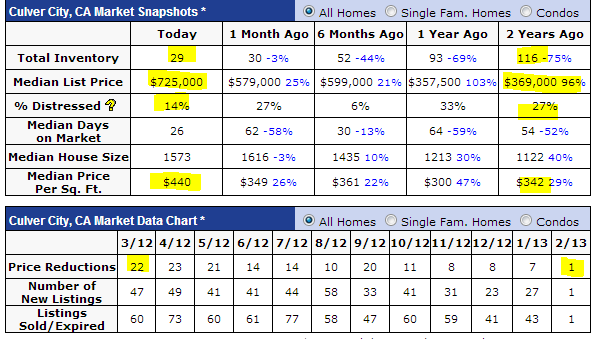

Flippers’ Paradise: The massive jump in list prices for Culver City. Median list price up almost 100 percent from two years ago. Record low inventory. Distressed properties 3 times the amount of MLS listed homes.

Desirable areas in Southern California have always carried some sort of premium. Yet the days of bidding wars and having to make offers with limited contingencies are back. Agents have told buyers that unless they make a bid that day with a cushy reserve, they are likely to lose out. Culver City is another prime example of how insane the current market has become. How crazy are things? Inventory is down by a stunning 75 percent from two years ago and the median list price is up over 100 percent. There is obviously no sustainability to this current market trend and the story continues to be the dwindling inventory causing people to lose their sanity and dive into homes with no contingencies and fighting over a home as if they were bidding on a baseball card on eBay. It is important to see what is going on in Culver City currently since this is a desirable area that is seeing some fascinating trends.

Culver City sales data

It is useful to first see what the latest sales data shows us:

Median sale price (last month)

Culver City (90230):                        $647,000 (17 sales – price up 17.2 percent y-o-y)

Culver City (90232):                        $705,000 (7 sales – price up 14.4 percent y-o-y)

For Los Angeles County, the median price is up 17.7 percent year-over-year so the trend is hitting the region. However, the median price for Los Angeles County is $352,000. This big push in the median price is driven by the massive shift in the mix of home sales. Distressed properties are not a big part of the market anymore in terms of MLS properties. Banks are finding a sweet spot by restricting properties given that mark-to-market valuation have been long suspended and there is little rush to sell. The Fed has also made it possible for banks to become temporary landlords if they desired. I haven’t seen many banks in SoCal go this route since the market is moving so fast and demand is off the charts for a low amount of supply.

If we look at what has occurred in Culver City over the last two years, the trend becomes even more dramatic:

Some critical points:

-1. Massive drop in available inventory (drop of 75 percent).

-2. Major increase in list price showing shift in makeup of homes (up from $369,000 to $725,000).

-3. Median price per square feet is up 29 percent.

-4. Price reductions went from 22 last March down to 7 last month.

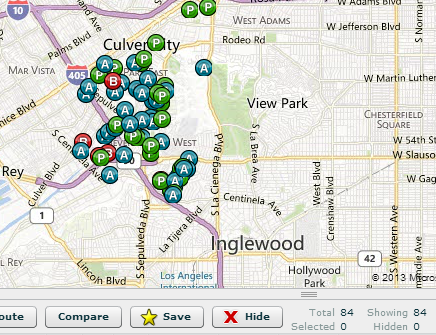

The incredible drop in inventory is really the big story. A 75 percent drop in a booming market seems to go against the rules of economics. Now consider the 29 properties listed as inventory versus the distressed properties in Culver City:

Over 84 properties are in some stage of foreclosure, nearly 3 times the total visible inventory. Would this change the pressure in the current market? Of course but ultimately for those looking to buy you can only purchase what is listed on the MLS. Of course with this kind of market, fraud is rampant (from a story last year):

“(CBS) Atiqullah Nabizada, 29, of Coto de Caza, and Kenneth Moore, 49, of Tustin, were arrested Thursday at their homes after a grand jury returned two indictments charging them and a third defendant – 32-year-old Ahmed Tariq Asghari, of Sherman Oaks – with fraud violations and identity theft in connection with a variety of schemes using real or fake short sale real estate transactions and home loans.â€

Short sale fraud has always been an issue but it will only get worse given the mania that is hitting (i.e., bids way above list, PowerPoint presentations, personal letters to sellers, dropping all contingencies, etc). When good deals hit, many times in very hot markets like the one we have right now these deals go to those with insider information. It is of course against the law but like that stopped people during the last part of our mania? In fact, fraudulent behavior became the status quo at many large institutions.

So how does the adjusted household income look like for Culver City? We can look at tax data for both zip codes:

Culver City 90230 (AGI 2010):Â Â Â Â Â $65,808

Culver City 90232 (AGI 2010):Â Â Â Â Â $133,031

What is interesting about the 90232 zip code is that AGI went from $66,825 in 2009 to $133,031 in 2010. That is a dramatic jump but also highlights that bigger money is entering some prime areas. $133,000 is still too low for diving into a $700,000 home. What does $700,000 get you in the 90232 part of Culver City?

4230 Revere Pl, Culver City, CA 90232

Bedrooms:Â Â Â Â Â Â Â Â Â 2 beds

Single Family:Â Â Â Â 910 sq ft

Lot:6,752 sq ft

Year Built:1923

Last Sold:Â Â Â Â Â Â Â Â Â Â Â Â Oct 2007 for $230,000

We also see that in 1993 it sold for $220,000 so the 2007 sale price was nearly unchanged for 14 years.

