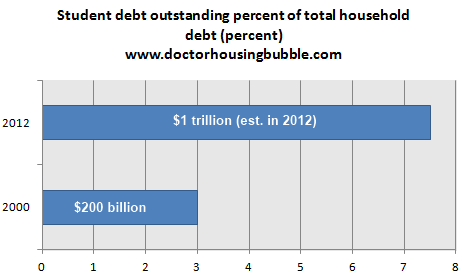

The brewing bubble in higher education – in 2000 student debt made up 3 percent of all household debt. Today it has doubled to 7.5 percent and has grown by 511 percent in the last decade.

There is high-quality evidence suggesting that higher education is deep in a bubble. When I examine the weakness in the housing market I also think of the massive expansion of debt with student loans. The biggest expansion in student debt occurred in a decade where household incomes stalled out. Many of the recent graduates are struggling to find good paying work so it has become much tougher for these young professionals to purchase homes. It becomes even more difficult if they live in a state like California where housing is still showing hints of a bubble in many markets. I get e-mails from young families looking to buy but their incomes simply cannot afford prices in mid-tier markets, at least where prices stand today. They are saddled with debt not seen in previous generations and they are more reluctant to jump into a massive mortgage payment. There is little sign that the bubble in higher education is slowing down and we have some new perspectives on the data.

Student debt as a percent of total household income

One good way to examine the burden of student debt is to measure it against total household debt. In 2000 student debt was roughly at $200 billion. At this point it was roughly 3 percent of all US household debt. Since that time it has more than doubled in percentage terms:

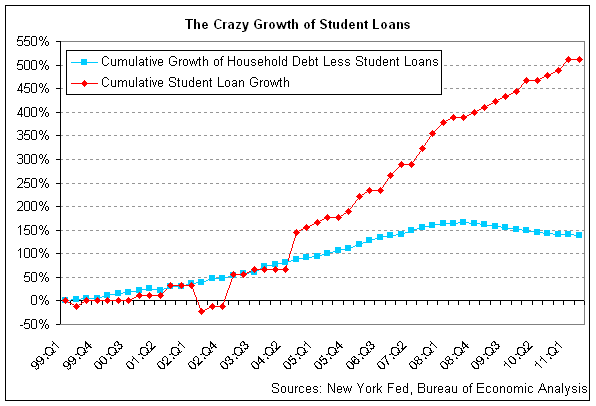

By the end of the year student debt should reach the $1 trillion milestone. Student debt now makes up 7.5 percent of all household debt. However, we need to remember that much of the run-up in student debt started in the early 2000s so this is a new phenomenon at least on a mass scale. There was an amazing chart that I found showing how much student debt has grown in the face of household debt. Even though household debt expanded by 100 percent in the last decade student debt put this trajectory to shame:

“(The Atlantic) This chart looks like a mistake, but it’s correct. Student loan debt has grown by 511% over this period. In the first quarter of 1999, just $90 billion in student loans were outstanding. As of the second quarter of 2011, that balance had ballooned to $550 billion.

The chart above is striking for another reason. See that blue line for all other debt but student loans? This wasn’t just any average period in history for household debt. This period included the inflation of a housing bubble so gigantic that it caused the financial sector to collapse and led to the worst recession since the Great Depression. But that other debt growth? It’s dwarfed by student loan growth.

How does the housing bubble debt compare? If you add together mortgages and revolving home equity, then from the first quarter of 1999 to when housing-related debt peaked in the third quarter of 2008, the sum increased from $3.28 trillion to $9.98 trillion. Over this period, housing-related debt had increased threefold. Meanwhile, over the entire period shown on the chart, the balance of student loans grew by more than 6x. The growth of student loans has been twice as steep — and it’s showing no signs of slowing.â€

