Welcome to Feudalfornia: the golden sarcophagus and the investor. Acceleration to price out masses.

California housing affordability may seem like an oxymoron. Many younger buyers are priced out in many markets across the state. The latest data from the California Association of Realtors (CAR) finds that still only 1 out of 3 families can actually afford to buy a home in the state in which they live. We also have a record number of young potential buyers (more likely potential renters) living at home with their parents. Starting in 2008 a large portion of housing sales started going to investors. These investors may have different timelines on when they will release property out into the market. In fact, this might be another big reason as to why so little inventory is out in the market. Some investors are looking to securitize cash flows and may be limited in terms of selling. Instead a regular buyer potentially looking to capitalize on equity and move up in more traditional times, you have different motivating factors. Since 2008 over 30 percent of all California home sales went to this group. Another group is baby boomers locked into their golden sarcophagus. This group from what I have found for the most part is house rich and cash poor. The notion that many will sell and cash in their lottery ticket is simply not happening in the market. Many are seeing kids move back home, many still have a desire to keep their place (even if it means living in an area gentrified by dual high income households/investors), and finally a large growing rental base. In essence the continuation of California becoming more feudal is still very much intact.

Welcome renters and growing wealth gap

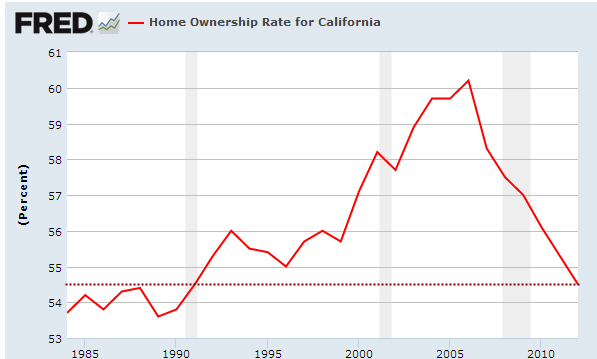

There is little doubt that people would like to own. The entire 2000s were dedicated to a time when anyone with a desire to buy could. The sales figures reflect this. Yet the home ownership rate is now back to where it was in the early 1990s.

We can argue that the 2000s were a time of excess. Yet remove this excess and we are back to 2000 yet the home ownership rate is now back to levels last seen in the early 1990s. Even as prices rise, the home ownership rate remains depressed:

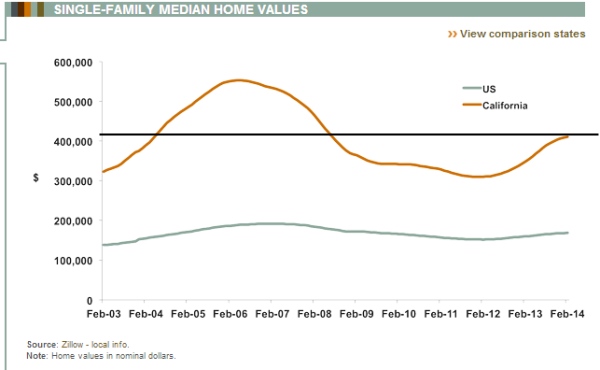

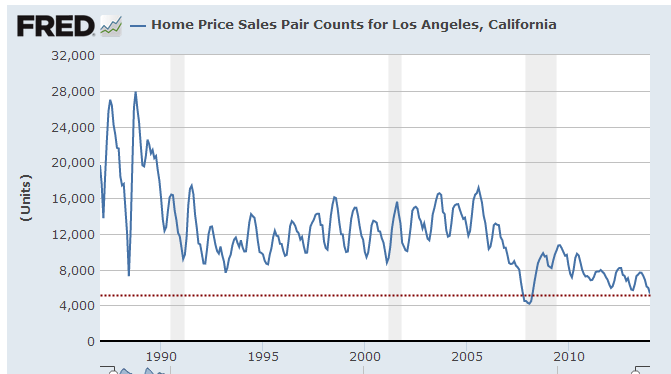

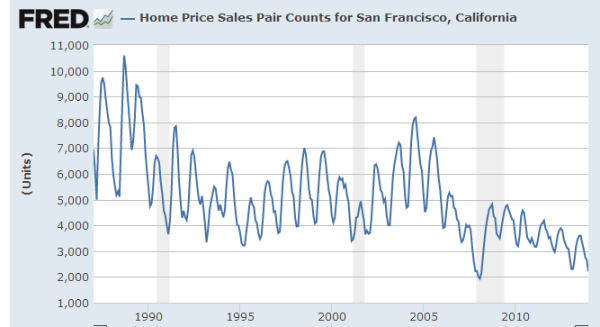

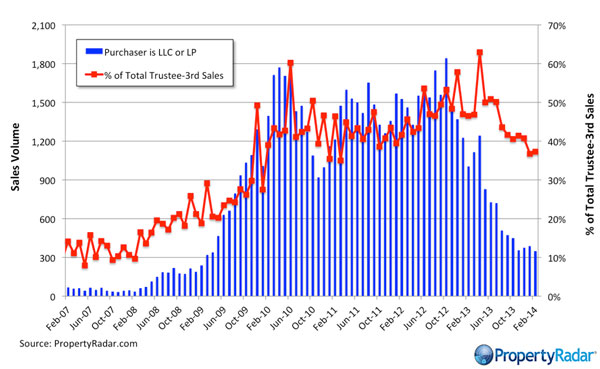

Now how is this possible during a time when home prices went zooming up? Part of it has to do with the groups of people buying homes. The traditional home buyer is a minority in the California housing game. Low sales volume and a desire to buy from Wall Street and other investors has propelled prices higher:

The bounce statewide is unmistakable although is tapering out as investors begin to pullback. All of this is accomplished on very low sales volume:

The data used in the S&P Case Shiller figures is pulled from the Greater Los Angeles area looking at L.A. and Orange Counties (this area covers close to 13 million people) while the San Francisco-Oakland-Fremont MSA covers close to 4.5 million people. The current sales volume is lower than what we saw in the early 1990s. In fact, current sales are the lowest since the market imploded a few years ago. What gives?

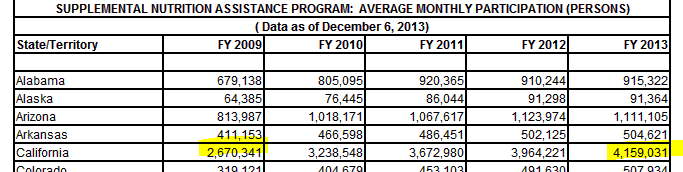

The current trend was driven by low inventory, investor demand, and house lusting buyers. As investors pull-back and affordability falls, it is natural to expect volume to naturally pickup as it has. Yet California is largely becoming a renter state. We have a growing group of people that are deep into poverty:

The recession ended officially in the summer of 2009 yet we have added close to 1.5 million people to the food stamp figures. Does this reflect a booming economy? I think people in pocket markets have blinded themselves to their miniscule areas and forget that for the state overall with rising poverty, stagnant incomes, and a massive drop in housing affordability things are simply getting tougher financially. It would be one thing if prices were rising because of the big addition of good paying jobs and rising incomes. These things are absent but what isn’t is a record number of investors.

