The echo bubble in Arizona – Home prices in Arizona surge over 30 percent over last year. Investor saturation and signs of market flooding.

The rumbling that you are hearing is the sound of an echo boom in the housing market. Mark Twain was absolutely correct in observing that history may not repeat itself but it certainly rhymes. I don’t even need to dust off economic books from the Great Depression for this evaluation since what is occurring in the current market only happened in the 2000s. It is an interesting parallel especially for California but for places like Arizona and Nevada investor action is off the charts. You might have noticed that the mixture of home sales has now pushed the median home price in Phoenix Arizona up by 30 percent in the last year. This kind of shifting and erratic behavior is part of the odd management of the housing market. Since the shadow inventory is being leaked out courtesy of modified accounting regulations, you now have a limited selection of homes on the market and a feeding frenzy occurring from investors. The numbers are worth noting and the stories are reminiscent of the early days of the bubble.

The big jump in Arizona

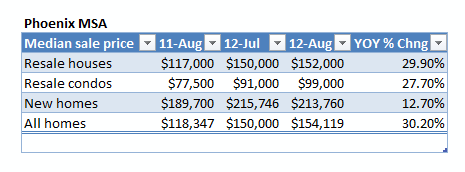

The big price jump has occurred in both resale houses and condos:

I don’t think people realize the amount of big money flowing into the real estate market for the tough business of landlording and flipping purposes. It is certainly tougher than trading derivatives when it comes to sweat equity. There is little doubt that big money is now in the housing game. I love the title of this Bloomberg story: Phoenix Picked Clean, Private Equity Descends on Atlanta:

“(Bloomberg) Wall Street has got billions and billions of dollars they need to place and it has been determined they want to come into this segment. There are only handful of markets that that’s going to go into. This is one of them that has not seen the appreciation. If I had another chance to go back to Phoenix and wind the clock back 12 months, that’s what I think this is.â€

This psychology behind the notion that you’ve missed the boat is exactly what led us into the housing crisis in the first place. Those 30 percent gains are simply a result of a shift in inventory mix but many fly by night investors are looking at these gains and are going to be playing yesterday’s game today. This mentality is largely present again except this market is completely managed and these short-term gains are largely built on unsustainable lower interest rates. The Fed will need to commit to buying nearly $500 billion of MBS in the next year to keep this thing going but as the story above indicates there is plenty of hot money willing to enter the game.

Is the game getting too hot?

It is interesting that investors are shifting their interest as well:

“Phoenix investors Chris Hanson, 29, and Ofir Levy, 35, slowed purchases of houses in Arizona in June because prices were too high and yields too low. They flew to Atlanta this month with the goal of buying about 100 homes, which they hoped to flip to the large investors within the next year. They were looking largely in fringe areas where the funds are less active.â€

In place like Arizona you have more room to navigate but in places like California people are in it for the very quick hipster flipping opportunities. Now here is an interesting observation:

“In Phoenix, owning is 49 percent cheaper than renting, narrowing from 55 percent cheaper a year earlier. The gap narrowed even as 30-year mortgage rates fell by an average 1 percentage point to 3.5 percent, according to Trulia economist Jed Kolko.â€

So you have to ask why would someone rent when they can buy for much cheaper? Of course the problem is the market is flooded with an insane amount of investors outbidding your average John and Suzy. Last month in Phoenix over 40 percent of purchases were for all cash. So when you look at the current sales count plus the lower cost of owning versus renting you have to wonder why sales are not even higher?

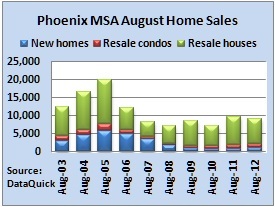

In Phoenix investor purchases have been hovering around 50 percent for almost three years. Investors are understanding this is unsustainable and are pulling out of markets and going to other places like Atlanta that saw home prices crash on a later trajectory compared to places like Arizona. At the peak some 20,000 homes were selling each month. For the latest month of data we have 8,979 homes sold, a drop of 4 percent from the last year.

