The financial psychology of negative equity – 1,880,000 California mortgage holders have no equity in their homes. California home prices will fall 15 to 25 percent in the coming years. 1 out of 3 California mortgage holders at risk of walking away or defaulting.

Negative equity is a polite way of saying someone over paid for a home. The technical term takes away the actual visceral reality of being underwater on a mortgage. Empirical research has come out of this nationwide housing crash and the number one predictor of foreclosure is negative equity. Now this is obvious on the surface but it is good to have actual data validating this reality. Being underwater puts many Americans in a negative net worth situation. Most Americans do not participate in any significant way in the stock market. The vast majority derive a large amount of their net worth from the equity in their homes. So the current nationwide housing crash has wiped out over $6 trillion in real estate wealth from the peak. Was this even wealth to begin with? Of course not but psychologically people were spending as if equity gains of 15, 20, and even 25 percent per year were a new paradigm. With the ability to leverage housing purchases for an entire decade we are now dealing with the unfortunate repercussions. As one would expect, home prices are now at a post-bubble pop lows.

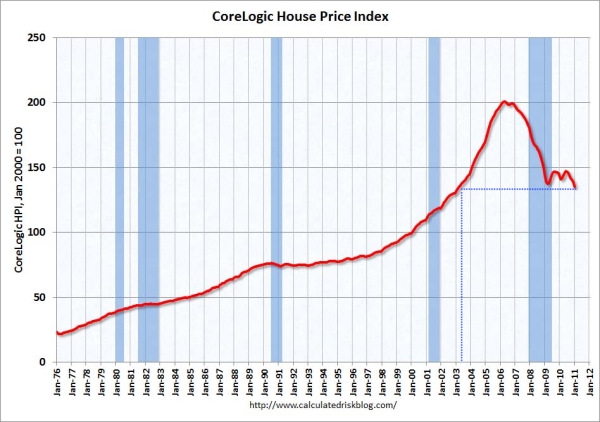

Home prices reach a new low

Source:Â Calculated Risk, CoreLogic

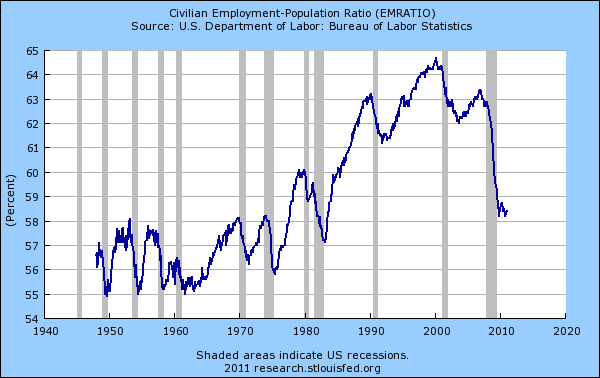

As the chart above highlights home prices nationwide have reached another new low for the crisis. Keep in mind this new low has occurred even with the Federal Reserve pumping trillions of dollars in loans, bailouts, and other gimmicks into the banking industry. The end result was that banks solidified their balance sheets while home prices saw a brief respite that is now coming to an end. This would be expected since people pay for their home mortgage with a job. Jobs are harder to come by as noted by the current civilian participation rate in the employment market:

The last time we had an employment-population ratio at this level was back in the early 1980s. The recent jobs that were added were largely lower paying work. So how are you going to pay for a $500,000 home working at Wal-Mart? Most in the country realize this unsustainability and that is why in places like Nevada, Arizona, and Florida with incredibly large housing bubbles, prices have fallen across the spectrum as the market adjusts to the new reality. Here in California aggregate prices have fallen dramatically but the delusion runs strong in certain niche areas. People find it hard to believe that a place like California can see another 15 to 25 percent cut in prices. Yet this is exactly what will and is happening and we have shown many examples in mid-tier markets of homes that serve as tipping points.

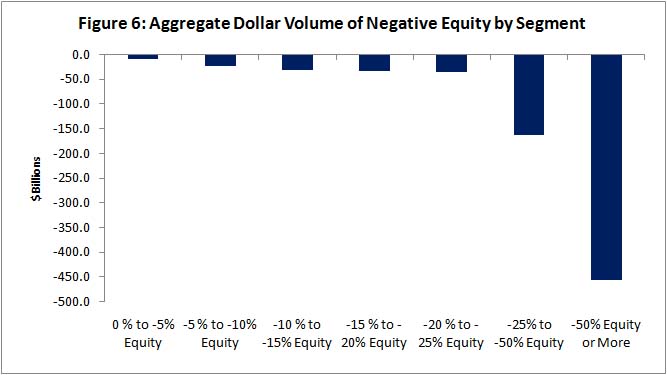

The big future losses come from severe negative equity

Source:Â CoreLogic

Not all negative equity is created equal. Say you have a home in Alabama that is underwater by 5 percent. This might translate into being under by $5,000. This is likely to have little impact on a family moving out. However, try a home in California with an option ARM that is underwater by 30 percent and was purchased for $800,000 at the peak. You are now talking about being under by $240,000 which is enough to mentally encourage you to walk away. $240,000 does make a decision easier. Psychologically many of these people have walked but are simply staying put enjoying the rent free aspect of the bubble bust. Keep in mind it is your taxpayer dollars paying for these people since the banks that allow this to happen would not even be in existence today without the trillions of dollars in various bailout programs. Banks are the largest beneficiary of the bailouts and the biggest culprits of the crisis.

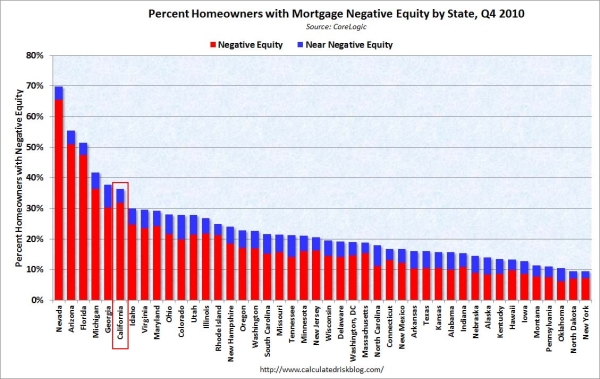

States of negative equity

Source:Â Calculated Risk

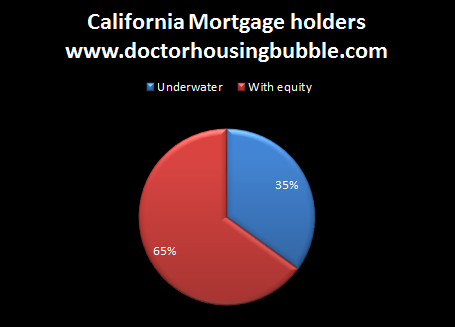

Over 35 percent of California homeowners are in a negative equity position or near negative equity (within a 5 percent range). This is an enormous number of mortgage holders:

What this translates into is 1,880,000 California mortgage holders have no equity in their home. They are essentially in a worse position than a renter and could be deep underwater if they used one of the common toxic mortgages that we are all so familiar with. Many of these people would walk today if given the chance or if forced to pay their mortgage. Psychologically it would make sense. Take the hit, rebuild your credit, and buy a home in this much cheaper environment.

