The rental revolution is crushing the poor but also the middle class: 43 million households in rentals, up 9 million from 2005 creating largest 10-year increase in history.

The house humping pundits lock into anecdotal evidence and ignore larger changes in the housing market. For example, many kept harping on the fact that the Fed would never raise interest rates. Well here we are, with the first rate increase in many years. Many also claimed we were going to have a flood of Millennials buying homes but that also never materialized. The only thing they are focused on is price and that is being driven by big money, foreign investors, and people stretching their budgets to the max making their wallets burst at the seams. The housing calculus overall is not good for most Americans. We have gained nearly 9 million rental households since 2005, the largest 10-year increase in history. At the same time, we have 8 million people that lost their home through foreclosure since 2004. Of these foreclosures 1 million happened in California, the perpetually sunny state. This seems to go against the notion that buying at any price makes sense. The reality is, we are undergoing a major rental revolution across the United States and a comprehensive Harvard study arrives at the same conclusion.

Renting instead of owning

It might be useful to add some color before diving into the study:

“The decade-long surge in rental demand is unprecedented. In mid-2015, 43 million families and individuals lived in rental housing, up nearly 9 million from 2005—the largest gain in any 10-year period on record. In addition, the share of all US households that rent rose from 31 percent to 37 percent, its highest level since the mid-1960s.

A number of factors have fueled soaring demand. The bursting of the housing bubble played an important role, with nearly 8 million homes lost to foreclosure since the homeownership rate peaked in 2004. Household incomes have also fallen back to 1995 levels and access to mortgage credit has tightened, making the transition to homeownership more difficult for many who might otherwise buy homes.â€

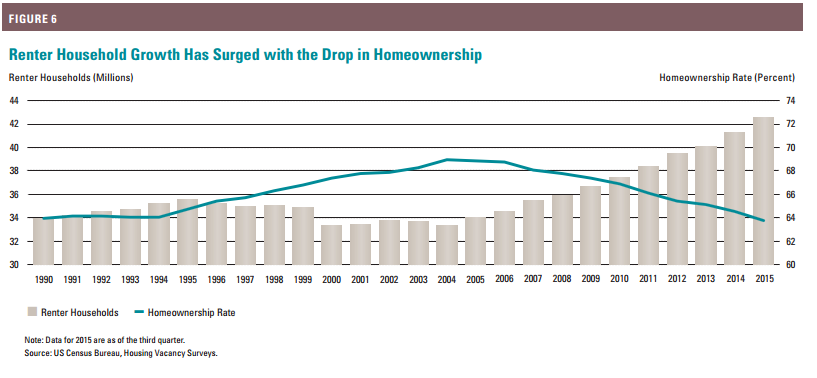

I would add that mortgages are still easy to get if you have the income. The only thing that got “tightened†is the toxic junk mortgages but even those are making a slight comeback. This is not a minor change or a slight deviation from the norm. This is a big structural change in how people look at housing. The growth in rental households is so dramatic it has shifted our homeownership rate dramatically:

What is interesting is that we started seeing a steady nominal decline in rental households starting in 1995 all the way to 2004. Of course this coincided with the raging housing bubble. But since then, we’ve added nearly 9 million additional rental households.

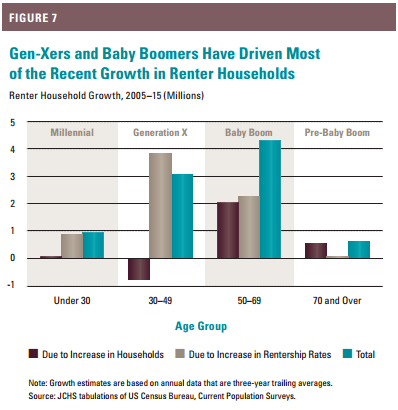

The idea is that somehow, this rental growth is being driven simply by younger households. We’ve already pointed out that in many high cost areas young people are stuck living at home with parents. The Harvard study backs this up and shows that older generations are the large driving force in rental growth:

The biggest rental household growth came from Generation X and the Taco Tuesday Baby Boomers. So much for thinking all of this rental growth was coming because of young Millennials being driven to rent. In fact, many Millennials can’t even afford the rent so they have to shack up with mom and dad or roommates.

