Betting the house with the Fed – Stock market at levels last seen in December of 2007 – Examining what has changed and impact of Federal Reserve on housing. QE3 preemptive strike on fiscal cliff?

It is hard to tell why the Federal Reserve moved so quickly into QE3 this past week. The move into QE3 was very specific in that it targets $40 billion a month of MBS purchases. It certainly caught markets off guard. Yet as some astute observers have pointed out, the nationwide housing market has been picking up and steady signs of inflation are now creeping in so why the sudden move in? Was this move necessary with mortgage rates already in negative territory? One camp believes that the fiscal cliff is very real and potentially will render a $500 billion gap in output next year. So $480 billion in MBS purchases nearly plugs that gap. Yet as we will highlight, the markets are probably missing the bigger picture just like they missed the timing on QE3. With the stock market reaching levels last seen in 2007, what has changed in this past half decade?

Measuring 2007 to 2012

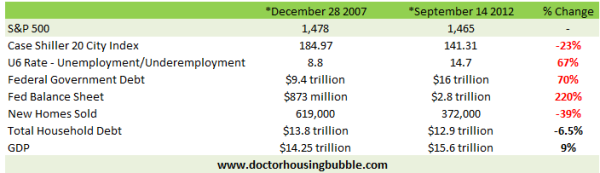

I wanted to pull up some key data on overall measures of economic health from 2007 and 2012. The S&P 500 is now back to levels last seen in December of 2007 so let us take a look at some key points:

Let us go down the list item by item. The Case Shiller Index is 23 percent lower than it was in December of 2007. As previously noted, home prices have started moving up in 2012 but this is largely a function of low interest rates (probably another reason for QE3) and stifled inventory. The same issues of weak household income are popping up this time around. That is why FHA insured loans are so popular during this recent move up with housing values. Do not confuse this with a booming economy. This is merely a system that is allowing more leverage with stagnant household incomes.

Take a look at the U6 measure of underemployment between 2007 and 2012. In December of 2007 this was at 8.8 percent and today it is at 14.7 percent.  Again, you need to try to examine where this recent stock run has come from. Take a look at government debt. From 2007 to 2012 the Federal Government went from $9.4 trillion in debt to over $16 trillion. A 70 percent increase in national debt resulted in GDP going up 9 percent over this half decade.

Take a look at the Fed balance sheet. This is up a stunning 220 percent over the last five years. So much for that being a temporary move. With QE3 on the horizon they are likely to push this above $3 trillion. This is why you are now seeing inflation stick in items like food, healthcare, education, and energy. However household incomes are not moving up.

New home sales are down 39 percent from where they were in December of 2007. Total household debt has deleveraged by 6.5 percent in this exact period. Does this justify the current move in stock values? Domestically it would appear this is not the case but remember many US companies now largely derive profits from abroad.

Fed targets employment via interest rates

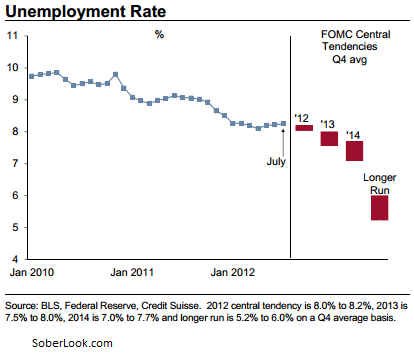

The Fed has some lofty goals in pushing the unemployment rate lower:

Their longer run goals it to get unemployment down to 5.2 percent but that seems like a very difficult task to accomplish merely by buying up MBS and suddenly becoming the entire mortgage market combined with the GSEs and FHA. What will this really do? Well, first of all it will funnel more economic activity into housing but is that necessarily good? This was an issue in the early 2000s with the housing bubble. Many of our college graduates went into the FIRE side of economy because so much money is directed in this industry. Does the Fed with QE3 exacerbate this problem? It is also very likely that some of this higher unemployment is structural. For example, will all those lost FIRE jobs come back with the government basically running the housing market?

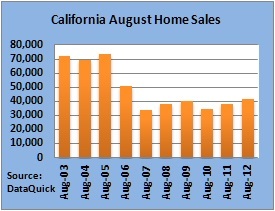

One thing is certain and that is housing has reacted in 2012:

California home sales in August reached levels last seen in 2006. Is this a sign that things have turned? In reality what has occurred is an unlocking of leverage via very low rates and dwindling inventory. Read any real estate forum and you can view the feeding frenzy again. Some of the comments seem to place blind faith in the Fed and ironically, these were the same comments that were hitting back during the housing bubble. It is true that people are laser focused on monthly payments and low down payments but when you are dishing out $500,000, $600,000, or even $700,000 you are still paying a hefty sticker price.

