Are foreign buyers driving up the price of real estate? A new record in dollar amount spent by foreign buyers on US real estate.

Foreign buyers are a big part of the US real estate game. I’m surprised that some people downplay this because on aggregate, foreign purchases of US real estate do make up a small portion of total sales. Yet foreign money is very targeted on certain areas. For example, Canadians love buying up Arizona real estate and prices must seem free when compared to the gigantic housing bubble Canada is going through. It should come as no surprise to you that the top international buyer of US real estate is now China. It should also be no surprise that Chinese buyers really enjoy buying in California. Are they buying in droves in Highland Park or other hipster areas? No. But look at places like San Marino and you will see giant pools of money flowing in. The National Association of Realtors (NAR) released a detailed report on foreign buying. I think it is worth examining closely.

Foreign buyers driving up prices?

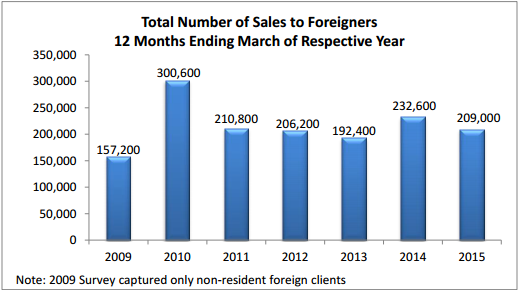

With low inventory and sales volume on the lower end, it is safe to say that foreign buying is driving up real estate in select markets. While total sales are down tracking the overall nationwide trend, total dollar volume is up tracking with the recent jump in home prices.

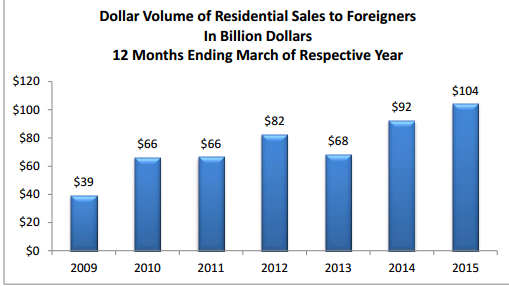

I’ve pulled a few charts from the report to highlight. First, let us look at overall sales volume and dollars spent:

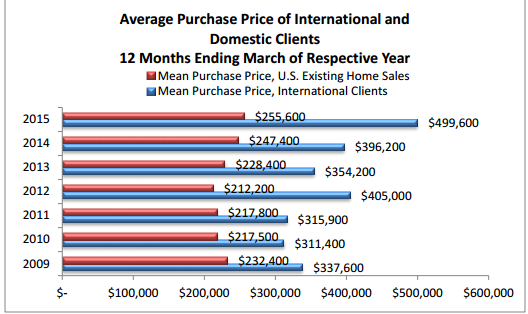

This is interesting data.  You will see that in 2010 we had a high number of sales. 2015 isn’t anything special so far but what is special is the amount being spent, which is at a record. Why is that? Because foreign buyers are paying much more than your typical domestic home buyer:

According to the NAR, the mean price paid by a US buyer is $255,600 versus $499,600 for a foreign buyer (a difference of $244,000). Compare this to 2009 when the difference was only $105,200. What this tells us is that domestic buyers are having a tougher time keeping up (hence rental Armageddon) while foreign buyers are easily able to pay higher prices.

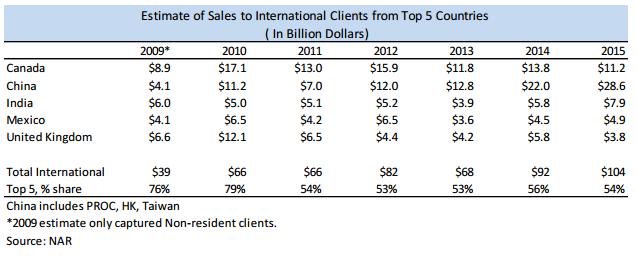

Let us look at some general trends:

What a difference six years can make. China was a small player overall in 2009 but now is the biggest buyer of all countries. The UK was a big player in 2010 but not anymore. Canada had a crazy year in 2010 as well but has since pulled back. You will notice however that China is out ahead of the game big time in 2015.

With that said, where is Chinese money going?