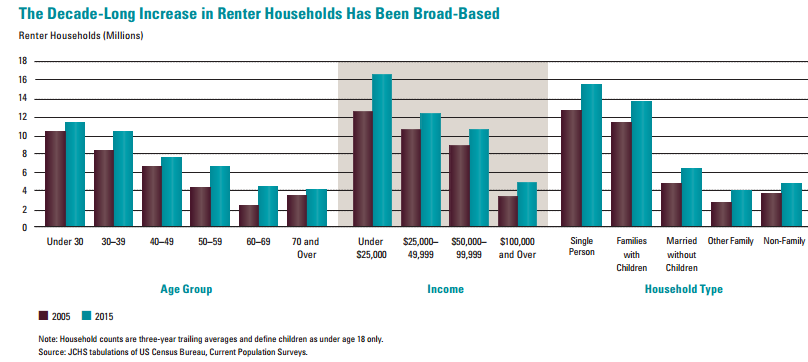

And this rental growth has been broad-based:

In other words, a rental revolution. Of course, a large part of this is being driven by stagnant incomes and housing prices outstripping any income gains. So how can prices rise? Introduce exogenous variables into local markets (i.e., foreign buyers, big money investors, flippers). Housing is driven at the margins. When inventory is tight, prices can zoom up especially in a low rate environment. We have seen this in many metro markets. But the opposite is also the case. When corrections hit, prices can slide at the margins quickly as well.

The rental growth is being driven by housing being unaffordable to many families. Affordability stems from household incomes. Those same people that thought the Fed would never raise rates are also the people that can’t foresee any correction in housing values. What the Harvard study finds is that millions are priced out and their only option is renting. And this is the “good†scenario as headline unemployment is low and the stock market has been in a six-year bull run. What happens when the inevitable correction hits?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

77 Responses to “The rental revolution is crushing the poor but also the middle class: 43 million households in rentals, up 9 million from 2005 creating largest 10-year increase in history.”

Housing crashing hard in 2017!!

Rental market in my area, Sacramento, ca, is currently flat lined. Smaller places like duplexes and condos are staying the same but houses are actually going down in price within the last 30 days. Maybe the winter slowdown? Maybe prices have stopped going up? They are still up 6 percent from last year, but the fluctuation has been wild throughout the year.

Housing is Tanking NOW!

Mr. Taylor, if you call the current housing market as tanking condition, I am going to vote for Trump in the coming election, as Putin recommended.

Keep the dream alive Jim!

Housing tanking Now!

We faked the Moon Landing!

Elvis Lives.

There was a 2nd shooter on the grassy knoll.

Nickelback music is good.

Etc. etc. etc.

Jim, just like a broken clock you will be correct one of these days. I can only hope that you are saving vast amounts of money that will be ready for your purchase when things tank, as you will have lots of competition.

I hope things work out for you Jim, but as we all know everybody has their breaking points.

Hunan: Jim might have been exaggerating, but if you believe housing will continue to appreciate and that there will be no future adjustment (tank), by all means, please leverage yourself to the max on a new primary residence and/or multiple rental properties. After all, the people who think housing will tank are just dreamers because it will never happen, so there’s zero risk!

Btw, I don’t know about the moon landing (I’m sort of 50/50 on that), but most people I’ve come across who’ve bothered to research the JFK shooting in any detail, seem to agree that there was more than one shooter.

Right on I agree about Moon landing I’m 50/50 as well. JFK absolutley more than 1 shooter.

But yeah Prices have not come down yet, but I am calling this the absolute top right now. Watch market action the next few weeks. Stocks to fall sharply after this rate hike gets digested. Mortgage rates to increase soon. Payments remaining the same means prices have to drop. Credit expansion has stopped and is contracting. Housing to Tank Hard!!!

If Elvis were alive now, he’d wish he was dead, as he was in horrible shape and its been decades.

If we’d faked the moon landing, the Soviets, the Chinese, hell, even the Swiss would have called us on it six ways to Sunday.

I’d like to see a shooting competition that replicates the conditions of the Kennedy shooting. Yes, it would be in horrible taste, but it would settle the question. There was one shooter, Oswald. He was only shooting across a hundred yards, at a large target, from a rest. For many seconds, due to the path of the car, said target was stationary. My only question is if oswald was actually trying to shoot Connoly, with whom he had a beef.

Housing is softening.

Nickelback music is never good.

Sacramento’s rental market is very different from San Francisco’s, LA’s and many other real estate market in most cities. It’s a big government town with a lot of Section 8 rentals which limits the amount of rent that can be charged.

I think unaffordable rents are localized. There are plenty of cheap rentals across much of the US. I own a rental and I have not raised rent in 10 years. I actually had to lower rent in 2009. I now may be able to raise rent back up to pre-2009 level. This rental is in a low income area but very affordable.

I agree it is localized, that was actually the reason the Fed was set up the way it was with 12 banks to represent the interests of each region. Because American is so large and has so many unique regions we should really have different interest rates for for each of the region; because a low interest rate policy that helps Iowa housing hurts California Housing, which in turns affect rents up or down. The inflation numbers are also skewed because the rustbelt brings down the average for everything, so while it looks like there is little to no inflation the reality for people in the blue coastal states is very different.

