What will be the impact of cash investors slowing purchases in California? Large investor sales drop 31 percent year-over-year in California. 1.2 million homeowners underwater.

The market in California is starting to splinter off into two distinct segments. First, in lower priced areas the pullback of investors has caused inventory to steadily rise. In places like the Inland Empire there doesn’t seem to be any urgency to buy anymore. In less desirable areas of L.A. and OC you have seen homes sit on the market as sellers try to ask for delusional pie in the sky prices. This segment of the market is feeling the withdrawal of investors. The second segment impacts smaller prime markets and prices have reached new peaks in some of these areas. Sales are dramatically down but house horny buyers are willing to stretch their budgets to whatever a bank is willing to lend them. Investors are pulling back here as well yet heavy buying still remains. The trend is very clear and that is large investors are not buying as many homes in California. Year-over-year large investors have dropped their buying activity by 31 percent. This is a big deal given the razor thin sales volume already happening. When you run the numbers in many markets, you see many areas overpriced on a variety of metrics. So what will happen to the market as investors continue to pullback?

Investor activity slows down dramatically  Â

First, there has never been a year where 30 percent or more of all sales went to investors. That is, until 2009. Since that point, for half a decade over 30 percent of all sales in the state of California have gone to the “all cash†crowd. Wall Street was the first house horny buyer leveraging cheap rates in a lustful attempt to chase yield. This is how you have the odd mix of a falling homeownership rate in conjunction with higher home prices.

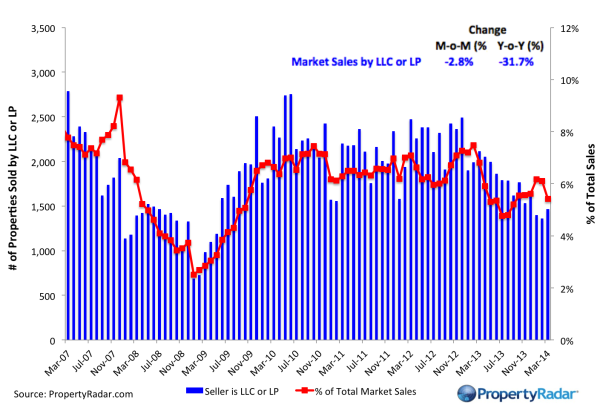

Some large investors seem to be pulling back from the California housing market and the sales data is clear on this. Year-over-year large investor sales are down 31 percent:

This is a big deal since investors have been a primary buying group since 2008. Also it should be noted that the above data will only look at MLS sales and not off the book auction sales which are a large part of the big money crowd. Some thought that once investors pulled back that regular buyers would step into the fold with massive incomes to purchase these high priced shacks. That simply isn’t happening. Inventory is building up across markets in the state. People continue to buy but people were buying well into 2007 when prices were clearly insane. Through the insanity, you are also seeing more homes having reduced price offers which in 2013 was an oddity in itself. As it turns out prices do matter and investors are running the numbers and don’t purchase properties based on absent minded mantras and “buying always makes sense†type of rhetoric.

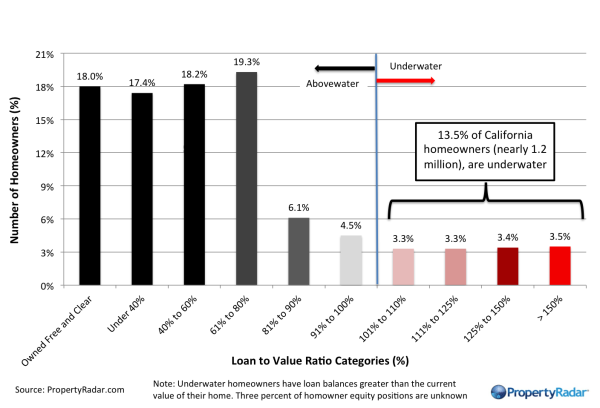

Running the numbers is important. You can ask the 1.2 million California homeowners that are currently underwater:

Or we can ask the hundreds of thousands in the state that lost their homes to foreclosures if running the numbers makes any sense. It absolutely does. So if that is the case, does the rise in inventory mean anything? Does the major drop in sales volume mean anything? Investors are voicing their opinions and good deals are rare to find like a diamond in the rough.

Inventory in the L.A. County area is up 15 percent year-over-year. In the spring of 2013 you had house lusting zombies loading up in minivans going to open houses as if they were following a rock star. You had families bringing in multi-generations to beg sellers to give them a taste of that sweet World War II built shack. The only thing missing was a t-shirt saying “take my money please!â€

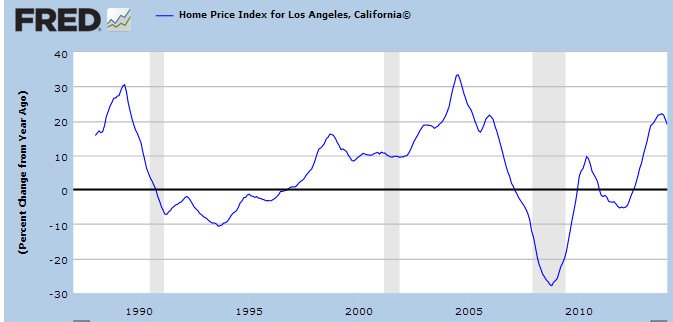

California is a boom and bust market. We’ve been booming nicely for a few years. Seeing enough of these trends over the years, the pattern is very similar. Sales slowdown, inventory picks up, prices hit a ceiling, and finally a correction. How much will prices fall by? Hard to say. Just like very few even saw the double-digit housing gold rush in 2013 led by investors, very few even think a housing correction is feasible in California. Currently the mindset is that the market will “slow down†whatever that means. The market is already slowing down, the numbers tell us this.

