Looking into the crystal ball of California real and the 2011 market – 5 charts examining the future of California housing and real estate. Case Shiller Los Angeles tiered home price index, nonfarm employment, unemployment benefits, and total market inventory.

The joy of the holidays provides a respite from all the economic challenges facing the California economy. It has been an arduous three years of riding on a financial rollercoaster and very few states depended on housing as much as California. There are varying metrics measuring the home price decline in California but overall the state has seen prices fall by 40 to 50 percent from the mountainous peak depending on what index you are looking at. A 40 to 50 percent decline screams like a Greek siren at a post-Christmas sale but is it a deal? Many Californians have adjusted their rose colored glasses and we have a generation of new home buyers that know nothing else than bubble home prices. To many, extreme home prices seem to come with the California territory like 405 gridlock or warm winter days. Yet bubbles do burst and the real question most should be asking is how much lower will prices go? To answer that, I want to examine a variety of measures including personal income to home price growth but also where the economy currently stands as we enter 2011.

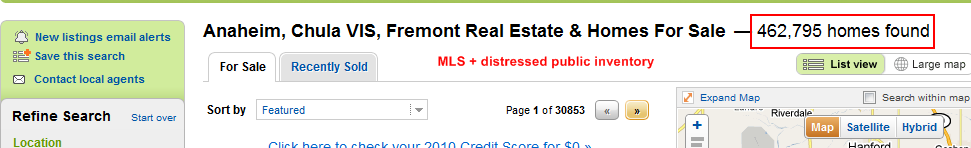

The first chart examines individual personal income and the California house price index. This index is provided by the Federal Housing Finance Agency. This index is generous since it puts the California home price decline from the peak at 31 percent. We’ll use this to measure it with personal income growth:

Chart 1 – CA House Price Index / CA Personal Income

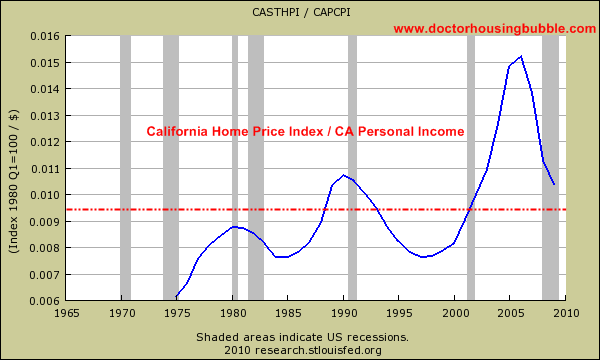

Even based on these generous assumptions, home prices on a statewide level are still inflated based on historical metrics going back to the early 1970s. What people need to keep in mind is that this metric averaged out during more prosperous economic times. What is odd is that with a statewide unemployment rate of 12.4 percent and an underemployment rate of 23 percent (second only to Nevada) you would expect that home prices would be below their historical average. This would make sense since housing should track the overall health of the California economy. What we see right now however is the housing market technically performing better if we use prices than the statewide employment market. Prices are coming down like tree sap from an exposed tree. We can measure this by using the CA House Price Index (CAHPI) and measure it up against total nonfarm employment:

Chart 2 – Nonfarm employees versus California Home Prices

Like a forensic investigator we need to find the turning points in markets and the chart above shows the story of two large employment bubbles. Through the 1990s it was technology based but in 2000 you see it move lower as the tech bubble burst only to rise up yet again as the California housing bubble took off. What is more fascinating about this chart is that home prices never corrected after the tech bubble burst and just kept going up like a silver helium filled balloon. So using the start of the housing bubble as the starting point may not account for the price correction that should have occurred after the technology bubble popped. What you find in the above chart is that employment kept expanding roughly 1 to 2 years more after the peak in home prices was reached in the latest real estate bubble. Nonfarm employment in the state is now back to late 1990s levels and California home prices are back to levels last seen in 2003. Inflation adjusted prices are now flirting with a lost decade similar to what Japan is experiencing with their two lost decades. If you look closely above, nonfarm employment has hit a trough but hasn’t moved up. The same applies to housing prices. The question is where do things go from here? It would be absurd to assume that home prices would go up and lead employment growth. This was the cause of the last bubble. It is safer to assume that employment growth will then lead to future home price growth. Yet home prices are still inflated simply by examining historical price metrics. But you also have to parse the data. A mortgage broker that made $100,000 or more a year and now can only find a $30,000 a year job is now counted as fully employed. Yet it would take 3 brokers and some change for what was produced in income (and tax revenues) from the peak bubble years.

