In housing debt we trust – why is it that with rising home values home equity is still near record lows?

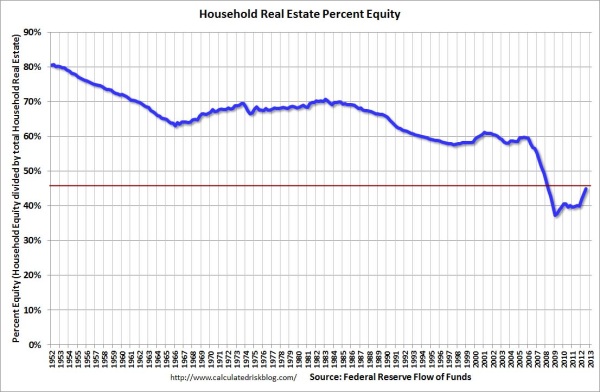

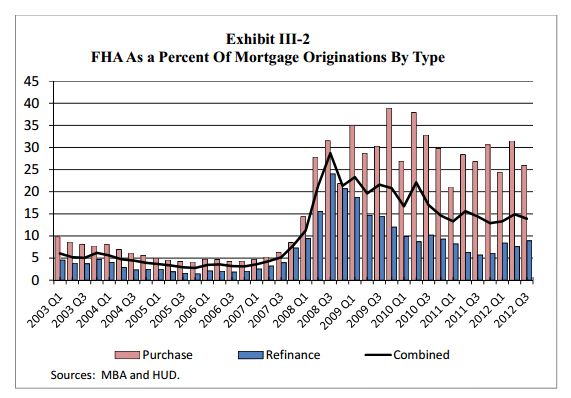

The assumption that households are doing much better simply because the stock market is up is really a problematic understanding of how wealth is dispersed across the United States. I vividly remember a handful of parties back during the peak of the bubble where people would often quote how much their net worth went up courtesy of the housing bubble. “My home that I bought in the 1990s is now worth over $1 million.â€Â As all of you know, until you sell the home those gains are largely on paper and many did not sell. In fact, many tapped out large portions of that equity and spent it. This is why even with home prices moderately recovering US households still have close to record low equity in their homes. It probably does not help that low down payment FHA insured loans are such a large part of the market encouraging Americans to make the biggest purchase of their lives with very little down. The Fed reported last week on net worth figures and it is worth digging deep into the data.

Home is where the net worth is for most Americans

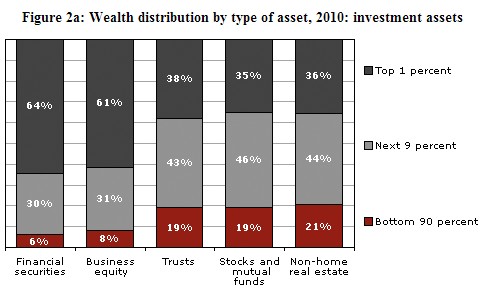

The strong rally in the stock market has done very little to improve the balance sheet of most Americans. Why? Because most do not own significant levels of stocks or mutual funds:

The bottom 90 percent of Americans own 6 percent of all financial securities. This same group only owns 19 percent of all stock mutual funds. To the point, the median family’s portfolio is worth well under $50,000. Keep in mind the stock market is down 10 percent from the previous peak. Does going from $50,000 to say $45,000 really change the dynamics of your typical American family? Probably not. But think of someone that bought at the peak with a FHA insured loan. Let us assume they paid $250,000 and went in with 3.5 percent down which is the most common down payment for these loans:

Home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $250,000

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $8,750

Current home price:Â Â Â Â Â Â $175,000

Underwater:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -$75,000

To reach the initial sale price, home prices would need to rise over 42 percent.

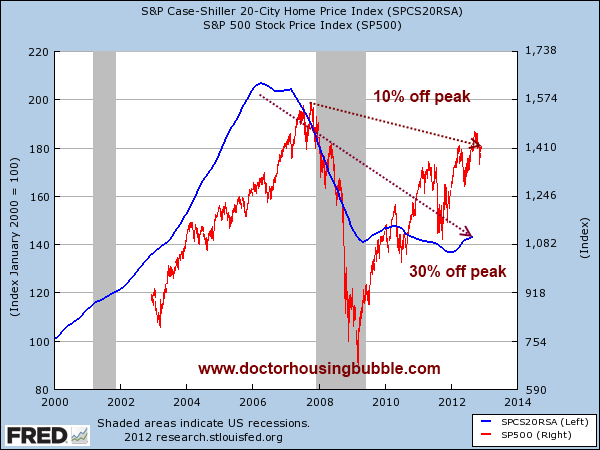

Welcome to the wonderful world of debt leverage. That massive stock rally has done very little for the typical household portfolio. Yet the now 30 percent decline in real estate values has blasted a hole in their net worth. Where are we getting the above numbers from? Right from the market:

While the stock market is only off by 10 percent from the peaks reached in 2007, housing is still down by 30 percent. This is why the good news in the Fed report needs to be looked at more carefully:

Q3 2012 household net worth:                 $64.8 trillion

Q3 2007 (peak) household net worth:Â Â Â $67.3 trillion

So overall, household net worth is down $2.5 trillion from the peak (3.7%)

Real estate values however are still significantly down (main net worth item for most families):

Q3 2012 household real estate values:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $17.2 trillion

Peak was at $22.7 trillion (according to the Fed, real estate values are down 24 percent from the peak versus the Case Shiller which shows a 30 percent fall from the peak). This is why this recovery still feels very much like a recession to the vast majority of Americans.

