Real Overpriced Counties of America: Orange County named most overpriced county in the entire United States. Fitch Ratings and Trulia point to a bubble in the OC with prices overvalued by 30 percent.

When it comes to real estate, we know that Californians enjoy drinking from the gold cup of mania. Lusting over real estate seems to be as common as traffic on the 405. People in California have a deep rooted cultural and economic amnesia. I bet half the population has very little idea regarding the history of many cities in Southern California. Heck, most don’t even know where their drinking water comes from. So trying to discuss Fed policy, skewing based on investors, or market manipulation with a large portion of people is like talking to your dog about Hemmingway. Some people only understand “real estate goes up!†and when it doesn’t, they only understand “buying is bad!†California real estate is overvalued by most economic measures. Sure, people are willing to pay insane prices but they did this as well in 2006 and 2007 and people also paid crazy prices for tech companies in a previous delusion based boom. Investors are pulling back because they simply don’t perceive value at current prices. We are now seeing more reports putting a price on how overvalued the region is. Fitch Ratings and Trulia both point to SoCal as being massively overpriced. In fact, Fitch Ratings has Orange County overvalued by a whopping 30 percent. Congratulations to Orange County for being the most overpriced county in the entire United States.

Real Overpriced Homes of California

Orange County is back in full bubble mode. This year however, we have seen inventory increase even in prime areas like Irvine. Paying $500,000 for a poorly built condo with mega-HOAs isn’t exactly a deal. I know some people that have paid off condos that pay $1,000 and more a month just in HOAs, taxes, insurance, and maintenance. You want cable, food, and internet? Add that in as well. Keep in mind these are people that failed to fund retirement accounts or build any other income streams because they thought “hey, once the home is paid off I won’t have any other costs!†Wrong. It is crazy to see people living in $500,000 to $1 million homes shopping at Wal-Mart and the 99 Cents Store because their budgets are so stretched. I’ve seen a handful of pizza delivery people driving in fairly new Mercedes and BMWs. Living the California dream baby! This is the type of financial logic that permeates in the region.

Compared to last year, the sales volume is dropping and homes are sitting longer. What always intrigues me is that people would be willing to buy in heavier volume if banks would simply give them the money. Can they afford it long-term? Hell no. Only 1 out of 3 California families can afford a home in the state to begin with and this also applies to crazy Orange County.

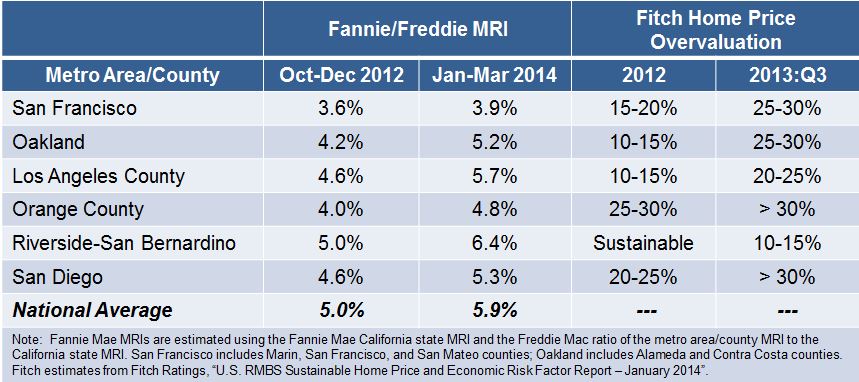

The bulk of people in the OC live in: Anaheim, Santa Ana, Irvine, Costa Mesa, and Huntington Beach. So it is no surprise that home prices are reaching an apex. Take a look at a report put out by Fitch Ratings regarding real estate values in California:

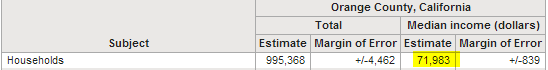

What is interesting is that Fitch had the Inland Empire priced as sustainable last year. That is of course before the house horny investors flooded the market and jacked prices up in 2013. What cracks me up about the list above is that Orange County is even more overvalued than San Francisco. Why is this the case? Because everyone thinks that all OC households are making six-figures driving around in foreign luxury cars. Hey, if a pizza delivery person is riding around in a Benz then things must be great right? Let us take a look at household income data:

Source: Census

The median household income in Orange County is $71,983. Much higher than the California and US figures. What is the median home price going for? The latest figures show that the median home that sold in March went for $580,000. In other words, the typical family in no way shape or form can afford to buy a home in the county in which they live. The story of SoCal. So it is no wonder that SoCal is a region of renters and this is only growing.

For a $600,000 home, you definitely need a household income of $150,000 or more without putting all your eggs in one basket. How many families make more than $150,000 a year in Orange County? 35 percent.

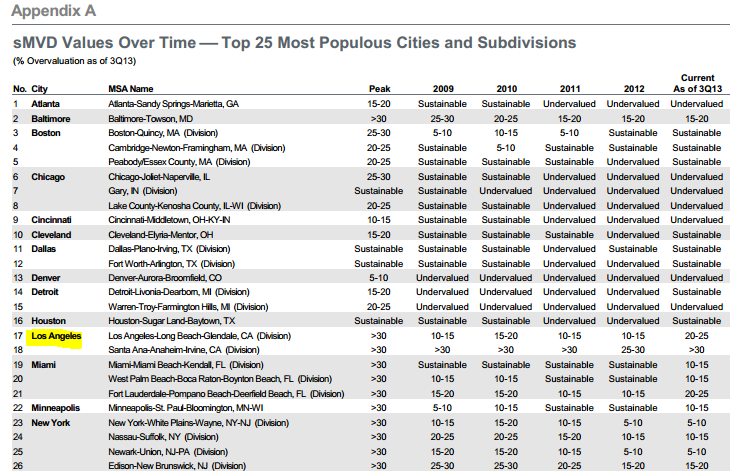

And don’t think that Fitch is only overvaluing California:

In fact, some markets are seen as undervalued. What is important to understand is that crazy high housing prices for giant regions are not sustainable. California is boom and bust central. I know a few people that work at Toyota that were blindsided with the announcement that the Torrance Toyota division is going to leave. Where? To lower cost Texas. I found the comments made by an executive at Toyota interesting:

“(Reuters) Our decision was not based on the dollar amount we received,” but rather on a friendly overall business climate and certain advantages for Toyota employees, from affordable housing and shorter commutes to the absence in Texas of a personal income tax.

Those supposed quality of life advantages don’t ensure success in a big corporate relocation, however.

Larry Dominique, a former Nissan executive, recalled how Nissan lost about two-thirds of its California employees in the move to suburban Nashville.

While some employees liked the lack of income tax in Tennessee, which was akin to “getting a 20-percent raise,” Dominique said many others couldn’t be persuaded to go. That included a sizeable number who were not their family’s primary earners.â€

Apparently housing costs do matter. Like the previous move from Nissan some of these people simply cannot give up the California weather. Like the baby boomers eating cat food instead of selling their home, many Californians are punch-drunk in love with real estate to the overall detriment to their lifestyle. You notice how the executive mentioned affordable housing, traffic, and taxes in his reasons for leaving? By the way, Torrance is massively overpriced and they just lost their largest employer. Zip codes in Torrance go from $500k to $800k.

