loan Officer: You lost your credibility with your very first stated “reason:”

“Home values AND interest rates are at historic lows, so real estate is very affordable to anyone with good credit and steady employment.”

The traditional housing price formula is that the median price for a house is between 2 and 3 times the median annual household income in the same area. At the peak of the bubble, this was distorted to as much as 6, even much more in some areas.

As shown in Comrade HB’s graph above, we’re still overpriced — a little under 4 times median household income. So it’s silly to proclaim that “home values are at historic lows” unless you take a very short view of “history.”

No, we’ve still got a long way to go before housing prices bottom. And this is especially true in California with its staggering unemployment and budget problems. People are tapped out or deathly afraid of being so in the near future. Can people make mortgage payments with state-issued I.O.U.’s?

Of course, I understand your desire to do well and keep food “on your family.” But your misleading advertising copy will play better elsewhere.

Comment by Jubilee Year

February 20th, 2009 at 2:43 pm

AnnS, you are incorrect, eliminating debt would be quite easy.

Step one, nationalize the banks. Step two, do whatever you want, since it is now government property. In a proper mortgage Jubilee, renters will also be given property that is currently abandoned/empty, and they will benefit as well from lower rents.

To avoid nationalization and legal challenge, the federal government could also simply write checks to cover the value of the debt.

The alternative is the chaos and panic of an uncontrolled and rolling crash, which we are now seeing. You tell me which is a better choice.

___

Nope you are wrong.

>>>

The outstanding loans are owned either by

>

(1) Fannie/Freddie who being owned by the taxpayer can reduce the principal if they choose (and pay a huge cost in political fallout)

>

(2) A few banks may hold their own loans but they are far and few between and are usually small community banks. My little community bank certainly will not be taken over by the FDIC or anyone else. They were vastly indignant when TARP first came out and it looked like they were going to force money on any and all banks. The senior VP huffily announced “We don’t want their damn money. We don’t need their damn money. We have something Wall St doesn’t have – capital, lots and lots of capital and it isn’t borrowed from some other bank or Treasury and we don’t have something Wall St does – bad loans stupidly made by financial morons! ” (And he is absolutely right. They are only leveraged 1::8 which is super conservative. They have had 1 foreclosure – a divorce situation. They have heard of exploding 2/28 ARMs and Option ARMS but have never seen the loan docs for such things. They have clung tightly to their old-fashioned standards of downpayments and DTI caps and having everything in life documented – and even usually know their prospective borrowers family back unto their great-grandparents!)

>>

So no one can seize that bank and process it through the FDIC or anything else. No one can tell them they have to reeduce the principal on their loans. Period. DC 9 aka Us Supreme Court would have a fit and toss out any such action.

>>>

(3) CDOs and SIVs – and that is where the loans are that are being administered by Citi, BOA, Wells etc. These are at least 50% or more of the mortgages extant. The banks do NOT OWN those loans. They merely administer them. The real owners are god-knows who since those loans were bundled into packages and sliced into bits and pieces and diced up more and sold off to organizations and institutions and investors all over the world. Happened with mortgages and with credit card debt and student loan debt and every kind of debt imaginable.

>>

So if Citi is thrown into recievership in the care of the Federal Government, the Federal Government can NOT reduce the principal on the mortgage or credit card or any other loan that is merely administered by Citi and owned entirely by someone else or partly owned by someone else. The OWNERS are someone else and Citi/Federal Government are just the ones collecting the money and administering the loans. And the Federal Government can NOT unileraterally say that the owner of the loan is not going to get their money.

>>>

That would get enjoined in Federal Court in a heartbeat and the DC 9 would call it an “unconstitutional taking.” Period.

>>>

Further, as the one in charge of a bank in receirvership, the government has an absoulte duty to maximize the value of the assets and the amounts available for creditors and shareholders. They can not ignore that fiduciary duty or the courts will land on them with both feet.

>>

>>>

The Federal government writes checks for trillions to pay off the mortgages of people who can’t afford to pay their mortgage???

>>

Are you looking for a second revolution? I can assure you that doing such a thing would be political suicide for any politician who proposed such a thing. There are far far far more voters who did NOT pay too much for their house, who did NOT take out huge loans they can not repay and who are NOT reneging on their debts because they (a) are having buyer’s remorse or (b) made reckless financial decisons. (Note: not all in foreclosure are there as a result of their choices. Some are there due to lost jobs or illness but the focus will be on those who do have culpability for their actions which led to the foreclosure. The others will get lost in the shuffle.)

>>>

Sorry but those of us (90% plus) who did NOT buy more than 2.5 -3 times our income and who did NOT take out exploding ARMs or Option ARMs and who did NOT have 16 credit cards are not going to agree to pay off the mortgages for those who are whining because they are upside down on their mortgage.

