Hypothetical family goes shopping in low inventory California housing market. How a $150,000 household income looks tiny in high priced middle class neighborhoods.

Housing inventory in California is back to levels last seen in the late 1990s and for certain areas, the hunger to purchase is intense. Regular buyers are competing with an entirely new ballgame of potential suitors for the few homes available. Sales are not surging. For example, year-over-year sales in Southern California are up 1 percent while the median home price is up 20.9 percent. This is another market that is new to a generation in regards to very low inventory, artificially low interest rates, and distressed properties being slowly leaked out. Uncharted territory again. Many that are looking to buy have their eyes set on very targeted prime markets. It is naïve to think that you will get a rock bottom deal in Malibu or Santa Monica. Foreign dollars and big domestic money is chasing hot markets. Local investors are also back to flipping these properties. But let us assume we are a family with a $150,000 income and looking to buy in a good area of Pasadena. What is running through our minds?

The current market

Let us assume that we are looking for a 3 bedrooms 2 baths home in Pasadena. We like the 91107 zip code so our energy will be focused there. The market has 61 properties that meet this criteria. We are looking for something closer to 2,000 square feet as well. Here is a new listing that looks nice:

430 Northcliff Rd, Pasadena, CA 91107

Bedrooms:Â 3 beds

Bathrooms:Â 2 baths

Single Family:Â 1,954 sq ft

Lot:Â 6,576 sq ft

Year Built:Â 1957

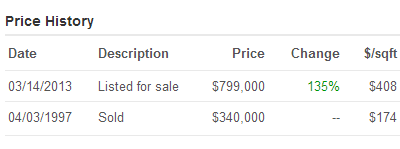

Seems like a good fit for what we are looking for. Â Let us look at sales history here:

Last sale appears to have been in 1997 for $340,000. So the current seller has a lot of wiggle room here since equity is likely to be high. Let us take another look at this home:

Clearly some work has been done on this place. This is a fairly new listing. We found other homes in the $600,000 range so it’ll be interesting if any potential buyers bite on this place at this price. But this is a good example since there are many others priced above this point as well. The question we have to ask ourselves is whether it makes sense to purchase at this price. We decide to look at Pasadena rentals that are comparable to this home:

1350 Riviera Dr, Pasadena, CA 91107

Bedrooms:Â 3 beds

Bathrooms:Â 2 baths

Available:Â Now, 4 days on Zillow

Single Family:Â 1,808 sq ft

This rental is listed at $2,900 per month. This place is nearly the same size, in the same zip code, and not too far from the home we are looking at. So let us run a buy versus rent analysis here:

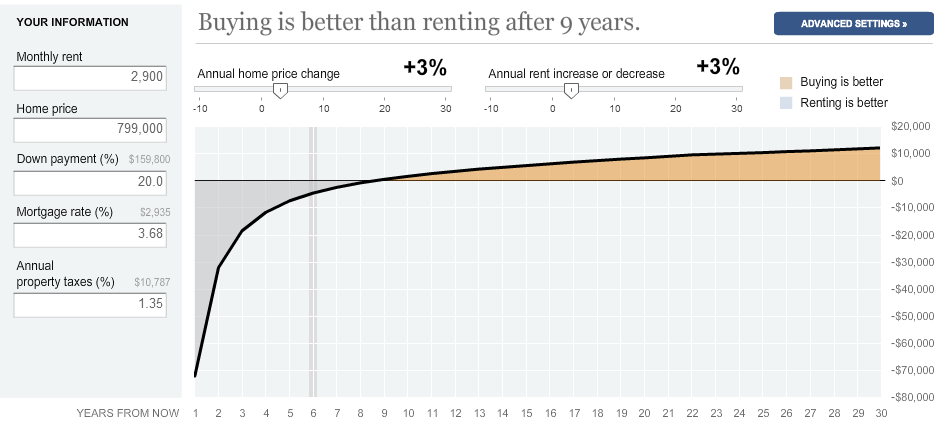

The above is using the following assumptions:

-1. Purchase price of $799,000

-2. Down payment of 20% ($158,000)

-3. Mortgage rate of 3.68 percent (current APR)

As you can see, it would make sense to buy this place assuming we stay put for 9 years and annual home prices continue to go up by 3 percent and rents continue to go up by 3 percent (big assumptions given income growth). In California, a big part of home prices staying where they are or going up is heavily contingent on whether the Fed can keep interest rates this low for many years. If you think the Fed is all powerful rewind to the early 2000s and tap into your memory with the first housing bubble.

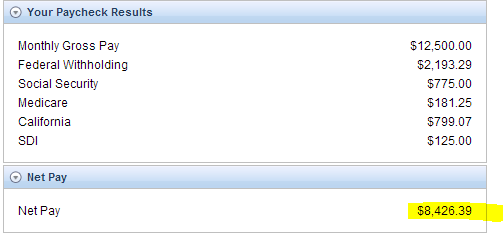

So you can see why some people are running the numbers and deciding to buy (or better stated, competing against hot money). The total monthly payment on this $799,000 home with 20% down will be close to $3,400. Now a family making $150,000 has this for their net take home:

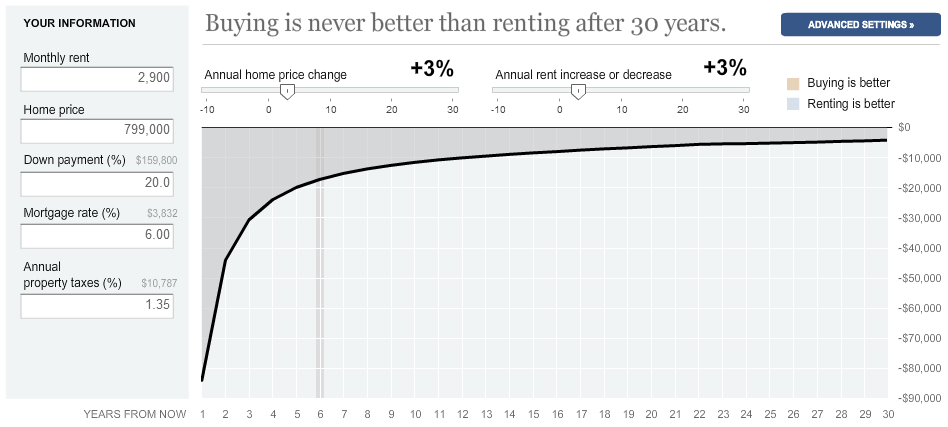

The current mortgage payment is 40 percent of take home pay. In California, this is very common. It is understandable why people are trying to buy in these sorts of markets where rents are very high and inventory is heavily constrained. All of this of course hinges on very cheap interest rates. Say rates go up to 6 percent (historically low and we were there only a few years ago) and see what it does to the buy versus rent numbers:

With mortgage rates at 6 percent, the decision becomes clearer. This is why the current housing market is facing such odd behavior in that millions are underwater, many are stuck, homes are off the market on bank balance sheets, in hot markets mania conditions persist, and finally low inventory is creating bubble like behavior with bidding wars and emotional pleas to sellers for buying a place. Keep in mind higher rates will do very little in markets in other parts of the US but will cause havoc in expensive coastal regions.

Ultimately psychology will drive a good amount of short-term behavior. I notice that some people say “well I want to paint the walls†or “I want to have a stable location†which is understandable but at what price point? $599,000? $699,000? Or $799,000 like our current example? Do you realize that the adjusted gross income of households in the 91107 zip code of Pasadena is $86,996? Our example uses a family making $150,000 a year. And many people looking to buy are dual income families planning on having kids. So there goes one piece of your income for a brief amount of time. Even if one spouse then goes back to work you are looking at daycare costs and many in these areas then seek to put their kids into private schools that tack on large amounts of money. In other words, life is going to get more expensive, not cheaper.

Yet one big explanation is that one-third of homes being purchased are from investors. That is, Wall Street hedge funds, flippers, or foreign money so they don’t show up in local tax records. Many things to consider when buying a home and obviously in California, there is a major difference versus the median priced home across the nation at $180,000. In California many local families have champagne tastes with beer budgets. Thankfully, low interest rates allow for champagne purchases with decades of future income.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “Hypothetical family goes shopping in low inventory California housing market. How a $150,000 household income looks tiny in high priced middle class neighborhoods.”

It would be interesting to see the amount of refi’s going on right now. People with some equity or at least approaching a sales price equal to their debt must be interested in getting some of this low interest rate deal.

How can the average California resident afford to rent, let alone buy a house? I could understand how someone could sell a house for decent profit, and then use that profit money to move up to a more expensive home, but I haven’t seen a move-up market Southern California since early 2007. Are Californians aware of how cheap it is to live well in most of the rest of the country?

I live on the water in Wilmington, NC. This place is paradise, and a house similar to the the houses pictured in the above article would sell here for less than $200,000. But why stop there? Here’s a house in a beautiful historic Daytona Beach neighborhood, a block and a half from the water. Instead of describing what kind of a deal one can get down there, here’s a picture that really is worth a thousand words. Disclosure: I’ve never been to Daytona Beach, but can it be worse than East L.A.?

http://www.zillow.com/homedetails/126-Cedar-St-Daytona-Beach-FL-32114/48044651_zpid/

What is the median income of Wilmington or Daytona? Availability of employment?

you are so right – many people think California is the end all, be all. My kids just gave up on their home search and are going to rent a 2 bdrm condo for 1300 a month – outrageous IMO but it’s the norm out here. If they would leave, we would follow, even tho our expenses are minimal, there would really be no difference for us either way.

my husband and i live in socal and have considered moving out of state to have more space for our four children and less expenses…one of the major things holding us back is that if we leave, it would be next to impossible to move back….

I have a vacation condo in Daytona Beach. Although it’s a great place to visit a couple weeks a year, you couldn’t pay me to live there. It’s a ghetto crap town

Great article. I’m in the same boat. I make 150K, and wife stays home with the kids. We rent a house. 3x my gross income gets you to 450K, but in any solid middle class neighborhood outside of the Inland Empire that gets you squat. those houses are 500K to 600K plus (easily). It was never my dream to either 1. stretch my budget to the point of breaking so I can afford such a home, or 2. move to the Inland Empire. At times I think I should just forget about it and go rent that home in a beach community that I could never afford to buy! Might as well if I’m stuck renting. But then I think, it’d be nice to have a home paid for by the time I retire….

You should expand your search to west of the 405… north of the 101…

LOTs of perfectly nice homes in the $300K-$400K price range and many in top ranked school districts. El Camino & Granada Hills charter high… top ranked nationally.