Those thinking that we will somehow go into a stable mode fail to look at history:

The one new variable that we have this time is the big money buying from Wall Street courtesy of low rates. The Fed is already telegraphing higher interest rates and big money is finding better homes for their money instead of single family homes for rent. One thing is certain and that is there is never a dull moment in California housing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

87 Responses to “What will be the impact of cash investors slowing purchases in California? Large investor sales drop 31 percent year-over-year in California. 1.2 million homeowners underwater.”

Howzing to go up fo-eh-vah!!!

only in good school districts ….. quietly waiting for slim pickens to ride the bomb into LA from mother russia

This post is correct on the divergence of the housing markets. Prime coastal areas continue to see price increases and frequent multiple offers.

Less desirable areas are having a problem.

I have never seen this occur. It seems as middle class home owners are falling further and further behind from a move up into a prime area. I don’t know what to make of this, but it appears the pattern will stay in place for a while.

Clearly, one is best to overextend themselves to get into the prime area. If you are unable to obtain the financing for a prime area, your next best option is to rent.

This seeming divergence happened at the beginning of the end last time. Less desirable areas started to see pullbacks, and everyone in the nice areas insisted they were immune. Undesirable areas are just the first dominoes to fall.

GenXer, at the 2007 peak, everything slowed at the same time. This time, multiple offers on coastal beach properties while little interest inland. This is very different.

Good Observation, GenXer

The bubble market actually toped out in the spring of 2006 and imploded in 2007 & 2008

“This time, multiple offers on coastal beach properties while little interest inland.”

I’d have to look at specific properties to understand you’re argument precisely, but I think Doc is right that the market is really bifurcated in most markets. You have the market for the households up to 150% of local median (which is strained) and you have the market for the truly moneyed.

Those numbers are now so far apart, it’s at least theoretically possible the two markets don’t directly impact each other if one stalls. It’s certainly possible to imagine a scenario where most property values fall but the top 5% or so don’t unless those buyers actually take a hit in the broader economy.

Of course, that’s the rub. Can the valuation of the bulk of homes fall without a ripple into the larger economy? In 2006-07 the bubble was nationwide, and RE was a big piece of what kept the economy firing after the tech crash. This time the bubble may really be limited to the coasts, and the midlands may continue to churn along.

“I have never seen this occur. It seems as middle class home owners are falling further and further behind from a move up into a prime area. I don’t know what to make of this, but it appears the pattern will stay in place for a while.”

It’s called ‘the transfer of wealth’ and it’s happening right now, in real time, right before our eyes.

The bottom fall out first.

Total BS. You must not be very old. Keep saying to yourself, “it’s different this time” if it is your equivalent of “Ommmm” but if not, you are going to need a reality check. And it’s coming, just as the good Doctor says. I was ready to buy in a nice coastal south OC area in 2007 and prices were in the low 900s (called “a steal” at the time). Didn’t buy. A few years ago I saw the same exact house for sale at $685K. This with an ocean view in a really nice area. Dude, nice areas tank too. I’d say you are going to find some people who haven’t tasted what you’re serving from your punchbowl. For those of us who have seen this before (numerous times), enjoy the Kool-Aid.

I looooove Koooooool-Aid!!! This time is different… Because rich “Red” Chinese will buy up “prime” areas fo-eh-vah!!!!

A single family home with an ocean view is usually very expensive … low 900s sounds far too cheap.

I think that the middle class is living in a dream where they think that they can afford more than is possible. This is obviously a result of marketing or even propaganda of the mortgage providers. It is already confirmed that people are overestimating their ability to pay mortgage. As a society, we should learn from previous mistakes and provide important economic knowledge to all people asap. If we don’t, we will see the same scenario again and again.

People don’t learn. That’s why a guy goes in for a quadruple bypass and the doctor says hey you gotta stop smoking and the guy gets wheeled out if the hospital and lights one up. There are plenty of existing AND up and coming morons buying the drivel that a lot of realtors are spewing. If you’re a realtor ITS NEVER A BAD TIME TO SELL OR BUY. Because no matter what you’re gonna get that commission if the sale goes through.

I bet the very same or people who got foreclosed on will pick up and try to get in that house to cash in on that equity ASAP. There are enough loons out there that will overestimate their purchasing power and screw themselves.

Rob, you are so right on about folks lining up right back to the trough after foreclosure. Check out any of the credit building forums (myfico, creditboards, city-data) and there is one person after another with tales of foreclosure trying to figure out how they can lever their way back in ASAP.