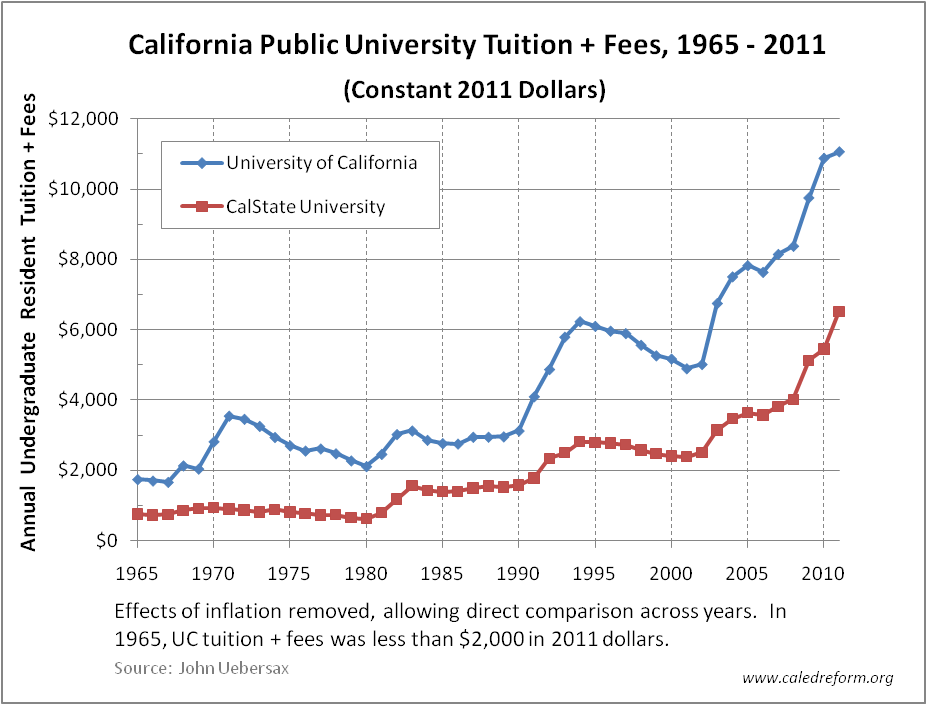

So in a decade where household incomes fell and the prospects of young Americans were hampered by the weak economy, college debt zoomed by 511%. In terms of magnitude this is a bigger bubble than the one in housing. A big push here has come from the for-profit institutions aggressively luring in unsuspecting students into systems that largely exist to suck out government loans. Yet even private and state schools are pushing fees and tuitions up. Take a look at the two large four-year college systems in California, the CSU and UC:

Source:Â CalEdReform.org via Satyagraha

This chart is extremely useful because it adjusts for inflation. You’ll notice that from 1965 to 1990 college tuition for both state schools were largely flat adjusting for-inflation. In constant dollars, if prices were leveled at where they were in 1990, the CSU would be around $2,000 a year and the UC would be around $4,000. Even between 1990 and 2000 prices moved up but nothing shocking. All the action began in 2000.

This is something that older Californians fail to grasp. Many had the fortune and luck to buy homes when they were “cheap†relatively speaking and also many had the chance to enter institutions when demand was much lower and entrance was almost guaranteed even in some of the more elite colleges. In 2011 the CSU has received over 621,000 applications. For the more competitive UC system over 160,000 total applications were received for fall of 2012. I get e-mails from many older Californians now griping that their kids won’t have the access they did and that college costs too much. Yet part of the issue is that prices remain inflated for key entrance points like housing and college which are now being carefully examined today. You expect someone to come out of college with $50,000 or $100,000 in student debt and suddenly they are eager to buy that shack for $500,000 in some mid-tier area of California? No wonder why the first time homebuyer market is shattered.

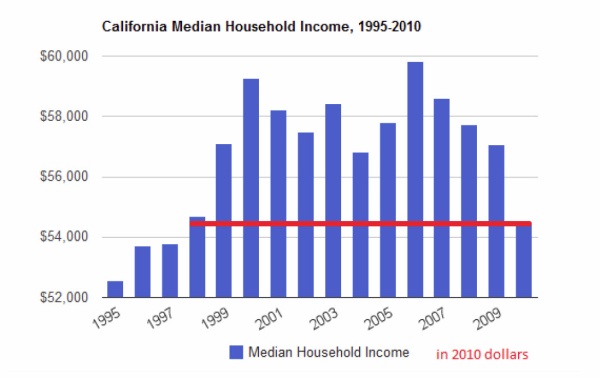

Some people keep arguing that household income went up (which it didn’t) in the last decade to justify the rising cost of college. The data shows us something very different:

So we are pumping out younger Americans with more college debt and lower incomes. Yet home prices remain inflated in many parts of the country. In many states however home prices are now very affordable even if you have two full-time entry level service sector workers like in Las Vegas. Prices are cheap if you have stable employment in those markets. Here in California even a stable job is not going to allow a two income household to purchase a home in a mid-tier city. Those that recently bought and have a vested interest in seeing home prices are blinded just like those that championed the housing bubble all the way up with toxic junk mortgages every step of the way.

