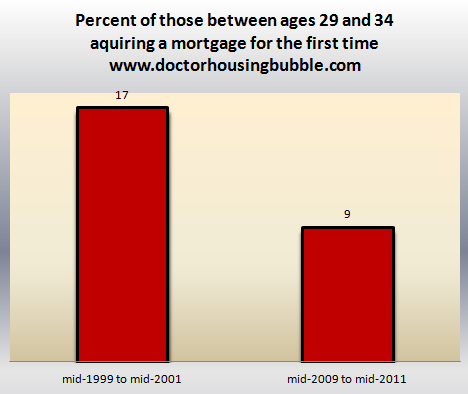

The down payment boogeyman – report finds requiring a 20 percent down payment would push out 60 percent of borrowers from qualified residential mortgages (QRMs). Those 29 to 34 acquired a mortgage for the first time in 1999 to 2001 at a 17 percent rate but that rate is now down to 9 percent.

There was a time in our more stable housing history where people wouldn’t even consider buying a home unless they had an adequate down payment. Part of the buying process required families to tighten their belts and save for a few years for that trek into home ownership. When so much time, effort, and capital is put into buying a property less people are going to walk away from a mortgage. This also created a positive buffer zone. Starting in the late 1990s and going into the 2000s the idea of a down payment played into the narrative that all debt was somehow golden. Why does anyone need to save when you can simply take on a mortgage and forego the years of saving? Banks loved it because the mortgage volume churn was like having a money making machine. Of course much of this philosophy and mentality is what led into the bubble peaking with no-doc, no-job, no-money down mortgages. Today we examine the down payment debate closely and analyze why it is important to have a bigger down payment especially with government backed loans.

The boogeyman of rising down payment requirements

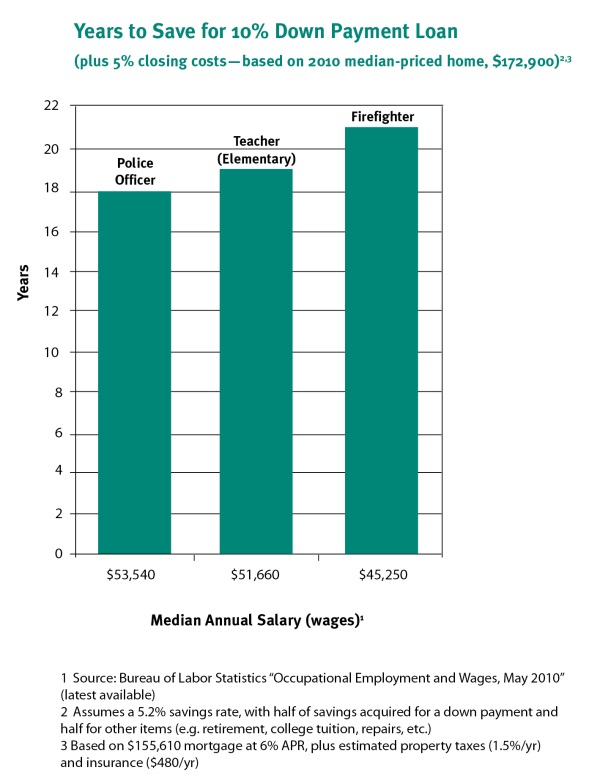

Recent proposals are examining higher down payment requirements. These proposals have been sitting around for a few years since the crisis hit but with 5 million completed foreclosures, it might be worth a consideration since something obviously went wrong with the way housing was being financed. The Center for Responsible Lending argues that increasing down payments will shut out many buyers from the market. They provide a chart like the below:

Source:Â Center for Responsible Lending

I understand their perspective. They argue the following:

“(CRL) Based on average home prices, it would take 14 years for the typical American family to save enough money for a 20% down payment.

Increasing down payment requirements would materially shrink the mortgage market with little increase in loan performance.â€

Let us break down some of the arguments against increasing down payment requirements. The chart above shows the average time it would take for someone to save a down payment but of course, if you read the notes, this is assuming they only save 5 percent of their pay and then this is reduced even further. The assessment is looking at the median priced home of $172,900 in 2010 (it is now down in the $150,000 range) and basing it on a 10 percent down payment. So realistically we are talking about saving $15,000 to $17,000 here. You’re telling me that it will take 20 years to save $15,000? I’m sure many of you have questions about these underlying assumptions.

Or could it be that home prices are still too expensive based on current household incomes? Keep in mind for many decades 10 to 20 percent down payment mortgages were the status quo. How is it that for nearly half a century the dominant 20 percent down payment mortgage kept prices in line with household incomes while the first chance that down payments go out the window we suddenly have a massive bubble? The math is simple here. People have less money saved. That we know. So each time you push down payments lower you open the pool to more potential buyers. During the bubble, you didn’t need a job or a down payment so in reality every person with a pulse was a potential home buyer. Not bad for banks packaging this junk together and selling it to unsuspecting investors pocketing billions of dollars. Today we still have FHA insured loans with 3.5 percent down payment requirements and still, people fear down payments going up? Which leads us to the massive problems now being faced with the FHA which is the model of the low down payment mortgage.

FHA insured loans a major issue now

I know the media is transfixed on the bread and circus that is our election system but the FHA is in some serious problems:

“(WSJ) The FHA has burned through its reserves over the past three years as defaults mount on loans it guaranteed as housing markets deteriorated. FHA-backed mortgages are an attractive option for borrowers because they can make down payments as low as 3.5%. But as home prices continue to fall, many of those borrowers have fallen underwater, where they owe more than their homes are worth and are at greater risk of default if they experience income shocks.

The estimates by the White House’s Office of Management and Budget show that the FHA’s capital reserves, which stood at $4.7 billion in October, would be wiped out in the coming year, forcing the agency to seek nearly $700 million from the U.S. Treasury.â€

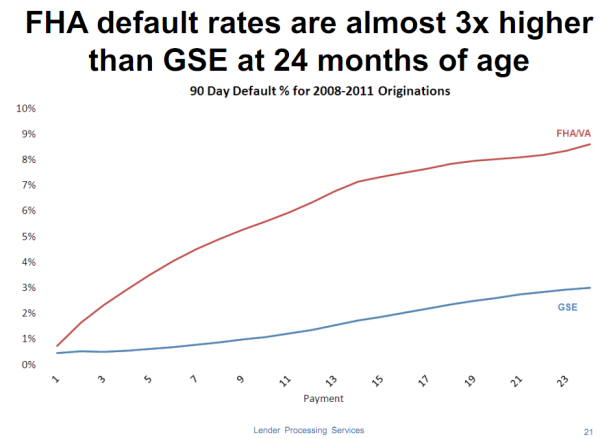

I thought these were safe loans? Apparently the data shows otherwise:

Source:Â LPS

Make no mistake that FHA insured loans never played a big roll like they have since the housing market imploded. FHA loans were always a tiny sliver of the market. That is until the market used FHA insured loans as a stop-gap for the vacuum created by exotic mortgages imploding. Today in California roughly one out of every three loans is of the FHA variety in a state that is still largely facing pocket bubbles. Yet I think this is simply a symptom of a bigger issue. Households are strapped for cash and the only method they can keep the gig going is by jumping into large amounts of debt. I think this is why so many people fret when talk of higher down payment requirements are mentioned, especially those with industry ties. Yet when things go bad the taxpayer pays the bill, not the gambling speculator banks. Who is paying for the major failures in the banking industry? You think it was free to save Fannie Mae and Freddie Mac? You think the investment banks of Goldman Sachs and Morgan Stanley would still be standing without the government stepping in? Would you lend your money to someone with only a 3.5 percent down payment for collateral on say a $500,000 2 bedroom home? It still seems like we have a large part of our population living in the “other people’s money†universe.

The upcoming new home buyer is more reluctant and less affluent

I was examining data by the Federal Reserve this weekend and found this data on first time buyers rather fascinating:

Source:Â Federal Reserve

This is really interesting but also strikes at the core of the down payment debate. Between mid-1999 and mid-2001 17 percent of those between 29 and 34 acquired a mortgage for the first time. This is the prime age for first time home buying. But look what happened between mid-2009 and mid-2011. During this time period the rate fell to 9 percent. What happened? Well the recession has hit the younger part of our country much harder and many of these people are saddled with mountain loads of student debt.  The first time home buyer has been crushed and this is usually the juice that keeps the market going.

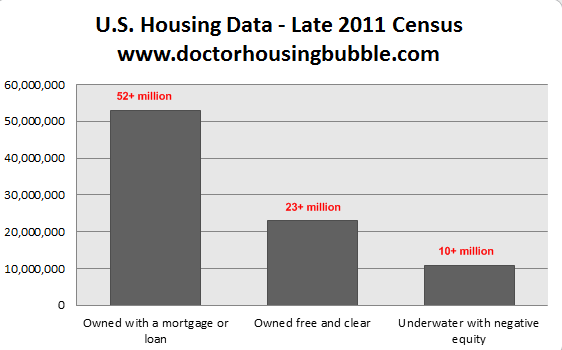

The property ladder game only works when housing values keep going up. But we have over 10,000,000 Americans underwater at this point:

How many others are close to negative equity? So whenever talks of down payment requirements perk up those in the industry largely understand that the balance sheets of many are flawed. Think of what is currently holding the market together:

-Artificial low mortgage rates (rates so low that we have never witnessed them in over a generation)

–FHA insured loans that require only 3.5 percent down

-Government backed loans largely the only game in town

-Bailout and gimmicks keeping the banking system running at the expense of the public

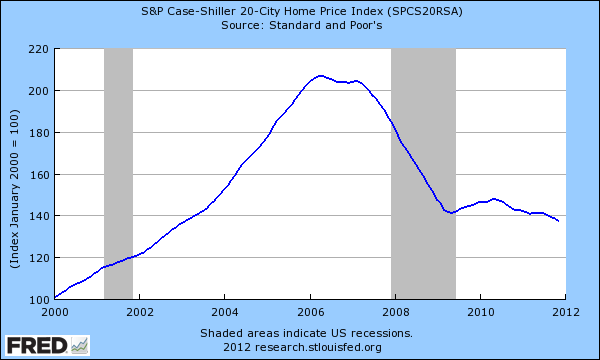

The assumption is never made that home values are simply too expensive relative to household incomes. More and more gimmicks are layered on top of each other like an ever growing debt cake and in spite of that home prices continue to make post-bubble lows:

Dean Baker makes a good point regarding the studies advocating for a continuation of low down payment government backed loans:

“(CEPR) I know of almost no planet where a slight increase in the cost of getting a mortgage will shut out 60 percent of creditworthy borrowers. On my planet, we just had a horrible housing bubble burst and wreck the economy for a decade in large part because banks were able to pass on junk mortgages at no risk. This is an incredibly modest provision that will have no impact on creditworthy borrowers.”

At this point in the game, anyone can jump in and grab a mortgage with very little down and a decent job. So if someone has a massive emotional need to buy, they have every path open to them. Yet home prices are going lower for more complicated reasons. Psychologically these people don’t jump in to buy (sales figures are still low) because they understand the above arguments. Where is the big income growth going to come from for these new buyers to sell their home when they try to play property ladder?

I completely agree with Dr. Baker’s assessment. Given a decade of stagnant wages, 5 million households with a foreclosure on their credit report, hundreds of thousands with short sales on their credit report, and a younger and less affluent crowd how many creditworthy borrowers can actually pay inflated home prices in many cities around the country? The fact that so many worry when even a 10 percent down payment requirement for a government backed mortgage is mentioned should tell you something (and look at how badly the FHA is now doing with those 3.5 percent down loans). You also have to ask, if there were so many creditworthy borrowers out there why wouldn’t banks simply write private label mortgages and keep the notes on their books? Banks are basically laundering government backed loans through the GSEs and collecting fees along the way and cheery picking prime loans to keep on their books. Given how little this is now happening with private label mortgages, there are very few cherries to pick.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “The down payment boogeyman – report finds requiring a 20 percent down payment would push out 60 percent of borrowers from qualified residential mortgages (QRMs). Those 29 to 34 acquired a mortgage for the first time in 1999 to 2001 at a 17 percent rate but that rate is now down to 9 percent.”

I don’t understand who’s underwriting all of the jumbo loans I see on houses that go pending within two weeks. I also don’t understand how the appraisals on these homes once again seem to jibe sol closely within four or five thousand dollars of the sellers asking. Some of these same houses were falling out of contract last year, which tells me that credit standards have been relaxed significantly since then. That, along with the lower interest rate has fuelled a mini-mania in my neck of the woods.

It’s uncanny to see the number of 5-800 K houses (which were 300K houses *if that* just seven years ago) getting snapped up.

I’ve been wondering the same thing in regards to the coastal area in NorCal where we are currently looking to buy: who the heck is buying up all these homes? Almost every reasonably priced home in the 500-850K range goes pending within a few weeks. We are looking in the 500-675K range, make a very good income by CA standards and have the luck of having wealthy parents who can help us with 20% down. Apparently there are many other families like us?

Apparently…but that does seem an oversimple conclusion. I think it’s innumerate buyers enabled by ________ facility to overpay.