The Fed is betting on confidence picking up and capitulation to hit. Yet the irony is there is little prodding that needs to be done as demonstrated by the results in 2012. People will spend here even if it means going into massive debt to do it. If you doubt this look at the prices being paid for homes in SoCal or the prices still being paid for many colleges. This can only happen because of massive access to debt and not some hidden storage of money. Instead of the private sector being leveraged to the hilt it is now on the government side of the equation that leverage is running high. Ultimately, the financial sector and government sector are one in the same. The Fed has stepped deep into uncharted waters.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

74 Responses to “Betting the house with the Fed – Stock market at levels last seen in December of 2007 – Examining what has changed and impact of Federal Reserve on housing. QE3 preemptive strike on fiscal cliff?”

> Instead of the private sector being leveraged to the hilt it is now on

> the government side of the equation that leverage is running high.Â

> Ultimately, the financial sector and government sector are one in

> the same. The Fed has stepped deep into uncharted waters.

The MMTers would point out that the debt is ultimately the result of trade deficit. That is, the total amount of money, in absence of printing by the fed, is constant. Total US$ = private US$ + public US$ + foreign held US$. Since Total US$ is constant, for foreign US$ to go up (because of the trade deficit), private US$ + public US$ must go down — more debt! Without printing more, the only way for the private sector to avoid going more deeply into debt is for the public sector to do it instead.

The public sector and the private sector are the same because we are in the same boat, being bled dry by lavish over consumption of foreign goods. Mathematically, we can begin to pay down our debts (except through inflation) until the trade deft is cured. Attempting to do so by cutting government spending and expecting private citizens to pick up the tab will just impoverish the private sector, and vice versa. Picking between a policy of cut our way out of the problem vs. spend our way out of the problem (sound familiar?) is a Hobbsons choice.

The two solutions are to print more or inflate more. The Feds actions seem likely to accomplish both. We could of course instead spend less on foreign imports — say get serious about drastically reducing our reliance on petroleum — but it seems apparent we’d rather cook the planet than do that!

Very misguided analysis. Any mention of the trade deficit, or current account, without mention of the capital account is misleading.

Debt is the result of spending exceeding revenue; it has nothing to do with whether I buy a Chevy or a Lexus.

I think U.S petroleum use peaked recently and Exxon seems to think it ain’t gonna rise anymore. The best thing we could do right now, while we have cheap gas is to transform that gas into windmills, other renewables, grid updates to run wind, etc., and use all those trillions of dollars we are going to spend waging future resource wars and put it into efficiency, EV’s and such. The less we are tied to oil and fossil related commodities, the less we get stuck with commodity related volatility which can screw with the economy, and the less we have to deal with economic sluggishness secondary to rising commodity prices.

How much are you going to spend on a house when the price of gas is at European levels, here in a few years? If you’re spending 10k/year on a mortgage and 2.5k/year on gas, how much do you want to spend on your mortgage when your gas price goes to 6k/year? How often are you gonna trade in your iphone for a new one, after a hike in gas prices? Now obviously when that happens, we’re gonna see more Prius’s, bicycles, EVs, ride sharing, etc. But the amount of people already in debt may not be able to afford a Chevy Volt or a Leaf or even a plug in Prius, so there’s a little drag happening there…

The Fed changed the REO rules so that banks now have 48 months before they must liquidate foreclosures. The old REO rule was 12 months. This rule change allows banks to selectively leak inventory to the market. This explains the obscenely low inventory inspite of massive foreclosures. However, by the end of 2014, providing the Fed does not change the 48 month REO rule to 60 months, we should see inventory return to normal levels and prices plunge in the mid-tier areas. In the meantime, expect constrained inventory and artificially higher prices in mid-tier areas. The Fed knows this and this is why QE3 was preemptively launched.

Do you have a link referencing this 12 -> 48 month REO rule?

One has to wonder what spooked Ben into taking such an unprecedented move.

