The broke versus all cash buyer: Over 56 percent of Southern California home purchase came from FHA insured buyers and all cash buyers. Last month record level of buying from all cash buyers.

As I dig through the monthly data on home sales, one trend continues to intrigue me when it comes to California housing. Call it the broke versus the big cash buyer. For example, over 23.2 percent of Southern California home buyers used FHA insured loans last month. These loans are no longer good deals even though they require only a paltry 3.5 percent down payment. Yet they are popular for those chasing the middle class dream in a state where it is becoming much more difficult to follow a middle class lifestyle. On the other side of the spectrum, we have the all cash buyers. A record 33.8 percent of all sales last month came from those with all cash in SoCal. In total, over 56 percent of SoCal buyers are diving in with 30x leverage loans or are investors going in with all cash.

The allure of a FHA loan

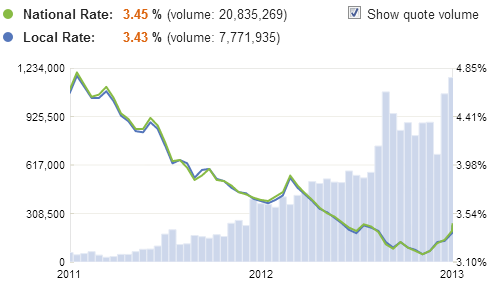

Who can argue with a low down payment loan when rates are so low? Of course the recent stock market rally has added pressure to mortgage rates:

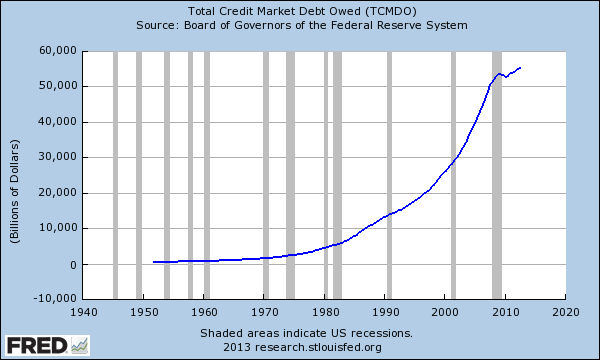

While mortgage rates are still ridiculously low courtesy of The Ben Bernanke, it is hard to see how they fall much lower without more massive Fed intervention. One of the reasons I see more of a Japan like scenario unfolding isn’t so much from the risk embedded in the housing market but the fact that we need low rates simply to pay off our insatiable spending at a national level without making our interest expense on the national debt become comically high. That is one reason. Another is how incredibly leveraged our system is now with easy access to debt:

We’re looking at a total credit market debt of $55 trillion and you can rest assured a good portion of that is already betting on low rates. Yet low rates are no panacea. In California, the rush to buy as we have noted is largely driven by easy money and hot money chasing properties in certain markets. What is interesting at least on a national level is that real estate prices in many locations now appear to be affordable given how far prices have fallen but also how much leverage can be had with mortgage rates in the 3 percent range. However, in many parts of California like Los Angeles County and Orange County many people thought they were going to get rock bottom deals in places like Santa Monica or Pasadena. That was never going to happen. So say a home drops from $3 million to $2 million. How many additional people can now afford the home?

What is also happening is a push up in many hipster markets like Echo Park and Silver Lake. I think some are chasing an old Norman Rockwell painting of how things were in terms of buying a home. People are forgetting that you have many professional couples with solid incomes and no kids (DINKs) that are willing to leverage up with mortgages to live in certain areas. I’m not sure if Rockwell had a good portion of hipster art or big hedge fund investors buying out places to use as rentals or potential flips.

The other side of California

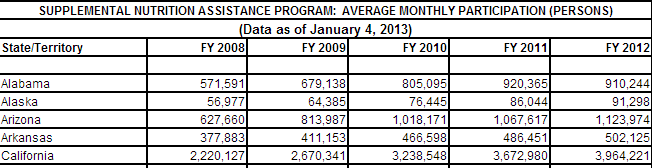

While talks of the recovery continue, I was amazed to see that throughout all this California’s food stamp usage has doubled from 2008 to 2012:

Nearly 4 million Californians are on food assistance, over 10 percent of the population. It also highlights how diverse the state truly is and how some areas are locked away in fortress like bubbles. The big push has come from constrains on the market and are heavily driven by low inventory. Remember again that over half the market is being fought for by low down payment buyers and all cash investors. It is ironic that you have both spectrums competing here, those with very little down payments and those that are willing to put down an all cash offer to buy a home.

