Beverly Hills foreclosure listed at $16.95 million now on the market for $8.59 million. In search of the largest foreclosures. Beverly Hills and the 90210 correction.

Financially California is staring into a dark and deep economic abyss. Even if we start adding jobs at a fast pace it is likely to do very little for the housing market simply because the jobs being added do not have the income potential of the real estate heavy jobs during the housing bubble. Inflated home prices equaled inflated paychecks for many. It is hard to see a sudden surge in real estate values based on recent job growth trends. What is troubling is that even if the nationwide economy picks up California is likely to face structural problems because of looming liabilities. California needs to figure out a way to grow even faster merely to pay for stated expenses. The upper crust of the housing market is seeing large foreclosures hitting the market. Today we will take a look at another Beverly Hills foreclosure that is the biggest foreclosure we have covered on the blog.

Beverly Hills and the $16,950,000 foreclosure

2600 BOWMONT DR, Beverly Hills, CA 90210

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 7

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 8/1

Square feet:Â Â Â Â Â Â 10,000

Lot size:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1 acre

Let me start off by saying this is a great looking place by any measure. A large Beverly Hills home with all the amenities a buyer can ask for. Yet this home is part of the grim foreclosure statistics. It is interesting that the upper range of the housing market has stalled out with an intense ferocity. FHA insured loans or non-jumbo mortgages do not provide any support here. In our current housing market to purchase a home like this will require substantial document income. No aspiring actor making $1 million a year and loading up on an option ARM here. It was amazing that back in the bubble days we were seeing multi-million dollar loans from lenders like Washington Mutual going with nearly zero down. No wonder why these lenders went extinct.

Let us marvel at this home before moving on to the details:

“Nice rug.â€

“Nice rug.â€

“Nice view.â€

This is definitely what you would consider a prime Southern California home. But apparently things are not moving so quickly. Let us look at the description:

“Lender Owned~Sequestered in a sml gated community resides this 10,000+ SF Contemporary Medit masterpiece. Features 7 bds, 8.5 ba~s + guest apt behind prvt gates w/ stunning city, canyon & valley views. Superior craftsmanship & sophisticated design in every corner of this well appointed homage to modern living. Grand vol & scale throughout. Stately columns, hand painted ceil & 2 stry entry lead to lrg LR, DR & FR w/ soaring ceilings, fplc & wall of windows. Lrg center isle eat in kit w/ Arclinea cabinets, 2 Elkay sinks, granite cntrs, side by side Subzero freezer & fridge, Miele oven & fpl. Spectac mstr suite w/ hrd wd flrs, fplc, prvt terr & huge walk-in closets. Top of the line amenities turn spacious his & her mstr baths into sophisticated personal spas. Covered loggia, rolling green lawns, well-designed pool & spa, outdoor kit w/ BBQ. Guest apt w/ full ba, walk in closet, prvt terr & sep entry. Motor crt & 5 car garage, Crestron Advantage System & CAT5 wiring. Orig listed at $16,950,000.â€

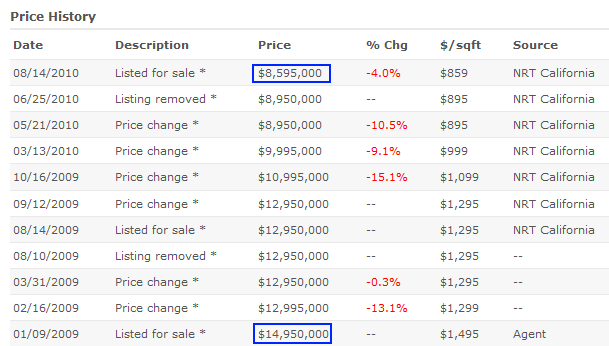

This place was originally listed at $16,950,000 so I know many of you are already getting your checkbooks ready. How much action has taken place with the listing price? Let us take a look:

Little by little the price has come down. From a listing price of $16.95 million to $8.59 million. This is a 50 percent price drop in Beverly Hills! As we all know the upper end of the housing market is still largely in a housing bubble. If this home was perceived as being worth $16 million it would have sold to someone that would be in the market for a $16 million home. Of course the pool of buyers for this home is extremely small.