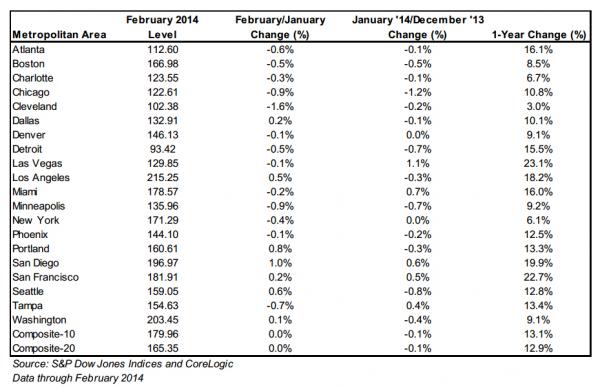

Back to Orange County however, you have a large number of people that are now making money because of high prices in real estate (i.e., banks, investors, flippers, agents, contractors, house furnishing stores etc). It is interesting to hear agents complain because of the incredibly low volume of home sales. You make more by selling five $400,000 homes compared to one $600,000 home. So what happens when prices ebb lower? The Case-Shiller Index saw a monthly decline for the OC/LA MSA data:

What do you expect? Prices went up by 18.2 percent year-over-year because of low inventory, house horny investors, and the continual flow of lemmings buying up homes. Even the Fed is telegraphing higher rates so what do you think this is going to do to housing? Or what above investors pulling back? These are things that are simply starting to happen. But use your common sense here. Fitch put a hard number on this saying that prices are overvalued by 30 percent. Trulia puts it at roughly 20 percent. At a $580,000 median priced home, this means prices are overvalued by $116,000 to $174,000. That is a big chunk of money given that the typical OC family is bringing in less than $72,000 a year.

Bottom line is that California is one giant speculation circus when it comes to real estate. Boom and bust central. The P.T. Barnum of housing. Those that say buy and stay put fail to realize that most people stay in their place for an average of 7 to 10 years. Many people buying in OC are squeezing into condos with insane HOAs or small beat up World War II shacks and guess what? Most are seeing this as their “starter†home for when they move up into that $750,000 to $1 million home. Are they counting on saving money to get there? Absolutely not. They are counting on multiple years like 2013 to build that equity so they can then have hundreds of thousands in equity to squeeze into their other home. Like the last bust, the hundreds of thousands that lose their homes will go off into the darkness to lick their wounds so they can spin the carnival wheel one more time once those FICO scores allow them to lever up once again. You know, because real estate in California is always a great buy no matter the price!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

68 Responses to “Real Overpriced Counties of America: Orange County named most overpriced county in the entire United States. Fitch Ratings and Trulia point to a bubble in the OC with prices overvalued by 30 percent.”

Housing to Tank Hard in 2014!!

Mortgage apps at 20 year lows! Oh it’s different this time :/ The new normal. Sorry Mortgage apps is a leading indicator and no its not different this time. You just think it is.

Cali is a boom, boom, boom state! How-zing to go up fo-eh-vah!!! Look at the stock/stoke market!!! It will never end! It can only go up from here because the rich “Red” Chinese will buy up ALL of the homes for sale fo-eh-vah!!!

Check out this property in Monterey Park:

http://www.redfin.com/CA/Monterey-Park/265-E-Fernfield-Dr-91755/home/6979312

The property is located in Monterey Park BUT is within the Montebello School District (crappy one). The seller is asking for nearly 600K for a 1,300 sf house. This is overpriced!

You have to ask yourself “do ya feel lucky? Well do ya punk”? If history is any indicator, then property prices 15 years down the road may be a lot higher than they are today in CA. But your going to need a lot of luck on your side to get there IMO. Can the FED continue to re-inflate bubbles that pop? As I surely think we are a few years away from another large market melt down. What the catalyst will be is anyone’s guess, but both the stock market and the RE markets were re-inflated way to fast by the FED rather than by the fundementals. Why they will pop again is anyone’s guess, but it will happen IMO.

After that, will the economy be strong enough to come back is the $64 question. Will we have come up with a new technology that drives the economy to new heights again or will we continue to languish as a country that doesn’t make much anymore, as we have off shored everything? I would like to be optimistic and think in the long run, prices will be higher as a reflection of our way of life not totally imploding.

Yeah, good points. But in 15 years time rent will be taking over 50% of salaries.What Trulia data is this post using? Last week Trulia used the rent/buy ratio to state that buying made sense in San Diego.