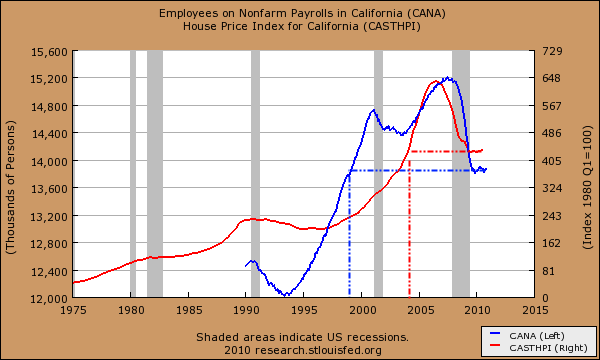

The following chart shows how much is being paid out in statewide unemployment benefits:

Chart 3 – unemployment benefits paid out

This is really where you see the bubble in housing imploding. What is troubling is how quickly the unemployment payout shot up. We are still near the peak and the recent decline above is largely due to 99ers (those on unemployment for 99 weeks) are falling off the rolls. It would be silly to argue that this is somehow good news. What large industry is absorbing up all this excess employment?

During the rampant expansion days of the bubble, I would see people entering the industry that really had little skills besides living in the state and the gift of gab. You had people with a high school education making six-figures a year by pushing toxic mortgage waste to California buyers. These people infused this money into the economy by purchasing foreign automobiles, expensive jewelry, and partying it up in the Los Angeles nightlife scene. The majority also bought into their own pitch and purchased over priced housing. The state was flush with revenues and had little incentive to intervene. In other words, the housing bubble was self-reinforcing and all the heavy hitters were taking their cut. That cut was so high that many will try anything to recreate that environment. The tax credits to buy homes or the artificially low interest rates are simply methods of keeping home prices inflated for those who live off the churning of real estate and yearn for the halcyon days of the bubble.

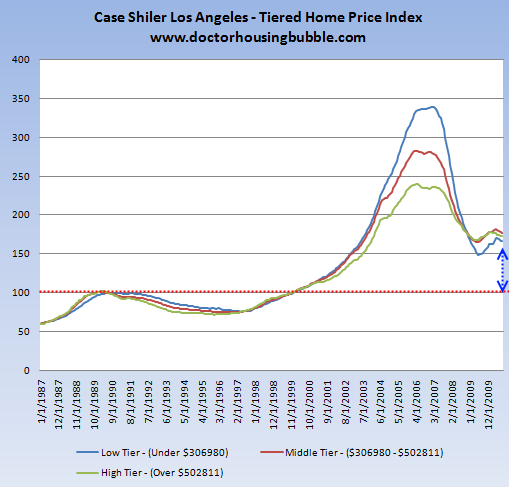

The irony is that in many niche markets where prices are still in bubbles these policies are keeping home prices unaffordable for working professionals. Prices are coming down but taking longer because of this expensive exercise in keeping economic policies that largely were causes of the bubble. This leads us to our next chart. Home prices from low to high tiers are all coming down:

Chart 4 – Case Shiller Los Angeles tiered home prices

This is an interesting chart. Every market segment has seen a price correction above. The recent tiny bump up was billions of dollars of bad policy and tax breaks yet that has now largely waned. Let us look at the actual percent decline for each category:

Low Tier – (Under $306,980)                     -             51% off peak

Middle Tier – ($306,980 – $502,811)         -             37% off peak

High-Tier – (Over $502,811)                        -             28% off peak

The above data is crucial but also shows the domino like effects of price corrections. The low tier went up higher than the high tier in percentage terms but prices are down significantly in many areas. It is also the case that places like Pasadena and Culver City shifted into the high tier price range and now need to come back down into the middle tier.  This housing bubble was like a tectonic plate shifting entire cities into price tiers that it had no economic justification of being in. The correction is and will continue to happen.