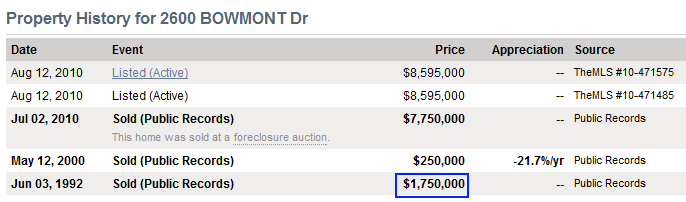

Let us look at some older sales history:

Source:Â Redfin

The place sold at a foreclosure auction in July of 2010 for $7.75 million. The current list price is still $845,000 over the foreclosure auction price. Assuming a six percent commission any profits on the second go around are getting slimmer.

Anyone in the market for a $16 million home for $8 million?

Today we salute Beverly Hills with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

51 Responses to “Beverly Hills foreclosure listed at $16.95 million now on the market for $8.59 million. In search of the largest foreclosures. Beverly Hills and the 90210 correction.”

Now, The real estate pyramid is being eaten away from the top and the bottom. The only suckers left are in the FHA sweetspot. You would think they would get a clue. Nothing will stop the ultimate correction for ALL levels of Westside Real Estate. Not govt, not banks or not real estate agents can stop the bleeding. Every area including Beverly Hills, Santa Monica, Brentwood, Pacific Palisades, Malibu and Westwood, are prime for another 20 – 25% drop.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Is this a planned flip? No way. There is despair and failure.

Following recent court cases, buyers need to worry about the chain of title being broken and whether their REO purchase may be challenged in future. In a nutshell, even in a place like Beverly Hills, money or the lack of it is a big issue!

Everything about this house, and the bizarre and incomprehensible prices it fetched at different stages, including the way the foreclosure auction was probably handled (intra-bank), reinforces to me that I made exactly the right choice to move to Alpharetta, GA and leave San Jose behind.

I can’t even begin to describe the great houses I can choose from under 200k in North Atlanta; I feel like I’ve just gotten out of debtors prison, and can finally go out in the world and buy things normal people take for granted–like a modest house on an acre of land. I will finally be able to afford something very nice for my money. Goodbye ridiculous rent, goodbye 450k chicken shacks and 400k condos with $500 hoa fees sitting in crappy school districts.

Between the state budget, the black cloud of over-priced foreclosures, terrible unemployment, and a remaining housing bubble of epic proportions, I’d prefer to watch this spectacle at a distance. Wow, I’ll have so much money left over after I buy a nice house for 200k, I’ll actually be able to save for my own retirement–and have no debt. Goodbye, CA, I’ll stop by to visit when prices have collapsed, and I’ve got a pocket full of cash. I loved the wine, goodbye Yoshi’s, I’ll miss you too.

Yea, and Alpharetta, GA, what fun! Downtown Atlanta is like a ghost-town at night, but who cares?? I can own the toys they tell me to own. You stupid stiffs out in California and elsewhere. I have hit heaven in Alpharetta, GA!

Um, San Jose is just a pretentious cow-town with a thin veneer of cash. Culturally, it is a wasteland dressed up with the money to look like something is going on–just overpriced wine and hicks who pretend to like the opera but can’t wait to get into their cars and listen to the Doobie Bros. The whole Bay Area can only support two real jazz clubs of the same name, and neither can make it without hip-hop and soft R&B performers bringing in the cash. Sorry, the idea that the Bay Area is all that is a fraud–and soon to be a very, very broke-ass fraud.

Timothy:

SJ is a “cow town” with a “thin veneer of cash”?

