Banks ignoring foreclosure in wealthy housing markets – Beverly Hills MLS lists zero foreclosures for the 90210 zip code but distress inventory still high.

2012 was a flashback to 2005 real estate. Bidding wars, flippers, and hungry investors all diving into the market with many purchasing homes without fully analyzing the numbers. There is a very clear trend in the current housing market and how banks are processing foreclosures. It is a parallel to what Mr. Getty once said about large loans owed to banks; the bigger your mortgage, the more likely it is that the bank will not foreclose on you in a timely fashion. I usually browse Beverly Hills real estate as a source of a prime Los Angeles market and also, because many people can understand that this is a selective area. Today I was looking at my data feed and found it amusing the mix of foreclosures and MLS listed properties.

90210 Analysis

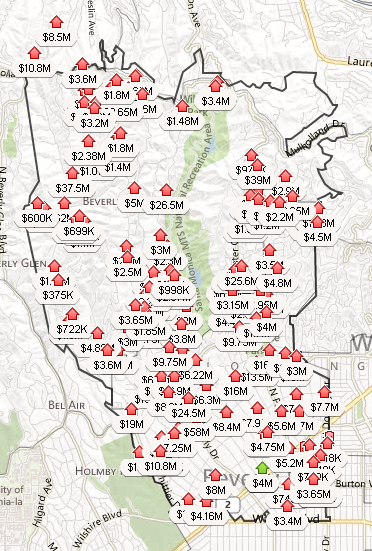

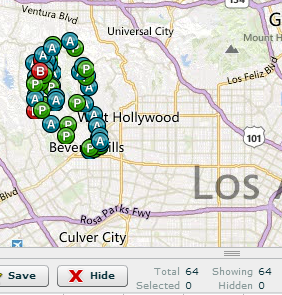

I ran a quick search and pulled up 160 properties for the 90210 zip code that are currently for sale:

Total data: Â Â Â Â 160 homes for sale (zero REOs)

This looks like one of healthiest markets around the country. What I found interesting however is when we dig into the distressed pipeline data. I went ahead and pulled the current distressed inventory for Beverly Hills and found the following:

64 homes have received a notice of default, are scheduled for auction, or are bank owned. This is a significant amount of distressed properties. Last month 24 homes sold in the 90210 zip code with a median price of $3.4 million (up 52 percent from the previous year). So I wanted to take a look at some of the REOs in the distressed pipeline for Beverly Hills.

This home is not listed on the market for sale even though it is currently bank owned. But it might help to follow the history on this place and see how motivated banks are to act on these kinds of properties:

October 1992:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $155,000

November 1999:Â Â Â Â Â Â Â Â Â Â Â Â Â $860,000 (sale price)

July 2004:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $500,000 (WaMu Loan)

Aug 2005:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $750,000 (WaMu Loan)

Aug 2006:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $250,000 (WaMu Loan)

Aug 2007:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,292,000 (WaMu Loan)

From looking at the history, it looks like the home was bought in 1999 for $860,000 and was then used as a home equity withdrawal machine. By August of 2007 WaMu had made loans on the property up to $1,292,000. Hard to say how much down was put on the initial purchase but by the end, it really did not matter since nearly $1.3 million was owed.

At a certain point this became too high of a cost. So let us look at how quickly banks will move on high priced Beverly Hills homes:

Notice of default (June 2011):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $65,237

So by the first notice of default, the owners were already in arrears by $65,237 which is already higher than the median annual income of California families. An auction was then scheduled on September of 2011. By this point, the balance was $1,411,201. Still nothing. Then another auction was scheduled for April of 2012 and at this point, $1,474,396 was owed. Keep in mind the last refinance put the place at $1,292,000.

So run the numbers:

Last refinance 2007:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,292,000

Last auction filing 2012:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,474,396

In other words, the bank allowed the loan balance to balloon by $182,396 with missed payments and fees for more than 1.5 years. Finally in November of 2012 JP Morgan that took over WaMu ended up taking the house as an REO. This is probably the unsettling truth for many when they examine these numbers. As it turns out, the bigger your mortgage and the wealthier the neighborhood, the more likely it is that banks are not going to foreclose on you quickly. Keep in mind that these families also have more disposable income and also know the loops of the game. For example stalling tactics or legal filings that reset the entire foreclosure process. In the end, this family likely stayed in a million dollar home without paying a dime for over 1.5 years.