Buffet recently mentioned that housing will be fine because of “hormones†as an implication that people will buy. Times have changed since Buffet was born and people are having smaller families and some are opting out being dual income and no kids. Hormones are there no doubt, but not necessarily the big families. Of course he made two calls in the last couple years clearly missing the trend when house prices continued to fall. With a median home price of $150,000 nationwide this isn’t a bold call. He likes to portray himself as this everyman but he bought a prime vacation home in Orange County and sold the place for a hefty profit:

“(Zillow) Buffett’s former California coast home was a vacation spot for Buffett and his former wife, Susan. The world-famous value investor sold the property in 2005 for $5,450,000.

According to public records, Buffett bought the home in 1993 for $1,100,000, turning a nice little real estate profit. Of course, what else would we expect from Buffett except handsome net gains?â€

The place is now up for sale at $4,995,000 7 years after the $5.4 million sale. California has many overpriced markets and Buffet is speaking more in general terms for nationwide housing. Just reading the e-mails of young professionals here in California, even with dual incomes, many are unable to buy a starter home in a market near their place of employment. Places like the Inland Empire are seeing very low prices for those in the area with solid jobs.  The fact that FHA insured loans with a 3.5 percent down payment dominate the first time buyer market tell us that many cannot even scrimp a 10 percent down payment.

The fact that 35 percent of homeowners with a mortgage in California are underwater or near underwater highlights a big issue. Who will they sell their homes to? Their massively in debt kids? Some other late comer that finds no more musical chairs like the last person to purchase Buffet’s home? The bubble in higher education is bound to burst and the large number of people now having trouble paying their student debt is a sign of things to come.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

44 Responses to “The brewing bubble in higher education – in 2000 student debt made up 3 percent of all household debt. Today it has doubled to 7.5 percent and has grown by 511 percent in the last decade.”

Sold condo in 2006, renting for six years, in westlake village, oak park area, waiting to re-enter. Husband wanting to re-enter now but seems like in the past two months houses have been flying off the mls, inventory is low in this area,not alot of choices anymore should we still wait it out or go for it?

I think after these new landlords learn that many if not most renters don’t have stable income, the housing market will be pressured down further. I also think that baby boomers need to down size sooner due to the low saving yield in their bond investment, if the interest rate is kept this low longer.

Much of the student loan debt that exists now was previously financed via home equity loans. So if you were lucky enough to have generous home owner parents and go thru school in the late 90’s thru 2005 you are nearly debt free at graduation.

Your parents howvers may be in a tough spot.

Today many more must pay their own way or sign a binding student loan agreement.

No easy way to bail on that obligation.

The Five Year Party is expensive! I have no sympathy for today’s college students, they live at the apex of the economic pyramid, drive nice cars, eat well, and party more than they study. No student loan debt forgiveness, ever!

Your college years must have been more fun than mine.

On what basis do you think this? Here are my anecdotes, based on 40 years of public-university teaching (and no, it wasn’t our salaries that drove up tuition). I saw students struggling desperately to keep up with 8-buck-an-hour part-time jobs, riding bicycles or driving old beaters, living on corn flakes the last week of the month, using the library because they couldn’t afford books, using unreliable campus computers because they couldn’t afford a laptop, worrying about families battered by the recession. The rich kids partying are out there, but they are certainly not the norm.

Get off my lawn

Nothing like pumping out a bunch of nasty lies and pathetic hostility Gramps. Your fantasy that kids today just party is just that: A fantasy.

+1

This student debt ‘problem’ is part of the logical fallout from globalization. Check out the charts related to minimum wage in the following linked article. http://oregonstate.edu/instruct/anth484/minwage.html

Nominal minimum wage rates have been rising steadily over the decades, but ‘real’, adjusted for inflation, rates have been falling since 1968. The reason for this is obvious. It makes a lot more sense to have menial work performed for $1.25/hr, with no benefits, than to have to pay someone $7.50/hr, plus unemployment and other benefits.