Excellent point about regional differences and needs, but on the flip side I fear Duh Fed having that kind of latitude for “gerrymandering”…

Different rates for different regions? I think that’s a terrible idea as it would provide another lever of manipulation open to abuse. This is a union, for better or worse.

Your post highlights the folly of central planning, which is what the Fed does. We have a country that covers a vast area, has over 300 million people buying and selling every day in it, has widely varying resources, climates, geographies, traditions, political beliefs, and economies, yet the Fed dictates a one-size-fits-all economic policy from Washington, DC. Having one policy for all leads to misallocation of resources, which we saw in a big way during the housing bubble.

If the Fed just let interest rates freely float, they would adjust based on the needs of the economy. If capital is scarce, rates rise, which encourages people to save and build up the capital base. If capital is abundant, rates fall and people and businesses are encouraged to borrow and invest, which leads to economic expansion.

The Fed is squandering our nation’s future prosperity by attempting to engineer and manipulate an economic recovery from on high. Look at Japan: they’ve been attempting what the Fed is doing for 20 years now and it hasn’t worked. So far that Fed’s stimulus hasn’t worked either, and now they’re talking negative interest rates. Seems to me that if what you’re doing isn’t working year after year, it makes sense to try something different.

Renting is not dying and going to hell. When I rented I didn’t have to worry about maintenance or property taxes. I live in a city with rent control laws and my rent was quite reasonable, especially after living in one place for several years. I didn’t have to worry about making a mortgage payment and I had money left over to invest. Now I own and there are plusses to that but I do miss the benefits I had while renting. I had a very good life and don’t regret a minute of it.

What I admire about renting is cost control. If you’re working and saving money, you can rent modestly, and you know what your expenses will be. All too often people buy more than they can easily afford, then they have to fill the place with new furniture, then there’s an assessment for a new sidewalk, then a pipe springs a leak….

Doc, you say “many kept harping on the fact that the Fed would never raise interest rates.”

I am one of those. The reason for that however was not that house prices will stay the same or go higher. The reason I was saying that was based on market fundamentals. I am still saying that based on market fundamentals the FED should not have risen the rate. But the FED stopped acting based on free market principle long time ago. Nothing surprises me anymore.

I was expecting the prices to go down just based on the number of jobs and the quality of those jobs (pay) plus an overly leveraged financial system – high risk. The whole system was imploding as is, without any additional raise in rate. That is just going to implode it faster – the FED did the same before the Great Depression. Maybe they want to do the same thing – that is when the crooks get richer the fastest.

Given 9 trillion bond market and over 500 trillions in derivatives the system will blow up faster.

There can be only two reasons as to why the FED raised the rate (zero chance for the reason stated by Yellen):

1. Save face/credibility after saying for so long that they will raise it (leaving it the same would be admitance that the numbers they publish for unemployment, inflation and GDP are bogus numbers).

2. A far more sinister/evil reason to implode the financial system of US is to create a new one with one currency and one world central bank (a central banker wet dream).

I’ll watch and see.

Or maybe we will have market adjustment and correction without financial system imploding and debtors keeping houses. Low rates didn’t do anything for my family, and instead led to lots of damaging speculation, yield chasing and doubling down on asset values. Now that can perhaps unwind from this point. Fed may have drawn in fools, so the core financial institutions can unwind (into a recession/crash) without failing (they are much more robust), and instead the risks are on wider market participants. The Governor of the Bank of England seems to think so, for the UK at lease. A former Chancellor of the Exchequer wrote this when Carney was taking up the appointment of Governor of Bank of England. I suggest a lot rings true for the US.

__________

Telegraph

Carney does not have a silver bullet to fire

The new Governor of the Bank cannot rely on quantitative easing to stimulate our economy, says Norman Lamont

By Norman Lamont

8:39PM BST 30 Jun 2013

[…]QE has pumped up asset prices to little visible effect on the wider economy. What point would there be in pushing asset prices up even further, other than to enrich a few more financiers? These prices in the eyes of many have already become seriously distorted. Both the IMF and the Bank for International Settlements have warned about “the sugar rush†– the artificial prices caused by QE and the danger of recreating the financial bubbles that caused the crisis in the first place. The policy has also been disastrous for many pensioners and savers who have had to endure the “financial repression†of government-induced low interest rates.

Central banks can’t magic up growth by printing money any more than governments can create growth by running deficits. The rationale for QE is that the recession left a large output gap and insufficient demand to fill it. I have long been doubtful. The truth is that in the past decade, households borrowed on an unprecedented scale. In doing so, we brought forward demand from the future. QE is an attempt to avoid the necessary adjustment.

