University of debt and home buying – recent college graduates and the growing inflation in college tuition. Many recent graduates unemployed or working in jobs that require no college degree. University of California tuition tripled in last decade while California incomes went stagnant.

Younger Americans, especially recent graduates are starting to question the limits of debt. Many are paying incredibly high prices for a college education and are living through a decade where most of the financial pain around the world was brought on by misuse of debt. Some of these younger Americans have seen their family’s household wealth plummet as they witnessed housing values crater while the debt secured to the following asset remained the same. The challenge being faced by many younger professionals is that there is very little in between in America in terms of good paying jobs. You either have a solid professional skill, this usually requires a college education, or will be left searching for low paying work in service sector jobs. First things first, many younger Americans are simply going to college and taking on incredible levels of debt. In California tuition prices are rising even though incomes have remained stagnant.

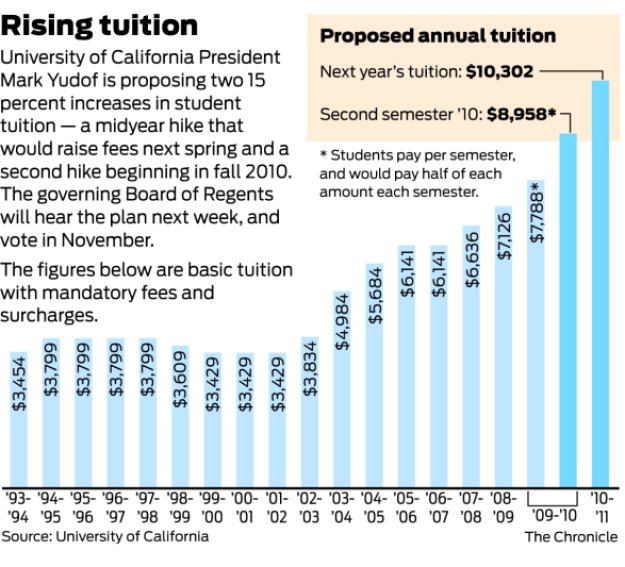

The price of a UC education in California

California has one of the biggest public university systems in the world. Many of these schools are well known and respected around the globe. Demand for these institutions are at all time highs even though costs have tripled in the last decade:

Source:Â The Chronicle

Now there are a few options when it comes to paying for college. You have grants, scholarships, money from mom/dad, and finally loans. Loans are now becoming a larger part of the equation. In 2012 we are set to break a troubling record in that student loan debt will grow beyond the $1 trillion mark. With this large amount of debt many recent college graduates are going to have a harder time stretching their wallet to purchase a home. Since household income has gone stagnant for a decade, many households are unable to pay for college without going into additional debt.

The debt load piles on and many recent graduates are entering a very tough employment market. For each good paying professional job that is out there (i.e., engineering, healthcare, etc) you have multiple jobs in the service sector and these rarely pay enough to purchase a home even a lower priced one.

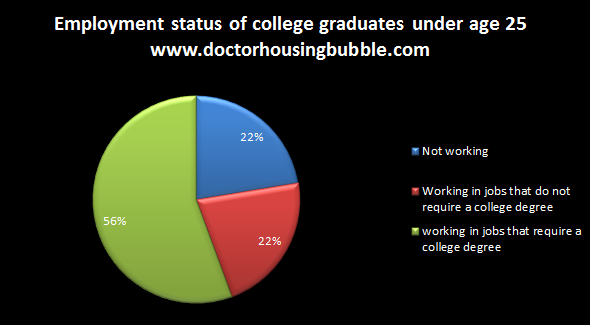

I recently put together data on the employment status of Americans under the age of 25 with a college degree:

You have 22 percent that are still not working and another 22 percent that are working in jobs that do not require a college degree. Yet the student debt still needs to be paid off so it is highly unlikely that this group will be purchasing a home anytime soon. You see public universities like the UC starting to hike tuition yet you have private institutions that charge upwards of $50,000 a year. Some of the horror stories coming out from the college debt world are truly astonishing.