Mises had it right imho…

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” -Ludwig von Mises

What I don’t get are the MSM pundits looking for housing to increase, i.e., a “housing recovery.†With incomes going steadily down (or staying the same if you are not in the 1 percent and have a job), who is going to buy my house from me in 5 or 10 or 15 years? They won’t be buying it at the price I want to sell at…and this will be even worse if interest rates ever go up (will they? How long can the Fed kick the can and cripple the ability of most of us to earn interest income on our measly savings?). So I ask, why does anyone WANT a “housing recovery� If houses get cheaper, they get cheaper for everyone. Sure, those who bought in the last 5-7 years and overpaid might not come out of it unscathed, but if incomes are stagnant or dropping, and houses in much of CA are so expensive and well beyond a sane income ratio (some places still cost 5-10X what people earn in those areas, and that is not a sign of a healthy market), house prices need to continue to drop for things to return to normal. I am fairly well priced out of any neighborhood I would like to live in, and I make a very good salary. It seems to me that the message is still, “borrow way more than you can afford.†I’m not playing that game. And the MSM still makes it sound like lenders aren’t lending (but plenty of them are – just not to anyone with a pulse…and the pundits want us to go back to that?!). I have pre-qualified to borrow 750K (5 X my salary), best rates, etc. But I don’t want to borrow that much – I don’t like rice or ramen noodles for dinner every night. Housing prices have to fall a LOT to get me at a comfort level of spending, like by half or close to it. And I can’t see that happening any time soon in CA.

I agree too bad there are so many ignorant buyers out there that don’t bother educating themselves and will buy into the hype and enter into bidding wars on the inflated priced homes whose only value is derived from fantasy on the banksters balance sheets.

Whenever I hear a talking head go on about a “housing recovery” it is in reference to bringing prices up, and I just want to scream a them. I know you (and most readers here) know it, but the message needs to be spread as wide as possible: A housing recovery will be in volume, not pricing.

@Nor Cal Renter:

To purchase a $750k house:

Estimated Monthly Payment

Price:Down payment:% ($150,000) 30 Year Fixed:$2,648/mo

Since you make $150k a year, that’s a bring home after tax of > $8500 / month. You should be able to swing $2648/month swimmingly and not have to live off of ramen. This is a perfect example of how the govt’s low interest rates are spurring massive home price increases in the past few months.

Not exactly. Our income is pretty similar, and we wouldn’t remotely stretch for a $750K (inflated value) house. After 401K contributions (non-negotiable), we take home around $7300/mo in post-tax income. And if we assume the 30-year fixed rate mortgage is $2650, we STILL need taxes, insurance, and maintenance, which will be more like $3500-$4000/mo. And in that range, it’s over 50% of my monthly takehome, which is pretty unsustainable. Account for emergency funds, regular expenses, healthcare costs, cars ever 10 years, kids… and we’re in ramen-land. Nice try on the real estate boosterism, though.

You forgot to include the monthly property tax bill of $800 for a $750,000 house. Someone making $150,000 a year is stretching it thin still for that price.

I think people are still stuck in the nominal home pricing world. The Fed has changed the rules and we now live in a “how much is my monthly payment” world. A 3.5% 30 yr 417K loan has a payment of $1872/month. When you factor in tax breaks and principal getting paid down, it is cheaper to buy a place with a 417K government backed loan than renting 1 bedroom apartment in many decent areas. When you couple this with no inventory available, you get the frenzy we are seeing. Now with QE3 coming, we might even have lower rates, if rates go down to 3% on a 30 yr 417K loan, payment will be only $1758/month.

The Fed changed all the variables in the equation, people need to accept this fact!

@ Becs, I’m not saying it’s a great time to buy a 750K place. Your equation needs to take into account the tax break, if you have $7300/month post tax income now…it will likely be over $8000/month post tax when taking the 600K loan interest and property taxes into account. Also, people treat principal payments differently. I see principal as forced savings. Principal on a 600K loan is almost 1K/month. That’s pretty significant.

So if you can fully fund your retirement plan, live in a 750K house and still have 4K per month for other expenses…I wouldn’t consider that ramen land at all. Like I said before, the Fed changed all the variables in the equation. Borrowing half a million dollars isn’t what it was 15 years ago.

I would have a huge down payment for a house, and I for one can tell you, principal and interest is really only half of the cost of owning a house. Yes, a real estate agent would have you believe it is the entire cost, but from experience, it is only half the cost.

Yes, I suppose you could let the house degrade, let the yard go and then you only have taxes and insurance to worry about beyond the payment, but, I just can’t live that way.

I would much rather invest in almost anything before I invest in a house, with my OWN money. But, hey, on the other hand, if it is the governments money, who knows?

Lord – add $417 per month to that FHA loan for your MIP. Soon to be $600 something. Flush.

Dom, I should have made it clear that those numbers are with 20% down. Having a sizable down payment right now is very beneficial to the overall cost. This is one of the few times where being a saver actually helped.

I crunched a few numbers with the theoretical 750K home, 150K down with 600K 30 yr loan @ 3.5%.