To paraphrase the Book of Job, what the Lord giveth, the Lord taketh away. There will come a time when QE will have to be reversed and the Bank will sell the government debt it bought. Businesses can see that and are unlikely to invest simply because equity markets are temporarily pumped up with excess liquidity.

Paul Volcker, the distinguished former chairman of the Federal Reserve, recently said that “central banks are no longer acting like central banks. I think it gets dangerous when they lose sight of the basic function of the central bank.â€

I hope Governor Carney will heed Volcker’s wise words. His role is not to find a monetary silver bullet, but to deliver some hard messages that a debt work-out is exactly that – tough, unremitting, but the only way to get the economy back into better shape. And the sooner Mr Carney returns the Bank of England to traditional central banking, the more successful a governor he will prove to be.

______

There’s a third possibility – that the Fed believes the numbers.

Somehow, an incompetent Fed (points 1 and 3) is somewhat easier to stomach than a sinister one is.

I think it’s Number 1. Face-saving.

It’s like a parent who keeps warning a child about an impending punishment, but the child keeps misbehaving. Eventually the parent must impose some minor discipline, just to maintain authority.

And the increase is minor. Just 0.25%. Just enough to signal that the Fed is serious.

I completely agree. If they keep interest rates at 0% for perpetuity or a few more years longer…their significance is greatly diminished. Kind of what do we need them for anymore?! It’s more about showing some illusion of control.

Not in the bay area, a 1400 sq. ft. 3 & 2 goes for 3100 a month in the east bay.

Jobs are here, and nobody wants to do the long commute any more.

Similar in the UK (London) – but recently things are-a-changing. Longer term future looks better for both better rental value and house price value. These days (below) are soon to be gone!

__________

Daily Mash

London tenant evicted for paying same rent as last month

16-10-15

A TENANT in a London flat has been evicted for attempting to pay the same amount in rent for two consecutive months.

Nathan Muir had set up a direct debit of £1,150 a month for his one-bedroom flat in Sydenham without making the necessary provision for the capital’s booming property values.

Landlord Carolyn Ryan said: “What does he think this is, September?

“I might have accepted £1,275 for October because he’s been a good tenant for the three weeks he’s been there, but I’d have been stealing from myself.

“He needs to get up to speed with the realities of the burgeoning property market or go back to the stinking, provincial hellhole out of which he crawled.â€

Muir, who is now paying £70 a night for a tent on waste ground in Barnet, is also being pursued by letting agents Cornell & Gray for failing to pay an Upward Rent Adjustment Processing Fee of £195.

http://www.thedailymash.co.uk/news/business/london-tenant-evicted-for-paying-same-rent-as-last-month-20151016102996

The FED does not set the interest for mortgages. The bond market does. It is true that it can influence the bond market indirectly.

Due to this action the bond market can eliminate the risk of inflation for the future and keep the mortgages lower for a longer time. If the FED raises again they will definitely spook and collapse the bond market.

One thing is for sure – the FED did not raise the rate because the economy is robust, wages are raising and inflation is rampant.

I remember moving to Sunnyvale in 2003, my rent was lowered when I renewed my lease.

At (sports complex) we used to take the bunk beds and put “extenders” on them to make the upper bunk higher, set up a desk and chair where the lower bunk was, sort of a mini-private-room. It really wasn’t bad. I’d happily pay $300 a month for a setup like that, hightened bunk bed small room thingie in a larger room – could probably put 4 guys in a standard bedroom but each would have a modicum of privacy, with a common kitchen and bathroom.

Renting long-term is fine under certain circumstances – and can be a sound financial choice – in my opinion, which includes when markets play out that way, and fair rents and strong tenant protection. (see below)

However I hope/expect we are actually set for a steeper correction over the next 5 years and opportunity for younger generations, productive individuals, to buy homes at more affordable prices. Core financial institutions are sat on vast sums of money, and the market risks carried by other market participants (including yield chasers and foreign money.

__________

There’s a nice hotel in North East London, England (Barnet? Not sure) that was once a Country Estate manor house. It has a lovely pictures on wall of history of the place.

The main resident, Lord Whatever, in the 2nd half of the 19th c, LEASED IT. 40 years!

1870-1913 (Fed year) was deflationary AND GDP per capita rose. Owning property was for mugs…

He made his money in The City, as you do.

__________

Sir Walter Scott himself died in heavy debt because of his commitment to the failure of the house of Constable in the crash of 1825-26. Later in the century, the great agricultural depression of the 1870s lasted for a generation. […] Since the mid-sixteenth century there have been nine of these depressions. All followed periods of excessive debt, all involve a credit crisis, all lead to a collapse of property values, all ruin independent businessmen, all have serious political consequences, and all cause high unemployment and social distress.