California becomes an older state:Â A U.S. trend

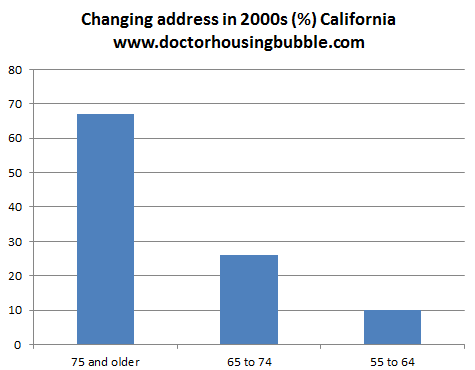

California is becoming an older state. Many students that go to institutions like the UC are likely going to stay in California. Demographic trends will create an environment where older Americans will be handing/selling off real estate to younger Americans:

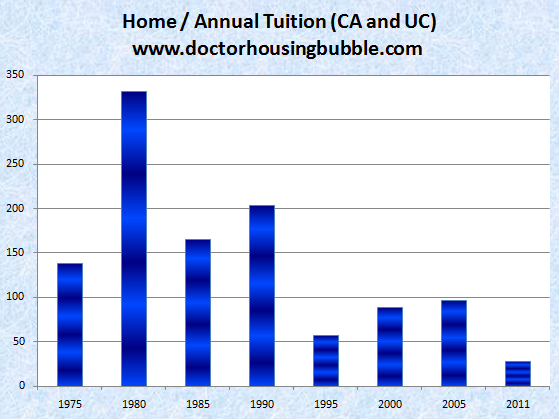

As the chart above highlights, many older Americans do become active in real estate at a later stage in life for a variety of reasons. The next big group to transition is the baby boomer group. The big challenge I see is that you have a more affluent baby boomer group that purchased homes at more affordable levels selling to a less affluent young American group that is dealing with still high prices of housing and more levels of debt. Take a look at home prices versus the cost of a UC education to compare:

In 1980 a California home would buy over 330 years of UC education. In 2011 it bought approximately 30 years. Both college tuition and housing has far outpaced earnings hence the usage of massive amounts of debt. Yet at some point, you reach too much debt just like we did with housing. We are quickly approaching that level with college.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “University of debt and home buying – recent college graduates and the growing inflation in college tuition. Many recent graduates unemployed or working in jobs that require no college degree. University of California tuition tripled in last decade while California incomes went stagnant.”

Sorry, the only way out of this mess is MASSIVE WAGE INFLATION… Even if it means raising the minimum wage to $20+ an hour… MASSIVE tax increases on the wealthy…. (I’m talking 90% on every dollar a certain amount… BUT, you can write off any money you spend on HIRING.. So if your a “JOB CREATOR”… everything after your first MILLION is taxes at 90% rate… Unless you invest in your infrastructure / hiring.. then it’s all a write off to lower your taxes.

Also some kinda of massive debt forgiveness for student loans and underwater owners.

Sucks for the savers.. But there’s just no other solution. If you let things collapse we’re all doomed. I know those on the sidelines are giddy for 1996 home prices or LOWER… But the consequences are far reaching. You might get to buy a home outright in cash.. But you won’t have a job anymore when unemployment is 50%.

CaliOwner you never cease to amaze me…

Ok, first lesson in econ 101 price is determined by supply and demand. If you ever studied econ you would know that price goes down when supply goes up all else held constant. I am confused how you could look at the employment chart in the article above and suggest that we need wage inflation. I truly believe that I need a 360 Modena but that does not mean that I will get one. It is very difficult to raise wages when there is slack in the labor market. This is especially the case when your economy is global. Now, artificially raising the price of something will cause a shift in the demand curve which will lower the demand for labor causing more unemployment.

I think the best bet would be to let the housing market correct and nationalize the banks as they are zombie banks that have in effect already been nationalized. We need a reset that would allow the economy to grow again. I do not see how job destruction will get us there. We have seen that currency/debt destruction has not worked as of yet.

The only way to have a workable civilization: Don’t eat your young. Provide reasonable rewards, and security in old age, for those who acted responsibly during their productive years. And stop believing in the merits of exponential growth.