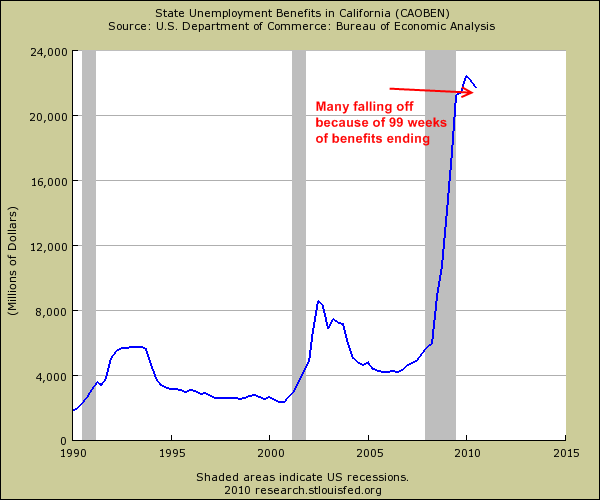

All of this coalesces around the massive build up with shadow inventory and leads us to our next items to examine in terms of forecasting out into 2011:

Chart 5 – Total California inventory

Looking at the MLS minus foreclosures gives us a tiny picture of the state of California housing. Total MLS California inventory is roughly 164,000. But if we add in all the distressed inventory of foreclosures and those in the pipeline the figure jumps up:

The pool of homes shoots up to 462,000 and what about all the other tens of thousands of homes with non-paying “owners†that don’t show up anywhere? We already have data on cure rates and 90 percent of these homes do end up as foreclosures because there is only so much you can modify when home prices have fallen roughly 50 percent. Aside from modifications, what about the employment scene that we examined above? People now need to pay more for healthcare, college, and typical items of a middle class lifestyle yet wages are stagnant. Where is the money going to come from to support housing prices moving forward especially at the current inflated levels?

The above tells us a very revealing story and that is that 2011 will bring lower home prices to California unless we have an economic revolution that produces hundreds of thousands of good paying jobs. This should be obvious merely by looking at employment trends but also the fact that home prices have yet to revert to their historical trends. As I have mentioned before, it is actually a surprise that home prices don’t fall under their historical trend based on the weakest employment market since the Great Depression. The fact that recent sales have collapsed tells you something significant. I’ve also had many random people tell me, “I’m not in a rush to buy since I don’t see home prices going up.â€Â This is a new trend. Those wanting to talk about the negative aspect of real estate.  I’m sure many of you encountered people at cocktail parties or gatherings during the bubble of how much they were making in real estate, “my home went up $150,000 in the last year.â€Â Now it seems many want to psychologically validate what the market is doing. I’m sure after Tulip mania there were many who didn’t participate and witnessed the insanity only to stay silent during the bubble. Once it popped, their silence is unleashed and it goes viral. This produces a society that then becomes resistant to any additional bubbles in that market at least in the short-term. That is why it is likely we will go a few decades with nothing coming close to a housing bubble in California. Just look at the Great Depression and how the stock market performed for nearly 30 years. 2011 is around the corner so gear up for another economically interesting year.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “Looking into the crystal ball of California real and the 2011 market – 5 charts examining the future of California housing and real estate. Case Shiller Los Angeles tiered home price index, nonfarm employment, unemployment benefits, and total market inventory.”