There is no way around it. Either you are an entrepreneurial type guy/gal that can start and run your own successful business (one in a hundred), or you better get a very good education. And since America is broke, and the free lunches are getting scarce, it is going to cost more and more to get a good education. You can always live in someone’s basement for a few years until you pay down some of your debt.

I would rather stay at home with my kids when they are young then own a house. Its what really matters to me.

You are a wise woman, Candace…and far wealthier than many living in lavishly decorated stucco boxes sitting empty all day because the parents are out feverishly working to pay the mortgage, credit card bills, car payments, day care, lessons, etc. Gotta impress friends, family, neighbors, be a “success”. Living the dream! Blecchh.

Guess who’s son is facing a mountain of student debt?

http://blogs.wsj.com/economics/2012/02/29/student-loan-debt-hits-home-for-bernanke/

Yeah, but, he probably said, “Don’t worry son, when this Fed thing runs it coourse, I’ll be making a mint writing books and “consulting”. Your loan is as good as paid.”

I’ll just print up some money for you son …. QE5 (bailing out Bernake’s son).

We all know the joke; I repeat it here so y’all can say “Yes, I know that.”

Two hikers in the middle of nowhere spot a bear, and it spots them. Hiker A takes off heavy boots and puts on running shoes.

B: Don’t be stupid. Bears can run 30mph. You can’t outrun a bear.

A: I don’t have to outrun the bear. I only have to outrun you.

The conventional wisdom says that advanced education will be needed for all the jobs just over the horizon. That doesn’t have to be true. It can be true that the work can be done by anybody, but only a degree will position the owner at the front of the line of applicants. Wherever that’s the case, the only education good enough will be the education no-one has yet.

Here’s a supporting anecdote:

http://open.salon.com/blog/annie_keeghan/2012/02/17/afraid_of_your_childs_math_textbook_you_should_be

It shows an “academic” industry that’s driven by production pressure and cost reduction, just as though their business were stamping out millions of steel washers. Worse because of the explicit statement from an executive that product quality doesn’t matter, since lousy product is selling anyway. You expect steel washers to have holes in the middle, and steel round the outside.

If the drive for education really is about positioning, and not substantive, then only a fraction of student loans will ever lead to employment. A huge proportion will be forever uncollectable. Just like our last bubble.

Mel – “A huge proportion will be forever uncollectable. Just like our last bubble.”

Unfortunately you’re wrong. Lenders can attach wages, including social security & pensions, and student loan debt is not dischargeable in bankruptcy. It’s worse than a mortgage foreclosure where you can hand the keys over to the lender and walk away, or IRS problems where you may be able to discharge taxes you owe in bankruptcy. Student loan lenders can chase you all the way to your grave. The current rules make student loan lending risk-free to the lender.

Taz, I normally agree with you but I will have to respectfully disagree on this one. The assumption you are making is that current laws/regulations will continue. I believe our current president has floated an idea where x percent of income max payment and total loan forgiveness after x years. I think this will be the TARP program of the near future. How are all of these new grads going to become American consumers if they have these shackles on their income? GDP growth will dictate some smoke and mirror actions to make our bankrupt country appear sound…

The collateral is your future labor instead of the property. I think the law of common sense will prevail, so i dont see the student loans being forgiven anytime soon.

@surfaddict,

I have yet to see the law of common sense prevail yet during a crisis. I think we have seen quite a bit of odd behavior from our “leaders” on the “housing crisis”. For instance, many would contend that the current crisis was created by easy money and our solution for a crisis fueled by easy money is more easy money… Oh and what about the solution for to big to fail? The Fed and Treasury encouraged the banks to get bigger… I am still waiting for the law to take effect in the housing crisis…

They can charge people all the way to the grave, but they can’t collect money that people don’t have. They can’t seize assets that no-one could afford to acquire. If new miracle jobs don’t appear for the new crop of degree holders, that will be the state of affairs.

Is it correct to think of this as a “bubble”, and, therefore, expecting that bubble to pop? I’m guessing that this may go on for many years, with no sudden crash of values or loan calls like the housing debacle. Parents will always strive for the best for little Jimmy and Sally, and government loans will be low on the list of programs to cut because, hey, who can argue that we need more college educated kids to “compete in the world market” (well, I can, but, I’m pretty sure I’m in the minority). Sure, eventually it has to slow down, these levels of debt aren’t sustainable in any market, but that will be gradual. This will be an enormous drag on our economy for a long time, though.