Mind you that the median home price went from $118,000 to $154,000 so it is unlikely to break many investors unless they over leverage or simply purchase in weaker areas. Yet many are going in with all cash. It is also interesting noting the large number of FHA insured buyers in the mix. There is little reason for prices to surge this much this quickly and we are already seeing people salivating thinking this game is going to last for a very long-time. In places like Arizona you also have very sensitive household budgets that depend heavily on cheap energy.

I had to write about this topic because this is the first time in many years that I have seen e-mails coming in with headlines of “30 percent annual gains†coming in. The fact that a large number of these investors are already getting tired in certain markets tells me they were never in it for the long haul. Let us not even address the reality that household incomes have been stagnant in Arizona for well over a decade. What happens when half of your buying pool begins to pull back? As far as I can remember, we now seem to be in a perpetual cycle of boom and bust. Try to time your entrance on the financial rollercoaster. Some are already getting off.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “The echo bubble in Arizona – Home prices in Arizona surge over 30 percent over last year. Investor saturation and signs of market flooding.”

Och-Ziff Hedge Fund bought real state when there was selling pressure and they are now selling into strength while the “smart money” is rushing in. Welcome to the asymmetric world of trading where the skew between winners and losers greatly widens.

http://news.yahoo.com/exclusive-och-ziff-hedge-fund-looks-exit-landlord-211902686–sector.html

If what you are saying is that the “long-haul, buy to rent” strategy was always BS and the real goal was to step between distressed sellers and buyer-occupants (extraction of easy cash from the desperate and the squeezed), then I whole-heartedly agree.

Well, Arizona only has two metro areas. Phoneix-Marcopia which has higher income than the large Texas metros and lower poverty than the Texas metros, in fact it wasn’t for the housing bubble Phoneix a betterplace than Dallas or Houston. The other Tucson is further behind in income.

We are clearly one year into another housing bubble. The only question is how long will it take for “Housing Bubble 2.0” to pop?

My opinion, from three months of searching for the right home to purchase, demand is starting to slack locally. San Fernando Valley, Simi Valley, Thousand Oaks…

I have also been too several open houses that were very sparsley attended. After lurking on this blog for a long time, i am now commenting because much of what i read here is contradictory to what i “see on the ground”

Namely, alot of houses that are still overpriced, or the appraised values are not what the homeowners had in mind.

People dont want to purchase knowing that the value of the property is likely going to go down, over the long term. As the election draws near, it seems to be enhancing that effect. With regards to DHB comments about wage growth i totally agree, and job creation, well the proof is in the pudding, via recent jobs reports. ITS A TOTALLY MANIPULATED MARKET FOLKS!

Millions of people buy cars every single year that cost a large share of their household income, knowing full and well that this huge “investment” will decline dramatically every year and eventually be worthless.

In markets that were traditionally very weak, people were often more inclined to rent than to buy a home.

Apples and oranges.

And still car cost 1/10th of a house and financial loss is neglible, in dollars, compared to a house. Car purchase may make a major dent on your wealth in one year, but it’s a one-time investment, not major monthly payment forever.

To most people, 30 years is same as forever.

Yep, I have been seeing exactly what you have been seeing. Clearly there is a floor of 375 to 550K, depending on the quality of the hood.

In the areas I have been looking from 92123 ( lower end) to 92104(higher end) I have seen the inventory in the higher range go from dozens of offers from this past spring to no offers and price reductions. Again, I am talking above 550K.

Actually here is an example of what I mean.