Principal = 944

Interest = 1750

Property tax = 750 (assumes 1.2% rate)

insurance = 100

maintenance = 200

total = 3744

If we assume you can write off 1/3 of the mortgage interest and property taxes, that still leaves us with 2919 total (944 principal, 1975 for everything else).

So buying a 750K house today with 20% down his is equivalent to renting a place for $2000/month and being forced to contribute $1000/month into a savings account. This is the math people are latching on to. Who knows what home prices or rent prices will do in the future. The calcualtion is for the here and now. People like Becs are probably do this anyway. I’m not trying to encourage people to buy, this is what ultra low interest rates do.

The DEBT-Holders, that’s who. Get it now? If I overspent=i hold a debt that is too high for the underlying collateral/house. Who is the largest debt holder? Big banks and governments. They are the only ones with motive to keep fighting the debt deflation, right?

@ Nor Cal Renter:

I agree with you that I don’t see prices will drop a lot in a good neighborhood either. Here in LA, there are only few good areas where you like your kids to grow up with and there are enough folks who are making decent money try to get into these neighborhood. Multiple bids are common these days. At least this is what I’ve experienced while purchasing mine. Sure you can get something in areas like south central LA for 300k. But you’ll ran into risks of getting mugged or shot at often. Wait if you can. I waited for ten years and didn’t feel like to wait any more. Boy, with the QE3 coming, good luck to everyone.

Plenty of $300-$400k homes in good LA neighborhoods. Northridge, Porter Ranch, Granada Hills, Lake Balboa, West Hills, Woodland Hills, Encino… All have nice areas and good to great charter schools… And all have older fixers in the $300-$400k range.

You might have to live next door to some, gasp, darker skinned minorities though. If you want all white and upper class asian… U gotta pay more.

@NotASucker:

Encino, maybe. I guess people have different definitions of ‘good neighborhood’. My point is there are plenty folks making enough trying to get into these fewer areas of ‘good’, Like beach cities where schools are 9 – 10 out of 10. 150k a year is not a lot money in LA or SF bay areas these days when talking about buying a decent property. You may have to wait for a long time if not forever to see prices dropping to a meaningful level in these areas. With savings value less, QE3 is coming, I just think the reality may not be what many folks here want to face.

On a personal level, I’ve settled in one of these areas mentioned above.

I agree with you guys. I housing recovery is a drop in price that makes houses more affordable to entry level buyers. Sales volume will then increase.

@NorCalRenter , hey I’m just laying it out there – that’s just reality. I personally don’t have a dog in the fight, but I am on your side. It makes me sick to my stomach the reality of it but the difference between you and me is I try to be objective about it. I already bought a home in 2009 at the perfect bottom in the top 5 safest cities in the country for less than $300k , and I make more money than what we’re talking about and I telecommute. I feel very fortunate that I lined up what I think to be a very good formula for long term financial stability but I can’t say it was all luck. The torture of going through years of waiting and waiting and waiting for the market wasn’t easy and even when I bought I didn’t feel it was right but I knew that the chances of the govt not intervening was slim to none. Anyway, i just keep on top of the market for investment purposes and looking out for others around me who are still waiting.

@slim , I do agree the Japanese home index graph shows their homes lost pricing. I’m just saying, how long are you willing to wait for that to happen? The graph I saw says it took 15 years and I’m not disputing that at all, just questioning is 15 years of your life lost worth it? What mental toll will that take on you and your family? What missed opportunities will you have lost out on other aspects of your life while dwelling on this and waiting 15 agonizing years? And it’s still yet a gamble no guarantees we will go the exact route of Japan. IMO I highly doubt we’d go through deflation I’m still arguing for inflation. It’s already happening – houses are inflating thanks to crappy USD and low interest.

So should we go long Ramen Noodles or not?

One more thing I wanted to add. I think everyone who has been waiting should just throw in the towel unless you want to wait a decade or more. The govt is going the route of japan (whom is still going through their 2nd decade of extend and pretend). I’d say it’s time to just forget the ticket price, go with the 30 yr monthly so that you can move along with your lives. It’s tough, I know but we are now in a new normal and I don’t think anything is going to go back to the way it was and should be.

Talke like “the new normal” worries me. I remember hearing that in the peak of the bubble. We’re in a bubble in a bubble or just a good buying season coupled with an election year.