Some of you lived in college apartments bigger than this. Keep in mind this place sold in 2007 for $230,000. This clearly had some work done:

These pictures almost make you forget that this is 910 square feet. The list price? $749,000. Have fun home shopping. Welcome to flipper’s paradise!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

96 Responses to “Flippers’ Paradise: The massive jump in list prices for Culver City. Median list price up almost 100 percent from two years ago. Record low inventory. Distressed properties 3 times the amount of MLS listed homes.”

It will be interesting to see how far the sheeple go in this round of mania.

The sky will be there limit.!!!

Debbie, you mean “their” limit. Spelling, dear.

According to sales volume:

Sheeple would describe those who bought in 2003-2007.

Sheeple would describe those who wanted to, but didn’t buy in 2009-2012

Our AGI is about $75k after it’s all said and done. Supposedly this is “good money” from what others tell me, and possibly so judging 1/2 the neighborhoods I see in SoCal.

And judging another 1/4 of them, I’d say $75k AGI is peanuts to those hill-siders.

So that leaves 1/4 of SoCal for us “normal folk”.

Nonetheless…I’d feel trapped and foolish spending over $250k on a home. Is this a SoCal thing or something to want to spend so much? How do you go out and have fun, credit cards? How many of those 1/4 of homes have decent schools? Never even mind the word “good”, these days you have to accept “decent”.

As we prepare to enter this fray, my co-worker told me he’s looking in Norwalk and that bidding wars are back. He said they aren’t crazy like 05, but they are definitely back and that all cash buyers are a reality too.

with your stated income I personally wouldn’t go over 225k – and remember, there are worse things than renting, as long as you’re still able to save regularly

But wait a minute, I thought that rental parity had been reached at this point in many desirable SoCa markets?

East of the 605, I’d say so.

Someone here recently referred to this as a bifurcated market and I agree. In my neighborhood in eastern Ventura County I’ve seen three houses listed in the last month. Two were flip/remodels listed in the mid-500’s and lasted for a couple of weeks before selling. One was a smaller crap-shack similar to mine that listed for $430K. It went pending it *2 days* (and I assume for a good chunk over asking price). These were all homes that would have sold at maybe $600ish during the peak of the last bubble, but I would have guessed recent values in the low to mid 4’s – so much for my evaluation. These houses are all what would be considered “starter homes” around here – 1200-1500 sq ft, 3-4 beds, 2 baths – and they’re all selling fast right now.

The move up market, however, is looking decidedly slower. The somewhat larger (3 car garage, ~2500 sqft) places I’ve been looking at (priced ambitiously in the mid 6’s) are still sitting after months on the MLS. A few are starting to get wise and have reduced their asking prices by 20-30K, but even then appear to be still overpriced in this market. What surprises me is that there seems to be only about a $100K gap between market segments where there’s a bubble-like frenzy and those in which there’s still a crash-like torpor.

While I’m not sure why there’s such a clear segmentation in markets I wonder if it has to do with the relative interest of investors. There’s lots of potential landlords looking at smaller/cheaper starter homes while the move up properties seem to cater almost entirely to owner/occupiers. I’ll keep a close eye on this over the upcoming months, but if there really is a price convergence between starter and move up home segments it may provide some good opportunities for owners of cheaper homes (like me) to trade up.

I’ve been following that area as well. T.O. N.P?

I see what you mean. Perhaps Fannie Mae loans having a slightly lower limit in Ventura County might create some price separation. Also, from what I’ve read, some of the hedge funds don’t like to go above the 300k range for single family homes.

Apolitical, I am seeing the same thing in my area. Essentially, houses priced above $550 are selling much more slowly, if at all, than houses under $500K. It pretty much follows the rent parity level.

At $2500/month, it’s not too difficult to find a decent 3/2 to rent. And even though there’s hardly anything now available to buy for under $500K, the higher priced homes are still not selling very well. This current bounce may not have enough momentum to carry into the higher price ranges. The summer/spring should tell the whole story.

Gosh, when you think of $2500/month for rent, it’s mind boggling. Who has that kind of money? Need to be making around $100K/year to make it with that kind of rent. Kills me that in the mid-90’s, the rent on these places would be half that. But, salaries have not doubled.

You’re right, Sadie — and the nineties were real boom years! I mean, if you could say the word COMPUTER, you were making decent money. Even people who worked in local call centers for companies like AOL and DELL were cashing in with their stocks. Nobody threw numbers like 2500 a month in rent around even three years ago. It was absurd. 30K in annual rent, – deposits and renters insurance? Screw that jazz.

What you have today is a consumer that has been perfectly brainwashed, which, of course, is the preliminary step before you take them to the cleaners. Consumers have had their price perception warped by the bubble and now this echo bubble.

What a dumb century this is starting out to be.

Also watching the same area. Things have slowed a bit in homes over $500K. They are not moving much. I agree that this Summer should be an interesting story. We’ve decided to wait it out for 2 more years. We have 20%+ down, no debt and credit scores just under 800. I’m not interested in overpaying for a house when $2200-$2500 rents a pretty decent place in a good neighborhood of T.O.

We’re not flippers. We just want a home for the family. A house is a building, a home is the feeling. There’s nothing wrong with renting for a few years. And yes, we have kids, etc. For us, the biggest advantage of renting is that we can always move if we want to change schools for the kids.

