California home prices plateau and sales fall: Inventory slowly rising in L.A. County and back in a big way for Orange County.

At the start of the year, discussing a year-over-year drop in California home prices seemed unrealistic. You can only defy gravity for so long and home prices for California are virtually unchanged year-over-year. The current median home price in the state is $396,750 up only 0.4 percent from last year and down 1.8 percent from the previous month. Sales are still low thanks to prices and the lack of inventory. California has seen a dramatic addition of rental households thanks to the current trend. The big question now with momentum tilting is where will it take home prices? California tends to do things in a big way with real estate since we perpetually go into a boom and bust cycle. Now with prices hitting a snag and inventory coming back you have to see how the media cycle is going to play into this. People are now used to prices moving up so quickly as if this was some law of nature. Los Angeles County is seeing normal inventory returning while Orange County is seeing a big jump in inventory. Let us take a look at the numbers.

California home prices hit a plateau

Since 2012 California home prices have gone in one direction only. California home prices have nearly doubled in a short period from a lower range of $221,000 (2009), staying steady until 2012 and then jumping to $404,000 (last month). The peak was $484,000 reached in 2007. A large portion of this price movement has come from investors buying up single family homes and removing them from inventory.

When you look at the trend it is very clear that this momentum has been strong but is now flattening out:

The median home price is virtually unchanged year-over-year. One more month like last month and we’ll have our first negative year-over-year month in years. How will this play in the media? And we are now seeing your regular jump in inventory in Los Angeles:

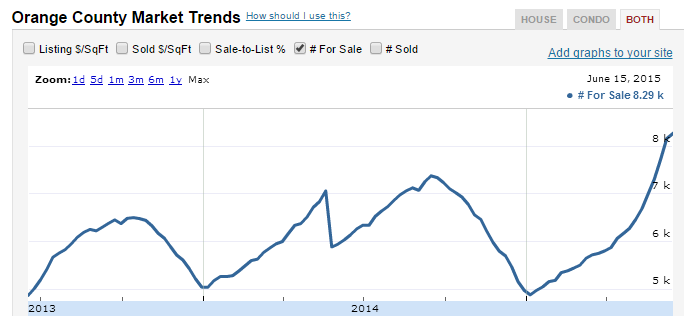

Inventory always picks up at the beginning of the year and goes throughout the summer. But look at Orange County’s inventory:

The inventory in Orange County is now at a level unseen for many years. Two reasons for this: sales volume has hit a snag and pie in the sky asking prices are keeping homes on the market longer. You have Taco Tuesday baby boomers cashing (or trying to) since prices seen very lucrative in some cases. Big investors left this game a long-time ago:

You can see that big money from Wall Street and hedge funds left the game in 2013. Now you have foreign money and leveraged up households buying. You also have late in the game flippers. I remember watching the flipping shows in 2007 and 2008 and you started to see mega fails and the participants seemed aghast with a look of “I thought you could only make money in California real estate?â€

You also notice that distressed sales are a small portion of all sales. This market now needs to stand on its own two feet. The problem of course is that only about one-third of households can afford your regular median priced home in California (forget about the crap shack in certain hoods). It is no coincidence that this slowing down is coming with the sideways moving stock market this year. Look at the biggest year-over-year gainers in terms of counties:

San Francisco:Â Â Â +20%

Stanislaus:Â Â Â Â Â Â Â Â Â Â +12.1%

Alameda:Â Â Â Â Â Â Â Â Â Â Â Â +10.3%

Sonoma:Â Â Â Â Â Â Â Â Â Â Â Â Â +10.6%

You better hope the tech rage continues going forward. As far as real estate prices go, Northern California is keeping California positive year-over-year.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

60 Responses to “California home prices plateau and sales fall: Inventory slowly rising in L.A. County and back in a big way for Orange County.”

This real estate market is holding on for its dear life and interest rates are still low. When mortgage rates jump by a point in the next year, prices are going to fall off a cliff. Millennials are still strapped with college debt and young people don’t even believe in the dream of owning a home any more. Get ready for flippers to run for the door. I’m seeing a lot of houses just sit on the market in So. Cal. This market is heading south.

You might see more than just a point increase. It looks like it’s (finally) game over for Greece and the EU. This could create havoc in the bond markets. If so mortgage rates could see an even higher jump. The FED is caught because raising will exacerbate the deflation but failing to raise could spook the bond markets in such a way that would make things even worse.