I wouldn’t describe even the worst parts of SJ as “cow town” – maybe 50 years ago, but not now.

Just for fun, I went onto Income Stats and although there are a few zips in SJ where average income is about $30k – $45k per year (depending on exact zip), *nonetheless many zips in SJ are the same or exceed* average income for Alpharetta GA (30004, 30005, 30009, 30022, 30023).

DeShawn Snow, one of the original Real Housewives of Atlanta, lived in Alpharetta until her divorce from her football player spouse. Suffice to say that I’ve read many emails regarding Alpharetta and the “wanna-be” and “ghetto-rich” culture that describes this area (not said by me, but by women living in Buckhead where, apparently, the *real* money lives). Whatever.

In my own town of Cupertino, the *average* income is $148k/year.

And in neighboring Los Altos, where I hope to own a SFH someday, the average income is $445/year.

And income is even higher in Los Altos Hills.

Then there’s Palo Alto, Woodside (Steve Jobs lives here), Atherton (Larry Ellison lives here), SF (esp Pacific Heights and the Presidio area) among many others such as San Mateo and Burlingame, down south there’s Los Gatos and Monte Sereno.

I wouldn’t classify these areas adj to SJ as culture-challenged. Even in SJ, such as Santana Row area, I’ve never heard anyone listen to the Doobi Brothers (are you a boomer???).

There several Michelin 1, 2, and 3 star restaurants here in the Bay Area, my favorite one is in Woodside (The Village Pub).

I’m sorry that you have apparently had bad experiences in San Jose and the Bay Area. It is my hope that home prices will continue the current trend downwards since we love it here so much and enjoy the many attributes to living here, not to mention all the free moisturizer via the air from the Pacific and the Marine Layer.

I’m glad you have found a home locale that you love and appreciate.

Next time, try not to trash Cali in order to feel good about your personal decision to relocate in another part of the country.

~Misstrial

dear tim

congratulations on your decision. l live in sydney and the housing prices here and all over australia are ridiculous. l happily rent. can you post some links of the types of properties you are talking about as l have no idea where aplpharatta ga is? do they have the title issues in alpharatta?

happy new year

michael

Alpharetta is just a pleasant bedroom suburb of Atlanta, just north of Buckhead. Good schools, no crime, good sized lots, and low taxes if you get into Forsyth County. Not much going on there, but there is plenty to do in Atlanta, especially the Buckhead area and into midtown. North of Alpharetta is Lake Lanier and the Chattahoochee National Forest. Much of north Atlanta is swarming with new rich trash and their parade of BMW’s, but then again, so is LA; that curse seems to accompany any city that falls into money by accident.

Check Redfin for the area, and say, 10 miles around it. Depending what you want, housing is no issue whatsoever, even for a modest income. And with housing cheap, life becomes more leisurely, from my experience. Fighting for a 2000k month studio apt in NYC and SF is not something I care to endure again for the thrill of a trendy meal or a bad art opening.

Tim, you just made a very wise move from living in a very expensive state to a less expensive state. I live in Chicago but it is nowhere close to being as expensive as New York or southern California. For people who choose to live a more financially prudent lifestyle, there are plenty of affordable places to live in our country.

Timothy:

Are you a real estate agent?

Reason why I’m asking is because its common on certain forums to trash California and at the same time, up-talk a distant State where the cost of living is lower in order to promote area home sales or to self-validate one’s decision.

This is not a criticism, as a native Californian (4th-generation) I am enthused about my State.

Nonetheless, I’m curious as to why you are posting here if things in GA are so wonderful.

Here is a link to city-data forum where you may be able to communicate with persons in your area:

http://www.city-data.com/forum/search.php?s=a92cade1c11fc66130de4052bbbefa21&searchid=26306247

~Misstrial

No, I am not a real estate agent. I work for the technology sector, for HP, and live in Sunnyvale. I actually design, build and make things–the activities that put San Jose on the map in the first place. Before that, I lived in Campbell, LA, San Clemente, and San Diego. Before that was Boulder, NYC, Dallas, Chicago, Florida, DC, Denver, Santa Fe, and Lexington KY. I know the United States very well.