Granada Hills, nice? Oy Vey. In 1984 we moved to Ventura County as the valley had its pattern set in cement. Thousand Oaks is now going down the same path. We bought in “white flight” Simi Valley , moving from T.O. We rented there, and ESL schools have taken over.

I did my teen years in the west valley. It has changed and not for the good. The only homes we saw in west hills for $400K were fixers with really bad issues. $400K buys you a shoebox in the decent school areas. L A ghetto creep has arrived in the SFV, parts of TO, and a few sections of Simi Valley. I think Simi is in the best demographic shape.

I would NOT live in Simi today. There’s a huge heroin problem in the schools and the “white flight” you refer to is (sadly) mostly white trash today. The schools are suffering – check the greatschools ratings and comments. T.O. and Newbury are starting to go down the same path as well. Moorpark is much further along the path. That leaves Camarillo to the west (schools are recovering from recent fiascos) or Agoura/Westlake/Calabasas to the east if you can afford them.

@Too Bad, You Lose: You need to rethink your 3x gross income argument. I honestly don’t think you could have used that ratio much at all in the last 30 years here (maybe in the mid 90s when things were rock bottom). Low interest rates change everything. Borrowing 450K at today’s super low rates is about 2K per month mortgage. Anybody making 150K per year salary should have absolutely no problem affording that. You have saved for a downpayment, haven’t you? So with your downpayment and bumping up your loan just a bit, you should be looking in the 600K neighborhoods where you can get plenty of nice houses. Am I missing something here?

We just bought in a nice part of San Pedro (other side of PV from the South Bay). If our house had been in Manhattan Beach it would be three times the price. I stay at home and my husband makes about 70K, we have two kids. We had 10% down, bought toward the end of 2011, right before the frenzy restarted. We are going to homeschool the kids so technically we are in LAUSD, property prices are lower because of this but we don’t care about the schools. Living near the coast is excellent and I would live anywhere else. I love it here and it’s worth every penny.

Good for you, congratulations! I know SP gets a bad rap, but I too find it charming and unpretentious, not many places along the coast that you can say that about

Where can I get the cool rent vs buy calculator to run scenarios of my own?

It is at the New York Times website. If you lose the URL you can always google it. It used to be a link on the RHS (probably still there at Patrick.net site). FYI here it is:

http://www.nytimes.com/interactive/business/buy-rent-calculator.html?_r=0

Be sure to play with the ‘advanced settings’ mode so you can capture all the extra taxes, etc. Also consider what the actual rental increases for *your* chosen rental (where you are parked, not what flippers advertise the home rental rates for) – mine have been nil for 5 years now – and also the ‘cost of money’ – what you would get if you did nothing down vs. 20% down, and invested the money in other asset classes.

Enjoy~!

I was looking through online dating profiles today and happened upon a 24 year old Chinese girl’s profile that said she pulled in between 150 and 250 grand per year. She explained, in broken English, that she helped run a family business of real estate investment, flipping, etc. in Los Angeles and in China. There’s a section on the profile where one is to answer what they spend a lot of time thinking about, so she answered, ‘I spend a lot of time thinking about how to become a billionaire.’ She also said she didn’t really need to work as her family had given her enough investment money when she was ‘young’ to purchase her own investment properties (apartments). Further, she then answered a question about government subsidized food programs, stating ‘Never a good idea – get a job’.

Now I ain’t no fan of the level of welfare happen’n out there, even though part of it is probably propping up my Coke and McDonald’s stock, but wow, these mini-1%er’s are kinda evil. I sent her a message giving her a hard time about her carbon foot print, from all the plane travel she say she does. Occupy Dating Site. Mission accomplished.

As far as the home in the picture above goes: I’ll give you $150 tops for it, because i actually plan on retiring when I’m 70.

This post is worthless without a pic of her and a link to her profile. I like a woman that can make money. Housing problem solved. 🙂

150k looks about right to me too

http://www.jchs.harvard.edu/sites/jchs.harvard.edu/files/son2012_appendix_tables.xlsx (Chart on page W-2 has price to income ratios while W-3 has payment to income ratios)

Here are the cliff notes for LA/LB/Santa Ana Metro Area:

Price to Income Ratio

2011: 5.18

2006: 10.36

2001: 5.06

1996: 4.07

1991: 5.76

Peak: 10.36 (2006)

Trough: 4.06 (1997)

Price to Mortgage Payment Ratio

2011: .28

2006: .70

2001: .36

1996: .32

1991: .51

Peak: .7 (2006)

Trough: .28 (2011)

—

I posted this on the other thread, but it’s probably more relevant to this one. SoCal has been unaffordable to the median income for the last two decades.

Affordability is all relative, and by comparing it to just the median income, you miss out on many of the other variables

Thanks for posting that in the other thread, too.

Looking at that data, it seems LA hovers around 5.0-5.5 income to purchase price. The 90’s were buying opportunity while the ’04-’07 was a bubble. Looks like we’re back to normal levels again today.

Yup. A typical Middle-class lifestyle is unaffordable in LA on middle-class income. That’s just the way it is. Complaining ain’t good do nothing about it.

Why didn’t you pick 1046 Del Rey to compare rent/buy. It’s closer and on the same side of the freeway? The same NY Times rent/buy page would have calculated 6 years for the break-even?

Also, where was this same rent-buy analysis in 2011?

