U.S. homeownership rate at lowest level since the Johnson Administration: Record low inventory and inflated prices keeps families from buying.

It is common wisdom that prudent investing requires diversification. If you were saving for retirement, you would want to buy a pool of funds to spread out your risk. This is why many people will buy index funds that represent the market. Sure, you only hear about the superstars that bought Google or Microsoft at an early stage but you don’t hear about the many more failures. Consider this survivorship bias. So it would be foolish to have your entire portfolio riding on one stock. Yet some people have most of their wealth locked up in one piece of property in one locked in location. Taco Tuesday baby boomers in high priced areas are sitting on an equity goldmine but many are unable to tap out their lotto ticket without selling their property. Yet when owning real estate diversification also helps. You don’t know if you have a future Detroit or San Francisco in your hands. Yet some people mistake blind luck with fortune telling capabilities. Housing right now is inflated when looking at historical data.

The low U.S. homeownership rate

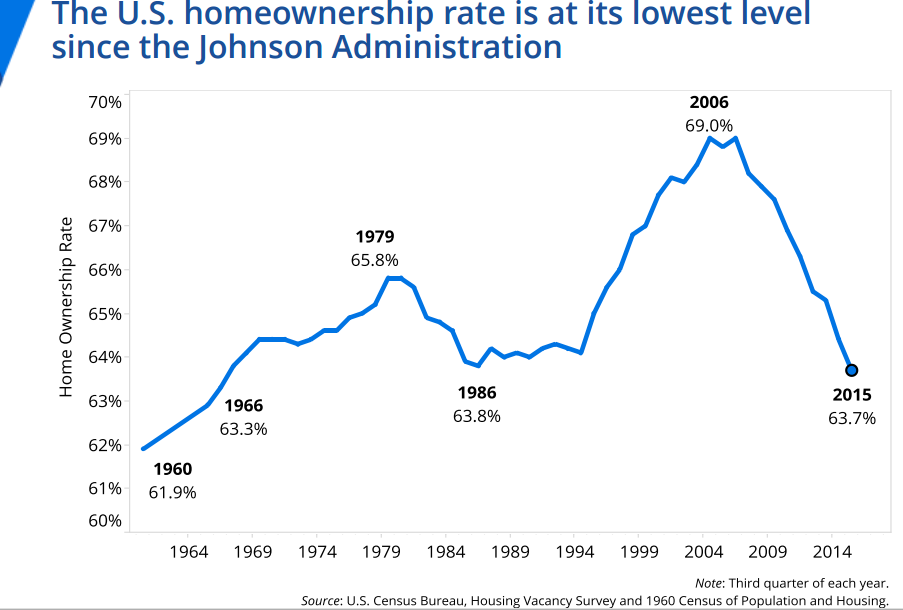

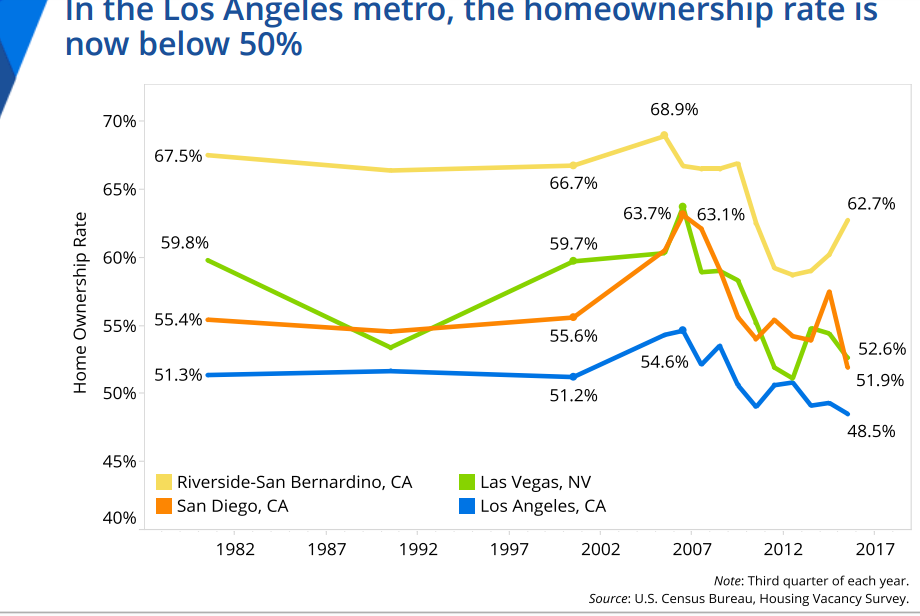

The U.S. homeownership rate is at levels last seen during the Johnson Administration. The cornerstone of the American Dream is simply getting much more difficult to achieve. There are many reasons for this but a large one is that home prices are inflated relative to what Americans are making. If this were a real market, then prices would balance out. But in a negative interest rate environment favoring banks easy money is used for investing purposes. Big investors bought a large amount of inventory and now the market seems to be dry with inventory – yet rents and prices are up. While the homeownership rate looks like this:

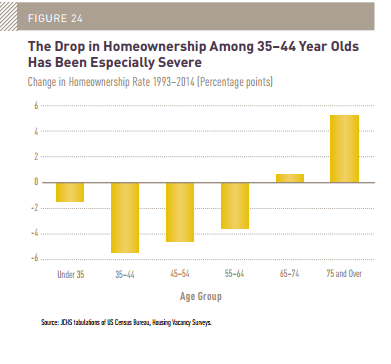

And a big part of this drop is also being driven by those who should be buying homes based on their age if they were following the Taco Tuesday baby boomer timeline. They are not:

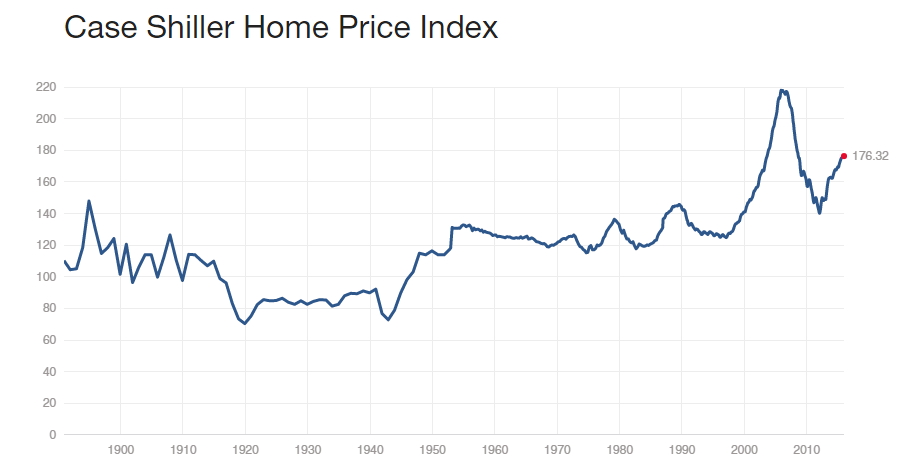

Those that should be buying simply are not. Then you have Millennials who are living at home in record numbers. The big problem of course is that home prices for the most part are inflated once again:

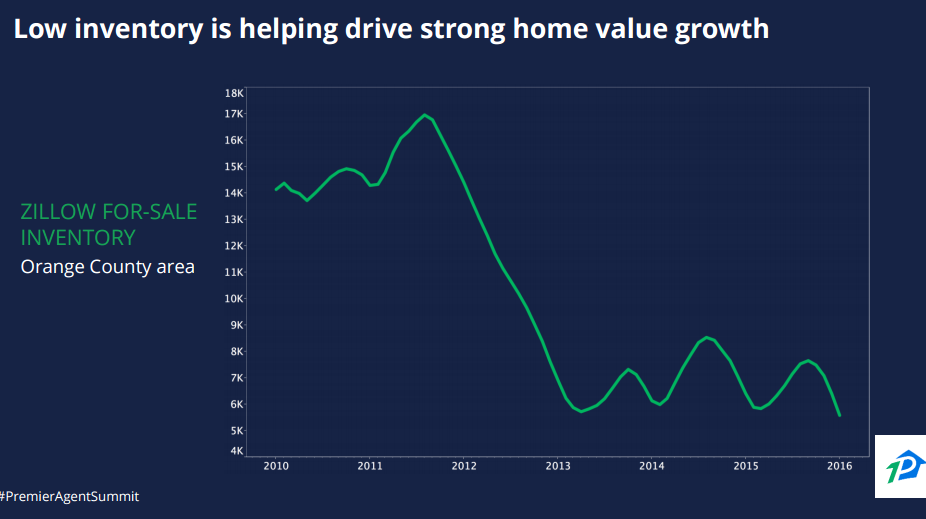

Relative to incomes home prices are incredibly inflated. But in a market with low inventory outside players like big investors and foreign buyers can push prices up with each marginal home sold. Sales volume continues to be weak. But with low inventory, prices get pushed up. Take for example Orange County in Southern California. Take a look at inventory:

Those looking to buy have very little to choose from. Then you have markets like Irvine where a giant portion of buyers are simply foreign buyers. This is why for the Greater L.A. area the vast majority of households rent:

It is interesting to see that the Inland Empire is seeing a sharp jump in the homeownership rate. This area was badly bruised during the housing slump. Things are moving up here because this area is somewhat affordable relative to household incomes. L.A. is the least affordable rental market in the entire country (based on what people make). So families have a hard time saving up for a down payment for one of those lucrative crap shacks.

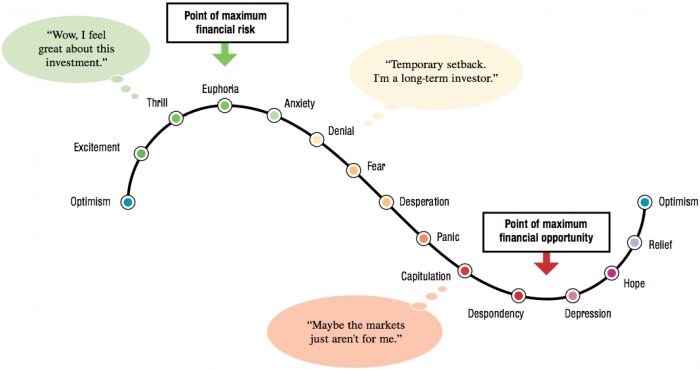

In the bubble psychology cycle people are between euphoria and anxiety:

People look at prices and feel like winners but look at all the other data and know something else is going on. A large number of people are lemmings and don’t follow any of this data. They are like butterflies in the wind not knowing if a gust is coming or a hurricane. Which is why buying a $700,000 piece of junk with a massive mortgage is so risky at this point. Would you buy $700,000 of Google or Amazon stock if this is all the money you had? Seems like a sure bet right now but history favors those that diversify. Some people are stretching their budgets just to buy. Well rents are also expensive but this doesn’t negate risk. All it means is that both rental and owner households are sitting on the edge and we see this with how much money is being spent on rents and housing payments.

If this were an easy bet the homeownership rate would be soaring because everyone would be diving in. It isn’t a sure bet. Builders are building for more future rental households. And just to show you that smart people can get it wrong, take a look at this quote from Paul Krugman back in 1988:

“(Dividend) In 1988, Long before his days as a Nobel Prize-winning economist, Krugman made a bold statement concerning the internet. Specifically, Krugman thought that the internet would have no greater economic impact than the fax machine adding:

“As the rate of technological change in computing slows, the number of jobs for IT specialists will decelerate, then actually turn down; ten years from now, the phrase information economy will sound silly.â€

The link has some other wonderful calls including “subprime is no problem†and DOW 36,000. Bottom line, exercise caution when you hear the perma housing cheerleaders talking about “housing will never go down and if it does, only a little†since these people probably don’t hold a Nobel Prize and even those folks get it wrong. Use common sense here and take a deep breath before diving into that crap shack. As we have said before, it is smart not to spend more than a third of your income on your housing payment. You should also diversify. But for some people, diversifying means having all of your wealth in your crap shack.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

105 Responses to “U.S. homeownership rate at lowest level since the Johnson Administration: Record low inventory and inflated prices keeps families from buying.”