Local cities and school districts will also be balancing their budgets by adding parcel taxes, (aound $1,000. Per residential unit) this year, on TOP OF regualar property taxes.

All they have to do is convince 67% of those voting, is “It’s for the kids.”

Fail to see how increasing teacher, firemen, and police salaries in a recession helps our kids.

“per unit”!!?? Does that mean if I own an apartment building I have to pay 1k per unit. Can’t see how raising the rent on people who can barley afford it helps the kids!! The politicians are really looking out for the poor among us aren’t they!? I can handle the $85.00 per month increase in my rent, but many, many cannot.

California is one of the richest states in the U.S. when it come to natural resources and brain power yet all we can do is over tax and drive people away. What a shame.

Torrance did that 2 yrs ago, measures Y & Z, tax property owners to pay for a scam to hire their buddies to “work” or “replace” poorly maintained solid school buildings with pre-fabricated shoddy “new” ones. Math and science curriculim didnt change, but kids get to see real life example of Accounting/bookeeping, corruption and mis management of hard-working taxpayer dollars.

The previous RE bubble in California occurred in the late ’80’s. Folks that bought at the peak didn’t recover until the late ’90’s. So 2018 when prices bet back to pevious recent peak?

Plus, look at what is happening in the world of innovation, where CA used to lead in the West. That has now shifted to Utah (most patents per capita, for instance). In 2006, I bought a car from a geek moving to Utah? I said, Utah? He said, Yeah, my company (formerly based in Santa Rosa) is moving there. Is the Big Orange losing its shine?

no

Official unemployment is over 12% in CA. That means that real un/underemployment is over 20%. This is deadly for CA real estate. If lenders finally start letting go of shadow inventory in 2011, there’ll be some price drops again.

Nice post, Doc. Prices in California will fall below that long term average, overcorrecting. The nicer areas still have a long way to go before incomes can afford the prices; something has to give and it won’t be incomes going up. You have been right all along – keep up the good work. – Tom in San Diego

I think the shock of main street is not being reflected in wall street/commodoties etc. It seems like two different universes. Housing has come down-but not enough to match the catastrophe of main street.

The closest correlation was the Great Depression. After the great collapse of 1929, stocks zoomed up and I think the then President even said the crash was over or some such. Then of course the real depression set in . I wonder if we are in store for something similar??

If anyone studies the history of the Great Depression what is happening today is following the same pattern that happened during that time. For example, after the great collapse, government intervened into the private marketplace “to save the world”, “to stop another Great Depression”, etc….. The real peak of the Depression occurred in late 1933 to 1936. Then the economy slowly recovered.

So nothing has changed. The only reason why the economy “grew” and we are in a “recovery” now is because of massive government support. Once the government’s hand is forced to no longer support the economy that is when the bottom will fall out.

2011 is short term. People can be patient and wait only three years, 2014, then things should be better. I think people need to get over the idea of months, or even a couple of years, and think longer term. Obviously, from an investment standpoint, now is not the time to buy. Keep the powder dry and be patient.

The real estate brokers say that the only people who sell now are the ones that are forced to, and what is the quality of these force sells? Sometimes it is hard to find a decent home to buy. Too many of them are run down and junk. In a few years the selection of quality homes should be better. In the meantime, I am going to buy a new Lexus to amuse myself.

I am confused.

I created (what I think is) a similar graph to your first one. See http://barnesfamily.com/CO-HomePrices.gif.

It does not look anything like your graph.

My data sources were:

http://research.stlouisfed.org/fred2/graph/?chart_type=line&width=1000&height=600&preserve_ratio=true&s%5B1%5D%5Bid%5D=COSTHPI#

and

http://www.economagic.com/em-cgi/data.exe/beapi/fips08

Here is how I see these.

Your California graph says that house prices went up faster than personal income.

My Colorado graph says that house prices went up slower than personal income.

Is my graph correct of wrong?

If my graph is correct, what does that imply about CA and CO house prices today?