Are investors distorting the natural inventory cycle?

Investors have caused a unique boost in the housing market. The bigger play here since the crash was to buy homes for rentals. A modern day Wall Street landlord system. Big investors have been busy buying up distressed property in California:

Even in 2013 big investors were buying up over 60 percent of all distressed property. These are usually better priced deals. A good portion of foreclosures were bought before they even hit the MLS so those thinking they had a chance to buy at rock bottom prices are out to lunch (unless they had full financing to go to auctions and out-bid these people). Plus, many bought with “all cash†and then spent more money renovating – many house lusting households barely have enough to move in and furnish the place after they plop their 20 percent down payment. Clearly the dominant force here was the “all cash†buyers.

Don’t think that these investors will suddenly turn around and sell their properties even with this big rise in prices (or will run when prices correct):

“(LA Times) These are income properties for us,†Rose said. “Eventually we’ll exit, whether it’s an IPO or selling them off. But that’s years down the road.â€

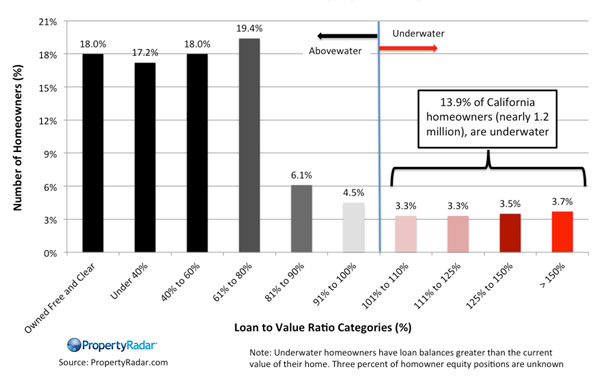

That is a very different mindset from the home owner or home debtor crowd. First, we still have a giant pool of underwater owners in California:

1.2 million home owners are fully in the red. Again you should look at the sales volume data above. This market is being driven by very low sales volume, tight inventory, and people simply stretching to buy. The investor crowd is pulling back:

“Prices have gotten to the stage where we cannot buy a house, renovate it, rent it and still make a reasonable return,” said Peter Rose, a spokesman for Blackstone, which owns roughly 41,000 rental houses nationwide. “There was a moment in time where it made sense.”

Among the 20 firms buying the most California real estate since January 2012, purchases are down more than 70% compared with last year in each of the last four months, according to DataQuick. At the 20 biggest foreclosure buyers, including arms of Blackstone and Colony American Holdings, purchases have fallen at about the same rate.â€

As we have said big money is not dumb and the numbers just don’t work anymore. However the herd is chasing the past trend and house lusting buyers are always a part of the California market, come boom or bust. But for the large part of households in the state, many are simply looking at renting even if they want to buy based on current home prices and incomes. This isn’t 2006. You have to document your income to buy. Unfortunately the pool here is not as big as some would like to believe – hence the gap being filled by big money investors.

The assumption is that somehow, we have this massive hidden group of people ready to buy. The data shows us something completely. You have a small group that is looking to buy in very targeted markets. Yet the state overall is facing some bigger issues when it comes to housing affordability. Many boomers have underfunded retirement plans and a large part of their money is locked in their golden sarcophagus.  I’ve seen it argued that people should forego retirement savings to stretch and buy a home. Some then argue that a reverse mortgage is fitting but now you are eating into any wealth you would pass onto your kids. These arguments are prevalent in California where real estate is a religion for many.

The market is changing and we will see how things go in the typically hot spring and summer months. The weather argument can only go so far. Canada doesn’t exactly have beach weather and they are more manic with their real estate. Other factors are at play here. Most of the e-mails I get are from folks in their 30s and 40s (many dual income high earners) running the numbers and wondering if buying is really a good bet. For some it is if their income is stable enough. Yet some plan on having a family and losing one income for a short period followed by the high cost of good childcare here in California. Plan on sending your kids to college? Not exactly getting cheaper there which means putting money away unless you want your kid deep in student debt.

The flood of boomers selling their homes isn’t going to happen. First, many have kids coming back home. Second, many have no desire to “downgrade†their living situation. The only way to capitalize on the golden sarcophagus is to go where housing is more affordable. From the people I’ve spoken with they have no desire to leave. They can’t even imagine going from L.A./O.C. to the Inland Empire which is less than a one hour drive. It is interesting to hear from some when they say “if I had to pay current taxes on my current home I would be priced out!â€Â So basically what is being said is that they no longer have the income makeup of those living in their current area yet enjoy all the amenities of living in said area (i.e., schools, safety, etc). For example, in Pasadena you may have someone paying annual taxes on a property being assessed in the $200,000 range while next door someone is paying $1 million. So you have someone paying $2,000 a year or so while next door someone is paying $10,000 and more per year for the same benefits (5 times more for a similar property). You don’t see much of this across the state thankfully but it is prevalent in these tiny niche markets were dual income professionals are looking to buy.

Investors? You already got their perspective above and it is unlikely they would flood the market (especially if these are sold off to investors as income streams). Slowly inventory is rising and prices are stalling out but that does not erase the current trend. The bigger picture shows this: a growing renter class, a high number of lower income households, and a smaller group of people able to afford in certain areas. Prices are likely to correct based on the current trend but looking at income figures I doubt this is going to open up buying opportunities for most households in the state. Welcome to Feudalfornia!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

93 Responses to “Welcome to Feudalfornia: the golden sarcophagus and the investor. Acceleration to price out masses.”

Housing To Tank Hard in 2014@!!!!

Housing tanks is hard! they don’t fit in a normal 2 car garage

LOL from another Cali appraiser

Housing To Tank Hard in May!!!!!

Can you narrow it down to at least a one week window in May? I’m looking to short some stocks here. Thanks.

Jim Taylor predictions are for entertainment purposes only…

Off topic but related to our messed up state of Kalifornia…

My girlfriend suffers from bipolar disorder (that is well documented) and had a manic episode. She tried to exit the car while I was driving and we had a tussle while I had to restrain her. The fascist police decided it would be best to arrest her and the DA charged her with domestic battery against me against my wishes and in the face of zero real evidence. While fighting this I am forcibly separated from my loved one by the state.

This is what we’ve devolved to. People like John Corzine walk free while mentally ill people are targeted as easy marks by prosecutors to pad their conviction rates. Yet we can’t keep these innocent people in jail because there’s no room or money (No matter what you think of Moonbeam he deserves credit for turning down the LASD request for 500 million in prison funding)

We’re not just in a Housing and Credit Bubble. We’ve reached “peak society”. Our entire system of consumption and human interaction is about to undergo a forced revaluation and reorganization. The human and monetary cost of maintaining this corrupt system of consumption, credit and incarceration (they are all linked) that empowers the ruling class can no longer be paid.

Sounds like you need to come on over to Texas. Texas is a free Republic. We do not take kindly to the government messing with our women or our business. California is a one party state, and under feudalism, remember the masses rose up and cut the king’s head off. Get out of town now before the poor folk riot and have revolution. Actually, the poor folk will vote more welfare(good by Prop 13 and tax deductions for interest and property taxes) that the Bay Area folks will have to pay for. Your society will slowly disintegrate like the city of the Angels. Who wants to live in a place that is slowly dying.