It’s maybe more agonizing for me as the houses I am looking are clearly overpriced. What’s more, I haven’t any rich parents or benefactors, paid my way through school and saved the money for a place when I would rather have been funding other projects or pursuits.

thanks to fha loans to “afford” a 725k home in ca all you need is 100k in annual household income and a 20k downpayment. so yes there are lots of households that meet this criteria.

^Steve – are you exaggerating? This can’t possibly be true…I earn $120k/yr and could make that downpayment and there’s no way I believe I’d be approved for anywhere near $725k. Even if I did, the PITI would be $4500 when my take home pay is about $5k/mo after taxes and 401(k)/insurance. There’s just no way a bank could possibly approve that…

I hate to be the one to inform you but the Bay area has a shitload of very very wealthy people. Having only enough for 20% down on a ~500-600k house would be considered laughable.

If 20% down payments are laughable in the Bay Area because of all the wealthy people then why is it that any time the FHA loan limits are brought up be allowed to return back down to normal, doom and gloom is predicted. Are you saying that if the FHA loan limits were allowed to fall, with the FHA currently providing such a large percentage of loans these days, that there would not be an impact to housing prices because 20% down is laughable for a $500k-$600k house? I would contend that those wealthy buyers you speak of, have no interest in the houses being offered for $500k-$600k.

Actually Blahone, you are incorrect and cannot generalize about “The Bay Area” because it’s very large and diverse from zipcode to zipcode. In Santa Cruz where we are currently in escrow on a property in the 500-700K range, the median income is something like 79K annually, with only about 34% of people making over 100K. We happen to be in the top 5% of incomes here and yet we are buying a home that is below average the average sales price of 600K. (And yes this is a coastal and desirable area.) Like I said, we have help and could theoretically put down more cash but why would we? Contrary to your statement that putting down 20% is “laughable” on a house in this price range most homebuyers here are actually not putting that much into a downpayment. 500k-600k is considered mid-low tier around here. Most people are buying more expensive homes with less down and less qualifying income…STILL.

lady6, San Francisco has a *median* family income of ~ $81k. We all know that isn’t telling of the wealth of the people living there. You need to look at other metrics. You can argue all you want , you already have the proof – you’re unable to buy a house.

According to Zillow it is closer to $50,000 Median Household Income.

http://www.zillow.com/local-info/CA-Santa-Cruz-people/r_13715/

People seem to believe that everyone is rich because they “look/act†rich…

According to Zillow SF is closer to $55,000.

http://www.zillow.com/local-info/CA-San-Francisco-people/r_20330/

Where is everyone getting these numbers from?

According to the Census Website SF $71,000. This is for the last 12 months in 2010 dollars:

http://factfinder2.census.gov/faces/tableservices/jsf/pages/productview.xhtml?pid=ACS_10_1YR_S1903&prodType=table

According to the Census Website Santa Cruz is $61,000 for the last 12 months in 2010 dollars:

http://factfinder2.census.gov/faces/tableservices/jsf/pages/productview.xhtml?pid=ACS_10_1YR_S1903&prodType=table

Whoa, spam much? Wikipedia:

“San Francisco 2007 Median family income is $81,136,[145] ”

http://en.wikipedia.org/wiki/San_Francisco

BOOYAH. Either way you’re really trying to tell me because your # of SF Median Income ~$55k or whatever, you really think there aren’t any rich people in SF? Spare me. Your $120k income won’t allow you to buy a $500-700k house anywhere.

I have a couple of observations:

First, how do all of these folks expect to retire with saving s of 5% or less? My math indicates that a couple in California will need roughly $1,000,000 – $2,000,000 to retire at 65 in the next 20 plus years assuming that there is no pension.

Second, GDP is the focus of our federal government and the last time I checked savings does not directly increase GDP. So, our federal government makes it as easy as possible to consume and as difficult as possible to save.

Third, what happens to all of these underwater or close to underwater folks when they lose a job and get an offer in another area? I have heard many state that they are ok buying a house that may be underwater in the short term because they are buying for the long term. What happens if that “stable†job ends up not so stable?

C’mon, people don’t retire in the old fashioned sense anymore. Those days are long gone.

Well, normal people don’t. If you’re either (a) one of the 1%, or (b) a public sector union employee who gets a pension that private sector people can only dream about, then sure, you can retire.

I know I sure as hell will not be encouraging my son to get a professional education or work in the private sector economy – you’re much better off starting a union job at 18 from which you can retire at 75% of max annual income (work a lot of overtime for a couple of years to ensure you end up at 100% of your regular salary) plus gold plated benefits at 48.

I think you will find that companies that tolerate this level of indulgence will not be in business for very long. The pension probably won’t be good for much.

Please try and find a cop or firefighter making under 100K per year (NOT including benefits) in California. They are rare as sighting a Condor in Bakersfield.

I got a good chuckle at the table showing how those poor cops and firefighters have an uphill battle saving for a downpayment. That may be true nationally, but NOT IN CALIFORNIA. I’ll go on a limb here, any safety officer getting the 3@50 retirement plan is part of the 1% period. Not to mention gobs of overtime and the huge number of people filing for disability that makes a big part of your pension tax free…oh, and don’t forget the lifetime free healthcare too.

Don’t be fooled by the stupid political ads about your “poor” cops and firefighters, not in this state. The politicians are nothing but puppets for their powerful unions…I think the general public is finally waking up to this.

Oh please, that propaganda from Faux Noise is getting tiresome. And your off the wall comment that these working class union guys are entering the one percent is beyond ridiculous. I wonder if you even know what 1% is. Here from Wikipedia: n 2009, the average income of the top 1% was $960,000 with a minimum income of $343,927. And from indeed dot com: Average Firefighter Salary in California: $62,000. Peddle your venom somewhere it’s wanted please like a snake pit.

It’s true. I live in an apartment across the street from the beach. As I type this, I can look out the window and count one, two three, four, five…yes, five properties all owned and/or lived in by CA firefighters. Only one is still actively working, the rest, all retired.

They are all nice guys and great neighbors, but yeah, they all live in nice homes within a block from the ocean; most have an ocean view. Nobody seems to be struggling here.

Sorry Wydeed, I must have hit a sore spot there. Love the faux news comment too! Let me guess, you are a bleeding heart liberal looking out for the “working man” that includes cops and firefighters. Do you also drive a Prius around with the Obama bumper sticker and probably still mad that Keith Olberman got booted off MSNBC?