Listing famous people does not make for any real culture, and if you think Santana Row is anything but Disneyland with worse traffic, I can’t help you. Like most people who live here, you can’t tell the difference between money and taste. But taste isn’t the issue, it’s overpriced housing eating up all the income–income that has to go to things like retirement.

Yes, I know all the places you mention, most of my coworker live there. They pay a staggering amount of money for little to nothing so they can stay away from…well, the other San Jose. We used to walk around Campbell (a laughable cow-town pretending to be something upscale) and snigger at the chickenshacks selling for 450k. Seriously, I could built those houses from scratch in a week. Los Altos is just a boring, super-rich enclave that is so relieved that Palo Alto is between them and East Palo Alto.

I’m not down on CA, just done with the hypnotic bullshit that pretends that everyone here is wealthy, can afford to live in million dollar homes, and can enjoy the good life in the fun and sun. People who have sunk their whole savings and all their self-deception into CA cannot bring themselves to see that it isn’t 1963, and that things are not what they seem to be. Worse, I think most of the people who claim to earm big money here are frauds: nothing they do or contribute actaully earns that cash–and the truth

the post accidentally sent early. The truth is that the amount of money people actually make in Santa Clara (about 82k median income for a family) is nowhere close to what it costs to live here. That’s why all over my neighborhood are modest houses with ugly rental projects in back, and more cars, transient populations, and all that goes with stuffing people into tiny spaces and not really being able to afford a house (or a condo, for that matter).

And when the people (rightfully) reject the tax increase this summer, then things get very interesting.

YES PLEASE GO TO ATLANTA THE HOT,HUMID VERSION OF GHETTO OAKLAND, REAL ESTATE PRICES ARE DICTATED BY SUPPLY AND DEMAND!! THERE IS ZERO DEMAND TO RESIDE IN GHETTO AFRICA ATLANTA, THAT’S WHY YOU CAN BUY YOUR $200K RAT-SHACK!

I am headed to Forsyth County, not Atlanta. Atlanta is in Fulton County. Forsyth County is quite nice. I drove all around it for a week, and saw nothing resembling a ghetto for miles. And I’m not PC when it comes to the hood–I won’t live anywhere near it. And though I would not consider the houses well-made by say, Chicago standards, they are fine for the climate–about the same as the shoddy houses here in San Jose.

The difference is a shoddy house here is at least 500k, and one there is under 200k. That’s a lot of money, a basis for a solid retirement, and several solid investments, and a good education at GaTech, and vacations I pay for and do not charge to a credit card..

The larger point isn’t Atlanta vs San Jose; it’s totally broke CA, so deep in debt I see no way to pay it off, and the cost of the biggest single family expenditure selling for x3 times what it’s worth. I’m not going to buy a 1100 sq/ft house here in Sunnyvale for 500k on up. I get nothing, nothing for my money, while the quality of life continues to go down.

So we are taking our 6 figure family income and going elsewhere, and I encourage anyone who didn’t get in here in 1965 and buy low to do the same–there are many, many great places in the country to live, from Utah to New Hampshire, to the South where the quality of life and the cost of that quality are rightfully aligned.

As for the uber-rich here in Santa Clara County, well, they had better keep making big money, because your going to need that money to keep the teeming, broke, unemployed masses as far away as possible.

In referring to “ghetto Oakland” and “ghetto Africa Atlanta”, was there something you meant to say but couldn’t quite bring yourself to do so openly? You can say it, it doesn’t bother me, but you seem a little…squeamish?

Anyway, I dig live jazz (hard-bop, not that fern jazz crap), so I can never stray too far from the ‘hood.