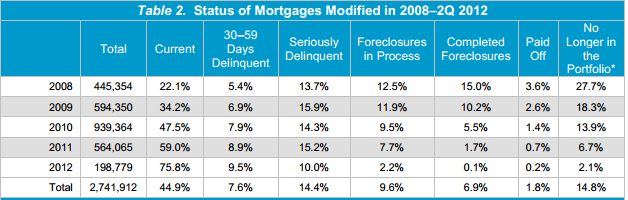

One other item we may have missed in the low inventory trend is the number of homes that have loan modifications:

I’ve heard some interesting stories of multiple loan modifications and others where the foreclosure process was dragged out for numerous years. The point being is that you have many homes in limbo and not on the market. If we look at the above data, over 2.7 million loans have been modified since 2008. Nearly half are current, but 31.6 percent are in the distress pipeline again.

The median home price in Southern California hit $323,000 last month, a jump of 19.6 percent in one year. Does this pace really seem sustainable? Some point out that this is due to the change in the mix of sales and the drop in foreclosure re-sales. That is true. Only 14 percent of sales in SoCal last month were foreclosure re-sales. But the question then becomes where do we go from here?

People didn’t suddenly see surges in household income in the last couple of years. However, with mortgage rates in the 3 percent range they saw a massive boost to their purchasing power. Align this with historically low inventory and investor demand and you have our current housing market. Keep in mind this demand is no longer just coming from locals but internationally. The amount of flipping activity is very high in some markets.

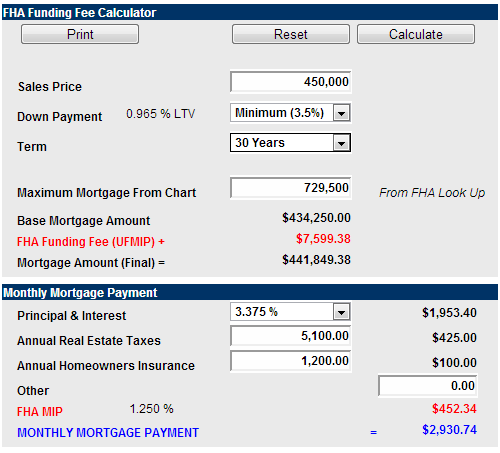

Some fail to realize how expensive FHA loans have become because of the incredibly high default rates in their portfolio. Yet they are willing to do anything to get a piece of the action. Take a look at a home with a $450,000 sale price:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $15,750

UFMIP:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $7,599

Monthly mortgage payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,930

As we have previously discussed, many changes have hit the FHA and some proposed items will make it harder to get rid of insurance premiums. Why? Because they are running in the red and need to make current buyers pay for all the past mistakes.

The reason so many opt for this loan is because they simply are unable to save for a down payment. On the other hand, you have a record number of buying activity happening with all cash buyers. There is very little “market†in this housing market. Most are now making their big decisions on the guesses of where the Fed will wink next. Interestingly enough, those that have such high faith with the Fed forget that the Fed was instrumental in the first round of this current housing mania. Any personal experiences with FHA buying or all cash purchases?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

64 Responses to “The broke versus all cash buyer: Over 56 percent of Southern California home purchase came from FHA insured buyers and all cash buyers. Last month record level of buying from all cash buyers.”

And the FHA MIP is now for the life of the loan!!!

If the original loan is >90% LTV, then you’re stuck with MIP for life of loan. Less than 90% you must pay MIP for 11 years.

Seems the MIP is statutorly required to retain 2% and is underwater -1.44% so this and increasing MIP by 5 or 10 basis points will reinflate the account (hopefully).

Really, when you see what a debacle this whole real estate scam has been you wonder why it wasn’t always like this anyway. This makes that 3.5% minimum down very expensive….and the 10% down pricey too. I had to pay a 2% MIP flat rate upfront on a CALVET…that was a screaming deal in hindsight. MIP is a layer of tax payer protection that hasn’t been expensive enough to protect the tax payer.

http://www.bloomberg.com/news/2013-02-04/jpmorgan-joins-rental-rush-for-wealthy-clients-mortgages.html

I just emailed/sent your link to Attorney General Eric T. Schneiderman asking how this can possibly be legal and that his law suit should consider this as well. This conjures complete and total outrage.

http://www.globalpost.com/dispatch/news/regions/americas/united-states/121002/jp-morgan-lawsuit-subprime-mortgage-securities

Another viewpoint about investor groups, the fast money crowd…

http://finance.yahoo.com/blogs/daily-ticker/housing-bubble-2-0-david-stockman-133026817.html

Chasing yields…if yields don’t materialize, hot money can disappear as quickly as it arrives, onto the next “golden opportunity”. Time will tell.