Even though housing values have gone up in 2012 (largely due to low interest rates increasing leverage and a massive decline in inventory) most Americans have near record low equity in their homes:

And this should be no surprise since a large portion of the market is being driven by low down payment FHA insured loans:

The market is addicted to real estate debt. This is also an explanation as to why so few new homes are being built even though the market is signaling for more property (that is, affordable property). The underreported story of all of this is Americans have very little saved up at a time when tens of thousands are reaching retirement age. As the adage goes, you have to live somewhere. But you also have to eat and pay for those medical bills plus send your kids to college. Younger buyers are opting for these low down payment mortgages in droves because of lower incomes and also, higher debt burdens from giant levels of student loan debt.

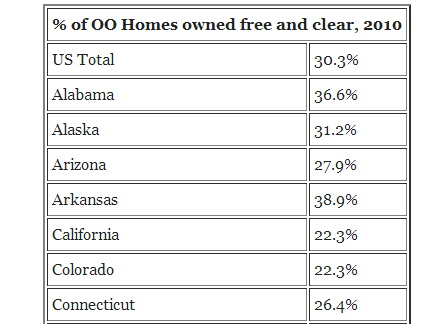

People think that somehow, a wealthier state like California has the majority of people buying homes with all cash. While this may be true in areas like Beverly Hills or Atherton, most California homeowners are deep in debt on their home purchase:

In California, only 22 percent of homeowners own their property free and clear (a much lower figure than the nationwide 30 percent figure). Not only is this the case, but a large number of Californians are underwater on their mortgages:

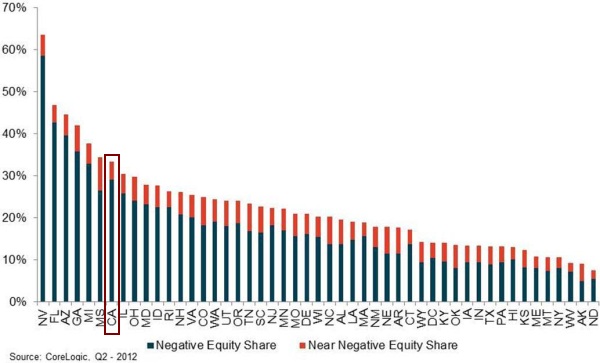

Roughly 30 percent of California homeowners are underwater and this figure goes up to 35 percent if we count those near negative equity. Equity in housing does count. And as the previous chart shows, equity in housing has been falling for a very long time. This is why those comments of “and after 30 years, you will pay off your house!â€Â That was true in previous generations. That is no longer the case. According to Census data and figures from the NAR, the typical homeowner stays put between 6 to 8 years. As many know, the first few years are heavily tilted to paying interest and less on principal. Throw in the 5 to 6 percent commissions for selling a home and a good portion of the equity can be wiped out unless you are in a market with perpetually higher home prices. We got a boost courtesy of the Fed with record low rates and QE but we are likely hitting a lower bound. Even if rates maintain the boost will run out of steam to match up with actual household incomes.

The current market is heavily dependent on real estate debt. The FHA now backs over $1 trillion in mortgage debt and is providing an obscene 30x leverage for many buyers. Then you wonder why they are in the red to the tune of $16 billion and are massively increasing mortgage insurance premiums.

We are starting to see the myth of “well after 30 years you will own your home†and then these are the same people looking to hop on the property ladder once they rid themselves of their starter home in 7 years. As we pointed out, in hyper consumption states like California, very few actually own their home free and clear because of this mentality.

Keeping up with the Joneses

I have recently seen many people so blindly focused on one tiny aspect of their balance sheet diving into buying a home because they ran the numbers. In fact, one couple I know bought last year and on paper, everything looked good. Heavily discounted home compared to bubble price. Just a bit more than renting on a net-net basis. That is, until they started trying to keep up with their neighbors. First, they “had†to buy a new car. After all, that 10 year old car looked like a clunker in a neighborhood with $40,000 to $60,000 SUVs. So add that as a new expense. These cars carry a much higher insurance premium. Add more to your monthly insurance. They also needed new furniture so there goes thousands of dollars. The spending is only beginning. They now need to update the kitchen and living room to match up with other hipsters. Clearly they have not worked with contractors in SoCal. The bill is going to jump up very quickly.

This is largely what happens. They also had to put their kids in a more expensive prep school. If all goes well, these kids might get accepted to a great college (if private, look at $50,000+ inflation adjusted to the future per year unless they are super star scholars). Then add to the mix that this will be the “starter home†and they will look to move into a bigger (more expensive) home shortly. 5 to 6 percent will come off the top in that transaction.