You Texan’s (the men at least) are a laugh riot – gov’t doesn’t mess with your women? Is that why nearly all the abortion clinics are closed now?

No thanks, your textbooks are twisted enough without you guys chiming in.

So in Texas if there is a physical altercation between 2 people after one tries to jump out of a moving car you’re telling me that the authorities won’t get involved? I am struggling to see how this is a good thing.

http://www.rawstory.com/rs/2013/08/19/texas-is-fracked-more-than-30-towns-will-soon-be-out-of-water/

Good luck with your property value when you run out of water. [Or when your well water has an uptick on heavy metals, etc. from nearby fracking]

http://www.msnbc.com/rachel-maddow-show/different-kind-stone-age?lite

Good luck getting to the hospital in a hurry, or good luck with maintaining a light duty vehicle when the DOT turns your paved road into a gravel road.

The conditions that led to the guillotining of the 1% in France were: the rich paid zero taxes whilst the poor and miniscule middle class paid all the taxes (there was no trickle-down effect), the state was broke, the state tried to tax the rich but because they had all the $ the state’s plan didn’t work, and there was terrible environmental damage happening in Paris where there was no well designed sewer system to take care of either human or industrial sewage (the state couldn’t afford to design a working sewage system).

It’s a shame that California has so many hate-mongering liberals like shellz. Maybe California would have one less bitter brainwashed liberal if shellz’s mother had only visited one of California’s many abortion clinics before giving birth?

No thanks shellz, your inane comments are twisted and we don’t need you and your neo-Marxist fascist cronies to constantly chime in about issues totally unrelated to real estate.

Shellz, it appears that when you look for a house, you look to see if there is an abortion clinic within driving distance. To each their own. My neighbors are right, they say that I should stop telling the California folk about the promised land and that they should stay in perdition.

@ Lost Name…

1) The top tier in France = 1% of 1% ==> They were scarce before the blade dropped.

2) Louis XVI blew up the royal accounts — financing the American Revolutionary War. (!)

3) Louis XV had ALREADY tapped the royal purse. The Seven Years War was a ‘Duesey.’

4) Everything came to a head when:

A) It was discovered that the royal treasurer had been running separate books. These were the Structured Investment Vehicles of that era. (SIV)

B) Very much in the manner of Freddie & Fannie, the royal house was borrowing (large) from commercial bankers — at premium rates — and kicking the debt can down the road — all the while trying to obscure the ugly reality that the crown was totally on the hook for said debts. Louis XVI was clueless — as was his court.

C) Upon the revelation that the bankers would no longer roll-over their paper matters came to a head. The King was compelled to call the French legislature together to raise taxes. In this, the French imitated the English. The monarch had wide latitude — until he needed more taxation. In the French case, the Crown had been able to avoid such confabs for about two centuries. (!)

D) ONLY UPON AUDIT did the French come to realize just how broke a monarch could be. Even at that late date, the King and his Court were clueless as to just how vast that kicked can had become. It would take epic taxation to clean up the books. Epic in the form of a WEALTH TAX upon even the nobility. (!)

E) While these matters had the nation in a total fiscal uproar, a bizarre plague infected the rye harvest. Contemporary accounts are now understood to evidence entirely accidental biological contamination of France’s primary food grain. You guessed it: LSD was contaminating the grain.

F) These bygone accounts were heavily researched by bio-warfare chemists during the Cold War. Their conclusions remained classified for obvious reasons. But, even as a civilian, one must conclude that it’s possible to spark a revolution by way of LSD contamination of the food supply; and you don’t have to afflict more than a trivial fraction of the population. Food riots promptly follow.

G) Said food riots brought down the government. They were the straw that broke the Bourbon dynasty.

%%%

The above sequence is STILL being pondered by asymmetrical warfare strategists.

It’s rather shocking just how far down the Bourbon road we’ve travelled.

5) The situation was resolved by taking away all of the Royal assets — and sacking the Crown.

The rest of the tale rapidly gets too deep and convoluted for even the most brief blog post. Suffice it to say: heads rolled.

@ Lost Name…

Since fracking is targeted at deep deposits typically thousands of feet deeper than the aquifer no-one is buying the alarmism — outside of the radical fringe.

The Pennsylvania squakers have been debunked: their water has been contaminated for years and years, long before drilling began. Nature, in all its randomness, has permitted natural gas to break up and through into aquifers — right on through the mists of time.

BTW, decontaminating drinking water from natural gas is idiot simple. There’s nothing to it.

The major components of natural gas are not bio-hazards. The concern is that they BURN. Venting them (from ground water) — at the trivial concentrations at issue — is not even an environmental worry. It’s been going on since — literally — forever.

The rest of the nasties should be easily purged by way of plain old water filters… the ones that use multi-stage filtration. These are already mandatory in most communities that use well water.

Phone Culligan. They’d be delighted to send out a tech rep.

One is foolish to drink unfiltered water. Think of the bio-contamination possible from septic systems gone awry. It’s not a national issue.

Correctives can be installed over a weekend.

Sheesh.

blert,

While I’m sure one with with vast knowledge of all things is merely exaggerating for effect, for the benefit of everyone else it’s worth pointing out that ergotism and LSD intoxication are very different. While 60s hippies on acid may have happily gone to protest marches hoping to smash the state those with ergotism would be far more inclined to lie around and watch their limbs fall off from gangrene – between the severe convulsions that is.

Y’all be careful not to chow down on rye fungus out there kids…

In Texas you both would have been shot dead by the cops. That is if you weren’t already dead from heatstroke, random gunfire, chronic pollution or an exploding industrial facility.

Sympathetic to your circumstance but wonder what this has to do with California, specifically. You don’t think the same scenario would have resulted in a similar outcome in any other state? Why is that?

Texas? HA! What single word did “Tex” utter regarding mental illness? Not. A. Single. One. “…messing with our women” is classic, though. Well done.

Mental illness is an underrepresented class of the “ill,” I have no doubt, since the condition still has a lot of stigma and stereotype…a whole 40 years after “Cuckoo’s Nest.” If the pancreas, stomach or heart can fail or have “defects,” why can’t the brain? Of course it can.

I’d weave in drugs into your call for incarceration/prison reform. Many dependent on drugs suffer from mental illness. Catch the crack, catch the crook says our system. Problem is, the person on crack is oftentimes suffering from mental illness. Crook goes to jail, mental illness doesn’t get addressed.

I’m pretty open about being in therapy and on meds to treat long-term depression and anxiety, and I remember back in the 90s, I’d have security people at work asking if I was getting any grief from the government about my clearances. Great; the security people were scared to admit that they were in therapy or on meds; worse, some were just scared to seek treatment. As usual, the government doesn’t care; they just want to know. If you’ve spent time in a facility as the result of a court order, they care, but I need to point out that a cop putting you there because he didn’t know what to do, that doesn’t count — it has to be on the other side of a judge’s order.