My point is proven Dr. Bubble. You said it; housing prices are going up because of foreign cash buyers, flippers, etc. Prices won’t go down dramatically because The Fed, federal government, etc. will use any means to continue to inflate the housing bubble from popping. There is no such thing as the free market setting prices. That is just pure fantasy.

Why have they ever allowed severe house price crashes in the past then?

Hello, this time is different!

They sucked at propping up prices in 2008. You give them far too much credit.

Nathan118 said They sucked at propping up prices in 2008. You give them far too much credit.

The Federal Reserve, politicians and their hedge fund cronies were successful in increasing real estate prices back to it’s peak levels. Sure the bubble popped, but then it was reinflated. Proving my point exactly; that The Fed, federal governmnet and God knows who else will stop at nothing to manipulate the markets for their own benefit. We live in a 1984 type of world. Yes I agree that markets should be free of interference. But that is living in a fantasy world. Business interests are not going to just sit on the sidelines and allow the vagaries of the free market to determine their fate.

But how well will they execute? If the inference is that TPTB will act to maintain real estate prices at a level which will never experience a significant real correction again, that would be something which has not happened before. The most valuable take away from your point is that timing matters.

Nimesh:

You appear to be contradicting yourself. A few posts above, you stated, “Prices won’t go down dramatically because The Fed, federal government, etc. will use any means to continue to inflate the housing bubble from popping.â€

But in your most recent post you state, “Sure the bubble popped, but then it was reinflated.â€

Since housing prices decreased dramatically in about 2009-2012, that’s pretty good evidence that the Fed/ government is not able to maintain absolute control of the market 100 percent of the time. So your assertion that “Prices won’t go down dramatically…†is clearly a guess at best, given that the all-powerful government has failed at their own game before, and they will probably fail again. It’s just a matter of being patient in my opinion.

@ Nimesh. The ‘foreign buyers’ seems to be overblown in my humble opinion. Last I checked in LA, foreign buyers were about 10% of the market last year. That does not seem like a big number.. and most are probably Chinese, whom are mostly buying in the Chinese areas. In LA, that is the San Gabriel Valley and in the OC, it is Irvine.

For those of us with interest in the Westside [WLA, Santa Monica, Venice, Culver City, etc] I dont think foreign buyers amount to much.

@QE Abyss, I agree about the foreign buyer misconception.

Foreign buyers do not buy in the middle, working class or lower income areas.

Foreign cash buyers are not competing with the average LA-Long Beach-Glendale household with a median income of $53K, or the average LA-OC household with a median household income of $59K.

Foreigner cash buyers are found in the areas where household incomes are above $200K per year and households with a net worth of $2MM are dime-a-dozen.

Foreign buyers are *not* buying in 75% of SoCal as 75% of SoCal is ghetto / barrio / garbage dump / armpit.

True, the most overvalued housing I seen in Orange County is the coastal areas like Newport Beach, and the OC South beach towns where their are fewer Chinese and more wealthy white guys that work up in higher management to command those salaries or have a business where they make that kind of money. In fact, the most expensive new housing was in Newport Beach houses at 3 million, not as many Chinese.

Nimesh is right:

http://www.bloomberg.com/news/articles/2015-12-18/u-s-poised-to-lift-35-year-old-real-estate-tax-on-foreigners

The tax affected foreign pension funds, not foreign individual buyers/investors. Money launderers didn’t care about such a tax anyway. The biggest impediment to foreign investors are the high cost of investments and the ability to fund them. The global economic turmoil is forcing foreign investors to scale back as either their source of income or credit is tightening.

I was very disappointed to see that Obama passed this legislation in a hurry. It doesn’t feel that it looks out for the best interests of the general population.

Doc, thanks for posting another excellent article. This is the first time I’ve seen this tenant info broken down by age group. Of course it’s a bit sad any way that one looks at it.

Regarding millennials, on more than one occasion I’ve seen people saying that millennials don’t want to buy housing. Do folks really believe that “millennials” would choose not to buy if they could afford to buy? Sure, there is a cohort that won’t buy, but I don’t see how that’s going to be any different than the gen x’ers for example. Both groups have seen and been impacted by job insecurity, crazy stock market movements, housing price booms/busts… They simply don’t have the money to buy.

Getting rid of their iphones and lattes isn’t going to pump up their savings accounts enough. Now the morons spending +$1k on bottle service in Vegas is a different story. If you haven’t heard, this is the ‘in’ thing – rent a table at an upscale club for the night by paying thousands for a whole bottle of vodka or similar.

