California cash sales surge while total sales volume plunges: Cash sales made up 30 percent of total sales last month.

Blame it on too much paperwork. The house humping cheerleaders are blaming the drop in sales volume on too much paperwork instead of the true underlying culprit. The real reason that sales collapsed was that prices are largely becoming unaffordable to most families. In virtually every part of California home prices are out of reach for families without them diving into massive mortgage debt for a piece of crap stucco box. Taco Tuesday baby boomers of course would like home prices to remain inflated but now they are getting a taste of economic karma when their boomerang kids move back home as adults. An indication of this insanity in California is based on the volume of investors buying homes. Last month 30 percent of home purchases went to all cash buyers. This was the highest amount going back to 2012. However, sales volume took a big dive. In other words, a large portion of those that can buy are investors. Is this trend sustainable?

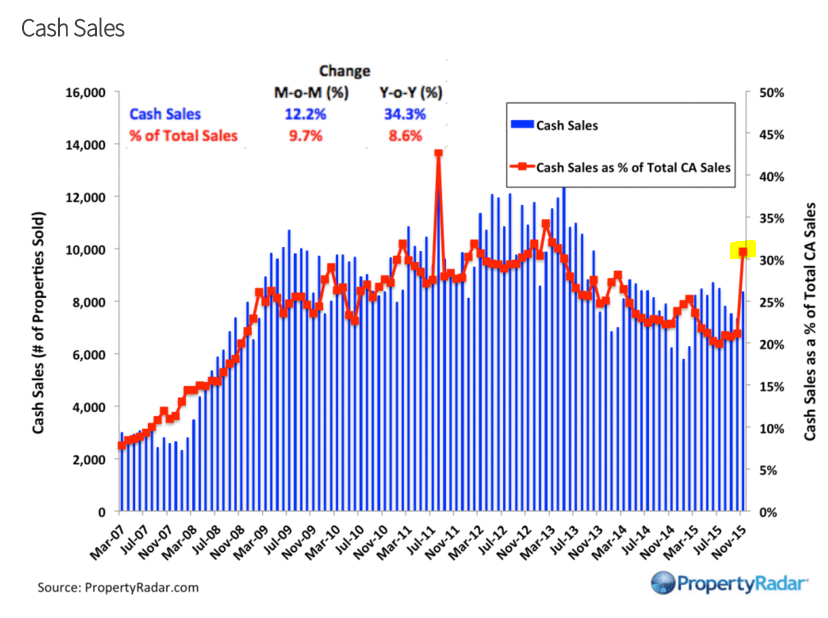

Cash buyers make up a big part of sales volume

Cash sales jumped up significantly again last month thanks in large part to foreign money flowing in from China.  While cash sales jumped up, this is still a small portion of the market. Most other crap shack wannabe buyers were unable to buy based on their pathetic income growth and the ridiculous sized mortgage they would need to take to purchase one of these cardboard boxes. 2015 looks like it will end with a wet towel thrown over the market. Price gains have hit the expected wall.

First, it should be noted that cash sales were never a big part of the market. In more “typical†years before housing turned into a speculative investment vehicle, cash sales made up about 10 to 15 percent of all sales. Last month cash sales cracked the 30 percent mark of total sales for the first time since 2012:

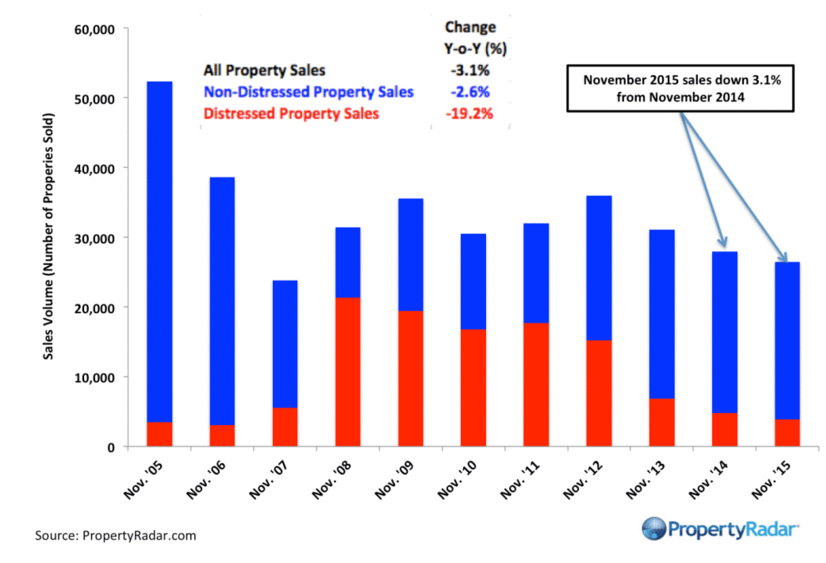

The force awakens with cash sales. But then again, look at the blue line showing the raw number of cash sales. Not really a big jump. But what did happen is that total overall sales took it on the chin:

This was the crappiest November since 2007 when the market did a Wile E. Coyote off the economic cliff. But the blinded house humpers keep on thinking the Fed is some sort of omnipotent god. The Fed was around the last time the market imploded as well. Maybe this is a new and modified Fed? Maybe the Fed really cares about row after row of Great Depression built housing to make sure folks in the entertainment industry have a nice and new hipster enclave. And by the way, no one is stopping people from buying a $700,000 crap shack. Heck, give your local real estate agent a call today and there is plenty of crap shacks available to buy right now if you truly believed it was a straightforward decision. The reason there is still plenty of analysis to be made on the housing market is because thinking people are questioning actual value. At current prices, a minor 10 or 20 percent correction would wipe out $100,000 or more in a down payment. You have some people talking about buying now because you can’t predict the future yet in the next sentence go on and talk about how buying a home is always a good value (recent history and millions of foreclosures provide a counterexample). That in itself is a prediction yet they are blinded by cognitive dissonance.