This house last sold in 2010 for 710K and is now on the market for 749K. Looks like the owner just wants out without losing any money. Most people would think prices are quite a bit higher than 2010, but not for this segment. This house probably will sell close to ask, probably 730K even though interest rates are so much lower than in 2010. By the way, I saw the house in 2010 and recently, no additional work was done. This house just 6 months ago would have sold almost instantly and now it lingers.

http://www.sandiegohomepage.com/properties/120050017-3446-utah-st-san-diego-california-92104

During the Housing Bubble, all housing sectors enjoyed appreciation, mobile homes included! This “H.B. 2.0” is something quite different. I am seeing condos in the nicest zip codes going for 2000 prices. I am seeing everything 10% above FHA limits showing weakness in price.

The million dollar question is, are the lagging sectors a warning sign of what is to come or is the lagging sector flashing a bargain signal?

Personally I am FED up with the housing market and thankfully have lost that urge to be an owner.

Just went to look at a house in Orange County (Fountain Valley to be exact). Nice large house (2700 sqft) but in need of major upgrades and improvements. Asking price was $490,000 (short sale). We found out from the agent that prior to the viewing day, there were already 10 offers. After the viewing day, there were four cash offers – all above asking price. The highest finance offer was $585,000 (almost $100,000 more than the asking price) and was not even considered! Bubble 2.0 is here!!

Wow, that’s scary and Fountain Valley is not an attractive city to live in. You couldn’t pay me to live there.

Bubble 2.0 may be here, but record affordability is here too. I think many people on this blog don’t realize that or more importantly don’t want to realize that since they want lower nominal prices. If you have been financially responsible (good credit and saved for a down payment) and didn’t get caught up in the housing bubble, now is actually not a bad time to buy based solely on monthly payments. Buying a 500K house with 20% down is likely cheaper than renting a 1 bedroom apartment in the same area…remember we’re talking about monthly payments here. Add to the fact you get a house, stability, no rent increases or being forced to move again because of irresponsible landlords and you get the frenzy we are seeing.

Payments on a 417K conforming loan (30 yr fixed 3.5%) are $1872 per month. Principal is $656, you can write off the $1216 in interest. It’s hard to argue with those numbers. Make no mistake, there is plenty of uncertainty ahead, but people seem very comfortable taking out a $1872 a month mortgage at this point. Good luck.

AH Bunk. The only houses I have seen that sell for that kind of money are not worth that kind of money. Even Martin’s 730K house is a revamped aged working class neighborhood property without even central air and heat. Please pay attention to the dollars being manipulated. Your 500K house was a 100+ K house a short dozen years ago. If and or when interest rates go back up without corresponding rise in incomes the nominal value of that overpriced asset will correct and correct hard. Nor do I buy that such prices equate to one bedroom apts unless you are cherry picking the corporate high end full amenity mega complexes – a hell hole of their own to live in.

Looking only are the monthly payment on debt is what got us into this mess. Look are your yearly income and how it compares to your neighbors. Can you pay off that debt in 30 years. Wages are going down, interest rates will go up. Upside down again.

This guy just won’t quit with this fantasy that the monthly nut on an overprice junker house is equal to a one bedroom apartment.

Cherry picking indeed.

@Joe, don’t have a hissy fit with me. The math is what it is. There are plenty of decent areas where you can buy a house for 500K. Monthly payment is what 95% of Americans care about, in this society the majority rules. Sorry to burst your bubble.

@Lord BF

Math? It’s not math, but merely arithmetic.

Moreover, retards like you only look at the STATIC numbers and that is how this bubble was able to take off (on top of the idiotic monetary policy of the Fed.)

What you need to consider are the DYNAMIC numbers. Dynamically, the Fed cannot hold these low interest rates for many more years. Interest rates WILL go up. Remember, interest is the price of credit, NOT the price of money. The price of credit is radically manipulated downward, thus it is not reflective of the real price of credit (i.e. a gage of default risk). When creditors (the government too) wake up, they will not extend credit. You can see this currently in the repo market, which was the pin that popped the housing bubble (c.2007) and subsequent equity market crash (c. 2008). This loss in “size†repo market (shadow banking) is what the Fed is shoring up with TARP, QE1, QE2, QEternity, etc. They are NOT trying to boost employment and price stability. People need to get this through their head. And what cannot go on forever, will not go on forever.