Blah, you took the words out of my mouth. Nobody could have predicted what would have happened regarding the housing bubble. While it sucks for savers, renters, responsilbe people and those that have been waiting for normalcy to return. The Fed and TPTB have declared that housing prices will be supported from here on out NO MATTER WHAT. It’s cheaper to own vs. rent in many parts of town. My advice: find a place you can stay for at least 10 years, lock in ultra cheap 30 year money and get on with your life. That is exactly what I’m in the process of doing. Time is worth something, every year that goes by counts!

I don’t know if you’ve looked at the result of Japanese housing over 2 decades but you should absolutely NOT buy if you think we are going that way. They have tried near-zero rates forever along with 50-100 year exotic mortgages to try to solve this. Pull up a graph and all you see is a long downward leak. You wonder why it’s a country of savers there? They’ve been dealing with deflation so cash is king and still residential prices continue to drop. You absolutely do not want to be sitting in an overpriced house and absorb leveraged losses on a home 3x or more of your gross income. This is a case of all the king’s horses and men not being able to fight the market – if the US goes the same way the result will be the same and it is an absolute nightmare for personal balance sheets to absorb leveraged losses on a basis price that is many multiples of your gross income.

I couldn’t have said it better. Who are these people that will pay these prices. How can you be smart enough to earn it but not understand what is really going on in the housing mkt

“How Could QE Work?”

http://krugman.blogs.nytimes.com/2012/09/16/how-could-qe-work/

I think many are buying because of low interest/low down; if the market soars, they’re geniuses…if the market tanks, they potentially squat for months/years in houses without making payments, then walk away; some faceless entity will surely eat the financial loss…the govt will surely craft another multi billion dollar Fresh Start, maybe call it Wonderful People Deserve To Be Homeowners Program, do it all over again, why not? Never an end game or day of reckoning; when the house simply presents another stack of chips once the first stack is lost, why not wager again…what’s to lose? Stock Market rallies no matter what the economy, futures green yet again, Ben’s gonna do another flyover in his magic helicopter, buy buy buy.

When govt has to take a bigger chunk of the mortgage business and banks are able to extend and pretend what should be foreclosed on, something is definitely wrong. And yes, the stock market no longer represents the U.S. as business is global. Corporations have given up on the U.S. consumers and are more than happy to do business elsewhere. Smaller tax burden, exploitation of foreign workers and huge profits. Meanwhile, they can unload their bad bets on The Fed and make 3% on free bailout money.

In addition, the U.S. consumer stagnates as household inflation rears it’s ugly head. $5 for a loaf of bread? But the govt says inflation is only 2%, excluding everything you need to live on (Food, Gas, and Housing). What a farce.

Housing prices have begun to rise in affluent areas due to stock market gains, artificial interest rates and constrained inventory. On the other hand, banks have begun unloading short sales on properties they see will show more modest losses on their books. So, we are seeing some 30-50% of deals on some Westside properties.

http://www.westsideremeltdown.blogspot.com

Doc,

I agree with your analysis, but none of what you discussed over the years have actually happened. If it’s the FED, Banks, Government or all controlling/propping up the housing market, it appears that they will do whatever it takes – after the FED announcement last week, it appears we are going to get a lot of inflation and housing will be affected. My question is why would I want to be on the sidelines with devaluing cash, when I could be locked into a low long term fixed rate? It seems like the premium to pay for realestate in today’s market will be greatly offset by inflation – I have to believe a lot of people are thinking that way.

How can housing inflate when salaries are deflating for those fortunate enough to have professional full-time employment? It makes no sense. Given the migration of labor to a disposable part-time work force, why buy into real estate? Your 3 year contract terminates & so does your pay check. But you still have to pay the mortgage (not to mention the local teacher’s union).

Renting make much more sense in the new normal economy.

Does anyone else see this latest Fed move as a preemptive gambit to head off the coming crisis in commercial RE loans? Under the cover story of helping “home owners” by purchasing MBS, the Fed could also take the burden off of the major banks who have been rolling over (largely-worthless) CRE notes for several years.

The commercial RE crisis occurred after the housing crisis several years ago. Most REITS are largely deleveraged now.

Deleveraged? I don’t believe that for a minute. Who bought the notes and at what haircut? In my small town there are dozens of empty strip malls and office buildings that are generating zero or negative cash flow. They haven’t changed hands because nothing is happening to them

A really troubling aspect is we have REAL (not money illusion) reasons for food prices to increase. The drought destroyed many crops. And now the Fed wants to pump more money into the economy which at this point has a good chance of leading to increased commodity (including food) speculation. Seems like a very bad combination.