Owners can move too. Matter of fact, Faster!! no 30 day notice required! You can rent it out in one day!!

Janum sounds like the prudent type who wouldn’t want to play the accidental landlord game.

Those of us who’ve done it know that it’s NEVER as easy as “simply renting it out”.

Either surfaddict has little to no experience in being a landlord or experienced a miracle of a long line of fantastic tenants and no issues.

I hope it works out well for you. I am in the process of deciding if I will wait and how much longer. My option is to wait or stay in my current townhome (which can barely rent for enough to cover payments and maintenance, leaving little room for vacancies or major tenant damage costs).

the prices here in CxC (Culver City gang logo) are shocking. I cant imagine why CxC fetches such prices… perhaps all the entertainment industry professionals. The amount of entertainment companies in CxC is quite high as seen here

http://www.culvercity.org/Services/BusinessDirectory.aspx?type=Entertainment%20Industry%20Service

but also the Calculated Risk blog wrote up this today: ‘homebuyer demand takes off”

http://www.calculatedriskblog.com/2013/02/redfin-homebuyer-demand-takes-off-in.html

Seems to me that the concern about home price appreciation needs to be tempered with low wage growth…. on the other hand, who knows what kind of black swan the Fed can throw at this further down the road. i.e. can anyone say home prices will drop more than 5% ever again?

That question was asked back in 2005/6.

Unless prices are at levels in line with proper valuation methods (as DHB continually talks about) a decline is inevitable.

I agree decline is inevitable – but the big question is how long they can kick the can down the road. 2 years, 5 years, 10 years, 20 years?

Also, there is this chance that housing will be predominantly investor/bank owned, leaving most in the rental market. If they dominate the market, prices will stay high.

@QE abyss

The high prices are all about artificially restricted inventory. Out in the midwest where some family members live, a city similar in size to Culver City has 120 active listings on the MLS versus 30 for CxC. They have sub 5% unemployment unlike the +10% in SoCal. Median listing price is about $150K over there, and median household income is about $50K/year.

I drive past numerous foreclosed houses here in Culver City every day. The banks currently rent those REOs out so they are part of the shadow inventory. In CxC, foreclosures do not hit the MLS, they get turned into rentals by the banks thanks to the Federal Reserve changing the REO rental rules back in April 2012.

I would also add that cultural differences come into play to some degree.

Small town Midwestern home buyers are typically more financially prudent types whom aren’t as likely to leverage to the hilt on a polished turd in order to impress people they don’t know.

Not only can they, that they will is a forgone conclusion.

This market is too crazy. It is not normal. This scares many buyers and sellers. Most people will wait until things become normal again. When the inventory comes, and/or the interest rates go up, then the people who buy now will have buyers remorse. Too bad, so sad.

Apologies if this has been discussed, I don’t follow the comment sections closely here….

Don’t higher interest rates disincentivize home buying?

If I buy a $400k house at 3.5% with 20% down, my mortage (not including taxes and prop insurance) would be $1436.94. Over the life of the mortgage I pay: $517,299.48

If I buy a $400k house at 6.0% with 20% down, my mortage (not including taxes and prop insurance) would be $1,918.56. Over the life of the mortgage I pay: $690,682.20

At 3.5% I can buy a house for about $535k and pay the same mortgage as I would for a house that cost $400k at 6.0%.

Is your point that prices are inflated because of the low interest rates? Weren’t they at 6% at the peak of the bubble?

Please tell me what I’m missing here.

Sub prime, NINA and full negAM loans. San Diego county,In 2005, the vast majority of mortgage loans were variable rate and interest only option loans. Many with stated incomes. So, the big difference now compared to then is that the underwriting or lack thereof was very loose. 6% PITI was actually being paid by very few mortgagees. It’s all about the monthly costs.

Trash face – All other things constant, Roger Rabbit is saying that people who buy today will have remorse if interest rates go up and/or inventory increases.

The problem with your example is that, from a nominal point of view and ignoring all other factors that might impact home prices… if you buy a home at $535,000 @ 3.5% today, your mortgage payment will be $1,921.91 per month. You’ll get to deduct ~$14,800 interest or so the first year.

Now lets say interest goes up to 6% next month. Looking only at the monthly payment, your house is now worth $400,698 (ignoring tax benefits, etc). While you spent $107,000 of a downpayment, someone else now only has to put down $80,140. In addition, the annual interest deduction is $19,200, providing an even greater benefit.

Remember, you can always pay down your principal if you have a high interest rate. Also, the short term impact of a drop in price is “fairly” easy to stomach, but what if your house is down 10% and you need to move because of job, illness, horrible neighbors, etc? You’re stuck unless you want to eat it, short sell, get a loan mod, or foreclose. You need 15% appreciation just to break-even after selling expenses are counted.

In the end, the low rates scare the heck out of me. Give me a (same house) $250k selling price @ 11% over a $535k selling price @ 3.5% ANY DAY!

I think we’d be looking at house prices 20%-30% lower than today had the interest rates remained constant (~6-7% in 2006).

@Jeff, while buying at low rates might scare you, I think they are here to stay for quite some time.

I agree with your other comment that if rates were in the 6 to 7% range today, prices would be 20 to 30% lower. The Fed agrees with your statement also and said there is no way in hell they will allow that to happen. If RE prices really were 30% lower today, tens of millions of people would be upsidedown and we would be facing economic chaos. I personally don’t see any of this nonsense changing for years.