Banks now have years of shadow inventory in their balance sheets and it has gotten to the point where Bank of America, the largest U.S. bank has discussed creating a bad bank to place $1 trillion of legacy loans in it to clear out over the next three years. Guess where a large number of these homes reside? In bubble states. Bank of America now owns Countrywide Financial which was notorious at making bad loans in California.

Never in our history have we had so many people underwater. So think of the psychology of those 1,880,000 Californians with no equity in their home. As of latest count 277,000 homes are in the process of foreclosure in California. Do you think 1.5 to 1.6 million people will simply keep paying their mortgage as charity? Of course not. Many can’t pay even if they wanted to because of lack of cash. We don’t have data on how many people have stopped paying yet banks simply continue to ignore this and allow them to live rent free. You have the corrupt banks helping the irresponsible. The large prudent majority in the U.S. is starting to wake up and realizes this is one large shell game and is essentially a Ponzi scheme. Banks are hoping there will be enough new suckers that will jump in at current prices to rescue their balance sheet but also the current buyer who willingly signed the paper to buy the home.

I don’t buy the tear jerking stories especially here in California. Are you going to shed a tear for the million dollar home owner who lives on the beach but has stopped making payments? Maybe you feel bad that they can only drive one Mercedes instead of two. Scams like this can only go on for so long and banks realize the quicker they can erase the past the better. After all, if they can hedge taxpayer money and speculate on global stock markets and make more money they can afford to unload property and rid themselves of the negative publicity. Think of BofA’s announcement were they plan to unload $1 trillion in legacy loans over 3 years.

Keep in mind many of these people will not be put on the street. They have an option that many Californians currently participate in. It is called renting. Nothing wrong with that.

People will walk away in many cases in California. There is no shame in walking away. The banks have set the moral standard so low that it would be ridiculous for someone to keep paying on a massively underwater property. Why continue paying on that tulip bulb? Manias are fascinating case studies in herd behavior and even logically minded people get swept up in it. Even today, you have people trying to justify bubble prices in many California cities. Prices will fall and fall hard because you have to have a steady source of income to support current prices. In many areas that is not the case. The only reason someone would pay today’s price in many markets is the belief that the bubble day appreciation gains are only one day, month, or year around the corner so it is time to get in.

Some in California keep talking about the million dollar market. Last year 22,000 homes sold for $1 million or more in the state. That is great but California sells about 546,000 homes a year. So now that we’ve addressed 4 percent of the market, what about the other 96 percent? Bubble markets have a long way to go before any bottom can be called.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

114 Responses to “The financial psychology of negative equity – 1,880,000 California mortgage holders have no equity in their homes. California home prices will fall 15 to 25 percent in the coming years. 1 out of 3 California mortgage holders at risk of walking away or defaulting.”

Hang on for 8 more weeks. The Japanese investors will come to SoCal with their bags of cash when Tokyo is under a feet of radioactive ash.

“The Japanese investors will come to SoCal with their bags of cash when Tokyo is under a feet of radioactive ash.”

I call BS: Fukushima isn’t Chernobyl. Not even 1% of it. More about this in previous article.

Yeah, listen to Cal Asian. Only 8 more weeks and the rich Japanese with bags of gold will start washing ashore…

Foolio, tho i agree, there aint no bags of gold coming our way, I find your humor attempt extremely distasteful as thousands of bodies in Japan are “washing ashore”.

Congratulations, you’re now no different than Gilbert Gotfried. Do you sound like him too? Oh boy.

Hi Doctor, on this one I have to disagree with you. Ever since the real estate bubble popped, I thought that even more homes would go into foreclosure because people who have negative equity will walk away. Boy was I wrong.

For some odd reason, people who do have negative equity continue to stay and pay their mortgage (if they can). I know people who bought a house for 600K to 1M and even though prices are down 40% to 60% they continue to pay because they in their heart believe prices will come back again. Honestly, they are not paying their mortgage on an underwater house because they are charitable, but they really do believe prices will come back again to those insane levels.

Further, I inquired what percentage do they think prices will come up and the usual response is “I dunno, but I know prices will come back again as soon as this recovery gets moving again”.

Percentages, fractions, interest, compound interest, etc… are all ideas and concepts that most of our fellow Americans are completely deficient in.

Nimesh, I think the second leg down is going to change that. There was a lot of hope in the bounce last year, I think people saw it as a sign of things turning around. When prices trend farther and farther down with this second double dip, it’s going to change a lot of attitudes about prices rebounding.

Michael D. you are right on the button. This second leg down may very well be the knockout blow. We are already witnessing the second leg down in the real estate market. Those who bought when prices were “cheap” and “now is a great time to buy a home” during 2007-2008 are already underwater. Those who bought in 2009-2010 are watching their investment go down.

As prices continue to decline all of a sudden real estate will be an asset class everyone will avoid. Prices will become so cheap that it will be the exact opposite of when the real estate bubble catapulted home prices to unheard of levels. I look forward to that day. But in the mean time will we see home prices slowly decline like Japan? Or will we see another sharp drop? Only time will tell and these are surely interesting times.

I wouldn’t even call this the second leg down – this is just the natural course of the ORIGINAL leg down, which was delayed 2 years by market manipulation and gaming the system via tax credits, Fed MBS and treasury purchases, Fed rate bottoming, QE1 and 2 etc.

We are just back on track to where we were at the beginning of 2009…the last 2 years were an artificially created bull trap.

I know several people paying mortgages on deep underwater houses, and they do it because that’s all they know how to do. They’re completely trapped – They can’t look for work anywhere but here, they can’t refinance, they can’t properly plan for financial emergencies. And yet none of them have hinted at the possibility of walking away – they just keep paying, hoping that home values will rise or that they’ll somehow get a big windfall. It’s sad really.

Good sub-thread here. My sister and many like her can’t bear the thought of losing their home. This is a fascinating psychology. On piece is the ego saying I bought this house for x-dollars and it must be worth that because I am not an idiot. The price will come back. Another piece is the shame of losing a house. It feels like a societal repudiation. Another is physical. Where do you move all your stuff if you have to go into a small apartment. Yet another is how averse to change we are. Change is scary. Add all these up and you will get lots of people who simply can’t even think about walking away from a house.

My mom bought her condo at the tip of the bubble and is now over $100,000, almost 50%, underwater. She still pays her mortgage and was planning on refinancing this year but now she’s decided to wait it out. She said to me the other day “I may just end up giving this place back to the bank”.. we’ve always been raised to pay our bills and she loves wearing her roses tinted glasses, so if she’s even considering the possibility of walking away you know things are ugly.

Yes, good thread. I walked about 8 months ago. It was so hard, but we were deeply underwater and our lender wouldn’t do a thing for us but defer payments (ballooned back on the mortgage). They did however give us a deed-in-lieu because we had a substantial drop in income and no 2nd.

I know people who are foreclosed and rent a few blocks away, for the school district. We moved a few towns away, not because of shame or expense but because our son was miserable in the school and we figured we would kill two birds with one stone. Our friends who stayed say it is hard (they had a NICE house) but they are coping. It was really hard to move schools and neighborhoods, but our son is much happier. No one gets everything they want!