Central Banks worldwide led by the FED have been arm wrestling the invisible hand since 2008. There about to lose. Either they give it one last “Ompf” and then get slammed to the table, or they are slowly pushed down. Either way there’s no beating the invisible hand.”

Are you suggesting that Bill Gross’ bond vigilantes will finally emerge from the shadows?

@Prince Of Heck

Something big is starting. Grexit, China Equities Implosion, Puerto Rican Debt Crisis. All in one weekend. And we’re a little over 2 months away from the FED either raising rates which will accelerate the decline. Holding rates which will do nothing to abate it. Or announcing more QE which will REALLY accelerate the decline! We’ll see how bullish our fellow bloggers can remain when mortgage rates get back up towards 5% plus and inventory goes even higher. The Boomers with equity and cash buyer fallacy is about to be exposed in a big way. It’s all borrowed money and leverage, just like last time.

We could see 6% mortgages in a couple of years. The heavy price cuts I’ve speculated on would be needed just to keep payment parity in such a scenario. This isn’t some far off theory, just look at the markets this morning. After listening to realtard bullish-shit for a over 2 years we’re seeing Mr Market initiate a correction, again. For anyone who still believes in Central Bank omnipotence, if the FED tried another QE now it would be suicide. Food would spike, rents probably are as high as they’d go, energy could spike, but also could collapse under lack of demand. More stock buybacks at companies that would be even worse off with cratering demand. QE that doesn’t go directly to consumers can’t work. At this point even a direct check to every man, woman and child couldn’t support these elevated asset prices because no one would spend the money! Once again we learn, SURPRISE, central planning doesn’t work! The Bull-tards disappeared from Housing Panic and Patrick.net back in 2008. I wonder how many will stick around with Dr HB during this correction. When it comes to housing I’d rather be a bear who’s right once than a bull who’s right 9 out of 10 times. The former may pay an opportunity cost, but the latter ALWAYS pays $$$ for the failed opportunity.

@NihilistZero

I’m in complete agreement. Not that I like to say “I told you so” but I’ve been hearing non-stop from friends and family about how “real estate always goes up” and to invest in real estate now. It’s so tempting to believe in the hype of buying because things will ‘always go up.’ How quickly do people forget that not just 10 years ago we were in the ‘Great Recession’ and somehow we are miraculously cured? The 2008 crash was never allowed to correct itself. We are now truly in the midst of something great, the great correction. We are in arguably the biggest bond bubble known in history. The central banks have been on a race to the bottom with the Fed, the ECB, BOJ and China, all printing like crazy trying to ‘stimulate the economy’ like metaphoric masturbation. I suspect housing will go down to 2010-2011 levels again.

One minute there is a housing shortage and no one can afford to buy and all have to rent. Few days later the inventory is increasing and the collapse is at hand because of rising interest rates – which means that prices are about to fall big time. Propaganda and MSNBC. The crap on TV is getting old and so are the doomsayer blogs. Good God get a clue people. We are in the down cycle as has been predicted. The stock market is going to crash sooner than later. We have been hearing this for awhile. It will happen soon. Those who sell into the story will lose money. Those who hang on will recover eventually. Another cycle of the rich scaring the middle class to rob them of their money. In case you did not know – the rich never sell and keep accumulating. That’s why they are rich. The middle class on the other hand panics and realizes losses. They have realized all they can get. They need the market to correct so they can buy on the cheap – and over time accumulate more wealth. The headlines on Monday will be Greece and the sheeple will panic. Greece is so small it is insignificant in realation to the rest of the world. But hey, how are they going to make money if you don’t panic?

I won’t claim to know what sort of contagion effect that Greece and China issues will have the rest of the world, and frankly I don’t think anyone else really knows either. But to claim that something is insignificant seems foolish to me. Sometimes all it takes to spark a forest fire is something seemingly insignificant such as a cigarette butt.

So jeffrey, how much in stock did you buy today due to the panic selling over the Greek debacle? Enough to make you rich several times over just because stocks “simply must go back up”?

BTW, the rich don’t sell IF they get in on an investment at a good price. Otherwise, they’re bagholders of Bernie Madoff IOU’s. Since you’ve got time to burn on this board, I doubt that you’re a member of the first group.