A low housing inventory? Not true. A greater problem in the housing market is, people cannot afford a house, working two part time jobs. Too many people refuse to acknowledge that our economy is not growing, but in decline. Manipulation of facts, figures and media, perpetuate the illusion of prosperity.

Glad someone is getting it.

I cherry-picked some inventory numbers for bigger areas last week: Corona, Mission Viejo, Irvine and some others. All had higher inventory numbers for this point of the year than they have had in quite a long time. So…inventory is there, just maybe not at the price point that people would buy (because they have no money).

Look at anything like Zillow there isn’t much out there.

Many people are working two jobs and cannot afford the rent, let alone buying a house. A shrinking middle-class has certainly been front-page news for some time now, it’s just the numbers showing corporate/Wall Street profits that skew the perception that everyone else is doing fine…

If we truly are in between euphoria and anxiety in that bubble psych cycle, how long do you think before we’re into the red dots on that graphic?

We are in the process of selling our second home, and the price war going on to see what buyer would get it stunned us. It amounted to a 14% increase over what price we had set before putting it on the market. Our realtor said there is definitely a shortage of inventory, which has put that home’s perceived value above where it was in 07 before the collapse.

With the proceeds from the sale, after all is said and done, we are going to purchase Gold and have it stored in a private commercial vault which is not a part of the banking system.

You must understand that when the American economy collapses your dollars, (currency) will be worthless paper. Money and currency are not the same thing regardless of what you have been told. Money will be precious metals as it has been for thousands upon thousands of years.

Future currency will be backed by “Real Tangible Assets” as it was in the first 150 years of this nation. That asset will be a precious metal and not the “Trust” it is now based upon.

Trust as you can see has not held us in good steed, because the criminals believed they could hide their activities behind that trust, and thus have robbed us blind.

Rumplestiltskin, please expand on your comment about the criminals hiding behind this trust. I’m getting sick and tired of this rigged system and am secretly hoping it implodes. I’m curious to see what happens to these rats.

“tired of this rigged system and am secretly hoping it implodes.”

This is the logic of a Trump supporter. I’m not saying you are one, but those who vote for Trump are hoping to Blow up the system. They feel they can’t get hurt any more than they already are. What have they got to use.

In 1980 many of us voted for Reagan in the hopes it will start the revolution. It didn’t. We just got MTV. Many now are saying that same thing about Trump. IF he gets elected, all bets are off. Literally. Yes, gold seems like a great bet right now.

Jed,

How can the wall street shill, liar and corrupt as hell witch of Clinton be better..

She got 3 out of 297 laws passed. She turned around a carrier fleet that was steaming to her pile of mess Libya….

Republicans and Democrats, same shit, 2 different piles..

A change is needed, Trump doesn’t offer much but he is 50X better than Clinton

A USD currency collapse is not likely. What is more likely is inflation wrecking the value of the currency. Personally, I would have held on to the real estate and skipped the gold. Real estate is the ultimate hard asset.

“Real estate is the ultimate hard asset.”

I don’t think so.

Once the location it’s on, becomes unfavorable for one reason or another (crime, earthquake, fire, loss of jobs), it loses most of the perceived value it once had. Hard asset is something you can take with you when you move.

Real estate is also a tax subject, not a good asset at all.

It does raise in value quite fast (and a lot in dollars) in a bubble but drops even faster when bubble breaks.

Last time the bubble broke here in North (about 1992) we saw about 40 to 50% capital loss for houses & apartments, even in the best places in the city.

It was only 24 years ago and they are selling 30 year mortgages all the time.

A USD currency collapse is not likely. What is more likely is inflation wrecking the value of the currency. Personally, I would have held on to the real estate and skipped the gold. Real estate is the ultimate hard asset.

A USD currency collapse is very likely, as in 100%. All fiat currencies have and will fail. This is just historical FACT. Don’t you think inflation wreaking havoc on the value of the currency is a collapse? Once that takes place trust is lost and the dollar will be reset with some “new and improved” currency. One in which you can trade your old fiat for the new but at a substantial loss on purchasing power on your part (Wymar Republic Germany).

Real estate has many problems in a currency crisis. 1. Unemployment will skyrocket and this will lead to massive foreclosures. 2. Social unrest will surely cause property damages and diminish home values. 3. Even if you own your home outright, if you can’t pay taxes then you will lose your home. With already bubble prices, a guaranteed credit crisis, and record low interest rates, housing has nowhere to go but down.

Gold /Silver is the ultimate safe haven in our given situation. It has zero counterparty risk and it is easy to keep safe and in your direct control. It is rather undervalued due to paper market manipulations (see Deutsche Banks recent admission) and these cannot continue forever. Metals are not tied down geographically and can easily be moved with you.

If you like housing, sell yours, buy precious metals, wait for a meteoric rise in the gold/housing ratio and then trade up for more houses in the future!

Jared: “Gold /Silver is the ultimate safe haven in our given situation.

Wrong. In a true and total economic collapse, gold and silver are just metal, no better than rocks.

The ultimate “safe haven” are things that people need: Food, Fuel, and Ammunition (ammunition, to protect your food and fuel).

Should have sold the house in December and invested in miners, you would be up about 50% on average, 500% on some ind. miner stocks….

what does this say? Miners were the strongest performing asset after the great depression ended, 2017 is looking ugly and the markets are about to get a little down move before one last banker orgasm heading into fall…..

cd, I agree, and have been watching that sector for several years; expecting miner stocks to appreciate. After getting slaughtered for four years, they are beginning to perform.