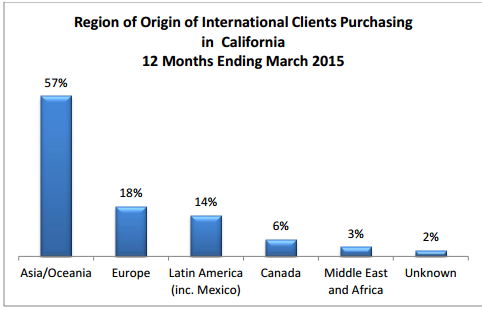

We can safely assume that Asia is largely dominated by China here and the bulk of the buying in California by foreign buyers is coming from China. So what is the intended use of purchases here?

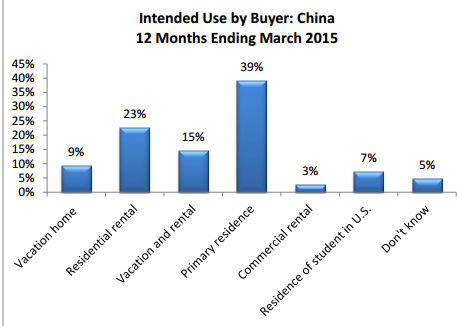

Only 39 percent of purchases to Chinese buyers are intended as primary residences. Some are looking at using the place as a vacation home, a rental, or both a vacation home and rental. I’ve heard from many readers saying that some neighborhoods are becoming “ghost†hoods thanks to absentee buyers. There is no rush to rent out the home once it is bought and many don’t move in for what would seem like a year or more. This also has the effect of removing inventory from the market in an already low inventory game.

This trend helps to explain how prices are moving up while incomes domestically remain stagnant. In many areas both local investors and domestic investors have pushed prices up. This is part of being in a global economy where money flows in an out. I’m sure many of you vividly remember Japanese money rushing into California real estate in the late 1980s and early 1990s. Foreign money is definitely having an impact in certain regions of the United States.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “Are foreign buyers driving up the price of real estate? A new record in dollar amount spent by foreign buyers on US real estate.”

I thought today’s NPR pod cast nicely compliments this post. It talks about LA becoming a global market like Manhattan.

http://www.scpr.org/programs/airtalk/2015/06/23/43390/real-estate-experts-weigh-in-on-socal-housing-mark/

Doc, not sure where you’re getting the downplay of foreign buyers from. The dispute is around the longevity and stability that said buyers offer the marketplace for domestic buyers. With a higher mix of Chinese come lately buyers, it’s rational to question their reliability as there isn’t much of a history to draw upon. Combine that with a propensity for gambling and I wouldn’t be surprised to eventually come to find out that they are largely treating SoCal real estate as another casino platform. The NAR intended use data for Chinese buyers is laughable, how reliable is that, seriously?

You are misinformed of the marketplace, Hotel

The Chinese marketplace has been building up for the last 30 years in southern California. The wealthier of the bunch tend to gravitate towards the better school districts, such as Arcadia, San Marino and Las Virgenes.

Take a drive to Alhambra and tell me that the Chinese community is not a vibrant asset to Southern California

You fail to point out exactly how I am supposedly misinformed. I make no representations contrary to anything you wrote.

As for the Chinese activity, it may have been building up for decades but it’s only in recent years that it’s been with a relative amount and increase in rate.

Last I checked it was nearly all of these parts of San Gabriel Valley.- San Gabriel, Rosemead, Temple City, Monterey Park, Alhambra. Also swaths of Diamond Bar, Hacienda Heights, etc.

Take a drive to Alhambra and tell me that the Chinese community is not a vibrant asset to Southern California

Tell that to those who have been priced out of the neighborhood they grew up in. Or seen there employer close because the “new demographic” doesn’t support his business. Or the remnants of the old demographic who can no longer receive services because the new demo has no interest in catering to them. If there was a corresponding “AmericanTown” I could move to in mainland China I might not take it so personally 🙂

Nihilist,

There is a “corresponding American town” that you can move into. It’s called hipsterland and it’s displacing the communities that thousands of native born Mexican-Americans, Asian-Americans, and African-Americans grew up in. The rents sky rocket so 40 year old businesses run by minorities close. The current frontier of American town/hipsterland is Eagle Rock and Highland Park. Gastropubs are going in. Panaderias are moving out. Venice beach is now tragically hip. And if hipsters aren’t your thing, Studio City seems like an “American town.” Among others.

And take heart, some friends of mine just moved to Alhambra because they could no longer afford renting in South Pas. They bought a place for a great deal and are of Northern European descent. The covered wagons are on the move.