Certainly here in North/Central San diego you can buy 3/2 detached house, no HOA, for 500,000 or you rent for 2400/month.

In this area I do not see houses dropping under $440,000. My reasoning is that you can get a loan for $417,000 with 5% down of around $21,000 (total price – around $440,000). This makes $440,000 the base for how far houses will drop in price. It is all to do with financing availability. By the same token, I do not see house prices going up much higher.

bbbbbbb – Did Only Son of Landlord lend you his crystal ball? You got a lot of “I see” in your comment…

I’m excited to see what the next 18 months hold. How Fitch could produce data on overvaluation that is so different from the OC Housing news is puzzling. Someone is looking at the wrong fundamentals. Fitch looks at prices relative to incomes. The other compares to rents. Fitch ignores stored wealth completely. I saw numbers on it recently. Mean stored wealth in the US is around 250,000 usd. Median was around 50k. Probably worth considering when talking about what people will pay for real estate. I need to recall the reference but I recall a study that suggested that maximum happiness due to wealth occurs under a salary of 100k. Since everyone here makes more than that by their own comments it is surprising that so many are surprised that real estate in coveted locations is getting bid up. Especially when they themselves can save so much each year while remaining perfectly happy.

Exactly!!! Income doesn’t matter because there is a LOT of money out there, like gazillions! My friend just got back from Vietnam and let me hold a million dong. I was a Vietnamese millionaire for a moment and boy did I feel gooooood!!!!

wow… so wealth… much money

35% of households in OC making over $150k is a lot of households. Most have families and they “have to live somewhere,” which means “ownership” because of the “American Dream.” Call them outdated cliches if you wish, but they are part of the American mindset and culture. What? and others are the outliers tilting at windmills. You want hh making $150k/year to rent? Good luck with that PR campaign.

Besides, yes, there the 1% is a large and growing global class, and, guess what, prime SoCal offers one of the best lifestyles in the world for the rich to buy! And, and, wait for it, SoCal is actually a bargain compared to other global destinations. Haters just don’t get it.

# # #

From 1981 to 2012, the share of income that the top 1% of Americans take in has more than doubled, according to a new report from the Organisation for Economic Co-operation and Development. The rich now earn about 20% of all pre-tax income in the United States, up from 8% in 1981.

The report called the increase “spectacular,” and noted that the share of income going to the super rich — the top 0.1% of U.S. earners — has more than quadrupled over the 30 years since 1980.

# # #

@DFresh,

You are so right.

Here is a lovely home is centrally located SoCal: http://www.redfin.com/CA/Compton/4228-E-Palmerstone-St-90221/home/7369711#main

Better hurry up! It’s been on the market for 1 year. Priced at $198,000 and minutes away from downtown Los Angeles, Long Beach, Orange County and coastal beach cities, hurry before a rich Chinese person with suitcases stuffed with gold bullion snatches this keeper.

Soon homes like this will be selling for $10 Million dollars!!!!!! Buy now or be forever priced out by the rich 1%’ers.

The view from the peak of the Ponzi is spectacular LOL!

And how many OC “owners” income is DIRECTLY tied to the Credit Bubble? Nobody serious is saying coastal OC is going to lose 50% but a 20-30% retraction (already priced in if you take Leslie Appleton’s 6.5% mortgage rate by 2016 prediction to heart) would be devastating to all the faux 1%ers hanging on by a credit thread. Over extending yourself to look richer than you are is always a losing proposition…

The all mighty Fed will hold interest rates down fo-eh-vah! How-zing will go up 30 – 40 % this year and next year and next year and…

I’m enjoying your new ‘The Mad Housing Bull” persona What? 🙂

And kudos for ignoring “little” robert. Seeing his weak comments isolated without reply is a good punishment for his shilling slash ignorance

OMG – you just gave me a million (dollar not dong) idea!!! How about you and I pitch an idea for a CNBC show called Mad How-zing Bull Crew? We bring on a shill to explain how how-zing can only go up fo-eh-vah and we have the blond girl with plunging neckline (you know the one I am talking about) bust out the pom poms and chant take that bitchez. F’ing genius!!!! My people will call your people and well do coffee…

>>Seriously, when interest rates go back up to their historical levels of 8% to 9% for a 30 year mortgage, selling price declines of 50% in SoCal are baked in.<<

You don't need any of this. You just need buyers to fall away. Market has already sucked in so many malinvestors in mega-bubble 2.0. A market can only crash when it's pulled in just about everyone who is willing and able to buy.