>>>

The current economic situation is chickens coming home to roost. We (in the national sense) have brought it upon ourselves by lusting after 4000 sq ft McMansions with more bathrooms than bedrooms, $50,000 SUVs to go to the grocery store, vacations to the Caribbean, plasma TVS, Iphones, and endlessly and forever shopping for more ‘junk’. It was a $5000 a bottle champagne lifestyle on what turns out to have been a Miller Highlife budget.

>>>

I am concerned about people going homeless and hungry. I will help them find rental housing. I will volunteer at and donate heavily to the food pantry. I will help them fill out their application for Food Stamps. I will NOT pay for their stupidity and greed – the utter and insatiable avarcious greed for more and more and more.

>>

This is not chaos. (For that read about Germany in the late 1920s and early 30s.) This is a systemic shock to the US population who believed themselves superior and entitled a very high standard of living – and that they could do it on borrowed money that they could not afford to pay back. This is a systemic shock to the US business world who believed they could endlessly outsource good paying middle class jobs to India and China in order to make more and more and more profit and yet still have the US populations keep buying and buying and buying their goods that the businesses reimport.

>>>

I have to say the current events are much preferable for causing the US to face reality than making the ants pay off the debts of the grasshoppers who over-indulged in conspicous consumption. Reality is a bitch – it will catch up with one sooner or later. It is the US’s turn to face the reality it has created by being a nation of consumers rather than producers (as defined by Smith in Wealth of Nations.) And now the piper has to be paid.

>>>

The population will get over their collective shock, move past the fear and move on. How they move on remains to be seen. They can turn to the right ala Germany and Italy in the 30s looking for a ‘saviour’ or to the left ala Russia in ’17 or find a path in the middle ala US in the ’30s. They will learn to scale back their expectations as to their lifestyle so that they are in accord with their real productivity.

>>>

Note: Smith considers ‘production of wealth’ to be the creation of tangible goods which can be used to produce more goods. Building and selling each other houses and selling each other junk from China or flooding the world with grotesque risk monsters (credit default swaps, CDOs, SIVs…) is NOT the production of wealth.

Comment by Loan Officer

February 20th, 2009 at 6:57 pm

Home values are about to pull out of this deflationary death spiral. They may not appreciate much, if any over the next year. But the bottom is here.

Here’s why:

Home values AND interest rates are at historic lows, so real estate is very affordable to anyone with good credit and steady employment

___

Trolling for business are we? Yes, I noticed the name of your business at the end.

>>>

House prices at a “historic low”? As compared to WHAT ? 2007? Try again. The prices are STILL to high in relation to income. The prices are STILL to high as compared to rent for the same property. (And yes my banker with the MBA from Wharton agrees with me.)

>>

Ah yes, the hackneyed – and false – claim that one should buy because ‘interest rates are low.” Uh huh….and all that means is that the seller can jack the price up. And that means that interest rates can only go UP in the future.

>>

Ex: Price $250,000. Interest rate 4.5% over 30 years. Payment (principal & interest) = $1,266. That means an income of $62,000 to cover principal, interest, taxes & insurance without exceeding 31% of gross.

>>

Interest rates go back up as they will at sometime.Now that owner wants to sell and at least break even.

>

Price $250,000. Interest 6.5% over 30 years. Payment (principal & interest) = $1,580. That means an income of $73,000 to cover principal, interest, taxes & insurance without exceeding 31% of gross. The seller has to find a buyer whose income is 17.75% HIGHER than theirs. That means there are fewer buyers who can afford the higher payment. Thaat means it is harder to sell.

>>

For the next buyer to pay the same PITI as out seller, the house price has to drop to $195,000 to have a principal and interest payment around $1266.

>>

Thanks but no thanks. I will take the high interest lower price over the higher price lower interest any day! You can always refiance the interest rate to something lower. You can not lower the price paid.

Great post Doctor. I don’t share your optimism about a 2011 bottom though.

~

When I was working in Wilmington, I asked one of our contractors if he would hire some of the locals to help brighten our image in the neighborhood. Told me he tried, but they didn’t have a decent work ethic. At the time he was bringing in workers from Bakersfield.

~

Longshoreman were making horrendous salaries unloading cars and cheap stuff for Walmart and even temporary labor at the docks paid very well for doing virtually nothing. Now, take a look a the Baltic Dry Index; international shipping is at a standstill. Even with their strong union, I suspect a lot of those extravagant jobs have stopped too.

~

The point of all this is, taxes are going up and with salaries disappearing, where is the money to make mortgage payments gonna come from?