The Fed did not act to save the housing market. It panicked to save the banks. It is buying their toxic paper to improve their balance sheets before the coming collapse. The economy is much worse off than they want to acknowledge. We have depressionflation. It is only going to get worse after the election. The Israelis will attack Iran and oil will go to $150 a barrel, but only after Obama is safely in place. Anyone who buys a $750,000 house at this time is an absolute fool.

I think when we hear “the recovery is too slow” from the Bernanke; he really means there is no recovery based on the latest Fed action. This is hands down the most aggressive action from the Fed ever! We are talking open ended monthly purchases of 40 billion in MBS’s until the end of time or when employment picks up, whichever comes first… Hey, what happens when there are no more MBS’s to buy? Hey, I got it! QE5 (I call the current action QE4 because operation twist counts) will be MBS derivatives! What could go wrong?

If you are playing odds, buying with your own money, yes, you would be a fool to buy now. I am buying with my own money and I don’t see worth in any of the crap on the market today, so I don’t buy.

But….because we can never know the future for sure, I think it is foolish not to buy now if you are using someone else’s money! Especially if things do go the wrong direction you get to live in the house payment free for years on end before you get kicked out.

And this is why we are where we are. The FED is counting on “moral hazard” to get the housing market moving in the hopes the numbers of people wanting a piece of of the action, FOR FREE, are so great, that it creates a critical mass in the housing market and it actually does recover .

We all know it won’t recover, unless the FED does QE to infinity, but it is the only game the FED can play at this point.

You’re never playing with “your own money” when there is a govt and bank collusion to keep bailing you out, forgive your debt, cut your principal, allow you to squat without paying any rent for years on end while stashing all that cash to buy your next home in cash, allow you to buy a new home after walking away in only 3 years, etc, etc, etc. You gotta start playing the game by the real rules with the rest of the snakes. Yesterday’s fiscal responsibility is out the window.

You’ve stated before you’re all cash. But, you don’t HAVE to use that cash for your house purchase. Stocks are rising due to all these liquidity in the market. You say it’s foolish not to use other people’s money right now to buy a home. So, why aren’t you taking advantage of probably excellent credit and 3.5% rates to be smart and feast from the government trough?

Because, my wife does not work due to disability and am a one income family. I have done well with my savings but my income will only support a 150K mortgage, when you include PITI.

If I am going to buy a house in southern ca. it means I need to risk MY money and not someone else’s. That is why all this is especially frustrating. On one hand as a prudent saver I am suffering the wrath of the FED yet I can’t take advantage of the “Moral Hazard” that the FED is pushing.

Actually, after thinking about it, I might quality for a 200 to 250K mortgage if I put nothing down, still, that gets you nothing in this market.

The 150K number was based upon putting 550K down, having a 150K mortgage. The taxes on a 650 to 700K purchase would be about 700.00. On a much cheaper house, the taxes would be much less so it makes sense I would qualify for more than the 150K .

Personally, I’d be thrilled if home prices stay FLAT over the next 10 years. I bought a $400K home in late 2011 for less than it would rent for.. and about on par with what I was paying to rent a 2 bedroom apartment a little closer to my work.. but the house is closer to my wife’s work… so it’s a wash in terms of commuting costs.

With a locked in sub 4% rate.. and ability to refinance below 3% right around the corner… I cautiously believe i may have bought at the bottom in a middle class LA suburb.

Thanks Kevin for giving us your bi-weekly update, keep em coming!

Good to hear you and the wife timed the Woodland Hills market perfectly Kevin. Do you have any tips for those looking to purchase a home in Woodland Hills?

timed perfectly? ha, ha!!! Everything’s great! Buy now! The fed will buy mbs from here to infinity! Nothing will ever get worse in the “good areas”! Rates will be at 0% in a moment’s notice! Hardly anyone has saved any money to even approach a 20% down payment for anything… but that doesn’t matter! Like I said, everything is great! Ha, ha, ha!!!!

bottom? ha, ha, ha!!!!!

One has to simply look at the Civilian Labor Force Participation Rate published by the Bureau of Labor, to grasp the sheer collapse of the USA economy these past several years. The number of civilian employees in 2012 is at levels last seen in 1980! Also the number of americans whom the U.S. Dept of Labor counted as “not in the civilian labor force†in August hit a record high of 88,921,000. This number is lower than in 2009!

http://research.stlouisfed.org/fred2/series/CIVPART?cid=12

I have a question for anyone. When house prices went up from 1997-2008, the reason the economy was thriving was because a lot of people were taking HELOC’s and spending the money having a good time. The goal of QE3 is inflate housing back up, but I would expect this time around there would be no HELOC’s because who knows if the banks will get bailed out again and from what I hear don’t want to make loans. So how is QE3 going to get the economy going when they won’t be able to take out the equity?