Prepare for the Tanking to Begin SOON!

September 15th…. +/- 2 weeks.

Everything to crash September 2015

Bubble pops seem to historically happen after September, so the next one is certainly due.

So, when are rents going to come down?

If Greece causes massive economic contagion, doesn’t that mean that the FED is trapped and can’t raise rates? External forces are irrelevant because the FED can and does buy bonds at auction.

If rents don’t come down and rates stay locked then lower house prices allow for investor profits. If rates stay locked we are due for inflation, which could make current house prices even stickier. I’m not sure that anyone can be sure of the FEDS exit strategy. Rather can we be sure that they have one? The counter to this is that external forces can force the feds hand, but the reality is that the fed can hold rates wherever they want to if they are willing to accept general inflation.

What people don’t get is that while their own incomes dropped, the income growth of the wealthy had accelerated. The wealthy bought the houses at a low price and now rent to the serfs at a high price. We screwed up, we watched too much TV, and now standards of living will be compromised. That’s it, it’s over, the transfer of wealth happened. If you didn’t get it, then at least it should be obvious that you missed it. That’s what we meant when we said that this was the largest transfer of wealth that ever happened.

External forces are irrelevant because the FED can and does buy bonds at auction.

Here we go again… The FED cannot control the entire bond, CDS and derivative market. You’re beyond simplifying by suggesting that the FED can basically just buy the whole market. The inter-dependencies between the various funds and market players make that impossible. And to what extent they can they find themselves in the position they are in now, that of pushing on a string.

Free markets based on individual pursuits of interest work and that’s why corrections happen

IE, if NINJA loans came back tomorrow, would the RE market resume it’s climb? I seriously doubt it because the vast majority would make the individual decision that they don’t want to fuck themselves as did the HB 1.0 home debtors. You’re positing a one sided market where real demand pressures can be stimulated at will. This market does not and has never existed There has to be action on the demand side by individuals. Even if it is based on irrational motivations, they still must BE motivated. The FED is out of motivational hopium for this cycle. There are going to be funds that will demand higher yields by necessity to balance positions this will put upwards pressure on mortgage rates and their is little the FED can do about that outside of mega QE which would crowd out any private market for bond debt which thereby giving us hyperinflation. The FED may be stupid, but I don’t think they’re suicidal.

Rents will come down some when lots of people lose their jobs and move back in with mommy and daddy. I remember back in 2008 lots of people I knew negotiated rent decreases, and the landlords who refused found themselves with vacant units. Never back to those levels, but they’ll come down. Home prices will also come down as distressed sellers who were recently making big startup salaries now find themselves on the dole. Rising interest rates will also turn the tide towards buyers, as stubborn sellers and their agents refuse to drop their prices to match the monthly nut until it’s too late. This will be a good buy opp, not like 2011 though, today we have a much higher percentage of homeowners with skin in the game.

You get what you vote for I guess: red or blue team. How about just stop voting or vote for another team for all that matter. It’s pretty much all dog and pony at this point. But it’s all natural I guess where empire rise and fall while the populace become engaged and dis-engaged only to be enraged when food run out.

Just another dog day in the kalifornia cesspool.

IMO I am betting all those apartment complexes that were bought by large investment companies are hedging on the bets people who are under water will foreclose or short sell while prices are close to their price point and be a new member of the feudal community. However, the rent will likely be a bit of pain which is what the investment companies need to make their earnings numbers. Seems plausible.

Well, until 2008, despite RE cycles, property values has always gone up. Due to the irrational spike early 2000s, you’d think we’d stay below 2008 levels for a loooooong time, but here we are, 7 years later, and we’re at 2009 levels (for the most part). Stop trying to make it out like RE is bad most of the time. The only time it’s been bad in history is 2003-2008. Every other time the peaks and valleys have been manageable for home buyers. That may be a thing of the past now, I don’t know.

Hey Doc, I saw this thread on reddit and thought of you:

https://www.reddit.com/r/RealEstate/comments/3bdgpj/backing_out_of_escrow_question_compton_ca/

mega facepalm…….i like how the author talks about the area being a “pocket” of what the rest of the area really isn’t, but, i think it really is.

I guess the “pocket” only gets crossfire, not actual targeting. Sounds ready for gentrification if you ask me.