And think like a banker. Have Fed/Gov friends help position things with QE (rates floored ect) to offload loads to debt-lovers and HPI forever buyers, at high prices. Reposition, then attack all those homes owned outright / equity rich by forcing a big crash, and tough luck to those who bought in with capital/mortgages in bubble 2.0.

Then get fresh mortgage debt on houses in volume, to younger smarter entrants, even at much much lower buying prices.

LOL! the market is still solid, even 4 years after most of said it would bust. I hope some of you bought back in 2014.

I’m guessing there’s another 2-3 years left in this cycle (it seems the fundamentals shows this).

20% down is in the bag. I told you all last year with the sighting of a Thursday open house. Who’s the bitch now??? Bahaha.

I’ve seen Wednesday, Friday and Saturday too. Yet to see a Monday.

No open houses on Mondays because the listing agents are all too hung over from the binge drinking crying in the corner after the empty open house on Sunday…

Stop it Johnny Utah. You’ll upset little robert.

This time is different….no wait! Nevermind…

Seriously, when interest rates go back up to their historical levels of 8% to 9% for a 30 year mortgage, selling price declines of 50% in SoCal are baked in.

Not all of SoCal, just everything E of the 710 and N of the 405. You know how these things work. It’s the working-class owners who will pay most of the price.

I’m a bear to Blo, but I don’t think we’ll see 8% mortgages anytime soon (and by that I mean decades). There is a liquidity “glut’ to paraphrase Greenspan. The monetary expansion of the past few years means that even a return of market forces will be offset by dollars seeking a return. Absent a grand reset, which would likely involve a new currency, i can’t see how any market conditions could give us a 9% mortgage rate.

If it is overpriced by 30% then you bet it is going down by 30%, at least. It can be more because the market is like a pendulum – searching for the equilibrium it goes too much to the right or to the left (overpriced or overcorrected).

The FED proved that they can not fight gravity just 6 years ago. When the amount of debt in the system is overwhelming it can crash even the FED. That is wise to let the market find the equilibrium instead of fighting gravity like the central planning FED tries to do.

The only thing the FED accomplishes by intervention is to delay the inevitable and make the economy crash from a higher level. I guess for the bankers it doesn’t mater as long as they benefit from this policy. For the Main Street it is going to be painful.

Research how Texas is waging financial arbitrage / warfare on California all over again (i.e., Enron) This time it is poaching big California employers to crash the housing market and manipulating housing prices via Appraisal Management Companies.

I agree that Texas is trying to attract/steal our best employees. But Texas is trying to crash the housing market and manipulating housing prices via Appraisal Management Companies? Huh? Please provide a link instead of telling us to research outlandish claims.

I am glad that you appreciate how powerful Rick Perry is compared to your Governor Moonbean and his beanie babies.

Just in BigTex…. http://finance.yahoo.com/news/boom-time-in-texas–jobs–traffic–water-worries-143250407.html

Texas WILL have lots of debt and new taxes in the coming years…and you know all those new California’s there will vote for these.

Take as many CA expats as you can Tex. Lower housing costs, congestion, strain on social services for me. And at least Moonbeam is for letting people out of prison instead of putting them in. All non-violent drug offenders are POWs of this stupid war .gov is waging on American citizens. A victimless crime is no crime at all and immoral to prosecute.

Texas has been courting businesses and residents here in Chicago for a while as well. Houston is growing quickly. Cost of living is reasonable, nice weather for the most part, but way too hot in the summer and way too conservative for my tastes.