I bought a few months ago because it made financial sense to me. Even if RE prices fall by 20% (which is highly unlikely), I don’t think rents will budge much…that sealed the deal for me. Renters are over a barrell right now, I really doubt that $2000/month rent will go down to $1500/month.

Apparently, you missed the fact that 6% was during a bubble.

@ Trash Face,

Yes: lower rates inflate prices. When rates are higher, you can buy a lot more house for the same money that buys you not that much when they’re lower.

The lower the price, the lower the property taxes and insurance, and the lower down payment required.

When interest rates are low and prices high, it’s easier to get priced out of the market. When interest rates are higher and prices are lower, the easier it is to afford to buy. Yes, when interest rates are lower your payments may be lower, but you have to pay back a lot more principal. A *lot*.

For my money, I’d always rather have lower prices and higher interest rates, even if they decrease or eliminate the mortgage interest deduction. That principal and those taxes are killers.

It irks me to see a lot of comments mention the mortgage interest deduction as if it were fixed. It’s foolish to count on it in an affordability equation. Congress could reduce it or eliminate it. We used to be able to deduct other types of interest. They took that away.

As for rents not budging, that’s another thing I see mentioned in the comments a lot. What makes anyone so sure that they won’t go down? If investors are rushing to rentals and toxic inventory is turning into rentals, wouldn’t this increase the supply? I think this idea of rents going up or not going down are premature.

One thing missing from the mortgage interest deduction is that you have to consider your tax burden as the difference between itemizing versus taking the standard deduction. Sometimes this is only $1000 or $2000 different. That difference is your net tax savings from your home loan interest.

I figured this out because last year, since I became head of household, tax savings from itemizing is less for me, so I gain no tax benefit from mortgage interest write-offs.

When I say tax itemizing is less for me, I mean that I get a better tax deduction from the standard “head of houshold” deduction than I do from itemizing.

No matter how many people buy into this market, valuations propped-up by unusual and fragile government manipulation are ultimately unsustainable. I fear what lies ahead. It brings to mind NYC about 40 years when most didn’t want to own real estate under any circumstances.

Huh? I’d be asking someone who bought NYC real estate 40 years ago if they regret it today.

some Sandy Storm victims might beg to differ

Amazing how smart hindsight makes you feel, hey?

There is a possibility that prices will bounce in a range until inflation actually makes them “fair” market value. Certainly other goods are rising in price. But I don’t think we are close to that point yet. In 5 years we might have inflated enough at 7-10% a year (if shadowstats and similar are to be believed) that many of the prices start to make sense again. Either that or another crash from over-leveraged buyers. Either way the risk factor seems to hint toward staying put and investing elsewhere.

The real news was that this blog, while having excellent information was forecasting that this type of market could not happen and in fact the chance of lower prices was great. Great to look back, value is looking forward. How many missed out on the best buying opportunity of this generation. High inventory, low prices and low mortgage rates. It is now running away fromt he fence sitters.

Look at the stock market, up almost 100% since the low. Since that time most commentators were reporting it was not sustainable, overpriced to company income etc, and well people missed out.

Umm, there is a simple reason for this though. The Government broke it’s rules. Rewrite, change, hybrid fascism / socialism, whatever you want to call it.

Following the founding fathers, Constitution, capitalism, and basic rules like don’t let banks takeover and this would have never happened. No one with any honesty or integrity saw this coming. Based on human history, some predicted it, but any American playing by the rules predicted Depression 2.0, not Socialistic bank bailouts.

Investor=Laughable Troll

The only thing that is going to make this mini-bubble bearable over the next 2 years will be the fun of watching the trolls vanish from sight ala 2007-8 when it all goes south. Good times 🙂

Investor is essentially right. The time to buy is when blood runs in the streets and hysteria is the mood for the day, and this forum is no exception. I certainly do not recall this forum being a bastion of calm during the storm — quite the opposite, really. I’m sure there were worse places on the net where people openly advocated digging underground bunkers and stockpiling pork and beans for the coming societal collapse, but DHB as noble chronicler of the insanity does attract some who are more prone to believe some mild form of economic Armageddon is nigh. Really, some prices went down and the imprudent and overextended lost their homes, but it was not another great depression.

Certainly it remains true that property values outstrip local incomes, and normally that would suggest that something is very wrong. But we’ve also seen ample evidence that many CA buyers are not actually CA buyers with CA incomes, and are instead investors from distant parts. So there is an explanation there. Prices outstrip local incomes because local incomes are often not the ones paying for the houses. The local 1% can still afford tha McMansion, of course. It’s not all foreigners.

Ultimately the investors will probably get bored with CA real estate and will lose their shirts. In the mean time, perhaps we should see some bright side in those overextended homeowners who have manage to stay afloat this long may finally be above water and can get out.

There is still blood in the streets.

Since 2009:

people on food stamps continue to increase

Gold is at $1666 versus $800.

Dollar has devalued causing food and gas inflation.

Wages have been flat, benefits cut

Health insurance costs continue to skyrocket

College costs continue to skyrocket

We are still fighting useless war in Afghanistan costing us billions.

We still have trillion dollar deficits.

National debt is up $6 trillion.

True unemployment is still high.

We have 0% interest rates on Fed rates.

We have QE to infinity still

Federal Reserve is buying bad loans every month.