We already tried taxing income at 90% – it doesn’t dig anyone out of problems, it simply leads to a mathematically unavoidable situation where you have skyrocketing unemployment and inflation while the economy’s growth goes stagnant. It’s called “stagflation”, and that’s exactly what happened in the 70’s after two decades of enormous taxes. How did we get out of that situation? We lowered the tax rate, which led to skyrocketing economic growth.

90% income taxes drove businesses out of the United States fifty years ago, and that was when it wasn’t so easy to shift production to other parts of the globe. Today, moving operations to another country is simple.

If you want to ensure 50% unemployment, raise income taxes to the point where it doesn’t pay off to start a business in the US. It doesn’t matter if you get to “write off” anything that you spend on infrastructure/hiring. What matters is that if you put the enormous amount of time and energy required into creating a new company (thereby creating new jobs where no jobs existed before), then you would expect to take home more than you would if you just worked a 40-hr/wk corporate job that was consistent and relatively risk-free. Remove the prospect for larger gains, and no one will take that risk anymore.

This is not a “theoretical” assumption. This is a real-world fact. You can see it happening on a smaller level when various locations in the world (and even inside the US) offer production tax credits to Hollywood film companies. When Canada offers tax credits, more films get shot in Canada and fewer in California. Ditto for Bulgaria. Several big-budget blockbuster films are being shot in New Mexico instead of California due to tax credits. On the flip side, very few films/TV shows are shot in New York because of the high production costs and taxes associated with it.

Higher taxes = fewer jobs. Lower taxes = more jobs. Period. It’s been proven over and over again.

whoa – settle down there Fox News. That “economic growth” from the 80’s on, has now been shown to be nothing but a bubble that the entire world economy is dealing with right now. It’s when we got off the gold standard and started artificially creating wealth.

Lower taxes hasn’t done anything for the past decade except create one of the largest wealth gaps in history. These people clearly aren’t creating jobs. What fixes our economy is having a country full of people with valuable skill sets. We’ve got too much unskilled labor or skills that aren’t in demand. People need to be re-trained, or sadly for older people, retire/die. It’s out with the old, in with the new. It’s sounds harsh and cold, but its pretty on point. Also – the cost of living in this country is so absurd, we need higher salaries just to get by, which makes our wages high in relation to the global market. I ran my budget the other day, and the amount of money I need just to pay my rent, car, and food is ridiculous…and I keep my costs VERY low compared to most. Outsourced jobs can be outsourced because a much lower wage goes a lot farther in those countries.

CaliOwner, you need to read what you just wrote a few times, absurd is not even the right word. There won’t be any wage inflation for a LOOOOOOOONG time, with interest rates pegged to be artificially low for an extended period of time and the crappy business climate that simply won’t happen. You can bet your ass if you start taxing “millionaires” at the 90% level rate they will pack up and leave.

Remember many parts of this country did not have a housing bubble or a tuition bubble, unfortunately California experienced both in extreme ways. I don’t think anybody in Texas or the Midwest gives a rat’s ass about some poor 25 year old kid in LA who can’t find a job or afford a house. Get used to it, it will be the norm for future generations to have a lower standard of living in this country!

Amen, America is about to find out it is a long way from being invincible. Our leaders are close to the bottom of the worlds list when it comes to leadership. All the praying in the world won’t save us. People have to quit relying on a mythical entity to pull our chestnuts out of the fire.

DHB once again illustrates that anything the government gets involved in predictably goes to shit. The government meddled in housing and mortgages with CRA, Fannie, Freddie, etc & the price of houses shot to the moon & aren’t back to earth because of continued meddling with FHA. Then the government took over the student loan program, made it non-dischargable in bankruptcy & the cost of college is shooting through the roof.

Re: “. . .anything the government gets involved in predictably goes to shit.”