Maybe my math is off in my 1%er comment…but you know and I know that anybody retiring in their early 50s with a 6 figure pension, cost of living adjustment and free healthcare for life is truly riding the gravy train for all it’s worth. Don’t give me any crap that it’s not true, in California this is the norm not the exception. I may have to lump the cops and firefighters in the top 3 or 5%…maybe you can check Wiki to see what category they fall into. The truth hurts my friend…

Wyeedyed- There are a lot of conservative yo-yos on this site. It’s good for info., but the comment section is full of uptight right-leaning head-in-the-sand Rethugs and Libertarians (I hazard to guess…).

One more thing wydeed. Your 62K yearly income for firefighters in CA includes part time employees. Hmmm, that number sounded a little suspicious to me.

From government-pay dot findthedata dot org, average FULL TIME California firefighter pay is 116K/year. Wow, that’s a big difference!

Throw in the copious amounts of overtime, gold plated cadillac pension and benefits package and bulletproof job security and you now see my side of the argument.

Not to mention the double-dipping of pensions. I know of a retired firefighter that is collecting his pension and got another government job as a school bus driver. He is an in-law of my sister. Over a poker game on Thanksgiving, he told me how he is going to double dip the pension system. His is not an isolated case. Some government jobs provide full retirement benefits after 20 yrs, or “buying time” and retiring with full bennies after 15 yrs. What the hell else are you going to do when you’re under 50 and too young for the rocking chair? Game the system of course.

I get a kick out of all these folks in town who think teacher’s, firefighters, and policemen are under paid. But I don’t want to call them over paid either. Government works tend to of had some resounding virtue to get into the system and some intelligence to stay in the system, most folks outside the government worker system don’t really understand how easy the ones in the system have it, I am a government work, and my job is not hard and doesn’t take a lot of intelligence, I make approximately $135K plus benefits with a 2.7% at 55 CalPers retirement system, I work 32 hours a week on average because of vacation, personal leave, and a holiday schedule I could only of dreamed about when I was busting my rear end in the Silicon Valley. I retired once in my mid 20’s and take in $250K from my investments from the hard days. Traveled the world and came home, I needed a job for something to do with my time. Yes government workers are over paid, many of the folks that I work with would not be able to make it in private enterprise, but they thrive within the walls of government- I know if the economy does recover people will once again take their focus off of the wages and benefits of government workers

if you got to ask “how much is it?” your not a 1%.

If you are someone who thinks that our country’s problems are caused by unionization, you are ignorant and propagandized beyond help.

I beseech you to move to a country without unions since they must be so nice. Take your pick:

Nigeria

Mexico

China

India

Haiti

Gee, mister, those don’t look like very nice places to live… maybe you can stereotype “bleeding heart liberals” some more, though?

californian, your list contains some countries where there is no rule of law. Are you trying to say that unions must be prevalent to have a “nice” country with rule of law?

I have one for you…how about Greece. Unions were king there. How’d that work out? :):)

Overlooking the fact that unions weren’t the problem in Greece but rather decades of corruption crossing class barriers, I’d rather be living in Greece than any of those nations. Do you hold a different opinion?

And please, illuminate me – which of those countries lacks rule of law? I don’t think that term means what you think it means.

Ok Californian… what does rule of law mean… One other question, where are you from…

You could easily look it up yourself, but here you go (from Wikipedia):

“The rule of law is a legal maxim that suggests that governmental decisions be made by applying known legal principles.”

Again, what listed country does not have a legal system? You can argue that there is selective enforcement of laws, but then you would be admitting that the USA has never implemented rule of law effectively, either.

I think it’s pretty obvious where I live.

My first question was supposed to be sarcastic… In the second question, I didn’t ask where you live, I asked where are you from.

Californian, I usually don’t respond to buffoons like you. I have decided to oblige you with a few minutes of my time.

First of all, where did I say that unions were “bad.” If you could please point me there, that would be great. Thanks in advance.

I really don’t have a problem with unions. I have a MAJOR problem when corrupt politicians conspire with corrupt unions to rip off taxpayers. My little example of the CA public safety 3@50 plan is perfect example of this. Remember, this whole argument started with cops and firefighters being overcompensated in CA…not only grossly overcompensated but outright ripping off the taxpayers. Since you like defending unions so much, step up to the plate and defend the egrigous 3@50 plan. I dare you…ball is in your court!

Am I crazy or when times where good and money was everywhere, people scoffed at working a government job. You could make twice as much money working in the private sector. Now that the economy is in the sh!itter, teachers and post office workers are all the sudden what’s wrong with America. And all the cops and firefighters making over 100k, aren’t they 40-50 years old? Doesn’t the system favor the middle aged and old, and the younger folks in these professions won’t have as great of benefits (concessions made by the unions these past years when re-negotiating contracts). I guess I am ambivalent about putting cops and firefighters in my crosshairs. At least they had at one point put their lives on the line for years. Wall-streeters getting multi-million dollar bonuses for making real money from virtual money, that gets me boiling.

Nope you’re sane. But it won’t go over well with those bent on scapegoating unions, the working class, immigrants, etc.

Yes, apparently theres been a mass irony bypass, amongst some of these Authoritarian personality types, who become incandescent with rage, about less than 20% of the working US population that still belong to a Union.

Yes, fighting the good McCarthyist fight from 60 years ago about TEH EBUL UNIONS eleventy!?!?! is our most important concern.

Oh, well, that and ensuring us womenfolk stay barefoot pregnant and uneducated. Obviously.

Meanwhile we live in an age of Citizens United, where “corporations are people too, my friend’ and the position of POTUS can be bought and paid for by the seven richest men in the room.

But no, Unions are the problem.

Seriously, someone making a living wage and retiring on a decent pension – after 25 years of delivering my mail, running into burning buildings, hosing RTAs off of the sidewalk and instilling the difference between subjunctive and conditional tenses to little Timmy – is our worst problem.

If only we can take away those hard-fought rights of those lazy ignorant Union workers, then we’d all be living in a Utopia! To Infinity and Beyonnnndddd!!

Please tell me how union bashing is germane to a housing blog?

{/snark}

Ahhh, what’s wrong with this country?

Idiots like this.

“Law enforcement”, “firefighters”, and “ecducators” need to be front and center in the cross hairs.

They are over compensated through forced payment of tax dollars.

A Wall Street Journal article from July 2009:

New Evidence on the Foreclosure Crisis

Zero money down, not subprime loans, led to the mortgage meltdown.

http://online.wsj.com/article/SB124657539489189043.html

When “affordability” is high, appreciation is low. That’s how it supposed to work. But the highest correlation to default rates is whether or not a home is underwater on its mortgage. So 20% down or not, a bubble loan is a loser.

Zero Hedge has an interesting article “Extend & pretend comes to an end.” The real estate section is particularly pointed in it’s critisism of the banking sector.