The truth of the matter is that home prices are overvalued relative to local family incomes. What do you pay your mortgage or rent from? Hence the large portion of sales going to all cash buyers from outside of the market. Since home prices are pushed up at the margin, this makes a big impact on where prices go. Then again, this is also what can cause home prices to reverse quickly. Things have the potential to revert to the mean aggressively. Look at oil for example. Only a short time ago there was a million pounds of internet ink talking about how $100 oil was here to stay forever. Buy now or be priced out before it goes to $200! Everyone needs oil. They aren’t making any new oil. And on and on was the rhetoric. Yet here we are with $2.50 a gallon gas in California and in some parts of the country $1.50 per gallon. Things can change and change quickly.

There is always the argument by house humpers that renting is throwing money away but buying is not. You realize that you have to pay that mortgage for 30-years before that house is yours right? Ask the people that paid a mortgage for 10-years and then got caught in the last recession and lost their home how much they “owned†that property before the bank took it back. You also realize that you don’t own food forever yet you don’t see everyone owning a farm because they don’t “own†a restaurant or grocery store. It is something that is a basic need – when you rent or pay the mortgage you are paying for shelter. Renting in many cases is cheaper, gives you more mobility, and for many is the only thing they can afford. Buying a home provides you tax deductions, forced equity build up, and a place so long as you can pay the mortgage. Both provide the same thing, shelter.

Even when a home is paid off, you still have taxes, insurance, and upkeep. In other words, it acts more like a liability when you live in it. That is why most really wealthy people don’t really look at their home as a cash flow item on their balance sheet. A rental is a different story. Income is being sent from the property to you. You can deduct a host of things that are not deductible from your primary residence. Beyond this, most in California can’t buy because of the simple fact that they are too broke to purchase at current price levels. You also have the funny phenomenon of boomers living in million dollar homes while shopping at the 99 Cents Store because they don’t have much income flowing back in (especially when their adult kids move back in).

Cash sales are dominating the market again because in reality, these are the only people that can afford to buy. The rest are having trouble filling out paperwork and scrimping dollars just to make up for the down payment on an overpriced crap shack. The Fed would never raise rates, some said. They just did. Housing values will never go down, until they did. Also, it should be noted that out of the 8 million foreclosures that happened in the last decade, most of these were at the hands of boring and stale 30-year fixed rate mortgages. A recession will do that to you. We’ve been in a wicked bull run since 2009. What happens when a minor recession hits and people are living on the financial edge? Thankfully there is a host of millionaire and billionaire investors buying up properties to provide you a nice and cozy rental.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

96 Responses to “California cash sales surge while total sales volume plunges: Cash sales made up 30 percent of total sales last month.”

SO ARE WE IN THE EARLY STAGES OF A CORRECTION MODE OR JUST HOLIDAY SALES SLUMP? Thoughts?

As I’ve said, when people go from renting to buying, they almost always overbuy. A smart person will only rent as much as necessary, no more. But when they buy, they tend to stretch right to the edge of affordability. Then here comes that second mortgage when the roof need repairing, next comes a round of downsizing at work…

The real problem with renting and buying is “timing”. No one knows where the bottom or top is and while the renter may potentially found a reasonable rental they don’t know when to get out of it. Seeing prices rises around you and then you are caught with rent hikes makes the renter curious if they should buy when they should have done it before everything went up.

Buyers have a lot to think about in today’s world. They worry about overpaying, loan process, buying new or resale upgrades to home, the cost to maintain, are taxes going up, home insurance increases, lost of job and maintaining the house payment.

This leads to trepidation and holding off on buying a home, The NRA would lead you to believe the market is hot and you must buy now, they always cheerlead that same old tune.

The fact is, many can’t sell their homes and delisted, many lost on the sell of their home and can’t buy another house, to many homes are overpriced (sellers want to get back 2005-2006 mistake of paying to much) many can’t qualify for a home, and many just don’t want the headache at this time or place.

No matter what you here nationwide not just CA. a big problem is happening and will continue, even if the real estate industry hides the truth about the anemic sales.

The fact is, housing is in a serious situation in this country (this coming from a hawk on RE like me) and if spring and summer of 2016 don’t get better it will be no hiding the collapse anymore?

I know what you mean. I’m in my thirties, and my family moved to Portland a year ago with the intent to eventually buy. Portland is much less expensive than LA, but the yearly home price increases here have been as large as anywhere. All of the stories we hear from everyone about how difficult it is to be “chosen” by the owners to buy, plus renting a beautiful home that is only 15-20% of my gross income, makes buying less and less appealing. Plus, I own a business that happens to be doing well, but you never know what’s around the corner, so spending that big downpayment chunk is a little scary.

I think the housing in Portland could easily take a 20% hit, as it’s gone up that much in only a couple of years, so I remain on the sidelines.

Portland and Denver are metro’s that went up a lot too because of low interest. They might have an adjustment as well. Tucson Arizona where I’m at will probably have less of an adjustment since it has not grown much and less demand for housing.

Yeah, Cynthia, the houses in Portland that we were looking at a couple of years ago, when planning our move, have all jumped up by $100K+. Now that we’re here, I’m going to wait it out. The standard loan limits in Portland have not been increasing like in other cities, which is very strange, but I’m glad to not be tempted into doing something silly. I was initially looking at houses around $400K-$450K with $50K-$100K down, but now the same houses are going for $500K-$550K, and, with the $417K conventional loan limit staying where it is, it means a lot more cash is required. With my income, the monthly payment on the $550K house would still be fine, but coming up with another $100K in cash takes a bit of time.