HOA fees in some of these condos or resort living is very misleading. Many people who pay cash still find a burden awaits them. It is like having a second mortgage, and of course if you miss payments you could still lose the property to foreclosure.

Please way all aspects when visiting these models. What looks like a nice clubhouse and golf course could be your noose around your neck. When selling these places the fees can lead to not selling your place for a profit. Be careful

U.S. economy slows to stall-speed with GDP growth at .1%. Let’s blame the weather!

http://money.cnn.com/2014/04/30/investing/gdp-economy/index.html

http://www.marketwatch.com/story/us-gdp-posts-smallest-gain-in-three-years-2014-04-30

I’ll drink to that! Polar Vortex was to blame for all evils in the world today including the Ukrainian “conflict”. Blue skies from here on out!

If this is truly the beginnings of a leg down in prices, this month should be epic in terms of listings hitting the market. We just got notice that our owner wants to sell (everyone, run for the exits, this is not a drill!), and we need to be out NLT the end of May. It’s one of the big drawbacks of renting, and it blows. But there are lots of overpriced rentals to look at. Saw one in Mill Valley on Sunday, 3 BR, 2 BA with carport, asking $5300. There were a LOT of people at that open house, like bees swarming. Monday the price went down to $4250. Ouch, talk about overreach! It is going to get interesting here very soon…all these listings for sale, if they materialize, people thinking that this is the “right time to sell”…I’d say it’s a recipe for a freefall. And thankfully, my money isn’t tied up in a house – if the music stops, I don’t need to worry about finding a chair. I feel the pressure of finding a new rental, but I can live anywhere while working from home. I will get a nicer place this time.

Momo stocks getting crushed. Lots of paper millionaires finding out they aren’t anymore. Twitter down 10% pre lockout expiry. FB great earnings? Down 5%. There’s a great unwind out of these tech stocks and the entire Bay Area is going to feel it. Not to mention risk of war & China bubble pop. Lots of things can/will go wrong.

NASDAQ 10000 by the end of the year! History “proves” that the stock market only goes up. Just ignore the fact that many of the companies in the NASDAQ in 1999 do not exist now. So we just replace lagers with new companies, problem solved. NASDAQ up fo-eh-vah!!!

Don’t knock Wal-Mart. I shop there and I am rich. I just don’t have rich wasteful tastes like the posers.

Is that you Sam Walton? I can’t shop in Walmart because we don’t have one in Santa Cruz county. The other problem is that they only sell dad jeans and I want to look cool in my skinny jeans. They will kick me out of Whole Paycheck aka Whole Foods if I don’t look cool. Peace out…

The Wal-Mart overalls are good if you work on engine #7 in Felton. I bet you live in a tent in Henry Cowell or Big Basin toking with the Banana Slugs coeds.

Seeing a notable increase in reductions just this past week on a bevy of listings tracked throughout various L.A. city neighborhoods. Also noticing more attributes of desperation such as (delist/relist vs simple reduction, weekday open houses, re-staged photos). Something seems afoot but it’s a little early to know for sure.

2125 Vallejo still remains the poster child. http://www.redfin.com/CA/Los-Angeles/2125-Vallejo-St-90031/home/6945511

“Also noticing more attributes of desperation such as (delist/relist vs simple reduction, weekday open houses, re-staged photos). ”

I’m noticing these magic tricks also. Lots of delist/relist and new pics. In my area (Sac foothills) buyers are not as crazed as the OC, a little less desperate – If I’m noticing these tactics I assume a percentage of other buyers are too.

You have expensive tastes.

For the starter home, here’s one a few minutes away: http://www.redfin.com/CA/South-Gate/9553-Victoria-Ave-90280/home/7376420

Who says a centrally located home in SoCal is unaffordable?

Finally some good news that others are noticing things are extremely overpriced.