I can say that my husband and I can breathe again, for the first time in two years. That is great. We are renting, and will continue for at least another year. But then, who knows? No rush there. We are building back our income and saving for a down payment. And all the upside is OURS, not the bank’s. I also have friends who are staying put, have accepted crappy “mods” and hope for the best. They are the most unhappy. Living in limbo. No hope for a better future. I cannot convince them to walk. Until people can screw up their courage or get kicked out it just won’t happen on a grand scale. If they did, however, I think they’d be surprised how much better they feel.

FEEL STUPID NOT BUYING LAST YEAR AT A TENTH OF THE LAST SALE PRICES WORRYING ABOUT FINDING RENTERS WHILE BEING BLED BY TAXES, INSURANCES, REPAIRS, UTILITYS…..ECT..ECT..ECT…

Nimesh-“For some odd reason, people who do have negative equity continue to stay and pay their mortgage (if they can).”

The odd reason may be that if is considered a crime to commit mortgage fraud. A homeowner would have to make up a lie to get the bank to believe they have suffered some financial hardship to warrant a short sale. This could lead to criminal charges if discovered. Jail time is not the way to go.

You might say to yourself forget the short sale and just walk away. Let the bank eat the negative equity. This is dangerous too! Banks could still come after you for deficiency judgments worth, in some case, hundreds of thousands. Plus the big credit stain for 7 years and 200+ drop in FICO scores.

These a couple reasons why someone would remain paying on their upside-down loan. Possible jail or huge deficiency judgments are problems that may never disappear in one’s lifetime. This may be the reason we are not seeing many more neg. equity homes on the market.

In Cali, first and second mortgages at time of home purchase are non-recourse, Confusedus. It’s only (most) refi’s and all HELOCs, non-purchase 2nds/3rds etc. that are recourse here in Cali.

On many levels an underwater mortgage does not a foreclosure make.

If a homeowner still has his job and his kids have been going to the same schools for years, he doesn’t just pack and leave because his mortgage is underwater. As long as he can still afford the monthly mortgage payment he is more likely going to continue writing his payment checks. If he has to sell (job loss, job change, divorce, illness, etc.) then the chance of him walking greatly increases.

Not necessarily – there are PLENTY of reports that show that as the negative equity amount or LTV ratio increases, the higher the probability of the ‘owner’ walking (strategically or otherwise). The affluent/wealthy are treating it as a financial decision/investment gone sour. You hit $100K, $200K+ in negative equity, and you find a MUCH higher percentage of these people jumping ship.

I’ll bet a vast majority of auto loan payers (including me) are upside down, but in the matter of a couple of years the car will be paid for…thus, no payment. The same is true for real estate… those “suckers” making their obligated payment over time will, soon enough, own the real estate without mortgage (imagine!). Granted, most people today don’t follow this model…but there are many that still do.

Makena –

“I’ll bet a vast majority of auto loan payers (including me) are upside down, but in the matter of a couple of years the car will be paid for…thus, no payment. The same is true for real estate… those “suckers†making their obligated payment over time will, soon enough, own the real estate without mortgage (imagine!). ”

Apples and oranges for people caught in the underwater-mortgage doom loop. Think about increasing your car payments to a third or more of your monthly income. Then extend that over the next 15, 20 or 30 years. What sort of brass ring will “free and clear” be at that point?

Like somebody else said, most Americans have no idea of things like opportunity cost, interest, depreciation, etc. They are still in these houses because they will not or cannot appreciate just how big a mistake that they made. They are mortgage-slaves and will NEVER come out ahead. The rational choice is to stop the bleeding. Walk away, declare bankruptcy if you must, and go lick your wounds in an apartment. That is the only way they can rebuild their household balance sheets.

I think there is another motivation for these homeowners to keep current on their underwater mortgages. Many DON’T want to move! Maybe they have raised families in the home or just plain love living where they do and don’t want to move solely based on a financial issue. Additionally, there are homeowners out there that believe they entered into a contract and are simply fulfilling their end by continue to pay what they promised to pay.

Just some thoughts.

Financially, it makes ZERO sense to throw more money at an upside-down mortgage. These homeowners are jeopardizing their family’s futures for a sentiment that the mortgagee wouldn’t honor for a split second were the shoe on the other foot. Their payments are at the expense of future college, retirement, medical emergencies, other equity opportunities, etc.

i understand the whole moral issue of homeowners feeling like they need to live up to the contact they signed. but what about the party on the other side of the transaction? why should homeowners feel they have a moral obligation to pay when the game has been completely manipulated by those on the other side of the contract – banks, fannie, freddie, federal govt? like the banks accepting bailout money, homeowners should look at walking away as strictly a business decision and do what is best for their stakeholders (family).

I have SEVERAL buddies I try to talk into walking, but they just dont get it. They are paying on $700k+ notes like fools. I’ll walk myself if I can get into my dream neighborhood (on the cliffs above perfect reefbreak) when/if prices come down there to what I owe on my current place (which is 7 minute drive from noted reef)

I live in the Bay area. What about the upcoming IPOs of Facebook and Zynga? Will that not keep the $1M priced homes where they are?

Probably not. Stock Options are no longer what they once were. If they were disbursed like back before the dot-com boom, then sure. Nowadays, the average employee gets a token share. Sure, many think it’s great, and it might be a good chunk compared to their salary. But if you’ve been around, it’s a joke.

The point here is that the real wealth is concentrated at the top, and the original founders. Those people already have homes.

Both Facebbook and Zynga will create a bubble of their own, but that’s for another forum.

We cannot afford / recover from another bubble like the dot com, and “dot” real estate.

Please no more BUBBLES.

Maybe we need to visit what worked in the past and learn from it, and do not repeat the same mistake over and over again [bubbles that is.]

Dr. H wrote an article few months ago [recommend everyone reading it] regarding one person working in the family and supporting a household of four and they had a decent living standards. Nowadays, two work (husband and wife) full time and they still cannot manage.

Schools no longer teach geography, current history, financial l matters or “real life” tools that would be useful as an adult.

But they still consider diagraming a sentence to be of use. I have NEVER used that as an adult.

Of course they don’t. The schools are run by the government. And they don’t want us knowing too much about how you are being used as a host for the parasitic banks that run the government.

It is always interesting that civics courses never teach much about the federal reserve. Now, yes this stuff is taught in college level money and banking courses, it’s not exactly hidden. But people are required to take civics classes at both high school and colleges levels with the alleged justification of making them informed citizens and this factor that costs us trillions of dollars is NEVER mentioned! How can we call this being informed?

When is the last time any of you were in our schools? This site is steeped in data until you get to the comments section and then opinion seems to dominate. Where are you getting your data from? What is the sample size?

Here here. As a social studies teacher who teaches both “American Government” and “Economics”, I can assure you that we do teach about the Federal Reserve (and a lot of other important institutions aside from the typical Congress/Court/Presidency axis). In government, we spend several weeks on non-elective offices and institutions. And in Economics, students spend a lot of time understanding not simply the Fed but also the intersection of economics and politics. etc. I’m guessing that the same people who are constantly bashing the schools and the teachers in them are also the ones that know the least about what we do.

There’s an old financial joke. An “Investor” is a trader who’s underwater. 🙂

I’m surprised the MSM hasn’t picked up on this. Calling these underwater mortgage owners as “Investors” has much more positive spin. But at least they aren’t calling them renters, which at this point they really are.

Hey now, let’s not insult renters. That’d be giving them far too much credit.