The odd thing is, judging by both the median income and people that I meet, high incomes aren’t exactly common here in Portland, so I have no idea who is buying all of these $550K-$750K homes. I have to think that people are over leveraging themselves. Granted, for what you get, those prices are still very low compared to LA, and I’m still glad we moved up here, since my income stayed the same.

supply shock…..we could c triple to 8 folds in this waves?? this housing bubble still have 5-8 years and it will crash like …. N…… shape as it did almost every decade or so??? but not like stocks u can live init or collect rent……

Housing TO Tank Hard Soon!

I am surprised to see the cash surge again, but then again China’s stock market is scary.

Buying on razor thin volume has implications for a large downside.

To the bears, the housing bubble at the epicenter of silicone beach is live and well. Check out this property.

https://www.redfin.com/CA/Los-Angeles/5742-Kiyot-Way-90094/unit-11/home/8123582

Sold 4 months ago for $1.4M (which is already bubble territory if you ask me), flipped, and just sold for $2M.

Your money is safer in prime markets. When the bubble bursts, it hits the subprime markets first, and ripple effect won’t hit prime markets until 2-3 years later (assuming no government intervention) which leaves plenty of time for some to get out unscathed.

This may anger some, this may cheer some up, this is reality.

But on the flip side, “The Great Default of 2017” is just around the corner.

That much marble is just yukky. First, it reminds me of bathrooms. Second, it’ s cold and clammy.

Geez, those houses are packed in like sardines (check out the aerial view)! Wasn’t this this same house referenced in the comments a month or so ago? That house actually looks pretty nice; however, it would suck to have to be 3 feet from all of your neighbors for $2M! I can’t afford $2M anyway, so it’s not really an issue for me.

Most or all of the prime markets in OC decreased in price fairly substantially in 2009-2011. I’m hoping that will again be the case within the next few years. If not, oh well; my down payment fund continues to grow in the interim.

The sales price for that thing is unfkingbelievable! Stoked people are throwing so much of their money, time and life energy at some stucco and marble. I’ll be busy living.

Playa Vista is a strange area. Close to the beach, but also close to LAX. I don’t know how loud the planes are from where that house is located.

If you think that’s crazy, you should see how much the new product costs in Playa Vista. This is the last unit (one of the model units) of the Camden condo project. It is in escrow for $1,600,000 for a 1,600 sf unit.

https://www.redfin.com/CA/Los-Angeles/12895-W-Runway-Rd-90094/unit-5/home/101759067

When this project first started selling, the 1,600 sf units were going for $950,000, this was last February 2014 when I first went to check them out. You can still see the pricing for all the units in the link below.

http://brookfieldsocal.com/neighborhood/camden-at-playa-vista/

@son of a landlord, LAX noise is a non-issue for Playa Vista. Playa Vista has less airplane noise than Culver City. Culver City / Mar Vista / Palms also gets airplane noise from the Santa Monica airport. Culver City / Mar Vista / Palms also gets a continuous drone of noise from the 405 and 10 freeways.

I know some very rich (billionaires and very successfully businessmen) who have bought second, third and/or fourth homes in Playa Vista for themselves and/or their family members. Playa Vista is not Inglewood, nor Paramount, nor San Bernadino.

That being said, we are in a real estate bubble in SoCal. The bubble is plateauing. The kind of people (i.e. the top 10% and frequently the top 1%) don’t care if prices crater in Playa Vista. For them this is chump change. For the bottom 80%, prices do matter.

But what if what you are all missing is that the people buying these properties are filthy rich, and therefore what appears to be “overpaying” to people like you and me, is really of no concern to them?

Put it like this: If you are dealing with people that are millionaires many times over and/or have incredibly high incomes coming in every month (i.e., the top 1%), what do they care if they are paying a several hundred thousand dollars more for these properties than what John Q. Middle Class/Working Stiff would be wiling to pay or afford?

Really, what do they care?

Moreover, factor in the fact that for many of these people, a Venice purchase is just one of several high end properties they own . . . . around the world.

I mean, places like Venice are becoming enclaves for the super wealthy (the top 1%). These people don’t play by the same rules as you and I.

To give you an illustration, earlier this year, in Venice, on Abbot-Kinney Street (the main commercial drag), a commercial/retail property with no more than a 4,000 square foot foot print (if that), and room for at most, six store fronts, sold for $44 million dollars. The rumor is that a New York hedge fund bought it.

$44 million!!!!

Here’s the story, by the way:

http://www.yovenice.com/2015/07/16/abbot-kinney-real-estate-price-explosion-former-hals-property-sold-for-44-75-million/

At that price (think of it, the property tax alone will be half a million a year), the owners will likely to get a 1% return on their investment–even with the retail rents being as expensive as they are in that neck of the woods. Nonetheless, some group of investors was willing to pay this amount of money for it.

So, why would these people pay this much money for a piece of commercial property in Venice, unless they HAVE MONEY TO BURN?

Also, why would retail businesses be wiling to pay the astronomically high commercial rents on this street, when they would have to move a lot of high-priced merchandise to just break even on the locations??

As was explained to me, the wealthy interests renting out commercial space at Abbot Kinney in Venice (a moderate sized store-front goes for about $20K a month) are doing so not so much to make money at those locations, as to create for themselves name recognition in a high visibility area frequented by the super wealthy. In other words, these store front operations, by opening businesses, are paying for ADVERTISING to create brand-recognition and cachet among a certain rarefied ilk of international super-wealthy that now hang out in Venice.

So, yes, from the perspective of working/middle class stiffs like us, these purchases make no sense.

But that is not who is buying these properties.

And I suspect that the same or similar dynamics are at work in much of California right now.

I think these examples are relevant to the idea of a price bubble. Money to burn also means money to lose.

@HC

I agree. Only when the tide goes out do you discover who’s been swimming naked. During a downturn, we shall see who leveraged themselves and who truly bought with cash.