Yes this is an especially important view on real estate cash flow. ZH article below:

http://www.zerohedge.com/news/guest-post-extend-and-pretend-coming-end

Great article! I did not know about the new FASB. Now it makes sense why there are more and more short/foreclosures on the market.

Doc, you could not be more correct in your assessment. Great post. Few people can afford 20% down at current home prices in the nicer areas. This can only mean one thing: home prices are still too high. Keep up the great work, Tom in San Diego

We got to these prices through ponzied equity being rolled over 3 decades (as interest rates dropped) and ridiculous credit speculation combined with ridiculous buyer speculation. Incomes had nothing to do with it, but they sure as hell have a bearing on cash savings people have (run that regression), and this is why 20% down payments are so “infeasible” right now.

Here’s the deal. Precious few people buying a $500K house can write a check for $100K. Those people are buying $1m+ houses (probably make $200K range combined at best). The $1m house requires a $200K check, and those people are living in $1.5-$2m houses (they make $350K for the most part I guess).

Note how incomes don’t get you to enough cash savings or proper multiple to afford the current home prices. The demographic/interest rate appreciation scheme is OVER. The credit bubble is OVER and even torching the FHA and agencies can’t bring it back.

I don’t see any way to avoid the middle-high end taking a hit this time around, not super lux high end but certainly the developments stuffed with $1-4m homes. The incomes are just not there and never were.

I recently attended a networking group were a very well known real estate investor in the California market was explaining “the folly of the 20% down-payment philosophy.” His point against 20% down was that the underwriting is much more important that the down-payment and should therefore, be the focus of new legislation.

I disagree with this philosophy, and here is the why..

What is the best leading indicator for foreclosures?

Is it unemployment? Is it over-stating your income on your loan docs? Is it saying you are going to live in a house, when you plan on using it for a rental?

NO…

It is negative equity.

However, here is the article with the data the the well-known real estate investor was using to prove his points, that down-payments do not make a difference. I would like to know some reader’s thoughts.

http://www.communitymortgagebankingproject.com/news/03_07_2011_PR_QRM_Downpayment_Data.pdf

“Mandatory down payments like those being contemplated by U.S. banking regulators are not a significant factor in preventing mortgage default compared with a comprehensive set of quality underwriting standards, according to a new analysis of 33 million home loans originated between 2002 and 2008, the Community Mortgage Banking Project (CMBP) said today.”

All you need to know is the study was funded by CMBP. Everything after that is to support whatever is in their best interest. Morals and truth be damned.

I’ve mentioned this many times before but no one I know (co-workers, relatives, friends) who has bought a home in the past twelve years did so without either inheritance money or help from their parents in paying the down payment. People without such access to financial aid did not buy a home even with the creative financing available. Home prices are too high to be supported by local incomes alone and have been for quite some time. They either have to go down significantly or there needs to be massive wage inflation to support the high prices….which will never happen.

Rode the ski lift Saturday in vermont listening to an RE agent try to sell a new 400,000 condo/second home, and his “clients” were unhappy that they had to come up with 30% down for such a frivolity. I just had to keep my mouth shut – I was there to have a good time.

“At this point in the game, anyone can jump in and grab a mortgage with very little down and a decent job. So if someone has a massive emotional need to buy, they have every path open to them. Yet home prices are going lower for more complicated reasons. Psychologically these people don’t jump in to buy (sales figures are still low) because they understand the above arguments.”

Spot on, Doctor. This completely describes my thinking! My wife and I have saved fiercely for several years, with ALL of our expenses paid from one job (and this after 15% to 401K and max Roth IRA contributions). All of the net income from the second job goes into savings. We could come up with a 20-30% down payment easily, but why would we want to tie our hard-earned savings to a sinking asset? We currently live in a comfortable 2bd apartment in the SGV. If/when a baby comes along, we’d rather rent a house than buy at the current prices.

Also, unmentioned in the article is the insanity with regards to FHA limits for So Cal. Just like 3.5% down FHA and artificially low interest rates, these insanely high FHA loan limits for LA and OC cty’s is juicing the market.

FHA loan Limit

Riverside County $500,00

San Bernardino County $500,000

San Diego County $697,000

Orange County $729,750

Los Angeles County $729,750

In a sane world, assuming 3.5% down ~~ lets go for a risky 10% of total, the limit should be around $350K, but instead as you rightly point out, we’ll just have to hold our ankles a little longer, and a little tighter.

I think there is a fundamental misunderstanding of the mindset of those who bought before and even during the bubble, and the legislation allowing them to put so little down and still get a fannie-freddie finance sweetheart loan deal. The reason that matters, is that the same psychology and accompanying action of the banks/legislators is supposed to “save” the FHA, and all the recent buyers even in a sinking market. That force is inflation. For forty years we have had rampant inflation. The banks profit nicely from creating the inflation. The endless inflation greatly motivated people to buy homes and thus create nice banker’s fees on every sale; and with inflation, even the most imprudent loan was ultimately a “good” loan even if the property is liquidated as it goes up with inflation while the loan doesn’t. That psychology and action on it by the fed, continues. People bought in the bubble because inflation was guaranteed; and might worsen (thus pushing up the home value regardless of cost to buy). All current policy and overspending and money printing is aimed at continuing the endless bubble of inflation…leading to higher wages in theory, higher social security for those pesky seniors who vote, lots of bank fees and ultimately, the total societal desire to own at least SOMETHING that is inflation proof. Nothing has changed, absolutely nothing, and at some point all that money printing is going to hit with 5-15% per year inflation, possibly hastened by China continue to buy energy and food. Think on it, if you read this, find one person who doesn’t think we face ENDLESS inflation in the next thirty years; there’s the ultimate, saturation factor of action and psychology. The housing bubble merely overran the inflation temporarily. All the same characters in charge continue to force inflation and no down payments, because it makes them rich. As long as that money-printing by the Fed/govt psychology remains, and the country is run by Wall Street and its wholly owned politicians, they do and will believe, and expect everyone else to believe, that despite this bubble, the housing prices will level, then burst up. Well, that and 20 million added Americans in the last ten years or so, population growth/immigration encouraged in part because it is pro-inflationary (while helping to keep wages to the lowest groups fixed and their unemployment high).

The money printing is virtually guaranteed.

Money in our economy is a zero sum game, counterfeiting and money printing notwithstanding. The money supply is collectively owned by government + private + foreign. We already know that the foreign owned portion grows every year from our trade deficit.* This amount must be correspondingly deducted from the private + government = domestic wealth. In order for the private sector to become more wealthy than it currently is, the government must borrow or print enough money to equal the trade deficit plus the amount by which the private sector is to be enriched. It is, in the end, basic math. Thus, in a trade deficit, in order for the private sector to become wealthier, the government must borrow.