In any case, mental illness is coming out of the closet, and it’s rapidly becoming “decriminalized.” The bigger problem is with your family and friends, who may think that it’s a sign of moral weakness. No, it’s not. I like to say that I can absolutely get a note from my doctor stating that I’m sane; can they?

Dfresh and LAer this is a CA issue because our lovely Prison Workers Union along with the Sheriffs and other law enforcement have a disproportionate lobbying influence vis-a-vis other states. Combined with our perpetual budget problems the “Justice” system is one of the least just in the country.

Why Do you think rolling a red light is a minimum $525 here but $75 in North Carolina? Why do you think it’s $5 a call to a loved one in county jail? Why are regulated people who make small mistakes like disorderly conduct treated with the same disdain as hardened criminals by our DAs? It’s not a matter of police getting involved, it’s HOW they intervene and in CA (and NY+Others) it’s about arresting people and meeting quotas. Sure this happens everywhere, but it has reached insane levels here.

To all reading I hope you never have a loved on ensnared by the system. But if you do call an attorney IMMEDIATELY. It’s a couple thousand dollars well spent as the “justice” system has one goal, to incarcerate as many people as they can. My girlfriend should be home with me right now. Instead her illness has her jailed without proper care.

Is that your idea of protecting and serving LAer? 🙁

Nihilist, I’m so sorry for what your girlfriend is going through. Even back in PA where the cops did not know how to treat the mentally ill, you would not get charges pressed on you like that. You would get sent to a mental hospital to be stabilized.

Does she have a psychiatrist or psychologist at all? They might be able to intervene and put her in the hospital, where she needs to be. Someone who is that manic needs to be helped right away.

I don’t know if me relating to you helps or not, but I’ve already had my time in the mental health system in California. I had to go to free clinics because I couldn’t afford anything. Needless to say, I will not be going back. They literally toss the homeless in and out of those places in 5 minutes, and the “professionals” are horrid.

Even in PA, I could get decent help. The poor had places to go (at least near me) and they encouraged you to seek help. Over here, I’m too afraid of the police to even attempt to go to the hospital when needed.

I wish the best for you and your girlfriend. I hope she gets help SOON. I hope you can get her a good lawyer in the meantime…

Thank you very much for the kind words CeeCee 🙂

Our lawyer is already filing a motion to withdraw her plea as she was obviously not competent. Unfortunately that will take a couple of weeks to get approved while she sits in the medical word of the county jail awaiting approval of her medications.

It’s a long story as far as her therapy goes… She’s in exponentially better shape than when I met her but we were still stabilizing things as far as medications and doctor visits. With any luck she’ll be back in my loving arms in a couple of weeks as there is no evidence to support the charge and she is now getting REAL representation! My sympathies truly go out to those mentally ill people who have no one to advocate for them… RIP Kelley Thomas

housing to tank or housing to boom in good school districts. either way CHILL

Used to be you had to pick 2 out of 3: house, kids, retirement. These days it’s looking more like just 1 of those is an option for SoCal. If you want 2 or 3 of those, look elsewhere. All 3 of those provide both stress and peace of mind simultaneously, require a ton of work, and can either pay off or blow up in your face. I’ve got the kids and retirement things going. The house part is a nice to have at this point. But most likely would require a move out of state at this point. I know a couple who got a townhouse in LA after putting in a total of 15 offers and getting outbid by all-cash buyers. Thanks but no thanks.

“(LA Times) These are income properties for us,â€

I can’t speak about the intentions of the corporate investors, but as someone who can be described as Mom & Pop, or a cash flow investor, that quote sums it up. Why would I want to sell? These houses were purchased for income, and I want this income to continue for the foreseeable future. If I pass this legacy down to my eldest son, he can continue to live off the fiefdom.

So if they don’t sell they still have to compete in a market of dwindling income and increasing rental inventory. This situation will only be exacerbated by the shadow inventory that will hit next year (see the foreclosure spike from a couple of months back) as for the generational wealth idea those death taxes will require some refinancing of the properties further eroding tax rates.

I’m skeptical of a neon serfdom future. If we go to far down the path were on you’re looking at a socialist revolution in California. Proper 13 would he terminated at the polls because their wouldn’t be enough property owners left to vote in favor. I wouldn’t be suprised if some type of split roll legislation gets passed in the near future. We still have some semblance of a democracy (despite the Supreme Court’s efforts to undue it via $=speech) and the people are kinda fed up. The Real Estate Industrial Complex is gonna have some tough going if there are no proles to actually live in the properties.

Boy, you belong in Texas. These liberals on the westside think you don’t belong here. Time to leave this place(Greece) and come on over to the Free Republic. As these articles on this blog imply, you don’t have a future in a state that is going the way of Greece. Flee, leave while you can, before Texas pulls the welcome mat. Already the folks in Texas want to stop me from communicating with the California folk. They don’t want to become like Colorado, a state where the California refugees went and then changed it for the worse.

Nothing against your state Tex, but no thank you 🙂 I have close family that takes medical marijuana to desalination with a debilitating condition. Drug laws in Texas are draconian by every account I’ve read. I’ll wait for the cyclical worm turning in my state. Luckily we’re to broke to keep putting people in jail for stupid victim less crimes. I believe in the principal of liberty so I prefer the state whose government is collapsing. Suits me just fine.

NihilistZerO , looks like you would like living in the Emerald Triangle. In Mendocino, you can get yourself a place and do the Lord’s work. Your girlfriend would fit in. Everybody learns to mind their own business, if you know what I mean. The Google, The City people are buying in the Triangle. But not enough to jack up the prices in some of the areas.

I have thought about that statement in the L.A. Times too. I think corporate investors don’t realize that many people cannot even afford to pay rent anymore. For example, I have a friend that shares a one bedroom apartment with his brother. They can’t afford a 2 bedroom apartment, so they hung a sheet on the ceiling somehow to make a “wall” and made it their “second bedroom”. The brother that has the real bedroom is paying his share of the rent with his school loan money while the other brother already graduated and has an $80,000 loan to pay back. Most of my friends still live with their parents and are in their late 20’s or early 30’s. Many of these parents are paying their children’s bills. It’s sad. The point is that a growing number of young people are going to find ways to improvise on paying rent whether it be by finding more roommates or mooching off other people. I foresee these corporate investors realizing their isn’t a lot of demand coming from people on a place to rent. Just my opinion.

“I foresee these corporate investors realizing their isn’t a lot of demand coming from people on a place to rent”

As long as there are people thinking that there is no life outside CA, people will go to extremes (like you said) to provide that cash flow for investors. Like the Doctor said: the investors are smart and they take advantage of people with tunnel vision. If they want to be a slave in CA rather than free in the big country out there, let them be.

Like it is often said – people have choices. It is their choice to be slaves in CA. Nobody keeps them there by force. If it is “cool” living the SoCal lifestyles, then it must be cool being a serf. If it becomes “cool” to think outside the box, then they will be free.

There are plenty of reasons to sell. I can’t see your portfolio, but it may even be a wise financial decision. A good portfolio is balanced and you wouldn’t want to have all your eggs in one basket. You should hold a certain portion in stocks, cash, bonds, real estate, etc.