A person can still go to a community college for the first two years at minimal expense and then transfer into a UC or state college for their final two years. I did this 30 years ago and was ultra cheap back then. Today it’s going to be around $25K. Still not bad.

But I looked at UC “registration” fees the other day and notice a huge chunk was for “medical insurance” that they demand students get unless they can be on private insurance of some kind. Can someone clarify this?

The medical insurance is required by law.

Medical insurance supplied by colleges tends to be pretty cheap. The college can compel students to visit the infirmary first, which generates HMO-like efficiencies of scale. On top of that, the kids are young and healthy, and the rate of childbearing is lower than in the population at large.

The California (UC and CSU) college tuition increases are reflective of what’s happening in other states. State tuition rates in NJ, TX and other states have also risen significantly, so CA is not alone. What is telling is that the number of out-of-state applications at UC/CSU have continued to increase, which suggests that quality is not suffering, at least in the short run. Longer term, I’m worried about the impact of cutbacks in their budgets, more than I am tuition increases. Both systems are critical pieces of CA’s infrastructure, and contribute significantly to our economic prospects by attracting the best and the brightest.

As for tuition itself, my view is that the user should pay, as they are the ultimate beneficiaries of a good (UC/CSU) education. There are plenty of ways to mitigate high tuition – participate in ROTC, join the military, agree to work in a ghetto school, etc. – or do what I did and work 60-hour/week summer jobs and make sure an employer has a tuition reimbursement program. I left school with no debt and appreciated the education I received, in large part, because I paid for it myself. Too many students and their parents expect a taxpayer handout so that they can”enjoy” college. Sorry, but not from my wallet, which Obama and Brown are already helping themselves to with too much frequency and little regard.

Yea, me too. I walked three miles to school barefoot. LOL. Look, college is for suckers. It’s a rip off. It’s only good for a place to party. The only way it’s worth it is if someone gives it to you and they know it. Maybe it’s good for those who are too dumb, gutless or immature to start their own business but anyone who works their way through college is a fool.

The increase in number of applications does not indicate anything about maintenance of quality. It’s driven mostly by population increases, and the general increase in the number of applications per student.

That having been said, it is true that the UC schools are comparatively better off. The Cal State system is getting hit harder, and the community colleges are getting hit hardest of all.

One guesstimate of what this total student debt for graduates done with their education in the year 2020 is about two trillion US dollars (or three trillion, some show, using inflation and rapidly rising costs). Now, if you assume that is the debt of those 24-36, and you then look to see what the total debt was (again, inflation adjust) for 2010, you may find that this large slice of young workers will owe far more than they do in 2010, with one huge difference: many of those younger newer workers are buying homes now, but future workers not doing so. In other words, present workers of this age have home equity debt and some equity; for the 2020 crop, the entire borrowing ability net and more will be dedicated to paying student loans. Of course, those at the top of the 2020 income stream will be better off; that’s the sucker bet luring the rest of them who take on overboard student loans, who will be stuck in low wage jobs despite their education credentials and have almost no hope of getting the debt ever paid, let alone buying a home by first having borrowing capacity left, and second, accumulating any kind of down payment. The debt also makes these younger people much less secure feeling about their prospects, thus less willing to buy a home which requires a long term stable job. Second, the entire boom in housing and continued building, has been primarily (not exclusively, primarily) to accomodate double households due to the soaring divorce/single rate; look at today’s New York Times for the very troubling statistics on divorce after 40 and that it is resulting in double the number of singles by age 60. One of the largest factors for divorce is financial distress, direct and indirect, real or perceived. If you are a 27 year old male worker with debt, do you really want to marry a female with 100,000 of debt and still start a family etc? Of course, we all say, “love conquers all” but the demographic studies so far, tend strongly to prove that isn’t the case statistically. This all assumes there isn’t a repeat recession, that the down payment never exceeds 3 percent on a home purchase in the future, and other costs and taxes on these younger people don’t rise due to debt.

Incidentally, the massive and growing loans to students have funded (and will fund more), a huge bubble in construction and financing of dormitories, classrooms, books, teachers, salaries; thus massive new dormitory housing is being constructed, but which is not counted as true housing. Junior college districts in CALIFORNIA are issuing immense amounts of low interest or zero coupon bonds, in anticipation of endless future growth, thus the state total muni bond load is doubling every ten years or so. What could go wrong?