Across the street in the Pacific Palisades, a perfectly good 1900 sq ft home on 9,000 sq ft close to the village sold as a $2.2 million TEAR DOWN!

Not sure how they’re going to make money on that, but let’s see. Houses up the street at 6,000 sq feet are down to 4.6 million and no one is buying them.

This will end no differently than 2007. However, this time around, there won’t be a quick bounce back up. Just a matter of time, be it 1 year or 10.

One of the differences this time around will be the amount of TARP needed to stop the systemic failure of the markets. It will definitely be more than the $700 billion the first time around. It really amazes me how short the memory is of people willing to pay up for overpriced assets and how this time it’s going to be different. Everyone (housing bulls included) knows this will end badly. The sad part is, much like the first time around, the people that caused it will suffer the least as the general public will be the one paying the bill via loss of job, higher taxes etc…. As mentioned above, its just a matter of when.

Why would you need another TARP when the big banks aren’t at risk? Housing Bubble 2.0 served its purpose, the Big 4 banks exposure has been greatly reduced. No dead cat bounce this time. Math and fundamentals are coming back to residential RE. 2015=2008

Nihilist, surely you don’t mean BAC and Citibank? Look at today’s news:

http://money.cnn.com/2014/04/28/investing/bank-of-america-stress-test/index.html

BofA stock tanked because of their Math error. Interesting note about Citi failing the stress test also. This is not about the Math, but rather about what the banks are hiding and/or lack of ‘Mark to Market’.

Nil – “Math and fundamentals are coming back to residential RE. 2015=2008”

That is the funniest thing I have heard on this site!!! What? You are serious??? Math and fundamentals went the way of unicorns! They are in your fantasies but have little to do with “reality”. That is why How-zing will go up fo-eh-vah!!!

RE: Janum

The banks have moved enough inventory and hid the rest via mark to fantasy that a TARP is unnecessary. I didn’t say they were solvent, but you don’t need another TARP. Also the banks NEED prices to fall so they can start lending again. A stagnant market serves no one. As GG of Wall Street fame said “Bulls make money, bears make money. pigs get slaughtered”

RE: What?

I’ll assume you forgot your /sarc tag. But if not, how can you deny that market forces are beginning to reassert themselves? We’re seeing it all around. the FEd fought the invisible hand and lost.

Nil – you forgot “this time IS different” and “real estate can only go up because it is “real”” and “you gotta live somewhere” and “the new normal” and “the Fed is “printing” so we will have hyperinflation – just like Japan” and “rich “Red” Chinese will buy up all the “prime” properties forever” and “there is a lot of “money” aka “cash” aka “debt” out there” and “look at history 1987 – 2014 where everyone got rich with real estate” and “holding cash is losing money” and “where else are you going to put your money” and…

I will only turn off sarc when the bullshit clowns stop posting stupid bullshit. Until then this is the new me.

@Nihilist: Your comment was “Why would you need another TARP when the big banks aren’t at risk?”. My points are:

– Big banks are not as healthy as the feds would like (see the link I had posted)

– Big banks are BSing about the value of the properties they hold. They WANT prices higher to inflate their book value. Also they believe (wrongly obviously) that the larger loans will lead to more fees, more interest, etc. I think they are underestimating the drop in demand that has started.

– On a side note, I know that the Fed has signaled higher interest rates, but I don’t see how they will control interest on the national debt. I wonder, is there a plan in the works to pay off the debt soon before rates go up? The Fed seems to have painted itself into a corner, but they always seem to do the illogical thing to keep this mess churning.

Janum wrote: >> – On a side note, I know that the Fed has signaled higher interest rates, but I don’t see how they will control interest on the national debt. I wonder, is there a plan in the works to pay off the debt soon before rates go up? The Fed seems to have painted itself into a corner, but they always seem to do the illogical thing to keep this mess churning. <<

When the banks have offloaded enough of their debt, it sure would suit their own purposes (Gov's too) to crash the housing market, and write volume new mortgages at 5%+. Housing owned outright by older owners and property-investors, is very little use to the banks. There is no one paying the bank any interest on any debt.

Way better to force huge volumes of property back to the market, and write mass volumes of new mortgages on houses at 50% less than they're valued today. At just 5.34% that's double the principal back over 30 years for the lenders. Also great for Gov in taxes, jobs, and new buyers at much lower prices having a bit more money left to spend in the economy. Housing owned outright, and those who are equity rich, is NO USE TO THE BANKS.

It's going to be good times, apart for complacent older and equity-rich home-owners who haven't cashed in during this window. Inventory has been razor thin, all but rolled out away, but prepare yourself for a future tsunami of supply as owners, especially equity rich owners at super-bubble prices, panic to cash in.

And values are set at the margin, by as little as 1 seller and 1 buyer, and can have the same telling effect as it does when prices are shooting up on little volume, but for prices falling rapidly. I'm reading reports that buyer demand is ebbing away, after so many schemes and hype to pull buyers into the market at super-high prices. There could be a chasm in what remaining buyers are wiling to pay, and more so when sentiment changes. The window to sell as silly stupid insane prices is closing. Get ready for the house price cascade.