House values are high right now. If you sold you would free up a lot of money. You could re-balance the house cash into other investments that will probably outperform housing. Good luck with the son thing. I am sure he is a hard work and will appreciate all you have done for him. Though he might need to move to leverage his skills in a work venture and he can unload that house.

Bingo, Paul. See my post further down regarding mom and pop investing. And Nihilist, some people are lucky enough to have positive cashflow in virtually any scenario, as long as the rent covers the meager property tax courtesy of Prop. 13, insurance, and repair/maintenance which are generally negligible. I’m talking a few thousand per property per year at most, versus rent rolls at minimum ten times that and usually much higher.

Death taxes and refinancing? That comes from poor financial/estate planning. Very easy to bypass, defer, avoid etc. any estate/death taxes and property tax reassessments.

You simply HAVE to be young, very young.

Family squabbles mean that it’s a RARE situation when the heirs can agree to a tax clever real estate gambit.

The amount of Prop 13 tax advantage that actually gets passed on to the next generation is a JOKE.

To top that off, most people would rather go to the dentist for a root canal than become a one house landlord.

You’re obsessing on a non-problem.

The PRIMARY reason that real estate is moving out of sight is big government.

It needs taxes at every level: on all property, on all income and on all retail sales.

In this manner, big government cures a society’s ills in exactly the same manner as an sixteenth century physician — bleeding his patients to improve their humours.

Such malpractices went on for centuries. So much for humanity getting wise.

It is now a question of when the massive inflationary tsunami will completely obliterate the capacity of the existing small property owners to pay their bills and transfer all wealth to the ruling plutocracy.They don’t want you to be productive anymore,because they don’t really care.They just print the money and buy you out through their proxy shell companies.

“I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”Thomas Jefferson

Very Serious People have been predicting Weimar- or Zimbabwe-level inflation for a few years now. Instead, we have had inflation between 0.1% and 3% for the last seven years: “http://www.usinflationcalculator.com/inflation/current-inflation-rates/”

What’s your prediction, John? When (what year) will we see US inflation of even 5%?

Care to make a wager? And don’t resort to “But everyone knows that real inflation (“core inflation”) is higher than the feds say it is – milk, gasoline, twinkies, whatever are have gone up a bunch, and that’s what most consumers spend a lot of money on.” The Billion Price Project says that’s false:

http://bpp.mit.edu/usa/

Thank you for referring to a well documented source like the Billion Prices Project. The ShadowStats “all government data is a lie” conspiracy meme is strong around here.

Stuffing your terms into another’s mouth must provide great satisfaction…

But I’ve not read of a single scribe predicting the horrific chaos of Zimbabwe.

My grocery bills now stand as impeachment of your banal optimism and the Billion Prices crew.

I don’t believe for a second that your MIT buddies are adjusting prices for product sizes — not withstanding their claim to do so. They’d need a massive clerical team at this time.

Instead, they’re using a ‘bot. That’s all.

The exponential ramp in EBT, SSDI, and all the rest are evidence of great economic stress.

Debasing the unit of account, the currency, is a certainty.

Survival in such a time requires being on the right side of the central governments economic abuse.

If that is true for you, then you’re numbed from the pain. Lucky you.

I have no idea where we get hyperinflation from in our current economic environment. Just because the Fed “prints†money that never gets into the economy (aka blert’s favorite term velocity) does not necessarily lead to inflation never mind hyperinflation. Price increase on some goods and or services does not mean that you are in the throes of currency devalued inflation. I believe we are witness to a falling standard of living which appears to the man in the forest as “inflation†when in reality their wages are not increasing at the same pace as the price of the goods and or services that they have become accustom to. The goods and or services start to crowd each other out causing the standard of living to fall. I really see no way to get inflation without wage inflation aka more money in the hands of consumers. It is true that TPTB would love to inflate/“grow†our way out of the current debt crisis but I am not convinced that their monetary “printing†experiment has really created any real inflation. Note to self. Giving more money to bankers does not create more economic activity…

Blert is correct, MIT bot program doesn’t look into packaging at all. I can guearantee inflation is here, I have kept every grocery, gas and costco receipt along with all utility, water, garbage bill for last 12 years on a spreadsheet….

that 1\2 gallon of ice cream was so 2004…good luck finding that one…the only way for home prices to rise from here is a serious case of wage inflation….without it, were just looking at a fed/govt/wall street price fixed housing market. No different than 20 years of libor rigging. I have the cash to buy a second home in gold country…I will wait patiently as housing has become a day trader like game. Right now day traders are being wiped clean by the big houses, soon the home buyers will get the same. Count on it…the system was setup to facilitate it.

So let me get this straight. You need a blog to tell you whether or not the things that you (or maybe not you because I cannot speak on your behalf) or others use on a daily basis have gone up in price? Then here are two blogs you might be very interested in:

http://bigfootevidence.blogspot.com/

http://lochnessmystery.blogspot.co.uk/2013/07/the-latest-nessie-pictures.html

I have two words for you DHB. Asset Bubble. This reminds me of past lives when folks would do all kinds of logistical acrobatics to rationalize a non rational environment. By definition asset bubbles are irrational, any attempt to explain or rationalize if futile…

no it’s not, lol

Knock down those SFH’s and put up more townhouses ala Europe: more energy efficient, less costly, helps overpopulation/lack of inventory, etc.

The only flaw in that is increased housing density requires a better public transportation system than most American cities have.

I agree it’s desirable, but you’d need more infrastructure changes than just in-fill.

Actually dense housing is already in the works. Check out CA SB 375. It’s a master plan for sustainable communities (which includes better public transportation). Let’s see how long we have to wait for it to happen…

You’d need to radically adjust zoning and property laws. Real European style townhouses butt up to the sidewalk – no 15 foot mandatory front yard bullshit. The biggest hurdle to this is US consumer culture – we need big houses to house all of our stuff. The concept of making do with less is anathema to most Americans.

@bler_not_blert – public trans is a result of better housing development design and not a prerequisite for it.

It can be, but it’s more chicken/egg in my opinion. You really need progress on both simultaneously, and at the least you need to have a ‘plan’ for transit infrastructure.

It’s not unusual for existing transit to not address current issues, and political opposition to raising funds to expand service is hotly contested. It’s a bit optimistic to assume you can in-fill and rely on transit to emerge to meet those needs, particularly if you’re looking at light rail or any other system that would need a dedicated right of way.

If you wait until after in-fill is in progress, there may be no right of way available, or the cost may be insurmountable.

Ugh, you’re advocating treating a symptom of overpopulation rather than the cause. The cause is too many damn people, period. Let’s fix that.

More people consuming more shit is exactly what feeds the growth monster the status quo needs to survive.

Your cure has been applied in the past.

Devolved slumming.

THINK.

Did anyone, ever, build slums, ab initio?

Slums devolve by splitting SFH into double, family houses… and beyond.

And, of course, you’re intending this compression for “the other guys” — never yourself.