You aren’t making an argument for broad-based deregulation, are you? Because financial deregulation permitted securitization of mortgages, a significant factor leading to the housing bubble,

Do you feel that government should not be involved in funding public education on the university level? You might find this article from the Atlantic interesting, discussing Finland’s successes in publicly-funded education:

http://www.theatlantic.com/national/archive/2011/12/what-americans-keep-ignoring-about-finlands-school-success/250564/

Jefferson was in favor of public education and founded UVA — what a commie!

It isn’t true that the financial markets weren’t regulated. There were just regulated in a way to satisfy the social engineering goals of those in power. I’d like to see the social engineering end. It’s destroying the economy and this country.

I agree with “deregulation”, but it has to be real deregulation. To use an analogy, you can’t send the kids off to college with a credit card, tell them to be fiscally responsible, but then also tell them that if they are not fiscally responsible, that no matter what you’ll be there to pay any of the bills that they incur on the credit card.

This is what happened in the world of home loans. Sure, the home loan securities market was deregulated (under the Clinton Administration, no less) but there was always an implicit understanding that if the securities went bad, the government would step in to bail everyone out. And it did. Home loans were guaranteed by Fannie Mae and Freddie Mac. Those entities KNEW what was going on, they KNEW people were being given loans that they would not be able to pay off, and they also KNEW these same loans were being packaged as securities. But they did nothing about it, and those same entities fought every outside effort to regulate the way they did business.

Again, there is nothing wrong with deregulation, so long as the government also refuses to step in when these banks or financial institutions screw up.

I always use the short form: Everything government touches it destroys.

Everything stupid people touch they destroy. It does not matter if they are in the government or not. Stupid people manage to get college educations, government jobs and positions of authority. The standards and qualifications have got to be raised no matter who’s feelings get hurt. Standards and qualifications based on warm and fuzzy will eventually lead to speaking Chinese or using prayer rugs.

It is hard to see this resolving itself any time soon. You can’t get a decent job without a good education, unless you are an entrepreneurial whiz, and most are not. I know that in my area, community college attendance has skyrocketed, so at least some students are deferring the big tuition bills a couple of years.

I know that in my own personal case, I had a liberal arts degree, but that was good enough to get me in the door at a big oil company. From there I was able to prove myself. I haven’t worked there in ages and I’m still using the spoils of that job to supplement my income.

I would say it is better to get an education than to buy a house. Perhaps a combination of part time work and other half measures, in order to limit student loan debt, might be a happy medium.

Yes:

Student loan debt is reaching crisis levels and is very damaging to students.

One of the many problems with education is that part time OR even full time employment can’t pay for it. Sometimes it can’t even come close.

As the esteemed Dr. Housing Bubble reported some schools are now charging $50k a year in tuition. You also have to add in books & living expenses. How are you going to get a job to pay for that?

I would go so far as to suggest that if you have a job that can pay for that level of education YOU DON’T NEED ANY EDUCATION!!!! (hahahaha).

Primary education needs to be overhauled and do a better job of educating the youts of America. Secondary education needs to come down in price. Student loan debt needs to be dischargeable.

Almost forgot! The educators need to be punished and take a taste of what they’ve been dishing out for years!

Everyone talks about college costing $50,000 a year but it should be kept in mind that these are the private schools. While public colleges still cost a lot more than when I went in the late 70s, we should be looking at these numbers rather than the cost to attend an elite private university when discussing the cost of education for most of us.

My Stepdaughter is attending a UC college in Northern Kalifornia — she is living with her unemployed dad and receives a Pell Grant, I provide medical insurance, a few hundred dollars per month for what the Pell Grant does not cover and I tutor her with her studies about 10 hours per week.

She will graduate DEBT FREE in another year — we have a little joke that during her Graduation Day she will label the top of her cute square Graduation cap “DEBT FREE”. She recently began to express concerns about the “DEBT FREE” labeling on her cap — because the vast majority of her graduating class is in debt to the tune of 30K to 70K and she is fearful that those fellow students in debt would resent her “DEBT FREE” status and would bring physical harm upon her or shun her in social gatherings.