The blood in the streets they talk about arises from widespread hysteria which drives markets to unnaturally low levels. That is the time to buy. That time is not now. The DJIA is within 200 points of its all time high. Return to normal unemployment looks to be 16 mo. out given current trends. (http://www.crgraphs.com) Private enterprise has been making record breaking profit for a long time. The lagging government sector is coming out of it. (It looks like there is one more Federal budget calamity to avoid.) Even California has balanced its budget.

The doom is over.

“The DJIA is within 200 points of its all time high.”

This does not mean much to me or 90% of us who have very little in stock market. DJIA dropped the following companies: Altria, Kraft foods, Honeywell, AIG, Citigroup, and GM since 2008, and replaced them with other companies. Volume trading in stock markets have been very low last several years. Taking into account true inflation, of at least 6% a year per Shadowstats.com, DJIA is actually not close to matching its previous highs.

Return to normal unemployment looks to be 16 mo. out given current trends. (http://www.crgraphs.com)

U-6 is a much better measurement of unemployment and it is at 15%! Also many have given up looking for work and they are no longer counted. This explains increasing food stamp usage.

Private enterprise has been making record breaking profit for a long time.

Actually only several large companies have been posting record profits and mostly due to cutting worker wages, benefits, and massive layoffs and not rehiring. You can google for much more info.

The lagging government sector is coming out of it. (It looks like there is one more Federal budget calamity to avoid.) Even California has balanced its budget.

California is in horrible shape still. There is still $28 billion of debt that has to be paid due to the fiscal emergencies last several years. Los Angeles Times and other newspapers debunked Brown’s statement that the budget is balanced.

The doom is over.

The doom has been masked by relentless government deficit spending, borrowing, and kicking the can down the road. The doom will reappear due to fiscal cliff. Meanwhile, food and fuel inflation is taking purchasing power away from families, Soaring health care and college tuition is killing families. Lastly, every single asset bubbles in history of the World pops, and reverts back to where is began. U.S. housing is just experiencing a dead cat bounce.

Falling interest rates, at these levels, is a clear sign of an economy on life support. There’s a veritable flock of Black Swans out there.

But, I bet we see housing keep moving up through this summer as the interest rates and rising prices suck in more buyers. The investor buyer is not interested in homes over $500K as they mostly don’t cash flow. But there may be some move-up buyers out there from all the low-end buying that’s been going on for the last year. A few more fence sitters may capitulate as well. With these incredibly low inventory levels, it won’t take too much to keep the prices rising.

Clearly the Banks are playing the waiting game, why not with Federal dollars backing them. Time will allow property values to increase, but if they wait too long their plans may backfire. Will still have problems with income disparity. RealtyTrac will give you some numbers on mortgages past 90 days and pending foreclosures. You might want to check out the community of your interest first. Hedge Funds (funded by many banks) have gobbled up thousands of homes nationwide but there are signs they may have some problems keeping renters, expensive unplanned maintenance, local economic conditions and lack of job growth. I suggested those looking for a personal residence should also play the waiting game. Money can at times be easily made, but too often hard to keep.

Two things two keep in mind. For house prices to rise, more credit must be available and buyers who qualify for the loans. Which means income must increase. Importantly,as prices rise, cash buyers leave the market and sell their inventory if they are smart. CxC is an enclave, not a market.

There is absolutely nothing pushing wages up. On the contrary, with budget cuts in defense, California will lose billions in wages. Take a look at what happened under Clinton’s surplus, all on the back of the military spending. Coming around again with a venjeance. Cash buyers, ironically, can act as a lid on price moves.

Can anyone, please provide a scenario where wages will increase significantly and/or thousands of new, high paid jobs will suddenly appear in Southern California? And, don’t forget, that California has anywhere between $167 billion and $335 billion in unfunded debt down the road.

As for “growth”, after the 2010 census, California gained no seats in the US House of Representatives for the first time since statehood in 1850. Maybe another gold rush will save the state.

Scenario: Wages increase elsewhere and the money is used to buy houses here as investments. Never underestimate the proclivity of the rich for rent seeking.

Seems pretty simple……there is plenty of cash around (booming stock and bond markets), more truly wealthy people, plus the economy is now solidly in the recovery mode, slow, but slow is good since more longer lasting. And, CA is currently BOOMING with the budget now forecast to be in surplus by 2014, the largest reduction in unemployment in 25 years, currently an oil boom in Bakersfield, Facebook IPO, Tesla being Motor Trend Car of the Year. And at about 12% of the nation, enough to lead the economy no matter what obstructionist politicians do. The BOOM is on…..maybe the greatest ever…..sure, there will be a bubble to be popped, but still much too early……as for bid-up RE prices in some areas, just a typical thing happening at the start of a boom. For those who think the middle and lower classes are being left out……true, but just a sign that there are so many more people left to keep the boom continuing, when they eventually benefit from the economy…….plus, booms always climb a wall of worry……the more I hear words like “crazy,” “insane” while things like employment and RE and stock prices are still well below highs, just makes me more confident.

@Joseph Oppenheim,

I will leave you with just one statistic for your “Booming” California economy. Net increase in number of Californias employed from Dec. of 2007 to Dec. 2012, minus -351,000. Yes, that is correct. Total jobs added in five years, minus -351,000.