Dr, can you add more coverage of Manhattan Beach? if you spend any time around 8th and the Strand you will see the family that bought three houses on the strand and tore them down to build a large house on three lots. The family is super friendly with the mom active in the PTA and the dad often seen surfing in front of his house or BBQing on his covered front porch which borders the Strand. This family told me that after they built their house the rules were changed to encourage other families to buy two lots and merge them, but to forbid other families from buying three lots and merging them. As a result you see other double lot houses going up but no other triple lot houses.

Are other cities adding rules that discourage lot mergers like this one in MB? If so isn’t that another factor that will push down prices

everywhere i go, stores are closing as more and more purchases are made online.

so these former middle class store owners have to work at Amazon.com now? or move to where they can make a living… maybe selling food, you can’t do that online.

it’s not a pretty picture.

do you think prop 13 has to be revised in order for property taxes to go up?

what are the chances?

Beachlover, I buy most of my stuff online (out of state) except for perishable food and gasoline. I feel sorry for the small business owners here in CA, but I refuse to keep feeding the spending orgy in Sacramento with my tax money.

Regarding prop 13, it definitely needs to be revisited. It’s inherently unfair to new buyers and benefits those who bought before the booms and bubbles. The commercial RE side needs to be reeled in also. I’m sure we all agree that at the end of the day property taxes pay for services (schools, roads, sewers, fire department, police, etc). Why is a new buyer forced to pay 5 to 10 times more for the same services compared to the neighbor who has lived there for 25 years. Many of these people benefitting from Prop 13 are baby boomers who made out like bandits and had opportunities the next generation can only dream about. Maybe a special baby boomer tax should be imposed, this would be unfair just like Prop 13.

wheresthebeef, two things.

one i hear that corporations make out really well with prop 13… they use shell corporations to pass land along decade after decade, even if the original business fails.

so lots of land is not paying much tax, also think… the railroads, churches, etc.

second, last year on my tax return CA asked me to report taxes due on all online sales.

I wondered if this was legal? Anyone know?

How much property tax should we pay? I pay nearly the same (a little less) property tax than my parents pay. They bought ther 2nd (current) home in 1986, I bought mine in 1995, same city. You ever hear of the property assesor? Yes, there are some dumbasses on their street that are paying $50,000 / yr, but I’m pretty sure they knew that, or were at least told when they signed their deed. I have to remind my 8 yr old often that “Life isnt fair” Do you need a reminder?

@ Beachlover, is it illegal not to report taxes for online sales? The guy in charge of the IRS failed to report tens of thousands of dollars of taxes due because of a “turbo tax error.” Turbo tax gave me the same error for the online sale taxes.

@ Surfaddict, I don’t really know what you are saying about property taxes. Your example of properties bought in 1986 and 1995 is not very good. Remember, 1995 was pretty much the bottom of the last cycle so prices would be close to 1986; hence, similar property taxes. Here’s an example for you. Someone buys a house for 150K back in 1980 in name your city. The poor chumps who buy today have to 850K for the house next door. Do you see the discrepancy in property taxes? I sure do. What’s fair? How about everybody pays similar taxes for comparable in the same city. What this be unfair too?

Old farts can not afford to pay the property tax that I do. Your approach would punish the poor. How is that good?

Surfaddict, I think you have bought into the urban myth that old farts can’t pay current property taxes. Do you have any proof of this? These old farts, mostly baby boomers had plentiful jobs, cheap energy and commodity prices, cheap education, got rich in California real estate, took advantage of huge stock market runups, have pensions, fat 401ks, starting to collect SS and generally only needed one income to support a family. Am I supposed to feel sorry for these people? If they can’t pay current property taxes they need to sell their personal gold mine and move somewhere cheaper. Prop 13 is one of the reasons we have severe real estate bubbles here in CA. None of this benefits first time buyers who are sometimes forced to “move somewhere cheaper.” I think the shoe should be on the other foot where everybody pays similar equitable taxes. Don’t like, tought luck.