@More Enlightened

Have you read about some luxury apartments in New York selling at a loss? Looks like the rich have a threshold of pain.

Prince, Dubai as well.

http://www.irishexaminer.com/business/dubai-property-market-cools-rapidly-371747.html

For all the talk of how globally connected Los Angeles is, the Dubai situation could be foreshadowing. What globally desirable speculative excess giveth, it can just as easily taketh. At least we have the climate feature, which wasn’t here before 2009 and somehow the absence of is forgiven for the other globally desirable everyone wants to live there cities of the world.

“why would these people pay this much money for a piece of commercial property in Venice, unless they HAVE MONEY TO BURN”

money laundering…….even if they lose half the value and sell in a down market it’s now nice a clean money,

Assuming no government intervention: Is a HUGE assumption in my opinion. I can see them trying another tax break or literally anything to keep this inflated market propped up. As much as I am tired of renting and waiting, the thought of losing my $100,000 down payment immediately gives me pause. (Looking at a conservative home of only $550K for 2 of us) My wife would like Upland, Ca, which is one city away from Los Angeles County. If I change my search area by 1/4 mile, to Claremont CA the FHA loan limit jumps $200,000. So, I could limit my risk to 4% as I would have no problem giving the home back, or living two years payment fee, as in the last down turn. With 20% at risk, those thoughts change. Yes, a home is a home. But wasting money, is still wasting money. So I wait. I predict intervention after this adjustment is seen as real, and not just seasonal. But who knows? I do clearly remember the last bubble and this seems all too familiar.

Jumbailey: you also have to pay hefty PMI with an FHA loan; it’s not like they let you have a 4% down payment with no other strings attached. Obviously the amount of interest you pay is also substantially more with 4% down, too (as opposed to 20% down).

Currently, the upfront PMI premium is 1.75% of the loan amount; the remainder of the PMI amount is an annual premium of 0.85% of the loan amount.

Source: http://www.bankrate.com/finance/mortgages/7-crucial-facts-about-fha-loans-6.aspx

I finally took the plunge and currently in escrow for a 2015 built 550k condo (1600 square feet) in Irvine, doing the monstrous 110k down payment as it seems Irvine market condo prices continue to be on the rise after 2012 and with the builders churning out 15000 new properties in OC with around 7k being in IR alone in 2015.

I got 3.75 interest rate & missed out on lender credit of $1600 (thanks to fed’s meeting).

I have taken in the factors of HOA/Insurance/Taxes/Mello-Roos and i will NOT break-even on the condo even if i rent it out and will have to shell out $400 per month in a best case scenario. I guess only time will tell if Irvine or the entire So CAL market will burst soon and if i will loose my 110k down payment or will i be the one building home equity and selling this same condo in 2017 for 650k

What to pay for a house is relative. Millionaires in Asia still think California prices are cheap and Asia is minting a lot of millionaires YOY.

Hong Kong apartment sells for record $76.7 mn. That is $13k per square foot.

http://news.yahoo.com/hong-kong-apartment-sells-record-76-7-mn-054015025.html

Property prices in Hong Kong, famous for its sky-high rent and super-rich tycoons, have more than doubled in six years due to record low interest rates and a flood of wealthy buyers from mainland China.

Yeah, housing here is cheap compared to the rest of the world. But it’s getting more expensive relative to foreign currencies. I think this will have an impact on foreign buyers. Crazy thing is that there is so much empty housing in most other countries. Europe is full of empty housing units because taxes are so high on rental income that it doesn’t make sense to become a landlord. China has tons of empty housing, India, Korea, even the Middle East with all that crazy overbuilding in Dubai and places like that. I wonder what’s going to happen to all of it.

i wonder if that was a straw buyer? who in their right mind would pay 1/2 a million+ more for a property that sold 4 months ago? that is fucking insane and makes no sense.

If we’re talking about all the cash sales why would we have “The Great Default of 2017”?

Because the “cash” buyer in some way may be leveraged. There are reports of investors having to cash out on recently purchased properties to satisfy their margin calls in other investments.

Some of these investors and flippers are getting hard money loans that make it look like they are paying cash to make their buying easier. I’ve also heard that foreign buyers on the visa program will later finance the house and cash out the “investment” portion required and set up a shell company. Looks like cash, smells like debt and leverage.

For 848K you can own this charming 100+ year old 3/1 property nestled between two run-down apartment buildings right on Crenshaw Blvd. complete with six foot walls/gates. Imagine, it’s like owning your own private prison. Hopefully those 6ft walls/gates keep the crackheads out. NICE!

https://www.redfin.com/CA/Los-Angeles/2205-Crenshaw-Blvd-90016/home/6899534

That Crenshaw house last sold in 2010 for $305k. Offering it in 2015 for $848k, even with renovations, is crazy-greedy.

I’m guessing the seller is testing the market, hoping for a crazy-greedy price. But I don’t think he’s overly exposed. He could likely sell for $500k and still walk away with a profit.

He’d be smart to sell at whatever profit he could get. If he waits too long, dipping the price by only $10k every few months, and housing tanks … then yeah, he’ll get less than he might of.

Some of these sellers are playing chicken. Lying in the middle of the road, seeing how close the car gets (or how high prices go) before they jump off.

Funny. Buy a home for $850K on the street made infamous by so many 90’s gangster rap albums.

Housing bubble 2.0 is just beginning.

I agree, they’ll bring back the liar loans before they let housing collapse again.

If not housing, where do you bears suggest we put our money? Stocks? Bitcoin? …Dogecoin? seriously, what are the alternatives? Bank account with .01% interest? How about a liberal arts degree in ethnic gender PC safe space modern art history studies?

FiatValue: yeah, your choices are generally securities (stocks, futures, etc.) or housing. Maybe gold, but that’s a total gamble, too. I have a lot of my money in 2% CDs, which almost keeps up with inflation. A 5-year, 2% CD is pretty easy to find at a decent credit union. My only penalty for early withdrawal is 6 months of interest.