So on paper, yes, it didn’t seem all that bad of a move to buy. Yet ancillary spending increased dramatically. Also, many younger people that buy are likely to lose one income for a period of time after a child is born if they plan on starting a family shortly after buying. If they go back to work, add in the cost of daycare. That is a sizeable hit to the bottom line.

And this is one of the items that people only focused on the numbers will miss. Consumer psychology and mass behavior. You have to examine both and this is part of behavioral economics but most can understand the common sense of this. This is why the home equity figures still look anemic above even in the face of rising home values. It is rather obvious that Americans are willing to go into massive debt to purchase (just look at FHA insured loans). The notion that everyone that is buying right now is going to stay put for 15 to 30 years flies in the face of the data. The idea that people will just buy and somehow not increase their spending to reflect that of their neighbors misses the core of our marketing driven nation. All you need to do is look at the hipster flippers and how they are tailoring their homes. This applies to many upper-income suburbs and cities. Keep in mind that with the typical US home costing $180,000 and median household income at $50,000 in raw numbers, most Americans can afford to buy (funny how that 3x annual income to mortgage ratio is coming back in line). Yet we are talking about households trying to purchase $600,000 homes with $100,000 incomes.

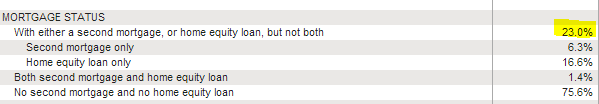

Some people get angry with flippers but remember someone on the other side has to close escrow on the place. In California, over 23 percent of mortgaged homes have either a second mortgage or a home equity loan:

Can you purchase in a prime neighborhood and not increase your spending? Of course. Yet the vast majority will not. You think all these people squeezing in with a 3.5 percent down payment have loads of cash? Of course not, otherwise they would go for a more conventional loan with better terms. It is interesting how the psychology of housing has shifted in the last generation. Today, we are still left with the mentality that housing is the road to riches asset class whereas in previous generations it was a place to live. You are even seeing this today where people are talking about how they perfectly timed the market. It reminds me of those people back in the high days of the bubble talking about the hundreds of thousands of dollars of equity they built up but never actually sold their home. Until you get that check when escrow closes, that money is just on paper. Many wanted the best of both worlds and simply tapped out the equity via more mortgage debt. Many can’t sell even today because they would “have†to buy an equally high priced home in the same location. That is, if they didn’t tap out their equity. There is one certainty about our economy and that is, we as a nation have very little fear of going into massive consumption debt.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “In housing debt we trust – why is it that with rising home values home equity is still near record lows?”

Doc, you keep hitting the nail on the head. 600K nothing special property on 100k income in this market with low down FHA just isn’t financially prudent. I know people who are doing this as well. They are part of the problem and it’s quite disturbing to witness.

It is totally disingenuous to say that housing has dropped 30% without taking into account the halving of interest rates. In terms of payments, which is all that counts to the average buyer, prices have effectively dropped 60% solely as a consequence of the Fed’s manipulation of interest rates. Imagine what the situation would be if mortgage rates were at the 7% norm?

Most of the world had a tremendous inflation spike in real estate prices five years ago. Generally, the way to bring down inflation is to raise interest rates. Remember Paul Volcker? However, this time around things are so bad that the net result of the spike is record low interest rates. Why did Volcker have to raise mortgage rates to 16% to bring down housing inflation and today we do just the opposite, we stimulate, and housing collapses regardless of this incredible interest drop. Real wages also continue to drop as well. I would suggest that one think long and hard about this situation before you dive into a $500 a sq. ft. box. The economy is doing things that no one has ever experienced. The outcome is very much in doubt.

Jeff, the worst part is that Volcker was brought back by the current administration to basically serve as a PR/potted plant, someone that looked responsible but whose advice no one had any interest in hearing. Akin to the Simpson/Bowles commission, it’s all window dressing to convince the plebes that everything’s still just peachy in the economy.

Simpson/Bowles recommendations make way too much sense for the current leadership of the Democrats or Republicans to get behind, because it benefits the true silent majority in America: those who want “fairness” derived solely from the fruits of their labors, not a tax loop-hole or government cheese.

The people who really are under the gun in the middle of all of this market manipulation are the folks who just want to buy a home within their means and actually live in it for awhile, and not try and trade up in a few years. Young families are in an unenviable position – if they buy now they may well be damned, but if wait they may be damned even more.

There is “very little fear about going into massive consumption debt” because people have gotten the idea that making good on their debts is “optional”.

As they learned from Wall Street, who made reckless trillion-dollar bets on garbage securities and then had them bought back at full price courtesy of the NY-DC crony capitalist complex.

Of course. I mean, I surely base my morality on what other people get away with. I almost considered murdering my kid after that crazy in Florida got away with it, but I figured I should wait for a few more test cases.

How about the idea that what is right is right, and what is wrong is wrong, regardless of how many other people, high or low, get away with wrong? Since when is right and wrong something we *vote* on?

and of this date, no one has been prosecuted for their malfeasance – Mozillo et. al. gets away with a slap on the wrist, and gets to keep his millions as well. If there was a ban on anyone currently serving in congress or the WH on performing any lobbying activities for a minimum of three years after they left their current job, some of this incestuous crap would at least begin to be minimized.

