Three dramatic housing trends closing out 2011 – Impact of overstating home sales, foreclosure wave will return in 2012, and a very creative agent picture of a property.

There is little mystery as to why home values remain depressed. Real household incomes have fallen for well over a decade and no amount of shape shifting of interest rates by the Federal Reserve is going to make home values spike up without a subsequent increase in household incomes. We have a few relevant stories and trends that have come out in the last few weeks to close out 2011. One of those stories comes from a top housing arm overstating sales for multiple years. Not so much of a shock here but you have to realize that one of the top associations for real estate basically is saying they were off on their bread and butter business for years. This is like a doctor saying he over diagnosed 15 to 25 percent of his patient with a severe illness. Next, reports are flowing out preemptively about the impact of the shadow inventory in 2012. This wave will hit and will have an impact on the market just as it has over the last few years. Finally we have a reader submitted home sale ad that provides some comic relief in the vertigo of the housing bubble bursting.

A picture of a picture is worth?

I realize it is a hard business fixing a home up and getting it ready for sale. With some Real Homes of Genius we have seen sellers, agents, and bank handlers flat out disregard the basics of good staging with leaving trash bins in full view or having grass so high that a California mountain lion could be living there. But it takes a special amount of creativity to take a picture of a picture for a real estate ad:

Source:Â Ad for property

Now this home is listed for sale for $100,000 in Rosamond, California so we don’t expect some elaborate staging or Beverly Hills like Photoshop images. But snapping a photo of a photo? Using a scanner would take two seconds. Good times in the California housing industry.

NAR comes out with official restatement of sales data

This isn’t really a shocker here:

“(CNBC) Data on sales of previously owned U.S. homes from 2007 through October this year will be revised down next week because of double counting, indicating a much weaker housing market than previously thought.

The National Association of Realtors said a benchmarking exercise had revealed that some properties were listed more than once, and in some instances, new home sales were also captured.

“All the sales and inventory data that have been reported since January 2007 are being downwardly revised. Sales were weaker than people thought,” NAR spokesman Walter Malony told Reuters.â€

The emphasis was added above but that may be an understatement of the month. Anyone tracking housing data in their own respective niche markets realized that home sales have been in the toilet. Yet the above official revision is a big deal because this is coming from the top organization in the housing industry when it comes to tracking overall home sales.

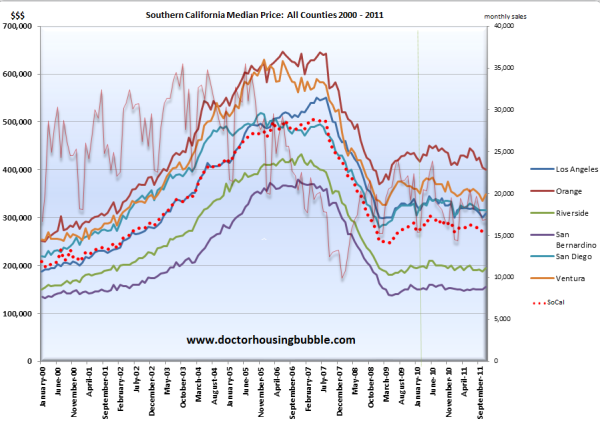

People are a fickle bunch and move in big waves when it comes to trends. My sense is that there is now a big distrust in the financial and real estate industry in general and it will take a very long time to regain the gangbuster years of the last decade (if they ever come back in this generation). This is why home prices even in the over inflated region of Southern California are flat and moving down in some cases:

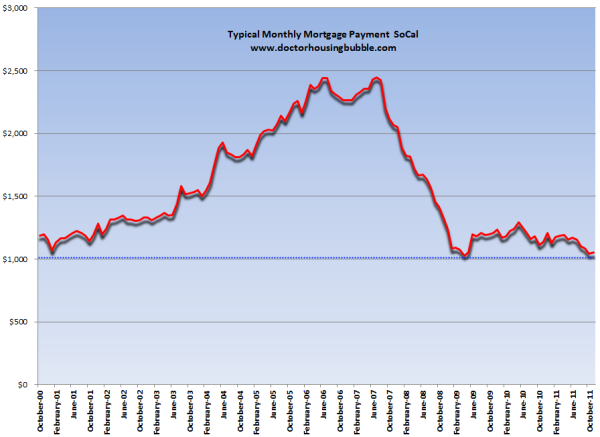

No spike is visible here. And when we break out the typical home mortgage payment we realize that households can only afford to cover what they covered in a mortgage payment from 2000:

The inflated price buffer comes from artificially low interest rates from the Federal Reserve. What people can pay out of pocket each month hasn’t changed much over the last 10+ years so higher home prices are coming from non-income based sources (i.e., bubble dynamics).