Looking into the crystal ball of California real and the 2011 market –

The crystal ball is shattered. Or put another way, Humpty Dumpty has broken into pieces, and all the king’s horses and all the king’s men cannnot put Humpty Dumpty (the housing market) together again!

CA Air Resources Board needs to be factored in, with all the silly air quality regs that will come on line in 2011. This will drive more industry out of the state.

Dr. HB, I would love it if you would do a feature on the Santa Clarita Valley. I have lived here all my life and we have been sitting on the sidelines since 2003, waiting for the right time to buy.

Can we stop with begging Dr. Bubble to research the area that an individual wants, the post is bad reading for others and it shows the poster is just lazy and wants somebody else to do their homework.

I live in Orange County where housing prices are still inflated in a bubble in all but a few cities. I make >$250,000 per year, and will never buy until prices come back to reality. The current state of affairs is unsustainable. The only thing I am afraid of is that the government will always try to intervene no matter what to keep home prices elevated forever. I live in a 950 sq ft apartment, and am perfectly happy doing so until home prices come more in line with incomes……………..

Well, if your single and have not one other person to think about, 950 sq. feet is fine…..change that to 2 kids and a wife living there, and things change a bit.

When I was single, I didn’t spend much time at home at all, so I could have feasibly lived in a bathroom with a cot and a TV. When you decide to spend your life with someone else besides yourself, you will find that 950 feet a tad restictive.

If you make more than 250k and a 950 foot place to “in your budget”, what do you have to make in order to make the leap to 1900 feet…..500k?

I agree with your analysis and unfortunately I’m a CA owner in the middle tier.

In the meantime, I am going to buy a new Lexus to amuse myself.

What a sad and disgusting comment.

Why would you care where he spends his money? To the Lexus dealer and sales guy that’s money in their pocket which they can then spend to stimulate the local economy. Would you rather that money be paid to the banks on an over priced mortgage? Only a banker or real estate person would think an alternative choice to spend one’s money is sad of disgusting.

Cuzz he shoulda bought a Chevy!!…No foget-that that is GM (Government Motors) How about a Ford instead? Dis-Lexus = a fool that will pay $42,000 for a $24,000 Toyota.

Some people buy viagra or ‘roids to pump up their sense of self. Some buy things. Some advertise (or invent) their educational attainments in Internet forum postings.

Don’t worry, Ty…the Bling Class will soon be occupied only by the most delusional members of society. Hopefully we can fit them all on the Ross Ice Shelf and let it calve them out into the North Atlantic.

But even if they continue to lurk among us like herpes, we can reflect on what pathetic specimens of humanity still cling to the ultimate boner drug, money. At the end of the day, after all, it’s just an artificially turgid cylinder (ATC) disconnected from an evolved human soul.

More power to DHB, whose blog remains thoughtful, and rooted in something far more evolved and mature than bigger better faster more.

haters

I arrived in Ca. in 1975, and paid 100K for a great house in Porter Ranch(Northridge)–pool, golf course,etc. Went to $650K. Owned another house in Westchester–paid $250K in ’83, sold for $1M+. People forget the fact that the houses went up 20%/yr for 10,20,30 years, and now prices drop 40-50% and we think it is a bargain….wrong!!! Prices will continue to drop…I promise.

Look at that classic example of free money. But but but,,, this guy is AWESOME and “did the righ thing”, while people who walk away from their absurd fraudulant mortgages are “morally and ethically wrong”. LOL!

This housing fraud effect will impact more than just housing, wait until I sit on a JURY. I feel bad for you if you are a government agent or the DA trying to get a conviction in court for something that *I* think is unacceptable (like drug use, or prostitution), because no matter what is said, I will vote non-guilty. I will find the justice I so crave even if I have to administer it myself.