This is what the Bible says about your precious metals and that they won’t save you

Ezekiel 7:19 “They shall cast their silver in the streets, and their gold shall be removed: their silver and their gold shall not be able to deliver them in the day of the wrath of the Lord: they shall not satisfy their souls, neither fill their bowels: because it is the stumblingblock of their iniquity.”

James 5:3 “Your gold and silver is cankered; and the rust of them shall be a witness against you, and shall eat your flesh as it were fire. Ye have heaped treasure together for the last days.”

Matthew 6:19-21 ” Lay not up for yourselves treasures upon earth, where moth and rust doth corrupt, and where thieves break through and steal:

But lay up for yourselves treasures in heaven, where neither moth nor rust doth corrupt, and where thieves do not break through nor steal:

For where your treasure is, there will your heart be also.”

The point of those statements is an indictment of those that value material wealth above all else. Gold and silver just happened to be the thing in those days, as it has been throughout history. What does the bible say about real estate? I seem to remember not building a castle in the sand.

The Jews wrote a book and declared themselves to the “chosen people”. Interesting perspective eh?

Steve:

This is what the Bible tells us in the very first chapter.

“3 And God said, “Let there be light,†and there was light. 4 God saw that the light was good, and he separated the light from the darkness. 5 God called the light “day,†and the darkness he called “night.†And there was evening, and there was morning—the first day.

6 And God said, “Let there be a vault between the waters to separate water from water.†7 So God made the vault and separated the water under the vault from the water above it. And it was so. 8 God called the vault “sky.†And there was evening, and there was morning—the second day.

9 And God said, “Let the water under the sky be gathered to one place, and let dry ground appear.†And it was so. 10 God called the dry ground “land,†and the gathered waters he called “seas.†And God saw that it was good.

11 Then God said, “Let the land produce vegetation: seed-bearing plants and trees on the land that bear fruit with seed in it, according to their various kinds.†And it was so. 12 The land produced vegetation: plants bearing seed according to their kinds and trees bearing fruit with seed in it according to their kinds. And God saw that it was good. 13 And there was evening, and there was morning—the third day.

14 And God said, “Let there be lights in the vault of the sky to separate the day from the night, and let them serve as signs to mark sacred times, and days and years, 15 and let them be lights in the vault of the sky to give light on the earth.†And it was so. 16 God made two great lights—the greater light to govern the day and the lesser light to govern the night. He also made the stars. 17 God set them in the vault of the sky to give light on the earth, 18 to govern the day and the night, and to separate light from darkness. And God saw that it was good. 19 And there was evening, and there was morning—the fourth day.”

So the Bible doesn’t always get it “exactly” right.

If I recall correctly people were supposed to guess Rumplestiltskin’s name. My guess is PETER SCHIFF.

Do I win?

California has always had a somewhat lower percentage of homeownership than other states and for the same reason. Housing is more expensive. The fact is that the great postwar surge in homeownership was probably a one of a kind historical anomaly built on VA/FHA loans, a rapidly expanding economy and wages and the highway system opening up lots of new land for suburban development.

Here is a chart showing historical homeownership rates by state from 1900 -2000

https://www.census.gov/hhes/www/housing/census/historic/owner.html

It maybe we will revert to the prewar level of under 50% as time goes by. To try and juice homeownership above that as government seems to want to do is probably unrealistic and dangerous as we have seen with the housing bubble of a decade ago.

I would think the flood of immigrants, mostly illegal, would drive the rental market higher. They come here and need to live someplace..

I went to an open house yesterday. Sacramento suburbs. Little townhouse style detached home that sold for $187k in 2012. Now listed for $340,000. Open house was jam packed with people. A few Bay Area buyers (can never compete with them). This tiny little place with no yard. It was nuts. How are these prices rising so fast? Nobody I know (with good jobs) earns more than they did a few years ago. The cost of living ie: food, utilities, consumer goods – has gone up, eating into our paychecks. IS THIS THE NEW NORMAL? The difference between Bubble 1.0 and this one is the NINJA loans are scarce in 2016, most buyers qualify for conventional P & I loans. And if you don’t want to join the bubble and commit most of your pay to a overpriced house, in Bubble 1.0 there were plenty of rentals around at reasonable prices. Now rentals are extremely scarce, the ones that do pop up are insane prices – you could buy in this bubble for what it costs to rent. Is the new normal people live on nothing and pay insane amounts of their income for a roof over their head? None of this makes sense….

The entire tech sector is in a massive bubble itself, and once that collapses, there won’t be incomes to support these home prices, despite the fact that the loans are more financially sound than they were in 2007.

Hard to conclude that loans are more financially sound when the industry upon which they depend are in massive bubble. Just like during the last downturn, job losses will make it that much harder to afford the already massively overpriced market.

This only means that now bay area residents that are there for the short time or retiring are cashing out and buying up real estate in cheaper areas like Sacramento. Not cheaper for current residence in Sacramento, just for out of towners who are used to a lot more expensive housing. Same game plan in 2008 except for less liar loans.

Low inventory because most of the homes are rented by mostly illegal immigrant a lot of illegals living in one homes so who will sell if the owner have a cash flow every month the last bubble will not happen again unless you flush out all the illegal and sold houses that yworth 1 million above to foreigner so that lower priced homes can be buy by the first time home buyer only in America that foreigner can buy anything they want the fed and politicians are not thinking of the consequences to local Americans

If you’re competing with illegals for housing, then you have bigger problems than the macro stuff this blog addresses. Given your writing skills, maybe I’m not that far off.

Not everyone’s first language is English. They may be thousands of times smarter than you but not speak English well, so you automatically assume they are stupid? Most of the world DOES NOT speak English and get along very well. Your superior attitude over a couple of errors shows a hell of a lot more is wrong with you than the poster.

this country was built my migrants….who r we to judge who can buy house or not? dr wang u sound like trump….