In response to Brian: If you consider just tuition paid on behalf of the the students, it would appear that the price of attending public universities is lower. However if you factor in the public funding, the costs are similar and it is not uncommon for public universities to cost more in the big picture. A good way to quickly estimate the state finding offset is to look at the out-of-state tuition (which is higher to account for the family of the prospective student having not paid into the system through state and county taxes). I recall when I was shopping for education about a decade ago, the ratio was approximately two state dollars matching each I would have spent at a UC school, and examining the current resident vs. out-of-state fees (13,200 to 36,078) it seems this is still the case. Interestingly, the anticipated costs of attending a UC are almost $55,000 per year for non-state-residents. source: http://www.universityofcalifornia.edu/admissions/paying-for-uc/cost/index.html

Also, it is worth noting that looking at just the tuition portion, USC is currently 30% less expensive than the UC out-of-state price. source: http://www.usc.edu/academics/classes/term_20121/tuition_and_fees.html

Food for thought.

We have the money to send our daughter to whatever school that she wanted. But, she is not a natural fit for more school (despite her 98th percentile SAT): she is much more action-oriented.

She is now in NYC, interning at a high-end fashion designer, and will be going to school at night and weekends at Hunter College (CUNY). I am very happy that she is placing an emphasis on work instead of college.

Times have changed since my wife and I went to college and graduate business and law school (’80s). I grew up doing good, menial labor (dishwashing, fast food cook, construction) in high school and college. It is a real shame that Mexicans have taken those jobs today (maybe I got those jobs back then because I am part Mexican, ha, ha).

With the high cost of college today, we will return to the good old days, when not all went to college, and many very happily went on to skilled labor positions instead. Our son, a near straight A student at a great private high school, may end up going that route, given that he is not aggressive and is not materialistic.

I feel terribly for students who incurred big debt and have little prospect for paying it off; what a terrible ball and chain that must be.

we will return to the good old days, when not all went to college, and many very happily went on to skilled labor positions instead.

Except many skilled labor positions evaporated when manufacturing went to China and Mexico, and those that are left pay a lot less than they used to.

When enrollment declines you will know that you have charged enough. Raise it some more….a lot.Like $4 large. Let’s see what happens.

We’re already way past the fiction that a state supported university system is created as a ladder for middle class and poor kids. It’s not and never really was for them. UC is for rich people. Get real. Let the 1%’ers have it….and let them pay for it.

Torabora,

You’re wrong. I have a professional degree from U.C. and my father never graduated from High School. It is absolutely essential that we as a society help all of our young people reach their maximal intellectual potential. In addition to college educated folks we need to invest heavily in technical education. We need to stop throwing away billions if not trillions on foreign wars and divert that money into educating our populace.

“Do you feel that government should not be involved in funding public education on the university level?”

This works in Finland (I should now, I’m there/here) because private unversities are, in reality, forbidden. You can’t get a degree from private university.

Still the student debt is significant compared to purchasing power/net earnings (10-20k e) and it often takes 10 years (the maximum allowed) to pay it back.

It also means that there’s oversupply of almost any degree and the pay is very low: typically 3k (euros/month) for engineers and even less in other areas. Most plumbers earn more and no debt on them.

Cost of living in towns is almost as high as in US and “free income” (i.e. anything left after house, food and having a job) is very low compared to price level of anything, almost 30% more than EU average. Cartels and monopolies rule: The shady side of a very small country.

Relative purchasing power of a salary man is almost as low as in Romania (which has the lowest in EU). The amount of debt (in $/e) is deceiving: Even a little debt kills your economy if there’s no free income to pay it off and that’s a reality here. Over 90% of the population has no savings at all: There’s nothing left at the end of the month.

So there’s two sides on this, too.

Why are we assuming young people even want to be home owners? Especially right away? Most students that I know don’t want to be tied down in one place when they graduate. And they are too smart to believe the lie of the American Dream.

I’ve been meditating on something and hoping for some helpful feedback, Doc and others.