Also, DYNAMICALLY people’s wages are declining at an increasing rate. So, fixed costs, such as food and energy go up, you are left with less money in your pocket per month.

A slight movement up will severely affect the debt markets (e.g. consumer loans, mortgages, etc.); your house price will pull a Baumgartner (which it is already doing, when priced in real terms: price your house in oil or gold and then tell me how your “investment†is doing). Also, you must consider the tax increases that are coming – governments are insolvent!

Welcome to the cold reality of Nature. Eventually gravity wins. You cannot fight Nature with your wishes, hopes and dreams. Stupid sheep.

Variance Doc,

Nice personal attack, you are a real class act I can see. You, I or anybody else has NO idea what the Fed and PTB will do regarding future manipulation. You can crow all you want on “rates HAVE to go up in the future.” How is betting against the Fed going so far you? They have been doing this song and dance for 5 years, do you really think it will stop tomorrow?

Let’s take your example that rates shoot up tomorrow and prices drop accordingly. What’s the monthly payment going to be then? Probably very similar to today…see where this is going? You are fighting the majority here. While you hope and wait for lower prices and higher rates, 95% of others think it’s a good time to buy. Good luck waiting!

Yeap. We’ve been checking-out larger homes in new Irvine developments, and all are selling extremely well at $800k-$1m+, with many sold-out. The mythical “foreign cash buyer” is alive and well here too.

Property values are likely to drop another 20%. This won’t affect the lower range too much since rents are stable. Too much demand from investors and regular folks who are still trying to buy at rent parody ranges. Rents are not going down so it’s a no brainer for investors and regular buyers to buy entry level condos even at their inflated prices. Rental prices support their purchases.

Employment/incomes have not changed so there is no support above what true incomes can afford. Median prices have gone up but it’s only due to the lower range getting bought up and moving prices higher. It won’t keep moving up above 500,000 or above jumbo range. Jumbo still likely to suffer another drop. This is a case of the bottom moving the market higher not wide spread increase to sales prices across the board.

No one knows where the bottom is, investors have made their best guess. Real home buyers have more to think about if they are buying a home for more than they can rent it…that is where it becomes a gamble. If you can buy it and rent it for what you pay, you are in a good zone to buy. If you are buying and cannot turn around and rent it for your costs, it needs thoughtful consideration.

I tried to buy a SFR rental in Phoenix last year, but rents weren’t in-line even with ROI on even distressed priced homes. Now rents are rising, so I may have blown it.

“No one knows where the bottom is…”

I think by now we’re seeing different bottoms in So Cal. There was the “crash” bottom in 2008, when things cratered across the board and investors and flippers were caught flat-footed. Those who jumped in and have since refi’d are looking like geniuses. There was the Inland Empire, which pretty much fully bottomed 2010/2011. Westside and OC condo’s seemed to have bottomed 2010/2011 as well. Certainly, the “rental parity” buy is now in play, which seems like sub-$500k SFRs (@ 20% down), as you’ve alluded, have already bottomed.

Without a significant change in interest rates, I don’t see prices moving 20% in any direction. However, I definitely can see your scenario of more and better properties in the $500-$800k range hitting the market over time, as local prices come more in line with local incomes.

We seem to be in an extended Western World deflationary cycle (another 5 years at least), so higher interest rates won’t be there to play a role in moving prices down.

Rents are not rising in Phoenix.I know people renting homes with same sq footage cheaper than last year by 20 percent.The media has been pumping the market with lies to get the last of the dumb money.From what I hear hedge funds ruined the market for rentals and there is too many SFR homes for rent.

http://www.zerohedge.com/news/2012-10-23/when-brazilian-model-brothers-come-miami-and-buy-rent-top-near

And of course, the fraudsters are back big time again (flopping?): http://money.cnn.com/2012/10/23/real_estate/mortgage-fraud-flopping/

$585,000 and a $100,000 down payment = a house payment in the $2800 range….+ maintenance….one would need a $9K monthly income.

i’ll never be able to afford to live in OC.