However, I’m still looking for this mystical family that can afford $3000/month for housing in LA even after the 20% reduction. I make a decent wage and don’t want to pay anywhere near that amount per month.

That is what you would pay for a one bedroom apartment in Santa Monica. Parking is extra of course…

@BubbaQ, It took me all of 30 seconds to find a house with a monthly nut of less than $1400 in centrally located SoCal.

Here you go: http://www.redfin.com/CA/Lynwood/2714-Norton-Ave-90262/home/7356972

They are not building any more land you know, so you better buy now before a rich foreigner snags this…

@BubbaQ,

Here is a lovely country home west of the 405 freeway! 😉 😉

Monthly nut? Around $1600 a month.

http://www.redfin.com/CA/Canoga-Park/22149-Valerio-St-91303/home/3087528

Hurry before a money laden foreign national from China/Brazil/Europe/Asia/India/etc. takes this.

P.S. Soon homes like this will be selling for $15 million in sunny desirable SoCal. It’s the sunshine tax as they say.

Update on the approved short sale “screaming deal” I was in escrow on @ 20% under market value. Just cancelled. Foundation problems came up in the inspection along with a host of other unexpected crap. You know what they say about if it sounds too good to be true…

As a broker the most important thing I can tell anyone thinking of making a purchase in this “market” is BUYER BEWARE. It is unbelievable what sellers AND some agents will try to hide from buyers. Inspect, then re-inspect, then inspect again. You’re burying yourselves for 30 years so take your freaking time.

Also, rates have flatlined for a while now. Still looking at 4.5% today for a conv 30 fixed loan. I’ll believe the rates are going up to 5+ when I actually see it happening. For now Old Yellen is holding them down.

In the meantime the lemmings are still flocking to listings at the current inflated prices. A condo listing I have in the overpriced OC just recently went into escrow over asking price. Of my 9 recently closed listings over the past 5 months all went under contract in under 15 days on market. 7 sold at or over ask. 2 went under ask, one by about 4% under and the other by about 1% under. Coincidentally 6 of 9 buyers were of Asian descent.

I am not cheerleading this insanity by any means. Just stating the facts.

@ CAB. Tell me more about inspections. I purchased a home and hired 3 inspectors: 1) general inspector: who also makes cursory inspections of roof and foundation. In other words, they are not a specialist in roofs or foundations. 2) Chimney inspector: looks esp. for cracks in fireplace and ensure that fireplace can be used safely (he informed me that about 35% of all homes in LA with a fireplace are unsafe due to cracks at the roofline or attic from earthquakes). 3) Mold inspector: I did this as an extra step, since I a have allergies. I was also informed I could hire a foundation inspector but given the house was built in the 50’s foundations were much stronger than then the preWW2 homes. Anyway, my question is was the foundation problems obvious? did it take an actual foundation inspector or general inspector or geologist? thanks

How much did the three inspectors cost? I paid $900 just for a mold inspector back in 06. The results, allowed me to get out of escrow.

Hi QE-

The general inspector located the foundation problems. I had some trepidation based on some cracked slate flooring inside the house but I am no expert. In addition I was so house horny because of the price I wanted it to be real. House was built in 87. I find the newer the home (generally speaking) the crappier the build quality.

Oh yeah, there was also some surface mold, rats, and roof leaks but I wasn’t afraid of any of that. I’ve tackled some ugly ones before but the foundation issues were just ugly. To top it off the freaking squatter that lived in this turd wanted $10K just to GTFO. It was sort of nice flipping the squatter the bird even though I didn’t get the house.

@ Clouseou ballpark was about $250 for mold inspection, $250 for chimney, $250 for sewer and $600 for general inspector. The sewer line was broken and the seller spent $6K fixing the sewer line. The general inspector did a great job, he gave me a 50 page report, with photos of foundation, under house, plumbing, circuit box, roof, etc. There were no problems with the house other than the sewer line. as an engineer myself I felt it was worth the money (and peace of mind).