I live in the Bay Area and I’ve been saving and saving for years and I have almost a hundred grand saved up at this point. I can keep saving, but prices are not falling much, and a decent place around here would require a 200k down payment, which would take another 5 years at least to save and then I’d be spending every dime I had to go deep in a hole I could never climb out of, or I could save for another 10 years or more to be able to buy and still have a few bucks in the bank, but by then I’d be in my 50s. Yes, prices have fallen some, but in the areas that are not a long commute from where I live or crime ridden, I still cannot afford a decent house, and it looks like the government’s effort to inflate away the issue will be ongoing for the foreseeable future, with QE3 on the horizon.

My question is this – why continue to save? I’ve been wanting to buy a house, but it looks like housing is not going to become affordable or reasonable cost at any point in the next decade – I’ve been waiting 6 years already, with little movement in the places I’d actually want to live, or at least not nearly enough to make buying a reasonable decision. With the government seemingly bound and determined to keep Bay Area housing unaffordable for anyone who doesn’t already own here or make $300k a year, and to inflate away the value of my meager savings, I’m thinking I should just spend it now – if the dollar is destined to be massively devalued, and no one can point me to an inflation hedge that isn’t already in a bubble of its own, there’s no protection to be had.

That $30k motorcycle I’ve always wanted? A long vacation? Might as well get it all now – the prices of food and energy have nearly doubled in the last few years (gas is now permanently floored at $4/gallon, a gallon of milk is now a full 50% more than it was a year or two ago, etc.), and I expect this trend to continue. So why keep saving? There’s no fighting the central bank, and a determined decision and course of action to devalue the currency seems pretty clear at this point. The government wants to brutally punish savers and keep anyone like me from ever being able to afford a house here, so why fight it? Sure, I could save up for another 10+ years and then buy, but then I’ll be too old to pay it off, so I don’t see the point. May as well be the consumer the government is pushing me so, so hard to be.

Jim, I feel your pain. I have saved/inherited a very large sum of money over the years and have the same concerns/thoughts that you do. I believe that one of the reasons the government is doing the things they are doing is to get us savers to go on a spending spree to increase economic activity. However, the economic activity will be short lived for a number of reasons including saver to debtor ratios in the US. There simply is not enough savings or debt to get us out of this problem. I think we have two choices here. One would be to continue to save and hope that the savings is worth something in the end. Or we can become fodder for the economic fire as it burns itself out. My main concerns are flexibility and retirement. That is probably why I chose the first option. I would suggest a little patients before sacrificing yourself into the fire….

To Jim in SF

Congratulations on being able to accumulate 100K. That is a huge accomplishment in our consumer oriented society.

I think that you should hold on and continue to save. I think that high demand areas like where I live (Santa Monica) and where you live (San Francisco) will in fact drop in value 15 to 20 percent in the next two years. We are truly on the cusp of another drop in value

It is shocking to see that outlying areas have actually droppped 50 percent in value. Look at Palmdale and Palm Springs. I believe these price drops will catch up in more affluent areas. I doubt the drop will end up being a full 50 percent, but it wil and it is occurring.

Jason in Santa Monica

Please add this separate paragraph into the comment that I just submitted

>>>It is important to remember that none of the programs designed to keep real estate prices propped up have succeeded. What really needs to happen, what should happen, and what probably WILL happen, is that prices will be allowed to fall to their realistic, intrinsic value. There is a price dop happening, and it is occuring now.

Jim,

Keep Saving..Diversify it into oil based commodities or gold/silver to reap the rewards of inflation or keep up with it. I live in San Francisco and it’s time is coming regarding valuation. I wouldn’t pay 500K for my place if you thru in Salma Hayek and 100K in silver…It’s not worth it.

The fed and government are rewarding greed. As Jason mentioned above, every program is about price fixing real estate ( which we have gone to war about before)

and keeping zombie banks alive. At the same time were devastating the prudent and savers. The fed is the very essence of evil. The pigmen of wall street could care less about savers. We are the enemy! They have created a ponzi scheme so large their is no way out but default or jublilee. Pensions for the college professor are unrealistic to meet. Most of the professors and teachers at these colleges rec’d a degree for less than 4K in the 60’s. Now they want the young to pay for their retirement. The baby boomers are the greediest generations of people this nation has ever known. They are complaining about salary and pension cutbacks when they don’t deserve them to begin with.