I missed the boat on buying a second house during the downturn, and I missed the boat on stocks as well. At this point, I’m just staying mostly cash (CD’s) until there’s somewhere I can put my money. I’m waiting for a good deal on stocks, a house(s), or some combination of the two. I know I can’t time the market precisely, but I don’t want to buy at the top (now).

I got bored a few weeks ago and decided to buy USO (oil futures ETF) when oil started to decline (again). Already lost about ¼ of my money, as oil has declined even further; luckily, I invested an relatively insignificant amount of money ($10k or so). I’ll probably make it back and then some eventually, whenever the cartel(s) can successfully execute a game plan to increase oil prices again. But that’s probably a good example of what would happen if I put all my money into the stock market at the moment.

If you’re going to hold USO for the long-term, I wouldn’t recommend that. Pull up a 10 year chart, note that is 1/2 below the bottom in ’09.

Oil isn’t 1/2 below the low in ’09. USO is a bad vehicle for long term investments.

@USO is junk: thanks for the reply, but I just bought USO to have a little fun (gamble). Although I’m not rich and I don’t want to lose $10K, $10K really doesn’t affect me much one way or the other, so I could lose it all and the impact would be negligible.

Since Wall Street’s tentacles are firmly entwined in real estate, you might as well invest in the stocks since they have lower maintenance costs and produce higher returns. Should the stock market struggle, look for real estate to struggle as well.

What can you do with a stock though?

You can’t live in it, you can’t eat it, you can’t fuck it, and you can’t even wipe your ass with it.

Stocks can be inflated the way any fiat currency can. Sure you might “profit” from it, get some green paper from it. But if the company wants, they can dilute you to nothing (lol the way Zuckerberg diluted, Eduardo Saverin, the cofounder’s shares) at any time.

I would at least own one house, to be able to live in it, if necessary. Sure “they” can raise the property taxes, but it’s not like renters are shielded from that either, it gets passed onto them (…what you thought landlords would pay for it out of the kindness of their own hearts? lol)

Also, why do some of you think this is the top of the market? What if it’s just the beginning of hyperinflation of the dollar? I have no faith in that green paper, I tell ya what.

FiatValue stated “…why do some of you think this is the top of the market? What if it’s just the beginning of hyperinflation of the dollar?…â€

You’re absolutely right, hyper-inflation could be right around the corner. However, since I (or anyone I know) have not had hyper-inflation of my pay check, I don’t see how house prices would hyper-inflate unless there is an even larger influx of foreign money. Since many house prices have reached (or surpassed) ridiculous 2006 prices when liar loans were prevalent, my guess is that we’re hovering around the top of the market. Also, house prices for almost any locale are generally more expensive than they have been at any point in history relative to mean and median incomes for that locale. Just my guess, though, and obviously I could be wrong.

@FiatValue

What can you do with a stock? How about collect dividends? Dividends can then used to pay for housing, pay for food, and buy condoms and toilet paper. Or sell your stock with very little commission fees for a profit.

Stock dilution? It’s not if real estate speculators don’t lose money either. Did you read about speculators in Detroit and New York markets losing money on their RE investments? As stated previously, what has inflated stocks has also inflated house prices. ZIRP tends to raise the value of all risky assets, not just stocks. If this is the beginning of hyperinflation (unlikely since its value the $ has been strengthening), then stocks and gold will take off.

Your primary residence is a consumption item, not an investment: HOA, maintenance costs, insurance premiums, property taxes, etc. The down payment at today’s prices is far more costly than the initial cost of buying stocks.

The inflation in house prices is already here. All of the tent pole propping from 2009 onwards have been counter-deflationary, thus inflationary.

One of the benefits of holding equities is that they are not depreciating assets. Income property is a pain in the ass. A home to live in is consumption, same as rent.

The possible reasons for a top have been gone over on this blog ad infinitum. Instinctually this has the markings of a top to me. Seen a few rodeos over the years. Of course I could be wrong and have no problem admitting it.

Ha you think USO is bad. Try UCO which is what I bought at 22 dollars a share a few months ago. Needless to say I’ve take a 50% bath and am prob going to be in it for years before I get even. We’ll see. But at same time you gotta put your money somewhere and a commodity that’s in the tank seems as good a place as any…

I recognize that stocks can be a great way to profit off of inflation, etc. But the key difference between stocks and a house is that if the price went to zero for both, the house would still be a tangible object with uses (i.e. Intrinsic value) wheras a stock would be nothing.

Are you that hard up for cash? Diversify a bit, at least get one house (and the land under it) to live in?

Also the inflation of the dollar does not automatically mean higher gold prices, it just means higher prices of something else. Buying power will be transferred to some other store of value, depending on human behavior, not necessarily gold (since the value of gold is not entirely intrinsic. But cultural, etc. which may change with time. But gold will never go to zero, as a stock or bitcoin can.)

Sorry for my delayed response, was moving into my new house 😉

Sure there may be a correction in a year or two but im in it for the long haul. If youre making money in the stock market, i commend you. But if youre holding cash under the mattress, id like to point you to inflation charts and the cost of housing a few decades ago. Perhaps extrapolate?

@FiatValue

One of the rules of stock investing is diversification; even if one stock went down to zero, your winners would still bring a hefty profit. Now, how would your money had gone into Detroit RE or properties that are still underwater since the last downturn?

To me, hyperinflation means extreme economic volatility and uncertainty. Those are the times when people flee to the safety of gold.

As mentioned several times before, professor Shiller has pointed out that over 100 years, real estate appreciation has barely beaten out inflation and stock market returns. Over the past decades, extreme house price appreciation could primarily attributed to rampant over-speculation and loose lending.