Home buying cost now or in the future will be determined by the level of government support for housing both in financing and tax deductions. Expect Federal support to decline to more historical levels with GSE loan supports falling back closer to national norms further impacting Calif housing above 400K. The future will see volume sales within a small band from say 150K to 400K here in Calif keeping traditional high priced area’s high and returning now higher marginal zips back into affordable middle class neighborhoods.

Foreclosures are piling up with no stop in sight. Do the banks believe the govt will let them cheat as long as possible? Sooner or later, somethings gotta give.

179 properties is some form of foreclosure in sacred Santa Monica !

http://www.santamonicameltdownthe90402.blogspot.com

I ran a successful business in Ca. for 10 years. I would never, ever start another business in Ca. The government bureaucrats do everything possible to make your life miseralble. Then they wonder why businesses are leaving, and tax revenues are down.

I could write a book about why.

Food – grown out of country or by corps

Shelter – not affordable and being bought up by foreigners

Clothing – made out of the country

All of our money is leaving the country or lining pockets of executives.

Capital spending too – we invest in other countries and buy non-USA – need to reverse trade treaties.

I was at Home Depot today – they put Main Street out of business, hired those owners and boasted top quality customer service. Now 95% of the ee’s are Viet, in 90% approx. non-Viet neighborhood and I am not qualified to judge the present quality of customer service but something is wrong here. Most of the inventory is made overseas. — again our money is leaving the country in this example.

In CA cities like LA and SF prices are still no where near affordable compared to renting. We still have lots of wannabe flippers and people who just bought too much hanging onto their mortgages and renting out properties at monthly losses in hopes that they’ll get enough equity back to sell. Many of these people have interest-only mortgages that have yet to reset and so still owe the original price! I know a few families in this predicament. Meanwhile, I know people with over $200k annual incomes and $400k cash still renting. It’s going to be a long wait. Many seem to think that 2011 will be the big tell in terms of what to expect. While I hope that’s the case I think this housing limbo could easily drag on for years. It’s frustrating because if you’re expecting more kids and need a bigger place, or if you need to downsize, you’re stuck.

So….you’re saying you know some dumb people, and you know some smart people. Hey me too!! It is really that simple folks, the world is full of both, and the “market” is made up of humans which are often, but not always, more rational than animals.

All I know is my tenants GOTS ta come up wit da KAYSH this New Year’s Day, and every other first o’ the month thereafter, ad infinitum! Iff’n I gots ta take the whip to get ’em up and out in the field, pickin’ ‘maters n’ ‘taters, then by gosh I expect The Ben Bernank to give me the legal authori-tah to do just that!… I kid, I’m a kidder, no emails… please. :p

On a serious note, perhaps the good DrHB could post some professional risk analyses of pending MUNI & STATE BOND *DEFAULTS* for 2011… *THAT* is something that might push housing off the front page. Mr. BILL! =:O

On the one hand, it would be “bad” (in a Keynesian/Wal-Mart sense) to layoff huge numbers of gov’t employees… OTOH, it HAS to happen, and… I have to admit… I’m going to LMAO when it does! ;’)

What should people do, who need to move; say a job change, or ourselves returning to CA after seven years overseas? What about those that are overextended? You hardly hear about acknowledgements of people who overspent, which is the main reason for this dip anyway. Having been overseas, I’ve come back with a different outlook. Don’t “hold on” to a house hoping for a better price! If you HAVE to move, allow the real estate agent to drop the price low enough. Like when we left CA in 1993, and could not sell our house; yet when it sold, it was still well above the price we paid for it, but the “market” was expected to “improve”. In the meantime, renters had demolished the house pretty bad :(, by the time we did sell it. In the meantime, Americans need to be educated on buying on credit, staying within your budget, and not assume you should be able to get into the next larger house!

redfin link for above comment:

3516 GREENWOOD Ave, Mar Vista, CA 90066

http://www.redfin.com/CA/Los-Angeles/3516-Greenwood-Ave-90066/home/6746087

redfin link for above comment:

http://www.redfin.com/CA/Los-Angeles/3516-Greenwood-Ave-90066/home/6746087

California is the nicest state to live…period

California was the nicest state to live…period

Fixed it for you.