According to a CNBC report, a shift away from home ownership has brought investors into buying apartments. Revenues up 8% yoy. Rising rents are making this a good investment at this moment. Of course I heard this on CNBC so take it with a grain of salt.

So when everyone starts renting, will rent skyrocket?

Since no ones buying, the condo’s will just get converted (back) to apt’s.

Of course it will skyrocket. It already has! Rental rates should be less than the cost of owning a home, but in some areas it costs more to rent.

Theoretically, both rent prices and homes prices are out of whack. Calif. median singe-earner annual income is $47,000 which could allow this family to purchase a $180,00 home with a monthly payment of about $900. Those numbers is what should be happening. Instead we continue to have homes priced (CA median 01/2011) at $305,000 thus requiring a 2 full-time earners to purchase. 2 earners means married couples and usually with children. Children means either mom stays home part-time or finds a babysitter (expensive). All other single-earners are mostly priced out of buying a home.

Rent is not much better. Since most still can’t afford to buy a home landlords pump up the prices to what the market will accept. 2-earner may go for 2+ bedroom place & pay rent of $1400-$1800 which is cheaper than buying. Single earner will look for 1 bedroom or less and hence rents of about $900-$1300, still lower than buying a home.

Overall, homes prices need to come down to levels that match what the potential home-buyers income is. Hence we need about a 40% further drop in prices to get to a market where the average consumer can buy. In the meanwhile, these people must rent. Because they must rent, landlords push rental rates to the level where it nearly costs the same to buy a home.

Why do homes prices remain high? Because naive home buyers keep buying over-priced homes that they believe are a bargain. Just because they are cheaper than 5 years ago does not mean they are a good buy. The old adage that about 25% of your annual income should go to housing expense (owning a home-not renting) remains true. Currently, people are fooled to think that 45-50% is OK. Hence our financial woes. No worries, when home prices finally drop so will the rents.

It’s starting to happen here in the North Bay (Santa Rosa)….I’m starting to see a lot of places on the MLS for <$199K (almost all or REO/Shorts…..and its getting harder and harder to keep paying $1,100/month to rent an average 2Bd 1Bath apartment in a so-so neighborhood.

Hopefully fall this will have fallen another 10-15% and I can get a nice place for the same as my rent, give or take (probably give) a couple hundred bucks.

Right not I'm just saving trying to a 20% of $199K.

Actually there are tons of vacant rentals. Some people may have gotten out of a mortgage and decided to rent in this recession, but I think an equal number left the state (that’s a pretty rational choice if you are unemployed, way too high unemployment to find a job here), got roommates, or moved back in with parents.

Hey not all of us that succumbed to the California Option Arm loan did so because we wanted to live in million dollar homes and drive mercedes. Try being a regular family with 3 kids, throw in a divorce and you have now a single head of household female who only made $18,000 a year helping here and there while the ex-husband was the major bread winner. After the equity split of the house combined with housing drops you end up with the obvious. Pam

A few questions:

1) If a borrower refinanced and/or got a 2nd on an original purchase, doesn’t the lender(s) have what is termed as a “with recourse” loan?

2) If the borrower, because he is underwater, decides to either not pay the mortgage and/or walk away, can the lender go after his/her other assets?

3) Assuming the lender gets a judgment lien on the delinquent borrower, can the lender still go after the future assets of said borrower?

I ask these questions because there seems to be misconception that if one walks away from a “with recourse loan”, one gets away free from further obligations. The with recourse loan will still get them, I surmise.

@Vince. Yes to all three. The only “no-recourse” loans out there are for the original purchase of a property. A 2nd mortgage, or a refi, is recourse.

Banks are going after these people. Or more accurately, they sell the loan to a collection company. That’s according to the reports that I’ve read.

The IRS is also going after those people, if they have used the money for anything except putting it into the house. After 2012, they’re going after everything. I believe CNBC had an article about this recently.

Do you have any evidence of that? I know a LOT of deadbeat friends and family that’ve walked away from their homes with massive heloc/2nd/3rd mortgages. Not a single one of them as far as I can tell have had anyone come after them for those toy purchases. From the lowly poor – can’t squeeze blood out of a turnip, to the rich and savvy – who’ve milked it for all it’s worth; Absolutely none of them paid a dime back. Not even the IRS have asked for the loss as income thanks to the gubment forgiving it.

Sorry, I didn’t process the last sentence of your response before replying. If it’s true that after 2012, they’re going after these friggin deadbeats, I will be soooo happy. Happy because I *might* have renewed faith in the system and maybe even the equality of America. I doubt it’ll happen though.

So “recourse” works this way – I buy a (not new) house (using VA), and there is no “recourse” if I walk away, but if I get a second mortgage or a re-fi on that same house then there is “recourse”?

Is that why I am constantly getting calls from banks saying “We can refi your loan for half the interest rate you presently have!”? So they can establish “recourse”?

@Sigma: The only evidence that I have are from news reports. I haven’t seen a wave of reports about the collections agencies, but I have seen some. The way that industry works is that debt collectors are extremely persistent, for years. I expect this to be a bigger issue as this stuff moves through the system.

@gman: Yes, in non-recourse states like California. The offers for cheap refi’s are probably more than just establishing recourse. They probably mean that the Bank has lost the chain of Title on your note. I.e. they have lost the right to foreclose on your house; though not on the loan. That is, the loan is now unsecured, if you choose to default, AND have a good lawyer. See if MERS is on your Title. If it is, the odds are good that the Title chain is broken.

Lots of people have gotten either suckered or bought off by this scam.

As I write this, it looks like the carry trade is collapsing, world wide. Tomorrow and the days ahead are going to be “interesting”. I would especially not take them up on their offer right now. You may need to use a non-recourse default.

if what you say is true, homeowners who are underwater need to make the decision to walk soon so the foreclosure is behind them by 2012 to avoid recourse/IRS issues. bells and alarms should be going off in underwater homeowner’s heads, but who will tell them? not the banks, fannie, freddie, or IRS. unfortunately many will find insult added to injury.

Wrong. Even if the loan is “recourse” the non-judicial foreclosure action prevents a further civil lawsuit for a deficiency. It’s called the “single action” rule. However, if a junior lien holder is wiped out by a foreclosing senior lien holder, that junior lien holder retains its right to sue on its note.

You are correct about the recourse/non-recourse – junior lien issue. I posted here several threads ago about the neighbor whose 1st was foreclosed on, leaving his HELOC holder in a position to pursue him for monies owed. My ex-neighbor just couldn’t wrap his brain around the fact that he was liable for the HELOC. I tried to explain to him that he did in fact owe the money and that they would obtain a judgement against him so he’d better settle now. Many ex-homedebtors who rode the HELOC/2nd/3rd free money train will be shocked to find out that their Mercedes, cosmetic surgery, and luxury vacations weren’t free after all.

Thanks for the correction, but for most underwater people, it is still correct. As noted here, most people wait too long before throwing in the towel; leaving most second lien holders wiped out.

“Home prices are now at post-bubble pop lows”

Don’t worry everybody, magically rich Japanese with bags of gold are coming over by the millions to buy property sight unseen. They are paying asking price and even double asking price. So nothing to worry about…

No disrespect Pam, but why should someone with a 4 person household own a house?