I agree with your points but life isn’t forever. Smart millennials can save and enjoy some fun as well. My friends and I spent 3k on bottle service once and once only. Do I miss the $600 portion of my share? No I don’t and that doesn’t make me a moron. You have to plan for the future but you can’t skip living for today. Good for you if you can but I will save as much as I can while still travelling and eating out at the local steakahouse.

By the way the bottle service isn’t for the vodka but for the plethora of 10’s that will be hanging out at your table. Like I said, there is a balance to things. That was before I got married of course.

All sorts of ways to pay for the company of 10’s in Vegas. More power to you if you found a way that lets you convince yourself you’re not paying for it directly.

Jeff funny you mention that, wife and I were invited to dinner last weekend, 4 couples hosted by what we call millennials, They rented a private room and proceeded to have bottles of rather expensive liquor at the table when we arrived, Of course I don’t drink so for me it was order a coke or Pepsi, my wife drinks one drink only. I understand the private room ran $500 to rent and the three bottles total $1200. He proceeded to tell us that his racket was a IT director and his wife had to leave her job as a county employee because he made to much money and the taxes were killing them? Now this is a nice worry, this couple rents a resort townhome with all the amenities and surly very high monthly fees. they drove a S class Benz and she has a Porsche Cayenne.

This is there new world order no kids thank goodness because They would be off to SWITZERLAND FOR SCHOOLING?

My wife and I said afterword’s who thinks like this and blows money when they don’t own the company, have no investments, just a job that can go away in a NY minute, but that must be the new generation, home buying seems out of the question. take care

He proceeded to tell us that his racket was a IT director and his wife had to leave her job as a county employee because he made to much money and the taxes were killing them?

I call BS on them. I’ve met people like that in L.A. They love to humblebrag about all the money they have. I was once at a dinner with some people, and one guy was lamenting that he had so much money, he didn’t know how to spend it. He’d drop remarks like, “Hey, what’s the point of having so much money if you don’t enjoy it?”

Some people drop the names of celebrities they barely met. Others drop quotes from Nietzsche or Plato, even though they haven’t actually read their books. Others drop remarks about all the money they (don’t) have and all the expensive stuff they bought (on credit).

I don’t come here to brag because many have it better than me. I come to get a another perspective of the market. Friends of my wife are members of a restaurant in Santa Monica that costs over 2k. They all make 230k plus by now as lawyers because they are smart and Stanford Law Grads. We’ve all had dinner there and no one acts like life is cheap and easy and they all save a bunch while still living a good life. 200k plus goes a long way and If you know how to spend it, you can live very comfortably and still enjoy a fancy lifestyle. So not all people that spend on private dinning are dumb or stupid with their money.

Bottle service, because there’s nothing like paying to be paid attention to at a douchebag club.

the key to understand this trend (as any other trend in economy) is the real value of salaries(discounting inflation).Stagnation in the buying power of working people and salaries can explain most of the stagnation in the economy and not the opposite,as many neo-liberals argue,because increasing the share of debt for buying is an artificial aid that cannot last long time.

As I said back in early 2015 rates would rise in Oct but it got delayed to Dec. This fed rate is symbolic, liken it to crossing a river, not sure how deep the river is so I will take little steps and hope I can cross without drowning, but I must attempt to cross it no matter what?

Our river in America is 2016, either we cross it safely with no worry of sinking or we sink, and 2017 is the crash of all crashes no matter what party gets in.

Here’s a good one for this forum…my wife and I have offers on two valley houses both overpriced in the upper $500ks…we offered about 550k a piece and even though we had the best offers the sellers wouldn’t sell to us and and are holding out to get there upper 500s price. HA! One of them was a flip that they investment company overpaid for (low 400s and want to make a big profit) the other is a seller who paid 600k in 2006 and wants to retrieve his equity and make us overpay. We are are holding at our offer despite light passive aggressive pressure from our agent who says cute things like “Well some buyers don’t mind paying a little extra for a house they like” or “We’ll just have to see what the rate hike does in the coming year” or “lots of offers of these places, someone will get this house…will it be you?.” I just think its funny that all these sellers and RE investment companies made irrational purchases both in the last bubble and in this one and want millennial buyers to bail them out and overpay on an overpriced SF Valley house. The real value of these places are 375-450k all day long but they all list at $590-615k. I for one think every qualified millennial buyer should stay the F out of the market and force a correction on these sellers. They will cave just watch.