How will this play out? In a struggle for wealth between the government and the public, the voting public will win every time. This is why the Tea party will ultimately lose. Likewise the Gold standard people will lose, because moving to a gold standard would prevent money printing, forcing the government either into bankruptcy or impoverish the private sector desperately, or both. Think Greece, which can’t print its own money. In a similar vein, we will not live up to our healthcare or social security commitments to the elderly as we have in the past, because we can’t afford to. If we do live up on health care, it will be because the profit drains out of the industry, perhaps because it is nationalized, or goes to a more centralized high throughput, low cost model — Imagine surgery factories using assembly line techniques. They do this in India and get better outcomes than US averages.

*To the extent that such figures accurately represent the real balance of trade. I don’t think they do, for something like a iPhone.

Be careful when you speak the truth like that, a price gets put on your head. You’ll notice our flamboyant “leaders” puposely deny or ignore the FIAT problem>>they are puppets, or ignorants.

Housing is too expensive for worker incomes. This is largely due to the type of homes constructed in the past several decades, which were much more house than average people were used to previously. Contractors like it since it meant higher profit for them, and mortgage lending practices accommodated much of this transition rather than rising incomes. Many of the people now living in MacMansions would have been living much more modestly and affordably instead, as their parents did. Living beyond one’s means has become institutionalized, and it is now considered an entitlement. This was unsustainable and was bound to implode at some point, which it did. It’s not a model that the US can go back to sustainably. But no new model is yet being considered, as contractors and banks look forward to continuing business as usual as soon as the recovery begins in earnest. Will that come? If it does, the next crisis is baked in.

MY 2 cents from San Diego.

I have been looking for going on 3 years now, my resolve may be my undoing.

Anyway, despite my commons sense telling me lower prices are to come, I see declining inventory and price appreciation where I am looking. It may not show up in Case Shiller for a few months but FEB. 2012 is an up month in San Diego.

I’ve noticed that too with the areas I follow. I haven’t seen price increases; however, inventory gets snapped up quick. We have just entered the “spring buying season” that traditionally gives the market a bounce. I certainly hope the majority of the sheep aren’t buying into the “strong economic recovery” that is underway.

We’re getting closer to the bottom as time passes. Many people on the fence might be deciding that it’s simply not worth waiting another ______ (insert your time in months or years) if their financial situation makes sense. We’ve seen this before two years ago in spring 2010 when the government offered the home buyer tax incentive…how’d that work out for those lucky buyers? 🙂

Here in lovely Culver City, both inventory and prices are declining. I would estimate the average age here for single family residence dwellers at 65. Most of the under 40 crowd live in apartments or condos. Running errands on weekends, it’s unusual to see anyone under the age of 30 in Culver City’s SFR areas, but lots of people well over the age of 60.

Declining inventory could be due to the plus 60 crowd pulling their houses off the market because the market values of those houses have declined to a point where it is no longer attractive to sell the house. For those who have no savings, they were counting on the sale of the home to fund their retirement. With interest rates on investment accounts near zero, any proceeds from selling their home would immediately begin drawing down.

Same here in OC. Strange to see the properties I’ve tagged getting sold for more than what I would offer in shorter time period than I’ve anticipated. I guess if the property is in good location and reasonably priced they will sell. I feel like I’m missing out but then I see all those stores (Lowes, Ralphs, shops inside malls) closing in my neighborhood and think I’ll let someone else catch the falling knife…. I sure don’t want to throw away my savings / down payment due to further price depreciation…

Absolutely agree – I see the same thing in TO. Inventory is ridiculously low such that I don’t see prices falling much even though everything is still overpriced. Anything below $700K is snatched up within weeks (supposedly with multiple offers but who knows if that’s true. From what I’m seeing lately I actually believe it). I went to an open house last Sunday for a place listed at $780K and there was a line to get in the front door. You’d think they were giving these places away for free! It’s very depressing, feeling I’m going to be renting forever! And yes we actually have 20% to put down or more!

renting in VC

You live in my area, and I can’t take this much longer. We are noticing many sellers are really in a pre-short sale stage, trying to get what they owe+, so they can walk away with a clean FICO. One home went on the market, and was off market in one day. They were using the SS to leverage a deal with the bank. I am licensed, so I hear a lot of the “dirt”.

T O isn’t worth what it was 20 years ago. The area is declining in demographic quality. They can keep their overpriced pos.

@ Mad as Heck

I’d imagine you hear and see a lot being licensed.

I know a couple currently in escrow short selling their house and at they same time they are also in escrow buying a house in the fancy pants part of town for even more money then they originally spent on the home they’re now short selling!?!? Tell me how is that even possible? And to top it off, the home they are buying – and yes, they are already 2 weeks into escrow – it is not even listed on the MLS. Hubby is also a RE agent… I wish I was a RE agent these days! I can’t even find a house to buy with perfect credit and 20% down!

Also the frustration with inventory goes beyond the absurdly low level of inventory. Furthermore, what is available on the market – especially in TO – isn’t anything I’d buy even if they knocked down all the prices 20 – 30%. Most available homes seem to be on a busy street, backing to a busy street, or are just a stone throw from a freeway (take your pick, the 23 or the 101). You’re not the only one out there who is mad as heck!

renting in VC

Turn in those sob’s for doing a buy and bail. They are gaming the system, and I personally want those people to serve time.Their realtor should have a complaint against their license. (Ca Dept of R E) Bust the Agent, too.

I hear you on what noise infested/& or bad location homes are left for us responsible home buyers. We’ve seen way too many of those pos, ourselves. The last 10 regular sales we’ve passed on were not quiet home/yard scenarios.

We use to live in a big Wood Ranch w/ view home. I would never ever entertain a McCr*p box again. We had a smaller one as a first home, too. Two-Story Jungles (even w/ big lots) HOA PUDS suck. And don’t get me started on what these a-holes consider an upgrade, is just plain old maintenance.

We’re a cash and close, and I’ll tell you, prices are still way too high. This area is starting to turn us off. So Pasadena is our ideal town, but $1.4M for a decent smaller home is just insane.We have cash, FICOs in the 800’s, no debt, and we feel punished for our together lifestyle. This is punishing us responsible folks. (We came from dirt poor childhoods. No one gave us “c”hit. We earned it.)

Glad I’m not alone. I’m seeing the same thing here in Long Beach.

Anything reasonably priced in a good area is gone before I even get a chance to see it. Almost seems like agents are hopping on these before they hit the MLS.

