Glamorous foreclosures – Beverly Hills foreclosure and short sales – $4 million Beverly Hills foreclosure goes for a second round and $2 million short sale.

The California housing market has enough diversity to seem like a world unto itself. You have areas like the Central Valley and the Inland Empire that are being swarmed by investors looking for cheap places to flip or to buy as a prospective rental. These investors are finding plenty of inventory since foreclosures are plastered all over these markets. Then you have coastal cities including Santa Monica that carry a certain premium, even if prices have adjusted lower. Then we have mid-tier cities like Pasadena and Culver City that are now correcting because people in those areas although with solid incomes, do not have enough to afford current sticker prices. Today we are going to look at Beverly Hills with the prestigious 90201 zip code. This market just like Hollywood puts on a certain front but behind the scenes things are not as pleasant as they appear.

Beverly Hills $4 million home

600 COLE PL, Beverly Hills, CA 90210

Listed   05/01/11

Beds     4

Full Baths           4

Partial Baths     1

Property Type  SFR

Sq. Ft.  5,300

$/Sq. Ft.              $923

Lot Size               20,480 Sq. Ft.

Year Built           1968

You do not get to see many homes in Beverly Hills because not many of the distressed properties make it to the public inventory list. The above home was only listed on May 1st and is certainly what we would consider a prime property:

5,300 square feet is certainly not a small home. I think the staged photos always add a certain Photoshop aroma. Thankfully a StreetView perspective helps:

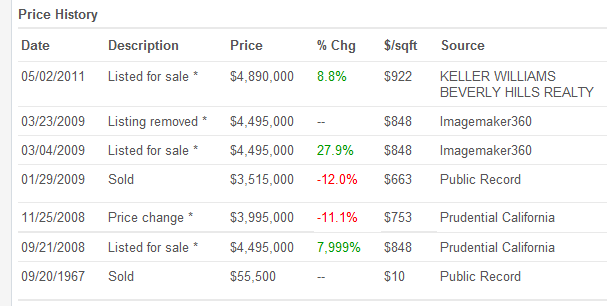

Not a bad place and certainly a nice home for many. Let us look at the listing history here:

It looks like someone tried selling this place back in 2008 for $4,495,000. It looks like the place did eventually sell for $3,515,000 in 2009. Someone tried to flip the place only two months later for $4,495,000. Of course that never panned out. Now the place is listed for $4,890,000. A very distressed property in Beverly Hills. This place only has a day on the market so we shall see if this time there is better luck.

Beverly Hills Short Sale

10051 CIELO DR, Beverly Hills, CA 90210

Listed   01/12/11

Beds     2

Full Baths           2

Partial Baths     0

Property Type  SFR

Sq. Ft.  2,363

$/Sq. Ft.              $1,014

Lot Size               1.2 Acres

Year Built           1926

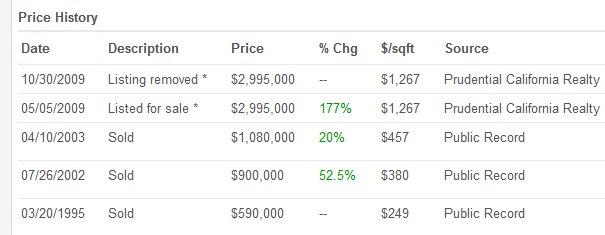

The above is a 90210 zip code short sale. I know people get all picky about the post office designation and actual Beverly Hills city so I’ve included two homes in this post. This is another nice home and would be considered prime as well. 2 beds and 2 baths with a listed 2,634 feet. Maybe looking at the history will help us out here:

The last official sale took place in 2003. At one point they listed this place at $2,995,000! Not going to happen. Today it is currently listed at $2,395,000. The 2010 tax assessment has this place listed at $1.2 million so I’m curious to find out what is going on here behind the scenes. Either way, no one is biting even in the 90210 area code.

For Beverly Hills I see 3 official MLS SFR foreclosures. There are another official 11 short sales. However there are 101 properties in the shadow inventory. This number may not seem high to you but keep in mind the area we are talking about. There are homes with $1, $3, and even $5 million in loans attached.

Welcome to the 90210 correction. At least you get to see nice photos of homes selling for millions of dollars but with loads of distress brought on by mega mortgages. How many people are living in Beverly Hills without making their mortgage payment? Well we know that 101 are having trouble keeping up with their mortgage.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

17 Responses to “Glamorous foreclosures – Beverly Hills foreclosure and short sales – $4 million Beverly Hills foreclosure goes for a second round and $2 million short sale.”

Ben will keep printing $ so that this mansion is available to poor guys like me… In meantime countries like India are raising interest rates to tame inflation.. Smart folks.. When will Ben stop playing to Wall Streeters?

http://www.cnbc.com/id/42871915

Love the blog. By the way that second property has the same address as the Sharon Tate home where Charles Manson and his gang killed her and her 4 friends. I know they took down the original home on the site and put up a new dwelling. I believe this one is it.

MY apologies, it is the home next door. http://en.wikipedia.org/wiki/10050_Cielo_Drive,_Benedict_Canyon,_Los_Angeles

I live in the San Francisco area. Neighbor put house on market last year at $900,000. No offers.

Going back on the market next weekend at “bargain” $890,000.

Will see, but my guess is that it will be a long time on the market.