Let’s be very clear – this country was built by immigrants. People came through Ellis Island etc…and went through the system and became part of the system. Maybe there’s a problem with the system – ok, let’s analyze, plan, and execute for the outcome we want not denial and randomless.

People are crossing boarders today illegally (this is really bad in some countries where it’s jail and not defacto rights and citizenship). Working illegally, which contrary to what certain parties say, does increase worker supply and suppress jobs and wages to citizens (supply/demand 101 – this is fundamental like gravity). If those jobs are “unattractive” to citizens and not wanted as I frequently hear…guess what, they’d have to pay more to become attractive…look at that, increased wages, living wage etc…those same people are clamoring over. Can’t have it both ways. These people are not paying into the system and are burdening the system built by and for people who legally reside in this country. Our country, just like any person or other entity, does not have unlimited resources. We are on an unsustainable path currently for a variety of reasons (gvt budgets driven by healthcare/entitlements etc…).

Now look – I realize this is a So Cal blog and when people say this in your area it’s perceived as meaning Mexican etc.. I happen to like Mexican people, they are welcome here just like any other people. What I say above goes for the whitest of waspiest whites too. A bunch of illegal aliens come from England or Canada or wherever, everything I said holds for them. This is not about race – this is about sustainability and economics of this country which have been on the path to hell for many years. It’s now closer and poor growth over the last decade made things far worse. This is accountability, not further impoverishing this nation and robbing from the younger generations moreso than they already have.

Granted we have a number of other issues to tackle, many more important than this. Immigration is no panacea. That said there is so much stupid BS on this issue it’s ridiculous. Supply/Demand/Budget/Plan/Execute vs living in denial.

It was built by LEGAL immigrants those who obeyed the law and wanted to become AMERICANS and abandoned their old country. Not by illegals who want to retain all ties to the homeland, vote in their elections and use our country as their source of income, instead of improving their own.

These are vastly different concepts you should’ve been taught in elementary school history.

haha, if you think illegal immigrants are the problem in the housing market, you are more ignorant than the average Trump voter.

Remember that any blame for current state of the US economy and the housing industry, should fall squarely on the shoulders of the American voters. They may be angry but have only to look into the mirror and point when assigning blame for the way things are.

“Remember that any blame for current state of the US economy and the housing industry, should fall squarely on the shoulders of the American voters”

OK, I’ll bite.

The state of housing industry is basically made up by banks, and eventually FED and as you know, FED doesn’t care about voters at all.

FED is just transferring money (via housing, biggest cost for most families, therefore best method) from everybody else to too big to fail banks (who happen to own the FED) and there’s nothing more in the policy.

Voters have exactly zero power to FED policy and therefore can’t be blamed.

Hey dummy, congress has oversight of the Fed and therefore voters do not have zero power. Like I said, the American voters have to elect individuals to congress that will take an interest in looking a little deeper into the Fed’s activities.

Sadly, Congress has very little oversight over the corrupt and out of control Federal Reserve. More needs to be done to reign in this rogue band of thugs and bandits!

http://www.cato.org/publications/testimony/fed-oversight-lack-transparency-accountability

Wrong congressional committees in Congress control the Fed. If the Senators from my state and Representatives from my state are not sitting on that ONE committee, my representatives in either Congressional House cannot get any bills passed.

It’s not nearly as simple as your making out. It’s all about dealing. This is something you should’ve been taught in fifth grade civics.

Perfectly said !

One of the key things to mortgaging a home is leverage. Very few people are going to pay cash for that 700K crap shack. They will likely put 20% down or less…140K. Ask anybody who bought 20 or 30 years ago in desirable socal areas what their rate of return is on their leveraged housing investment, it will be astounding.

I agree that buying today likely isn’t a good idea. However, it all comes down to one’s specific situation. Unlike owning stocks, housing (whether renting or buying) is a necessity. Given this, there are many factors to considers when compared to buying xyz stock.

I live in Simi Valley and a new development of houses has already sold out its first phase in a little over a week of selling. The first phase of houses was selling for roughly $725-900K. A realtor friend of mine said the second phase would be selling for close to 100K higher than phase one. I wonder how many investors or realtors bought into phase one? By the time the houses in phase one are ready to move in, the buyer could sell it for at least a 80K profit without ever moving in?

Not sure if the housing market is slowing down yet. A neighbor just sold his house for 705K and was asking 685K. It sold in 4 days. I personally don’t think we will see any correction for years to come. Yes I do remember the crash in ’08 but I also remember reading blogs in 1998 that were talking about the bubble and it did happen after 10 years of calling for it.

I owned from 1998 – 2015. Now I rent. I rent because the tax benefits of owning are not worth locking up my down payment funds.

Because interest rates are so low, and only interest expense is deductible (not the entire mortgage payment), I only get an approx net after tax benefit of $200 per month to buy versus rent. Is $200 per month worth locking up $40k? I think not. I’d rather put the down payment into something liquid, and be ready to pounce on a property when the bust comes. And notice I said ‘when’ the bust comes.

Good observation, interest investment deduction is next to useless during zirp.

You “lose” $200 a month renting. Don’t forget about maintenance and repairs for homeowners, and the time they steal out of your life. If the market has a downturn, which it does on a regular basis, you lose a lot more than this. You lose you down payment and become upside down in your mortgage. You can’t move to take advantage of a career move or personal reasons. The house becomes a millstone around your neck.

Yes and no. Regardless of whether the market goes up down or sideways your home still provides a service, it puts a roof over your head and your family. Without it you would have to pay a rent probably more then your mortgage. You shouldn’t look at a home solely as a investment, and yes it is a large investment, but it still provides you a basic service you could not do without regardless of it’s current or future value.

Johnson was a native son of the Republic, Texas, that is. He started a war on poverty with guns(for his predecessor’s war, JFK had an accident) and butter. California is a state for looosers, under Governor moonbeam, whereas Texas, is a Republic for winnners. Me and Kinky are doing fine in Kerrville, thank you. We look at many people in California as being as smart as a box of rocks, or as dumb as a post, some are even lower down than a snake in wagon rut, you know these types.