Tricia,

You answered your own question. The economy is going south, that is why the Fed panicked. They think they can avoid a collapse, forget about “growth”. We are in a systemic lock-down that requires massive deleveraging by the private sector (mainly banks) and reduced spending by the public sector. It is like getting hit by a tornado and a hurricane at the same time. The only intelligent way to play the next few years is to preserve as much cash as possible and to hedge with about 20% in the commodity of your choice, just in case Ben goes completely berserk. Real estate, unless you do Ben’s financing, see below, is the last place you want to be.

On another topic, Martin has a good point. If you are using Ben’s “money” why not put down 3% on a FHA and live free for at least two years, other than lights and water?

“just in case Ben goes completely berserk.” cmon, reading your comment, you have a grasp of what’s going on. $40 billion printed a month (conservatively) until unemployment reaches 7%? Read Cam Harvey’s latest cfo survey (http://gardenofecon.com/2012/09/qe3-is-a-mistake/) and I’m positive most contemplative thinkers would conclude 7% employment is any more than a pipedream for quite some time. Which leads to the conclusion that, indeed, Heli Ben has been, is and always will be “beserk”.

berserk

Tricia, I don’t think QE3 has anything to do with HELOCs. What it is meant to do is put a floor under the housing market and attempt to drive up prices. There is a variety reasons for doing this…reignite the wealth effect via rising home prices, attempt to get more people out of their underwater positions and free up more money by allowing people to continuously refinance to lower rates…all this is an attempt to get the economy moving again. As we have witnessed, this can be done with ultra low rates and almost no inventroy to choose from. The big question is how long can this go on for? The Fed has made it abundantly clear that they waged war with savers and renters. With our corrupt political system, I see no end to this in sight. Politicians are self serving and short sighted, most could care less what happens after they are out of office.

I want to thank all of you for responding. Lord, you actually answered my question. So I have another question for all of you. Since we know what the Fed wants to do (inflate prices), shouldn’t everybody be buying houses for the next run up and then get out when they are back up to their peak prices of 2008? I have throught why not get an FHA loan and buy a house (I now rent), why gamble with my money if it doesn’t work?

By the way, another post of your states no one could have predicted the housing bubble. I did. A year before the collapse, I changed my 401k to all cash. They only thing I didn’t do was my IRA where I put the money in precious metal fund (which has done great). So when the colapse happened I did not take a hit. But I haven’t got back in because I didn’t forsee all of this, I forsaw another crash.

Tricia,

You are assuming wage inflation. The only way housing will inflate is if wages inflate. Food and fuel will crowd out other expenditures if there is no wage inflation. Globalization and slack in the labor market make it unlikely that we will see any wage inflation in the near future. I believe the Fed is attempting to offset deflation and debt evaporation. Remember that the majority of money supply is debt in a fractional reserve system…

Tricia,

I tend to agree with both Jeff and Lord but I think they both missed your point/question. We can never recover unless housing comes back into line with income and interest rates come back into line with the cost of money. Over the past 20 odd years we had a very artificial economy based capital gains rather than on income growth. The government spurred this on via taxing capital gains less than income. The capital gains on a sale of a house (up to a certain amount) were not taxed at all. We for some reason found the need to subsidize bankers by not taxing the income used to pay the interest portion of a mortgage.

The fact that income did not grow over the past 20 years was offset by homeowners’ growth in asset values along with tax benefits of holding these appreciating assets. Now that values no longer increase, there are no capital gains to extract from these overpriced assets. At this point we are stuck with overpriced housing costs in relation to income, negative returns on savings and inflating food and fuel costs.

I do not see how an economy can recover by pushing on the string of interest rates. Can we artificially hold up housing and hold down savings? Yes! Will this create economic growth over the long term? Not likely! Is high cost housing, rising food and fuel prices and declining incomes a recipe for economic recovery? Probably not. Food and fuel will crowd out other expenditures now that over priced housing is no longer subsidizing our falling incomes…

There is one very large problem with the Fed’s manic desire to reflate assets. They are killing the patient even if the operation was a success. They have inflated CONSUMABLES, which takes money out of the demand side of the economy. This includes such thing as: gasoline, food, tuition and even clothing. However, housing is still flat with millions of unsold houses even with trillions in MBS purchases and the lowest interest rates in history. It will not work because there is weak demand and what little demand is being deluded by the above mentioned inflation in consumer products and the lowest worker participation rate in history. But, there is only one patient that matters, as mentioned by CAE, the big banks. Here is the BIG PROBLEM. What good does it do the economy if you save the big banks if the patient dies!!! The reckoning will be very interesting.