Following on from DMAC’s comment, BP got crucified and although we saw the likes of Jamie Dimon testifying before committees, I don’t feel the punishments were anything near as tangible. Banks seem to float in that protected space somewhere between government and the corporate world.

Good article about how “lower classes” loos all their worth in their home equity.

Primary residence equity sucks…. because is an emotional investment vs. financial #deal!

Many will not sell their primary residence at the top of the market and buy a fixer at the bottom. It’s just not part of the “social behavior” of a family or couple. She wants the best at the top not the dump at the bottom… That’s why married men are “whipped” not “financial geniuses”….. and why women are “emotional buyers” not financial geniuses like the few on CNBC…

Oh, example in real life: woman and husband own 34 properties, $5 million in debt at $10 million in equity in 2006. All properties are “negative cash flow” aka “alligators” and they are separated. I suggest to her to QUICKLY & AS FAST AS POSSIBLE TO SELL YOUR 1/2 OF THE PORTFOLIO. SPLIT THE EQUITY NOW! No, they emotionally fight like cats & dogs in a cage. In the end they split after costs & losses & legal fees $500,000. AKA 1/20th of the equity at the start. Dumb! Here is another example: 2 men, X-Friends try to steal $100,000 of equity from me. I “LEGALLY FORCE A SALE” and get rid of their greedy lying A$$ES. About 2005. I continue to sell into the market, 198 sale escrows from 1999 to 2008. These 2 dummies keep buying to 2009 and then go BK with all their debt & no equity. They drag down their wife too. No College finance or accounting = stupid. I laugh at their “emotional stupidity”. That’s only 3. In general, about 80-90% don’t take profits & about 30-40% sell at the bottom vs. buy at the bottom. Really “cattle call stupid”…

Mr. Chun, if you haven’t been contacted by A&E, Lifetime, Discovery, etc. to star in your own reality show, it hasn’t been for lack of accumulating an astounding number of personal factoids:

“Owned over 35 different boats, 7 different motorcycles, 30 different cars, raced cars in 10 states & jet skied 2000+ hours in 2 years from Canada to Boston to Florida to Texas to Cancun to Beliez to Guatemala to Honduras to El Salvador to Puerto Escondito, Acapulco to Mazatlan to Gulf of California to Cabo to San Diego to Newport Beach to Ventura!”

“Red Cross Vip Blood Donor Card.”

“4 Japanese computers, 4 Multi-Function HP printers, 6 LCD screens, 3 Tvs in office, Windows7, 3xternal HD’s!”

“Android 4G 1.2Ghz Dual Core 6Gig Ram + 32Gig SD card + Unlimited Data + Cord & Wifi HOTSPOT from 4GPhone!”

The Gramm–Leach–Bliley Act (GLB), also known as the Financial Services Modernization Act of 1999 http://en.wikipedia.org/wiki/Gramm%E2%80%93Leach%E2%80%93Bliley_Act Brought to you by the banking industry and gladly setting Americans up to fail (and collecting the payoffs) since the turn of the millennium.

Attributing the mortgage meltdown and related events to repeal of Glass-Steagall or to Gramm-Leach-B is idiotic. You might just as well blame global warming. There is no rational connection between the two. If you believe otherwise, please explain your reasoning.

But don’t just call people names, don’t just make unexplained and unsupported assertions, explain.

The repeal of G-S allowed investment banks to merge with regular banks. They then went on a lending spree and packaged the loans into securities. Pass through fees with no risk.

GLB was the prime legislation in the overturn of Glass-Steagall.

Perhaps more importantly, Gramm drove the Commodity Futures Modernization Act (2000), which exempted derivatives, including credit default swaps, from regulation.

GLB just allowed our banks to game the system to generate paper returns. The source of our problem was US industry avoiding US labor and environmental laws by moving offshore.

I would like to see a full reinstatement of the Glass – Steagall Act, along with a concerted effort to break up the near – monopolization of our current banking system. The TARP act demonstrated that the large bank’s confidence in being “too big to fail” was fully justified. Their risk is now off – loaded to the US taxpayers, and not the shareholders. It’s a terrible system for capital creation, and ultimately leads to an inordinate amount of influence in the hallways of DC.

None of that actually makes any sense.

1. Yes, G-S repeal allowed mergers between investment banks and deposit taking banks. But the deposit taking banks that failed and others that engaged in risky lending did not get into trouble by engaging in prop trading via investment banking subsidiaries. They got into trouble by making bad loans secured by residences. They did exactly the same things under G-S. Similarly, G-S did not prohibit investment banks from buying RMBS securities, G-S did not prohibit the creation of RMBS securities and did not prohibit deposit taking banks from selling mortgages via RMBS or via any other mechanism. All of those things were ongoing activities by the same players while G-S was still in place and before GLB was passed and signed into law by Pres. Clinton.