A rise in interest rates will bust California’s housing boom in a flash. Things are slowing down. More inventory and price cuts are happening. Smart sellers are getting out now. Buyers who feel they have to buy should wait another year. Buying will be much better nov 2014-March 2015. I’m selling homes now and look to buy again 2015, 2016 or 2017. Investors are out of the market now and it’s time for some new home buying programs for the lambs led to slaughter.

This Pasadena house was listed for $678,000 and sold for $750,000 http://www.redfin.com/CA/Pasadena/1357-E-Mountain-St-91104/home/7199979

Pasadena is weird. Some houses sell high after a bidding war, while other, cheaper ones — similar size and location — can’t even be sold for less.

That actually looks like a pretty nice house. Not $750k worth of nice, though.

I went to the open house. The house was okay, but not as pristine as the photo-shopped images make it appear.

One trick I’ve noticed is to photograph the house at night, with the lights on. Then photo-shop the image to transform the night into beautiful hues of dark blue and violet, with some deep greens, contrasted with the warmly golden-glowing windows.

The houses invariably look less impressive when you see them for real.

The schools are pretty awful…. But i guess buyers are loaded and planning on sending their kids to private school anyway.

This is a lot like a comment I made some time ago (when I still believed in Math, Gravity, Physics, etc.). I know much better these days now that I come to realize that we live in a unicorn fart fueled e-con-oh-my. Silly gloom and doomers. I almost feel sorry for them…

http://www.zerohedge.com/news/2014-04-30/17-facts-show-anyone-still-believes-us-economy-just-fine

Why do you think that I live in the mountains by Felton? We are ready for the economic collapse. It will not affect our lifestyle. I also have a little weed patch up in Humboldt.

Not a threadjack, but I lived in Santa Rosa for years and years and knew a lot of working couples that grew for extra income. Since WA and CO have legalized it, the prices are falling and they are sitting on lots and lots that they can’t move. Even with new crops (indoor) ready to be go….

The wholesale prices of weed is collapsing….gotta love a what real free market actually looks like. Good luck in the weed biz over the next 1-2 years….prices will collapse again when WA goes all-in.

Nice to see some local references- and cooler heads. Here in Aptos everyone still seems to think real estate is the end all!

Gotta love good ole Aptos! 1200 sf tear downs on a postage stamp for 1 gazillion doll hairs. It is all about surplus and demons…

“While there’s still good money to be made flipping houses in Ventura County, it isn’t as lucrative as it was a year ago, according to a report released Wednesday.”

I’m still seeing reductions where I’m looking in north San Diego County, but nothing new is coming on the market. Used to be about 3 new homes a week average, now nothing for days. Also – this is an interesting article: http://theweek.com/article/index/260761/a-mortgage-is-a-terrible-investment

What the heck Jim?

Ahem *clears throat…housing to tank hard in 2014.

I look forward to that every article and I didn’t see it.

Texas WILL have lots of debt and new taxes in the coming years…and you know all those new California’s there will vote for these

Texas is the next Anaheim California, I tell my conservative friends this 100 of times. That the poorer Hispanic population is growing faster than the middle to upper middle white population in Texas according to all demographic studies but they are just in ignore it as bask in conservative politics and the oil industry. If alternative energy pricing could dropped then Texas is in big trouble since a lot of the Hispanic population best jobs are the oil rigs. In fact in some ways Anaheim California is better than Houston and Dallas both have very poor Afro-American and Hispanic areas. Ward 3 in Houston has a poverty rate of 47 percent its mainly Afro-American and Ward 2 is 86 percent Hispanic and over 30 percent poverty in Houston Texas. As more people moved to Texas housing prices will rise and while being less than the US average many people will not want to moved to a state where at best the major metro areas outside of the upper-middle class suburbs will look like Anaheim California.

I am waiting for the bubble to burst. No way in hell am I paying $500k+ for 90% of the properties out in the market today. The real market value of these properties (most of them needing a ton of work) is $370k at best.

Leave a Reply to ernst blofeld