Blue Moon

Ooops!

Nihilist, please disregard my message.

I failed to notice that you specified “In China.”

My bad.

Blue Moo

@Blue Moon

Cool Story Bro… But has little to do with there not being an immigrant patch in China that would have any equivalence to the takeover of the San Gabriel Valley. Just Sayin’…

We’re talking 2 different types of Chinese. The vast majority of Chinese and Chinese-Americans have Cantonese roots from southern China or Hong Kong descent. These folks mostly came over relatively poor and started businesses and were regular middle-class immigrants – American dream Horatio Alger stuff.

These new ones are Mandarin speakers from Beijing/Shanghai who are coming over with millions of dollars.

Different groups.

This is what I think of a lot too, having spent time in China. Not just gambling but superstitions and trends, it’s all about appearance. Take this for example:

http://www.nytimes.com/2015/04/18/world/asia/once-prized-tibetan-mastiffs-are-discarded-as-fad-ends-in-china.html?_r=0

It speaks volumes toward their attitude. One minute it’s worth 200k, the next it’s worthless because the fad is gone. I know it’s a dog but I think they treat the US real estate the same way.

If Irvine split off an area code and got a number with too many ‘bad numbers’ in it I wouldn’t be surprised if it affected purchases. Or if any little thing disturbs the APPEARANCE of worth, it could quickly drop…

They place an insane amount of importance on what other people think. As you know all it takes is ONE sale/comp to propagate and drop the sales around it. That’s with normal buyers…what do you think happens with Chinese buyers at the SLIGHTEST drop in perceived value? I feel like it moves out just as fast as it moves in, rational thoughts out the window…

Thank you, yes, this. Hello red door fad.

I decided to answer my own question and dig into the report. To begin with, Doc cites “foreign buyers” making for a fairly broad classification. The NAR report breaks it down to about 50% with a permanent residence outside of the U.S. and the other half living here for less than two years or on a temp visa.

“Sales to foreigners are split between resident and non-resident purchasers. Resident foreigners may be in the U.S. for business, educational, or other purposes. Non-resident foreigners are typically looking for a vacation or investment property.”

Half of surveyed Realtors are signalling that their clients may not intend on taking a permanent stake in the purchase area which boils down to a nice place to visit but… Then we have the other half defined using a weak methodology determining intent on staying. This matters because as I wrote above, nobody is disputing the scope of foreign buyer influence on the market today, it’s the goals and eventual outcomes which are up for debate. How much of the foreign buying activity is investing and how much is speculation? The NAR states that “There is a substantial and increasing level of global wealth, and the U.S. is a secure and attractive location for investments and owning property” which is not really news, what’s important are the motivations and intentions which are not qualified in the report.

A common refrain of the SoCal real estate price pumping brigade is that international interest is a mitigating factor of red flag issues which have come to define domestic market activity over many decades.

More about that NAR methodology. Data is based on survey responses from about 5% or less of randomly selected real estate agents who are also Realtors(tm) which was gathered over a two and a half week timeframe in April “about the characteristics of the REALTORS ® most recent sale during the 12 month period ended March 2015.” “Among REALTORS® who reported dealing with an international client, approximately 58 percent reported 1 to 2 clients.”

Yes, I’m calling into question the pertinency of the data, especially considering that it’s sourced from agents’ perceptions of their clients intentions.

Some other relevant observations from the report:

“Approximately 209,000 houses are estimated to have been sold to foreign buyers over the time period, approximately 4 percent of total Existing Home Sales.”

“The total foreign sales dollar volume is estimated at $104 billion, approximately 8 percent of total Existing Home Sales dollar volume.”

“Unit sales of homes to foreigners declined by 10 percent in the 2014/15 timeframe, possibly due to the strengthening of the U.S. dollar in relation to foreign currencies and weakening foreign economics.”

“International sales were approximately 8 percent of the total U.S. Existing Homes Sales (EHS) market of $1.3 trillion for the 2014/15 time period. The number of sales transactions was approximately 4 percent of total Existing Home Sales.”

“About half of Chinese purchasers were resident buyers. About 35 percent of reported purchases by Chinese buyers were in California. Other major destinations included Washington, New York, Massachusetts, Illinois, and Texas. About 39 percent of purchases were for residential purposes, and another 7 percent of purchases were for residences for students while studying in the U.S.”