Sound the alarm, all hands(except for the band, aka the media) man the life boats. The rats(investors) have already abandoned ship. Francesco Schettino will be in the bridge, I am going to fall into the lifeboat this time.

when home prices get back in line with my stagnant income i’ll consider buying but that would mean prices need to fall back to 1991 prices levels……or where they were when my income stopped growing.

Your income may not have changed since 1991…but median household income as a whole is certainly up since 1991. Expecting a return to 1991 levels is not going to happen.

I’m assuming he’s referring to his lack of wage increases in Real Dollars since 1991 and for hosing prices to fall to 1991 levels in Inflationary dollars. That’s not to bold a projection as 1991 was near that cycles peak. I think around 2011/12 you could get many houses that were at 1991 level in inflation adjusted dollars. Yet another reason I’m looking for a retrench to 2011 prices in all but the most prime areas.

On an inflation adjusted basis, in 2015 dollars, median household income in Los Angeles County was $63K in 1991. Today it is $54K.

@ernst blofeld

Those numbers are clearly based on BLS/CPI bullshit. The fact that you’re even on this site should make you to smart to believe, much less quote such nonsense.

@ernst blofeld

On a second reading my last comment came off as very rude to you. Obviously you realize the absurdity, I was merely surprised that you didn’t at least make a note in your comment of the alternative measures of inflation that show the real wage carnage. In any case, my apologies. 🙂

@NihilistZerO, no offense taken.

It’s no secret that the government’s CPI and cost of living numbers are a sham if not outright fraud.

That being said, my personal gut feeling is that real income in Los Angeles County in 1991 was probably around $75K in 2015 dollars, not the official $63K we see published.

Also, the current $54K per year median household Los Angeles County income fails to factor in that many of these households have 2, 3, 4 or even 5 incomes/jobs just to scrape along at that dismal level. It wasn’t that way in the early 1990s or late 1980s.

“2011 prices…”

What would that require, like a 25-40% decrease? LOL

Even around my block and city I see houses sitting there and not selling. Based on what I perceive around me it appears prices have plateaued somewhat. It may inch up a few fractions more slightly, but not by much.

The situation in Greece could be a potential black swan event. This doesn’t even include the fact that all the central banks have been on a QE ‘stimulus’ binge since 2008 that has likely only delayed the inevitable correction. There’s a whole lotta hurt waiting in the balance sheets sadly and it’s going to get worse before it gets better.

Lets go Jim….I was loosing my head and thinking may be houses will never go down again, and may be I need to jump in it now and buy, but then comon cense tells me, wait.

WHEN EVRYBODY IS BUYING YOU BE FEARFUL, AND WHEN EVERYBODY IS FEAEFUL YOU BUY.

“There is, of course, the old Rothschild maxim: ‘Buy on the sound of cannons, sell on the sound of trumpets,’ or as [Warren] Buffett puts it: ‘Be fearful when others are greedy, and greedy when others are fearful.’

—–

The trumpets are still blaring, so plenty of time for homeowners to cash out with lottery-winning price. Just that if markets slide, then other sellers/buyers decide lower values for the other homeowners.

Stockton – Modesto housing prices are starting a downward trend according to Zillow,

Compared to the Bay Area, They are the last to rise and the first to drop in relationship to the Bay Area. A lot like Riverside – San Bernardino is to LA.

I haven’t seen so many for sales in Fremont in years.

Last chance to sell your crapshack for 800 K?

The 12% uptick in Stanislaus seems crazy to me.

I have relatives who are longtime Central Valley residents. They told me large houses struggles to get $400K in San Joaquin and Stanislaus counties. Now, 3-4 houses in their neighborhood sold for close to $600K. They are retirees as is everyone in their hood and the next one (500+ houses all built for upper-middle class folks in the 80’s). I asked them who would buy all these homes, they said Bay Area people. The drive from Stockton or Modesto to Bay Area job centers is easily 3 hours with traffic. I don’t know if enough Bay Areans will move to the inner Central Valley to buy up thousands of housing coming up for sale in the next 5 years.

My relatives are a bit older than Boomers, but I can foresee this happening to all areas with high Boomer concentration. In the Bay, there are areas in the East Bay, Fremont, Southwest SF, Berkeley, Marin and San Jose which is all Boomers. How do the next 10 years look when they all need to downgrade or move to retirement communities?