Which leads us into the foreclosure wave for 2012.

2012 foreclosure wave with 4 million delinquent loans      Â

The foreclosure wave is going to continue into 2012 with the clearing out of shadow inventory:

“(CNBC) Despite a seasonal slowdown in overall foreclosure activity, and a process still bogged down and backed up by the “robo-signing” processing scandal, the U.S real estate market is about to be hit by another surge of bank repossessions, according to a new report from the online foreclosure sale site RealtyTrac. As banks resubmit millions of documents and courts begin hearing cases again, the backlog of over four million delinquent loans will start surging through the pipeline again.â€

In other words the lull that is occurring is because of legal problems from the fast and loose paperwork from bankers and also the typical seasonal slowdown. Yet the numbers will be moving up again:

“November’s numbers suggest a new set of incoming foreclosure waves, many of which may roll into the market as REOs [bank repossessions] or short sales sometime early next year,†said James Saccacio, co-founder of RealtyTrac. “Overall foreclosure activity is down 14 percent from a year ago, the smallest annual decrease over the past 12 months, and some bellwether states such as California, Arizona and Massachusetts actually posted year-over-year increases in foreclosure activity in November.”

There are some holiday wishes from the governments sponsored mortgage monsters:

“Troubled borrowers will get a reprieve over the holidays, as mortgage giant Fannie Mae says they will not evict anyone until after the new year. A spokeswoman, however, stressed that foreclosure processing would continue through the holidays, so as not to slow the system down any more than it already is.â€

In other words, the foreclosure process will continue to be a mish-mash of whatever the financial sector wants to do. Read the above statement again. You may or may not be kicked out of your house over the holidays. Happy holidays from the American banking sector!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

34 Responses to “Three dramatic housing trends closing out 2011 – Impact of overstating home sales, foreclosure wave will return in 2012, and a very creative agent picture of a property.”

Rosamond is good spot to live if you happen to work at WSIR.

Pictures like that one are but one of the many reasons I have no respect for most of these agents. I’ve seen listings with pictures of houses with trash all over the floor. Pictures of bathrooms with toilet seats up. Pictures of garages full of rubbish. And it’s not just the pictures. I’ve gone into the houses themselves and seen them littered with trash. That kind of laziness and arrogance shows absolutely no respect for either buyers or sellers. What is it these people are being hired for again?

You would think for the amount of money these agents make for doing virtually nothing, they could manage to take some flattering pictures and run a vacuum over a few floors. And they wonder why they have such bad reputations.

Agent is not to clean a house for anyone – too much liability – get bit by dog, allergies, slip and fall, etc. Agent gives checklist to owner on how to sell the home, clean it, fix it up to fetch highest price. Such lists are all over internet as well. Owners losing their home often are not motivated to do a damn thing to clean-up and agent can not tell people to not be total, total slobs. No agent takes bad photos of messes out of laziness — they want the house to sell to make commission. Messes are 99% reflection on the owner’s lifestyles. They also own the decisions they make regarding how they choose to live, be messy or be clean. We’re all adults, who cleans your room?

EXACTLY,

Yes Virginia there is a Santa Claus and most of the agents I’ve ever met believe that Manual Labor is a Spanish Prince.

It could be the seller paid the listing agent $300 or so just post the property on the MLS, in which case you get what you paid for. Also, an agent cannot force an owner to clean their homes and if I dealt with listings where the owner occupies the home (I don’t, I buy foreclosures on the steps) I certainly wouldn’t clean the place, nor would I shell out $200 for a maid to come deep-clean a $150,000 resale POS in San Bernadino. If I was making a percent, after broker fees and taxes, it just isn’t worth my while.

Landlord–I’m not sure how long you have been posting here, but the ‘photo’ issue is a continuation of an ongoing theme at Doc Housing. Doc Housing has shown that realators are frequently too lazy to even move a trash can prior to snapping a photo.