In other words, small in scope as it relates to the applicability to the national picture of which this report is based. The only thing the NAR offers as an idea of how it breaks down to regional markets are weighted metrics of searches on realtor.com and they admit that the largest cohort of buyers from the survey (China) has hardly any activity on realtor.com. It’s telling that the Bay area market isn’t at the top of the realtor.com charts presented in the report.

As for the regional data they do offer based on the survey, the Chinese were only closing in CA 35% of the time and out of those, only 39% were reported to be for those wanting to take some sort of a long-term stake in the area.

“The dollar volume of residential purchases by resident and non-resident foreigners is estimated at $104 billion for the 12 months ended March 2015, based on a 10 percent decline in units sold along with a 26 percent increase in price. Sales to resident and non-resident foreigners accounted for approximately 8 percent of total Existing Home Sales of about $1.2 trillion over the period: $54.4 billion (non-resident); $49.4 billion (resident). In terms of units of sales, the number of sales decreased to 209,000, a 10 percent decrease from the previous period level of 232,600.”

“However, for international buyers the share of purchases that are financed by a mortgage appears to be on the uptrend, possibly due to the increasing share of resident clients who are more likely to seek mortgage financing in the U.S. than is the case for non-resident clients.”

“About 43 percent of those who had international clients reported they had at least one client who did not purchase a property, a slight decrease from the 45 percent in the previous period. In a number of cases REALTORS® had international clients who did not purchase a U.S. property. “Could not find propertyâ€,“could not obtain financingâ€, “cost of propertyâ€, and “other reasons†accounted for many of the cases. For example, “Could not find property†accounted for 17 percent of the cases and may represent a case in which the REALTOR® had trouble connecting with the needs, desires, culture, or objectives of the potential purchaser.”

“The bulk of purchases by international clients were all-cash, accounting for approximately 55 percent of reported foreign transactions.”

International clients, paying cash, have had issues moving money from their home country. Longer process than it once was.”

55% is hardly a “bulk” and while foreign buyers are a declining factor, increasing numbers of them are seeking financing?

“U.S. property taxes, condo fees, real estate laws and regulations, and ways of doing business may be substantially different from those with which the potential foreign purchaser is familiar.”

“For example, potential foreign buyers may also be unfamiliar with U.S. practices in regards to condo and other fees and property taxes.”

“Taxes, dollar exchange, insurance are huge factors”

“International clients have a hard time understanding our laws and our processes.”

I imagine there are probably a lot of foreign buyers, especially Chinese that are setting up expectations for their “investments” on the basis of inexperience with the dynamic nature of our taxes and fees, but hey I’m sure that will all end well when they find out how sharp these tools can cut in the future.

“Nearly half of international clients preferred to locate in a suburban area, and about a third located in a central city/urban area. Approximately 9 percent of foreign buyers located in a resort area.”

Apparently most don’t want to live in the congested prime urban shores of SoCal.

I have lived in Irvine for 35+ years and follow the higher end neighborhoods quite closely. (ie. Turtle Rock, Shady Canyon).

FWIW, to my eyeballs, the number of Asian (and to a certain extent Middle East) buyers has up-ticked noticeably in the last 10 years.

If a property has good Feng Shui, properties do sell quickly and without too much price negotiation.

Irvine is certainly a nice place, and is home to some of the best schools in the USA. (ie. University High in Turtle Rock) and UCI University, which is very very important to many families.

I might note that I am a long time reader of this blog and really thought that higher end property prices would decline a bit or at least bottom out. So far that hasn’t happened. Prices just keep going up and up and up. Available inventory for sale is also quite low. Current situation is just unbelievable with apparently no end in sight.

If any Dr. HBB reader knows the Irvine area and would care to comment, I sure would appreciate some insight as to the internal gearing of all this endless price appreciation.

Irvine inventory is now higher than it has been at any time in the past five years. The explanation for the post 2008 bubble bust low inventory putting upward pressure on prices dynamic shouldn’t be any mystery and it’s not specific to just Irvine. The pre-2008 over leveraged crowd did not experience the haircuts that would have otherwise happened had government (includes the Fed) not stepped in to change the rules of the game midplay. Therefore, people instead deleveraged in other categories and sheltered in place with the hope that their household balance sheet would recover soon enough. My guess is now that prices are back in the stratosphere and word on the street is that rates will rise, they’re coming out of the woodwork to sell in time, hence the spike in inventory. Problem is that there weren’t enough greater fools created in the space of the past seven years, Chinese/Asian buyers notwithstanding. Either prices will have to adjust down or sellers rediscover debt purgatory.