“California is the nicest state to live…period”

Apparently, only if you’re on gov’t assistance, or the gov’t payroll. Business owners and employers seem to have an opinion in contravention to yours. ;’)

Is the below house considered a good buy in the neighborhood it is in? It was listed for 679k (approved short sale). Ton of traffic during the one and only open house a couple of weeks ago. Check out the photos first on redfin, and then factor in the sqft. Thanks for your comments.

3516 GREENWOOD Ave, Mar Vista, CA 90066

http://www.redfin.com/CA/Los-Angeles/3516-Greenwood-Ave-90066/home/6746087

The house is a real horror show outside. Lovely stucco and cinderblock retaining wall. Take away the inside furnishings, nicely done BTW, and you have a $300,000 house, if that. Maybe more like $250,000.

You’re trying to catch a falling knife, but the only true answer is it’s a good buy if you can afford the stroke, you’re comfortable with your continuing income stream and you love the home and neighborhood.

If you lose your job you’re sunk (can’t cash-flow+ as rental and will lose a chunk of cabbage on re-sale).

RE psychology is shifting, but we’re nowhere near the tipping point into dispair. The stronger economy/stock market is pushing the housing morasse to the background. Ironically, the more things look better outside of housing, while housing continues to languish and become less afordable due to rising interest rates, the more psychology will turn red.

re the 3516 Greenwood residence. I like the floor plan and some of the interior features, but not feeling the bubular pricing.

That’s not prime Santa Monica by any stretch, and that is paying $550 sq/ft which is prime+ pricing to say the least.

Not to mention, one of the bedrooms and 1/2 bathroom are in the garage and counted in the total square footage (permits?) further shrinking your living space. Too small unless you are doing the bachelor thing. Can’t really tell from the pics but it looks like the home has no closet space at all. I’d probably start getting interested in a place like this at below $450k. The current price is laughable, even if there may be a sucker out there willing to pay it out…

See those wood floors?

Neat huh?

I made the mistake of installing the same kind of “hand scraped” floors in a house I used to own. They look nice, however, you’ll never be able to refinish them. Now, after what I know, floors like that will be a dealbreaker for me in the future.

I am a Ca. Broker…I moved out of Ca to another state that stays on budget and has a health housing market. CA is a mess…they can’t seem to GETTER DONE!!!!

Sherman Oaks has come down a tiny bit but is still double the price it was in 2000. I have no intention of paying 500K-600K for a 1400 square foot home. Why are so many people still buying here at these prices. I was given 12 furlough days this past year and will probably never get a COLA raise in the next 10 years. All realtors have to stop promoting this insanity.

I am confused.

I created (what I think is) a similar graph to your first one. See http:// barnesfamily.com/CO-HomePrices. gif

It does not look anything like your graph.

My data sources were:

http:// research.stlouisfed. org/fred2/graph/?chart_type=line&width=1000&height=600&preserve_ratio=true&s1id=COSTHPI#

and

http:// http://www.economagic. com/em-cgi/data.exe/beapi/fips08

Here is how I see these.

Your California graph says that house prices went up faster than personal income.

My Colorado graph says that house prices went up slower than personal income.

Is my graph correct or wrong?

If my graph is correct, what does that imply about CA and CO house prices today?

How low can the CA market go? My son is looking to buy in Carlsbad. Here is how low. The cost of the materials is the absolute bottom. Labor cannot be counted, the value was destroyed by shady employers using cheaper labor. This has happened in smaller scale in many communities over the the last 30 years. I have a development here that was 90% done and 1 year later it was bulldozed. I advised my son to wait and keep his freedom. 50% drop from todays prices seems imminent.

Indeed prices will continue to fall in Carlsbad – I suggest renting over buying for now. Foreclosures are only now starting to creep through that area en masse.

Leave a Reply to Anon2