Dang, so the banks just found another trick. It’s all so sickening. I long for the late 1980s through late-1990s, when I understood the rules.

So I received a 1099-C in the mail from the HELOC. I look up in the tax code, and because I re-structured my mortgage and the HELOC was part of the re-structure, all I have to do is fill out Publication Form 982, check the box, and life goes on. No taxes due and I’m still living in the home. Bummer for all those who didn’t fight the good fight and keep their residences. After all the fraud and stealing, now the banksters are paying the government for all their wrong doing, but the people, yea, the people can suck a big one. Here’s your $500 check, thanks for the house! Oh, it’s illegal? Ok U.S. Government, here’s the fine. America – Land of the Scam, Home of the Fee.

Sorry to burst your bubble, but that is not exactly right. It depends what you did with that HELOC. If you took out the money and invested in your home, then your ok. But, if you went out and bought a car and had a good time with the HELOC well then your looking at declaring that as income. Unless, you can prove your insolvent. The IRS is looking at 1099C’s so expect an audit.

Why all the crying? America was founded on lying, cheating, and stealing. We stole America from the Indains and Mexicans for beads and shady land deals. What’s changed?

I’ve learned years ago that the only way to live the good life here in the States is to lie, cheat, and steal. My life has been better for it.

When I was out of work for over a year, I didn’t fret. I cashed out all my credit cards and buried the cash in the back yard. It was so easy filing for bankruptcy. No job, no income, no savings! Full clean sweep of all my debt. Now I owe nothing. So, what if my credit is crap? I can get all kinds of loans at higher interest. Big deal. I just live with in my means now and I’m all cash baby!

As the redneck on TV always says……

I’m debt freeeeeeeeeeeee!!!!!!!!

The article below is provided for context.

We seem to get mired in their methods vs. their motives. Constrained inventory and subterranean interest rates are plain for all to see as they are methods used to keep prices inflated. The question is, “What is their motive?” And by “they” I mean the banksters; Lords of the Universe.

Since the too big to fails are becoming giant servicers with little exposure to the value of their mortgages I think if you track how much of the country’s mortgage debt has been and is being moved from the banksters to the suckers at these elevated prices then their goal may come into focus. Once they’ve insulated themselves from the loss the holders of these mortgages will suffer in the next leg down then interest rates will rise and the banksters will have dodged the death blow. Wanna guess who gets to take it between the eyes?

Maybe someone can help me with this next question. If the FED loses 30% of the value of its mortgage backed securities due to rates rising to normal levels, exactly what happens to that loss considering that the FED just invented the money to buy the MBS in the first place? Who, if anyone, actually takes that loss?

————————————————————–

Fed balance sheet size hits record in latest week

Thu Jan 24, 2013 5:35pm EST

(Reuters) – The size of the Federal Reserve’s balance sheet reached a record, Fed data released on Thursday showed, due to the central bank’s purchases of Treasuries and mortgage-backed securities that are part of its unconventional policy aimed at supporting economic growth.

The Fed’s balance sheet – a broad gauge of its lending to the financial system – stood at $2.994 trillion on January 23, up from $2.946 trillion on January 16.

The Fed’s ownership of mortgage bonds guaranteed by Fannie Mae (FNMA.OB), Freddie Mac (FMCC.OB) and the Government National Mortgage Association (Ginnie Mae) totaled $983.2 billion, up from $947.61 billion the previous week.

The Fed’s holdings of Treasuries totaled $1.697 trillion as of Wednesday, higher than $1.689 trillion the previous week.

California…land of the haves and the have-nots. All the cash buyers should make everyone feel better about housing trending up. It’s not easy money…this alone should tell you things have turned a corner. You can’t stop home purchase and household formation even with bad employment numbers.

I don’t care how many graphs you post, people at a certain stage of their life will pay whatever it takes to purchase a home. Just like no one saves for college before they attend college if they don’t have the funds. High school graduate (Mark) does not work two jobs for countless years before he enters college in order to afford the debt. There is a time and order to life that is undeniable.

So you don’t care about any actual numbers or those pesky inconvenient facts that this blog persists in posting, only that you know what the real story is regarding the housing fundamentals. Thanks for that insight.