Yeah, and you guys got Lyin’ Ted. Still feel like braggin’?

Product of the TX education system there. Can’t even spell “losers” correctly. I love my quirky L.A., thank you very much!

After reading your posts about Kerrville for the past several years, I finally took a few minutes to read the wiki on it, and look at some photos. I guess if someone wants to live in rural mid texas with these demographics, really white, with ample poverty, it could be paradise (as you describe)

[https://en.wikipedia.org/wiki/Kerrville,_Texas]

As of the census[1] of 2000, 20,425 people, 8,563 households, and 5,411 families resided in the city. The population density was 1,222.5 people per square mile (471.9/km2). The 9,477 housing units averaged 567.2 per square mile (219.0/km2). The racial makeup of the city was 85.89% White, 2.99% African American, 0.55% Native American, 0.57% Asian, 0.08% Pacific Islander, 8.20% from other races, and 1.73% from two or more races. Hispanics or Latinos of any race were 22.73% of the population.

Of the 8,563 households, 8.9% had children under the age of 18 living with them, 49.8% were married couples living together, 10.2% had a female householder with no husband present, and 36.8% were not families. About 33.1% of all households were made up of individuals, and 19.4% had someone living alone who was 65 years of age or older. The average household size was 2.21 and the average family size was 2.79.

In the city, the population was distributed as 21.0% under the age of 18, 8.0% from 18 to 24, 21.3% from 25 to 44, 20.4% from 45 to 64, and 29.3% who were 65 years of age or older. The median age was 45 years. For every 100 females, there were 87 males. For every 100 females age 18 and over, there were 83.0 males.[11]

The median income for a household in the city was $32,085, and for a family was $38,979. Males had a median income of $27,555 versus $19,923 for females. The per capita income for the city was $20,193. About 11.7% of families and 15.6% of the population were below the poverty line, including 25.8% of those under age 18 and 7.8% of those age 65 or over.[11]

@Jon, I would not be slamming Kerrville or any any flyover part of the United States.

Using more up-to-date stats from the U.S. Census department – 2014 – ( http://www.census.gov/quickfacts/table/PST045215/00,06037,0644000 ), we see that per capita income in Kerrville is $25K, Los Angeles is about $28,000. The poverty rates for LA County 19% and LA City 22.5%, and Kerrville is 17.5%

People here tend to think housing bubble will just pop over night. Housing will not collapse unless S&P 500 drops 30% and stays there for at least 6 months. Remember, RE will always lag behind stock market for a good amount of time. Then, subprime market will collapse. Prime markets will not collapse unless interest rates jump. Though there are a lot of subprime markets where locals think is prime. If rates rise, there’s much more things to worry about than losing your house.

LOL, what are you smoking?

Vote for trump

none r goog …too extreme …old Ronald Reaganor jerry brown goog

Low inventory? No, manipulated population numbers via mass immigration.

I tend to agree there. Erosion of the middle class has been supplanted with mass immigration to maintain the demand that was previously there.

As a mortgage broker— Believe you me, only about 62-63% of the citizens can handle home ownership. Above that and house prices become inflated and risk goes over the top.

I have seen people who shouldn’t be approved for a car loan get a mortgage. If they break a shoelace, they lose the house.

LA Vacancy rent for rentals is only 3% with a 6% increase in rental rate YOY.

http://la.curbed.com/2016/4/27/11520298/los-angeles-rental-market-bad

Today in Bad News for People Who Rent Their Homes, Forbes decided to put together a list of best and worst cities for renters. Guess which one of those lists Los Angeles is on. Those who guessed “worst” are right! Congratulations for guessing correctly and condolences if you are a renter, though you probably already knew that Los Angeles has been growing increasingly unaffordable for you.

Ok, ok, but how bad is LA for renters? As far as the top 10 go, LA was just number five. Just number five? The number one spot went to Manhattan, where the average rent in the last quarter of 2015 was a truly painful $4,374, while the second, third, and fourth slots all went to the Bay Area (Oakland, San Francisco, and San Jose, respectively).

To come to its conclusions, Forbes (with data from Marcus and Millichap) looked at the average rent in the last quarter of 2015, the vacancy rate, the average share of household income spent on rent (multi-family units only), and the year-over-year changes in rents for 50 of the largest metro areas in the nation.

What they found for LA was that the average monthly rent amounted to $1,892. With an average household income of $58,023, that means rent gobbles up roughly 39 percent of that cash. (Half of each metro’s score was based on the straight cost of renting.) LA’s tiny 3 percent vacancy rate and big 6.1 percent year-over-year increase in rent sealed the deal. It’s still about $700 dollars cheaper to rent than own in LA, Forbes found,

but with housing prices being as high as they are, there’s a pretty good chance most renters are staying put anyway.

Those numbers are pretty shocking. So many people get hung up on how expensive housing prices are. What they need to focus on is what is the comparable rental price.

2006 was an awful time to buy and a great time to rent. The same can’t be said for 2016. Houses (unless in very prime areas) are cheaper today and rates much lower. Rents have went up yearly like clockwork. Those 3 to 5% yearly rent increases are extremely painful when compounded over many years.

Actually, people need to be focusing on the fundamentals of the economy, both nationally and globally! If you believe the current economic stagnation is temporary, then real estate may be a good bet, but if you believe that we have obsoleted human labor, slowing the rate of consumption and commerce, and that economic growth is a thing of the past, then you may want to rethink owning that home or condo! Despite high rental prices, at least you have a built in out in 12 months. With a home, timing will be everything … now is the time to sell real estate when people will bid up your asking price! Waiting too long, may put you on the wrong side of the equation!

When rent gobbles up 39% of income that means some those people should technically be evicted because they no longer qualify, they are about $10,000 short of income.