Housing to Tank Hard in 2014!!@

As chart shows, nearly 25% of CA “owners” can’t get out with a gain (after RE commissions). People don’t sell at zero profit unless a life event forces their hand. CA economy has stabilized, as has unemployment rate. These “frozen in place” owners will put a constraint on inventory, which will be a big factor helping keep a floor under prices.

Or, the 75% of house owners that can sell will over time leaving the 25% who can’t with ever increasing losses. The key is the younger generation with poor job history, low credit scores, no savings, and low household formation. If housing stays high forever, these folks will opt out and find non-traditional housing arrangements – communes, squatting, multi-generation housing.

The problem with the supply-informed price vacuum theory is that it presumes buyers don’t have other options available and that all suppliers won’t compete on price. Wake me up when there are no sellers.

“People don’t sell at zero profit unless a life event forces their hand. CA economy has stabilized, as has unemployment rate.”

Yeah, right. Constant rise in the cost of living and many/most good paying jobs in SoCal directly or indirectly related to the Stock Market/RE ponzi. Retail is cratering everywhere. If things are “stable” why are wages and consumption imploding. Even those who would take a loss selling may prefer that to a foreclosure.

Your thesis doesn’t jive with anything were seeing on the ground in the economy.

“many/most good paying jobs in SoCal directly or indirectly related to the Stock Market/RE ponzi.”

Many/most. Which is it? Kinda makes a difference.

If you mean most, you’re 100% wrong.

“CA economy has stabilized”

Toyota to move jobs and marketing headquarters from Torrance to Texas

http://www.latimes.com/business/autos/la-fi-toyota-texas-20140428,0,2881400.story#ixzz3099kLEqG

@ tired of the BS: You’re absolutely right. The local economy is stabilizing by flatlining. High paying employers are leaving. Too expensive to do business here. Doesn’t make sense anymore. Housing is pricing out business.

hmm,toyota is packing it up? makes me wonder….

I read this article (or maybe another version of it) but it states that the cost of being in CA was high. Yeah they brought up all this taxes and regulation bullshit again, but that wasn’t the reason they gave – it was high costs. It’s really about attracting workers. Schwab is moving workers out of SF. If successful companies like Toyota and Schwab have to pay workers insane amounts just to live comfortably, then something is messed up. Companies cannot afford their workforces in CA and that’s saying something.

As soon as I hear “…should keep a floor under prices” or anything similar, I know it’s an inflection point…down. Those who want there to be a floor, say things to convince themselves that it is true. It’s funny to watch this, like a slow moving train wreck. Some people will say, “the market is stable, we have a six month supply, which is the sign of a healthy market.” Well, as anyone knows, when you go from Point A (undersupply) to Point B (oversupply), there will be a point in time that you are in the middle of the two. I.e., on the way to oversupply, the number will at some point hit (and then pass by) “normal.” It’s like a broken clock being right twice a day. Let’s just see how long the supply stays at “normal” or “average.”

“There will be big gains!” changed to,

“Moderate gains, which is healthier for RE” which changed to,

“The market is stabilizing” and that changed to,

“Weather is stalling the market” which changed to

“It will stay flat because there is no inventory” and that is now changing to,

“It may fall some, but not in PRIME areas”

anyone want to guess what is next?

Reverse mortgage baby! Unlock that equity!!! Time to party!!! Whooohooo!!! What? You say you need equity to get a reverse mortgage? That is crazy talk. We need legislation that allows all home owners to have equal access to equity regardless if it is there or not…

QE didn’t work. The rush of cash is beginning to peter out without enough greater fools to continue the scam. Banks are solvent “yah” and bigger than ever “oops”.

2010s and we are still trying trickle down economics? Where is the wealth effect? “… calculations show that since the recession ended in 2009, households have spent 1.7 cents of every extra $1 earned in wealth http://www.businessweek.com/news/2014-04-17/wealth-effect-failing-to-move-wealthy-to-spend-cutting-research.

There will always be inventory. People will always have to sell for this reason or that. No one has to buy a particular house. Holding long may not work out for everyone. Buying “low” is only one half of the equation. My aunt sold out and got what she wanted before we saw a lot of discounting. Interesting times.

In my opinion, most buyers aren’t scarred to buy because they think housing is going to take a dive. Instead, they have crunched the numbers and they are only willing to buy at some limit. I feel that limit is below what many people think their house is worth. Big problem!

Economists and analysts are increasingly finding it difficult to explain and desperately trying to rationalize the notable real estate demand destruction trend without admitting that the past two years of housing market activity was largely driven by stimulus and unconventional demand, not end-user fundamentals. In doing so, they are talking in circles citing key metrics that contradict their statements. Of course, this is because instead of admitting that the past two years “is not what a durable recovery is supposed to look like”, they went all-in selling the 5 to 10 year dream and are panicked it’s ending after

2. This is just another instance of how similar this is to 2007/08…then they relented.

Sacramento CA Feb house sales the lowest in 6-years, down 18% YoY. Supply up 88% YoY meaning demand destruction can’t be due to lack of supply.