Numbers and graphs are great but apparently it’s failed the vast majority of the followers of this blog. I hate it just as much as you guys do but I knew how to interpret the graphs a little differently and tried objectively to remove my own bias and it worked because I bought a house at the absolute bottom +/- ~4 months. Being completely rational, conservative and fiscally responsible has failed you all. I’m sorry but there’s a point where if you can’t beat them join them.

Don’t get me wrong love this blog, I love data, I like charts. I’m a day trader and I use charts everyday as part of my work. Those who follow this blog are not part of the masses.

I bought a property when things started to upturn. My little 170,000 investment made in Sept is already commanding a 250,000 appraisal. This site has really helped me time my buy. I will no doubt sell within two years but meanwhile I enjoy the positive cash flow…what’s not to love!

Yes, I believe in numbers and data but I also know a lot about the psychology of novice buyers/traders, that’s how I make my money.

Thank you Dr. Housing Bubble Blog!

Christie, make the system work for you baby!

I love investor emotion. That’s how I roll. I sold my silver coin collection to tons of doom and gloomers that thought the dollar was going to collapse tomorrow. Cash in, cash out! 🙂

christie s.,

You realize that positive cash flow only occurs after youve sold the house right?

Also, it’s not making you any money right at this moment… No monthly income. it’s just equity that can drop below your purchase price, however unlikely this may occur under these market conditions..

I think when she says ‘Positive cash flow’, that implies that she is renting it out.

That’s my Cristy.

Here’s hoping you two become acquainted as landlord/tenant.

http://www.youtube.com/watch?v=zYSgjHQWFN8

people at a certain stage of their life will pay whatever it takes to purchase a home.

LOL!!! that’s pretty funny, and all this time i’ve only been able to pay what i can afford AND i certainly con NOT afford to live in california.

The problem is very few people at that stage of life (20s-30s) have the money for an all cash home purchse in CA, so no until you have some actual demographic information I don’t believe “people at that stage of life” make up the majority of the all cash purchases (investors and older people who have equity from prevous housing purchases probably do). By the way plenty of people go to college after they have more money to pay for it, it’s like you’ve never heard of adult students.

It sounds like this “housing recovery” is really just at the low-end of the price spectrum. With few transactions and most being from some kind of duress…we won’t see the “move-up” buyer as well. It starting to look more like a bounce in the market than a recovery.

“While buying single-family homes to rent is among “the smarter ways to invest going forward,†Pastolove advises wealthy clients to buy the properties to rent themselves if they are able. Morgan Stanley isn’t purchasing homes or managing them; instead it’s making loans to high-net-worth customers at rates lower than a typical mortgage, and using their investment portfolios as collateral. That provides people the capital to purchase investment properties, he said.”

And there you have it. The wealthiest investors getting the money cheaper than anyone. Driving down the freeway will using the review mirror may be a big mistake.

Not right, I tell you, not right. Giving them a lower rate. But, something tells me that only a few of the wealthier investors are going to come out ok in this. There will be another crash to wipe them clean and think of how many houses will be off the banks’ books because of this scam on the wealthier.

I don’t think you’re right. Here in the SoCal it seems like a very large part of the upswing is the 500-800k segment. Unless you meant that is considered ‘low end’?

If you are on the westside, that is the cost of dirt.

Naw, not true at all. If you actually lived here you could speak but you don’t. $800k will buy you a decent home. not amazing but decent.

In a pretty decent suburb of San Francisco. Median home price is $500K. I’ve seen many homes in the $600K and above range that have been on the market over 4 months and the seller is lowering the price and still can’t sell. But anything below $450K is selling in days. But there are very few now available.

$2.5K/month rent will get you a decent 3/2.

Party is not going to last:

http://www.marketwatch.com/story/sp-may-face-suit-over-mortgage-bond-ratings-wsj-2013-02-04

“The Justice Department and state prosecutors intend to file civil charges alleging wrongdoing by Standard & Poor’s Ratings Services in its rating of mortgage bonds before the financial crisis erupted in 2008, according to people familiar with the matter. “

Yes it is. Yes it is. Yes it is. Get used to it. No one is going to jail. Someone will pay a small fine. Here’s how the government works.

1) The house is on fire

2) People start screaming there is a fire

3) The government debates for years and years and years, going on about how Democrats are socailists, and Republicans are nazis.

4) Nothing gets done until the house burns to the ground and there are trees growing everywhere.

5) The government then blames it on something totally unrealated because they say so.

6) Repeat

I agree with Balls… They will pay a fine and the money will be used to write down mortgages. This can’t end. The whole financial system will colapse if it does.