Decided to take a closer look at Irvine inventory. 20% with at least one price reduction in the last two weeks alone. All the way from $285K to $9MM and in practically every reach of town.

well to do koreans have been moving into irvine for more than 20 years. it’s the schools plain and simple. torrance cerritos fullerton irvine etc. ….

Hotel CA – Are you saying that foreign buyers are now selling their properties in Irvine due to the possibility of a housing downturn in prices?

Jimmy, what I am theorizing is that the recent spike up in inventory is a result of formerly underwater mortgage holders now looking to cash out before interest rate increases.

Between USC endowment spending and Chinese speculators, downtown LA will continue to build at a rapid pace. Just in the last 4 years so much has changed. Massive apartment building popping up everywhere with no increase in jobs to support those people’s luxury craving lifestyles. i don’t understand how this dynamic will work.

Exactly. Tons of new inventory but no wage or job growth to support it. Hmmm…how does this end well?

Doc,

Great article as usual. The chart that compares US resident mean purchase price to international buyer’s purchase price: any chance that’s available on a per state basis?

Like Hotel says, I too wonder about the bias in the last chart, although I think the respondents are going to be the source of bias (lots of people will say their main purpose is “Primary Residence” as that’s what they’re supposed to say if the primary/secondary reason to purchase is to gain citizenship. As long as their business back in China is still running and still needs ownership/management on-site, they’re not going to reside in the US until the SHTF..)

8% of the total national market place are Foreign Buyers, certainly we have see the Chinese impact here in Irvine CA

In the last report for existing home sales, even though the top line number beat expectations the % of cash buyers are falling year over year and are under 30% for every month in 2015.

http://loganmohtashami.com/2015/06/22/existing-home-sales-the-good-the-bad-the-ugly/

One of the other aspect of the Chinese buyer is that you go into the new commercial lots built in Irvine you can see it’s primarily suited for Asians…. which makes sense due to he demand curve

I read somewhere — maybe Doc wrote it — but the gist is that the Realtors lobby pushed through legislation that gave foreign buyers exemption from showing where their cash came from whereas you and I would have to have paperwork supporting our all cash offers. Open to being corrected but this the way I remember the article.

It’s awfully peculiar that an American citizen would have to prove a money trail when buying a property, but a foreign investor does not. The USA is selling out to the highest overseas bidder.

@Bubble Pop — I found the info. Realtors fought to make foreigners exempt from due diligence checks on their money while every American is having their money scrutinized. The people saying they bought “all cash” no problem either didn’t or their money trail was clear and apparent or the check was done without their knowledge. The article is in this thread.

There wasn’t any extra paperwork on my last all-cash residential purchase. You just cough it up during escrow as usual.

Same here. If I buy cash, nobody is asking me where is it coming from. I bought both residential lots and comercial buildings and all they ask me was for the cashier check. …and I am not an international buyer.

“Turns out, buying a home in the US with laundered money is OK for foreigners. But don’t try to do this if you’re American. And that’s on purpose, thanks to the most un-American, big-brother, insidiously misnamed law that just doesn’t stop giving: the Patriot Act. The New York Times explains:

As signed into law in 2001, the Patriot Act would have required real estate brokers and others involved in real estate closings and settlements to conduct due diligence checks on their customers. After heavy lobbying by the industry, the industry was exempted from the final regulations.

This “temporary†exemption for foreigners, handed to the real estate industry in 2002, is now under fire. In their letter to the Treasury’s Financial Crimes unit, the 17 groups are asking that this exemption be yanked, that real estate professionals and banks be required to perform due diligence on these foreign buyers – just like they already have to with American buyers. Why should foreign buyers go scot-free?”

Read more at http://investmentwatchblog.com/a-privilege-rich-foreigners-have-that-americans-lack-when-buying-a-home-in-the-us/#xWfZCcJOH0Zdv1AC.99

Treasury Urged to Scrutinize Foreign Real Estate Buyers for Money-Laundering Risk

http://www.nytimes.com/2015/03/11/business/treasury-urged-to-scrutinize-foreign-real-estate-buyers-for-money-laundering-risk.html?_r=1

My question is why are places like Australia implementing restrictions on foreign real estate investments? And, there are many places around the world where foreigners don’t just step in and buy, there are hoops and restrictions. Is the foreign investment really beneficial, or are we Americans just too greedy and will do anything for a buck? And, really ins’t that greed by both overreaching buyers, over zealous lenders, realtors and speculators with $$ in their eyes, the real reason for the bubble and big pop?