Savers and the prudent people are the patriots. Rewarding greed is nothing more than rewarding stupidity. Debtpushers are worse than drugpushers, you can overcome addictions, you can’t overcome credit, enslavement, serfdom…

I look forward to the day the sheeple rise and throw out every one of these crooked corporate heads, congress critters, the fed and treasury, SEC, etc etc…

Buy silver and gold, that is the only way to defeat the bankers. The burbs will fall more as oil at $150 will decimate production, jobs and the suburbs…

The only people who made it out of Poland, Germany, Russia and Argentina with anything had the yellow metal.

The fed will print until the ink is try but it will not be enough.

Caliowner is underwater and bought the greed juice, now he wants to unleash a wave of hunger, death and destitution on the people…typical pigman…

Great post. Being a saver today is difficult, but the alternative is much worse. Just ask CaliOwner, he took the bait…hook, line and sinker. Now he realizes the mistake he made and wants the government to implement all sorts of irrational, irresponsible programs to save his ass and other fools just like him.

Kudos to you for saving up! Don’t turn around and waste it. Down here near Phoenix, your $100K will buy you 1500+ sf with a pool in the back yard. Another 50K and you can have 3000 sf. San Fran is a gorgeous city. I’ve visited it myself. But there’s lots of other places to have a nice home and a second career.

Turn yours dollar savings into metal savings…gold, silver, copper, it doesnt matter. You’ll have a better chance of seeing your savings worth what you put into them 5-10 years from now. I would if I had extra money to “save” but I dont. SS, retirement and working in old age sucks. Should have taken my advice 30 years ago. Good luck!

JIM IN SF:

Buy defensive, dividend paying stocks with your money. Rampant inflation will inflate the value of the stock market, too (how could it not?), just be sure you are invested in solid blue chips with a significant portion if not the majority of their revenue coming in from international markets.

This way, at least you will get a 3 percent return plus appreciation while you wait and continue to save. Also, don’t be stupid and spend your money. That is exactly what the government wants. Keep your powder dry, diversify (but not into real estate) and wait. Your life is not “on hold” just becasue you do not own a house. If you feel that way, just decide to have a different attitude / perspecitive. It really is up to you.

Jim in SF:

My post is a few days late so hopefully you will see it. I completely agree that savers will be punished for a VERY long time. Just look at how long interest rates have been low in Japan – it will probably make you even more frustrated than you already are.

But here’s the good news: You managed to save considerable $$ and you can INVEST it and let it make more money for you. You seem to only be looking at 2 options: Save or spend. But INVEST is definitely a path you might want to investigate. There’s nothing worse than letting your savings get eaten up by inflation and you’re also losing out to the opportunity cost of your money making money for you, compounding in the short to medium term, etc.

I am a full-time cash flow investor and I can tell you first-hand that there are MANY ways to invest your savings in alternative cash flow investments that will yield returns in the 8-20% range that are relatively low-risk. Here are a few examples (6-12 month hard money loans for home flips – 12-15%, ATMs – I have been averaging about 40% annually, cash flowing real estate (you’ll probably want to look out of state in less volatile markets to protect your downside risk) – 8-12%, etc, etc). I can go on and on but I hope these give you some ideas.

You’ll have to trade off liquidity for returns in some cases but you already know that your goal of buying a home is at least a few years away so you have to be sure that you protect yourself from inflation…

Good luck,

Investor J

University of California is one of President Obama’s largest campaign donors. Let’s see President Obama put his actions to work for ALL taxpayers who are affected by the outrageous student and parent plus loan federal funding scheme, both public and private!

What is it going for people to understand Clinton “told” the banks to start lending and face penalties if they did not. Not any one group just produce Alt-A or no-doc or liar loans and his friends on wall street sold them around the world. All this effort and disaster to move home ownership from 65% to 69% and now we are moving back. 40% of homes are paid off. Frank/Dodd/Obama should be smilin. Cisneros helped clinton and is back helping Obama with a new scheme.

Leave a Reply