One could have picked up 1320 Riveria (just up the street from that rental) for $600k in 2011

@MB:

I took a look at 1046 Del Rey, Pasadena, CA 91107. This place is still priced at $728,900. From an investor perspective, you want a place to rent at 1 percent of the total purchase price. That is, this place should rent for above $7,000. In many parts of the US this is typical where homes can be bought for $100,000 and rented for $1,000.

Hard to believe that a $728,000 home with only 3 bedrooms is somehow seen as a deal. Of course this relies on very low interest rates which may or may not stay for the duration. How do the numbers work if mortgage rates go back to historical norms? I think some people are now in the belief that the Federal Reserve will be able to keep rates this low for one or even two decades.

This is definitely not your mother’s housing market.

I wasn’t implying that the home I pointed out was necessarily a good investment. I was merely wondering why that home wasn’t used in the rent/buy comparison instead since it’s closer to the rental house in the article.

I then pointed out another great comp (since it’s a couple doors down) that was purchased for 600k in 2011. Using the same NY Times rent/buy those buyers are just 2 more years away from their break-even point; a pretty clear signal that it was a decent time to buy.

If interest rates skyrocketed immediately tomorrow then we’d have a huge economic problem, of which housing would be one of many. Unemployment would be through the roof, stocks would probably plummet, everybody would be worried about a run on the banks, and I think we’d see large scale social unrest.

The more likely scenario would be falling unemployment precedes rising interest rates. Would 3 million extra jobs soften the blow of higher rates? Would continued low inventory offset higher rates? I guess we’ll see.

This is the current state of affairs. But there is no fix in sight. The big bubble drop in nice areas NEVER happened. West LA is still expensive. Pasadena, San Marino, … Still costly.

Lets face the music…these areas are different. Prices will never be affordable for the masses in these areas. Average income people not welcome. If you want average then enjoy Riverside. Oh, you just thought…but I don’t want to live that far away…well you and millions of others think the same way. And that folks, is why the prices won’t fall in highly desirable areas to match income.

Housing IS affordable. It’s actually cheap. What is off is expectations. If you are priced out of a market you have champagne taste and a beer budget. You need to shop in the beer isle … Welcome to Arizona, Nevada, or even the inland empire.

Reality sucks, I know. I too can’t afford a nice area on a good income.

And before the rental posts start, please show me a few rental options in San Marino. I can’t find any!

Maybe the issue is that Californians can remember when these areas were affordable, or at least their parents can. In East Coast areas, that are much older and established, no one who isn’t wealthy expects to be able to own in the most desirable areas. In fact, they don’t even expect to be able to rent in those areas, unless they have a rent controlled hook up. In California, the affordability of those areas is just in the rear view mirror, so we keep looking back and mourning. The housing boom and bust allowed people to dream that they could turn back the appreciation and opportunity clock. My parents bought their first home in Santa Barbara decades ago; I drove by not so long ago and it is a small dilapidated mess, but still I couldn’t even afford this home on today’s income. I think the next generation won’t have the same feeling. They will accept that the wealthy claimed these areas and they are walled out. The opportunity that once existed in California simply isn’t there anymore … accept it and move on. It’s still better than working in Manhattan and commuting in underground tunnels… at least we have the sun.

I think you’ve hit on a very valid point. CA’s population has doubled since the 1980’s and the metro areas have stayed pretty static. And of course, the desirable areas have not gotten any larger. So, there’s way more buying pressure on the areas that have been traditionally desired.

That’s probably part of it.

In my opinion I think LA has had the good fortune of having a great deal of build-able land and an excellent freeway system which contributed to the great housing booms in the 50s, 70s, 90s and 2000s. Having a lot of new construction adding to the SoCal housing inventory has prevented LA from becoming as expensive relative to other international cities (NY, SF, LA in the US)

I do think however given that high gas prices look like they’re here to stay and traffic reaching a maximum the suburbs and exurbs can’t continue expanding. The idea of a 2 hours commute with gas prices where they are seems insane. Perhaps telecommuting will ease the need to be near employment hubs, but that hasn’t progressed as quickly as I thought it would.

You guys hit the nail on the head. I’ve lived in this area for the last 25 years and there has always been plenty of money in certain pockets. As time goes on, more and more people will want to live in these pockets (Westside, South Bay, etc) and it becomes simple econ 101 with supply and demand. I was out in Manhattan Beach today and you would think the Great Recession never happened. Plenty of happy people spending money, driving 100K cars and not a care in the world. I was originally one of the naysayers, but these areas are not going down in value at all. It’s that simple!

LB wrote: “I was out in Manhattan Beach today and you would think the Great Recession never happened. Plenty of happy people spending money, driving 100K cars and not a care in the world. I was originally one of the naysayers, but these areas are not going down in value at all. It’s that simple!”

A close family member has lived in the same tony SoCal beach town for decades. Walking around the ‘hood, seems every third house has a car with a little red “firefighter hat” decal on the window. Most retired, nice guys, pensions provide sweet steady income no matter how the CA economy performs; could be a factor why some areas seem “recession proof”.

The word for this is Manhattanization, where as it applies to So Cal, it’s not the region outright, but certain enclaves that have reached a demand tipping point where the floor for SFR prices has been elevated in proportion to the rest of the region, never to recede again (barring natural or economic calamity or major public policy changes like prop 13).