This article is great as always but failed to mention the cause which was the 1999 Banking Modernization Act which allowed the brokerages and depository banks to act as one and the same. Student loans, car loans, mortgages and any asset has been securitized and over leveraged. The difference with student loans is they can never be discharged. It’s all Planned to make banks wealthier and the rest become debt slaves.

The really sad thing is that even though there is a student debt bubble, the choice facing a high school grad now is either 1) Absolutely crap, terrible job (high school education is virtually worthless) or 2) College. Unfortunately, many are still running up more debt than necessary, and pursuing toilet-paper degrees (e.g. most of the arts) because they won’t have to worry about the debt for a few years. And the parents don’t want to say “No, son, I don’t support your C-average in sociology, how about you change majors or learn how to be a plumber instead?”

At least in my case I have some years before my kids go to school and I’m optimistic the bubble will have burst by then. Unfortunately, there will continue to be strong pressure for people to get a degree for anything approaching a decent income, because the lower class now (and increasingly in the future) are getting squeezed behind their lack of skills and ever more efficient outsourcing/technology replacement. So, without a degree you’re going to be at a greater disadvantage than you are now. The lower class are more and more going to be a kept people, really of no benefit to the economy laboring due to low level of skills, just basically kept chugging along meagerly on the social safety net, with chronic high unemployment (historically speaking).

And really, if the question is between a half decent job and a ton of debt or no debt but no education, who here is really going to urge their kid to not go to college? There’s really not else they can do at this point but take their lumps and if they’re smart get a degree worth having.

That’s making the assumption that one needs college to become educated or to have skills. Lol what is needed is a desire to learn..! Anyone can become educated if they want to. The only thing college provides is debt that cannot be discharged ever! a nation of debt slaves, that is what this debt is creating period. You need to learn what game is being played in order to be successful at it conquering it. Wake up snd smell the corruption and get educated! The information is out there if you seek it.

”

Parents Beware.

Party schools can ruin your children’s lives!

The cost of college tuition is rising faster than health care or gasoline, and students are struggling to pay the bill. They take out tens of thousands of dollars in student loans, and assume they can pay them off from their high salary jobs after graduation. It’s a bad assumption. Half of college students move back in with their parents because they can’t find good jobs. Students are working as waiters and clerks while struggling for decades to pay for an education they didn’t use.

Where does all that tuition money go? Only one dollar out of five is spent on instruction. The rest goes for bloated administrative salaries and multi-million dollar buildings like student centers, workout centers, and gourmet food courts that have little to do with education. These unnecessary frills push the costs up year after year, while national surveys show that students are learning less and less, and many of them are functionally illiterate.

Party schools operate more like adolescent resorts than higher education institutions. Students are pampered with five-star residences and gourmet food courts, but education is strictly optional. Students get away with doing as little work as possible while still earning A’s and B’s. Half of the freshmen class drops out before graduation.

“The Five-Year Party†unravels the mystery of why so many of our colleges have become so dysfunctional. The book helps parents determine which colleges are party schools, and includes recommendations for the reforms necessary to restore rigor to these colleges’ programs and put education ahead of entertainment on their agendas.”

The pigmen are parasitic and must have a new host to feast on when their last host dies, as it’s not a symbiotic relationship. I’m trying to figure out who’s next. What’s left to tap beyond pensions, IRAs and 401Ks? This student loan scam to the tune of a trillion is nothing short of institutionalized criminality.

The one thing I’ll say is that at least education is a positive contribution to society. It doesn’t come anywhere near justifying the absurd prices it’s at today, but housing is not a positive in my mind. Housing should ALWAYS be a break even, steady thing. We all need a place to live, but there is no benefit to having more people own a home. There IS a benefit to having more people with a higher education. Unfortunately, the price levels have gotten so out of hand, it’s negating it’s positive effects.

No it’s not.

Having more people with initiative and marketable skills is better.

Having a bunch of useless “educated” types wastes money and time that could have been spent doing something productive like picking up cans or delivering pizza.

Simple – the next thing that will be looted is Social Security. The continuing propaganda that all under 30 year olds believe is that SS won’t be there when they are older. It will be an easy looting. The media does a good job.