The primary difference between 2003 to 2007 and 2011 to 2013 is that the latter — a small group of investors deploying all-cash using mostly subjective and often flawed house price models — was more powerful than the former, when every ma and pa end-user in America was the speculative group armed with exotic loans.

The last few years of insatiable all-cash investor demand has influenced house prices much the same way as the exotic loan bubble did. That is, all cash investors controlling the market — buying without a “mortgage loan house price governor” — were able to run up prices way beyond what the average end- user could really afford. The next phase for this market is lower house prices until end-user fundamentals and house prices reach a point of equilibrium.

The next phase for this market is lower house prices until end-user fundamentals and house prices reach a point of equilibrium.

Good Luck

I heard on NAR… I mean NPR this morning that new contracts are up so that means how-zing is back baby! Quick, buy now or forever be priced out!!!!

I was thinking about the recent cheerleading for the MoM figures in the latest NAR report and how little useful takeaway there is to extrapolate from it.

Reminds me of a sports team that’s had a few shitty past seasons, currently a few months into the current season and already not looking good, then they barely eek out a win on the most recent game against some other marginal team and all of the fans are ready to proclaim a championship outcome.

Albertsons-Safeway merger is another important jobs decision for North Cal, the distribution of all products will be ether Idaho or Cal. A minor player in the decision told me because of Cal business climate Idaho has a leg up.

Another concern for all states, their constent battle with the federal Gov’t sticking their nose in every aspect of life. This makes for uncertainty for states to try to improve job outlook, this translate of course to citizens putting off most major , job security along with poor pay increases or lost of job is really the issue.

The Fed and Banks have a great thing going, banks are awash in cash, pay no return on deposisys

Land is and always will be the Achilles heel for most of Cal new home builders. Very little left that makes sense in terms of location and profit returns.

The resale market could capture some of theses sales, but the grossly underwater can’t list and the take a small loss or break even homeowner has nowhere to buy once they sell.

A line is in the sand again, who crosses first or flinches will be interesting. BTW, that builder who said no to my offer, I’m still waiting for a call, I bet arrogance wins out with these folks, all well how does arrogance pay bills?

Inland Empire, always a worry for many of these hard working middle class people. They seem to be a catch 22, they work in auto distribution and many spin off companies along with a ton of small business ownership.

Any bad news has these folks on edge everytime, they sit in traffic, think about if the job or business they own is stable( it isn’t). What a worry for them?

stable ( it isn’t), and paying the mortage.

” The Fed is already targeting higher interest rates …. ”

I’ll believe that when I see it. Yields higher than 3% on the 10 year Treasury would push mortgages into the 5% area and create even more pressure on affordability. All of the major central banks are terrified of deflation in highly leveraged real assets ( residential and commercial real estate ). They will collude together to prevent a spike in long bond yields for this reason and a host of other valid threats, like the financing costs of the ever growing Federal debt.

ZIRP is deadly to savers and a lifesaver to the bubbled Ponzinomics the central banks have created. They will do anything, including sacrificing the former, to save the distortions of the latter.

We need interest rates to go negative. I mean really negative like “-5%” for a home loan. The banks pay you to borrow money. That would make a lot of sense in this unicorn fart fueled e-con-oh-my…

@zigzag, banks are not issuing mortgages because of ZIRP. At 4.5% on a 30 year mortgage, banks would go broke if they did not flip the loans back to Freddie Mac or Fanny Mae. As such it makes no sense for banks to fund fixed rate mortgages until rates go up. That is why it’s either all cash or GSE backed mortgages for the last few years.

demand will decreases, inventory will explode as homeowners will try to unload their homes and prices will crater

Went to an open house on Saturday around the corner from my rental. Cute house but priced 40% higher than its bottom value in 2011. They tried to sell it last year too, $50,000 above what its priced at now. It didn’t get any bites so they took it off the market in November. Just relisted it a few weeks ago.

Agent started the BS speel: “there is not going to be a decline in prices because IT’S DIFFERENT THIS TIME”. I asked how is it different? She said well the crash happened because banks were not lending, now its easier to get a loan. I said yes but incomes have not risen and the job market especially in Sacramento is not good. This woman clearly has no grasp of the forces at play over the past 2 yrs, and I suspect nor does she care. She just wants to sell it at whatever inflated price she can.

She emailed me yesterday asking if I was interested in buying that house. I said “call me when it hits 35% less than it is now and we can talk”.

Good for you. I’ve been doing the same with our realtor. “My goal is to get you and your family into a house this year.” Sorry honey, it ain’t gonna happen until prices come down to reality. Meanwhile, I’ll save and live frugally. I’ve got nothing but time and I do not trust the “good news” that the Fed is spewing though their various outlets.

Save and live frugally: Me too. I am in no hurry whatsoever to give up my sweet, very comfortable rental house on one of the quietest and best streets I’ve ever lived on.

I pay relatively little in rent, compared to what it would cost me to buy it right now. I have no expensive repair bills, no worries about how I’m going to pay for a broken sewer line, HVAC system, etc.