This is merely one example of the 64 properties in distress. Banks now realize that prices are going up so why rush to sell? This home is not listed for sale but the market has been hot in 2012. Better to constrain inventory and inflate prices since the entire accounting system is frozen in place to allow for easy disposal at high prices of this distressed inventory.

Don’t you just love California? Even when you go broke in a wealthy neighborhood you still get the privileges that are not available to most Americans. Compare this to Arizona, Nevada, or even the Inland Empire where banks are yanking homes quickly to unload to hungry investors and flippers.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

38 Responses to “Banks ignoring foreclosure in wealthy housing markets – Beverly Hills MLS lists zero foreclosures for the 90210 zip code but distress inventory still high.”

Foreclosing is Tabu right now , Not just for High end and not just in Ca.

Why should the banks foreclose when the FED and Bernanke are subsidizing the banks balance sheets ?

Its a simple as that .

— Foreclosing is Tabu right now —

I believe you’re thinking of Shamu. That is the killer whale’s name, not Tabu. Plus, he is not even close to being in the 90210 zip code. I thought he used to live off of Palos Verdes but may have been moved at some point or swam free.

Oh, “taboo”, !! Never mind.

Banks want to clear the books of lower priced homes, first.

On the Penninsula, near San Francisco, anything under $800,000. sells within day,

often before even the first open house.

Houses over $1,500,000. tend to sit on the market for a month or two.

I am not sure how wealthy this family is given what they paid for the home and they have been living off their ATM equity. They just have gamed the broken system very well What did they do with all that cash? This is is another example of how unfair things are for the next generation who was not of age to purchase during the over leveraged, stated income insanity. Between Prop13, unnaturally low inventories, flipper bidding wars, people living mortgage free while rents are going up for the rest of us (making it more difficult to save for a home) the scales are so UNFAIRLY tipped toward “homeowners” who are already settled in.

Not to mention the lifeline of lower rates for the bubblicious buyers 2000-2007 to refinance their albatrosses and the safety net of HARP allowing refinancing under-water mortgages at these historically low rates.

If you were prudent, you were a sucker.

It sucks for the prudent buyers. They had a very small window to get into the market (2009-2011) where the buyers were definitely calling the shots. Who knows how this will all pan out in the end. One thing is for sure, the PTB will always favor homeowners versus renters. And the renters are getting royally screwed now with annual rent increases and inventory that has all but disappeared. Who would have guessed that the biggest bubble in human history only saw a few bad years before the “recovery” was in full effect.

This LB guy is a real laugh.

Joe, the only thing that will be a real laugh is when you get hit with your next yearly $100 rent increase. At that point I’ll probably refinance at an even lower rate, saving me greater than that per month. It is what it is my friend…

Curious to know what kind of mortgage insurance do these refi’s pay?

I looked around my crappy neighborhood today and became shocked and disgusted that a household income just over $100k a year gets us such a depressing soulless ugly environment. The house itself is kind of ok but the neighborhood is full of old couples holding onto family homes and most can’t afford to even have them painted. Everything looks so run down. The houses. The cars parked in the drive ways. I’ll assume the tattoo businesses are booming.

Maybe it’s an acute case of culture shock but it feels like I’m living in a very broken society. This country is very strange.

Which way are those rates headed now, LB?

Exactly.

The real laugh will be when Sac gives the municipalities the effective ability to override prop 30, thereby increasing your property taxes, and the dead cat bounce losing its momentum which will have obvious impact on the ability to sell for a foreseeable future.

The difference here is that you chose to shackle up and need this market to do well, bar whatever manipulation may be. I can leave unscathed.

By the way, rents don’t always go in one direction, friend. Property taxes and HO insurance almost always head in a straight line.

Enjoy your ball and chain!

Wow..you have a bizarre notion of what Prop 13 is. If prop 13 were ever to be repealed do you actually think that anything would be any different in Sacramento? Like do you think that with new revenue that they would stop overspending? There is a sickness in this country, that affects the left, that is born of the belief that government needs more money. Well nothing is stopping YOU from giving them more money. Go right ahead….with YOUR money, not mine.