I’m seeing these as well. There are two types. The first is the set which was bought in 2006, and they want to get out for what they paid for it. My guess is a 5-year ARM was used, and that has either recast or reset so that the payments can no longer be afforded.

I suppose they have to at least try and find a sucker, but jeez, I’d rather pick it up after the foreclosure.

The second are the old folks who have lived at a place forever, and are pricing things at 2007 or so prices. 20+ percent overpriced. Clearly fishing for a sucker, and not serious about selling. Then these go off the market, presumably because they think next year will be better. Good luck with that. I can wait too, and I know it will be cheaper.

There does seem to be a “pop” this Spring though. Lots of pent up demand, with people who just can’t wait. These folks clearly haven’t been following the economy and have absolutely no clue about macro-economics. I feel somewhat sorry for those underwater home owners who fell for the bait during the bubble years. But I have absolutely no sympathy whatsoever for anyone who bought after the Fall of 2008. That should’ve been a clue stick, but some people need to get hit repeatedly before they wise up.

Great response, Questor, and you call it exactly as I’ve seen it as well. Lots of suckers and idiots still out there, though far far fewer than in the peak bubble years. Still plenty of delusional sellers too, fishing in vain.

And I love to hear idiot listing agents say “well the sellers NEED to get $X amount for reason A,B, and/or C”, as if I give a shit about the poor little sellers’ personal situation and needs. Realtor, please! List it 10% below current REAL market value (meaning, 25-33% below current list price) or wait forever to sell!

LOL… yeah, that’ll do it… YEP, that’s the tipping point! It was “fairly priced” at $900k, but $890k, now THAT is the proverbial “sweet spot”! (LMAO) 🙄

Yikes…isn’t 10050 Cielo Drive the site of the Manson murders, or am I confused? Is this across the street? Of course this is LA, notoriety of being near a famous murder scene might attract that special buyer.

“Well we know that 101 are having trouble keeping up with their mortgage.” Maybe Doc, or maybe they decided to quit paying, and start saving up those mortgage payments until they get tossed…at those size mortgages, I assume that adds up to a tidy sum fairly quickly.

The “Cah-lee-fone-ya Premium” is mostly due to… The BABES! How could I forget? Was just out in San Diego recently, and took a little tool up through Long Beach into LA proper… Santa Monica… WeHo… Design District for a little furniture shopping… the ladies expect a certain level of panache at the Enzo digs… ;’)

Anyway… DAY-um!… I mean we’ve got SOME babez in So-Fla, fer shure, but So-Cal has ALL the rest, from ALL OVER THE PLANET, drawn to “Hollyweird”!… I’d forgotten, blanked it out I guess… just stroll down SM Blvd. and every greeter at every eatery and watering hole IS a magazine cover girl… with a SAG card… and some minor TV commercial or music vid to her cred… just enough to keep her hanging on… paying whatever she has to in rent… doing “whatever” she has to… do… to, you know… get the callbacks… =:O Same for guys, I imagine.

I digress… I guess my point is: more than any other area of CONUS, it’s very difficult to get a prehensile grasp on “fair value” in So-Cal, because you’ve got so much starry-eyed not-too-smart money always on the sidelines, ready to make an impulse buy.

Can someone translate this post?

Translation:

Southern California real estate (specifically L.A.) are distorted by the constant influx of young people willing to work multiple jobs and pay outrageous rents, just to be in Southern California.

I see the same thing in San Diego.

Check out the appreciation from 1967 on that first property!!! Sold in 1967/1968 at $55K, and by 2005 it could probably fetch $5.5M That’s a cool 100X appreciation in under 40 years. Off the top of my head, that CAGR/appreciation is about 12% per annum, and with Prop 13, you get to keep the low tax rates of yester-year, so not shelling that much out in taxes. Plus you live in it. No wonder real estate WAS a great buy in California!

Now? Not so much. Real estate agents are telling me that banks are starting to loosen up their lending requirements again. But I don’t think the days of 1.25% 3-year ARMs and NINJA loans is coming back soon. Note to self: Sell when these types of loans come back – it will be the peak of the next bubble.

Henry

What are you talking about, Henry?!? It’s ALWAYS a great time to buy (and sell) real estate. Affordability hasn’t been this great since the age of the dinosaurs, buy now or be priced out forever, blah blah blah.

Here just watch this fantastic vid with all the greatest real-turd/real-tard selling points put to good use (xtranormal is the site where you can craft your own rendered goofy movies with robo-speech):

http://www.xtranormal.com/watch/8095915/you-should​-buy-a-home-now

….

California dreaming has a new meaning……

This post underscores the adage that people spend what they make. I don’t care how filthy stinking rich you are, a jumbo mortgage makes no financial sense. And most people aren’t filthy stinking rich, even (perhaps especially) in Hollywood. But it seems there’s always enough greater fools using artificially cheap credit to bid housing prices up.

What a mess. I wouldn’t be surprised 20 years from now if Hollywood is an abandoned ghetto.

Won’t happen. It’s a tourist trap, it generates an income, so it will continue to get better as it gets safer. Great location near the 101 and it draws a young crowd with big dreams and 3 jobs until they hit it big. I used to live in Hollywood and it’s a unique area not replicated anywhere else in the US.

Leave a Reply to Enzo MiMo