I’ve heard that foreigners cannot buy land in Mexico. At most, they can lease the land for 99 years.

OTOH, Canada seems pretty welcoming of foreign money. Vancouver is another favorite Chinese destination.

haha we’re talking about good ol US of A. As much as that idea will probably make sense to protect the real citizen of US…we can’t even get simple gun control to pass after many massacre at different schools.

We have gun control….turns out people that want to kill others don’t care.

Laws are only for law abiding citizens. The lawless care less if you have 10 laws against funds or if you have 100. What is the purpose of new laws? Aren’t there enough laws to prosecute those who shoot in schools and churches ????…..

If you want to PREVENT shootings, then make sure the citizens are well armed. By the time the police shows it is already too late. Call 911 and by the time they come at least 30 will be dead. There is no better preventions than well armed citizens.

The druggies and psychos will kill with or without legal guns – they can use knives or stolen guns.

Against guns not “funds”

We currently have the EB-5 visa program – https://en.wikipedia.org/wiki/EB-5_visa – and other countries such as Canada have such programs in place from time to time. We turn on the spigot, then turn it off/replace it with new programs. EB-5 allows foreigners to apply for residency with the promise of opening US-based businesses with 500,000 – one million dollars and provide at least 10 jobs. It can vary by state and special economic zones. It can also be gamed like anything else.

http://www.seattletimes.com/business/real-estate/money-from-investor-visas-floods-us-doesnt-reach-poor-areas-meant-to-benefit/

JN,

The latter part of your comment is correct. We are addicted to the Chinese money.

Realtors, Banks, Cities, Pension Funds, and service businesses.

The Irvine company is building homes especially for the mainland China market, because they have the $$$.

Zillow lists U.S.properties in China, because that is where the $$$ is.

So how do they do it? Wire the money to a realtor’s escrow account? Open a bank account here and then wire to it and then on to the title company? I have two friends now overseas who worked hard and have the extra money and both want to buy a house here since they have heard so much news about “everyone is doing it.” So where do they look? Where can they find info about this and all the requirements? Can’t be that easy, right?

Considering many people here are not enthusiastic about foreign buyers helping to drive up real estate prices, I certainly wouldn’t expect a very helpful reply to your inquiry.

I thought they didn’t like US? Is this the planned invasion they always talk about?

People with money living in corrupt countries are always looking to get money out before corrupt officials tax it, take it, change the rules, whatever. They look to countries that have strong rule-of-law like the US, Canada, UK, Australia to put/hide their money.

“officials tax it, take it, change the rules, whatever”

Which is why they will be in for a big surprise when they find out that the exact same things take place in the U.S. in ways they can’t imagine. Once it’s happened, they’ll be stuck with the same realities and outside of their homeland to boot. There is no free ride.

Not the same by a long shot. Chinese communist leaders can basically do anything they want – confiscate all your money, shut down your business, force you to hire cronies, charge you with a crime and stick you in prison – whatever they want. And this capitalist gravy-train they are playing can change whenever they please as well. And yes, some of this money is ill-gotten gains by US standards. So if I owned a factory there and was making big money, I’d try to get it out to wherever in the law-abiding world I could get it out to while I had the chance.

Also, the spigot of people allowed out of the country hasn’t been turned on that long – Chinese know the spigot could be tightened shut at any time.

Split hairs all you want but it doesn’t change the fact that new taxation, rules, and confiscation happens here to. There is no hiding place, especially real estate.

Canadian buyers slowing down in the states. Chinese who can blame them get out and come to America, China is time bomb ready to go off they have so many unsolvable issues.

I wouldn’t doubt they go back to everybody wearing gray flannel and wood clogs in the streets again, they are a Communist regime in case you missed it.

I would categorize China as a centrally planned capitalistic regime. Kind of like the USA is now.

That is a good observation. Every time you get a powerful private central bank you get everything planned for wealth transfer from the middle class to the money changers.

By that definition, every country in EU is in the same boat. They want to get Putin on board but he doesn’t cooperate too much – that’s why the conflict.