In times of great uncertainty, and i mean shtf uncertainty, people gravitate not towards gold but to the similarly colored brass, well that and food and water… And shelter.

Well in anycase theres tons of dollars out there looking for something real to latch onto, look at our deficit, debt, etc.

Monthly is only slightly higher than rent, im cool wit it. Time will tell. I own stocks too, im not an extremist. But anyway this is starting to sound like a rap song, i got this i got that watch me floss, they see me rollin, etc. etc.

I imagine u intend to buy a house eventually right? Did u buy during any of the crashes?

“But the key difference between stocks and a house is that if the price went to zero for both, the house would still be a tangible object with uses (i.e. Intrinsic value) wheras a stock would be nothing.”

It’s comparing a consumption item against a non-consumption item.

If both became worth zero, the holder of the equity could then pick-up a house for nothing to live in and have an equity certificate.

A more realistic comparison would be investment property vs equities, although it’s not a simple one.

A house costs money to hold. An equity certificate costs nothing to hold.

This is really at the root of the problem — that too many people can’t help but think of the house they live in as investment instead of the consumable depreciating asset that it is.

Responder my condolences. If there’s one thing I’ve learned since the crash it’s that I just don’t understand this stuff. Oil’s in the toilet and I have no idea why. Hot college degrees ten years ago are nearly worthless. Music teachers I know are laughing their way to the bank.

Housing is going to tank very hard. Get the popcorn ready.

Lol, did you predict the same in 2005 and 2009 when housing prices went through the roof and people made millions !

The question in my mind about all these cash sales is: where does the cash come from?

Is it derived from cashing in stocks or drawing out of savings?

Or is it just another form of OPM where the “investors” are using forms of credit other than mortgages?

All of these “cash” purchases from “investors” make me very suspicious that this is all just another manifestation of our janky shuck and jive economy.

First off, glad to see the word janky used – havent seen it in a while and was really missing it.

Second, I agree, the source of the cash is a very good question. I have read of firms that allow one to “borrow” against the value of an investment portfolio (assuming composed mostly of stocks and reluctant to sell due to cap gains tax). We’ve seen this movie before of course. I imagine some fools go that route. You also have foreign money, boomers retiring and wanting something tangible and with a greater yield than low risk bonds but there seems to be a few more missing pieces as to where all this cash is coming from. I have also heard of private equity firms forming reits that are not publicly traded and they’ve probably sucked in individuals and more than a few pension funds.

We’ll see what the deal is when the tide rolls out.

I know that anecdotes obviously aren’t evidence, but, as a 30 something person, I can only think of one friend or acquaintance who didn’t use a sizable inheritance or family gift to buy a house in L.A. or Portland in the last 5 years, and that friend used FHA to buy a place in “bad” neighborhood in the Bay Area in 2010 (I keep telling him to sell now, as his home is now worth double.) Those friends who did manage to buy also filled me in on how difficult it was to be “chosen” by the owner to receive these run-down gifts. What a nightmare.

@ init4thelulz, the term to remember is “Margin Loan”.

This is what people use to borrow against their stock and/or investment portfolios. Larry Ellison (Oracle billionaire and one of the richest people in the world) uses this technique to avoid having to sell his Oracle stocks to fund his activities.

I also believe that margin loans will be the 2016 to 2018 equivalent of 2003 to 2006 subprime loans.

Smart investors rarely go all in with their own cash. Big hedge funds have taken out billions in low-interest loans to make their “all cash” real estate acquisitions.

Perhaps to you and I, it is unfathomable that there are people (or groups of people) that have access to this kind of cash.

But, what if this is what it means to be part of the 1% . . . . or the top .5%?

What if, hard it is for you and me to believe, there are enough people that are FILTHY RICH, who are gravitating to highly desirable places like Venice, California, or San Francisco, and have money to burn . . . . they’re THAT wealthy!!!

Granted, you and I and the probably most of the people we socialize and work with aren’t in that ilk, but that doesn’t mean that that ilk doesn’t exist.

Welcome to wealth disparity in the United States as it exists today!!!

That they exist and seek out certain locales isn’t surprising, but the amount of money one has isn’t necessarily inversely proportional to the ability to place sure bets.

For example, similar musings were being made about wealthy people in Tokyo just long enough ago that Millennials either missed being around when it occurred or were too young to remember it.

There are rich people and they tend to congregate. They are also human and prone to fickle behavior. How is this supposed to invalidate the thesis that the west side is currently in the grip of a speculative bubble? Am I misunderstanding what the takeaway is supposed to be?

Good Question.

To that point “cash” could mean anything from Bill Gates bank account (he isn’t going to need it anytime soon), to a credit card cash advance at 20%, to a hedge fund taking advantage of near free money and heavily leveraging their assets.

My guess is all of those and everything in between. Cash can be obtained by leveraging heavily, which can pretty much cause a hedge fund or investor to go to 0 with a 10% decrease. Cash does not equal solid or safe.

Well, I basically think in the long term its a good thing, a dropped of 20,000, 50,000 or 100.000 in some Ca markets will make it more affordable. If rising the interest rates works, and then continue this into 2017 the mortgage interest ratess will be about 5 plus percent with 30 years. Granted, a lot of people are getting hurt and that is 2nd houses baby boomers and first house gen-xers. Who will be more underwater again but there is no smooth landing in real estate.

Here is a Forbes article on Fed Rate Hike and Foreign Buyers

excerpt

The Federal Reserve’s steady round of rate hikes over the next two years will hold back foreign home buyers from Western Europe and Canada. The reason is the Federal Reserve policy change to raise interest rates will make the U.S. dollar stronger. That in turn will make it more costly to buy in America for foreigners. One major exception to this trend is likely to be Chinese buyers.

http://www.forbes.com/sites/lawrenceyun/2015/12/21/fed-rate-hike-impact-on-international-buyers/?ss=real-estate

This article is likely using stale data and therefore leading to an outdated conclusion. It presents a graph for the weighted index through October 2015 but Larry Yun doesn’t specify at what point in 2015 his CNY/USD numbers are from. We can only surmise his numbers are from 1/1/2015, which indeed compared against any point in 2012 the CNY/USD fix is relatively unchanged.