While S & P is as much responsible for the financial collapse as the banks they were allegedly overseeing (ahem), no way anyone’s going to seriously suffer for their actions. Once Mozillo was allowed to stay out of jail and keep his ill – gotten millions, the game was laid bare for all to see – no one’s going to pay for their fiscal and moral malfeasance.

My kid just got an FHA loan. He can always refinance out of it at a later time when he has more equity.

Hehe, I have to snicker a little when I hear that because it sounds exactly like people who bought into the interest only and ARMS loans. I’ll just refinance when … fill in the blank.

what if the equity never shows up?

Then the kid has no skin in the game…who cares as long as it is cheaper then renting.

Theory:

1. Government runs 1 trillion USD / yr deficit or more.

2. No one likes taxes OR cuts so option 3: “Print” and issue the deficit, sell some domestically and much of it to other countries.

3. More fiat money devalues the currency. Prices rise.

4. All the extra printed money comes home to roost; foreign buyers seek an asset that will survive the inflation or destruction of the currency.

5. Housing prices rise despite poor domestic incomes.

This can continue until many underwater houses come back up ? In any case borrowing seems to work regardless of the outcome. It’s all becoming funny money so max student loans, mortgage, HELOC (if investing elsewhere) and just focus on income streams and cost reduction and pay off the house/rental now. Shelter is still shelter regardless of the currency games.

This vid makes a lot of sense

This Is Housing Bubble 2.0: David Stockman

http://finance.yahoo.com/blogs/daily-ticker/housing-bubble-2-0-david-stockman-133026817.html

Great video! This is exactly what I am doing and what Wall Street is doing right now. We are in a housing bubble right now. Buy now, get some profits, get out by the time interest rates rise which will bring housing prices down once again.

I’m selling all real estate to get max profit by watching the timing of when interest rates hikes begin. I will sell and then sit on the sidelines and pick up a new residence when prices crash yet once again. There is no stability in this market. Few people want to live this kind of life but it works for me.

There will be a buying frenzy when interests rate start to rise…people will want to get in before rates go too high but they fail to realize that prices will have to come down. Employment does not support these prices and the cheap money will have moved on. We are most definitely heading for another real crash once interests rates rise. Just when you think you have equity again, it will be snatched away from you.

We are in a bubble, no real recovery. Just a lot of cheap money chasing dividends. When those dry up, as bubbles tend to do, they burst.

I agree with most of what you have to say Christie.

1) I do believe people will rush to buy as interest rates rise. But, when will that happen is the question.

2) Bad yields in savings accounts is putting money into stocks, but not all stocks are created equal.

3) I like discounts too. I’m a cheap ba$tard.

Not so sure about another crash. That seems a bit too far ahead to forcast. Also, if these are ALL CASH BUYERS, how can it crash? If there is no credit involved and they are using Yankee Greenbacks, how is that possible?

I admire your patience, Christy – but as you said, few people (including myself) have the temperament to buy a property and then sell at the height of a market, then rent and do the entire process all over again. I also agree with your contention that much of this bubble can be placed on “hot money” chasing the latest trendlines. As I discussed this with a neighbor who’s also a RE agent yesterday, even she agreed that this is mostly composed of investors and/or flippers hoping to max out their gains before the latest round of musical chairs ends.

We have a bifurcated market with speculators and subprime buyers. I wonder how this ends? Bubblicious once again. But it’s different this time! Still alot of properties being disposed of by the banks. Even on the Westside we had over 40 last month at 2002 – 2004 prices.

http://www.westsideremeltdown.blogspot.com

Morgan Stanley is recommending its wealthy clients purchase rental properties? Cash buyers competing with FHA borrowers. It’s time to run like hell from real estate!

flight to quality does not exist in this economy not even real estate, grab your popcorn, this will not end well

Ha,ha,ha! Chase food stamp PhD’s in a house bid wars with the Sinaloa drug cartel live by HSBC smart TV.

I said years ago that as the GSE’s broaden programs to provide funding to mortgages at lower rates and down payments than private industry would be willing (well, really, *able*) to accommodate, we would run the risk of creating a situation in which private lending dries up. It simply cannot compete and make a profit. Either people would have to save very large sums (up to and including 100% cash) or hope that they fall under the guidelines to qualify for federal aid. So how does MIP work? I saw mention that it’s for the life of the loan? Is it a tax write-off? If not, I’m thinking it looks like mortgage interest write-off has effectively been nullified for low-down-payment FHA buyers, or to re-phrase, that there’s a regressive taxation now built into home buying.