Most of the ones I have been able to see are on a noisy street, foreclosure flips or extremely overpriced.

Went to an open house this weekend. They already had an offer and the house probably needed another 30-50K of upgrades (original 1940s bath and 1970s kitchen).

I have a feeling there are quite a few of us out there that have been saving, waiting for falling prices. With the limited available inventory, we’re stuck fighting over scraps.

But the prices still feel like bubble prices to me. Are banks holding on to short sales to keep inventory prices up in hopes of increasing short sale prices? Cause I still still a lot of short sales listed with 100+ days on the market.

Is this article even relevant considering how a loan is TRULY funded via credit entry…… The banks never had anything at risk . There is pretty much ZERO chance of a seller taking cash and redeeming the FRN notes at the FED.Banks are simply shuffling digits. AGAIN ! No bank capital was ever at risk. A larger down payment does nothing except extract more substance from the economy.

Great article from the Dr. HB like always. I’ve been following this post for several years and I’m in a very similar situation like all of these well disciplined readers, 20% down, excellent credit, and looking for good neighborhood with value in mind. What I’ve seen lately is complete garbage going for $430k-$475k here in South Orange County. We are talking stock homes built in 1972-1980, so they need at least $60k to bring them up to today’s standard. However, I’m semi emotional because of the clown Bernanke holding rates low for the next three years and FHA encompassing a larger percentage of homes. I really want to be patient and wait for prices to become more inline with wages, but it seems like the bankers will win this battle and next thing I know, it’s 2004 all over again with $550k homes and 6.5% interest rates. I placed a full bid offer on a Mission Viejo house (1890sqft single story) a few weeks back ($450k), letting the selling agent have both commissions, I later found out that someone outbid bid me with a $480k offer. This house also has an $80 a month association. This was not gem and it needed at least $15k to repair cracks, wood trim and other finishing necessities. To make matters worse, it sounded like they were not a 20% buyer, but somehow qualified for the house with FHA down payment requirements. Obviously down here people are going crazy and making full price offers of complete fixers for well above $400k. UGH!

Lord Blankfein

wrote:

Sorry Wydeed, I must have hit a sore spot there. Love the faux news comment too! Let me guess, you are a bleeding heart liberal looking out for the “working man†that includes cops and firefighters. Do you also drive a Prius around with the Obama bumper sticker and probably still mad that Keith Olberman got booted off MSNBC?

Maybe my math is off in my 1%er comment…but you know and I know that anybody retiring in their early 50s with a 6 figure pension, cost of living adjustment and free healthcare for life is truly riding the gravy train for all it’s worth. Don’t give me any crap that it’s not true, in California this is the norm not the exception. I may have to lump the cops and firefighters in the top 3 or 5%…maybe you can check Wiki to see what category they fall into. The truth hurts my friend…

Hello? Yes, there are excellent govt pensions. Workers for utility companies also have very good pensions. Managers as Sears when I started working had it even better. The manager of the Sears I was at drove a rolls and one sales dept lady had hundreds of thousands of dollars in profit sharing – that was in the sixties. But I digress as American workers slide down into the muck of robber barons the wealthy get wealthier. Funny you don’t reference those statistics.

But what you do is not deny a love for faux news while you attack me calling me what to you is a dirty name. Robert Graves had a poem with lines about love coming in the letter charged overweight. My impression your post in reply comes dripping with the venom of jealousy. Or perhaps you really are a Lord, in this case a business magnate who wants to throw off the yoke of all fairness and regulation so you roll in money like scrouge McDuck. Defense much? In your world god forbid that a working man should have a good life, the thing reserved for Wall St bankers.

You may want to go back to the last DR HB article regarding how little $100,000.00 income will buy in major Calif cities.

Wydeeyed, I am totally confused by your post. Yes, in the 1960s almost every company had a pension for employees. Today, virtually no private companies have them because it is a cost they simply can’t control and they need to stay competitive unlike public sector counterparts. I’m sure you are also aware that Calpers (CA employee pension program) assumes a rate of return of 7.75% forever…any shortfalls will be made up by the tax payer. Huh, how can this even be legal? Why not assume 10% returns then?

You started the mudslinging with your faux news comment, I answered in kind knowing exactly what you represent. And for the record, I despise both Dem and Repub parties. You obviously have an allegiance to one of them. Both these parties and their loyal followers are responsiblle for flushing this country down the toilet in the span of 50 years. The leaders of these parties are nothing but whores who will sell themselves to get votes and have power…forever kicking the can down the road on tough decisions that need to be made to right the ship.

Keep up the rhetoric, the sheep get dumber and the hole gets deeper every year! 🙂

You sir, (or madam, I care not) are a buffoon. I suggest you learn the parable of ‘the crabs in a barrel’. Unless the 1% take steps to alleviate the situation, the Blankfeins of the world will find themselves rightfully at the end of a gibbet.

Yeah, heaven forfend those that pay into their pensions for the span of their careers should be able to retire comfortably and without worry…

I ‘m always surprised by the attitude, that if someone has something good, there will always be some sad sack that wants to pull everyone down to their level of misery.

And, yes, you do sound envious Lord Blankfein. And mean spirited.

Can you please stop confusing me with your facts! I prefer to remain ignorant… I want to talk about how I feel. I want to make decisions based on fantasy and expect the government to rescue me when I lose. I do not want to hear how state and local government appeased unions and artificially balanced budgets by promising future benefits in lieu of current pay raises. I do not want to hear that the chickens are now coming home to roost…

Weinerdog43, I wouldn’t worry about the Blankfeins one bit, they are a protected class. Afterall, Goldman Sachs was the largest donor to the Obama presedential campaign. If you can’t beat’em, buy’em! Even Obama won’t refuse money from evil, wicked, wretched, crony capitalism central Wall St. 🙂

Speedingpullet, you obviously have not been paying attention to the issue of bloated public sector pensions. They are a problem now and will be a MAJOR problem in the not so distant future. I am not envious of these pensions, I am irrate…you should be too if you are an ordinary tax payer in this state.

You say “Yeah, heaven forfend those that pay into their pensions for the span of their careers should be able to retire comfortably and without worry…” I have no problem granting a pension to someone who pays into it and the payout is a fair amount.