CantAfford’s comment is short but directly to the point.

Im not sure about the math, but with the current job(s) market, and decreasing incomes, who in ther right mind thinks current real estate values are sustainable…?

With the current economic headwinds, rampant goverment spending, and history as a guide, after MAJOR upheavels.? Does anyone really think the housing market will continue to climb, while corrupt policy’s keep the market stangled via shadow inventory. Artificially low interest rates anyone?

Is that shrinking middle class able to afford 9 THOUSAND dollar a month payments.

Let’s face it, things are still dramatically over-priced vs incomes. Someone tell me i am wrong on that! I welcome the information a counter argument provides! BeLie DAT.

People in this country, when it comes to what occured in 2008, WOW, they have AbSolutly NO memories of it? Do they?

If people put down the crack pipe long enough, they will realize this is NOT 2006.

Yup your wrong. It is not a 9,000 a month payment. Can’t afford posted a 2800 a month payment. But that is the only thing you are wrong on. Other than the fact that Americans love their auction fever and will pay way more than the house is worth as long as the “authorities” tell them to. Think realtors, mortgage brokers, bankers, colluding reporters.

cant_afford: depends on what part of OC and family status. If you are single or +1 child, you could easily get affordable condos even in Irvine. 1 bedroom and studios are dirt cheap there. Santa Ana and Garden Grove ghettos are cheap as well.

This new mortgage rate level is getting attention. But, as Kyle Bass recently said about the housing market, “if you were interested in buying a house at all, you’re probably doing it right now or have done it already.” So this run up is not long for this world.

Gosh oh golly gee, I’m getting the pop corn out for this show…..pop!

What ever happened to people buying a place just to actually live in it…what a novel concept.

Ah yes, it’s bubblicious time again in some areas. Banks are still leaking out totally upside down inventory in the form of short sales. My favorite this week was a penthouse condo in Westwood on Wilshire Blvd., that sold in 2011 for $9,200,000 and just closed escrow this week for $6,550,000. Almost 30% off. We have seen 86 meltdown properties over the last month in West LA, Malibu, Pacific Palisades, Brentwood, Bel Air, Westwood, Beverlywood, Beverly Hills, Beverly Hills Post Office, West Hollywood, Marina del Rey, Cheviot Hills/Rancho Park, Santa Monica, Mar Vista and Culver City. More to come.

http://www.westsidermeltdown.blogspot.com

I’ve been house hunting the Phoenix market for over 1 year, have made 15-20 offers, several up to 15% over list, never to have an offer accepted. Crazy thing, as I’ve tracked the homes I have offered on, most of them have not closed—even after 7-10 months, they show as “Removed Listing†or “Inactive†, not sold. I have an incredible data sources and I trust the data. I live in the zip code that I am offering in, and I see most of these places empty.

The second thing, is that the new listings, are trashed, or in horrible locations, like high traffic streets, next to retail, or near a proposed freeway expansion. I do know sales in the exurb fringes of the valley, and in the ghetto areas where homes sell for $40. Listen, I don’t buy how wonderful this market in Phoenix. I am amazed at the number of businesses that continue to close, the available jobs are 100% commission, and guess what—generate your own leads!

It is not a second housing bubble — there has never been a precedent for the reflation of an asset bubble. It’s an investor feeding frenzy, desperately seeking yield, which in turn, is stoking something a mania. But it’s not a bubble. It is a spike or a rally, at best.

Dead cat bounce

Back in 2006 I was talking to a couple who excitedly announced they had just bought a house in OC. I had a ballpark of their take home income and thought “how can they afford this?” Banks making goofy loans?

Fast forward to this weekend…not one, but two couples announced they just bought houses in OC…again, having knowledge of their income, I thought, “how can they afford this?” FHA making goofy loans?