Dan, I’m afraid not, as the SS Admin holds intra-governmental bonds which are not money good in any market. As this Ponzi unwinds and payments into the system no longer equal payments to seniors (AKA Ponzi Scheme), the SS Admin. will have to go back to Treasury so that Treasury can issue more sovereign debt which will be bought by the FED until it all blows sky high as it must with exponential math and maximum potential.

I find the chart on Calif. Tuition Fees quite interesting. After just paying for a 5 year major at a CSU for my daughter I can tell you that tuition costs are merely the beginning. She was born in 1988 and I immediately opened a college savings, stock market invested, account at that time. I put as much money in it as I possible could afford. This, during the stock market hey days of the 90’s, and I still had to contribute funds to pay for expenses. Any parent trying to put a child through a CSU or a UC school knows that the real costs are living expenses; including books, rent, food, computers, phones, recreation, and myriad other costs. Those who have more than one child are hit very hard. The good paying jobs upon graduation are not there for the vast majority. How is all this debt going to be serviced while these newly minted professionals work in low paying jobs just to survive? Most know that student loans are the only loans that cannot be discharged through bankruptcy. Something’s gotta give. The education bubble will burst or shrink over time. Community colleges and living at home are viable alternatives for many people.

Check out how many people go through college without paying anything, then figure the people paying, are paying for then also. So long as people pay, it is not going to change. When I went to Cal Poly in 1980, I paid for everything with a part time job. Tuition was $80 a quarter and that was equal to one months rent. You could not find a rent to tuition ratio like that anymore.

I’m surprised that no one (that I’ve seen) has mentioned the apartheid system that is evolving in the upper echelon schools. For example, I got my BA in the 70’s in a mid-Atlantic area, and the student body was about 70% Jewish, even though the city we were in was mostly Black. I’m a WASP.

Then in the 90’s, a took an extension class that was held on the UC San Diego campus. The class was half white and half Asian, and 100% of the workers in the food court were Mexican. I’m pretty sure San Diego was less than 10% Asian race at that time.

I’m sure a Black or Latino high school student with good grades can get enough scholarships to get into college, and maybe even finish. But I’m thinking averages, and they look like they are dividing the nation along racial lines.

The obvious way to level the playing field would be to forgive a lot of the student debt. But that would just shift the burden to the taxpayer at a time when the budget is already seriously out of balance. At this point I would assume a higher priority would be to improve inner city schools in the k-12 area, and worry about college later.

Regarding the comment about everybody starting their own business, that poster has not been to Latin America. Everybody and their uncle has a little store or shop where they sell Coca Cola, phone cards, and chips. How’s that working out on a macro level, lol?

Regarding the comment about

How is it possible that a system exists that rewards Asian immigants but discriminates against African Americans who have lived here for generations? Or rewards Asian Americans but not Mexican Americans? If there is an “apartheid” system, it may be a natural outcome based upon individual effort, and if so, who gives a crap? Folks have to learn to take off the race classification glasses and view individuals as just that.

Affirmative action hurts Asians and whites both. If it wasn’t for AA, there would be practically zero blacks at upper tier schools.

I would be interested to see a breakdown of the student loan debt by type of institution. I seem to recall that a massive percentage of it is owed to private, low or no ranked for-profit Collleges that are horrible at providing a real eduction, and make misrepresentations to prospective students about the quality and pay that graduates can expect. Also, there is a lot of fraud where a fraudster “helps” low income minority kids with little college prospects fill out student loan apps, and gives them a “cut” of their own student loan money. Both parties then take the money and run, never even attending class or paying tutition. Of course, the hapless “student” is saddled with the debt forever.

I think when it comes to legitimate institutions of higher learing (e.g., the UC system) it is still economically worth it to take out student loans to obtain the right degree. Anything below CSU? Not so much . . .better to be an arc welder, airplane mechanic, commercial plumber, miner for iron ore in Australia, merchant marine, or whatever . . .

Could there be a changing of the guard, whereby students don’t choose college anymore? It does make sense to earn a skill or trade, as those are the jobs being created as opposed to business management. We can thank off shoring for that. Will the higher end homes suffer now as less move-up buyers come into the marketplace? Santa Monica only had 14 sales all month in February and is back to 2003-2004 pricing.

http://www.westsideremeltdown.blogspot.com

This villification of certain disciplines and disdain for those who seek higher education degrees in them is strangely familiar. Not on my watch.

Leave a Reply to Jason Emery