The problem is that China has had significant devaluation moves in 2015 and this article is dated just one week before the end of the year.

https://ycharts.com/indicators/chinese_yuan_exchange_rate

Since the start of 2015 the Yuan has weakened against the dollar back to 2011 levels and is trending toward more weakening. Again, the year is nearly over with 2016 just over a week away. Good grief, really with this NAR bullshit?

It’s reported that China has been tightening up their enforcement of capital controls in lockstep this year and Larry Yun suggests us to “wait for the data to see what really happens.” Of course, because when you wait a year to bring forward the data, you can use it to paint a picture which masks the inconvenient reality that the stronger dollar has made our real estate more expensive for all foreign buyers.

The head NAR cheerleader can’t be expected to present an objective point of view that would derail his tradegroup’s narrative. He and Yellen are experts at practicing cognitive dissonance.

Biggest buyers in Hawaii the past couple years and Manhattan the past year were the canucks per bloomberg radio. I think its safe to say they are donezo. Perhaps yellen is heading north now to perform mouth to mouth – yuck!

Perhaps it is just supply vs demand pushing ridiculous prices. New home sales volumes are telling! We are only just now back to the prior correction lows of the early 70’s, 80’s and 90’s! And our population has grown from 210 million in the early 70’s to over 320 million today. The enigma is that these numbers partly address the shortage of housing and therefore high prices, but also leads one to question its sustainability! How long can an anemic economy sustain American households abilities to pay ever increasing housing costs????

It’s the oversupply of cheap credit desperately searching for investment yields driving up prices. Previous to the last downturn, the lack of real estate inventory was not a reason for rising prices. Instead of organic buyers, investors are now the ones taking on too much debt.

It used to be that overheated housing markets were local and so were the housing busts. Texas in the late 80’s had a real problem when oil prices dropped and so did their housing market. California barely noticed. In fact this was the thesis that made many blind to the looming financial crisis of 2008. Housing prices just wouldn’t fall nationwide simultaneously.

Like a lot of things economic, the old models and theories may no longer apply. It may truly be ‘different this time’. For those ‘rooting’ for a major housing price correction in California ( or D.C., Portland you name it) may not be so happy if it comes. A collapse in Silicon Valley is not going to remain confined to Santa Clara or San Francisco. It will reveberate around the world just as the fall of Countrywide and WAMU spread to New York, London and Europe. Its a globalized world and if California coastal real estate ever got ‘affordable’ it would only be because no one,

including YOU, can afford to buy it even at those low prices!

I think most people are simply choosing to be patient which is hardly “rooting” for failure.

If house prices fall by some ridiculous amount (like 60-70%), then I will be a cash buyer!

The problem is during a real depression any asset, other than physical cash, may lose value. Since you can’t buy a house with a suitcase full of cash you would be left hoping your bank deposits, money market funds and other credit based ‘money’ was still wprth something and available. Experience suggests it may not be.

That was the problem during the 1930’s. Banks failed wiping out depositors, wages fell destroying incomes and even though choice property was cheap few had the money ( or could get a loan) to buy it. Today the FDIC has nowhere near the funds to cover a failure of a major bank. In Europe bank bond holders and depositors will be bailed in rather than put the taxpayer on the hook for another round of bank bailouts. Even cash can called in and redominated with old notes declared worthless.

What did you buy in 2010/11 when prices cratered from the ’06 peak?

But why does it matter? A huge portion of young people in many countries are jobless. If the recipients of Fed largesse have their fun ride stop, it doesn’t mean anything for the masses of jobless – it’s just the same old thing for them. It does make things cheaper and that’s good for business because materials, labor and equipment becomes cheaper. The problem with the last recession is that nothing except for cars and flat screens became cheaper.

Good entry Doc. Good reading.

Now you can own your very own genuine crackhouse for 500K+! It’s like a dream come true. Maybe you’ll even find some crack left behind by the previous tenants/squatters. NICE!

BEFORE: https://www.redfin.com/CA/Los-Angeles/2426-S-Harcourt-Ave-90016/home/6897071/crmls-MB15117259

AFTER: https://www.redfin.com/CA/Los-Angeles/2426-S-Harcourt-Ave-90016/home/6897071

I’m pretty amazed that they fixed it up that much. Before, it looked like a fantastic candidate for a bulldozing.

Although, it looks like they probably cheaped out in some areas. The shower is cheap (a curtain, really?) and they didn’t even put handles on the cabinets. Who knows what else they skimped on that we can’t see.

And this is the typical house to sell to a bagholder. Someone who thinks that this house is a “great value” in todays market. Yet when the bubble bursts, it is still located on ghetto avenue and is worthless. Classic

This is what makes me miss Anchorage. With climate change it’s actually 50 degrees there right now, and with oil prices bottoming out you can get a house like this for $500k where the commute to midtown, or downtown where most office buildings are would be ~ 10 minutes-

http://www.zillow.com/homes/for_sale/house,condo,townhouse_type/27517_zpid/61.200245,-149.909863,61.168432,-149.986253_rect/13_zm/0_mmm/

Current web cam shot-

https://www.dropbox.com/s/kewfnunxcogobap/ANC_Lakehood.jpg

Live-

http://www.borealisbroadband.net/vid-airmuseum1.htm

Home sellers are going to hold on as tight as they possibly can to sell at lottery ticket prices. Home owners (sellers) are going to be very stubborn and emotional about their expectations, the last bubble, and the panic to get back to bubble prices, just seems like too much to miss out on.