2. The Commodity Futures Modernization Act did not “exempt” CDS from regulations and the so-called “failure” to regulate CDS transactions had nothing to do with sub prime meltdown. If anything the availablity of CDS transactions created a market which spread risk and, on net, probably reduced the need for bank bailouts. That’s exactly what CDS are supposed to do. What regulations would you proposed, even today, concerning CDS which you believe would have avoided or mitigated the meltdown?

3. GLB had nothing to do with the generation of “paper returns” and did not result in anyone “gaming the system.” Every activity which has been suggested by anyone as a cause of the mortgage meltdown was ongoing before GLB passed and was engaged in by exactly the same players. In fact, GLB probably helped save the system by allowing BofA to buy Merril Lynch and allowing Chase to buy Bear Stearns. Without those purchases, Merril and Bear would have resulted in a second and then a third Lehman Bros.-type collapse.

4. No, “our problem” is that the left has no understanding of, or interest in, basic enconomics. If you really want to know what happened, this would be a good start http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2172549

I agree the CRA plated an important part in the bubble, but banks traditionally held the paper and didn’t securitize it into RMBC. You also have to take into account all of the exotic loan products the “best and the brightest” thought up.

hmmmm……..seems that bmcburney is another who has problems with poor people of color living in his country. One wonders is he is a wealthy banker type spreading the word that most scoff at, that those poor people of color are actually that important that they brought down the entire western developed world’s economies for a what will be a decade or even more. I guess the next best solution is to just starve them all and put them to work fixing the roads in Greenwich for all of their misdeeds.

Mozilo is laughing, sitting at his poolside, someplace warm and tropical. His kids are plotting another bout of thievery. Hey, worked for Dad, right?

According to Yves Smith at NC, by the time that G-S was repealed, banking laws had been so watered down over the years that the repeal only had marginal effects. The repeal was a formality to allow Citi to legally merge with Travelers.

Let’s review.

1. Mike G. asserts, without the benefit of any supporting facts or analysis, that GLB or the repeal of G-S caused the mortgage crisis.

2. I ask for an explanation and, instead, receive more unsupported assertions from Mike and others.

3. I respond to each of the assertions with actual facts and published research to support my opinions.

4. Mike M points out that I must be a racist and, probably, a wealthy banker as well.

Another example of Huffington Post analysis at its best. Another triumph for the “reality-based” community.

This is again a good & great article, to learn more….. I suggest you buy the book: real estate market timing by: Robert Campbell on amazon. Under $15. Read it every 3 months till you buy 5-10 properties & sell 5-10 properties at the top of the market. About 2018-2022 this next time. ME? I bought and sold over 22,000 acres, 750 escrows. I bought about 9000 acres in the 1990′s & from 1999 to 2008 I sold 198 properties, about 8000 acres, average GROSS PROFIT WAS 1167% per deal per acre! Yup, and the average GROSS PROFIT PER MONTH WAS 49% AND IRR NET NET NET WAS 27.12% PER MONTH FOR 10 YEARS ON 198 SALE ESCROWS. I’m a 1996 CCIM & my math is good, since I took 4 semesters of Calculus, at 17, 18, 19 & age 20… Jr@High School. Sr@Early admissions/college, @College of Engineering & @College of Business. My average cost of goods (basis accounting) of the 198 sale escrows was under 8cents/$dollar. From 2009-2012 I bought over 5000 acres back at an average cost of goods of 2.7cents per acre. My goal is a gross return of about 3600 to 7200% per deal per acre from 2017 to 2023.

2.7 cents per acre? What were you buying, an irradiated wasteland filled with giant mutant radscorpions?

IRS and Obama to the rescue to help renters feel less screwed over by nasty homeowners who’ve paid off their mortgage. Its called implied income and will probably be used to help subsidize the Obamafone family who rents housing. Comments?

http://www.breitbart.com/Big-Government/2012/12/08/the-most-absurd-loophole-in-the-tax-code

Quoting Brietbart has about the same credibility level as Joe Isuzu.

I don’t think so. I think Breitbart has some very sharp stuff there. They’re at least as worth reading as the Times or Post, and often better, more honest, less BS.

Maybe you’re afraid of them, huh?

Considering all the dozens of types of welfare for homeowners, including the mortgage interest deduction, untaxable housing gains and so on, if renters every managed to get a comparable tax break it would just be leveling the playing field. But mostly they should just eliminate the mortgage interest deduction, stop treating housing so favorably for capital gains compared to stocks and so on.

A quickie lesson on the big boys vs. us’n peons….Thank You

Take a look at Japan. They’ve had mortgage rates in the sub 2% for a while. This is what happens in a depression. When ZIRP starts to get passed on to the consumer, you know we’re in trouble.

Wages/income have been stagnant for over a decade. In a credit based system, raising rates means no one can pay a higher price for things since any large capital purchases are based on being able to make the monthly loan payments. So lowering the interest rates is the last attempt at getting the consumer to take out the loan on a large debt.

At 3.5%, rent parity exist in most homes valued at $200K or under. Depending on where you want to live, the rent parity can be a lot higher.

This is what’s getting the retail buyer off the fence right now. I bet the rates come down next year since it will keep the market going.

This is another indication that the ideal that our children will be more prosperous than us, and their children than them, is gone. If not gone forever, its gone for a long time.