For those who like to see the facts, please check link below. Pay special attention to the labor participation rate. Warning: It will take at least a 6th grade mathematics comprehension level to understand the statistics. However, why not just ask your realtor how things are going?

http://www.calmis.ca.gov/file/lfmonth/calmr.pdf

CA booming?! I’m certainly not seeing it anywhere around me. All I’ve seen is Jerry Brown claiming the CA budget is now ok. But we still have fewer jobs than 4 years ago and the sales volume and number of homes for sale in this “housing recovery” is quite small.

The question in my mind is ‘once the investors stop buying will the retail sheeple take up the slack and drive the housing market up another 20%?’. Their pump and dump may not work out all that well. I think the ‘tell’ will be if we see homes that are selling for $500 right now jump up to $600K and above this summer. That seems to be a squeeze zone.

It will take at least a 6th grade mathematics comprehension level to understand the statistics.<<<<<

You are looking at the wrong facts, if you want to understand what is happening now (the current trend), unemployment dropped significantly in the last year (2012), over 12%.

Things that slow in your RE office. Must be with the lack of inventory 🙂 Maybe your Broker is rewarding you with Happy Meals for trolling RE Blogs??? LOL!

Thank you Mr. Obama. Where’s my phone?

I swear, there’s something in the water in California.

Things are looking bubbly up here in Silicon Valley– open houses have more traffic than a gun show, and price to rent is >20 in many areas such as Palo Alto. E.g. $850K 2/2 TH with a fair rent of $3K ~ ratio of 23.6. But I think a majority are cash buyers (Facebook, Chinese), so this indeed may be forming a short-term top.

Short term indeed. Did folks forget that slick Dot.Com burst over a decade ago in Silicon Valley ? Living there in 2003, I remember you could not give your property away. It is all cyclical, will crash and burn again, just a matter of when.

Can someone help me understand this? Why are banks holding back inventory when price are reaching bubble levels again?

I was wondering the same thing. How does it make sense for a bank to hang onto a property in that area, when clearly they should be able to sell easily enough?

I was also wondering why, with prices like that going on, why there would be any distressed properties inside that neighborhood. I mean how underwater could those people be?

I guess I’m unclear on the timing of this.

How long has this been building? Not long enough? Is there an expected lead time that hasn’t yet elapsed, to explain both questions?

@watermelonpunch

“…I was wondering the same thing. How does it make sense for a bank to hang onto a property in that area, when clearly they should be able to sell easily enough?…”

December 2012 Sales Info:

Culver City 90232: median SFR price $705K

Culver City 90230: median SFR price $647K

July 2007 Sales Info:

Culver City 90232: median SFR price $925K

Culver City 90230: median SFR price $850K

As you can tell, Culver City has about 30% to go before reaching the previous peak prices. If the banks were to sell now, they would incur losses of about $200K per SFR. In other words, the current mini-bubble no where near the previous mega-bubble.

I think we’re still at least 20% below the 2006 highs of the last bubble. Probably close to 40%. Calling this a “bubble” is premature, IMO. It’s a clear bounce in price, but not a bubble, yet.

This is how I understand it:

If you want a BIG shadow inventory number you would take:

1. Foreclosed homes that are not for sale

2. Loans that are 90 days delinquent

3. Loans that are between 30-90 days delinquent

4. A percentage of underwater homes that one could speculate would become a distressed sale

That number was very large and very scary and if the banks would not have taken extraordinary steps to get rid of the shadow inventory it would still be a massive problem.

However the banks started to do a few things that weren’t common before the 2000s

1. Loan mods/principal reductions (even if the homeowner was underwater)

2. Large volume sales to investors

3. Short sales (Before this current wave, short sales were uncommon)

If we would have gone by the pre-2000 rules we’d have a massive amount of inventory coming on as foreclosure sales. The thought process was that since foreclosed homes sell for substantially less than non-distressed homes we’d fall downward spiral.

Now we see banks doing loan-mods and principal reductions. We see corporate investors buying large swaths of properties. Short-sales are making up over 20% of all sales. People that are/were underwater on their homes but current in payments and didn’t walk away yet, are even less likely to walk away as each month passes and they gain a little more principal.

All this means that a huge chunk of the properties are being sold before they hit the courthouse.

Makes a lot of sense.

In my area, they have seeped out 13 homes in the past 8 days (very rapid pace), in a market that had only 90 total homes for sale on Jan. 31st. It could be a fluke. But it may be that they are trying to sell some extra ones. However, there has to be a tipping point – one at which they put too much inventory on the market and prices drop relatively quickly. If that happens, they’ll take a few losses and go back to restricting supply.

One of my favorite statistics in California’s “balanced” budget: UNEMPLOYMENT INSURANCE (U.I.) FUND BALANCE currently minus -10billion dollars. Yes, only ten billion in the hole.

Bubble 2.0 has gone mainstream. I just watched a CNBC interview with author David A. Stockman that discussed how the FED has created the new bubble. Diana Olick, a CNBC Reporter, also added how the wall street money and the banks holding back inventory are also part of the problem. Both Mr Stockman and Ms Olick both seem to agree that once the wall street hits their number they will cut bait and sell causing a even bigger crash than 2008. Ms Olick stated housing prices were up 8% last month alone.

And in a related story, I lost another bid this week to an all cash buyer who over paid for a dumpy condo that I’m sure he plans to flip. I hope he chokes on it.