The taxes due to Prop 13 really tipped the balance into making a home purchase in SoCal unaffordable. My realtor is still not fessing up to the 50% drop in prices and I feel that the level of integrity in the business is as low as the worst on Wall Street.

Perhaps a Chinese landlord would be a welcome relief.

Loan Officer,

Charts don’t lie. Real estate “professionals” do.

Uh yeah-um Good luck with that Loan Officer.

T-bone

@Loan Officer: under the assumption that your post was not satire, I will respond by saying that your arguments are the same ones used at the peak of the bubble and all the way down. They were false then and are still false now. For example, your dollar argument is ridiculous. The dollar has rallied strongly off its lows against the Euro, for example. Looking for russian tycoons to buy two-bedroom hovels in the Inland Empire? The ruble has collapsed along with their billions.

As far as prices having fallen 50% and therefore representing a fantastic bargain, I offer you the following deal: I have a $100 dollar bill which was assessed at $300 last year; I will sell it to you at half off. What a deal!

To ExpaT,

I live in the Cote d’Azur and have been in the market for an apartment for a while.

I have seen drastic changes in the price of apartments in Nice/Cannes in the last 3-4 months. Notably the Italian owned weekend getaway apartments are up for sale at a MUCH lower price than just last summer.

I have yet to meet anyone that claims that the prices are not dropping.

Have a good day,

Eyjo

Loan Officer, you’re wrong (and obviously you have a dog in this hunt.)

The whole reason home prices rose so quickly (out of line w/ income) was because of unnaturally cheap money. It’s not that homes were suddenly worth more, it’s just that money became easier to get, so people could get a home without more pain.

Well, loans are damn hard to get now, and home prices are still out of whack with regard to incomes.

If we could find a legitimate, mutually-agreed upon escrow service, I’d put up $10K against yours that we’re not near the bottom. We’d have to quantify the terms but I’d LOVE to see you put your money where your mouth is. And you won’t.

Loan Officer

You wouldn’t happen to be dependent on that 2% commission would you????

I love how optimistically wrong you are!

My younger brother is currently shopping for a home. My older brother tells him to buy now and to not wait any longer because now is the right time and home values in LA County won’t go down any lower than what they are now. I tell my younger brother to wait by Dec-09 because homes will drop an additional 25%.

I referred my little brother to this website. I placed a bet with my older brother that homes will drop at least an additional 20% in 2009.

Loan Officer home will continue to drop in value in LA County. You sound like my brother.

“Home values are about to pull out of this deflationary death spiral.”

Will all the government bailouts home values may pull out – but only being a few hundred feet from the ground – it will be too late.

Crash and Burn with very few survivors…

Absent from ALL of these discussions is the likelihood of rising interest rates.

I expect that they will.

Just because.

So, if I have a $300,000 mortgage at 6% my monthly interest charge is %1500 a month.

What happens if that 6% jumps to 9% on renewal?

$2250 monthly.

Who can afford a $750 increase?

And when rates start to climb, house prices will have to decrease.

The market has to follow what people can pay.

Renting and waiting….

I know, “loan officer”, if we don’t buy now, we’ll be priced out of the market FOREVER!!!!!! 🙁

I have to agree with loan officer. Nationally, the rent/own ratio has come into balance in many areas, housing starts are way down which means there is no additional inventory coming, home affordabilty is at it’s best level in years.

Given all the negative sentiment, the multitudes of “experts” who are certain prices will go down, and housing bubble blogs, it is surprising prices are not lower. We are at the bottom.

Remember, to all who are poised to walk away from your homes, you actually PAY OFF your house in 30 years (assuming you have a amortorizing loan), and pay it down by half in about 15 years. I find it amazing this important detail is being lost in this frenzied national debate.

I am old enough to have seen this 2 times before: mid 1970’s, and late 1980’s, and each time it did end.

Each time everyone says “this time is different”, and they are right, it is always a different set of circumstaces, which always eventually heal.

Sean O,

“Remember, to all who are poised to walk away from your homes, you actually PAY OFF your house in 30 years (assuming you have a amortorizing loan), and pay it down by half in about 15 years. I find it amazing this important detail is being lost in this frenzied national debate.”

Your statements are quite misguided and not at all applicable to today’s market. First off, interest is front loaded into a mortgage so the payoff is not a linear function, ie. the principal does not lower by the same amount every month for the life of the loan. Because of this, a home is not halfway paid off at the halfway point of the loan (year 15 of a 30-year mortgage). For example, a $500k mortgage with a 30-year fixed rate loan would have a balance of ~$350k at the 15 year point. The balance of the loan would not reach $250k until the 21st year . And with the plummeting values today, $250k would be half of the original mortgage but probably 75-100% LTV. If you are implying that the LTV would be 50% at the 15 year point you are even more wrong. The sad thing is that in this market, anyone who bought a home (with <5% down) in the past 2-3 years will very likely have to pay down their mortgage for 20 years just to get to the break even point. Home values are down ~40-50% and will likely drop a bit further before stablizing. When you add in the costs associated with selling, 20 years to break even is in the ballpark.