@QE Abyss,

http://www.census.gov/quickfacts/table/PST045215/00,06037,0644000

In 2014 dollars, the U.S. Census department puts Los Angeles city median household income at $49,700 and Los Angeles County median household income at $55,900.

So the economic situation in SoCal is much worse than reported. This is especially bad because back in 1990, median household income was about $63,000 in L.A. in inflation adjusted terms.

I’ve been reading this blog faithfully since 2013. I agree with all the fundamentals in the articles . But if I would have just bought anything in 2013 I’d be better off than now. If prices collapse, they might go down to 2013 levels.

In 2013 you needed an all cash offer to buy a house. That was a very hot year for investor purchases. QE was in full effect. The years prior, you had a better chance, but the available inventory was awful. The whole thing is rigged now. Both buying and renting. When risk becomes real risk again, the whole thing will come crashing down. I also don’t buy into the inflation mantra, yes things are more expensive, but try removing the massive amounts of new debt/credit created and see what happens to prices. A few years ago people were convinced oil would never fall below $100 a barrel. The debt keeps piling up and we are either going to have massive tax increases or massive defaults or a bit of both, hopefully not war. Meanwhile the herds keep betting on debt being inflated away and leveraging up on overpriced assets.

It was difficult to compete with all cash buyers back then, but there were still some good deals to be had. I know a couple of different first time buyers from 2013 and while they didn’t get in on the price bottom after the crash, they are still happy to have gotten in when they did. The first time buyers today have it much worse.

I live in Redondo beach, and inventory IS VERY low. But I don’t see how in 4 years my crappy little rental house went from $500k to $800k. There is no more people here. Just the speculation bubble, which unfortunately is very real even with no fundamentals… and we just break even with rent income vs mortgage… And ante negative when you figure in maintenance. So even buying at prices in 2011 and renting in 2016 in not profitable.vthe numbers don’t work out here. Talking to my friends at Toyota, however, very profitable to be a landlord there.

I don’t know about Redondo, but it was possible to buy cash flowing properties in Huntington Beach in 2011. Rents have gone up 15-20% since then, but prices are up 85-90% from the low, so it wouldn’t be possible to cash flow now.

In Texas

Conventional mortgages is effectively government subsidized financing (Try getting those rates on any other type of loan that is not subsidized by the government). If similar was available for stocks, we would see a massive stock bubble.

Unfortunately the average person is unable to assess whether an asset is worth purchasing, or is caught up in investment euphoria. If you are middle or older, your home should never be worth more than your total net worth. Yet for so many Californians, it is, since they owe the bank and assume the house will always rise in value.

You can easily get a car loan for a lower rate than a conventional mortgage. In fact, you can get a jumbo mortgage for a lower rate than a conventional mortgage, because there are no g-fees or other government overlays.

Japan has had 1% mortgages for a long time now. Why are the US mortgages hovering at 4%? There is room to drop so I’m not refinancing for a .5% drop. I used to be jealous of my parent’s 6% mortgage in the 80’s when we were paying 10.5%. Mortgage rates have never been this low in the US. What does this mean for the long term?

Housing To Tank Hard Soon!

Jim,

It is inevitable. Keep up the good work.

Check out this beautiful little condo in a lovely (not really) corner of Orange. For a modest $395K, you get to live in this gem with assigned parking and community laundry.

http://www.realtor.com/realestateandhomes-detail/2525-N-Bourbon-St-Unit-L1_Orange_CA_92865_M15681-39782

Would you pay that much for this place??

Looks depressing, but you can claim you live on Bourbon St. 🙂

If you can’t afford the premium areas of socal, why not pack up and move somewhere where your quality of life will be orders of magnitude better. This is a glorified apartment that costs almost 400K. You can get a beautiful house for that in many other parts of the country.

And: $3ooo a year in property taxes and HOA fees. Such fun.

Participating on this site for years…chose to ignore the sentiment last year, bought, and have never looked back. Ignored the sentiment in stock years ago, up a bundle. Drank the “buy gold” cool aide 2 years ago… Ya, right. Face it, we are just sheep… Believe nothing of what you read, and simply do what YOU want…

but,..but,..but… housing to tank hard soon!

Low inventory and high demand in San Diego is driving up sky high prices on crap shacks in the San Diego metro area. I see tons of homes sold in days and house horny buyers everyplace.

Yeah it’s out of control. It’s like a feeding frenzy. I’m seeing mediocre properties going pending within days of being listed, some within 24 hrs. Inventory seems to be even smaller now then it was at the beginning of the year, if that’s even possible.

Nobody can call peaks or spot bottoms, but if you have purchased in the last year you have definitely purchased real estate at or near market highs which is always a bad investment strategy. Simply ‘doing what you wish whenever you feel like it’ has a cost. It is better to be patient and strategic. Unless you don’t care about making money, then do what you feel. This party will end soon.

That depends. You are assuming that we have a correction in the very near future. if the market continues on it’s current path for the next 2-3 years, many will wish they had bought in 2015-1016. It’s very possible we have a correction in say 2020 which brings prices back to 2017 levels. You just don’t know, so saying things like, “….. but if you have purchased in the last year you have definitely purchased real estate at or near market highs which is always a bad investment strategy.” is being shortsighted.

I remember when we bought our first home in Santa Barbara in 1988, our mortgage + taxes were at 45% of our income. We needed a co-signer to qualify. We sold the house in the mid 90’s for a modest return. That was when prices were 200K and have risen now to 800K. People kept telling us we were crazy at the time because “Prices can’t get any higher”. We sold instead keeping the house as a rental because we believed it. We were wrong. Jim Taylor will probably be right someday but so far, we’ve all been wrong.

Bruce Norris has a good track record of calling tops and bottoms in SoCal. Actually, calling the bottom isn’t all that difficult IMO, but calling the top is trickier with all the different inputs involved (loan programs, rates, employment, incomes, etc.). People tend to be much more emotional near the top so it’s also hard to go against the grain when nobody wants to believe they are about to lose money on a property. You become a bad guy for telling them.