Everyone keeps referring to 3rd quarter of 2007 as the peak housing period but here in Las Vegas I purchased a 2200 sq ft home in a gated community in the 3rd quarter of 2007, for 282000.00 down from 360,000.00 approximately 6 months before. I think we get a lot of manipulated stats.

It’s possible the neighborhood/community in which you bought was a bellwether or had some other issue that caused it to crater 6 months before the rest followed. It doesn’t really mean the facts are skewed, IMO.

I think it is solely based upon the perspective based upon where you lived.

The “crash” hit Phoenix and Vegas first. I was in Phoenix in 2007 early to mid 2007 desperately trying to sell my house and falling prices were definitely occurring in many parts of Phoenix by then.

On the other hand, many bubble markets of California didn’t start cracking until 2008.

At least that is how I remember it.

The “crash” started, for me, in May of ’06, when I read a speech by the then departed Central Bank chairman and eternal housing optimist Greenspan warn the world that the upside to the housing market had now stopped. You couldn’t sell a house or condo in Florida at the time, all of a sudden.

“Today, we are still left with the mentality that housing is the road to riches asset class whereas in previous generations it was a place to live.”

I’m not so sure home buyers in So Cal are looking at it this way. Rather than thinking prices will go up, up, up and they see see an HGTV flip for fortune or home equity orgy in their future, aren’t people just tired of putting their lives on hold post 2007? They see 3.5 interest rates and high-limit FHA policy greasing the skids and they’re just going for it, looking at nominal rental parity versus the real price of the home on that $600k home with $100k income.

What these people might not realize is that right of passage of moving up to a bigger home or nicer neighborhood in 5 years is a bygone notion. They’re truly stuck, as it looks like incomes stagnation and restricted inventory are here for some time. If you’re buying, choose your home and neighborhood very carefully!

I agree and would like to pile one more downside for those who got tired of putting their lives on hold…the property taxes on “their” house will be based on the inflated/manipulated price they paid, not the real worth of the property, and will unfortunately only go up from there. Many may eventually get squeezed out of their own homes by those ever-expanding taxes based on a high number. (Thank God for Prop 13, the only thing saving many of the owners in my family) The damage of the people buying now having overpaid will follow them for a lifetime. It is extremely depressing the way the game is stacked against the prudent and well-researched. I happen to feel that .gov/Wall St. will still eventually lose the war of changing the course of a thus-far historically consistent bubble deflation, but every day it becomes more and more depressing – the thought that they could win at least for the next 5, 10 years?. But even then, long term, I take solace in the fact that the baby boomers will someday HAVE to sell to a smaller, lazier, entitled, student-loan saddled, minimum-wage earning generation, and that’s where I think it’s checkmate for housing values. I just don’t see where Gen Y GETS the money to qualify to overpay. We’re now in a world where the TPTB win coming AND going, so who knows even then.

DFresh, it depends on how long and how much rates lower over the next few years. If the government keeps the pretend game going over the next 5 to 10 years where prices remain stable or even go up slightly, those that bought now can feasibly move up. At current rates, you can gain about 10% equity after 5 years, and it’s likely anyone who buys now won’t be underwater at all because home prices are rising (even if it is artificially manipulated).

This is not to say everything is great and good times are rolling for new buyers. But it is to say that there’s a window of opportunity to upgrade in a few years if this extend and pretend game continues. Buyers who bought this year will have the combination of equity and lower interest rates to finance a bigger home in a nicer area with similar expenses.

I do not advocate planning to upgrade while buying a starter home, because the future is still unknown. For all we know, the home prices may collapse anyways despite government effort, and negative equity will pin people in place. One should still consider longevity when buying a home today, but it’s not the end of the world if you buy now. You just have to calculate the risk of not being able to move due to unfavorable market conditions in the near future, but the window is definitely not shut for those that bought this year.

In real terms housing prices are close to all time highs. The undereducated will always be about the payment and not about what something really costs. I guarantee those buying 3.5 down are not thinking about maintenance and remodeling costs, or about anything for that matter.

I am accepting my life as a renter. I have money to enjoy life and freedom to move wherever I wish. I have gold and silver if things go wrong, bank stocks if things go right and cash if we have more deflation.

HI Martin are there any good mathematical models or calculators for the ‘real cost’ of a home?

Daniel, I should have really clarified, I am really only referring to places like coastal California. Places like the Midwest are probably in line with where they should be, and with current rates, probably a bargain.

There are graphs that show real home prices, adjusted to inflation but those graphs are averages, not specific to coastal ca.

Specifically in answer to your question, I don’t know of any.

I do know that if rates were ever to rise due to an improving u.s. economy, it wouldn’t phase most of the u.s. but it would be devastating to markets like Ca. I don’t think the FED cares about Ca. specifically, only the u.s. economy as a whole.

Contrary to the beliefs of many, the FED does have the capacity to raise rates. Many like to point to the 15 trillion that we owe as proof the FED could never raise rates but since the average maturity of the U.S. treasury is now nearly at 70 months and climbing, they could raise rates because the vast majority of debt is already financed at low rates. It is only the new debt that will have the higher rate and that of maturing debt. Eventually the debt burden would put the FED and the Federal government in a pickle, but it would be years before there would be a crisis.