Your just not making sense. Size of household has absolute zero to do with ownership. Pam’s problems are created by the modern social fabric and not her household size. Move on, nothing to see here.

This state (CA) is going to face severe budget pain when voters say “no more taxes!” Then many state and local government will have to lay off and furlough. Plus don’t forget all the contractors to the state who will be told their service is no longer required! Then see how much money people have left for housing. Gas prices and food prices are already taking a toll. Lower income residents will not be ever able to afford the rents investors are hoping to get. It’s the circular pattern of the toilet flush. Eventually it all goes down!

CC:

Do you (and the other readers) think some cities, and probably even the State may decide to use contract services and outsource jobs to private contracting companies in order to save on the benefits (Vacations, sick leaves, PENSIONS, unions, office spaces, etc.?)

It is the employer market now. People who were making 30-50 dollar an hour (with benefits) are now making 10 and they have a part time job with no benefits. The Doc has been saying it all along, if we don’t create many high paying jobs over here (along with job security), real estate prices will continue to drop over years to come.

Gotta love realturd spin about rich asians buying up houses.

Yeah, we better get in before we’re priced out forever!

Ok weighing in as one of the “deadbeats” living rent free. Many of us came to this decision slowly and painfully when the banks helped us not at all. My investors are a private securities firm, WF is the servicer. We paid 640k with 20% down fixed rate 61/2 percent 780 and above credit in 2006. Now its worth 340k We bought less house than we could afford at the time (we were conservative). Now we have both had paycuts and our medical costs have gone up 1000 a month. Still because our mortgage is owned by a private security they want 41% instead of the governments 31% of our income for our payment, that is a large monthly difference. All we wanted was a 500 dollar a month modification so we could continue our sons autism therapies, and we would have kept paying. They offered us a 12 dollar a month cut, yes 12 dollars. Why they want it I dont know, but they can now have it. We would have kept paying if we could, I get why people do it. Its one of the worst things you can go through. We stopped paying in Oct. Why would I move out until they foreclose as I might then be liable for people trashing the house while I still own it, and yes its free rent. We told them just tell us when you want us out. Why dont they work with people? Many of us were responsible just stupid and wanted our own home.

Huh? What?

You said you and your husband were teachers.

A pair of teachers are buying $640,000 houses?

It’s official. Teachers are overpaid.

@EconE: Are you being funny? I don’t see where she said she was a teacher? Of course, teachers are public enemy #1 these days…

Average teacher salary in CA is $70,430. per NEA.

4 School districts have average pay of over $90,000.

6 School districts have average pay of $80,000 to $90,000.

Of course, you DO have to work 9 whole months of the year.

Where does it say she is a teacher? Take off your fox news puppet strings and quit reiterating that hateful propaganda. Teachers are not to be demoralized like they have been. I know of no rich, overpaid teachers, shame on you.

She.stated that she and her husband were both. CA teacher in the thread before thee last one. Two threeads prior to this. Try to keep up.

I stand by my statement. Teachers are overpaid.

Well unfortunately I don’t have the time to check. If true were in agreement. They bought more house than their salaries dictate. I have a reply to Ann also. EconE you need to research both sides of an issue. You might find that with the amount of extra time they put in preparing progects, grading homework, not to mention using their own money for supplies (in CA. public schools) it’s not this life of opulence the well funded recent lobby against them suggests. Maybe go and talk to a couple teachers before you jump on the fox bandwagon.

I’ll have to comment on this (first time commenter). Where are these magical districts that average 90K a year? Both my wife and I are high school math teachers. We both graduated with CS degrees from UC schools, near the top of our class. She is in her 7th year, making 54K, I am in my 2nd, making 52K. We live in the SF Bay Area, and to me it seems like most districts top out at around 90K, and I wouldn’t even expect everyone to be at that 20-year experience mark.

Oh, and we have crappy health benefits, to correct another misconception. $1700/month in our district for a family of 3 for health care alone. The surrounding districts are the same way.

We work hard during the school year, always taking work home, working pretty much every weekend as well. Summers? I’m sure I’ll be working as well, to supplement my “huge” paycheck, in order to even afford a rental around here. Yes…as you can see, we are all massively overpaid…

I understand some in the public sector are getting too much (maybe with benefits to match), but please, let’s not lump everyone into one category. With all the hate directed towards teachers, perhaps those high-achieving teachers who could do another job will finally choose to do so, leaving only those who can’t get any other job. Is that what we want?

Oh, and we have crappy health benefits, to correct another misconception. $1700/month in our district for a family of 3 for health care alone.

We work hard during the school year, always taking work home, working pretty much every weekend as well. Summers? I’m sure I’ll be working as well, to supplement my “huge” paycheck, in order to even afford a rental around here. Yes…as you can see, we are all massively overpaid…

I understand some in the public sector are getting too much (maybe with benefits to match), but please, let’s not lump everyone into one category. With all the hate directed towards teachers, perhaps those high-achieving teachers who could do another job will choose to do so, leaving only those who can’t get any other type. Is that what we want?

Hey Bob,

For teachers

Starting salary in CA is $35,760

Average is $59,825

there are 300,223 teachers in CA

you are quoting stats that require at minimum a masters degree and 10 years experience. This must also include university professors of which 9 times out of 10 a PHd is required, and private school teachers (usually a masters degree also)

Bottom line public schools in CA are underfunded including teachers at that level.

Greg…

If you look at my original post, it refers to a pair of teachers (which Ann pointed out in the prior thread (from March 11… along with the Autism, 41% etc etc…so it’s the same Ann) buying $640,000 homes.

And yes, I know that teaching isn’t a walk in the park…nor is it as hard as teachers like to claim. I “volunteered” as a substitute teacher for a few years so I’m not ignorant on the subject. I saw the “lessons” they had to plan, I graded papers and homework and I sat in on their district meetings as the representative for all the substitute teachers in the district.

So, once again…I stand by my statement.

Schoolyear? You crybabies get summers off, $54K for 9 months of work. STFU!!

I have been encouraging a friend to stop paying too. They have tried the loan mod. Nightmare too. This makes good logical business sense for the family, and there should be no shame involved, however, you have hurt people like me twice over. First you bought on impulse not logic for anyone with common sense could see these prices were unsustainable. You helped support the delusion of appropriate prices, and locked me out of the market Then the banks take my taxes that the Government gives them funded by treasuries that they sell to banks paying them interest, and use it to fund the loss that they’re taking on your house. So forgive me if I don’t feel too bad for you while you squat for two years rent free while I wait to pay an appropriate price for your house.

Ann, who can claim they would have acted differently if they had been in your situation? ** I keep hearing of people who get offers in the mail to modify or refi without costs. More taxpayers’ money at work?

This is a somber blog worthy of being understood in its depth.

Ann thank you for sharing your story. You are not a deadbeat. You bought a house and in hindsight it was a poor decision and the value went down and then you had to meet medical bills.

You seem like a responsible person who had the misfortune of having the real estate market go south at the wrong time in your life.

For those who lambaste this poor woman, shame on you. As if you are perfect and never made a mistake. Sure there are many con artists who bought a house they couldn’t afford and took out the cash and bought a boat, luxury vacations, expensive clothes, etc…. For people like them, I don’t feel sorry. But for people like Ann, I can feel their pain and I sincerely hope for the very best. Each person’s situation is unique in relation to this real estate crisis and not everyone fits the same mold of a lazy person who bought a house that they couldn’t afford.