I think the better approach is to do what John Hussman does for stocks. Instead of trying to call a top, look at things in terms of odds. What are the odds that the value of an investment is going to be higher or lower in five to ten years? How does that match your hold period for said investment? If asked, I think Hussman would likely say that CA home prices are more likely to be lower 5 to 10 years from now because they’re already at historic highs. If you’re planning to buy and your time frame is less than 10 years, odds are home values will be lower when you need to sell. If you’re planning to buy and stay for 20 or 30 years, then prices now may not matter as much (assuming you’re OK with the big down and monthly payments).

Frankenstein house in Venice.

Love how they justify the cheap materials, “both second story and original home remain faithful to an aesthetic of exposed plywood”

https://www.redfin.com/CA/Los-Angeles/1564-Cabrillo-Ave-90291/home/6741235

It’s almost good inside but weird from the outside.

But maybe I’m just not cool enough, entirely possible.

Looks like someone dropped a small cheap commercial building right on top of a small old house. Kind of cool inside but butt-ugly from the outside. $1155 per sq ft. for exposed particle board. Wow! Maybe some rich hipster will buy it. Too hip for me.

I was never in my life “cool” enough for such an ugly house with so much damn plywood.

However, I find myself rather liking that black kitchen, especially the beautiful, high-end induction range. But I don’t need to pay $1.5M for a hideous house to get one like it.

Embrace the zero, Laura. “Architecturally acclaimed”, dontcha know.

So much for THAT idea… (tanking hard)

http://www.laweekly.com/news/thanks-millennials-las-population-tops-4-million-for-the-first-time-6889490

The population of LA is increasing, and LA is on the agenda to become one of the world’s top 20 megatropolis in the future, as more people from rural areas are moving into the megacities rather than away from them. The strength of the US dollar is still looking good (due to EU crisis), mortgage delinquencies are at all time lows since 2008, unemployment is lowest since Obummer took office, multi-generational living is becoming more common, no NINJA loans, baby boomers NOT selling their homes.

IMHO the main event that could cause a crash in house prices is a job-loss recession. Lack of water or earthquake will be blips on the screen in terms if causing a housing crash.

A hi-tech stock crash (could cause the job loss recession) would disrupt the Bay Area more than LA, because the hitech industry is not as prevalent in LA as it is in SF and SJ. THEN when a housing crash is in full swing, the all-cash crowd will swoop in again and buy more homes and rent them out….

While you’re correct LA and the metro is increasing in population it will not be among the 20 largest metropolis. By 2050, even NYC which will be far ahead of LA will be ranked a conservative 25th place among world metropolitan areas.

The world and Asia and African urban areas will easily control the top ranks in the coming decades.

“We’ve been losing Latinos and kids,” Myers said. “So this increase in population is not due to immigration at all. It’s due to millennials and jobs.”

So much for the narrative that “illegals” are causing L.A. to become over-crowded and ruining EVERYTHING.

Do you imagine that Myers is The Last Word on all things? That others voice opinions, but that Myers is The Expert who always speaks Ultimate Truth?

He’s wrong, California as a whole and NYC as well are only increasing in population at all because of immigration (both legal and illegal). The outmigration far exceeds the in-migration of citizens and resident aliens.

@eden, yes Los Angeles is growing, but most of the jobs created in the L.A. area are low paying McJobs. This is why people are stacked like sardines, 2, 3, 4, 5, 6, 7 persons to a housing unit.

Great post! It led me to post this one showing The Fed’s complete inability to stem the tide in homeownership rates and real median household income. https://confoundedinterest23.wordpress.com/2016/05/04/us-homeownership-rate-back-to-lbj-and-the-great-society-days-despite-real-income-growth-of-33-3/

Hunan, of course none of us have a crystal ball but I highly doubt anyone will regret not buying real estate in 2106. It is a huge gamble to buy at historic highs, not shortsighted. I’d rather run the risk of missing a few bucks of profit by sidelining my cash in 2016 than ride the mudslide way down. The strategy has worked very well for me financially but everyone is different.

For all of us constantly speculating about what housing would do, I thought you’d enjoy this Dr HB blast from the past-

bought in 2005 for $900k

sold in 2011 for $675k

Currently OFF MARKET Zestimate®: $1,651,562

http://www.doctorhousingbubble.com/real-homes-of-genius-santa-monica-bubble-real-estate-935-square-feet-home-foreclosure-santa-monica-westside-los-angeles/

I have a serious question. It is undeniable that the current market RE market in S. California is moving at a brisk place. Decent properties are going pending quickly and are closing for top dollar. I see multiple bidding wars many times with all cash. This is in a environment with low inventory and high prices. In some areas prices are equal to or higher then they were during the last peak. My question is this: Where is the money coming from? Let’s assume one does not have all cash. To buy a home valued at 500K you would need a down payment of 100K (+ closing costs) and income of approximately 80K a year. Not to mention that the income has to be verifiable, no more undocumented loans. From my experience it’s difficult to get a mortgage today. If you don’t have the downpayment you can go FHA. But it is my understanding that FHA has even stricter underwriting guidelines and your monthly payments+PMI are incredibly high which can make it even more difficult to qualify. You may have the option of a hard money loan. These seem to be more prevalent today because of the low interest rates and investors chasing yield. But I find it hard to believe that a large majority of people buying today are getting hard money loans. I also don’t think that foreign money is buying ALL the RE in S. Cali. So what am I missing?

I would love to own a home in San Diego but the only thing in my price range under 500K are 2 bedroom tiny crapshacks.

The state and local government would love you to buy at todays home prices and lock in your tax rate. No thanks.

Banks want to lock up your down payments while collecting interest on over valued property for the next 30 years. By keeping interest rates low forever banks can keep inflating this bubble get larger down payments while collecting more interest off the morons that buy into this artificial induced frenzy.

Leave a Reply to Sammy Sams