I go to open houses to check out of the properties, I am building my own interest list so when prices do come down, I know which ones I’d be interested in buying.

I don’t buy into the hype. I’ve seen this BS before. I just cannot believe this craziness is in any way sustainable, especially now the investors are pulling back, and in some cases, bailing out.

You got not a lot of time. Life is short.

“You got not a lot of time. Life is short.”

Behold yet another oft-parlayed meme from the housing industry cheerleader crowd:

“You’d better buy it before you die!”

This fits neatly into the “create a sense of urgency” bag of tricks. The idea is to take advantage of most folks’ sense of accomplishment and innate fear of death. Implicit to this, of course, is the concept that ownership of some thing is the hallmark of personal achievement.

Because when you’re on that death bed looking back, you’ll be sorry you didn’t buy enough real estate to make you feel better about the whole dying thing.

“there is not going to be a decline in prices because IT’S DIFFERENT THIS TIMEâ€

Yes!!! Exactly!!! This is the new new new new new new new new new new new new…

High 5 for the backhanded comments to the realtor! Make them earn their money… feels like they barely do their job anyways might as well use them as a punching bag while your at it. While my wife and i were looking in Folsom, through loomis, and all the way up to Auburn … we encountered the same idiots acting as if Sacramento were the bay area and that the current prices were “good” and would continue the trend up. They also treat spending almost 400k like its purchasing a stereo. Never answering the serious questions seriously, they just wanted some arrogant statements about our views on money and RE … point taken, so i speak with my money … no sale….

Inventory has been rising in the area and not many buyers are biting (i know must be spring inventory right?) … no … meaning we have reached the impasse between sellers and buyers regarding price in the area … some divergence in sentiment … sellers are starting to find that a plateau has occurred and buyers are shying away and balking at the inflated price. If that doesn’t say plateau … i don’t know what does. Not saying it will crash either, but i’m not missing out on big gains as of today … so might as well find what i want or not buy until i’m financially ready for what i want. And yes, QE and easy money policy is absolutely propping this market. Unnatural would be an understatement for 20%+ increases in 1 year. Sustainable moving forward? We’ll see. They can’t drop the rates much further and are running out of tricks to keep the upward momentum. That, to me, says the fundamentals will start to matter again soon.

At any rate, just wanted to echo that we’ve looked at many homes in the area and were not impressed at all. We gave up looking for now because, to us at least, owning is not that important to lock in something we don’t love for 30 years. In talking to people from other parts of the nation, this is not really an “American” lifestyle anymore here in the area … just some wanna be version of it pumped up by investors and speculators. I think you brought up looking at those new homes in Folsom off Iron Point past the high school in a prior post … my wife and I laugh at whoever buys those … they’re pretty much a 400k condo on a 2500sqft lot. Must be looking for suckers from the bay area who think that’s a good deal…

Wish ya best in your searching … keep giving them hell, someones gotta keep them honest.

Sad/crazy part is the house I rent is actually a lot nicer/better street/better condition than the overpriced homes I’ve seen in the past 12 mths.

The realtors make out I’m missing out not leveraging myself to the hilt on a money pit that needs lots of $$$ pumped into it to make it somewhat nice. I do not agree.

You nailed it GenY,

I’m an agent, and it’s almost like a mantra amongst the midwesterners. I enjoy being a visionary by watching what goes on out there.

This time it’s different…and nobody is naive!

Been lurking here for a while and wanted to jump into this conversation. We’ve been looking in the Sac foothills for about 6 months. We’ve put everything on hold too. Prices are WAY too high. $450k for a typical house, no thanks…keep it.

We’re renting. We have time. We’ll buy when the time is right.

The fucked up thing is that if she actually called you and said the house was 35% off, you’d know the house was worth even less than that and wouldn’t buy it anyways.

All those saying the jobs are leaving CALI are mistaken. California can change it’s policies TOMORROW if things start going south too quickly. Legalizing marijuana use alone will bring in tons of new businesses. (As long as everyone just doesn’t put grow houses in their backyards).

Oh really…looks Like Toyota is moving its HQ from Torrance to Texas. Honda is slowing moving to Ohio. Nissan left a long time ago.

http://www.usatoday.com/story/money/cars/2014/04/28/toyota-move-texas/8358361/

I wonder if U-Haul and Budget Truck Rental would agree.

Rick Perry claimed that it was cheaper to rent a truck to go from Austin to SF vs the other way around, therefore implying that supply and demand realities were proving Austin’s appeal. I took that as a challenge to verify it, and indeed he was right. So I looked at various city pairings on U-Haul’s site and found that on average, a 23% discount is given to bring a truck back to Los Angeles from another major US city.

Check out Budget’s main page, go ahead, you’ll find three very peculiar promotions. They are incentivizing potential customers to bring their trucks back to the Northeast and California. In other words, more people are renting their trucks to move out of those places than are moving in.

https://www.budgettruck.com/50offcal.aspx?iadid=hp_cal2014

“Rent one-way and keep more money in your pocket.

Save up to 50%, when you rent one-way from Arizona, Texas and Rocky Mountain States.”