LOL, Ann. Next time you try to troll yourself, try changing your Name before submitting the fake reply.

Ann, did you actually mean to respond to yourself positively using the same name/handle? Next time, you might want to switch your name. Jeeze, I guess it’s true what they say – “those who can’t do, teach”

“Next time, you might want to switch your name. Jeeze, I guess it’s true what they say – “those who can’t do, teachâ€

Foolio, I actually felt bad when I was laughing…. Strange feeling.

Ann, if you bought your house at 3-4 times your income that’s one thing. If you purchased at a ratio more than that (which most californians did) then these consequences are a result of your decisions. I’ve had a couple friends that had to walk away and get foreclosed on. They bought at 7 times their income. Used a toxic loan product yada, yada, yada, we’ve heard it a thousand times before. Listen to the good Dr. Most people aren’t rich, and now the parties over. they had some fun playing the game for a couple years. With no funny loans to be found, Housing will reset to local incomes. Sorry reality sucks. One more note, Two other friends, one is a cop the other a nurse sold there house at the peak in 2006, made 250,000 put it down on a 1,000,000 home. Guess what they couldn’t afford that house. Because they are a cop and a nurse. They don’t bring in the 300,000 dollar yearly income that justifies that home. They lost the house and are divorced. Again reality sucks sometimes, get used to it. In california it’s here to stay.

I’m sorry but early on in this many news bytes showing the crying couple in the driveway, we were victims of pred lending boo-hoo, would have carried more weight had the moved the matching range rovers out of the camera shot, pleeease.

HAHAHA, yes indeed Rudy. Never mind the waterfall pool slide in the backyard you can see popping up over the roof, the new jet skis and boat in the driveway, the new breasts-esses and plastic enhancements all over “trophy” wife.

Every aspect of the American and in fact world economic system is a giant Ponzi scheme, so no one can tell the real value of anything–only the apparent value based on the current normal. People think Gold is worth $1500 an oz. and it is until one day it isn’t. A lot of smart people just get swept up in the current normal. As long as we can’t see the real picture, how can we make valid decisions? Good luck.

One response in regard to your comment about gold would be that it’s not gold that’s rising tremendously in value, it’s the dollar that’s falling tremendously. Some of this is hidden by the simultaneous fall of the euro and yen but let me ask one quick question.

You have a choice of leaving either $20,000 of cash or $20,000 (at present day prices) of gold for your children in a box not to be opened for 10 years. Which do you leave?

If you have any hesitation, watch CSPAN and see the repubs and dems bicker over whether to cut or $1.6 Trillion budget deficit by essentially nothing (dems) or by less than 4%, $60 billion (repubs). Do you see any political will to get our fiscal house in order?

Nobody sane is leaving cash in that box.

There is a gambit in used car sales. Offer loans to any and all, bad credit, no credit you get the loan for the car. When you can’t pay the seller repos the car – and guess what – he resells it. Since he a) never paid full price for the car but floored it (monthly payments) or b) made a several thousand dollar profit from you when you bought it cause blue book wholesale is hundreds less than you will ever see published and you paid “good condition” bluebook on the car. He makes the same or a few percentage points less on the resale. My son’s used car dealer friend running a corner lot makes 500K a year.

I suspect the bank, as most major financial business has over the last decades stolen the tricks of the trade such as payment sales rather than value sales, plans to make the same killing on your house. They never loaned you the money. Investment groups did. They did get a goodly percentage of the $128,000.00 down plus all those sweet fees perhaps running into the tens of thousands. Since they never lost a nickle on your house (ahhh mark to market) they can actually pocket money again from a bank owned sale.

(the above is the opinion of this poster and is not substantiated with any research or factual information on the workings of the banking industry).

Good for you Ann. Dr. HB makes a great point that the banks set the example for the rest of society by creating the mess then taking trillions in bailout funds rather than face their fate of going bankrupt.

Very little has been done for homeowners besides the largely disappointing HAMP, which turned out to be a government-mandated speed bump to the foreclosure pipeline. HAMP and FHA’s Hope For Homeowners (remember that from 2008?) is all the homeowners got.

On the flip side, the banks have received:

TARP

TALF

PPIP

FASB suspension of Mark-to-Market accounting

QE1

QE2

HAMP

HAFA

HARP

Zero Interest Rates at The Fed

Watered down Dodd-Frank

Vigorously fought proposals for Bankruptcy cram down’s on mortgages (though BK’s can cram down every other debt)

Countless Fed “liquidity facilities” to be fretted out by the Freedom of Information Act for years to come – thanks Bloomberg.

FCIC essentially let them off the hook scott-free

Not to mention bailouts/nationalization/forced marriages of Bear Stearns, Merrill Lynch, Countrywide, Wamu, AIG, FNMA, FDMC, Citi, BofA, etc.

Walking away from your crummy investment is spare change compared to the damage done by the masterminds of destruction on Wall Street.

If you really wanted to extend your rent-free living an additional 18 months on top of the 15 it will already take in California, you could do what the professional deadbeat homeowners gaming the system do: they file an emergency Chapter 13 Bankruptcy the morning of their foreclosure sale 3 or 4 times until the court finally said enough is enough. This usually buys them an additional 18-24 months depending on the state.

Look Ann, you took a risk, it failed, and unfortunately, one of the consequences is, yes, society now labels you as a “deadbeat”. It sucks hearing about your son’s autism therapies, but my heart goes out to all the other families w/ autistic kids where their parents now can’t afford to give them a nice house in a low crime neighborhood and better school district, because you took a risk and blew it, now living rent free.

Don’t get me wrong, you share the blame w/ the bank, just that the bank is still profitting as your family struggles. You need to channel your anger towards the banks and here’s how. After the bank kicks your family out, and your home becomes an REO, sneak back in, turn on all the water faucets (wear a glove of course) and flood the dam property.

P.S. just kidding about the vandalism part.

Seems rather cold hearted to essentially blame Ann for the housing bubble. Ann may have acted in ignorance in buying a home in 2006 but that is not moral hazard. She unfortunately believed in the housing prices but she acted otherwise prudently in putting 20% down. What’s that old adage about learning from our mistakes.

Funny, while reading the post I didn’t look at the author’s name, but after I finished I just knew it was going to be by a woman.

I take it you read The-Spearhead too?

Notice the “womanly” patterns?

1. Appeal to emotion.

2. Lack of ability to use logic.

3. Quickly fall back on the “shame on you” load of shit.

4. Feign innocence (It was allll the banks fault)

5. Accept NO responsibility (Damn bank only lowered the payment 12 BUCKS!)

@EconE – gotta say, your postings seemed very slanted and off topic. Are you one the Koch Brother funded trolls that Anonymous exposed a couple of weeks ago?

Hmmm, great points EconE. I wonder if Suzanne represented Ann and her hubby on their $640,000 pyramid scheme mistake???

http://www.youtube.com/watch?v=Ubsd-tWYmZw

The first three are actual tactics of the American marketing and advertising industries, industries mostly dominated by men. The last are clear tactics of American corporations.

@ ChrisSoCali…

You mean there is someone who will pay me to say that teachers buying $640,000 homes are overpaid and that women (not all women) are debt driven materialists?

Where do I sign up?