The people buying now (exclusive of the people rich enough to not care about how much they spend on a house or if they lose money on a house) and largely since the most recent crash in 2007-2008 (depending upon where you live) are relying pretty heavily on the greater fool theory. I sense that we are not only at another peak in terms of a housing bubble, this one is substantially more structural that previous bubbles. Meaning, a recovery (from the as-yet bubble bursting) is nowhere to be seen on the horizon. Given all of the economic indicators discussed everywhere (no jobs, sending jobs overseas that aren’t coming back, public and private debt beyond imagination, crooked banking industry, etc.), I think we’re headed for a real blaze. I have never been much of a doomer and am certainly no “prepper,” but as I see it, all arrows are pointing away from buying anything for the foreseeable future unless I lose my mind. I don’ think there will be enough greater fools in the future…maybe we have hit “peak greater fools”?

You should come up here to the Emerald Triangle, truly a land of bliss, and we raise the best stuff as you know. I am not a farmer(don’t own), but a farm advisor. Doing the Lord’s work. Don’t need to be a prepper up here. This is truly God’s country.

The one variable that transcends all known statistics and median incomes is the fact that far more people – possess far more money – than anybody realizes. And BTW, i also saw this as far back as the 1980’s.

Originally the liquidity trap

(free reserves for the banks ‘

in lieu of loss taking) meant

stay away for investing in debt

(as soon as rates rise, which is

all they can do from nominal, it

takes less principal to earn

comparable return.)

The logical adaptation of borrowing to

earn more on savings sometime not in the

distant future has been negated by

manipulated net interest margin and

the evidence of the liquidity trap being

long term self-perpatuating.

The latter is reinforced by:

those who SOLD the bubble now

6 years in to receiving noting on

their proceeds being progressively

less able to do what they properly

would have done (in a non-privatized

market,) which is clear the market.

value destruction: the cost to society

of carrying the banks’ dead weight,

pre-adjusting for other market growth/shrinkage,

currency buying power, etc.

Manipulated supply (Fed-assisted controlled

release of delinquent inventory, facilitated

by MBS purchases) means youngsters living

with Mom/Dad longer plus more homelessness,

the essence of the difference between

demand and need.

It’s really substantially dubious (my view)

that “prices have risen” in the manner

most think.

http://pages.citebite.com/o2c0d2e1j0mlb

http://pages.citebite.com/d1i8e3n1t3rpv

Keith Jurow Released

Partial Free Access,

“The So-Called Housing

Recovery Is Coming

Apart”

http://www.keithjurow.com/excerpt-from-issue-18/

But bankers have bought the adversity and

now apparently are expecting more delinquent

inventory to start appearing.

http://www.doctorhousingbubble.com/california-home-real-estate-inventory-up-cash-sales-percent-of-market/

Formatted like a poem and as difficult to read

Dude it’s the internet. Boil it down to a ten second video clip. Ok 15 for Instagram

Ie. housing to crash hard in May. Texas sucks. UConn kicked butt.

I have yet to see mentioned in any of these articles the reason for the investors like Blackstone et al. the Federal Reserve put a special program in place about 4 years ago that the banks could sell large vats of foreclosed homes to investors, large institutional investors , the investors must hold the homes as rentals for at least 5 years. They can renew that for an additional five years before they are allowed to sell the properties so this manipulation was put in place by the Federal Reserve to try and save the market. And it did to some extent however it is nothing like a free market. If we had a free market housing prices would have experienced deflation to the point where you could buy a house or a sandwich. So they saved the market unfortunately not for the regular person.

You are not too far off regarding the sandwich versus a home. That did (and has) come to pass in Detroit and other parts of the rust belt due to the perfect storm of economic and industrial downturns, globalization, rampant tax and spend out of control, huge population exodus resulting in far too much excess inventory versus nonexistent demand.

I’m seeing a few more houses showing up for sale in my little whitebread corner of Eastern Ventura County than in previous years. Interestingly many of these appear to be those who’ve been stuck underwater and now sense that prices have risen enough for them to escape. As a result the asking prices appear to be “optimistic” at best – and by and large the houses languish for months. In the midst of this I see the occasional house that I’d judge to be properly priced (typically about 10-15% less than those others) that gets snapped up in a week or two.

What I wonder is how long these underwater hopeful sellers can hang on. Evidently they have assets as they’ve waited this long to sell. If they don’t get their desired prices will they drop them enough to sell – or just pull back from the market for another few years to wait for some inflation?

This latter scenario is the one that frustrates me the most. Despite the proclamations of Real Estate triumphalists on this blog there were very few decent properties available during the “cheap” years of 2009-2012. I was out looking with cash in hand during those years and saw maybe 2-4 houses I actually would have considered buying (and lost out to insiders on those I tried to buy). In contrast there are that many “desirable” houses in my area of choice for sale right now, but they’re all priced at a level I consider unreasonable.

So we’re left with the same old stalemate: Plenty of houses are out there, but buyers (like me and many others on this blog) won’t pay the asking price and sellers have the resources to wait. And so we sit…

Hello Doc.

Rather shocking to me, this article from April 5th LA Times. “More homeowners are becoming first time landlords”.

By Tim Logan(the entire article is long, so I have pasted in the LA area comments mainly)

The real estate market has long worked on a simple system: If you want to buy a new house, sell the old one and use the equity for a down payment.But the last few years of low ownership costs and rising rents have some move-up buyers trying a new approach: Buy the new house. Keep the old one. And rent it out.

Real estate firm Redfin recently asked 1,900 prospective home buyers nationwide what they planned to do with their old house when they bought a new one. As you’d expect, the majority said they would sell. But 39% said they’d rent it out. In Western markets like Los Angeles that have seen big price growth lately, the percentage was even higher.

“We certainly didn’t expect that,” said Ellen Haberle, Redfin’s real estate economist and the survey’s author.

It’s the first time that Redfin has conducted this kind of study. But real estate agents and property managers say they’re seeing the same thing: a noticeable uptick in the number of home buyers who want to rent out their old place.

“We’ve had more calls in the last two months with situations like this than we’ve had in two years,” said Trevor Henson, managing partner at First Light Property Management in Manhattan Beach. “It is definitely on the upswing.”

If this trend holds, it could mean even fewer homes for sale in an already tight market. But for a certain type of homeowner, becoming a landlord could make a lot of sense.

Rents are up, having climbed in each of the last three years to now average $1,435 a month in Los Angeles County, according to USC’s Casden Multifamily Housing Forecast. They’re expected to climb nearly 4% more by 2015.

Buyers who bought at the bottom of the market in 2009 got a bargain. Then came years of opportunity to refinance into record-low interest rates. That means many owners can rent out their home for more than it costs them each month, even with taxes and other ownership costs figured in. With the tenant covering the note, they can build equity — especially if home prices continue to rise.

“It’s a market-based decision,” Henson said. “They know they can get really high rents right now. If I’m locked in on a 30-year fixed [mortgage] at 4%, and if home values are going up, it can make a lot of sense.”

Many of the new landlords are affluent and financially savvy, Haberle said. They’re not necessarily in it for the long haul, but they see a chance to profit right now.

“These amateur landlords aren’t people who are doing this for a living,” she said. “They just kind of happened into this opportunity.”