This is why I bought in San Pedro. There is no buying in the expensive areas and expecting prices to zoom up or waiting it out until they fall. The best advice, if you really want to buy is to try and find an area that has seen better days and invest in your community and be part of the solution. Take a chance on an area that you and others like you can actually turn it around. Get on the neighborhood council, shop locally, eat locally. Support your community and make it into the place that you want it to be. Basically if it looks super nice to you, it looks super nice to thousands of others too. So many people talk trash about San Pedro and there are areas that suck, but I got a huge house for a great price because everyone else is too busy keeping up with the Joneses in Palos Verdes. I also knew going in that they were planning on redeveloping the waterfront in 2014, in addition to all the other improvements over the last couple years. I am hoping for the best and that I can be the change in my neighborhood not just some fool who moved into an overpriced already gentrified area along with everyone else once it is deemed “safe” for families. As much as people want to minimize the homeownership thing, it’s fantastic not having a landlord, it’s fantastic knowing your children will grow up in the same house, it’s fantastic living near the coast in one of the most exciting cities in the world with some of the best weather, it’s great being able to paint the walls and all of that is worth something.

@Candace,

There was no reply button below your post, but that’s what I’m answering.

I love your suggestion. I’ve been reading this blog for some years now, and it’s always struck me that there’s a lot of complaining and analyzing, but I don’t see many people trying to fix things. I think you’re absolutely right: help change things. It’s hard and frustrating, but if we don’t do it, someone else will always set the agenda. If everyone who comments here banded together to help improve the situation, we might actually make some inroads.

This is exactly the analysis we ran, adding $25K to our DINK income, and changing the neighborhood to Miracle Mile (where we currently rent, where it makes sense for our careers, and where starter homes are now $800,000). We can’t justify the math. We want to start a family and the questions of partial income loss and daycare weigh heavily. We’ve also considered the impact from a potential – albeit temporary – job loss. We weathered two downsizing layoffs during the recession. We were lucky and found new work within two months each time, but other equally talented colleagues didn’t fare so well. We have no illusions about job stability in this brave new world. So although we could technically stretch and afford these homes, it would leave us very much living on the edge if a crisis hit, or unable to adjust for self-selected career shifts. And I have no confidence that the market will appreciate 3% per year, given the current price inflation due to low interest rates.

So I don’t think it makes economic sense for us to buy, despite having generous middle class incomes that far exceed most of our peer group and friends. However, I’m fully aware this may mean another 10+ years of renting, until the investor homes are really unwinding into the marketplace or there’s any real pressure on baby boomers to start downsizing and leave LA, and the pent up demand has been dealt with enough to ameliorate panicked bidding wars. To speak to CAE’s comment above, the three people we know who bought in 2009 have all refi’ed to lower rates and will stay for life. My parents (in LA) and their friends have all refi’ed. I think most who bought in the last 20 years and have enough equity have probably secured a low enough down payment that they’ll be staying put for a looooong time because they’ll never see LA monthly-cost deals like this again.

It’s going to be an ugly, constrained market for a long time and we’ve resigned ourselves to renting. On the plus side, renting has changed our perspective. We’re talking about living abroad for a year or two. We can move into a better school district than we might be able to purchase into. We might buy and retire in another city. Who knows?! We feel pretty secure with a huge savings cushion and we can live a nice life without living beyond our means or worrying about if life sends us a financial curveball. We were forced into this position by the math and the manipulated market, but it turns out it’s not a terrible place to be.

My advice as a mom of two kids who planned on going back to work. Never ever ever buy a house BEFORE you have kids unless you can afford it on one income. I have known plenty of moms who have said they wish they could just stay home with their kids in a one bedroom apartment rather then return to their job to pay the mortgage on the three bedroom house.

Thanks for the reinforcement. We’re getting so much pressure from our families to buy now because we’re doing well and interest rates are low. I keep stressing that our financial lives could change a lot in the next few years and eat up major portions of the downpayment. I’m planning to work (I love my career) but I could need IVF or adoption or could run into pregnancy/recovery complications and need a lot of time off. Who knows?! It seems like the wrong time to make a home purchase, when you’re facing so many financial question marks. However, in popular consciousness, you should buy a home when you’re *planning* for a family. It seems nuts to me (although I do still feel the buybuybuy pressure), and I appreciate your perspective.

Great analysis and article.

We have been happy renters since ’04 here in La Jolla, after having owned three homes in California.

Me, I will buy after gold skyrockets or after The Fed folds.

In my opinion, it is the cheap and easy money from The Fed — and the first users of that money here in California: e.g., defense contractors, real estate speculators — that has greatly contributed to the wild disconnect between household incomes and home prices.

agree. easy money is, once again, fueling this latest bubble. but, unlike the previous one, the fed will not have any bullets in the chamber to try and kick the can down the road another time. when the fed can’t keep interest rates from continuing to fall (or some other financial calamity that could come along before ie. Cyprus and the collapse of the euro), then we will see just how resilient all housing markets are across socal.

Great blog today. It’s a lot of money(150k) to live in a tired 1960’s below average looking home. These homes are dated and ugly. If I had to live in that home with that kind of income I would be in a permanent depression. Now you can’t even buy this ugly thing and and hope to make money in the future to move up.

What you buy today you better stick with…ugh! Sure some of them have been remodeled and the lipstick on that pig is an improvement. Something is wrong when you make a 150k…the top of the food chain and all you can buy is that! Oh my goodness and they are desperate to buy theses uninspired boxes. The weather better be worth it because the schools, future taxes, infra structure are all declining.