I live near the Chicago neighborhoods of Lakeview and Lincoln park. There is a similar attitude of buying decked out condos and McMansions similar to SoCal. The only difference is renting and apartments aren’t quite as frowned upon, but the conspicuous consumption is still rampant.

I see many large, empty homes and unfinished structures around here. The amount of foreclosures is skyrocketing due to the economy shaking out those who were treading water anyways. Yet, they still cling to their expensive cars and $300 pairs of jeans. The impact isn’t nearly as large as SoCal, but it’s still here.

Dear Doc,

I would like you to write an article about the effects of rising gas prices on the housing market.

Californians use 14.5 Billions of gasoline and 2.5 Billion Gallons of diesel a year. That’s 17 Billion gallons of fuel purchased every year or 1.4 Billion gallons a month. The average cost of gas/diesel per gallon in March 2011 is around 80 Cents more than it was a year ago. That’s 1.1 Billion Dollars more spent for gas in March than a year ago. That’s around one billion not going spent at restaurants, shoes, clothes, walmarts, car purchases, movies, etc. This will have a huge impact on the housing market and employment in general. And i didn’t even include the rising costs of Food, apparel and other commodities.

– Som

I recently told my brother in law to stop paying his mortgage. Every part of me was saying it was wrong to do so, but in the end it simply made no sense for him to stay. He has paid the mortgage on time and every month for the past 2.5 years and finally stopped paying last month after trying to get his monthly payment lowered via interest reduction. It is unfortunate that those of us that have been responsible will help flip the cost and it pisses me off. But as the DR said, the banks are the worst of all! So as the old man in Legends of the Fall said, “SCREW EM!”

I just don’t understand people like “Ann”. She cites 20% down and her credit rating to bolster the image that she is responsible. You put yourself 512K in debt. That is insane. I could only imagine having 512K in debt if I knew I could pay it off real quick and I just happened to have liquidity issues at the time that were going to be resolved.

Even if you make decent money, why the hell would you ever want 512K in debt over your head? Why not just save money the old fashioned way and when you can actually afford whatever it is you want, then you buy it. If everyone had practiced this type of thinking we wouldn’t be in this mess. Was it just impossible not to own a home? Insanity.

It’ stupid to blame the buyer who wound up underwater.

C’mon!

Wall St. invented the market for toxic paper, and since Wall St. owns the government they got away with it.

Compare the elite educations of the Wall St. thieves to the average education of the sheep like home “owner.”

If I was underwater with no down payment and no equity, I’d definitely walk.

Screw the banks.

I truly wish that the bankers would die so we can start over.

None of this had to happen. If the post Depression regulations had been kept in place, none of this thievery could have been accomplished.

It sickens me…the wasted resources, the wasted and ruined lives…the Wall St. scum reaping cash bonuses. If only the tsunami had hit Wall St. instead of Japan.

Hear! HEAR!… WELL said, Huzzah!

Just a reality check real quick…who was buying the toxic paper off the banks? Who wanted it? They created this because there was a market, they held some themselves yes but never forget that there was an end market for this crap. Also recall the politicians removed Glass-Steagall as well as leverage limits on the banks. Then they allowed the banks to leverage like mad on “securities” which were nothing more than bundles of loans (as if it’s any safer than the underlying loans themselves). Note that politicians also forced lending into lower economic groups and bad areas by mandate.

Sure the banks were run like casinos but they had been protected in the past and were being directed by our wonderful politicians. Lots of blame to go around including the ratings agencies and the borrowers who signed 6 and 7 digit mortgages like buying a happy meal.

Yes the politicians are in bed with the banks. I think that’s fairly well established by now. It doesn’t even require a conspiracy theory see how quickly they move back and forth between the Treasury and the investment banks. But Glass-Steagall hasn’t been reinstated has it? Why not? This is the key to everything. What is widely blamed for causing the crisis has not been fixed. No attempt was made to fix it (sure we got some “financial regulations” but not the reinstatement of Glass-Steagall). Why not?

When will men in this country learn?

All the chow meow I’m reading here…all the underwater bs…..all of it seems to be driven by we “need” this and that.

I’d imagine

Granite

Remodleing

Tile, etc,etc,etc.

And instead of being a f—ing man and putting the foot down and saying FOUR simple words “WE CAN”T AFFORD IT”, the men play passive aggressive and extend the HELOC so that they can buy their unaffordable toys also…the jet skis, the Yamahas, etc.

Time for men to start being men. Put things in their proper place at the begining of a relationship.

And if the va jay jay can’t take it…your better off without her. Find someone down to earth, with less pie in the sky faux rich dreams.

What What? said, Truth. If “your” woman/wife/spousal unit has a worldview formed primarily by soap operas, faux-reality shows, and related Boob Tube/Hollyweird brainwashing, if her true inner happiness (assuming capable of such) actually rests on the acquisition of faux-status shyt YOU canNOT afford, it is TOO LATE to “re-program”… cut your losses ASAP, before you experience thee worst life-ruining “ROI” ever!

Happy/sad state of the world, 2011 A.D.:

American men are the most sought after husbands on the planet Earth;

American women are the least sought after wives on that same planet… and it’s their own (un)doing… D’OH!! ;’)

I have a 16 yr old son and I worry about what kind of a woman he is going to spend his life with. I see tons of miniature bleach blondes in his school with the attitude of O.C. Housewives. Scarry world out there tellin ya.

Testify!

Predictions are for another 10-20% correction for 2011. We will see if that comes to fruition or not. If so, many, many, many more will walk away from their homes.

Knock down this straw man if you can:

1) Given the sheer ENORMITY of the Real Estate market;

2) Given the sheer % of net worth it represents to the MAJORITY of sheeple;

3) Given the ILLiquid nature of said market;

4) Given the length of time such assets were HISTORICALLY (Healthily) held;

5) Given that virtually zero RESIDENTIAL RE is purchased with CASH, but instead requires the ACTIVE PARTICIPATION of GSEs and FED-chartered BANKSters,

Given all that (and more), Real Estate, and ESPECIALLY RESIDENTIAL R.E., should be THEE MOST stable of all financially measured markets, and thus The Bernank, Greenspan & Co. should’ve been using their LONGSTANDING REGULATORY AUTHORITY to make it so, rather than their shameful path of FUELING this now-deflating disaster! Thus we can only conclude that housing was just one gamepiece in a larger and more sinister scheme/scam, eh?

Even without one of the world’s giant economies in peril, things were in great danger. Japan 20110311 is the beginning of the end of life as we’ve known it. Prepare yourselves for the next dark ages. A different Tsunami is coming to Manhattan.

Dark Ages – you may very well be right. I have been thinking the very same thing lately – we may be entering the new Dark Ages. It’s sad to think the Dark Ages could be happening in 2011, all because of human greed and human misdeeds. How sad. We have technology, resources, cars, airlplanes and evertything, but we just might be entering the New Dark Ages. How sad.

While you have a number of good points, I don’t buy the larger scheme/scam. The theme since Alan Greenspan took over has been to blow one big bubble after another. Every time a bubble popped, as they always do, he’d blow another one, and bigger. The Dot-com bubble was followed by the Housing bubble, which has now been followed by the Treasury bubble. And unfortunately, that looks like it’s in the process of deflating too.