“’The Best Available Rate’ for one-way consumer rentals

From Origins in TX, AZ, NM, OK, CO, UT, WY, WA, OR, ID, MT (there are some areas within these states that are excluded).

To California.”

By the way, this isn’t the first I’ve seen of this “please help us bring our equipment back to California” for both Budget and U-Haul. In fact, U-Haul has had “Phoenix to LA” specials – $99 on 24″ trucks.

These businesses have the data and the experience to model these promotions. Last time I checked, they are profit motivated.

The writing is on the wall. It’s quite obvious that California has rested on its laurels and burned out its candle. Look, I don’t live in Texas and never have. Don’t want to either. But that doesn’t mean it makes sense to stick my head in the sand. Good grief.

As for the Toyota decision, Nissan was the bellwether back in 2006 – before SHTF – and Carlos Ghosn himself sited that “Tennessee has significantly lower real estate costs…”, so… Honda, you’re next.

Schwab moving a bunch of employees out of San Francisco. 1,000 this year with 2,200 later.

http://lonetreevoice.net/stories/Schwab-starts-work-on-third-office-building,152399?

This could also mean that U-Haul makes more money on higher-demand intra-city and inter-city rentals within California than with interstate rentals across the sparsely populated Rocky Mountains and Great Plains. It could also mean that lots of small importers are carrying loads to sell in other parts of the county. I’m not saying CA doesn’t have some structural problems, but I wouldn’t take anything any politician says as being anything other than self-serving.

I used to do this “u haul test” during the last bubble and believe you are correct. The Budget site quotes me $230 to go from Austin to Santa Monica but over $1000 to go one way from Santa Monica to Austin. It is clear they need the trucks in LA quite badly.

However, I’ve also noticed that TRAFFIC is now as bad as it was during the boom times even though incomes are lower and gas prices are quite a bit higher. From what I see I don’t think it’s just the top 1% driving around. Perhaps people driving between their three minimum wage jobs?

Any other evidence of a net outflow from CA cities to the desert southwest? Perhaps the good Doctor could research that a bit for a future piece….

“All those saying the jobs are leaving CALI are mistaken”

I am saying that jobs are leaving CALI and I AM NOT MISTAKEN. Read any paper and get the facts for yourself. Denial doesn’t help anyone.

Just today Toyota announced that they move to Texas. They are not the first company to announce that and they are not the last. They are part of a continuous trend.

You must be a politician from Sacramento. Denial didn’t help Detroit. It didn’t happen overnight. It was a process over many years the same way it happens now in Cali.

Don’t tell me about the weather. Tijuana has better weather than anywhere else in US. Without a strong economy it still looks like Detroit. Toyota is not an isolated case. You may deny all you want – the real income for californians, adjusted for inflation was going down for about 6 years now. It continues on the same slope. If you adjust it for the REAL inflation, not the cooked up numbers by the FED, then the adjusted income is in free fall.

Facts are inconvenient for dreamers.

Yeah, but there are great fortunes to be made flipping houses so we never really needed those jobs in California.

HAHAHA, so now MARIJUANA is the miracle job creator that will save Cali? Take a break from the shit you’re smoking and give us a break too. PUFF PUFF PASS hahaha

What you folks don’t realize is that your state is done. One of the serious flaws of our particular system is that the land becomes monopolized when an area is too successful. Overpaying by many times what something is actually worth while using credit is not a path to long term financial success. CA is in for a long frustrating decline once this final bubble is done. It may have a few years to run yet but remain vigilant. Much better opportunities will be presenting themselves elsewhere. Don’t believe the hype. A plywood box is still just a plywood box.

But there’s so much culture here. You know, ethnic restaurants… because you can’t get that anywhere else.

Exactly!!!! Welcome to the dark side my friend…

It appears many Cal people have checked out Vegas and Phoenix over the last 4 months, they left without buying. Sure they got a nice buck for their shoebox Cal home, then they traveled out of sate and found nice 12ft ceiling houses and great floor plans. The issue, they wanted to steal these homes and sellers said just hold on here.

Most have held the line, if Cal folks think they are going to sell 1300ft homes in San Jose for $1.2m and go to these towns and buy 4000ft homes for $400k to 500k with all the upgrades and top zip codes forget it baby isn’t going to happen.

Go back to Ca. is the cry in these towns, sure they haven’t sold, but they also continue to be looking in and not out.

So you’re saying Vegas and Phoenix are overpriced too.

Robert, I don’t think the Cali people checking out those homes and the ones who’ve sold out for !.4 million. I think they are refugees looking for a place to live that is reasonably priced. I guess they won’t find it in Vegas any more…

One reason companies might be moving out of L.A. slash California is the unreasonable cost of housing duh! Found a flier on my doorstep this morning (west L.A. area) for a one-bed, one-bath condo for $350k. So a single person or young couple must come up with $70k cash to own a place to live on the west side. Most young people I know (in their 30s) are still coping with 15-50 thousand in college debt. Nobody can afford to live here anymore unless you have been grandfathered in in some way. If you go anywhere in the city, the parking fees alone make it impossible to visit parts of this town. Going to Century City? $40 please. Need to visit the doctor at the hospital complex? $12. I can’t wait to get out of here.