Vanessa Ginn, president of Platinum Property Management Group in Sherman Oaks, said she’s seeing a lot more people considering the idea and looking for help. But being a landlord has its challenges, including fair housing laws, tenant screening and the potential for costly repairs. It can be particularly difficult for first-timers or homeowners who move out of town.

http://www.latimes.com/business/la-fi-first-time-landlords-20140405,0,4909586.story#ixzz2yDxi1ARX

Another spot on brilliant analysis of the data from the good Doctor. And I absolutely concur with the anecdotal evidence regarding baby boomers and elderly having no interest in relocating – with weather this nice and your property tax rate being one tenth (or less) of the going rate, and with the property usually more paid off (if not fully) than not, would you make a different choice?

As a personal anecdote, I will share my family’s situation. Doc gives an example of a long term owner in Pasadena paying $2K per year in property tax while their neighbor pays the current going rate of say $10K per year. Even the $2K per year figure is ridiculously high. My parents own (held by various LLCs/trusts etc.) a few properties in LA City/County. As noted by the Doctor, they are “locked in” at a ridiculously low property tax rate courtesy of Prop. 13 and most have been so since Prop. 13 was passed back in 1978. Forget paying one fifth of one percent of the real property value per year, they are paying less than one tenth of one percent of the current property value per year, and that is including the added assessments, school bonds etc. I’m talking property taxes of $800, $850, $900, sub $1000 PER YEAR (two payments annually of $400-$500 each) on these properties that could sell on the open market anywhere from $750K to over a million a piece.

Meanwhile on my primary residence, bought at/near the post bubble bottom end of 2011, I am paying over $10K per year, although I guess I should be grateful for Prop 13 as the rough estimate is that its “value” is up at least 50%, probably over 66%, from when I bought.

I once met an elderly woman that had a house in Redondo Beach. She complained about her property taxes being $1000/year, even though she was only a few miles from the beach. She also had a huge pension, social security, and stocks.

I imagine people who don’t have a house and are younger would laugh so hard at that story, as they would have to fork over $750,000 back in 2011 for the privilege of owning in her area.

My family is in the same position, almost to a T. Most wondered why we hadn’t picked up a cheap fixer as a first home (as if we were saving up for some ‘perfect’ first place). All of them haven’t bought, or shopped around, in over 25 years.. it’s like explaining palm trees to an Eskimo.

Thankfully that L.A. times article came out as they admitted that what I had been saying (ok, sometimes yelling) about the housing market for the last year and a half was in fact correct.

Jim Taylor is right. http://www.zerohedge.com/contributed/2014-04-07/hot-air-hisses-out-housing-bubble-20-even-two-middle-class-incomes-aren’t-eno

In reply to NihilistZerO – I completely agree with you in regards to the prison industrial complex especially in CA. We’re all victims of that and there’s no way to stop it. But I think Texas’ lock ’em up and let God sort ’em sort mentality is probably worse. In fact, the racial biases and civil judgements in Texas’ legal system are far worse abuses than ours.

In regards to your gf, think about the cops perspective. They get a call and if they don’t do anything and then later something worse happens – someone gets hurt or killed. What would the community response be if there was this situation and then you or your girlfriend got killed because they didn’t respond to the situation? I don’t think your gf should be in jail, but as a society we just want problems swept under the rug. Funding mental health services is something most people sadly don’t give a fuck about.

LAer let me make it clear for you. The cops came out. I was calm. She had already calmed down. We both clearly explained the incident and instead of letting me take her home they arrested her and charged her with battery though I was completely unhurt. Then the DA pressed forward with the charges in the absence of her having representation.

Quit making excuses for the fascist police state we’re living in. The cops saw the chance for an arrest. The DA saw the chance for an easy conviction. Justice had nothing to do with it! You seem like a reasonable guy, and when reasonable guys aren’t willing to see through bullshit we go down the toilet.

All it takes for evil to succeed is for good men to do nothing.

You spoke to the police without an attorney to represent you.

Don’t do that.

Especially if you haven’t done anything wrong.

Won’t make that mistake again Blert. In the moment I was worried about my girlfriend and was hoping they’d do some of that “protecting and serving” stuff I hear so much about 🙂

Had an interesting conversation with a brokerage firm today which shed some light on ALL CASH BUYERS. The Doc has mentioned brokerage loans in previous posts. It was interesting to hear it straight from the horses mouth. The broker described a client who has a 3 million dollar bond fund. The brokerage lent him 1.5 Million against it at 1.6%. He said the client was buying a property. I asked him what would happen if his bond fund dropped and he said the borrower would get a Margin Call and if he couldn’t make the margin call they would liquidate his bond fund. He said a lot of people are doing this. Nice…

Meanwhile, our Victorian charmer in Lincoln Heights just keeps a sittin’……

Now at a $549K ask, $146K off of the original $695K ask – a 21% discount

http://www.redfin.com/CA/Los-Angeles/2125-Vallejo-St-90031/home/6945511

First listed on 10/26/13. I’m surprised they haven’t played the delist/relist game on this thing.

But yeah, I’m sure this is simply an outlier, not a canary but rather a cherry picking, nothing to see here folks.

So you own it or what? Close to Phillips for a French dip. But a mexican under every rock.

??? Xenophobic, yes, but that last line just made me laugh. Reminded me of “a chicken in every pot.” Perhaps the new California Tourism Board’s slogan can be “Visit (or move) to California. A chicken in every pot; a Mexican under every rock”

Higher interest rates will pop this bubble in no time. But FED, Wall Street, Banks and the rich are very afraid of higher interest rates. Higher interest rates will bring all prices back to earth, will destroy speculators. Raise the interest rates and bring down home prices, rents, food prices, medical expenses….everything will be lower.

Why are lower prices not good for Americans???????????????

They are only no good for the Rich who own all assets that value would be cut in half and more.

What we need is Deflation. Deflation is not your enemy. It would be painfull and it would hurt many, especially speculators, banks, the rich, our economy but it’s necessary medicine. We need to pop all bubbles, like housing bubble again so that Americans can afford to buy a house in their own country.

Remember even it will be extremely painfull and it would test your faith DEFLATION is your friend. Don’t let the media, Goverment and the rich tell you otherwise.

Deflation and depression would cut California home prices alone in half, maybe even 70% in some areas.

Raise the interest rates over 10% and run the default machine wild. Destroy all speculators, cut rent prices in half, cut home prices in half. At the end that is exactly what will need to be done. Do it now or do it later.

Japan has had ZIRP for how long, now? What makes you think interest rates will be allowed to go up?

Well they will have no choise but to raise interest rates once inflation shows is ugly head.

Today our economy is run just like Russians had it back in SSSR, by central bankers who think they have controll over everything. Few people @ the Fed think they can have control over our economy all th time. It’s pure insanity and they will lose controll one day over present insane policies they have put in place.

What are we supporting and cheering for today? We certainly don’t have free markets anymore. Our country looks like more and more as being run by Karl Marx.

Americans are getting priced out of buying a house in their own country.

How sad is that when you can’t afford to purchase a basic shelter for yourself and your family in your own country?

Another problem with high real estate and rent costs is that it kills our economy. People are allocating to much money for rents or housing, they have not much money left to support our consumer based economy.

We will never see any real economic growth in this country unless we cut home and rent prices in half so that consumer is able to support our consumer based economy.