Other commodities don’t have such a stubborn and emotional grip. Unless I’m wrong.

@Passing Through, you are correct.

I know many elderly people in the Culver City / Palms / Mar Vista / Marina Del Rey / Westchester area who in 2006 were convinced their 900 sq foot crap shacks would soon be selling for $2MM and they would cash out when it did. That never happened. Roll forward to the year 2015 and these same people are again waiting for that same crap shack to hit $2MM so they can cash their lotto ticket.

We are closer to the next recession than the next economic expansion. Collapsing oil, gas, lumber, copper, shipping prices point to recession not economic expansion. So these crap shack lotto ticket holders missed the boat again.

Saw the movie “The Big Short” last night. Interesting how this blog and a few other housing blogs called it. Recommend seeing it if you’ve been following this whole housing debacle for the last decade.

Rich Russians(mafia types) are buying up real estate in Santa Monica for investment purposes. America is the land of shelter for people who rape their home country and come here to shelter their pirate booty. These foreign pirates buy the best places (usually costal areas-not the Inland Empire), so only a few local folks can compete with them.

All of you arm chair quarterbacks crack me up big time. Don’t you get it? If you don’t get it by now then you will never, ever, ever get it. The entire investment landscape is manipulated and we are just puppets. The masters pull the strings and we as puppets think we have autonomous choice but we just go in the direction they want us to go. Whether it is real estate, stocks, bonds, or even precious metals.

If the government and the Fed can’t do it via pulling the puppet strings then they just pass a “law” and they will outright take away what you earned. In the Great Depression of the 1930’s precious metals were “outlawed”.

Just wake up and see reality for what it is and then go on with your life. Don’t become so damn obsessed with all of these economic events. Realize that there are some things you can control and some things you have no control over.

So why come back to a bubble blog if your convictions so strong? I suggest leveraging yourself up to the max so that you can buy as many properties as possible.

Indeed, we must have ideological purity here! None of those nasty dissenting viewpoints to disturb our unswerving faith in the crash to come.

Nimesh: any semi-intelligent reasonable person knows that the investment landscaped is thoroughly manipulated, including housing. I don’t know why you keep asserting that people don’t know or acknowledge this. What I think you don’t understand, or refuse to acknowledge, is that the folks in charge make mistakes, not everything goes according to plan, and/or they are no able to manipulate everything with perfection. Therefore, circumstances occur that us commoners are able to exploit to our advantage (see 2009 stock market crash and real estate crash, as well as various preceding stock market and housing market crashes/adjustments).

I took advantage of the 2009 market crash and bought a house. Many people I know bought a house in 2009-2012 which have appreciated significantly as mine has, and have also realized substantial increases in net worth due to the rising stock market. Unfortunately, I didn’t have the money I do now in 2009, so I wasn’t able to take advantage of the stock market crash (that, and I was too timid to try my luck, even in a simple investment like an S&P 500 fund). However, if you are prepared, as I have tried to do over the past 6+ years, you can take probably advantage of the next downturn in the housing and/or stock market. Or you can do nothing and whine about the next crash and subsequent lost opportunity to make money.

@apolitical scientist

I don’t mind dissent. But then, Nimesh has been repeatedly spewing the same message and often in a condescending manner using little or no substance.

I agree….everything has been gamed, the Libor rate was for years and years while everyone used it as an Adjustable rate tied to mortgages…Oil, Gold, Lumber, stocks, housing…

Housing was the biggest rig of all….everything done to save banks, big pensions, trusts, investments, state, CALPERS, the government etc…..

The fed and their cartel of banks have seemingly pulled off the greatest heist of wealth the world has ever seen….

Thank you,

signed your PE buddies whom bought in bulk at pennies on the dollar…

while vets come home to nothing…..until the government of hubris is rattled the beating will continue

“We’ve been in a wicked bull run since 2009.”

this is a bull run? sheesh, I’d hate to see a recession.

Although your salary might not have increased much, if you invested in the stock and/or housing market in the 2009-2011 time frame, you likely would have done very well.

less than 75% in 92660…

My wish for all is to have a healthy 2016, if any of you are in the market for a home may you make a great deal and for many who still have to wait lets hope prices and your dream of either owning a home or getting a better deal on renting goes forward in 2016. The goal for our country is return to greatness, if a country can do it America can, it is the most blessed country the world has ever known, we must do something with this blessing in 2016 and beyond, our status is at stake, American prosperity for all. Enjoy the new year with happiness for everyone.

WE WILL MAKE A STRONG COMEBACK AS A NATION, THE WORLD LOOKS TO US, LETS NOT DISAPOINT AGAIN.

Boy are you deluded. My wish for this new year is that I can stay under a roof. Otherwise I get to join my street homeless buddies outside. Yes, most have a tech background.

@Alex

While I understand your cynicism, it gets a little old after awhile. I am sure being ‘in tech’ and in silicon valley isn’t all that its cracked up to be, and I while am sure there is more ageism at play there, almost everyone, regardless of location or profession will hit their peak earning potential (salary wise) by their 40’s… It sounds like you got a raw deal, and might consider moving to Denver, or somewhere they have a stronger social safety net, as opposed to San Jose which as I am sure you know, serves eviction notices to ppl in homeless encampments-

http://sanfrancisco.cbslocal.com/2014/12/01/notice-given-to-residents-of-san-jose-homeless-encampment-to-clear-out/

Welcome to the Jungle!

Seems money has nowhere to go: http://www.bloomberg.com/news/articles/2015-12-28/the-year-nothing-worked-stocks-bonds-cash-go-nowhere-in-2015

No investment asset is providing much growth at this time. So one may as well put their money into real estate. It’s as solid (or weak) as anything else.

People buying up properties are probably investors. They’re buying all these properties and putting them out for rent.

Leave a Reply to son of a landlord