We have a lot of Chinese buyers paying cash up in Silicon Valley. Between them and G/F/A stock options, this place has gone from unaffordable to obscene. We have a lot of Chinese buying for investment only, leaving $5-10M houses vacant, with no intent of occupying. My benchmark for this insanity is a typical 3/2 Eichler in Palo Alto, now going for about $1.8M, that sold for $400K in ’98.

the foreigners are not buying here in Oxnard. You send them over here to Oxnard and I can get them a good deal. We are much cheaper than Newport Beach. Time to go, it is Corona time as I take my boat out of its slip. Good luck getting back in.

When Oxnard gets rid of its gang problem, when there are nearby jobs available (besides being a gang member or a fast food worker), and when the average Great Schools rating is above a 4 (out of 10), please let us know! Otherwise, foreigners seem to have the right idea about Oxnard. Btw, the average Great Schools rating for the real Newport Beach is a 9. As is typical, you get what you pay for.

Sources:

http://www.greatschools.org/california/oxnard/

http://www.greatschools.org/california/newport-beach/

Carlos… Chinese people are big on so called status and location. Don’t think they are interested in a good deal, they buy crazy because they think it is so cool to have a house in No CA. or O.C. They gamble the same way without a conscience. When buying cars they rather buy a used Aston Martin 2008 than a new Benz or a used Maserati over a new 7 series BMW. Yes if they had common sense than they could put a lot of areas in good standing in relation to house buying, but they won’t. I have dealt with them many years, the women buy jewelry for thousands of dollars because it is flashy most of it is poor quality, but when you buy on impulse like most these folks do, you can’t tell them or guide them on anything expensive.

PS Japanese buyers are entirely different.

Yes, Japanese are very different than the Red Chinese. Japan is our little brother, but still a brother, unlike the Red Chinese. Undisclosed Japanese people have already informed me about the Red Chinese(and others), I will not say more since it would not be PC.

a friend bought a townhome in a brand new development in torrance in 2/07 for $520,000 and zillow says it’s now worth $568,000.

my point is that if the area is in a good school district the houses are above the highs of 2006, 2007

ben please Zillow??? Don’t ever use them as a source or guideline, lazy folks use them public records and even news papers that print closed listings in a zip code you need to know the value of the street and blocks surrounding the investment.

Would you buy a stock in days or up to the minute to get a good deal. Zillow is generally weeks or even months away from what properties have closed by then it is to late to learn a true market value. The site in the end I feel will go under, it is a cesspool of misinformation like the internet is?

Zillow accuracy varies from location to location – price estimate is a fast-moving target in California anyway – at least currently. Zillow gets the sales info from the county the day it is recorded – if comps are the only criteria for gauging value, which it sure is not.

What you left out is that a lot of this money is being taken out of China and put into US real estate for purely safe haven purposes. Some of the money is ill-gotten (“corrupt official” is China’s leading occupation) and removed from the country illegally.

Real estate investment is a great way to make most of your investment. This invites foreign investors to the US because real estate is booming in the US. Great Figures and illustrations of how the US is being invaded by foreign investors.

Not only that but a lot of large real estate investment companies are funded in part with Chinese money. Google it. And, a lot of Chinese investment gets missed as it may be in the name of a relative who is a US citizen. A lot of the money is being laundered- they don’t care if it generates an income or not.

I suspect some money is also being counterfeited. This is happening world wide, not just in the US, Canada, Australia and England. Just huge.

bigger question: Is foreign money investing into U.S. real estate a good or bad thing? And why?

Well, if those properties are not being rented out then it’s undoubtedly a bad thing; shortage and overinflated housing. Rents go up, less people can afford them, more homeless, more emergency services, more crime. On a social level- less community which means more crime and emergency services, poorer quality of life. The only ones benefiting are those who need to hide their money without any returns and corrupt politicians, regulators and a minority of RE agents.

Oh! and some homeless people who now have good places to squat. I guess there is a positive… Although a lot of homelessness is caused by the whole sequence.

It’s like a dog in the manger kind of thing- nobody likes seeing that except the dog.

Homelessness is NOT caused by expensive housing. Does anyone still really believe that idiotic leftist/pro-rent control narrative?

Normal, healthy people get roommates, or move back home, or move to a poorer section of town, or leave the state. Normal people rarely become homeless, and if they do, not for long.

Chronic homelessness is caused by alcoholism, drug addiction, and/or mental illness.

During the 80’s when Reagan closed the mental hospitals most of the homeless were mentally ill.