This is a much simpler explanation. The other problem that I have with the larger scheme/scam idea is that it assigns a lot of intelligence and competence to where I think there is either little or none.

However, I don’t discount whatsoever the influence of the Bankers. You cannot understand what goes on in this Country without understanding that the Bankers control all of the main sources of power; from the Governments, through the Corporations, and consequently the military, and who you get to vote for. If you don’t see that, you’re left wondering “why?” to so many things which go on around you.

This Country doesn’t work the way that they taught you in High School Civics.

So IMO, the Bankers’ greed gets in the way of their competence. And unfortunately, people are going to pay a lot, for a very long time, because of it.

Enzo,

You nailed it man.

The very stability of our entire society depends on economics

and housing. I agree with you totally that those idiots had a moral responsibility

to keep housing stable, and they failed miserably. Greenspan admitted that he was wrong, but then he later recanted and claimed it wasn’t his fault.

Slim earlier mentioned that there was a “market” for toxic paper, but that isn’t accurate. The market was for AAA rated paper, not garbage. There was fraud from top to bottom and from side to side, and yet nothing was done about it. I read that Pimco got out of bonds the other day, and Schiff says that bonds are in a bubble. If that bubble pops, oh yeah, then the other shoe drops.

The government needs to get out of the housing business entirely. I’m tired of paying for other people’s mistakes.

My understanding is Pimco got out of bonds because they were afraid the interest rate on those bonds would have to rise when the Fed stopped subsidizing it to the tune of $600 billion (qualitative easing). It’s not that they think noone will buy our debt but that noone will buy it at this puny interest rate when the Fed stops buying.

This really spells trouble ahead.

If the Fed stops qualitative easing what happens to stocks? Since it’s qualitative easing pumping them up they go down. Yea I know the recovery is supposed to be self-sustaining at this point and if so that might not happen, but some have their doubts. As mentioned bonds will go down as the interest rate goes up (and all U.S. interest rates are influenced by the “risk free” treasury interest rate). So bonds in general go down. Houses go down as the interest rate goes up as explained here many times. Cash is ok. The national debt becomes even more unpayable due to the increase in interest expenses, they start eating more and more of the national budget (oh sorry we just have to cut x, y, z and a, b, c and raise taxes!)

What happens if the Fed doesn’t stop qualitative easing and goes into qualitative easing round 3? Sadly I think this is the more likely scenario. More money created out of nowhere is pumped into the banks, helping to make their balance sheets more whole, some of that money finds it’s way out into the world, frothy stocks rejoice. Meanwhile threats of inflation. Commodities are already out of control for both real (supply and demand issues) and monetary (money creation) reasons. The situation gets worse. The average joe finds his paycheck buys less and less of course except for maybe houses. But they have to reduce us all to the status of 3rd world workers anyway right? So we can be “competitive” in a market dominated by global capital, bailed out with our dollars and at the sacrifice of our currency.

As is oft said, we live in interesting times.

This last bubble was a whopper, the Economist said it’s the biggest in history, yet boom/bust cycles seem to be the norm. Just this time there was more a lot more gas in the fire.

In Orlando during the boom many people were afraid that if they did not buy they would be priced out of the market. That fear factor, and the greed option of how much money they would make since, of course, prices could only continue to rise. Plus there was the belief it could only go up. For example, a close friend, a very intelligent retired judge living in Miami, was confident rich folks from Latin America would keep coming to buy and keep prices going up and up; he did not downsize his home during the boom but is OK still living there.

Back to Orlando, the flippers were almost as dense as the mosquitoes after a month-long rainfall in the summer. They were amazing, self-righteous, helping the economy along, etc. One, who came for a short period to a meditation group I attended, was furious when a neighbor reported his fixing-up-without-a-license work on a flip-house. Many vignettes, bottom line is it was a blend of fear, greed, delusion, i.e., standard bubble psychology (plus a lot of shoddy workmanship). Clearly those writing the MBSs fit in the greed category.

All this started as a partial response to the string about Ann. I can see being swayed by the strong surge of price increases to buy, I cannot say here what is her mix of fear of being priced out later and greed. But perhaps she also went to bars, as I did in Orlando then, and almost constantly overheard people saying, in effect, that they bought a house 6 months ago and now it’s worth $50K more. That’s got to have an effect for many people (at the time I was just a curmudgeon, living in a cheap townhouse I had paid for in full, and was not even aware of ‘fog the mirror’ loans).

For now, living in CO, seeing prices still high but edging down (and much higher than FL is now), I get grief over not purchasing from a friend, but perceive, maybe wrongly for this market, that there is room to go on the downside.

Enzo MiMo and EconE: Your misogynist tripe is not welcome here.

Surfaddict

“Schoolyear? You crybabies get summers off, $54K for 9 months of work. STFU!!

There is no call for that. You in response to the next blog whine about having housing come down enough so you can move to the beach from 7 minutes away. Give me a break on your selfish attitude. If you can do that you need to be thanking teachers not insulting them. I think you and Econe have zero idea about teaching. I simply do not buy his story about “volunteering as a substitute”. One of the hardest jobs in teaching and he does it with his eyes closed. Baloney. I am with the posters who say get off your Fux news horses and stick to the housing market of DR HB.

Econe

You are one disingenuous misogynist. You didn”t say teachers were overpaid. You said that she and her husband had no right to buy that home even though they put 20% down and were then unable to keep up with the payments because they cared enough about an autistic son to get him treatments that insurance would not cover while losing income they had because of being furloughed. These furloughs by the way are not the result of “overpaid” teachers or state workers but Republican corporate thieves, think Enron robbing California and the banking industry pumping up state coffers with the housing bubble that then deflated the govt income as it collapsed.

You sir need to take two classes one in sensitivity, the other in critical thinking skills. And you might need therapy for your anger towards women.

“@ ChrisSoCali…

You mean there is someone who will pay me to say that teachers buying $640,000 homes are overpaid and that women (not all women) are debt driven materialists?

Where do I sign up?”

There seem to be a lot of people blaming Ann and I don’t understand it. Like Joe F says, there was a fear factor and people were afraid that if they didn’t get in, they never would. This was perpetuated by realtors and mortgage brokers who had nothing to lose and everything to gain by getting you in the most expensive house they could find for you. We are underwater but can afford the mortgage and will stay because we don’t plan on moving for a long time. I remember realtors and brokers saying, “you can afford so much more and me telling them that no we can’t.” We didn’t buy the most expensive house we could qualify for but we are still underwater because of timing. Some stupid people made a lot of money on housing and other very smart people lost a lot on housing because of timing and luck. We should all understand that. I don’t blame someone for walking away if they are severely underwater. Why shouldn’t they think of their family’s future first? It is a business decision and businesses make decisions like this every day. Sure, some people were irresponsible but others were not and that is just a fact.

One other point I would like to make. I hope that people blame the realtors, mortgage brokers and banks as much as they blame the homeowners who took these risky loans. Sure, the homeowners had to sign the documents but look at it this way: if you had a neighborhood full of drug addicts, I am sure you would blame them for their predicament. But would you also blame the drug dealer on the corner who was constantly facilitating their habit? I sure would. In this situation, I think the realtors, mortgage brokers, and the banks were the drug dealers.

Why would anyone worry about non recourse vs. recourse. They can just file BK.

Leave a Reply to AT