My opinion!

It’s whatever I say it is. That’s a good enough answer for me as it should be for you.

O’ Doyle Rules!

Very well put, Dr. HB. All we have to do is look at Japan. Choose wisely folks, the housing casino is stacked against you. Make sure you love the house and the neighborhood for the next 10-20 years. Japan is now into their 3rd decade of stagflation in order to fix the banking sector and keep their economy from a full scale depression.

http://Www.westsideremeltdown.blogspot.com

More crystal ball theory from people that have no idea what they are talking about. I guess if you say it enough times, it has to be true.

Let’s all say this together folks!

THERE’S NO PLACE LIKE SO CAL, THERE’S NO PLACE LIKE SO CAL.

Just tap your ruby slippers and all will be well!

I threw in the towel and bought something. I figured I and my family needed some place to live and the housing trend is upward in my area. So I did it. I will see if I will regret it. But now I thoroughly enjoy it.

You’ll enjoy the utility it provides, sure — but don’t be blindsided by the positive feedback loop created by all the other capitulating buyers who monkey-see-monkey-do and shoehorn themselves into a mortgage.

I see these people all the time, turning themselves inside-out trying to rationalize why it’s okay to overpay. Meanwhile, they really just seem like losers in a staring contest. There’s no good argument outside of emotional stress to pay thrice as much for a house as it would have cost in 1996 (boom year/gas .99 cents/low unemployment) and for which you will likely never be able to re-finance into a lower rate.

I still think the smart money is on the sell side.

Thanks for keeping us all in the loop. We will be anxiously standing by for any further updates.

BMCBurney – You know *just enough* to be dangerous.

The credit default swaps were deregulated through the Commodity Futures Modernization Act. The swaps allowed the banks to hedge against risk whether they were commercial or investment banks. And the investment banks did not have access to this CDS insurance prior to the assault by the Gramms on GS.

It’s insane and dishonest to suggest that GLB wasn’t a major schematic in the overall design of total market deregulation, as pushed for by the banks and the likes of Summers, Rubin, Greenspan, et al.

Unregulated CDSs are potentially disastrous, since, unlike traditional insurance policies, they are not limited to the principals in the loan. Anyone can take them out on most any loan making them vulnerable to all sorts of dubious scheming. Thanks to deregulation in one case and the absence of regulation in the other, banks were able to purchase large blocks of mortgages, divide them into tiers, make one profit by selling the packages and another by betting on the lower tier to fail, even though they no longer had a proprietary stake in the loans. Admittedly, unregulated CDSs can be terribly profitable, particularly if you are in a position to rig the game, in which case I can understand your throaty defense.

When we stop allowing home purchase with little or nothing down we may get to a sane, dependable situation. You don’t have the right to own a home if you can’t afford it.

Fish breath – you don’t know what you are talking about. The CFMA did nothing with respect to CDSs except make it clear that they weren’t subject to regulation as “futures.” This got some press then (and more now as left-wingers try to find a reason why “deregulation” caused the meltdown) but nobody really thought they were “futures” before CFMA. CDSs existed and were traded freely for twenty years before CFMA.

You are absolutely wrong, just wrong, wrong, wrong, to say that investment banks did not have access to CDS prior to the repeal of G-S. Investment banks were the main issuers, buyers and dealers in CDSs before and after repeal of G-S.

I don’t know what you mean by “a major schematic in the overall design of total market deregulation” and I don’t think you know what you mean either. My contention is that G-S repeal had nothing to do with the mortgage meltdown. If you disagree you should find some facts and a sensible argument to support your position. And here is a little logic tip, I might make a particular argument because I am insane or I might do so because I am dishonest, it really can’t be both at the same time.

Among other things, your last paragraph appears to confuse CDSs with mortgage backed securities and your discussion shows that you really don’t understand either one. It is true that, for participants in the market, CDSs are “disastrous” or “terribly profitable” depending on how events play out. For people who aren’t engaged in the transaction, however, CDS just shift a certain type of risk from one player to another. You can argue that some players, such as deposit taking banks, should not be allowed to issue CDSs because of the “moral risk” arising from the fact that the loss may be imposed on taxpayers when the institutions are bailed out. As it happened, however, deposit taking banks did not issue CDSs, on balance they were purchasers and holders of MBS were the biggest purchasers of CDSs. That mitigated, it did not cause, it MITIGATED the effect of the meltdown.

And, of course, we have the usual accusation that I must be “in a position to rig the game” if I have an opinion that differs from stuff you read yesterday in the Huffington Post or saw on Maddow. Who “rigged the game”? What “dubious scheming” are you talking about? All of the major players in the mortgage industry, investment banks, deposit taking banks, hedge funds, mortgage brokers, GSEs, big pension funds, endowment funds, insurance companies, all of those big money players suffered huge losses during the meltdown. And who gained? The ugly truth is that, aside from John Paulson and a few others, the “winners” were millions of “oridinary American” deadbeats who took out trillions in loans they had no ability or intention of ever paying back. The people that “gamed” the system bought a house for nothing down, never made a payment and did a “cash out” re-finance every year. And when the music finally stopped, they lived rent-free and mortgage payment-free for five years while suing their bankers for fraud and listening to Maddow tell them that THEY are the victim.