You couldn’t pay me 500K to live in the SF Valley.

sf valley millenial buyer: why bother with a buyer’s agent? In your case, it sounds like it’s to your detriment if s/he is trying to talk you into something you don’t want (indirectly or directly). You might have had a better shot at an acceptance of your offer if the seller’s agent knew that s/he would be getting the full commission instead of having to split it with a buyer’s agent. Just get a pre-approval letter from your lender and make an offer directly to the seller’s agent yourself. Pretty easy.

sfvmb – I always appreciate when folks quantify their positions/opinions. When you say these homes are really worth 375-450, what do you base that on? How much is the value of the lot and how much is the structure? Have you broken it down to the per sq ft cost? Looked at what construction would cost? Of course if the area is completely built out it’s not a great metric, but it still says something about ‘value’. I’m not disagreeing, just interested to hear how you come to this particular conclusion.

It’s good that you’re sticking to your guns and everyone here hates a-hole realtors, buyer’s agents included. But the truth is, paying an extra 10% for a house is probably not going have much impact on your life or your lifestyle and if it does, then you probably shouldn’t be in the market right now anyway, so I’m not sure you’re thinking about this correctly. If you like the house and can afford it I would just bite the bullet. If you had done that a year or two ago, you wouldn’t have regretted it. Otherwise, you’re likely going to just keep waiting. I don’t think you should being viewing your home as some sort of speculative investment where you are trying to get the best price possible, because that is never going to happen. Just enjoy your life.

I agree, paying 10% extra than you would like is probably not going to change your life much. I’d be much more concerned about overpaying by 30%-40% (or more), given our precarious economic climate and the current apparent housing bubble. Overpaying by that much is definitely something I’d regret. And that’s exactly why I’m not buying (although technically I could afford to buy). I’d like to wait a few years to see how things pan out for the current bubble.

As for viewing a house (primary residence) as a speculative investment, I agree, it probably shouldn’t be thought of that way. It’s just a place to live, and the cheaper the better unless you’re rich. However, you obviously have to be judicious with the use of your hard-earned money. A fool and his money and all that. As such, we are pretty much forced to speculate on future prices in the current environment. If we don’t, there exists the likelihood of getting burned pretty badly. I don’t think anyone can time the market perfectly; however, there are better and worse times to buy, and this seems like the latter.

Surely it’s not a speculative bubble. “highly desirable Lennox”

https://www.redfin.com/CA/Inglewood/10924-S-Burin-Ave-90304/home/6485657

Third time’s a charm?

Have you seen this one in the same neighborhood?

https://www.redfin.com/CA/Inglewood/926-E-Brett-St-90302/home/6430062

Its a HOT HOME, that never sells. Looks like they take it down, put up again every few days.

Also, Lennox is directly under the LAX flight path. You have the amenity of seeing the belly of hundreds of planes that fly in daily. Really neat if you’re into plane spotting.

Yes, I’m aware of this particular flip on a budget crap shack and its goofy relisting game. At least its neighborhood is better than Lennox but this is a tale of two shitty choices. In one you have the certainty of carcinogenic jet fumes showering down around you while in the other it would simply be wafting over irregularly. This flipper overpaid, probably overspent on renovations (although you couldn’t tell by looking at it) and is desperate for a bail-out by a greater fool.

Renting isn’t the worst thing that can happen! But, buying in a market that has already been driven to the stratosphere, might be! What actually surprises me is that there hasn’t been a meteoric rise in listings as both Boomers and investors try to capitalize on current prices! Of course all the comparisons may be off-base as the crazy real estate bubble of 2000 – 2006 may have been an anomaly driving by loose money and lending. Existing housing sales are now back to roughly where they were in 1998, and existing sales volumes may actually represent normal!

Here’s the thing with low volumes combined with low inventory and high prices. Too many people can’t afford to sell so they’re stuck. The previous bubble’s buyers don’t want to take a haircut, the different era buyers don’t want an overpriced replacement, and there are hardly any greater fools left. It’s all finally catching up.

Renting is not always a bad idea, but buying at high prices is always a bad idea, especially as a traditional buyer. Finding a reasonable rental for a few years while prices moderate a bit and bidding wars cool off is a good idea. Not only are rising prices a problem, bidding wars have created quite a frenzy where we live (Denver.) Not only is it very stressful to compete with people still willing to pay above and beyond asking price, it makes very little sense to me personally from the standpoint of equity and chaining oneself to a hefty mortgage over a 30 year period. Jobs are not nearly as stable as they were in our parents’ generation, and I think that is having a significant impact on millennials’ view of home ownership, as much as or more than just rising prices while wages do not rise to compensate for the cost of housing.

I’d point out the nature of employment has changed over the years. Secure employment is hard to find and a mortgage requires secure employment. If you need two incomes to cover the mortgage that means two people need secure jobs. Think of those bond traders at Morgan Stanley. Top 1% incomes and they got pink slips for Christmas. Unless you are ensconced in the bosom of a large corporation or a government sinecure ( and even those at the state and county level aren’t as secure as they once were) the chances of you having the same employer in 10 years are a lot less than in the past. Being tied to a home and mortgage under those circumstances just doesn’t make as much sense as it once did.