Last year we bought three properties in Murrieta, all cash. Excellent deals. You could have bought newer properties for about 100-120K that yield $1300-$1400 a month. Even with HOA/taxes/property management fees, you still get about 6-8% ROI. Given Murrieta is a very nice town that is central in location (an hour or less to LA, Orange County, San Diego and Palm Springs), it was a deal. If you bought for cash, an instant revenue stream without a leverage. Those days are gone now, the market has dried up.

I thought I’d chip in, because one of those properties was a condo that was an FHA home. We bought it for cash, but it became available because an FHA-er (a colloquial for a person who takes an FHA loan) bought it earlier, but quickly defaulted. We often see such homes. We have learned to just wait for an FHA-er to buy a home and then to default. Then buy it for cash the moment a 30 day waiting period expires (that opens it for investors). We talked with plenty of RE agents. They all know there is lots of people who cannot possibly afford these homes, even with depressed prices, and even with next-to-nothing down. But the system likes a FHA-er. Say, a property for 120K or so. RE agents will make about 7K, pop, easy money! Government will make money on fees and monthly payments. The FHA-er defaults in a short period of time (say 3months to a year). Pop! Again, RE agents makes money, again, government makes money. It’s a perpetual money making machine. If homes were being sold realistically, prices would have to be halved. That’s the only way the ‘regular Joe’ is not going to default. But then the endless easy money would stop. The biggest obstacle to a stable RE market is the government. It makes everything a ‘teaser’ that makes hard-working folks lose ton of money and end up without owning a home anyway. Sad.

The way things are going, there is only one thing that will put an end to this: high inflation and rise in interest rates. Dollar can’t really default, so the question is when will the inflation rise to a breaking point. I think inflation is now about 10-15% annually. I think 25% is when public can no longer buy into Fed’s 2% story.

In any case, now is not a good time for a cash investor to buy. This is the time when everyone thinks markets (Dow, S&P) is going to go up. This is the time when everyone thinks housing market is on the upswing. For that reason (and because of fundamental weakness of job market), it’s going to be the opposite by the end of 2013. If you are a small cash buyer (i.e. like us, you work hard, save money and takes you several years to save a few hundred thousand dollars), I wouldn’t bother in this market. I think, wait for early 2014, I think the deals will be better. Higher interest rates will push the prices down. FHA will have a harder time defying gravity. Even with higher interest rates, even if you don’t buy an all out cash (say you buy with 60% down), if you can pay off the loan quickly, you’re much better off that with higher prices and lower interest rates.

I know people that go places like Las Vegas, to get 10% ROI. I would advise against that. When economy muddles through, and I think it will muddle through for decades to come, people don’t fly to Vegas. Vegas may dry up and go under. Consider SoCal. SoCal is Vegas’ main client. When you go to Vegas, probably a good 30% of license plates are ‘California’. But what happens now? Lots of people go to Temecula: you have Pechanga (bigger than any casino in Vegas), a gorgeous wine country where just last year about $500 million was invested, it’s an up and coming wine country that’s gaining traction beyond SoCal. It’s a Disneyland for adults. My point, more and more SoCal people will find local attractions for cheap, because SoCal has lots and lots to offer. So I think SoCal is still one of the places for RE investor, only not now, perhaps end of 2013.

1800’s – San Fransisco (gold rush)

1900’s – Los Angeles (defense)

2000’s – Inland Empire (land, cheap, L.A. spillover)

6-8% ROI of up to $150k per property is not that great when you compare the risk downside. Let’s face it, any person who is renting somewhere like Murrieta would be a very un-creditworthy and high risk tenant. If you can’t buy in Murrieta, you are a low worth individual. The only reason to live in Murrieta/Temecula is because of affordability of home purchasing. If you are going to rent you might as well rent somewhere worthwhile given the cost of transportation to commute to work it will either be the same or cost you a lot more to rent in this area. $8-10k can be lost very quickly in a home. A tenant can easily render a property’s yard, carpet, tile, floor, paint, etc, etc worthless in no time flat. That can easily erase any gains and then some and then not to mention the difficulty of getting tenants out of a property when they don’t pay can be tied up in court for many many months.