Listen Hon, if Sac isn’t getting you from the front, they’re getting you from behind. Just because your prop tax burden is artificially capped just means they get more from somewhere else to make up the diff. This whole idea that Prop 13 inhibits spending is simply wishful thinking.

I’m looking forward to the eventual Prop 13 unwinding. Wealth redistribution to the property owner class since 1978. Interesting how government intervention is okay when one is benefitting from it.

Ha,ha,ha…remember Country Wide? It is country wide time again!!! Riding on top of this big rough house purchasing wave again, you can see from afar the fat cat hedge fund jugglers, surfing next to some Ben collegato banchieri,and the half naked flippin illusionists pushing red buttons behind.Pump it baby!

A caste system in the U.S.? What?! That can’t be. We’ll get Diane Feinstein with her concealed carry license but desire to confiscate everyone else’s firearm right on it.

Pull out 600-800k from that “ATM” => go retire in another country. Now I’d be disappointed if they blew all that money on luxury living.

There are few subjects so rife with misunderstanding as fractional reserve banking and interest in this country. Interest, which used to be called by its real name ‘usury’, has bankrupted the entire planet, while burying individuals, businesses, and governments in mountains of inescapable debt. It has, with no exaggeration, turned anyone except the most elite into de facto slaves. If you disagree, run the full amortization tables for that amazing 30 year, 3.25% mortgage you were salivating over, where you will find an ACTUAL apr near 87%!

The other edge of this blade, fractional reserve banking, is simply legalized counterfeiting. All money is ‘loaned’ magically into existence. This is why the US dollar has lost 97% of its purchasing power in the past 100 years. It’s why the same home your parents paid $12k for 40 years ago cost you $250k, and why the current generation of young adults is unlikely to ever attain a similar standard of living as their parents.

Finally, no whopper of a home loan is ever approved without a bank appraisal. That bank assessment of home values coincidentally matched whatever price “the market” assigned it throughout the recent bubble, should tell you all you need to know about banker integrity.

That may be true with the left when you look at California or New York or New Jeresey higher taxes but high debts but the right things now all you have to do is have tax cuts, a lot of southern states are in the hole too like Miss, South Carolina and so forth.

Prop 13 is not the problem. State spending is. Property tax revenues more than matched increases in population and ‘need’, but spending increased even more.

Most homes in CA have turned over more than once since Prop 13 was voted into effect, and property taxes have been kept pretty current.

The folks protected, as was the desire, are those who were long established, perhaps even retired, who could not afford the taxes on their virtual ‘fortune’ held in their home, and were forced to sell to pay the taxes.

It is illusory to think that Prop 13 has had a negative effect. The market in CA has changed so much in the past 20 years, when I left, that I could never afford to move back into either of the homes I sold. Both have tripled or quadrupled or more in ‘value’ such that my income would no longer qualify me to buy.

There is still a lot of ‘crash’ left in CA property values before the median income, of the current residents, can afford to live there. There just isn’t enough income to support property values.

tom

With respect, you admit to having been away from California for some time. Where do you get your data? Your claim — Most homes in CA have turned over more than once since Prop 13 was voted into effect, and property taxes have been kept pretty current — even if true, would only mean > 50% of homes have turned over since prop 13. I’ve lived in multiple areas of the Westside and South Bay over the past 20 years and I’m telling you neighbors all around me are admitted Prop 13 lottery winners. Even those who purchased pre-2000 are Prop 13 lottery winners.

With Prop 13 property tax protection and 3% interest rates at your disposal with which to trim interest payments dramatically, anyone who purchased in desirable neighborhoods pre-2000 is HEAVILY incentivized to stay put.

DFresh, you are 100% correct regarding Prop 13. Anybody who bought prior to 2000 in a “desirable” area is getting a huge Prop 13 subsidy. I recently bought in the South Bay and have first hand experience with this talking with long time neighbors. Isn’t it awesome when you can collect 2013 market rent and only payed property taxes based on a 1980 adjusted purchase price. As time goes on, the Prop 13 effect will become even more prevalent.

stop complaining and pay your property taxes. What will you replace “prop 13” with? What is your solution?