Just like any other job (and most certainly more so) you can be damn sure that Morgan Stanley let go the employees that weren’t netting the company money.

Frankly, the whole country would be far better off if the financial industry was a much smaller fraction of the economy/gdp. This is proven via research – I’d give you a link but don’t have it handy. So I’m happy to hear that Wall St just got a minuscule amount smaller.

In my opinion either way you look at it there is going to be another correction down the road. Murphy’s Law is an obvious answer since anything that can happen will happen.

The question is what category will this fall into:

1. Housing Slowdown with moderate to lower prices

2. Housing slows way down due to direct impact by the FED meddling with rates.

3. Housing crash due to recession and other sector wide issues.

4. Housing collapse due to unforeseen Depression…err.. GREAT RECESSION.

5. Housing.. .

I’ll take Option 1….

I wonder how much of the rental stat’s are a result of the inability to purchase a home, or a result of conscious choices to rent and not own? As a Boomer, there is some merit in renting and know several retirees who’ve opted to sell and rent instead. I’ve owned homes for 40 plus years. Homes require constant maintenance and upkeep which require lots of labor and money. Real estate prices go through regular boom and busts. Waiting these cycles out until prices come back isn’t always an option! Finally, the neighborhood … they undergo changes which you cannot control and if the change is negative, the value of your home is impacted!

Foreclosures that should have hit the market, resulting in greater affordability through increased supply, were sold in bulk to hedge funds at wholesale prices.

Can anybody quantify the shadow inventory that is still out there?

I know of three different people who haven’t made a mortgage payment in over two years. They are still living in their houses, and there is no movement from the banks to evict.

I am in FL, so maybe CA is different, but does CA have this sort of shadow inventory as well? When or how will this be unwound and what effect will it have on the market?

2+ years of rent-free living? I could save quite a bit. Maybe I should look into this!

It’s happening here in WA. There is a home near us that a couple has been ‘squatting’ in for over 2 years. The house is finally going into foreclosure in February, but the bank waited until they could get all their money or more out of it. The prices have gone thru the roof in our neighborhood.

Interesting article on SilverLake, as a place of ‘Westside-ification’ (higher rents, trendy shop take over, etc).

Another one of LA’s gentrification spots

http://www.laweekly.com/news/the-year-silver-lake-became-santa-monica-6396310

I am starting to see many homes with price listing history being removed. Anyone know if there was a new regulation that made it easier for that info to be removed?

I would see it in the past but now it seems like a lot more homes are doing this. As a buyer, I look at listing history to see if I may have more leverage. Sellers play the relisting as new home all the time, I should be able to know if your home didn’t sell for your dream price or if you had massive price reductions.

Not sure what medium you are using, Zillow continues to list price history. Just look at the purchase price of the house you are interested in. Check like Resales and the temp of the neighborhood, if it is hot you can’t make deal, if it is Luke warm okay to deal, if cold your best shot at getting a deal. Good luck

Nominal prices aren’t going down… but housing probably will correct in inflation-adjusted terms going forward.

Recoveries are historically tied to the job market and the housing market. As both are still in the tank, and the monetary policies of the Fed control the ups and downs of our fake economy, then it is silly to say that we are not still in recession.

OC Native opines that the govt should just let interest rates float. That is the correct course of action. Unfortunately, doing so would signal that the liberals who have gotten us into this centrally planned economic mess have been wrong all along, and as we all know, liberals cannot fail. Would-be gods are narcissistic things, and cannot admit their failures….

Everyone likes to make fun of mobile homes but in the US mobile home parks are declining. Many are getting sold to developers and new parks are expensive to invest in since they rent has to come in for sometime. If you looked at mobiles in LA/Oc they are relatively cheap to renting or owning a regular house. The rent varies and has recently gone up. Few people pushed this as a solution to give tax breaks or land buying breaks to built new mobile home parks.

QE / 0%, as distinct from S & L sector wipeout / Resolution

Trust Cp., was Americans buying/laundering/underwriting

large banks’ inventory, the inflation transfered especially to

bonds and stocks, supported by the incumbent benchmarking

of the economy and dollar investment value to 0% and the

dollars chasing P/E’s and economic data of dubious significance

as the co-opting of the business cycle has to have occurred

instead of far more velocity and the uncorrupted passing of

assets, in this case, to the entire bubble selling side of the market,

and especially first time home owners pursuing family

startability, let alone family sustainability and family values.

Leave a Reply