During this depression most of the homeless are women and children according to an article I read last year

I read about a block of homeless in Downtown LA that consists exclusively of recently displaced residents of Highland Park. People who are down and out and lack a safety net. Btw where is the “poorer” place to live on minimum wage? The Eastside of Los Angeles is rapidly gentrifying. Where should the gardeners, bus boys, housekeepers, and nannies live? The (upper) middle class can’t afford to pay the help a living wage. They’ve got the house payment and the payment on that Prius/Lexus/Mercedes.

Blue Moon: “where is the “poorer†place to live on minimum wage?”

Maybe in Barstow. Maybe Arizona. And maybe Mississippi.

Lots of lower-cost cities and states in these United States.

Dr HB – Time to do another article on Ventura County. Prices in east county are generally at or above 2006 levels. A lot of price reductions albeit numerous sales propping up insustainable prices. Please address! Thanks!

If Chinese buyers are coming in buying houses in Irvine and other cities, what do you think will happen to home prices in these areas when the next recession occurs? I would imagine prices will not fall too much because there is endless money coming from China? Or will the Chinese SELL their US real estate when the Chinese economy takes a big hit (which is coming very soon)?

@Jimmy, home prices in May 2015 are down year-over-year in 5 of 8 Irvine zip codes.

Home prices in many Irvine zip codes have been trending down year-over-year since January 2015.

The Red Chinese government started a crackdown on hot Chinese money about 3 years ago. This is why prices in places like Irvine, gambling in Macao,and real estate prices in mainland China are now in reverse.

Do you think the Chinese will SELL their US Real Estate when the Chinese economy collapses in the near future? The Japanese sold when their economy tanked in the early 1990’s.

“You will notice however that China is out ahead of the game big time in 2015”

the Chinese are printing yuan like there is no tomorrow and buying up thew world with it, and nobody seems to care.

If US interest rates go up .25% and theirs go down by 6-7%, our currency will be crazy valuable in relation to theirs. I don’t think they will be able to continue buying. It’s funny because all it will take on our end will be .25% to not only increase dollar’s value but this will also trigger massive capital outflows from China meaning the end of their $4 trillion or so in foreign reserves.

China just cut the benchmark rate and bank reserve requirements. Seems like a desperate move.

Sitting on the fence, waiting for the Chinese money to stop flowing to Cali real estate.

Maybe then I can afford a crapshack in Fremont.

What’s so bad about American homes for American citizens?

Realtors will have to work for their commissions again?

On one hand, this is awesome if you are in the real estate business.

On the other, it sucks for those who can’t complete and are not willing to pay over the top, inflated prices.

I don’t think the “bubble” will have any affect on these Foreign buyers. They are immune to the bubble. After all, they bought it cash.

Depends on how you define immunity because the leveraged can simply walk away leaving the lender holding the bag.

Interest rates in California up almost 13% in the last 3 months.

http://i.imgur.com/9H437OS.png

Good entry Doc. I don’t like the market, but I do like your cold hard analysis of it.

Similar phenomenon in other prime global conditions. It’s going to be interest to see what happens when values begin falling. I will not chase this market, but wait until the deals begin coming to me; when realtors are the ones trying to cajole me to a viewing, to tell me there’s a lot of flex in the asking price, to beg me to make an offer.

_____

‘It’s like a ghost town’: lights go out as foreign owners desert London homes

Absentee owners and the ‘buy to leave’ market are hurting businesses as housing rises up the political agenda in the capital.

Sunday 25 January 2015

In the exclusive streets of Kensington and Chelsea, foreign buyers account for 20% of all property purchases in the last four years. The borough has the highest proportion of empty homes in the capital.

more http://www.theguardian.com/uk-news/2015/jan/25/its-like-a-ghost-town-lights-go-out-as-foreign-owners-desert-london-homes

its gonna be interesting

it does not look like it is sustainable

we need to see how does the bubble pop if it indeed pops..

http://www.msn.com/en-us/money/markets/with-dollar21-trillion-chinas-savers-are-set-to-change-the-world/ar-AAc8DoR

What do you think about this article?

Doc: I’m sure many of you vividly remember Japanese money rushing into California real estate in the late 1980s and early 1990s.

_____

I hope that is subtle code for crashy times coming. A repeat of the topping out as per Japan late 80s early 90s.

It will be interesting to see how the recent stock market crash in China will affect real estate in the U.S. I’m hoping many Chinese owners will sell in CA increasing inventory and lowering prices 🙂

Leave a Reply to robert