Here is where the math lesson comes to play…pay attention. If a cop/firefighter retires at 50 and collects a 6 figure pension plus COLA plus free healthcare for life (which many people are currently doing) and collects this for the next 30 to 40 years…how percent of their pay would they have to contribute to make this sustainable? Math says about 50% along with decent investment returns. Do you think any cops or firefighters are putting 50% of their paycheck into their pension account? I’ll answer that question for you, NO. That’s where you the tax payer come in to make up the shortfall. Isn’t that a great system! 🙂

Lord Blankfein,

Though I generally support collective bargaining, I must agree that the process is flawed when it comes to public safety employees. Our political discourse is so wrapped up in hero-worship of anything in uniform that a politician will always gain stature aligning him/herself with our brave troops or our brave policemen/firefighters. The payback comes when contracts are negotiated and said politicians are on the hook to approve all manner of benefits. In the private sector management has a built in incentive to be aggressive in negotiations with labor as any concessions will come directly out of their pocket. No comparable incentive exists for public sector managers and I believe this distorts the process and has resulted in the public/private benefits imbalance we see today.

That said, I think you overgeneralize by suggesting that all CA public sector employees have similarly generous compensation/pension packages. I have some good friends who are community college professors and the pension formula for them is something like 1.5% of salary x number of years worked. Still somewhat better than the private sector, but a far cry from the gold-plated 3% of public safety officers.

So I do think that demonizing all public sector employees as pigs at the trough is inappropriate. Furthermore it is counterproductive. The public sector is a large constituency and making them all out to be bad guys won’t get nearly as much political traction as would isolating the “big pigs”. Even many public sector employees would agree that police/firefighter/prison guard pensions are excessive. That’s where to start.

Lord: A+ The touchy-feely folks skipped math class. In my world, I save a dollar for retirement, i get a dollar. In my Brother’s world he contributes a dollar to his pension and gets $10. Who covers the $9 shortfall? Wydeeyed, that’s who!!!

@BLANK, keep up the good factual posts. I left CA because of the bills due for the public employee unions. The sweetheart deals with the democrats were criminal. Now they have to cut essential services to pay for it. The people that dispute what you are saying are not providing facts, which means they are probably liberal democrats. Screw them all.

I have no problem with private lenders offering low or no-down payment mortgages. I have a huge problem with the FHA and Fannie/Freddie offering low down payment mortgages while under pricing the risks.

The FHA’s problems are well known, and according to the FHFA, the gfees on Fannie/Freddie were grossly under priced for high LTV mortgages, see Figure 7, page 31 in the report below.

If the government charged appropriate rates for high LTV mortgages there would be much fewer of them.

http://www.fhfa.gov/webfiles/22642/2011GFeeReportFinal.pdf

The upfront mortgage insurance premium for an FHA loan is going from 1% to 1.75% in April.

http://online.wsj.com/article/SB10001424052748703837004575013690004466692.html

That will put an FHA buyer in a negative equity position even faster.

Right now, they put 3.5% down, but roll-in the 1% upfront mortgage insurance premium for a total LTV of 97.5%.

In April, they will put down 3.5% and roll-in 1.75% upfront mortgage insurance premium for a total LTV of 98.25%.

If that person needs to sell within a few years, even if the home holds its value, they would be upside down by about 8%.

A person selling a $200K home with 8% negative equity needs to bring $16K to the closing table, and that is without contributing any money to the buyer’s closing costs.

Of course, the larger the loan amount, the larger the amount they would need to bring to closing.

What are the odds of them having that amount of money available to bring to the table?

Approximately zero.

Well we are where we are. We need solutions and made by people who have clue!

Do tou see rhe headline this morn. ATTORNEY GENERAL SEEKS A HALT IN FORECLOSURES. it goes on to say 12 billion to help home owners reduce principle! Stop!

The banks should adj ALL exsisting mortgages to current interest rates. BOOM! Mortgages payments would be reduced by 100’s of $ each month, people could afford their mortgages which they cannot refinance because the are underwater, money would go into economy and taxpayers would not be paying to bail out banks.

The problem with this, which nobody talks about, is that the Government can make these “pronouncements” about new problems all it wants, but there is no legal way they can force the banks to adjust these mortgages. In fact, there is already a program in effect (as of September 1, 2010) which purports to do just what you describe. Little catch, though. The banks have to “sign on” to the program. Surprise, surprise! None have!! So how is this new program going to be any different? The only way it would work is if the Government set up its own mortgage banking house and agreed to refinance every mortgage in this country at its appraised value and at the current interest rates, using taxpayer dollars to pay off every borrower’s original loan to their original lenders. This seems like it would be far outside the realm of possibility.

I think the bigger problem is that the “banks†are loan servicers and not note holders. The federal government already holds over 90% of all notes via the GSE’s and the MBS’s on the Fed’s and Treasury’s B/S. The write downs will come out of the tax payer one way or another…

I am sure the banks would rather refinance their loans than lose the property to foreclosure. The cure rate for “notice of default” is abysmal. The problem is that all of these mortgage notes were diced and sliced, then packaged into securities and sold based upon the expected rate of return – which is tied to the interest rate on the debt. If the banks unilaterally decide to cut interest rates on outstanding loans, they will be open to all kinds of additional investor lawsuits.

To my knowledge, nobody has figured out how to fix this, except for the Treasury buying up tons of these worthless investments. And that still doesn’t fix the problem – it just postpones it. At some point I imagine the Treasury is going to unload those investments. Who wants to buy it when you think the interest returns could drop through the floor at any time?

I think the bigger problem is that the mortgages are underwater. The mortgages should be cut to market value, but that would introduce moral hazard and really annoy people who made prudent decisions.

“The best way out is always through.”

-Helen Keller

Your comments makes zero sense. The idea that banks should be required to adjust all mortgages to the current interest rate is preposterous. It is simply another rationalization for a free lunch at someone else’s expense.

There is no Free lunch folks. Someone is always paying for it.

Except the wealthy one percent.

I am so sick of people attacking public workers. I am a public worker and my yearly income is only $30,000 a year. The only reason I took the job was for the benefits, and now they are trying to take them away, and making us pay for it. I make a grand net pay of $1600 a month (which can’t even pay for an apartment lifestyle where I live) and when I retire, if they don’t take away our “pension” which they are threatening to do, I will be lucky if I get 500 dollars a month. Wow, what riches to live on. I hope that I will be be able to live on that lovely 500 dollars plus the social security that will probably be gone by the time I’m retirement age – so basically, if I’m not forced into retirement because of age discrimination – I will be working until the day I die. And by the way – this well -off public worker you conservatives love to knock – is living grandly renting a room in a friend’s house. Stop stereotyping all the public workers. You don’t know what you are talking about.

Every single cop or firefighter I know makes over 100k a year and work for 10-15 years then retires ….goes and gets another government job then retires from that job and double dips the system and on top of that will collect his social security when that time comes…..California is going to collapse because of these greedy bastards. They live by the beach drive fancy cars and throw parties off their balconies till the wee hours of the night.

Leave a Reply