One parasite protecting anaother.

I have made good photos from photos, its not the photo part its the photographer part that matters. This is a photo from a phone. Why not just use the photo ON the phone 🙂

Judging by the way it was taken it would not matter if they had a $1000 camera at the real site because skill can’t be printed.

I love the picture of picture. I can’t believe society pays these people 5% commission. I feel like we all got hoodwinked!

That is one picture from who knows who!

Commission is split 4 ways. Buyers agent, Buyers agent Broker, Sellers Agent, Seller Agent Broker. An Real Agent pays National, State, county Association fees, MLS, E&O Insurance, office fees to broker, their own health insurance, etc. it is a tough business. Are there agents who do a bad job. Absolutely. Are there agents who do a great job and work alot of the time for free. Absolutely.

I’ll give you that one. Many agents spend lots of time driving clients around without closing on the deal. That’s the nature of the business and it is a risk you take when you decide to take on that career path.

I do believe the CAR and NAR are in the business of self preservation (like most people and companies). You can never really and completely believe what they say because their compensation package is dependent on the closing of a sale. You wouldn’t listen to everything your used car salesman would say right?

Sandy.

Here in the UK, the realtors take 1.5% total. Are there services you provide that the UK realtors do not?

yep, they work hard doing what any layman could do for themselves with an Internet connection and some basic common sense. In the case of a buyer agent, they work hard to make sure their client pays as much as possible for that house so as to fatten their own bottom line. Excepting *maybe* Red Fin agents, RRE agents have got to be the most egregious examples of conflict of interest when it comes to any job. I won’t even call it a profession, because it doesn’t rate that. Hairdressers — that is a profession with a real service invloved.

Duh NAR fudges stats, in Realtards’ favor… I’m shocked, SHOCKED I tell ye… [roll]

In a way it’s supremely sad, all this futile WISHING by alleged grownups.

IOW, Liar-in-Chief Lawrence Yun is duh perfect repl. for David Lereah, LOL!

This is a picture lifted from Google Earth.. right down to the grass length ..

Off topic, but does anyone know how to lower property taxes? Can anyone explain how they are accessed? My husband and I purchased our home in ’86 for 325.000 For a good decade we paid the 1/4 % plus city fees. (Roughly 3,400 per year) In ’94 we had a huge earthquake. I think we were given the choice to reduce our taxes then, due to the severity of the quake.(maybe by 500.00) Over the subsequent years we: added a pool (25,000) and added 700 sq. feet (75,000) I thought that our taxes would have ‘increased’ by the amounts paid in improvements (100,000 added to the 325,000= 425,000) But our last tax bill is at 8,100–and we can barely pay it. Our home is falling apart, we have to paint it ourselves, and it feels like there is no recourse. Any ideas? Note: neighbors who bought in ’98 (downturn) pay 3,800 property tax for a 4100 sq ft behind us on a much nicer street. Checked ‘Blockshopper’ and really got annoyed, as our home is 2900 + 700 add on=3600 sq. ft. Both are on 1/2 acre lots and have pools. Thank you for any help.

Call your county tax assessor and ask if your home has been adjusted to current market value and if so what is their system in doing so. They may be open to receiving a list and comparative properties and a letter from you requesting a reassessment of your home. Good Luck

I’m assuming you live in LA County somewhere near Northridge so here is the info I got off the LA county tax assessor website: If you disagree with an assessment……Contact the Assessor First

If you disagree with the assessed value of your property, you should contact the Assessor’s Office to request a review of the value.

To protect your right to appeal the value of your property you may file a formal appeal with the Assessment Appeals Board. For Supplemental, Adjusted Supplemental, or Adjusted Property Tax Bills, a formal appeal may be filed within 60 days of either (1) the mailing date printed on a Notice of Assessed Value Change, (2) the date of mailing printed on the tax bill, or (3) the postmark date for the tax bill, whichever is later. For the “Regular Assessment Roll,” a formal appeal may be filed from July 2 though November 30 of the particular roll year.

Appeals must be filed with the Assessment Appeals Board, Room B-4, Kenneth Hahn Hall of Administration, 500 W. Temple Street, Los Angeles, CA 90012-2770. Visit the Assessment Appeals Board website for more information and to file your appeal online, or call 213.974.1471 to request an application by phone.