I disagree about Murrieta/Temecula (also known as Murricula in local’s jargon). Many people call it the ‘new OC’. The average income in the area is as high as it is in south OC. Family income is about 100K. Infrastructure is great, shopping, best schools. The only problem right now is that there are no big corporate offices here (except for medical industry which is thriving in the area), but given everything else and the location, that’s bound to change. We lived in the OC all our lives and to us, this is what OC was 30 years ago. Many people agree. Maybe you haven’t heard of Murrieta? Many people haven’t because it grew from about 20,000 residents in 2000 to over 100,000 now (and the total area with Temecula and a few nearby towns is now over quarter million). When most people realize that it’s a good opportunity, it will no longer be a good opportunity. We also lived there for a few years (we are now traveling across the US looking for the next opportunity). While no one can claim to have a crystal ball, we have done lots of research and seen it first hand, and we think Murrieta/Temecula area is a high-potential, low-risk area, due to proximity to large SoCal centers.

A generic comment about ROIs. Firstly, it’s shocking how many investors don’t even know what it is. Secondly, most of them count ROI pre-investment (i.e. they think of taxes, mortgage, HOA… and they ‘calculate’ ROI off the top of their heads). That’s fine to begin with. But I am talking about final ROI. It includes things like management fees, insurance, maintenance, turnover (one month of turnover, including cleaning/fixing up the place can ruin your life), everything. My ROI is post-investment ROI, after *everything* is said and done. In reality, many people talk about great ROI, but never bother to really look at the numbers once they acquired and ran the property. In those terms, ROI of 6-8% is great, in my view.

Also, as for commute and such. Lots of people in Murrieta are white collar workers who telecommute. Both of my neighbors were telecommuters, and so am I. Secondly, given how costly it is to do business in the OC/LA/SD, it’s just a matter of time before big business moves to southwest Riverside (i.e. Murrieta/Temecula) and discovers a large pool of highly educated white collar workers. People used to say that OC was very risky and that LA ruled the day. How things have changed. I am not saying things will play out this way. But chances that it will are very good.

John, maybe you haven’t seen my prior posts but I live in Murrieta been here for 3 years. I’ve never heard anyone call it Murricula and no the median income isn’t $100k and no it’s not as affluent as South OC. I love the area, don’t get me wrong but what you’re saying it being the new OC is as far from the truth as anyone can imagine. However, to me that is a good thing. I do notice there are a lot of new transplants coming in with the same attitude as you though. You need to just drop the make believe pretentiousness and just accept reality for what it is. You moved here simply because you couldn’t cut it in the OC. It is NOT the OC.

Murrieta/Temecula is not YET the OC, regarding the business development. According to the Wiki, the median income in Murrieta in 2007 was 91K, and say in Aliso Viejo is 99K. However, average family in Aliso Viejo pays much more for its mortgage, because prices of RE are about double that in Southwest Riverside. Average Joe in Murrieta has more disposable income than in Aliso Viejo. Quality of living is better. Houses in Murrieta are much nicer, most of them are newer, have granite countertops and other upgrades, there is more space overall. Houses in the OC are generally more vanilla, tiny in comparison and nothing to write home about. Sure there are exceptions, but I’ve seen hundreds of houses for sale in both markets, so I’ve formed an opinion. I don’t know what ‘being able to cut it in the OC’ means. I own RE nationwide and I don’t look at things that way. I don’t live in California anymore and never had intention nor need to ‘cut it in the OC’. I look at the potential for long term appreciation and the potential for making money today.

I lived in the OC for 38 years, so I feel like I never had to ‘cut it’ there. I still own 2 houses in the OC, and they yield >10% ROI, but only because they were bought a long time ago, survived couple of major crashes and Prop 13 helped too. Buying RE in the OC for investment would be (generally) a disaster today. I am aware of the ‘poser’ mentality in the OC, but believe me that’s not a good thing. It wasn’t always there and I sure hope it won’t be there forever. I remember times when in the back of the houses there were orange orchards and cows pastures, right in the smack middle of the OC. I like the people in the southwest Riverside better, I am hoping the nicer mentality stays that way for years to come and does not turn into what OC is today. When I say, becoming the OC, I strictly mean the amount of money and business that is today in the OC, not the poser mentality. For those uninitiated, the ‘poser’ mentality of the OC means not having much money at all but pretending like you do (such as leasing a bmw and wearing fancy clothes and botoxing yourself to death to the point where you don’t have money to pay your taxes and IRS garnishes your wages), and scorning those who are not like you.

Great insight! I always think that way when people mention the joys of having tenants in places like Murrieta, Temecula, Lake Elsinore, Perris, etc. What are the chances of getting quality long-term renters? Like you say, if they were stable people they would probably own in “cheap” places like that.