Maybe it’s Different This Time, or QE1,2,3, infinity changes everything.

This time is different. If you ignore the sticker price, and look only at the monthly it certainly is more affordable to buy a home in the OC. You can buy a $600k home with 10% down is aprox $3300/month after taxes and PMI (pmi is only .5% when you do conventional 10% down). 10% of all household incomes in the country can afford this payment (making over $120k per year).

A person making $120K a year nets about $3,300 per paycheck. That is equivalent to the mortgage and PMI in your example. That leaves $3,300 for life expenses, car payments, car insurance, homeowner’s insurance, property tax, bills, gas prices, entertainment, food, clothes, house maintenance, and much more if you have kids. This couple certainly can’t afford a $600,000 house.

To make matters worse, true inflation is running about 6% a year with food and gas prices leading the way. In a few years, without significant wage increases and/or cuts in health benefits, this couple will be heavily in credit card debt, borrowing from parents, and try to find other jobs to make ends meet. Meanwhile the house will be worth probably $450,000. This will not end well.

1. If you have kids, your take home is going to be a lot higher than $6600 a month. 2. Interest deduction will net you about ~1000$ (calculated based on your proposed tax rate of 33%) per month. And besides, why wouldn’t you be able to live off of $3300 a month? I would be able to swimmingly!

“This time it is different” – good one 🙂

Interest deduction will net ~$1000/mo?!?!

How do you figure that?

@Joe, that’s based on the $3300 monthly payment , most of which is interest , property tax and PMI which are all tax deductible. If your tax bracket is 30% as assumed by the prior discussion, then you get to write off about ~$1k off the taxes you owe or that will the amount you will get back. Let me know if I’m wrong.

Ignore the sticker price. Wow that makes lots of sense.

Long time reader looking for a concise newbie explanation to the current challenges and re-inflating bubble. My parents – who have owned on the westside of LA since 1976 – are looking to buy another home as an investment and to downsize (while offering me the childhood home for my growing family). Although it would be a great deal for me, it could ruin my parents and their retirement, so I’m advising strongly against it. Since they want to stay on the Westside, the 3/2 houses they’re seeing all run $700k+. Since they’re seeing a buying frenzy and they’re doing some wishful thinking monthly payment math and low interest rate cheering, they’re convinced this is a great opportunity.

As I try and explain the major systemic market issues and demographic shifts that threaten the long-term “investment” potential, I’m finding my arguments are above their heads. They don’t understand, because the world is so different from when they were starting their careers and family. They don’t understand, because my explanations layer interest rates/demographic changes/unemployment rates/long term economic projections/over-leveraged families and FHA loans/shadow inventory/large-scale investor buying and other related issues in the same argument. It’s too much for anyone who hasn’t been living in the data for years.

Therefore, I need an “”intro to the issue” post or articles. I’m terrified they’re about to make an awful financial decision that will have lifelong ramifications for them (and me, when I have to bail them out of what should have been a secure retirement). They are in an asap frenzy to jump into the market NOW. No logic to it. I think the best I can do is hold them off until after the election, unless I collect more easily understandable information for them to process.

Ideas also welcome from anyone else who’s had luck convincing friends/family to stay away from the recent insanity.

This might be a long shot, but what about making a spread sheet about future expenses? A lot of retired folks do NOT think about what will happen if they have one broken hip, or suddenly need a caregiver. Also, what about modifications for the house? When people get older, a lot of them need more railings, ramps, wheelchair accessibility. What about health insurance? Maybe explain to them the current issues surrounding medicare and ask what will happen if something happens to that system? Also, throw in inflation for more fixed expenses like food and car insurance. This will surely eat away at their monthly income, and might have them think twice before they dive in. If that doesn’t work, maybe poke around to find the real reason they suddenly want to sell. I wouldn’t be surprised if they heard from a well off friend or some “expert” on the news that now is the time to buy. Maybe relate current financial issues with this country (and the uncertainty with it) to something they dealt with when they were younger.