I am looking to move from my desirable neighborhood in Orange County where it’s a mix of custom and track, horse trails, nature and green spaces. With all that, I can’t wait to move as soon as my daughter graduates from a High School that is top rated in California but sub-par with the of the top 1/4 of the world of like income structures. Her school is a joke…it’s great compared to the collapsing schools all over California/US that have become the norm. Just try to check graduation rates in your district and you will find that they are running 98% graduation rate…sounds good right? Well what they don’t tell you that if it looks that a student won’t graduate they ship them off to a continuation school and don’t get counted in the stats.

I don’t understand why smart high earning professionals would choose such a challenging path when their skill set could clearly take them elsewhere that is not on the decline. I get it that people get stuck here because of the type of work they do or have a home that they are still upside down on or need to finish things out like me but I would never make California my first choice for quality of life for starting a family. We are in another bubble and as soon as interests rates rise…more people will be underwater and you better just plan on dying in that ugly home because this next leg down won’t be pretty.

The Fed can promise to hold down rates but there are other market factors which may force rates up. We as a nation need the low rates to survive but at the expense of devaluing the dollar.

A home is one of the biggest investments that most people make and needs to made with consideration of current market environment. Stocks are up and that makes everyone feel good, housing prices are up…looks like a recovery right? Money printing is fueling the stock market along with low interest rates. Low inventory is fueling home price rises. Take those two away…does the investment environment still look good or are these just Novocain injections? Ask yourself what happened last time the Fed massively lowered interests rates…hence crash of 2008, 2009. Low rates are not a sign of strength.

Employment is on the rise right? No, employment is up for people who are getting second and third jobs at low wages…the real employment numbers is job participation which has been on a continual decline and there has not been one uptick. You don’t hear that number on the news because it’s a real indicator that reveals the true employment market. I can go on and on but all I can say is that we are on shaky ground and government rarely releases the stats that show the real picture. The headlines are all good right now… Dig deeper.

Go on Youtube and look at what Gerald Celente, Peter Schiff, Keiser Report, Greg Mannarino. They are way out of what the mainstream media puts out there. If you believe in optimism, probably won’t change your thinking but if you like math, charts and data this will be an eye opener.

I listened to Gerald Celente for 4 years and have come to the opinion he is a sham. Yes he tells it like it is, but all he wants is to spread doom and gloom to buy his Trends Journal, which is falt out wrong most of the time. He’s right about Fascism but keeps trending Capitalism. He makes no sense and you’ll lose money following him.

Schiff and Celente are probably right in what will EVENTUALLY happen. However, it’s pretty tough putting your life on hold for an indefinite period waiting for the doom and gloom predictions to come true. Most people simply won’t live like this. If all hell breaks loose, housing is the last thing anybody will be worrying about. Might as well make some decisons based on the information you have today rather than some thing that might happen down the road.

My God, just listen to the self-appointed monarch (sorry, though I thought hard about including a dig, just couldn’t resist my primal instincts). But heh, housing is untouchable, they aren’t making any more land in socal etc., etc. You know, Christie and I could be way off base, but really: a top salary gets you the nice part of Whittier? The numbers just don’t match and the math doesn’t compute. I simply believe that when the Fed is forced to stop, or is forced by the markets to have no influence over interest rates any longer, then we will finally see the true cost of housing everywhere. Can’t say when that will be, but it will happen much sooner than most think.

from SilverDoctors:

With QE4 and the recent return of NINJA loans as the Fed attempts to re-inflate the housing bubble, The Doc asked Willie whether the Fed would be able to kick the can down the road one more time with one last bubble:

They have 15-20 fingers and toes, but there are just too many different areas that they need to plug.

This real estate bubble is a joke. There’s no new bubble coming or even on the horizon. What we’ve got is the US government has sponsored a whole new round of sub-prime mortgages. Expect instead of the big banks underwriting them, it’s the Federal government. We have not seen a rebound in demand for housing, even though the 30 year mortgage rate is under 4% and has been for quite a few months.

What’s not shown in the press is that there’s still 10 million homes that are sitting on the bank balance sheets. They’re called REO’s, and they’re selling their REO’s or short sales, which ARE NOT INCLUDED IN THE CASE SHILLER INDEX!

It’s a parallel of the discouraged workers no longer included in unemployment! They’re bringing labor market calculations to the housing market. They’re not going to revive the housing bubble for a simple reason- there’s not widespread finance available, it’s exclusively coming out of the FHA. The other reason is that people have a great distrust for buying homes after they saw so many people foreclosed on. Another reason is that the people don’t have brisk income.

The factors are not there, it’s kind of a lunatic claim to state that the housing market is going to be re-bubbalized. Not even close, it’s stuck in a depression!

full story:

http://www.silverdoctors.com/jim-willie-the-collapse-is-at-our-doorstep/

That is good information.

Unfortunately, the Federal Reserve is a banking cartel that is wholly owned by the big banks. The Fed is doing everything possible to keep it’s shareholders (i.e. the big banks) from going under.

What should have happened is that the banks should have been declared insolvent and broken up. What did happen is the Federal Reserve has Japanified the banking sector, effectively kicking the can down the road.