As a landlord with tenants in both the OC and Murrieta/Temecula, I can tell you that a typical tenant is tapped out financially. I have a tenant in the OC who is a regional VP but who just vacated a nice condo of mine in Laguna Niguel, only to move to a more expensive condo (as a renter). This person can totally afford to buy, technically, but I happen to know this person and I know money goes on so many frivolous things despite a six figure income. High income means nothing if you don’t know how to save money. On the other hand, I have a conservative family as tenants in Murrieta who make approximately the same amount of money, however they are frugal. They just lost their house to foreclosure and they cannot buy a house, but I can see them buying one day, but that day is not this year for sure. Saving 20% for a home (unless you do FHA, which will change soon enough) is tough. Especially for a nice home. Or take a look at another tenant of mine in the north OC. They also just lost their home to foreclosure so they have to rent. And all these people are cream of the crop, trust me, I even pay for MLS to bring in more qualified tenants! Most others have terrible credit scores, poor employment situation, and even evictions. It used to be better, it got a lot worse in a just a few short years. This economy is dragging lots and lots people down, everywhere.

Another thing: Murrieta and Temecula have family incomes comparable to the OC, and the cities look comparable to the OC (especially south OC), both very nice, with great schools, especially the Copper Canyon area in Murrieta (awesome and beautiful!) with a California-10 school district. Both are consistently among the top 10 safest cities in the nation, according to the FBI. I see future for my properties there.

Menifee is up and coming with the new hospital and widening of I-215, I think it has potential. Not sure, but can happen.

Lake Elsinore (around the lake) is not a desirable area, and the east part of (across the I-15) is nice. Perris is far from any of these, and many people will tell you it is not a good place at all.

So to bundle Murrieta and Perris in the same sentence is like saying that Santa Monica is a bad place because it’s in LA, and Compton is in LA too. The two are far from one another in so many ways, including geographically.

The game is rigged, period. Until that admission is made, and clear rules are established, there will be no market equilibrium. Violent swings will continue as the tug-of-war remains.

Playing the flip side of the coin for a second, to join the doom and gloomers.. I ran across this today:

http://www.eutimes.net/2013/01/russia-issues-critical-alert-for-us-as-billions-flee-american-banks/

http://www.businessweek.com/articles/2013-01-23/missing-114-billion-from-u-dot-s-dot-banks#r=rss

Both very interesting.

The European article is classic. Most likely the money found it’s way into stocks.

i believe rates will stay low.low interest, low tax return. 3% vs 7% mortgage rate adds up to quite a savings for uncle sam.

We’re a cash and close on a primary (Sept 2012). We heard back then all cash buyers were out there. I believe a lot of this “all cash” is embellishment in our area.

Now we live in the “poor house ” in style. Love our new digs.

LG truly makes great appliances, but the learning curve is insane. I just want to cook my food, not get a Ph.D. in programming. Holy Cr*p!

It appears that the Crazies are infiltrating this blog.

Since February 1st, 9 new listings appeared in San Luis Obispo. Now there are 99 homes for sale in SLO (total). Eight of the new listings are mid-range homes (3 to 4 bedrooms, most all needing significant work). The other is a supposedly 2 million dollar home. This is more than double the new listings I’ve seen in a one week period, for a couple of years.

It’s too soon to tell if this means anything (only one week), but I am wondering if anyone else has seen something like it in their area.

Hi Sadie

I am an active buyer in the Western LA and Culver City adjacent area and there have not been any upticks in homes on the market, on the contrary, there are even fewer now then in the Fall. The result of this from a buyer perspective is that when a home comes on the market, I need to go to the first open house and decide that day if I want to make an offer. From a sellers perspective, often times the offers made on the first day are the best, because many buyers have seen plenty of homes and know what they want or dont want to buy. Therefore, it is said that the first offers are usually the best.

Thanks QE.

If Rates go Up Housing Will Implode-Fabian Calvo

Calvo says, “The Fed realizes there needs to be a low rate environment for housing to recover or it’s a huge implosion. They have thrown underwriting guidelines out the window. They are going to continue with no money down loans or very little equity.†The Fed also knows that many big banks are technically insolvent. Calvo contends, “You have a lot of these zombie banks. If you mark-to-market their assets, they would be bankrupt.†So, the Fed and the government will continue to print money to keep housing prices and the big banks from collapsing. Join Greg Hunter as he goes One-on-One with Fabian Calvo.

video here:

http://www.silverdoctors.com/if-rates-go-up-housing-will-implode-fabian-calvo/

Leave a Reply to BlahBlah