Surfaddict, if you must ask, here is my solution (and I do pay my property taxes…and those are market rate taxes my friend):

1. Stop the corporate welfare.

2. No more gifting Prop 13 tax basis to family members.

3. Prop 13 only applies to primary residences (no investment properties).

4. The 2% annual increase is ludicrous. This probably needs to be increased quite a bit.

5. Prop 13 will only go into effect after people reach federal retirement age.

These are all great ideas going forward. What do we do with all the people on Prop 13 welfare right now? Come up with an equation regarding current home value versus adjusted Prop 13 welfare value and meet somewhere in the middle. The Prop 13 lottery winners in Santa Monica and Palos Verdes will definitely feel the effects of this, but then again I don’t think anybody will shed a tear.

So there is my solution. Do you have one? Probably not since you greatly benefit from an unfair law.

I don’t “benefit†from whatever your silly misperception is. I bend-over and pay my taxes every quarter, and it freaking hurts. Property tax is based upon purchase price. What do you suggest it be based upon? It is capped to increase 2% annually, and YES my taxes have gone up every year, same as yours. Compound 2% for a decade & more…why should they go up to infinity? Let me call Krugman, he can sell me the whole FIAT fantasy you buy into. Did you NOT know you had to pay taxes when you bought your place? Or indirectly as renter you pay them? Sounds like you have buyer’s remorse. You covet other’s financial positions versus yours. You are morally corrupt, besides being illogical.

#1 is a paper tiger argument.

#2 I concur

#3 I concur

#4 Ok yes it should be 500%, 100%, whatever YOU decide, since you know best.

#5 Is valid for further discussion and examination

Go here and read: http://www.city-journal.org/2010/issue_20_2.html

The article titled: Don’t blame Proposition 13 by William Voegli.

http://www.city-journal.org/2010/20_2_prop-13.html

What happened in 2000 that meddled with Prop 13? Memory has it as being a 1978 initiative.

Having neighbors who pay taxes based on their purchase price seems reasonable to me. The ‘value’ of increased property only becomes relative when the property is sold. Increased property taxes based on inflated values only serves to feed the beast, so to speak. The average home in CA sells every 5 years. The ‘base’, or current value of the tax rolls is significantly increased from 1978 valuation, and tax rates have not been decreased.

Simply put, the state government has spent way beyond their means, and those who are slightly sheltered from profligate spending by Prop 13, should they remain in their homes – for over 35 years – should retain that shelter. Anyone who buys a home later should realize their expected taxes on the HUD closing form. It is NOT hidden. Methinks there is a bit of schadenfreude going on here.

I purchased a home in Oakland, for less than $50k, and sold 8 years later for just over $110, less the realtors commission. That home peaked at somewhere near ~$800k, and the Dublin home I bought for $175k in 1984 peaked at near that value at the same time. Anyone who could afford payments on a 3/4 $MILLION mortgage should have no problem paying ‘their fair share’ of property tax. I cannot afford those payments, nor the tax bill either. Never could. That is part of the ‘deal’ of CA living, I guess. My thought then and now, was ‘step off the escalator at your own risk’, but you’ll never get back on. And I won’t.

As the Doctor notes, and I have thought previous to the burst of the bubble, there is no way these prices can be supported. There are not enough jobs and not enough income to pay the freight. I was right, unpublished so to speak, then, and think I am now. Prices will continue to fall until there is income available to pay the PITI.

tom

Surfaddict, if anybody is morally corrupt it is YOU. Cry me a river that your tax basis goes up a measly 2% per year. This is less than inflation and much less than CA housing apprectiation for the last 35 years. You don’t seem too bright so let me explain what Prop 13 does to any decent area. People will not sell solely due to being grandfathered in at Prop 13 rates. This alters the natural supply/demand curve and creates premiums (some utterly ridiculous) in many areas. And Tomw is wrong also that the realized gains aren’t seen until the property is sold. You can rent out a Prop 13 protected property for market rents and still only pay the Prop 13 welfare rate taxes. Sounds like you profiting quite handsomely without selling.

With Prop 13 we’ve told a whole generation of potential home buyers that “tough luck if you can’t afford it, move somewhere cheaper.” I’m going to reverse this and say “tough luck long time owners, if you can’t even pay market rate property taxes, sell your place and move somehwere cheaper.” What’s the difference here? Nothing! Pay your fair share!

I don’t think anyone here is advocating that Prop 13 is “the” problem. It is but one of many problems in CA, including over indulgent spending.