Our country needs to re-set,we have created bubbles everywhere. We need to allow deflation and depression to do it’s job. You can’t have growth forever, nothing is growing forever except cancer cells and we know how that ends.

We need to POP housing bubble, student loan bubble, healthcare cost bubble, we need lower rent prices, lower food and energy prices, lower prices in general.

Raise the interest rates and run the default machine wild.

As I said before, do it now or do it later but at the end this is exactly what needs to be done. There is no way we will be able to avoid deflation and depression after this, we have bubbles everywhere that need to be popped.

Here’s the thing, Bub. The Yen has not been the world’s reserve currency backed by oil. In other words, the U.S. is not Japan.

I think the better question would be what does the Fed do during the next inevitable recession? With interest rates at zero and debt at economically crushing levels what tools does the Fed have to “stimulate†the economy in the next downturn? Given that the best the Fed was able to produce this time was a “recoverless†recovery, there is no real hope that any new tools will have any real effect on GDP. Japan is our future however Japan has the luxury of Japanese citizens holding the majority of their debt. The US, not so much so, it is going to get harder and harder to control the bond market with funny money.

What?, we’ve *BEEN* in the “next downturn”, “next recession”, etc. since the RE meltdown and subsequent credit crisis. The FED will continue to use the most powerful tool it has and has been using like mad – propaganda via statistical manipulation and outright lies.

wizard of oz,

many years ago fed economists chastised the bank of Japan on their interest rate polices and how it was hurting GDP. growth, savers etc. We just followed their well studied course but added 4 trillion in fresh dollars to bailout bankers. Zirp is the worst policy of all. It actually reduces GDP as savers would use that interest income off real rates to purchase. It’s evil in design and favors only elites, wall street and bankers. The people who have rigged every market known to man. Their will be an epic fail and housing will be just a memory. A giant flash crash will wipe most people clean, its getting closer and if you think gold is expensive now wait until then.

if things were peachy, FASB 157-8 would be applicable. 6 years later, still under hibernation. If bankers don’t have to mark to market…either should u….

The game is being played. Most people are now a day trader mentality with little patience.. Patience will be key moving forward. Disclosure, I have a flat in the city of San Francisco. It’s not worth the price all these real estate people say it is, as an underwriter I can tell you the pool of buyers is minimal at best. Bubbles are not what I want, I like reality and reality is a SOB…get ready for that son of a bitch showing up soon..

The banks have got rid of their real estate owned and the bad mortgages. Now they can make money with higher interest rates, which of course, will cause house prices to go down.(also, the investors are starting to unload before the rush to the door). It is all about the banks. House prices went up so the banks could unload. Now that this is done, it is time for interest rates to go up. The country is run by the banks.

The minutes were just released. The party continues with low interest rates and the markets rally. People make money on Wall Street and use it to buy property. Of course these peeps are the top 10%.

Blert is accurate is his assessment. The greatest tax of all is inflation the hidden tax.

I’m a single father of two paying out over a third of my income in taxes even with my mortgage interest deduction. Frankly I don’t want to make more money because the sum I give away now is revolting. Not to mention our Defense that it is largely spent upon is a supreme failure. I was born purportedly into the greatest nation on earth, turns out NAFTA, HD T.V. ,cheap goods, and face book reduce greatness. At least I can impart unto my children that we know a loving god that has overcome this world.

@805 Colin………Very true!

don’t forget were fast becoming the dumbest people on earth…sheeple of america are just that…flocking and always ready to be sheared….

the banker pigmen like wool coats

Are “experts” really saying you should delay retirement savings in order to buy a property? That makes sense. Especially if you enjoy eating kitty litter.

Ha! Meant *cat food.

Bay Area insanity continues.

A huge house on a hill, with turrets!, view of the Bay. 4 bed, 3.5 bath. Crumbling inside and out. (walking up/down inside/outside stairs a true adventure.) Even staging couldn’t hide the awful condition. I figure it would take at least 1 million just to bring it up to code and reasonably modern condition (am not talking granite kitchens or deluxe bathrooms). Asking price was $817K. Sold for 1,080,000. On the day bids were due.

Another house. Different neighborhood. 2 small bedrooms, 1.5 bath. No view. good location. Sewage hookup problems. 2nd bath plus two add-on rooms never got permits, not up to code (poorly constructed, leaks). Needs extensive plumbing, electrical, seismic work. Windows in very bad shape. Termites. Fungus infections. Asking price was $650K. Sold for $840K. On the day bids were due.

I figure the first house was bought either by a developer who plans to do minimal fixup work then rent out to students or a Tech millionaire who is willing to put 2 – 3 million into it to create a castle on a hill (the potential is definitely there for somebody with money to burn). Who was willing to pay $840K for the second house? Have no idea.

Please note: rents in this area are very high and apartments are hard to find. Two bedroom apartments average about $3,000-4,000/month.

Dr HB,

I would like to see a newsletter on how investors were able to buy properties before they hit the MLS. Why are they able to do this? Will this change? It’s not fair that they have this advantage.

Fed March Minutes released today:”The pace of activity in the housing sector appeared to soften. Starts for both new single-family homes and multifamily units were lower in January and February than at the end of last year. Permits for single-family homes–which are typically less sensitive to fluctuations in the weather and a better indicator of the underlying pace of construction–also moved down in those months and had not shown a sustained improvement since last spring when mortgage rates began to rise. Sales of existing homes decreased in January and pending home sales were little changed, although new home sales expanded. House prices registered a further notable rise in January. Mortgage interest rates and their spreads over Treasury yields were little changed over the intermeeting period. Both mortgage applications for home purchases and refinancing applications remained at low levels through early March. Financing conditions in residential mortgage markets stayed tight, even as further incremental signs of easing emerged. Housing activity remained slow over the intermeeting period. Although unfavorable weather had contributed to the recent disappointing performance of housing, a few participants suggested that last year’s rise in mortgage interest rates might have produced a larger-than-expected reduction in home sales. In addition, it was noted that the return of house prices to more-normal levels could be damping the pace of the housing recovery, and that home affordability has been reduced for some prospective buyers. Slackening demand from institutional investors was cited as another factor behind the decline in home sales. Nonetheless, the underlying fundamentals, including population growth and household formation, were viewed as pointing to a continuing recovery of the housing market. “

This is not say underwater sellers don’t exist they certainly do, but check sales of homes against public records you will see many sellers took a bath to get out from under in the last 9 months.

Now you see many more sellers who can afford the payments and won’t list. What is left you say, sellers who have listed their homes to turn a profit, bargain hunters check the records and see what they paid and if they are in trouble, when they see they can’t steal it they wait and wait. Thus a slow down.

Now in any market there are folks who need a house, along they come trying to get the dream, sellers would not take very low ball offer like 2008 they don’t have to, so a standoff is occurring.

Sellers will always look at a offer of course, I have been in this game a long time I see it everyday, sellers who are not in problems and just want a offer to live with are not getting it. Buyers want a steal and not willing to step up, because Uncle Harry got a deal in 2008.

Buyers and Sellers will get together eventually, the investor or I want 2008 back can just about wait till China because a Democracy before that happens?

Actually, 2008 looks like its just around the corner.

Leave a Reply