Here is a video of one of David Stockman’s interviews.

http://finance.yahoo.com/blogs/daily-ticker/housing-bubble-2-0-david-stockman-133026817.html

http://video.cnbc.com/gallery/?video=3000146599&play=1

It seems unlikely they will dump all their inventory at once. Foreclosures have to be fixed up for sale, paperwork done, etc. with limited manpower. It seems more likely that the remaining shadow inventory will simply serve as a drag to keep the bubble from inflating too much too quickly.

Dumping inventory would kill the thing their trying to do right now….push up prices by holding back inventory. And, there’s a financial dis-incentive to sell due to taking the loss on the books. Right now, FASB let’s them hold the foreclosure at market value on their books, indefinately. So, this inventory level is going to come out of lenders in drips and drabs for as long as it takes them to bleed them off their books. I would not be surprised to see them start squelching short sales as well.

So banks are holding inventory off the market to create scarcity and prices increase? They then sweatily and breathlessly spin on their heels to advise all these people with nowhere to put their mega-money to come on down, do I have a deal for YOU, help us buy up all these cheap houses, we’ll rent them out for mega-bux? that’s gonna end up hurting someone. that bank who told their investors to go purchase their own investment property – with mega-cheap money – should be ashamed of themselves. To actually send the mega-bux holders into these neighborhoods is just being a mean-bean. those cheap loans are danger box.

Yep, a majority of these seemingly wealthy investors (not at the top of the food chain) will lose their shirts, when the banks decide they are in a good position.

Schools are good in LA. big giant ha!!!!

Having now experienced elementary schools in Florida, Las Vegas and Los Angeles, I have one question. WHY DO LOS ANGELES SCHOOLS SUCK SO BAD?

Why do they need to continually cut the budget there? Property values doubled and tripled over a decade, which increases property tax revenues which fund schools. Property values in LA by and large are well above 2000 levels.

It is not prop 13 to blame. Far too many properties resold to blame that. My former property in Eagle Rock had a tax bill of 6999.00.

On the other side, in Las Vegas, my children attend an excellent public school. In LV, I bought a property for a price last seen in 1980. Property taxes are about 778 a year. That’s about one tenth of what I used to pay in Eagle Rock, part of Los Angeles.

In Eagle Rock they gave the parents a choice between a school nurse or a librarian. Class size was often 32 kids.

In Las Vegas one kid is in a class of 18, the other has 24. School has a nurse, librarian, art and gym. Music sometimes also.

My property tax bill and quality of school is amazing in LV compared to the nasty schools in LA.

I still commute back for work but I just dont get the math.

Just sharing some thoughts on the discrepancies of tax dollars equaling better education.

You know what’s scary. I think you might be wrong on the amount of housing turnaround, despite the decade plus of housing frenzy. And Prop 13 does play heavily into this. What blew my mind is propertyshark.com. You can sign up for the free version which allows you to get info on 1 property per day. I looked up a house for sale in the area I wanted to live in – the PicFair area. Propertyshark not only gives you specific info on the house, but statistics and info about the area the house is in. The most interesting of all is the tax per square feet map. You can see clearly that a large amount of people are paying less than $5 a square feet based on the shades of blue with a significant amount paying less that $3. Any pink areas I assume are people who bought near the top of the market. God help the person that’s in the red and god love the person in dark blue…lol…check it out and you’ll see what I mean.

Prop 13 both limited tax increases and cut rates in half, to the extent that localities could not support themselves without substantial money from the state. The state gets most of its money from a very progressive income tax. Because the income tax receipts come mostly from the wealthy, and their income is heavily tied to the business cycle / stock market, state tax receipts boom and crash with the economy. (Wealthy people frequently make no money at all or lose money in down years.) Consequently, localities, since they depend heavily on state funding, also boom and crash with the economy.

A return to pre-prop 13 tax would probably solve most of California’s tax problems at all levels.

Prop 13 is really an incentive to keep a property a long time. New buyers are stuck paying on the price they just paid. What Sacto is talking about right now is getting the corps that hold property to pay-up. Because they sell shares to change ownership, corps don’t ever change title on the properties they have and thus don’t get their taxes recalibrated.

If you consider that most people change properties every 5 to 7 years, Prop 13 should not be a big problem. Sacto has a spending problem, not just a revenue problem. But that’s another discussion.

But why on Earth would anyone subsidize long term home ownership to the boundless extent that we do in California? I can think of a lot more worthy and cheaper things to subsidize.

Prop 13 rate freezes should have excluded anyone still working and all companies. I can understand coddling the elderly on fixed incomes. Cynically, they are time limited anyway.

CAE – Wonder if there’s a way for homeowners to sell shares of their houses, instead of transferring ownership?

While I completely agree on the quality and cost stuff in LA, not having gone to school in US one of the dilemmas you present seems weird. I went to six schools over 14 years and we never once had a nurse at a school. No school did. Why do you have a nurse at school? If a kid is sick they should go home. They don’t here? My son’s school here doesn’t have a nurse. It sounds so 1950’s!

We just went and laid down on a bed provided located near the office and waited until someone picked us up. Office staff were trained in first aid and fixed you up if you broke. If it wasn’t that bad you went back to class, if it was pretty bad, call the parent. Really bad call an ambulance. I don’t get what a nurse would actually do. Or maybe a nurse here is different to a nurse where I’m from. They go to university here, right?

When I was in school (70s/80s), the school nurse did the first aid, assessed the level of illness, let you lay down until you felt better or and made the call to the parent if you needed to go home.