Timothy:

You’ve encapsulated the dream of many of us in SoCal, too, as we long for a sane solution to the insane cost of housing here.

I live in a neighborhood in the San Fernando Valley where tract homes built in the 1950’s, <1000sqft, are STILL being put on the market for $600K -$700K (during the bubble peak, they were going for $800+K) – which is well over $500/sqft for a 60-year-old cracker jack box.

But as far as moving goes, the biggest problem for me, as I'm sure others, is that I've been living here in SoCal so long that it's difficult to imagine giving up family and friends in one fell swoop.

But the allure of fiscal sanity is strong, and may eventually tip the scales…

I lived in Tarzana, right on the border of Encino. Very overcrowded, the 405 is a nightmare, and a crappy house that a plumber’s apprentice bought for peanuts 30 years ago now requires 2 six-figure incomes to own. And that area has some of the best value for the dollar in LA County. I liked LA much more than San Jose, but I’m not going to live in a tiny apt, spending half my income, getting nowhere, just to eat at a mediocre restaurant on Ventura Blvd. I’d take that cash and buy a gorgeous spread outside Albuquerque, or with a great view of a lake in New Hampshire, and then fly into Boston for a show. All I’m saying is look around, America is huge and there are many, many fantastic places to live. Let the very rich (and the very large number of very rich pretenders) and the very poor sort it out among themselves in desirable CA.

My best friend lives south of Atlanta, I’d move there in a heartbeat if there were surf there.

did you bring the weather with you too?

It’s so easy to be overwhelmed by the incredible wealth on display in Beverly Hills in particular and the Western burbs of L.A. in general, that it’s easy to forget how statistically rare are the incomes it takes to support houses like this, even in California.

While you can borrow most of the price of a modest home because it is relatively easy to replace a modest job with another that pays comparable wages, it is almost impossible to replace a $1M a year job when you lose it, let alone the type of income you need to support a house that costs $10M or more. That is why, back in the sane pre-bubble days, you could not get a loan to buy a house like this, and I believe that in the future you won’t either. You had to come in with the cash for places like this- if you couldn’t, you couldn’t afford it. A very professional old RE agent here in Chicago told me, back c. 1990, that you had to have at least 50% down for any house over $500K, and over $1M, you had to either pay cash, or get a mortgage against your cash in bonds or the bank. Never for the world would a lender grant a loan for houses in this class.

I see that Cindy Spelling has her megamansion, that cost $45M to build, on the market for over $100M. How big a pool of buyers are there for something like this, and would they not prefer to build their own dreams? I can’t imagine who is going to buy a house like that.

..and what are the taxes (that never go away) for something like that? Nobody, not even a Laker can afford that forever. There ARE no people that exist like that. O.K. , maybe a shiek, but they tend to be smart enough to not waste their $$ on more than a few places scatered across the globe.

By the way, this is a really beautiful house. I like the restrained, quiet decor. It’s beautifully staged.

The 1992 price gives perspective on a place that should find a buyer once priced at $4M or so. Even that reflects the unique location since that amount of money will buy you a nice estate in most parts of the country with 100+acres and a nice house with what we refer to as “dependencies” on the property. Going forward into a troubled economy, anyone paying $8.5M will be catching a falling knife.

The 1992 price was for the land.

Perhaps more than just this individual lot was bought for the $1,750,000? That’s what I’m thinking as I can only guess that the $250k sale was for just this particular lot.

My guess would be the 250k price was a sweetheart deal of some kind – selling at below cost to a relative or some such.

The purchase price is only the beginning cost for this home, its all about maintenance and up kept not only the building but the landscaping,cleaning, heating all pointing to a large monthly tab. These homes today remind me of the castles in much of Europe that have either been abandoned, or only partially occupied given their huge overhead maintenance cost.