If a person who bought a $500k home in the past 2-3 years was to stop paying altogether and save the money or use it to pay down other debts such as credit cards or car loans, they will be in a much better financial situation in 5 years than they would be continuing to pay on their underwater home. I would guess that a person who stops paying today will not lose their home to foreclosure until at least late 2009 if not early to mid-2010. If they are paying $2500-$3000 a month now, that is a savings of ~$30,000 with which they can move, rent and start building up a down payment for another home purchase in 5 years or so. Not only could someone get out of debt, but in 5 years, if they work hard to improve their credit and save diligently, they could buy a home at least as nice as the one they currently own for ~40% less than the one they are in now.

The absolute worst advice which could be given to someone in danger of losing their home would be to accept a modification which turns their purchase money non-recourse loan into a recourse loan. If someone agrees to this, they lose the ability to exchange their credit score for the difference between the balance of the loan and the foreclosure sale price. Getting foreclosed on a recourse loan is the worst of both worlds, a foreclosure on your credit report and still having to pay the difference. No one should consider this if you want any chance of financial recovery in the future.

I live in SoCal so our market may not reflect your own, but your advice and information is grossly inaccurate and financially imprudent. Next time you wish to throw out some numbers on a blog, check out a mortgage calculator first so you can gets your facts straight.

It is amazing that you can address my blog and completely miss the point.

My advice to you is relax. The sky is not falling, just your property values. If you are employed and can afford the mortgage, be an adult and pay it.

To advise homeowners to walk-away simply because they are upside-down, and might loose money (actually you will never loose money if you pay off your mortgage) is the kind of selfish attitude that has gotten us into this problem in the first place.

Sean,

It seems as though your issue is more about the “morality” of walking away vs. paying and not the actual financial implications of that decision. You said in your post, “you never lose money if you pay off your mortgage”. This is incorrect. You will lose money because of a little thing called opportunity cost. If paying a mortgage = $3000/mo and renting the same house = $1500/mo, then paying the mortgage is a $1500 loss in the form of opportunity cost. Long term, well very long term, there may be some benefit to paying the mortgage but by walking away and pocketing as much as possible on the way out, it is very likely that an identical home to what someone owns now could be bought for 50 cents on the dollar in a few years when their credit score recovers. If you do not disagree with this premise, how can you think that paying the mortgage is a good idea?

How about this for an idea. Let’s all put our houses on the market at the same time, and then, lets all go to the banks and demand all our savings be liquidated at the same time.

Sure, we can all panic and head for the exits at the first taste of a dip in values, but all that will accomplish is chaos, and ensure our own behvior brings about that which we are trying to avoid.

No one knows for certain the future value of any asset unless everyone tries to sell at once, and then we all know it will be close to nothing.

“have to agree with loan officer. Nationally, the rent/own ratio has come into balance in many areas, housing starts are way down which means there is no additional inventory coming, home affordabilty is at it’s best level in years.”

Well ok what about LOS ANGELES? Yes, this is to some extent a national blog but it’s even more a Southern CA blog. Because the rent/own ratio is still out of whack anywhere you’d want to live in L.A. (maybe not Compton), and neither have we really reached any level of affordability to incomes here. Maybe we never will. In which case my advise would continue to be: leave California!

Sean O. I’ve run the numbers about 1000 times and there is almost no scenario where I make out better over 5 years or 30 years by sticking with my mortgage versus walking. We’d be exceptionally lucky if the market in 5 years is dead even with where it is now. In that case my $375,000 note is worth $175,000. On year 5 I will owe $355,000(40 year loan). I already have $20,000 in the bank from not making payments. I may well have $40,000 by the time they foreclose. I can rent a place and save $1500 a month over what I am currently paying. $1500×12 = 18,000 a year. Now if I save all this money ,and I can honestly say if no emergency arises I’m damn good at saving money, 5×18 = $80,000. Add the $40,000 I saved during the foreclosure process and suddenly I have 120k as a down payment. I can buy that same house and only have a $50,000 mortgage. So to review on year 5 I can either have a note for $355,000 or a note for $50,000 on the exact same house. Do you see why your logic makes absolutely no sense from a financial standpoint?

Loan Officer,

While the Euro is 15% higher than it was last year, All of the countries in E.U. are economically in the same boat as the US.

With great R.E. bargains in the E.U. it is doubtfull that Europeans will return to the US R.E. market anytime soon.

Leave a Reply