Most schools in california have health assistants assigned to schools and nurses assigned to 5-7 schools within the district. In addition to dealing with bumps and bruises, they screen vision, hearing, height and weight, do dental assessments and insure vaccinations are up to date and lawful. Then of course they also deal with homeless, special needs, and in some cases, abuse victims, try to stem outbreaks of lice, get clothes for needy kids, and try to give general health education to the parents of these unfortunate children. It’s a pretty exhausting day for the most part

“A 75 percent drop in a booming market seems to go against the rules of economics.”

The rules of economics don’t apply to cartels (See OPEC and De Beers).

http://www.salon.com/2013/02/07/the_housing_recovery_is_a_myth_partner/

That article explained a lot. Thanks Gerhardt.

Yes, thanks. I did not know that the hedgies were doing their handy work in GA as well. Amazing bet they’re placing. I don’t usually wish ill upon anyone, but these thieves could use a real dose of humble about now.

haha

I live in a 900sqft house.

I always thought it could have a better layout – but now I’m more appreciative after seeing those pictures!

Of course, I also have a much bigger yard (especially when you take into account that we have 2 floors).

They obviously chose pictures that give the impression of a bigger house footprint. But at the same time it looks kind of awkward.

I’m not in California.

Even so, $749,000… with a price history of 230,000 in 2007.

Sure seems hinky.

Median prices are all over the shop. In Beverly Hills, one zip is down 46%, and another up 60%. Artesia is up 50%. There is no pattern here. With the Case Shiller I doubt the gains represent what you’d necessarily get it you sold today in any given of the 20 composites. However, low inventory is frustrating a lot of buyers, and best advise is rent. It’s a bad time buy in many places.

Latest from Robert Shiller, seems to accord with Dr. HB: “we should be cautious with the enthusiasm; housing is not a great investment; newer houses are better than old ones; market may come back but not with the same force as before; buying a house should be a personal decision otherwise not great for a sure-investment; rental premiums will get more people buying”

the video is here: http://www.businessinsider.com/robert-shiller-home-investment-a-fad-2013-2

[Shiller admits he owns 2 homes and buying them was a personal decision].

Laugh out loud.

New rule – whenever I purchase without regard to financial prudence, I’ll simply state that it’s a “personal” decision.

What Shiller doesn’t say is you have to live somewhere, it’s either:

1. Buy

2. Rent

3. Live in a van

Option 3 is out for most people. On a monthly basis, cost of ownership is the lowest in decades and rent seems to be creeping up every year. Those are essentialy options people are weighing. I don’t think anybody buying today (other than flippers) plans to make any money in home price appreciation for a LOOOOONG time (maybe this entire decade). Homeownership gives you protection from the rental market and gives many fringe benefits renters don’t get (living free for years if you stop paying).

California RE is a constant boom bust cycle. Over the last 25 years, there has been a very short time frame where we had a normal market (mid to late 90s). The rest of the years had large gains, losses, abnormal circumstances (foreclosures, short sales, etc). This is just normal here. Anybody waiting to get that 3/2 SFR in premium Westside, South Bay, coastal OC neighborhoods for 500K better not hold their breath.

Yes, but unquestionably the rental market is more in-line with real economics. So, if you can show good credit, good work history and good references (i.e., are a solid “investment” for the landlord), you can still get a good deal; whereas the RE market is rigged against buyers and there isn’t a SINGLE good deal to be had “west of the 605.”

I rent a small 2/1 SFR in Torrance. It’s decent, but I would never commit to a 30 year mortgage here. My kids are young enough…they actually love the place. I’ve learned to really like being a renter.

It’s not “rental parity” it’s “cash flow” for me. I’m saving real cash every month and biding my time.

“Homeownership gives you protection from the rental market”

Protection for what exactly? Sounds like a load of BS.

Schiller owns 2 homes and therefore contradicts his claims with an excuse. He said his wife wanted them? He sys one thing and does another. Sounds like a politician to me.

http://www.financialsensenewshour.com/broadcast/fsn2013-0209-1.mp3

About halfway into this podcast there’s the interview with Burt D.

Pretty interesting. He thinks the big investors in residential homes will be dumping hard as soon as they feel there’s a decent rise in prices.

Well, some school districts in Ca are good like Irvine and others bad like Garden Grove. Garden Grove wasn’t that great before there was a lot of Hispanic students or prop 13. Probably a kid would get a better education in Irvine than Garden Grove. I would say a lot of the south OC schools that don’t have a lot of hispanics are better than the schools in Garden Grove and Anaheim in the 1970’s when most of the kids were still white. Being a babybommer in Ca schools a lot of the class size was hugh in the 1960’s and 1970’s over the 30 mark unless it was special ed. Not certain about the class size but the easiest way is to interduce more charter schools like Arizona. Actually, Ca birthrate is falling faster now since even Hispanics are haivng less kids.

I personally know this property, and is a perfect example of how bad statistics can be. Their parents owned the house since the original purchase in the 90’s. It did not sell in the $200’s in the last few years, that’s laughable. It’s on the most desirable street in Culver City on the end of a quiet street with space and lots of street parking. I think that’s actually a fairly high, but very reasonable price, and I’m a huge real estate skeptic.

Now a duplex in Culver City just sold for $930,000 and it was a dump! I personally know that these units rent for $1650-2000/mo and this house would be on the low end. It was a big lot, but it went for $100,000 over asking price

Leave a Reply to Ian Ollmann