Way back in the late 80’s I worked wiring homes similar to this in the Sacramento foothills. They really aren’t constructed much differently than a $200k house…there is simply more of the house. Tile v formica, granite v tile, multitudes of can lights and ceiling fans, one bathroom usually has a step up tub with a window and a sauna. The real killers are a) the insane amount of property tax even at 1% and b) the UTILITY bills!. These monster houses cost $1000-$1500/mo in electricity to A/C in 100 degree heat. It’s almost a full time job to keep them clean and the grounds tended. The monthly cash drain is enormous on these, probably close to $50000/yr. before mortgage costs. Crazy money. The kind of houses drug lords own.

With jumbo loans out of style … who can afford to pop a couple million for a down payment on a $8 million dollar mansion?

NO ONE is my answer … so what if the home sells —

What I’m about to describe here … I have no proof … only speculation. But let me think like a banker for a second. Suppose Bank of Whatever has an overbalance offbalance sheet investment vehicle called Nationwide Investments and another offbalance sheet investment vehicle called Countywide Investments.

Suppose Bank of Whatever made a $15 million dollar loan to Mr. Movie Star. Mr. Movie makes a dud of a bad flick and can’t pay the loan. Countrywide repossess the home ‘for’ Bank of Whatever but because of FASB rule changes Bank of Whatever takes no loss on the transaction because the loan is still on the books of one of its investment vehicles. Then Nationwide ‘buys’ the house at foreclosure from Countrywide at $7.5 million and flips the property back to Bank of Whatever for $8.5 million for a cool $1 million dollar profit for Nationwide.

Since one of Bank of Whatever’s investment vehicles made money … so did Bank of Whatever. Long story short … instead of a loss at Bank of Whatver … on a bum loan … Bank of Whatever has made a cool million dollars.

Someone needs to find out who the ‘buyers and sellers’ of these properties are … and if the transactions occuring aren’t actually to the same ‘individual or company.’

Bryan Cappelletti

Let’s take your hypothesis one step further.

The Bankers own Hollywood.

“You want a hot part in a movie that we’re financing Mr Moviestar? We have a role for you, but first you have to take out a loan and buy a house.”

The Bankers giveth and the Bankers taketh away.

Advanced Accounting #499 – Large corps must do intercompany eliminations upon consolidating these three companies owned by bank Whatever. Simply stated, net you have left on the books a (15Mil) loan default and a repossessed house at $7 to 8.5Mil market value. The newer rules are supposed to force the house to be marked to this market value, not the inflated appraised value of 15 Mil used to get the 2nd mortgage, reflecting a true loss of about 7.5Mil for these transactions.

America’s CPAs that specialize in financial reporting for banks and financial institutions will be computing exact figures now that audit season is upon us. HEY CPA’s what will bank W show — a REALIZED loss on the 15Mil loan defaults (probably a first and second on that house) less their security which is the house at market value? Or will the loss be DEFERRED until the house is sold? Or OTHER …

Banks loan producers money not actors. Banks securitize their production loans with the film sales orders and cash receipts go directly from the customer to a bank owned collection account.

I’m not an accountant … the subject really bores me … but I’m well aware of the fact … that funny ‘creative’ accounting has become pervasive in the global banking business … in the past couple of years.

My point being … that accountants are being allowed … to hide bad debt at the banks … and that most governments across the globe … accept such a practive.

And to continue … on the above … thinking like a bankster …

By doing such a transaction as described … both home lending … and home buying and selling … ‘HAS IMPROVED’ … and ‘INCREASED’ … thus proving ‘a better economy’ for all … so that realtors will have no problem peddling overpriced homes in 2011.

Whatever happened to that old saying,”If you have to ask the price, you can’t afford it.” Just kiddin’!

Laura, you are so right about needing a mortgage on this. People who can afford this don’t take mortgages.

Also, I think one reason many of these home aren’t moving is the expense of maintenance and upkeep, inc. HOAs and taxes.