The whole argument that higher rates down the road will finally kill the California bubble is a very valid argument and has kept me on the sidelines, but, I am about to capitulate and buy a house a tad further out (92123 zip) that is now about 20 to 25%off the bottom. I have made an all cash offer and am about to be in a bidding war but I intend on winning this once since the price point is at my low end. For me, it is pay 25K a year in rent and earn 7K a year in interest on my cash and hope prices fall or stagnate………or buy outright with the cash and pay 6K a year in taxes and insurance and at the same time, no longer have to worry that the FED will inflate the value of my cash to zero.

With the government ever changing the CPI metric, we may never have inflation higher than 2% again, (real inflation is a different story) or at least not for awhile which means 30 year rates may not climb above 4 or 5% for a decade or more.

I have been in several bidding wars in the last 2 years and everyone of them had at least 2 other ALL CASH offers. So, in a world where there is all cash offers all the time, how exactly would that play out with rising interest rates?

There are a few places in this world where real estate seems to always want to rise and during recessions at worst stagnant. It is increasingly seeming like all of coastal California is one of those special places.

I have been expecting common sense to begin dictating world markets for over ten years now and it does not seem to be in the cards. If you think about it, the current FIAT monetary system simply could not function with sound monetary policy and world Central Banks have no choice but more of the same.

And more of the same means 30 year rates could very well be 1% 10 years from now. Who knows at this point?

Of course, the day I sign for my house, (a decent house but not in the area I had hoped), is probably the day the market tops and FED influence has peaked.

Rates are going to stay low for decades. One of the final Fed moves is going to be moving all debt to 30 year notes, and keeping those at 3%. If America can’t fix her problems in 30 years, we deserve the fate of Greece.

The elephant in the room is Medicare and all medical spending. We can handle all the other entitlements and SS (which is not an entitlement, it’s a fund that’s paid into) but we must get a grip on medical. Eventually all the current legacy folks that are dragging us down with their pensions will be gone (20 more years?) and off the system, thus freeing up that capital.

Combine that with the fact few pensions are offered these days, and guys like Paul Ryan and Rand Paul are pushing for eventual budget balance, I feel someday America will have a balanced budget as long as we can rein in entitlement and war spending.

You think Republicans are going to reduce war (defense) spending? What are you smoking?

When the Kool Aide(Jim Jones type), stops, then it is foreclosure time because the house prices will fall fast. You all know, down deep, that some day soon, the artifical low interest rates will end, then it will be hell to pay.

and now lets look at REAL median income in Pasadena…63K 63×5=315K house, and we can’t even find a 400K fixer

http://projects.latimes.com/mapping-la/neighborhoods/income/median/neighborhood/list/

I pulled the trigger Im under contract for $540k in orange county. 20% down, leaves me a $2500 pament. Rent is around $3000. We are in a unique place southern california, If interest rates go up baby boomers will be getting better income on their savings and start cuting checks for $200k to their kids. They still have a lot of pensions as well. Whats their options sending their grand kids North Carolina, also the cultural diversity plays a role, does a Vietnamese, Koren or Mexican look at the east coast as viable there are some pretty racisit walls that still exist there. I see a baby boom money transfer bubble occurring. Believe me Im nervous my house under contract sold for $470k in 2003. And could be worth $400k in 20 years……..so i could have rented yea but. 20 years of smelling your neighbors cooking, fighting for parking ect….There are a lot of 68 year olds with a pension, 1.2 million in the bank and 2 kids who need cash………Its my theory but I think we need to be real, southern California is spottie, when you look at decent areas, close to the jobs in the 500k to 650k rand the cities are few………….Just my thoughts……….I spending all I have to get in and a bit of a nervous wreck…….But I have been reading this board I wanted to give you my thanks

The IE is really hot and basically a cultural wasteland. Save for the university areas, but that’s not saying much.

Disregard my previous comment! Wasn’t for you 🙂

What is is with some people bring so prejudice against the IE? It’s almost like Californians look down upon non-Californians, but then you move here and now if you don’t live on the Westside, you’re still ‘not good enough’. I beg to differ.

I work in the Southbay for a large company, amongst the many large companies that surround me as well. I can tell you for a fact, come into any of these parking lots, and look at the ridiculous amounts of vanpools and BUS pools that pull into these places every day. Self included. Riverside, Corona, Rancho, Fontana, etc.

Why?

Because contrary to many beliefs, the neighborhoods are good and fun places to live with many of the same amenities as anywhere else, now that the building boom of the 2000’s happened. Dos Lagos, Tyler, Victoria Gardens and Ontario Mills hang with the best of em, and previously living in Glendale I know.

The commute is only 1 hour, to 1 1/2 on a friday. How long is the L.A. commute? After stoplights and the 110/101 and all that, it was 1/2 hour, so it’s honestly not that much different, for a much bigger and cheaper lifestyle. No, you don’t have Silverlake cafes and all that, but if that’s what you want then go live in that s**thole.

There are many, many wonderful and afforadble neighborhoods in the IE, it’s not same place it was pre-2000.

I’ve got nothing against IE but considering weather, amenities, commutes, etc., why not live someplace like Austin, Scottsdale, Vegas, etc? Travel ten miles from the coast in SoCal, it’s hot summers not unlike other parts of the Southwest. These locales can offer lower cost lifestyle, easier commutes, more housing bang for the buck, etc.

Commute “only” 60/90 minutes each way, 10/11 hours daily M-F spent commuting and working? As children grow older/have more needs, your ideas about spending that much time away from home, that far away could change. Just my opinion.