So it looks like this will continue for quite sometime. Then mix in all the recent FHA loans that are in default and you have another bump in pricing. Then all those that lost their homes first go round will be ready to repurchase and start this cycle again. The new America where your never held accountable, there is no winning or loosing and if you fall down Uncle Sam will pick you up and dust you off.

And once 24 months in the FICO penalty box is over, with all the money they saved from living mortgage-free for 2-3 years, they’re able come in and out-bid those who’ve been paying their landlord on time and socking away 10% of their paycheck over the past 10 years. Lovely.

The house pictured might sell for about $200,000 in today’s Atlanta.

Not that I want Californians to come east or anything. As “Lawrence” in “Office Space” phrased it, “No, thanks, man. I don’t want you f**king up my life, too. “

Hey Patrick,

Just wanted to calm your nerves. Don’t think too many Native Californians will be headed your way. However does seem like quite a few of your transplants will be returning home soon. Feelings are mutual.

Auntie’s probably right. A lot of The Californian’s you’re thinking of are too busy thinking about how they are the most interesting people in the world for living here. There’s no time to consider better alternatives when you’re busy trying to impress the other sheep.

I wonder how long this new mortgage rate can continue? It’s the real wild card in the whole mix.

“Keep in mind that these families also have more disposable income and also know the loops of the game. For example stalling tactics or legal filings that reset the entire foreclosure process.”

I think that’s more of the story, frankly, than the price of the home. Whether or not people are savvy, or have someone in their lives that are savvy enough to help them take every legal option they can.

Take a middle class senior citizen with an attorney in their family, whose spouse dies after a long illness and leaves them with an underwater mortgage because of the housing crash, and unable to pay it without the significant pension/SS income of the deceased spouse.

They would of course be quickly advised that paying less than the full mortgage payment is useless, and that paying a lawyer a monthly fee to seek solutions (ie: stall until they get a viable deal like a deed in leui or something) & hold the foreclosure off for 2 years & 2 months, is a lot cheaper than paying rent somewhere for 2 years, let alone a mortgage.

Sounds unethical. Maybe sounds morally questionable. Maybe sounds dishonest to people outside these situations. But it’s COMPLETELY LEGAL and for someone in that situation, maybe the only option.

The system is set up that way. The banks brought it on themselves more or less.

And yes, the more money you have, the more likely you are to know enough to go immediately to a lawyer the minute you can’t pay your mortgage payment in its entirety.

What a mess our beloved FED has been cornered into. What’s even worse is the banks have a free pass to rape and pillage the public and the moral hazard problem just intensifies. If this continues for years and years, we eventually inflate to the moon while the new generation sinks further into poverty. We are creating islands of wealth that will be surrounded by indebted slaves, as the price of everything skyrockets and wages stagnate. I guess banks never have to foreclose anymore. That’s the real gamechanger.

http://Www.westsideremeltdown.blogspot.com

I don’t think the moral hazard is intensifying. But the immorality sure is! Banks sitting on particularly nice properties is probably a sign of risk-aversion… no one to unload garbage to right now & I guess not a big enough market for those particular houses?

I used to think they were sitting on properties fantasizing about housing prices to bounce back up, or in order to control inventory so prices bounce back up. Or at least some kind of financial scheme that benefits them somehow with something.

As time goes on though… I wonder if at least a portion of the problem is that these banks really just don’t know wtf to do with it all, because they’re still under the delusion that profits should be made like they were in the bubble. In other words, denial leads to paralysis.

I’ve begun to think that “too big to fail” turned into “too big to be functional”.

Always remember in these scenarios – laws only apply to the little people. So shut up all of you proles, and thank the government and their cronies in the banking industry for not taking everything you own that’s not nailed down.

I see many vacant houses now in Dallas/Houston/Austin/San Antonio with no “For Sale” sign in front. Most are not even listed on the internet. I can’t imagine how the banks can sit on these as the lawns go unmowed, fences fall, windows break, etc and the entire neighborhood is dragged down by these empty boxes.

people complain about China’s “Ghost Cities” …well, we have millions of vacant “Ghost Houses” rotting away with many suburbs turning into slums as a result.

Obama is such a big sell out for allowing all that you mention happen under his (two) watches. The Banks are destroying the american way of life each and every day and the politicians just sit back, take their bribes, and watch it all happen.

Leave a Reply to Big Ben