Just think about a $5 million home for a moment. Assuming a 2% annual cost for tax, insurance, HOA (if any), and upkeep, that amounts to $100K a year. Heck, that is a great salary for most people, even in sunny So Cal.

So, in summary, of course the astronomical prices are even out of the league of all but a few of Hollywood’s elite. Secondly, most people, even Hollywood’s upper crust don’t want the upkeep costs of these monsters.

Lastyl, look at the Spelling house. Would you rather have the house or sell and het the cash for the things you really want? Sure, that may have been a great house for the Speeling’s at one time, but now they want the cash.

People, at every level of this bubble/crash, have forgotten that house cost more than just the PITI! Many people forgot about that. They figured that sending in the monthly nut was enough. Not so fast, my friend!!!

As an anecdote only, I used to have a neighbor that literally spent about 90% of his non-work waking hours working on the house and he was the original owner and this was from day 1 of ownership. In some ways I admired his work ethic, but in others, I vowed never to be a slave to bricks and mortar.

Believe it or not, people actually do take out monster mortgages. There were advertisements in the L.A. Times for mortgages up to $10,000,000.

That was just the advertised stuff. There are much larger mortgages than that taken.

I asked IrvineRenter to pull up the mortgage on the biggest, most expensive spread in Bel-Air just for shits and grins.

http://www.zillow.com/homedetails/10644-Bellagio-Rd-Los-Angeles-CA-90077/20526802_zpid/

There was a $50,000,000 mortgage on it if I recall correctly.

On the lower end of the totem pole…just think Nic Cage or Ed McMahon

My take on McMahon is that he lived beyond his means and consequently dipped into the bubble mania taking money from the property. Cage, on the advice of his financial guy looked at his huge net from his run of mega movies and jumped into the flipping game only on the scale of mega mansions – obviously in hindsight a bad move.

Thanks for that, EconE! I love the ZEstimate graph on that place…like a crackhead’s W. 60 million down to 20 million, bumping up to 50 million, then flatlining to 20 million, then back up to 70 million.

“Anyone in the market for a $16 million home for $8 million?”

If a coke snorting RE agent had originally listed it for $100 million would you be claiming a 92% discount? ;^)

These mega-mansions are white elephants. The celebrities who buy them aren’t being sold a house as much as they’re being sold their own egos.

“These celebs/billionaires/studio heads/CEOs etc. aren’t being sold a home they’re being sold their ego.” DING DING DING!!! BINGO! Once you get up to the multi million (usually 5-10 million range plus) plus market, the asking prices are just arbitrary, random numbers juiced to the sky. One mega mansion asking 10 million, another which isn’t half as impressive asking 20 million because it’s on a “more special” lot or has “more special” “more rare” building materials or is in a “more special” block. All bullshit.

Architecturally, this faux “Med” manse is a waste of a great (albeit non-waterfront) lot. The “details” on the pillars, etc., are STYROFOAM, covered with stucco, LOL! Just say NO to Faux! ;’)

Overall, the flooring, finishes, furnishings, etc., while “upscale”, do NOT look like $16M, or even $8M custom estate, but rather like Toll Bros. “McMansion”… Oh yeah, discriminating buyers will be beating the doors down… not.

PS: Spelling mansion, yeah, that wedding cake palace will move quickly, LOL… guess that “Arab prince” didn’t come through. No doubt it’s very cozy, and requires only a part-time staff of 2… :p

You’re right, it does not look like a house that should cost $8M, even though it is very pretty.

I’m getting used to the blandness and lack of fine craftsmanship in most modern dwellings, but I remember when the term “mansion” referred to something loaded with incredible craftsmanship, which this place lacks. The exquisite millwork and plasterwork and stonework that used to be commonplace in upper-class homes is absent here.

Still, a very attractive house which I suppose is more representative of modern taste than the beautiful, intricately crafted homes of the elder days. But it’s sad when people are so brainwashed by the design magazines that they buy a beautifully crafted old house or apartment just to clean-wall it and otherwise “modernize” it to death.