I used to dis Riverside until I went to visit a friend that teaches at the UC. I was surprised at live-able it really is. If I had a job there or a reason to live there, I would not hesitate to buy a house there.

The IE is really hot and basically a cultural wasteland. Save for the university areas, but that’s not saying much.

pay no mind to that poster – it’s easy to criticize other people’s options when you’ve inherited a house in Pasadena

Are you referring to me? I did not inherit a house in Pasadena first off. Anyone can have an opinion on urban vs suburban living, no? Nice try.

Didn’t inherit a house anywhere for that matter, lol! Wish I had sometimes.

And another thing – the misconceptions about living OUT of Cali. No, it is not as hard to own a house in other states, like other people think it is. Some people seem to think the cost of living is the same everywhere, or that you make peanuts working in Fargo. This is far from true.

I happen to know the unemployment rate in Eastern Iowa hovers around 5%. The average home costs $138k, and you don’t see a plethora of apartments in those areas. Why? High homeownership rates with a lot of good jobs. Mostly in factories, or corporate management with some Aerospace thrown in. It’s relatively easy to find a job for $15/hr, and if you get on at Quaker Oats, Oral B, General Mills, PMX, or one of a hundred other factories you will make well over $20/hr. Financial services your field? There are plenty of those as well that pay well. It is a very middle class area, with pockets of richer folk. Homes range from $50k for older specimens in questionable areas, to $150k in widespread average neighborhoods. If you make great money and/or marry well, you can clearly afford over $300k and will be living in well over 3000 sq. ft.

Now I’m of course aware that appeal becomes monetary, thus a less appealing place will cost less. Shoveling snow and 90/90 (humidity/temp) August days are far from what someone will experience paying for a life in Dana Point, but the idea that those people are ‘less than’ is just as garbage as the person who thinks that is.

The world hardly revolves around those that live in LA, SF, NYC, etc all. But the attitude clash is striking. Coastal people look down on interior folk, and interior folk think coastal people can rot and die for all they care.

My apologies for my spelling and grammar on my previous post, it’s a hazy Monday…

Question: When will DHB give up the ghost when it comes to the local income to home price metric for So Cal? Already, he’s conceded that “if you want to get a deal in Santa Monica or Manhattan Beach, forget it,” but that’s not throwing in the towel of his primary thesis for real estate price formation in Southern California.

How many other areas will this metric no longer apply?

The larger issue as I see it:

1) While the marginal buyer is paying the top dollar price on restricted inventory and absorbing mega taxes, the overwhelming majority of people are sitting in homes they absolutely could not afford to buy at today’s pricing. Said another way, there are many many times more $1m homes than there are people who can afford to buy a $1m home at normal interest rates or centrally planned ones.

2) At some point incomes and prices align and incomes are not high enough to purchase these. Also while we can play games with artificial financing and rigged markets to get people into much higher priced homes (say 5-7x gross vs. 3x gross), the reality is that the savings and cash flow of these buyers is insufficient to withstand the volatility on an asset that big. Basically anything goes wrong making an ill timed or forced exit (life happens) and you break or do irreparable balance sheet harm (i.e. losing 5-10 years of savings given an already marginal cash flow post-home payment).

3) It won’t be too long before the “marginal” buyer is going to be one from a younger generation. Immigration isn’t bringing in top of the food chain earners and the young organic generation in this country has seen the issue of people overextending themselves on a home and paying too much. Extracting this ponzied equity value en masse is going to be far harder than people think. I also wonder if those underwriting a reverse mortgage might start seeing this issue (if the US Gov’t starts doing reverse mortgages to hold this up – I renounce citizenship).

Couldn’t agree more!! There was a story in business week last month that showed compared to 30, 40 years ago the average American has most of their capital locked up in housing which leaves them vulnerable. Honestly this is like watching a Shakespeare play. It must suck putting some much of your happiness on where you live or if you own a home. Yes there are better places to live than others but a lot of people who bag on the I.E are spoiled babies. I moved to Sacramento from the OC 3 months ago and i was bummed, but you know what its nice here. It is what you make of it. Happiness comes from within. It’s sad that so many people are sheep and base need to own a house at any price to be happy

This.

“…the overwhelming majority of people are sitting in homes they absolutely could not afford to buy at today’s pricing.”

Agree.

Yet, there they sit, and will continue to sit, either passing down the family heirloom to debt-ravaged children when they die or renting out for positive cash flow while they downsize.

I found this study useful: http://www.demographia.com/dhi.pdf . I was considering buying a house and moving to AU or NZ, but they have inflated prices too. Look at page 18 – Cali has the most metros listed at 5x income or higher, but on average we are doing better than a lot of countries with around 3x income (in aggregate). When I look inland more I see better ratios but not a lot of tech firms within commute distance. However, buying something in a cheaper area to rent out may be the only viable real estate play, and then you have to wonder about the quality of the remaining inventory. Part of me thinks that the smart money has already gobbled up the fairly priced housing.

Yes I think that is why there is such a surge in the “Share Economy” at little more income can really go a long way http://www.corporatehousingbyowner.com/successstories/1011.html

At CHBO we see more Mother In Law properties that help compliment income

“MIL suite supplements couple’s income by $10,000 per year!

In July 2003, Colleen Cameron and her soon-to-be-husband, Michael, were looking to buy a house in the North Shoreline area of Seattle. While house-hunting for their dream house the couple stumbled upon a beautiful chateau that had everything they wanted and then some.”

Leave a Reply