It is the “selling” season so inventory should increase but I agree with your observation. Prices in Fremont are stupid. As much as I share Jim’s enthusiasm for a rout, prices are very sticky on the way don. Dont hold your breath.

The Doc was pointing out that not only is inventory increasing, but in the OC especially, it’s increasing A LOT.

And prices can fall just as fast as they rise. This is median sale price in California (below). That downslope in 2008 is pretty steep. Interestingly enough…2008-2012 basically erased 2004-2008. Now, for the last 3 years, we’ve seen gains. Who’s to say these last three years don’t get wiped out in the next 3?

http://i.imgur.com/csuGLnX.png

Tell this to Long Beach,

Sales have picked up and people are fighting for homes. This is in the 800’s to low millions.

Price are up…but sales look to be coming down, and just like the Doc posted…inventory is shooting way up.

http://i.imgur.com/z4Zinum.png

And just looking at the top tier….price still look to be topping out.

http://i.imgur.com/FnHSaJe.png

In regard to lack of capacity of sales 7 years into the economic cycle with 4% rates…

When 82% of the working population in CA are priced out once you X out the cash buyers and those making 3 times median income 190K this is the data lines you see

MI2MP

Median Income to Median Prices

CAR has roughly 68%-71% of CA people price out but that is due to their 20% Down 740 Fico stating #DTI at 25% model which means 190K income buyer and Cash buyers would have a financial profile like that. In a state of 38 million… hmmmm

Bloomberg Business Housing Interview: New Home Sales , Housing Inflation & The Chinese Buyer

http://loganmohtashami.com/2015/05/26/bloomberg-business-housing-interview-new-home-sales-housing-inflation-the-chinese-buyer/

Commodities have been in a bear market for several years. First the metals (almost 4 years) and oil (about 1 year). The real estate, bond, and stock markets look like they’re beginning to follow.

Bay area Tech is in a bubble. There are over 50 small and medium sized startups in the bay area that are valued at over a billion each. Few, if any of these companies are actually worth that much. Expect a correction and a lot of layoffs to come.

Large southbay companies like Cisco and HP are already laying off workers. Expect more to follow.

Good take Shawn, tech is going down and so is Slilcon Valley housing market. Also look for NYC to be empty stores and can’t give away their grossly overprice apts. The Mayor of NY is setting the place back 25 years he is a disaster.

Ditto on Mike’s comment. Long Beach is getting multiple offers in a day of listings for homes in the 700’s and up.

Nothing screams market top louder than the middle class jumping in at peak prices.

The same thing happened in 1991 and 2007. I remember Long Beach, Culver City, Palms, Mar Vista peaking then.

IN san diego, houses which are priced right are selling

other houses where sellers have put out their dream price are staying in the market for long time..

I can see that the price rise have peaked more or less in san diego..

we need to see when and if it goes down..

John this secnario is not unique to San Diego, Denver market coming to a halt, 900k and up housing not going to fly there, and overprice your homes means sitting a long time and now that includes CA?

+1 on Denver – the high end homes there are continue to stack up like cord wood.

I have been watching that market – esp. south end of Denver area, Doug Co etc. and prices are just through the roof compared to even 3 years ago. Any home – new or used at 600k + is sitting for a long while. In addition – land prices there are insane.

High end gets hit first – they know whats up in the economy better than the rest due to many business owners and similar types with finger on the economic pulse. Happened in Rancho Santa Fe in late 2003 and took another year and a half+ to get down to the 300K homes. It was hard to argue that the bubble was bursting when there was still a frenzy in places like North Park, but it was what it was.

Right now I’m seeing a lot of 1M+ homes being listed. We all know there aint that many buyers in that price range. I’ve seen this movie before, time to grab the popcorn!

Looking at the comments above, one has to wonder what segment of the economy isn’t poised for a major fall?

Everything in LB, Mar Vista, West LA, etc. is driven by tech money. “A bunch of billion-dollar ‘unicorn’ startups are just ‘horses with sticks taped on their heads,’ top New York investors say. The valuations are a function of 2 things:

1) Too much capital piling into the ‘winners’ and entrepreneurs having the upper hand. So to have less dilution in a round, you have a bigger valuation. Taking on $100M for 5% of a company makes it ‘worth’ $2 Billion, it’s just a paper valuation, it’s very speculative.