You’re so right, nothing in this house is even remotely worth the asking price. Cheap stucco contruction, wood veneer flooring, cheap faux-Mediterranian architecture. Rediculous.

I recently viewed a mansion for sale in Sands Point, New York. It is currently listed at $17.5 million. I was genuinely impressed with the architectural style and craftsmanship of this Long Island cottage.

So, if you’re a Wall Street bankster and you have just received your year-end bonus, this may be just the place to hang your hat. Your ego will thank you.

Take a look… http://www.realtor.com/realestateandhomes-detail/240-Middle-Neck-Road_Sands-Point_NY_11050_M44696-91341

zillow shows value @ 4.89 lol

Here’s a virtual tour from one of the pre-foreclosure listings:

http://www.postrain3.com/cb/2600bowmont/mls.php

The windows seem tiny in this place to me. Anyway, this is a spec house that was kind of late to the party, not the best lot, the house is squeezed in along a narrow winding street. This is BHPO – Beverly Hills post office address, but in the city of Los Angeles, not a big deal as a lot of the most expensive stuff is in the hills above BH proper. I guess someone didn’t like the official address number – county records show 2666 Bowmont, not 2600. As to the history, this house was built in 2008 so those earlier transfers were without this house. The $250,000 transfer in 2000 shows as a partial transfer, which in this county means that the transfer amount was either subject to existing liens or was of a % of the title, an equity transfer if you will; here it was between two companies and the loans later recorded on it showed as 80%/20% between these two entities.

Total published debt on the loan at time of foreclosure was $8,386,361.19, bid was set at $7,750,000 and it went back to the bene. There did appear to be some private junior stuff behind that was wiped out.

The house is now co-listed between two Coldwell Banker agents, one of whom had the house listed originally, that’s a little odd in that lenders rarely want to have anything to do with the previous listing agents, but in this price range everything’s a little different.

i have been looking for a condo in in oak park. there are three of them on the market, and i was about to give an offer to one of them. yesterday i happened to log into realtyzip foreclosure .i was shooked tofind out there are six condo in the same area are going to be foreclosed. two are going to auction and four are in pre-foreclosre but the price of the condos in the same area don’t really fall much. i don’t want to give any offers after i read the oreclosure info. the area i was looking at is a very small aea of oak park and six of them are in foreclosure isjust insane. and. six

Shela, good for you! Two things that are certain about this market (unlike Duh Bubble):

1) There is NO RUSH, no time pressure to pull any triggers–YOU go as slow as YOU like. Anyone pushes, let ’em know you’re walkin’…

2) FORECLOSURES *ARE* VALID COMPS! And all the Real-tard gnashing of teeth cannot make it otherwise!

BEAT THEM DOWN IN PRICE! No such thing as a “low-ball” offer when Duh Seller is in a zero-bid market.

Charting California’s Demise

Graphic:

How the recession changed us.

Links to more graphics and full article.

This changing color graphic shows the geography of the recession for all states:

http://www.latoyaegwuekwe.com/geographyofarecession.html

~Misstrial

This is no mansion, just a big house. It’s trying to be this:

http://www.google.com/images?client=safari&rls=en&q=rosecliff+mansion&oe=UTF-8&um=1&ie=UTF-8&source=univ&ei=rZwrTdiMO4qCsQO69P37BQ&sa=X&oi=image_result_group&ct=title&resnum=3&ved=0CDEQsAQwAg&biw=1900&bih=1400

Which *is* a mansion. 🙂

The architecture and craftsmanship of the Newport Beach mansions is incredible. But what would Rosecliff cost to build today…. if it could even be built? It would cost a couple hundred million at least, and many of the crafts that went into building it are almost unknown today.

I’ll give them fifty bucks for the joint. That thing is costing them a lot more than fifty a day just to own it. Take it or leave it.

Leave a Reply