Isn’t Medicare gonna run out of money in the next decade?

I know the price of food is gonna double in real terms by 2030.

Woo-hoo, unaffordable housing for all! The American Dream.

“So you have to ask why would someone rent when they can buy for much cheaper?”

I would ask in response a rhetorical question which is often pondered here: Can they buy? With joblessness and a foreclosures as common as they have been in the past several years, it is entirely possible that a large cross-section of potential buyers is still on the ropes, financially speaking.

Also, please anyone correct me if I’m wrong, but is this not the way it should be? I would expect that to be able to rent a house, in addition to paying whatever the mortgage note would run, there would be a premium attached as well to cover the sundry liabilities that come along with ownership and a reasonable profit. Perhaps 50% is larger than nominal but I the days of monthly mortgage payments exceeding neighborhood rents should have fizzled with the pricing implosion. That, afterall, was an effect of houses being purchased as equity assets. With the current pricing outlook, it would be logical to expect to see a widespread shift toward investment purchases to operate in and income role instead.

If some nut or a family with noisy kids moves in next door, you can move easier when renting. Plus, maintaining a home can be expensive…

Yes, if those maintenance costs aren’t factored into the rent, then it’ll result in a poor or possibly even negative ROI. The notion of being able to easily move away is a convenience for the renter. I’ve found generally true in life that conveniences do not come free of cost.

“There is another problem with the housing recovery story. It isn’t real.”

http://www.zerohedge.com/news/2012-10-24/guest-post-new-home-sales-not-strong-headlines-suggest

There are a number of factors driving this rally (besides REITs) which rarely get addressed, but the capitulation of the jumpers is a big one. Jumpers are the lucky sellers who made a bundle at or near the apex of the housing bubble and have been renting ever since, waiting for the inevitable over-correction. The thing is, this market already has that 100-500K in phony equity priced into it. IOW, the inflated asking prices and selling prices we are seeing are due in part to a still sizable buying pool awash in easy bubble money, who are losing the staring contest with the Fed, and their interest rate games. I know of at least three such souls personally who have capitulated and overpaid this past summer. It’s not like they actually worked for the money; easy come, easy go.

Once a lot of this paper works its way through the system, (a decade or so), and is destroyed by the same asset class from whence the wealth was created, you will see an over-correction in housing that no amount of easy leverage or government subsidy will be able to avert.

Don’t forget one thing – the majority of people who sold in 2006 also bought another home in 2006. The so-called jumpers were only a tiny fraction of sellers. I’d be very surprised if more than 5% of 2006 sellers converted to renting, since the majority of home owners in 2006 were still drinking the cool aid. I know exactly one couple who did this, but I think they became renters in 2004. I actually know more “jumpers” who jumped in 2003 or 2004 and then capitulated and bought between 2005 and 2007.

Being a jumper is easy, but timing it to the peak is very difficult.

The upper crust are giving out their friendly reminder: ‘Remember all that money you made back in 2006 selling your home? Well, we’re gonna need that money back…’

I watched a video last year of a fella analyzing his market (sorry don’t have the reference), who said that of those who had purchased in 2006, are large portion were people who had taken on a previous mortgage on a previous home something like 2 or 3 years before. In other words, a large portion of the class of 2006 were speculators.

Phoenix, Atlanta…….Maybe the big money has found out each American community is isolated in a manner that equities aren’t, so that if they pump enough readily available money in, their action alone can swing the market upward significantly:

Take a billion dollars, buy 5000 homes over a couple years time. That pushes up the prices up significantly more than buying a billion dollars of KO stock. 5000 homes over 2 years time, or 2500 homes per year, represents a little over 25% of Pheonix’s current volume. That’s a huge amount of power a hedge fund has over a market. Alternatively if they would buy the KO stock instead, that’s less than 1% ownership, and it certainly won’t pump the stock significantly – perhaps a few cents upward.