2) Playing the hype game. Massive valuations get investors, founders, employees excited, but also partners, the media etc. going i.e. it signals that they are a ‘real company’ etc..

But when they go IPO there will be a new level of scrutiny and reckoning, as we see with Box and soon Dropbox? Even then some valuations are still stupid.

The retail investors are left holding the bag at the end of the hype – and that was the name of the game all along: from founders to VC’s, to IPO underwriters, to early stage IPO buyers – they systematically play the ‘hype game’ – each making a buck before the musical chairs stop and Grandma and Grandpa have lost a chunk of change to the bankers.”

Read more: http://www.businessinsider.com/first-round-capital-lp-letter-about-tech-bubble-2015-6#ixzz3eUNP3NKM

Read more: http://www.businessinsider.com/first-round-capital-lp-letter-about-tech-bubble-2015-6#ixzz3eUNCVCPF

I’ve seen many apartment buildings in expensive, trendy areas up for sale all at once. There now seems to be a frenzy to sell before interest rates go up. Similarly, I see lots of expensive homes for sale in trendy neighborhoods just sitting…sitting…sitting for weeks on end. Yet, apparently, there are still bidding wars on homes priced under $450,000. Makes me wonder. Meanwhile, thousands of apartment units are coming online in the next 6-12 months.

We shall see.

With the Fed’s easy money policies and credit expansion, the QE only extended the 2008 crash. The market was never allowed to correct itself through the painful contraction to free up all the malinvestments. Unfortunately, because of the Fed’s policies, there has been a lot of these malinvestments have been slushing around due to artificial market signals. The easy money that developers like the Blackstone Group received are also largely responsible for this boom in rental prices, because the low interest rates created an artificial demand for housing again forcing many people to rent. This time it was a different type of bubble, different from the easy lending policies of 0% down, adjustable rate mortgages. The name of the game is still the same – central banking wizardry trying to account for every variable in a complex system. In the end, it’s going to end the same way. Unfortunately, when the turds hit the fan, people are going to call for yet more government intervention to ‘do something about it.’ Never will we learn.

Wooo-hoooo. Ok we don’t know anything for certain, but it’s been a long time since I’ve read anything indicating some normalisation of even part of the market. Thanks Doc!

Interesting read from a start up millionaire – “Why I’ll never buy a home again”

http://www.businessinsider.com/why-ill-never-buy-a-home-again-2015-6

Los Angeles Metro condo prices are down significantly year over year.

http://www.zillow.com/los-angeles-metro-ca_r394806/home-values/

The American housing crisis is threatening to put us all on the streets

http://www.salon.com/2015/07/01/the_american_housing_crisis_threatening_to_put_us_all_on_the_streets_partner/

Prices at the top and in prime areas will fall, but those looking for another crash are kidding themselves. Completely different circumstances. 2003-2008 bubble was due to shady lending, and it fell becuase once prices fell, people who didn’t have skin in the game walked away, causing a domino effect where the rich and investors who could afford their mortgage chose to stop paying theirs, further exacerbating and prolonging the steep crash. This time around the bubble is led by supply/demand issues, foreign/specuvestor money and low interest rates. Large scale investors permanently (or indefinitely, at least) eliminated a chunk of inventory that had readily been available in previous decades, exacerbating supply/demand problems and home ownership rates vs renting. There will be ebb and flow in real estate, more so in prime areas, but don’t delude yourself into believing waiting for 2011 again, or even 2012 again. I think a lot of posters here feel good telling themselves they’ll taste those prices again as they marinate in the rage and disappointment at other people who are sitting pretty with their real estate decisions/investments.

You don’t think the tech bubble crashing, rising interest rates, and the specuvestors unloading properties is going to cause the next crash?

If history has taught us anything, then socal real estate is a boom n bust cycle.

If anyone thinks otherwise, then he/she is drinking the koolaid. I heard it many time mainly from realtors e.g. real estate in socal never goes down yada yada.. . Last time I heard it in 2007 when I sold my house and was renting. I finally bought in 2011 end

The boom and bust cycles are constant only the reasons are different every time..

Only time’d tell us…

By “This time around…” he really means “This time is different” and the rest of his message is basically “buy now or be priced out forever.” Famous last words.

Leave a Reply to nathan118