Realtors in Beijing get a 2.7% or less real estate brokerage fee. Makes you wonder what additional value U.S. brokers give with their exorbitant commissions they charge.

Look around minute 4:02

http://www.bon.tv/China-Price-Watch/

Home ownership rates have plunged as we all know on this blog… but did we also know that rental rates are on the rise?

Seems to make sense that the population is increasing and the big banks bout up houses and rented them out.

excerpt:

…Furthermore, even as household formation has continued to implode (more on that in a subsequent post) despite the shrill promises of housing bulls who still have to realize that the transitory pick up in home prices has nothing to do with organic growth or a stable consumer, and all to do with the Fed’s balance sheet, the now effectively finished REO-To-Rent program, and illegal offshore cash parked in the US, Americans have to live somewhere. That somewhere is as renters of Wall Street and other landlords. As the next chart shows, the median asking rent has soared to fresh records and hitting an all time high of $766 as of the first quarter….

http://www.zerohedge.com/news/2014-04-29/new-normal-american-dream-homeownership-rate-plunges-19-year-low-asking-rents-soar-r

I guess anything compared to Cal is underpriced. As for the Vegas and Phoenix markets it is about underwater sellers taking a loss or break even to get from under and they have priced homes with that in mind. The buyers of course don’t care about your past mistakes thus the stand off.

The grossly underwater are not listing, they are the ones in the most trouble, they have a long wait.

Leave it to the gloom and doom site to push false propaganda that how-zing could ever go down…

http://www.zerohedge.com/news/2014-04-29/case-shiller-has-longest-home-price-decline-stretch-2012-13-20-cities-see-price-drop

Lies!!!!

itwasntme

The great escape from Cal. makes for a grass is greener scenario. The variables are really now in a case by case basis. The one size fits all is not in play anymore, moving to another state must make sense in every aspect.

We left Ca. 17 years ago and thought Denver was the get, it wasn’t and after 7 years we were gone. We have the means to move to where we want, so the decision was not based on economics. For most this is not the case, you could be stuck in a place I like to say you don’t want to wake up in.

Ca. is very unique, it has many, many, ills, it also has a tug at ones heart to live there or return to it. We never ever want to live in Denver again, it just wasn’t for us, but at times we wish Ca. would go back to the way it was many years ago. We would return maybe, but it won’t ever so now our final resting digs is second best place for us to live other then Ca. and we are now satisfied with our choice.

Folks need to make a list, if the positives out weigh the negatives then do it and don’t ever look back.

left CA six times for places that were better (Denver, Boulder, Miami, Germany, etc.) and came back seven times. I went with a friend to look at houses near Austin, TX this month. I have no desire to leave CA again, but I will probably be a renter in CA until the next bust. I have come to accept CA’s boom/bust cycle as part of the terrain, just like wildfires and mudslides. You need to manage the risk but expect such things. The positives still outweigh the negatives.

Pros: Weather is nice

Living near an ocean I never go to is nice

Mountains are nice

Laughing at the bronzed muppets in OC is amusing

Cons: Barely affording food isn’t nice

Racking up debt to keep status quo isn’t nice

Ridiculous cost of living isn’t nice

Watching large companies leave the state isn’t nice

Area doesn’t look as nice as it does on TV or movies

RedFin: 1 in 4 regret buying their home. Lots of interesting statistics about home buying regrets.

http://finance.yahoo.com/news/homeowners-regrets-buying-a-house-redfin-163113390.html

Having been a broker since 1971, I have seen you renters seem to know all about real estate, time and time again. Go back to see how their doing 10 or 20 years later and you find they are still waiting for the market to “get down to where it belongs.” The know-it-alls don’t have a pot to piss in, but they’ll tell you when is the best time to buy some real estate. So what else is knew?

Dick Denis – Real Estate broker since 1971 says: “So what else is knew?”

Why do so many property-investors appear to have atrocious grammar and spelling – it’s especially so on UK landlord/property-investor forums, as they keep buying in at ever higher prices, such as today as they cream their pants at today’s mainstream newspapers reporting average UK house prices will go from today’s mega-bubble values of $400,000 to $1.6m in 20 years time. And crummy crummy housing stock too, on a cold damp rainy island, with very little by way of natural resources. Hurry up and get your much needed house price crash going USA, so you can liberate UK from the tyranny of bubble prices and investor idiots as well.

It’s like the idiots have the very best in housing, oldies and younger people with no fear of mortgage debt, and the younger smart are totally punished by outrageous HPI – a long wave house price treble-bubble.

http://www.dailymail.co.uk/news/article-2617686/Average-house-price-QUADRUPLE-1million-20-years-leaving-half-35s-living-mum-dad.html

What else is new, you ask, Tricky Dicky? Well, apparently mistaking “their” for “they’re” and “knew” for “new”. Broker since 1971, and it’s obvious why. Those who can’t do, teach…and those who can’t teach, become agents/realtors/brokers.

Leave a Reply