Probably ain’t no laws against pumping (or pumping and dumping) RE, either.

Multiple offers, flips, 30% annual increase, investors, Arizona, “get in before it’s too late”. One word. PONZI.

How soon people forget.

This ends really bad.

http://www.westsideremeltdown.blogspot.com

http://finance.yahoo.com/blogs/daily-ticker/rising-housing-prices-forcing-low-wage-workers-leave-122000221.html

“High housing prices actually decrease income mobility and ultimately hurt the U.S. economy, according to a new study by Shoag and his colleague Peter Gangong.

“What higher housing prices have done,” Shoag tells the Daily Ticker, “is they’ve taken half the country off of this income convergence track.” Certain U.S. cities have “become prohibitively expensive for low-skilled workers and they’ve sort of become segregated places full of high-skilled workers. That’s contributed to regional income inequality and played a part of the rising income inequality that we see.”

Laborers are being priced out of cities like San Francisco and New York City and migrating to smaller cities like Las Vegas and Phoenix. This phenomenon slows economic growth, Shoag argues.”

How the hell can you now say they will “leak out” the shadow inventory, when last year, you confidently told us:

Dr. HB said…reports are flowing out preemptively about the impact of the shadow inventory in 2012. This wave will hit and will have an impact on the market just as it has over the last few years.

http://www.doctorhousingbubble.com/three-dramatic-housing-trends-closing-out-2012-shadow-inventory-overstating-home-sales-picture-of-a-home/

Sorry but this frustrates me to no end. Last year, you created a very clear picture that if we waited juuuust a little longer, the dam would break and finally, FINALLY, the inventory and prices would come crashing down all around us.

Never in my wildest dreams did I think that here in late 2012, all of us would instead be fighting over the last few scraps of inventory. It just wasnt supposed to be like this.

GH,

Why are you upset with the doctor? As a doctor, he is merely letting us know his diagnosis and suggesting treatments/strategies. The housing market is a complex system with many variables, all of which are unpredictable.

Add this the the amount of manipulation the government has been using, and it seems that they can keep this game going indefinitely as America is a wealthy country and many people have money to buy.

The goal for everyone who reads this blog is to find affordable housing in a decent neighborhood, but the landlords, property owners and government are against us. Hang in there and one day I think you’ll get your wish. Good luck!

I know the housing market will not stabilize for decades since i am hearing ads on the radio once again advertizing “free classes” how to ‘Flip That House’ from your home without getting out of your pajamas. Let them have all the houses they want. I just wish they would mow the lawn and repair the falling fences on all those vacant rentals. They make the neighborhood look bad.

MLS inventory in the Phoenix Area is up 50 percent in the last few months.Lot of dumb investors gonna be holding the bag on this one especially the Canadians who buy sight unseen then realize they bought a house with structural issues.

I haven’t visited housing bubble site in a couple years, but from what I see talked about here, the bubble is expanding again. Now is the time to buy or be priced out forever! Can’t get any cheaper than this market! I’ll know it’s deja vu all over again when Flip that House is the top rated show. All this buying mania does is make housing again not affordable to most. I am amazed that the US consumer is so easily swayed by the housing herd mentality. Party on!

And the local cheerleader, er “newspaper”, the Arizona Republic, this past weekend had an article gushing about the rise in home prices. Gannet. Idiots.

Wow, that’s scary and Fountain Valley is not an attractive city to live in. You couldn’t pay me to live there. Its not a bad town its that if you face the Santa Ana side of the city all the schools are in Garden Grove and they are mainly hispanic. I graduated from Los Amigos in 75 when it was about 80 percent white and 20 percent hispanic, its no 79 percent hispanic, 16 percent asian and 3 percent white.

Well, Maricopia is where all the action is in Arizoa, Pima is less than a million and there are a lot less investors in Tucson.

Leave a Reply