Click Here to watch a video about the assessment appeals process.

Here is the url where I got the info: http://assessor.lacounty.gov/extranet/guides/contest.aspx

Hope this info helps.

Salvage, you need to contact / visit your counties assessors office/website. they will have the forms and directions of how to proceed with your real properties value assesment. based on my knowledge of my local area, usalley a petition of reassement is done by online/written request and if accepted, value will revert back to last assesment (usalley prior January). you will also have option to meeting in front of council to petition your case. both are not real fast solution but, you need to start asap. some state laws are very threfore my advice may not be accurate outside of CA.

Buy a house

325K in ’86 was a poop ton for a house. I’d say your taxes sound about right. Sounds like you’re living beyond your means. Frankly, you should sell and buy a more appropriately sized/priced place.

Have you ever been to Rosamond? It’s incredibly dismal and nobody who isn’t employed at Edwards or other nearby facilities would have to be insane to want to live there. I almost don’t blame the realtor for not wanting to actually set foot out there.

Salvage, try this:

http://assessor.lacounty.gov/extranet/guides/prop8.aspx

I love how the MSM reports that housing prices will not be affected even with the restatement in sales figures. Hey dumbasses, lower demand means lower prices! Simple supply/demand dynamics. It’s called equilibrium you fools.

Stop confusing me with your facts!!! I want to base all my financial decision on hope!!! I want to hear things like “this neighborhood is unique†or “foreign buyers†or “housing sales are up this month (NAR)†or “California is different†or “housing recovery†or “housing bottom†or “it’s a great time to buy†or “God isn’t making any more land†or “prices only go up†or “you should buy when rates are low†or etc…

What?

You left out the “immigrants with the all-cash businesses” that will support prices in the “nice” areas. You know, the mom and pop shops that take in $15k a month in cash and don’t report any of it. Once that one fails, the trolls will pull out the trump card: They’ve found Hirohito’s gold and plan to use it to buy up all the real estate east of Japan to relocate all of Japan’s citizens.

Anyone happen to catch 60 Minutes last Sunday? The City of Cleveland & the county are demolishing blighted homes. They have already taken down 1,000 this year & plan on an aditional 20,000 in 2012. The land is being given away to the home owners ajacent to these properties. This is happening not just in low income areas, but in upper middle class communities as well.

You get the land free but have to pay taxes on it for ever. Houses are being abandoned not because they uninhabitable but because people cannot afford to live in them even if they are free. Add up taxes, utilities, repairs and transportation and you are sure to be over $1,200 a month in a low utility region. Electric bills in AZ and TX in the summer for a 3,500 sq. ft. house can over a $1,000. Yea, you own your home.

The problem is not the taxes. The problem is the income.

If you were paid more, you would not find the taxes so burdensome. The question is why haven’t you been paid more? This has been going on for a long time:

http://stateofworkingamerica.org/who-gains/#/?start=1970&end=2008

Is it so hard to believe that “Limits to Growth” is starting to play out?

http://en.wikipedia.org/wiki/The_Limits_to_Growth

Yes. Malthus has been proven wrong over and over again.

Eventually, I am sure he will be right, but certainly not in his lifetime.

Another thing that may be depressing the market is stringent loan requirements. We are getting ready to close on a refinance at a lower rate and the amount of documentation required is unlike anything experienced in buying previous 5 houses over 40 years. I think lenders have gone from one extreme to the other.

Here in Culver City, a frequent kicking target of Dr. HB, I’ve been waiting for this foreclosure wave for four years. Inventory is abysmally low. What is for sale is the same inventory that gets listed, unlisted and relisted every three months. One bedroom condos are the only things that seem to be on a downward trajectory here in CC. SFRs seem to be quite stable, as are two and three bedroom condos/townhouses. Where is this foreclosure wave? How many more years will we in CC have to wait for this wave to materialize?

Money for nothing and chicks for free, that ain’t working…

Oh I feel so bad for those poor realtors. The same ones that were destroying family finances by encouraging ignorant idiots to drink the koolaid so they could make the commission.

The world economy is going to CRASH next year. Hello!

Buy an M16 with that new house so you can fend of the hoards of unemployed “occupy something” crowd. And merry Christmas happy new year!

Leave a Reply