And, as an added benefit, the Fed is causing a food crisis throughout the developing world that will have dire consequences.

This message is for Jeff. The patient you refer to doesn’t live in the United States. Corporation profits are now becoming 80% overseas with China looking to be the patient. Let’s face it corporations, run the world. I don’t think they care that the dollar menu at McDonalds is now the $8 menu.

Everything the Fed does is for its member banks and the govt, when they dove tail together. That’s all you need to know. What ever the banks need, they will get.

By the looks of it, the Fed has decided to become the “Bad Bank” everyone was postulating about after the crash of ’08. Accumulating trillions of US$ of garbage.

Do we remember where the term “drink/drank the Kool Aid” came from? How did that work out for them?

Just incase you don’t remember…

http://en.wikipedia.org/wiki/Drinking_the_Kool-Aid

Actually, drinking-the-kool-aide is the wrong analogy because the end result is expedient death. The Fed and its controllers are much more interested in debt paying brainwashed slaves. If you wish to really understand the game, follow the money to the people who have benefited from the asset bubbles, the “financial sector”. Highly productive at malinvestment, rigged pricing of capital and outright fraud, just for starters.

always follow the money

“Investor”

I visited the 2B/2b Inglewood condo my good friend bought. He paid just over $90K , put in $5K to renovate to rentable condition, and has a renter moving in this week, at $1350/mo. This was REO, not at auction. This clearly cash flows, and I’m unclear why this wasn’t snapped up by a seasoned investor or group… I thought the banks were selling big tranches like this to large Equity firms etc. Both my friend who bought this place, and I have been saving and sitting on the sidelines, waiting for more inventory and normal market conditions to return, as well as for Case-Schiller to fall in line with historical norms… but he became frustrated with the crazy low inventory and bidding wars etc. So he bought this investment instead. He estimates that with reasonable upkeep, 75% occupancy, and managing it himself he should net $5-600 per month. Thats about 6.5% annualized return. And hedged against inflation, since rent pays in current dollars… over the long haul this could work out nicely… THOUGHTS?? I’m thinking of doing the same as him… I realize that the chicken little perspective is total economic collapse, or tidal wave destruction of the 1968 wood-frame building… etc. etc.

Why does it have to be a Chicken Little perspective or “housing recovery”? What about us following the Japanese model for the next 10 – 20 years? Slow and painful deflation… Housing will correct one way or the other, either nominal value goes down or inflation goes up faster than the nominal value of the property. It may just take a lifetime to see the correction…

Looks like your friend got a good deal. Cash flow investors can do well in this market, just don’t expect capital appreciation from real estate in the near future. As you correctly stated, rent paid in current dollars will protect against inflation. I don’t recommend borrowing money for this type of investing, it works best for for folks who are frustrated with low returns on other investments.

Will work well in the long haul, may be difficult to sell, especially if the condo complex is full of renters, may have to sell to the next investor who will pay cash.

When the fed balance sheet goes from 873,000,000 to 2,300,000,000,000, I’m pretty sure that’s more like a 320,633% change, and not a 220% change.

“Take a look at the Fed balance sheet. This is up a stunning 220 percent over the last five years. So much for that being a temporary move. With QE3 on the horizon they are likely to push this above $3 trillion. This is why you are now seeing inflation stick in items like food, healthcare, education, and energy. However household incomes are not moving up.”

You got this Infiation thing completely wrong. As soon as there is a seasonal blip in Inflation , hawkers start to beat the inflation drum. We need modest inflation and rising expectation of investment or the prlivate sector is not willing to invest and sitting on incredable cash. The Fed is being irresponsible so that the private sector can start investing and also people start increasing demand. This problem is not structural and all research is showing its not structural because unemployment has been uniform in segment of the economy not just housing.

Although you are exactly right about stagnant middle class earning, at this point we need modest inflation. The economy has deleveraged from past half a decade and it is time for the private sector to start investing instead of sitting on cash. Lower interest rates is the only way people are going to invest in housing. I do not understand what the fed is supposed to do, rise interest rates in the midst of lower demand. Come on. You can do better than this.

Every major growth period of modern economic history has commenced with a surge in residential construction. With mortgage rates at historic lows and far more bank credit available than the banks can lend, why is our housing recovery anemic, insufficient to accelerate economic growth? It’s because the community-based institutions which historically funded housing booms have been forced by deregulation into unequal competition and a negative spiral of speculative lending contrary to their natural purpose.

Leave a Reply