But it is easier to insult than it is to argue. Above, Mike M says I must be a racist. How could you forget that one?

bmc –

It sounds like you have a good grasp of the details of what was happening.

What lead to the point where Countrywide Bank was creating its “The Hustle” policy, where it was focusing on quantity of loans and not the quality of of the folks they were lending to. I’ve read blogs where ex-Countrywide loan brokers were complaining about the work conditions that arose secondary to such policies. For example one employee was saying that middle management bonuses were focused on a volume metric, and thus any brokers spending time verifying appropriateness of those wanting loans were unable, because of the amount of time such took, to meet volume goals and were replaced by employees that too were only focused on volume. In short the volume bar was set too high to ensure quality of candidates for loans.

How did such a situation arise?

Also some places in the US, like where I used to live, were not affected by the bubble (home values there are closely coupled to interest rates, but there is no ‘hump’ like there is in the CA market; (once interest rates rise, though, there could be a hump)). It seems the bubble happened in places where there was already large flows of cash happening. How does this tie into the fiasco?

I tend to blame everyone equally – the man on the street and the man on Wall St. and all between – as i have no way to quantify and assign the blame. To me it just looks like a large, manic push, secondary to easy credit which was in place to offset the decline in real income in the American middle class over the last several decades (which again is based on multiple factors and policy decisions layering themselves over the years). For example, one such factor in the multitude, might be the idea of corps expecting bail outs from time to time (Savings and Loan, etc..), or the idea of socializing costs.

I love how your last paragraph is a comment on the paragraph before it. I am by no means an expert in how financial markets work but I will remind you of one thing – the people taking out those high risk liar mortgages were handed the opportunity to do so by ??? – deregulated banks.

Wyeedyed,

The “deregulated bankers” were not “deregulated” as to the thing that caused them to make risky loans. They were making NIJA loans before and after G-S was repleaded. Nothing in G-S addressed those loans or that type of risk. G-S addressed different risks which did not contributed (and, in fact, probably mitigated) the mortage meltdown. Those are the facts. If you think I am wrong, show me how I am wrong by pointing out the provisions of G-S which prevented or could have prevented NIJA loans.

On the other hand, banks were NOT making NIJA loans before the CRA was passed and were making few such loans before the CRA was modified during the Clinton Admin. The evidence overwhelmingly shows that banks made more bad loans during CRA examinations then at other times. CRA directly addressed whether loans should or should not be made to risky borrowers and actually REQUIRED banks to make specific numbers of those loans. In short, the banks were regulated INTO making bad loans, not de-regulated into making those loans.

When I bought in 2005, nobody was saying, “You’ll pay that thing off in 30 years”. Everybody around me was saying, “Well you’re not gonna keep the place forever; right?” Real estate arses, loan brokers, and the like all had that same mantra perfected, as they found it a credible means to grease their victims before they loosened their belts.

Funny it sounds like you are now disagreeing with bmc. According to his prior post you were the bad cry victimizing the bank not the victim.

Something that few seem to mention is job instability. Taking a 30-year mortgage was one thing in a time when there was the illusion of a long-lasting boom, right now it is delusional. It reminds me of Invasion of the Body Snatchers as people come here and capitulate to the system trying to rationalize it not only to themselves but others. I’ll break it down thusly: Many people want a normal life in abnormal times and they are going to have it THEIR way, instead of seeing reality. We want the picket-fence and McMansion, dang it, who is going to tell us we can’t have it, WE are US! But that is how we all got into this mess, on so many levels. Americans have that classic combination of willful ignorance, blind optimism, and the arrogance to think they can never fall, that makes them perfect dupes.

The reason that, one by one, even people with economic common sense are falling like dominoes, however, is that they cannot grasp how big this really is. That is because they are missing the religious/prophetic angle ( punishment for sin, insane greed leading to chaos in society ). Think the Flood — not the Great Depression — and you will be getting closer to how big this is. But without going too much into that, the point is that ultimately they can’t see any other way; and so they figure it HAS to be like this forever, and that the banks and governments in collusion will work something out. And that really is possible. There is a way that this can be extended and pretended even longer: It’s called Antichrist, a one-world government. That is really what the powers-that-be NEED to produce to keep their system going; because a world government could force certain refractory nations into toeing the line and continuing to buy all this bad debt. Antichrist is the punishment sent by God on people that only care about money and not their souls; he restores prosperity while making people believe lies that will damn them, out of fear and delusion. We are not far off, all anyone talks about even now is money, there is zero comprehension of why this is really happening.

If that does not happen, which hopefully it won’t, however, this country and many others will crash and burn, and that would be great, a wake-up call for everyone. Contrary to what some say, no, this cannot go on forever. A deindustrialized declining nation with a bunch of jobless people using welfare to buy cheap Chinese stuff cannot go on forever.

My god (word play intended) new meaning to the delusional housing market.

Leave a Reply to Roberts